- Institute of Dual Carbon Industry, Shanxi University of Finance and Economics, Taiyuan, China

Carbon emission reduction is crucial for high-quality development and realization of China’s “dual-carbon” goal. Based on the data taken from Chinese A-share listed companies from 2013 to 2023, this article examines the effect and mechanism of ESG performance on corporate carbon emission intensity. The results show that high ESG performance has a significant effect on corporate carbon emission reduction, and this conclusion still holds after the robustness test and endogenous analysis. The potential mechanism suggests that ESG performance significantly reduces carbon emission by improving the green technology innovation and total factor productivity. The heterogeneity test indicates that the carbon intensity reduction effect induced by ESG performance improvement is particularly pronounced in manufacturing enterprises, enterprises located in Eastern China, and state-owned enterprises. The results of the study lead to the conclusion that companies should deeply integrate their own strategic blueprints with ESG concepts to improve the level of green technological innovation and total factor productivity, thus promoting China’s accelerated realization of carbon reduction and emission reduction goals.

1 Introduction

In recent years, the rapid advancement of global economic integration has attracted much attention to the issue of sustainable development. Enterprises, as the main driving force of economic activities, are the main body of natural resource consumption and also the key force to promote green production and achieve carbon reduction and emission mitigation goals (Li et al., 2019). On 30 July 2024, the General Office of the State Council officially issued the “Work Plan for Accelerating the Establishment of a Dual Control System for Carbon Emissions”. The plan focuses on optimizing the management of energy conservation and carbon reduction in enterprises and sets the following goal: by 2025, the statistical accounting system of carbon emissions will be significantly enhanced, and a series of carbon emission accounting standards for industrial enterprises and product carbon footprint standards will be developed and implemented. In this context, identifying actionable pathways to facilitate corporate compliance with carbon emission standards and the attainment of decarbonization objectives becomes particularly imperative. The present research provides theoretical–practical empowerment for emission reduction initiatives, playing a vital role in supporting China’s critical national strategies of “carbon peaking” and “carbon neutrality”.

Driven by the “dual carbon” goals, China has actively explored the field of ESG, fostering the in-depth development and application of the ESG concept. Consequently, ESG has gradually emerged as a major concern. The origins of ESG trace back to socially responsible investment (SRI) in the 1970s, also known as “sustainable development and socially responsible investment”. As its core, ESG asserts that when selecting an enterprise for investment, one should not only assess its financial performance but also consider its fulfillment of corporate social responsibility (Beisenbina et al., 2023).

In 2004, the United Nations formally proposed the concept of ESG, which marked that the international community began to attach importance to the environmental performance (E), social contribution (S), and corporate governance performance (G) of enterprises and considered them important indicators to evaluate the value of enterprises (Li et al., 2021). The environmental aspect focuses on the enterprise’s environmental practices and carbon emissions; the social aspect emphasizes the enterprise’s responsibility to employees, communities, and supply chains; and the governance aspect focuses on the enterprise’s corporate governance structure and transparency.

In the ESG concept, one of the important indicators of environmental factors is climate change, and carbon emission is most closely related to climate change, so it is particularly important (Zhang and Zhou, 2024). At the same time, as a comprehensive management strategy and governance approach, ESG aims to encourage enterprises to take into account and fulfill their responsibilities and obligations to multiple stakeholders such as employees, consumers, environment, and communities, while maximizing shareholder value and achieving profit goals (Ghaly et al., 2020). Therefore, active implementation of the ESG concept to improve the performance of enterprises, is expected to significantly reduce the carbon emission intensity of enterprises, and thus providing strong support for the realization of China’s “dual-carbon” goal.

Existing ESG literature primarily focuses on enterprise-level studies, centering on digital transformation, information disclosure, and green innovation. Among them, digital transformation can improve the ESG performance of new energy enterprises by playing providing energy utilization efficiency, internal control quality improvement, and green technology innovation (Y et al., 2024). Moreover, the quality of information disclosure and efficiency of innovation are also possible paths through which digital transformation affects the ESG performance of enterprises (Zhou and Wang, 2025). Conversely, the ESG performance can also have an impact on their internal development. For example, ESG disclosure can affect the corporate credit ratings through the channels of information, protection, and reputation (Cha et al., 2025), where carbon disclosure in the environmental dimension has a positive impact on total factor productivity (TFP) improvement (Yuan and Pan, 2022). Furthermore, it has been found that corporate ESG performance can promote the quality of corporate green innovation by increasing internal capital acquisition, talent pooling, and strengthening external social supervision (Qing et al., 2025), and it can also effectively promote corporate innovation by promoting the quality of corporate internal control and enhancing corporate innovation R&D input and output (Tu, 2024). Corporate ESG performance can achieve green innovation enhancement by alleviating financing constraints and enhancing human capital (Zhang and Liu, 2023). In addition, ESG performance can promote corporate green innovation by attracting analysts’ attention (Wang and Guo, 2024). Thus, scholars have analyzed the interaction effects between corporate ESG performance and various factors from different perspectives, and a large number of studies have shown a positive influence effect between them.

Many scholars have begun to examine the relationship between ESG performance and carbon emissions. In terms of environmental performance, some researchers, while studying the relationship between green finance and corporate carbon emission intensity, have found that it facilitates corporate carbon reduction through pathways such as raising environmental awareness, alleviating financing constraints to increase green investment, and enhancing productivity (Zhang and Zhou, 2024). Other studies suggest that boosting the environmental protection investment can effectively reduce carbon emission intensity, thereby contributing to the achievement of city-level carbon mitigation targets (Sun and Li, 2024). In the context of social responsibility, some scholars focusing on the mining sector have proposed that cultivating a new generation of professionals equipped with green skills will significantly accelerate the industry’s transition toward intelligent and low-carbon development (Ma, 2025). Moreover, in the pursuit of enhanced reputation and sustainable development, companies are motivated to reduce opportunistic and short-sighted behaviors, fulfill their social responsibilities, and achieve carbon emission reduction targets (Huang et al., 2023). In terms of corporate governance, information disclosure has become a critical area of concern. Against the backdrop of China’s “dual-carbon” goals, companies often adopt misleading, exaggerated or inaccurate approaches when promoting information related to carbon emissions and carbon footprints of their products or services (Sun et al., 2023). Such practices can, to some extent, exacerbate carbon emissions. Furthermore, as the core decision-makers within an enterprise, managers hold the authority over resource allocation, strategy formulation, and operational management, which are key aspects of corporate governance. Their decisions directly shape the future trajectory of the company (Wu and Hua, 2021). Notably, executives with heightened environmental awareness can significantly enhance the firm’s environmental performance (Zhang et al., 2025) and contribute to the reduction of carbon emissions.

A synthesis of the existing literature studies reveals that they has placed greater emphasis on the governance (G) dimension of ESG, particularly in areas such as corporate digital transformation and information disclosure, while relatively less attention has been paid to environmental performance (E) and social responsibility (S). Regarding the relationship between ESG performance and carbon emissions, while existing studies have touched upon the individual effects of the environmental (E), social (S), and governance (G) factors on carbon emissions, few studies have integrated all three ESG dimensions into a comprehensive analytical framework. Moreover, research on the underlying mechanisms through which ESG influences carbon emissions remains notably underdeveloped. A relatively relevant study examined the impact of ESG ratings on corporate carbon emission intensity and found that such ratings, as a form of soft regulation, can significantly reduce carbon emission intensity (Sun and Zhang, 2024). However, the research dimension remains relatively narrow, focusing solely on whether firms are covered by an ESG rating. Based on this, the present study utilizes data from A-share listed companies spanning the period 2013 to 2023 as the sample and draws upon the resource dependence theory, reputation theory, stakeholder theory, technological innovation theory, and information transfer theory to examine the influencing factors and underlying mechanisms between ESG performance and corporate carbon emission intensity.

The possible marginal contributions of this study are as follows. First, it breaks through the single-dimension consideration of carbon emission reduction. From the perspective of ESG, this paper studies whether ESG can help enterprises achieve carbon emission reduction, combining the three dimensions of environment, society, and corporate governance with enterprise carbon emission reduction, thus breaking through the limitation of traditional carbon emission reduction studies that only focus on environmental factors.

Second, it provides a theoretical basis and empirical analysis for ESG performance, enabling enterprises to reduce carbon emissions. At present, there are few studies on the impact of ESG performance on the carbon emission of enterprises. Through empirical analysis, this study collects and analyzes ESG data and carbon emission data of enterprises and scientifically reveals the internal relationship and law between ESG performance and carbon emission reduction of enterprises. At the same time, integrating the ESG concept into carbon emission reduction research will help deepen its understanding, enrich and improve the theoretical system of carbon emission reduction, and provide theoretical support for formulating more effective carbon emission reduction strategies from different perspectives.

Third, it provides empirical evidence for ESG performance, which enables enterprises to reduce carbon emissions. The influence mechanism of ESG performance on carbon emission reduction of enterprises is discussed in details and the ESG performance and carbon emission reduction characteristics of enterprises in different industries, regions, and ownership types are analyzed. The research results can be directly applied to enterprise ESG management and carbon emission reduction practice so as to guide enterprises to optimize ESG performance, improve the carbon emission reduction effect, and provide a basis for the formulation of differentiated carbon emission reduction strategies. Through practical verification, the ESG management and carbon emission reduction model can be replicated and promoted, which can provide reference and citation for more enterprises and help the country to achieve economic, social, and environmental sustainable development goals to a certain extent.

2 Theoretical analysis and research hypothesis

2.1 Impact of ESG performance on enterprises’ carbon emissions

An enterprise’s ESG serves as a key indicator of its comprehensive capabilities in sustainable development (Xi and Zhao, 2022). Strong ESG performance positively influences corporate carbon reduction efforts through multiple pathways. First, the ESG principle pays special attention to the environmental protection measures and carbon emissions of enterprises, including energy efficiency, waste management, pollution prevention, carbon emission management, and other aspects, which are directly related to the environmental impact and carbon footprint intensity of enterprises. According to the resource dependence theory, an enterprise functions as an open system whose survival and development critically depend on various resources supplied by the external environment. To achieve its objectives, the enterprise must draw essential resources from its surroundings, necessitating interdependence and continuous interaction with the environment (Davis and Cobb, 2010; Lu et al., 2025). In the process of pursuing good ESG performance, enterprises may adopt a series of environmental measures to reduce dependence on external resources and improve environmental performance. By implementing clean production technologies, adopting circular economy models, and improving the green management level of their supply chains, companies can significantly reduce their dependence on scarce natural resources while minimizing the generation of waste and pollutants during production processes, thereby contributing to the reduction in carbon emission intensity.

Second, from the perspective of reputation theory, corporate reputation serves as a unique intangible asset that is difficult to imitate, conveying signals to external stakeholders about the organization’s reliability and commitment to value. In the pursuit of enhanced reputation, enterprises actively fulfill social responsibilities to cultivate a positive corporate image and strengthen identification among employees and the public, thereby facilitating talent attraction and retention (Fang and Hu, 2023). A stable workforce, along with high employee motivation and innovative potential, lays a solid human capital foundation for long-term corporate development, thereby driving improvements in ESG performance. On the one hand, strong ESG performance enables companies to raise employees’ environmental awareness and motivate them to actively adopt emission-reduction practices in production processes, technology development, and management decisions, thereby empowering corporate carbon mitigation efforts. On the other hand, excellent ESG performance sends a positive signal to the market regarding the enterprise’s capability for long-term risk management and sustainable development. This helps gain the interest of sustainability-oriented investors and consumers, broadens financing channels, and provides financial and technical support for carbon reduction, thereby accelerating green transition.

Furthermore, a robust corporate governance structure serves as the cornerstone for the long-term and stable development of enterprises. By establishing a board of directors with expertise and independence, implementing executive compensation incentives linked to long-term ESG goals, and proactively disclosing ESG-related information, companies can ensure transparent and equitable decision-making processes. This approach helps regulate executive behavior, effectively curbs management’s short-term tendencies, and reduces actions that prioritize immediate gains at the expense of sustainable growth (Sun and Zhang, 2024). Consequently, it also contributes to lowering the corporate carbon emission intensity.

In summary, this study proposes the following research hypotheses:

Hypothesis 1. The better the ESG performance is, the lower the carbon intensity of the enterprise.

2.2 The mechanism of ESG performance on enterprises’ carbon emissions

In the context of the sustainable development strategy, the protection of the ecological environment has become increasingly important. As the primary entities engaged in economic activities, enterprises have a significant impact on the environment through their production and operational practices. Green technology innovation is an important form of technological innovation. Enterprises can significantly reduce their energy consumption and achieve the goal of carbon emission reduction by adopting clean energy technology, efficient energy-saving technology, and other means.

When companies demonstrate strong ESG performance, they tend to place greater emphasis on green technology innovation. Based on stakeholder theory, improved ESG performance enhances relationships with various stakeholders, thereby facilitating access to external knowledge and information, which provides essential support for corporate green innovation (Ding and Zhao, 2025). A high level of environmental (E) performance indicates that a company has established systematic environmental management mechanisms. To further secure policy support and market recognition, enterprises are motivated to allocate more resources to green technology development, such as energy-saving processes, renewable energy applications, and waste recycling technologies. Regarding the social (S) dimension, companies that fulfill their social responsibilities significantly enhance their brand reputation and stakeholder trust. This enables them to secure financing more easily, thereby providing stable external resources to support green technology innovation. Internally, strong social performance helps attract and retain high-quality talents who identify with sustainable development principles, contributing human capital and creativity to advance green technology initiatives. At the governance (G) level, a sound governance structure provides an institutional foundation and strategic assurance for green technology innovation. Effective governance mechanisms include robust internal controls and disclosure systems. High-quality reporting of corporate ESG information enhances trust among investors and the public, thereby creating a stable internal environment and external expectations conducive to green technology innovation.

According to the theory of technological innovation, there is a close causal relationship between technological innovation and industrial transformation, showing a dynamic and circular evolution mode in the process of economic development (Denison, 2010). On the one hand, through intelligent production process and meticulous management, green technology innovation enables enterprises to optimize the production process, help enterprises improve energy utilization efficiency, reduce energy consumption, and minimize pollution emissions (Xu et al., 2024). Through recycling technologies, enterprises can extend the service life of resources and reduce the demand for new resources, thereby cutting down carbon emissions generated from resource extraction and processing. This drives the transition from use of traditional energy-intensive models toward green and intensive practices, enabling companies to gain a competitive edge amid tightening policies and the deepening carbon market. On the other hand, green technology innovation is an important driving force to promote the transformation and upgradation of industrial structure. Through green technology innovation, enterprises can develop more environmentally friendly and efficient products and services to meet the green consumption needs of consumers. This transformation not only helps enterprises to improve product competitiveness but also helps enterprises to reduce carbon emission intensity and drive green development of the entire industrial chain.

Existing studies usually consider the number of green patent applications of enterprises as a common index to measure the level of green technology innovation (Hu and Xiong, 2024), in which green invention patents refer to innovative, creative, and practical technical solutions obtained in the fields of environmental protection technology, clean energy, energy conservation, emission reduction, and resource recycling by using new technologies, new methods or new applications. It is a form of innovation that breaks through the existing level and has a revolutionary impact (Huang and Qi, 2024). The research and application of these technologies contribute to further acceleration of the reduction in carbon emissions during the production process in enterprises.

To sum up, this study puts forward the following hypothesis:

Hypothesis 2. ESG performance reduces enterprises’ carbon emission intensity by improving the level of green technology innovation.

Companies with outstanding ESG performance typically demonstrate higher TFP. High environmental (E) standards compel enterprises to adopt clean production practices, optimize their energy structure, and reduce resource consumption and environmental costs per unit of output. This enhances the efficiency of capital and energy use, enabling greater output from the same factor inputs and thereby driving growth in TFP. According to the stakeholder theory, companies with strong ESG performance effectively respond to the expectations of diverse stakeholders, such as investors, employees, and communities, thereby significantly mitigating conflicts arising from information asymmetry. This leads to improved access to resources and enhances the efficiency of resource allocation. Furthermore, by fulfilling social responsibilities (S), these enterprises build trust capital and human capital advantages, which help broaden financing channels, attract high-caliber talent, improve labor quality, and optimize the structure of human resources. These efforts collectively provide intellectual support for sustainable corporate development (Park and Jang, 2021). In terms of governance (G), high-quality information disclosure and effective stakeholder communication mechanisms contribute to greater precision and adaptability in resource allocation decisions. This helps avoid resource misallocation and thereby enhances TFP. It is evident that enterprises with high ESG performance achieve higher output and lower resource consumption through efficient resource utilization in the production process. This leads to improved production efficiency and product quality, thereby significantly enhancing TFP (Gao and Zhao, 2025).

According to the signal transmission theory, in an environment with asymmetric information, enterprises transmit positive information to the outside world through their good ESG behavior (Acemoglu and Restrepo, 2018), thus affecting the decision-making of investors, consumers or governments. The improvement in TFP can itself be regarded as a strong market signal. By disclosing information related to gains in TFP, including achievements in technological innovation, efficiency enhancements, and optimized resource allocation, companies demonstrate outstanding capabilities in resource integration, technological innovation efficiency, and long-term growth potential. This practice enhances the external stakeholders’ understanding of the company’s operational performance, helps mitigate information asymmetry, and strengthens the confidence of investors and consumers. Furthermore, it improves the flow efficiency of resources, reduces resource waste, and contributes to reduction of corporate carbon emission intensity. Furthermore, the improvement of enterprise TFP also helps promote the development of the industrial structure to a higher level and a more environmentally friendly direction, and it shifts resources from high-energy and high-emission industries to low-energy and low-emission industries, thereby completely reducing carbon emission intensity and achieving efficient utilization of resources and sustainable development of enterprises.

In summary, this study puts forward the following hypothesis:

Hypothesis 3. ESG performance reduces enterprise carbon emission intensity by improving TFP.

3 Research design

3.1 Sample selection and data source

This study selects the data of A-share listed companies from 2013 to 2023 as research samples to test the relationship between ESG performance and carbon emission intensity of enterprises. Considering the progressive standardization of ESG disclosure regulations since 2012, post-2013 data demonstrate significantly improved completeness and reliability. Moreover, the dataset employed in this study is currently updated through 2023, and this paper utilizes the period from 2013 to 2023 as the sample period. Additionally, given the substantial challenges in acquiring data from non-listed small and medium enterprises due to their large population size, this study focuses on A-share listed companies. Among them, the industry main cost and industry total energy consumption data used to calculate the carbon dioxide emissions of enterprises are derived from the “China Industrial Economic Statistical Yearbook” and “China Energy Statistical Yearbook”, respectively. Enterprise ESG rating data are derived from the Huazheng ESG rating database. In addition, the financial data at the enterprise level are mainly derived from the CSMAR database, and the data of the remaining variables are derived from the CNRDS database. In this study, the data are matched and combined. At the same time, in order to ensure the quality of the data, the samples are processed as follows: (1) ST and ST* companies were excluded; (2) samples with missing key variable data were eliminated; (3) in order to avoid the influence of potential outliers, the continuous variables were indented at the level of 1% and 99%. Finally, a total of 27,012 enterprise–year observations were obtained.

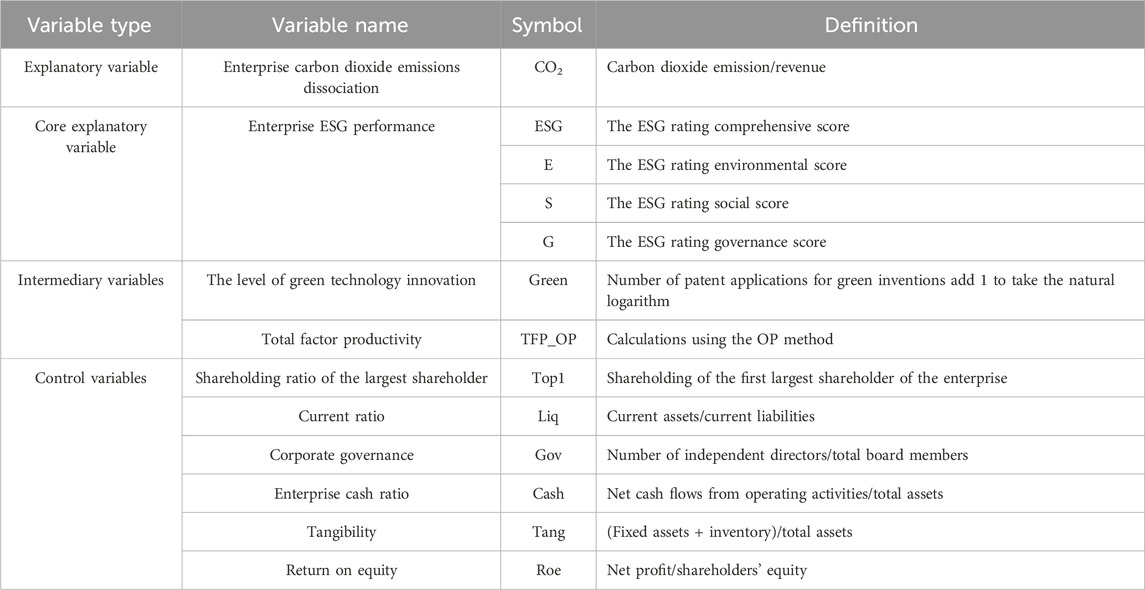

3.2 Variable definition

3.2.1 Explained variable

The explained variable is the carbon emission intensity of the enterprise (CO2). Based on previous studies, this study measures the carbon emission intensity of an enterprise by taking the natural logarithm of the ratio between corporate carbon dioxide emissions and operating revenue (Chapple et al., 2013), in which the carbon dioxide emissions are calculated based on the main cost of the enterprise, the main cost of the industry, the energy consumption of the industry, and the carbon dioxide conversion coefficient (Shen and Huang, 2019), and the carbon dioxide calculation standard of Xiamen Energy Conservation Center is referred to. The carbon dioxide conversion coefficient of 1 ton of standard coal is 2.493. The specific calculation formula is as follows:

3.2.2 Core explanatory variable

The core explanatory variable is the ESG performance of the enterprise (ESG). In this study, the ESG performance of an enterprise is measured based on the Huazheng ESG rating database. The evaluation system consists of three first-level indicators, 16 second-level indicators, 44 third-level indicators, and several other indicators, which are divided into nine grades of “AAA - C”. After assigning values, E, S, and G are calculated, respectively. Finally, the ESG rating comprehensive score is used to measure the ESG performance of enterprises, and the score range is from 0 to 100. The higher the score is, the better the enterprise ESG performance. Furthermore, given that greenhouse gas (GHG) emissions are key indicators of the environmental (E) dimension in the ESG rating methodology, we have included an analysis of the impact of the three sub-dimensions (E/S/G) on carbon emissions in the empirical research section to enhance the methodological rigor. Since ESG scores are measured on a percentage scale (0–100), they were normalized by dividing by 100 to maintain dimensional consistency.

3.2.3 Intermediary variables

3.2.3.1 The level of green technology innovation

In this study, the level of green technology innovation is used as the intermediary variable (Green). Scholars often use the number of green patent applications to measure the level of green technology innovation of enterprises (Li J. L. et al., 2024). Applications for green patents of enterprises are generally divided into four categories, among which green invention patents are more groundbreaking and innovative and have a higher application threshold, which can better reflect the level of green technology innovation of enterprises (Zhang et al., 2023). Therefore, this paper adds 1 to the number of green invention patent applications and takes the natural logarithm as the index to measure the level of green technology innovation of enterprises (Yan et al., 2024).

3.2.3.2 Total factor productivity

In this study, TFP is used as the intermediate variable (TFP_OP). At present, the methods to measure the TFP of enterprises include the OP method, LP method, OLS method, and FE method (Gao and Zhao, 2025). Building on prior research (Lu and Lian, 2012), this paper employs the OP method to estimate TFP. The OP method addresses the simultaneity bias by using enterprises’ current investment as a proxy variable under the assumption that investment decisions reflect contemporaneous productivity conditions.

The OP method is built upon a Cobb–Douglas production function in logarithmic form: yi,t = β0+βl li,t + βk ki,t + ωi,t + ηi,t. The second term on the right-hand side represents the labor input, and the third term denotes capital input. A key assumption of this approach is that a higher level of ω in the current period leads to higher investment in the same period. The estimation procedure consists of two main stages:

1. The coefficient of labor input (βl) is estimated using a semiparametric regression approach.

2. The coefficient of capital input (βk) is estimated via nonlinear least squares approach.

This paper selects the following indicators for measurement: gross output value is used to measure firm output, and the perpetual inventory method is adopted to calculate the actual capital stock, establishing the relationship between a firm’s current capital stock and its investment through the formula: Kit+1 = (1 − δ) Kit + Iit, where K represents the firm’s capital stock and I denotes current-period investment. The number of employees is selected to measure labor input, while cash payments for the acquisition and construction of fixed assets, intangible assets, and other long-term assets are chosen to gauge investment expenditures.

3.2.4 Control variables

Based on existing research (Sun and Qu, 2024; Dai et al., 2021), this study selects the following six control variables: shareholding ratio of the largest shareholder (Top1), current ratio (Liq), corporate governance (Gov), enterprise cash ratio (Cash), tangibility (Tang), and return on equity (Roe). Refer to Table 1 for further details.

3.3 Model establishment

3.3.1 Benchmark regression model

In order to verify Hypothesis 1, this study establishes a panel benchmark regression model, which is constructed as follows:

where i is the enterprise and t is the year. The explained variable CO2i,t represents the carbon emission intensity of the enterprise, the core explanatory variable ESGi,t represents the ESG performance of the enterprise, and β is the corresponding coefficient. If β is positive, it indicates that the better the ESG performance of the enterprise is, the higher the carbon emission intensity. If β is negative, it indicates that the better the ESG performance of the enterprise is, the lower the carbon emission intensity. Thus, Hypothesis 1 is verified. α is a constant, ∑Controlsi,t is a series of other control variables that affect the carbon emission intensity, yeart and industryi are time effects and individual effects, respectively, and εi,t is the random disturbance term.

3.3.2 Intermediary effect models

In order to verify Hypothesis 2 and Hypothesis 3, this study draws on existing studies (Sun and Qu, 2024; Jiang and Luo, 2022) to establish mediation effect models, which are constructed as follows:

where Mi,t are the intermediary variables, namely, the level of green technology innovation (Green) and total factor productivity (TFP_OP).

4 Empirical research

4.1 Descriptive statistical analysis

The descriptive statistical results of the main variables in this study are shown in Table 2. The maximum value of the carbon emission intensity of enterprises (CO2) is 5.3326, the minimum value is 0.0001, the mean value is 1.2742, and the standard deviation is 0.3647, indicating that under the influence of the sustainable development strategy, carbon emission decreases, but there is still a certain gap between enterprises. The maximum value of the ESG comprehensive score (ESG) is 0.9093, the minimum value is 0.3662, the mean value is 0.7327, and the standard deviation is 0.0500. It can be seen that the ESG performance of different enterprises has a large gap (range: 0–1), and the ESG performance of a considerable number of enterprises in the sample is lower than the average level, which needs to be further improved. The mean scores for the three ESG dimensions are as follows: environmental (0.6156), social (0.7482), and governance (0.7893). The results indicate a relative underperformance in the environmental dimension compared to the closely aligned social and governance scores. This underscores the imperative for corporations to enhance environmental awareness and commit to sustainable operational practices.

The maximum value of the enterprise green technology innovation level (Green) is 6.8957, the minimum value is 0.0001, the mean value is 0.6629, and the standard deviation is 1.0644, which shows that certain gap still exists in the level of green technology innovation among enterprises, and the overall level is low. The maximum value of enterprise total factor productivity (TFP_OP) is 10.3258, the minimum value is 2.7812, the mean value is 6.8511, and the standard deviation is 0.8505, which shows that the average level of enterprise TFP is more considerable, but some enterprises still need to be improved.

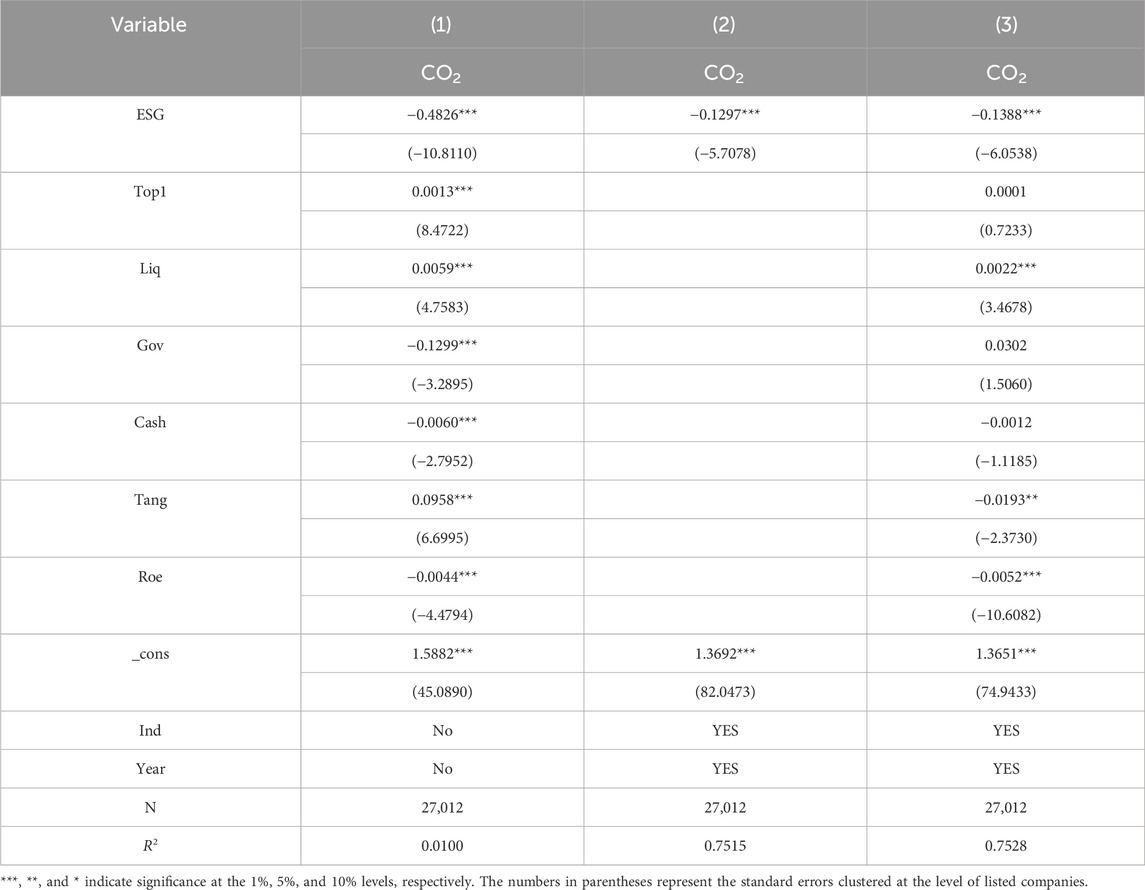

4.2 Benchmark regression

In order to verify Hypothesis 1, regression analysis is performed on Equation 3. The benchmark regression results of the impact of ESG performance (ESG comprehensive score) on the enterprise carbon emission intensity are shown in Table 3. The first column shows the regression results incorporating the control variables but excluding the fixed effects. The regression coefficient is −0.4826, and the regression result is significant at the level of 1%, which preliminarily proves that the better the ESG performance is, the lower the carbon emission intensity of enterprises. The second column shows the regression results obtained by adding the fixed effects but no control variables. The regression coefficient is −0.1297, and the regression results are significant at the 1% level. The R2 in column (1) is merely 0.0100, whereas column (3) demonstrates a substantial improvement to approximately 0.7528 after incorporating both industry and time fixed effects. This suggests that much of the variation in corporate carbon emission intensity can be explained by firm-specific characteristics (industry) and time (year). This is because high-energy-consumption industries naturally have a higher carbon intensity, and macroeconomic conditions and policies in specific years have a universal impact on all companies.

The third column shows the regression result obtained after including the control variables and fixed effects. The regression coefficient is −0.1388. This suggests that a 1-point increase in the ESG score is associated with a 0.1388 reduction in corporate carbon emission intensity. Based on this coefficient, a one standard deviation increase in the composite ESG score from its sample mean would lead to a 0.0035 decrease in the emission intensity. This reduction represents approximately 0.54% of the sample’s average carbon intensity (1.2742). In addition, the regression result is significant at the level of 1%. It further indicates that after controlling other factors that may impact the carbon emission intensity of the enterprise, the better the ESG performance is, the lower the carbon emission intensity of the enterprise. The reason is that enterprises that perform well on ESG pay more attention to employee welfare and commitment to social responsibility, are more willing to invest in green technologies and practices, and prioritize long-term sustainability goals, thus contributing to reducing carbon intensity.

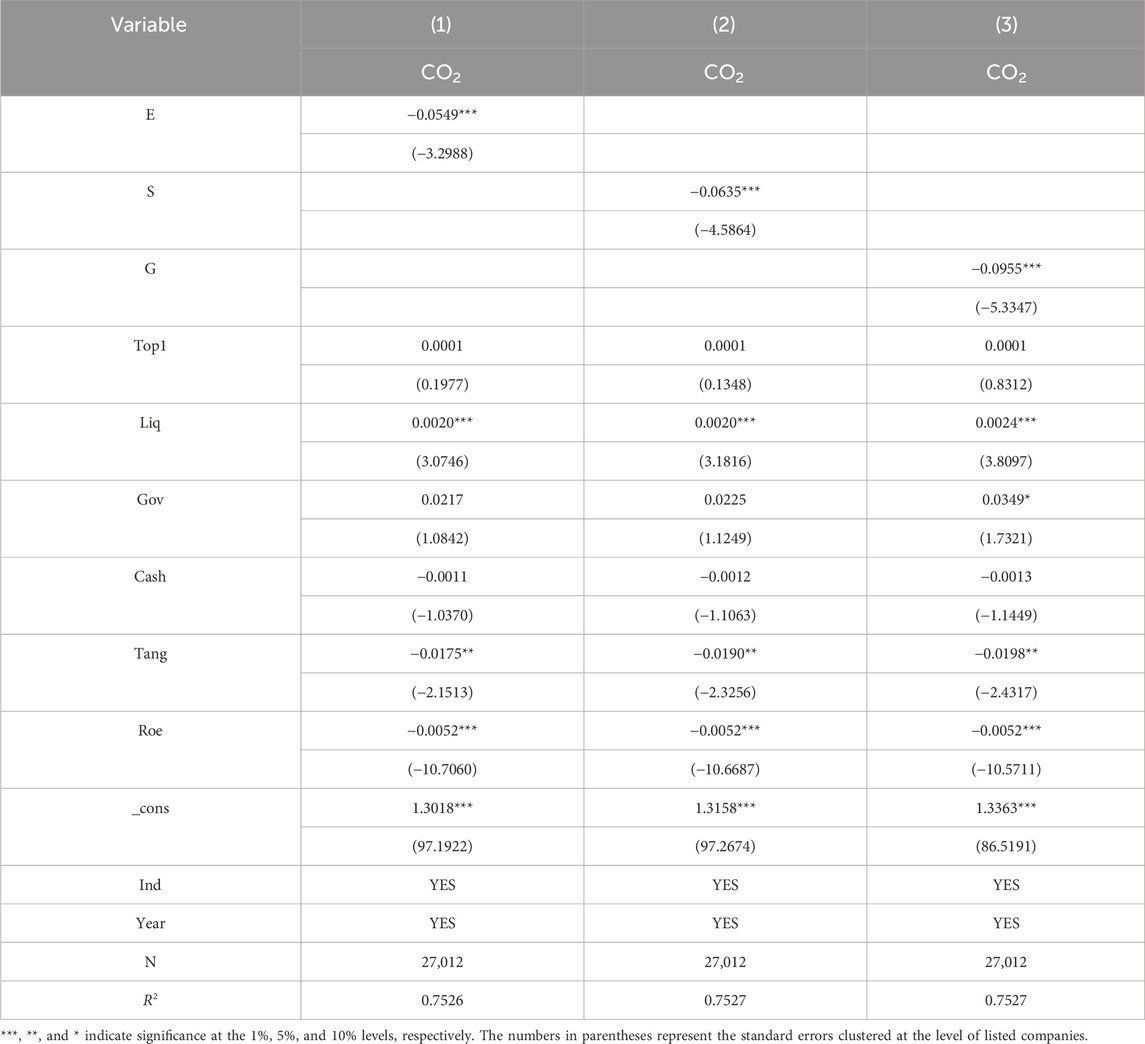

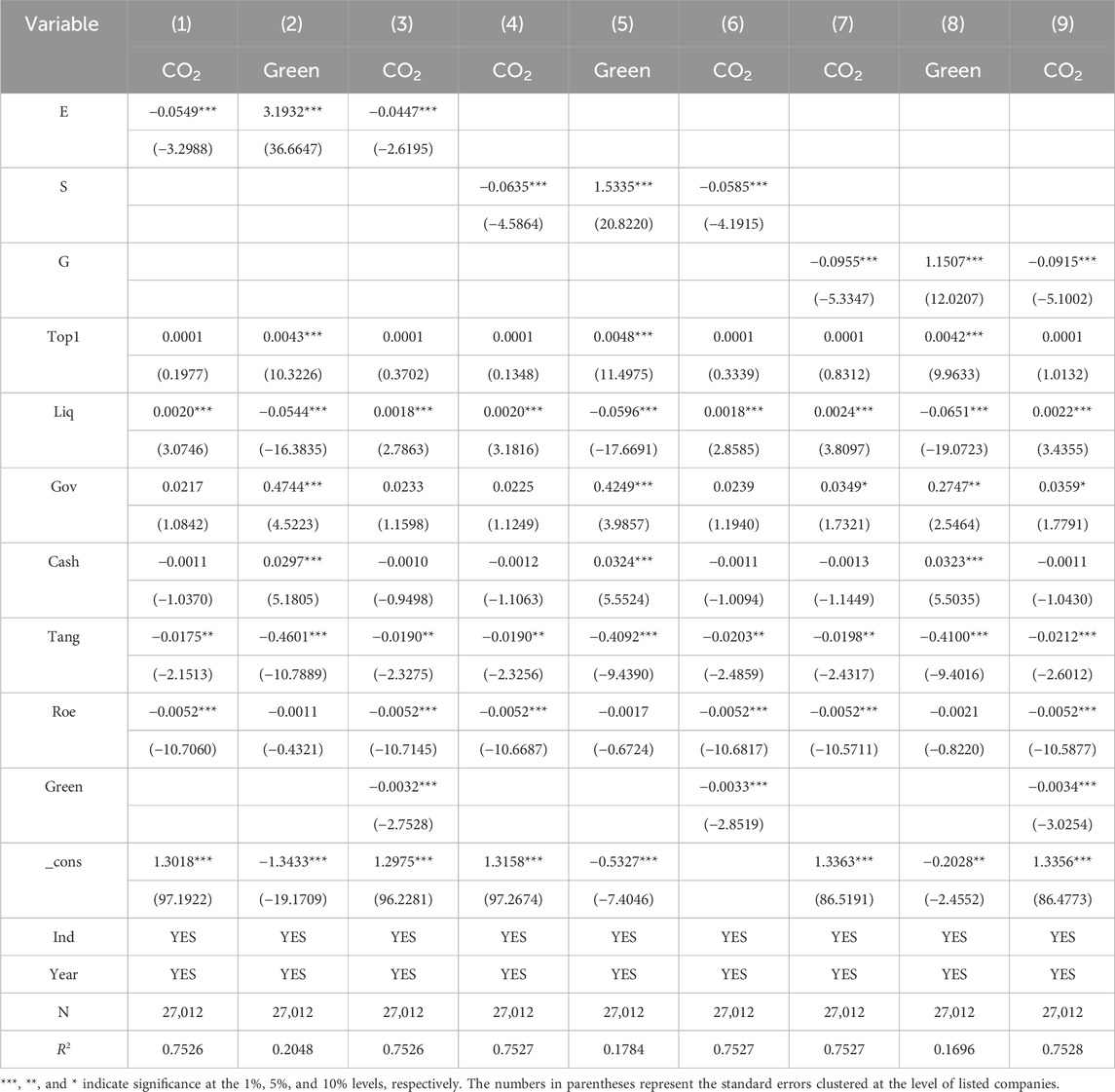

To provide granular evidence supporting Hypothesis 1, we conducted separate regression analyses for each ESG sub-dimension (E/S/G). The baseline regression results demonstrating the impact of these three sub-dimensional scores on corporate carbon emission intensity are presented in Table 4. Columns (1)–(3) present the baseline regression results incorporating the control variables and fixed effects for the environmental, social, and governance dimensions of ESG, respectively. The findings demonstrate statistically significant negative associations (p < 0.01) between all three ESG sub-dimensions and corporate carbon emission intensity.

4.3 Robustness test

The core purpose of the robustness test is to verify the reliability and generalizability of the research results, i.e., to exclude the influence of chance factors (e.g., special year, variable measurement bias, and model setting bias) on the conclusions. In this paper, the correlation between ESG performance and corporate carbon intensity is examined by eliminating special years, replacing explanatory variables, and replacing regression models.

4.3.1 Excluding special years

Considering the lasting impact of the outbreak of COVID-19 on the production and operation of enterprises, the polarization of different types of enterprises is more serious, so the sample data from 2020 to 2023 are eliminated, and the regression analysis of model (3) is conducted again. The regression results are shown in column (1) of Table 5. It was found that the ESG performance of enterprises is still negatively correlated with the carbon emission intensity, and the regression coefficient is −0.0395, which is significant at the 10% level. To specifically isolate the pandemic’s impact, we conducted robustness checks by excluding data from 2020–2021 (the peak COVID-19 years). As shown in column (2) of Table 5, the negative association between corporate ESG performance and carbon emission intensity remains statistically significant. The robustness check demonstrates that the better the ESG performance is, the lower the carbon emission intensity of enterprises will be after excluding special years.

4.3.2 Replacing explanatory variables

This study referred to the existing research and replaced the measurement method of ESG. The regression analysis was conducted again using Bloomberg’s ESG score (ESG) as a replacement for the Huazheng ESG score (ESG) (Sun and Li, 2024). The regression results are shown in column (3) of Table 5. It was found that ESG is negatively correlated with the carbon emission intensity, and the regression coefficient is −0.0008, which is significant at the 1% level. The conclusions obtained are consistent with the above baseline regression results.

4.3.3 Replacing the regression model

In order to make the results of hypothesis testing more credible, this study changed the regression model, added individual cluster variables to model (3), and conducted regression analysis again. The regression results are shown in column (3) of Table 5. It was found that enterprise ESG and carbon emission intensity are still negatively correlated, and the regression coefficient is −0.1388, which is significant at the level of 1%. The regression results remain robust.

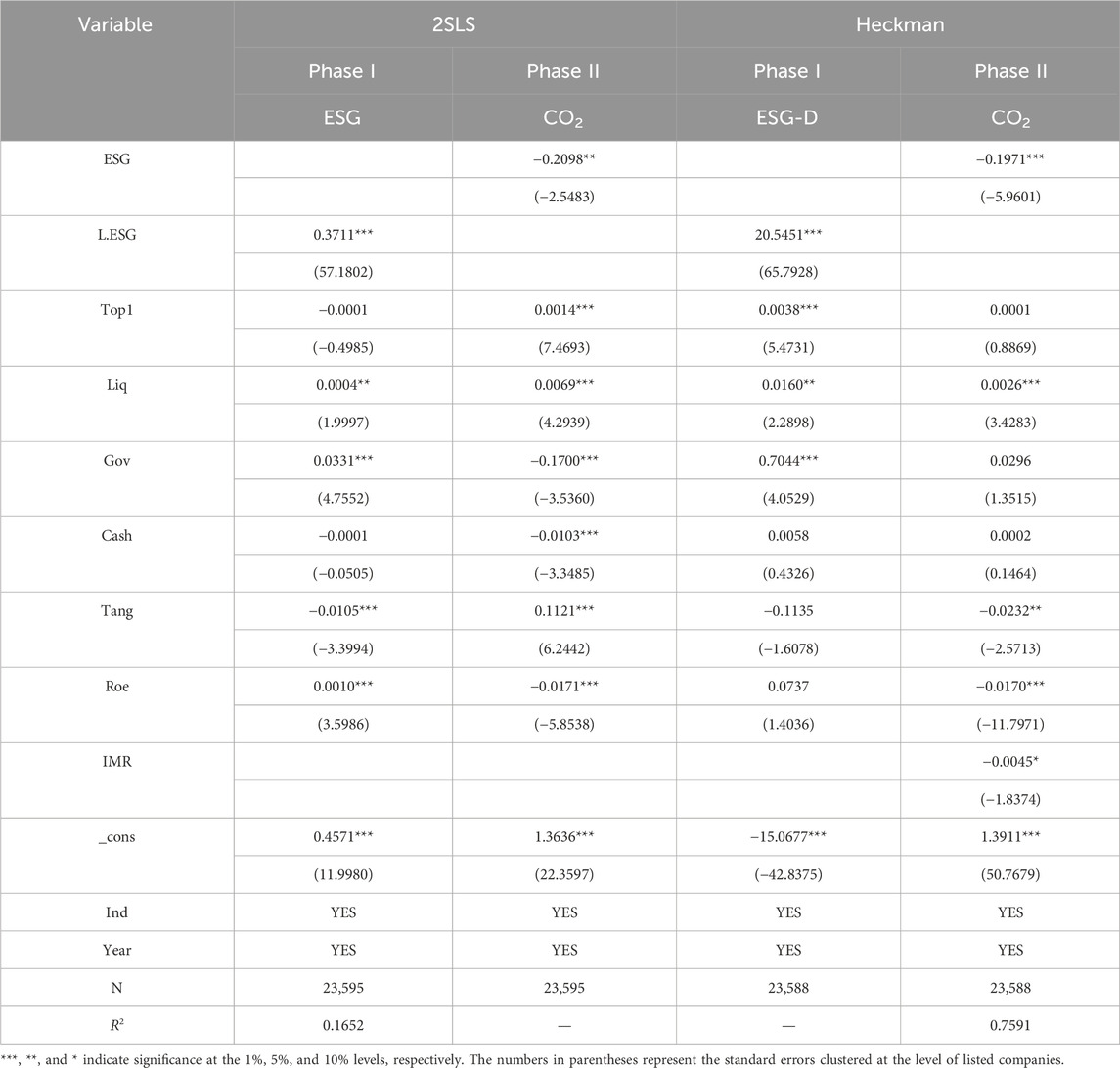

4.4 Endogeneity test

The central purpose of endogeneity testing is to address causal inference in the model, i.e., to rule out endogeneity problems such as reverse causation and omitted variables from interfering with the estimation results. In order to alleviate the endogeneity problem caused by two-way causality, this paper adopts the two-stage least square method (2SLS) to conduct the regression test (Faccio et al., 2006; Sun and Li, 2024). ESG is an endogenous variable, and the first-order lag term of ESG is taken as the instrumental variable. The regression results are shown in column (1) of Table 6, which shows that the regression coefficient of L.ESG in the first stage is positive and significant at the 1% level. Thus, a significant correlation exists between the independent variable and the instrumental variable. In the second stage, the average ESG scores of other firms in the same industry were selected as the instrumental variable. The regression results are presented in column (2) of Table 6. After using the instrumental variable, ESG still exhibits a negative correlation with carbon emission intensity, and the regression result remains significant at the 5% level. Furthermore, since not all firms disclose their ESG information, this study is potentially subject to sample self-selection bias. To address this concern, we employ the Heckman two-stage test, following the approach of prior research (Sun and Qu, 2024). In the first stage, the firm’s ESG performance is converted into a dummy variable, ESG_D, which takes the value of 1 if the ESG performance is above the sample mean and 0 otherwise. The lagged ESG term remains the exogenous instrumental variable. Probit regression is then conducted by regressing ESG_D on L.ESG along with all control variables from the baseline regression, from which the inverse Mills ratio (IMR) is derived. In the second stage, the IMR is incorporated into model (3) for regression. The regression results are presented in columns (3) and (4) of Table 6. It can be observed that the coefficient of IMR is statistically significant, and the regression coefficient of ESG remains significant at the 1% level. This indicates that even after accounting for endogeneity concerns, the conclusions remain consistent with those mentioned above.

5 Mechanism and heterogeneity analysis

5.1 Mechanism

In order to test the mechanism of the effect of two intermediary variables and the green technology innovation level and TFP on the impact of ESG performance on the carbon emission intensity of enterprises, and thus verify Hypothesis 2 and Hypothesis 3, this study conducts regression analysis on Equations 4-6.

5.1.1 Intermediary effect of the green technology innovation level

The intermediary effect of the green technology innovation level on ESG performance (ESG comprehensive score) is tested, and the regression results are shown in Table 7. The first is the benchmark regression result of the influence of ESG performance on the carbon emission intensity of enterprises after adding control variables and fixed effects. It can be seen that ESG performance and carbon emission intensity are negatively correlated and are significant at the 1% level. The second is the influence of ESG performance on the green technology innovation level after adding control variables and fixed effects, and the regression coefficient is 3.6408; i.e., ESG performance of enterprises is positively correlated with the green technology innovation level. Specifically, a 1-point increase in the composite ESG score is associated with a 3.6408-unit rise in green technology innovation output, and it is significant at the 1% level, indicating that enterprises with better ESG performance attach more importance to green technology innovation. These enterprises are more environmentally conscious and will actively seek sustainable ways of business models. The third is the impact of ESG performance on the carbon emission intensity after the introduction of the intermediary variable of the green technology innovation level. The regression coefficient is −0.1289, indicating that under the influence of the intermediary effect of the green technology innovation level, ESG performance is also negatively correlated with carbon emission intensity and is significant at the 1% level. At this time, the regression coefficient of the green technology innovation level is −0.0027, which has an inhibitory effect on the carbon emission intensity of enterprises. Specifically, a 1-point increase in the green technology innovation score is associated with a 0.0027-unit reduction in corporate carbon emission intensity, and it is significant at the 5% level. The higher the ESG performance is, the higher the level of green technology innovation, and the lower the carbon emission intensity of the enterprise. By introducing or developing more environmentally friendly technologies, enterprises can reduce the emission of pollutants in the production process and improve the efficiency of resource utilization, thereby reducing the negative impact on the environment and reducing carbon emissions. Thus, Hypothesis 2 is verified.

The intermediary effect of the green technology innovation level on the three ESG sub-dimensions (E/S/G) is tested, and the regression results are shown in Table 8. Columns (1), (4), and (7) present the baseline regression results for the environmental, social, and governance dimensions of ESG on corporate carbon emission intensity, respectively, with all models incorporating control variables and fixed effects. These findings remain consistent with our prior results. Columns (2), (5), and (8) report the estimated effects of the three ESG sub-dimensions (E/S/G) on green technology innovation levels, respectively, with all specifications incorporating control variables and fixed effects. The regression coefficients of 3.1932 (p < 0.01), 1.5335 (p < 0.01), and 1.1507 (p < 0.01) demonstrate statistically significant positive relationships between each ESG sub-dimension and green technology innovation. However, the environmental dimension exhibits a relatively stronger effect on green technology innovation. Specifically, a 1-point increase in the ESG environmental score is associated with a 3.1932-unit rise in corporate green innovation output, indicating that environmental performance exerts a disproportionately positive influence on enterprises’ green technology innovation. The stakeholder theory posits that enterprises should prioritize not only the interests of shareholders but also those of other relevant parties, such as employees and consumers, in their operations. Consequently, to maintain partnerships with key clients, companies are increasingly motivated to enhance their environmental management and sustainable development practices. This, in turn, strengthens their environmental awareness and ultimately improves the level of green technology innovation (Yan et al., 2024). Moreover, given the significant dependence of corporate activities on the external environment, certain environmental regulations, such as carbon taxes, emission standards, and waste disposal requirements, must serve as binding constraints. In addition, environmental regulations effectively promote green technology innovation (Wang et al., 2020).

Columns (3), (6), and (9) report the estimated effects of the three ESG sub-dimensions (E/S/G) on carbon emission intensity after incorporating green technology innovation as a mediator. The regression coefficients of −0.0447 (p < 0.01), −0.0585 (p < 0.01), and −0.0915 (p < 0.01) demonstrate statistically significant negative relationships between each ESG sub-dimension and carbon intensity through the mediation channel of green technology innovation. However, the governance dimension exhibits a relatively stronger effect. Given that green technology innovation is often characterized by substantial investment, long cycles, and high uncertainty, it tends to conflict with the management’s short-term performance pressures. By establishing executive compensation incentives linked to long-term ESG goals and improving corporate governance structures, companies can effectively curb managerial short-sightedness and foster a strategic vision for long-term green technology investments. Furthermore, enhancing corporate disclosure can improve the forecasting accuracy of analysts, reduce information asymmetry among investors, and lower capital costs, thereby facilitating increased investment in green innovation (Alkaraan et al., 2022). It is evident that compared to the external influences and regulations in the environmental (E) and social (S) dimensions, strengthening green technology innovation from the governance (G) perspective directly determines whether enterprises can translate pressures into fundamental technological solutions through internal decision-making mechanisms, thereby achieving significant and sustained carbon emission reductions. The regression coefficients for green technology innovation are −0.0032, −0.0033, and −0.0034, respectively, with all of them demonstrating statistically significant inhibitory effects (p < 0.01) on corporate carbon emission intensity across specifications.

5.1.2 Intermediate effect of total factor productivity

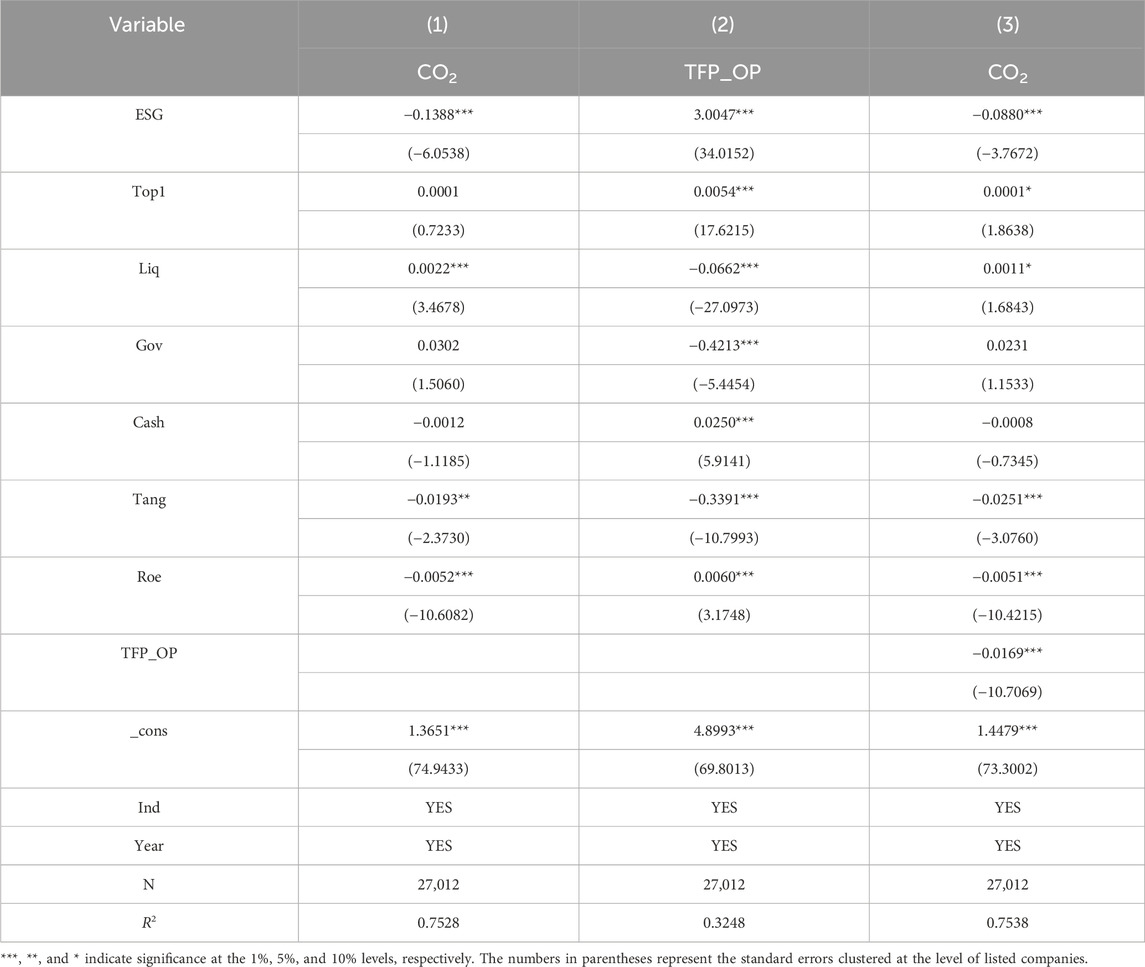

The intermediary effect of TFP on ESG performance (the ESG comprehensive score) is tested, and the regression results are shown in Table 9. The first column also shows the benchmark regression results of the influence of ESG performance on carbon emission intensity after adding control variables and fixed effects. The second is the influence of ESG performance on TFP after adding control variables and fixed effects. The regression coefficient is 3.0047; i.e., ESG performance of enterprises is positively correlated with TFP. Specifically, a 1-point increase in the composite ESG score is associated with a 3.0047-unit rise in TFP, and it is significant at the 1% level, indicating that the better the ESG performance of enterprises is, the higher TFP. The reason is that enterprises with good ESG performance tend to have higher resource allocation efficiency, and such enterprises can use capital, technology, human talent, and other resources more effectively, thereby improving production efficiency. The third is the impact of ESG performance on carbon emission intensity after the introduction of the intermediary variable of TFP. The regression coefficient is −0.0880, indicating that under the influence of the intermediary effect of TFP, ESG performance is still negatively correlated with carbon emission intensity. Specifically, a 1-point increase in the TFP score is associated with a 0.0880-unit reduction in corporate carbon emission intensity, and it is significant at the 1% level. At this time, the regression coefficient of TFP is −0.0169, which also has an inhibitory effect on the carbon emission intensity of enterprises, which is significant at the level of 1%. It shows that the better the ESG performance of enterprises is, the higher the TFP, and the lower the carbon emission intensity. Enterprises with high ESG performance usually pay attention to employee welfare. Improving corporate governance structure and strengthening internal control can enhance employee loyalty and improve production efficiency, thus optimizing resource allocation, reducing waste, and reducing energy consumption and carbon emissions.

The intermediary effect of TFP on the three ESG sub-dimensions (E/S/G) is tested, and the regression results are shown in Table 10. Columns (1), (4), and (7) present the baseline regression results for the environmental, social, and governance dimensions of ESG on corporate carbon emission intensity, respectively, with all models incorporating control variables and fixed effects. These findings remain consistent with our prior results. Columns (2), (5), and (8) report the estimated effects of the three ESG sub-dimensions (E/S/G) on TFP, respectively, with all specifications incorporating control variables and fixed effects. The regression coefficients of 2.3890 (p < 0.01), 1.2392 (p < 0.01), and 1.1687 (p < 0.01) demonstrate statistically significant positive relationships between each ESG sub-dimension and TFP. However, the environmental dimension exhibits a relatively stronger effect on TFP. Specifically, a 1-point increase in the ESG environmental score is associated with a 2.3890-unit rise in TFP, indicating that environmental performance exerts a disproportionately positive influence on enterprises’ TFP. Under the green transition backdrop, strong environmental performance is increasingly emerging as a non-price competitive advantage for businesses. According to the signaling theory, conveying positive environmental outcomes to the public helps overcome barriers to factor mobility, facilitating resource integration and flow. Such signals enable companies to secure procurement orders from environmentally conscious consumers, thereby supporting business expansion and enhancing competitive positioning in the market (Gao and Zhao, 2025). By producing a substantial volume of low-carbon and environmentally friendly products, companies can more easily access premium markets and capture brand premiums from green-conscious consumers. This expansion in output and revenue enables economies of scale, thereby enhancing TFP. Such market advantages, derived from “green” labels, are unique to environmental performance. Social and governance attributes, in contrast, are less directly capable of conferring this type of product differentiation.

Columns (3), (6), and (9) report the estimated effects of the three ESG sub-dimensions (E/S/G) on carbon emission intensity with incorporation of TFP as a mediator. The regression coefficients of −0.0123 (p > 0.01), −0.0419 (p < 0.01), and −0.0751 (p < 0.01) demonstrate that all three ESG sub-dimensions maintain negative associations with carbon intensity via TFP mediation. However, the environmental dimension’s effect becomes statistically insignificant after accounting for TFP, and this suggests that the carbon reduction effect of environmental practices is almost entirely achieved through the enhancement of TFP. Meanwhile, TFP itself shows consistently significant negative coefficients of −0.0178, −0.0175, and −0.0174 (all p < 0.01) across specifications, confirming its robust inhibitory effect on corporate carbon emissions. The New Trade Theory posits that heterogeneous firm-level factors such as TFP influence both product quality and export decisions. Firms with higher TFP typically possess more advanced technologies and more efficient production processes (Gervais, 2015), enabling them to produce higher-quality and greener products, thereby contributing to carbon emission reduction. Moreover, the most immediate effect of improved corporate environmental performance is the enhancement of resource utilization efficiency and energy productivity (Hu and Xiong, 2024). This aligns directly with the core concept of TFP, which captures the residual efficiency after accounting for the contributions of factor inputs. Therefore, the carbon reduction effect of environmental performance is essentially achieved through the improvement of technological efficiency and resource allocation efficiency, i.e., the growth of TFP. When both environmental performance (E) and TFP are included in the model, TFP incorporates the efficiency improvements driven by environmental factors. This implies that the impact of the environmental dimension (E) on carbon emissions is mediated by TFP, leading to an insignificant direct effect of the environmental dimension (E).

5.2 Heterogeneity analysis

5.2.1 Industry heterogeneity

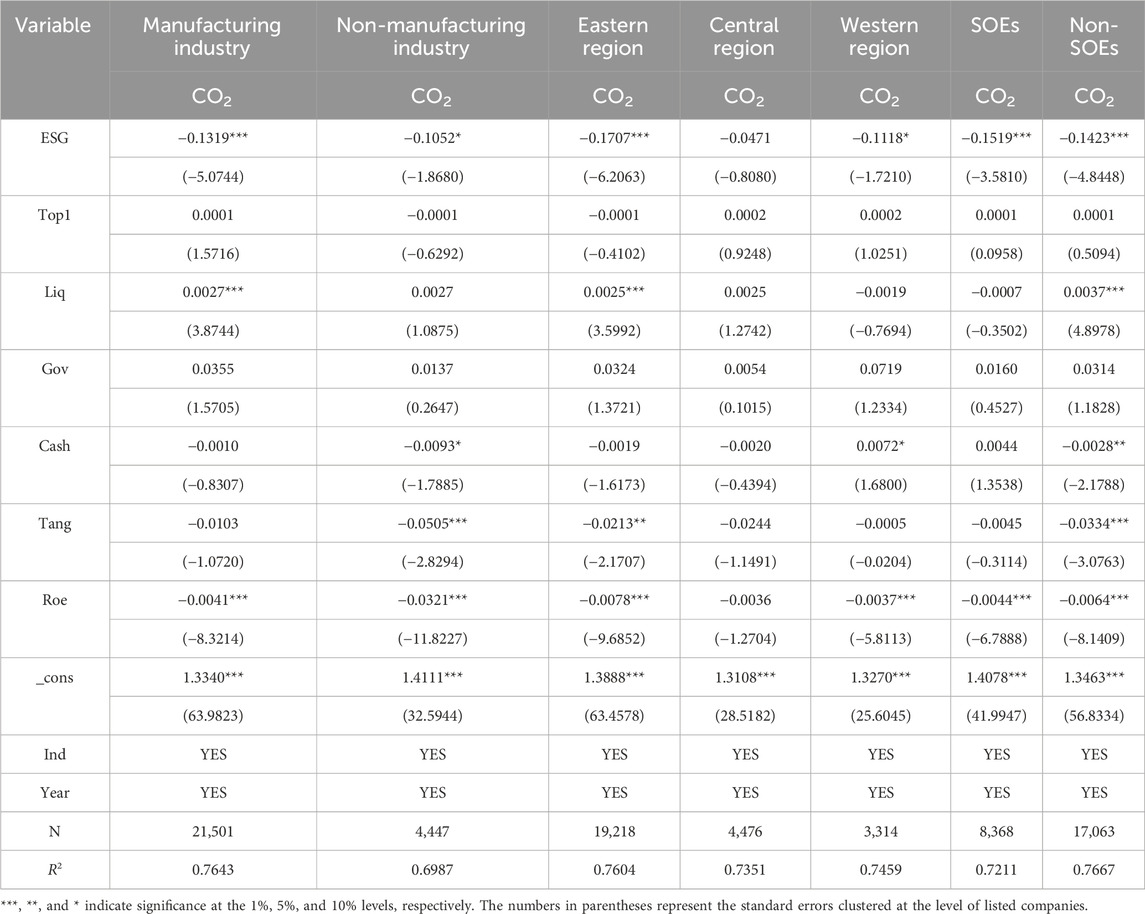

Due to the different characteristics of different industries, the carbon emission intensity of corresponding enterprises is also different, and the action path of ESG performance on carbon emission intensity will be different to some extent. Among several industries, the manufacturing industry constitutes the core and the foundation of the real economy and is the pillar of the national economy (Zhang et al., 2024). According to the data of the Ministry of Industry and Information Technology, China is currently the world’s largest manufacturing country, and the global proportion of manufacturing added value increased from 22.5% in 2012 to nearly 30% in 2021, continuing to maintain the status of the world’s first manufacturing country. However, compared with other industries, the total carbon emission of manufacturing enterprises in the production process is larger, and the carbon emission proportion of the manufacturing industry reached 80% in 2021 (Li Z. G. et al., 2024). Therefore, this study adopts the industry classification standard issued by the China Securities Regulatory Commission (CSRC) in 2024 to categorize the sample data into manufacturing and non-manufacturing sectors. Regression analysis is then conducted on model (3), with the results presented in Table 11. It is found that the ESG performance of the manufacturing enterprises is significantly negatively correlated with carbon emission intensity (p < 0.01). For non-manufacturing enterprises, the negative correlation remains observable (p < 0.1), though with relatively weaker statistical significance, which may be attributed to their diverse business types and smaller sample size.

5.2.2 Regional heterogeneity

Due to the different regional divisions, the corresponding enterprises’ industrial structure, resource distribution, and economic development level are significantly different. Based on China’s regional classification framework, this study categorizes the sample into eastern, central, and western regions for conducting regression analysis on model (3), with the detailed results presented in Table 11. The study reveals a statistically significant negative correlation between ESG performance and carbon emission intensity for enterprises in eastern China (p < 0.01). While enterprises in the central region also demonstrate a negative association, the effect is not statistically significant (p > 0.1). For enterprises in the western region, a relatively weaker negative correlation is observed (p < 0.1). The reason may be the superior institutional environment and higher economic level in the eastern region. Compared with those in the central and western regions, enterprises in the eastern region have higher awareness and willingness to fulfill environmental and social responsibilities and will take more initiatives to undertake ESG responsibilities, thus reducing their carbon emission intensity (Zeng et al., 2023). Although the central and western regions are relatively rich in natural resources, the lack of economic development and technological innovation makes it difficult to balance the relationship between resource development and environmental protection, and it is easy to waste resources, which hinders the full display of ESG performance enabling carbon emission reduction.

5.2.3 Ownership type heterogeneity

Considering the substantial differences in production decisions, operational activities, and governance philosophies among enterprises with different ownership types, these factors may potentially influence the effect of ESG performance on carbon emission intensity. Based on ownership types, this study categorizes the sample into state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs) and conducts regression analysis on model (3). The regression results are presented in Table 11. The results indicate that both SOEs and non-SOEs exhibit statistically significant negative correlations between ESG performance and carbon emission intensity, with regression coefficients of −0.1519 (p < 0.01) and −0.1423 (p < 0.01), respectively. The findings reveal that a 1-point improvement in ESG scores is associated with a reduction in carbon emission intensity by 0.1519 units for SOEs and by 0.1423 units for non-SOEs. Although the numerical difference appears modest, the two effects remain statistically distinct due to unit-based measurement considerations. On the one hand, compared with non-SOEs, SOEs receive stronger policy support that markedly alleviates financing constraints and lowers market risk, thereby fostering the development of green-innovation technologies and substantial productivity gains. On the other hand, SOEs are subject to stricter oversight and bear heavier social responsibilities, leading them to prioritize sustainable development and, consequently, to exert a greater effect in reducing carbon intensity.

6 Conclusion and policy suggestions

In today’s society, ESG performance has become an important measure of an enterprise’s sustainability and long-term value. Stock exchanges and regulators in many countries have formulated policies and regulations requiring listed companies to disclose ESG-related information. Investors have also begun to incorporate ESG factors into the investment decision-making system to evaluate the long-term investment value and risk resistance of enterprises. Under the ESG framework, enterprises, as one of the main sources of carbon emissions, bear an important responsibility, and they need to focus not only on their own economic efficiency but also need to actively respond to the challenges posed by climate change. Based on this, starting from the ESG dimension, this study selects the data of A-share listed companies from 2013 to 2023 as research samples, explores the intermediary mechanism affecting the carbon emission intensity of enterprises through empirical analysis, and finds the influencing factors and empirical evidence that ESG performance can enable enterprises to reduce carbon emission. The results are as follows:

First, superior ESG performance can significantly reduce the carbon emission intensity of the enterprise. The better the ESG performance is, the lower the carbon emission intensity of the enterprise. This conclusion is still valid after robustness test and endogeneity analysis. Second, ESG can reduce the carbon emission intensity of enterprises by improving the level of green technology innovation and TFP, and it can significantly affect the carbon emission reduction effect of enterprises under the two intermediary mechanisms. Furthermore, through the mediating effect of green technology innovation, all three ESG sub-dimensions (E/S/G) can significantly influence corporate carbon emission reduction. When examining the mediating role of TFP, both the social (S) and governance (G) dimensions continue to exhibit significant effects on carbon reduction. However, after introducing TFP as a mediator, the direct impact of the environmental dimension (E) becomes statistically insignificant, indicating that its carbon abatement effect is almost entirely achieved through the enhancement of TFP. Third, through the heterogeneity test, it is found that there is a significant heterogeneity in the carbon emission reduction of enterprises empowered by ESG performance. Specifically, ESG performance enhancement exerts significantly stronger effects on carbon intensity reduction, specifically in the manufacturing sector, eastern China-based enterprises, and SOEs.

This study’s findings offer valuable insights for both corporate strategy implementation and government policy formulation:

At the enterprise level, it is necessary to deeply integrate its own strategic blueprint and ESG concept as the cornerstone and driving force for enabling enterprises to reduce carbon emissions. This integration is not only a positive response to the requirements of the era but is also a key strategic deployment for enterprises to move toward sustainable development and enhance market competitive advantages. (1) Technological innovation serves as a key driver for corporate green transformation and plays a crucial role in helping companies achieve their carbon emission reduction targets. Regarding the environmental (E) dimension, enterprises should directly apply green technological innovations to the production and operational processes, thus reducing carbon emissions at the source and throughout the value chain. This involves investing in R&D and deploying clean energy and energy-saving technologies on a large scale, thereby decreasing the reliance on fossil fuels and optimizing production workflows. Regarding the social (S) dimension, companies should leverage green technology innovation to establish close connections with various stakeholders. By developing green products and building transparent green supply chain management systems, they can cultivate a responsible corporate image. These efforts help translate social expectations into long-term market competitiveness, thereby achieving sustainable development. Regarding the governance (G) dimension, companies should establish executive compensation incentives linked to long-term ESG performance, incorporating key performance indicators such as emission reduction targets and the number of green patents. Additionally, regular disclosure of ESG-related information is essential to demonstrate the company’s capability to manage risks associated with low-carbon transition and bolster external confidence. (2) Enterprises should achieve higher output with fewer factor inputs, thereby reducing carbon emissions through improved TFP. From an environmental (E) perspective, enhancing TFP is critical for carbon reduction. Companies should implement real-time monitoring of production processes to enable precise resource allocation and waste management. By deeply integrating efficiency improvements with reduced resource consumption, they can directly achieve energy conservation and emission reductions at the production level. Regarding the social (S) dimension, companies should recognize the importance of human capital by recruiting top-tier talent externally and providing targeted training internally. Employees with advanced skills and strong environmental awareness can perform their tasks more efficiently, thereby significantly enhancing TFP and contributing to carbon emission reduction. Regarding the governance (G) dimension, enterprises ought to establish dedicated green funds to prioritize projects that are both highly efficient and effective in reducing carbon emissions, thus ensuring that financial and human resources are allocated to sustainable initiatives. Furthermore, they should disclose the risks and opportunities associated with TFP improvements, breaking down information barriers and enhancing resource circulation efficiency to further support decarbonization efforts. (3) Companies across all industries must proactively integrate environmental protection and sustainable development into their strategic core, systematically incorporating environmental (E), social (S), and governance (G) factors into long-term planning. It is essential to establish a standardized ESG management framework and carbon accounting system, regularly disclosing high-quality ESG performance and carbon emission data. By embedding ESG principles throughout the entire production and operation process and implementing concrete actions such as optimizing energy mix and promoting circular economy practices, enterprises can achieve synergistic outcomes of enhanced efficiency and reduced emissions.

In the process of driving enterprises to achieve carbon emission reduction targets, the government plays an irreplaceable leading role. (1) A complete ESG information disclosure system should be established to urge enterprises to legally comply with the requirements of ESG information disclosure in a true and comprehensive manner and to take warning, fines, and other disciplinary measures against enterprises that do not meet the disclosure requirements so as to improve the overall importance and compliance level of enterprises on ESG information disclosure. Such enhanced ESG information disclosure requirements can enhance market transparency and improve enterprise efficiency, enabling enterprises to quickly provide accurate decision-making information to the public in the process of dealing with carbon emissions, thus guiding capital flow to more sustainable investment areas. This not only effectively protects the rights and interests of all stakeholders but also encourages enterprises to accelerate the transformation to a green, low-carbon, and sustainable operation model and promote long-term and healthy economic development. (2) Policy and financial support for technological innovation should be strengthened. The government should formulate a series of forward-looking green technology innovation policies, clarify the direction and focus of green technology innovation, provide policy guidance and support for green technology innovation, establish a multilevel innovation incentive system including patent awards and scientific and technological achievements and transformation awards, and set up a special fund to support the research and development and industrialization of green patents. It should also take steps to stimulate the enthusiasm of scientific research personnel of enterprises to research, develop, and apply for green invention patents. At the same time, enterprises should be encouraged to take actions in line with ESG standards through research and development tax relief, research and development subsidies, and other incentive measures, such as giving incentives and subsidies to enterprises that have achieved significant green innovation results, and provide further motivation to enterprises to reduce carbon emission. (3) Targeted support should be strengthened for central and western regions and non-SOEs to help them overcome resource and capacity bottlenecks in green transition through differentiated ESG policy incentives. On the one hand, the government could establish regional green transition funds to provide financial support for low-carbon technology development and upgrades in these regions and enterprises. On the other hand, it should build public ESG service platforms offering professional services such as carbon accounting, information disclosure, and sustainability strategy consulting, thereby reducing the costs associated with compliance and green transformation. Additionally, targeted incentive policies could be implemented in fiscal and financial domains to support central/western regions and non-SOEs that actively fulfill environmental responsibilities and improve social performance. Preferential measures such as facilitated financing, lower interest rates or tax reductions can be offered to incentivize the integration of ESG principles into their entire management processes. This approach enables enterprises to maintain stable economic growth while simultaneously enhancing environmental and social outcomes, thereby contributing to the high-quality and timely achievement of the carbon peak and carbon neutrality goals.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

XZ: Writing – original draft. YX: Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This study was supported by the Fundamental Research Program of Shanxi Province (202403021211057) and the Project of Humanities and Social Sciences Research Planning Fund of the Ministry of Education of China (22YJAZH124).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., and Restrepo, P. (2018). The race between man and machine: implications of technology for growth, factor shares, and employment. Am. Econ. Rev. 108 (06), 1488–1542. doi:10.1257/aer.20160696

Alkaraan, F., Albitar, K., Hussainey, K., and Venkatesh, V. G. (2022). Corporate transformation toward industry 4.0 and financial performance: the influence of environmental, social, and governance (ESG). Technol. Forecast. Soc. Change 175, 121423–139. doi:10.1016/j.techfore.2021.121423

Beisenbina, M., Fabregat-Aibar, L., Barberà-Mariné, M.-G., and Sorrosal-Forradellas, M.-T. (2023). The burgeoning field of sustainable investment: past, present and future. Sustain. Dev. 31 (02), 649–667. doi:10.1002/sd.2422

Cha, D. L., Chen, S., and Liu, L. (2025). ESG information disclosure and corporate credit ratings: empirical evidence from China’s bond market. Account. Mon. 46 (01), 18–25. doi:10.19641/j.cnki.42-1290/f.2025.01.003

Chapple, L., Clarkson, P. M., and Gold, D. L. (2013). The cost of carbon: capital market effects of the proposed emission trading scheme (ETS). Abacus 49 (01), 1–33. doi:10.1111/abac.12006

Dai, R., Liang, H., and Ng, L. (2021). Socially responsible corporate customers. J. Financial Econ. 142 (02), 598–626. doi:10.1016/j.jfineco.2020.01.003

Davis, G. F., and Cobb, J. A. (2010). Chapter 2 resource dependence theory: past and future. Stanford’s Organ. Theory Renaiss. 28, 21–42. doi:10.1108/S0733-558X(2010)0000028006

Denison, E. F. (2010). Accounting for slower economic growth: the United States in the 1970’s. Washington DC: Brookings Institution Press.

Ding, F. L., and Zhao, W. J. (2025). Research on the impact of corporate ESG performance on urban green and low-carbon development from the perspective of new quality productivity: evidence from China’s A-share listed companies. J. Xiamen Univ. (Arts and Soc. Sci.) 75 (04), 26–38. Available online at: https://kns.cnki.net/kcms2/article/abstract?v=bJ89lKU86K_XGiIMT7f0MAuIsPGnwdrdi0qqgfzHCltph_5gxARGM4mQW_jiVDIwUjw163iB8Xy9iwQC3TDRiZEuR2xSY_8ckqlg6T64rVLJubsNxqXgCYXoeXhzqyaRDHCgxWaYgby_vN3lPZTAobry_BkzbXl74q_LFN41PQU=&uniplatform=NZKPT.

Faccio, M., Masulis, R. W., and Mcconnell, J. J. (2006). Political connections and corporate bailouts. J. Finance 61 (06), 2597–2635. doi:10.1111/j.1540-6261.2006.01000.x

Fang, X. M., and Hu, D. (2023). Corporate ESG performance and innovation: evidence from A-Share listed companies. Econ. Res. 58 (02), 91–106. Available online at: https://kns.cnki.net/kcms2/article/abstract?v=bJ89lKU86K9FLz3FiE-Wp0Wp_soyhSV81A-nIjjuRDF5Tg9Og1ob3kpiywIFj7aw8zq3azlktSlNj3JSnxrUd6FaCJZg3oO293iSwDcVL40yvmuGNh1Yz3ZuQpwt6_-vuPDU4c1bq_vWybsho6BRnHcFBt0HwR2Hjoc_r7x6xME=&uniplatform=NZKPT.

Gao, H., and Zhao, J. P. (2025). How ESG empowers high-quality development of enterprises under the “dual carbon” goals. Tianj. Univ. Tech. J. 1–10. Available online at: https://link.cnki.net/urlid/12.1374.N.20241122.1114.046.

Gervais, A. (2015). Product quality and firm heterogeneity in international trade. Can. J. Econ. 48 (03), 1152–1174. doi:10.1111/caje.12171

Ghaly, M., Dang, V. A., and Stathopoulos, K. (2020). Institutional investors’ Horizons and corporate employment decisions. J. Corp. Finance 64, 101634. doi:10.1016/j.jcorpfin.2020.101634

Hu, L. S., and Xiong, P. P. (2024). How green technological innovation promotes the low-carbon transition of manufacturing enterprises: an examination of the mediating effects of environmental regulations in the Beijing-Tianjin-Hebei region. Ecol. Econ. 40 (12), 63–70. Available online at: https://kns.cnki.net/kcms2/article/abstract?v=bJ89lKU86K_SawKkNwiqjPdEyRZ-neRavQMMj46WsXbRMkwRzM9UHFGnt09TPxBNh9r4EeaN723LC2BiEnABfOY0fGz_vRXqwPKxGkqkXxC2YnMedl5EFjtgit6v6ft84NIK0eLD2AFbRiSDKpP-z0NA1gDh4TMSlyLo1-3eeuc=&uniplatform=NZKPT.

Huang, H., and Qi, B. L. (2024). A study on the green innovation effects of corporate information disclosure: perspectives from environment, society and governance. Res. Industrial Econ. (01), 71–84. doi:10.13269/j.cnki.ier.2024.01.003

Huang, M. H., He, S. Z., and Dai, Y. W. (2023). The impact of ESG performance on organizational resilience in listed companies under the “dual carbon” goals: empirical evidence from high-carbon industry. Manag. Mod. 43 (06), 85–97. doi:10.19634/j.cnki.11-1403/c.2023.06.010

Jiang, T., and Luo, Z. B. (2022). LOC102724163 promotes breast cancer cell proliferation and invasion by stimulating MUC19 expression. China Ind. Econ. 23 (05), 100–120. doi:10.3892/ol.2022.13220

Li, W. A., Zhang, Y. W., and Zheng, M. N. (2019). Research on green governance and its evaluation of Chinese listed companies. Manag. World 35 (05), 126–133+160. doi:10.19744/j.cnki.11-1235/f.2019.0070

Li, T.-T., Wang, K., Sueyoshi, T., and Wang, D. D. (2021). ESG: research progress and future prospects. Sustainability 13 (21), 11663. doi:10.3390/su132111663

Li, J. L., Yang, Z., and Chen, J. (2024a). How does ESG performance empower corporate green technological innovation? Micro evidence from Chinese listed companies. J. Manag. Eng. 38 (05), 1–17. doi:10.13587/j.cnki.jieem.2024.05.001

Li, Z. G., Kong, W. J., and Li, Z. Z. (2024b). Carbon performance of digital transformation in manufacturing enterprises: internal mechanisms and empirical evidence. Contemp. Econ. Sci. 46 (04), 100–111. doi:10.20069/j.cnki.DJKX.202404008

Lu, X. D., and Lian, Y. J. (2012). Estimating TFP in China’s industrial sector: 1999–2007. China Econ. Q. 11 (02), 541–558. doi:10.13821/j.cnki.ceq.2012.02.013

Lu, Q., Wang, X. Y., and Yang, Y. D. (2025). The concentration of supply chains and the digital transformation of enterprises: a contingency perspective based on resource dependence theory. Sci. Stud. Manag. Sci. Technol. 46 (06), 63–83. doi:10.20201/j.cnki.ssstm.20240929.001

Ma, Y. H. (2025). Strategic pathways for talent development with an ESG orientation in the geological exploration industry under the background of green transformation in mining. China Mining Magazine 1–16. doi:10.3033/td.20250820.1131.002