- College of Economics and Management, Northeast Agricultural University, Harbin, Heilongjiang, China

Introduction: Enterprise innovation in low-carbon technology is essential for achieving carbon peak and neutrality goals. A thorough understanding of the evolutionary dynamics among the government, financial institutions, and enterprises is key to fostering low-carbon technology innovation.

Methods: This paper develops an evolutionary game model involving the government, financial institutions, and enterprises engaged in low-carbon production and uses MATLAB to simulate evolutionarily stable strategies under different conditions. This approach enhances the understanding of stakeholder conflicts in low-carbon production, strengthens the dual regulatory framework, encourages enterprises to innovate in low-carbon technologies, and explores the interactions among these stakeholders.

Results: When the government implements green economic policies, financial institutions develop innovative green financial products to provide green financial services, enterprises engage in low-carbon technology innovation, and the system reaches an optimal evolutionary state. Under dual regulation, enterprise income and the initial willingness of the government and financial institutions to participate significantly influence enterprise behavior. The government should regulate enterprises’ operating risk coefficient and the feedback coefficient of low-carbon technology innovation on social welfare, ensuring that they remain within reasonable limits, thus motivating enterprises to pursue low-carbon innovation and implement low-carbon production practices. Moderate government incentives and penalties can motivate enterprises to pursue low-carbon innovations, with subsidies proving more effective than taxes in reducing rent-seeking behavior that exploits green financial dividends.

Discussion: This study provides effective strategies and insights for promoting low-carbon technology innovation with stakeholder participation and offers policy recommendations for strengthening the dual regulatory system.

1 Introduction

The rapid expansion of the global economy has resulted in a significant rise in greenhouse gas emissions, which in turn has an impact on global climate change. As a key driver of economic growth, the manufacturing sector is often associated with “high pollution and high emissions.” China, as the world’s largest manufacturing hub and a major carbon emitter, accounted for 26.16% of global carbon emissions in 2022, exerting a substantial influence on global carbon emission levels. In particular, manufacturing enterprises consumed approximately 3.07 billion tons of standard coal, representing 56.2% of total energy consumption. While contributing 27.7% to China’s GDP, this sector generates over 50% of the country’s carbon emissions. This high emissions and high energy consumption pattern harms China’s sustainability goals and contradicts the national aspiration to achieve dual carbon targets (Zhang et al., 2024). As the world faces the pressing challenges of energy sustainability and environmental degradation, promoting low-carbon technologies has become a leading priority for governments worldwide (Wang J. et al., 2024).

Enterprises, as the primary drivers of economic growth, should prioritize the integration of low-carbon technologies into their production processes to reduce carbon emissions (Kang et al., 2019; Rao et al., 2023). The use of LCT (Low-carbon technology) enhances energy efficiency, reduces greenhouse gas emissions, and supports domestic green innovation and emission reduction targets (Deng et al., 2021b; Cobbold et al., 2024). LCT achieves this through innovations in technology, management, and practices (Zhou F. et al., 2024). The advancement of low-carbon technologies has reduced per capita carbon emissions, stimulated economic growth, and driven the steady expansion of the low-carbon market (Duarte et al., 2018). Ali et al. (2024) suggested that fostering the trade of environmentally sustainable products and encouraging innovation in LCT through the optimization of green market structures can further promote these technologies. Low-carbon technology innovation (LCTI) improves energy efficiency and resource allocation to lower carbon emissions. This helps enterprises overcome green transformation challenges and addresses energy and environmental challenges, contributing to sustainable economic development (Zhao et al., 2023).

Existing research has demonstrated that various stakeholders, including governmental bodies and financial institutions, significantly influence enterprises’ innovative behaviors regarding low-carbon technologies. On the one hand, as the main regulator of the market economy, the government imposes limits on enterprises’ carbon emissions (Nyambuu and Semmler, 2020; Sun et al., 2022). The implementation of the government’s “incentive policy” can significantly improve urban environmental quality while promoting sustainable economic growth (Ma et al., 2024). Strict government regulations can enhance cooperation between manufacturers and suppliers, facilitating the achievement of carbon reduction targets more rapidly (Wei et al., 2024a). Strengthening environmental governance and augmenting government innovation subsidies can significantly promote green innovation among both environmentally sustainable enterprises and traditional polluting industries (Cao and Yu, 2024). An effective regulatory strategy can notably encourage manufacturers to adopt low-carbon technologies, thereby assisting enterprises in reducing carbon emissions (Xu A. et al., 2023). Increasing incentives is conducive to increasing the likelihood that enterprises will opt for green innovation (Wang et al., 2011; Deng et al., 2021a). However, government regulation still faces inherent constraints in influencing manufacturing firms to adopt low-carbon technologies. Solely relying on government oversight may prove insufficient, as it could incentivize businesses to engage in rent-seeking behaviors and foster collusion or fraudulent activities among local authorities. On the other hand, financial institutions providing green financial services to low-carbon production enterprises also consider the carbon-reduction practices of these businesses (Sun and Qu, 2023; Wu X. et al., 2024). The increasing consumer preference for low-carbon products presents new development opportunities for enterprises. Consequently, the demand for green finance has emerged as a critical factor influencing corporate decision-making and is increasingly recognized as an essential strategy for companies pursuing low-carbon technology innovation (Nie et al., 2016; Li et al., 2018; Zhou and Li, 2019). Chen Y. et al. (2024) emphasize the pivotal role of green finance in fostering sustainable green transformation and driving technological innovation within industrial enterprises. By issuing green credit to promote cleaner production, enhance the efficiency of green technology innovation, and optimize energy consumption structures, financial institutions can effectively drive the eco-friendly transformation of economic structures and achieve sustainable green economic growth. Green credit, as a financial instrument aimed at supporting China’s carbon neutrality goals, is identified as one of the critical indicators of bank performance (Chen G. et al., 2024). This innovative financial service (Chen D. et al., 2024) is designed to assist companies in green sectors, including environmental protection, energy conservation, carbon reduction, and renewable energy, while also fostering green innovation (Tseng et al., 2013). Su et al. (2023) argue that green credit serves as a powerful mechanism for fostering innovation within corporations. The government seeks to promote low-carbon production by encouraging financial institutions to offer green financial services to enterprises (Yan and Gong, 2024). Dong and Yu (2024a) assert that the liberalization of China’s bond market has a significant impact on the financial environment. Furthermore, they emphasize that the issuance of green bonds has substantially improved the quantity and quality of green innovations undertaken by enterprises (Dong and Yu, 2024b). Consequently, financial institutions must oversee and encourage enterprises to actively implement LCT in coordination with government regulations.

Multiparty oversight involving financial institutions and governmental bodies can reduce the regulatory burden on governments while promoting low-carbon production. Although the current literature focuses primarily on the government regulation of low-carbon technologies, it seldom explores the efficacy of a multisupervisory approach. This study, therefore, explores the implementation of a multisupervisory strategy for LCT by enterprises. It specifically focuses on the underexplored role of financial institutions in delivering green financial services. Additionally, enterprises not only receive funding from these institutions but also operate within politically influenced frameworks. Considering that enterprises might engage in rent-seeking to access green financial services, this study incorporates rent-seeking costs into an evolutionary game model. This model helps analyze the strategic choices of three stakeholders while accounting for such behavior. This study seeks to answer several critical questions: (1) What is the evolutionary process of participants’ oversight and adoption of low-carbon technologies? (2) Can financial institutions and governmental regulation motivate manufacturers to adopt low-carbon technologies? (3) How do the monitoring behaviors among multiple stakeholders interact, and what are the effects of key parameters on their monitoring strategies concerning low-carbon technologies?

The rest of the paper is structured as follows. The evolutionary game model is developed in the subsequent section. Section 3 elaborates on the interaction mechanism among the three stakeholders and outlines the key assumptions underpinning the evolutionary game model. Section 4 presents the equilibrium analysis of the model and the analytical results for the evolutionarily stable strategies (ESSs) of the tripartite stakeholders. Section 5 presents a numerical analysis of the ESSs, as well as the potential driving factors influencing these strategies. Section 6 discusses the results and their policy implications. Finally, the paper concludes by outlining its limitations.

2 Literature review

2.1 Low-carbon technology innovation

Low-carbon technology innovation (LCTI) plays a crucial role in reducing carbon emissions (Shi et al., 2021; Gu et al., 2024; Wei et al., 2024b). LCTI serves as a crucial component in advancing sustainable and environmentally responsible business practices (Xu and Liu, 2024; Li Y. et al., 2024). LCTI optimizes energy use and improves resource allocation to lower carbon emissions. This eases the burden of green transformation for enterprises, addresses energy and environmental challenges, and supports sustainable economic growth (Qi et al., 2021; Chi et al., 2022).

Prior research has indicated that government interventions at the policy level, including financial incentives, regulatory sanctions, and carbon trading schemes, are essential for driving corporate innovation in low-carbon technologies (Wang and Chen, 2024). The literature focuses primarily on the influence of individual enterprises’ positioning, low-end enterprises within the supply chain, and financial institutions on their inclination toward green financial services. Concurrently, scholars should focus more on the crucial role played by financial institutions. To address this disparity, some scholars have explored factors pertaining to financial institutions, such as banking competition and credit financing (Liu and Zhao, 2024). Kong et al. (2024) emphasized that financial development fosters corporate green technology innovation. However, most studies rely on linear regression to analyze enterprise behavior in low-carbon technology innovation (Zhao et al., 2024).

2.2 Regulatory mechanisms and their functions

Several scholars have examined the regulation of governments, financial institutions, and third parties from both static and dynamic perspectives. Wang W. et al. (2024) examined the strategic behaviors and interactions of governments, construction enterprises, and financial institutions in advancing carbon emission reduction (CER) by integrating regulatory and market-driven mechanisms. By formulating an evolutionary game model involving the government, cold chain logistics enterprises, and financial institutions, Wu R. et al. (2024) explored how environmental regulatory policies and green credit influence the improvement of low-carbon operational efficiency in cold chain logistics enterprises. A study by Guo et al. (2022) used various recycling structural models to assess how government regulations influence corporate efforts to reduce carbon emissions. Additionally, Zhang et al. (2023) proposed a tripartite evolutionary game model that includes the government, enterprises, and energy regulatory service centers (ESCs). They examined the influence of government subsidies on promoting independent innovation within photovoltaic enterprises. Similarly, Cui et al. (2020) and Xu J. et al. (2023) developed an evolutionary game model that incorporates four key stakeholders: the government, financial institutions, enterprises, and consumers. Their study demonstrated that the robustness of the green financial system positively influences sustainable development and clean production. Chen et al. (2021) explored the influence of government oversight on enterprise behavior via a two-party evolutionary game theory framework. Li Q. et al. (2024) explored the impact of government incentives and constraint mechanisms on carbon offset and carbon neutrality through an evolutionary game model incorporating local governments, tourism enterprises, and tourists. Although numerous scholars have utilized evolutionary game models to explore the effects of regulatory mechanisms imposed by governments and financial institutions on enterprises or consumers, there exists a limited body of research that specifically examines the impact of collaborative governance between these entities on enterprises’ low-carbon technological innovation. This is particularly true regarding the behaviors exhibited during the financing process for low-carbon production.

2.3 Application of the tripartite evolutionary game

Several researchers have increasingly employed tripartite evolutionary game theory to depict and simulate stakeholder decision-making processes as well as conflict resolution strategies. Evolutionary games underscore dynamic equilibrium, rendering them more realistic. In the field of low-carbon technology innovation, Shi et al. (2023) and Zhou W. et al. (2024) applied tripartite evolutionary game theory to analyze the dynamic evolution process. The interactions among governments, financial institutions, and businesses are influenced by both internal and external factors. These stakeholders can ascertain an optimal strategy only through prolonged engagement; however, it remains unclear how their interactions will unfold or what implications they may hold for curtailing corporate innovation in low-carbon technologies.

Numerous scholars have extensively engaged in theoretical studies on the tripartite evolutionary game, yielding a plethora of valuable findings across various research domains. Furthermore, tripartite evolutionary game theory is applicable to emergency supply chains (Zhang and Kong, 2022), as are green building supply chains and other contexts (Wan et al., 2021). A tripartite evolutionary game model encompassing governmental entities, blue carbon trading platforms, and news media is proposed. They suggested that news media could exert positive regulatory control over the platform. Pan et al. (2023) conducted an innovative study recognizing the role of third-party media in shaping local governments’ environmental regulations. They developed a four-party evolutionary game model involving the central government, local authorities, enterprises, and the public to improve environmental governance in China. Zhou et al. (2022) developed a tripartite evolutionary game model involving sewage enterprises, the government, and the public, incorporating spatial analysis into strategy evolution. Their findings emphasize the importance of a reward and punishment mechanism in pollution control, resulting in the creation of an effective framework (Fan et al., 2024).

The tripartite evolutionary game, involving the government, financial institutions, and enterprises as stakeholders, has been applied primarily to sectors such as agriculture (Luo et al., 2023), traditional manufacturing (Liu et al., 2024), and the green supply chain (Huo et al., 2024).

3 Construction of the evolutionary game model

3.1 Problem description

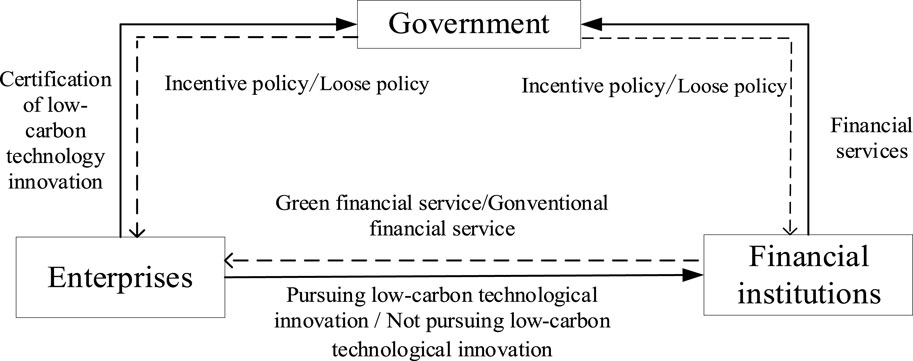

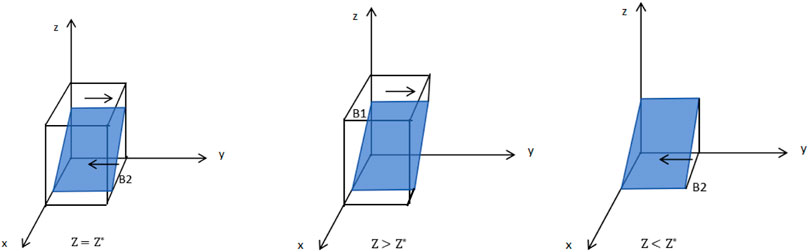

Governments, enterprises, and financial institutions are working together to advance carbon emission reduction efforts. Enterprises reduce their emissions to increase their corporate reputation but must strengthen their capacity for emission reduction by developing low-carbon technologies. However, the high costs of such efforts can dampen financial institutions’ enthusiasm, leading to reduced investment in low-carbon innovations. By implementing permanent policies, governments can incentivize positive behavior from enterprises and financial institutions. Given the high cost of regulation, governments may also opt for negative regulation. The production of low-carbon products by enterprises generates positive societal benefits. This study, therefore, assumes that the government’s strategic scope is to “encourage low-carbon production” and “let conventional production go unchecked.” Similarly, enterprises have the option to choose between “innovating in low-carbon technologies” or “not pursuing innovation in low-carbon technologies”. The strategic options for financial institutions are “green finance” and “conventional finance.”

Figure 1 illustrates the logical relationships among the participating entities within the tripartite evolutionary game model of low-carbon production in enterprises.

3.2 Basic assumptions

Hypothesis 1. The game involves the government, enterprises, and financial institutions as stakeholders; it is characterized by bounded rationality and operates under conditions of asymmetric information.

Hypothesis 2. The strategy space α = (α1,α2) = (innovating in low-carbon technologies, not pursuing innovation in low-carbon technologies), with α1 chosen with probability x and α2 chosen with probability (1-x), where x ϵ [0,1]; the strategy space of the financial institution is β = (β1,β2) = (green financial service, conventional financial service), with the probability of choosing β1 being y and the probability of choosing β2 being 1-y, where y ϵ [0,1]. The government department’s policy space is θ = (θ1,θ2) = (incentive policy, loose policy), with θ1 selected with a probability of z and θ2 selected with a probability of 1-z.

Hypothesis 3. The government regulates financial institutions and enterprise sectors through a variety of measures, including incentives and subsidies, to generate fiscal revenue and promote social welfare. Financial institutions provide financing to the enterprise sector and benefit from financing income as well as government subsidies. The enterprise sector pursues different strategies to achieve the benefits of innovation or noninnovation while also facing constraints from regulations and transformation costs.

Hypothesis 4. The government department income and loss variables W1 represent the social welfare obtained by the government from economic growth, employment, resource allocation, etc. a represents the positive outcomes of reputation enhancement and sustainable economic growth achieved by the government through encouraging financial institutions and the enterprise sector to actively engage in green financial activities, thereby facilitating the green and low-carbon transformation of the economic structure. b argues that insufficient government support for green production drives enterprises to opt for traditional methods, negatively affecting the government. m represents the feedback coefficient of the influence of low-carbon technology innovation on social welfare. K1 denotes government subsidies to low-carbon innovation enterprises. G1 refers to a tax imposed by the government on non-low-carbon technology innovative enterprises. K2 represents government subsidies provided to financial institutions offering green financial services. G2 represents the institutional constraint values imposed by the government on the “effectiveness” and potential “green-washing behavior” of financial institutions’ services, as evaluated through the “transparency of green credit assessments.” C0 stands for governmental regulation costs.

Hypothesis 5. Financial sector income and loss variables: N1 denotes the revenue generated by financial institutions from providing innovative green financial services, green products, intermediary fees, and other enterprise services. n represents the increase in the credit risk ratio due to the innovation of green financial services by financial institutions. U1 represents the revenue generated by the financial institution from providing traditional financial products (including credit risk). C1 encompasses costs associated with financial institutions’ innovation in green financial services, staff training, green product development, promotion, ancillary expenses, asset transfer losses, and related expenditures. f1 indicates that the provision of green financial services to support low-carbon technology innovators can result in indirect benefits such as increased market share, enhanced competitiveness, and greater social recognition.

Hypothesis 6. Profit and loss variables of enterprises: U2 represents the profits of enterprises engaged in low-carbon technology innovation. N2 represents the additional income gained from higher product sales and lower energy consumption and waste disposal costs achieved through low-carbon production. L denotes the probability of loss due to the enterprise’s failure to achieve the anticipated outcomes from low-carbon technology innovation. f2 signifies that enterprises opt for low-carbon technology innovation to obtain development prospects, improve social reputation, and obtain other indirect benefits. C2 represents the total expenses for technology development, equipment upgrades, and personnel involved in low-carbon technology innovation. F1 denotes the financial expenses incurred by enterprises while utilizing green financial services. F2 refers to the associated financial costs that enterprises are required to pay when accessing traditional financial services. S denotes the cost associated with rent-seeking behavior by companies not opting for low-carbon technology innovation to access green financial services.

3.3 Symbol description

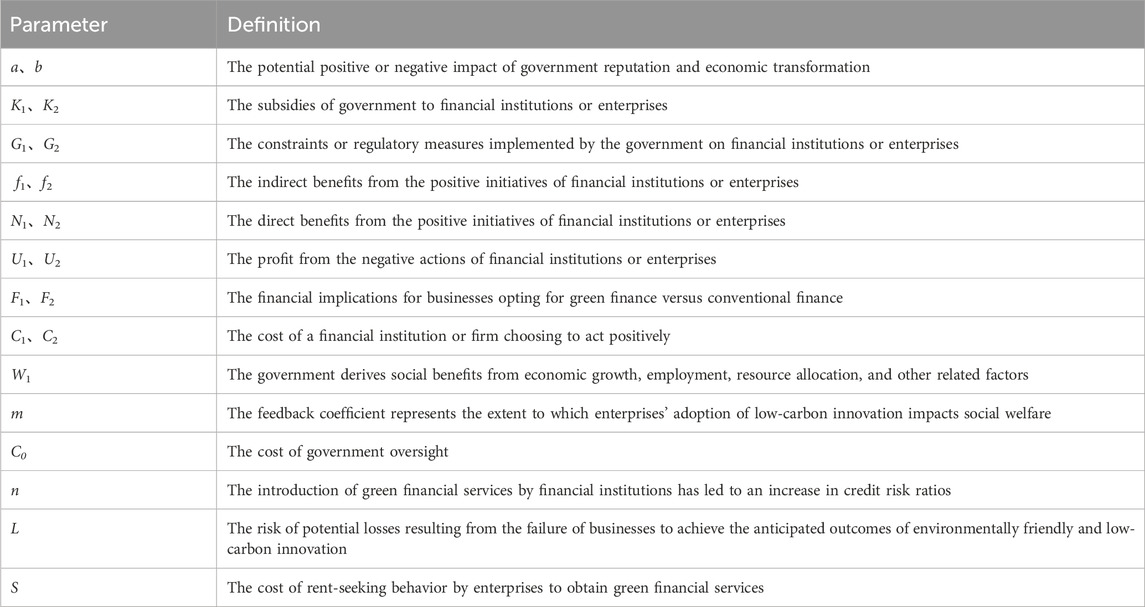

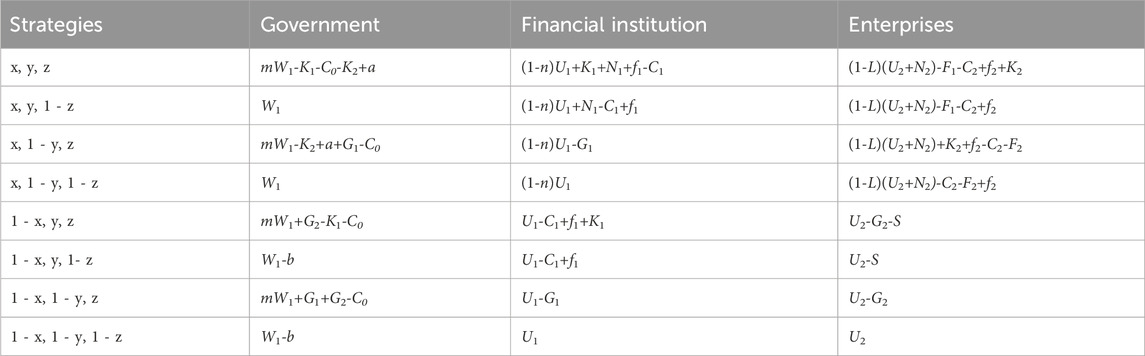

We set some relevant parameters and defined their meanings, as shown in Table 1.

3.4 Revenue matrix and replication dynamic equations

Table 2 presents the tripartite payoff matrix derived from the symbolic assumption outlined above. The analysis further explores the evolutionary stable strategies and various equilibria arising from the interactions among the three stakeholders.

4 Model analysis

4.1 Analysis of the strategic stability among three parties

4.1.1 The enterprises

The anticipated returns and average expected returns (E11, E12,

The replication dynamic equation for enterprises adopting the “low-carbon technological innovation” strategy is as (Equation 2) follows:

The first derivative with respect to x and the set G(y) are respectively defined as (Equations 3, 4) follows:

According to the stability theorem of differential equations, combined with existing academic research on structural equation models (Li et al., 2025), for an enterprise to maintain a stable state while adopting the “low-carbon technological innovation” strategy, the probability must satisfy the following condition:

Since

4.1.2 The financial institution

The anticipated returns

The replication dynamic equation for financial institutions’ adoption of the “green finance” strategy is as (Equation 6) follows:

The first derivative of y and the set Q(z) are as (Equations 7, 8) follows:

According to the stability theorem of differential equations, for financial institutions to maintain a stable state when adopting the “green finance” strategy, the following condition on probability must be satisfied:

4.1.3 The government

The expected returns, denoted as E31 and E32, along with the average expected returns

The replication dynamic equation of the government’s choice of the “incentive-based” strategy is as (Equation 10) follows:

The first derivative of z and the set K(y) are defined as (Equations 11, 12) follows:

According to the stability theorem of differential equations, and the academic analysis of the incentive ratio (Cheng et al., 2024), for the probability of the government adopting an “incentive-type” strategy to reach a stable state, the following conditions must be satisfied:

4.2 Tripartite evolutionary system equilibrium analysis

The Jacobi matrix for the tripartite evolutionary game system is expressed as (Equations 13-22) follows:

The replicator dynamic equations for the government, enterprises, and financial institutions are as (Equations 23-25) follows:

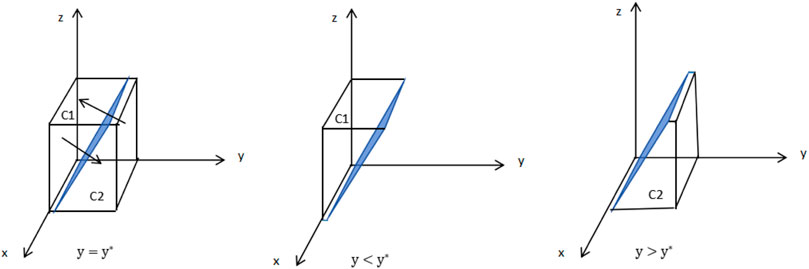

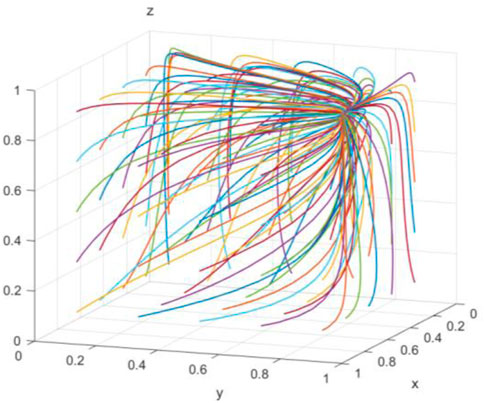

When the above equation satisfies F(x) = 0, F(y) = 0, and F(z) = 0, eight valid local equilibria are determined. At each equilibrium point, the three stakeholders adopt pure strategies to establish the domain boundary. E9 may also emerge as an equilibrium point within the domain but is ultimately excluded as it falls outside the domain. The stability of each of the eight equilibrium points is subsequently assessed via the Jacobi matrix. The evolutionary game model yields eight equilibrium points and eight potential ESSs. Table 3 illustrates the relationship between costs and benefits for each stakeholder, which largely influences the selection of an evolutionary stabilization strategy.

To maintain the general applicability of the stability analysis for the game evolution system, it is assumed that the parameters follow a set of constraints, namely, S + G1-C2-F1+ K1 + N2 + f2-N2 *L-U2 *L, G2 + K2-C1 + N1 + f1 and a-C0-b-K1-K2-W1+m*W1. In the context of green financial service development, the benefits derived from government regulation strategies, enterprises’ low-carbon technology innovation strategies, and financial institutions’ green financial service strategies are greater than those derived without such strategies. Given the complexity of the parameters involved in this model, we discuss stability strategies for evolutionary game models in four specific cases.

Scenario I: When G1 - C2 - F2 +K1 + N2 + f2 - N2*L - U2*L < 0 and K2 + G2- C1 + f1 < 0, the equilibrium points E2 (0, 0, 1) and E1 (0, 0, 0) represent stable strategies for the evolution of the tripartite game system, in which financial institutions do not engage in green financial services owing to a smaller sum of subsidies, constraints, and value-added benefits than the cost of low-carbon production and transition income. Additionally, when enterprises do not carry out low-carbon technology innovation, the benefit of financial institutions carrying out green financial services under government regulation is smaller than the basic benefit of not carrying out such services.

Scenario II: When G1 - C2 - F2 +K1 + N2 + f2 - N2*L - U2*L < 0 and K2 + G2- C1 + f1 > 0, the financial institutions fail to provide green financial services, and the sum of government regulation subsidies, taxes and value-added benefits to enterprises is less than the difference between enterprise low-carbon innovation costs and transformation benefits. In addition, when enterprises do not engage in low-carbon technology innovation, the benefits of the green financial services provided by financial institutions under government supervision are greater than the basic benefits when enterprises do not use green financial services. E8 is the equilibrium point, and {low-carbon technology innovation, green financial services, and incentives} represents the evolutionarily stable strategy of the tripartite game system.

Scenario III: When G1 - C2 - F2 +K1 + N2 + f2 - N2*L - U2*L > 0 and K2 + G2- C1 + f1 < 0, the financial institutions fail to provide green financial services and the total amount of subsidies and taxes and the value-added benefits from government regulations to enterprises surpass the gap between the cost of low-carbon innovation and their transition income. Furthermore, the benefit for financial institutions to offer green financial services when enterprises do not engage in low-carbon technology innovation is smaller than the basic benefit of not providing green financial services. E8 is the equilibrium point, and {low-carbon technology innovation, green financial services, and incentives} represents the equilibrium point and serves as an evolutionary and stable strategy within the tripartite game system.

Scenario Ⅳ: When G1 - C2 - F2 +K1 + N2 + f2 - N2*L - U2*L > 0 and K2 + G2- C1 + f1 > 0, the sum of subsidies, taxes, and value-added benefits of government regulations to enterprises exceeds the difference between the cost of low-carbon innovation and the transition income of enterprises when financial institutions do not provide green financial services. Furthermore, the net benefit of financial institutions providing green financial services in comparison to no green financial services is greater than the basic benefit. E8 is the equilibrium point, and {low-carbon technology innovation, green financial services, and incentives} represents the equilibrium point and evolutionarily stable strategy in the tripartite game system.

5 Numerical analysis

This section employs MATLAB 2016 for model simulation and analysis, highlighting the convergence patterns among the three parties and examining the impact of critical parameters on the ESSs. Firstly, in this study, based on real-world cases such as Guozhong Water and Power Investment Energy, the parameter G1 is set to 20. By referencing practical examples from Bank of China Financial Leasing Co., Ltd. and Ningbo Beilun Rural Commercial Bank, G2 is determined to be 30. Furthermore, considering the low-carbon production subsidy policies implemented in 15 provinces and municipalities including Shanghai, Zhejiang, Anhui, and Shandong, K1 is assigned a value of 10. Drawing upon specific instances like Jiujiang Bank’s “Digital Carbon Finance” product and Jiangsu Bank’s “Su Carbon Finance,” K2 is established at 20. Similarly, by referring to authoritative sources such as reference (He and Chen, 2021; Jiang et al., 2022; Duan and Li, 2023; Li and Li, 2023), the “China Statistical Yearbook,” and the “China Energy Statistical Yearbook,” and taking Company H as a case study, where H is a manufacturing enterprise with advanced engine remanufacturing technology and state-of-the-art production lines, the parameters in this study are assigned as follows:

N1 = 100, C1 = 50, f1 = 30, U2 = 20, N2 = 50, f2 = 30, C2 = 30, F1 = 20, F2 = 25, S = 15, L = 0.5, a = 120, b = 90, K1 = 10, G1 = 20, K2 = 20, G2 = 30, C0 = 5, and m = 0.5.

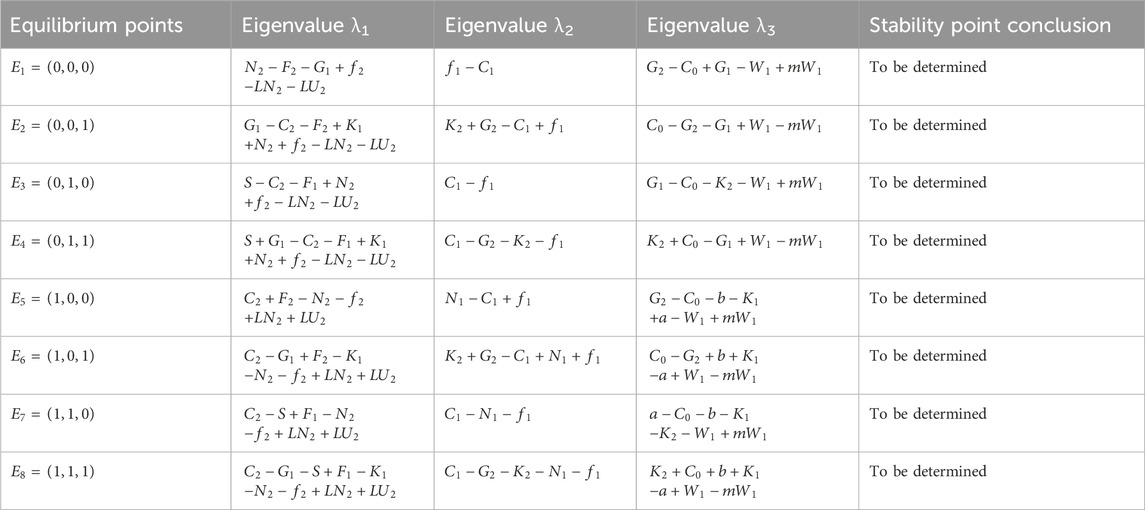

5.1 The impact of the initial probability of participants on the evolutionary game

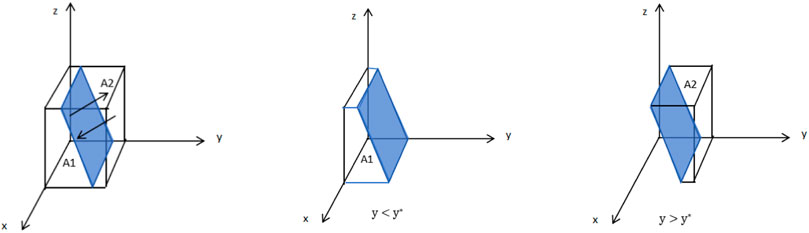

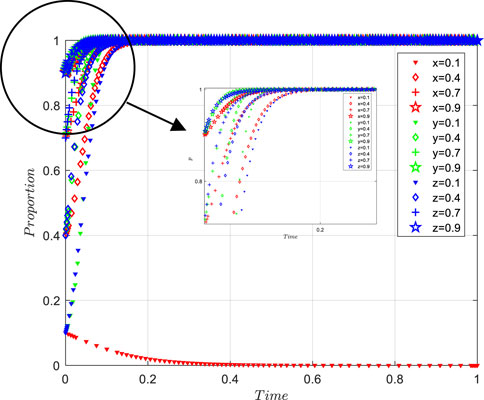

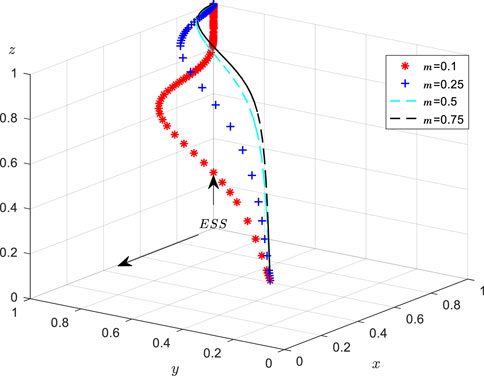

The X-axis in Figure 5 represents enterprises, the Y-axis represents financial institutions, and the Z-axis represents government departments. As the initial proportion increases, all enterprises eventually opt for the “low-carbon technology innovation” strategy. Similarly, as the number of evolutionary iterations increases, the strategic combinations of participants can be represented via three-dimensional stochastic graphs. Ultimately, the evolutionary path through which financial institutions select green financial services and governments promote green production decisions can be identified.

Figure 6 shows that x, y, and z tend toward 1, with the evolutionary equilibrium point approaching (1, 1, 1). When the three parties demonstrate minimal initial willingness, the rate at which z tends toward 1 is significantly higher than that of x and y. With a rise in the initial willingness of all three parties, the speed at which x and y approach 1 accelerates noticeably, whereas z’s convergence slows. The simulation results indicate that when the initial willingness of all three parties is weak, government regulation plays a crucial role in driving low-carbon technology innovation in enterprises and promoting green financial services provided by financial institutions. As the willingness of enterprises and financial institutions to participate increases, the government can appropriately reduce incentives and regulatory costs compared with previous measures, thereby promoting green enterprise transformation and fostering the development of green financial services.

5.2 The influence of government regulatory measures on evolutionary systems

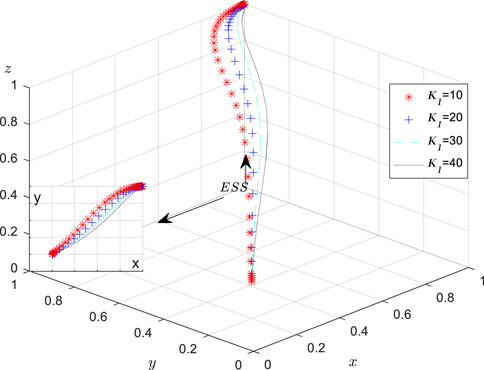

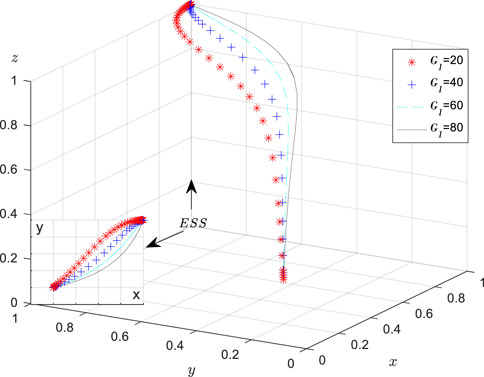

To investigate the influence of variations in K1 on the process and outcome of evolutionary games, the values of K1 were set to 10, 20, 30, and 40, respectively. Through simulation, the results after 50 iterations of the replicated dynamic equation system were observed, as specifically illustrated in Figure 7. To analyze the impact of changes in G1 on the game process and outcome, the values of G1 were set to 20, 40, 60, and 80, respectively. The corresponding simulation results are presented in Figure 8.

As depicted in Figure 7, during the evolution of the system toward a stable equilibrium point, an increase in government-provided incentive subsidies to enterprises accelerates the convergence rate of enterprises’ low-carbon production stability. Similarly, as shown in Figure 8, an increase in the taxation intensity for traditional production practices by enterprises enhances the speed at which enterprises adopt low-carbon production strategies. Moreover, as K1 and G1 increase, the likelihood of enterprises engaging in low-carbon production rises, while the probability of the government adopting incentive-based strategies diminishes. Furthermore, by comparing Figures 7, 8, it is evident that the effectiveness of government taxation in promoting low-carbon production exceeds that of government subsidies. Consequently, while the government employs subsidies and tax policies to encourage low-carbon production in enterprises, it must also reinforce supervision over these entities. In particular, for enterprises lacking mature low-carbon production technologies, the subsidy period can be appropriately extended to ensure the quality of low-carbon production and effectively promote sustainable enterprise development.

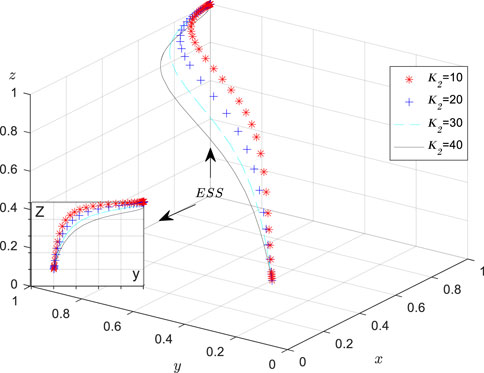

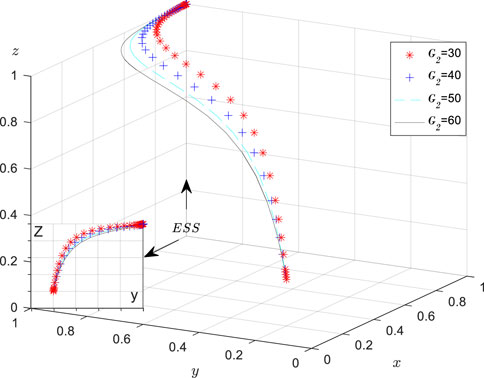

Next, set K2 = 10, 20, 30, 40 to investigate the impact of government subsidies on financial institutions. The results are presented in Figure 9. Additionally, set G2 = 30, 40, 50, 60 to analyze the influence of government regulation on the “transparency of green credit services” constraint value for financial institutions. The simulation outcomes are illustrated in Figure 10.

Figure 9 demonstrates that as K2 increases continuously, the likelihood of the government adopting incentive policies decreases, while the probability of financial institutions opting to implement green financial services increases. Similarly, as shown in Figure 10, with the rise of G2, the regulatory constraint imposed by the government on financial institutions becomes stricter, leading to a decline in the “transparency of green credit services,” which in turn elevates financial risks. Consequently, the feasibility and effectiveness of government regulation over green financial services improve. Therefore, the government should prudently design supervision and subsidy policies for financial institutions, enhance the regulatory framework, and encourage financial institutions to collaborate with the government in promoting low-carbon production among enterprises.

5.3 The impact of the low-carbon production feedback coefficient, operational risk, and rent-seeking costs on the evolutionary system

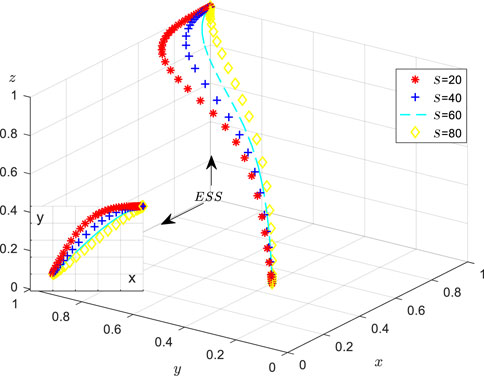

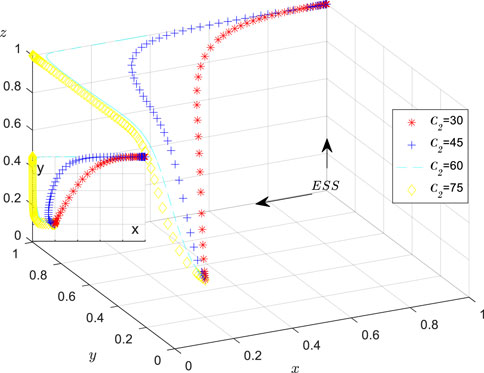

To analyze how changes in S affect the dynamics and results of the evolutionary game, S values of 20, 40, 60, and 80 were assigned. Figure 11 illustrates the simulation outcomes of the dynamic equations across 50 iterations. Similarly, to assess the impact of changes in C2 on the processes and outcomes of evolutionary games, C2 values of 30, 45, 60, and 75 were assigned. The corresponding simulation results are depicted in Figure 12.

Figure 11 shows that during the evolutionary process, as S increases, enterprises become increasingly likely to choose low-carbon technology innovation, whereas the probability of financial institutions selecting green financial services decreases. To increase the propensity for low-carbon production, the government can implement market-oriented measures such as increasing media transparency regarding corporate information, amplifying the social reputation of enterprises, raising consumer awareness of low-carbon initiatives, and increasing the rent-seeking costs associated with enterprise operations.

Figure 12 shows that as the system advances toward a stable state, lowering low-carbon production costs for enterprises can accelerate their shift to low-carbon technology innovation and increase financial institutions’ willingness to offer green financial products. As production costs for low-carbon manufacturing (C2) increase, enterprises become less likely to pursue low-carbon technology innovation. When C2 reaches a critical threshold, high costs may deter enterprises entirely from low-carbon technology innovation. Furthermore, the evolution from C2 = 30 to C2 = 45 indicates a greater likelihood of financial institutions opting for green financial services. However, when C2 increases to 60, due to the high costs of green production, financial institutions are no longer motivated to offer green financial services. Therefore, to encourage low-carbon production, the government must enforce strict oversight of enterprises’ green infrastructure development while simultaneously addressing prohibitively high low-carbon technology innovation costs that could undermine efficient green output. Additionally, financial institutions and enterprises adopting low-carbon practices should receive subsidies to support their transition. Relaxing price controls strategically could help reduce low-carbon production costs at the enterprise level and lower financing expenses from banks—thus shifting the motivation for low-carbon practices from compliance-driven (“having to do”) to initiative-driven (“wanting to do”).

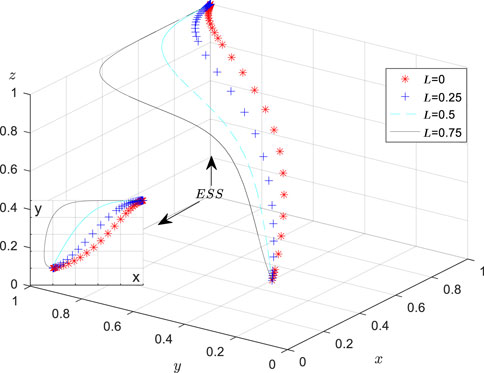

Subsequently, the values of L were assigned values of 0, 0.25, 0.5, and 0.75, with the simulation results shown in Figure 13. The parameters m were set at 0.1, 0.25, 0.5, and 0.75, with the corresponding simulation outcomes displayed in Figure 14. Figure 13 shows that throughout the evolutionary process, an increase in L is associated with a reduced likelihood of enterprises pursuing low-carbon technology innovation, while it simultaneously increases the probability of financial institutions engaging in green financial services. Conversely, Figure 14 reveals that the feedback coefficient linking enterprises’ low-carbon technology innovation with social welfare increases significantly, accelerating their transition to low-carbon practices and prompting greater government adoption of incentive policies. Consequently, governments must prioritize monitoring business risks faced by enterprises to ensure supply chain security and stability through robust internal control systems, sound corporate governance structures, and transparent decision-making processes. Furthermore, governments should actively encourage and support enterprises in increasing investments in low-carbon technology research and development (R&D). Promoting collaboration within industrial chains can help build a green supply chain ecosystem that incentivizes suppliers and partners to adopt low-carbon production methods. This ecosystem approach can create cluster effects that enhance environmental performance across industries, improve social welfare, and ultimately strengthen the feedback coefficient between enterprise-level low-carbon technology innovation and societal benefits.

5.4 The influence of direct and indirect benefits, as well as the costs associated with green financial services, on the evolutionary system

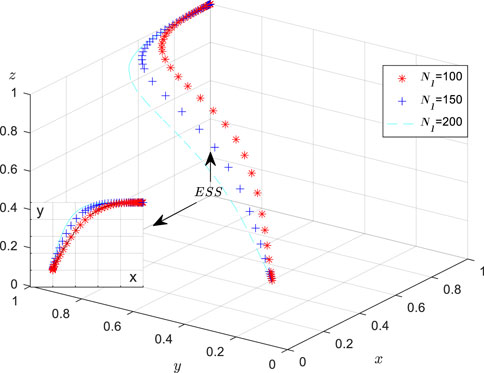

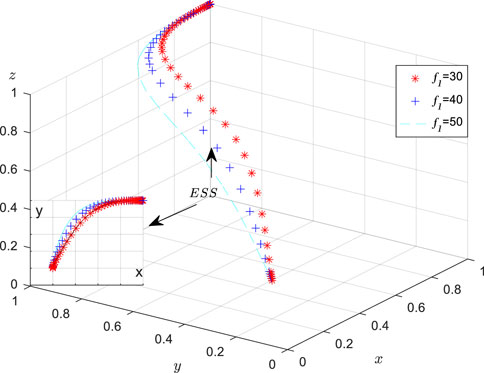

To analyze the impact of the benefits and costs associated with the green financial services offered by financial institutions on the dynamics and outcomes of the evolutionary game, we define the direct benefits of these services as N1 = 100, 150, 200 and the indirect benefits as f1 = 30, 40, 50. The simulation outcomes generated from iterating the dynamic equations with an initial probability allocation of (0.2, 0.2, 0.2) across fifty cycles are illustrated in Figures 15, 16.

When the other conditions remain constant and the N1 values are set at 100, 150, and 200, the outcomes of the simulation are depicted in Figure 15. During the system’s evolution toward a stable state, increased direct revenue from green financial services increases the likelihood of financial institutions engaging in such services. As shown in Figure 16, the simulation outcomes for f1 values of 30, 40, and 50 indicate that higher indirect revenue from green financial services accelerates the system’s evolution. Therefore, it is essential for financial institutions to prioritize both direct and indirect income streams. Direct benefits can be increased by creating a variety of green financial products, including green bonds, green funds, green insurance, and carbon financial derivatives, which cater to diverse investment and financing requirements. Indirect benefits can be strengthened by building a robust green ecosystem through employee or team capacity building and by reinforcing social responsibility initiatives. Increasing both direct and indirect income streams further incentivizes financial institutions to invest in low-carbon enterprises and promote sustainable practices within these organizations.

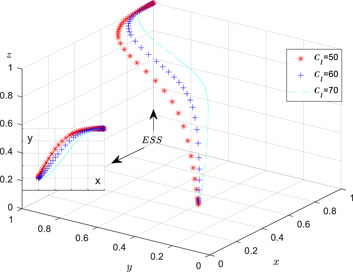

Subsequently, values of C1 = 50, 60, and 70 were assigned, with the simulation outcomes presented in Figure 17. The findings in Figure 17 indicate that rising costs associated with green financial services tend to discourage financial institutions from adopting these services while increasing the likelihood of government adoption of incentive policies. Therefore, it is essential for government bodies to account for the costs that financial institutions incur in implementing green financial services. This can be achieved by improving processes such as credit approval, project evaluation, and risk management through digitalization and automation technologies to reduce labor and time costs. Additionally, standardizing product design and operations can streamline green financial products. Establishing a unified certification and rating system for green finance will further reduce redundant evaluations, lower the overall cost of green financial services, and promote low-carbon technology innovation among enterprises.

6 Conclusion and policy implications

This study introduces a trilateral evolutionary game model that incorporates the government, financial institutions, and enterprises under dual oversight, aiming to increase incentives for businesses to adopt low-carbon technology innovations. By employing this model, the study investigates how each stakeholder can develop stable strategies over time. It evaluates the influence of government and financial institution oversight dynamics, taxation policies, and subsidies for low-carbon innovation on individual behaviors.

(1) The optimal state of system evolution is achieved when the government implements green economic policies, financial institutions develop innovative green financial products and provide green financial services, and enterprises engage in low-carbon technological innovation. The key factors shaping the optimal strategy for low-carbon technology innovation include government incentives and subsidies for green enterprises, taxes on traditional enterprises, rent-seeking costs, and low-carbon production expenses.

(2) The initial intentions of the government, financial institutions, and enterprises exert varying degrees of influence on one another. When initial willingness is low, government regulations and incentive measures serve as the primary drivers for advancing low-carbon technology innovation in enterprises and promoting green financial services in financial institutions. Enterprise low-carbon technology innovation is influenced by regulatory actions from both financial institutions and government agencies, whereas the strategic decisions of government agencies remain unaffected by the initial intentions of enterprises and financial institutions. Thus, the government can adopt green economic policies and promote green advocacy to encourage low-carbon technology innovation in enterprises and support green financial services in financial institutions through regulatory signaling.

(3) An increase in the feedback coefficient of enterprises’ low-carbon technology innovation related to social welfare accelerates the progression of enterprises, financial institutions, and the government toward the strategic set of innovation, green finance, and incentives. As the business risk coefficient increases, the probability of enterprises opting for low-carbon technology innovation diminishes, whereas the probability of financial institutions developing green financial services increases.

(4) Government regulatory measures exert varying influences on strategy selection. For financial institutions, government subsidies for green financial services encourage them to adopt green financial strategies. For enterprises, moderate government rewards and penalties promote the choice of low-carbon technology innovation, with subsidies having a stronger promotional effect than taxes do. This approach also reduces the likelihood of enterprises gaining green financial service benefits through rent-seeking behavior.

On the basis of the findings of the above study, the following management implications can be drawn:

(1) Strengthening government supervision is pivotal in fostering the sustainable development of green financial services offered by financial institutions and ensuring the economic stability of enterprises. First, it is imperative to establish comprehensive regulatory frameworks for green finance that clearly delineate the roles and responsibilities of regulatory authorities. Effective supervision should be implemented concerning the transparency of green financial services provided by financial institutions, as well as addressing rent-seeking behaviors among enterprises engaged in low-carbon technological innovation. This approach will enhance both the effectiveness and relevance of oversight. Second, efforts must be directed towards promoting legislation within the realm of green finance, encouraging regions with suitable conditions to enact local regulations. Such regulations should elucidate banks’ social responsibilities and outline due diligence exemptions during credit assessments while imposing penalties and public disclosures on enterprises that fail to meet low-carbon technological innovation requirements or have committed environmental violations.

(2) Enhance fiscal subsidies and incentives for green finance and enterprises’ low-carbon technological innovation. Specifically, qualified financial institutions should be provided with low-cost funds to support their green financial services and facilitate the greening of bank asset allocation. Furthermore, a dedicated fiscal fund should be established to subsidize enterprises engaged in R&D of low-carbon technologies as well as innovative projects, including R&D expense subsidies and grants for project construction. Enterprises that achieve significant results in low-carbon technological innovation and meet carbon reduction targets should be rewarded accordingly. Lastly, tax reductions and exemptions related to low-carbon technological innovation should be implemented, encompassing additional deductions for R&D expenses, tax credits for the purchase of environmental protection equipment, and preferential tax treatment for the production and sale of low-carbon products. These measures aim to encourage enterprises’ efforts in advancing low-carbon technological innovation.

(3) Minimize the costs associated with green financial services for financial institutions and low-carbon technological innovation for enterprises. It is essential to establish clear and unified standards for green financial services to prevent operational confusion among financial institutions and mitigate increased costs arising from inconsistent standards. Furthermore, policy guidance should be enhanced to encourage enterprises to foster close collaborations between industry, academia, and research institutes. Collaborative efforts in low-carbon technology research and development, as well as the transformation of research outcomes, will facilitate shared R&D resources and lower the costs associated with low-carbon technological innovation. Simultaneously, it is imperative for the government or industry associations to create a low-carbon technology sharing platform that disseminates advanced technological information, organizes technology exchange activities, and promotes cooperation among enterprises in terms of technology sharing. This approach will help avoid redundant research endeavors while reducing overall innovation costs.

This study has several limitations. While it considers the government, enterprises, and financial institutions as stakeholders, future research could further classify enterprises into manufacturers, retailers, and suppliers, allowing for the analysis of a four-party evolutionary game. Moreover, the role of third-party regulatory organizations could be investigated in future studies to explore their interaction with enterprises.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

QZ: Formal Analysis, Resources, Writing – review and editing, Data curation, Project administration, Investigation, Methodology, Funding acquisition. DZ: Formal Analysis, Data curation, Validation, Writing – review and editing, Software, Methodology, Conceptualization, Writing – original draft. JW: Data curation, Resources, Writing – review and editing, Supervision.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by the Heilongjiang Province Social Science Fundation (Project Numbers: 22JYB241).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ali, E. B., Shayanmehr, S., Radmehr, R., Bayitse, R., and Agbozo, E. (2024). Investigating environmental quality among G20 nations: the impacts of environmental goods and low-carbon technologies in mitigating environmental degradation. Geosci. Front. 15, 101695. doi:10.1016/j.gsf.2023.101695

Cao, W., and Yu, J. (2024). Evolutionary game analysis of factors influencing green innovation in enterprises under environmental governance constraints. Environ. Res. 248, 118095. doi:10.1016/j.envres.2023.118095

Chen, D., Hu, H., Wang, N., and Chang, C.-P. (2024a). The impact of green finance on transformation to green energy: evidence from industrial enterprises in China. Technol. Forecast. Soc. Change 204, 123411. doi:10.1016/j.techfore.2024.123411

Chen, G., Lim, M. K., and Tseng, M.-L. (2024b). Green credit and transformation to enhance the plastic supply chain in China: a three-player evolutionary game perspective approach under dynamic green awareness. J. Clean. Prod. 448, 141416. doi:10.1016/j.jclepro.2024.141416

Chen, H., Wang, J., and Miao, Y. (2021). Evolutionary game analysis on the selection of green and low carbon innovation between manufacturing enterprises. Alexandria Eng. J. 60, 2139–2147. doi:10.1016/j.aej.2020.12.015

Chen, Y., Zhang, Y., and Wang, M. (2024c). Green credit, financial regulation and corporate green innovation: evidence from China. Finance Res. Lett. 59, 104768. doi:10.1016/j.frl.2023.104768

Cheng, Y., Deng, X., Li, Y., and Yan, X. (2024). Tight incentive analysis of sybil attacks against the market equilibrium of resource exchange over general networks. Games Econ. Behav. 148, 566–610. doi:10.1016/j.geb.2024.10.009

Chi, Y., Zhao, H., Hu, Y., Yuan, Y., and Pang, Y. (2022). The impact of allocation methods on carbon emission trading under electricity marketization reform in China: a system dynamics analysis. Energy 259, 125034. doi:10.1016/j.energy.2022.125034

Cobbold, E. Y., Li, Y., and Obobisa, E. S. (2024). Technology transfer and innovation through trade; assessing the role of low carbon technologies imports on domestic green innovation. J. Technol. Transf. doi:10.1007/s10961-024-10155-w

Cui, H., Wang, R., and Wang, H. (2020). An evolutionary analysis of green finance sustainability based on multi-agent game. J. Clean. Prod. 269, 121799. doi:10.1016/j.jclepro.2020.121799

Deng, Y., You, D., and Zhang, Y. (2021a). Can the behavioural spillover effect affect the environmental regulations strategy choice of local governments? Int. J. Environ. Res. Public Health 18, 4975. doi:10.3390/ijerph18094975

Deng, Y., You, D., and Zhang, Y. (2021b). Research on improvement strategies for low-carbon technology innovation based on a differential game: the perspective of tax competition. Sustain. Prod. Consum. 26, 1046–1061. doi:10.1016/j.spc.2021.01.007

Dong, X., and Yu, M. (2024a). Time-varying effects of macro shocks on cross-border capital flows in China's bond market. Int. Rev. Econ. and Finance 96, 103720. doi:10.1016/j.iref.2024.103720

Dong, X., and Yu, M. (2024b). Green bond issuance and green innovation: evidence from China’s energy industry. Int. Rev. Financial Analysis 94, 103281. doi:10.1016/j.irfa.2024.103281

Duan, W., and Li, C. (2023). Be alert to dangers: collapse and avoidance strategies of platform ecosystems. J. Bus. Res. 162, 113869. doi:10.1016/j.jbusres.2023.113869

Duarte, R., Sánchez-Chóliz, J., and Sarasa, C. (2018). Consumer-side actions in a low-carbon economy: a dynamic CGE analysis for Spain. Energy Policy 118, 199–210. doi:10.1016/j.enpol.2018.03.065

Fan, W.-J., Fang, Y., and Jiang, R.-B. (2024). An analysis of optimal equilibrium in the carbon trading market - from a tripartite evolutionary game perspective. Int. Rev. Financial Analysis 96, 103629. doi:10.1016/j.irfa.2024.103629

Gu, Q., Hang, L., and Jiang, Y. (2024). Compound carbon policy for promoting low-carbon technology innovation in enterprises considering government supervision. Environ. Dev. Sustain. doi:10.1007/s10668-024-05336-4

Guo, Y., Wang, M. M., and Yang, F. (2022). Joint emission reduction strategy considering channel inconvenience under different recycling structures. Comput. and Industrial Eng. 169, 108159. doi:10.1016/j.cie.2022.108159

He, L., and Chen, L. (2021). The incentive effects of different government subsidy policies on green buildings. Renew. Sustain. Energy Rev. 135, 110123. doi:10.1016/j.rser.2020.110123

Huo, H., Lu, Y., and Wang, Y. (2024). Evolutionary game analysis of low-carbon transformation and technological innovation in the cold chain under dual government intervention. Environ. Dev. Sustain 27, 12893–12920. doi:10.1007/s10668-023-04457-6

Jiang, Y., Hu, T., Zhao, D., Liu, B., Zhang, H., Zhang, Y., et al. (2022). Decision model to optimize long-term subsidy strategy for green building promotion. Sustain. Cities Soc. 86, 104126. doi:10.1016/j.scs.2022.104126

Kang, K., Zhao, Y., Zhang, J., and Qiang, C. (2019). Evolutionary game theoretic analysis on low-carbon strategy for supply chain enterprises. J. Clean. Prod. 230, 981–994. doi:10.1016/j.jclepro.2019.05.118

Kong, Z., Du, J., Kong, Y., and Cui, X. (2024). Financial development, environmental regulation, and corporate green technology innovation: evidence from Chinese listed companies. Finance Res. Lett. 62, 105122. doi:10.1016/j.frl.2024.105122

Li, D., Zhang, M., Zhou, S., and Yu, X. (2025). Structural equation modeling and validation of virtual learning community constructs based on the Chinese evidence. Interact. Learn. Environ. 0, 1–16. doi:10.1080/10494820.2025.2503235

Li, G., Zheng, H., Ji, X., and Li, H. (2018). Game theoretical analysis of firms’ operational low-carbon strategy under various cap-and-trade mechanisms. J. Clean. Prod. 197, 124–133. doi:10.1016/j.jclepro.2018.06.177

Li, Q., Xiong, C., and Yao, J. (2024). A study of the evolutionary game of carbon offset involving tourism stakeholders under incentive and constraint mechanisms. Sci. Rep. 14, 14935. doi:10.1038/s41598-024-65964-8

Li, T., and Li, Y. (2023). Carbon emissions of 5G Mobile networks in China. Nat. Sustain. 6, 1522–1523. doi:10.1038/s41893-023-01208-3

Li, Y., Qian, K., Wang, Z., and Xu, A. (2024). The evolution of China’s wind power industry innovation network from the perspective of multidimensional proximity. Technol. Analysis and Strategic Manag., 1–15. doi:10.1080/09537325.2024.2405145

Liu, D., Feng, M., Liu, Y., Wang, L., Hu, J., Wang, G., et al. (2024). A tripartite evolutionary game study of low-carbon innovation system from the perspective of dynamic subsidies and taxes. J. Environ. Manag. 356, 120651. doi:10.1016/j.jenvman.2024.120651

Liu, X., and Zhao, Q. (2024). Banking competition, credit financing and the efficiency of corporate technology innovation. Int. Rev. Financial Analysis 94, 103248. doi:10.1016/j.irfa.2024.103248

Luo, J., Hu, M., Huang, M., and Bai, Y. (2023). How does innovation consortium promote low-carbon agricultural technology innovation: an evolutionary game analysis. J. Clean. Prod. 384, 135564. doi:10.1016/j.jclepro.2022.135564

Ma, Q., Zhang, Y., Hu, F., and Zhou, H. (2024). Can the energy conservation and emission reduction demonstration city policy enhance urban domestic waste control? Evidence from 283 cities in China. Cities 154, 105323. doi:10.1016/j.cities.2024.105323

Nie, P., Chen, Y., Yang, Y., and Wang, X. H. (2016). Subsidies in carbon finance for promoting renewable energy development. J. Clean. Prod. 139, 677–684. doi:10.1016/j.jclepro.2016.08.083

Nyambuu, U., and Semmler, W. (2020). Climate change and the transition to a low carbon economy – carbon targets and the carbon budget. Econ. Model. 84, 367–376. doi:10.1016/j.econmod.2019.04.026

Pan, F., Diao, Z., and Wang, L. (2023). The impact analysis of media attention on local environmental governance based on four-party evolutionary game. Ecol. Model. 478, 110293. doi:10.1016/j.ecolmodel.2023.110293

Qi, S. Z., Zhou, C. B., Li, K., and Tang, S. Y. (2021). Influence of a pilot carbon trading policy on enterprises’ low-carbon innovation in China. Clim. Polic. 21, 318–336. doi:10.1080/14693062.2020.1864268

Rao, Z., Li, P., and Bai, C. (2023). Unraveling the impact of carbon markets on corporate green technology investment behavior: an evolutionary game approach from the lens of competitive manufacturers. J. Knowl. Econ. 15, 11397–11429. doi:10.1007/s13132-023-01544-x

Shi, R., Cui, Y., and Zhao, M. (2021). Role of low-carbon technology innovation in environmental performance of manufacturing: evidence from OECD countries. Environ. Sci. Pollut. Res. 28, 68572–68584. doi:10.1007/s11356-021-15057-0

Shi, T., Han, F., Chen, L., Shi, J., and Xiao, H. (2023). Study on value Co-creation and evolution game of low-carbon technological innovation ecosystem. J. Clean. Prod. 414, 137720. doi:10.1016/j.jclepro.2023.137720

Su, T., Meng, L., Wang, K., and Wu, J. (2023). The role of green credit in carbon neutrality: evidence from the breakthrough technological innovation of renewable energy firms. Environ. Impact Assess. Rev. 101, 107135. doi:10.1016/j.eiar.2023.107135

Sun, H., Gao, G., and Li, Z. (2022). Evolutionary game analysis of enterprise carbon emission regulation based on prospect theory. Soft Comput. 26, 13357–13368. doi:10.1007/s00500-022-07527-5

Sun, X., and Qu, X. (2023). Multi-stage dynamic evolution of green financial system from the perspective of bilateral moral hazard. Environ. Sci. Pollut. Res. 30, 63788–63810. doi:10.1007/s11356-023-26637-7

Tseng, M., Chiu, S., Tan, R., and Siriban-Manalang, A. B. (2013). Sustainable consumption and production for Asia: sustainability through green design and practice. J. Clean. Prod. 40, 1–5. doi:10.1016/j.jclepro.2012.07.015

Wan, X., Xiao, S., Li, Q., and Du, Y. (2021). Evolutionary policy of trading of blue carbon produced by marine ranching with media participation and government supervision. Mar. Policy 124, 104302. doi:10.1016/j.marpol.2020.104302

Wang, J., and Chen, W. (2024). Energy-consuming right transaction and low-carbon technology innovation: evidence from Chinese listed enterprises. Heliyon 10, e36277. doi:10.1016/j.heliyon.2024.e36277

Wang, J., Cheng, S., Guo, X., Xu, X., and Wang, Z. (2024a). An evolutionary analysis of the diffusion of low-carbon technology innovation in supply networks. Res. Int. Bus. Finance 70, 102400. doi:10.1016/j.ribaf.2024.102400

Wang, J., Zhou, Z., and Botterud, A. (2011). An evolutionary game approach to analyzing bidding strategies in electricity markets with elastic demand. Energy 36, 3459–3467. doi:10.1016/j.energy.2011.03.050

Wang, W., Hao, S., Zhong, H., and Sun, Z. (2024b). How to promote carbon emission reduction in buildings? Evolutionary analysis of government regulation and financial investment. J. Build. Eng. 89, 109279. doi:10.1016/j.jobe.2024.109279

Wei, J., Li, Y., and Liu, Y. (2024a). Tripartite evolutionary game analysis of carbon emission reduction behavior strategies under government regulation. Environ. Dev. Sustain. doi:10.1007/s10668-024-04972-0

Wei, J., Ying, Z. J., and Liu, Y. S. (2024b). Evolutionary game analysis of emission-dependent supply chain carbon abatement behaviours considering cap-and-trade mechanism. Int. J. Environ. Sci. Technol. 22, 419–432. doi:10.1007/s13762-024-05648-y

Wu, R., Zhu, L., and Jiang, M. (2024a). Research on the evolution game of low-carbon operations in cold chain logistics considering environmental regulations and green credit. Heliyon 10, e30559. doi:10.1016/j.heliyon.2024.e30559

Wu, X., Wen, H., Nie, P., and Gao, J. (2024b). Utilizing green finance to promote low-carbon transition of Chinese cities: insights from technological innovation and industrial structure adjustment. Sci. Rep. 14, 16844. doi:10.1038/s41598-024-67958-y

Xu, A., Wang, W., and Zhu, Y. (2023a). Does smart city pilot policy reduce CO2 emissions from industrial firms? Insights from China. J. Innovation and Knowl. 8, 100367. doi:10.1016/j.jik.2023.100367

Xu, J., and Liu, S. (2024). Current status, evolutionary path, and development trends of low-carbon technology innovation: a bibliometric analysis. Environ. Dev. Sustain 26, 24151–24182. doi:10.1007/s10668-023-03640-z

Xu, J., Tong, B., Wang, M., and Yin, S. (2023b). How to systematically reduce the carbon emissions of the manufacturing industry? Evidence from four-party evolutionary game analysis. Environ. Sci. Pollut. Res. 31, 2614–2639. doi:10.1007/s11356-023-31261-6

Yan, M., and Gong, X. (2024). Impact of green credit on green finance and corporate emissions reduction. Finance Res. Lett. 60, 104900. doi:10.1016/j.frl.2023.104900

Zhang, H., Pan, S., Ma, B., Huang, T., Kosolapov, D. B., Ma, M., et al. (2024). Multivariate statistical and bioinformatic analyses for the seasonal variations of actinobacterial community structures in a drinking water reservoir. J. Environ. Sci. 137, 1–17. doi:10.1016/j.jes.2023.02.037

Zhang, M., and Kong, Z. (2022). A tripartite evolutionary game model of emergency supplies joint reserve among the government, enterprise and society. Comput. and Industrial Eng. 169, 108132. doi:10.1016/j.cie.2022.108132

Zhang, X., Zhu, Q., Li, X., and Pan, Y. (2023). The impact of government subsidy on photovoltaic enterprises independent innovation based on the evolutionary game theory. Energy 285, 129385. doi:10.1016/j.energy.2023.129385

Zhao, S., Abbassi, W., Hunjra, A. I., and Zhang, H. (2024). How do government R&D subsidies affect corporate green innovation choices? Perspectives from strategic and substantive innovation. Int. Rev. Econ. and Finance 93, 1378–1396. doi:10.1016/j.iref.2024.04.014

Zhao, X., Chen, H., Hu, S., and Zhou, Y. (2023). The impact of carbon quota allocation and low-carbon technology innovation on carbon market effectiveness: a system dynamics analysis. Environ. Sci. Pollut. Res. 30, 96424–96440. doi:10.1007/s11356-023-28943-6

Zhou, F., Chen, T., and Lim, M. K. (2024a). Strategic low-carbon technology supervision in the closed-loop supply chain: an evolutionary game approach. J. Clean. Prod. 450, 141609. doi:10.1016/j.jclepro.2024.141609

Zhou, K., and Li, Y. (2019). Carbon finance and carbon market in China: progress and challenges. J. Clean. Prod. 214, 536–549. doi:10.1016/j.jclepro.2018.12.298

Zhou, K., Wang, Q., and Tang, J. (2022). Evolutionary game analysis of environmental pollution control under the government regulation. Sci. Rep. 12, 474. doi:10.1038/s41598-021-04458-3

Zhou, W., Shi, Y., Zhao, T., Cao, X., and Li, J. (2024b). Government regulation, horizontal coopetition, and low-carbon technology innovation: a tripartite evolutionary game analysis of government and homogeneous energy enterprises. Energy Policy 184, 113844. doi:10.1016/j.enpol.2023.113844

Keywords: low-carbon technology innovation, low-carbon production, green finance, dual supervision, evolutionary game

Citation: Zhang Q, Zhao D and Wang J (2025) Analysis of enterprise low-carbon technology innovation via a tripartite evolutionary game under dual supervision. Front. Environ. Sci. 13:1623520. doi: 10.3389/fenvs.2025.1623520

Received: 06 May 2025; Accepted: 16 June 2025;

Published: 26 June 2025.

Edited by:

Yuanjun Zhao, Nanjing Audit University, ChinaReviewed by:

Changyu Liu, Shandong Normal University, ChinaXiao Hanjie, Huzhou University, China

Pingjian Yang, Chinese Research Academy of Environmental Sciences, China

Copyright © 2025 Zhang, Zhao and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jinyuan Wang, NTM5MTU1MEBxcS5jb20=

Qiwen Zhang

Qiwen Zhang Dechao Zhao

Dechao Zhao