- 1Xi’an University of Architecture and Technology Huaqing College, Xi’an, China

- 2School of Economics, Minzu University of China, Beijing, China

- 3Yellow River Institute of Hydraulic Research, Yellow River Conservancy Commission, Zhengzhou, China

- 4Yellow River Laboratory, Zhengzhou, China

As a substantial developmental framework aimed at tackling environmental challenges, the development of intensive use of urban land (IUUL) has yet to actualize its ecological efficacy fully. Improving the spatial distribution of factor resources can play a pivotal role in unlocking the ecological potential of IUUL, with a special emphasis on the effective allocation of financial resources. The emergence of digital finance (DF), such as Alipay and Pocket Banking, has notably enhanced the efficiency of financial resource allocation. Nonetheless, empirical data concerning the ability of DF to enhance the ecological significance of IUUL are scarce, and the mechanisms driving these processes remain obscure. This research utilizes panel data from 282 prefecture-level cities spanning 2011–2020 to explore the potential of DF in enhancing the ecological value of IUUL through the lens of urban ecological resilience (UER). The results suggest that DF has the potential to significantly enhance the positive impacts of IUUL on UER significantly, thereby further unlocking the ecological value of IUUL. Mechanisms analysis reveals the potential of DF to unlock the ecological value of IUUL by fostering regional green innovation (GI), rationalizing industrial structure (RIS), and overall upgrading of industrial structure (OUIS). Moreover, the heterogeneity analysis suggests that the effect is more prominent in economically advanced eastern regions, regions with more comprehensive infrastructure, and regions with more favorable innovation environments. This paper highlights the potential of DF to enhance UER through IUUL, offering empirical evidence for the profound fusion of the digital economy and the real economy to drive green transformation. It also charts a course for the real economy’s green transformation and the sustainable development of the economy.

1 Introduction

Urbanization is the predominant theme in contemporary global development; however, rapid urbanization and economic expansion have led to many ecological and environmental challenges. The continuous ramifications of human production activities, extensive infrastructure development, and ineffective resource management have led to the over-exploitation of energy resources, the degradation of urban ecology, and notable environmental issues. Despite the favorable outcomes stemming from China’s recent economic advancement, the nation is grappling with substantial environmental challenges. To maintain economic growth, prioritize ecological advantages, and foster sustainable development, it is essential to investigate innovative approaches that can harmonize environmental considerations with economic progress.

Intensive use of urban land (IUUL), as a specific manifestation of land intensification, emerges as a crucial model for conserving land resources and striking a harmonious balance between ecological preservation and economic development. Viewed from an economic development standpoint, IUUL can trigger knowledge spillover effects and the scale effect within the regional economy, boost urban land use efficiency, and facilitate swift and efficient economic advancement, thereby forming a crucial element of high-quality economic growth. From an ecological standpoint, IUUL can yield several advantageous outcomes. Initially, it can help curb urban sprawl into neighboring natural terrains, thereby preserving biodiversity and ecological equilibrium. Additionally, it can foster the judicious management of hydropower resources. Thirdly, IUUL can curtail energy consumption and enhance urban ecological advantages. However, there are inherent constraints to the efficacy of IUUL in fostering eco-efficiency. In traditional economic models, the mobility of capital, information, and other production factors is relatively restricted. This limitation leads to insufficient incentives for innovation and suboptimal resource distribution, consequently limiting the ecological advantages derived from IUUL. The rise of the digital economy has heralded a paradigm shift in the allocation of production factor resources, hastening the optimization of methods that empower factor resource allocation. Digital finance (DF), a modern addition to the financial landscape, plays a critical role in refining resource allocation and facilitating the flow of information. It presents a promising route to enhance the mobility of production factors, improve resource allocation practices, and increase the eco-efficiency of urban areas. Currently, the existing knowledge base does not provide a conclusive determination regarding the capacity of DF to enable the ecological valorization of IUUL, and the precise mechanisms through which it operates remain incompletely understood. In this vein, conducting comprehensive research on how DF can enhance the optimization of IUUL is of paramount importance, both theoretically and practically. This exploration could show how DF might heighten urban eco-efficiency by refining IUUL.

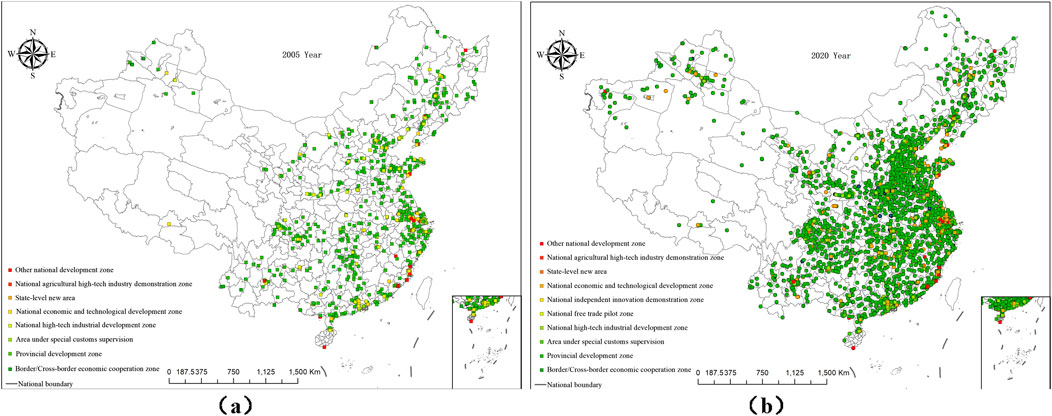

The primary aim of IUUL is to optimize economic, social, and environmental advantages. The relentless pursuit of economic expansion and urban development has given rise to significant challenges, including the excessive depletion of natural resources and environmental degradation. With the advancement of national economic development, ecological conservation has emerged as a critical imperative. IUUL has been proven to foster economic advancement (Kong et al., 2014) and safeguard land reserves (Wang et al., 2023), offering a crucial solution. This trend stands as a key impetus behind the IUUL in urban growth. In China, land intensification has surged notably over the last twenty years, accompanied by a simultaneous expansion in the number of land intensification development zones (as depicted in Figure 1). Intensive development has emerged as a pivotal model of economic progress in China. Existing studies on the ecological efficiency of IUUL have predominantly concentrated on its contribution to alleviating air pollution challenges. Industrially speaking, IUUL hinges on businesses using fewer resources while upholding productive economic performance. This mechanism, consequently, works to curtail the influx of low-value-added and highly polluting industries. As a result, this process diminishes the volume of carbon emissions in the vicinity and mitigates the air pollution predicament (Wu et al., 2022). From a resource vantage point, IUUL can yield numerous advantages. These encompass the scale effect, improved resource utilization and recycling efficiency, and centralized handling of resource-induced pollution, ultimately leading to decreased treatment expenses. As a result, this strategy can play a role in managing air pollution (Wang and Yin, 2017). This scale effect can stimulate the uptake of environmentally sustainable methods among local businesses, thus aiding in reducing pollutant emissions (Ling et al., 2023). Nevertheless, it is crucial to recognize that excessive industrial clustering and overly intense land development can potentially result in significant ecological issues. In terms of biodiversity, illogical land development has been demonstrated to adversely impact the functional diversity of land vertebrates (Etard et al., 2022), the intricacy of soil food chains (Tsiafouli et al., 2015), and the overall population of soil organisms (Yin et al., 2020). These consequences lead to a deterioration of the land’s ecological functionality and a significant impact on soil resilience. With IUUL emerging as the prevailing theme in urban development and the ecological landscape demanding immediate consideration, there remains a dearth of research pinpointing how to refine the framework of IUUL to guarantee its role in enhancing urban ecological effectiveness. Building upon this premise, this paper pioneers an exploration of a novel trajectory for IUUL in the digital age approached through the lens of DF. Moreover, it advances strategic recommendations for IUUL, establishing a paradigm that reconciles economic development with ecological protection.

Figure 1. The number of IUUL development zones in China. (a) The number of IUUL development zones in China in 2005. (b) The number of IUUL development zones in China in 2020.

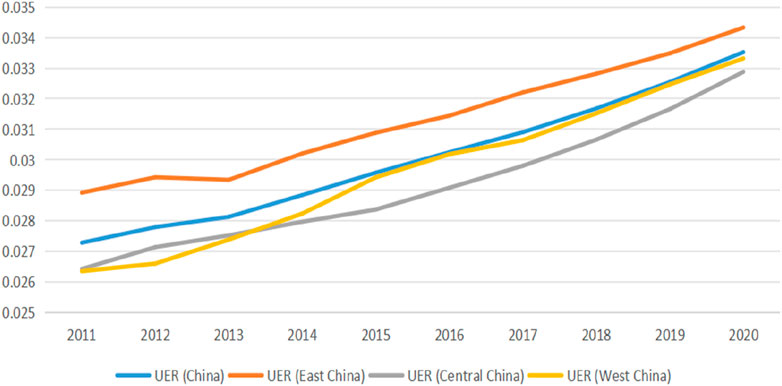

Urban ecological resilience (UER) definitions have a well-established historical background. The term “resilience” originally emerged in the field of materials science to signify a material’s capability to absorb energy during plastic deformation and rupture. Over time, “resilience” was increasingly adopted within the ecological domain, defined as an ecosystem’s ability to absorb state variables and driving forces while preserving its integrity (Holling, 1973). The concept is steadily gaining momentum, with one notable application being UER. UER is a key focus area in sustainable urban development, showcasing diverse significance. Economically, enhancing UER can enhance a city’s ability to adapt to severe weather conditions and environmental pressures. The improvement of UER can effectively mitigate the impacts of disasters on infrastructure and the welfare of residents, thereby reducing social and economic costs (Lu and Luo, 2024). From a social well-being perspective, UER plays a crucial role in safeguarding urban ecosystem services. These services encompass, among others, air purification, water management, and temperature regulation. The profound influence of these services on improving residents’ quality of life and health is extensively documented (Gómez-Baggethun et al., 2013). As the Chinese government attaches growing significance to ecological considerations, Chinese cities display a strengthened UER, as depicted in Figure 2. China’s overall UER has experienced a steady improvement since 2011, with the eastern region showing a more significant enhancement. Human economic activities have been proven to have a dual effect on the resilience of urban ecological systems. Humans must conduct economic activities in a manner that ensures a harmonious balance between economic growth and ecological stability. IUUL is a developmental model that can harmonize economic growth and environmental conservation. Its central aim is to facilitate resource sharing by concentrating economic activities. This approach reduces unnecessary infrastructure development and resource depletion, fostering synergistic ecological advancement while enhancing production value. However, it is crucial to note that IUUL does not imply a random aggregation of economic activities. In areas characterized by a proliferation of polluting industries and overpopulation, the ecological advantages of IUUL diminish, resulting in exacerbated environmental deterioration and a decline in UER (Shi et al., 2022). Consequently, the question of how to implement green and value-driven IUUL has become a pivotal issue for enhancing UER and promoting the construction of environmentally sustainable cities.

IUUL can potentially harmonize economic progress and environmental conservation, thereby strengthening the UER of cities. Nonetheless, its efficacy is presently curtailed by several factors. Initially, the conventional factor-driven economic development model is characterized by non-green and high-intensity practices (Wang, 2024), which lead to issues such as land overexploitation and energy inefficiency. These challenges culminate in environmental pollution and ecological imbalances, ultimately compromising UER. Secondly, the lack of scientific planning and proficient management of industrial structure throughout the process of IUUL has resulted in resource misalignment and excessive resource utilization (Fuhong and Yong, 2024), impeding the complete attainment of the ecological advantages associated with land intensification. Moreover, the process of IUUL continues to be marked by a level of disregard, with high-energy, high-pollution, and low-value-added industries prevailing (Li et al., 2023a). IUUL without concurrent industrial upgrading has been demonstrated to lead to the wastage of resources and ecological deterioration, subsequently weakening UER. Therefore, within the context of the current dual objectives of accelerating economic growth and preserving the environment, it is imperative to improve IUUL to maximize its ecological effectiveness. Finance, the crucial circulatory system of economic advancement, plays a pivotal role in providing essential capital for IUUL. Nevertheless, the traditional financial paradigm is characterized by notable information asymmetries, inefficient capital allocation, and limited service coverage (Jiang et al., 2019). These factors give rise to two primary limitations. Firstly, it hampers the ability of financial resources to back high-risk, innovative initiatives, thus obstructing the evolution of economic development. Secondly, it gives rise to a deficiency in industrial restructuring, restricted industrial upgrading, inefficient resource utilization, and excessive resource consumption. Digital finance (DF), as a quintessential product of the digital age, is distinguished by high informatization, liquidity, and universality (Tu et al., 2024). The integration of digital technology into the financial sector has the potential to empower IUUL. This fusion has brought about a transformative shift in financial products, heralding a new era of innovation. Simultaneously, technological progress has enhanced the ability to aggregate financial data, accelerating the flow of capital and lowering the barriers to capital financing. Under these conditions, the profit-seeking nature of capital will cause capital to flow more rapidly to high-productivity industries, stimulate the growth of these industries, transform the economy from a factor-driven to an innovation-driven model, and optimize the allocation of capital within the framework of land intensification. Consequently, this will increase regional resource use efficiency, reduce ecological overexploitation, and optimize UER. Therefore, this study focuses on DF to comprehensively explore its potential to increase IUUL. This approach aims to promote improved UER and establish a more equitable balance between economic development and ecological conservation.

This study employs a panel dataset encompassing 282 prefecture-level cities between 2011 and 2020 to examine the optimization of IUUL patterns through the lens of DF. The aim is to strike a balance between economic advancement and UER. The study’s main conclusion is that IUUL has a positive influence on UER, with DF playing a vital role in this relationship. Furthermore, the paper thoroughly examines how DF enhances the IUUL model across three dimensions: industrial development dynamics, structure, and direction within the context of IUUL. Studies have shown that DF can enhance the degree of green innovation (GI) in urban regions, thereby supporting the green revolution of IUUL. DF also holds promise in rationalizing industrial structure (RIS). Consequently, this could trigger an internal restructuring of IUUL, ultimately showcasing characteristics synonymous with ecological harmony. DF can drive the overall upgrade of the industrial structure (OUIS), nudging it towards becoming knowledge-intensive, high-value-added, and highly processed. This shift could subsequently alleviate environmental strain and bolster UER. Heterogeneity analysis indicates that the empowering impact of DF on IUUL is particularly pronounced in eastern regions, areas with well-developed infrastructures, and areas characterized by substantial investment in science and education.

This paper offers notable contributions to research in the following ways: Firstly, it substantially advances existing literature concerning UER. The topic of UER is crucial for fostering sustainable economic growth and safeguarding the welfare of inhabitants. Existing research on human activities influencing UER primarily focuses on intensive development aspects, such as population agglomeration (Zhu et al., 2023) and urbanization (Wang et al., 2022). Nevertheless, there is a scarcity of studies that investigate unlocking the ecological potential of the intensive development model to bolster UER. This study draws on the theoretical foundations of DF to explore how it can activate the latent potential embedded in the development of IUUL, ultimately fostering the augmentation of UER. This pursuit carries substantial practical importance for advancing sustainable urban development initiatives.

Secondly, this paper also enriches the current research landscape on IUUL. IUUL stands out as a crucial urban development trend, offering a strategic approach to boost efficiency and optimize the urban landscape. Extensive research has explored the ameliorative impacts of IUUL on air pollution, encompassing aspects such as emission reductions (Zhao et al., 2017; Shang et al., 2022), facilitation of the low-carbon shift (Wei and Chen, 2021), and improvement of carbon emission efficiency (Liu et al., 2024a). However, there has been little research on the eco-efficiency of IUUL in the digital age. It directly examines the ecological merits of IUUL through the lens of UER, a comprehensive indicator of ecological benefits. Moreover, leveraging the perspective of DF, the paper investigates how DF promotes IUUL in the digital age, consequently enhancing its ecological effectiveness. This discovery holds profound theoretical and practical importance for merging the development of IUUL with digital technology.

Thirdly, this paper adds to the current research on the impact of DF services on the real economy. DF stands out as a notable innovation within the financial sector in the digital age. This technological progression has brought about a paradigmatic change in the economic development sphere, playing a crucial role in augmenting economic efficiency. Existing studies on DF have primarily focused on its direct effects on enterprise financing costs (Li et al., 2023b), financial performance (Wu and Huang, 2022), enterprise value (Tang et al., 2022), and total factor productivity (Li et al., 2024). On the contrary, investigations into the capacity of DF to enrich the conventional economic model and consequently delve deeper into the ecological worth embedded within the traditional economic framework have been relatively scarce. From the standpoint of UER, this study examines the moderating role of DF within the economic development model to unlock the potential of IUUL. It systematically examines how DF and IUUL mutually advance each other to expedite the development of the economic model, the optimization of industrial structure, and industrial improvement, thereby enhancing urban ecological efficacy. This study enhances the theoretical framework of DF by examining eco-efficiency and offers practical recommendations for advancing DF, thereby highlighting its significant theoretical and practical implications.

The structure of the current study is outlined as follows: The second section comprises the theoretical analysis and research hypotheses. The third section introduces the research model design, variable selection, methods for constructing variables and descriptive statistics. The fourth section presents the empirical analysis, which incorporates basic regression, and robustness tests. The fifth section provides a more detailed analysis, focusing on mechanism testing and heterogeneity analysis. The sixth part comprises the study’s conclusion and the development of policy recommendations.

2 Theoretical analysis and research hypotheses

2.1 Digital finance has the potential to facilitate the contribution of intensive use of urban land to urban ecological resilience

IUUL has been shown to optimize resource allocation, decrease land wastage, and capitalize on scale effects to lower resource consumption, ultimately bolstering UER. The level of UER significantly hinges on the diversity and intricacy of ecosystems (Shamsipour et al., 2024). Diversity refers to biofunctional diversity, which denotes the ecological functions of various species within an ecosystem. Complexity is characterized by the intricacy of an ecological network, representing the complexity of the pathways that enable the movement of energy and matter within it. An ecosystem exhibiting high levels of diversity and complexity can depend on diverse species with varied energy flow pathways to sustain its overall functionality in the presence of external disruptions, consequently enhancing ecosystem resilience (Downing et al., 2012). The advancement of IUUL has had a positive impact on the environment, as evidenced by its ability to lower pollution emissions and reduce resource exploitation. Consequently, this has been proven to mitigate the harm inflicted on the diversity and intricacy of ecosystems resulting from economic development. Initially, IUUL has been shown to enhance UER via multiple mechanisms. These encompass elevated land-use efficiency, safeguarding of land resources, direct deceleration of the pace of land development for urban expansion, and maintenance of the diversity and complexity inherent in undisturbed ecosystems (Zhao et al., 2021). Secondly, the theory of agglomeration economy asserts that IUUL promotes resource sharing for economic endeavors within the area (Weber, 1929), including the sharing of infrastructure, energy, and waste management. The utilization of shared resources has been proven to reduce duplication in infrastructure construction, enhance energy utilization efficiency, and lower the cost of managing pollutant emissions. Subsequently, these strategies effectively alleviate the ecological harm resulting from urban development, thereby bolstering UER.

The financial sector directs capital flows, stimulating economic growth and development. Effective capital flow can provide vital backing for developing IUUL and promote the advancement of high-productivity industries in the IUUL zones. Consequently, this can boost the efficiency of industrial resource usage and UER (Huang et al., 2025). Traditional finance presents drawbacks, including low efficiency, high costs, and restricted scope. These limitations contribute to constrained capital flow, resulting in issues such as regional resource mismatches and the clustering of inefficient industries during the development of IUUL. Consequently, this curtails the ecological benefits of IUUL development. DF, emerging as a disruptive innovation in the financial sector amidst rapid digital technology advancements, can bolster IUUL, thereby broadening its positive influence on urban ecological resilience. Firstly, DF has been proven to expedite the pace of capital flows (Tang et al., 2022), facilitating the effective distribution of capital to high-efficiency sectors. Consequently, this has been illustrated to enhance resource utilization efficiency, alleviate over-exploitation, and bolster UER. Secondly, the heightened liquidity features of DF will enable capital to respond swiftly to government environmental policies, stimulate urban GI, enable IUUL to maximize its eco-efficiency, and enhance UER (Wu et al., 2020). DF holds the potential to advance financial inclusion, alleviate consumer credit limitations, and spur diversification of consumer demand. Developments in DF will lead to the upgrading of the urban industrial structure and the encouragement of knowledge- and technology-driven services, as well as high-value-added manufacturing. The emergence of advanced industries often coincides with the integration of new technologies, thus facilitating the swift replacement or enhancement of industries marked by low value-added outputs and significant pollution levels. Urban industrial upgrading will significantly enhance the city’s overall resource efficiency, reduce energy usage and pollution emissions, and amplify the beneficial effects of intensive land utilization on UER (Gu et al., 2024). Considering the above points, the current paper aims to:

Hypothesis 1:. DF can potentially enhance the positive influence of IUUL on UER.

2.2 Mechanisms of digital finance in unlocking the urban ecological value of intensive use of urban land

IUUL represents a pivotal model for harmonizing economic progress with ecological preservation. A pressing concern lies in optimizing the ecological benefits of this model in the digital era. The degree to which IUUL can enhance UER is contingent on the characteristics of industries and the developmental pathways of industrial activities within IUUL frameworks. When an industry exhibits characteristics such as high value-added, low pollution, and high efficiency and progresses toward knowledge-intensive and technology-intensive operations, IUUL can further enhance UER beyond its original baseline. IUUL inherently fosters a clustering effect and serves as a possible catalyst for stimulating the growth of industries in the aforementioned direction. Nonetheless, within the traditional industrial framework, the mobility of capital factors is inadequate, thereby limiting the extent to which regional agglomeration effects can drive industrial upgrading. DF, characterized by its liquidity and widespread accessibility, stands out for its capacity to expedite intra-regional capital movements and offer enhanced financial backing for industrial progress. This dynamic can magnify the agglomeration impact of IUUL, facilitate the reshaping of prevailing industrial development models, and further advance UER. In the forthcoming analysis, this paper will explore three key facets: industrial development dynamics, the structure of industrial advancement, and the trajectory of industrial progress within the context of IUUL. Subsequently, the discussion will elucidate how DF can catalyze the latent capabilities of IUUL, thereby amplifying the beneficial effects of these practices on UER.

2.2.1 Digital finance has been shown to effectively govern the intensive use of urban land, fostering a transition towards environmentally conscious industrial development dynamics

GI stands out as a crucial driver for reshaping the industrial development paradigm. It entails advancing resource conservation, environmental preservation, and sustainable growth through technological, managerial, and institutional breakthroughs in production and consumption. The overarching goal of GI is to boost environmental preservation and economic prosperity concurrently. This concept is intricately intertwined with the idea of UER. GI has proven to spur technological advancements and institutional transformations across diverse industries. Research has shown that GI can drive the eco-friendly evolution of industries, leading to reduced energy usage and lower pollution outputs. GI promises to boost the environmental standards of industries and urban areas, ultimately reinforcing UER (Khan et al., 2022; Zhou et al., 2025). According to agglomeration economy theory, IUUL can yield spillover effects and foster the advancement of GI (Chen et al., 2023). By focusing on regional enterprises, IUUL optimizes resource allocation, fosters the exchange of technology and knowledge, and accelerates the adoption of green practices and management strategies. Consequently, these factors bolster the efficiency and productivity of GI (Ke et al., 2022). Additionally, the effective execution of initiatives such as green buildings and environmentally friendly facilities in densely developed zones yields demonstrable results (Wang, 2021), showcasing the viability and advantages of green technologies to other businesses and regions. As a result, this contributes to the green transformation of other regions. GI often requires significant initial investment, with many green projects facing considerable financial constraints. Information asymmetry within the established economic framework’s parameters commonly leads to a lack of comprehensive information regarding GI endeavors among investors. Consequently, this shortage contributes to a limited understanding among investors regarding green initiatives, thereby hindering the ability of such projects to garner adequate financial support. This situation inevitably hampers GI’s progress. DF, a nascent product resulting from the fusion of digital technology and finance, promises to establish a clearer channel for information dissemination between investors and GI initiatives (Fu, 2024). DF can lower the cost of information acquisition for investors, boosting their confidence in investment decisions. This enables enterprises to possess adequate financial resources for GI and amplifies the knowledge spillover and demonstration effects of IUUL. Consequently, this advancement further propels the level of GI within the region. Considering the above points, the current paper aims to:

Hypothesis 2a:. DF has been demonstrated to advance UER by amplifying the impact of IUUL on the progression of GI.

2.2.2 Digital finance has been illustrated as elevating the intensive use of urban land and encouraging the rationalization of industrial structure

The reconfiguration of industrial composition impacts UER. Following the principles of resource allocation, it is anticipated that resources will be directed toward industries showcasing heightened productivity levels. This trend is projected to trigger a modification in the industrial framework. Elevated productivity within these sectors signifies improved resource efficacy, increased value enhancement, and diminished energy consumption per product unit (Zhang and Dilanchiev, 2022). Assigning resources to these more efficient and environmentally conscious sectors promises to curb resource squandering and local pollution discharges, consequently boosting UER (Pan, 2019). IUUL has demonstrated attributes such as spatial streamlining and economic intensification, thereby fostering the rationalization of regional industrial frameworks. Primarily, IUUL constrains the spatial expansion of industrial growth, thereby directly limiting the advancement of industries that exhibit inefficient land resource utilization. Secondly, IUUL has proven to reduce the spatial gap between industries, streamlining their resource flow. This process enhances resource allocation efficiency and propels RIS (Zhang and Weng, 2022). Nonetheless, the impediments to information and capital transfer between the capital supply and demand sectors cannot be eliminated solely by diminishing geographical distances. This obstruction impedes RIS and the sustainable progress of urban areas. DF can efficiently enhance information and capital circulation, easing the breakdown of obstacles and expediting RIS. DF has emerged as a pivotal driver for disseminating financial information, fostering the creation of groundbreaking products that harness digital advancements to enhance investment decision-making processes. An exemplary instance is the deployment of intelligent investment advisors, which utilize cutting-edge technologies such as big data and artificial intelligence to assist investors in making informed investment decisions. These advisors methodically gather and scrutinize vast datasets to produce actionable suggestions, thereby enriching financial decision-making processes (Solanki et al., 2019). Simultaneously, the emergence of DF has decreased the expenses associated with gathering, analyzing, and divulging financial and operational data (e.g., XBRL). This advancement has not only markedly alleviated the restrictions on corporate finance (Li et al., 2023b) but has also facilitated improved corporate transparency (Jiang et al., 2022). The integration of technologies such as smart contracts and digital payments has proven to streamline the capital flow process, ultimately reducing associated costs and expediting capital flows (Бунич et al., 2024). Considering the above points, the current paper aims to:

Hypothesis 2b:. DF has been demonstrated to enhance UER by amplifying the promotional effect of IUUL on RIS.

2.2.3 Digital finance has been shown to enhance the intensive use of urban land, thereby fostering advanced industrial development

The process of industrial upgrading in the region can yield several benefits, including the creation of added value, resource conservation, and the mitigation of environmental pressures under specific resource conditions. Consequently, this process can enhance UER. Industrial upgrading transforms industries from resource-intensive primary to secondary and tertiary industries. This transition aims to reduce the reliance of economic activities on natural resources, mitigate environmental impact, and enhance the ecological carrying capacity of cities (Shi et al., 2024). Moreover, industrial diversification has been shown to decrease the city’s economic dependency on a single industry, thereby reducing systemic risks associated with the decline or collapse of a particular sector. This diversified economic framework can allocate more social resources to manage ecological crises and post-disaster recovery, thereby boosting UER (Tan et al., 2020). IUUL has been shown to facilitate the advancement of the secondary industry and drive the emergence of the tertiary industry, thereby achieving industrial upgrading. IUUL has been proven to offer more concentrated space and resources for the secondary industry, stimulate the establishment of industrial parks and science and technology parks, and foster the growth of advanced manufacturing and intelligent manufacturing. Consequently, this shift has resulted in an expedited transformation of the economic structure, transitioning from one that was predominantly reliant on the primary industry to one that is predominantly driven by the secondary industry (Cao et al., 2023). Simultaneously, IUUL can streamline the distribution of land resources and establish commercial hubs, financial service districts, scientific and technological innovation zones, and other clustered areas. It can attract capital and technology, foster the growth of cutting-edge industries and high-end service sectors, and subsequently steer the economic structure toward an upgrade in the direction of the service industry (Luo et al., 2022). In the digital era, DF has significantly hastened the process of industrial upgrading within the framework of IUUL. DF has been proven to boost land market transparency and enhance resource allocation efficiency by offering flexible and efficient financing avenues. As a result, DF has been illustrated to enhance IUUL and establish conducive circumstances for industrial upgrading (Xu, 2022). DF offers financial support for land development, infrastructure construction, and related projects by leveraging innovative financing tools. The integration of DF has been proven to enhance the effectiveness of land resource development and utilization. Moreover, the availability of these financial resources has been shown to offer spatial security for clustering high-value-added industries, such as industrial parks and innovation zones (Qiu et al., 2023). Simultaneously, DF has been demonstrated to improve transparency in the land market, reduce information asymmetries, enhance the efficiency of land transactions, and facilitate the optimal flow and redistribution of land (Zhang and Zhuang, 2022). This optimal allocation has been demonstrated to enhance the efficiency of IUUL and facilitate industrial upgrading. Considering the aforementioned points, the present paper aims to:

Hypothesis 2c:. DF has been shown to enrich UER by amplifying the promotional impact of IUUL on the overall upgrade of industrial structure (OUIS).

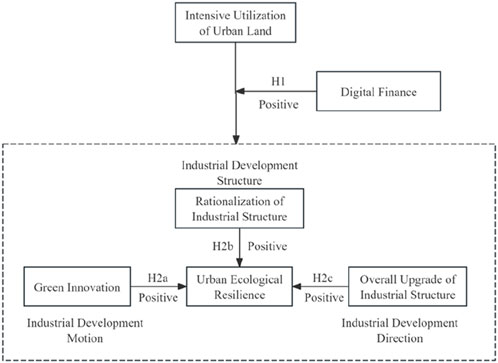

The theoretical framework for this article is shown in Figure 3.

3 Research design

3.1 Data sources and data cleansing

The study encompasses the period from 2011 to 2020 and involves 282 cities at the prefecture level and above in mainland China. The data for this study were sourced from multiple outlets, including the Digital Finance Research Center of Peking University, the China Urban Statistical Yearbook, the China Urban Construction Statistical Yearbook, provincial and municipal statistical yearbooks, various public information sources, and other relevant materials. After removing missing values, 2778 valid sample data points were obtained. Continuous variables underwent trimming at the 1% and 99% levels to ensure the data’s reasonableness and stability. This process aimed to mitigate the potential bias effects of outliers on the research outcomes, thereby establishing a robust data foundation for subsequent in-depth and precise analysis.

3.2 Model setup

3.2.1 Existence test model

The present study employs empirical analyses to investigate whether DF can positively influence the impact of IUUL on enhancing UER. The study explores the inherent connection between IUUL and UER. In this regard, correlation analysis and an Ordinary Least Squares (OLS) model are utilized to examine the findings. Subsequently, a two-way fixed effects model is constructed, guided by the outcomes of Hausman’s test, which distinguishes between random and fixed effects (Equations 1, 2). A two-way fixed effects model is developed to explore the correlation between IUUL and UER and further evaluate DF’s moderating role in this context.

In this study, the region is represented by

The explanatory variable

The explanatory variable

The interaction term

As previously discussed, it is expected that

3.2.2 Mechanistic analytical modeling of the moderating effect

This paper employs a two-step approach to investigate the relationship between IUUL and UER from the perspective of DF (Equation 3) (Ting, 2022). The first step entails assessing the mediating effect through regulatory effect testing. The second step involves constructing the channel model. The specific model is defined as follows:

It is imperative to note that

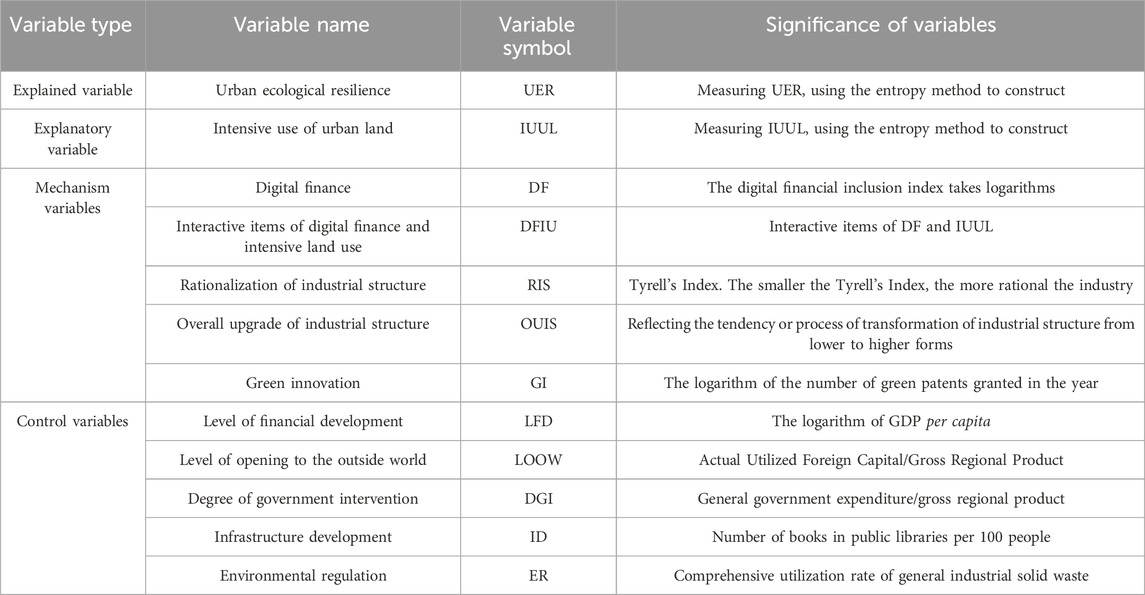

3.3 Variable definitions and descriptions

3.3.1 Explained variable: urban ecological resilience (UER)

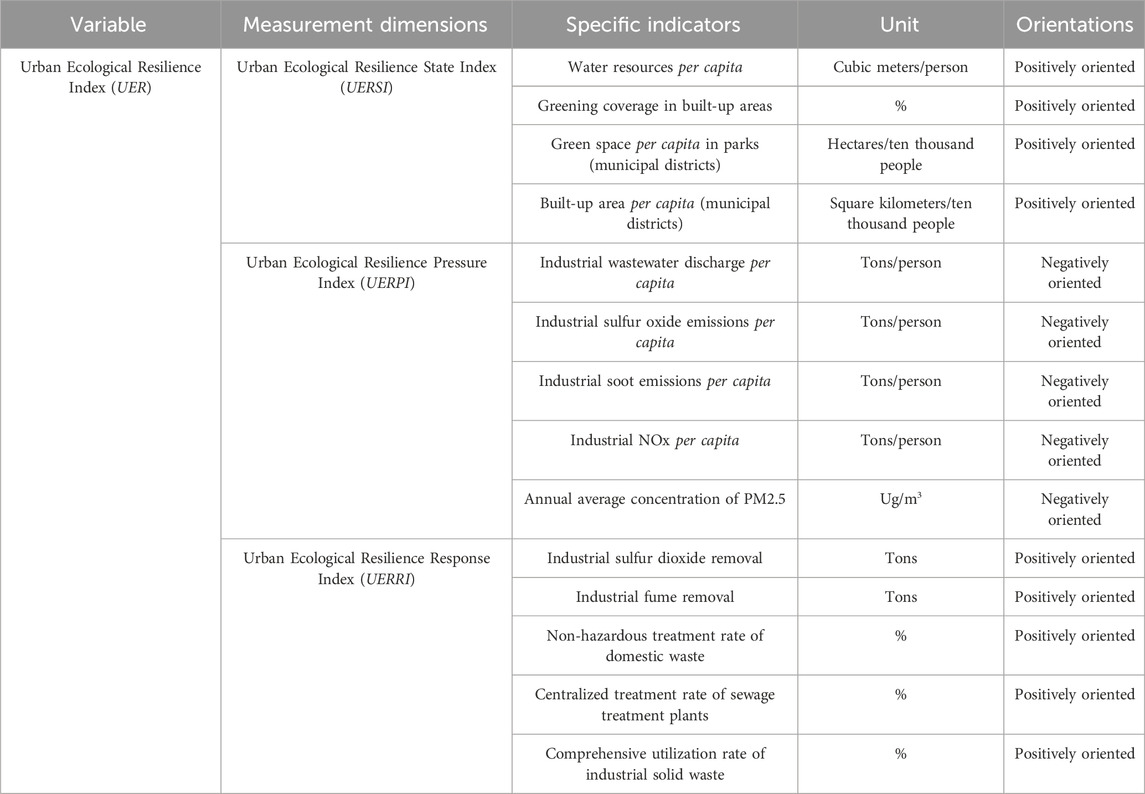

The primary explanatory variable in this study is UER. This index assesses the comprehensive capacity of an urban ecosystem to regulate pollutant emissions, maintain ecological stability, and enhance governance in the face of stress or emergencies. The current study examines UER from three perspectives: state resilience, pressure resilience, and response resilience, utilizing 14 tertiary indicators. These perspectives and indicators are compared against established practices in mainstream literature (Chen et al., 2022; Zhang et al., 2023), as depicted in Table 1. In this study, the sub-indicators were dimensionless, and the entropy method was employed to assign weights for synthesizing the indicators of UER.

3.3.2 Explanatory variables: the intensive use of urban land (IUUL)

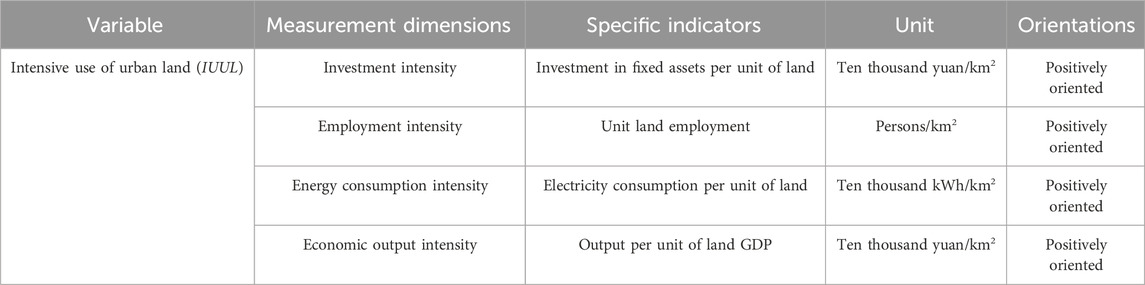

The explanatory variable in this research is IUUL, a crucial comprehensive indicator of urban land resource efficiency. As depicted in the Table 2, this study assesses the level of IUUL through four dimensions: investment intensity, employment intensity, energy consumption intensity, and economic output intensity. This assessment is informed by existing research in the field (Wu et al., 2022; Pan et al., 2024). The indicator is constructed from four foundational indicators: investment in fixed assets per unit of land, employment per unit of land, electricity consumption per unit of land, and GDP output per unit of land. These indicators are weighted utilizing the entropy value method, and the aggregated weighted sum is employed to evaluate the level of intensification of IUUL.

3.3.3 Moderating variable: digital finance (DF)

In its broadest sense, DF is characterized as a novel financial model that merges traditional financial methodologies with digital technology (Liu and Shen, 2021). This integration enables the efficient allocation of resources within a particular region, showcasing attributes such as universality and efficiency. This research selects the natural logarithm of Peking University’s Digital Financial Inclusion Index as a proxy variable for DF (Yu et al., 2022; Li et al., 2020). The Digital Financial Inclusion Index is a comprehensive measure that assesses the coverage, depth of utilization, and digitization of digital financial services within a specific region. It offers a detailed insight into the developmental stage of a region. This index provides a comprehensive overview of the adoption and use of digital financial services across various geographical areas, thereby capturing the differences in accessibility and utilization of these services.

3.3.4 Mechanism variables

3.3.4.1 Green innovation (GI)

The utilization of GI indicators is crucial in evaluating the degree of GI within a specific region. This study aligns with established research methodologies by utilizing the logarithm of the count of green patents granted to the region in a particular year as a proxy variable for the level of GI in that region. The indicator of the number of GI licenses in a region evaluates a region’s GI capacity from the perspective of innovation outcomes. It can visualize the specific green technologies, products, or processes generated within a region during a specified period. Regarding logical correlation, a higher count of green patents granted in a region indicates a stronger GI capacity. This suggests that regions with more green patents will likely exhibit a more robust ability to innovate in green technologies, products, or processes.

3.3.4.2 Rationalization of industrial structure (RIS)

The RIS index represents the outcomes of comprehensive coordination among industries and the effects of resource utilization. It measures the degree of coupling between the factor input and industrial structures. Currently, the academic community utilizes the degree of structural deviation to assess the RIS, employing the Equation 4:

In this model,

The Theil Index (TL) is a widely used measure of income inequality. This paper refers to the mainstream literature on this subject (Equation 5) (Yang et al., 2023). The construction of the Theil Index is as follows:

A novel Tyrell index has been created to address the challenge of computing absolute values, considering industry weighting, and maintaining the economic significance of structural deviations. Within industrial structure analysis, the Tel index is a quantitative measure for assessing the relative importance of various industry sectors. A lower Tel index signifies a more equitable distribution of industry impact.

3.3.4.3 Overall upgrade of industrial structure (OUIS)

The term “OUIS” refers to the ongoing tendency or process of continuously upgrading the industrial structure from a lower to a higher level based on industrial advancements (Xiao et al., 2024). The present study utilizes the industrial structure hierarchy coefficient as a proxy variable for OUIS (Hu et al., 2017), as Equation 6:

In industrial structure analysis, the overall upgrading of industrial structure is denoted by

3.3.5 Control variables (controls)

Concerning the selection of control variables, the following have been selected in alignment with relevant mainstream literature (Liu et al., 2024b; Liu et al., 2022): Level of financial development (LFD), Level of opening to the outside world (LOOW), Degree of government intervention (DGI), Infrastructure development (ID), Environmental regulation (ER). The variables discussed in this study are listed in Table 3 below:

3.4 Descriptive statistics

The descriptive statistical results of the samples are shown in Table 4. We can find that the mean value of the explanatory variable UER is 0.030, with a maximum value of 0.069. This suggests that the UER level of Chinese cities is relatively low amidst the rapid development of the digital economy. Regarding infrastructure development (ID), the mean value is 64.4, with a maximum value of 553 and a standard deviation of 85.2, indicating a substantial variation in infrastructure development across cities. Regarding environmental regulation (ER), the mean value is 79.420, with a maximum value of 100 and a standard deviation of 22.490, indicating notable disparities among cities in terms of environmental protection, corporate environmental disclosure, and achieving harmonized economic and environmental progress. These metrics highlight the diverse levels of infrastructure development and environmental regulatory practices across cities, emphasizing the importance of addressing these disparities to promote sustainable economic and environmental growth. The regional variances in the remaining control variables are minimal, with the degree of government intervention (DGI) showcasing the lowest standard deviation of 0.093. This observation is consistent with the established descriptive statistics reported in existing literature. The degree of government intervention across regions shows relatively slight variation, suggesting a level of consistency in this aspect across the studied cities or regions.

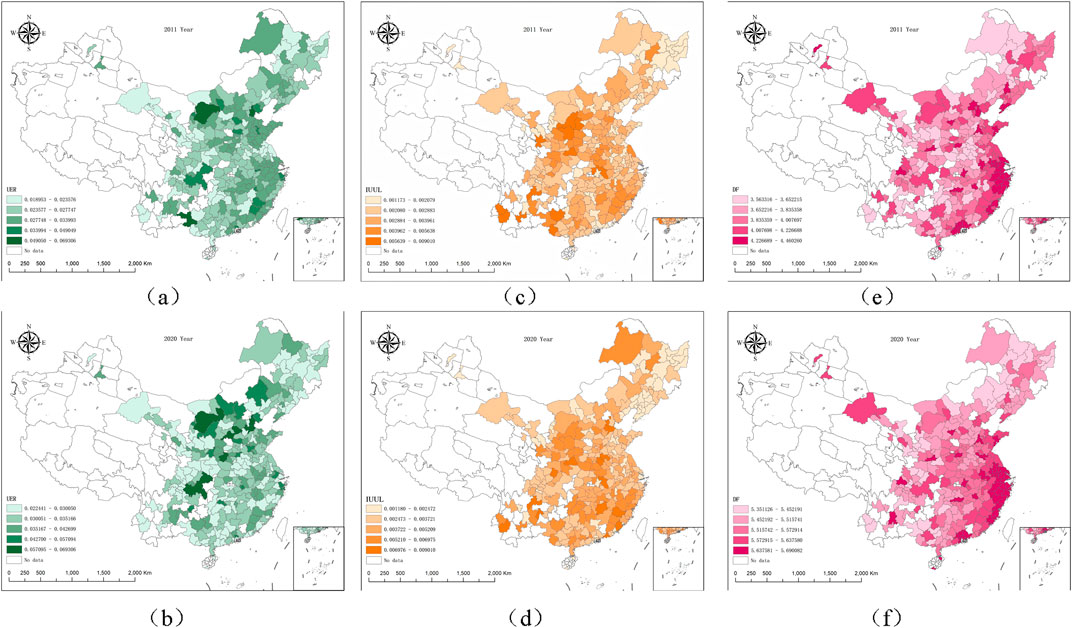

In addition to these findings, the study utilizes a spatial distribution to represent the shifts in urban land visual use efficiency across China from 2011 to 2020 (Figure 4).

Figure 4. Spatial distribution of UER, IUUL, and DF in China. (a) Distribution and Index of UER in Chinese Cities in 2011. (b) Distribution and Index of UER in Chinese Cities in 2020. (c) Distribution and Index of IUUL in Chinese Cities in 2011. (d) Distribution and Index of IUUL in Chinese Cities in 2020. (e) Distribution and Index of DF in Chinese Cities in 2011. (f) Distribution and Index of DF in Chinese Cities in 2020.

In the map, darker colors indicate higher levels of efficiency. Figures 4a,b depict the alterations in the UER of Chinese cities over the decade. The analysis reveals that the UER of China’s eastern coastal cities generally exhibits higher levels, with a discernible trend toward increasing UER over time. The mean value of the explanatory variable IUUL is 0.003, indicating that the current benefits derived by cities from their limited land area are relatively modest. The maximum value of IUUL is 0.009 with a standard deviation of 0.002, suggesting that there is no significant disparity in the level of IUUL across cities.

Figures 4c,d in the study illustrate the transformations in China’s IUUL efficiency over the 10 years. These figures illustrate that cities characterized by higher levels of IUUL are predominantly clustered in the eastern coastal region. Moreover, the level of IUUL has shown an uptrend in the northeastern region over the years. The degree of DF exhibited minimal variation across regions, evidenced by a standard deviation of 0.505. The median and mean values were closely aligned, with a median of 5.222 and a mean of 5.061, indicating a relatively stable distribution of DF levels across regions.

Figures 4e,f visually represent the significant changes in China’s DF development over the 10 years under study. Notably, the figures reveal more developed DF areas in the eastern region. Conversely, a decline in the level of DF development has been observed in the Northeast region over the same period. These findings highlight the spatial disparities in digital financial development across various regions of China, with contrasting trends observed in the eastern and northeastern regions. The observed decline in DF development in the Northeast region can be attributed to the region’s less sophisticated model of DF advancement, leading to a reduction in the efficiency of DF development, as discussed in reference (Wantong, 2024).

4 Empirical results

4.1 Existence tests and moderating effects tests for digital finance

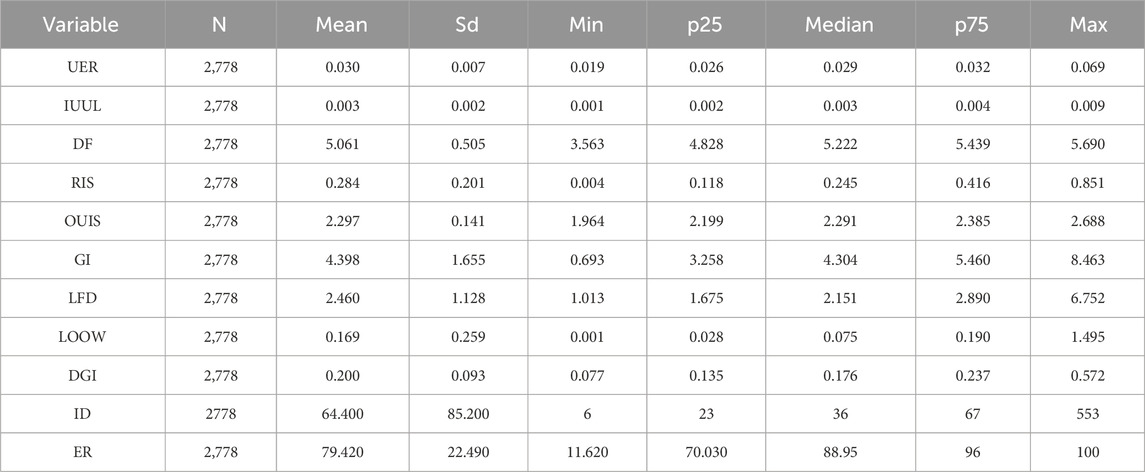

Based on the provided information, the sample has been subjected to regression analysis using Equations 1, 2, with the year and region fixed in both directions to examine the relationship between IUUL, DF, and UER. The regression results are then presented in column (1) of Table 5 to illustrate the analysis outcomes. The regression coefficient for IUUL is 0.2124, which is positive and statistically significant at the 5% level. This indicates that for every unit increase in IUUL, the UER of the corresponding city increases by 0.2124. The second column of Table 5 presents the findings from incorporating the moderating effect of DF. Specifically, the interaction term (DFIU) coefficient between DF and IUUL is 0.1721, indicating a positive association at the 5% significance level. From an economic perspective, this suggests that for each unit of improvement in IUUL facilitated by DF, the UER of the corresponding city is expected to increase by 0.1721.

The findings illustrated in column (1) of Table 5 establish a favorable correlation between IUUL and the extent of UER within the research locale, thus affirming Hypothesis 1. Similarly, the results depicted in column (2) of Table 5 indicate that DF has the potential to significantly enhance the influence of IUUL on UER significantly, thereby confirming Hypothesis 1.

4.2 Robustness testing

4.2.1 Lagged period tes

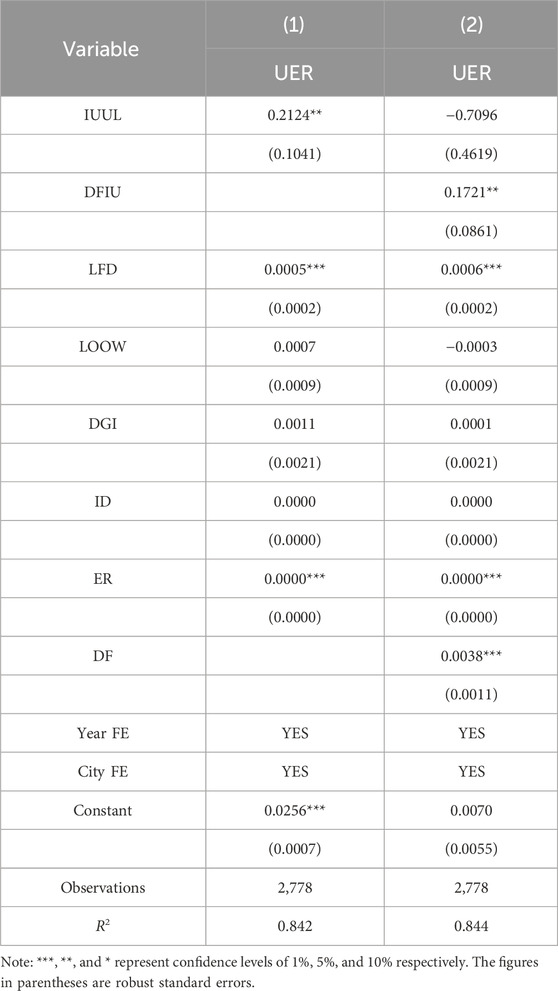

Considering that DF-driven IUUL may have a time delay effect on UER, this study adopts a method similar to existing studies to address this issue (Wang and Ma, 2022). Specifically, the explanatory variables are lagged by one period, and the empirical analysis is reiterated using L.DFIU, L.DF, and L.IUUL. The outcomes of this regression analysis are delineated in column (1) of Table 6. As in column (1) of Table 6, the coefficient associated with the interaction term (L.DFIU) of DF and IUUL demonstrates a positive significance at the 1% level. This discovery aligns with the initial regression outcomes, thereby enhancing the robustness of the findings to a certain degree.

4.2.2 Reduction of sample period

The developmental trajectory of DF in China exhibited volatility, particularly during economic crises, with its driving impact arguably less pronounced. The year 2013 marks the inception of China’s Internet finance (Shen and Huang, 2016), a period during which the evolution of DF stabilized. Consequently, this study shortens the sample period of the baseline regression and adjusts the starting year to 2013. The regression outcomes are detailed in column (2) of Table 6. The interaction term (DFIU) coefficient of DF and IUUL is also positive at the 5% significance level, consistent with the results of the benchmark regression.

4.2.3 Excluding the Xinjiang sample

As a resource-based economy, Xinjiang’s digital economy penetration rate is lower than the national average, potentially creating a structural deviation. Due to its climatic peculiarities, the UER in this area needs to be measured differently. To ensure the reliability of the experimental results, this study excludes the sample of cities from the Xinjiang Uygur Autonomous Region and reruns the regression analysis. The outcomes are detailed in column (3) of Table 6; the coefficient of the interaction term (DFIU) between DF and IUUL is statistically significant at the 5% level of confidence. This result concurs with the benchmark regression findings, thereby underlining the sustained robustness of the conclusions.

4.2.4 Replacement of explanatory variables

In the research design section, IUUL indicators were selected based on perspectives related to investment, employment, energy, and output. Regarding the economic emphasis of IUUL, this research conducts regression analyses from an economic output perspective (Miguelez and Moreno, 2017; Hu et al., 2024). It integrates insights from mainstream academic literature and substitutes the explanatory variables with indicators of economic agglomeration (EA). Subsequent regression tests are conducted, with the EA indicator quantified as non-farm economic output per unit of land. The outcomes are presented in column (4) of Table 6. The interaction term (DFEA) coefficient of DF and EA is positive at the 1% significance level, consistent with the benchmark regression results, and the study’s results remain robust.

5 Further analysis

5.1 Mechanisms analysis

5.1.1 Improvement of GI

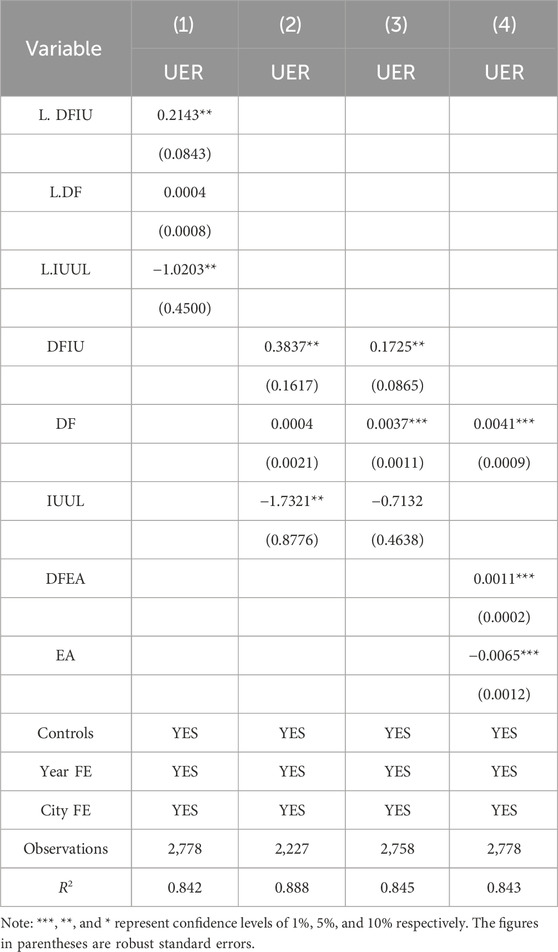

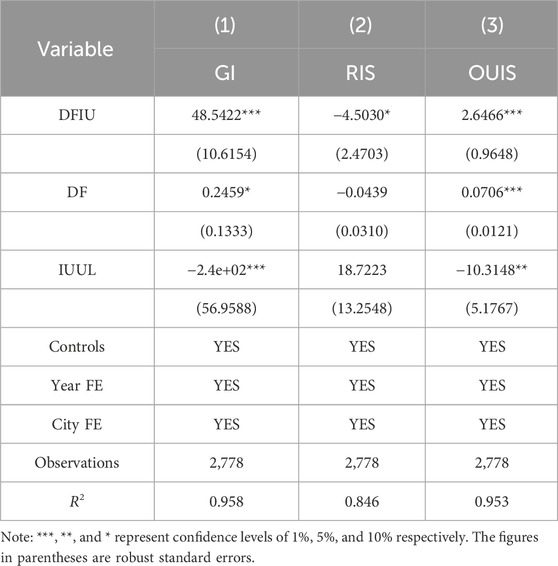

Preliminary analyses suggest that DF can mitigate information asymmetries between GI projects and external stakeholders. It can facilitate financial services for GI endeavors, thereby amplifying the influence of knowledge and technology spillovers in land intensification and utilization. Consequently, this can elevate the significance of GI and bolster the role of IUUL in advancing UER. The regression outcomes of the mechanism test are delineated in column (1) of Table 7. The results in this column illustrate that the regression outcome of the cross-multiplier term DFIU on GI is positive, indicating a favorable moderating impact of DF on innovation spillovers from IUUL. This validates Hypothesis 2a as posited in the study.

5.1.2 Promoting RIS

As evidenced in the preceding theoretical analysis, RIS has positively impacted the development of efficient, high-value-added industries in the region. The enhancement of industrial structure is a multifaceted and pivotal procedure, with the intervention of DF introducing a fresh impetus to this progression. DF has been shown to expedite the velocity of capital circulation and enhance RIS by streamlining the information disclosure practices of enterprises and simplifying investment and financing procedures (Shen and Ren, 2023). The results are displayed in column (2) of Table 7. The result of the cross-multiplier term DFIU on the RIS indicator is negative, suggesting that DF can advance the synergistic advancement of IUUL and RIS. This occurrence inhibits the irrationalization of industrial structure and strengthens the influence of IUUL utilization on UER. The current study scrutinized Hypothesis 2b in this context.

5.1.3 Promoting OUIS

Initial analyses suggest that DF can offer significant financial backing for land development and the establishment of expansive parks. Moreover, it can improve the transparency of the land market and stimulate the rational allocation of land resources, thereby fostering OUIS. As depicted in column (3) of Table 7, the cross-multiplier term DFIU displays a positive regression coefficient for OUIS. This suggests that DF could stimulate IUUL, thereby enhancing OUIS and strengthening the impact of IUUL on improving UER. The current study investigated Hypothesis 2c in this context.

5.2 Heterogeneity analysis

5.2.1 Heterogeneity in levels of economic development

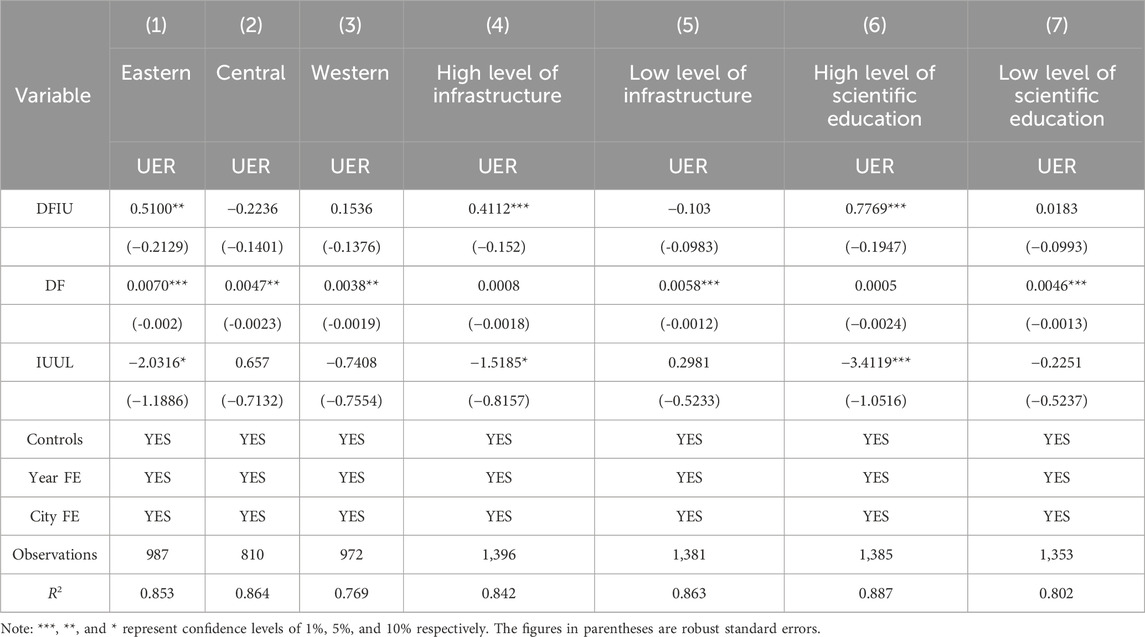

The positive impact of IUUL, propelled by DF, on UER varies across regions with distinct levels of economic development. Regions with a higher echelon of economic development typically exhibit greater capital endowment. DF facilitates the circulation of capital, which allocates resources preferentially to high-productivity industries within economically advanced regions. This process enhances the overall efficiency of resource allocation, mitigates excessive developmental pressures, and strengthens UER. Simultaneously, economically advanced regions possess more sophisticated market mechanisms, reduced transaction costs, and greater information transparency. These areas are better positioned to facilitate capital allocation through DF, a process that renders IUUL more instrumental in enhancing UER. On the other hand, less economically developed regions typically face challenges such as limited economic development, inadequate capital resources, and imperfect market structures. As a result, the positive influence of IUUL, underpinned by DF, on UER is not as pronounced in these regions due to these constraints. Uneven regional development is a common phenomenon in the modernization process of developing countries. In China, differences in natural geographical conditions, insufficient accumulation of historical foundations, and gaps in industrial structure and innovation capacity have led to more rapid economic development in the eastern region than in the central and western regions (Li et al., 2022). Reference to existing studies (Lei et al., 2024), which categorize the sample into eastern, central, and western regions based on the province of location and perform separate regression analyses for each category. The regression results are presented in columns (1)–(3) of Table 8. Notably, in column (1) of Table 8, the regression coefficient of the interaction term (DFIU) between DF and IUUL is positive and retains statistical significance at the 5% level. The regression coefficients about the interaction term (DFIU) between DF and IUUL in columns (2) and (3) do not exhibit statistical significance. This indicates that the advancement of UER through IUUL, facilitated by DF, holds greater significance within the eastern region.

5.2.2 Heterogeneity of urban infrastructure

The positive contribution of DF-driven IUUL to UER exhibits heterogeneity across cities of divergent scales. Urban infrastructure is a crucial component for industrial progress, with the comprehensiveness and caliber of prevailing infrastructure directly influencing the pace of industrial development. Major cities boast more comprehensive infrastructure, providing a robust groundwork for industrial advancement. In this context, the infusion of capital into a high-productivity sector and meeting its capital requisites is positioned to spur the industry’s rapid growth. Consequently, this phenomenon is anticipated to lead to a notable improvement in resource utilization efficiency and UER. Conversely, areas defined by smaller cities exhibit a relatively weaker foundation for industrial growth. This is predominantly due to their recent entry into industrial development, the lack of well-established infrastructures, and environments that are less supportive of information exchange and innovation. It is apparent that, even though the financial needs of high-productivity industries are met, their capacity for growth remains limited. This occurrence contributes to a gradual improvement in UER, stemming from IUUL within the framework of DF. This study conducts group regressions, categorizing the large city size sample as the high infrastructure level group and the small city size sample as the low infrastructure level group. These regression analyses are predicated on the city size metric delineated by the World Bank (Alves et al., 2015). The outcomes of these regressions are delineated in columns (4) and (5) of Table 8. Within these results, the regression coefficient associated with the interaction term between DF and IUUL (DFIU) in column (4) retains statistical significance at the 1% level. In contrast, the regression coefficient for the same interaction term in column (5) lacks significance. This discovery suggests that the advancement of UER through DF-enabled IUUL holds greater importance in cities endowed with more comprehensive infrastructures.

5.2.3 Heterogeneity of innovation environments

The moderating impacts of DF exhibit diversity across various innovation environment regions. Advancements in scientific and educational infrastructure serve as foundational support for the innovation and advancement of digital finance. Primarily, regions characterized by exceptional innovation landscapes typically exhibit enhanced research capabilities, a more robust talent pool, and accelerated IT advancements. This framework provides technical support for the development of DF; simultaneously, a conducive innovation environment fosters environments favorable for GI, thereby amplifying the mutually beneficial impact of DF and IUUL on GI and consequently strengthening UER. Conversely, regions with less robust innovation ecosystems face challenges, including technological obsolescence and shortages of skilled personnel. This not only imposes substantial obstacles to the advancement and dissemination of DF-related products but also introduces limitations to GI, thereby making the positive contribution of DF to UER via its positive regulation of IUUL less pronounced or evident. Regions that allocate substantial resources to scientific endeavors and educational initiatives are better positioned to draw in talented individuals and stimulate innovation. The OECD approach was employed to quantify science and education expenditures (Organization For Economic Cooperation And Development, 2016), using Research and Development (R&D) expenditure as a percentage of GDP to gauge these expenditures. The dataset was subsequently divided into regions with elevated science and education expenditures compared to those with lower expenditures, based on the median annual expenditure for science and education. As evidenced in columns (6) and (7) of Table 8, the regression coefficients associated with the interaction term (DFIU) between DF and IUUL in column (6) exhibit statistical significance at the 1% level. On the contrary, the regression coefficients of the interaction term (DFIU) between DF and IUUL in column (7) do not demonstrate statistical significance. This implies that the moderating influence of DF is more conspicuous in regions characterized by elevated science and education expenditures.

6 Conclusion and policy recommendations

6.1 Conclusion

Urbanization, a core process of worldwide progress, has spurred a significant ecological dilemma alongside economic advancement. China’s historic economic advancement strategy, labeled “leapfrogging,” has traditionally leaned on a conventional and rudimentary model. Nevertheless, this strategy has encountered notable hurdles, encompassing environmental constraints and deficient governance. The current juncture is defined by a pressing necessity to surmount the existing dichotomy between “environment” and to forge a sustainable trajectory through technological advancements, institutional enhancements, and eco-friendly transitions. It is essential to strike a dynamic balance between economic progress and ecological sustainability. This research utilizes panel data from 282 prefecture-level cities spanning the period from 2011 to 2020 to investigate the influence of IUUL on strengthening UER. Additionally, it scrutinizes how DF propels IUUL, consequently amplifying UER. The study’s outcomes suggest that DF can augment IUUL, thus positively impacting the mounting influence of IUUL on UER. The consistency of the results persists even after undergoing a battery of robustness tests. Additional research is crucial to delineate the precise pathway of digital financial empowerment of IUUL in industrial development dynamics, industrial development structure, and industrial development orientation. Mechanism analysis reveals the following: the current study showcases a favorable moderating impact of innovation spillovers from DF on IUUL; at the same time, DF holds the potential to enhance the synergy between IUUL and RIS, consequently curbing the irrationalization of the industrial structure. Furthermore, DF can enhance the efficacy of IUUL in driving holistic industrial structure upgrading, thus strengthening the effect of IUUL on UER. Heterogeneity analysis discloses that the influence of DF facilitates IUUL, thereby augmenting the impact of IUUL on UER. This effect is more pronounced in cities with higher levels of economic development, well-developed infrastructure, and robust innovation ecosystems.

6.2 Policy recommendations

Firstly, it is crucial for policies to prioritize macro-control and resource guidance to facilitate the seamless integration of IUUL and DF. The government should enhance land-use planning, intensify the management of urban land resources, and steer efficient land utilization through optimized policies. Simultaneously, robust support for DF, particularly in infrastructure construction and inclusive finance, is essential. Additionally, the government should provide technical aid and financial resources to less developed regions. Moreover, proactive implementation of policies that promote green innovation is vital. Initiatives such as establishing special funds or offering tax incentives can incentivize enterprises and financial institutions to increase investments in green technology research and development. The government may consider establishing pilot industrial parks that focus on integrating green and digital transformation, accompanied by targeted financial subsidies and tax incentives. These initiatives aim to create a conducive environment for enterprises to engage in green innovation and adopt sustainable production practices. Furthermore, prioritizing regional synergistic development is key. By leveraging the demonstration effect of the eastern region and cities with notable scientific and educational contributions, the government can foster balanced regional progress by exchanging experiences and replicating successful policies.

Secondly, the synergistic relationship between IUUL and DF presents a significant opportunity for enterprises to undergo a green transformation. Aligned with government policies, enterprises should actively adopt digital tools and green technologies to enhance land use efficiency, thereby accelerating the optimization of their industrial structures. Digitalization is a tool for green development, and its rational use can promote and drive sustainable progress (Zeng et al., 2025). Within the framework of DF empowerment, enterprises are obliged to prioritize the enhancement of their GI capacities, explore novel business paradigms and technological implementations, and cultivate sustainable competitive advantages. Enterprises should establish dedicated green R&D departments or innovation teams to implement innovative practices in green product development, low-carbon process innovation, and circular economy models. Enterprises should also actively seek new financial products, such as green loans and digital green bonds with ESG rating functions, to provide long-term and stable financial support for their green transformation. Large enterprises are urged to shoulder greater social responsibility, serving as exemplars for environmentally sustainable development. They should lead by example in guiding small and medium-sized enterprises to collectively contribute to creating eco-friendly cities through the dissemination of technology and collaborative demonstrations. Conversely, small and medium-sized enterprises can leverage the inclusive nature of DF to lower financing barriers and enhance competitiveness in land resource utilization with financial support.

Thirdly, the pivotal role of DF in IUUL demands a strengthening through the innovation of financial products and service models. Financial institutions must prioritize the development of green financial products, such as green credit and bonds, focusing on supporting green projects and technological advancements within intensive land-use contexts. Simultaneously, leveraging fintech to boost service efficiency, reduce operational costs, and extend the reach of DF is essential. Digitization is the key to efficiency in today’s age, and so is the financial industry (Wu et al., 2024). Financial institutions can use big data and artificial intelligence technology to conduct credit assessments on enterprises and projects, accurately identify projects with green development potential, and improve loan approval efficiency. At the same time, they can develop an online green project financing platform to digitize the entire process, from financing application and assessment to approval and loan issuance, thereby lowering the financing threshold for small and medium-sized green projects. Financial institutions should forge stronger partnerships with the government and enterprises, crafting financial support schemes aligned with market demands through coordination with policy frameworks and industry requirements. Moreover, financial institutions should enhance their risk management capabilities, particularly when supporting GI and OUIS projects. They ought to conduct scientific assessments of project feasibility to ensure the secure and effective allocation of financial resources and facilitate the enhancement of UER.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.stats.gov.cn/.

Author contributions

YL: Conceptualization, Data curation, Investigation, Project administration, Supervision, Writing – original draft, Writing – review and editing. CL: Conceptualization, Formal Analysis, Methodology, Software, Writing – original draft, Writing – review and editing. ZH: Methodology, Software, Supervision, Writing – original draft, Writing – review and editing. JL: Formal Analysis, Funding acquisition, Resources, Visualization, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by the National Key Research and Development Program of China (No. 2024YFC3211300) and the Central Public-Interest Scientific Institution Basal Research Fund (HKF202414).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alves, L. G., Mendes, R. S., Lenzi, E. K., and Ribeiro, H. V. (2015). Scale-adjusted metrics for predicting the evolution of urban indicators and quantifying the performance of cities. PloS. One. 10 (9), e0134862. doi:10.1371/journal.pone.0134862

Cao, H., Chen, W., Tan, X., and Li, Q. (2023). Identification and driving mechanism of the industrial land use transition in China. Habitat. Int. 138, 102848. doi:10.1016/j.habitatint.2023.102848

Chen, M., Jiang, Y., Wang, E., Wang, Y., and Zhang, J. (2022). Measuring urban infrastructure resilience via pressure-state-response framework in four Chinese municipalities. Appl. Sci. 12 (6), 2819. doi:10.3390/app12062819

Chen, Q., Zheng, L., Wang, Y., Wu, D., and Li, J. (2023). Spillover effects of urban form on urban land use efficiency: evidence from a comparison between the yangtze and yellow Rivers of China. Environ. Sci. Pollut. Res. 30 (60), 125816–125831. doi:10.1007/s11356-023-30976-w

Downing, A. S., van Nes, E. H., Mooij, W. M., and Scheffer, M. (2012). The resilience and resistance of an ecosystem to a collapse of diversity. PLoS One 7, e46135. doi:10.1371/journal.pone.0046135

Etard, A., Pigot, A. L., and Newbold, T. (2022). Intensive human land uses negatively affect vertebrate functional diversity. Ecol. Lett. 25 (2), 330–343. doi:10.1111/ele.13926

Fu, Y. (2024). A theoretical analysis of digital finance enabling green innovation. Highlights. Bus. Econom. Manage. 33, 251–259. doi:10.54097/wdn7ds67

Fuhong, W., and Yong, X. (2024). Characteristics of unbalanced and inadequate intensive use of cultivated land in China and causes. Resour. Sci. 46 (1), 130–144. doi:10.18402/resci.2024.01.10

Gómez-Baggethun, E., Gren, Å., Barton, D. N., Langemeyer, J., McPhearson, T., O’farrell, P., et al. (2013). Urbanization, biodiversity and ecosystem services: Challenges and opportunities: a global assessment. In: Urban ecosystem services. New York, NY: Springer. p. 175–251. doi:10.1007/978-94-007-7088-1_11

Gu, H., Guo, G., and Li, C. (2024). Treating the symptoms as well as the root causes: how the digital economy can mitigate the negative impacts of land resource mismatches on urban ecological resilience. Land 13 (9), 1463. doi:10.3390/land13091463

Holling, C. S. (1973). Resilience and stability of ecological systems. Annu. Rev. Ecol. Syst. 4, 1–23. doi:10.1146/annurev.es.04.110173.000245

Hu, F., Zhao, S., Bing, T., and Chang, Y. (2017). Hierarchy in industrial structure: the cases of China and the USA. Phys. Stat. Mech. its Appl. 469, 871–882. doi:10.1016/j.physa.2016.11.083

Hu, Z., Li, B., Guo, G., Tian, Y., Zhang, Y., and Li, C. (2024). Unlocking the power of economic agglomeration: how digital finance enhances urban land use efficiency through innovation ability and rationalization of industrial structure in China. Land 13 (11), 1805. doi:10.3390/land13111805

Huang, Y., Zhou, Q., Yang, C., and Albitar, K. (2025). The relationship between FinTech and energy markets in China. Technol. Forecast. Soc. Change. 217, 124188. doi:10.1016/j.techfore.2025.124188

Jiang, D., Ni, Z., Chen, Y., Chen, X., and Na, C. (2022). Influence of financial shared services on the corporate debt cost under digitalization. Sustainability 15 (1), 428. doi:10.3390/su15010428

Jiang, F., Xu, Y., Xiao, R., and Du, C. (2019). Research on the coordinated development strategy of regional science and technology finance. In: 2019 annual conference of the society for management and economics. New York, NY: Springer, vol. 4. p. 126–130. The academy of engineering and education. doi:10.25236/icemct.2018.002

Ke, H., Yang, B., and Dai, S. (2022). Does intensive land use contribute to energy efficiency? —evidence based on a spatial durbin model. Int. J. Environ. Res. Public. Health 19 (9), 5130. doi:10.3390/ijerph19095130

Khan, T., Khan, A., Wei, L., Khan, T., and Ayub, S. (2022). Industrial innovation on the green transformation of manufacturing commerce. J. Mark. Strategies 4 (2), 283–304. doi:10.52633/jms.v4i2.219

Kong, W., Guo, J., and Ou, M. (2014). Study on land intensive use response on economic development and regional differentiated control of constructed land. Chin. Popul. Res. Environ. 24, 100–106. doi:10.3969/j.issn.1002-2104.2014.04.014

Lei, L., Zhou, H., and Wang, D. (2024). Marketization and corporate cash holdings: role of financial constraint alleviation. Int. Rev. Finance 24 (4), 743–771. doi:10.1111/irfi.12467

Li, C., Wang, Y., Zhou, Z., Wang, Z., and Mardani, A. (2023b). Digital finance and enterprise financing constraints: structural characteristics and mechanism identification. J. Bus. Res. 165, 114074. doi:10.1016/j.jbusres.2023.114074

Li, C., Zhang, Y., and Yu, H. (2024). Digitalization and the “Too Big to Fail” Dilemma: mechanisms and asymmetric effects of banks’ fintech innovation on total factor productivity. Technol. Econ. Dev. Econ. 30 (2), 464–488. doi:10.3846/tede.2024.21299

Li, H., Wang, Z., Zhu, M., Hu, C., and Liu, C. (2023a). Study on the spatial–temporal evolution and driving mechanism of urban land green use efficiency in the yellow river basin cities. Ecol. Indic. 154, 110672. doi:10.1016/j.ecolind.2023.110672

Li, J., Wu, Y., and Xiao, J. J. (2020). The impact of digital finance on household consumption: evidence from China. Econ. Model. 86, 317–326. doi:10.1016/j.econmod.2019.09.027

Li, X., Shao, X., Chang, T., and Albu, L. L. (2022). Does digital finance promote the green innovation of China's listed companies? Energy Econ. 114, 106254. doi:10.1016/j.eneco.2022.106254

Ling, X., Gao, Y., and Wu, G. (2023). How does intensive land use affect low-carbon transition in China? New evidence from the spatial econometric analysis. Land 12 (8), 1578. doi:10.3390/land12081578

Liu, D., Liu, W., and He, Y. (2024a). How does the intensive use of urban construction land improve carbon emission efficiency?—evidence from the panel data of 30 provinces in China. Land 13 (12), 2133. doi:10.3390/land13122133

Liu, J., Fang, Y., Ma, Y., and Chi, Y. (2024b). Digital economy, industrial agglomeration, and green innovation efficiency: empirical analysis based on Chinese data. J. Appl. Econ. 27 (1), 2289723. doi:10.1080/15140326.2023.2289723

Liu, J., Feng, H., and Wang, K. (2022). The low-carbon city pilot policy and urban land use efficiency: a policy assessment from China. Land 11 (5), 604. doi:10.3390/land11050604

Liu, Y., and Shen, Y. (2021). The practice and development of digital inclusive finance in China. In: Proceedings of the first international forum on financial mathematics and financial technology. Singapore: Springer. p. 1–19. doi:10.1007/978-981-15-8373-5_1

Lu, T., and Luo, P. (2024). Rare disaster, economic growth, and disaster risk management with preferences for liquidity. Int. Rev. Finance 24 (2), 195–212. doi:10.1111/irfi.12437

Luo, J., Wu, Y., Choguill, C. L., and Zhang, X. (2022). A study on promoting the intensive use of industrial land in China through governance: a game theoretical approach. J. Urban Manag. 11 (3), 298–309. doi:10.1016/j.jum.2022.02.003

Miguelez, E., and Moreno, R. (2017). Networks, diffusion of knowledge, and regional innovative performance. Int. Regional Sci. Rev. 40 (4), 331–336. doi:10.1177/0160017616653447

Organization For Economic Cooperation And Development (2016). OECD science, technology and innovation outlook 2016. Paris, France: Organization For Economic. doi:10.1787/sti_in_outlook-2016-en

Pan, J. (2019). Reflections on paradigm shift in urban system reconstruction. Chin. J. Urban Environ. Stud. 7 (02), 1950004. doi:10.1142/S2345748119500040

Pan, Y., Liu, J., and Cheng, C. (2024). Research on urban resilience from the perspective of land intensive use: indicator measurement, impact and policy implications. Buildings 14 (8), 2564. doi:10.3390/buildings14082564

Qiu, H., Li, X., and Zhang, L. (2023). Influential effect and mechanism of digital finance on urban land use efficiency in China. Sustainability 15 (20), 14726. doi:10.3390/su152014726

Shamsipour, A., Jahanshahi, S., Mousavi, S. S., Shoja, F., Golenji, R. A., Tayebi, S., et al. (2024). Assessing and mapping urban ecological resilience using the loss-gain approach: a case study of Tehran, Iran. Sustain. Cities Soc. 103, 105252. doi:10.1016/j.scs.2024.105252

Shang, Y., Xu, J., and Zhao, X. (2022). Urban intensive land use and enterprise emission reduction: new micro-evidence from China towards COP26 targets. Resour. Policy 79, 103158. doi:10.1016/j.resourpol.2022.103158

Shen, Y., and Huang, Y. (2016). Introduction to the special issue: internet finance in China. China Econ. J. 9 (3), 221–224. doi:10.1080/17538963.2016.1215058

Shen, Y., and Ren, X. (2023). Digital finance and upgrading of industrial structure: prefecture-Level evidence from China. Finance Res. Lett. 55, 103982. doi:10.1016/j.frl.2023.103982

Shi, C., Zhu, X., Wu, H., and Li, Z. (2022). Assessment of urban ecological resilience and its influencing factors: a case study of the beijing-tianjin-hebei urban agglomeration of China. Land 11 (6), 921. doi:10.3390/land11060921