- School of Finance, Shanghai University of Finance and Economics, Shanghai, China

China’s reliance on land finance poses challenges to green economic efficiency. This study examines how local governments’ land finance dependence affects green economic efficiency, using panel data from prefecture-level cities and a super-efficiency SBM model. Findings show that land finance dependence significantly reduces green economic efficiency, particularly in non-resource-based, environmentally protected, and urban agglomeration cities, by diverting fiscal resources to short-term development and increasing debt risks. Policy reforms are recommended to reduce land finance dependence and promote sustainable fiscal incentives.

1 Introduction

Over the past few decades, China has strategically shifted its development focus to green sectors. The purpose of this transition is not merely to improve ecology, but to build a new development pattern where economic progress and ecological sustainability complement each other, while ensuring the momentum of economic growth. However, a series of reforms that centralized fiscal revenues while decentralizing expenditure responsibilities has placed fiscal pressure on local governments responsible for infrastructure, public services, and environmental governance. To bridge these gaps, local governments have increasingly relied on land finance, leveraging monopolized land supply to generate revenues, often at the expense of environmental priorities. This institutional tension raises a critical question: How does local governments’ dependence on land finance shape urban green economic efficiency, and through which mechanisms do these effects manifest across diverse city types? This study investigates these dynamics, offering a novel perspective by linking fiscal incentives to resource misallocation and environmental externalities in China’s decentralized system.

Behind this overarching green strategy lies a profound institutional paradox rooted in the fiscal relationship between central and local authorities. Stemming from the 1994 tax-sharing reform, which shifted revenue authority upward while devolving spending responsibilities, this paradox reshaped intergovernmental resource allocation. Local governments, charged with infrastructure provision, public services, and environmental governance, continue to face persistent fiscal shortfalls. To bridge these gaps—and to meet growth-oriented performance assessments—local officials have increasingly relied on land finance, a model that monopolizes the supply of land to generate revenues. While this reliance has reshaped local economic structures, it frequently clashes with environmental objectives. Consequently, the central government’s green-development vision is constrained by local behavioral logic, generating tension between economic expansion and ecological protection. This study seeks to analyze the environmental externalities of such fiscal dependence and to unveil the intricate landscape shaped by institutional design and local rational choice.

A pivotal question for the success of China’s development transition remains unanswered: How, in quantitative terms and through which mechanisms, does local governments’ dependence on land finance shape urban green economic efficiency? Existing scholarships are sharply divided. One strand highlights the positive side of land-finance revenues, arguing that they have supplied critical capital for rapid urbanization and large-scale infrastructure, some of which has improved green public facilities and thus fostered economic growth and public-goods provision. Gyourko et al. (2022) provide a comprehensive analysis of China’s land finance system, emphasizing its core role in funding urban development and infrastructure projects that have been crucial for China’s economic growth. Similarly, Mo (2018) finds that land finance has positively contributed to county-level economic growth by providing necessary funds for local development projects. Furthermore, Pan et al. (2015) note that land finance helps local governments manage fiscal deficits and invest in real estate markets, thereby stimulating economic activity.

The opposing strand of literature is markedly critical, asserting that overreliance on land finance distorts local officials’ incentives, ensnaring them in a “growth-for-competition” prisoner’s dilemma. In pursuing short-term fiscal gains and investment attraction, governments loosen environmental regulations and partake in a “race to the bottom,” resulting in resource misallocation, industrial lock-in, and profound environmental damage. Van der Kamp et al. (2017) contend that decentralization and land finance prioritize economic expansion over ecological safeguards, yielding lax regulatory enforcement. Zheng et al. (2014) caution that this model jeopardizes China’s sustainability by fostering “ghost cities” and social unrest. Wang et al. (2020) show empirically that land finance has escalated carbon emissions since 2003, linked to economic progress. Recent works add nuance: Chen et al. (2024) examine land finance’s role in inter-city integration, noting spatiotemporal effects on sustainability; Wang D et al. (2021) assess its influence on industrial shifts, highlighting environmental and social drawbacks. This scholarly divide highlights the multifaceted effects of land finance on green economic efficiency, making resolution of the positive-negative paradox vital for evidence-based policies that harmonize growth and environmental goals in China’s transition.

This study employs panel data from Chinese prefecture-level cities over the period from 2015 to 2023, utilizing a super-efficiency SBM model to assess green economic efficiency and a two-way fixed effects model for baseline regressions, which demonstrate that land finance dependence substantially hinders green economic efficiency after accounting for various controls such as per capita GDP and financial development; endogeneity concerns are mitigated through two-stage least squares estimation with a retail sales-to-GDP ratio as an instrumental variable, reinforcing the adverse relationship; robustness is confirmed via alternative efficiency measurement approaches like directional distance functions and global Malmquist-Luenberger indices, substitute indicators for land finance dependence, and exclusion of potentially anomalous data years; mechanism examinations reveal that land finance dependence indirectly impairs green economic efficiency by diminishing environmental regulation—evident in reduced policy emphasis and protection expenditures—and by escalating local debt risks through higher debt balances and investment bonds; heterogeneity analyses indicate more pronounced negative effects in non-resource-based cities, key environmental protection cities, and urban agglomeration cities, highlighting the institutional tensions between fiscal incentives and ecological priorities, with policy recommendations advocating for reduced reliance on land finance via sustainable reforms to harmonize economic growth and environmental sustainability in China’s green development pathway.

This study makes three significant contributions to the literature. First, it extends research on resource misallocation by introducing land finance dependence as a critical institutional determinant of environmental inefficiencies. While foundational work quantified productivity losses from factor market distortions (Brandt et al., 2013), this analysis demonstrates how a specific fiscal arrangement induces misallocation in the environmental domain, resulting in measurable losses in green economic performance. Second, this study provides a critical institutional perspective—specifically focusing on local governments’ land finance dependence (Porter and Claas van der, 1995; Dechezleprêtre and Sato, 2017), it reveals that fiscal pressures inherent in decentralization systematically weaken regulatory stringency, thereby explaining why the purported innovation-driving benefits of environmental policy may fail to materialize in fiscally constrained local governments. Third, the study advances the understanding of how local economic structures mediate the effects of national policies, a line of inquiry influenced by institutional analyses of innovation and reallocation (Acemoglu et al., 2018).

The paper is structured as follows: Section 2 reviews the relevant literature and presents the research hypotheses; Section 3 outlines the data sources, variable definitions, and methodology; Section 4 presents and discusses the regression results, along with robustness checks; Section 5 explores the mechanisms through which land finance dependence influences green economic efficiency; and Section 6 concludes with policy recommendations.

2 Research hypotheses

2.1 Impact of land finance dependence on urban green economic efficiency

Urban green economic efficiency represents a city’s capacity to achieve economic outputs while minimizing resource inputs and environmental externalities, serving as a core metric for sustainable development under resource constraints. From a fiscal decentralization perspective, local governments in China operate within a system where revenue-sharing reforms have centralized fiscal authority while decentralizing expenditure responsibilities, creating incentives for officials to pursue short-term growth targets to secure promotions and revenues. Land finance dependence emerges as a rational adaptation to these pressures, as governments monopolize land supply to generate off-budget revenues for infrastructure and urbanization. However, this dependence is expected to undermine green economic efficiency because it fosters a “growth-at-all-costs” logic: by prioritizing land sales and real estate-driven investments, local officials divert resources toward expansive, pollution-intensive projects that maximize immediate fiscal gains but impose long-term ecological costs, such as habitat loss and increased emissions. This relationship is theoretically rooted in the principal-agent problem, where misaligned incentives between central environmental mandates and local fiscal imperatives lead to suboptimal resource allocation, perpetuating inefficiencies in green transitions. Supporting this, Wang P et al. (2021) demonstrate that land finance reduces urban land use efficiency, leading to sprawling development that increases energy consumption and environmental degradation, while Wang et al. (2020) find that land finance significantly contributes to carbon emissions. Similarly, Gyourko et al. (2022) argue that land finance drives up land and housing prices, encouraging investment in high-pollution sectors, and (Cheng et al., 2022) highlight resource misallocation under fiscal pressures, though Zhao et al. (2024) note that green finance could mitigate volatility but is often overshadowed by land dependence.

H1. Land finance dependence negatively affects urban green economic efficiency.

2.2 Land finance dependence and environmental regulation

Environmental regulation comprises a suite of institutional tools—laws, policies, and enforcement mechanisms—designed to internalize environmental externalities and align economic activities with sustainability goals, as posited by the Porter Hypothesis, which suggests that well-crafted regulations can stimulate innovation and efficiency. In the context of China’s decentralized governance, land finance dependence is theorized to weaken these regulations because it heightens fiscal vulnerabilities, compelling local governments to relax enforcement to attract investment and sustain land revenue streams. This dynamic arises from a “race to the bottom” incentive structure: under performance-based evaluations focused on GDP growth, officials face a prisoner’s dilemma where competing jurisdictions undercut environmental standards to secure economic advantages, resulting in diluted regulatory stringency. Consequently, weakened regulations fail to curb pollution or promote green innovations, amplifying the negative spillover from land finance to green economic efficiency by allowing unchecked resource exploitation and environmental degradation. Empirical insights align with this, as Wang et al. (2019) find that land finance encourages relaxed regulations leading to a “race to the bottom,” and Zhuge et al. (2020) highlight paradoxes where economic targets undermine efforts. Regional variations are noted by Zhao et al. (2024), while Dechezleprêtre and Sato (2017) confirm regulations’ innovation potential but fiscal constraints from land dependence divert resources.

H2. Land finance dependence weakens environmental regulation, which in turn negatively affects urban green economic efficiency.

2.3 Land finance dependence and local government debt

Local government debt in China often accumulates through land-collateralized borrowing and financing platforms, reflecting a broader fiscal mismatch where decentralized spending exceeds centralized revenues. Theoretically, land finance dependence exacerbates this debt expansion by creating a leverage cycle: governments use anticipated land revenues as collateral to fund infrastructure, but volatile real estate markets and over-reliance on non-recurring income sources trap them in a debt trap, as per the soft budget constraint theory. High debt levels are expected to constrain green investments because they crowd out funding for long-term, low-return environmental projects in favor of short-term, high-yield urban developments, perpetuating a vicious cycle of fiscal risk and ecological neglect. This mediation pathway underscores how debt acts as an amplifier of land finance’s negative externalities, limiting fiscal flexibility and prioritizing debt servicing over sustainable initiatives. Consistent with this framework, Cai et al. (2021) and Geng and Qian (2024) describe land as collateral driving debt risks, while Qu et al. (2023) and Tao et al. (2010) highlight regional competition and infrastructure financing limitations. Mechanisms are further explored by Zhou et al. (2023), who link debt to increased pollution, Xu (2019) tracing origins to fiscal pressures, and Wang et al. (2020) connecting to carbon emissions, with Jin et al. (2021) noting green finance’s constrained mitigation potential.

H3. Land finance dependence leads to local government debt expansion, which negatively affects urban green economic efficiency.

3 Methodology

3.1 Data

To ensure data availability and completeness, this study utilizes panel data of Chinese prefecture-level cities from 2015 to 2023 for empirical analysis. The input-output indicators for green economic efficiency are primarily sourced from the China Environmental Statistical Yearbook and the China Statistical Yearbook. Data on land finance dependence are compiled from official statistics published by provincial and municipal departments of finance. Other control variables are obtained from the China City Statistical Yearbook and local statistical bulletins. Missing values are supplemented through manual searches; samples with irreparable missing data are excluded. All monetary variables are adjusted to constant 2011 prices using the GDP deflator of each city’s respective province to eliminate the effects of inflation. All continuous variables have been trimmed at 1%. Ultimately, a total of 2199 valid observations are obtained.

3.2 Variable definition

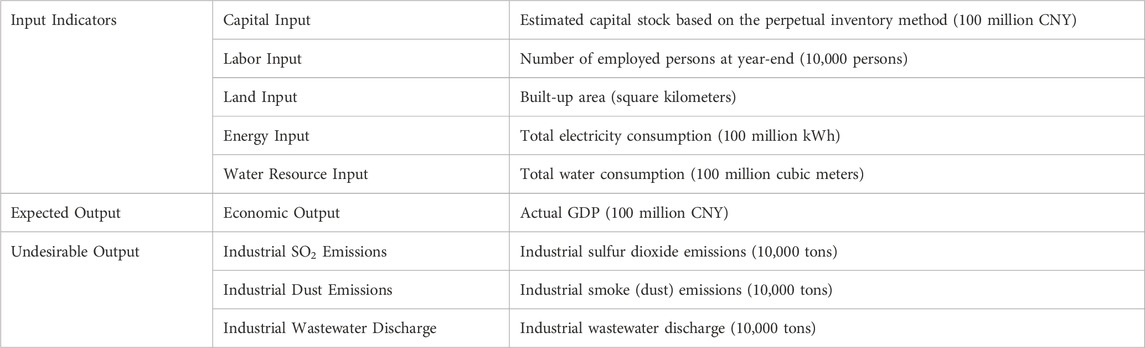

3.2.1 Independent variable

The measurement of green economic efficiency (GEE) requires an analytical framework capable of simultaneously handling desirable outputs and undesirable outputs. Traditional Data Envelopment Analysis (DEA) models, such as CCR and BCC, are not suited for this task as they are typically radial, assuming proportional changes in inputs and outputs, and fail to account for non-radial slacks, which can lead to an incomplete assessment of inefficiency. To address this, we adopt the non-radial Slacks-Based Measure (SBM) model, which directly incorporates input excesses and output shortfalls into the efficiency calculation, providing a more accurate and comprehensive evaluation (Tone, 2001). The variable selection of input-output indicators is shown in Table 1. Furthermore, to overcome the limitation of standard DEA models that often assign multiple Decision-Making Units (DMUs) an identical efficiency score of ‘1′and thus cannot be ranked, we employ the super-efficiency SBM model. This advanced method allows efficiency scores to exceed unity, enabling the ranking of all DMUs, including those on the efficiency frontier, which offers superior discriminatory power for detailed comparative analysis.

For the dynamic analysis and robustness testing of GEE, this study selects the Directional Distance Function (DDF)-based Global Malmquist-Luenberger (GML) index model. The evolution of productivity analysis began with the Malmquist index, which, while foundational for measuring total factor productivity change, could not incorporate environmental externalities (Färe et al., 1994). A significant advancement was the development of the Malmquist-Luenberger (ML) index, which utilizes a DDF to handle undesirable outputs by simultaneously seeking to increase desirable outputs while decreasing undesirable ones (Chambers et al., 1996). However, the conventional ML index suffers from key methodological issues, including the potential for infeasibility in its linear programming and a lack of circularity, which compromises the reliability of inter-temporal comparisons. The GML index, proposed by Oh (2010), overcomes these limitations by constructing a single, global production frontier that envelops all periods. This approach ensures both the feasibility and transitivity of the results, making it a more robust and theoretically sound method for tracking the dynamics of environmental efficiency.

In essence, the dual-methodological approach employing both the super-efficiency SBM and the DDF-GML models is uniquely suited for this research because it provides a comprehensive, robust, and nuanced assessment of green economic efficiency. It has been successfully applied in similar contexts to evaluate environmental performance (Zhang and Choi, 2013). The super-efficiency SBM model offers a precise and high-resolution static analysis, capable of accurately measuring inefficiency by directly accounting for input and output slacks and providing a complete ranking of all entities, which is a critical feature that overcomes the limitations of traditional DEA models. Complementing this, the DDF-GML index provides a methodologically superior dynamic analysis. By constructing a single global frontier, it avoids the problems of infeasibility and non-transitivity that plague earlier Malmquist-Luenberger models, thus ensuring that the tracking of efficiency changes over time is both reliable and consistent. This combination allows the study to capture the robust, long-term dynamic trends, offering a far more complete and analytically rigorous evaluation than a single model could provide.

3.2.2 Dependent variable

The dependent variable in this study is local governments’ land finance dependence (LFD), defined as the extent to which local governments rely on land-related fiscal revenues to support their public budgets. Conceptually, land finance broadly encompasses all fiscal revenues derived from land and real estate activities, including land transfer revenues (fees collected from leasing or selling state-owned land use rights) and associated taxes, such as urban land use tax, land value increment tax, and real estate-related taxes. However, due to the practical challenges of accurately and consistently capturing the full range of direct and indirect land-related taxes across jurisdictions—stemming from variations in tax reporting and data availability—this study adopts a narrower and more precise definition of LFD. Specifically, LFD is operationalized as the proportion of land transfer revenue in a local government’s public budget revenue. This measure is widely used in the literature due to its reliability and availability in official fiscal data, enabling a clear and consistent assessment of local governments’ reliance on land-based financing.

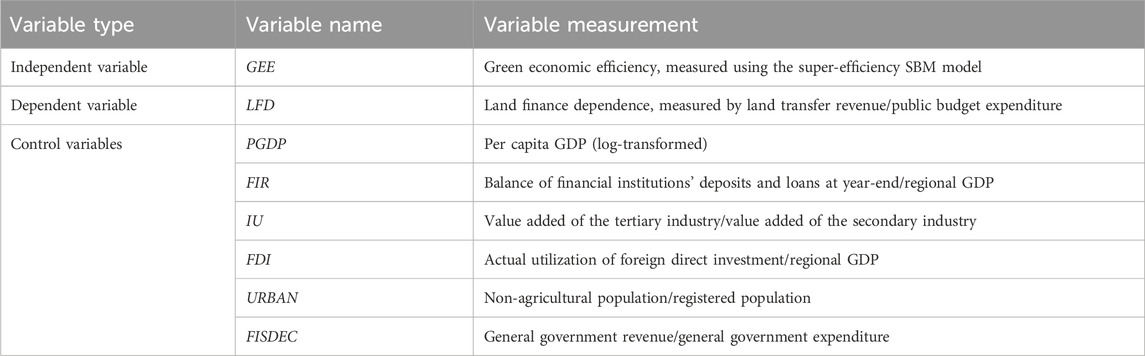

3.2.3 Control variables

This study selects control variables from the perspectives of urban macroeconomic characteristics and land resources, including economic development level (

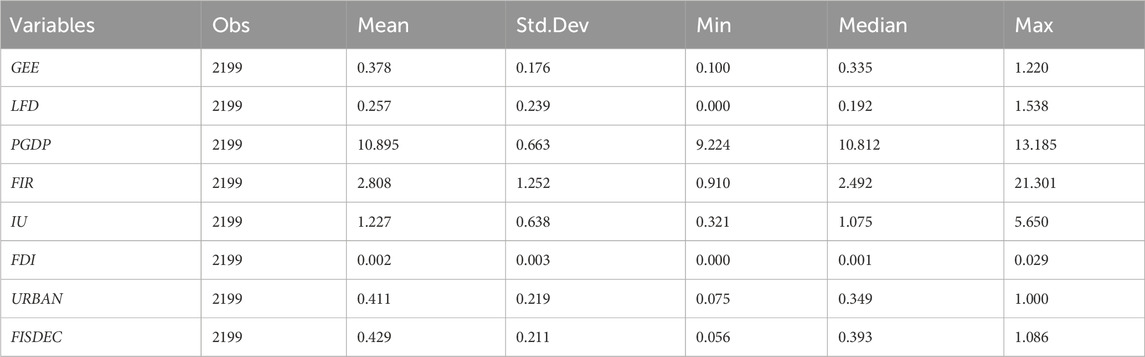

Prior to the regression, multicollinearity in the baseline OLS model is diagnosed using the Variance Inflation Factor (VIF) method. The results show that the VIF values of all variables are below 10, suggesting that serious multicollinearity is not a concern. Since the number of cross-sectional units (N) exceeds the time span (T), Levin–Lin–Chu (LLC) and Fisher-ADF unit root tests are conducted to ensure the stationarity of the panel data and the robustness of the regression results. Both tests reject the null hypothesis of a unit root, indicating that the sample data are stationary. In addition, as shown in Table 3, there are considerable differences between the mean, maximum, and minimum values of several variables, implying potential heterogeneity across samples.

Table 3 presents the descriptive statistics of the key variables in this study. The dependent variable,

3.3 Model construction

This study employs a panel data model for empirical analysis. The results of the Hausman test indicate that a two-way fixed effects (FE) model with robust standard errors is more appropriate, given the significant differences across provinces. Therefore, the FE model is adopted for regression. The model is shown in Formula 1:

where

4 Basic results

4.1 Basic regression analysis

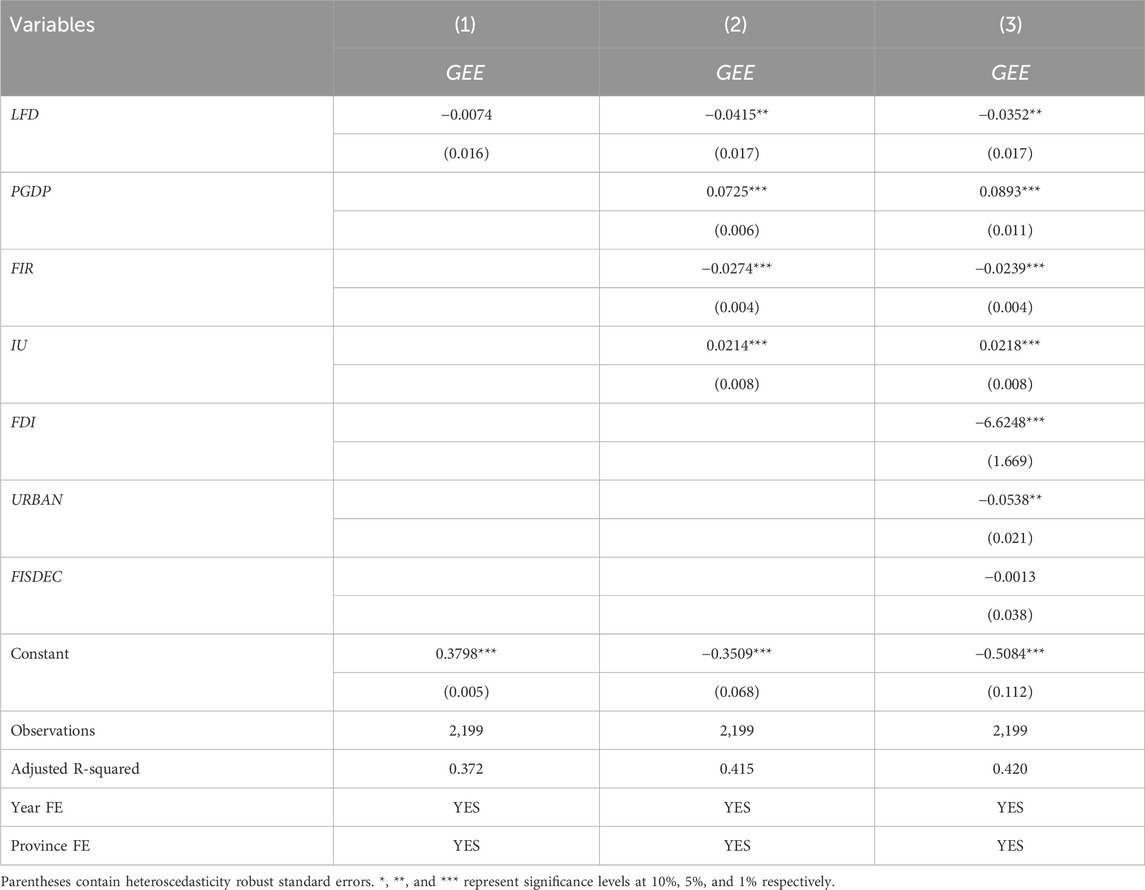

The results of the baseline regressions are presented in Table 4. All three models control for both year and province fixed effects. Column (1) shows that when land finance dependence is included as the sole explanatory variable, the estimated coefficient is statistically insignificant. This suggests that, in the absence of other key controls, the impact of land finance dependence on green economic efficiency is not clearly identifiable. A likely reason is the omission of important structural economic variables, which may weaken the explanatory power of the model.

In Columns (2) and (3), the model progressively incorporates additional control variables. After these inclusions, the coefficient on land finance dependence becomes significantly negative at the 5% level, indicating that land finance dependence has a statistically significant suppressing effect on green economic efficiency. This finding supports the negative externalities of land finance, which posits that heavy reliance on land-based revenues by local governments may erode their intrinsic motivation to pursue green transformation, thereby contributing to resource inefficiency and environmental degradation. So, Hypothesis 1 has been proven.

The theory of Fiscal Federalism explores the division of expenditure responsibilities and fiscal powers between central and local governments. While the theory emphasizes that decentralization can better meet the demand for local public goods, it also warns of the potential negative consequences of inter-jurisdictional competition. Research by scholars such as Wilson and Wildasin (2004) has provided a solid theoretical foundation for the “Race to the Bottom.” To attract mobile capital and investment, local governments not only compete on taxes but may also engage in a “downward competition” on environmental, labor, and other standards. Driven by land finance, local governments have a strong incentive to maximize land transfer revenue by attracting industrial and real estate projects that can be quickly implemented. To this end, they might relax regulations in areas such as planning approval and environmental assessment, tolerating or even encouraging the entry of high-pollution, high-energy-consumption firms, thereby sacrificing environmental quality for short-term economic growth and fiscal revenue. This prevalent “race to the bottom” behavior is a significant reason for the widespread suppression of green economic efficiency at the regional level.

4.2 Endogeneity tests

In the study of green economic efficiency, land finance dependence as a core explanatory variable may suffer from endogeneity issues. On the one hand, local governments’ reliance on land-based revenues can directly influence the formulation and implementation of urban green development strategies. On the other hand, changes in green economic efficiency may in turn affect the extent to which local governments depend on land transfer income, resulting in potential bidirectional causality. Additionally, omitted variable bias and institutional differences at the city level may introduce further endogeneity concerns. To address these issues, this study adopts the two-stage least squares (2SLS) estimation method and employs an external instrumental variable to identify the causal impact of land finance dependence on green economic efficiency.

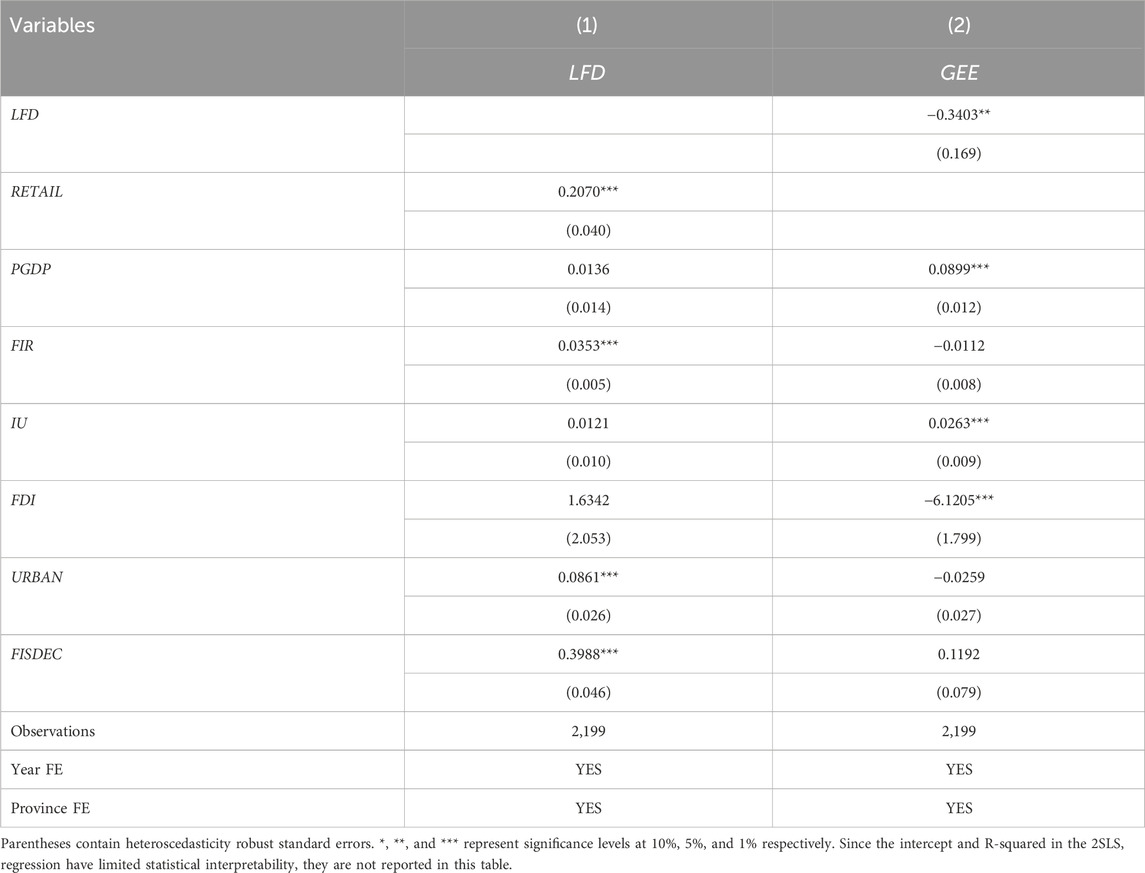

This study selects the ratio of total retail sales of consumer goods to GDP (RETAIL) as the instrumental variable for the endogeneity test in the baseline regression. First, in terms of relevance, retail sales of consumer goods reflect the vitality of domestic demand and the consumption structure within a city, which indirectly influences the fiscal revenue capacity of local governments. When a city exhibits strong consumption capacity and high household spending levels, the reliance of local governments on land transfer revenues tends to be lower, suggesting a strong statistical correlation between RETAIL and LFD. Second, from the perspective of exogeneity, RETAIL serves as an indicator of economic dynamism, and its fluctuations are primarily driven by factors such as household income, consumption preferences, and demographic structure. It does not directly intervene in the mechanisms that determine green economic efficiency, nor is it likely to affect GEE through channels such as green technology innovation or environmental regulation. Therefore, it satisfies the condition of exogeneity. Overall, RETAIL is a theoretically sound and operationally feasible instrumental variable, making it appropriate for identifying the net effect of land finance dependence on green economic efficiency.

The 2SLS regression results of Table 5 confirm the robustness of the baseline finding that “land finance dependence suppresses green economic efficiency,” even after addressing endogeneity concerns. The F-value of the first-stage regression is 22.555, indicating that there is no issue of weak instruments. Specifically, a high level of reliance on land-based revenues by local governments not only affects the structure of municipal finance but may also incentivize them to overlook ecological and environmental costs in the process of urban expansion. This, in turn, undermines the effectiveness of green transition policies and significantly hampers improvements in green economic efficiency. After addressing potential reverse causality and omitted variable bias using an instrumental variable, the negative impact of land finance dependence on green economic efficiency remains statistically significant. This provides further empirical support for the theory of negative externalities of land finance. Therefore, advancing green development requires not only technological and industrial efforts but also institutional reforms in fiscal policy and land management. Reducing dependence on land transfer revenues and restructuring a green-oriented fiscal incentive mechanism are essential steps in this process.

4.3 Robustness tests

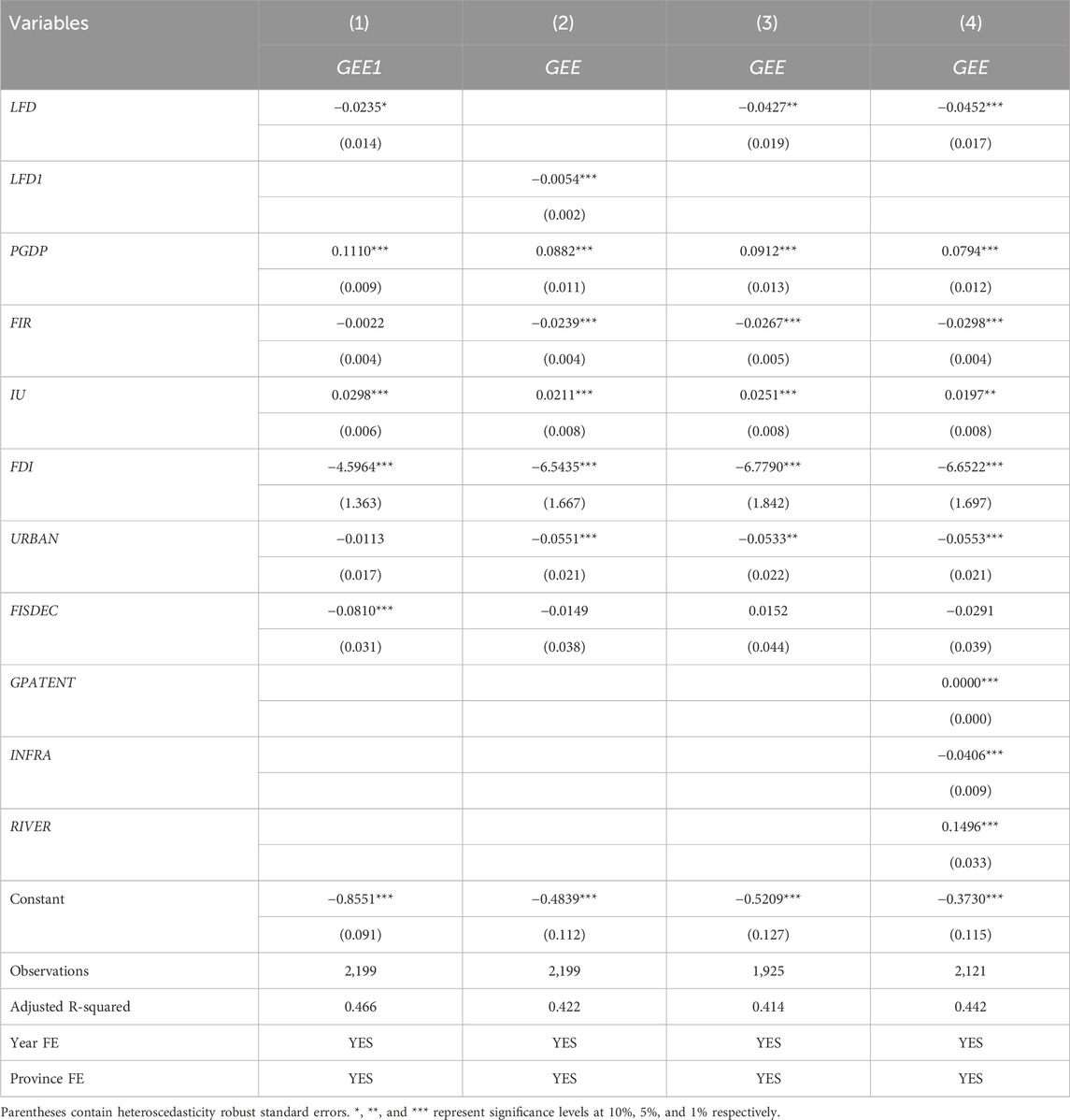

To ensure the reliability of the baseline findings, this study conducts a series of robustness checks. First, to verify the robustness of the green economic efficiency measurement, this study recalculates green economic efficiency (GEE1) using the Directional Distance Function (DDF) and the Global Malmquist–Luenberger Index (GML) under the assumption of variable returns to scale (VRS). The inputs include the total number of employed persons, capital stock estimated using the perpetual inventory method with 2003 as the base year, and electricity consumption. Desired output is represented by real GDP at constant prices, while undesirable outputs are measured by the three types of industrial pollution. Second, to test the sensitivity of the results to the construction of the core independent variable, this study introduces an alternative indicator, defined as the ratio of land transfer revenue to local government comprehensive fiscal capacity (LFD1). Comprehensive fiscal capacity includes local revenue, tax rebates, transfer payments, government fund budget revenue, and part of the extra-budgetary income, thus providing a more comprehensive reflection of the local fiscal situation. Third, this study addresses the potential influence of anomalous events. In 2015, the National Audit Office launched a nationwide “land audit storm,” conducting extensive investigations into land transfer violations. This event may have led to structural anomalies in land transfer revenue and usage behavior. To ensure the robustness of the results, this study excludes the 2015 data and re-estimates the model. Finally, to account for potential omitted variable bias, the model is re-estimated after controlling for three additional variables: green patent applications (GPATENT), infrastructure quality (INFRA), and urban river density (RIVER), to account for the influence of innovation capacity, physical infrastructure, and natural geographic factors.

The regression results from these tests confirm the stability of the baseline conclusions. As shown in Column (1) of Table 6, when using the alternative GEE1 measure, the coefficient of LFD is −0.024, which is statistically significant at the 10% level. This indicates that the research conclusions do not depend on a specific efficiency measurement method; although the SBM and DDF-GML models differ in structure, the empirical findings consistently show that land finance dependence significantly suppresses green economic efficiency under both methods. The results for the alternative land finance dependence indicator are presented in Column (2) of Table 6. The coefficient of LFD1 is −0.005, statistically significant at the 5% level and consistent with the baseline regression. This suggests that even with a broader definition of land finance dependence, the conclusion that a higher reliance on land revenue corresponds to lower green economic efficiency remains valid. When the 2015 data is excluded, the results, presented in Column (3) of Table 6, show that the coefficient of LFD is −0.043, statistically significant at the 5% level. This indicates that the negative impact of land finance dependence on green economic efficiency is a persistent phenomenon and not driven by an anomalous event in a specific year. In Column (4) of Table 6, after including additional controls for innovation, infrastructure, and geography, the coefficient of land finance dependence remains significantly negative. This demonstrates that the negative relationship is not a mere artifact of a city’s innovation level, infrastructure quality, or natural geography. The stability of the coefficient under this expanded set of controls confirms the robustness of the findings and provides stronger evidence for a direct link.

5 Heterogeneity analysis

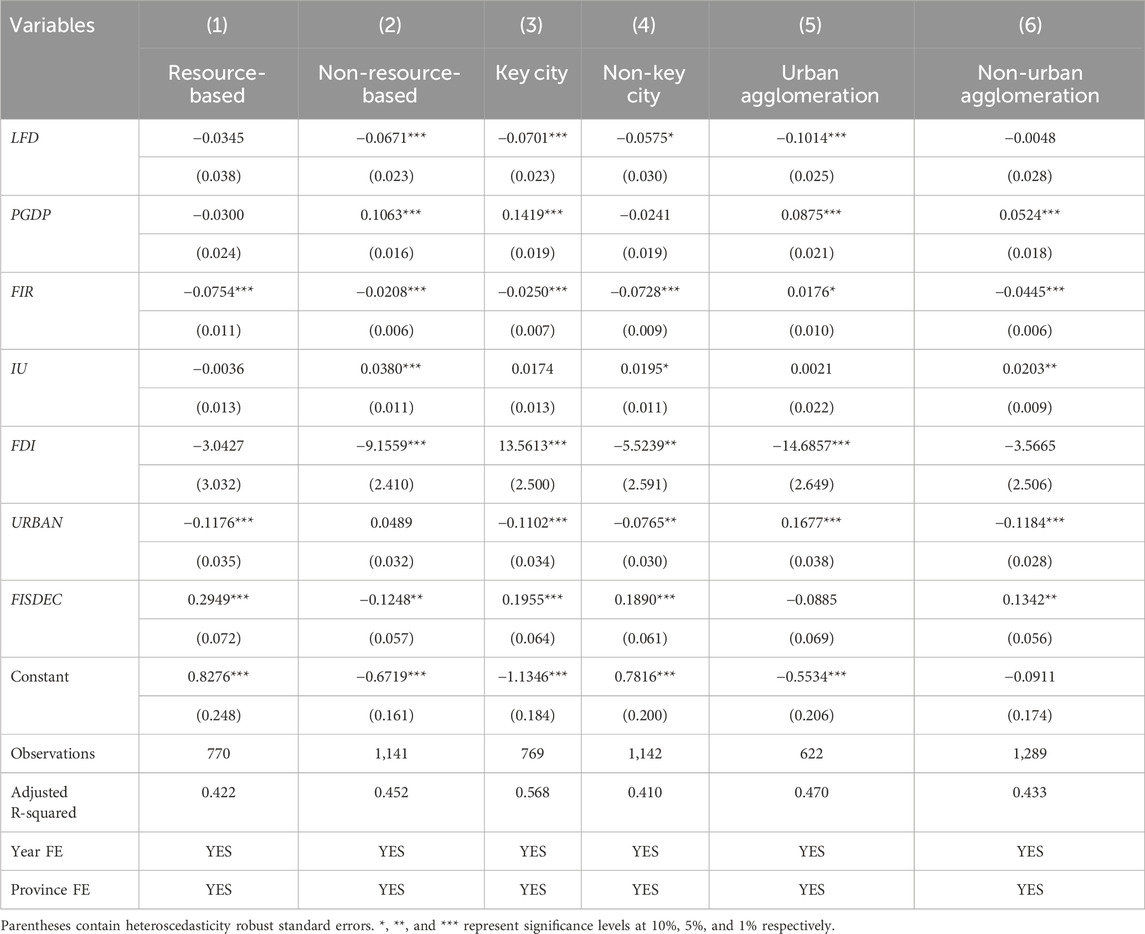

Heterogeneity analysis is essential for uncovering how the impacts of land finance dependence on green economic efficiency vary across city types, providing insights into underlying mechanisms and informing targeted policy interventions. Drawing on resource dependence theory and fiscal decentralization frameworks, we theorize that structural differences in fiscal bases, environmental pressures, and competitive dynamics moderate these effects. We conduct subgroup regressions based on three dimensions: resource-based vs non-resource-based cities (per the National Plan for Sustainable Development of Resource-Based Cities, 2013–2020), key vs non-key environmental protection cities (per the National Environmental Protection “11th Five-Year Plan”), and urban agglomeration vs non-agglomeration cities (focusing on five major national clusters: Beijing–Tianjin–Hebei, Yangtze River Delta, Pearl River Delta, Central Yangtze, and Chengdu–Chongqing). Results are reported in Table 7.

Resource-based cities, endowed with natural resources, often benefit from alternative fiscal revenues like resource taxes and central transfers, theoretically buffering against heavy land finance dependence and allowing more balanced environmental investments despite inherent pollution pressures from extractive industries. In contrast, non-resource-based cities lack such buffers, making them more vulnerable to LFD-driven fiscal shortfalls that crowd out green initiatives and exacerbate resource misallocation under decentralization incentives. This aligns with the “resource curse” literature, which argues that the economic impact of a dominant revenue source is conditional on institutional quality; in contexts with weaker governance or intense rent-seeking pressures, such dependence can distort incentives and crowd out investment in more sustainable, productive sectors (Mehlum et al., 2006). The results in Columns (1) and (2) support this: the LFD coefficient is insignificant in resource-based cities but significantly negative in non-resource-based ones. Mechanistically, this links to weakened regulation in non-resource cities, where land finance dependence intensifies a “race to the bottom” to attract non-extractive investments, impairing green economic efficiency.

Key environmental protection cities are designated with stricter mandates and enhanced central support, theoretically fostering stronger regulatory frameworks and green awareness to mitigate harms to land finance dependence. Counterintuitively, however, fiscal pressures from land finance dependence may amplify negative effects here: heightened environmental standards increase compliance costs, but LFD-induced revenue volatility forces trade-offs, diluting enforcement and crowding out investments, as central mandates clash with local fiscal imperatives. This reflects the inherent tensions in fiscal federalism, where local governments are caught between central mandates and local economic pressures. The intense competition for capital can discipline governments to adopt pro-business policies, sometimes at the expense of regulatory stringency (Cai and Treisman, 2005). Columns (3) and (4) show the coefficients of LFD is significantly negative in key cities while milder and less significant in non-key ones. This mechanism ties to debt escalation, where land finance dependence in mandated cities leads to leveraged borrowing for compliance, paradoxically undermining long-term green economic efficiency.

Urban agglomerations feature intense intercity competition, regional integration, and infrastructure demands, theorized to exacerbate the effects of land finance dependence via amplified “growth-for-competition” dilemmas. The high density and close proximity within urban agglomerations intensify inter-jurisdictional competition (Duranton and Diego, 2020), pressuring local governments to use land finance as a tool for rapid, large-scale development to attract mobile capital and talent. Clustered governments face heightened pressures to leverage land for coordinated development, often at ecological costs, while non-agglomeration cities operate with less rivalry and more localized strategies. Columns (5) and (6) confirm this: LFD’s coefficient is significantly negative in agglomeration cities while it is insignificant in non-agglomeration ones. Mechanistically, this reflects regulatory weakening and debt risks in agglomerations, where competition drives relaxed standards and collective borrowing, intensifying environmental inefficiencies.

6 Influence mechanisms

6.1 The intensity of environmental regulation

Theoretically, the fiscal structure of local governments not only determines the direction of fiscal resource allocation but also shapes their policy implementation preferences. When local governments heavily rely on land transfer revenues, they tend to prioritize land supply and infrastructure investment to attract investment and boost GDP growth. This, in turn, reduces their fiscal attention and political commitment to environmental protection and ecological governance. Therefore, the intensity of environmental regulation may serve as a key mediating variable through which land finance dependence affects green economic efficiency. This paper selects “environmental regulation intensity” as one of the transmission channels in the mechanism analysis. By examining whether land finance dependence significantly influences local governments’ willingness and capacity to engage in environmental governance, the study further explores how it constrains green development.

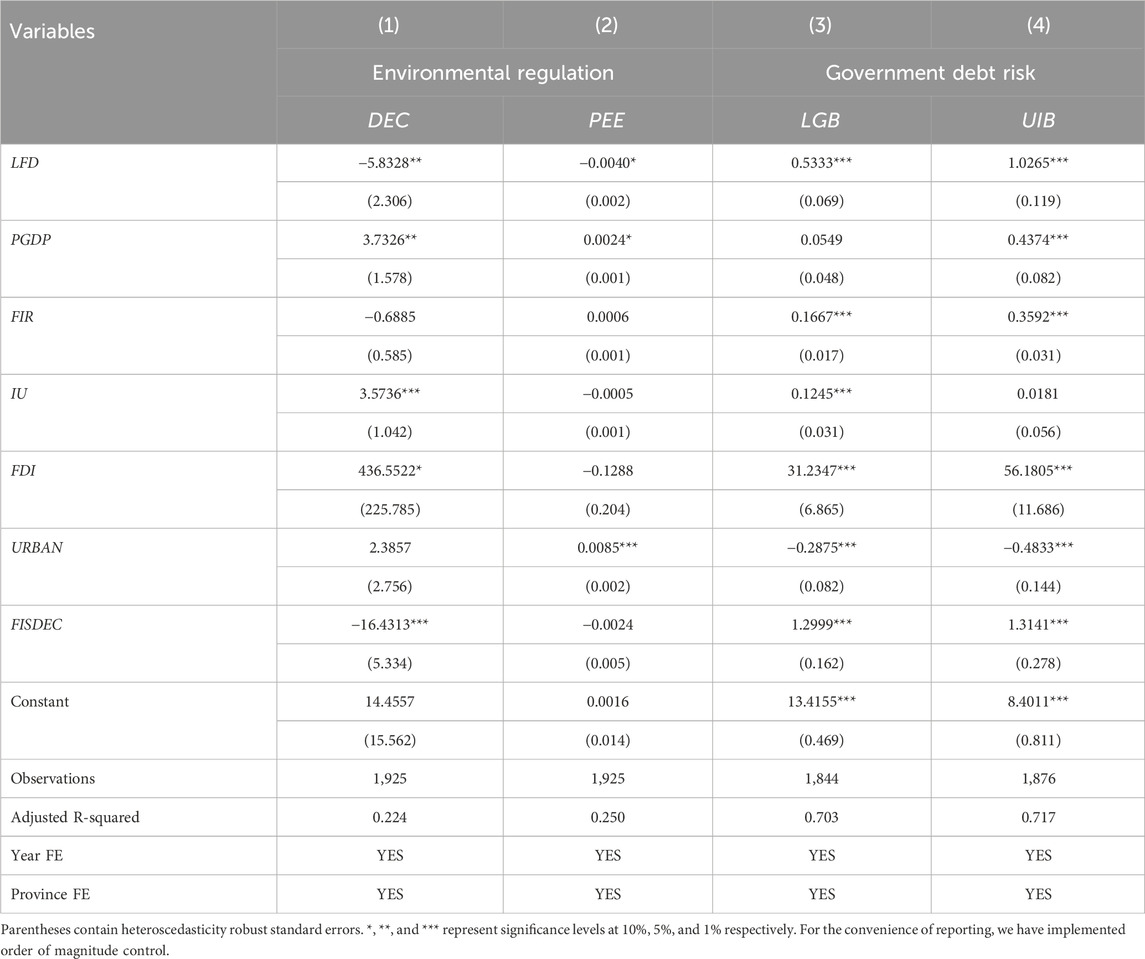

Columns (1) and (2) of Table 8 present the regression results for the environmental regulation mechanism. Drawing on the text-based policy indices constructed by Baker et al. (2016), Caldara and Iacoviello (2022), and Li et al. (2024), we calculated the government attention index on environmental issues; this rigorous measurement method has been applied to the analysis of a broader range of government reports. Specifically, in Column (1), the dependent variable is the frequency and proportion of environmental terms appearing in local government work reports (DEC), which serves as a proxy for government environmental governance following (Chen et al., 2018). Government work reports are official, programmatic policy documents that outline administrative agendas and implement decisions of legislative bodies. As such, the frequency and relative weight of environmental language in these reports offer a comprehensive reflection of the government’s regulatory emphasis and environmental policy stance. The regression result shows that the coefficient of land finance dependence is −5.8328, statistically significant at the 5% level, indicating that higher land finance dependence is associated with fewer environmental expressions in formal policy documents—reflecting a reduced emphasis on environmental concerns.

Column (2) uses the share of energy conservation and environmental protection expenditure in total fiscal expenditure (PEE) as the dependent variable. The coefficient of LFD is −0.0040, statistically significant at the 10% level, suggesting that as local governments become more dependent on land finance, they allocate a smaller proportion of their fiscal resources to environmental protection.

These findings demonstrate that land finance dependence indirectly affects urban green economic efficiency by weakening the intensity of environmental regulation. Both mechanism variables are significantly and negatively impacted by land finance dependence, providing further empirical support for the theory of negative externalities of land finance, Hypothesis 2 has been verified. This mechanism highlights that to effectively enhance green economic efficiency, it is necessary to reduce reliance on land-based revenues at the source, strengthen the political incentives and fiscal support for environmental policy, and enhance the capacity and willingness of local governments to engage in effective environmental governance.

6.2 Local government debt risk

In addition to the intensity of environmental regulation, local government debt risk may also serve as a crucial mechanism through which land finance dependence affects green economic efficiency. Under the current fiscal system, local governments face an imbalance between revenue and expenditure responsibilities, often resorting to borrowing to fill fiscal gaps. Especially as land transfer revenues become a key source of fiscal income, governments may engage in large-scale borrowing by leveraging land assets or anticipated revenues to sustain intensive infrastructure investment and urban expansion, thereby escalating debt risk. More critically, excessive reliance on land finance and implicit debt instruments reinforces short-term growth preferences, crowding out fiscal support for environmental governance and green industries. Therefore, if land finance dependence significantly increases government debt risk, it provides indirect evidence that its negative effect on green economic efficiency may operate through a “leveraged expansion” pathway.

Columns (3) and (4) of Table 8 present the regression results for the debt risk mechanism. In Column (3), where the dependent variable is the outstanding balance of local government debt (LGB), the coefficient of land finance dependence is significantly positive at the 1% level, indicating that greater dependence on land finance is associated with higher government debt levels. Column (4) uses the scale of urban investment bonds (UIB) issued by local government financing platforms as the dependent variable. The LFD coefficient is again significantly positive at the 1% level, suggesting that land finance dependence significantly promotes the expansion of urban investment bonds, further reflecting the accumulation of government debt risk.

These results indicate that land finance dependence suppresses green economic efficiency indirectly by increasing the debt burden of local governments. Hypothesis 3 has been verified. The volatility of land revenue, combined with aggressive fiscal behavior, encourages local governments to maintain urban expansion through a land–debt–investment cycle. This not only exacerbates fiscal unsustainability but also undermines strategic investment in green transformation. Faced with mounting debt pressure, local governments are more likely to prioritize projects with short-term fiscal returns over those with long-term environmental benefits. This mechanism confirms that the “leveraged expansion logic” inherent in land finance dependence is a critical cause of inefficient and unsustainable green development. Therefore, curbing the expansion of local government debt and regulating land finance behavior are institutional prerequisites for improving green economic efficiency.

7 Conclusions and implications

This paper empirically investigates the impact of land finance dependence on green economic efficiency. The results indicate that a high dependence on land finance significantly suppresses green economic efficiency. Using the super-efficiency SBM model to measure green economic efficiency and conducting heterogeneity tests to examine differences across various city types, the study finds that the negative impact of land finance dependence is more pronounced in non-resource-based cities, key environmental protection cities, and urban agglomerations. This supports the theory of negative externalities of land finance, which suggests that local governments, in pursuit of short-term economic growth and fiscal revenue, often overlook environmental protection and green development, leading to a decline in green economic efficiency. The study also explores the mediating mechanisms of environmental regulation intensity and local government debt risk, revealing the pathways through which land finance dependence affects green economic efficiency and highlighting the importance of fiscal and land policy reforms.

These findings carry significant implications for the literature on environmental economics and public finance. By demonstrating how a specific fiscal institution, land finance dependence, induces environmental inefficiency, this study contributes a crucial institutional perspective to the resource misallocation literature. The results suggest that the growth-at-all-costs driven by fiscal pressures, systematically undermines the effectiveness of environmental governance. The identified mechanism of weakened environmental regulation challenges the universal applicability of the Porter Hypothesis, which posits that stringent regulation can foster innovation. Our findings indicate that in contexts of high fiscal stress, local governments may lack the political will or financial capacity to enforce such regulations, leading to environmental standards becoming more lenient rather than stricter. Similarly, the link between land finance and escalating local debt reveals a critical trade-off between short-term urban expansion and long-term sustainable development. This pressure on fiscal revenue growth crowds out necessary green investments, suggesting that achieving environmental goals is intrinsically linked to fiscal reform and the management of systemic financial risks. Therefore, the very mechanism designed to fund urbanization through land finance simultaneously erects barriers to a sustainable green transition.

While this study contributes to understanding land finance dependence’s impact on green economic efficiency, limitations exist. First, panel data from prefecture-level cities may miss regional variations, especially in counties. Second, other fiscal sources like external inflows were not fully considered. Future research can expand by exploring dynamic relationships across city types, introducing variables like governance capacity and green innovation as moderators, and using natural experiments with longer data for robustness.

Data availability statement

The data analyzed in this study is subject to the following licenses/restrictions: The datasets contained in the article are from the publicly available documents of various departments and have been manually organized. We are willing to provide them when readers need them. Requests to access these datasets should be directed to CG,Y2hlbl9mdUBzanR1LmVkdS5jbg==.

Author contributions

CG: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., Akcigit, U., Alp, H., Bloom, N., and Kerr, W. (2018). Innovation, reallocation, and growth. Am. Econ. Rev. 108 (11), 3450–3491. doi:10.1257/aer.20130470

Baker, S. R., Bloom, N., and Davis, S. J. (2016). Measuring economic policy uncertainty. Q. J. Econ. 131 (4), 1593–1636. doi:10.1093/qje/qjw024

Brandt, L., Tombe, T., and Zhu, X. (2013). Factor market distortions across time, Space and sectors in China. Rev. Econ. Dyn. 16 (1), 39–58. doi:10.1016/j.red.2012.10.002

Cai, H., and Treisman, D. (2005). Does competition for capital discipline governments? Decentralization, Globalization, and public policy. Am. Econ. Rev. 95 (3), 817–830. doi:10.1257/0002828054201314

Cai, M., Fan, J., Ye, C., and Qi, Z. (2021). Government debt, land financing and distributive Justice in China. Urban Stud. 58 (11), 2329–2347. doi:10.1177/0042098020938523

Caldara, D., and Iacoviello, M. (2022). Measuring Geopolitical risk. Am. Econ. Rev. 112 (4), 1–81. doi:10.17016/ifdp.2018.1222r1

Chambers, R. G., Chung, Y., and Färe, R. (1996). Benefit and distance functions. J. Econ. Theory 70 (2), 407–419. doi:10.1006/jeth.1996.0096

Chen, Z., Kahn, M. E., Liu, Yu, and Wang, Z. (2018). The consequences of Spatially Differentiated Water pollution regulation in China. J. Environ. Econ. Manag. 88, 468–485. doi:10.1016/j.jeem.2018.01.010

Chen, D., Li, Y., Hu, W., Lang, Y., Zhang, Y., and Chen, C. (2024). Uncovering the influence of land finance dependency on inter-city regional integration: an explanatory framework integrating time-nonlinear and spatial factors. Land Use Policy 144, 107207. doi:10.1016/j.landusepol.2024.107207

Cheng, Y., Jia, S., and Meng, H. (2022). Fiscal policy choices of local governments in China: land finance or local government debt? Int. Rev. Econ. & Finance 80, 294–308. doi:10.1016/j.iref.2022.02.070

Dechezleprêtre, A., and Sato, M. (2017). The impacts of environmental regulations on competitiveness. Rev. Environ. Econ. policy. doi:10.1093/reep/rex013

Duranton, G., and Diego, P. (2020). The economics of urban density. J. Econ. Perspect. 34 (3), 3–26. doi:10.1257/jep.34.3.3

Färe, R., Grosskopf, S., Norris, M., and Zhang, Z. (1994). Productivity growth, technical progress, and efficiency change in Industrialized Countries. Am. Econ. Rev., 66–83. Available online at: http://www.jstor.org/stable/2117971.

Geng, X., and Qian, M. (2024). Understanding the local government debt in China. Pacific-Basin Finance J. 86, 102456. doi:10.1016/j.pacfin.2024.102456

Gyourko, J., Shen, Y., Wu, J., and Zhang, R. (2022). Land finance in China: analysis and review. China Econ. Rev. 76:101868. doi:10.1016/j.chieco.2022.101868

Jin, Yi, Gao, X., and Wang, M. (2021). The financing efficiency of Listed energy conservation and environmental protection firms: evidence and implications for green finance in China. Energy Policy 153, 112254. doi:10.1016/j.enpol.2021.112254

Li, Q., Shan, H., Tang, Y., and Vincent, Y. (2024). Corporate Climate risk: Measurements and Responses. Rev. Financial Stud. 37 (6), 1778–1830. doi:10.1093/rfs/hhad094

Mehlum, H., Moene, K., and Torvik, R. (2006). Institutions and the resource curse. Econ. J. 116 (508), 1–20. doi:10.1111/j.1468-0297.2006.01045.x

Mo, J. (2018). Land financing and economic growth: evidence from Chinese counties. China Econ. Rev. 50, 218–239. doi:10.1016/j.chieco.2018.04.011

Oh, D.-hyun (2010). A global Malmquist-luenberger productivity index. J. Prod. Analysis 34 (3), 183–197. doi:10.1007/s11123-010-0178-y

Pan, J.-N., Huang, J.-T., and Chiang, T.-F. (2015). Empirical study of the local government deficit, land finance and real estate markets in China. China Econ. Rev. 32, 57–67. doi:10.1016/j.chieco.2014.11.003

Porter, M. E., and Claas van der, L. (1995). Toward a new conception of the Environment-Competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qu, Xi, Xu, Z., Yu, J., and Zhu, J. (2023). Understanding local government debt in China: a regional competition perspective. Regional Sci. Urban Econ. 98, 103859. doi:10.1016/j.regsciurbeco.2022.103859

Tao, R., Su, F., Liu, M., and Cao, G. (2010). Land leasing and local public finance in China’s regional development: evidence from prefecture-level cities. Urban Stud. 47 (10), 2217–2236. doi:10.1177/0042098009357961

Tone, K. (2001). A slacks-based measure of efficiency in data Envelopment analysis. Eur. J. Operational Res. 130 (3), 498–509. doi:10.1016/s0377-2217(99)00407-5

Van der Kamp, D., Lorentzen, P., and Mattingly, D. (2017). Racing to the bottom or to the Top? Decentralization, revenue pressures, and governance reform in China. World Dev. 95, 164–176. doi:10.1016/j.worlddev.2017.02.021

Wang D, Di, Ren, C., and Zhou, T. (2021). Understanding the impact of land finance on industrial structure change in China: insights from a spatial Econometric analysis. Land Use Policy 103, 105323. doi:10.1016/j.landusepol.2021.105323

Wang, X., Zhang, C., and Zhang, Z. (2019). Pollution haven or Porter? The impact of environmental regulation on Location choices of pollution-intensive firms in China. J. Environ. Manag. 248, 109248. doi:10.1016/j.jenvman.2019.07.019

Wang, L.-Ou, Wu, H., and Yu, H. (2020). How does China's land finance affect its carbon emissions? Struct. Change Econ. Dyn. 54, 267–281. doi:10.1016/j.strueco.2020.05.006

Wang P, P., Shao, Z., Wang, J., and Wu, Q. (2021). The impact of land finance on urban land Use efficiency: a panel Threshold model for Chinese provinces. Growth Change 52 (1), 310–331. doi:10.1111/grow.12464

Wilson, J. D., and Wildasin, D. E. (2004). Capital tax competition: Bane or Boon. J. Public Econ. 88 (6), 1065–1091. doi:10.1016/s0047-2727(03)00057-4

Xu, N. (2019). What Gave Rise to China’s land finance? Land Use Policy 87, 104015. doi:10.1016/j.landusepol.2019.05.034

Zhang, N., and Choi, Y. (2013). Total-factor carbon emission performance of Fossil Fuel power Plants in China: a Metafrontier non-radial Malmquist index analysis. Energy Econ. 40, 549–559. doi:10.1016/j.eneco.2013.08.012

Zhao, X., Zeng, B., Zhao, X., Zeng, S., and Jiang, S. (2024). Impact of green finance on green energy efficiency: a pathway to sustainable development in China. J. Clean. Prod. 450, 141943. doi:10.1016/j.jclepro.2024.141943

Zheng, H., Wang, X., and Cao, S. (2014). The land finance model jeopardizes China's sustainable development. Habitat Int. 44, 130–136. doi:10.1016/j.habitatint.2014.05.008

Zhou, M., Jiang, K., and Chen, Z. (2023). The side effects of local government debt: evidence from urban investment bonds and Corporate pollution in China. J. Environ. Manag. 344, 118739. doi:10.1016/j.jenvman.2023.118739

Keywords: land finance dependence, green economic efficiency, SBM model, environmentalgovernance, local government debt risk, fiscal reform

Citation: Guo C (2025) The impact of land finance dependence on green economic efficiency: evidence from China. Front. Environ. Sci. 13:1659821. doi: 10.3389/fenvs.2025.1659821

Received: 04 July 2025; Accepted: 23 September 2025;

Published: 09 October 2025.

Edited by:

Shikuan Zhao, Chongqing University, ChinaReviewed by:

Barış Kahveci, Niğde Ömer Halisdemir University, TürkiyeHao Dong, Wuyi University, China

Copyright © 2025 Guo. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chunyu Guo, c3VmZWdjeUAxNjMuc3VmZS5lZHUuY24=

Chunyu Guo

Chunyu Guo