- 1School of Economics, Marien Ngouabi University, Brazzaville, Republic of Congo

- 2School of Finance and Economics, Jiangsu University, Jiangsu, China

This study comprehensively investigates the effects of gold price, financial development, renewable energy consumption, economic growth, urbanization, and environmental taxation on environmental degradation. The analysis is conducted using panel data from nine gold-producing countries in West Africa, covering the period from 2000 to 2020. To ensure the credibility and robustness of the findings, the study employs a range of advanced econometric techniques, including Fully Modified Ordinary Least Squares, Dynamic Ordinary Least Squares, Canonical Cointegrating Regression, Robust Least Squares, and Granger causality tests. The motivation for this research arises from the urgent need to address escalating environmental challenges in West Africa resource-dependent economies, where gold mining remains a key economic driver but simultaneously contributes to significant environmental damage. Therefore, this study aims to provide practical insights that can guide the formulation of sustainable policies that balance economic growth with environmental preservation. The results reveal several important dynamics. Firstly, both financial development and urbanization exert a significant positive influence on environmental degradation, indicating their role in exacerbating ecological pressure. In contrast, economic growth appears to play a mitigating role by helping reduce environmental degradation, suggesting that economic expansion, if managed efficiently, can be aligned with sustainability goals. Moreover, environmental taxation proves to be an effective policy tool in limiting pollution levels, thereby reinforcing its significance as a regulatory mechanism. However, the analysis shows that neither gold price fluctuations nor renewable energy consumption has a direct, statistically significant impact on environmental degradation. Nevertheless, the Robust Least Squares estimates suggest that renewable energy consumption, GDP growth, and urbanization may contribute to environmental improvements under specific conditions. Furthermore, the Granger causality tests reveal notable causal relationships. There is a unidirectional causality running from gold price fluctuations to environmental degradation and from economic growth to environmental sustainability. Interestingly, urbanization and environmental degradation exhibit a bidirectional causal link, implying a feedback loop between these two factors. Additionally, environmental degradation is found to Granger-cause environmental tax implementation, highlighting the reactive nature of policy responses to environmental deterioration. On the other hand, no significant causal connection is detected between financial development, renewable energy consumption, and environmental degradation. Overall, these findings offer valuable insights for policymakers seeking to promote sustainable development pathways in resource-reliant economies. At the same time, the study acknowledges existing limitations and recommends future research to explore these dynamics in broader contexts and with more granular data.

1 Introduction

The deterioration of the natural environment has emerged as a major global challenge, posing significant obstacles to achieving sustainable development and maintaining economic stability. Environmental degradation encompasses the progressive depletion and destruction of natural resources, including water, soil, and air, along with the disruption of ecosystems, loss of biodiversity, habitat destruction, and increased levels of environmental pollution. The overuse of natural resources, escalating greenhouse gas emissions, and the harmful environmental consequences of rapid industrialization have further heightened global concerns regarding ecological sustainability (Usman et al., 2022; Wang and Azam, 2024).

In light of these growing threats, extensive research has sought to identify the underlying drivers of environmental degradation and propose effective policy mechanisms to mitigate its impact (Groffman et al., 2006; Haque and Ntim, 2018). Within this context, the present study assesses the role of gold price fluctuations, financial development, renewable energy consumption, economic growth, urbanization, and environmental taxation in influencing environmental deterioration. Although previous studies highlight that financial development and economic growth can foster industrialization and resource exploitation, they are often accompanied by increased environmental pollution and ecological harm (Bambi and Pea-Assounga, 2024a; Usman et al., 2022; Yang and Ni, 2022), others argue that financial markets facilitate investments in green technologies, which can mitigate environmental damage (Cao et al., 2021; Tong et al., 2022). Similarly, urbanization is often associated with rising carbon emissions and ecological degradation due to higher energy consumption and waste generation (Bambi et al., 2024; Li and Lin, 2015; Sun et al., 2022). However, planned urbanization can also promote sustainable practices and infrastructure that reduce environmental harm (Leitmann, 2017; Ramyar et al., 2021). The influence of gold prices on environmental degradation remains underexplored, despite the mining sector’s well-documented environmental footprint (Maponga and Ngorima, 2003; Pea-Assounga et al., 2025). Additionally, while renewable energy is widely recognized for reducing emissions and improving environmental quality (Bambi and Pea-Assounga, 2025; Dincer, 2000; Panwar et al., 2011), its large-scale deployment requires financial support and policy incentives. Environmental taxation, in turn, serves as a regulatory tool to curb emissions by discouraging pollution-intensive activities (He and Zhang, 2018; Wang et al., 2023), yet its effectiveness depends on economic structures and enforcement mechanisms. The primary problem this study seeks to address is the lack of empirical consensus on how these variables interact to shape environmental outcomes, particularly in resource-rich developing economies.

Although the existing body of research on environmental degradation continues to expand, there remains a significant gap concerning studies that assess the combined influence of macroeconomic, energy, and policy-related factors specifically within the gold-producing countries of West Africa. Moreover, this region faces acute challenges in managing its gold resources, which considerably contribute to environmental degradation in the form of pollution, deforestation, biodiversity loss, and soil erosion. Inadequate governance of the gold sector further intensifies these problems by accelerating resource depletion, destroying habitats, and contaminating essential water sources, thereby posing serious threats to ecosystems, public health, and socio-economic stability. Consequently, it becomes essential to investigate how economic growth, financial development, renewable energy consumption, urbanization, environmental tax policies, and fluctuations in gold prices collectively influence environmental degradation. Such an assessment is vital not only to fully comprehend the scale of ecological damage but also to evaluate the extent to which gold market dynamics impact the sustainability of resource management and the adoption of environmentally responsible mining practices.

In this context, variations in gold prices can significantly shape extraction intensity, regulatory enforcement, and investment decisions related to cleaner technologies. For example, rising gold prices often incentivize rapid, poorly regulated mining activities, whereas declining prices may reduce production levels but simultaneously hinder investments in technological innovation and environmental protection. Thus, understanding these interactions is fundamental for designing effective, evidence-based environmental policies, particularly in resource-dependent, developing economies.

In line with these considerations, the primary objective of this study is to empirically assess the effects of gold price fluctuations, financial development, renewable energy consumption, economic growth, urbanization, and environmental tax policies on environmental degradation in gold-producing nations across West Africa. By doing so, this research addresses crucial gaps in the literature by exploring how economic, financial, energy, and policy factors collectively shape environmental outcomes in mineral-rich developing regions.

The motivation behind this research stems from the assumption that environmental degradation patterns differ significantly across West African gold-producing countries, primarily due to variations in gold resource dependency, institutional strength, environmental governance frameworks, and levels of economic diversification. For instance, countries such as Ghana and Mali have long-established gold industries that present complex environmental challenges, while emerging producers like Côte d'Ivoire, Senegal, and Liberia are still in the process of shaping their regulatory systems and investment environments. Such structural disparities are likely to produce heterogeneous environmental outcomes across the region, thereby highlighting the need for a comparative, country-specific empirical assessment.

Accordingly, the central research question guiding this study is: What is the impact of gold price fluctuations, financial development, renewable energy consumption, economic growth, urbanization, and environmental tax policies influence environmental degradation in the gold-producing economies of West Africa?

In addressing this research question, the study makes an original contribution by focusing on nine major gold-producing nations in West Africa, namely, Ghana, Burkina Faso, Guinea, Mali, Côte d'Ivoire, Niger, Liberia, Senegal, and Sierra Leone over the period from 2000 to 2020. These countries were deliberately selected due to their significant reliance on gold exports, which represent a critical share of GDP and foreign exchange earnings. However, this economic dependence has also been accompanied by severe environmental consequences, including widespread deforestation, biodiversity loss, water contamination, and land degradation. Incorporating complementary variables such as financial development, renewable energy consumption, and environmental tax policies into the analysis provides a more comprehensive understanding of how broader economic, financial, energy, and regulatory factors interact with gold price dynamics to influence environmental degradation. Moreover, the selected timeframe from 2000 to 2020 enables a thorough examination of long-term trends, capturing the impacts of global financial volatility, technological advances in the mining and energy sectors, and the evolution of environmental regulations over two decades.

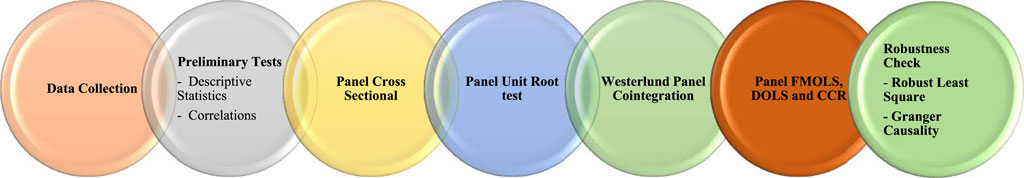

From a methodological standpoint, this study applies a comprehensive and cutting-edge econometric framework, combining Fully Modified Ordinary Least Squares (FMOLS), Dynamic Ordinary Least Squares (DOLS), Canonical Cointegrating Regression (CCR), Robust Least Squares, and Granger causality techniques. These advanced methods are specifically designed to capture long-run relationships within panel data structures while effectively resolving key econometric concerns, including endogeneity, serial correlation, cross-sectional dependence, and heteroscedasticity (Drukker, 2003; Sarafidis and Wansbeek, 2012). Many empirical studies in environmental economics suffer from two fundamental shortcomings: first, the overreliance on conventional panel estimation methods, particularly Ordinary Least Squares (OLS) mean regression models, which only capture the conditional mean of the dependent variable (Wooldridge, 1991); and second, the failure to account for heterogeneous data distributions, leading to inefficient and biased parameter estimates (Pesaran and Smith, 1995). FMOLS and DOLS address these limitations by correcting for endogeneity and serial correlation, while also mitigating the issue of omitted variable bias, thereby improving the accuracy and efficiency of parameter estimates (Kao, 2000; Phillips and Hansen, 1990). Moreover, CCR enhances robustness by accommodating non-stationarity and ensuring valid cointegration properties among the variables, making it particularly suitable for long-term equilibrium analysis (Dahmani, 2024). Robust Least Squares further strengthen the empirical robustness of the results by minimizing the impact of outliers and heteroskedasticity, which are common in environmental datasets characterized by structural breaks and extreme variations in economic and environmental indicators. Finally, the inclusion of Granger causality tests offers a more comprehensive understanding of the directional and dynamic relationships among gold price fluctuations, “financial development,” “renewable energy consumption,” economic expansion, urbanization, and environmental tax policies in shaping environmental damage. Unlike traditional static models, which only capture correlation, Granger causality analysis provides insights into the temporal causality and feedback mechanisms that drive environmental outcomes (Friston et al., 2014). By applying this comprehensive and sophisticated econometric framework, the study significantly improves methodological rigor and addresses a critical gap in the literature by offering nuanced insights into the complex interactions that drive environmental degradation in resource-dependent, developing economies. Based on these methodologies, the study formulates the following hypotheses to be empirically tested: H1: Fluctuations in gold prices have a significant impact on environmental degradation across gold-producing nations in West Africa. H2: Financial development contributes to environmental degradation through increased industrial and resource exploitation activities. H3: Renewable energy consumption mitigates environmental degradation by promoting cleaner energy alternatives. H4: Economic growth initially intensifies environmental degradation but subsequently reduces it in line with the Environmental Kuznets Curve hypothesis. H5: Urbanization exacerbates environmental degradation by driving increased resource consumption, infrastructure expansion, and pollution. H6: Environmental tax policies play a mitigating role by discouraging environmentally harmful practices.

The results of this study are anticipated to provide significant contributions to the literature and practitioners in this field by elucidating the economic, energy, and financial mechanisms that either exacerbate or mitigate environmental degradation. Unlike previous studies that have examined these factors in isolation or focused on broader geographic regions (Bambi and Pea-Assounga, 2024b; Mudd, 2007), this research provides an integrated analysis specific to gold-dependent West African nations. By identifying key drivers of environmental harm, the study offers a foundation for designing more effective and sustainable policies tailored to resource-rich economies. The integration of advanced econometric methodologies enhances the robustness and reliability of empirical evidence, ensuring that policy recommendations are grounded in rigorous analysis.

The structure of this manuscript is arranged as follows: Section 2 presents a comprehensive review of the existing literature. Section 3 describes the methodological framework adopted in the study. Section 4 reports and interprets the key empirical results. Section 5 discuss and elaborates on the practical policy implications arising from the findings. Finally, Section 6 concludes the paper by outlining the study’s limitations and proposing avenues for future research.

2 Literature review

This section offers a detailed exploration of the intricate relationships between each variable and ecological footprint, focusing on their individual effects on ecological footprint. Through this analysis, it aims to uncover the underlying dynamics that shape ecological footprint, highlighting the direct influence of each variable. The review will begin with the historical perspective of the gold price, after that the formulation of hypotheses will be examined, then the constructing framework based on the hypothesis will be done, and lastly, research gaps will be set.

2.1 Historical review of West Africa gold mining market report overview

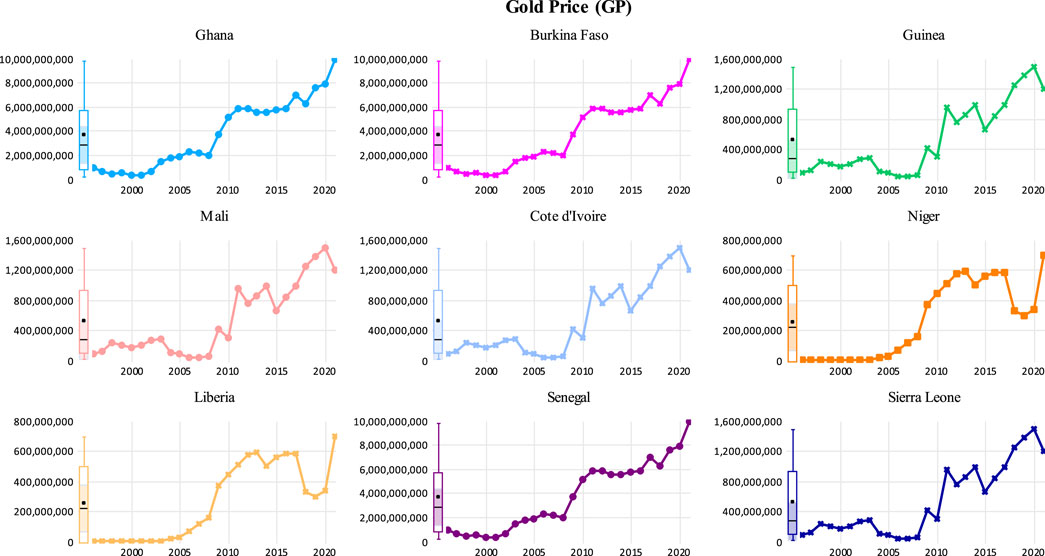

West Africa has long been a pivotal region for gold production, with a rich mining heritage spanning centuries. By 2024, the region’s total gold output is projected to reach approximately 11.83 million ounces (moz), reinforcing its status as a major global mining hub. Ghana, Burkina Faso, Guinea, and Mali remain the leading contributors, collectively accounting for a significant portion of the region’s gold production (Lanzano, 2018). At the same time, several emerging gold-producing nations, including Côte d’Ivoire, Niger, Liberia, Senegal, and Sierra Leone, are actively enhancing their mining industries through targeted incentive policies. Among these, Côte d’Ivoire stands out due to substantial foreign direct investment in its gold sector, driven by a supportive regulatory environment and continuous improvements in mining infrastructure (Seiyefa and Oyosoro, 2024). Similarly, Senegal has implemented initiatives to formalize small-scale mining operations, aiming to boost gold production and optimize tax revenue collection (Dossou Etui et al., 2024). From an economic standpoint, gold price trends (GP) in West African producing countries between 2000 and 2020 reveal considerable volatility, largely influenced by global economic conditions, monetary policies, and regional stability. In the early 2000s, gold prices remained relatively low due to weak global demand. However, the 2008 global financial crisis marked a turning point, triggering a surge in gold prices as investors sought refuge in this safe-haven asset. Consequently, West African gold producers experienced a substantial increase in revenues (Bekiros et al., 2017). The period from 2010 to 2012 proved particularly advantageous for the gold sector, with prices reaching historic highs. This upward trend spurred significant investment in mining operations and accelerated the development of new exploration projects across the region (Hilson, 2019). However, from 2013 onwards, gold prices began to decline, primarily due to weakening global demand and the appreciation of the US dollar. This downturn had far-reaching consequences, leading to revenue contractions in several West African economies heavily reliant on gold mining (Hopkins, 2019). The outbreak of the COVID-19 pandemic in 2020 triggered another surge in gold prices, driven by heightened financial uncertainty and global supply chain disruptions. Amid this turbulence, gold once again asserted its role as a safe-haven asset, leading to increased demand and a sharp rise in prices. Figure 1 below illustrates the fluctuation of gold prices in key West African producing nations between 2000 and 2020, underscoring both market volatility and the external economic forces shaping the regional gold industry.

2.2 Hypothesis development

2.2.1 The gold prices and environmental deterioration

Examining the relationship between gold prices and environmental deterioration has been the focus of numerous empirical studies employing diverse methodologies, time frames, and findings. This review highlights a selection of some of these studies in order to provide a comprehensive understanding of these relationships. For instance, drawing insights from the study titled Wounding Guyana: Gold Mining and Environmental Degradation, (Pea-Assounga and Wu, 2022; Roopnarine, 2002), reveals that gold mining in Guyana has led to significant environmental challenges, including waste pollution, extensive soil erosion, and widespread deforestation. Additionally, (Müezzinogˇlu, 2003), highlights that substantial amounts of hazardous chemicals, such as mercury and sodium cyanide, are utilized in the extraction of gold from its ores. Consequently, they emphasize the need for stringent regulation of this activity through globally enforced directives grounded in the latest advancements in ecotoxicology and contemporary environmental standards. Similarly, (Mencho, 2022), drawing on primary data collected from 283 randomly selected samples within the study area, identifies gold mining as a major contributor to various environmental issues. These include water shortages (8.8%), brook dehydration (10.6%), soil erosion (20.8%), street damage (17.6%), and ecosystem destruction (7.0%). Moreover, (Zhang et al., 2025), incorporate uncertainty shocks into the MIDAS framework to assess their relevance and validity in forecasting gold price volatility. Their analysis reveals that the significance of parameters indicates a positive correlation between uncertainty indicators and gold price volatility. However, the impact of these shocks varies depending on their magnitude, highlighting the dynamic nature of their influence on gold price fluctuations. Conversely, (Laker, 2023), uncovered that gold mining in South Africa has significant and detrimental environmental consequences. Moreover, (Porgo and Gokyay, 2017), focusing on the northeastern region of Burkina Faso, reveal that gold mining activities, both direct and indirect, significantly contribute to air pollution in the Essakane district. The utilization of hazardous chemicals such as cyanide in industrial gold mining and mercury in artisanal gold mining poses serious risks to the ecosystem, the health of the local population, and livestock production. Furthermore, (Bashir et al., 2024), employ the Cross-Sectionally Augmented Autoregressive Distributed Lag (CS-ARDL) model as the primary econometric technique to examine the asymmetric relationship between environmental degradation and its key determinants. To ensure the robustness of their results, they also utilize methods such as Augmented Mean Group (AMG), Cross-Sectional Distributed Lags (CS-DL), “Driscoll-Kraay standard errors, and Feasible Generalized Least Squares.” Their analysis reveals that energy resource prices and renewable energy consumption contribute to reducing environmental degradation, whereas rising gold prices exacerbate environmental pollution. Lastly, (Ouoba et al., 2024), utilize a probit model to analyze data from a sample of 251 households residing near four industrial mining sites. Their findings indicate that mining activities have positively impacted household per capita income in the vicinity of some industrial mining operations. However, these economic benefits are offset by a decline in the overall quality of life for nearby households, primarily due to noise and air pollution, as well as social challenges such as increased instances of banditry.

2.2.2 Financial development and renewable energy consumption on environmental degradation

Investigating the connection between “financial development and renewable energy consumption on environmental degradation” has been explored in numerous empirical studies showcasing varying methodologies, time frames, and findings. This review highlights a selection of some of these studies in order to provide a comprehensive understanding of these relationships. For instance, drawing insights from the study conducted by (Prempeh, 2024), utilizing the Driscoll-Kraay panel regression technique and panel quantile analysis “on a dataset spanning 10 ECOWAS countries from 1990 to 2019,” demonstrate that enhanced “financial development and greater adoption of renewable energy” are significantly linked to reduced levels of environmental degradation. Additionally, (Atsu et al., 2021), focusing on South Africa as a case study over the period 1970–2019, employ “Autoregressive Distributed Lag,” “Dynamic Ordinary Least Squares,” and “Fully Modified Ordinary Least Squares” methodologies. Their findings reveal that both renewable energy consumption and financial development play a significant role in mitigating environmental degradation. Moreover, (Khan et al., 2021), analyze the influence of financial development and energy consumption on environmental deterioration across 184 nations utilizing a dynamic panel framework. Their findings suggest that financial development and renewable energy consumption contribute to reducing environmental degradation. However, the Seemingly Unrelated Regression (SUR) results reveal that financial development also has a positive association with environmental degradation, highlighting the complexity of its influence. Moreover, (Kirikkaleli and Adebayo, 2021), employ a range of advanced econometric techniques, including “Fully Modified Ordinary Least Squares,” “Dynamic Ordinary Least Squares,” “Canonical Cointegrating Regression,” “Bayer and Hanck cointegration tests,” and frequency-domain causality analysis. Their empirical results validate a long-term association among the variables, demonstrating that global financial development and renewable energy consumption significantly and positively contribute to enhancing environmental sustainability over time. Conversely, (Assi et al., 2021), analyze the ASEAN+3 economies over the period 1998 to 2018, employing panel ARDL analysis and the Dumitrescu-Hurlin panel causality test to evaluate five hypotheses. Their results indicate that financial growth has no substantial impact on environmental pollution. Additionally, the study uncovers “a negative correlation between renewable energy consumption and environmental pollution.” Moreover, (Tran et al., 2023), ASEAN countries from 1995 to 2020, utilizing fully modified OLS, dynamic OLS, canonical cointegration regression, and Granger causality analysis. Their findings indicate that increased “renewable energy consumption” contributes to a reduction in environmental degradation, whereas financial development exacerbates environmental degradation. Lastly, (Çetin et al., 2023), analyze 14 emerging economies over the period 1991 to 2018, employing advanced econometric techniques such as the AMG estimator, “Driscoll-Kraay standard errors,” “Panel-Corrected Standard Errors,” and “Feasible Generalized Least Squares.” Their findings reveal that, in the long run, renewable energy consumption significantly mitigates environmental degradation, whereas financial development contributes to its increase.

2.2.3 Economic expansion and urbanization on environmental deterioration

Investigating the connection between economic growth and urbanization on environmental degradation has been explored in numerous empirical studies showcasing varying methodologies, time frames, and findings. This review highlights a selection of some of these studies in order to provide a comprehensive understanding of these relationships. For instance, drawing insights from the study conducted by (Shahbaz et al., 2014) examine “the United Arab Emirates over the period 1975 to 2011,” employing the ARDL bounds testing approach and the VECM Granger causality framework. Their analysis reveals “a positive relationship between urbanization and environmental degradation.” Additionally, the results indicate that both economic growth and urbanization Granger-cause CO2 emissions. Conversely, study by (Destek and Ozsoy, 2015) reveals that while economic growth and urbanization contribute to environmental degradation, economic globalization plays a mitigating role by reducing CO2 emissions. However, in analyzing a panel data from 30 provinces and cities in China between 2006 and 2015. (Liang and Yang, 2019). find that environmental pollution significantly hinders urbanization and that both economic growth and urbanization exhibit an environmental Kuznets curve, Demonstrating a nonlinear, inverted U-shaped correlation with environmental pollution. On the other hand, study (Yusuf, 2023) analyze annual time series data from Nigeria spanning 1980 to 2020, employing the Autoregressive Distributed Lag (ARDL) technique. Their findings reveal that, in the long term, urbanization significantly contributes to environmental degradation, whereas, in the short term, it leads to a reduction in biodiversity loss. Additionally, (Rehman et al., 2022), analyzed annual data from 1990 to 2020 using the nonlinear autoregressive distributed lag (NARDL) method. Their findings revealed that economic growth exhibits both “positive and negative coefficients in response to positive and negative shocks,” highlighting both beneficial and harmful effects on CO2 emissions in the Maldives. In contrast, urbanization was found to have a negative relationship with CO2 emissions. Furthermore, (El Khoury et al., 2025), investigate the factors driving environmental degradation in MENA economies from 1991 to 2020. Using the augmented mean group estimation approach, they find that both economic growth and urbanization significantly influence environmental outcomes. Lastly, (Ul Haq et al., 2025), analyze a panel of 22 member countries from the Organization of Islamic Cooperation (OIC) across various income groups, covering the period from 1990 to 2022. Using the cross-correlation coefficient (CCC) method proposed by Narayan et al., they find evidence of a U-shaped Environmental Kuznets Curve (EKC) in only 1 out of 22 (5%) OIC countries. Their findings reveal that both economic growth and urbanization have a significant impact on environmental outcomes.

2.2.4 Environmental tax and environmental deterioration

Investigating the connection between environmental tax and environmental degradation has been explored in numerous empirical studies showcasing varying methodologies, time frames, and findings. This review highlights a selection of some of these studies in order to provide a comprehensive understanding of these relationships. For instance, drawing insights from the study conducted by (Kartal, 2024) investigate the role of environmental taxes (ET) in G7 countries, applying innovative quantile methods to data spanning from the first quarter of 1995 to the fourth quarter of 2020. Their findings reveal that environmental taxes have a heterogeneous impact on environmental degradation across these countries. (Lans Bovenberg and Goulder, 2002). note that much of the analysis is conducted within a second-best framework, where the government depends on distortionary taxes to fund part of its budget. They emphasize that general-equilibrium factors are crucial when evaluating environmental policies. In fact, some of the most significant effects of these policies occur outside the market being directly regulated. On the other hand, (Piciu and Trică, 2012), discovered that the evolutionary approach follows cyclical phases, including the implementation, self-assessment, and enhancement of key environmental taxes. This process aims to ensure higher quality in their application and effectively reduce environmental impacts. Similarly, (Galaz et al., 2018), integrate quantitative analysis with case studies to explore and quantify the links between tax havens and environmental issues, particularly in global fisheries and the Brazilian Amazon. Their findings show that, while only 4% of all registered fishing vessels are currently flagged in tax havens, a striking 70% of the vessels involved in illegal, unreported, and unregulated fishing are or have been flagged under tax haven jurisdictions. Moreover, using data from “the 2015 Chinese General Social Survey which covers 28 provinces in China,” (Liu et al., 2019), found that air pollution significantly negatively impacted residents’ happiness in “baseline-tax areas coefficient −0.162, 95% confidence interval −0.239, −0.086, p < 0.001.” However, this effect was less pronounced “in high-tax areas coefficient −0.030, 95% CI −0.060, 0.000, p = 0.051.” Furthermore, (Mehboob et al., 2024), utilized an innovative dynamic ARDL simulation model to examine long-run relationships, complemented by the KRLS method for robustness testing and frequency domain causality analysis to explore causal links from 1990 to 2020. Their findings indicate that environmental taxes effectively reduce both consumption and production-based carbon emissions. Finally, (Farooq et al., 2023), using a 20-year dataset from 2000 to 2019 covering 10 industrialized economies, employed the generalized least squares method and strengthened the regression analysis with the system generalized method of moments technique finds that environmental taxation effectively curbs environmental degradation.

2.3 Theoretical framework

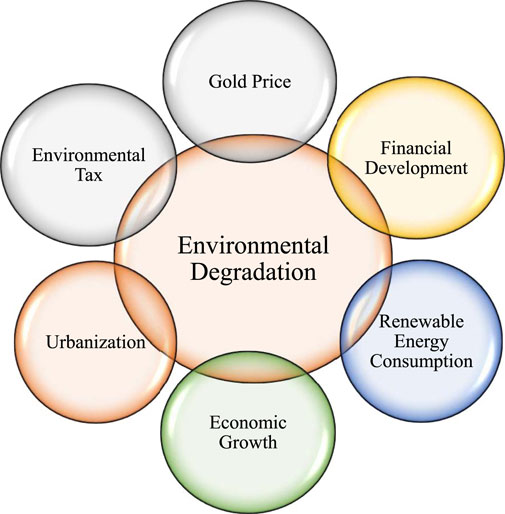

The theoretical foundation of this study is constructed around an empirical hypothesis that systematically examines the relationship between key variables, namely, gold price, financial development, renewable energy consumption, economic growth, urbanization, and environmental tax, and their influence on environmental degradation. To provide a clear understanding of these dynamics, Figure 2 offers a visual representation of how each of these factors contributes either to aggravating environmental harm or to promoting its reduction. To begin with, the gold price exerts a positive influence on environmental degradation. Specifically, as gold prices increase, mining activities tend to intensify, leading to heightened deforestation, land degradation, and water pollution, especially in regions where regulatory mechanisms are weak or poorly enforced (Gbedzi et al., 2022; Kumah, 2006). In addition, financial development is found to have a positive relationship with environmental degradation. This occurs because increased access to credit, investment capital, and financial services fuels industrial expansion and resource extraction (Money and Money, 2025). In contexts where environmental regulations are inadequate, such financial growth amplifies ecological pressures, contributing to pollution and resource depletion (Saqib et al., 2024; Yu et al., 2023). Moreover, renewable energy consumption demonstrates a negative effect on environmental degradation. As “the share of renewable energy in total consumption rises, reliance on fossil fuels diminishes, resulting in lower greenhouse gas emissions and improved air quality” (Bölük and Mert, 2015; Panwar et al., 2011). This shift towards cleaner energy alternatives significantly mitigates environmental harm and supports ecological sustainability. Furthermore, the impact of economic growth on environmental degradation follows a non-linear trajectory, aligning with the Environmental Kuznets Curve (EKC) hypothesis. During the initial phases of economic development, environmental quality tends to deteriorate due to increased industrial output and resource exploitation (Bartolini and Bonatti, 2002; Xi and Zhai, 2023). However, as economies grow stronger and more technologically advanced, higher income levels enable investment in environmental protection measures, which ultimately lead to a reduction in ecological damage (Jänicke and Kao, 2012; Omer, 2008). In contrast, urbanization is associated with a positive contribution to environmental degradation. Rapid urban growth, particularly in developing regions, often results in increased energy consumption, deforestation, pollution, and inefficient waste management, thereby placing considerable strain on environmental resources (Madlener and Sunak, 2011; Rana, 2011). Lastly, environmental tax is observed to have a negative impact on environmental degradation. By imposing fiscal penalties on pollution-intensive activities and incentivizing the adoption of cleaner technologies and sustainable practices, environmental taxation serves as an effective policy tool to curb ecological harm and promote long-term sustainability (Afshan and Yaqoob, 2023; Li et al., 2022). In summary, this theoretical framework highlights the intricate and interconnected pathways through which economic, financial, energy, and policy factors collectively shape environmental degradation.

2.4 Research gap

Despite the expanding body of literature, research remains limited in assessing the combined impact of economic and financial factors on environmental degradation in gold-producing nations of West Africa. Considering that gold mining serves as a primary catalyst for deforestation, water pollution, and soil degradation in the region, a deeper understanding of the underlying economic and financial mechanisms is essential for formulating effective and sustainable policy interventions. To address this gap, this study conducts an empirical analysis of nine key gold-producing countries in West Africa from 2000 to 2020, employing a comprehensive and robust econometric framework. Specifically, it integrates “Fully Modified Ordinary Least Squares,” “Dynamic Ordinary Least Squares,” “Canonical Cointegrating Regression,” “Robust Least Squares, and Granger causality tests to ensure methodological rigor and reliability.” By leveraging these advanced econometric techniques, this study not only strengthens the analytical precision of existing research but also provides critical insights into the intricate linkages between these factors in shaping environmental degradation in resource-rich economies.

3 Methodology

3.1 Method application

This study will utilize Fully Modified Ordinary Least Squares (FMOLS), Dynamic Ordinary Least Squares (DOLS), and Canonical Cointegrating Regression (CCR), all of which are recognized as interdimensional group average estimators. These advanced econometric techniques effectively address issues related to serial correlation and endogeneity in explanatory variables, thereby enhancing the reliability of long-term relationship estimations (Kao and Chiang, 2001; Pedroni, 1999). When analyzing the panel data for a set of countries, denoted as i = 1, 2, . . ., N over the time period t = 1, 2, . . ., M, the following cointegration Equation 1 can be applied:

The Equation 2 panel FMOLS estimator for the coefficient β is shown below:

The Equation 3 DOLS and CCR is written as follows:

In the Equation 4 below the estimated coefficient, β is given by:

In which

3.2 Data collection

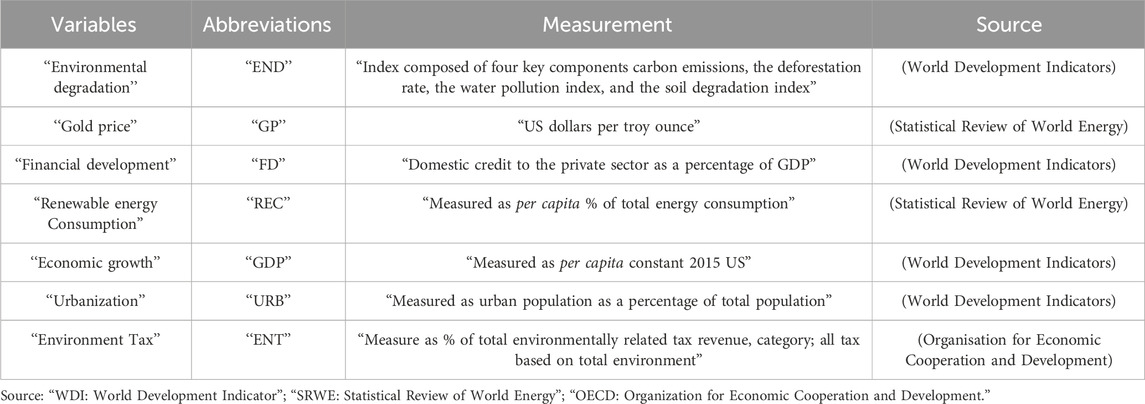

The study analyzes and focuses on the selection of nine countries of West Africa recognize for their gold minerals such as Ghana, Burkina Faso, Guinea, Mali, Cote d'Ivoire, Niger, Liberia, Senegal, and Sierra Leone. The data of this study were sourced from the Statistical Review of World Energy, World Development Indicator databases, and the Organization for Economic Cooperation and Development, covering the period from 2000 to 2020. The study examines several variables such as environmental degradation, gold price, “financial development,” “renewable energy consumption,” “economic growth,” “urbanization,” and “environment tax.” Table 1 provides the abbreviations, measurements, and data sources for these variables.

3.3 Quantification of variables

3.3.1 Environmental degradation

Environmental degradation (END) serves as the outcome variable is commonly quantified in metric tons per capita of carbon dioxide (CO2) emissions, as it serves as a widely recognized proxy for environmental harm (Stern, 2004). However, relying solely on CO2 emissions may overlook other critical environmental concerns. To provide a more comprehensive assessment, several studies have developed composite indices integrating multiple dimensions of environmental degradation, such as the works of (Hilson, 2002; Usher and Vermeulen, 2006; Xiong et al., 2023). These studies highlight the necessity of incorporating broader ecological indicators to capture the full extent of environmental deterioration. Building on this approach, the present study follows and applies a multidimensional index composed of four key components. First, carbon emissions (CO2 per capita) serve as a fundamental measure of air pollution and greenhouse gas emissions, which significantly contribute to climate change (Budescu et al., 2014). Second, the deforestation rate acts as a crucial indicator of land degradation and biodiversity loss, reflecting the extent of forest cover depletion due to logging, agricultural expansion, and mining activities (Food and Agriculture Organization). Third, the water pollution index assesses contamination levels in water bodies by considering chemical, physical, and biological parameters, thereby capturing the effects of industrial discharge, agricultural runoff, and domestic waste. Lastly, the soil degradation index measures land deterioration by evaluating soil erosion, fertility loss, and contamination caused by intensive farming practices, deforestation, and industrial activities. By integrating these interconnected components, this multidimensional index offers a more holistic representation of environmental degradation, moving beyond carbon emissions alone to encompass broader ecological harm. This approach ensures a more robust understanding of the environmental challenges faced by resource-rich economies, particularly in regions experiencing rapid industrialization and land-use change. To develop the composite index for environmental degradation, all four components, carbon emissions, deforestation rate, water pollution, and soil degradation, were standardized using the min-max normalization technique, ensuring that each indicator operates on a consistent scale. Equal weighting was applied to each variable to signify their shared significance in capturing the overall extent of environmental degradation. The normalized values were subsequently combined through a straightforward arithmetic average, producing a unified environmental degradation score for every observation. This approach enhances cross-country and temporal comparability while effectively reflecting the complex, multidimensional aspects of environmental degradation.

3.3.2 Independent variables

The first dependent variable is gold price, acting as a key independent variable, is measured in US dollars per troy ounce, reflecting its standard valuation in global financial markets. The remaining variables, which also serve as independent variables, are defined based on their respective measurement approaches. Specifically, financial development is quantified using domestic credit to the private sector as a percentage of GDP, reflecting the availability of financial resources for economic activities. The “renewable energy consumption” is expressed as its share of total energy consumption per capita, capturing the extent of reliance on sustainable energy sources. The “economic growth” is measured by real GDP per capita (in constant US dollars), providing an inflation-adjusted indicator of economic performance. Urbanization is assessed as the proportion of the urban population relative to the total population, illustrating demographic shifts towards urban centers. Lastly, environmental tax is represented as a percentage of total environmentally related tax revenue, encompassing all tax categories associated with environmental regulations and sustainability initiatives.

4 Empirical finding

4.1 Summary of descriptive statistics

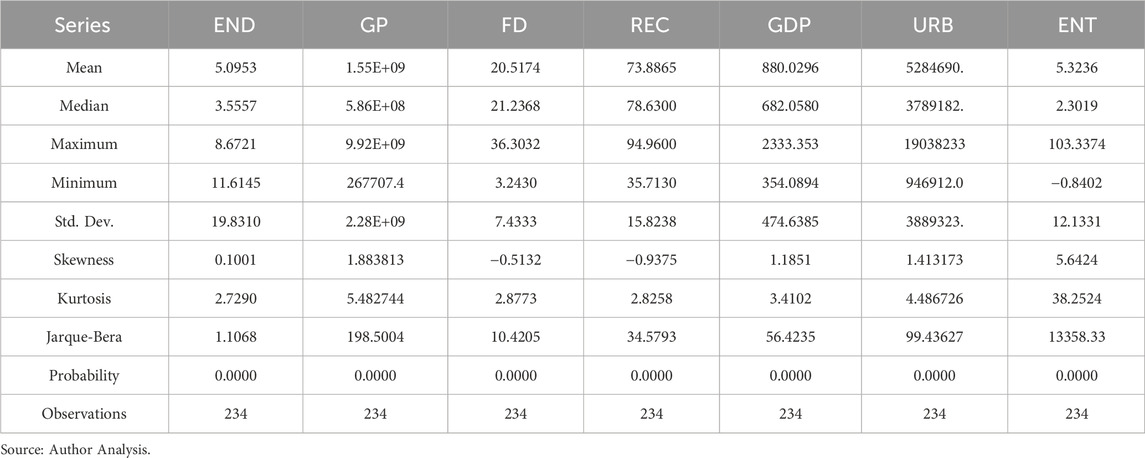

The descriptive statistics presented in Table 2 provide essential preliminary insights into the distributional characteristics and structural patterns of the variables examined in this study, offering a clearer understanding of environmental, economic, financial, and demographic dynamics across gold-producing nations in West Africa. To begin with, the average value of environmental degradation (END) reflects a moderate level of ecological pressure across the region, though the notable gap between the minimum and maximum values highlights significant disparities in environmental performance among countries. Similarly, the gold price (GP) exhibits considerable variation, as evidenced by the wide range, which is consistent with global market fluctuations in gold prices over the study period. In the same vein, financial development (FD), measured by domestic credit to the private sector, reveals moderate average levels but displays substantial variability across countries, suggesting uneven financial sector advancement within the region. Renewable energy consumption (REC) also shows pronounced disparities, indicating differences in energy transition efforts and renewable energy adoption among these economies.

Moreover, economic growth (GDP per capita) presents a wide range, reflecting the structural economic inequalities among countries, with some nations demonstrating relatively high-income levels, while others remain at the lower end of the development spectrum. Urbanization (URB), as indicated by urban population levels, demonstrates a positively skewed distribution, implying that urban expansion is more concentrated in certain countries, likely due to differing urban policies, migration trends, and demographic pressures. Environmental tax (ENT), however, stands out with extreme variability, as shown by the significant difference between the maximum and average values, coupled with a high standard deviation. This reflects inconsistencies in the application, enforcement, or design of environmental taxation policies across the region, possibly driven by divergent institutional capacities and policy priorities. Looking further into the distributional properties, the skewness and kurtosis values reveal clear deviations from normality for most variables. Notably, the gold price, urbanization, and environmental tax variables exhibit positive skewness, indicating the presence of extreme high values within the dataset. The particularly elevated kurtosis of environmental tax points to sharp distributional peaks and heavy tails, suggesting the existence of extreme observations or outliers, which could influence estimation results if not properly addressed. Finally, the Jarque-Bera test results confirm the rejection of the normality assumption for all variables at the 1% significance level, reinforcing concerns over the presence of structural breaks, non-linear patterns, or unobserved heterogeneity across countries. Finally, the number of observations remains consistent across all variables at 234, ensuring a sufficiently large sample for further econometric analysis.

4.2 Pearson matrix outcome

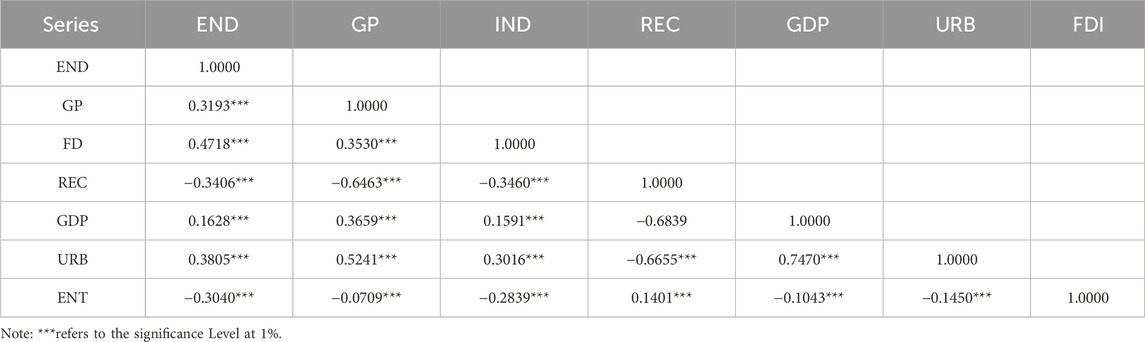

Table 3, the Pearson correlation matrix, provides valuable insights into the relationships. For instance, environmental degradation (END) exhibits “a moderate positive correlation with gold price” (0.3193), suggesting that rising gold prices may be associated with increased environmental degradation, potentially due to heightened mining activities. Similarly, END has a positive correlation with financial development (0.4718), indicating that financial expansion might contribute to environmental stress, possibly through increased industrial and economic activities. In contrast, END is “negatively correlated with renewable energy consumption” (−0.3406), implying that higher “adoption of renewable energy sources may help mitigate environmental degradation.”

Gold price is positively correlated with financial development (0.3530) and economic growth (0.3659), suggesting that gold price fluctuations influence financial markets and economic performance. However, GP “has a strong negative correlation with REC” (−0.6463), indicating that economies reliant on gold production might invest less in renewable energy. Similarly, financial development has a negative correlation with REC (−0.3460), reinforcing the notion that financial resources may not be adequately channeled toward green energy initiatives.

Economic growth shows a moderate positive correlation with urbanization (0.7470), reflecting the natural linkage between urban expansion and economic advancement. However, GDP is “strongly negatively correlated with REC” (−0.6839), suggesting that higher economic growth in these countries may still rely on non-renewable energy sources, leading to sustainability concerns. Likewise, urbanization (URB) is negatively correlated with REC (−0.6655), further supporting the idea that urban expansion may be associated with higher energy consumption from conventional sources rather than renewables. Lastly, environmental tax (ENT) is negatively correlated with END (−0.3040), FD (−0.2839), GDP (−0.1043), and URB (−0.1450), implying that taxation policies aimed at curbing environmental degradation may have some effectiveness but could also be linked to reduced financial and economic activities. Interestingly, ENT “has a weak positive correlation with REC” (0.1401), suggesting that environmental taxation may incentivize renewable energy consumption, albeit to a limited extent.

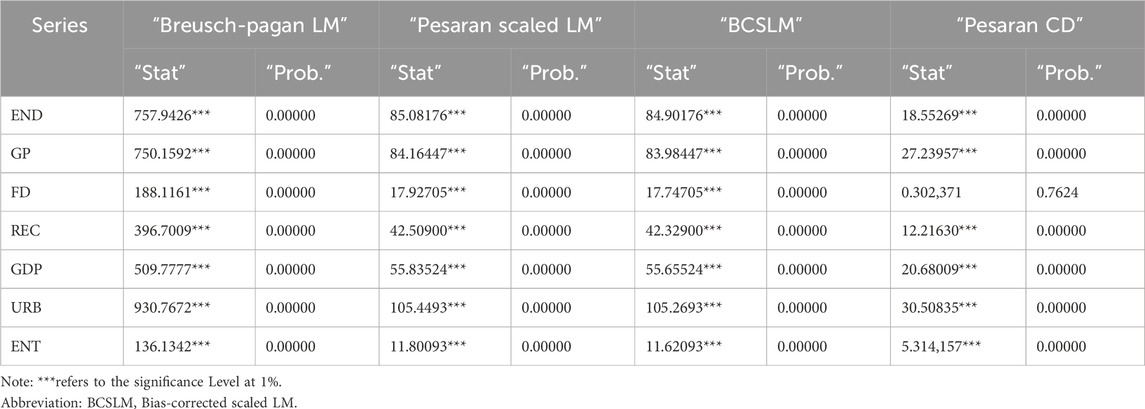

4.3 Cross-sectional outcome

The cross-sectional dependence test results as presented in Table 4 provide critical insights into the presence of interdependencies among the variables in the dataset. The Breusch-Pagan LM test, Pesaran scaled LM test, Bias-Corrected Scaled LM (BCSLM) test, and Pesaran CD test are used to examine whether cross-sectional dependence exists in each series. For environmental degradation (END), all four tests yield statistically significant results (p-values = 0.0000), indicating strong cross-sectional dependence. This implies that “environmental degradation” in one country is significantly influenced by that of others, likely due to shared environmental policies, transboundary pollution, or regional economic activities. Similarly, gold price (GP) exhibits strong cross-sectional dependence across all tests, with p-values of 0.0000. This finding is expected, as gold markets are globally interconnected, meaning price movements in one country or region influence others. Additionally, financial development (FD), however, presents an exception. While the Breusch-Pagan LM, Pesaran scaled LM, and BCSLM tests indicate significant cross-sectional dependence (p-values = 0.0000), the Pesaran CD test (p-value = 0.7624) suggests no significant dependence. This discrepancy indicates that while there might be some interdependence in financial development across countries, it is not strong enough to be detected by the Pesaran CD test, which is more sensitive to weak dependence. Moreover, “renewable energy consumption,” “economic growth,” and urbanization all show strong “cross-sectional dependence as indicated by their consistently significant test statistics” (p-values = 0.0000). This implies that changes in renewable energy adoption, economic performance, and urban expansion in one country significantly impact others, possibly due to shared energy policies, trade linkages, or regional development trends. Lastly, environmental tax (ENT) also exhibits significant cross-sectional dependence, with p-values = 0.0000 in all tests. This suggests that tax policies related to environmental protection are influenced by regional and international factors, such as global climate agreements and coordinated fiscal policies.

4.4 Panel unit root test results

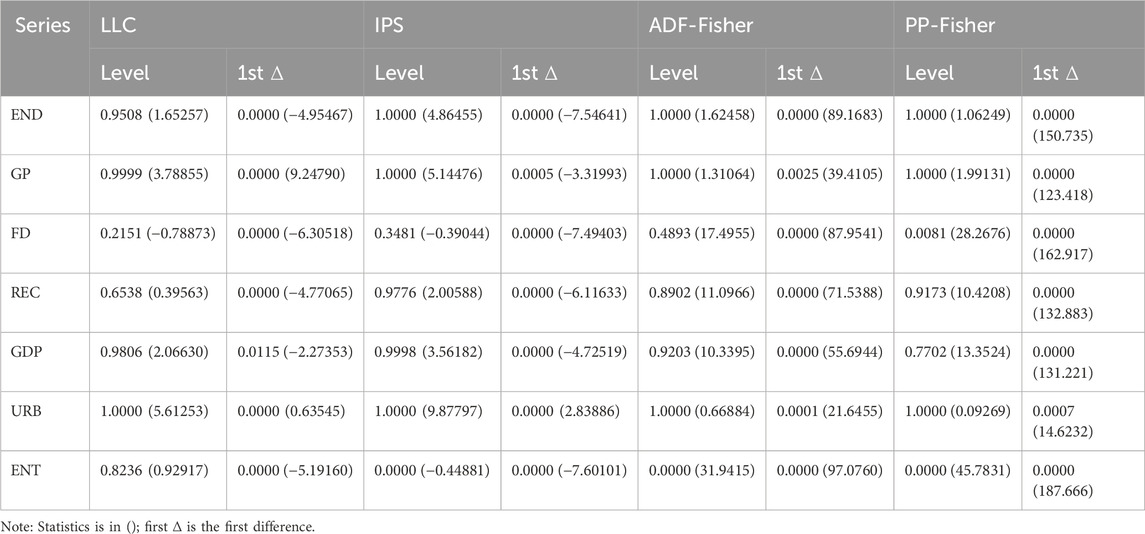

The panel unit root test results in Table 5 provide a comprehensive assessment of the stationarity properties of the variables using four distinct tests: Levin-Lin-Chu (LLC), Im-Pesaran-Shin (IPS), ADF-Fisher, and PP-Fisher. At the level, most variables except for financial development (FD) and environmental tax (ENT) exhibit “non-stationarity as indicated by high p-values exceeding the 5% significance threshold.” Specifically, environmental degradation (END), gold price (GP), “renewable energy consumption,” “economic growth,” and urbanization (URB) fail to “reject the null hypothesis of a unit root across all four tests,” implying that these variables follow a random walk and require differencing to achieve stationarity.

However, after applying the first difference, all variables become stationary, as reflected in the significant p-values (0.0000) across all tests. This implies that “these series are integrated of order one I(1),” meaning their variations over time become more predictable once differenced. Notably, financial development (FD) presents an interesting case: while “the LLC and IPS tests at the level” indicate potential stationarity (with p-values of 0.2151 and 0.3481, respectively), the ADF-Fisher and PP-Fisher tests suggest non-stationarity (with p-values of 0.4893 and 0.0081, respectively). Nevertheless, after first differencing, FD becomes stationary across all tests, aligning with the behavior of the other variables. Furthermore, the strong rejection of the null hypothesis after first differencing for all variables underscores the necessity of employing appropriate econometric techniques such as first-difference transformation or cointegration analysis to ensure robust empirical modeling. These findings indicate that the examined economic and environmental factors exhibit long-term trends, necessitating models that account for non-stationarity in levels but stationarity in first differences. Consequently, the results justify the application of long-run equilibrium modeling techniques, including panel cointegration, Fully Modified Ordinary Least Squares (FMOLS), Dynamic Ordinary Least Squares (DOLS), and Canonical Cointegrating Regression (CCR), as implemented in this study, to effectively capture the underlying relationships among these variables.

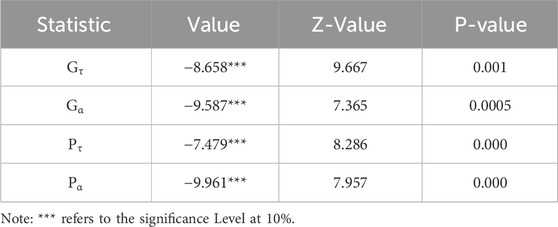

4.5 Westerlund cointegration outcome

The Westerlund cointegration test results as presented in Table 6 provide strong evidence of a long-term equilibrium relationship among the variables. The test reports four key statistics, all of which are highly significant. Specifically, each statistic exhibits a substantial negative value, accompanied by high Z-values, reinforcing the robustness of the findings. Moreover, the consistently low p-values confirm the rejection of the null hypothesis, indicating the presence of cointegration. This suggests that the examined variables move together over time, maintaining a stable long-term relationship despite short-term fluctuations. As a result, employing long-run modeling approaches, such as panel fully modified least squares, dynamic ordinary least squares, and canonical cointegrating regression, is appropriate for effectively analyzing their interdependencies.

4.6 FMOLS, DOLS, and CCR outcome

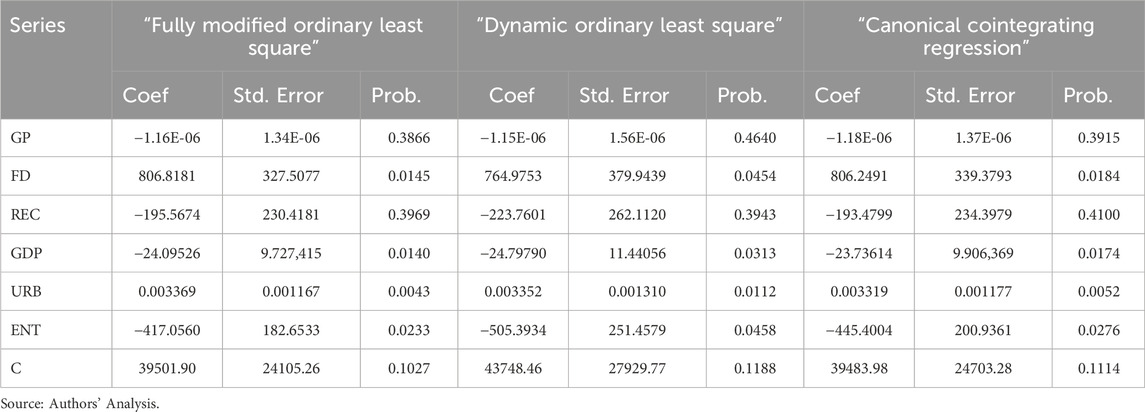

The estimation results from the fully modified least squares, dynamic ordinary least squares, and canonical cointegrating regression models presented in Table 7 provide valuable insights into the determinants of environmental degradation in West Africa. The results indicate that “financial development has a significant positive effect on environmental degradation” across all three models, with coefficients ranging from approximately 764.98–806.82 and p-values below 5%, indicating that an increase in financial development is associated with higher environmental degradation. Similarly, urbanization exhibits “a significant positive relationship with environmental degradation,” as reflected in its coefficients (0.003319–0.003369) and p-values consistently below 1%, suggesting that urban expansion contributes to environmental pressures.

Conversely, “economic growth exerts a significant negative impact on environmental degradation,” with coefficients between −24.10 and −24.80 and p-values below 5%, implying that higher economic growth is associated with improved environmental outcomes, potentially due to enhanced efficiency and cleaner technologies. Environmental tax also demonstrates a significant negative effect, as indicated by its coefficients ranging from −417.06 to −505.39 and p-values below 5%, underscoring its role in mitigating environmental degradation by discouraging pollution-intensive activities. However, the impact of gold price and renewable energy consumption appears statistically insignificant across all “models with p-values well above 5%,” suggesting that these factors do not have a substantial influence on environmental degradation in the region. Additionally, the intercept term is not statistically significant, implying that unobserved factors captured by “the constant term do not play a decisive role in shaping environmental outcomes.” Overall, the results highlight the critical role of “financial development,” “urbanization,” “economic growth,” and environmental taxation in shaping environmental quality in West Africa.

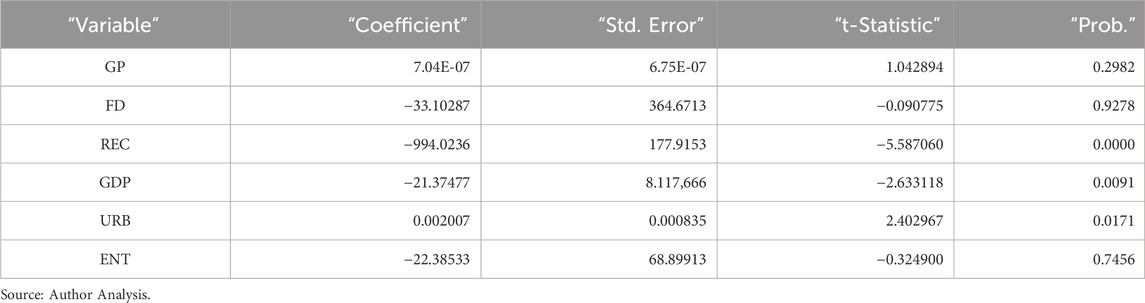

4.7 Robustness outcome robust least square

The robust least squares estimation results presented in Table 8 provide critical insights into the factors influencing environmental degradation in West Africa. Notably, renewable energy consumption has a significant negative effect on environmental degradation, with a coefficient of approximately −994.02 and a p-value of 0.0000, “indicating that an increase in renewable energy usage substantially reduces environmental harm.” Similarly, economic growth also “exhibits a significant negative relationship with environmental degradation,” as evidenced by its coefficient of −21.37 and a p-value of 0.0091, suggesting that higher economic growth contributes to improved environmental conditions, possibly due to investments in cleaner technologies and sustainable practices. On the other hand, urbanization exerts a positive and significant impact on environmental degradation, with a coefficient of 0.0020 and a p-value of 0.0171, implying that increasing urbanization intensifies environmental pressures, likely due to higher energy consumption and pollution. In contrast, the effects of gold price, financial development, and environmental tax appear statistically insignificant, with p-values of 0.2982, 0.9278, and 0.7456, respectively, indicating that these factors do not have a substantial direct influence on environmental degradation in the region.

Table 8. Robust Least Square with environment degradation (END) as dependent variable in west Africa.

4.8 Pairwise granger causality outcome

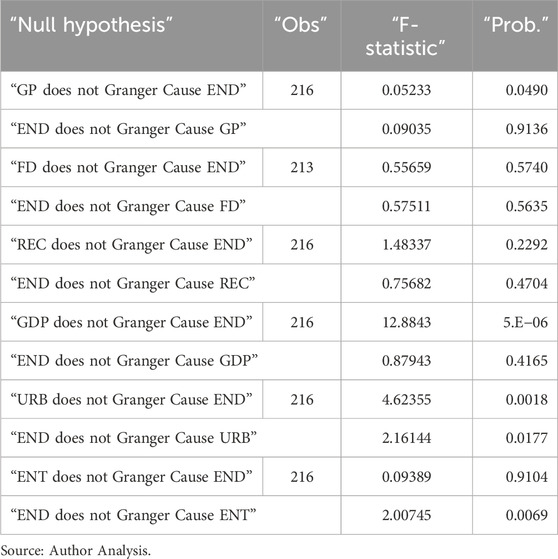

Table 9 Granger causality test results provide valuable insights into the causal relationships between environmental degradation and its potential determinants in West Africa. “A unidirectional causal relationship is observed from gold price to environmental degradation,” as the null hypothesis that gold price does not Granger-cause environmental degradation is rejected at a 5% significance level (p-value = 0.0490), while the reverse causality is not supported (p-value = 0.9136). Similarly, economic growth exhibits a unidirectional causal relationship with environmental degradation, as economic growth significantly Granger-causes environmental degradation (p-value = 0.000005), but the reverse effect “is not statistically significant” (p-value = 0.4165). Conversely, urbanization demonstrates “bidirectional causality with environmental degradation,” meaning that urbanization Granger-causes environmental degradation (p-value = 0.0018), and environmental degradation also Granger-causes urbanization (p-value = 0.0177), highlighting a feedback loop between these two variables. Additionally, a unidirectional causality is found from environmental degradation to environmental tax, as environmental degradation Granger-causes environmental tax (p-value = 0.0069), whereas the reverse relationship is not supported (p-value = 0.9104). Conversely, no causal relationship is found between financial development and environmental degradation, as both directions yield insignificant p-values (0.5740 and 0.5635). Similarly, renewable energy consumption does not Granger-cause environmental degradation (p-value = 0.2292), nor does environmental degradation influence renewable energy consumption (p-value = 0.4704), suggesting no direct causal linkage between these variables.

5 Discussion

The integrated results from the fully modified least squares, dynamic ordinary least squares, and canonical cointegrating regression models, complemented by “robust least squares estimation and Granger causality tests,” offer a thorough understanding of the factors driving environmental degradation in West Africa. The findings suggest that “financial development has a significant positive impact on environmental degradation,” suggesting that as financial activities expand, environmental pressures intensify (Çetin et al., 2023). This aligns with previous research indicating that increased financial activity facilitates industrial expansion, leading to higher carbon emissions and resource depletion (Khan et al., 2021; Prempeh, 2024). The transmission channels through which financial development contributes to environmental degradation in West Africa include increased access to credit and investment, which fuels industrialization and infrastructure expansion, often at the cost of deforestation and higher energy consumption. Additionally, financial liberalization can attract foreign direct investment (FDI) in extractive industries, exacerbating pollution and ecological damage. Furthermore, the expansion of financial markets enables higher consumption levels through increased disposable income and consumer loans, leading to greater demand for energy-intensive goods and services. Lastly, weak environmental regulations in many developing economies allow financially driven industrial growth to proceed with minimal environmental oversight, worsening ecological degradation.

Similarly, urbanization consistently exhibits a positive relationship with environmental degradation, highlighting the environmental challenges associated with rapid urban expansion, including increased energy consumption and pollution (Ul Haq et al., 2025). This finding supports the argument that uncontrolled urbanization in developing economies exacerbates air pollution, deforestation, and inefficient waste management (El Khoury et al., 2025; Yusuf, 2023). The transmission channels through which urbanization drives environmental degradation in West Africa are multifaceted. First, rapid population growth in urban areas leads to an increased demand for housing and infrastructure, often resulting in deforestation and land-use changes that contribute to biodiversity loss. Second, urban expansion drives higher energy consumption, particularly from fossil fuels, as cities rely on carbon-intensive power generation and transportation networks, increasing greenhouse gas emissions. Third, inadequate waste management and sanitation systems in many rapidly urbanizing regions contribute to severe air, water, and soil pollution, as improper disposal of industrial and household waste contaminates natural ecosystems. Additionally, the expansion of informal settlements, often lacking access to clean energy and efficient public transport, exacerbates reliance on biomass fuels and inefficient transport systems, further increasing pollution levels. Lastly, weak urban planning and governance structures often fail to enforce environmental regulations, allowing unregulated industrial activities and unsustainable construction practices to persist, intensifying environmental degradation.

Conversely, “economic growth plays a crucial role in reducing environmental degradation,” implying that higher economic performance fosters cleaner technologies and more sustainable practices, aligning with the Environmental Kuznets Curve (EKC) hypothesis, which posits that environmental degradation initially worsens with economic growth but later declines as nations develop cleaner technologies and implement stringent environmental regulations (Destek and Ozsoy, 2015; Liang and Yang, 2019). The transmission channels through which economic growth contributes to environmental improvement in West Africa are multifaceted. First, as economies expand, they generate higher revenues that can be allocated toward environmental protection initiatives, such as reforestation programs, pollution control measures, and investments in green infrastructure. Second, “economic growth often leads to increased research and development expenditure,” fostering innovations in cleaner production techniques, energy-efficient technologies, and sustainable industrial practices that reduce carbon emissions and resource depletion. Third, as nations experience higher levels of income, public awareness and demand for environmental quality rise, prompting governments to enforce stricter environmental regulations and adopt policies that promote sustainable urban planning and renewable energy adoption. Additionally, structural transformation plays a critical role, as economic development shifts labor and capital from pollution-intensive primary sectors, such as mining and agriculture, toward service-oriented and technologically advanced industries with lower environmental footprints. Finally, globalization and economic integration facilitate technology transfer and foreign direct investment (FDI) in eco-friendly industries, accelerating the adoption of cleaner production methods and reinforcing environmental sustainability in the long run. Additionally, environmental tax is found to have a mitigating effect on environmental degradation, reinforcing its role in discouraging pollution-intensive activities, the finding is consistent with previous studies that highlight the effectiveness of environmental taxation in promoting green investments and reducing industrial emissions. However, “gold price and renewable energy consumption do not appear to have a significant direct influence on environmental degradation,” as their effects are statistically insignificant across all models (Balsalobre-Lorente et al., 2018; Ertugrul et al., 2016). The lack of a significant direct effect of gold price on environmental degradation suggests that fluctuations in gold prices do not independently drive changes in environmental quality; rather, the environmental impact may depend on broader macroeconomic conditions, regulatory frameworks, and mining practices. For instance, while high gold prices may incentivize increased mining activities, leading to deforestation and water contamination, these effects could be mitigated by stringent environmental policies or technological advancements in the mining sector. On the other hand, the insignificant direct effect of renewable energy consumption on environmental degradation could be attributed to the relatively low penetration of renewable energy in West African economies, where fossil fuel dependence remains dominant. The transition towards renewable energy is often slow due to infrastructure constraints, high initial investment costs, and policy inefficiencies, limiting its immediate impact on reducing environmental harm. Furthermore, the effectiveness of renewable energy in mitigating environmental degradation depends on the energy mix, technological advancements, and government support for green energy initiatives.

The robustness of these findings is further supported by the least squares estimation, which confirms the positive impact of urbanization and “the negative effects of economic growth and renewable energy consumption on environmental deterioration” aligning with the results by (Rehman et al., 2022; Ul Haq et al., 2025; Tran et al., 2023). The positive relationship between urbanization and environmental degradation can be explained through multiple transmission channels. Rapid urban expansion often leads to increased energy consumption, deforestation, and inadequate waste management systems, exacerbating environmental pollution. Additionally, higher population densities in urban areas contribute to higher demand for transportation, industrial activities, and residential energy use, all of which generate significant carbon emissions and air pollution. The lack of sustainable urban planning, weak environmental regulations, and poor infrastructure further compound these adverse effects, making urbanization a key driver of environmental degradation in developing regions. This highlights the significance of advancing renewable energy as a sustainable solution to mitigate environmental harm while leveraging economic growth to drive environmental improvements. The negative effect of economic growth on environmental degradation suggests that as economies expand, they tend to adopt cleaner technologies, improve energy efficiency, and implement stronger environmental policies, aligning with the Environmental Kuznets Curve (EKC) hypothesis (Liang and Yang, 2019). This transition occurs through various mechanisms, including increased investment in research and development (R&D) for green technologies, stricter environmental regulations that encourage industries to adopt sustainable practices, and shifts in economic structures from pollution-intensive industries to service-oriented economies. Furthermore, higher income levels in growing economies lead to greater public awareness and demand for environmental sustainability, pressuring governments to enforce stricter environmental standards. Similarly, the negative effect of renewable energy consumption on environmental degradation highlights the role of clean energy sources in reducing pollution and mitigating climate change. The expansion of renewable energy contributes to lower carbon emissions by replacing fossil fuel-based power generation, decreasing reliance on non-renewable energy sources that contribute to air and water pollution. However, the effectiveness of renewable energy depends on factors such as energy infrastructure, government policies, and financial incentives that encourage the transition to sustainable energy sources (Çetin et al., 2023). Moreover, technological advancements in renewable energy storage, grid integration, and energy efficiency improvements further enhance its impact on environmental quality.

The Granger causality results add another layer of understanding by revealing that gold price unidirectional causes environmental degradation, while economic growth also has a unidirectional causal effect, reinforcing its role in shaping environmental outcomes (Mencho, 2022; Shahbaz et al., 2014). This unidirectional causality from gold price to environmental degradation suggests that fluctuations in gold prices drive increased mining activities, leading to deforestation, soil degradation, and water pollution. When gold prices rise, mining operations intensify as firms seek to maximize profits, increasing land exploitation and greenhouse gas emissions. Additionally, informal and unregulated mining often expands during periods of high gold prices, exacerbating environmental damage due to inefficient extraction methods and lack of proper waste management. However, urbanization, exhibits a bidirectional relationship with environmental degradation, indicating a feedback loop where urban expansion leads to increased environmental pressures, which in turn influence further urbanization dynamics (Yusuf, 2023). This bidirectional causality suggests that urbanization contributes to environmental degradation through rising energy demand, increased vehicular emissions, and inefficient waste disposal. In turn, worsening environmental conditions such as air pollution and inadequate water resources can influence migration patterns and urban planning decisions, further shaping the trajectory of urban expansion. Poor air quality, for instance, can drive suburbanization as people seek to escape polluted city centers, leading to further land-use changes and deforestation at the urban periphery.

Furthermore, environmental degradation is found to Granger-cause environmental tax, suggesting that policymakers implement stricter environmental regulations in response to worsening environmental conditions (Galaz et al., 2018; Kartal, 2024). This causality underscores the reactive nature of environmental policies, where governments tend to introduce pollution taxes and stricter regulations only after environmental conditions deteriorate. The introduction of such taxes aims to internalize the negative externalities associated with industrial pollution, encouraging businesses to adopt cleaner technologies and reduce emissions. However, the effectiveness of environmental taxes depends on proper enforcement, public compliance, and the reinvestment of tax revenues into green initiatives. In contrast, no causal relationship is observed among “financial development and environmental degradation,” as well as among “renewable energy consumption and environmental degradation,” implying that these factors do not directly drive environmental changes in the region (Çetin et al., 2023; Tran et al., 2023). This suggests that financial development in West Africa may not yet be sufficiently directed toward green investments or sustainable projects capable of influencing environmental quality. The weak institutional frameworks and limited financial incentives for green financing could explain this lack of causality. Similarly, the absence of a “causal link between renewable energy consumption and environmental degradation may indicate that renewable energy” has not yet reached a scale where it significantly offsets fossil fuel consumption in the region. Structural barriers such as inadequate infrastructure, high costs of renewable energy technology, and weak policy support may be limiting the effectiveness of renewables in mitigating environmental harm.

5.1 Practical policy implication

Based on the obtained results, several practical policy implications can be proposed to mitigate environmental degradation in West Africa. Since financial development contributes to environmental degradation, policymakers should integrate green financial instruments, such as green bonds and sustainable banking regulations, to ensure that financial expansion aligns with environmental sustainability. Additionally, urbanization, which significantly exacerbates environmental pressures, necessitates the implementation of smart urban planning policies, improved waste management systems, and investment in eco-friendly infrastructure to minimize its ecological footprint. Considering that economic growth is essential in mitigating environmental degradation, governments should focus on policies that promote sustainable economic development through incentives for cleaner production technologies, energy-efficient industries, and investment in research and development for environmental innovation. Furthermore, the significant role of environmental tax in mitigating environmental degradation underscores the need for the implementation of more stringent environmental taxation policies. Policymakers should design tax frameworks that discourage excessive emissions while encouraging industries to adopt greener technologies and sustainable practices.

Despite the insignificance of gold price and renewable energy consumption in influencing environmental degradation, the bidirectional causality between urbanization and environmental degradation suggests that urban growth management policies should be reinforced. Implementing sustainable urban expansion strategies, such as green zoning laws and urban greening programs, could help reduce environmental pressures. Moreover, the unidirectional causality from environmental degradation to environmental tax suggests that taxation policies should be proactive rather than reactive, ensuring that pollution control measures are in place before environmental conditions deteriorate. As no direct causal relationship is observed among “financial development and environmental degradation,” as well as among “renewable energy consumption and environmental degradation,” policymakers should work towards strengthening the link between finance and sustainability by incentivizing green investments and ensuring that renewable energy adoption is effectively integrated into national development plans. By adopting these policy measures, West African countries can balance economic development with environmental sustainability, ensuring long-term ecological and economic resilience.

6 Conclusion

The study investigates the influence of gold price, “financial development,” “renewable energy,” “economic growth,” urbanization, and environmental tax on “environmental degradation” in nine West African gold-producing countries including Ghana, Burkina Faso, Guinea, Mali, Côte d'Ivoire, Niger, Liberia, Senegal, and Sierra Leone over the period from 2000 to 2020. Utilizing “Fully Modified Ordinary Least Squares,” “Dynamic Ordinary Least Squares,” “Canonical Cointegrating Regression,” “Robust Least Squares,” and “Granger causality tests,” this analysis offers a thorough insight into the factors driving environmental degradation in the region.

The findings indicate that financial development significantly contributes to environmental degradation, suggesting that as financial activities expand, environmental pressures intensify. Similarly, urbanization exacerbates environmental challenges, likely due to “increased energy consumption and pollution associated with rapid urban growth.” Conversely, economic growth “plays a crucial role in reducing environmental degradation,” implying that improved economic performance fosters cleaner technologies and more sustainable practices. Additionally, environmental tax proves effective in mitigating environmental degradation by discouraging pollution-intensive activities, highlighting its role as a regulatory tool for environmental protection.

However, gold price and renewable energy consumption do not exhibit a significant direct influence on environmental degradation across all models, suggesting that their impact may be mediated through other economic and policy mechanisms. Nevertheless, the robust least squares estimation implies that “renewable energy consumption has a beneficial effect in reducing environmental harm,” reinforcing the need for greater integration of renewable energy in environmental policies.

The Granger causality findings offer deeper insights into the dynamic interactions among these variables. “A unidirectional causal link is found between gold price and environmental degradation,” suggesting that fluctuations in gold prices can influence environmental outcomes in the region. Economic growth also unidirectionally causes changes in environmental degradation, reinforcing its role in shaping environmental sustainability. Urbanization, however, exhibits a bidirectional causal relationship with environmental degradation, indicating a feedback loop where urban expansion drives environmental pressures, which in turn further influence urbanization patterns. Moreover, environmental degradation is found to Granger-cause environmental tax, implying that policymakers tend to implement stricter environmental regulations in response to worsening environmental conditions. In contrast, no direct causal relationship is observed among “financial development,” “renewable energy consumption,” and “environmental degradation,” suggesting that these factors may require additional policy interventions to effectively influence environmental sustainability.

6.1 Study limitations