- 1School of Economics, Shanghai University, Shanghai, China

- 2School of Accounting, Guangzhou College of Technology and Business, Guangzhou, China

- 3Humanities and Social Research Center, Northern Border University, Arar, Saudi Arabia

- 4Department of Basic Health Sciences in the Foundation Year for Health Colleges Program, College of Languages, Princess Nourah Bint Abdulrahman University, Riyadh, Saudi Arabia

Amid growing climate and resource pressures, E7 countries face the urgent challenge of aligning economic growth with ecological sustainability. The current study examines the influence of population growth, industrial development, mineral resource rents, institutional quality, and green finance on environmental sustainability in E7 nations using annual data from 1996 to 2023. Environmental sustainability is measured using the Load Capacity Factor (LCF), contributing to the literature by applying a comprehensive and balance-sensitive metric rarely used in emerging economy contexts. Using 196 observations and advanced panel methods—MMQR, GMM, FGLS, and CCEMG—the analysis addresses key econometric challenges, including endogeneity, slope heterogeneity, non-stationarity, and cross-sectional dependence. Results show that industrial growth consistently harms sustainability, while green finance has a robust, non-linear positive effect, particularly in higher-performing countries. Mineral resource rents improve sustainability in countries with stronger institutions, revealing the moderating role of governance. The CCEMG findings confirm the sensitivity of these effects to common shocks, and GMM models validate the persistence of sustainability outcomes. This study offers robust empirical evidence for policymakers in emerging markets, emphasizing the conditional benefits of green finance and institutional governance in supporting long-term ecological sustainability.

1 Introduction

The E7 nations (China, Brazil, India, Mexico, Indonesia, Russia, and Turkey) represent some of the fastest-growing economies in the world, yet their rapid industrialization, urbanization, and resource utilization have intensified environmental challenges (Dai et al., 2024; Hassan et al., 2024; H. Liu et al., 2022; Wang and Xu, 2024). As these countries try to make their economies better, they are under more and more pressure to find a balance between growth and protecting the environment. In this case, it is important to uncover how socio-economic development and environmental resilience are linked (Imran et al., 2024; Melnyk et al., 2023; Scown et al., 2023; Terra dos Santos et al., 2023). E7 economies are pursuing growth to reduce poverty and build infrastructure, but this often makes environmental problems worse because it relies on sectors that use a lot of energy and produce a substantial carbon emissions (Alhashim et al., 2024; Ameer et al., 2024; Hao and Yang, 2024). Population growth (PG) makes these problems worse by raising the demand for natural resources and public services, which in turn raises ecological footprints (Li et al., 2024; Tal, 2025). Green innovation and efficiency gains do not change the fact that industrial growth (IG) is a major cause of pollution and resource depletion (Akram et al., 2024; Caglar et al., 2023; Cai et al., 2025).

Mineral resource rents (MRR), when poorly managed, can deepen ecological stress and institutional vulnerabilities (Bilgili et al., 2023; L. Li et al., 2024). However, under sound governance, they can serve as a strategic fiscal tool to support environmental investments (Christmann, 2021). Green finance (GF), emerging as a transformative mechanism, offers a pathway to shift capital flows toward low-carbon, climate-resilient development (Xing et al., 2024; Xu et al., 2025).

While a growing body of literature has begun to examine the environmental implications of green finance in E7 economies, using methods like panel quantile regression, NARDL, and difference-in-differences approaches (e.g., Sun and Rasool, 2024; Simeon et al., 2024; Dai et al., 2024; Liu et al., 2022), critical gaps remain regarding indicator robustness, distributional heterogeneity, and the role of governance. Many existing studies emphasize CO2 emissions or energy intensity, but such metrics provide only partial perspectives on ecological pressure. This study contributes to the literature by using the Load Capacity Factor (LCF), defined as the ratio of biocapacity to ecological footprint, which reflects whether a country’s natural capital can support its consumption demands. A value greater than one indicates ecological surplus, while a value below one reflects ecological deficit. By integrating both consumption and regenerative capacity, LCF offers a more comprehensive and policy-relevant sustainability metric, particularly suited for assessing ecological balance in emerging economies.

The research adds important regional depth to the sustainability debate by focusing on E7 countries: Brazil, China, India, Indonesia, Mexico, Russia, and Turkey. We selected these countries because their economies are growing quickly, they use a lot of resources, and their digital and financial infrastructures are getting better (Dai et al., 2024; Wang and Xu, 2025).

According to Hussain et al. (2022), E7 economies will probably grow faster than G7 economies in the next few decades. In the last few years, the World Bank highlighted that its share of the world’s economy has grown from 13% to 26% (World Bank, 2025). On the contrary, this path of growth puts more strain on the environment (Xu et al., 2022). This demonstrates the significance of implementing regulations that protect the environment while still letting technology move forward. Because of their changing industries, large natural resource reserves, and demographic advantages, the E7 is an excellent environment for testing new digital and financial technologies (Duan, 2025; Liang et al., 2024). But the institutions, energy systems, and reliance on extractive resources are very different in these countries. Brazil gets most of its energy from renewable sources, while Russia gets most of its energy from fossil fuels. Turkey’s economy is based on services, while Indonesia’s is based on resources (Zhu et al., 2024). The study employs the Method of Moments Quantile Regression (MMQR) to deal with this issue. MMQR enables the marginal effects of explanatory variables change based on the quantile of the sustainability level.

The Common Correlated Effects Mean Group (CCEMG) and dynamic two-step System Generalized Method of Moments (GMM) estimators are also used in this study to deal with slope heterogeneity, cross-sectional dependence, endogeneity, and changes in sustainability trends over time. These methods show that the effects of green finance, industrial growth, resource rents, and the quality of institutions are different for countries with strong or weak sustainability. When combined, they provide a strong empirical basis for evaluating the pros and cons of the environmental approach and formulating specific policies for the E7’s ecological resilience.

This research looks at how substantial factors like the economy, population, institutions, and capital affect the environment in the E7 countries. It uses seminal theories like IPAT, the Porter Hypothesis, the Environmental Kuznets Curve (EKC), and resource-curse theory to test five hypotheses in order to explain the complex interactions between factors influencing environmental sustainability in developing nations:

H1. Population growth negatively affects environmental sustainability.

Rooted in the IPAT identity (Impact = Population × Affluence × Technology), increasing population is expected to escalate pressure on ecological resources through higher consumption and urban expansion. Thus, we expect a negative marginal effect.

H2. Industrial growth undermines environmental sustainability.

Guided by the Porter Hypothesis and structural transformation theory, industrial growth—unless accompanied by green innovation—typically leads to increased emissions and resource depletion. In rapidly industrializing economies, this relationship is expected to be adverse.

H3. Mineral resource rents reduce sustainability outcomes in the absence of strong governance.

The resource-curse theory suggests that natural resource wealth can degrade environmental and institutional quality if not managed effectively. As such, mineral rents are expected to negatively impact sustainability.

H4. Green finance enhances environmental sustainability, with a non-linear effect at higher levels.

Drawing on the theory of sustainable finance and the Environmental Kuznets Curve (EKC) hypothesis applied to financial flows, green finance is anticipated to contribute positively to sustainability. However, its effectiveness may diminish at higher levels due to inefficiencies or absorptive constraints, leading to a hypothesized inverted-U shape:

H5. Institutional quality strengthens the positive environmental impact of mineral resource rents.

According to institutional resource-curse theory and the environmental governance hypothesis, effective governance structures can transform extractive rents into sustainability-supporting investments. This moderating effect is captured through an interaction term (MRR × IQ).

These hypotheses are operationalized in three econometric models:

• Linear baseline model testing H1–H5 directly

• Non-linear specification including GF2 to test H4

• Interaction model testing conditional effects between MRR and IQ (H5)

By incorporating the Load Capacity Factor (LCF), defined as the ratio of biocapacity to ecological footprint, as the dependent variable, this study applies a more comprehensive measure of environmental sustainability than conventional CO2-based metrics. LCF captures both consumption intensity and ecological regeneration capacity, offering a more balanced and policy-relevant perspective on sustainability in emerging economies.

Through this theoretical and empirical structure, the study links macro-financial mechanisms, demographic transitions, and governance quality to ecological resilience in the E7. It provides a robust foundation for analyzing how policy instruments like green finance and institutional reforms can be leveraged to reconcile development goals with environmental limits.

The rest of the paper is structured as follows: In Section 2, we review the prior literature. The third section describes data, models, the theoretical framework, and empirical methods. The fourth section discusses the results. Section 5 concludes the research and provides policy recommendations.

2 Review of literature

A few studies have examined how IG, PG, GF, and MRR affect load capacity factor.

2.1 Ecological sustainability and industrial growth

Recent studies provide valuable insights into how industry can balance growth with ecological sustainability through innovation, policy frameworks, and technological advancements (Waris et al., 2023; Zhang et al., 2022). Ramesh et al. (2024) highlighted the role of industrial development in promoting environmental sustainability and green development. Their study highlighted the necessity of reducing pollution and managing resources efficiently to ensure long-term ecological balance. Setyadi et al. (2025) conducted a systematic review analyzing key dimensions of sustainable manufacturing from 2019 to 2024. They recommended the integration of emerging technologies like AI-driven circular economy solutions and blockchain, which may significantly improve sustainability outcomes. A study by Sun et al. (2023) focuses on how green innovation contributes to industrial ecosystem reconstruction and environmental sustainability. It inspects global efforts toward carbon neutrality and the impact of industrial spatial co-agglomeration on green economic efficiency.

2.2 Ecological sustainability and mineral rents

A study by Qian and Chen (2025) focusing on G7 countries analyzed how different types of resource rents (oil, coal, minerals, and natural gas) affect green growth. The outcomes propose that coal and natural gas rents negatively impact sustainability, while oil rents have a positive effect, and mineral rents show an insignificant impact. Zambrano-Monserrate and Ormeño-Candelario (2023) explore the association between ecological sustainability and revenues derived from natural gas, oil, and mineral resources. They find that oil rents have a more pronounced effect on environmental degradation compared to mineral and natural gas rents. Research by Aboulajras et al. (2025) investigates the role of natural resource rents, energy efficiency, and economic growth in environmental sustainability. It highlights that renewable energy and resource rents significantly diminish CO2 emissions, improving environmental quality (Usman et al., 2021). Bilgili et al. (2023) further stated that MRR is linked to environmental damage, which reinforces concerns about the resource curse and the ecological cost of mining and drilling.

2.3 Ecological sustainability and green finance

Mudalige (2023) conducted a systematic literature review that revealed important themes in GF, such as its role in environmental sustainability, investments, innovation, policy frameworks, and corporate social responsibility. The research shows how important green financial tools are for promoting long-term growth (Dong and Yu, 2024). Khan et al. (2024) use a systematic review and bibliometric analysis to study the complicated link between GF and ES. They analyze how GF has become an important tool for promoting environmental sustainability by encouraging investments that support the environment (X. Liu et al., 2025). Xing et al. (2024) study the connection between green finance, environmental deterioration, and long-term growth. They used robust methods to find out how GF helps protect the environment and encourage long-term growth. These studies show that green finance can enhance environmental sustainability by promoting investments and policies that are good for the environment (Wang et al., 2025; Wei et al., 2024). Ali et al. (2025) discuss how GF and health expenditures (HE) can help new economies lower their ecological footprint (EF). Using panel data and advanced econometric methods, the study illustrates that both GF and HE are helpful in protecting the environment.

2.4 Gap in the literature and study contributions

This work adds to the growing body of research on ES, green finance, and resource management, especially in the context of developing economies like E7. A lot of research has used carbon dioxide emissions or energy intensity to measure ecological damage, but these indicators fail to illustrate how environmental systems recover themselves. This study, on the other hand, uses the Load Capacity Factor (LCF) as the main dependent variable. The LCF is a more complete ecological indicator that shows the ratio of biocapacity to ecological footprint. Despite its robustness and policy relevance, LCF remains underutilized in empirical analyses, especially for emerging markets.

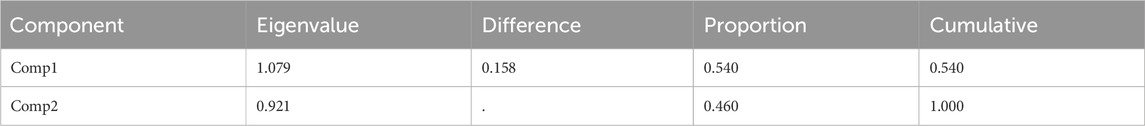

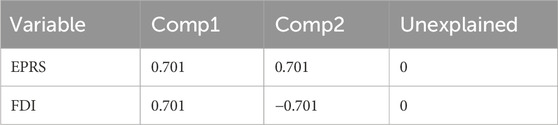

Second, the study enhances GF measurement by constructing a Principal Component Analysis (PCA)-based proxy that integrates renewable electricity generation (excluding hydro) and foreign direct investment (FDI). This multi-dimensional indicator captures both domestic financial flows and cross-border investments in green infrastructure, overcoming the limitations of single-variable green finance proxies.

Third, the study addresses the distributional analysis gap in the sustainability literature by employing the Method of Moments Quantile Regression (MMQR). While most studies estimate mean effects, MMQR uncovers how the relationships between environmental sustainability and its determinants vary across the distribution of LCF, highlighting, for example, that green finance and institutional quality are more effective in higher-performing countries. This approach better reflects the policy diversity and structural heterogeneity within the E7.

Fourth, it addresses the issue of endogeneity and simultaneity, which are often ignored or inadequately treated in sustainability studies. We use the Durbin-Wu-Hausman test and simultaneity diagnostics to check that variables like green finance, industrial growth, and mineral resource rents are not affected by other factors. The work then uses a two-step System Generalized Method of Moments (GMM) technique to fix endogeneity, unobserved heterogeneity, and dynamic persistence in environmental sustainability.

Fifth, the research uses the Common Correlated Effects Mean Group (CCEMG) estimator to deal with the problem of cross-sectional dependence due to global shocks, like changes in commodity prices or coordinated climate finance initiatives. Adding cross-sectional averages to the model makes the estimates more accurate when economies are very dependent on each other, as shown by CD tests.

Sixth, the study uses Variance Inflation Factor (VIF) diagnostics to check for possible multicollinearity among regressors. This ensures that the coefficient estimates are free from multicollinearity. Furthermore, to deal with heteroskedasticity and serial correlation, Feasible Generalized Least Squares (FGLS) is used for robustness checks.

Finally, the study adds to the existing research by looking at the non-linear effects of green finance (through GF2) and the interaction effects between mineral resource rents and institutions (MRR × IQ). This latter shows how the quality of institutions affects the environmental impact of mineral resource rents. These factors are rarely examined together in one framework, especially when it comes to emerging economies with high growth rates.

The study as a whole gives an ecologically significant and methodologically robust analysis of factors influencing environmental sustainability in E7. By combining relevant and understudied indicators with advanced econometric methods, it gives useful information into how green finance policies, institutional reforms, and industrial strategies affect environmental quality in emerging nations.

3 Theoretical framework and empirical methods

3.1 Data description

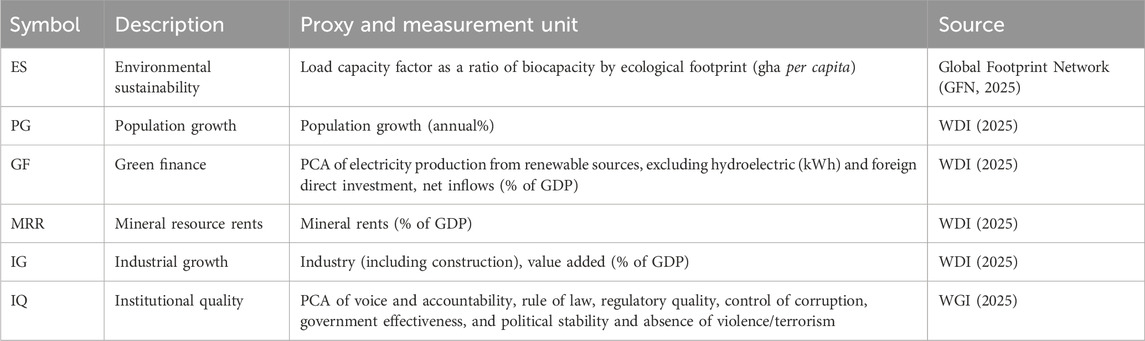

Table 1 shows the main variables used in this study, which focuses on E7 countries—Brazil, China, India, Indonesia, Mexico, Russia, and Turkey—between 1996 and 2023. We chose 1996 as the start year because it was the first year with consistent data on institutional quality. This also ensures that the panel dataset is consistent across all indicators. We used the exponential smoothing method to fill in any gaps in the data. The advantage of this method is that it fills gaps in the dataset while keeping the time series patterns as close to their original shape as possible.

Each variable in the dataset has a different but complementary role in reflecting the dynamics of green finance, sustainability, and development. LCF, which is the ratio of a country’s biocapacity to its ecological footprint (measured in global hectares per capita), is a proxy for environmental sustainability (ES). This metric is very important for assessing the resilience of environmental performance over time. Population growth (PG) is an important socioeconomic factor to understand how population growth influences the environment.

As a key variable in this study, green finance (GF) is represented by electricity production from renewable sources (not including hydroelectric) and foreign direct investment inflows as a percentage of GDP (see Appendix 1). This composite indicator shows both the effects on the environment of expanding green infrastructure and financial resources that makes such progress possible. It gives a more complete picture of how green finance may drive sustainable outcomes. Mineral resource rents (MRR) as a percentage of GDP show how much a country relies on extractive mining industries. This provides an idea of the trade-offs that may need to be made in resource-rich economies to become more sustainable. Finally, industrial growth (IG), measured as the value added of industry, including construction, displays the structure of the economy and its implications for emissions, resource use, and the shift toward greener production models. The data were sourced from official global databases, including the Global Footprint Network (GFN, 2025) and World Development Indicators (WDI, 2025), confirming consistency, comparability, and credibility across indicators.

Together, these indicators represent a multidimensional dataset that enables assessing how environmental outcomes, financial mechanisms, institutions and green finance interact in E7 economies.

3.2 Theoretical framework and model formulation

The econometric models specified in this inquiry are designed to identify the drivers of environmental sustainability (ES) in the E7 nations, with a specific focus on the role of green finance (GF). Equations 1–3 present the models employed in this study.

Equation 1 posits environmental sustainability (ES) as a function of five independent variables: institutional quality (IQ), population growth (PG), industrial growth (IG), mineral resource rents (MRR), and green finance (GF). This model is grounded in multiple theoretical frameworks. Population growth is included based on the IPAT identity (Impact = Population × Affluence × Technology), where increasing population directly escalates environmental pressure (Ehrlich and Holdren, 1971). Industrial growth, a component of structural economic transformation, is included due to its dual potential: it can drive resource use and emissions, but may also facilitate cleaner production technologies and green industrial policies, as suggested by the Porter Hypothesis (Porter and Van Der Linde, 2017). Mineral resource rents are included following the resource curse theory, which posits that reliance on natural resource revenues can undermine sustainable development unless managed through strong institutions and green policy frameworks (Sachs and Warner, 1995). Finally, green finance is included as a contemporary mechanism intended to bridge financial markets and environmental objectives. The theory of sustainable finance and stakeholder theory underpin its relevance, arguing that financial systems can be reoriented to support long-term environmental and social goals.

Institutional quality (IQ) is added to reflect the governance mechanisms that can amplify or dampen the impact of other drivers, including rents and green finance, on sustainability (Zhang et al., 2025). Strong institutions support regulatory enforcement, reduce corruption, and improve the allocation efficiency of green and resource revenues.

Equation 2 builds on this framework by introducing a squared term for green finance (GF2), enabling the detection of a non-linear (typically inverted U-shaped) relationship. This reflects the possibility that while initial increases in green finance may enhance sustainability, excessive or inefficient allocation may lead to diminishing or even adverse returns due to issues such as greenwashing, misalignment with local needs, or absorptive capacity constraints in developing economies.

Equation 3 empirically operationalizes the linear form of the full theoretical model, capturing the marginal effects of each determinant, demographic, industrial, financial, and institutional, on environmental sustainability. It establishes the baseline relationships by including the interaction term between mineral resource rents and institutional quality.

The empirical counterparts of these functional forms are expressed in Equations 4–6, which are linear panel regression models estimated over the E7 countries across the 1996–2023 period. Equation 4 is expressed as follows:

The dependent variable ESit denotes the environmental sustainability in country i at time t. The term αit captures country-specific fixed or random effects, allowing the model to control for unobserved heterogeneity, while ϵit represents the idiosyncratic error term. The coefficients β1 through β5 measure the marginal impact of each explanatory variable on environmental sustainability.

Equation 5 extends this model to incorporate a quadratic term for green finance:

Equation 6 introduces an interaction term between mineral resource rents and institutional quality (MRR × IQ), grounded in the institutional resource-curse literature. This specification tests the conditional hypothesis that the ecological impact of resource rents depends on the strength of governance. In countries with higher institutional quality, extractive revenues may be channeled into environmentally beneficial outcomes through targeted investment, stronger environmental oversight, and reinvestment strategies. A significant and positive β6 would suggest that institutional quality moderates and potentially reverses the negative effect of resource rents on sustainability.

In general, these models are based on theory and are structured to uncover the complicated connections between the macroeconomic, demographic, industrial, and financial factors that affect environmental sustainability in developing economies. Adding non-linear and interaction terms is especially helpful for understanding how green finance and mineral rents behave in complicated and conditional approaches.

Taiwo Onifade et al. (2021) provide empirical evidence of a troubling paradox in E7 economies: their impressive progress in financial and economic development has come at a high cost to biodiversity. As these countries have grown, so have their ecological footprints. This is because of rapid industrialization and urban growth. This dual path, progress along with stress on ecosystems, lays the groundwork for the current study’s investigation into how socio-technical systems and macro-financial dynamics affect ecological resilience and sustainability in these rapidly changing nations (Huang et al., 2025).

Population growth (PG) puts stress on ecosystems by increasing the need for energy, the spread of cities, and the use of natural resources. The IPAT framework (Impact = Population × Affluence × Technology) indicates that a growing population makes the environment worse unless technology becomes more efficient or policies are implemented to address the issue. So, in these economies, a growing population is likely to make the environment less sustainable, which means there is a negative relationship

Industrial growth (IG), used as a proxy for the scale and intensity of industrialization, is traditionally associated with increased emissions, higher fossil fuel consumption, and expanded material flows. Unless accompanied by green technologies or circular economy practices, industrial expansion tends to exacerbate environmental stress. This aligns with the theory that uncontrolled industrial growth undermines ecological resilience, particularly in resource- and energy-intensive sectors. Thus, the expected coefficient is negative:

Mineral resource rents (MRR) convey how much of a country’s GDP comes from natural resources. They also indicate whether the economy depends on a limited number of environmentally harmful economic activities. The “resource curse” theory suggests that relying heavily on resources can harm the environment, lead to bad governance, and discourage ecologically friendly investments. These rents are usually linked to deforestation, contaminated soil, and degraded water, which are likely to harm the environment:

Green finance (GF) is the allocation of financial resources to projects with positive consequences on the environment. In this study, it is defined as the main component that includes both renewable electricity production (excluding hydro) and foreign direct investment as a share of GDP. It supports the shift to energy systems with less carbon, more efficient energy use, and infrastructure resilient to climate change (Fu et al., 2023; K. Liu et al., 2025). GF is based on the idea that financial capital can be aligned with environmental goals, which is the idea behind sustainable finance. Green finance is expected to affect the environment in a positive way:

Institutional quality (IQ) refers to the effectiveness of governance systems in shaping the environment. When institutions are strong, it is possible to establish rules, enforce them, and ensure transparency. The fight against corruption, the quality of laws, and the rule of law all influence the effectiveness of environmental regulation and the proper use of green finance flows. People are more responsible and involved in high-quality institutions, which allows protecting the environment and makes policies more stable over time. When it comes to mineral rents or industrial externalities, institutions can help protect the environment by ensuring that businesses reinvest their profits effectively, respect the rules, and reach their sustainability goals. Consequently, better institutions lead to a healthier environment, so that

To summarize, the model employed in this study shows how demographic trends, industrial growth, resource rents, institutional quality, and long-term financial mechanisms affect the environment. It additionally enables to understand how these factors shape the future of ecological sustainability in the E7 countries.

3.3 Estimation techniques

The current study uses a broad econometric approach designed for panel data to identify factors affecting environmental sustainability in E7 economies from 1996 to 2023. The procedure consists of the following steps: diagnostic testing, checking for stationarity, cointegration analysis, estimation using MMQR, and checking for robustness.

3.3.1 Slope heterogeneity and cross-section dependency

The initial task in the empirical study is to explore two main issues with panel data: cross-sectional dependency (CD) and slope homogeneity (SH). It is important to test for cross-sectional dependence because economies are connected through shared trade systems, financial flows, and geopolitical shocks, including the COVID-19 pandemic or the Russia-Ukraine conflict. The Pesaran (2004) CD test is used to find interdependencies between the E7 countries, which ensures that the findings are appropriate and consistent.

The study uses the slope homogeneity (SH) test that Pesaran and Yamagata (2008) developed to assess whether the parameter estimates might be different in various countries. This test checks if the slope coefficients are the same for all panel units. The adjusted test statistic (ΔASH) gives a more accurate result. Equations 7 and 8 provide the formulas of the ΔSH and ΔASH statistics:

3.3.2 Stationarity tests

Following the confirmation of CD and SH, the stationarity of the series is tested using the second-generation cross-sectionally augmented Im-Pesaran-Shin (CIPS) test as proposed by Pesaran (2007). Unlike first-generation unit root tests, the CIPS test accounts for cross-sectional dependencies, providing more reliable inferences in globally integrated datasets. The stationarity equation is given in Equation 9:

where

3.3.3 Cointegration test

After stationarity is established, the long-run equilibrium relationship between ES and its drivers is investigated using the Westerlund (2007) cointegration test. Unlike traditional tests (e.g., Pedroni), this second-generation method accommodates cross-sectional dependence and checks cointegration through an error-correction framework. The core equation is given in Equation 11:

This formulation produces four statistics reported in Equations 12–15 (Gt, Ga, Pt, Pa), where Gt and Ga assess average group cointegration and Pt and Pa assess full-panel cointegration:

3.3.4 Multicollinearity check

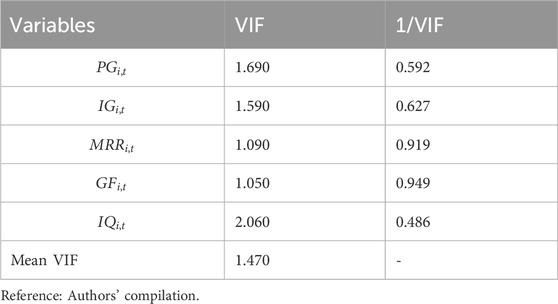

Before model estimation, multicollinearity among independent variables is checked using the Variance Inflation Factor (VIF) test. High VIF values (typically above 10) indicate problematic multicollinearity, which could bias coefficient estimates and standard errors. The test confirms that all VIF values fall within acceptable limits, ensuring the reliability of estimated parameters.

3.3.5 MMQR test

The primary estimation technique is the Method of Moments Quantile Regression (MMQR), developed by Machado and Santos Silva (2019). MMQR captures the full conditional distribution of the dependent variable, here, environmental sustainability (ES), rather than mean effects. This method is particularly suited for environmental data, where relationships may differ across quantiles (e.g., high vs. low sustainability contexts).

Unlike conventional OLS or basic quantile regression, MMQR is robust to outliers, nonlinearities, and unobserved heterogeneity, and avoids quantile crossing. It allows for differential policy insights across low- and high-performing nations, enhancing the depth of ecological analysis.

The MMQR method has gained substantial adoption in recent environmental economics literature, as evidenced by applications in diverse contexts by Miao et al. (2022) and Dogan et al. (2021), further validating its suitability for complex and nonlinear environmental-economic models like the one adopted in this study.

3.3.6 Endogeneity testing: Durbin-Wu-Hausman test and system GMM

Even though MMQR is robust enough to handle distributional asymmetry, it does not automatically fix for simultaneity or reverse causality. If green finance, industrial growth, or resource rents are determined simultaneously with environmental sustainability, endogeneity may happen. As a result, the estimates may be biased.

To fix this, we employ the Durbin-Wu-Hausman test, which uses instrumental variables to check endogeneity and ensures that the coefficient estimates are robust (Liang and Yang, 2019). This approach allows to re-estimate the key relationships while controlling for potential simultaneity, thereby validating the robustness of our main results.

Additionally, to examine dynamic effects and further control for endogeneity, we apply a two-step System Generalized Method of Moments (System-GMM) estimator (Mawutor et al., 2024). Following the methodology of Fingleton (2022), the dynamic panel model incorporates a lagged dependent variable (ES) and instruments endogenous regressors using their own lagged values, as shown in Equation 16:

Here, the lag of the dependent variable (ES) of a country i at time t–1 is denoted by

3.3.7 Robustness tests

This study employs two additional robustness checks, the Feasible Generalized Least Squares (FGLS) method and the Common Correlated Effects Mean Group (CCEMG) estimator, to make sure that the MMQR results are reliable and that the estimated relationships are robust.

The FGLS method deals with problems of panel-level heteroskedasticity and autocorrelation, which can make standard error estimates less accurate in regular fixed or random effects models. FGLS gives better and more reliable coefficient estimates when there is cross-sectional heterogeneity by modeling error variance structures. Using FGLS allows concluding if the mean-based effects match up with the quantile-specific results from the MMQR framework.

In addition, the study applies the Common Correlated Effects Mean Group (CCEMG) estimator, developed by Pesaran (2006), to account for cross-sectional dependence due to unobserved common factors. This is particularly relevant for globally exposed economies like the E7, which are influenced by shared macroeconomic shocks (e.g., commodity price fluctuations, financial crises). CCEMG incorporates cross-sectional averages of all variables into the regression, thereby avoiding bias from unobserved but correlated shocks across countries.

Together, these robustness estimators strengthen the empirical analysis. FGLS checks the direction and consistency of relationships at the mean level, while CCEMG validates the findings under broader cross-sectional dependence structures. This triangulated approach ensures that the observed patterns, especially the role of green finance, industrial growth, and mineral rents, do not depend on a specific estimation method, but instead reflect consistent and methodologically sound results.

These steps reflect rigorous practices in environmental econometrics and enhance the credibility of the study’s policy-relevant conclusions for improving ecological sustainability in emerging economies.

4 Results and discussion

Table 2 presents the descriptive statistics for the key variables included in the empirical analysis: Environmental Sustainability (ES), Population Growth (PG), Industrial Growth (IG), Mineral Resource Rents (MRR), Green Finance (GF), and Institutional Quality (IQ), based on 196 observations across the E7 countries for the 1996–2023 period.

The mean value of Environmental Sustainability (ES), measured via the Load Capacity Factor (LCF), is 1.032, suggesting that, on average, biocapacity slightly exceeds ecological footprint across the panel. However, the wide standard deviation (1.002) and the range between the minimum (0.219) and maximum (3.760) reveal considerable heterogeneity in sustainability performance among E7 countries. The high Jarque-Bera statistic (46.460, p < 0.01) indicates strong non-normality, justifying the use of distribution-sensitive methods such as MMQR.

Population Growth (PG) averages around 0.93% annually, with a slightly positive skew indicated by the median (1.044) exceeding the mean. The variation is modest (SD = 0.583), but the non-normality (Jarque-Bera = 11.960, p < 0.01) may reflect demographic transitions across countries like China and Russia versus younger populations in Indonesia.

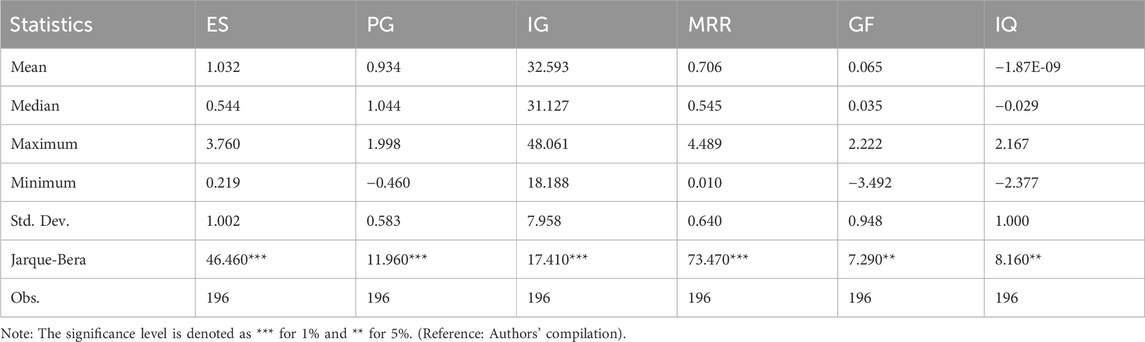

Industrial Growth (IG) shows a high mean (32.59%) and substantial variation (SD = 7.96), consistent with structural differences in industrial intensity across the E7 bloc (Figure 1). The range (18.19%–48.06%) underscores diverse industrial pathways, while the significant Jarque-Bera test (17.410, p < 0.01) suggests non-normality—likely driven by transition economies or resource-heavy industries.

Mineral Resource Rents (MRR) average 0.706% of GDP but range from 0.01% to 4.49%, reflecting large asymmetries in natural resource endowments—most notably between heavily extractive economies like Russia and Brazil versus service- or manufacturing-oriented nations like Turkey. The high skewness is confirmed by the Jarque-Bera statistic of 73.470 (p < 0.01).

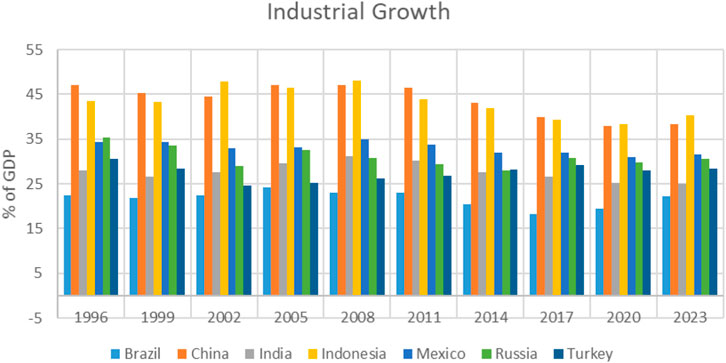

Green Finance (GF), a PCA-derived index, has a low mean (0.065) but a wide range (from −3.492 to 2.222), with a large standard deviation (0.948). This dispersion reflects divergent trends in renewable electricity deployment and foreign capital inflows. The Jarque-Bera value (7.290, p < 0.05) indicates modest but statistically significant deviation from normality. Average trend of GF is shown in Figure 2.

Institutional Quality (IQ) centers near zero (mean ≈ −1.87e-09), as expected for PCA-constructed governance indices normalized across countries. However, the large standard deviation (1.000) and wide range (−2.377 to 2.167) highlight stark institutional disparities within the E7 group. The distribution is also non-normal (Jarque-Bera = 8.160, p < 0.05), consistent with differing governance models and political stability scores across countries.

In sum, the descriptive statistics suggest substantial variation and significant departures from normality across all key variables. These patterns underscore the importance of adopting flexible, distribution-sensitive econometric techniques—such as MMQR and CCEMG—to capture underlying heterogeneity and avoid biased inferences.

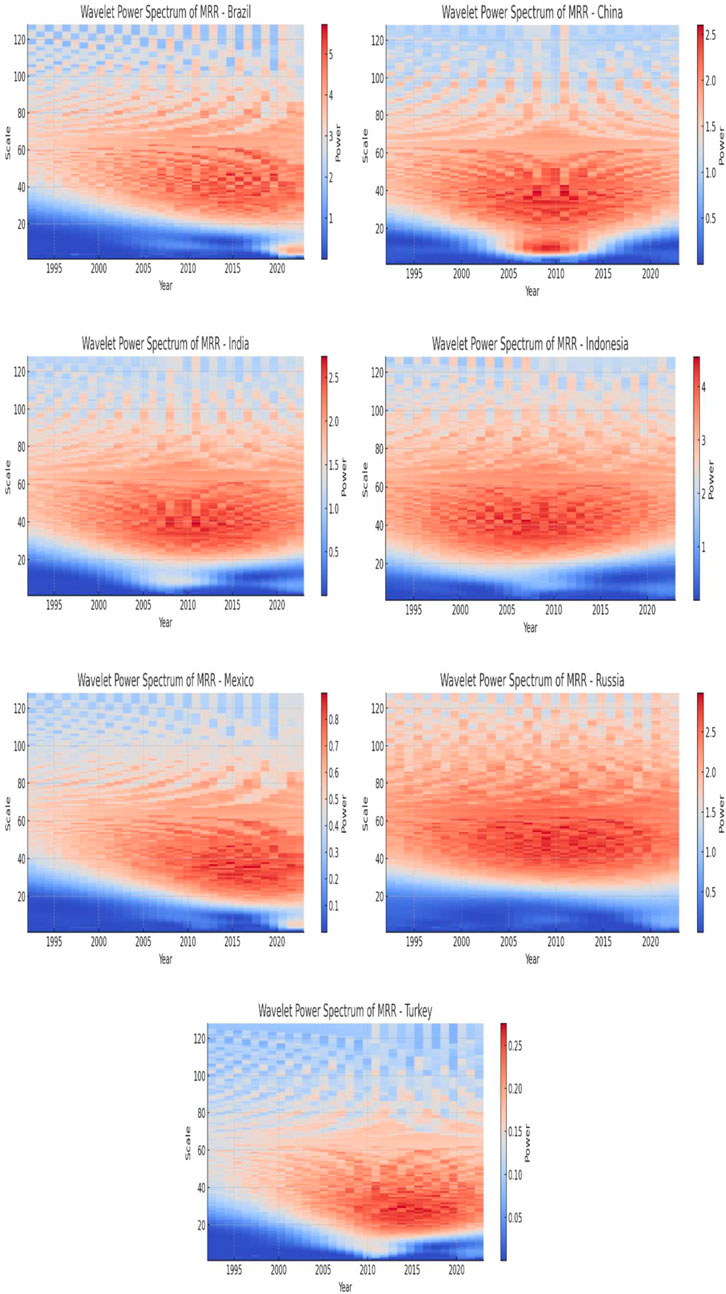

The wavelet power spectra of MRR across E7 countries in Figure 3 reveal diverse temporal patterns. Brazil and Russia show sustained high-power periods, indicating long-term resource dependence. China and India exhibit moderate, shifting patterns, reflecting economic diversification. Indonesia and Mexico display intermittent spikes, tied to commodity cycles, while Turkey shows minimal activity. Overall, these patterns highlight structural differences in resource reliance and underscore the importance of tailored, yet coordinated, resource and sustainability policies across the E7.

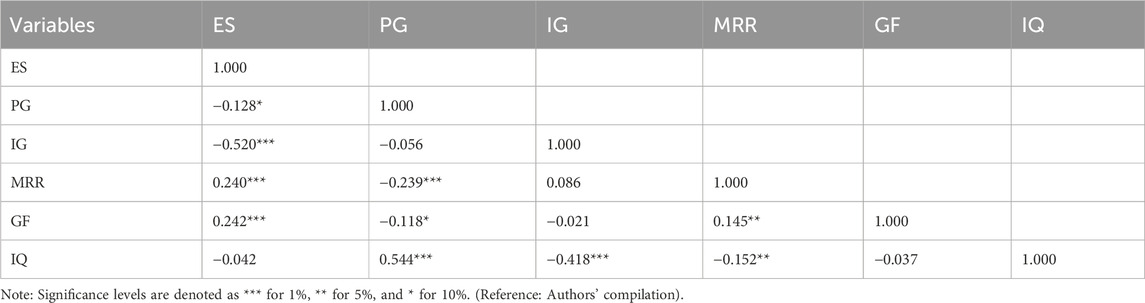

The correlation matrix presented in Table 3 provides a comprehensive view of the relationships between the key variables used in this study, based on 196 annual observations (1996–2023). Several important insights emerge from the correlations, which help to understand the dynamics influencing ES in the E7 countries.

The negative correlation between ES and PG (−0.128, p < 0.10) suggests that higher population growth is linked to lower environmental sustainability. This finding is consistent with the IPAT framework, which posits that growing population can put increasing pressure on environmental resources, thus undermining sustainability. Industrialization, represented by IG, shows a stronger negative correlation with ES (−0.520, p < 0.01), indicating that industrial expansion, particularly in energy-intensive sectors, tends to deteriorate environmental outcomes. This result reinforces the conventional understanding that industrial growth can contribute to environmental degradation unless accompanied by cleaner technologies or effective environmental policies.

Interestingly, MRR shows a positive correlation with ES (0.240, p < 0.01), suggesting that mineral resource rents may support environmental sustainability. This could be due to the effective reinvestment of resource rents into sustainable development initiatives or the use of these funds to support environmental governance, which mitigates the negative effects of resource dependence. This result contrasts with the expectations set by the resource curse theory, which generally predicts adverse environmental impacts due to over-reliance on extractive industries. However, this positive correlation may reflect that better governance or reinvestment policies can reduce the ecological risks associated with mineral extraction.

The correlation between GF and ES (0.242, p < 0.01) further underscores the positive role that financial investments in sustainable initiatives can play in promoting environmental resilience. Green finance, which includes funding for renewable energy and climate-related projects, appears to significantly contribute to improving environmental sustainability in the E7 countries. This supports the growing literature on sustainable finance, which suggests that aligning financial systems with environmental goals is crucial for advancing ecological outcomes.

IQ shows a strong positive correlation with PG (0.544, p < 0.01), indicating that countries with stronger institutions tend to manage population growth more effectively. This could be due to better governance systems that promote sustainable urbanization, family planning policies, or resource-efficient practices. Additionally, IQ is negatively correlated with Industrial Growth (IG) (−0.418, p < 0.01), suggesting that countries with stronger institutions may be able to mitigate the environmental impacts associated with industrial expansion. This finding is consistent with the idea that effective governance can promote the adoption of cleaner industrial practices, reducing the negative ecological consequences of industrialization.

The relationship between IQ and MRR is also negative (−0.152, p < 0.05), albeit modest. This indicates that countries with better institutional frameworks may be more adept at managing the potentially harmful environmental effects of resource extraction. Strong institutions may facilitate policies that regulate the use of resource rents and direct them towards environmentally sustainable uses, thereby mitigating the adverse effects typically associated with reliance on mineral resources.

In summary, the correlation matrix highlights the complex interactions between the various determinants of ES in the E7 nations. While industrial growth and population pressure are negatively correlated with sustainability, green finance and mineral resources appear to support environmental resilience. The positive relationship between mineral resource rents and environmental sustainability suggests that institutional quality plays a critical role in mediating the effects of resource dependence, which may offer useful insights for policy design aimed at fostering sustainability in emerging economies.

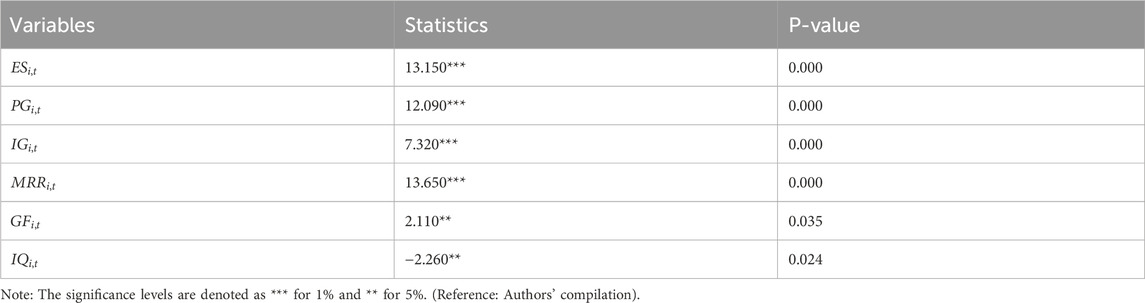

Table 4 presents the results of the cross-sectional dependence (CD) test for the key variables in this study. The test statistics are significant at the 1% or 5% levels, indicating the presence of strong cross-sectional dependence among the variables. Specifically, ES, PG, IG, and MRR exhibit high test statistics with p-values of 0.000, confirming significant interdependencies across the E7 countries. This suggests that these variables are influenced by shared global shocks, such as economic or environmental crises, which impact multiple countries simultaneously.

The GF variable shows a weaker but still significant result (coefficient = 2.110, p < 0.05), indicating some degree of cross-sectional dependence in the green finance data. Similarly, IQ shows significant dependence (coefficient = −2.260, p < 0.05), suggesting that governance quality in these countries may be similarly impacted by global or regional factors.

Given the significant cross-sectional dependence, we recognize that MMQR, as implemented, assumes independent errors across units, which may not be appropriate in the presence of strong dependence. To address this concern and improve the robustness of our findings, we also employ the Common Correlated Effects Mean Group (CCEMG) estimator. As suggested in recent econometric literature, CCEMG is a useful method for dealing with cross-sectional dependence by incorporating cross-sectional averages of the variables in the regression. This adjustment accounts for unobserved common factors influencing all panel units simultaneously.

By employing CCEMG, we can more effectively mitigate the bias introduced by cross-sectional dependence, offering more reliable estimates and enhancing the robustness of the study’s conclusions. This ensures that the empirical results are not driven by shared global trends and better reflect the underlying relationships within the E7 countries.

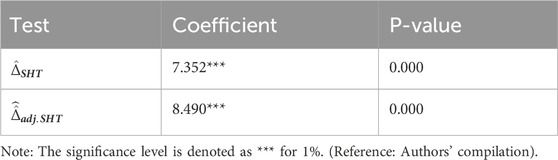

Table 5 presents the results of the Slope Homogeneity (SH) test, which assesses whether the slope coefficients are homogeneous across the E7 countries. The test statistics, Δ̂

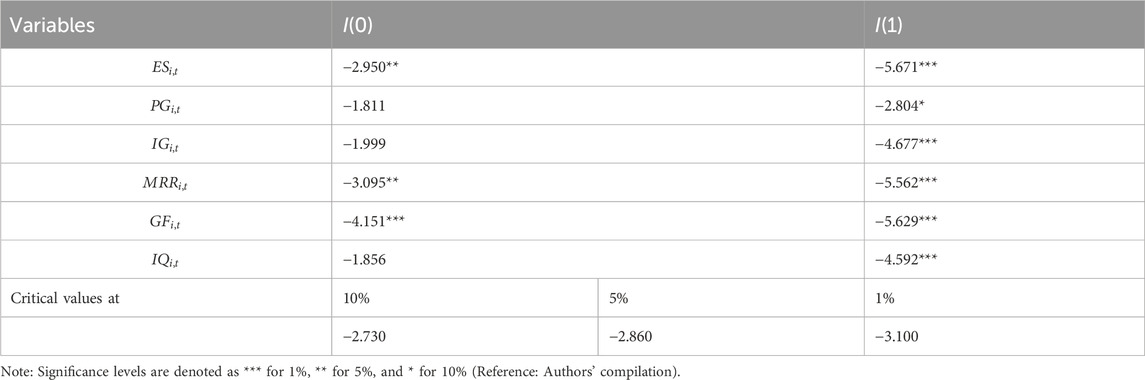

The findings from the CIPS unit root test in Table 6 indicate that most of the key variables, including PG, IG, and IQ, are non-stationary at levels and require differencing to achieve stationarity. In addition, the test statistics for variables, such as ES (−5.671) and IG (−4.677), exceed the critical values for I(1) at the 1% significance level. In contrast, PG and IQ show significant I(1) results. Because these variables are not stationary, there is a risk of endogeneity, which means that they could create spurious relationships if they are not handled correctly. To deal with this, the Durbin-Wu-Hausman test is used to check endogeneity, and instrumental variables are used to ensure that estimates are consistent.

MMQR is also used to reduce the risk of spurious relationships due to non-stationary variables. This method allows for robust estimates even with data that is not stationary. It captures the full range of environmental sustainability without relying on mean-based methods. MMQR avoids the problems of traditional regression methods that need stationarity. It gives more reliable and detailed information about how key variables are related to each other across different quantiles. Finally, the CCEMG method is used to account for cross-sectional dependence, which is important because the E7 countries are connected to each other. This method adds cross-sectional averages to the regression, which mitigates bias caused by shocks that affect the whole world or a region and ensures that the results are robust in a wide range of economic situations.

The Durbin-Wu-Hausman test, MMQR, and CCEMG provide a comprehensive econometric framework for addressing endogeneity, non-stationarity, and cross-sectional dependence. This gives a better and more reliable picture of the potential drivers of environmental sustainability in E7 countries.

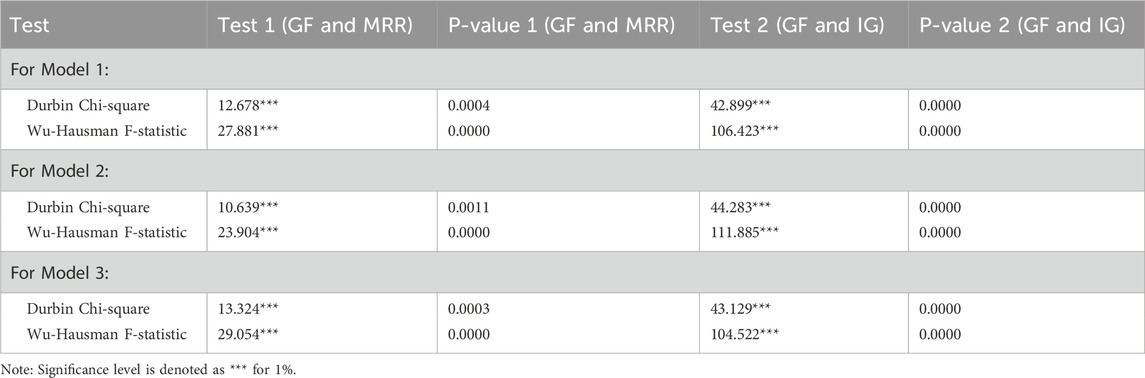

Table 7 shows the results of the simultaneity test for two specifications focusing on GF, with MRR and IG as possible endogenous variables. The tests for simultaneity examine if the explanatory variables and the dependent variable are determined at the same time. This means that instrumental variable methods are needed to handle this particular issue.

In all models, both chi2(1) and F-statistics are statistically significant, with p-values below 0.01. For Model 1, the robust score chi2 and robust regression F-statistics for both GF and MRR (12.678, 27.881) and GF and IG (42.899, 106.423) indicate strong evidence of simultaneity, suggesting that GF, MRR, and IG are endogenous in these regressions.

Similarly, Models 2 and 3 confirm simultaneity for both pairs of variables, with statistically significant chi2 and F-statistics across the tests. The high values for the robust regression F-statistics further emphasize the need to address the simultaneity bias.

In summary, the simultaneity test results provide compelling evidence that GF, MRR, and IG are jointly determined with the dependent variable, reinforcing the necessity of using instrumental variable techniques to mitigate simultaneity bias.

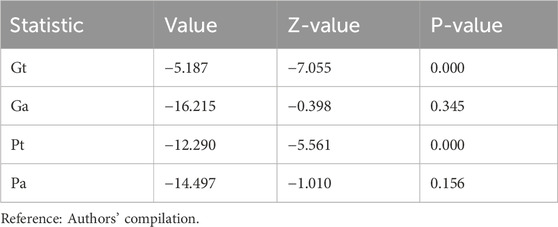

The results of Westerlund’s cointegration test (Table 8) provide insights into the long-run equilibrium relationships between environmental sustainability and its key determinants in the E7 economies. The test produces four statistics, Gt, Ga, Pt, and Pa, which test different aspects of cointegration across the panel.

The Gt statistic is −5.187, with a Z-value of −7.055 and a p-value of 0.000, indicating strong evidence of cointegration at the 1% significance level. This suggests that there is a long-run equilibrium relationship between ES and its explanatory variables for at least some of the countries in the panel, supporting the presence of a stable long-term association.

On the other hand, the Ga statistic is −16.215, with a Z-value of −0.398 and a p-value of 0.345, which fails to reject the null hypothesis of no cointegration at any conventional significance level. This suggests that, for the group cointegration, there is no strong evidence of a long-term relationship across all countries in the panel when considering the average group effect.

Similarly, the Pt statistic is −12.290, with a Z-value of −5.561 and a p-value of 0.000, strongly indicating full-panel cointegration at the 1% level. This result further supports the existence of a long-run equilibrium relationship across the entire panel of E7 countries, consistent with the findings from the Gt statistic.

However, the Pa statistic is −14.497, with a Z-value of −1.010 and a p-value of 0.156, which does not provide strong evidence for full-panel cointegration, as the p-value is greater than the conventional significance thresholds.

In summary, the Westerlund cointegration test suggests that while there is strong evidence for cointegration between ES and its determinants in some parts of the panel (as indicated by the Gt and Pt statistics), the results are less conclusive for the overall group and full-panel cointegration (Ga and Pa). This indicates that long-run relationships may exist for specific subsets of countries, but the full-panel relationship is less certain.

Table 9 presents the multicollinearity diagnostic results using the Variance Inflation Factor (VIF). All variables have VIF values well below the critical threshold of 10, with a mean VIF of 1.470, indicating no significant multicollinearity among the regressors. This confirms that the explanatory variables in the model are sufficiently independent, ensuring stable and reliable coefficient estimates in the regression analysis.

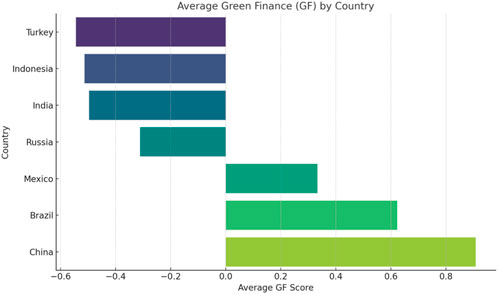

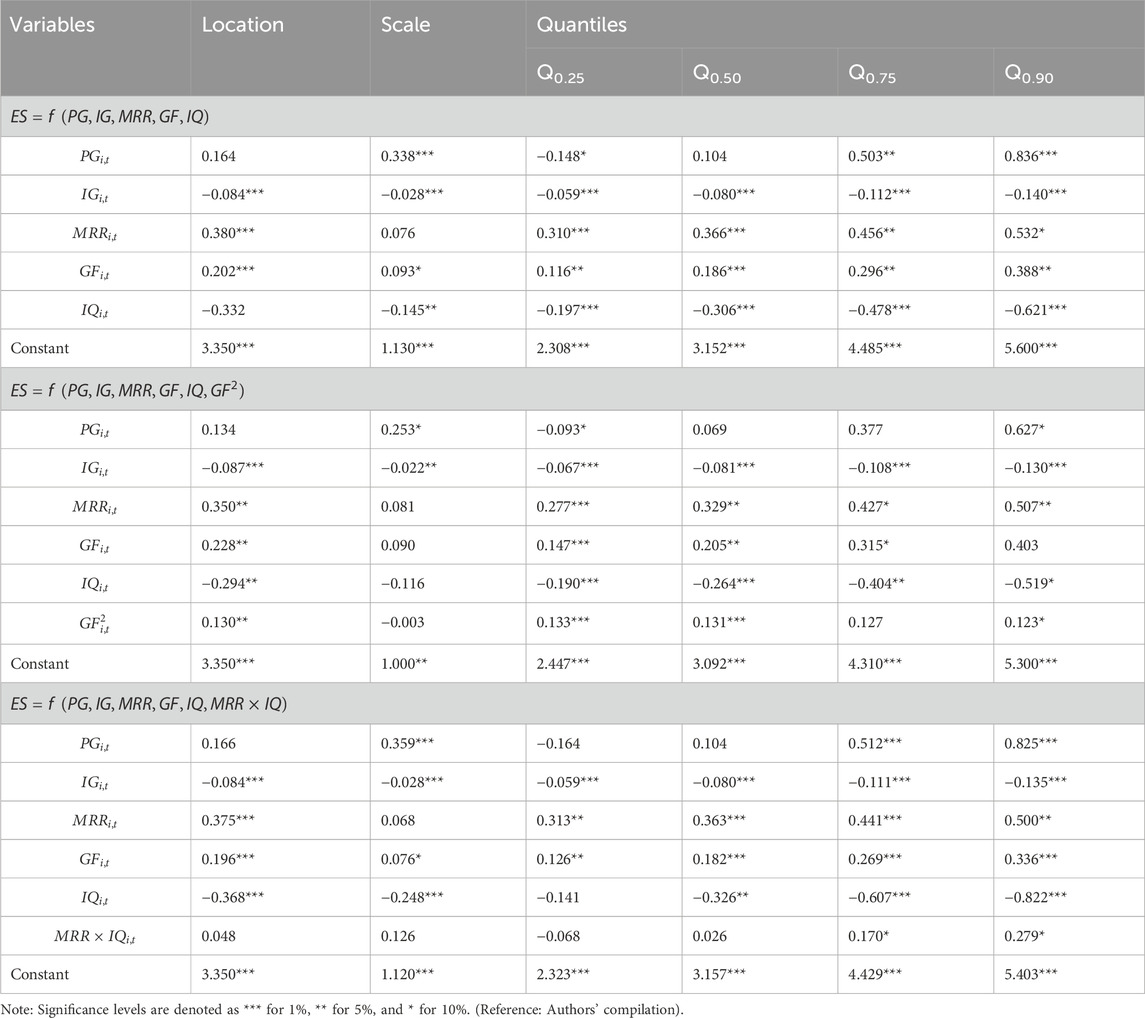

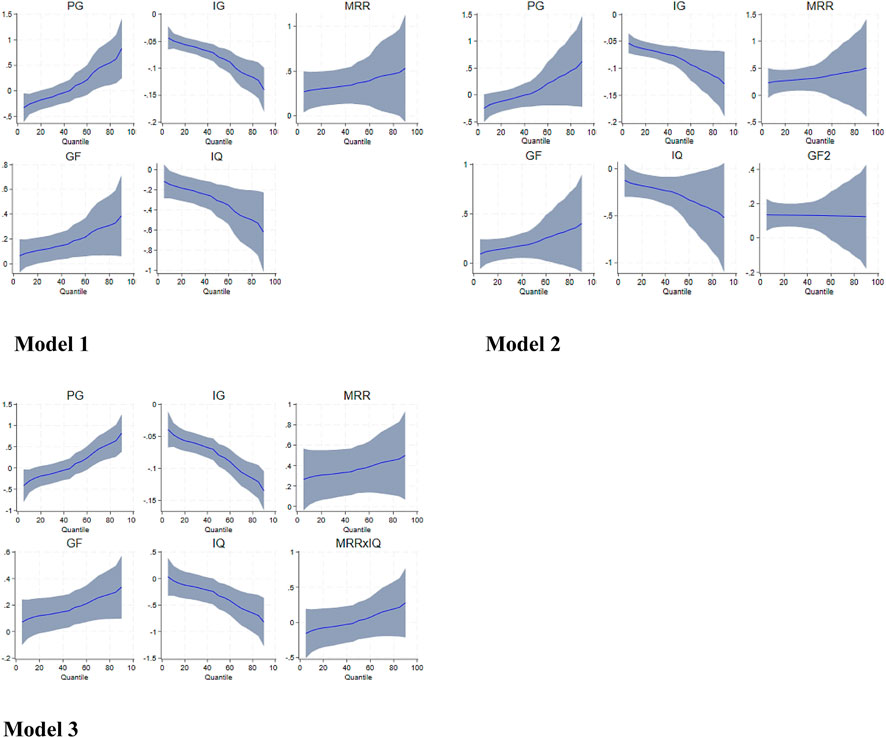

The MMQR results presented in Table 10 provide a detailed exploration of the relationships between environmental sustainability (ES) and its key drivers across different quantiles (Q0.25, Q0.50, Q0.75, Q0.90). The outcomes show that the explanatory variables have different effects on ES at different levels of sustainability, both linear and non-linear.

In the first model, where PG, IG, MRR, GF, and IQ are used to predict ES, we note that PG has a positive effect on ES at the higher quantiles (Q0.75 and Q0.90). The coefficients are significant at Q0.75 (0.503, p < 0.05) and Q0.90 (0.836, p < 0.01). This means that population growth is more likely to be linked to sustainability in countries with good environmental quality, possibly because they handle population pressures better. Muhammad et al. (2020) support these results. On the other hand, IG always has a negative effect across all quantiles, with significant coefficients at all quantiles (for example, Q0.25: −0.059, p < 0.01; Q0.50: −0.080, p < 0.01). This shows that industrial growth generally makes the environment less sustainable, especially in countries with higher levels of sustainability performance. Caglar et al. (2023) corroborate this finding.

At lower quantiles (Q0.25: 0.310, p < 0.01), MRR and ES are positively related, but this relationship gets stronger at higher quantiles. This means that resource rents may help protect the environment in all countries, particularly in those with a better initial environmental quality. Ajayi (2024) and Caglar et al. (2025) support these results. Across all quantiles, the link between GF and ES is always positive and strong, getting stronger at higher quantiles (Q0.90: 0.388, p < 0.05). This shows how important green finance is for promoting sustainability, especially in countries that are already doing well in terms of sustainability. Jin et al. (2024) confirm these results.

IQ and ES are always negatively related, and the effect gets stronger at higher quantiles (Q0.90: −0.621, p < 0.01). This means that there may be stronger regulatory controls and governance mechanisms in countries with better performance. These could limit the positive effects of other factors, like green finance or population growth, on sustainability. This could show the complicated choices that have to be made when putting sustainability policies into action with stronger institutions.

In the second model, which introduces GF2 (the squared term for green finance), the results suggest a non-linear relationship between green finance and environmental sustainability. The positive coefficient of GF2 at higher quantiles (Q0.5: 0.131, p < 0.01; Q0.90: 0.123, p < 0.10) suggests that the impact of green finance on sustainability remains positive at higher levels of sustainability (de Angelis et al., 2019). However, at Q0.9, GF shows a non-significant effect, and the squared term (GF2) also becomes less significant. This finding supports the Environmental Kuznets Curve (EKC) hypothesis, where green finance’s effectiveness is most noticeable in higher-performing countries, but its marginal impact diminishes or becomes negative in lower-performing nations. This outcome contradicts the study by Trabelsi and Fhima (2025), which reveal that enhancing financial inclusion, often linked to green finance initiatives, can lead to increased CO2 and total GHG emissions.

Lastly, in the third model, which includes the interaction term MRR × IQ, we see that IQ has a stronger negative relationship with ES at the higher quantiles (Q0.90: −0.822, p < 0.01). On the other hand, MRR × IQ is positive at the higher quantiles (Q0.90: 0.279, p < 0.10). This means that the quality of institutions can influence how mineral resource rents affect the environment. Countries with stronger institutions may be better able to manage mineral resource rents and use them to protect the environment, like through sovereign wealth funds or reinvesting in green projects. This is due to the positive interaction term at higher quantiles.

In summary, the MMQR results highlight the heterogeneous and non-linear effects of the different variables on environmental sustainability across different quantiles (Figure 4). The findings emphasize the critical role of green finance in promoting sustainability, particularly in high-performing countries, while also illustrating the mixed effects of industrial growth and mineral resource rents. The incorporation of institutional quality further underscores the complexity of these relationships, suggesting that governance has a key role in mediating the effects of economic and financial factors on sustainability.

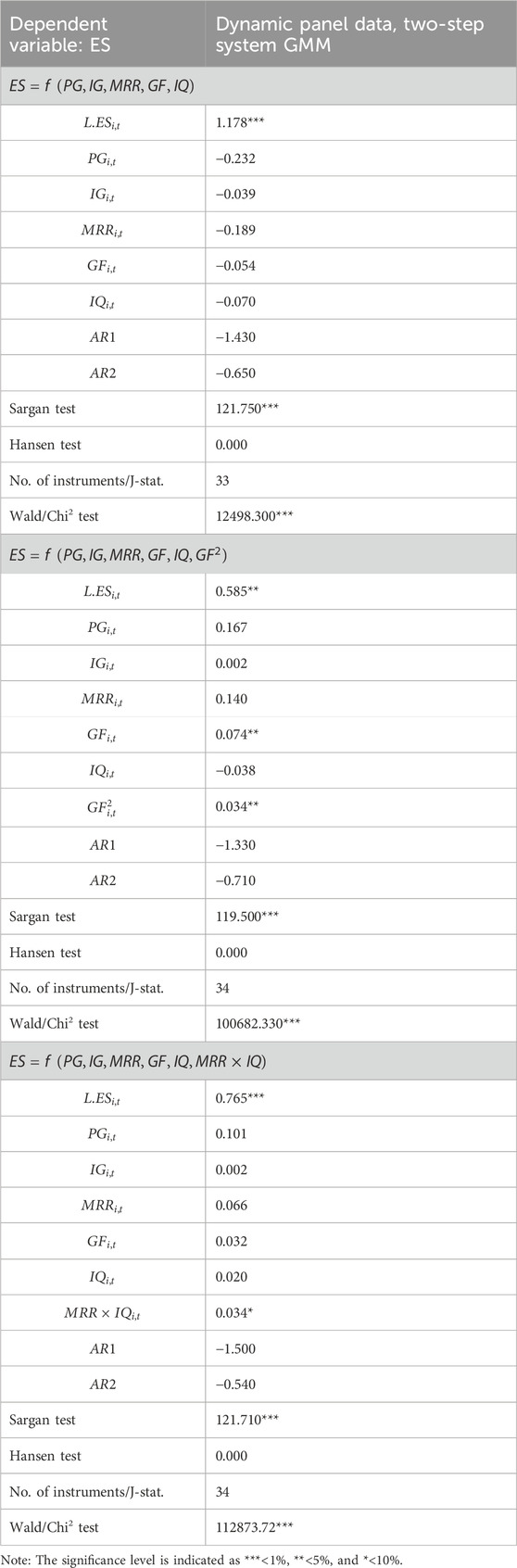

Table 11 presents the results of the dynamic panel data estimation using two-step system GMM, examining the effects of various factors impacting environmental sustainability (ES). The system GMM method is used to control for endogeneity, unobserved heterogeneity, and reverse causality, providing more reliable coefficient estimates in the presence of these issues. The results are divided into three models, each with different specifications of the key independent variables.

The coefficient for the lagged dependent variable (L.ES) is highly significant (1.178, p < 0.01), indicating strong persistence in environmental sustainability. This suggests that past levels of environmental sustainability strongly influence current sustainability outcomes. Among the explanatory variables, PG, IG, MRR, GF, and IQ are all insignificant, with their coefficients being negative or close to zero. The lack of significance for PG (−0.232), IG (−0.039), MRR (−0.189), GF (−0.054), and IQ (−0.070) suggests that these variables may not directly influence environmental sustainability in the short run, or their effects are masked by the persistence in sustainability levels captured by the lagged dependent variable.

The AR1 statistic is −1.430, and AR2 is −0.650, both of which suggest no significant autocorrelation in the model (AR1 is significant, but AR2 is not), indicating the absence of first- and second-order autocorrelation in the model residuals. This is an important diagnostic result, as serial correlation in the residuals could indicate model misspecification.

The Sargan test statistic of 121.750, which is significant at the 1% level, and the Hansen test statistic (0.000) suggest that the instruments used in the model are valid and that there is no problem with over-identification. The Wald Chi2 test (12498.300, p < 0.01) indicates that the model is statistically significant as a whole.

In this model, the inclusion of GF2 (the squared term for green finance) tests the potential non-linearity in the relationship between green finance and environmental sustainability. The lagged dependent variable (L.ES) remains significant (0.585, p < 0.05), indicating persistence in environmental sustainability. However, the effects of PG, IG, MRR, and IQ are still largely insignificant, except for GF the 5% level (0.074, p < 0.05) and GF2 (0.034, p < 0.05). The positive coefficient for GF2 indicates that green finance may have a positive, albeit non-linear, effect on sustainability at higher levels of environmental performance.

The diagnostics in this model show similar results to Model 1. The AR1 value (−1.330) and AR2 value (−0.710) suggest no first- or second-order autocorrelation. The Sargan test (119.500, p < 0.01) and Hansen test (0.000) confirm the validity of the instruments, and the Wald Chi2 test (100682.330, p < 0.01) indicates that the model is statistically significant.

In Model 3, the interaction term between MRR and IQ is introduced to examine how institutional quality (IQ) moderates the effect of mineral resource rents (MRR) on environmental sustainability. The coefficient for L. ES (0.765, p < 0.01) remains significant, further indicating persistence in sustainability outcomes. While PG, IG, MRR, and GF remain largely insignificant, the interaction term MRR × IQ is positive and significant at the 10% level (0.034, p < 0.10). This suggests that stronger institutions may help mitigate the adverse effects of mineral resource rents on sustainability, potentially through improved governance mechanisms and policies that direct resource rents toward sustainable production.

Again, the AR1 (−1.500) and AR2 (−0.540) values suggest no significant autocorrelation, and the Sargan test (121.710, p < 0.01) and Hansen test (0.000) confirm the validity of the instruments. The model’s overall significance is indicated by the Wald Chi2 test (112873.72, p < 0.01).

In conclusion, the system GMM results indicate that lagged environmental sustainability plays a crucial role in determining current sustainability levels, with green finance and institutional quality showing varying effects across different models. The interaction term between MRR and IQ in Model 3 suggests that stronger institutions can moderate the negative impact of resource rents on sustainability. While industrial growth and population growth do not appear to have significant short-term effects on sustainability, the results underscore the importance of green finance and institutional governance in driving sustainability outcomes. The diagnostic tests confirm the robustness of the models, with valid instruments and no autocorrelation, further reinforcing the reliability of the findings.

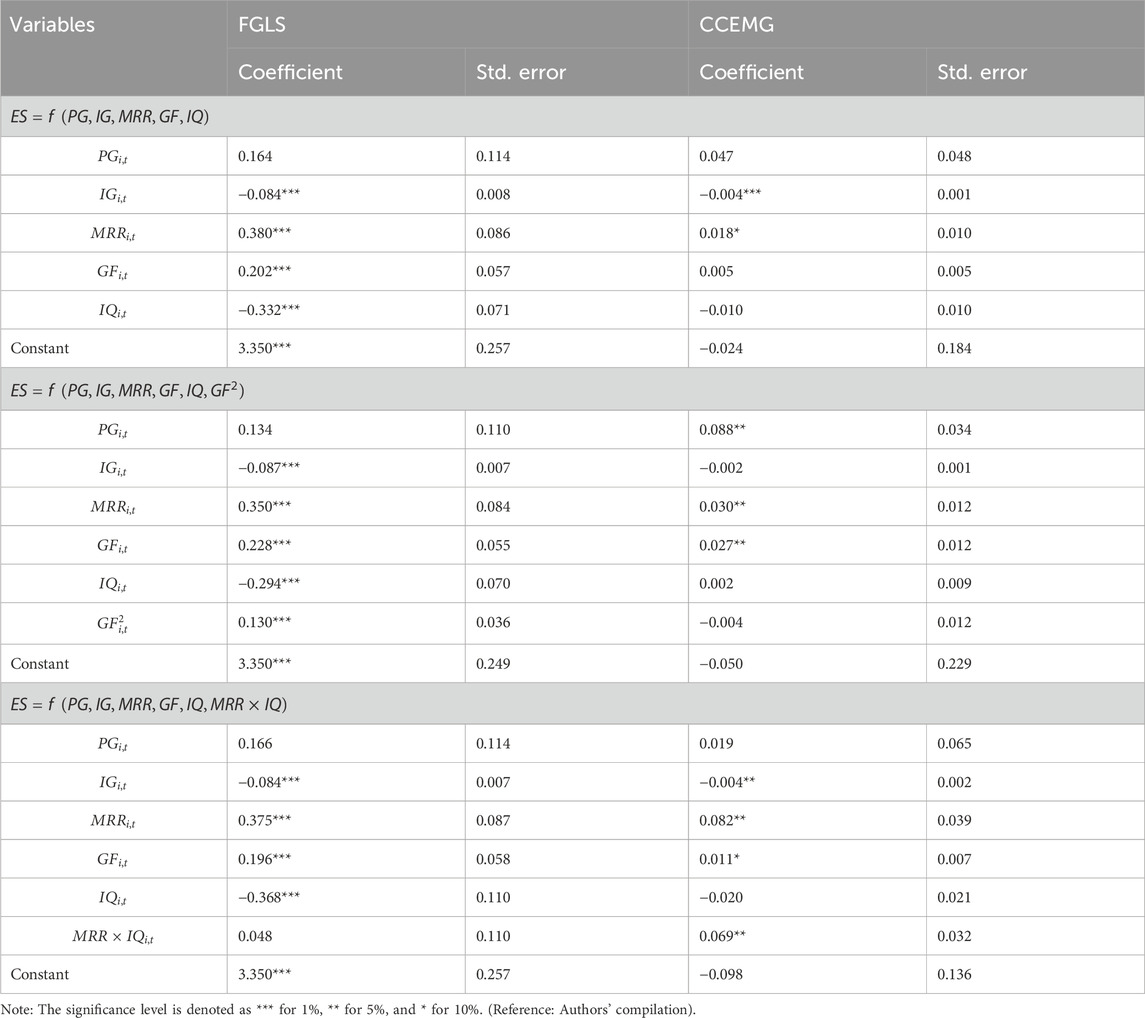

Table 12 presents the robustness tests results using two alternative estimation methods: Feasible Generalized Least Squares (FGLS) and Common Correlated Effects Mean Group (CCEMG). These tests help to verify the robustness of the baseline findings using different modeling techniques that account for potential issues such as heteroskedasticity, autocorrelation, and cross-sectional dependence. The analysis of these results is essential for confirming the validity and reliability of the conclusions drawn from the three models.

In the first model, FGLS results indicate significant effects for IG, MRR, GF and IQ, with IG having a negative and significant impact on ES (−0.084, p < 0.01), while MRR (0.380, p < 0.01) and GF (0.202, p < 0.01) both show positive effects on sustainability. This is in line with the main findings from the baseline model. The CCEMG results, however, reveal that MRR and GF become less significant, with the coefficient for MRR (0.018, p < 0.10) and GF (0.005) turning insignificant. This suggests that while green finance and mineral resource rents might be important drivers in the FGLS model, their impact appears to diminish when controlling for unobserved common factors across countries using the CCEMG approach. Interestingly, IQ maintains its negative relationship with ES across both models, though it becomes insignificant in the CCEMG model (−0.010), implying that institutional quality might not be a direct driver of environmental sustainability when common shocks are accounted for.

In the second model, which introduces the quadratic term for green finance (GF2), FGLS results show that GF (0.228, p < 0.01) and GF2 (0.130, p < 0.01) both significantly contribute to environmental sustainability, indicating a positive and non-linear relationship. This supports the hypothesis of a compounding benefit of green finance in driving sustainability, particularly as GF rises. However, in the CCEMG model, the coefficient for GF becomes slightly less significant (0.027, p < 0.05), and the coefficient for GF2 turns negative and insignificant (−0.004, p < 0.10), suggesting that the non-linear effect of green finance weakens when controlling for cross-sectional dependence. This result underscores the importance of accounting for common unobserved factors that may influence the relationship between green finance and environmental outcomes. PG and IQ remain relatively insignificant in both models, suggesting that their direct effects on ES are weak, particularly after introducing GF2.

In the third model, which includes the interaction term MRR × IQ, the FGLS results show that MRR and IQ have significant effects on ES (positive for MRR and negative for IQ), with the interaction term (MRR × IQ) also showing a positive but insignificant relationship. The CCEMG results present some differences, particularly for MRR and GF, where their coefficients (0.082, 0.011, respectively) become significant at the 5% and 10% levels. This indicates that MRR and GF have a significant relationship with ES when accounting for cross-sectional dependence. The interaction term MRR × IQ becomes more significant (0.069, p < 0.05), suggesting that the relationship between MRR and environmental sustainability is moderated by the quality of institutions, particularly in countries with stronger governance frameworks.

These findings generally corroborate the main results, though some differences emerge when accounting for cross-sectional dependence and unobserved heterogeneity. In terms of GF, both FGLS and CCEMG confirm the positive relationship between GF and environmental sustainability that was observed in the MMQR and system GMM models. The results for GF are consistently significant across both methods, with FGLS showing a positive effect (0.202, p < 0.01), which is similar to the findings from the previous models. However, in the CCEMG model, the effect of GF diminishes slightly (0.005) and becomes not significant, suggesting that when accounting for cross-sectional dependence, the impact of green finance is attenuated. This finding underscores the importance of considering common global or regional shocks in panel data analysis, as these can influence the relationship between GF and ES.

For MRR, both the FGLS and CCEMG results corroborate the earlier MMQR and system GMM findings, where MRR has a positive but diminishing effect on ES. In the FGLS model, MRR remains positively significant (0.380, p < 0.01), supporting the idea that resource rents can contribute to sustainability. However, in the CCEMG model, the effect of MRR becomes less significant (0.018, p < 0.10), highlighting that when cross-sectional dependence is accounted for, the impact of resource rents is less pronounced, possibly due to the influence of shared external factors that are not captured using the FGLS method.

The negative impact of industrial growth (IG) on ES is also corroborated across both the FGLS and CCEMG models. In the FGLS results, IG consistently shows a negative effect on sustainability (−0.084, p < 0.01), which aligns with the earlier findings from MMQR and system GMM. Similarly, the CCEMG results confirm this negative relationship, though the effect is slightly weaker (−0.004, p < 0.01), suggesting that industrial growth may have a weaker adverse impact on ES when accounting for cross-sectional dependencies.

For IQ, the FGLS results show a significant negative relationship with ES (−0.332, p < 0.01), consistent with earlier models. However, in the CCEMG model, the effect of IQ is much weaker and no longer significant (−0.010), indicating that the influence of institutional quality on sustainability may be overstated when ignoring common global or regional shocks. This result suggests that the direct effect of IQ on environmental sustainability may be less significant than previous outcomes, particularly when considering the broader macroeconomic context.

In terms of the non-linear effects of green finance through the GF2 term, the FGLS results confirm a positive and significant relationship with ES (0.130, p < 0.01), which was in line with the earlier findings from the MMQR and system GMM models. However, in the CCEMG model, GF2 shows a weak and insignificant negative impact, suggesting that the non-linear effects of green finance might be overestimated when accounting for cross-sectional dependence. This indicates that the marginal returns of green finance may not be as pronounced in higher-performing countries when controlling for shared regional or global trends.

Finally, the interaction term MRR × IQ in Model 3 also shows some discrepancies between the FGLS and CCEMG results. While the FGLS results show an insignificant positive effect (0.048), the CCEMG model reveals a stronger and significant positive effect (0.069, p < 0.05), indicating that institutional quality may play a more substantial role in moderating the effects of mineral resource rents when accounting for cross-country dependencies. This suggests that the positive moderating effect of IQ on MRR is more robust when considering common regional factors influencing the economies in the panel.

In summary, the robustness checks generally support the main findings from the MMQR and system GMM models, confirming the positive role of green finance, the negative impact of industrial growth, and the complex interactions involving mineral resource rents and institutional quality. However, the CCEMG results highlight the importance of accounting for cross-sectional dependence, as some variables, particularly green finance and mineral resource rents, exhibit weaker effects when shared external shocks are considered. These results emphasize the need for robust modeling approaches that account for both heterogeneity and interdependencies in panel data analyses of environmental sustainability.

5 Conclusion and policy recommendations

This study provides a comprehensive and empirically rigorous analysis of the determinants of environmental sustainability across E7 economies over the 1996–2023 period. Drawing on a suite of advanced econometric techniques, including Method of Moments Quantile Regression (MMQR), Common Correlated Effects Mean Group (CCEMG), and system GMM, the paper addresses key challenges in panel data modeling such as cross-sectional dependence, non-stationarity, endogeneity, and slope heterogeneity. The results from the CD test justify the use of CCEMG, which effectively absorbs unobserved common factors through cross-sectional averages, improving the reliability of coefficient estimates in the presence of global or regional shocks.

The findings reveal a consistently negative and statistically significant relationship between industrial growth and environmental sustainability across all quantiles, reinforcing concerns about the environmental costs of rapid industrialization in emerging economies. Green finance emerges as a driver of environmental sustainability, with its effect strengthening at higher quantiles of environmental performance. This suggests that green finance is most effective in countries already progressing toward sustainability, consistent with the Environmental Kuznets Curve framework. The non-linear specification, incorporating a squared term of green finance, further validates this relationship, though its significance is moderated when common external shocks are controlled for using CCEMG, indicating that the marginal returns of green finance may be more sensitive to broader macroeconomic conditions than previously assumed.

Mineral resource rents show a positive impact on sustainability at higher quantiles, but this effect diminishes at lower quantiles. Importantly, the interaction between mineral rents and institutional quality becomes more pronounced in later models, particularly under CCEMG, underscoring the moderating role of governance. In contexts with stronger institutions, resource rents are more effectively managed, potentially through reinvestment in green infrastructure or the establishment of sovereign wealth funds that support sustainable development. Institutional quality on its own, however, shows an ambiguous effect: while it is negatively associated with environmental sustainability at higher quantiles in some models, its impact weakens once cross-sectional dependence is accounted for, suggesting that institutional effects may be indirect or context-specific. Dynamic panel analysis using system GMM further reinforces the persistence of environmental sustainability, with the lagged dependent variable consistently showing strong significance. The direct short-run impacts of the explanatory variables, however, are insignificant indicating that structural factors and historical sustainability trajectories may play a larger role than immediate policy shifts. Robustness tests using FGLS and CCEMG confirm the central findings, while also highlighting the importance of controlling for unobserved common factors, which, if ignored, can lead to over- or underestimation of the effects of green finance and natural resources.

In sum, the study demonstrates that environmental sustainability in E7 economies is shaped by a complex interplay of economic, financial, and institutional factors that vary across the sustainability distribution. The consistent findings across multiple estimators lend credence to the core conclusion that green finance and governance reforms, when effectively integrated, hold the potential to offset the environmental degradation associated with industrialization and resource extraction. These insights carry important implications for policy design, emphasizing the need for differentiated, institution-sensitive strategies to advance sustainability in emerging markets.

5.1 Policy suggestions

Based on the study’s findings, actionable policies should prioritize the promotion of green finance mechanisms and the reconfiguration of industrial and economic strategies to align with ecological objectives. At the national and regional levels, E7 governments should collaborate with financial regulatory bodies and development banks—such as the Central Banks of E7 nations and the New Development Bank—to mainstream green finance instruments, including green bonds, sustainability-linked loans, and tax incentives for clean energy projects. Establishing dedicated national green finance frameworks, modeled after the European Union’s Green Taxonomy, can help standardize definitions and reporting, thereby enhancing investor confidence and scaling environmental investment.

To mitigate the adverse ecological effects of rapid industrial growth, governments must integrate mandatory environmental impact assessments into industrial licensing, encourage energy efficiency in manufacturing, and promote circular economy practices. Ministries of Industry and Environment should jointly enforce decarbonization pathways, supported by mechanisms such as carbon pricing or emissions trading schemes, aligned with the guidelines of the UNFCCC and the International Energy Agency.

Globally, institutions like the World Bank and the International Monetary Fund (IMF) should expand climate-aligned funding portfolios to target green transition efforts in emerging markets, including concessional financing linked to environmental performance. Additionally, multilateral cooperation under bodies like G20 and UNEP should facilitate knowledge transfer, technology sharing, and capacity-building programs for green finance innovation and sustainability monitoring.

Finally, population-related pressures require integrated development strategies that couple demographic planning with education, urban resilience, and resource-efficient infrastructure—efforts that can be coordinated under the auspices of UNDP and UN-Habitat. Through coherent, multi-level policy action that emphasizes financial greening, industrial transformation, and responsible governance of natural resources, E7 nations can make substantive progress toward achieving ecological sustainability and advancing global environmental goals.

5.2 Limitations and future directions

While this study offers a robust analytical framework across E7 nations, several limitations warrant acknowledgment. The green finance proxy, based on principal component analysis of renewable electricity and FDI inflows, offers only a macro-level approximation, lacking project-level or taxonomy-consistent granularity. Although the 1996–2023 timeframe provides appropriate historical coverage, some data gaps were addressed through exponential smoothing, which may have dampened genuine shocks and introduced bias in slope estimations. This limitation is recognized, and future research may implement more rigorous missing-data treatments such as multiple imputation or model-based estimation frameworks.

Additionally, the analysis omits some important issues like spatial spillovers, sectoral energy transitions, and real-time policy heterogeneity. Future studies should incorporate spatial econometric techniques and machine learning models to better capture nonlinear patterns and regional interactions. The current dataset also lacks dynamic panel instrumentation to address simultaneity and endogeneity concerns in relationships like those between green finance and environmental sustainability—an issue partially addressed in this study using GMM and Durbin-Wu-Hausman tests but warranting further extension.

The study’s empirical design also does not fully capture the influence of disaggregated capital flows or institutional quality beyond broad governance indicators. Future research should integrate more refined measures, including green bond issuances and ESG-screened financial instruments, as well as moderation effects of specific governance indicators. Expanding the sample beyond E7 economies and incorporating institutional resilience, post-conflict variables, or energy security dimensions would offer broader generalizability and policy relevance in light of ongoing global disruptions.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://data.worldbank.org/country.

Author contributions

XD: Conceptualization, Methodology, Writing – original draft, Writing – review and editing, Project administration. WH: Software, Data curation, Writing – review and editing, Resources, Conceptualization, Visualization, Formal Analysis, Writing – original draft. OB-S: Resources, Funding acquisition, Writing – review and editing, Writing – original draft, Validation, Conceptualization, Visualization, Investigation, Project administration. DC: Methodology, Conceptualization, Supervision, Validation, Investigation, Writing – review and editing, Visualization, Software, Formal Analysis, Writing – original draft, Resources, Funding acquisition.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. Princess Nourah Bint Abdulrahman University Researchers Supporting Project number (PNURSP2025R855), Princess Nourah Bint Abdulrahman University, Riyadh, Saudi Arabia. The authors extend their appreciation to Northern Border University, Saudi Arabia, for supporting this work through project number (NBU-CRP-2025-2922).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.