- 1School of Business, Macau University of Science and Technology, Taipa, Macao SAR, China

- 2Industrial Economics Research Institute, Research Institute of Machinery Industry Economic & Management, Beijing, China

- 3School of Finance, Hunan University of Technology and Business, Changsha, China

- 4Business School, Hunan First Normal University, Changsha, China

Introduction: Promoting the improvement of corporate environmental performance is an important micro-foundation for achieving green high-quality development.

Methods: This study takes Chinese A-share listed firms on the Shanghai and Shenzhen stock exchanges from 2011 to 2023 as the research sample, regards the climate resilient city construction (CRCC) pilot policy as a quasi-natural experiment, and employs the difference-in-differences (DID) method to empirically examine its impact on corporate environmental performance.

Results: The empirical results show that CRCC significantly improves corporate environmental performance. This conclusion remains valid after a series of robustness tests, including the parallel trends test, placebo test, and PSM-DID. Mechanism analysis reveals that CRCC promotes the improvement of corporate environmental performance through three channels: enhancing urban environmental attention, strengthening environmental regulation intensity, and increasing corporate climate risk disclosure. Heterogeneity tests show that the policy effects are more pronounced in the southeast region of the “Hu Huanyong Line”, non-state- owned firms, and heavily polluting industries.

Discussion: This study provides empirical evidence for understanding the micro-transmission mechanism of climate resilient policies and offers insights for improving climate governance policies and promoting corporate green transitions.

1 Introduction

As a defining challenge of our era and beyond, climate change drives extreme weather events that are fundamentally altering global economic development pathways and reshaping the human living environment at an astonishing speed (Akpuokwe et al., 2024). Additionally, Wang et al. (2024a) points out that renewable energy technologies drive energy conservation but may unexpectedly increase electricity consumption in some scenarios, underscoring the need for integrated climate resilience strategies at urban and corporate levels. Wang et al. (2024b) further document the complex ramifications of China’s current environmental policies for sustainability governance. Thus, climate governance and environmental regulation have become an essential pathway for China to achieve its dual carbon goals (Zhong et al., 2021).

Urban areas, as dense hubs of economic activities, are particularly exposed to climate change risks. The Intergovernmental Panel on Climate Change (IPCC) explicitly states in its Special Report on Climate Change and Cities that cities account for approximately 70% of global GHG emissions when considering both production- and consumption-based accounting. Consequently, there is an urgent need for nations to proactively adapt to climate change, continuously strengthen their capacities for climate risk prevention, resilience, and recovery, so as to successfully achieve the goals of the Paris Agreement.

Amid this imperative, CRCC has emerged as a crucial climate governance action, offering a systemic approach to enhance urban resilience while simultaneously influencing corporate environmental performance. As an active player in global climate governance, China has gradually established a multi-level policy system for climate change resilience. This started with the 2013 release of the National Strategy on Climate Change Adaptation, which forms the cornerstone of its national strategy to address climate challenges. Subsequent policies include the Urban Climate Change Adaptation Action Plan (2016), targeting 30 pilot cities by 2020, as well as the complementary Pilot Work Plan for Climate-Resilient City Development (2016) and Notice on Launching Pilot Initiatives for CRCC (2017), which designated 28 initial pilot cities. Building on prior pilot initiatives, China’s Ministry of Ecology and Environment (MEE), in collaboration with seven ministries including Finance and Housing and Urban-Rural Development, issued the Notice on Deepening Climate-Resilient City Pilot Projects in May 2024. This policy outlines a systematic three-phase roadmap: (1) prioritizing 39 cities with robust infrastructure and governance for enhanced pilots by 2025; (2) expanding pilot coverage to approximately 100 cities by 2030; and (3) achieving comprehensive climate-resilience development across all prefecture-level and higher cities by 2035. Dong et al. (2025) noted that such multi-level systems reflect the deepening of China’s environmental governance. This policy evolution marks a new stage in China’s climate-governance action, shifting from a focus on climate mitigation to a balanced approach that emphasizes both mitigation and resilience.

These climate governance actions enhance cities’ climate change resilience through specific measures, including increasing urban green coverage, optimizing water resource management, and strengthening disaster prevention facilities (Mao et al., 2024). Supporting this, Amirtham and K. C. (2024) found that green spaces improve outdoor thermal comfort, highlighting such measures’ role in boosting urban microclimates. A growing body of empirical research acknowledges CRCC’s transformative role in urban development. For instance, Zhang et al. (2024) showed that CRCC advances urban development by fostering human capital accumulation and scaled investments in resilient infrastructure. Nassar et al. (2024) further noted that effective resilience strategies address diverse urban contexts, which aligns with CRCC’s systemic approach. Concurrently, CRCC’s systemic benefits extend to sustainable development via industrial structure optimization and talent attraction (He et al., 2025; Yu et al., 2025). However, a critical research gap remains: the microeconomic implications of CRCC on corporate behavior and performance are underexplored, offering a promising direction for future research on firm-level policy efficacy.

Businesses act as the backbone of urban economic growth and the key entities driving proactive environmental protection. However, they remain highly vulnerable to the multifaceted shocks emanating from extreme climate events. As elucidated by Sun et al. (2020), climate change exerts its influence on firms through dual pathways: direct physical shocks and indirect transition shocks. Physical shocks, as explored by Chen et al. (2025), manifest as disruptions to core business operations, including damage to production materials, infrastructure, and the fragmentation of production networks caused by extreme weather phenomena. Meanwhile, transition shocks, as analyzed by Chen et al. (2023), materialize in the form of stranded assets stemming from evolving climate policies, technological advancements, and shifting consumer preferences towards sustainability. Cevik and Miryugin (2023) further underscored the financial ramifications, demonstrating that climate risks significantly exacerbate the debt financing challenges. Liu et al. (2024) specifically highlighted that firms situated in China’s climatically vulnerable coastal regions bear a disproportionately higher brunt of these impacts.

By enhancing urban resilience, CRCC not only aims to mitigate the physical and financial risks posed by climate change to urban economies, but also creates an institutional environment that can shape corporate behavior. Despite the growing body of research on the implications of climate change for corporations, the existing literature predominantly focuses on the impact on corporate financial performance (Aibar-Guzmán et al., 2024). In contrast, the role of climate governance actions, particularly CRCC, in influencing corporate environmental performance and sustainable development remains underexplored. This research gap highlights the need for a more in-depth examination of how CRCC initiatives can effectively promote corporate environmental performance, which this study seeks to address.

Climate governance action represented by the CRCC can effectively mitigate the adverse impacts of extreme weather events, providing a favorable environment for corporate sustainable development. Therefore, the mechanisms through which climate change and its related policies affect the sustainable development of Chinese firms have received considerable attention. Emissions trading policies (Zhang et al., 2023a; Zhang et al., 2023b) and extreme climates (Tang et al., 2024; Xue et al., 2025) can significantly improve corporate ESG performance, while increased uncertainty in climate policies deteriorates corporate ESG performance (Ge and Zhang, 2025). The aforementioned literature provides highly valuable references for studying the impact of climate policies on ESG. However, it still fails to assess the impact of CRCC on ESG and environmental performance. Regrettably, with the notable exception of Zhou et al.'s (2024) study, which demonstrates that CRCC significantly enhances corporate environmental performance by inducing green innovation among firms.

Figure 1 illustrates the changing trends of the mean values of Huazheng ESG Score, E Score, and E/ESG among the sampled listed firms. As can be observed from the Figure 1, prior to the pilot implementation of the CRCC policy in 2017, the changes in ESG, E, and E/ESG were relatively slow. It is noteworthy that after 2017, ESG maintained a very stable trend, while E and E/ESG exhibited rapid growth. This can preliminarily indicate that the CRCC policy has the most significant positive impact on the E dimension within corporate ESG ratings. Therefore, evaluating the impact of CRCC on corporate environmental performance is very important. It helps improve the analysis of the microeconomic consequences of CRCC policies, and also contributes to formulating corporate strategies for climate resilient and response.

The possible marginal contributions of this study are as follows: First, from the research perspective, we focus on the micro-level impact of CRCC on corporate environmental performance. By analyzing corporate specific behavioral decisions in response to climate risks, we make up for the deficiency that existing studies mostly focus on macro policy effects while ignoring micro transmission mechanisms, and provide a new analytical perspective for understanding corporate responses to climate governance.

Second, in terms of the theoretical framework, we incorporate the dual logics of corporate “passive compliance” and “active transformation” into the analysis, breaking through the limitation that existing studies solely emphasize the forcing effect of environmental regulations. We systematically explain the multiple impact paths of climate resilient policies on corporate environmental behaviors, enriching the theoretical dialogue between climate economics and corporate sustainable development.

Third, in terms of empirical strategies, we construct a multi-dimensional analysis framework based on corporate heterogeneous characteristics. By subdividing boundary conditions such as regional resource endowments and corporate ownership nature, we accurately identify the differential performance of policy effects, providing more operable empirical evidence for formulating targeted climate resilient policies.

The remaining content of this article is arranged as follows: The second part presents the theoretical analysis and research hypotheses; the third part covers the methodology, specifically including data, variables, and models; the fifth part presents the results of the empirical analysis; and the seventh part contains the conclusions and policy implications.

2 Theoretical analysis and research hypotheses

The frequent occurrence of extreme climate events such as floods, heatwaves, and typhoons has brought significant negative impacts on economic development, prompting China to adopt multi-level intervention policies to reshape the interactive relationship between urban ecosystems and economic systems. Government climate governance action represented by CRCC aim to form a framework of joint action involving resource reallocation, institutional pressure transmission, and market incentive mechanisms through pathways such as enhancing the resilience of urban infrastructure and improving climate risk early warning systems. These actions reduce losses caused by the exposure of economic entities such as firms to climate risks (Zhou et al., 2024), improve their ability to proactively adapt to climate risks, thereby strengthening climate resilience, consolidating cities’ ability to cope with climate change, and ultimately providing a favorable external environment for corporate sustainable development.

2.1 The impact of climate governance action on corporate environmental performance

The mechanism through which climate governance actions affect corporate environmental performance forms a theoretical chain of “climate governance - impact mechanism - environmental performance.” As core participants in urban economic activities, firms are deeply embedded in the institutional and market environments shaped by CRCC. Climate change exposes firms to dual risks: physical shocks (Chen et al., 2025) and transition shocks (Chen et al., 2023). CRCC addresses these risks not only by mitigating direct climate harms but also by reconstructing the institutional logic that guides corporate behavior.

Based on signaling theory (Ross, 1977), government climate governance actions send a clear market signal of determination to address climate change and environmental pollution. This signal raises societal attention to climate resilience issues, creating institutional pressure that compels firms to proactively adopt measures to meet environmental governance goals (He et al., 2023). This signal is twofold: it communicates societal expectations for sustainability to consumers and investors, who then reward firms with strong environmental performance, while also indicating policy priorities that guide firms’ strategic adjustments.

At the same time, this policy will also be regarded by the market as a signal of increasing demand for environmentally friendly products, which can guide firms to adjust their strategies as well as production and operation to meet the market’s demand expectations for environmental products (Spence, 1973). Wu et al. (2025) emphasized the role of theoretical frameworks in guiding empirical analyses, and our study aligns with this approach to explain how policies impact firms. Additionally, based on the institutional economics theoretical framework, the institutional pressure formed by climate governance actions will shape corporate organizational management behaviors and decisions, driving firms to optimize their environmental goals and behaviors, thereby reducing carbon emissions (Dahlmann et al., 2019). This institutional pressure operates through both “passive compliance” (avoiding penalties for non-compliance) and “active transformation” (seizing opportunities in green markets), creating a dynamic where firms integrate environmental performance into long-term strategy.

Therefore, firms in CRCC pilot cities, under the dual pressure of external institutions and market demand, will continuously optimize their environmental performance from the perspective of their own strategies and business operations.

Based on the above theoretical analysis, this study proposes the following Hypothesis 1:H1:. Climate governance action can significantly improve corporate environmental performance.

2.2 The influence mechanism of climate governance action on urban environmental attention

As an important part of climate governance actions, CRCC is a significant government-led institution that can enhance the attention of local governments, the public, and other economic entities in pilot cities to climate and environmental issues, thereby creating multiple institutional and public opinion pressures on corporate environmental performance. This heightened attention operates as a “normative cascade,” where shared expectations about environmental responsibility spread through society and shape corporate behavior.

First, local governments will incorporate climate governance goals with environmental performance as the key into government performance assessments, forming strong environmental policy signals (Acquah et al., 2024). Local governments continuously strengthen environmental attention, the frequency of environmental law enforcement, and the intensity of penalties, forcing firms to integrate environmental performance assessments into their production and operation processes, thereby reducing carbon emissions (Liu et al., 2023). For instance, CRCC pilot cities often increase the frequency of environmental keywords in government work reports (You et al., 2024), which not only reflects shifted policy priorities but also guides bureaucratic behavior toward stricter oversight of corporate environmental practices.

They can also provide a favorable external environment for corporate sustainable development by promoting the greening and intelligentization of urban infrastructure. Second, the gradual promotion of the CRCC policy will raise consumers’ green awareness, strengthening the environmental ethics standards for corporate products and services, and guide firms to adopt green production technologies (Meng et al., 2024), thus improving their environmental responsibility performance. Public attention, amplified through media coverage of climate resilience efforts, turns consumers into “social auditors” who penalize firms with poor environmental records through boycotts or reduced patronage.

Third, due to competition among firms, the environmental performance practices of industry benchmark firms will prompt other firms to learn and imitate, thereby improving corporate environmental performance (Zheng and Ye, 2023). When leading firms in a region enhance their environmental performance in response to CRCC, peers face reputational and market share risks if they lag behind, creating a ripple effect of improvement. At the same time, the government regulatory pressure from the new Environmental Protection Law, as well as external supervisory pressures from public environmental attention and analysts’ attention, can improve corporate environmental performance through channels such as executives’ green cognition (Wei et al., 2025) and integrating the concept of sustainable development into strategic planning and daily operations.

Taken together, these dynamics suggest that urban environmental attention serves as a critical transmission channel through which CRCC influences corporate behavior. Thus, we propose:H2a:. Climate governance action improves corporate environmental performance by enhancing urban environmental attention.

2.3 The influence mechanism of climate governance action on environmental regulation intensity

The core of climate governance actions represented by the CRCC policy lies in constructing a relatively complete policy system to form a collaborative framework for climate risk management featuring “policy supervision - market incentives - firm participation”, enhancing the ability of economic entities to respond to climate change, and thereby comprehensively consolidating corporate environmental performance. A key pillar of this framework is the strengthening of environmental regulation, which operates through both constraints and incentives to drive corporate environmental improvement.

According to the externality theory in environmental economics, corporate environmental behaviors often generate positive externalities. For instance, Dong and Yu (2024) found that green bonds promote green innovation in energy firms, indicating that financial tools can complement regulations in incentivizing environmental investments. Corporate environmental investments and behaviors not only benefit themselves but also bring public benefits of environmental improvement to society. However, the market mechanism cannot effectively solve the externality problem. Firms may not be able to obtain all the social benefits generated by good environmental behaviors, which reduces their enthusiasm for environmental investment. Through government environmental guidance and incentive measures such as tax incentives and financial subsidies, the CRCC policy can partially internalize the positive environmental externalities of firms, thereby reducing the risks of green innovation, promoting firms to explore green technologies, forming green competitive advantages (Li C et al., 2024; Li P et al., 2024), and improving environmental performance.

Moreover, command-based environmental regulation can enhance corporate green production practices (Feng et al., 2021), while public participation in environmental governance stimulates innovation in cleaner production technologies (Zhang et al., 2023a; Zhang et al., 2023b). CRCC strengthens these effects by aligning regulatory standards with climate resilience goals—for example, setting stricter emission limits for pollutants that exacerbate climate vulnerability or mandating climate-adaptive technologies in production processes.

Based on the Porter hypothesis and the regulatory synergy theory, the punishment mechanisms formed by policies such as mandatory environmental energy consumption quotas, technical standards, and emission permits increase the violation costs for firms with negative environmental externalities, prompting them to adopt more environmentally friendly production technologies (Chen et al., 2018). This “pressure to innovate” is particularly pronounced in CRCC pilots, where regulation is paired with support to balance cost burdens. Institutional pressures significantly enhance firms’ supply chain governance capabilities, thereby, integrating circular economy principles into supply chain management has emerged as a critical strategy for enterprises to reconcile economic, social, and environmental objectives (Zeng et al., 2017).

In addition, as a key component of the CRCC policy, the carbon trading policy also drives corporate green innovation by internalizing environmental costs, increasing the marginal revenue of environmental protection investments, and generating positive spillover effects on firms in regions adjacent to pilot provinces, thereby improving corporate environmental performance (Zhang and Gan, 2024). Together, these regulatory and incentive measures create a clear pathway through which CRCC strengthens environmental regulation intensity to improve corporate environmental performance.H2b:. Climate governance action improves corporate environmental performance by strengthening urban environmental regulation intensity.

2.4 The influence mechanism of climate governance action on corporate climate risk disclosure

The CRCC policy will optimize corporate climate cognition and promote their green transformation. Through approaches such as internalization of climate risks and reallocation of resources, it will enhance corporate attention to climate-related risks and drive them to raise their awareness of environmental protection (Wang H. et al., 2024). A tangible outcome of this heightened attention is increased climate risk disclosure, which in turn shapes corporate environmental behaviors.

Based on the resource-based view and dynamic capability theory, climate attention can be transformed into defensive and proactive climate response strategies, which can improve corporate ability to adapt to climate change (Yao et al., 2025). Climate risk disclosure is both a product of these strategies and a driver of further improvement: by systematically reporting climate risks, firms are forced to identify gaps in their environmental management and take corrective action.

Meanwhile, the increased climate attention of firms will enhance the management’s awareness of climate risks, prompting them to adopt more effective strategies, production technologies, and corporate governance (Wei et al., 2025), reduce the rate of environmental violations, improve corporate climate risk management capabilities, facilitate green and low-carbon transformation, and ultimately enhance corporate environmental performance. Disclosure also responds to stakeholder demands: investors, increasingly focused on climate resilience, use disclosure quality to evaluate firms, creating pressure to improve both reporting and underlying performance (Lee et al., 2023).

Furthermore, investor attention enhances corporate environmental performance by alleviating financing constraints and augmenting R&D expenditures (Lu et al., 2025). Firms with transparent climate risk disclosure often access green financing at lower costs, enabling greater investment in environmental technologies and practices. In CRCC pilot cities, where climate risks are more salient, this link between disclosure and resource access is strengthened, as policy signals amplify investor focus on climate-related metrics.

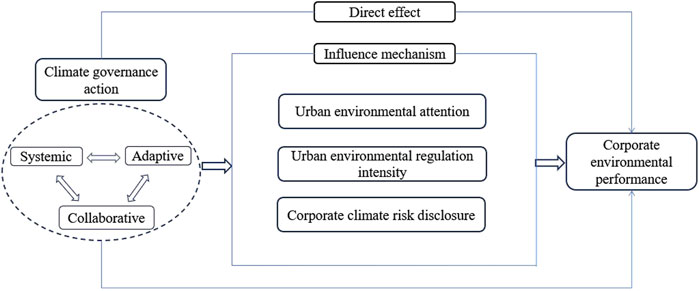

Synthesizing the preceding theoretical analysis, the impact mechanisms of climate governance action on corporate environmental performance are illustrated in Figure 2. Thus, we propose:H2c:. Climate governance action improves corporate environmental performance by enhancing corporate climate risk disclosure.

Figure 2. The impact mechanisms of climate governance action on corporate environmental performance.

3 Methodology

3.1 Data

This paper takes Shanghai and Shenzhen A-share listed firms from 2011 to 2023 as the research sample, with the following screening procedures: excluding ST, *ST and PT firms to avoid interference from abnormally operating samples; excluding financial industry firms due to significant differences in their business characteristics from other industries; excluding firms with missing key variables to ensure data integrity; and performing 1% two-tailed winsorization on continuous variables to reduce the impact of extreme values. Finally, 15301 firm-year observations are obtained. Among them, environmental performance data is sourced from the Wind database, other financial data from the CSMAR database, environmental attention data through text analysis of municipal government work reports, and municipal-level data from the China City Statistical Yearbook.

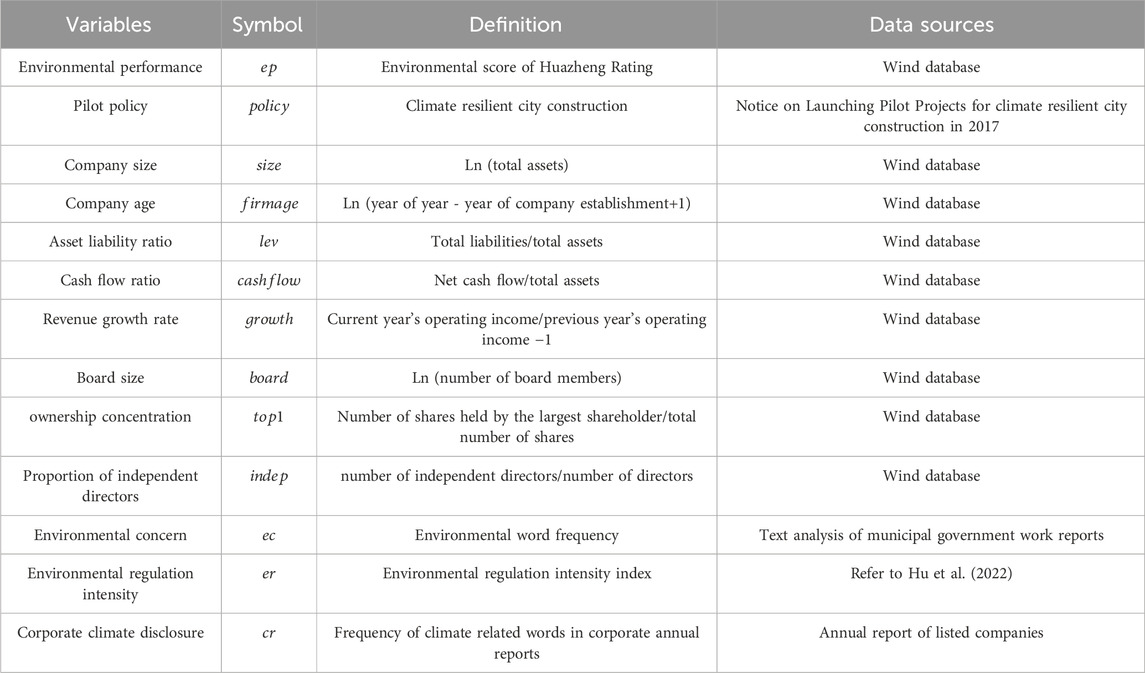

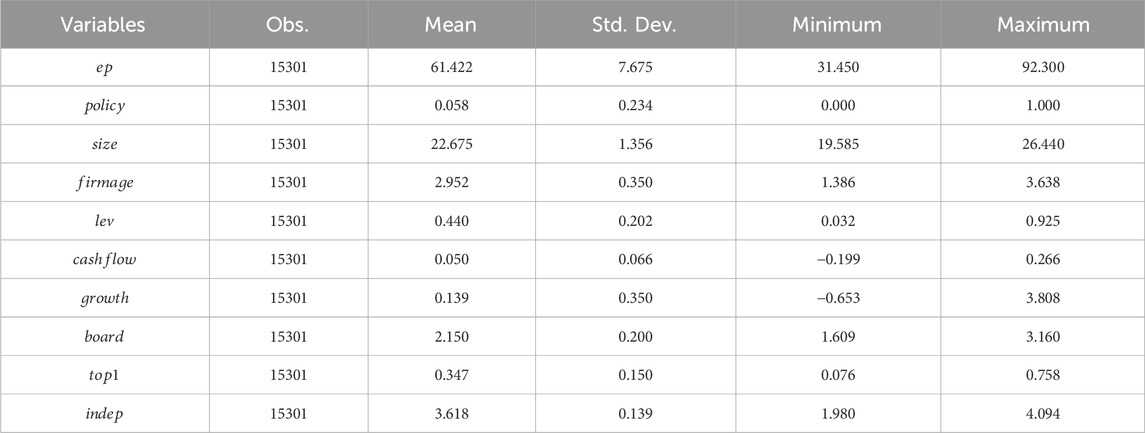

3.2 Variable definitions

3.2.1 Explained variable

This paper selects corporate environmental performance (EP) as the explained variable. Referring to the research method of (Li C et al., 2024; Li P et al., 2024), it uses the E score in the environmental dimension of Huazheng ESG rating for measurement. The selection of this indicator is mainly based on three considerations: first, Huazheng ESG rating covers all A-share listed firms in China, and its environmental dimension indicator design is closely combined with the current environmental policy orientation and the actual characteristics of Chinese firms, which can better reflect the current situation of environmental governance of domestic firms; second, the rating sets 5 secondary indicators in the environmental dimension, including climate change, resource utilization, environmental pollution, environmental friendliness and environmental management, covering 17 tertiary indicators such as greenhouse gas emissions and carbon emission reduction routes, which comprehensively depict corporate environmental behaviors and performance from multiple dimensions and avoid the limitations of a single indicator; third, compared with the rating forms adopted by some databases, the environmental score of Huazheng ESG is presented as a specific value, which is easier to capture the subtle differences in environmental performance between firms, and its evaluation system takes into account industry characteristics, making the measurement of environmental performance of different types of firms more targeted (Fang and Hu, 2023).

3.2.2 Explanatory variable

The core explanatory variable of this paper is the impact of the pilot policy for CRCC, which is reflected by the interaction term of the policy dummy variable and the time dummy variable. In 2017, China launched the pilot project for CRCC to explore paths and models for such construction. The policy dummy variable is divided according to whether a city is a pilot city: 28 pilot cities are set as 1, and other cities as 0; the time dummy variable is bounded by 2017: the years 2017 and later are set as 1, and the years before 2017 as 0. This interaction term is the core explanatory variable, and its coefficient can indicate the specific impact degree of the pilot policy for CRCC on the research object.

3.2.3 Control variables

To mitigate the endogeneity issue caused by omitted variables, we refer to the practices of Chen et al. (2024), Wang H. et al. (2024) and introduce the following control variables into the model. Firm size (

3.2.4 Mediating variables

Based on the previous theoretical analysis, the mechanism variables selected in this paper specifically include: urban environmental attention (

Among them,

3.3 Model specification

This paper regards the construction of climate-resilient cities as a quasi-natural experiment and uses the difference-in-differences method to evaluate its impact on corporate environmental performance. Firms included in the pilot scope of climate-resilient cities are taken as the experimental group, and those not included in the pilot scope as the control group. The net effect of the policy is identified by comparing the differences in environmental performance between the two groups of firms before and after the implementation of the policy. Meanwhile, to control the potential impact of individual firm characteristics and time trends on the estimation results, firm fixed effects and year fixed effects are introduced into the model, as shown in Equation 4.

In the formula,

4 Results

4.1 Benchmarkregression result

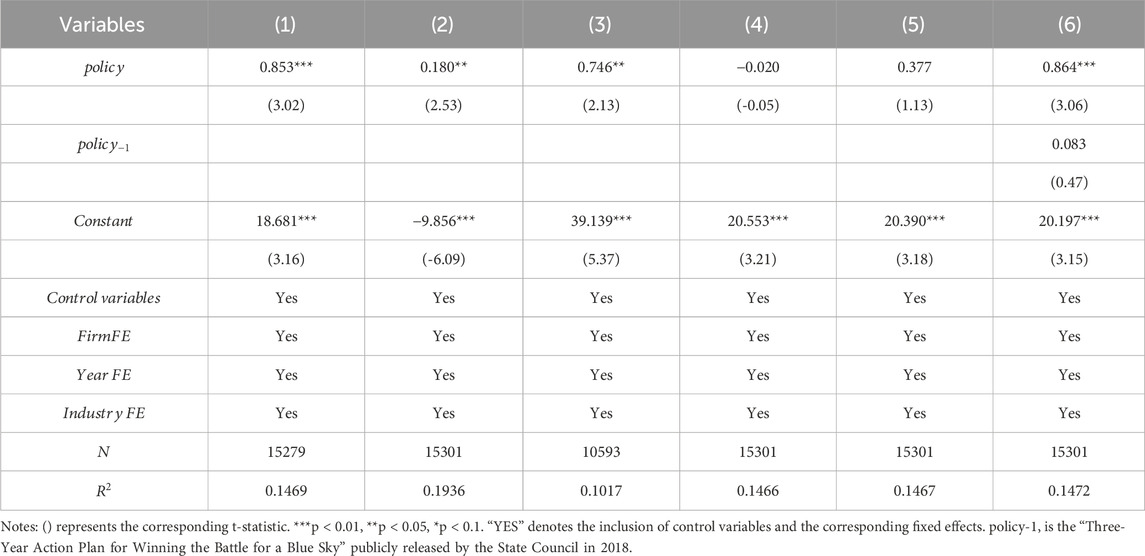

Based on the panel data of A-share listed firms from 2011 to 2023, this study employs a DID model with triple fixed effects (firm, industry, and year) to empirically test the impact of CRCC on corporate environmental performance. The regression results are presented in Table 3. Column (1) only includes the core explanatory variable without any controls, and the coefficient of

Observing the control variables in Column (4) of Table 3, the estimated coefficient of

4.2 Robustness checks

4.2.1 Parallel trends test

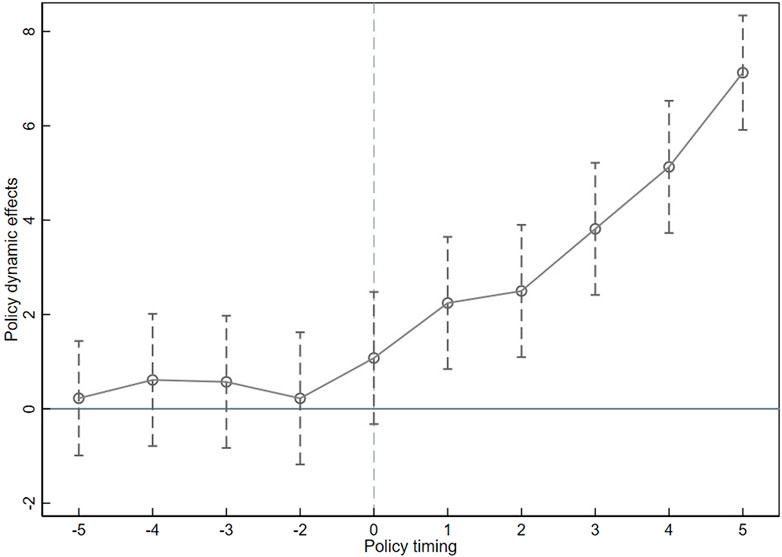

In evaluating the impact of the pilot policy for CRCC on corporate environmental performance, the effectiveness of the difference-in-differences (DID) method is highly dependent on the satisfaction of the parallel trend assumption, which is the core premise for ensuring the reliability of causal inference. This assumption requires that before the implementation of the policy, the environmental performance of firms in pilot cities (as the experimental group) and those in non-pilot cities (as the control group) should show similar changing trends. Considering that CRCC, as a long-term policy, may have a dynamically persistent impact on corporate environmental behaviors, this paper refers to the research method of (Roth et al., 2023) and constructs a dynamic effect model through the event study method to test whether the parallel trend holds.

Figure 3 presents the results of the parallel trend test. Before the implementation of the CRCC (t < 0), the estimated coefficients of the interaction terms between the policy dummy variable and the year fluctuated around zero, and the 95% confidence intervals all included zero. This indicates that before the policy implementation, there was no significant systematic difference in corporate environmental performance between pilot cities and non-pilot cities, and the two groups of samples satisfied the parallel trend assumption. In the year of policy implementation and thereafter (t ≥ 0), the estimated coefficients of the interaction terms turned into significantly positive values, and the confidence intervals no longer included zero, indicating that after the policy implementation, the environmental performance of firms in pilot cities showed a significant improvement compared with those in the control group. It further verifies that the promoting effect of the CRCC policy on corporate environmental performance has dynamic effectiveness. In conclusion, the sample selection of this study satisfies the parallel trend assumption, and the benchmark regression results have a robust basis for causal inference.

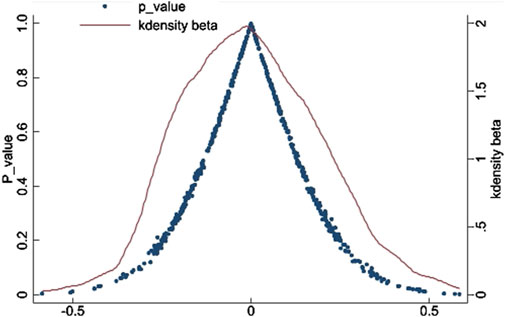

4.2.2 Placebo test

To rule out the interference of unobservable factors or omitted variables on the benchmark results, this paper further adopts a placebo test. By randomly assigning policy pilot cities and constructing a false policy variable based on this, 500 regressions are repeated to obtain the corresponding distribution of estimated coefficients (see Figure 4). The results show that the mean value of the estimated coefficients of the false policy variable is close to 0, and most of the coefficients are concentrated around 0. Meanwhile, the true coefficient of the core explanatory variable in the benchmark regression is in an extreme position in the coefficient distribution of the placebo test, indicating that the benchmark regression results are not driven by random factors or unobservable omitted variables.

4.2.3 Excluding sample selection bias

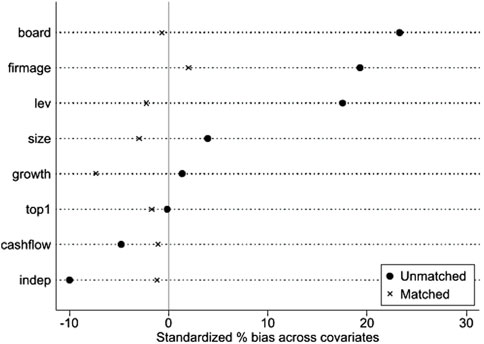

To eliminate the potential interference of sample selection bias on the estimation results and ensure the accuracy of policy effect estimation, this paper uses the Propensity Score Matching (PSM)-DID model for robustness testing. This method effectively mitigates the selection bias caused by differences in individual firm characteristics by constructing a control group sample with similar characteristics to the experimental group firms, thereby enhancing the reliability of policy effect identification. Figure 5 presents the bias distribution of the treatment group and the control group before and after matching. The results show that the standardized bias of each covariate is significantly reduced after matching, indicating that the systematic differences in firm characteristics between the two groups of samples have been effectively eliminated. The benchmark model is re-estimated based on the matched samples, and the regression results are shown in column (1) of Table 4. The coefficient of the core explanatory variable

4.2.4 Other robustness tests

(1) Replacing the measurement method of environmental performance. To enhance the reliability of the research conclusions and avoid the limitations that may exist due to the use of a single indicator for measurement, this section conducts a robustness test by changing the measurement method of corporate environmental performance (EP). With reference to existing studies, a new environmental performance indicator is constructed using the comprehensive scoring method based on the ENV database of CSMAR, covering 9 secondary indicators such as environmental protection concepts, environmental protection goals, and environmental protection management systems. Each indicator is scored 1 if satisfied and 0 if not, and the total score serves as the new proxy variable for EP. According to the regression results in column (2) of Table 4, the coefficient of the core explanatory variable

(2) Adjusting the time window. To further rule out the potential interference of the sample time span on the estimation results, this paper conducts a robustness test by limiting the sample time window to 2014–2022. The selection of this interval mainly considers that a certain observation period should be retained before and after the policy was launched in 2017, while avoiding the bias that may be caused by samples in the earlier period (2011–2013) which have weak correlation with the policy. This setting not only retains the complete observation period before and after the policy implementation, but also avoids the heterogeneous fluctuations that may be introduced by too long a time series. The results of re-regression based on the adjusted samples are shown in column (3) of Table 4. The coefficient of the core explanatory variable

(3) Counterfactual test. To rule out the interference of potential time trends or other unobserved factors before the policy implementation on the estimation results, this paper adopts a counterfactual test method. The hypothetical implementation time of CRCC is advanced to 2013 and 2014 respectively, and false policy variables are constructed and included in the benchmark model for re-regression. The results are shown in columns (4)–(5) of Table 4. It can be seen that the estimated coefficients of the two false policy variables are −0.020 and 0.377 respectively, and neither passes the significance test. This indicates that before the actual implementation of the policy, the difference in corporate environmental performance between pilot and non-pilot cities was not driven by some potential trends, further supporting that the promoting effect of CRCC on corporate environmental performance is real, rather than caused by other time-related factors.

(4) Excluding the impacts of other policies. Considering that the “Three-Year Action Plan for Winning the Blue Sky Defense War” issued by the State Council in 2018 may have a concurrent impact on corporate environmental behaviors, this paper incorporates this policy variable (

4.3 Mechanism test

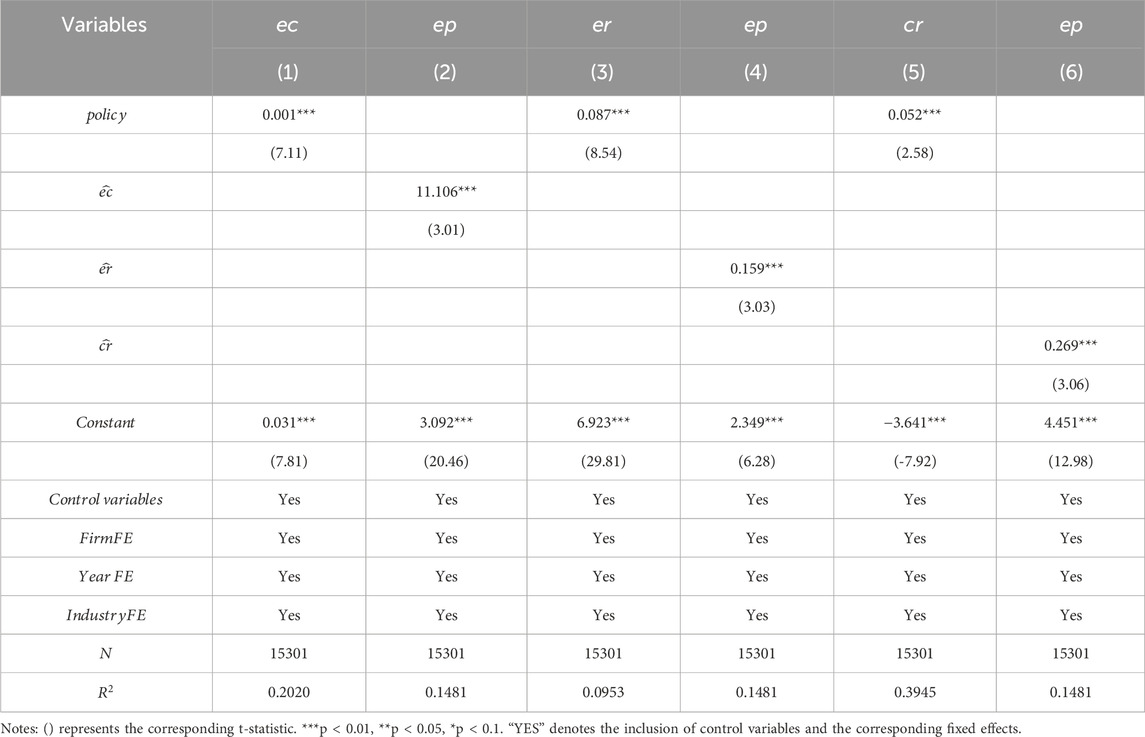

To further reveal the mechanism through which CRCC affects corporate environmental performance, this paper conducts a mechanism analysis from three dimensions: environmental attention, environmental regulation intensity, and corporate climate risk attention based on the two-stage regression method. Specifically, Equation 5 is first used to verify the impact of CRCC on mediating variables, and then Equation 6 is used to test the effect of the estimated values of mediating variables on corporate environmental performance. If the coefficients of both stages are significantly positive, it indicates that this influence channel is valid. Referring to the practices of Duan et al. (2021) and Di Giuli and Laux (2022), the following econometric models are constructed:

Among them,

Column (1) shows that the regression coefficient of the policy variable (

Column (3) shows that the coefficient of the policy variable (

Column (5) shows that the coefficient of the policy variable (

4.4 Heterogeneity analysis

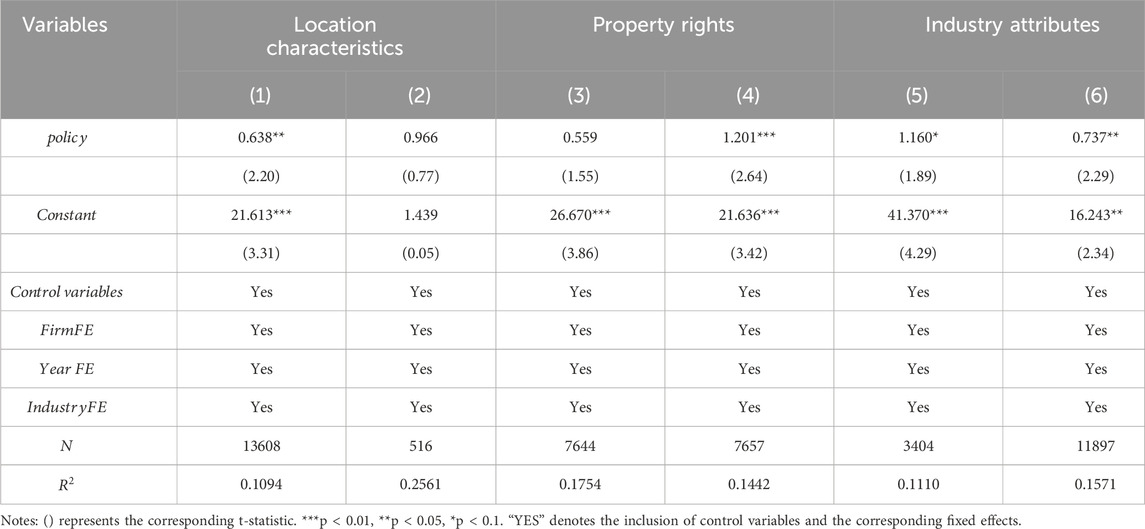

4.4.1 Geographical location heterogeneity

The “Hu Huanyong Line” is an important geographical boundary that reflects differences in population density, economic activities, and natural environments in China, and can indicate significant disparities in resource endowments and development foundations across different regions. Therefore, this paper divides the sample into the southeast region and the northwest region using the “Hu Huanyong Line” as the boundary. The regression results in columns (1)–(2) of Table 6 show significant differences. The policy coefficient in the southeast region is significantly positive, indicating that CRCC has an obvious promoting effect on corporate environmental performance in this region; while the policy coefficient in the northwest region fails the significance test, indicating that the policy effect has not yet emerged. This difference may stem from two reasons: first, the southeast region has a high economic density and a good foundation for environmental governance, and firms have a stronger ability to respond to policy signals. This region has a high degree of industrial agglomeration, more mature environmental regulation enforcement and social supervision atmosphere, and firms have more sufficient motivation and conditions to improve environmental behaviors (Li et al., 2016). Second, the northwest region has a fragile ecological environment but faces greater pressure for economic development. Some firms may find it difficult to quickly respond to climate resilient policies due to cost constraints, and the coverage of policy pilots is limited, failing to form a scale effect. In addition, most cities in the southeast are climate risk-sensitive areas, where the urgency and pertinence of policy implementation are stronger, and corporate investment in environmental governance is more likely to be converted into performance improvement (Shao et al., 2024).

4.4.2 Heterogeneity in property rights attributes

State-owned firms and non-state-owned firms differ essentially in terms of governance structure, goal orientation, and market constraints, and these differences may lead to variations in the intensity and manner of response to policies. Columns (3)–(4) of Table 6 report the regression results for different property rights attributes. It can be found that the policy coefficient for non-state-owned firms is 1.201, which is significant at the 1% level, while the coefficient for state-owned firms is 0.559 and does not pass the significance test, indicating that the policy has a more prominent role in promoting the environmental performance of non-state-owned firms. This result is closely related to the differences in the governance logic of the two types of firms. Non-state-owned firms face more direct market competition pressure. The strengthening of environmental regulations and the improvement of social attention brought about by CRCC will force them to reduce compliance costs and maintain brand reputation by improving environmental performance. At the same time, non-state-owned firms have shorter decision-making chains and are more flexible in adjusting to policy signals, enabling them to quickly convert environmental protection investments into actual benefits. In contrast, although state-owned firms assume more social responsibilities, their improvement in environmental performance may be constrained by the balance of multiple goals due to more administrative interventions in their governance structure, and some firms are in monopoly industries with relatively weak market competition pressure, resulting in a relatively limited policy-driven effect (Xu et al., 2024).

4.4.3 Heterogeneity in industry attributes

Heavily polluting industries and non-heavily polluting industries differ significantly in environmental impact, regulatory intensity, and emission reduction potential, and policies may have different constraints and guiding effects on the two types of industries. According to the regression results in columns (5)–(6) of Table 6, after classification by industry attributes, the policy coefficient for heavily polluting industries is 1.160, and that for non-heavily polluting industries is 0.737, indicating that the policy has a promoting effect on both types of industries, but the effect is more significant in heavily polluting industries. The strong response characteristic of heavily polluting industries is in line with the logic of the “Porter Hypothesis”. Heavily polluting industries already face stricter environmental regulations, and CRCC further strengthens emission reduction requirements and technical standards, forcing firms to improve environmental performance through equipment upgrading and process improvement (Tian et al., 2024). At the same time, it also promotes them to convert environmental protection costs into motivation for technological innovation. Wang and Hui (2024) finds that the negative impact of climate risk on firm value is more pronounced for firms in heavily polluting industries, which further emphasizes the importance of CRCC in promoting environmental performance improvement of heavily polluting firms. Although non-heavily polluting industries face relatively less environmental pressure, heightened public environmental awareness and the policy-driven shift toward green consumption incentivize them to enhance performance by optimizing resource utilization and improving environmental management systems, aligning with the overall orientation of urban green transformation.

5 Conclusion and policy recommendations

This paper takes the pilot policy of CRCC as a quasi-natural experiment, using panel data of Chinese A-share listed firms from 2011 to 2023 and the DID method to empirically examine the impact of CRCC on corporate environmental performance. Through mechanism tests, heterogeneity analysis, and robustness tests, the key findings are as follows: First, CRCC significantly improves corporate environmental performance. This conclusion remains valid after rigorous robustness tests, including parallel trend test, placebo test, PSM-DID, replacement of explained variables, adjustment of time window, counterfactual test, and exclusion of interference from other policies. Second, mechanism analysis identifies three transmission channels: CRCC enhances urban environmental attention, strengthens environmental regulation intensity, and promotes corporate climate risk disclosure, thereby improving corporate environmental performance. These channels form a multi-dimensional driving force for firms to improve their environmental performance. Third, heterogeneity tests show that the policy effect is more pronounced in cities on the southeast side of the “Hu Huanyong Line”, non-state-owned firms, and heavily polluting industries, reflecting the differential impact of CRCC under heterogeneous conditions. Based on the above conclusions, the following policy recommendations are put forward:

Firstly, on the basis of existing pilot achievements, expand the scope of CRCC pilot cities, with special attention to cities on the northwest side of the “Hu Huanyong Line”. Corporate environmental performance should be incorporated as a key indicator in evaluating urban climate resilience capacity building, with strengthened linkages between policies and corporate behaviors. In view of the regional differences in the intensity of environmental regulations, guide developed cities in the southeast coast to provide experience, technology and talent support to northwest cities, so as to improve the environmental supervision level in northwest China. At the same time, considering the differences in economic development, industrial structure and corporate characteristics in various regions, further explore a policy tool system suitable for local climate response capacity building.

Secondly, accurately advance environmental regulation and guidance mechanisms to form endogenous motivation for firms to protect the environment. Non-state-owned firms are relatively sensitive to climate governance policies. While strictly enforcing environmental protection laws and regulations to ensure that violations are punished, policy support such as priority in green credit, tax reductions and exemptions, and innovation subsidies can be provided to non-state-owned firms that actively improve their environmental performance. In addition, advocate that large state-owned firms incorporate strict environmental standards into supply chain management to drive upstream and downstream non-state-owned firms to improve their environmental performance. At the same time, guide consumers to choose green products, forcing firms to pay more attention to environmental performance from the demand side. For heavily polluting firms, carry out dynamic rating of environmental performance, provide policy incentives and regulatory convenience to firms with high environmental performance, and adopt strict regulatory measures for firms with low environmental performance. In addition, formulate policy measures for the rectification of heavily polluting firms, set reasonable environmental performance goals, and help firms transform towards green and low-carbon development.

Thirdly, comprehensively enhance climate risk management capabilities and consolidate the environmental information disclosure and support system. On the basis of existing environmental responsibility reports, listed firms are required to disclose in detail the substantial climate-related risks and opportunities they face in batches. For non-listed firms, mandatory or encouraging disclosure requirements should be gradually implemented. At the same time, governments, industry associations, etc. should develop and promote practical climate risk assessment tools and management standards, and carry out special training for firm management and environmental protection responsible persons to improve their attention, cognition and management capabilities of climate risks. In addition, encourage financial institutions to develop financial products linked to climate risks, and use market-oriented mechanisms to promote firms to effectively manage climate risks and improve environmental performance.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

ZL: Methodology, Resources, Writing – review and editing. KB: Data curation, Software, Writing – review and editing. XH: Conceptualization, Writing – original draft. CG: Methodology, Writing – original draft. YW: Supervision, Writing – review and editing. TZ: Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work has been supported by the Excellent Youth funding of Hunan Provincial Education Department (23B0600, 22B0649), General Project of the Hunan Provincial Social Science Achievement Evaluation Committee (XSP2023JJZ010).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acquah, I. S. K., Quaicoe, J., and Gatsi, J. G. (2024). Modelling circular economy capabilities and sustainable manufacturing practices for environmental performance: assessing linear (PLS-SEM) and non-linear (fsQCA) effects. Technol. Forecast. Soc. Change 205, 123501. doi:10.1016/j.techfore.2024.123501

Aibar-Guzmán, B., Raimo, N., Vitolla, F., and García-Sánchez, I. M. (2024). Corporate governance and financial performance: reframing their relationship in the context of climate change. Corp. Soc. Responsib. Environ. Manag. 31 (3), 1493–1509. doi:10.1002/csr.2649

Akpuokwe, C. U., Adeniyi, A. O., Bakare, S. S., and Eneh, N. E. (2024). Legislative responses to climate change: a global review of policies and their effectiveness. Int. J. Appl. Res. Soc. Sci. 6 (3), 225–239. doi:10.51594/ijarss.v6i3.852

Amirtham, L. R., and K. C., K. A. (2024). Impact of semi-private open spaces on outdoor thermal comfort in a residential neighbourhood in warm humid climate. Geol. Ecol. Landsc., 1–12. doi:10.1080/24749508.2024.2359777

Cevik, S., and Miryugin, F. (2023). Rogue waves: climate change and firm performance. Comp. Econ. Stud. 65, 29–59. doi:10.1057/s41294-022-00189-0

Chen, C., Yan, Y., Jia, X., Wang, T., and Chai, M. (2024). The impact of executives’ green experience on environmental, social, and governance (ESG) performance: evidence from China. J. Environ. Manag. 366, 121819. doi:10.1016/j.jenvman.2024.121819

Chen, G., Wang, J., and Zhao, X. (2023). Impact of climate transition risks on corporate default rates. J. Manag. Sci. 36 (03), 144–159. doi:10.3969/j.issn.1672-0334.2023.03.010

Chen, G., Xu, X., and Zhao, X. (2025). The propagation of natural disaster shocks in production-finance network linkages. Syst. Eng.-Theory Pract., 1–19. doi:10.12011/SETP2024-1488

Chen, X., Yi, N., Zhang, L., and Li, D. (2018). Does institutional pressure foster corporate green innovation? Evidence from China's top 100 companies. J. Clean. Prod. 188, 304–311. doi:10.1016/j.jclepro.2018.03.257

Dahlmann, F., Branicki, L., and Brammer, S. (2019). Managing carbon aspirations: the influence of corporate climate change targets on environmental performance. J. Bus. Ethics 158 (1), 1–24. doi:10.1007/s10551-017-3731-z

Di Giuli, A., and Laux, P. A. (2022). The effect of media-linked directors on financing and external governance. J. Financ. Econ. 145 (2), 103–131. doi:10.1016/j.jfineco.2021.07.017

Dong, X., and Yu, M. (2024). Green bond issuance and green innovation: evidence from China's energy industry. Int. Rev. Financ. Anal. 94, 103281. doi:10.1016/j.irfa.2024.103281

Dong, Z., Wang, B., and Shao, C. (2025). The historical evolution and modernization path of China’s ecological and environmental governance. Energy Environ. sustain. 1 (2), 100014. doi:10.1016/j.eesus.2025.100014

Duan, Y., El Ghoul, S., Guedhami, O., Li, H., and Li, X. (2021). Bank systemic risk around COVID-19: a cross-country analysis. J. Bank. Finance 133, 106299. doi:10.1016/j.jbankfin.2021.106299

Fang, X., and Hu, D. (2023). Corporate ESG performance and innovation: empirical evidence from A-share listed companies. Econ. Res. J. 58, 91–106. Available online at: https://libproxy.hutb.yitlink.com:8444/https/443/net/cnki/kns/yitlink/kcms2/article/abstract?v=liLFU49ICVuIZV8riwSBfIPIiqpee_3RMEYuB2VqOA5zaeRGgeQ-Z-fur2IELWaVYQiRFmemtZkeybJQIpxYUXWtOZ4dOvTdDDHAnMCHSQ4L8rEuCR6bPXeB5pJAr782IS0S5iso2xnXESue5qA4TnYI8fb43yglKp4Wx_QOW6BbPz_kwAnIWw==&uniplatform=NZKPT&language=CHS.

Feng, J., Yan, J., and Tao, X. (2021). Exposing the effects of environmental regulations on China’s green total factor productivity: results from econometrics analysis and machine learning methods. Front. Environ. Sci. 9, 779358. doi:10.3389/fenvs.2021.779358

Ge, H. H., and Zhang, X. X. (2025). From uncertainty to sustainability: how climate policy uncertainty shapes corporate ESG. Int. Rev. Econ. Financ. 98, 104011. doi:10.1016/j.iref.2025.104011

He, S., Zhao, W., Li, J., Liu, J., and Wei, Y. (2023). How environmental leadership shapes green innovation performance: a resource-based view. Heliyon 9 (7), e17993. doi:10.1016/j.heliyon.2023.e17993

He, W., Guo, X., and Zhang, C. (2025). Assessing the impact of climate-resilient city development on urban sustainability: evidence from China. Sustainability 17, 4381. doi:10.3390/su17104381

Hu, S., Bao, H., Hao, J., and Zeng, G. (2022). Research on the impact of environmental regulation on urban green development in the Yangtze River Delta: an analysis of intermediary mechanism based on technological innovation. J. Nat. Resour. 37 (5), 1572–1585. doi:10.31497/zrzyxb.20220614

Lee, C., Kuo, S., Hsu, H., Mo, T., Chang, E., and Huang, K. (2023). How does the research community contribute to corporate climate-related risk disclosures? The gap between ideals and reality. Corp. Soc. Responsib. Environ. Manag. 30 (2), 927–940. doi:10.1002/csr.2397

Li, C., Tang, W., Liang, F., and Wang, Z. (2024). The impact of climate change on corporate ESG performance: the role of resource misallocation in enterprises. J. Clean. Prod. 445, 141263. doi:10.1016/j.jclepro.2024.141263

Li, P., Zou, H., Coffman, D. M., Mi, Z., and Du, H. (2024). The synergistic impact of incentive and regulatory environmental policies on firms’ environmental performance. J. Environ. Manag. 365, 121646. doi:10.1016/j.jenvman.2024.121646

Li, X., Wang, S., and Hao, L. (2016). Environmental regulation, innovation-driven, and changes in inter-provincial carbon productivity in China. J. China Univ. Geosci. Soc. Sci. Ed. 16 (1), 44–54. doi:10.16493/j.cnki.42-1627/c.2016.01.005

Liu, J., Zou, Z., and Qiu, G. (2021). Impact of environmental regulation on industry green total factor productivity: mediating effect of short-term liquidity. Acta Sci. Nat. Univ. Pekin. 57 (1), 189–198. doi:10.13209/j.0479-8023.2020.122

Liu, L., Beirne, J., Azhgaliyeva, D., and Rahut, D. (2024). Climate change and corporate financial performance. J. Risk Financ. Manag. 17 (7), 267. doi:10.3390/jrfm17070267

Liu, X., Cifuentes-Faura, J., Zhao, S., and Wang, L. (2023). Government environmental attention and carbon emissions governance: firm-level evidence from China. Econ. Anal. Policy 80, 121–142. doi:10.1016/j.eap.2023.07.016

Lu, D., Meng, T., Lau, Y., and Ong, T. (2025). Mechanisms of investor attention in enhancing ESG performance: evidence from Chinese listed companies. Discov. Glob. Soc. 3 (1), 66. doi:10.1007/s44282-025-00218-0

Mao, Y., Li, Z., Rui, S., Wu, G., Fu, X., Tian, Y., et al. (2024). Changes and divergences of urban climate adaptability in Pearl River Delta: spatiotemporal patterns and driving forces. Int. J. Sustain. Dev. World Ecol. 31 (7), 912–928. doi:10.1080/13504509.2024.2345222

Meng, X., Kong, F., Fu, H., Li, S., and Zhang, K. (2024). Is more always better? How government ecological attention influences corporate environmental responsibility: empirical evidence from Chinese listed companies. Ecol. Indic. 159, 111686. doi:10.1016/j.ecolind.2024.111686

Nassar, E. T., Elgazouly, H. G., Elnaggar, A. M., and Ayyad, S. M. (2024). Exploring climate change tackling in slums integrating ArcGIS data management and slums regenerative development model: case study of El Kharga city – egypt. Geol. Ecol. Landsc., 1–11. doi:10.1080/24749508.2024.2441017

Ross, S. A. (1977). The determination of financial structure: the incentive-signalling approach. Bell J. Econ. 8 (1), 23–40. doi:10.2307/3003485

Roth, J., Sant’Anna, P. H., Bilinski, A., and Poe, J. (2023). What’s trending in difference-in-differences? A synthesis of the recent econometrics literature. J. Econ. 235 (2), 2218–2244. doi:10.1016/j.jeconom.2023.03.008

Shahzad, M. F., Xu, S., An, X., Asif, M., and Jafri, M. A. H. (2024). Effect of stakeholder pressure on environmental performance: do virtual CSR, green credit, environmental and social reputation matter? J. Environ. Manag. 368, 122223. doi:10.1016/j.jenvman.2024.122223

Shao, S., Ge, L., and Zhu, J. (2024). How to achieve the harmony between humanity and nature: environmental regulation and environmental welfare performance from the perspective of geographical factors. J. Manag. World 40 (8), 119–146. doi:10.19744/j.cnki.11-1235/f.2024.0088

Sun, Y., Yang, Y., Huang, N., and Zou, X. (2020). The impacts of climate change risks on financial performance of mining industry: evidence from listed companies in China. Resour. Policy 69, 101828. doi:10.1016/j.resourpol.2020.101828

Tang, H., Tong, M., and Chen, Y. (2024). Green investor behavior and corporate green innovation: evidence from Chinese listed companies. J. Environ. Manag. 366, 121691. doi:10.1016/j.jenvman.2024.121691

Tian, J., Li, T., and Yang, X. (2024). Environmental regulation intensity and ESG rating quality. Rev. Econ. Manag. 40, 58–69. doi:10.13962/j.cnki.37-1486/f.2024.06.005

Wang, H., Rispens, S., and Demerouti, E. (2024c). Boosting firm environmental performance: the roles of top management team functional diversity, environmental disclosures, and government subsidy. Group Organ. Manag. 49 (5), 10596011241257029. doi:10.1177/10596011241257029

Wang, Q., and Hui, Y. (2024). Impact of climate risks on firm value. China Popul. Resour. Environ. 34, 22–31. doi:10.12062/cpre.20240711

Wang, S., Feng, T., Fan, S., and Balezentis, T. (2024a). Traversing the Jevons Paradox: the dual role of residential photovoltaic systems in electricity conservation and increased consumption in an emerging economy. J. Clean. Prod. 483, 144264. doi:10.1016/j.jclepro.2024.144264

Wang, S., Wang, Y., Fan, S., Shahbaz, M., Guo, X., and Yu, R. (2024b). Does residential photovoltaic installation matter for coal-to-electricity transition? Evidence from self-determination theory perspective. Curr. Psychol. 43, 24622–24637. doi:10.1007/s12144-024-06152-9

Wei, R., Yu, Z., and Zhen, D. (2025). The differentiated effect of China's new environmental protection law on corporate ESG performance. Econ. Anal. Policy 85, 2126–2141. doi:10.1016/j.eap.2025.02.035

Wu, C., Wang, R., Lu, S., Tian, J., Yin, L., Wang, L., et al. (2025). Time-series data-driven PM2.5 forecasting: from theoretical framework to empirical analysis. Atmosphere 16 (3), 292. doi:10.3390/atmos16030292

Xu, Y., Song, Y., and Shen, Y. (2024). Can local governments’ environmental governance target constraints improve corporate ESG quality? Empirical evidence based on textual analysis. China Popul. Resour. Environ. 34, 137–150. doi:10.12062/cpre.20230901

Xue, M., Lu, M., Du, A. M., and Zheng, B. (2025). How do firms respond to climate change? evidence based on ESG performance. Int. Rev. Econ. Finance, 98, 103863. doi:10.1016/j.iref.2025.103863

Yao, K., Lai, C., Shyr, W., Chou, D., and Huang, K. (2025). Exploring key factors influencing ESG commitment: evidence from Taiwanese listed companies. Sustainability 17 (13), 6208. doi:10.3390/su17136208

You, J., Yu, M., Cao, X., and Wu, X. (2024). Government environmental concern and corporate environmental governance: based on the perspective of textual analysis about government work reports. Manag. Rev. 36 (5), 235–247. doi:10.14120/j.cnki.cn11-5057/f.2024.05.018

Yu, C. Y., Zhao, X. Y., and Zhang, Z. F. (2025). The effect of pilot climate-adapted city policy on urban sustainability: an empirical analysis based on difference-in-differences model. Acta Ecol. Sin. (20), 1–12. doi:10.20103/j.stxb.202504040784

Zeng, H., Chen, X., Xu, X., and Zhou, Z. (2017). Institutional pressures, sustainable supply chain management, and circular economy capability: empirical evidence from Chinese eco-industrial park firms. J. Clean. Prod. 155, 54–65. doi:10.1016/j.jclepro.2016.10.093

Zhang, S., and Gan, H. (2024). Is carbon emission trading a green blessing or a curse for firm performance in China? A quasi-experiment design and exploring the spatial spillover effect. Environ. Sci. Pollut. Res. 31 (46), 56736–56752. doi:10.1007/s11356-023-28511-y

Zhang, Y., Hu, H., Zhu, G., and You, D. (2023a). The impact of environmental regulation on enterprises’ green innovation under the constraint of external financing: evidence from China’s industrial firms. Environ. Sci. Pollut. Res. 30 (15), 42943–42964. doi:10.1007/s11356-022-18712-2

Zhang, Y., Zhang, Y., and Sun, Z. (2023b). The impact of carbon emission trading policy on enterprise ESG performance: evidence from China. Sustainability 15, 8279. doi:10.3390/su15108279

Zhang, Z. Q., Yao, M. Q., and Zheng, Y. (2024). Impact of the pilot policy for constructing climate resilient cities on urban resilience. China Popul. Resour. Environ. 34 (4), 1–12. doi:10.12062/cpre.20230604

Zheng, H., and Ye, A. (2023). Direct imitation or indirect reference? Research on peer effects of enterprises’ green innovation. Environ. Sci. Pollut. Res. 30 (14), 41028–41044. doi:10.1007/s11356-023-25184-5

Zhong, S., Xiong, Y., and Xiang, G. (2021). Environmental regulation benefits for whom? Heterogeneous effects of the intensity of the environmental regulation on employment in China. J. Environ. Manag. 281, 111877. doi:10.1016/j.jenvman.2020.111877

Keywords: climate resilient city construction, corporate environmental performance, green transformation, difference-in-differences method, influencing mechanism

Citation: Lu Z, Bao K, Hu X, Gao C, Wen Y and Zhang T (2025) Climate governance action and corporate environmental performance: evidence from climate resilient city construction. Front. Environ. Sci. 13:1651610. doi: 10.3389/fenvs.2025.1651610

Received: 22 June 2025; Accepted: 21 July 2025;

Published: 05 August 2025.

Edited by:

Yuanjun Zhao, Nanjing Audit University, ChinaReviewed by:

Jinxuan Ling, Macau University of Science and Technology, Macao SAR, ChinaQianqian Huang, Shanghai Jiao Tong University, China

Shali Wang, Guizhou University of Engineering Science, China

Yao Yao, Heihe Municipal People’s Government, China

Qing Xia, China University of Mining and Technology, China

Copyright © 2025 Lu, Bao, Hu, Gao, Wen and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiliang Hu, eGlsaWFuZzEzMEAxMjYuY29t; Chen Gao, Z2FvYzkyMDZAMTYzLmNvbQ==

Zhihan Lu1

Zhihan Lu1 Xiliang Hu

Xiliang Hu Chen Gao

Chen Gao Ya Wen

Ya Wen