- Department of Shipping Finance, College of Maritime Economics and Management, Dalian Maritime University, Dalian, China

To address the issues of climate change, many countries are taking transitions from traditional fossil energy to renewable energy. The renewable energy enterprises are more sensitive to the impacts of policy uncertainty and weather conditions compared to other types of investment. This study employs data from 179 A-share listed renewable energy enterprises in 2008–2022 to explore the impacts of different types of climate risk on the investments of renewable energy industry. The results show that transition risk has a positive effect on the investment of renewable energy enterprises, especially when the level of economic development is below the threshold. In the panel threshold model, extreme high temperature and extreme precipitation would promote the investments of state-owned renewable energy enterprises. When renewable energy enterprises are under high financing constraints, only transition risk can promote the investments.

1 Introduction

In recent years, in order to effectively reduce the risks brought by climate change on industries, lots of countries in the world have launched corresponding environmental governance policies. In 1992, The United Nations Framework Convention on Climate Change (UNFCCC) was set up at the United Nations Conference on Environment and Development, which was the first international convention related to the control of carbon dioxide and other greenhouse gases. The Paris Agreement reached at the 2015 Paris Climate Change Conference covers the emission reduction plans of nearly 200 countries and regions, which clarifies the governance strategy for the global economy to tackle the problem of climate change. In 2020, China officially proposed to achieve “carbon dioxide peaking” by 2030 and “carbon neutrality” by 2060. In order to address the problem of climate change and reduce carbon dioxide emissions, lots of countries are taking transitions from traditional fossil energy to renewable energy (Urban, 2018; Wang et al., 2018; Aquilas and Atemnkeng, 2022). Under the impetus of 14th Five-Year Plan on Renewable Energy Development, China has also increased investments to improve its technological innovation capacity, which demonstrates great opportunities for future development.

China has plenty of renewable energy resources, however the development of renewable energy industry still has higher costs, which requires large amounts of investments on technological development and infrastructure equipment. Investments in renewable energy industry generally require large amounts of capital, which also have the characteristics of higher risk and long payback periods. The renewable energy enterprises which focus on the acquisition and utilization of renewable energy resources, such as solar and wind, are more sensitive to the impacts of policy uncertainty and weather conditions compared to other types of investment (Kim and Park, 2023). Extreme weathers caused by climate change could damage the business infrastructure of renewable energy enterprises, or even lead to catastrophic events, which lead the enterprises to promote the investments.

Typically, climate-related risks can be divided into two main categories: transition risk and physical risk. Transition risk arise when the society take the transition to a low-carbon economy in response to climate change, which include policy risks relevant to climate change, market risks related to the changes of consumer preferences, legal risks and enterprise technology risks. Physical risks include extreme high temperatures, extreme low temperatures and flooding, etc., which could cause the severe damages to enterprises or even economic stability of financial institutions (Gupta and Pierdzioch, 2022). In the face of challenges from climate change, companies could quickly adjust their allocation of assets and improve their operational strategies, which could mitigate the negative impacts from both transition risks and physical risks (Zhang, 2022).

The previous studies indicate that climate risk, as a complex phenomenon, could lead to the changes of the enterprise through direct and indirect effects that are difficult to estimate (Juhola et al., 2023). The developments of renewable energy resources, especially hydroelectricity or biomass, are highly dependent on weather conditions, so physical risks of weather disasters may lead to more consumptions of traditional energy (Ji et al., 2018). However, climate change will make government to promote relevant environmental policies, which will lead the enterprises to change their business management strategies for development of renewable energy.

Previous literature has shown that climate risk could stimulate the enterprises to improve its risk-taking capacity to avoid potential losses from extreme weather (Adu and Roni, 2024). The changes in external market demand would also promote the development of new energy technologies (Liu et al., 2021; Xie et al., 2022). These will not only improve the firms’ confidences to invest in high-risk projects, but also prompts them to adjust their management strategies to optimize their investment structures, which could improve their overall investment efficiency. At the same time, government take steps to transfer the subsidies from traditional fields to industries dedicated to climate change, which have positively increased the investments from renewable energy firms. In particular, in the well-developed regions, the increase of government policy supports could significantly reduce the impact of the uncertainty of the external environment on the operation of the enterprises, which enhance the capability of renewable energy enterprises to cope with climate risks (Yang and Park, 2020; Lin and Xie, 2024). Therefore, there may exist non-linear threshold effect of the government subsidies and institutional environment on the investment behaviors of renewable energy enterprises.

Even though the previous literature has discussed about the relationship between climate risk and corporate behavior, most studies focused on the corporate entities in all the industries or particularly financial institutions. There exist few studies that focused on renewable energy enterprises. In addition, the discussions about the relationship between climate change and the renewable energy industry are mainly at the macro level as the overall industry, while there is a lack of analysis at the micro level as the corporates (An et al., 2022; Dutta et al., 2023). Especially, previous literature lacked of research on the non-linear relationship between climate risk and enterprises investments. In this study, we will analyze the threshold effect of climate risks on investments of renewable energy enterprises which could show the nonlinear relationship between climate risks and renewable energy enterprise investment. Moreover, this study supplements and extends the existing literature by distinguishing between different types of climate risks, while focus on their impacts on corporate behaviors at the micro level. Besides, we further explore the heterogeneity of the impacts from climate change on renewable energy enterprise investment behavior based on the types of ownerships, financing constraints, and regional locations.

The rest of the paper is organized as follows: the second part is the literature review and study hypothesis; the third part introduces the study design, which describes about the sample selection, model setting and variable definition; the fourth part presents the empirical analysis; the fifth part provides the conclusions and recommendations.

2 Literature review

2.1 Investments of renewable energy enterprises

In recent years, the renewable energy industry is gradually expanding which has shown the advantages for long-term development compared with traditional energy sources. Renewable energy project requires larger capital investments in the early stage, and it also has higher investment risks compared with the traditional fossil energy. However, in the long run, investments in renewable energy companies have the opportunities to generate more economic benefits with the supports from government policies. More importantly, renewable energy is beneficial to the environment, which make it suitable for the development goal of green economy. At present, renewable energy enterprises are still in the early stage of development, thus making investments in renewable energy enterprises more risk-sensitive than investments in general enterprises (Egli, 2020; Wang and Fan, 2023).

Previous literature has investigated about factors affecting investment in renewable energy firms, including government support, financial markets and environmental regulation (Akintande et al., 2020; Abban and Hasan, 2021; Zhang et al., 2021). Government R&D subsidies can have impacts on firms’ external investors, increasing the opportunity that firms receive venture capital for renewable energy investment. The impacts of government subsidies on renewable energy investments are significantly stronger with lower economic development level or higher intensity of energy consumption (Aguirre and Ibikunle, 2014; Yang et al., 2019).

The development of financial industries is also influential for renewable energy enterprises to raise funds and attract investors. Naeem and Li (2019) indicate that the development of financial market is helpful for the investment of renewable energy firms, which could provide broad range of financial services and improve the efficiency of business investment. Financing constraints in financial markets can have a significant impact on firm investment. Firms’ financing capacities have varying degrees of impacts on their level of investment (Naeem et al., 2021; Rasoulinezhad and Taghizadeh-Hesary, 2022).

The relationship of renewable energy investments with environmental regulation has also received extensive attentions from scholars. Many scholars show that there is a facilitating effect of environmental regulation on enterprises’ green investments, while there exists a non-linear relationship between the two (Yang et al., 2020). However, there also exist studies indicating that environmental regulation may inhibit enterprises’ green investment (Huang and Lei, 2021).

2.2 Impacts of climate risks on enterprises’ investments

Previous literature has shown that climate risks could make influences on enterprises’ investments from multiple dimensions, which include exacerbation of business risks, direct threats of business solvency and reductions of enterprises’ credit ratings. Financial institutions have already added the climate risk as a factor in the assessment of credit risk, therefore the business with higher climate risks could potentially have higher financial costs. The enterprises that lack adaptive capacity or lagged behind in the transition to low-carbon economy will possibly loss their financial support, preventing them from long-term development. On the contrary, firms that take proactive measures to prevent from climate risk are more likely to attract investments, becoming competitive in the market (Wu et al., 2022; Wu and Tian, 2022).

Both transition risk and physical risk could have impacts on the investors’ decisions. In terms of transition risks, government has introduced a series of policies to support low-carbon industries, while make restrictions to the high-carbon sectors. These policies may facilitate companies to take challenges of transformations, including investments on technological innovation or adjustments of business strategy. At the same time, with the promotion of environmental, social and governance (ESG) standards, investors increasingly prefer to choose environment-friendly companies, which would further drive the enterprises to take transitions to green economy (Yang et al., 2022; Amiraslani et al., 2023).

In terms of physical risks, extreme weather events may directly damage firms’ physical assets, reducing the efficiency of business investments. For industries that are highly dependent on the climatic conditions, physical risks could also affect the stability of their supply chains and product quality, which may cause the increase of operational costs. Therefore, the enterprises are promoted to make investments for their market competitiveness, in order to mitigate these negative impacts from physical risks. Furthermore, with frequent extreme weather events, the consequent equipment damages and technical challenges exacerbated operational risks for renewable energy projects, which also incentive the investments from renewable energy industry (Bolton and Kacperczyk, 2021; Soergel et al., 2021; Pankratz et al., 2023).

2.3 Threshold effects of economic development

In recent years, the occurrence of extreme weather events has led to substantial economic losses, which had huge negative impacts on capital inflows especially in the developing countries. These have caused widespread concerns among business owners and investors, while some companies affected by climate changes have taken corresponding measures to cope with these issues. Climate risk has become one of the important factors affecting the stability of financial system, which further have impacts on renewable energy investments (Battiston et al., 2021; He et al., 2023; Wang et al., 2023).

The risks introduced by climate change are with more complexity, which makes much diverse impacts on corporates’ investment decisions. For the renewable energy industry, technological innovation is one of the main factors that could influence decisions on investments in renewable energy firms. The impacts of climate change on technology innovation in renewable energy industry follow the non-linear relationship, which has the threshold effects (Lin and Zhu, 2019).

At the same time, the level of economic development is also an important factor that may affect the enterprises’ investments (Vukicevic et al., 2021). When economic development levels are low, renewable energy enterprises may lack sufficient funding and technological support to address the issues of climate risks, making their infrastructure more vulnerable to the impacts of climate change in the future. When economic development arrives at a high level, renewable energy enterprises will be more likely to obtain government policy supports and financial assistance. These will further bring cluster effect that attract investments on emerging technologies, which could support for the development of renewable energy industry (Ghosh and Kanjilal, 2020; Guliyev, 2023). The renewable energy enterprises gradually would have stronger capabilities of technological innovation and risk management, which leads to a decrease in the sensitivity to climate risks. Besides, the impact of climate risks on renewable energy enterprises may be more sever for a less developed economy with bad business infrastructure. Extreme weathers, such as rainfall and high temperature, may have significantly impact the operation of renewable energy projects, such as hydropower (Alam and Murad, 2020; Soto et al., 2025).

The transition from traditional fossil fuels to renewable energy requires not only technological innovation but also substantial capital investment. However, differences in economic development levels, technological capabilities, and geographic locations lead to varying degrees of financial market support for corporate investments. Enterprises in high-economic-development regions are more likely to mitigate risks through diversified investments and technological innovation, while those in low-economic-development areas may struggle due to insufficient resources, facing greater climate risk challenges. With the development of economy, renewable energy firms could get more resources to address climate risks. However, this process does not follow a linear progression but exhibits distinct threshold effects (Xiong and Dai, 2023; Zhang et al., 2023; Feng and Li, 2024).

Previous studies have demonstrated the impacts of climate risks (Krueger et al., 2020; An et al., 2022), however there still no research that investigate whether climate risk has a non-linear impact on renewable energy enterprise investment. In this paper, we consider the level of economic development as a threshold variable, and investigate the mechanism of the impacts of climate risk on investments of renewable energy business at the corporate level.

3 Research design

3.1 Sample selection and data sources

According to the Industry Classification Guidelines (2017) issued by the China Securities Regulatory Commission, renewable energy enterprises include enterprises in the fields of “Electricity, heat, gas and water production and supply industry (industry codes D44, D45 and D46)”and the fields of “Ecological protection and environmental management industry (industry code is N77)”. The data about transition risks were obtained from companies’ annual reports, while the Daily Surface Temperature Data were collected from 842 observation stations operated by the National Meteorological Information Centre (NMIC) in China. Renewable energy companies listed on China’s A-share market from 2008 to 2022 were selected as the study sample, which can be obtained from the CSMAR database. The threshold variable, level of economic development, is measured by GDP, which were obtained from the National Bureau of Statistics of China.

3.2 Variable definition and model setting

3.2.1 Climate risk

Climate risks can be divided into two main categories: transition risks and physical risks, which were chosen as our key independent variables. Physical Risks are measured by Extreme High Temperature Days (Htd), Extreme Low Temperature Days (LTD) or Extreme Precipitation Days (Ipd). For transition risk, we employed the text analysis method by (Li et al., 2024) to construct the indicators in this study. We extract the frequencies of the words representing the transition risk in the company’s annual report, and take their percentages of the total word frequencies as the explanatory variables (Transition). Besides, we measure the annual number of extreme weather days in the province where the renewable energy companies are registered to represent the physical risk (Guo et al., 2024).

3.2.2 Other variables

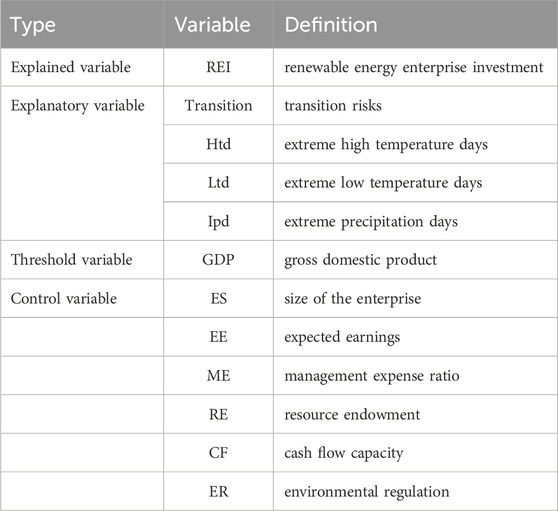

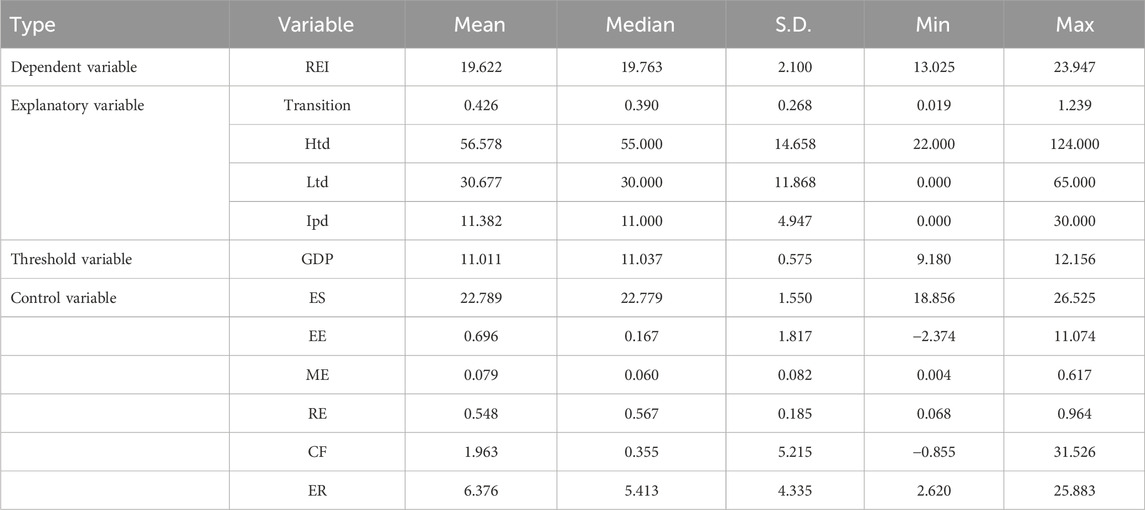

The dependent variable in our study is investment of renewable energy enterprise (REI), which is the funding paid by enterprises for the purchases or constructions of fixed assets, intangible assets and other long-term assets (Wang and Fan, 2023). The threshold variable is defined as the level of economic development, which was measured by the per capita GDP in each province of China. The control variables include enterprise size (ES), expected earnings (EE), management expense ratio (ME), resource endowment (RE), cash flow capacity (CF), and environmental regulation (ER) of the renewable energy enterprises. The summary statistics of all the variables are shown in Table 1.

3.3 Model specification

Based on the theoretical analysis in the previous section, to analyze the impacts of climate risk on the investment of renewable energy enterprises. The panel data models are first built as the basic model, which are shown as Equations 1, 2.

where i represents each individual enterprise, t represents each year, t-1 represents the lag period, and

When the threshold variable reaches a certain value, it will lead to a change in the degree of impacts from climate risks on the investment of renewable energy enterprises. Considering this possible non-linear relationship between climate risk and investments, this study employs the panel threshold model proposed by Hansen (1999) to check about the threshold effects of the level of economic development. The single threshold models are shown in Equations 3, 4.

Where GDP denotes the level of economic development, c and k represent the threshold values of the level of economic development for the two explanatory variables of transition risk and physical risk,

4 Empirical results

4.1 Results of basic models

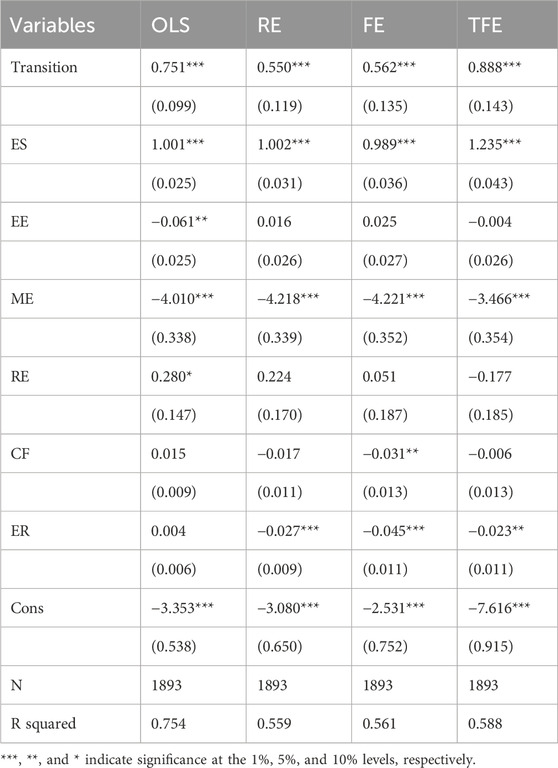

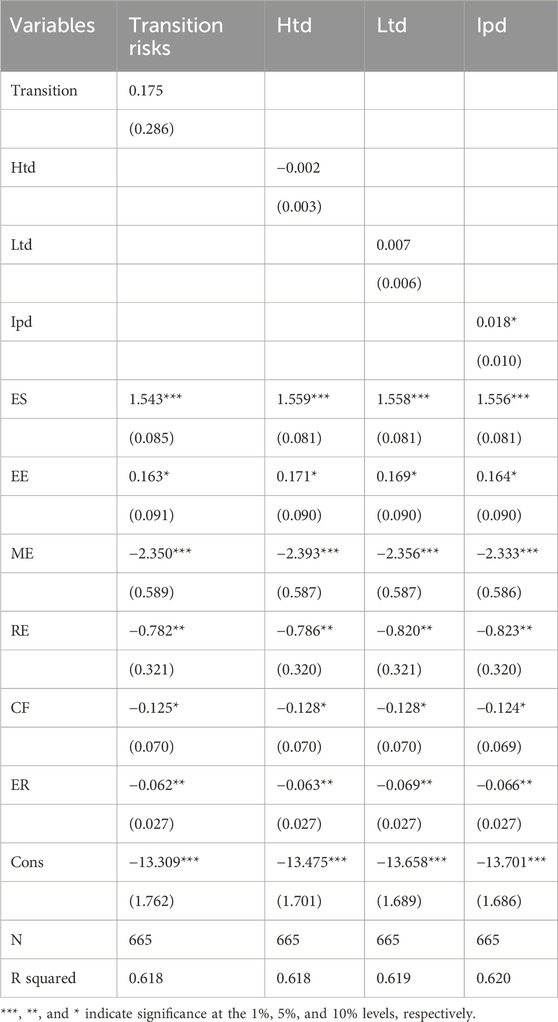

The summary statistics of all the variables are shown in Table 2. Table 3 shows the analysis results about the effects of transition risk based on the panel data model, including random-effect model (RE), fixed-effect model (FE) and two-way fixed effect model (TFE). The regression results show that the coefficients of variable Transition in all the models are significantly positive at 1% level, which imply that transition risk would incentive the renewable energy enterprises to increase their investments. The challenges faced by enterprises in transition to low-carbon economy could stimulate the innovation of new technologies and adoption of business strategies, which promotes the growth of investment in the field of renewable energy.

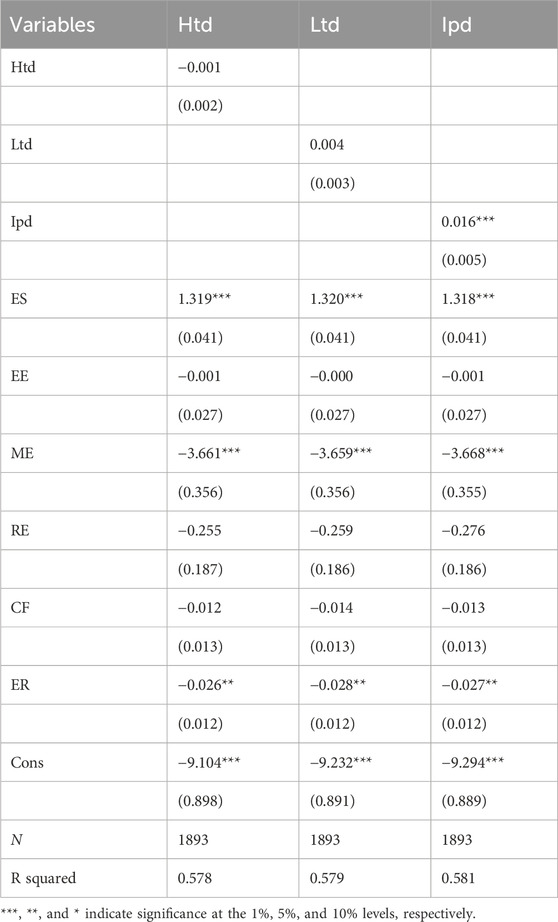

For physical risk, several indexes are employed to measure the extreme weather conditions, including extreme precipitation, extreme high and low temperatures. Table 4 represents the regression results about the impacts of physical risks on renewable energy enterprises’ investment based on the two-way fixed effects model. The results show that only extreme precipitation has a positive impact on renewable energy enterprises’ investments at the 1% significance level, with a coefficient of 0.016. In contrast, extreme high and low temperatures do not show significant effects on the investment decisions of renewable energy companies. This may be due to the fact that most renewable energy technologies (e.g., wind power, solar power) are able to operate stably over a wide range of temperatures under current technological conditions, therefore the investments are more sensitive to extreme precipitations. The control variables ES, ME, and ER have significant effects on the investment decisions of renewable energy companies in all models.

4.2 Estimation results of the threshold model

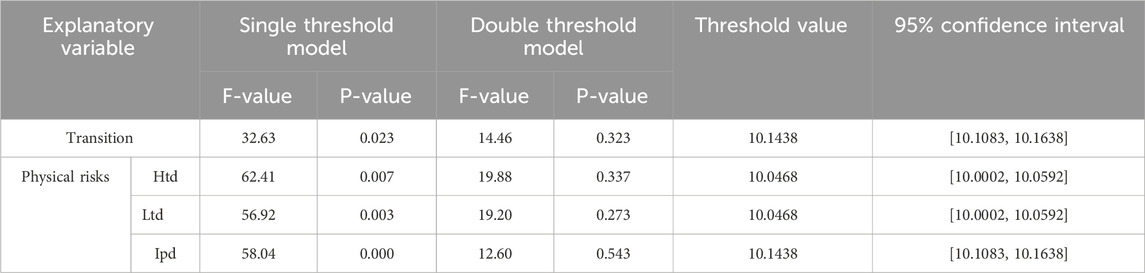

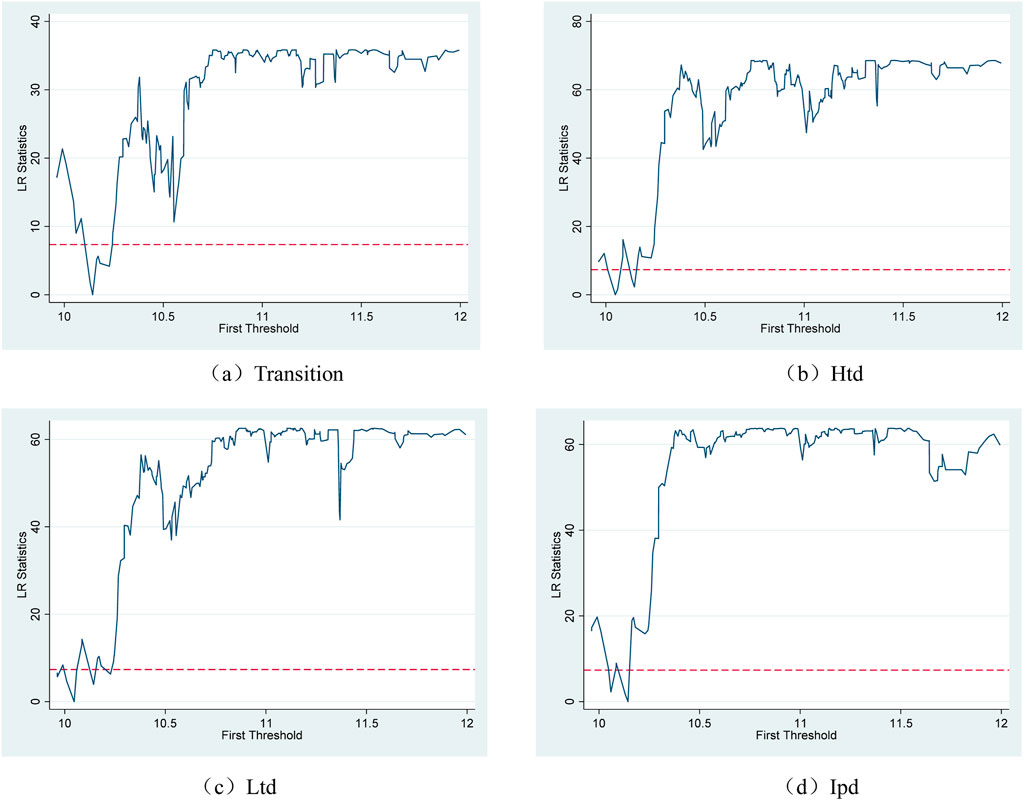

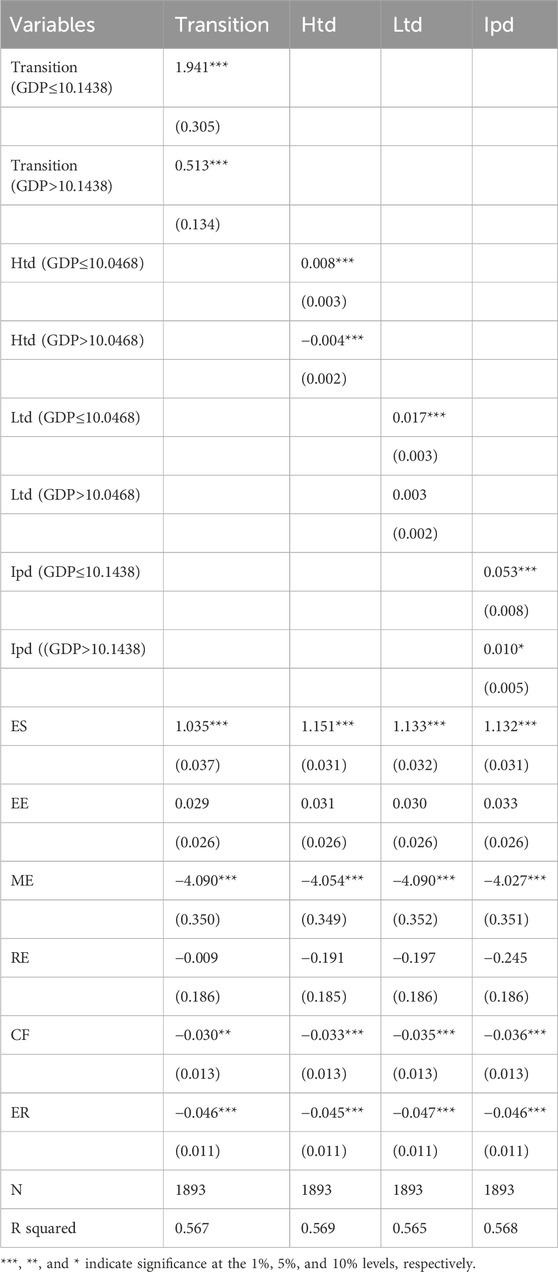

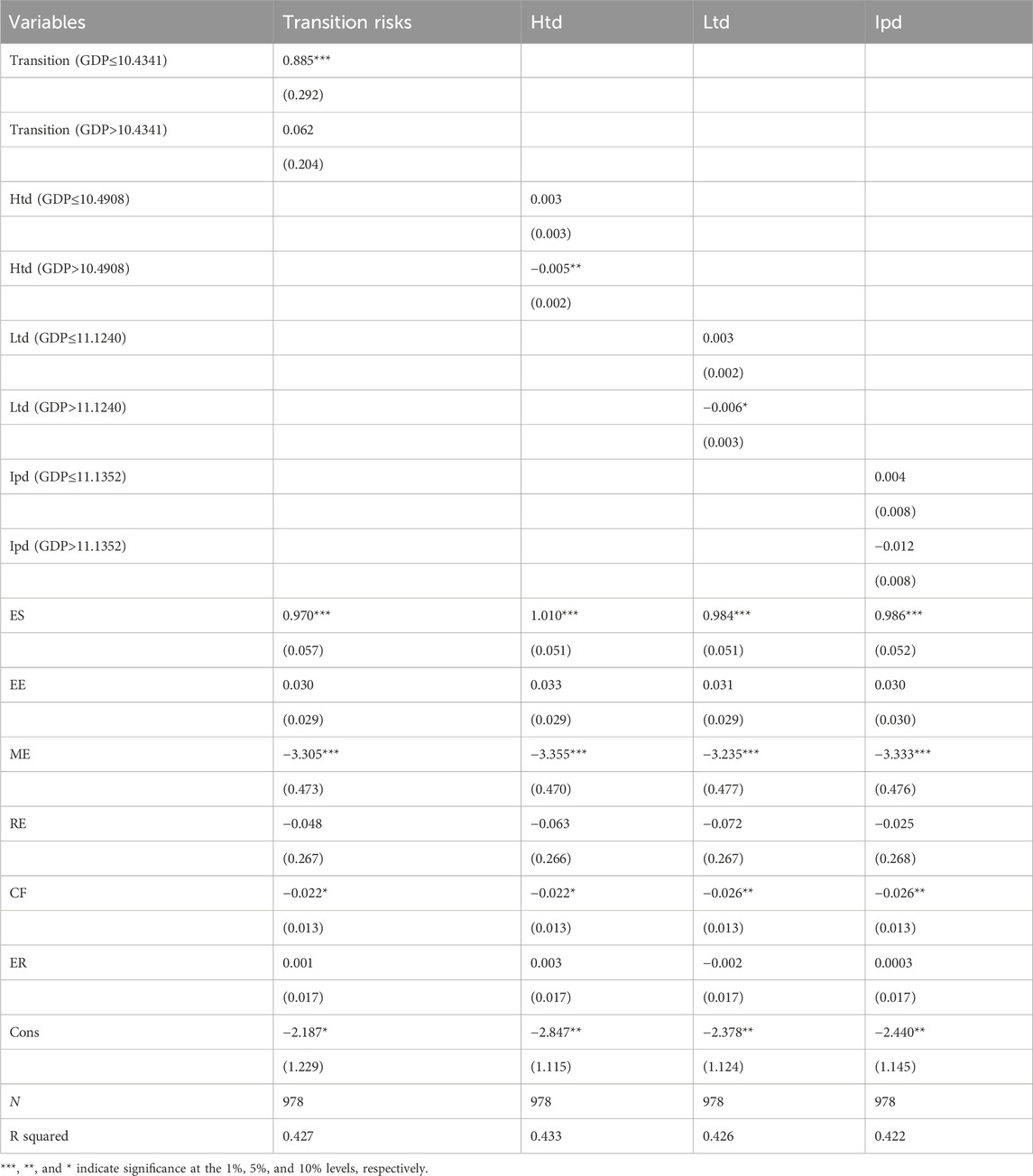

The results of the likelihood ratio test based on threshold model are shown in Table 5, which indicate that the threshold variable have passed the single threshold test at the 5% significance level. The estimated threshold of GDP for variable Transition is 10.1438. The estimated threshold of economic development for physical risks are 10.0468 for variable extreme high temperature days or extreme low temperature days, and 10.1438 for extreme precipitation days. The corresponding likelihood ratio statistics are represented in Figure 1, which is based on single threshold likelihood ratio model for the level of economic development.

Table 6 illustrates the non-linear relationships between climate risks and renewable energy firms’ investments. Specifically, transition risk promotes investments of renewable energy firms at the 1% significance level when GDP is both higher or lower than the specific threshold value. However, when GDP exceeds the threshold value, the coefficient of transition risk turns to be smaller. The reason could be that the renewable energy firms in well-developed region may already applied the new technologies which alleviate the pressure on firms to make large investments in face of transition risk.

Meanwhile, within a certain threshold, physical risks, including extreme high and low temperatures and extreme precipitation, also incentive investments in renewable energy companies, which are positively significant at the 1% level. However, the impacts from variable extreme low temperature days and extreme precipitation days change to be not significant when GDP is higher than the threshold level. Moreover, the impact from variable extreme high temperature days turns to be negative at the 1% significance level when GDP is higher than the threshold level.

When the level of economic development is within a certain threshold, extreme weather events increase society’s awareness of the urgency to replace traditional energy with renewable energy. This will stimulate investors’ interest and confidence in renewable energy projects, thereby promoting investments in renewable energy enterprises. The development of economy could promote new energy technologies and improve cost-effectiveness of renewable energy. This could enhance the competitiveness of renewable energy enterprises, while also decrease the physical risks posed by extreme weather events and other external environmental factors.

4.3 Analysis results about group heterogeneity

The renewable energy enterprises are further separated into different groups according their registered locations, ownerships, and financial constraints. Then we try to examine the heterogeneity of impacts from climate risks on the investment of renewable energy enterprises in different groups of enterprises.

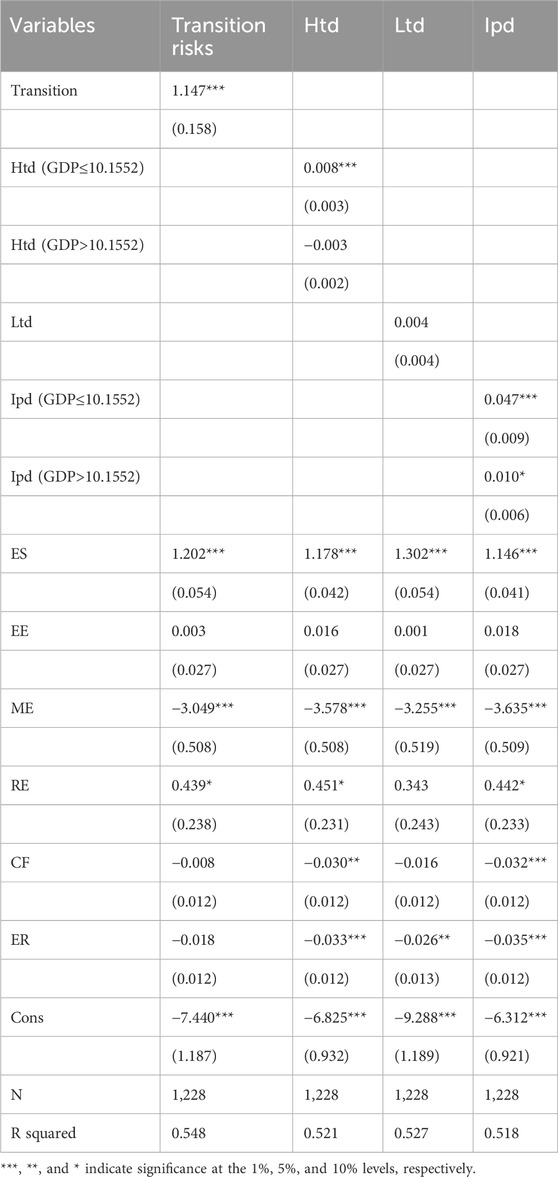

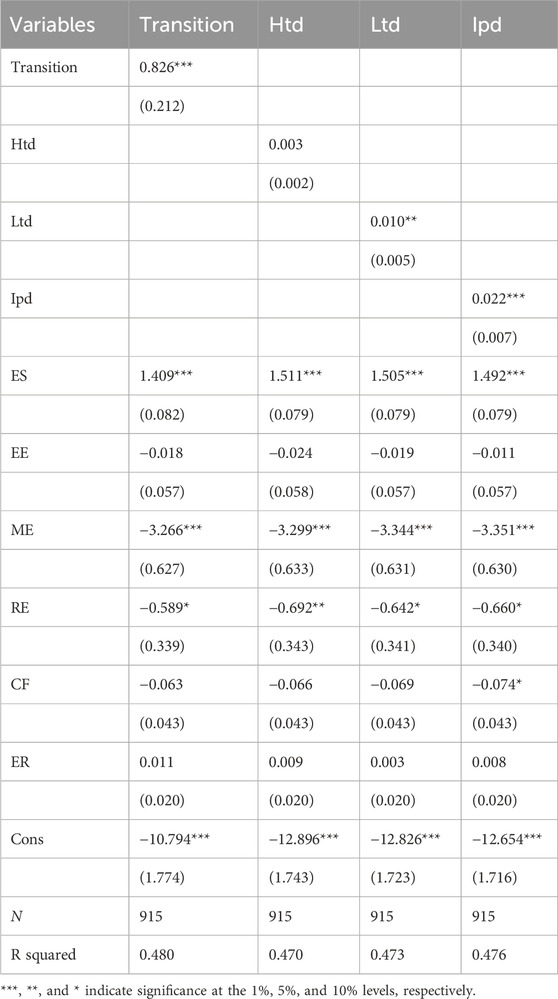

4.3.1 Different types of enterprise ownerships

The study sample is divided into two groups, state-owned enterprises and non-state-owned enterprises, based on the enterprise ownership. The regression results of the impacts from climate risk on renewable energy business investment for the two groups are shown in Tables 7, 8 respectively. The results show that transition risk has a significantly positive effect on renewable energy firms’ investment only for state-owned enterprises. For physical risk, none of the climate risks has a threshold effect on renewable energy investment of the non-state-owned firms. However, the physical risks have threshold effects on renewable energy investment of the state-owned firms. When GDP is less than the threshold, the coefficients of variables extreme high temperature days and extreme precipitation days are both positive at 1% significance level. When GDP is greater than the threshold, the impacts from physical risks turn to be not significant for the state-owned firms at 5% significance level.

This may be because that compared to private or foreign-funded enterprises, state-owned enterprises have larger technological capability. They usually possess stronger financial resources to make large-scale R&D investments. In contrast, non state-owned enterprises often lack of funding to invest new technologies. At the same time, state-owned enterprises have more access to policy support, such as financial subsidies, leading to lower operational risks. As a result, state-owned enterprises could more proactively implement measures to address climate risk issues with sufficient financial support and technological capability.

4.3.2 Different financial constraints

We measure the financial constraints based on the SA index proposed by (Hadlock and Pierce, 2010), which is calculated based on two variables, firm size (SIZE) and firm age (AGE). This index is defined as follows:

The smaller value of SA index means lower financial constraint. In our study, the median of SA index is taken as the critical point for classification of financial constraints.

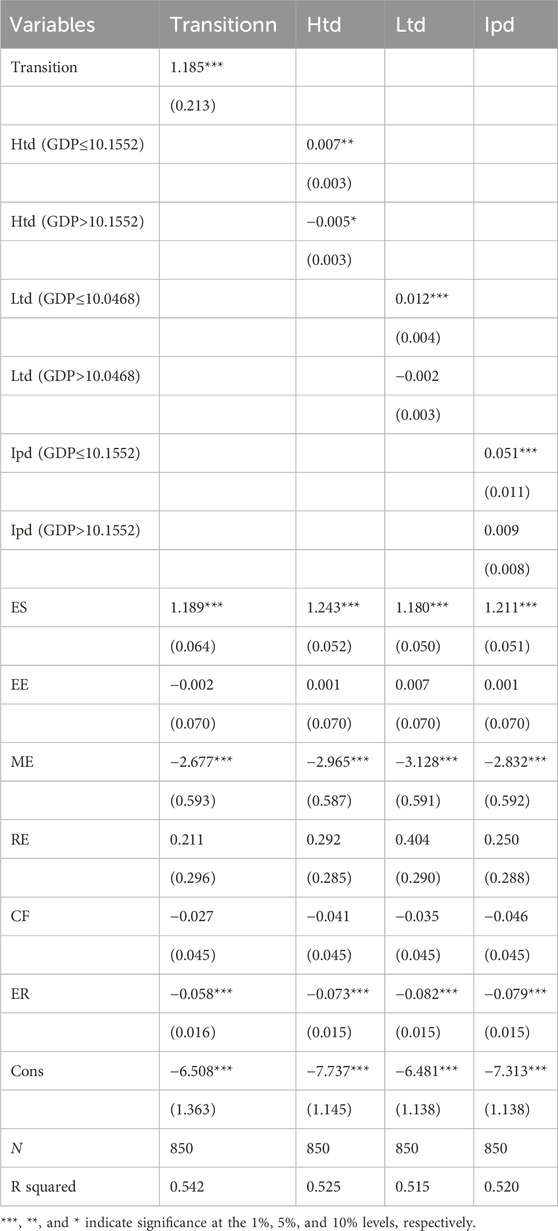

The analysis results about the effects of climate risks on the renewable energy investment for firms with high financial constraints are shown in Table 9. Both transition risk and indicators of physical risks have threshold effects on the investment of renewable energy firms with high financial constraints. The transition risk has a positive impact on renewable energy investments at the 1% significance level only when GDP is within the threshold value. For physical risks, only indicator of high temperature days has a significantly negative correlation with renewable energy firms’ investments when GDP is larger than the threshold value.

The analysis results about the effects of climate risks on the renewable energy investment for firms with low financial constraints are shown in Table 10. There exist no threshold effects on the investment of renewable energy firms from any indicator of climate risks. Transition risk is positively correlated with the investments of renewable energy firms with low financial constraints at the 1% significance level. For physical risks, the indicators of extreme low temperature days and extreme precipitation days have significantly positive effects on the investments of renewable energy enterprises with low financial constraints.

4.3.3 Different locations

The enterprises are divided into two groups according to the region where the enterprises locate. One group is the eastern region, while the other group include both central and western region. The estimation results for the eastern region are shown in Table 11, which indicate that only extreme precipitation days has a threshold effect on renewable energy investment of the firms in the eastern region. There exists a positive relationship between transition risk and renewable energy investments of the firms in the eastern region at the 5% significance level. For physical risk, there exist no significant effects on the investments of renewable energy enterprises in the eastern region.

The estimation results for the group of enterprises in central and western region are shown in Table 12, which shows that all three indicators of physical risks have threshold effects on the investments of renewable energy firms in the central and western region. Transition risk has significant positive effect on the investment of renewable energy enterprises in this region, which is stronger than the eastern region. When GDP is less than the threshold value, the coefficients of all three indicators of physical risks are significantly positive, however none of the coefficients are significant at 5% level when GDP is greater than the threshold. Generally, renewable energy investment is more sensitive to the impact of climate risk in the central and western region than in the eastern region.

5 Conclusions and discussion

Our study employs A-share listed renewable energy enterprises in China as the research sample to explore the impacts of climate risks on the investments of renewable energy enterprises from 2008 to 2022. The study results illustrate that there exist positive impacts of transition risks on the business investments of renewable energy enterprises. The impacts from physical risks on investments of renewable energy enterprises are not consistent among different indicators, while only extreme precipitation days show positively impacts.

Moreover, there exist a single threshold effect of the relationship with economic development level. While transition risks have significant effects at all the levels, physical risks only have significant effects when the level of economic development is lower than the threshold value. The reason could be that the enterprises in the economic well-developed regions could already have the stable policy environment and advanced technologies, which make the enterprises have less pressure to take urgent investment decisions in face of climate risks. However, the extreme weather events may increase the social awareness of the enterprises in low economic developed regions to replace traditional energy sources with renewable energy, which would promote investors’ interests in renewable energy projects.

The study results also show the heterogeneity for the impact of climate risks between different groups. Climate risks only influence the investment decisions of state-owned enterprises, while the physical risks have the significant positive effects on state-owned enterprises’ investments only in less developed regions. The reason could be that state-owned enterprises are more concerned about environmental issues compared with private or foreign enterprises. State-owned enterprises are able to effectively implement government support policies, while they usually have stable of capital and financial resources to take effective measures against climate risks.

There also exist heterogeneity for the impacts of climate risks between high financial constraints and low financial constraints groups. Climate risk has a significant impact on investments in renewable energy firms with low financing constraints, while only transition risk having a positive impact on investments of firms with high financial constraints when the level of economic development is below the threshold. Because firms with low financial constraints have adequate financial resources and higher risk tolerance, allowing them to adjust their investment strategies more flexibly to meet the challenges and opportunities posed by extreme weather. Whereas renewable energy firms with high financial constraints are more sensitive to the government support and environmental policies, therefore they only change their investment strategies in response to transition risks.

Moreover, transition risks have significant impacts on renewable energy enterprises’ investments in both the eastern, central and western region, however physical risk only show significant impacts in central and western region when the level of economic development is lower than the threshold. This could be because the climatic conditions in the central and western regions are more complex than in the eastern region, with more extreme weather events. The renewable energy business in the central and western regions does not have well-established business infrastructure, which are more sensitive to climate risks and need the support of government policy.

We make the following recommendations based on the theoretical assumptions and empirical results. Firstly, the government need to improve the disclosure of climate risks and build up standards measures, which could help the enterprises to adjust their business management strategies. Secondly, the government should provide financial subsidies to attract more financial capital into renewable energy sector, while strengthen the construction of business infrastructure for renewable energy sector, especially in economic less developed regions. Moreover, the financial institutions should provide policy supports to reduce the financing constraints of renewable energy enterprises, which would be helpful to promote the renewable energy industry to cope with climate risks.

This study has several limitations. First, there are other factors that can influence investments in renewable energy firms, which may limit the applicability of the findings to other contexts. Future research could apply dynamic panel threshold model to estimate both the long-run and short-run coefficients for the explanatory variables which allow us to better understand the causal mechanisms. In addition, we could apply our analysis to specific sectors of renewable energy industry in further analysis, such as solar or hydropower industry, which could help to check the different impacts from climate risks on these sectors.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

XL: Project administration, Methodology, Writing – review and editing, Funding acquisition, Conceptualization, Investigation, Writing – original draft, Resources, Supervision. ZZ: Software, Writing – original draft, Formal Analysis, Visualization, Methodology, Writing – review and editing, Data curation, Validation. HL: Supervision, Investigation, Writing – original draft, Conceptualization, Funding acquisition, Writing – review and editing, Data curation, Project administration, Resources.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by the Fundamental Research Funds for the Central Universities, China, grant number 3132024285, and Dalian Federation of Social Sciences, grant number 2024dlskzd096.

Acknowledgments

The authors would like to thank reviewers and editors.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abban, A. R., and Hasan, M. Z. (2021). Revisiting the determinants of renewable energy investment - new evidence from political and government ideology. Energy Policy 151, 112184. doi:10.1016/j.enpol.2021.112184

Adu, D. A., and Roni, N. N. (2024). Bank climate change initiatives, ownership structures, and corporate governance mechanisms: evidence from emerging economies. Bus. Strategy Environ. 33 (4), 3039–3077. doi:10.1002/bse.3640

Aguirre, M., and Ibikunle, G. (2014). Determinants of renewable energy growth: a global sample analysis. Energy Policy 69, 374–384. doi:10.1016/j.enpol.2014.02.036

Akintande, O. J., Olubusoye, O. E., Adenikinju, A. F., and Olanrewaju, B. T. (2020). Modeling the determinants of renewable energy consumption: evidence from the five most populous nations in Africa. Energy 206, 117992. doi:10.1016/j.energy.2020.117992

Alam, M. M., and Murad, M. W. (2020). The impacts of economic growth, trade openness and technological progress on renewable energy use in organization for economic co-operation and development countries. Renew. Energy 145, 382–390. doi:10.1016/j.renene.2019.06.054

Amiraslani, H., Lins, K. V., Servaes, H., and Tamayo, A. (2023). Trust, social capital, and the bond market benefits of ESG performance. Rev. Account. Stud. 28 (2), 421–462. doi:10.1007/s11142-021-09646-0

An, Y., Liu, N., Zhang, L., and Zheng, H. (2022). Adapting to climate risks through cross-border investments: industrial vulnerability and smart city resilience. Clim. Change 174 (1), 10. doi:10.1007/s10584-022-03431-x

Aquilas, N. A., and Atemnkeng, J. T. (2022). Climate-related development finance and renewable energy consumption in greenhouse gas emissions reduction in the Congo basin. Energy Strategy Rev. 44, 100971. doi:10.1016/j.esr.2022.100971

Battiston, S., Dafermos, Y., and Monasterolo, I. (2021). Climate risks and financial stability. J. Financial Stab. 54, 100867. doi:10.1016/j.jfs.2021.100867

Bolton, P., and Kacperczyk, M. (2021). Do investors care about carbon risk? J. Financial Econ. 142 (2), 517–549. doi:10.1016/j.jfineco.2021.05.008

Dutta, A., Bouri, E., Rothovius, T., and Uddin, G. S. (2023). Climate risk and green investments: new evidence. Energy 265, 126376. doi:10.1016/j.energy.2022.126376

Egli, F. (2020). Renewable energy investment risk: an investigation of changes over time and the underlying drivers. Energy Policy 140, 111428. doi:10.1016/j.enpol.2020.111428

Feng, H., and Li, Y. (2024). The role of fintech, natural resources, environmental taxes and urbanization on environmental sustainability: evidence from the novel panel data approaches. Resour. Policy 92, 104970. doi:10.1016/j.resourpol.2024.104970

Ghosh, S., and Kanjilal, K. (2020). Non-fossil fuel energy usage and economic growth in India: a study on non-linear cointegration, asymmetry and causality. J. Clean. Prod. 273, 123032. doi:10.1016/j.jclepro.2020.123032

Guliyev, H. (2023). Nexus between renewable energy and economic growth in G7 countries: new insight from nonlinear time series and panel cointegration analysis. J. Clean. Prod. 424, 138853. doi:10.1016/j.jclepro.2023.138853

Guo, K., Ji, Q., and Zhang, D. (2024). A dataset to measure global climate physical risk. Data Brief 54, 110502. doi:10.1016/j.dib.2024.110502

Gupta, R., and Pierdzioch, C. (2022). Climate risks and forecastability of the realized volatility of gold and other metal prices. Resour. Policy 77, 102681. doi:10.1016/j.resourpol.2022.102681

Hadlock, C. J., and Pierce, J. R. (2010). New evidence on measuring financial constraints: moving beyond the KZ index. Rev. Financial Stud. 23 (5), 1909–1940. doi:10.1093/rfs/hhq009

Hansen, B. E. (1999). Threshold effects in non-dynamic panels: estimation, testing, and inference. J. Econ. 93 (2), 345–368. doi:10.1016/s0304-4076(99)00025-1

He, X., Khan, S., Ozturk, I., and Murshed, M. (2023). The role of renewable energy investment in tackling climate change concerns: environmental policies for achieving SDG-13. Sustain. Dev. 31, 1888–1901. doi:10.1002/sd.2491

Huang, L., and Lei, Z. (2021). How environmental regulation affect corporate green investment: evidence from China. J. Clean. Prod. 279, 123560. doi:10.1016/j.jclepro.2020.123560

Ji, C.-J., Hu, Y.-J., and Tang, B.-J. (2018). Research on carbon market price mechanism and influencing factors: a literature review. Nat. Hazards 92 (2), 761–782. doi:10.1007/s11069-018-3223-1

Juhola, S., Laurila, A. G., Groundstroem, F., and Klein, J. (2023). Climate risks to the renewable energy sector: assessment and adaptation within energy companies. Bus. Strategy Environ. 33 (3), 1906–1919. doi:10.1002/bse.3580

Kim, S. K., and Park, S. (2023). Impacts of renewable energy on climate vulnerability: a global perspective for energy transition in a climate adaptation framework. Sci. Total Environ. 859, 160175. doi:10.1016/j.scitotenv.2022.160175

Krueger, P., Sautner, Z., and Starks, L. T. (2020). The importance of climate risks for institutional investors. Rev. Financial Stud. 33 (3), 1067–1111. doi:10.1093/rfs/hhz137

Li, Q., Shan, H., Tang, Y., and Yao, V. (2024). Corporate climate risk: measurements and responses. Rev. Financial Stud. 37 (6), 1778–1830. doi:10.1093/rfs/hhad094

Lin, B., and Xie, Y. (2024). Impact assessment of digital transformation on the green innovation efficiency of China's manufacturing enterprises. Environ. Impact Assess. Rev. 105, 107373. doi:10.1016/j.eiar.2023.107373

Lin, B., and Zhu, J. (2019). Determinants of renewable energy technological innovation in China under CO2 emissions constraint. J. Environ. Manag. 247, 662–671. doi:10.1016/j.jenvman.2019.06.121

Liu, F., Kang, Y., Guo, K., and Sun, X. (2021). The relationship between air pollution, investor attention and stock prices: evidence from new energy and polluting sectors. Energy Policy 156, 112430. doi:10.1016/j.enpol.2021.112430

Love, I. (2003). Financial development and financing constraints: international evidence from the structural investment model. Rev. Financial Stud. 16 (3), 765–791. doi:10.1093/rfs/hhg013

Naeem, K., and Li, M. C. (2019). Corporate investment efficiency: the role of financial development in firms with financing constraints and agency issues in OECD non-financial firms. Int. Rev. Financial Analysis 62, 53–68. doi:10.1016/j.irfa.2019.01.003

Naeem, M. A., Farid, S., Ferrer, R., and Shahzad, S. J. H. (2021). Comparative efficiency of green and conventional bonds pre- and during COVID-19: an asymmetric multifractal detrended fluctuation analysis. Energy Policy 153, 112285. doi:10.1016/j.enpol.2021.112285

Pankratz, N., Bauer, R., and Derwall, J. (2023). Climate change, firm performance, and investor surprises. Manag. Sci. 69 (12), 7352–7398. doi:10.1287/mnsc.2023.4685

Rasoulinezhad, E., and Taghizadeh-Hesary, F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Effic. 15 (2), 14. doi:10.1007/s12053-022-10021-4

Soergel, B., Kriegler, E., Bodirsky, B. L., Bauer, N., Leimbach, M., and Popp, A. (2021). Combining ambitious climate policies with efforts to eradicate poverty. Nat. Commun. 12 (1), 2342. doi:10.1038/s41467-021-22315-9

Soto, G. H., Nghiem, X.-H., and Martinez-Cobas, X. (2025). Analyzing the role of main energy transition policies upon renewable energy penetration in the EU: an assessment of energy productivity and low carbon economies. Environ. Sustain. Indic. 25, 100573. doi:10.1016/j.indic.2024.100573

Urban, F. (2018). China's rise: challenging the North-South technology transfer paradigm for climate change mitigation and low carbon energy. Energy Policy 113, 320–330. doi:10.1016/j.enpol.2017.11.007

Vukicevic, J., Fallon, G., and Ott, U. F. (2021). A theoretical and empirical investigation into investment activities of technologically-intensive Chinese state-owned enterprises in the UK. Int. Bus. Rev. 30 (1), 101763. doi:10.1016/j.ibusrev.2020.101763

Wang, B., Wang, Q., Wei, Y.-M., and Li, Z.-P. (2018). Role of renewable energy in China’s energy security and climate change mitigation: an index decomposition analysis. Renew. Sustain. Energy Rev. 90, 187–194. doi:10.1016/j.rser.2018.03.012

Wang, L., Ali, A., Ji, H., Chen, J., and Ni, G. (2023). Links between renewable and non-renewable energy consumption, economic growth, and climate change, evidence from five emerging Asian countries. Environ. Sci. Pollut. Res. 30 (35), 83687–83701. doi:10.1007/s11356-023-27957-4

Wang, Q., and Fan, Z. (2023). Green finance and investment behavior of renewable energy enterprises: a case study of China. Int. Rev. Financial Analysis 87, 102564. doi:10.1016/j.irfa.2023.102564

Wu, N., Xiao, W., Liu, W., and Zhang, Z. (2022). Corporate climate risk and stock market reaction to performance briefings in China. Environ. Sci. Pollut. Res. Int. 29 (35), 53801–53820. doi:10.1007/s11356-022-19479-2

Wu, Y., and Tian, Y. (2022). The price of carbon risk: evidence from China’s bond market. China J. Account. Res. 15 (2), 100245. doi:10.1016/j.cjar.2022.100245

Xie, Q., Hao, J., Li, J., and Zheng, X. (2022). Carbon price prediction considering climate change: a text-based framework. Econ. Analysis Policy 74, 382–401. doi:10.1016/j.eap.2022.02.010

Xiong, Y., and Dai, L. (2023). Does green finance investment impact on sustainable development: role of technological innovation and renewable energy. Renew. Energy 214, 342–349. doi:10.1016/j.renene.2023.06.002

Yang, S., Li, S., and Pan, Z. (2022). Climate transition risk of financial institutions: measurement and response. Appl. Econ. Lett. 30, 2439–2449. doi:10.1080/13504851.2022.2097630

Yang, S., and Park, S. (2020). The effects of renewable energy financial incentive policy and democratic governance on renewable energy aid effectiveness. Energy Policy 145, 111682. doi:10.1016/j.enpol.2020.111682

Yang, X., He, L., Xia, Y., and Chen, Y. (2019). Effect of government subsidies on renewable energy investments: the threshold effect. Energy Policy 132, 156–166. doi:10.1016/j.enpol.2019.05.039

Yang, X., He, L., Zhong, Z., and Wang, D. (2020). How does China's green institutional environment affect renewable energy investments? The nonlinear perspective. Sci. Total Environ. 727, 138689. doi:10.1016/j.scitotenv.2020.138689

Zhang, D., Mohsin, M., Rasheed, A. K., Chang, Y., and Taghizadeh-Hesary, F. (2021). Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153, 112256. doi:10.1016/j.enpol.2021.112256

Zhang, S. Y. (2022). Are investors sensitive to climate-related transition and physical risks? Evidence from global stock markets. Res. Int. Bus. Finance 62, 101710. doi:10.1016/j.ribaf.2022.101710

Keywords: climate risk, renewable energy, investment behavior, threshold effect, transition risk

Citation: Li X, Zheng Z and Li H (2025) The impact of climate risk on renewable energy investments. Front. Environ. Sci. 13:1614968. doi: 10.3389/fenvs.2025.1614968

Received: 20 April 2025; Accepted: 29 May 2025;

Published: 13 June 2025.

Edited by:

Lin Zhang, City University of Hong Kong, ChinaReviewed by:

Ma Lihua, Hebei University, ChinaZhi Li, Hebei University, China

Wenjing Yu, Shandong Technology and Business University, China

Copyright © 2025 Li, Zheng and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Haixia Li, bGloeDExOUAxNjMuY29t

Xiaoshu Li

Xiaoshu Li Haixia Li

Haixia Li