- 1School of Management, Guangdong University of Science and Technology, Dongguan, China

- 2School of Economics, Jiangxi University of Finance, Nanchang, China

- 3Humanities and Social Research Center, Northern Border University, Arar, Saudi Arabia

- 4Department of Basic Health Sciences in the Foundation Year for Health Colleges Program, College of Languages, Princess Nourah Bint Abdulrahman University, Riyadh, Saudi Arabia

OECD countries, despite being global leaders in economic and technological advancements, face significant environmental challenges due to industrial expansion, resource depletion, and globalization. Achieving ecological sustainability requires a comprehensive strategy integrating green energy transition, financial incentives, technological diffusion, and stringent environmental policies. This study investigates the impact of the “Triple Green Strategy”—green energy (GE), green innovation (GI), and green finance (GF)—alongside ecological policies (EP), technological diffusion (TD), economic growth (EG), and globalization (GB) on environmental deterioration (ED) across 34 OECD countries from 1990 to 2022. Unlike prior research limited to single-factor analysis or narrow environmental indicators, this study adopts the ecological footprint as a comprehensive measure of environmental degradation and incorporates globalization and policy frameworks into an integrated model. Using two-step system GMM estimation, the analysis accounts for endogeneity, dynamics, and cross-sectional dependence, with additional robustness checks via FGLS, CCEMG, and FE models across three distinct periods: pre-crisis (1990–2007), post-crisis (2008–2019), and the pandemic era (2020–2022). The results show that GI consistently reduces ED in the pre-crisis phase (β = −0.007, p < 0.01), while EP becomes significant only before the financial crisis. TD and EG stand out as major contributors to environmental pressure, especially during the post-crisis and pandemic years. Interestingly, GE is found to have a positive link with ED during the pandemic period (β = 0.034, p < 0.01), which may reflect temporary inefficiencies in the transition toward cleaner energy. Granger causality analysis uncovers two-way relationships between ED and GF, EG, and TD, pointing to complex feedback mechanisms. Based on these findings, the study proposes policy actions aligned with SDG goals, including tailored recommendations on innovation funding, green financial tools, and regulatory measures. While the focus on OECD countries introduces some data and sample limitations, the study offers a detailed picture of how green policies interact with broader economic shifts and provides practical, adaptable guidance for advancing sustainability.

1 Introduction

As climate change strengthens with environmental degradation deepening, environmental sustainability (ES) achievement has become one of the most critical challenges of the 21st century. Because industrial activities rapidly grow and carbon emissions rise, in addition to economic practices are not sustainable, ecological deterioration has accelerated, which is posing serious risks to biodiversity, public health, and economic resilience (Hossain et al., 2023; Moreno et al., 2023; Oliveira and Moutinho, 2021). In response, adopting green strategies is now a global necessity, as this seeks to reduce environmental harm while supporting long-term economic development (Ma et al., 2023).

Countries in the Organization for Economic Co-operation and Development (OECD) guide this work. Their economic strength with technological advancement allows them to address all of these environmental crises from such a pivotal position. Well-funded OECD countries possess strong infrastructure plus established institutions, thus they can implement sustainability policies fitting global climate pledges like the Paris Agreement (Choi, 2024). Their contributions to global carbon emissions, historically high, occurred at the same time. Thorough coordinated green policy action is thus a pressing need (Ristanović et al., 2024).

This study examines the roles that green energy (GE), green innovation (GI), technological diffusion (TD), green finance (GF), ecological policies (EP), with globalization (GB) playing a role shaping environmental outcomes across OECD countries. Evidence grows, and it points toward the central role of GE in shrinking ecological footprints. We measure GE as a share of renewable energy within total consumption, typically for the reduction of reliance upon fossil fuels (Doğan et al., 2023; Duan, 2025; Zhang and Chen, 2022). For instance, Wang et al. (2023) discovered that a 5% decrease in carbon emissions over the previous 10 years was linked to a 10% increase in the use of renewable energy across OECD nations. With nations like the United States, United Kingdom, and Germany making notable advancements in the deployment of wind, solar, and hydroelectric power, investment in GE has increased throughout the region (Chu et al., 2022; Razzaq et al., 2021; Saqib et al., 2023). By reducing reliance on fossil fuels and the emissions that go along with them, this increasing move toward renewable energy not only lessens environmental degradation (Behera et al., 2023; Chu, 2023; Razzaq et al., 2021), but it also advances the goal of carbon neutrality (Wang and Lee, 2022; Xu et al., 2022).

In parallel, GI, measured through patents in environmental technologies, has emerged as a critical lever in driving the transition to greener economies. The effective deployment of eco-technologies can help minimize environmental impacts, including the reduction of ecological footprints (Hu et al., 2024; Uddin, 2020). Research by Chang et al. (2024) highlights that countries with stronger investments in GI tend to achieve faster declines in industrial emissions, underscoring the value of innovation in environmental strategy.

Technological diffusion (TD), which is shown by more people having access to and using the internet, has been very important in spreading sustainable practices in OECD countries. Li et al. (2024) say that the internet’s wider reach has made it easier for people to share and use green technologies. This has led to better waste management and more efficient use of energy (Saeed et al., 2024; Xu et al., 2025; Yan et al., 2025). Financial tools like green finance (GF), which is measured by how much credit is given to the private sector in the United States, have also been very helpful in encouraging eco-friendly investments. Jamel and Zhang (2024) state that these kinds of projects led to a 15% increase in funding for renewable energy in OECD countries, showing how important they are becoming for sustainability efforts.

Ecological policies (EP), particularly those that are stricter and more consistently enforced, help ensure industries remain accountable for their environmental impact. Evidence from several studies (Behera et al., 2023; Cai et al., 2025; Chu, 2023; Dam et al., 2023; Saqib et al., 2023; Şeren and Çelekli, 2024; Xu et al., 2023; Yang et al., 2024) shows that countries with more stringent regulations tend to report cleaner air and water (Fatima et al., 2024). Globalization (GB), assessed using the KOF Index, has also shaped sustainability outcomes by encouraging international collaboration on environmental governance and facilitating technology sharing. Research by Ristanović et al. (2024) confirms that greater global integration often aligns with broader adoption of environmental standards, especially in the OECD context.

This study focuses on 34 OECD countries, chosen for their established role in both global economic leadership and environmental policy implementation. Unlike many emerging economies, where rapid industrialization often takes priority over ecological concerns (IEA, 2022; Shan et al., 2021; World Bank, 2023), OECD nations typically have the infrastructure and institutional support to adopt and enforce green policies more effectively (Dong and Yu, 2024; Wang et al., 2024). These countries are also responsible for a large portion of global carbon emissions, which makes their commitment to sustainability especially vital in meeting international climate goals.

OECD countries still have serious environmental problems, though they are getting better. These problems include plastic waste, pollution, loss of biodiversity, and the effects of climate change getting worse faster (He et al., 2023; Li et al., 2023; Saqib et al., 2023; Wahab et al., 2024). The study’s goal is to give useful policy advice that could also help developing countries that want to move toward sustainable development by focusing on these countries. When trying to be more sustainable, nations often have to make choices. The goal is to combine economic and environmental goals (Sohag et al., 2024; Zhang et al., 2025), but early transitions can sometimes cause short-term environmental costs before the long-term benefits are discovered.

Since January 2023, environmental sustainability has taken center stage in the OECD policy agenda, shaping actions across energy, industry, agriculture, and urban development (OECD, 2023). Yet, challenges remain—fossil fuel subsidies, for instance, doubled in 2022 to over USD 1.4 trillion (IEA, 2023), highlighting ongoing financial and structural barriers to a full transition to renewables (Behera et al., 2023; Chu, 2023; Ren and Zhu, 2025).

A key contribution of this study lies in its methodological and conceptual refinement. While many previous analyses relied primarily on CO2 emissions as a measure of environmental deterioration, this research uses ecological footprint (EF)—a broader, multidimensional indicator that includes factors like forest use, water consumption, cropland pressure, and built-up land impacts (Li and Li, 2023). This shift allows for a more complete and nuanced picture of environmental degradation, better aligning the study with global goals that go beyond just carbon reduction.

In light of intensifying global environmental concerns, this study aims to explore the complex and evolving factors driving environmental deterioration (ED) in OECD countries. Unlike many prior studies that rely solely on carbon emissions as a measure of ecological harm, this research takes a broader approach by using the ecological footprint as the primary indicator. This metric captures a wider range of environmental pressures—including land use, natural resource consumption, and ecological overshoot—offering a more complete picture of sustainability performance (Liu K. et al., 2025).

Although green strategies like green energy (GE), green innovation (GI), and green finance (GF) have gained increasing academic interest, much of the current evidence remains piecemeal and lacks a cohesive framework. What is often missing is an integrated understanding of how these sustainability tools interact with broader forces such as globalization (GB) and environmental policies (EP) to influence long-term ecological outcomes. Additionally, the effects of major global disruptions—like the 2008 financial crisis and the COVID-19 pandemic—have not been sufficiently examined in this context. This absence of temporal perspective and multidimensional analysis limits the effectiveness of policy interventions in high-income economies.

To address these limitations, this study makes several key methodological and conceptual contributions. It employs a suite of advanced panel econometric models, including two-step system GMM, FGLS, fixed effects (FE), and Common Correlated Effects Mean Group (CCEMG) estimators, to ensure robustness against endogeneity, heterogeneity, and cross-sectional dependence. These techniques not only enhance the precision of the estimates but also allow for country-specific heterogeneity, which is critical in policy design for the diverse economic and regulatory landscapes of OECD nations. Moreover, the inclusion of Granger causality analysis enables the study to distinguish between reactive and proactive dynamics, uncovering whether policy and economic variables influence ED unidirectionally or via feedback loops.

By incorporating GB and EP into a unified analytical model, this research bridges a critical gap in understanding how global integration and environmental governance jointly affect sustainability. Importantly, it also moves beyond generic recommendations by providing targeted, empirically grounded insights that can inform differentiated green strategies for advanced economies.

The research is directed by numerous core research inquiries that have not been comprehensively addressed in the literature:

• How do GE, GI, and GF impact ED in both the short and long run, and are there efficiency lags in their effectiveness?

• To what extent does EP mitigate the environmental risks associated with GB, and can well-structured policies convert globalization into a sustainability catalyst?

• Does technological diffusion (TD) support ecological improvement, or does increased digitalization contribute to new forms of environmental pressure?

• Is EG compatible with ecological sustainability, or does it persist as a trade-off variable?

• Finally, are the effects of these drivers unidirectional, or do bidirectional feedback mechanisms exist that complicate the policy landscape?

By addressing these questions, this study contributes a coherent, policy-relevant, and theoretically grounded framework for understanding the complex drivers of environmental sustainability in OECD nations. It shifts the conversation from isolated policy tools to an integrated model of economic, technological, and regulatory interactions—ultimately enabling more effective transitions toward long-term ecological resilience.

The study is organized as follows: Section 2 provides a comprehensive review of the literature, highlighting existing research gaps. Section 3 outlines the methodological framework, including model specification and variables selection. Section 4 delivers the empirical results along with an in-depth analysis. Finally, Section 5 synthesizes key findings, explores their broader implications, and proposes directions for future research.

2 Literature review

2.1 The existing literature

This part of the study reviews empirical studies on green energy, technological diffusion, green innovation, green finance, globalization, and environmental policies on environmental sustainability in developed and emerging countries.

Green energy plays a crucial role in boosting energy efficiency and lowering harmful emissions, making it a central pillar of sustainable development efforts. A growing body of research underscores its environmental benefits. For example, Sharma et al. (2024) report that over the last decade, the use of renewable energy in OECD countries has helped cut carbon emissions by around 15%. Imran et al. (2024) further show that in South Asia, green energy adoption not only reduces ecological stress but also supports ongoing economic development. Similarly, Maka and Alabid (2022) explore how innovations in solar technologies are advancing sustainability goals, particularly by lowering greenhouse gas emissions and improving overall energy use. Taken together, these findings highlight the vital role of renewable energy in shaping a more sustainable and resilient environmental future.

Technological diffusion (TD) supports environmental sustainability by enhancing how resources are managed and helping to cut pollution levels (Truong, 2022; Xia et al., 2022). Research by Chen and Hao, (2022) and Wang et al. (2022) shows that TD contributes to corporate sustainability, particularly in companies subject to strict environmental regulations. Khan et al. (2020) also emphasize its importance in reducing emissions, especially within developed countries.

Green innovation (GI) is another key pillar in the push for sustainability. It helps limit environmental damage while improving how efficiently resources are used. Liu and Liang (2024) explored this dynamic across countries with varying income levels. They found that innovation—tracked through environmental patent filings—led to a marked decline in fossil fuel use, underlining the strong role innovation plays in supporting environmental goals in both advanced and developing economies.

Green finance, particularly measured through domestic credit, has become a key instrument in driving sustainable development by channeling capital into environmentally responsible projects. Multiple recent studies highlight its potential to address ecological challenges while also supporting economic growth. For instance, Xing et al. (2024) investigated green finance practices in 30 emerging economies and found that allocating domestic credit to green initiatives significantly reduced carbon emissions and encouraged the use of renewable energy, pointing to the importance of well-designed financial policies.

In a similar vein, Xiao et al. (2024) showed that expanding credit access for green investments spurred energy transitions and industrial modernization in China’s pilot regions. Their work also pointed out that cities with different levels of resources experienced varying outcomes, emphasizing the need for context-specific financial strategies to fully leverage green finance. Additionally, Fu et al. (2023) stressed that credit availability for low-carbon ventures plays a central role in fostering sustainable economic growth, and they called for stronger regulatory oversight to ensure that green finance is directed toward genuinely impactful environmental efforts.

Recent studies have explored the complex relationship between globalization (GB) and sustainable development. Diachenko et al. (2024), using the KOF Globalization Index, examined how GB influences economic progress across multiple countries. Their findings suggest that globalization enhances economic inclusion and facilitates the spread of technology, both of which can support sustainability goals. However, the study also highlighted significant challenges, particularly the uneven distribution of benefits and the environmental costs linked to increased trade and industrial expansion.

Building on this, Oluwagbade and Ibidapo (2024) focused specifically on Nigeria. Their research examined how GB affects economic growth (EG) and sustainability outcomes in the local context. They found that while globalization has the potential to open up economic opportunities, it may also pose risks to environmental quality if not paired with appropriate policy frameworks. This underscores the need for balancing global integration with strong environmental governance.

Amin et al. (2025) find that in BRICS economies, globalization and technological diffusion increase CO2 emissions, but the combined use of green finance, renewable energy, and innovation significantly offsets this impact. Green finance is shown to be essential for directing capital toward clean technologies. Similarly, Zhu et al. (2025) show that in China, the integration of green finance with digital innovation improves carbon efficiency and reduces environmental degradation, with the digital economy amplifying green finance’s environmental benefits in globalized contexts.

Khan et al. (2024), through a systematic review, emphasize green finance as a key instrument for managing environmental risks linked to globalization. They highlight trends such as green finance performance indices, fintech’s role in scaling green investment, and the importance of resilience frameworks for protecting green capital. Liu X. et al. (2025) further argue that embedding green finance within carbon neutrality strategies helps align globalization with sustainability, promoting cross-border green technology diffusion, sustainable industrial transitions, and stronger environmental governance.

Environmental policies are crucial in guiding nations toward sustainable development. A study conducted by Ambreen et al. (2025) studied the impact of eco-policies and laws on promoting ecological health in Pakistan. They highlighted that rigorous EP, along with community involvement and ecological education programs, markedly enhance sustainability results. Political instability and corruption were recognized as impediments to successful policy execution. OECD (2025a) emphasized the necessity of synchronizing environmental policy with financial mechanisms to address the funding shortfall for sustainable development. They emphasized that creative policy frameworks are crucial for resource mobilization and the attainment of global sustainability objectives. Alatrash et al. (2025) found that EP had a minimal but positive impact on reducing consumption-based CO2 emissions (CCO2). While the effects were not as pronounced as other factors like GE consumption, EP contributed to fostering compliance with environmental regulations.

2.2 Research gaps

Despite the growing body of empirical work on green finance, energy transitions, innovation, and globalization, several critical gaps remain in the existing literature that this study seeks to address.

First, prior research tends to focus narrowly on individual dimensions of sustainability—such as CO2 emissions or energy use—rather than adopting a comprehensive ecological indicator. For instance, research by Yasir Mehboob et al. (2024), Mehboob et al. (2024a), and similar recent studies primarily assess carbon emissions but overlook broader environmental pressures such as land use, biodiversity loss, and resource consumption. This study fills that gap by using the ecological footprint as a holistic measure of environmental deterioration, providing a broader perspective on sustainability outcomes.

Second, most studies focus on single-country contexts (e.g., China or Nigeria) or small groups such as BRICS, without considering the structurally different policy environments of advanced economies. The OECD region, despite being a leader in environmental governance, remains underexplored as a unified sample in terms of how the “Triple Green Strategy” interacts with globalization and policy efforts to affect environmental outcomes. This study addresses that gap by examining 34 OECD countries over 3 decades, offering a comparative macro-panel analysis rarely undertaken in earlier work.

Third, while several studies emphasize the role of green finance, the operationalization of this concept remains problematic. Most literature uses broad credit indicators, without distinguishing green credit from conventional lending, which dilutes causal inferences (e.g., Fu et al., 2023; Xing et al., 2024). This study acknowledges this limitation but proposes the use of macro-financial proxies in combination with policy recommendations for more refined future measures.

Fourth, green innovation is frequently proxied by patent counts, but without assessing whether such innovations are commercially viable or environmentally impactful in practice. As highlighted by Khan et al. (2024), the lack of commercialization metrics may overstate innovation’s ecological benefits. This study addresses this issue by recognizing GI’s limitations and recommending future studies to incorporate innovation effectiveness indicators such as adoption rates or green R&D expenditure.

Fifth, many studies overlook temporal heterogeneity, especially the structural breaks introduced by major global events such as the 2008 financial crisis and the 2020 COVID-19 pandemic. This research bridges that gap by segmenting the analysis into pre-crisis, post-crisis, and pandemic periods, allowing for a more nuanced understanding of how the effectiveness of green strategies fluctuates across economic cycles.

Lastly, existing literature often lacks a strong theoretical integration across disciplines. While some studies touch on aspects of ecological modernization or the environmental Kuznets curve, few embed them into a systematic empirical framework. This study incorporates both, offering a cohesive theoretical base to explain the nonlinear and policy-mediated nature of green-economic-environmental linkages.

Together, these gaps highlight the need for more integrated, dynamic, and context-sensitive investigations—an area where this study makes a novel and timely contribution.

3 Empirical data and techniques

3.1 Data statistics

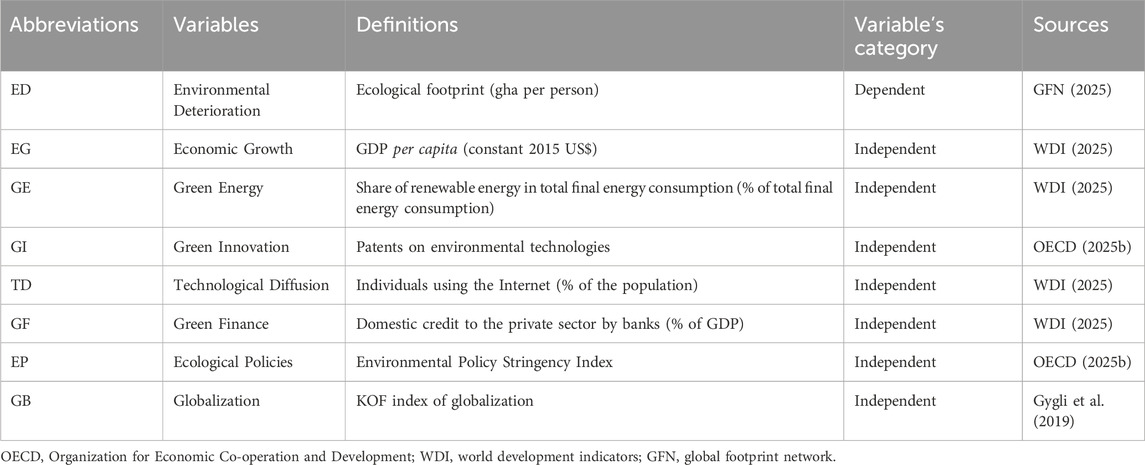

This work analyzes the relationships between GE, GI, GF, EP, GB, and TD with ED in 34 OECD countries over the period 1990–2022. The dataset is compiled from reputable sources, including QoG, GFN, the OECD database, and WDI (see Table 1). This period is selected based on the availability of comprehensive data for all variables, ensuring consistency and minimizing potential biases from missing observations. In cases where certain data points were unavailable, the average imputation method was employed, a widely accepted approach in sustainability research to maintain data continuity without distorting the overall trend.

The timeframe from 1990 to 2022 holds special relevance for studying environmental sustainability, especially within the context of OECD countries. This three-decade span captures several landmark global policy milestones, such as the Kyoto Protocol, the Paris Agreement, and the launch of the European Green Deal—all of which significantly shaped environmental agendas across developed nations (Choi, 2024; UNFCCC, 2024). Beyond policy, this period also witnessed major leaps in green innovation, including the rise of renewable energy, rapid digitalization, and the growing role of green finance (Ristanović et al., 2024). Covering such an extended timeframe enables evaluating not only the immediate effects of environmental initiatives but also their deeper, long-term structural impacts, providing a richer, more nuanced picture of how sustainability efforts have evolved and taken hold over time.

With 1,122 data points for each variable, the dataset offers a strong basis for analyzing what drives sustainability, helping to ensure reliable statistical results and reduce issues like inconsistent variance or missing key factors. Focusing on OECD countries adds further value, given their active roles in enforcing environmental regulations, adopting cutting-edge green technologies, and using financial tools to support sustainable growth. This enables the study to generate policy-relevant insights applicable to both developed and developing economies, facilitating a broader understanding of global sustainability dynamics.

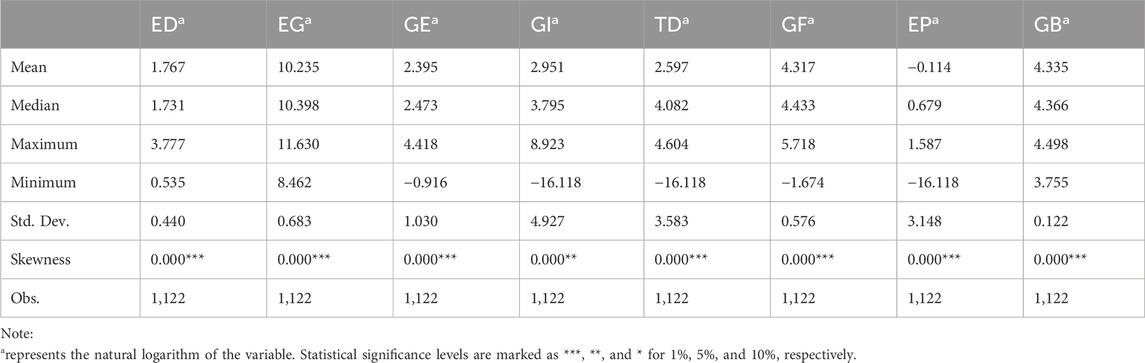

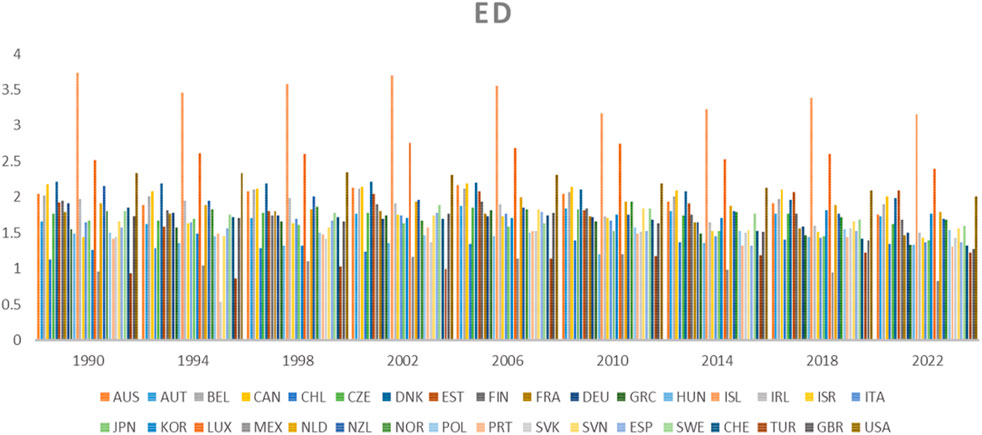

Table 2 provides the descriptive statistics for the 34 OECD countries, reflecting the distribution and variability of key variables. The mean values indicate that ED averages 1.767, while EG stands at 10.235, showing stable economic patterns. Figure 1 illustrates the fluctuations in ED across selected OECD countries throughout the study period. GE and GI have means of 2.395 and 2.951, respectively, with GI displaying substantial variation, as highlighted by its high standard deviation of 4.927. TD and GF exhibit moderate mean values of 2.597 and 4.317, though TD shows significant dispersion with a standard deviation of 3.583. EP presents a negative mean (−0.114), indicating variations in policy effectiveness among the selected countries. GB remains relatively stable with an average of 4.335 and low dispersion (standard deviation of 0.122). The lowest values highlight extreme fluctuations, particularly in GI, TD, and EP, suggesting that some economies experience severe downturns in these variables. The statistically significant skewness values confirm deviations from normality, necessitating advanced econometric techniques to ensure robust modeling.

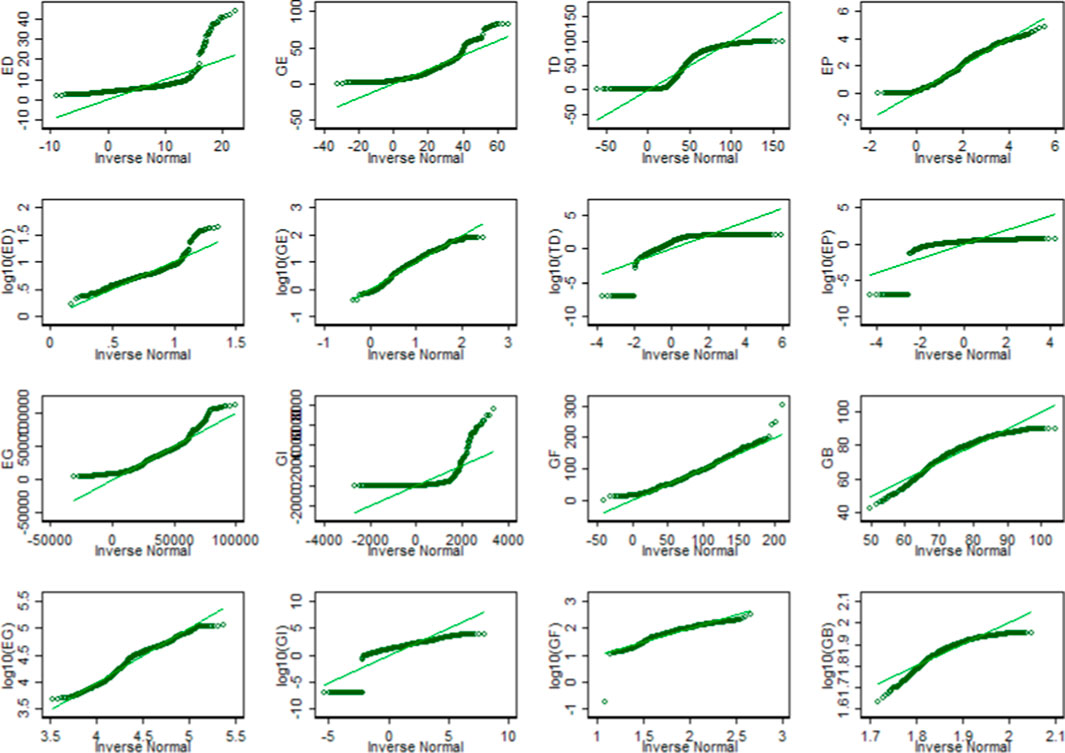

Figure 2 presents Q-Q plots assessing the normality of the variables used in the study. The deviation of data points from the diagonal line indicates that most variables exhibit non-normal distributions, with noticeable skewness and heavy tails in some cases. The log transformations applied to certain variables, such as TD, EP, and GF, improve normality but do not eliminate deviations. These results suggest that robust econometric techniques, such as panel unit root tests and estimators accommodating non-normality and heteroskedasticity, are necessary to ensure reliable inference in the study.

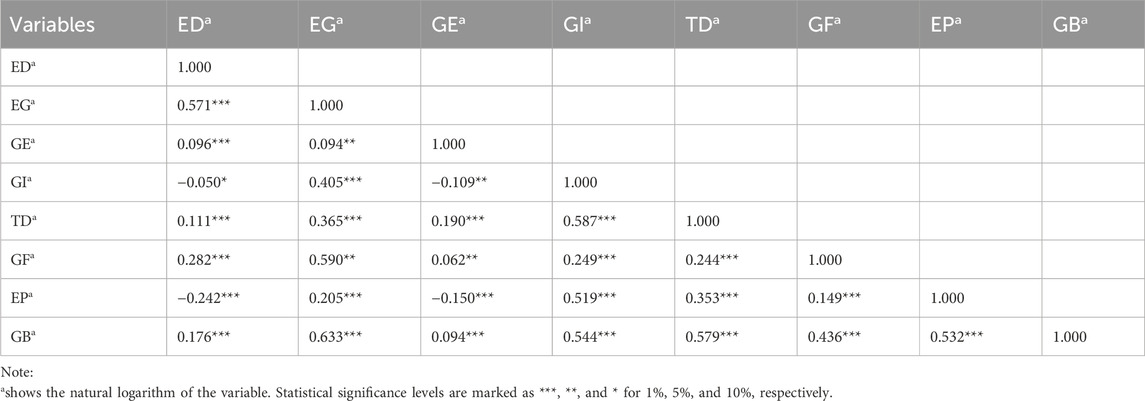

Table 3 presents the correlation analysis, illustrating the relationships among the study variables. ED shows a strong positive correlation with EG (0.571), indicating that economic growth is associated with higher environmental degradation. GE and GI exhibit weak correlations with ED, with GE having a slight positive effect (0.096) and GI showing a marginal negative association (−0.050), suggesting that green energy alone may not significantly curb degradation, while green innovation could play a role in mitigation. TD and GF display positively inclined correlations with ED (0.111 and 0.282, respectively), implying that technological diffusion and green finance influence ecological outcomes. EP has a notable negative correlation with ED (−0.242), reinforcing the role of environmental policies in reducing degradation. GB maintains a positive link with ED (0.176), hinting at financial sector dynamics contributing to ecological strain. Notably, GI and EP show a strong correlation (0.519), indicating that innovative policies complement environmental regulations. The significant correlations among multiple variables highlight complex interactions, necessitating advanced econometric modeling to capture the underlying causal mechanisms.

3.2 Model formulation and theoretical framework

This study draws on the foundations of ecological modernization theory and the environmental Kuznets curve (EKC) hypothesis to establish a theoretical connection between economic development, green strategies, globalization, and environmental outcomes. Ecological modernization posits that environmental degradation can be mitigated through technological innovation, institutional reform, and market-based mechanisms such as green finance and renewable energy. In parallel, the EKC framework suggests a nonlinear relationship between economic development and ecological impact, where degradation initially upsurges with evolution but declines as income and environmental regulation strengthen.

Guided by these perspectives, this research conceptualizes environmental deterioration (ED) as a function of multiple interconnected drivers, particularly those representing sustainable growth and global integration. Accordingly, the baseline functional form is expressed as in Equations 1, 2:

Where ED, EG, GE, GI, TD, GF, EP, and GB stand for ecological deterioration, economic growth, green energy, green innovation, technological diffusion, green finance, ecological policies, and globalization, respectively.

The following is the log-linear transformation form of Equation 1:

Log-transforming variables standardize magnitudes, simplifying regression analysis and capturing nonlinear economic effects on ED. This approach manages variability while retaining key variables in their original form for clarity, ensuring easier interpretation of factors like EG, GE, GI, TD, GF, EP, and GB on sustainability.

The coefficients β1 through β7 represent the elasticity estimates, indicating both the strength and direction of the relationship between each explanatory variable and environmental deterioration. The term β0 denotes the intercept of the model, while εit captures the stochastic error component. In this panel dataset, t denotes the time dimension spanning from 1990 to 2022, and i refers to the cross-sectional units, specifically the 34 OECD countries included in the analysis.

3.3 Empirical methodology

3.3.1 Cross-sectional dependence test

Pesaran’s (2015) CSD test detects cross-sectional dependence in panel data, ensuring accurate econometric models. Ignoring it risks biased, inconsistent estimates and weakening result reliability in Equation 3.

3.3.2 Slope homogeneity test

To assess whether the slope coefficients in the cointegration equation are consistent across cross-sectional units, a slope homogeneity (SH) test is employed. Originally introduced by Swamy (1970), the test was later refined by Pesaran and Yamagata (2008), who extended the framework to generate two test statistics for evaluating parameter homogeneity across the panel in Equations 4, 5.

For the null hypothesis of slope homogeneity to hold, the p-value must exceed the 5% significance threshold.

3.3.3 Second-generation unit root test

Given the nature of OECD panel data, which, similar to time series, may exhibit nonstationarity, it is essential to conduct unit root tests to prevent spurious regression results. Accordingly, this study employs second-generation unit root tests—the Cross-sectional Augmented Dickey-Fuller (CADF) and Cross-sectional Im, Pesaran, and Shin (CIPS) tests—developed by Pesaran (2007). These tests account for cross-sectional dependence and provide more robust stationarity diagnostics for panel data. The CADF specification used in this study is as follows in Equations 6–9:

CIPS is exhibited in Equation 9:

If variables are non-stationary, the unit root test is repeated after first differencing, ensuring accurate cross-sectional dependency and heterogeneity analysis.

3.3.4 GMM estimation

This research uses the two-step system Generalized Method of Moments (GMM), to investigate the dynamic impact of key explanatory variables on environmental deterioration (ED) across 34 OECD countries. The choice of GMM is driven by the need to address potential endogeneity and simultaneity among the variables, which traditional estimators such as OLS or fixed effects cannot adequately resolve. In line with prior studies such as Chang and Lee (2013), Becker et al. (2009), and Attila (2008), the system-GMM framework enables efficient estimation in the presence of endogenous regressors and unobserved heterogeneity, particularly within a dynamic panel context.

The baseline dynamic model is specified as follows in Equation 10:

Here,

3.3.5 Robustness analysis

To validate the reliability of the GMM results, we conduct a series of robustness checks using three alternative estimators: Feasible Generalized Least Squares (FGLS), Common Correlated Effects Mean Group (CCEMG), and Fixed Effects (FE).

Following Wolde-Rufael and Mulat-Weldemeskel (2022) and Pesaran (2006), CCEMG is employed to address cross-sectional dependence and unobserved heterogeneity, making it particularly suitable for macro-panel datasets. It estimates country-specific coefficients and then aggregates them, offering robustness to parameter heterogeneity.

Due to the limited time dimension (T = 3) during the pandemic period (2020–2022), CCEMG becomes infeasible. In this case, we apply the Fixed Effects estimator, which controls for time-invariant unobserved heterogeneity and is more appropriate under short-panel constraints.

Collectively, these robustness techniques help confirm the stability of the main findings and ensure that the estimated relationships are not artifacts of model specification or unaccounted structural biases.

3.3.6 Granger causality test

The Dumitrescu and Hurlin (2012) Granger-causality test detects causality in heterogeneous panel data, accounting for cross-sectional dependence.

This strategy is exemplified as in Equation 11.

Figure 3 presents the methodologies employed in this study.

4 Results and discussions

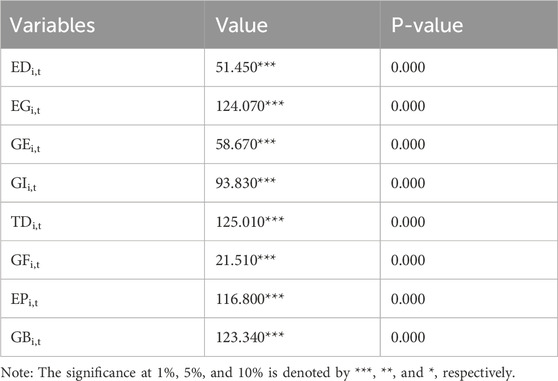

Table 4 presents the results of the Cross-Section Dependence (CSD) test, confirming the presence of significant cross-sectional dependence among all variables, as indicated by highly significant test values (p-value = 0.000). ED, EG, GE, GI, TD, GF, EP, and GB all exhibit strong interdependencies across the 34 OECD countries, with EG, TD, EP, and GB showing particularly high CSD values, suggesting that economic growth, technological diffusion, environmental policies, and globalization share common shocks or spillover effects across nations. The existence of CSD highlights the necessity of employing second-generation econometric techniques to ensure robust and reliable estimations that account for these interlinkages.

Table 5 presents the slope homogeneity test, assessing whether relationships among variables are uniform across OECD countries. The null hypothesis (slope homogeneity) is strongly rejected (

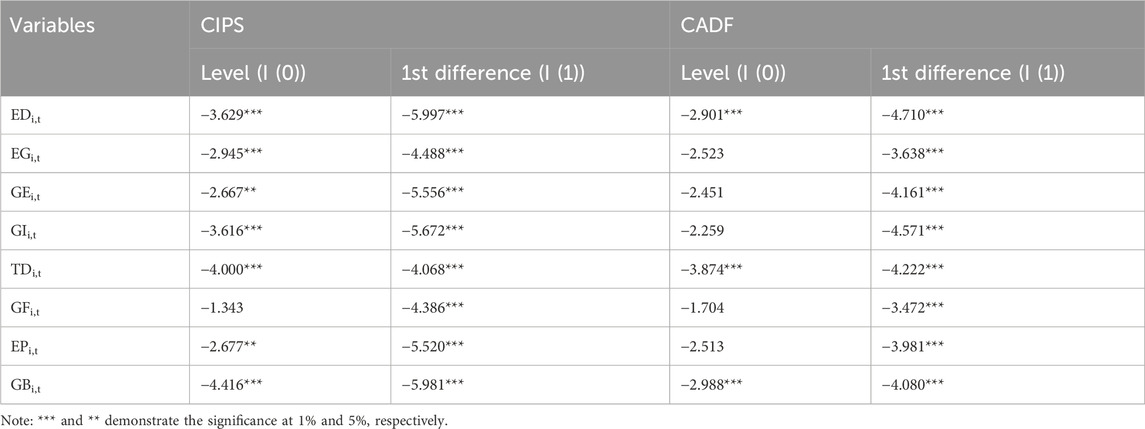

Table 6 presents the results of the CIPS and CADF unit root tests, assessing the stationarity properties of the variables. The CIPS test indicates that all variables, except for GF, are stationary at level (I (0)), as they are significant at 1% or 5%. Conversely, GF requires first differencing to attain stationarity at I (1), confirming the presence of a unit root. However, the CADF test provides a more mixed outcome, where only ED, TD, and GB are stationary at level, while the remaining variables exhibit non-stationarity at I (0) but become stationary at I (1). These findings highlight the need for an econometric approach that accommodates variables with mixed integration orders, reinforcing the suitability of the GMM technique for robust estimations.

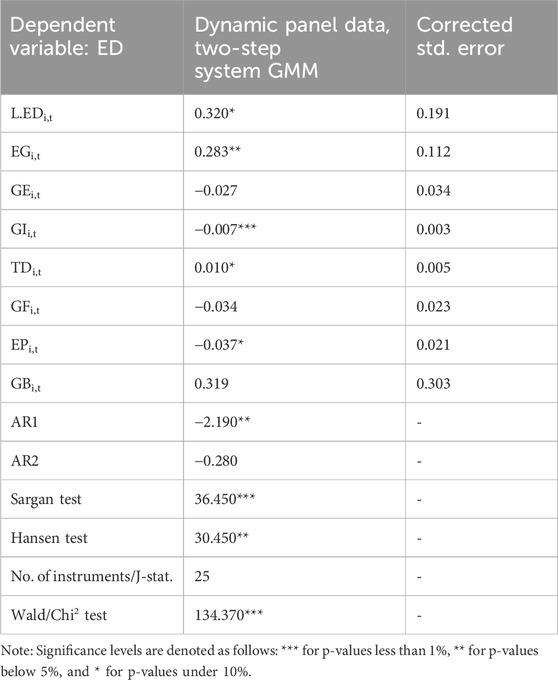

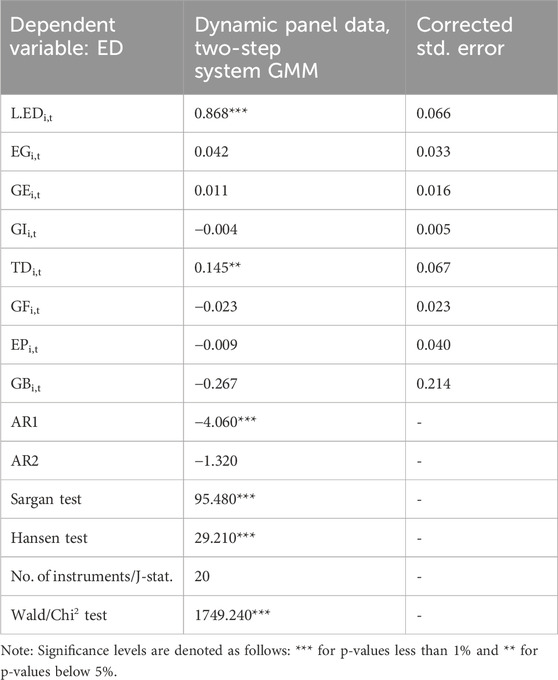

The pre-crisis era GMM results in Table 7 indicate that environmental deterioration (ED) exhibited moderate persistence, as reflected by the significance of its lagged value. EG has a positive and statistically significant impact on ED, suggesting that economic expansion during this period contributed to increased environmental pressure. GI demonstrates a negative and highly significant effect, confirming its role in mitigating ED through technological advancement. TD shows a small but significant positive influence, indicating that early-stage digital growth may have exerted additional environmental burdens. EP also contributes to reducing ED, albeit modestly, highlighting the early effectiveness of regulatory measures. In contrast, GE, GF, and GB do not exhibit statistically significant effects, implying that their environmental influence was limited or not yet well-integrated into national frameworks during this period. Overall, the outcomes underline the significance of innovation and strategy in addressing environmental challenges before the global financial crisis, while pointing to the underdeveloped roles of finance, energy, and globalization in shaping ecological outcomes during that time.

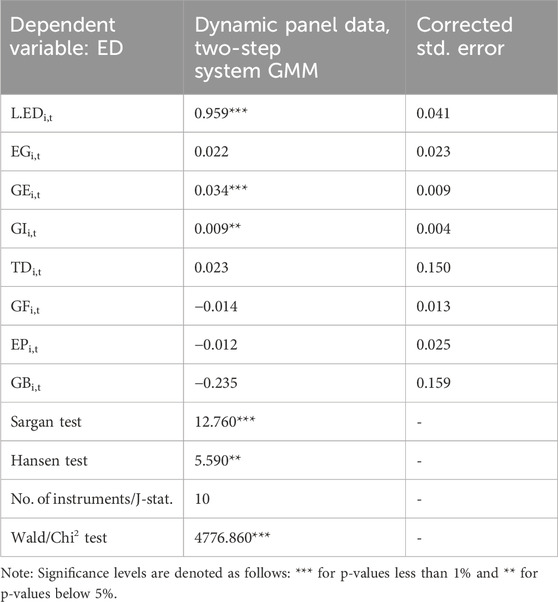

The results from Table 8, covering the post-crisis and pre-pandemic era (2008–2019), reflect a shift in the dynamics of environmental deterioration (ED) within OECD countries. The lagged ED remains highly significant with a strong coefficient, indicating a high level of persistence in environmental outcomes during this period. However, EG is statistically insignificant, suggesting that economic growth no longer has a direct and substantial impact on ED, possibly due to structural adjustments, cleaner growth practices, or enhanced regulation following the 2008 financial crisis.

Table 8. Outcomes of factors impacting environmental degradation: direct channel (Post-crisis and pre-pandemic era).

GI also becomes statistically insignificant, implying that although innovation efforts continued, their environmental effects may not have been immediate or uniformly effective. Similarly, GE shows no significant impact, indicating that the scale or speed of renewable energy integration may not have been sufficient to alter ecological trends during this period.

TD, however, emerges as a significant driver of ED, pointing to increased environmental pressure from expanding digital infrastructure and usage. Both GF and EP remain statistically insignificant, suggesting limited effectiveness of financial and regulatory instruments in reducing ED across the broader OECD context. GB shows a negative but insignificant relationship with ED, indicating a possible but unconfirmed decoupling effect of globalization.

Overall, the findings in Table 8 highlight a period marked by inertia in environmental deterioration and limited direct effectiveness of green strategies, with only TD maintaining a significant positive impact. This underscores the need for stronger alignment between innovation, policy, and finance to translate sustainability efforts into measurable ecological improvements.

The findings from Table 9, which represent the pandemic era (2020–2022), reveal a distinct environmental dynamic shaped by the disruptions and policy responses of the COVID-19 period. The lagged value of ED is highly significant and very close to one, indicating strong persistence in environmental degradation and suggesting that short-term interventions may have had limited influence in altering ecological trajectories during this crisis phase.

EG is statistically insignificant, reinforcing the idea that economic activity was decoupled from environmental deterioration, likely due to temporary lockdowns, production halts, and shifts in consumption patterns. Interestingly, GE exhibits a positive and highly significant impact on ED, a result that may seem counterintuitive but could reflect transitional inefficiencies—such as reliance on hybrid systems or the rebound effect—where initial shifts toward renewables do not immediately translate into ecological benefits.

Even more notably, GI is also positively and significantly associated with ED, suggesting that during the pandemic, innovation activities may have been redirected toward short-term crisis response, lacking environmental focus or creating unintended ecological pressures. TD, GF, EP, and GB are all statistically insignificant, indicating a broad reduction in the effectiveness or responsiveness of these instruments under the extraordinary constraints of the pandemic. This likely reflects institutional and market disruptions, delayed policy implementation, and weakened international cooperation during the health emergency.

Overall, Table 9 highlights the pandemic era as a time of environmental inertia and complex, possibly counterproductive interactions between green interventions and ecological outcomes. The results underscore the importance of integrating resilience and adaptability into green strategies, particularly under conditions of systemic crisis.

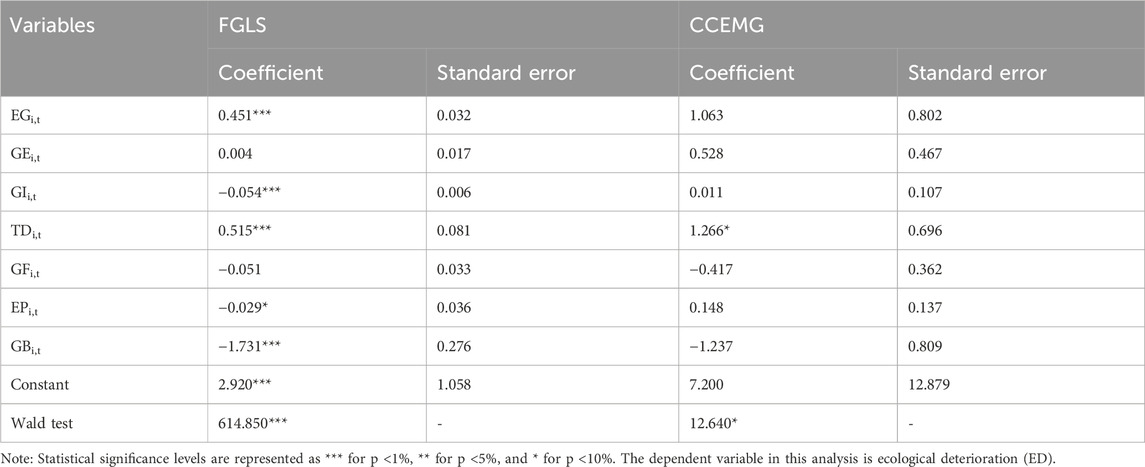

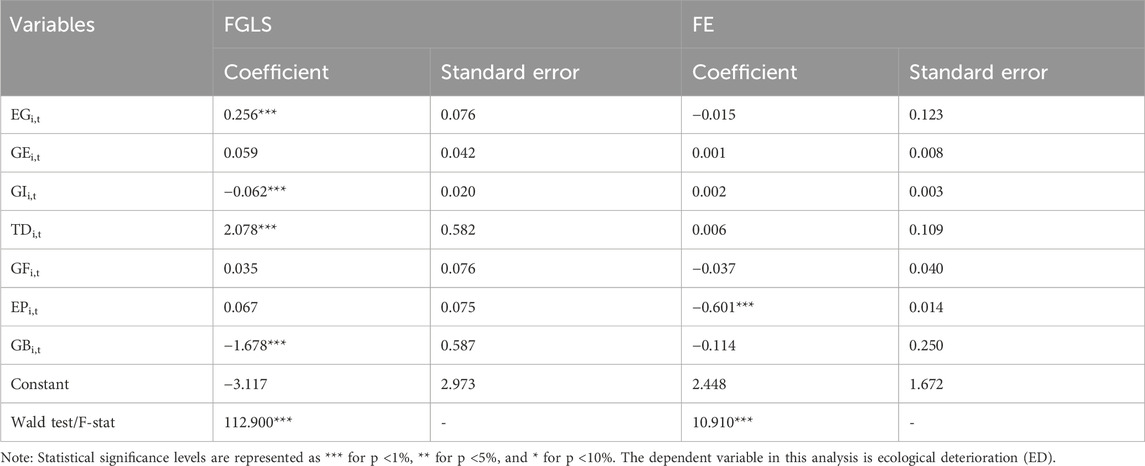

The robustness checks across all three periods using FGLS, CCEMG, and FE models largely reinforce the core insights of the GMM estimations, while also revealing notable nuances and model sensitivities.

In the pre-crisis era (Table 10), FGLS strongly corroborates GMM by confirming the positive effect of EG and TD and the negative effect of GI on ED, with high significance and consistent direction. GE, though insignificant in GMM, shows a significant negative effect in FGLS, suggesting a potentially understated role of renewables in the main model. CCEMG, while less consistent, supports the negative role of GI, albeit at lower significance, but diverges on EP, where it shows a positive effect, contradicting both GMM and FGLS. This may reflect cross-country heterogeneity in policy implementation that GMM averages out. GB is insignificant in GMM but becomes significant in both robustness models, suggesting that latent global dynamics may have influenced ED more than captured by the main estimation. The negative impact of GE is in line with Mehboob et al. (2024b).

For the post-crisis and pre-pandemic era (Table 11), FGLS again aligns with GMM in confirming TD’s strong positive effect and the continued significance of GI. EG, though insignificant in GMM, becomes highly significant in FGLS, possibly due to the dynamic nature of GMM downplaying short-run effects. CCEMG agrees with FGLS on TD but contradicts GMM on GI and EP, where signs flip or lose significance. GB consistently exhibits a negative and statistically significant impact in the FGLS estimation, matching the GMM direction, but CCEMG results are weaker, indicating model sensitivity to globalization effects.

In the pandemic era (Table 12), the results diverge more sharply due to the short time frame. FGLS finds EG and TD to be strong positive contributors to ED, in contrast to the insignificant effects observed in both GMM and FE. GI, which was positively significant in GMM, becomes negatively significant in FGLS, and entirely insignificant in FE, indicating instability in its short-term effect. EP is insignificant in both GMM and FGLS, but strongly negative and significant in FE, possibly reflecting sudden regulatory tightening or reporting shifts during the crisis. GB remains negatively significant in FGLS but loses power in FE, aligning more closely with GMM’s results.

Overall, FGLS offers the most consistent corroboration of GMM, especially in identifying EG, TD, and GI as key drivers. CCEMG introduces more variability, likely due to its sensitivity to cross-sectional heterogeneity. FE, used only for the pandemic period, highlights the fragility of short-term estimates and reinforces the need for cautious interpretation of crisis-period dynamics.

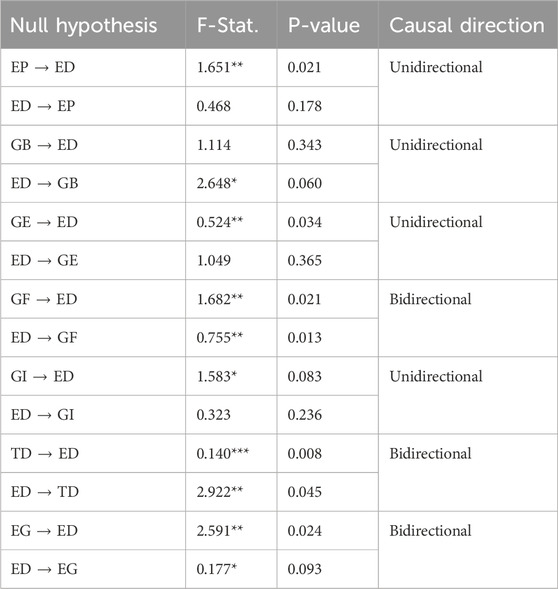

The Granger causality analysis in Table 13 reveals meaningful directional relationships between environmental deterioration (ED) and its potential drivers, providing depth to the dynamic interactions inferred from the GMM estimations.

A unidirectional causality from EP to ED confirms that policy efforts significantly influence environmental outcomes, but changes in ED do not appear to trigger immediate policy responses. Similarly, GE and GI both Granger-cause ED, supporting their proactive roles in shaping environmental quality, although ED does not influence their evolution, indicating that environmental challenges do not yet feed back into innovation or energy choices in the short run.

In contrast, GF and ED share a bidirectional relationship, suggesting a reinforcing feedback loop where green finance both responds to and shapes ecological conditions. TD also exhibits bidirectional causality with ED, reflecting how digital expansion and environmental quality influence each other, possibly through energy demands and information access.

EG, traditionally a key factor, also displays bidirectional causality with ED, reinforcing the notion that while economic growth impacts the environment, ecological conditions can in turn influence economic performance, likely through regulatory, resource, or productivity channels.

Lastly, GB shows reverse causality, where ED Granger-causes GB but not vice versa. This suggests that environmental stress may be prompting changes in global integration patterns, rather than globalization directly degrading the environment in the observed period.

These findings validate several of the structural results from the main models, particularly the causal influence of EP, GI, and GE, while also uncovering dynamic feedback loops in GF, TD, and EG that merit policy attention for long-term sustainability.

5 Conclusion and future suggestions

This work explores the environmental impacts of green strategies and globalization across 34 OECD countries over the period 1990–2022, using the ecological footprint as a comprehensive measure of environmental deterioration. By applying a two-step system GMM and validating results through FGLS, CCEMG, and FE models, the analysis captures both short- and long-term dynamics under structural shifts, including the 2008 financial crisis and the COVID-19 pandemic.

The results reveal that green innovation and ecological policies are significant in reducing environmental degradation, especially before the crisis era. Economic growth and technological diffusion contribute positively to degradation in most periods, while the effects of green energy and green finance are more period-specific and occasionally counterintuitive, particularly during the pandemic. Globalization’s impact is largely indirect, with limited short-run significance. Granger causality analysis further supports unidirectional effects from innovation, energy, and policy measures to environmental outcomes, alongside notable bidirectional feedback in green finance, technological diffusion, and economic growth.

Overall, the study emphasizes that while proactive green interventions have begun to shape ecological outcomes, their effectiveness varies across time and context. Policymakers must strengthen green finance mechanisms, ensure innovation is environmentally targeted, and enhance the execution efficiency of ecological procedures to achieve enduring sustainability in advanced economies.

5.1 Policy recommendations

Grounded in the empirical findings and aligned with SDG objectives, this study offers targeted and operational policy recommendations that extend beyond general directives and address the diverse institutional realities of OECD countries.

First, the significant role of green innovation in mitigating environmental deterioration—especially pre-crisis—highlights the need for structured innovation frameworks. OECD governments should adopt targeted subsidies for environmental patents and promote industry-university-research collaborations, similar to Germany’s Fraunhofer model, which has effectively bridged applied research and green technology commercialization. Lessons from Sweden and Finland, which emphasize mission-driven innovation funding, should be replicated through tailored national innovation strategies that align R&D with climate goals.

Second, while green finance showed mixed impacts, the observed bidirectional causality with environmental outcomes underscores the need for explicit green financial taxonomies and regulatory incentives. Countries like France and the Netherlands have advanced green bond frameworks and sustainability-linked lending benchmarks, which can serve as blueprints for others. Policies should focus on de-risking green investments, mandating environmental disclosures, and mobilizing private sector capital toward climate-aligned sectors.

Third, the limited yet occasionally significant impact of ecological policies calls for enhancing not only policy stringency but also implementation efficiency. Successful models like Denmark’s environmental performance contracts and Japan’s voluntary corporate compliance schemes can be adapted to suit other OECD economies with different governance capacities. Enforcement must be matched with monitoring infrastructure and transparent compliance metrics to ensure policy effectiveness.

Fourth, the environmental burden of technological diffusion—especially post-crisis and during the pandemic—suggests a need for greener digital transitions. Policy frameworks should support low-energy digital technologies and circular electronics value chains, drawing from the EU’s digital sustainability regulations.

Finally, green energy, while expected to reduce ED, showed mixed effects across periods. This signals a need for phased renewable integration strategies that are coupled with grid modernization, storage infrastructure, and fossil phase-out timelines, exemplified by Spain’s just transition framework and Canada’s clean energy incentives.

In sum, the study advocates for differentiated, evidence-backed policies rooted in successful OECD practices. These measures should be dynamically aligned with SDG targets, particularly Goals 7 (affordable and clean energy), 9 (industry, innovation, and infrastructure), 12 (responsible consumption and production), and 13 (climate action). By combining policy stringency with innovation pathways and financial alignment, OECD countries can lead a credible and scalable ecological transition.

5.2 Constraints of the research

While the current work offers meaningful perceptions into the ecological impacts of green strategies and globalization across 34 OECD countries from 1990 to 2022, several limitations warrant careful consideration.

First, the analysis is restricted to OECD countries, which represent a relatively homogeneous group of high-income economies. This limits the generalizability of the findings to developing countries, where institutional capacities, resource endowments, and economic structures differ significantly. Moreover, the study does not consider within-OECD heterogeneity, such as differences in income levels, industrial structures, or natural resource dependency, which may influence how green policies and globalization affect environmental outcomes. Future research should disaggregate OECD samples or expand to include non-OECD nations for broader applicability.

Second, the measurement of green innovation (GI) relies solely on the number of environmental technology patents. While this indicator captures formal innovation output, it does not reflect the commercial application or real-world impact of these innovations. This may lead to an overestimation of GI’s effectiveness in improving environmental outcomes. Incorporating alternative indicators, such as patent citations, innovation adoption rates, or environmental R&D expenditures, could enhance the robustness of future analyses.

Third, the proxy used for green finance (GF)—domestic credit to the private sector as a share of GDP—does not distinguish between green and non-green financial flows. This dilutes the precision of the measure and may obscure the specific role of financial mechanisms in supporting sustainability transitions. More targeted indicators, such as the volume of green bonds issued, green loans, or ESG-aligned capital flows, would better capture the essence of green finance, although such data are not yet uniformly available across countries and time.

Finally, while the model controls for key econometric concerns and includes robustness checks, some variables may suffer from measurement limitations or temporal lag effects, especially during the pandemic era when structural disruptions were highly nonlinear. The short time frame for that sub-period also constrains the reliability of dynamic estimates.

Addressing these limitations in future research—through refined indicators, expanded geographical coverage, and greater temporal granularity—will strengthen the analytical depth and policy relevance of studies in this domain.

5.3 Prospective research avenues

Building on the limitations identified, several directions emerge for future research to deepen and refine understanding of the environmental impacts of green strategies and globalization, particularly within diverse national contexts.

First, future studies should aim to expand the geographical scope beyond OECD countries to include developing and emerging economies. This would enable comparative analysis across varying institutional capacities, environmental vulnerabilities, and economic structures, thereby enhancing the global relevance of policy insights. Including low- and middle-income countries could also reveal differentiated pathways for sustainable development under resource and regulatory constraints.

Second, there is a clear need to capture intra-group heterogeneity among OECD nations. Future research could stratify countries by income levels, natural resource endowments, or industrial composition to assess whether the effects of green innovation, finance, and policy differ significantly across sub-groups. This stratified approach would yield more context-sensitive recommendations and help identify best practices adaptable to specific national profiles.

Third, refinement of indicator selection is critical. The current reliance on environmental patents as a proxy for green innovation should be complemented with metrics that reflect innovation impact and adoption, such as patent citations, technology diffusion rates, or sector-level innovation outcomes. Similarly, replacing or augmenting the green finance measure with explicitly green instruments—such as green bond issuance, sustainable loan portfolios, or ESG-based financial indices—would provide a more accurate picture of financial contributions to environmental goals.

Fourth, future analyses should incorporate nonlinear effects and threshold dynamics, particularly around policy stringency, trade openness, and digital expansion. Advanced techniques such as panel threshold regression or machine learning models can uncover tipping points or diminishing returns in environmental responses to policy or economic variables.

Finally, the temporal scope should be extended in future updates to capture post-pandemic trajectories and emerging structural shifts in the global green economy. As green recovery packages, digital transitions, and climate targets intensify, updated data will be crucial for evaluating the long-term efficacy of current strategies and informing adaptive policymaking.

In sum, future research should pursue greater inclusivity, precision, and methodological innovation to fully capture the evolving complexity of ecological sustainability in a globalized and transitioning world.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://data.worldbank.org/country.

Author contributions

XM: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Project administration, Resources, Software, Supervision, Writing – original draft, Writing – review and editing. OB-S: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Writing – original draft, Writing – review and editing. DC: Conceptualization, Data curation, Investigation, Project administration, Resources, Supervision, Validation, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. Princess Nourah Bint Abdulrahman University Researchers Supporting Project number (PNURSP2025R855), Princess Nourah Bint Abdulrahman University, Riyadh, Saudi Arabia. The authors extend their appreciation to the Deanship of Scientific Research at Northern Border University, Arar, KSA for funding this research work through the project number NBU-CRP-2025-2922.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alatrash, M. B. A., Bein, M. A., and Samour, A. (2025). The impact of world uncertainty, environmental policy stringency, and technological innovation on environmental sustainability: evidence from high-income countries. Sustain 17, 1134. doi:10.3390/SU17031134

Ambreen, S., Wenbao, M., Khoso, W. M., Mangi, T. A., and Baloch, Z. A. (2025). Impact of socioeconomic and sociopolitical factors on environmental sustainability in Pakistan. Environ. Dev. Sustain., 1–25. doi:10.1007/s10668-025-05989-9

Amin, N., Shabbir, M. S., Pan, Y., and Asif, M. (2025). Beyond growth: the triple green strategy (green energy, green innovation, and green finance) for sustainable emissions reduction in BRICS countries. Sustain. Dev. doi:10.1002/SD.3411

Attila, J. (2008). Is corruption contagious? An econometric analysis. SSRN Electron. J. doi:10.2139/ssrn.1275804

Becker, S., Egger, P., and Seidel, T. (2009). Common political culture: evidence on regional corruption contagion. Eur. J. Polit. Econ. 25, 300–310. doi:10.1016/j.ejpoleco.2008.12.002

Behera, P., Haldar, A., and Sethi, N. (2023). Achieving carbon neutrality target in the emerging economies: role of renewable energy and green technology. Gondwana Res. 121, 16–32. doi:10.1016/j.gr.2023.03.028

Cai, X., Xiang, H., and Akbari, F. (2025). Integrated sustainability perspective to interconnect circular economy, environmental development, and social status: designation of sustainable development spillovers. Socio-Economic Plan. Sci. 101, 102253. doi:10.1016/J.SEPS.2025.102253

Chang, C. P., and Lee, C. C. (2013). The economic voting hypothesis in the presence of threshold effects: evidence from asymmetric modeling. Singap. Econ. Rev. 58, 1350004. doi:10.1142/S0217590813500045

Chang, G., Yasin, I., and Naqvi, S. M. M. A. (2024). Environmental sustainability in OECD nations: the moderating impact of green innovation on urbanization and green growth. Sustain 16, 7047. doi:10.3390/SU16167047

Chen, P., and Hao, Y. (2022). Digital transformation and corporate environmental performance: the moderating role of board characteristics. Corp. Soc. Responsib. Environ. Manag. 29, 1757–1767. doi:10.1002/csr.2324

Choi, C. H. (2024). A quantum leap towards sustainability? Exploring the interplay between green trade exports and environmental performance in OECD countries. doi:10.21203/RS.3.RS-4270045/V1

Chu, L. K. (2023). Environmentally related technologies and environmental regulations in promoting renewable energy: evidence from OECD countries. J. Environ. Stud. Sci. 13, 177–197. doi:10.1007/S13412-022-00810-9

Chu, L. K., Doğan, B., Abakah, E. J. A., Ghosh, S., and Albeni, M. (2022). Impact of economic policy uncertainty, geopolitical risk, and economic complexity on carbon emissions and ecological footprint: an investigation of the E7 countries. Environ. Sci. Pollut. Res. 30, 34406–34427. doi:10.1007/s11356-022-24682-2

Dam, M. M., Işık, C., and Ongan, S. (2023). The impacts of renewable energy and institutional quality in environmental sustainability in the context of the sustainable development goals: a novel approach with the inverted load capacity factor. Environ. Sci. Pollut. Res. 30, 95394–95409. doi:10.1007/S11356-023-29020-8

Diachenko, O., Dolynska, O., Hrynenko, I., Zalievska-Shyshak, A., and Sokhatskyi, O. (2024). The impact of globalization on the economic development of countries. Arch. Des. Sci. 74, 234–239. doi:10.62227/AS/74336

Doğan, B., Shahbaz, M., Bashir, M., Abbas, S., and Ghosh, S. (2023). Formulating energy security strategies for a sustainable environment: evidence from the newly industrialized economies. Renew. Sustain. Energy Rev. 184, 113551. doi:10.1016/j.rser.2023.113551

Dong, X., and Yu, M. (2024). Green bond issuance and green innovation: evidence from China’s energy industry. Int. Rev. Financ. Anal. 94, 103281. doi:10.1016/J.IRFA.2024.103281

Duan, N. (2025). The quest for balance: the journey of energy, environment and sustainable development. Energy Environ. Sustain 1, 100001. doi:10.1016/J.EESUS.2024.12.001

Dumitrescu, E. I., and Hurlin, C. (2012). Testing for granger non-causality in heterogeneous panels. Econ. Model. 29, 1450–1460. doi:10.1016/J.ECONMOD.2012.02.014

Fatima, N., Xuhua, H., Alnafisah, H., Zeast, S., and Akhtar, M. R. (2024). Enhancing climate action in OECD countries: the role of environmental policy stringency for energy transitioning to a sustainable environment. Environ. Sci. Eur. 36, 157–24. doi:10.1186/s12302-024-00978-7

Fu, C., Lu, L., and Pirabi, M. (2023). Advancing green finance: a review of sustainable development. Digit. Econ. Sustain. Dev. 11 (1), 20–19. doi:10.1007/S44265-023-00020-3

GFN (2025). Global footprint network. Available online at: http://data.footprintnetwork.org.

Gygli, S., Haelg, F., Potrafke, N., and Sturm, J. E. (2019). The KOF globalisation index – revisited. Rev. Int. Organ. 14, 543–574. doi:10.1007/S11558-019-09344-2

He, P., Zhang, S., Wang, L., and Ning, J. (2023). Will environmental taxes help to mitigate climate change? A comparative study based on OECD countries. Econ. Anal. Policy 78, 1440–1464. doi:10.1016/J.EAP.2023.04.032

Hossain, M., Singh, S., Sharma, G., Apostu, S., and Bansal, P. (2023). Overcoming the shock of energy depletion for energy policy? Tracing the missing link between energy depletion, renewable energy development and decarbonization in the USA. Energy Policy 174, 113469. doi:10.1016/j.enpol.2023.113469

Hu, F., Qiu, L., Wei, S., Zhou, H., Bathuure, I. A., and Hu, H. (2024). The spatiotemporal evolution of global innovation networks and the changing position of China: a social network analysis based on cooperative patents. R. D. Manag. 54, 574–589. doi:10.1111/RADM.12662

IEA (2022). World energy outlook 2022 – analysis. Paris: IEA. Available online at: https://www.iea.org/reports/world-energy-outlook-2022 (Accessed November 11, 24).

IEA (2023). Net zero roadmap: a global pathway to keep the 1.5 °C goal in reach – analysis. Paris: IEA. Available online at: https://www.iea.org/reports/net-zero-roadmap-a-global-pathway-to-keep-the-15-0c-goal-in-reach (Accessed April 10, 24).

Imran, M., Kamran Khan, M., Alam, S., Wahab, S., Tufail, M., and Jijian, Z. (2024). The implications of the ecological footprint and renewable energy usage on the financial stability of South Asian countries. Financ. Innov. 10, 102. doi:10.1186/s40854-024-00627-1

Jamel, M., and Zhang, C. (2024). Green finance, financial technology, and environmental innovation impact on CO2 emissions in developed countries. J. Energy Environ. Policy Options 7, 43–51. Available online at: https://resdojournals.com/index.php/JEEPO/article/view/373.

Khan, H. H. A., Ahmad, N., Yusof, N. M., and Chowdhury, M. A. M. (2024). Green finance and environmental sustainability: a systematic review and future research avenues. Environ. Sci. Pollut. Res. 31, 9784–9794. doi:10.1007/S11356-023-31809-6

Khan, Z., Ali, S., Umar, M., Kirikkaleli, D., and Jiao, Z. (2020). Consumption-based carbon emissions and international trade in G7 countries: the role of environmental innovation and renewable energy. Sci. Total Environ. 730, 138945. doi:10.1016/J.SCITOTENV.2020.138945

Li, T., and Li, Y. (2023). Artificial intelligence for reducing the carbon emissions of 5G networks in China. Nat. Sustain. 6, 1522–1523. doi:10.1038/S41893-023-01208-3

Li, Y., Li, H., Miao, R., Qi, H., and -, Y. Z. (2023). Energy–environment–economy (3E) analysis of the performance of introducing photovoltaic and energy storage systems into residential buildings: a case study in shenzhen, China. Sustainability 15, 9007. doi:10.3390/su15119007

Li, Y., Xu, Y., and Wen, C. (2024). Digital pathways to sustainability: the impact of digital infrastructure in the coordinated development of environment, economy and society. Environ. Dev. Sustain. 2024, 1–34. doi:10.1007/S10668-024-05842-5

Liu, G., and Liang, K. (2024). The role of technological innovation in enhancing resource sustainability to achieve green recovery. Resour. Policy 89, 104659. doi:10.1016/j.resourpol.2024.104659

Liu, K., Luo, J., Faridi, M. Z., Nazar, R., and Ali, S. (2025). Green shoots in uncertain times: decoding the asymmetric nexus between monetary policy uncertainty and renewable energy. Energy Environ. doi:10.1177/0958305X241310198

Liu, X., Zhang, W., Liu, M., and Han, J. (2025). Green finance and carbon neutrality: strategies and policies for a sustainable future. Front. Environ. Sci. 13. doi:10.3389/FENVS.2025.1560927

Ma, R., Abid, N., Yang, S., and Ahmad, F. (2023). From crisis to resilience: strengthening climate action in OECD countries through environmental policy and energy transition. Environ. Sci. Pollut. Res. Int. 30, 115480–115495. doi:10.1007/s11356-023-29970-z

Maka, A., and Alabid, J. (2022). Solar energy technology and its roles in sustainable development. Clean. Energy 6, 476–483. doi:10.1093/ce/zkac023

Mehboob, M. Y., Ma, B., Mehboob, M. B., and Zhang, Y. (2024a). Does green finance reduce environmental degradation? The role of green innovation, environmental tax, and geopolitical risk in China. J. Clean. Prod. 435, 140353. doi:10.1016/J.JCLEPRO.2023.140353

Mehboob, M. Y., Ma, B., Sadiq, M., and Zhang, Y. (2024b). Does nuclear energy reduce consumption-based carbon emissions: the role of environmental taxes and trade globalization in highest carbon emitting countries. Nucl. Eng. Technol. 56, 180–188. doi:10.1016/J.NET.2023.09.022

Moreno, J., Van de Ven, D. J., Sampedro, J., Gambhir, A., Woods, J., and Gonzalez-Eguino, M. (2023). Assessing synergies and trade-offs of diverging Paris-compliant mitigation strategies with long-term SDG objectives. Glob. Environ. Chang. 78, 102624. doi:10.1016/J.GLOENVCHA.2022.102624

OECD (2023). Agriculture and sustainability. Paris: OECD. Available online at: https://www.oecd.org/en/topics/policy-issues/agriculture-and-sustainability.html (Accessed December 11, 24).

OECD (2025b). OECD data explorer. Available online at: https://data-explorer.oecd.org/(Accessed November 19, 24).

Oliveira, H., and Moutinho, V. (2021). Renewable energy, economic growth and economic development nexus: a bibliometric analysis. Energies 14, 4578. doi:10.3390/EN14154578

Oluwagbade, E. O., and Ibidapo, C. O. K. (2024). Impact of globalization on the economic development of Nigeria. Int. J. Dev. Econ. Sustain. 12, 26–51. doi:10.37745/ijdes.13/vol12n12651

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74, 967–1012. doi:10.1111/j.1468-0262.2006.00692.x

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 22, 265–312. doi:10.1002/jae.951

Pesaran, M. H. (2015). Testing weak cross-sectional dependence in large panels. Econom. Rev. 34, 1089–1117. doi:10.1080/07474938.2014.956623

Pesaran, H. M., and Yamagata, T. (2008). Testing slope homogeneity in large panels. J. Econom. 142, 50–93. doi:10.1016/j.jeconom.2007.05.010

Razzaq, A., Wang, Y., Chupradit, S., Suksatan, W., and Shahzad, F. (2021). Asymmetric inter-linkages between green technology innovation and consumption-based carbon emissions in BRICS countries using quantile-on-quantile framework. Technol. Soc. 66, 101656. doi:10.1016/j.techsoc.2021.101656

Ren, Z., and Zhu, Y. (2025). The trade-off between middle class and ecological footprint: empirical cross-country analysis. Ecol. Econ. 235, 108631. doi:10.1016/J.ECOLECON.2025.108631

Ristanović, V., Primorac, D., and Dorić, B. (2024). The importance of green investments in developed Economies—Mcdm models for achieving adequate green investments. Sustainability 16, 6341. doi:10.3390/su16156341

Saeed, R., Rahman, S. U., and Sheikh, S. M. (2024). Green investment, energy consumption and environmental pollution nexus G-7 countries: a historical perceptive. Pak. J. Humanit. Soc. Sci. 12, 127–136. doi:10.52131/PJHSS.2024.V12I1.1986

Saqib, N., Ozturk, I., and Usman, M. (2023). Investigating the implications of technological innovations, financial inclusion, and renewable energy in diminishing ecological footprints levels in emerging. Geosci. Front. 14, 101667. doi:10.1016/j.gsf.2023.101667

Şeren, E., and Çelekli, A. (2024). “Biodiversity loss: a global issue threatening ecological balance,” in ICHEAS 7th international conference on health, engineering and applied sciences, Sarajevo, June 28 - 30, 2024.

Shan, S., Genç, S., Kamran, H., and Dinca, G. (2021). Role of green technology innovation and renewable energy in carbon neutrality: a sustainable investigation from Turkey. J. Environ. Manag 294, 113004. doi:10.1016/j.jenvman.2021.113004

Sharma, V., Monteleone, G., Braccio, G., Anyanwu, C., and Aneke, N. N. (2024). A comprehensive review of green energy technologies: towards sustainable clean energy transition and global net-zero carbon emissions. Processes 13, 69. doi:10.3390/pr13010069

Sohag, K., Husain, S., and Soytas, U. (2024). Environmental policy stringency and ecological footprint linkage: mitigation measures of renewable energy and innovation. Energy Econ. 136, 107721. doi:10.1016/j.eneco.2024.107721

Swamy, P. (1970). Efficient inference in a random coefficient regression model. Econ. J. Econom. Soc. 38, 311–323. doi:10.2307/1913012

Truong, T. (2022). The impact of digital transformation on environmental sustainability. Adv. Multimedia 2022, 1–12. doi:10.1155/2022/6324325

Uddin, M. (2020). What are the dynamic links between agriculture and manufacturing growth and environmental degradation? Evidence from different panel income countries. Environ. Sustain. Indic. 7, 100041. doi:10.1016/j.indic.2020.100041

UNFCCC (2024). What is the Kyoto protocol?. Bonn: UNFCCC. Available online at: https://unfccc.int/kyoto_protocol (Accessed April 12, 24).

Wahab, S., Imran, M., Ahmed, B., Rahim, S., and Hassan, T. (2024). Navigating environmental concerns: unveiling the role of economic growth, trade, resources and institutional quality on greenhouse gas emissions in OECD countries. J. Clean. Prod. 434, 139851. doi:10.1016/J.JCLEPRO.2023.139851

Wang, E. Z., and Lee, C. C. (2022). The impact of clean energy consumption on economic growth in China: is environmental regulation a curse or a blessing? Int. Rev. Econ. Financ. 77, 39–58. doi:10.1016/J.IREF.2021.09.008

Wang, L., Liu, S., and Xiong, W. (2022). The impact of digital transformation on corporate environment performance: evidence from China. Int. J. Environ. Res. Public Health 19, 12846. doi:10.3390/IJERPH191912846

Wang, Z., Sami, F., Khan, S., Alamri, A., and Zaidan, A. M. (2023). Green innovation and low carbon emission in OECD economies: sustainable energy technology role in carbon neutrality target. Sustain. Energy Technol. 59, 103401. doi:10.1016/j.seta.2023.103401

Wang, Z., Wang, T., Zhang, X., Wang, J., Yang, Y., Sun, Y., et al. (2024). Biodiversity conservation in the context of climate change: facing challenges and management strategies. Sci. Total Environ. 937, 173377. doi:10.1016/J.SCITOTENV.2024.173377

WDI (2025). World bank (World development indicators). Available online at: https://databank.worldbank.org/indicator/NY.GDP.PCAP.CD/%201ff4a498/%20Popular-Indicators.

Wolde-Rufael, Y., and Mulat-Weldemeskel, E. (2022). The moderating role of environmental tax and renewable energy in CO2 emissions in Latin America and Caribbean countries: evidence from method of moments quantile regression. Environ. Challenges 6, 100412. doi:10.1016/j.envc.2021.100412

World Bank (2023). Global economic prospects. Discusses the role of energy security in economic development. Available online at: https://thedocs.worldbank.org/en/doc/5443e6bba11cd7fa7c0c678a20edd4dd-0350012023/original/GEP-June-2023.pdf (Accessed November 11, 24).

Xia, H., Liu, Z., Efremochkina, M., Liu, X., and Lin, C. (2022). Study on city digital twin technologies for sustainable smart city design: a review and bibliometric analysis of geographic information system and building information modeling integration. Sustain. Cities Soc. 84, 104009. doi:10.1016/j.scs.2022.104009

Xiao, Y., Lin, M., and Wang, L. (2024). Impact of green digital finance on sustainable development: evidence from China’s pilot zones. Financ. Innov. 10, 10–32. doi:10.1186/s40854-023-00552-9

Xing, L., Chang, B. H., and Aldawsari, S. H. (2024). Green finance mechanisms for sustainable development: evidence from panel data. Sustain 16, 9762. doi:10.3390/SU16229762

Xu, A., Dai, Y., Hu, Z., and Qiu, K. (2025). Can green finance policy promote inclusive green growth? based on the quasi-natural experiment of China’s green finance reform and innovation pilot zone. Int. Rev. Econ. Financ. 100, 104090. doi:10.1016/J.IREF.2025.104090

Xu, D., Abbas, S., Rafique, K., and Ali, N. (2023). The race to net-zero emissions: can green technological innovation and environmental regulation be the potential pathway to net-zero emissions? Technol. Soc. 75, 102364. doi:10.1016/j.techsoc.2023.102364

Xu, Y., Umar, M., Kirikkaleli, D., Sunday, T., and Altuntas, M. (2022). Carbon neutrality target in Turkey: measuring the impact of technological innovation and structural change. Gondwana Res. 109, 429–441. doi:10.1016/j.gr.2022.04.015

Yan, M. R., Yan, H., Chen, Y. R., Zhang, Y., Yan, X., and Zhao, Y. (2025). Integrated green supply chain system development with digital transformation. Int. J. Logist. Res. Appl., 1–22. doi:10.1080/13675567.2025.2492217

Yang, X., Chen, J., Li, D., and Li, R. (2024). Functional-coefficient quantile regression for panel data with latent group structure. J. Bus. Econ. Stat 42, 1026–1040. doi:10.1080/07350015.2023.2277172

Yasir Mehboob, M., Ma, B., Sadiq, M., and Mehboob, M. B. (2024). How do nuclear energy consumption, environmental taxes, and trade globalization impact ecological footprints? Novel policy insight from nuclear power countries. Energy 313, 133661. doi:10.1016/J.ENERGY.2024.133661

Zhang, Y., Ding, Y., and Yan, W. (2025). United in green: institutional dual ownership and corporate green innovation. Finance Res. Lett. 84, 107814. doi:10.1016/J.FRL.2025.107814

Zhang, Z., and Chen, H. (2022). Dynamic interaction of renewable energy technological innovation, environmental regulation intensity and carbon pressure: evidence from China. Renew. Energy 192, 420–430. doi:10.1016/J.RENENE.2022.04.136

Keywords: green energy, green innovation, green finance, environmental policies, globalization

Citation: Ma X, Ben-Salha O and Choukaier D (2025) Beyond economic growth: the synergistic effects of globalization, environmental policies, and the triple green strategy on environmental sustainability in OECD countries. Front. Environ. Sci. 13:1649166. doi: 10.3389/fenvs.2025.1649166

Received: 18 June 2025; Accepted: 14 July 2025;

Published: 21 August 2025.

Edited by:

Muhammad Farhan Bashir, Chengdu University of Technology, ChinaReviewed by:

Sanglin Zhao, Hunan University of Finance and Economics, ChinaMuhammad Yasir Mehboob, Central South University, China

Copyright © 2025 Ma, Ben-Salha and Choukaier. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiang Ma, bWF4aWFuZ0BnZHVzdC5lZHUuY2g=; Ousama Ben-Salha, b3Vzc2FtYS5iZW5zYWxoYUBpc2dzLnJudS50bg==

Xiang Ma

Xiang Ma Ousama Ben-Salha

Ousama Ben-Salha Dhouha Choukaier4

Dhouha Choukaier4