- Department of Economics, College of Business Administration, King Saud University, Riyadh, Saudi Arabia

Introduction: Environmental degradation has emerged as a significant concern in recent decades, particularly for developing nations. The study examines the dynamic relationship between economic complexity, FinTech, green innovation, and environmental degradation in emerging economies.

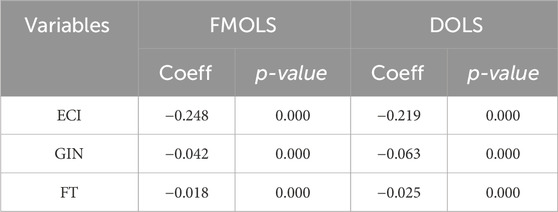

Methods: To achieve the study objectives, the study employs a robust estimate, namely MMQR, which incorporates FMOLS and DOLS, for the period from 1990 to 2024.

Results: The findings suggest that economic complexity and FinTech play a role in promoting cleaner manufacturing and expanding access to green financial services, thereby enhancing environmental sustainability. The adoption of green innovation mitigates environmental deterioration, albeit to varying degrees, across different emissions intensities. In addition, the results of the co-integration test revealed a long-run correlation between the variables ECI, GIN, and FT, and CO2 emissions. The slope heterogeneity test results indicate considerable variance in the relationships between emerging economies. This highlights the fact that crucial variables differ significantly across countries.

Discussion: The study contributes to the debate on the green transition in emerging economies, providing policymakers with solid data for balancing economic growth and environmental protection. The research also reveals that institutional and technical restrictions in emerging economies may limit or even harm these drivers in lower quantiles. These results highlight the importance of tailoring green growth programs to specific environmental settings and quantile levels.

1 Introduction

Environmental degradation has emerged as a significant concern in recent decades, particularly for developing nations. Sustainable development and environmental protection are frequently at odds with one another as these countries pursue rapid industrialization, urbanization, and economic expansion (Anser et al., 2025; Chang et al., 2024). Public health, food security, and long-term financial viability are all gravely threatened by the environmental degradation that has become apparent through polluted air and water, deforestation, declining biodiversity, and rising carbon dioxide (CO2) emissions (Leddin, 2024; Richardson, 2010).

The growing population, industrial production, and GDP of emerging economies, such as Turkey, China, India, Brazil, South Africa, and Indonesia, ensure that these countries will continue to shape global development (Halim & Moudud-Ul-Huq, 2024; Wang and Xu, 2025). Nevertheless, elevated levels of environmental stress often accompany their rapid development rates. The energy systems, industries, and land-use practices of many of these nations are highly dependent on fossil fuels, which leads to increased emissions of greenhouse gases, soil erosion, and the depletion of natural resources (Priya et al., 2023; Zheng X et al., 2023).

The ability of emerging economies to reduce environmental degradation is hindered by institutional restrictions, limited technical capabilities, and weak regulatory frameworks, in contrast to industrialized economies (Zhang et al., 2024). There is still an unsustainable pattern of growth in many areas, with a focus on immediate financial benefits rather than environmental resilience. According to the “pollution haven hypothesis” (Cole, 2004), emerging economies with lax environmental regulations may exacerbate local environmental conditions by attracting polluting companies from countries with more stringent standards. Furthermore, inequality in wealth and social stratification in developing nations may limit citizens’ ability to participate in environmental policymaking, which in turn increases vulnerability to environmental threats and perpetuates social injustice (Green and Healy, 2022; Islam, 2024).

However, remedies to the environmental issue in emerging economies do exist. Environmental innovation, green financing, renewable energy investments, and international environmental cooperation are among the recent efforts that have stepped up to support sustainable development (Raman et al., 2025; Tang et al., 2024). Other multilateral accords, like the Paris Climate Accord, have encouraged emerging economies to set climate goals and adopt low-carbon development plans. Environmental degradation must be addressed effectively through a comprehensive policy framework that incorporates economic complexity, technical innovation, and institutional change. The amount of development, however, remains uneven, highlighting the need for this framework (Olarewaju et al., 2025). Environmental degradation is common in development driven by fossil fuels (Jiang and Hassan, 2025). Individuals, communities, and countries must begin transitioning to renewable energy sources to build robust and equitable economic systems and save the Earth.

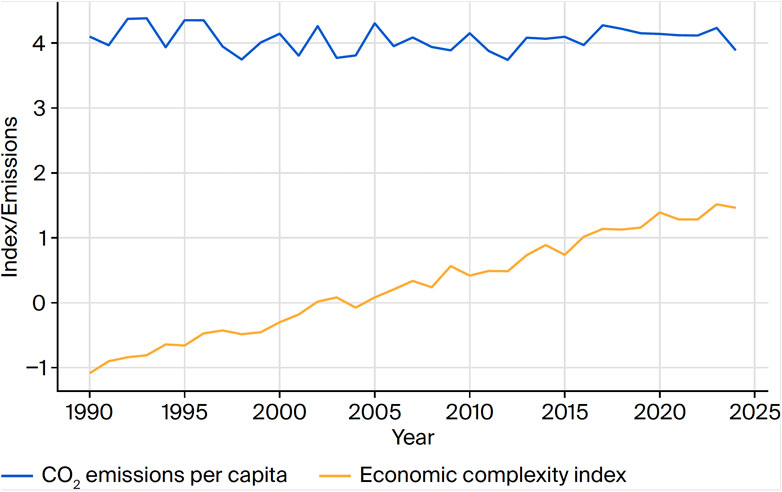

From 1990 to 2024, the predicted data indicate that CO2 emissions from rising economies are expected to decrease gradually (Figure 1). This demonstrates a gradual but noticeable shift toward an emphasis on environmental sustainability. Emissions of carbon dioxide from emerging economies have been falling steadily from 1990 to 2024. Although there is considerable variation among countries and their policies, this change indicates the progressive implementation of eco-friendly practices and energy transition programs. The reaction of emerging economies to climate change is reflected in the overall drop. To accomplish long-term environmental objectives and carbon neutrality targets, it is necessary to implement stronger policy interventions, make more sustainable investments, and garner international support. Nevertheless, the modest rate of decrease shows that progress has been inconsistent.

However, it remains unclear how economic complexity relates to environmental deterioration (Neagu, 2020). Increasing industrial activity and resource use are two ways in which economic complexity may exacerbate environmental problems. Although some studies suggest that economic complexity reduces emissions and increases production, others indicate the opposite (Tabash et al., 2024; Wang et al., 2023). Further, Economies with higher complexity have greater capabilities in terms of human capital, infrastructure, and institutional quality, which are necessary for developing and implementing green technologies. These economies often have a more diversified and technologically advanced industrial base, allowing them to engage more easily in complex innovation processes (Hidalgo and Hausmann, 2009). This demonstrates how complexity reflects a country’s productive knowledge, which is essential for innovation. However, further research is needed into the relationship between economic complexity and environmental effects, particularly in emerging economies where the economy is evolving rapidly (Boleti et al., 2021; Neagu, 2020).

In terms of the relationship between the ECI and CO2 emissions per capita, Figure 2 illustrates this relationship hypothetically. The ECI measures the degree of development in an economy’s export structure, while CO2 emissions per capita serve as a measure of environmental degradation. This graphically represents the simulated patterns, which show that economic complexity is steadily rising while emissions follow an inverted U-shaped pattern.

Another association is between green innovation and carbon dioxide (CO2) emissions, which are central to current discussions about sustainable development and mitigating the effects of climate change (Li et al., 2023). An increasingly popular strategy for attaining environmental efficiency and separating economic growth from environmental deterioration is green innovation, which refers to the creation and adoption of new goods, processes, and behaviours that reduce the negative impact on the environment (Aliani et al., 2024; Dash et al., 2024; Hoa et al., 2024). While discussing CO2 emissions from a theoretical perspective, it is essential to note that green innovation serves as a tool for both prevention and correction (Chang et al., 2023). To reduce emissions at the source, it promotes the development of cleaner industrial technology and low-carbon alternatives. By enhancing carbon capture, reuse, and recycling technologies and optimizing current operations for greater energy efficiency, it serves as a corrective tool (Min et al., 2022; Saxena et al., 2024).

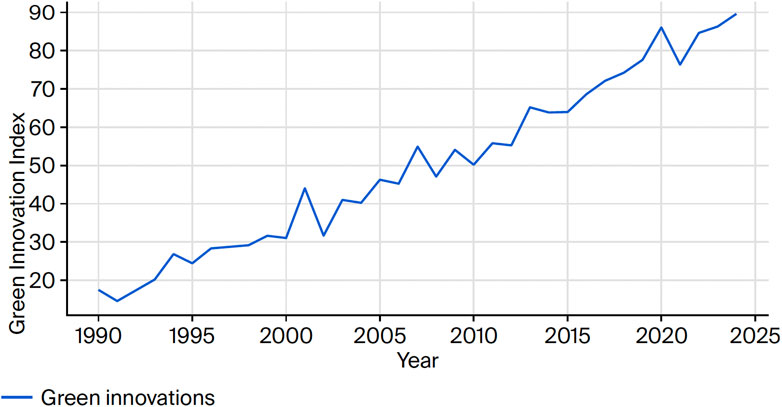

The Green Innovation Index has shown a consistent rise from the early 1990s to 2024 (Figure 3). The trend suggests that rising economies are increasingly prioritizing environmentally friendly practices in industry, research into sustainable technologies, and clean energy solutions. This era of initial modest growth (the 1990s to the early 2000s) is consistent with the historical fact that many emerging economies put economic development ahead of environmental concerns. During this time, innovation growth was relatively slow. Green innovation, finance, energy, and development are all profoundly impacted when developing nations adopt renewable energy (Hoa et al., 2024; Nawaz et al., 2025; Xuan et al., 2024).

The relationship between FinTech and environmental sustainability, specifically regarding CO2 emissions, is a relatively new field of study (Osei-Assibey Bonsu et al., 2025; Rabbani and Kiran, 2025). Mobile banking, blockchain, crowdfunding, digital payments, and robot-advisory platforms are all examples of financial technology (FinTech). This field can improve the efficiency, inclusivity, and sustainability of economic systems, which in turn could change environmental outcomes (Javaid et al., 2022). According to environmental economists, FinTech has the potential to significantly contribute to reducing CO2 emissions through various direct and indirect mechanisms (Wang et al., 2024). Included in this category are efforts to increase the availability of green financing, facilitate the measurement of carbon emissions in real-time, pave the way for managing climate risk, and encourage individuals to adjust their purchasing habits to reduce their carbon footprint (Hasan et al., 2024).

The study’s overarching goal is to determine and measure the extent to which these interrelated variables, ECI, GIN, FT, and CO2 emissions, exist in emerging economies. To achieve this, the study will use the Method of Moments Quantile Regression (MMQR) model to 1(a) examine how ECI, GIN, FT, and CO2 emissions affect environmental degradation in emerging economies; (b) To compare the impact of ECI, GIN, FT, and CO2 emissions overall across various quantiles of both environmental and economic performance; (c) Utilize quantile regression to examine the nonlinear effects and impact heterogeneity across emerging market sectors and varying degrees of development; and (d) to guide policymakers in these countries toward more rapid adoption of ECI, GIN, FT, and CO2 emissions to ensure their economic growth in the long run by suggesting environmentally friendly policies and allocating appropriate subsidies. Only the group of emerging economies, as defined by the World Bank and IMF, was included; due to their structural changes, varying ECI, GIN, and FT, which provide a clear analysis of the impact of CO2 emissions.

Investigating this association will enhance the existing information repository by enabling policymakers to develop more targeted interventions through a comprehensive, quantile-specific analysis of the effects of green initiatives on economic and environmental indicators in emerging nations. For this investigation, the MMQR (Machado and Santos Silva, 2019) is employed to examine the relationship between ECI, GIN, FT, and CO2 emissions. Because it facilitates the evaluation of heterogeneous effects across multiple quantiles of the environmental degradation distribution, the MMQR technique is particularly well-suited for this analysis.

The MMQR approach, in conjunction with Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS), was applied to ensure methodological rigor, as MMQR can capture distributional heterogeneity across the conditional distribution of CO2 emissions. Furthermore, it enables an examination of how ECI, GIN, and FT exert differential impacts at lower, median, and higher emission quantiles, a heterogeneity that is significant in the context of developing regions. Moreover, the MMQR is robust to outliers and skewed data distributions, which are characteristic of environmental and financial indicators.

Complementing MMQR with FMOLS and DOLS allows for the examination of long-run equilibrium relationships among the variables. The FMOLS corrects for the endogeneity and serial correlation inherent in non-stationary panel data. Therefore, it can provide an efficient and unbiased estimate of cointegrating relationships. DOLS, on the other hand, incorporates leads and lags of the differenced regressors to account for dynamic adjustments, addressing small-sample bias and ensuring robustness of the long-run estimates. Employing both FMOLS and DOLS validates the stability of the long-run coefficients, thereby enhancing confidence in the empirical findings. Hence, offering a comprehensive econometric strategy.

The following sections will serve as a synopsis of the reviewed literature. The technique goes on to detail the data and econometric methodology. Finally, the study will review the results, provide policy suggestions, outline limitations, and identify potential avenues for further research.

2 Theoretical framework and literature review

2.1 Theoretical framework

The relationship between economic complexity ECI, FT, GIN, and CO2 emissions is examined in emerging economies over a 35-year period, from 1990 to 2024. By integrating viewpoints on productive capabilities, financial intermediation, and innovation-driven growth, we suggest that ECI, FT, and GIN are interconnected factors that influence environmental outcomes. Economic complexity (ECI) has an ambiguous impact on CO2 emissions, reflecting both positive and negative channels. Financial technology (FinTech): (FT → CO2 emissions) positions FinTech as a double-edged sword: it can accelerate green transition but may also introduce new environmental pressures without clean energy integration. Green innovation (GIN) reduces emissions intensity and encourages the adoption of renewable energy. The following hypotheses are derived:

Hypothesis 1. ECI has a significant influence on CO2 emissions in emerging economies.

Hypothesis 2. FT significantly reduces CO2 emissions in emerging economies.

Hypothesis 3. GIN significantly reduces CO2 emissions in emerging economies.

2.2 Literature review

The nexus of ECI, GIN, FT, and CO2 emissions has become a focal point of academic and policy discussions, particularly in the context of Emerging Markets. The MMQR approach has been demonstrated to be effective in illustrating the diverse implications of economic complexity across various environmental domains, as evidenced by recent empirical studies. An example of this is the study by (Can and Gozgor, 2017), which investigated the relationship between economic complexity and CO2 emissions in France. Their findings showed that the effect of complexity on emissions changes dramatically across different quantiles of the carbon emission distribution. Similarly, MMQR was employed to investigate how economic complexity influences environmental footprint in BRICS countries (Akadiri et al., 2023; Caglar et al., 2025; Dabbous et al., 2025). They discovered that the level of environmental pressure has a significant impact on the various consequences that are observed. Another study by (Nuta, 2024) examines how economic complexity and renewable energy consumption affect CO2 emissions in the presence of economic growth and urbanization in emerging economies. The study analysis covers the period from 1995 to 2021 and employs cointegration regression (CCR), FMOLS, DOLS, and Driscoll–Kraay regression. Their findings show that ECI reduces CO2 emissions. Another study for the G-10 countries, spanning from 1995 to 2020 (Saqib et al., 2023), examined the impact of green innovation, ECI, energy productivity, renewable energy, and environmental taxes on CO2 emissions. They utilized panel econometric analysis to identify both unidirectional and bidirectional links between CO2 and other variables. They found that green innovation, economic complexity, and renewable energy reduce CO2 emissions.

Furthermore, the adoption and export of green technologies can diversify a country’s export basket, add high-complexity products, and increase the ECI. Engaging in green innovation may stimulate the development of new sectors (e.g., solar panel manufacturing, battery technology, wind turbine components), which require and generate advanced skills and institutions (Mealy et al., 2019). This discussion highlights how targeted green industrial policies can foster the development of complex economic capabilities. Several recent studies (Bakhsh et al., 2024; Olaniyi and Odhiambo, 2025; Zhang et al., 2024) show positive correlations between green innovation and economic complexity: countries with higher ECI levels are more likely to generate and adopt green patents. These countries can better leverage global value chains and R&D networks to scale green technologies. Shows that economies specializing in complex sectors are more likely to develop green technologies.

Moreover, green technology exports are positively associated with future increases in the ECI, indicating that green innovation can catalyze economic upgrading (Al-Ayouty, 2023; Bergougui et al., 2024). Empirical evidence suggests that countries specializing in green technologies exhibit higher financial performance and greater complexity (Al-Ayouty, 2023; Ha, 2023; Müller and Eichhammer, 2023). Green innovation and economic complexity are mutually reinforcing; complex economies are better positioned to develop green technologies, while engagement in green innovation contributes to increased economic complexity. Understanding this relationship is vital for designing policies that promote both environmental sustainability and economic development simultaneously. A study (Apergis and Payne, 2022) found that the consumption of renewable energy leads to a significant reduction in carbon emissions among a group of OECD countries.

The financial technology industry is revolutionizing the financial landscape and transforming businesses through the convergence of financial services with technology. Traditional financial services utilize information technology to promote innovation and increase efficiency. When conventional banking options are unavailable, fintech alternatives are stepping in to make loans and payments possible (Kou and Lu, 2025). Consumers, companies, and the economy at large may all reap the benefits of fintech’s capacity to enhance and develop new financial services. Financial technology (fintech) facilitates the development of products and services within the financial sector (Perez-Saiz and Sharma, 2019).

The researchers (Doğan et al., 2021; Doğan et al., 2022; El Khoury et al., 2025; Zhang and Zhou, 2023) suggested that in rapidly growing economies, accompanied by higher levels of industrial activity and energy consumption, environmental deterioration may be exacerbated. This mismatch highlights the importance of local judgments, particularly in rapidly growing economies. The framework of a recent study (Abbasi et al., 2024; Gyawali et al., 2025) demonstrates that strong governance can be improved (Boleti et al., 2021; Khezri et al., 2022; Neagu and Teodoru, 2019).

Innovation processes are easier in countries with a more diverse and technologically advanced industrial base (Hidalgo and Hausmann, 2009), indicating that productive knowledge, essential for innovation, is reflected in greater complexity. Granger causality was employed to assess the impact of renewable energy use on air pollution in China from 1990 to 2022.

Using the MMQR approach on the dataset spanning from 1990 to 2017 (Usman, 2023), the research was conducted on the BRICS states. The findings indicated that the use of green energy and investments in it have a significant negative impact on carbon emissions (Xie et al., 2023). The MMQR method was applied to the 30-year dataset spanning from 1990 to 2017, and the research was conducted on the BRICS states. The findings indicated that the use of green energy and investments in it have a significant negative impact on carbon emissions (Usman, 2023). Moreover (Xie et al., 2023), applied the MMQR method to the 30-year dataset of OECD nations to ensure that investments in green innovation technologies will preserve the environment.

Recent empirical investigations have demonstrated that the MMQR technique can highlight the diverse implications of green finance and innovation across various environmental domains, particularly in the context of institutional development. Their findings demonstrated that complexity has a significant impact on emissions across carbon emission quantiles. Consequently, researchers have paid considerable attention to green innovation during this shift (Zhou et al., 2022). Determining the effect of green innovation on CO2 emissions and the environment is a source of anxiety for academics.

Green technology adoption and export can diversify a country’s export basket, adding complex items. Green innovation may spur the development of new sectors, such as solar panel manufacturing, battery technology, and wind turbine components, which demand and produce advanced skills and institutions (Mealy et al., 2019). By using global value chains and R&D networks, these countries can scale green innovations. Green innovation creates new industries, such as solar panel manufacturing, battery technology, and wind turbine components, that redefine and develop advanced skills and institutions. Focused green industrial methods can create sophisticated economic capacities. Integrated approaches that address these concerns in emerging markets require this. In low-income nations, regional collaboration and information exchange are crucial for environmental solutions (Gao et al., 2024). Emerging economies are examining the intersection of green and sustainable development within the context of development economics (Cisneros Chavira et al., 2023; Kwilinski, Dacko-Pikiewicz, et al., 2025).

Green innovation refers to products, processes, and actions that protect the environment and promote sustainability. Clean transportation, energy efficiency, waste reduction, and renewable energy are key areas of focus (Chel and Kaushik, 2018). In their analysis of data from G7 nations from 1997 to 2019 (Akram et al., 2023), they determined the impact of cleaner energy consumption on CO2 emissions. Moreover, according to the findings, the G7 area may be closer to achieving its objective of carbon neutrality by switching to renewable energy sources (Tabrizi et al., 2025; Xu et al., 2024).

The reduction of carbon dioxide and industrial transformation depend on green innovation. The adoption of green technology is uneven, particularly in emerging markets, with limited resources and financial constraints (Daga et al., 2024; Kwilinski, Lyulyov, et al., 2025; Li and Qamruzzaman, 2023; Qamruzzaman and Karim, 2024; Sachan et al., 2025). The MMQR approach is utilized to demonstrate that green innovation yields greater environmental benefits in polluted nations, differentiating its application in targeted policy interventions (Khan et al., 2025). Environmental degradation is a serious problem, particularly in developing regions that are undergoing rapid industrialization. MMQR examines the effects of varying levels of degradation. (Wang, 2025; Wei et al., 2024), demonstrate that nations under extreme environmental stress are more susceptible to financial and technological innovations.

On the other hand, FinTech may affect the environment through several potential avenues (Ghazouani and Hamdi, 2025; Jangid et al., 2025; Mertzanis, 2023; Ni et al., 2023; Osei-Assibey Bonsu et al., 2025; Teng and Shen, 2023; Xian, 2025; Yuan, 2025). To start, FinTech creates online venues to raise money for eco-friendly initiatives, thereby expanding people’s access to green financing. Second, the dematerialization of financial transactions is made possible by digital financial services, which reduce paper consumption and carbon footprints. Finally, third-party technologies, such as blockchain, make carbon markets and emissions monitoring more transparent and traceable. In the fourth place, environmental, social, and governance (ESG) rating systems and green investment portfolios are made possible by FinTech, which encourages people to act sustainably (Charfeddine and Umlai, 2023; Li and Chen, 2024). Moreover, digital banking and mobile payment systems may lessen the need for energy-intensive infrastructure while also promoting sustainable consumption (Mavlutova et al., 2025).

The relationship between environmental policy, ECI, and FT contributes to energy transitions in 29 countries, as evidenced by panel data from 2010 to 2020 (Dabbous et al., 2025). The findings reveal that FinTech has a positive impact on the energy transition and mediates the effect of the ECI. A study in China (2005–2020) reveals that regional disparities stem from economic, policy, investment, and innovation differences, as well as the country’s reliance on fossil fuels (Zheng J et al., 2023). Globally, countries with strong environmental regulations and well-developed internet infrastructure are the areas where FinTech has the most noticeable impact on sustainability. Researchers emphasized the importance of the institutional setting as a moderator (Mertzanis, 2023; Okere et al., 2024).

New empirical research suggests that FinTech has a positive impact on environmental quality (Yang and Razzaq, 2024). Research examining digital finance in China from 2011 to 2020 found that regions with high green innovation capabilities experienced the most significant drop in CO2 emissions due to greater FinTech penetration (Cai and Song, 2022). A positive association was found between green finance, fintech, and renewable energy, affecting CO2 emissions in eight mineral-rich countries from 1990 to 2019, using the MMQR approach to capture effects across different CO2 emission levels (Alsedrah, 2024). At the global level, countries with strong environmental regulations and well-developed internet infrastructure are those where FinTech has the most noticeable impact on sustainability. Researchers emphasized the importance of the institutional setting as a moderator (Mertzanis, 2023; Okere et al., 2024).

2.3 The literature gaps

Many studies have examined the impact of ECI, GIN, and FT on CO2 emissions; however, there is a limited understanding of how these factors interact with one another, particularly in emerging market contexts. Most previous studies have focused on industrialized nations, which have quite different institutional frameworks, levels of technological preparedness, and financial infrastructures compared to those of emerging or transitional economies.

This paper offers suggestions for enhancing green policy tools based on empirical data. To guide environmental policy in emerging economies, this research examines these connections. Scholars, stakeholders, and policymakers may all benefit from the study’s findings as they work to advance sustainable development and mitigate environmental damage. Moreover, the analysis can be utilized by development practitioners, investors, and policymakers to inform the development of green economic policies that encourage the adoption of renewable energy.

In addition, thorough analytical frameworks seldom include sustainable finance and FinTech as possible mediators or facilitators of environmental sustainability in the face of increasing economic complexity. MMQR and other quantile-based techniques are necessary since the effects of these variables probably change across quantiles of environmental degradation and development levels. By utilizing these strategies, it obtains a comprehensive understanding of how these variables interact within various environmental and economic contexts. This approach enables us to thoroughly capture the nuances of distributional variability, highlighting the diverse patterns and trends that emerge across different scenarios. Consequently, this study aims to address the existing knowledge gap by developing a comprehensive empirical model that considers asymmetries, structural differences, and threshold effects to analyze the interrelated impacts of ECI, GIN, FT, and CO2 emissions in emerging markets.

3 Data and methodology

3.1 Data sourcing, variables, and model

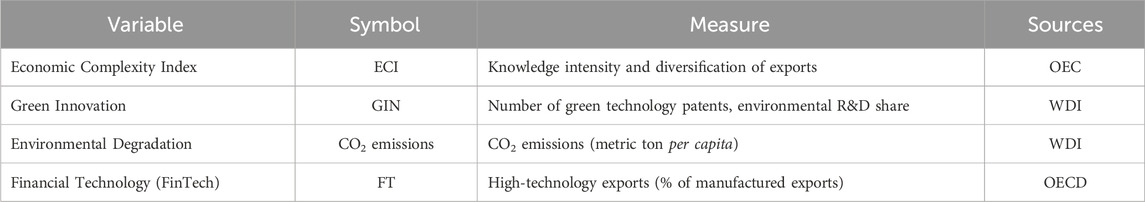

The purpose of this study is to investigate the nexus between ECI, GIN, FT, and CO2 emissions for the data period from 1990 to 2024, as extracted from Our World in Data, the World Bank Group’s website (https://oec.world/en), and the World Bank Group’s FinTech data. (Table 1).

This section is tailored to examine the nexus of ECI, GIN, FT, and CO2 emissions in emerging markets for the period from 1990 to 2024. The MMQR approach has emerged as a powerful tool for examining heterogeneous effects across various quantiles of a distribution. The included variables are

The MMQR approach captures fluctuations across the distribution, offering more comprehensive insights into the underlying dynamics. This study presents the following research model (Equation 2):

Where:

•

•

•

The distinctive constituent of U, given by V, is the k-vector.

Therefore, after converting the data to its logarithm, the model Equation 3:

3.2 Econometrics techniques

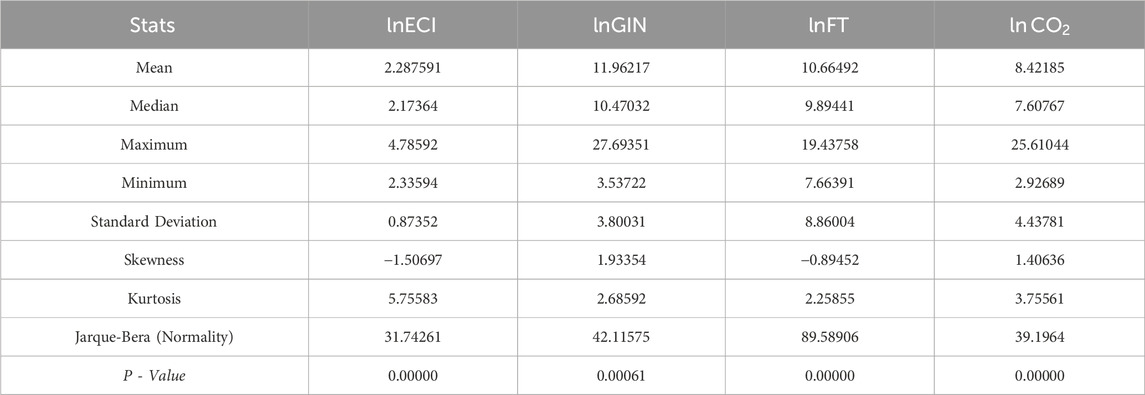

This research also focuses on the normal distribution, addressing skewness and kurtosis, while exploring data normality and significance through a thorough normality analysis (Jarque and Bera, 1987) that assumes zero skewness and excess kurtosis, indicating a normal distribution (Table 2). Jarque-Bera (Jarque and Bera, 1987) Equation 4:

Where:

• N = sample size

• S = Skewness of the sample

• K = Kurtosis of the sample

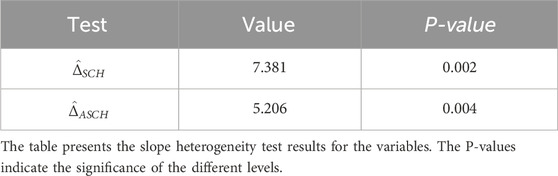

3.3 Slope heterogeneity (SCHT) test

The Slope Heterogeneity Test (SCHT), developed by (Pesaran and Shin, 1998) and later extended by (Hashem Pesaran and Yamagata, 2008), examines factors related to heterogeneous slope coefficients. The formula is shown in Equations 5,6:

Where:

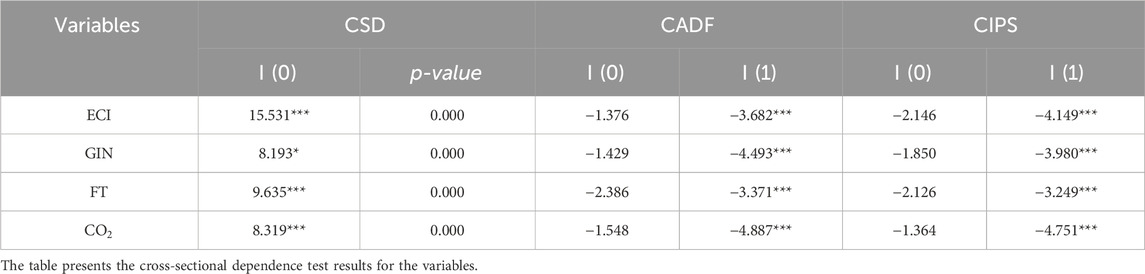

3.4 Cross-sectional dependence (CSD) test

This section covers CSD tests, which help identify cross-sectional dependency and aid in choosing suitable econometric methods. CSDs frequently influence panel methods (Pesaran, 2004; Pesaran, 2007). In addition to improving the strength and reliability of estimates, CSD testing can address challenges associated with panel data. Cross-section Dependence (CSD) is a critical measure analyzed in this panel investigation. Recently, testing for cross-sectional dependence (CSD) in panel data analysis has gained significance, as neglecting it can lead to misleading and inaccurate results. To demonstrate the importance of cross-sectional dependence, we utilized the cross-sectional CSD test (Pesaran, 2021), as shown in Equation 7.

3.5 Unit root estimation

To determine the level of integration of ECI, GIN, FT, and (CO2 emissions), second-generation unit root tests such as CIPS and CADF, as developed by (Pesaran, 2007), are used, owing to the potential limitations of CSD and SCH, which could compromise the reliability of first-generation unit root tests. Furthermore (Pesaran, 2006), introduced a factor approach for determining the unexplained averages of cross-sectional dependence; also, according to (Pesaran, 2007), this extension of the ADF linear model includes the mean and first-differenced cross-section lags, employing the same methods. It is imperative to conduct a stationary test to prevent inaccurate outcomes during regression analysis. An explanation of the CIPS test is as follows (Equation 8):

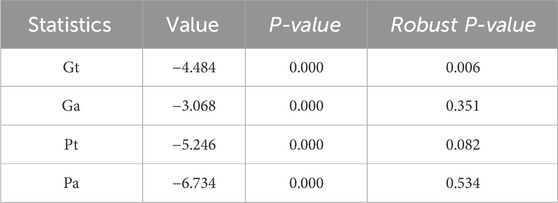

3.6 Cointegration test

To evaluate the long-term cointegrating relationship among the variables, which included ECI, GIN, FT, and CO2 emissions, this study employed the advanced panel cointegration approach by (Westerlund, 2007). This approach was adopted to evaluate the relationship. This test takes a direct approach to addressing the problem of factor limitation, a typical concern in the initial generation of cointegration tests. An evaluation is conducted using an error-correction model cointegration test to investigate the null hypothesis that there is no cointegration. A conditional panel error-correction model is subjected to a test, which assesses whether the error-correction term in the model equals zero. The T-statistics that are employed in the (Westerlund, 2007) cointegration test are defined by the following equations, which are illustrated below (Equations 9–12):

where:

• α^ = the estimate of the error-correction coefficient,

• T = time periods,

• N = sample size

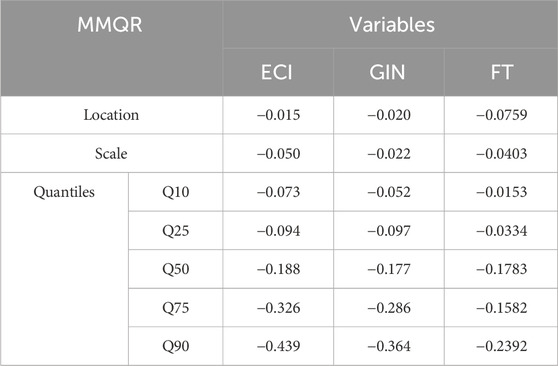

This study employs the Method of Moments Quantile Regression (MMQR) technique (Machado and Santos Silva, 2019) to investigate the relationship between ECI, GIN, FT, and CO2 emissions, examining their asymmetry. In contrast to previous regression methods, MMQR utilizes current circumstances to derive results by assuming distributions or claiming the existence of the moment function. The MMQR method is superior because it considers the conditional heterogeneous covariance that arises from the components of the endogenous explanatory variables (Koenker and Bassett, 1978). By examining several quantiles, the MMQR method shows the relationship between the parameters. Panel quantile regression is a valuable tool for studying diverse effects and distributional factors across quantiles (Binder and Coad, 2011).

Furthermore, it considers the consistent impact of distributional disparities and accurately portrays the actual data on the link between the examined variables. Consequently, conventional regressions based on average variable estimates fail to capture the many relationships between chosen parameters in various conditional distributions that are exposed by the method’s study. To determine the distributive effect of the independent variable on the dependent variable across different quantile ranges, it is essential to evaluate the tested variables at the conditional distribution within conditional quantiles (Koenker, 2004). Equation 13, shown below, is the location-scale variant model.

Where:

•

•

•

•

• The distinctive constituent of U, given by V, is the k-vector (Equation 14).

Where.

1.

2.

3.

The outside qualities and reserves are stable; hence, the study model may be used to determine the conditional quantiles

The fixed influence of the (τ) quantiles on (i), is generated by the scalar coefficient

The function being verified by:

3.7 Panel of FMOLS and DOLS test

To determine the stability of the estimated variables, this research employed several econometric methods associated with longitudinal data analysis, including FMOLS and DOLS. Panel data show variation between cross-sections in the mean and the cointegration equilibrium. Hence, the FMOLS econometric technique for panel data analysis was introduced. The individual intercepts and serial correlation features of error processes across specific cross-sections are accounted for in Pedroni’s FMOLS model. Accordingly, the FMOLS method’s intercepts show distinct serial correlations across various cross-sections (Koenker, 2004). Estimates that account for non-stationarity and heterogeneity in time-series data are produced with high precision by the (FMOLS) and (DOLS) approaches. Through the mitigation of endogeneity and serial correlation concerns, both parametric (DOLS) and non-parametric (FMOLS) estimators provide reliable results. The FMOLS equation as follows Equation 17:

Where,

The DOLS technique considers lag parameters that affect the asymmetric error term of the cointegration equation.

4 Results

Table 2 presents the descriptive statistics that are examined in the empirical analysis. The mean values for ECI, GIN, FT, and CO2 emissions are 2.287, 11.962,10.664, and 8.421, respectively. The skewness value indicates that GIN and (CO2 emissions) exhibit positive skewness. In contrast, ECI and FT exhibit negative and left-skewed distributions. The kurtosis value suggests that the values of ECI, GIN, and (CO2 emissions) are greater than three; on the other hand, the values of GIN and FT are less than 3, and statistically non-normally distributed. The results of the Jarque-Bera test demonstrated that the variables deviate from a normal distribution, offering valuable insights into their behavior. As a result, we used the novel MMQR approach to evaluate these relationships.

The slope heterogeneity test results, as demonstrated in Table 3, indicate considerable variance in the relationships between emerging economies. Both the

Table 4 presents the Cross-Sectional Dependence (CSD) test estimates. Supporting second-generation unit root tests, such as the CADF, CIPS, and the CD test, which account for cross-sectional dependence. The variables stabilize, and all are integrated of order 1 (I) at the 1% significance level. Based on the results, there is CSD evidence in the dataset, which suggests the use of the unit root tests of the second-generation CADF and CIPS to examine the stationary characteristics of the variables under investigation when both SCH and CSD are present. Moreover, according to the outcomes of (CSD), (CADF), and (CIPS) Tests, the Westerlund cointegration test is also recommended.

Table 5 summarizes the statistical results regarding the existence of co-integration in the evaluation. The test results confirm the existence of cointegration among the variables, although the statistical significance is excluded. The findings showed that the existence of co-integration was accepted as the alternative hypothesis, while the null hypothesis was rejected. This analysis lends credence to the study’s hypothetical testing by establishing a long-run relationship between the variables. Additionally, the results revealed a long-term correlation between the variables ECI, GIN, FT, and CO2 emissions.

The relationship between ECI, GIN, and FT on CO2 emissions across various quantiles in emerging economies is shown in Table 6, which displays the results of the Method of Moments Quantile Regression (MMQR). Quantile regression provides a comprehensive understanding of how these variables impact emissions differently at various levels, enabling the identification of the exact emission intensities that require prompt intervention.

There is a clear negative correlation between (ECI) and CO2 emissions, which becomes stronger at higher quantiles (−0.4392 at the Q90). (ECI) is correlated with the adoption of cleaner technology in countries with higher emissions. Nevertheless, policies should be implemented to encourage green growth strategies during the initial phases of development, as the decreasing negative impact at lower quantiles (−0.0734 at Q10) suggests that in areas with low emissions, (ECI) may not directly lead to substantial reductions in emissions.

Moreover, a significant negative relationship exists between (GIN) and CO2 emissions, and this relationship becomes stronger as the emission quantiles increase (−0.3647 at Q90). In cases where emissions are high, this highlights the importance of (GIN) in reducing emissions. Additionally, there is a strong negative correlation between CO2 emissions and (FT) at all quantiles, with the negative correlation increasing with higher CO2 emission levels (−0.2392 at the Q90). This suggests that fintech solutions will play a crucial role in reducing emissions in areas with high levels of pollution.

Table 7 shows that for every 1% rise in ECI, the adverse effect of ECI on CO2 emissions is 0.248 and 0.219, respectively, according to FMOLS and DOLS. This contradicts the previous results, as in the GIN and CO2 emissions nexus, FMOLS and DOLS indicate that GIN has an adverse effect on environmental degradation and CO2 emissions, resulting in decreases of −0.042 and −0.063, respectively, with a 1% rise in GIN. Moreover, the results from FMOLS and DOLS indicate a negative correlation between Financial Technology FT and CO2 emissions, with advanced estimates suggesting that a 1% increase in FT tends to reduce CO2 emissions by −0.018 and −0.025, respectively.

5 Discussion

This study empirically examines the association between CO2 emissions and other factors in developing economies, which may be better understood from the study’s results. The study examines the relationship between ECI, GIN, and FT and the dependent variable CO2 emissions. This provides strong evidence of different effects on the conditional distribution of CO2 emissions, green innovation, and green growth indicators using econometric methodologies, including MMQR, FMOLS, and DOLS. Several key insights are offered by the results, which contribute to the ongoing conversation on sustainable development in developing countries.

ECI mitigates environmental deterioration, particularly at the highest quantiles of CO2 emissions (Montagna et al., 2025). This suggests that economies that are more complex and expanding are better positioned to outperform polluting companies, diversify their production patterns, and adopt cleaner technologies. At higher quantiles, ECI is negatively associated with emissions, indicating that economies with more sophisticated production structures are better equipped to mitigate environmental degradation (Christoforidis and Katrakilidis, 2025; Marić et al., 2020; Martins et al., 2021). This aligns with the theoretical perspective that complex economies enable resource efficiency and innovation in cleaner technologies, such as technological diffusion, cleaner production, and institutional upgrading (Kumar et al., 2025). On the other hand, the opposite is true for the lower quantiles, where the coefficient of ECI is positive or insignificant, implying that economic complexity may initially exacerbate environmental pressures (Saqib et al., 2023). Studies have demonstrated that more complex economies tend towards cleaner production systems over time (Montagna et al., 2025; Zeng et al., 2024). These dynamics reflect the Environmental Kuznets Curve (EKC) hypothesis, which posits that environmental degradation may increase in early stages of industrial development before declining at higher levels of economic sophistication (Almeida et al., 2024).

The statistics support the hypothesis that FinTech contributes to the funding of green innovation for the top quantiles. Because FinTech has a negligible effect at lower quantiles, infrastructure constraints and digital divides continue to limit the full potential of financial innovation (Cao et al., 2025; Hossain et al., 2024; Musa et al., 2025). Further, the study utilizes high-technology exports (as a % of manufactured exports) as a proxy for FinTech (FT), which also aligns with previous research (Meral, 2019; Navarro Zapata et al., 2023; Srholec, 2007; Wang and Huang, 2025; Yang et al., 2024). However, High-technology exports do not fully capture the FinTech ecosystem, such as digital payments and mobile banking (Chand et al., 2025; Tut, 2023).

In addition, the results of the co-integration test revealed a long-run correlation between the variables ECI, GIN, and FT, and CO2 emissions. The slope heterogeneity test results indicate considerable variance in the relationships between emerging economies. This highlights the fact that crucial variables differ significantly across countries (Capelleras et al., 2025; Musa et al., 2025).

On the other hand, the findings show that for every 1% rise in ECI, the adverse effect on CO2 emissions is 0.248 and 0.219, respectively, according to FMOLS and DOLS. This contradicts the previous results, as in the GIN and CO2 emissions nexus, FMOLS and DOLS indicate that GIN has an adverse effect on CO2 emissions, resulting in decreases of −0.042 and −0.063, respectively, with a 1% rise in GIN. Moreover, the results from FMOLS and DOLS indicate a negative correlation between FT and CO2 emissions, with advanced estimates suggesting that a 1% increase in FT tends to reduce CO2 emissions by 0.018 and 0.025, respectively.

The MMQR test revealed a clear negative correlation between ECI and CO2 emissions, which becomes stronger at higher quantiles (−0.4392 at the Q90). Economic complexity (ECI) is positively correlated with the adoption of cleaner technologies in countries with higher emissions, as indicated by this study. Nevertheless, policies should be implemented to encourage green growth strategies during the initial phases of development, as the decreasing negative impact at lower quantiles (−0.0734 at Q10) suggests that this approach may be particularly effective in areas with low emissions. ECI may not directly lead to substantial reductions in emissions. Moreover, a significant negative relationship exists between GIN and CO2 emissions, and this relationship becomes stronger as the emission quantiles increase (−0.3647 at Q90). In cases where emissions are high, this highlights the importance of GIN in reducing emissions.

The discrepancies between MMQR and FMOLS/DOLS estimates arise because FMOLS/DOLS capture a homogeneous long-run average effect, while MMQR accounts for distributional heterogeneity, revealing that the impact of economic complexity varies across quantile groups. Although it was significantly negative, its magnitude depends on the specific quantile group to which it belongs (Fatima et al., 2024; Zhao and Arshad, 2025).

Additionally, there is a strong negative correlation between CO2 emissions and FinTech (FT) at all quantiles, with the negative correlation increasing with higher CO2 emission levels (−0.2392 at the Q90). It follows that fintech solutions will be crucial in reducing emissions in areas with high levels of pollution (Guo et al., 2023).

For instance, if there were no restrictions on the movement of energy-consuming equipment between nations, this could lead to increased emissions, as there would be no environmental safeguards in place to prevent environmental pollution. This study’s quantile-based findings highlight the asymmetric and non-linear character of the connections being studied. It is crucial to address the diverse capacities and limitations of emerging economies through targeted policy initiatives. The findings also reflect the idea of institutional theory, which emphasis is placed on the influence of regulations, governance, and social norms in promoting green innovation and FinTech, as well as the connection between institutions, green innovation, FinTech, and their roles in reducing CO2 emissions (Khan et al., 2024; Li and Zhang, 2025; Ni et al., 2023). It also demonstrates that economic and technological developments do not occur in isolation but are closely tied to the regulatory environment (Glover et al., 2014). To encourage the adoption of low-carbon practices and policies by financial institutions and companies within a sustainability framework, key pillars such as carbon taxes, environmental regulations, and clean energy standards should be highlighted and addressed (Habib et al., 2025; Omri and Ben Jabeur, 2024). Furthermore, national systems operating within a compliance framework strengthen the credibility of sustainable efforts, which require the development of specific policies, methods, and mechanisms to enforce relevant laws (Alnaim and Metwally, 2024).

6 Conclusion and policy implications

This study contributes to our understanding of ECI, GIN, and FT as key factors in reducing CO2 emissions in emerging economies, spanning the period from 1990 to 2024. This provides strong evidence of varying effects on CO2 emissions, highlighting the significant differences in these variables across countries. The empirical findings offer several important policy implications. It emphasizes the importance of customizing green growth programs to specific environmental settings and quantile levels. This also includes the need for tailored policy strategies and adapting green growth initiatives to environmental conditions and quantile levels. In other words, the lower-emission countries should prioritize preventive policies, such as early investments in renewable energy, and tax incentives for eco-friendly innovation. The upper quintile countries redirect structural change away from carbon-intensive industries and toward green and technology-based ones.

Emerging economies can reduce digital inequality by making internet access affordable, enhancing digital literacy, subsidizing smartphone purchases, fostering broadband partnerships, and promoting interoperable mobile payments (Michael, 2025; Pasupuleti, 2024). Governments are encouraged to back agent banking in local shops and create regulatory sandboxes to advance inclusive FinTech; such steps make FinTech more accessible in underserved areas (Lukonga, 2018).

Ultimately, the association highlights the interconnection between economic and environmental issues, underscoring the need for policies that are both comprehensive and proactive. Strict environmental restrictions are necessary, but policymakers developing markets must also recognize that production systems, innovation ecosystems, and financial frameworks must undergo fundamental transformations to adequately address environmental concerns. However, it is impossible to tackle the problem with separate policy actions. Therefore, for a sustainable transition, governments are encouraged to coordinate technological advancements, economic innovation, and environmental preservation in a manner that considers both financial inclusion and environmental resilience. It has been demonstrated over the years that development opportunities can be created from environmental problems by utilizing an integrated policy framework. Additionally, they should support international sustainability efforts, such as the SDGs and the Paris Agreement. Emphasize expanding green funding through FinTech and work towards standardizing global carbon markets.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: 1. https://ourworldindata.org/grapher/eci-ranking-vs-gdp-per-capita?tab=table 2. https://documents.worldbank.org/pt/publication/documents-reports/documentdetail/897251468156871535/green-growth-technology-and-innovation 3. https://www.worldbank.org/en/topic/fintech.

Author contributions

MA: Funding acquisition, Validation, Writing – review and editing, Formal Analysis, Supervision, Resources, Data curation, Methodology, Software, Project administration, Investigation, Conceptualization, Visualization, Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbasi, K. R., Zhang, Q., Ozturk, I., Alvarado, R., and Musa, M. (2024). Energy transition, fossil fuels, and green innovations: paving the way to achieving sustainable development goals in the United States. Gondwana Res. 130, 326–341. doi:10.1016/j.gr.2024.02.005

Akadiri, S. S., Adebayo, T. S., Asuzu, O. C., Onuogu, I. C., and Oji-Okoro, I. (2023). Testing the role of economic complexity on the ecological footprint in China: a nonparametric causality-in-quantiles approach. Energy and Environ. 34 (7), 2290–2316. doi:10.1177/0958305x221094573

Akram, R., Ibrahim, R. L., Wang, Z., Adebayo, T. S., and Irfan, M. (2023). Neutralizing the surging emissions amidst natural resource dependence, eco-innovation, and green energy in G7 countries: insights for global environmental sustainability. J. Environ. Manage 344, 118560. doi:10.1016/j.jenvman.2023.118560

Al-Ayouty, I. (2023). Economic complexity and renewable energy effects on carbon dioxide emissions: a panel data analysis of Middle East and North Africa countries. J. Knowl. Econ. 15, 12006–12025. doi:10.1007/s13132-023-01540-1

Aliani, K., Borgi, H., Alessa, N., Hamza, F., and Albitar, K. (2024). The impact of green innovation and renewable energy on CO2 emissions in G7 nations. Heliyon 10, e31142. doi:10.1016/j.heliyon.2024.e31142

Almeida, D., Carvalho, L., Ferreira, P., Dionísio, A., and Haq, I. U. (2024). Global dynamics of environmental kuznets curve: a cross-correlation analysis of income and CO2 emissions. Sustainability 16 (20), 9089. doi:10.3390/su16209089

Alnaim, M., and Metwally, A. B. M. (2024). Institutional pressures and environmental management accounting adoption: do environmental strategy matter? Sustainability 16 (7), 3020. doi:10.3390/su16073020

Alsedrah, I. T. (2024). Fintech and green finance revolutionizing carbon emission reduction through green energy projects in mineral-rich countries. Resour. Policy 94, 105064. doi:10.1016/j.resourpol.2024.105064

Anser, M. K., Akhtar, M. Z., Ahmad, I., Abro, M. M. Q., Naseem, I., and Zaman, K. (2025). Addressing environmental degradation and socioeconomic inequities through sustainable urban planning in Pakistan. Urban Gov. 5 (2), 266–277. doi:10.1016/j.ugj.2025.05.006

Apergis, N., and Payne, J. E. (2022). Natural disasters and monetary policy: evidence from an augmented taylor rule. J. Financial Econ. Policy 14 (3), 317–332. doi:10.1108/JFEP-04-2021-0110

Bakhsh, S., Zhang, W., Ali, K., and Oláh, J. (2024). Strategy towards sustainable energy transition: the effect of environmental governance, economic complexity and geopolitics. Energy Strategy Rev. 52, 101330. doi:10.1016/j.esr.2024.101330

Bergougui, B., Mehibel, S., and Boudjana, R. H. (2024). Asymmetric nexus between green technologies, economic policy uncertainty, and environmental sustainability: evidence from Algeria. J. Environ. Manag. 360, 121172. doi:10.1016/j.jenvman.2024.121172

Binder, M., and Coad, A. (2011). From average Joe's happiness to miserable jane and cheerful john: using quantile regressions to analyze the full subjective well-being distribution. J. Econ. Behav. and Organ. 79 (3), 275–290. doi:10.1016/j.jebo.2011.02.005

Boleti, E., Garas, A., Kyriakou, A., and Lapatinas, A. (2021). Economic complexity and environmental performance: evidence from a world sample. Environ. Model. and Assess. 26 (3), 251–270. doi:10.1007/s10666-021-09750-0

Caglar, A. E., Daştan, M., Demirdag, I., and Avci, S. B. (2025). Is low carbon energy consumption sufficient for a sustainable environment in BRICS economies? Evidence from novel fourier asymmetric CS-ARDL. Stoch. Environ. Res. Risk Assess. 39 (4), 1291–1306. doi:10.1007/s00477-025-02913-5

Cai, X., and Song, X. (2022). The nexus between digital finance and carbon emissions: evidence from China. Front. Psychol. 13, 997692. doi:10.3389/fpsyg.2022.997692

Can, M., and Gozgor, G. (2017). The impact of economic complexity on carbon emissions: evidence from France. Environ. Sci. Pollut. Res. Int. 24 (19), 16364–16370. doi:10.1007/s11356-017-9219-7

Cao, Y.-Y., Rehman, S., Subhan, M., Onwe, J. C., and Khan, K. A. (2025). How do supply chain disruptions, digitalization, and environmental policies shape renewable energy innovation in the United Kingdom? A wavelet quantile regression analysis. J. Environ. Manag. 391, 126434. doi:10.1016/j.jenvman.2025.126434

Capelleras, J.-L., Martin-Sanchez, V., and Zhang, C. (2025). The curvilinear relationship between digitalization and export propensity: the role of home country corruption in emerging economies. Technol. Forecast. Soc. Change 214, 124043. doi:10.1016/j.techfore.2025.124043

Chand, S. A., Singh, B., Narayan, K., and Chand, A. (2025). The impact of financial technology (FinTech) on bank risk-taking and profitability in small developing island states: a study of Fiji. J. Risk Financial Manag. 18 (7), 366. doi:10.3390/jrfm18070366

Chang, K., Liu, L., Luo, D., and Xing, K. (2023). The impact of green technology innovation on carbon dioxide emissions: the role of local environmental regulations. J. Environ. Manag. 340, 117990. doi:10.1016/j.jenvman.2023.117990

Chang, G., Yasin, I., and Naqvi, S. M. M. A. (2024). Environmental sustainability in OECD nations: the moderating impact of green innovation on urbanization and green growth. Sustainability 16 (16), 7047. doi:10.3390/su16167047

Charfeddine, L., and Umlai, M. (2023). ICT sector, digitization and environmental sustainability: a systematic review of the literature from 2000 to 2022. Renew. Sustain. Energy Rev. 184, 113482. doi:10.1016/j.rser.2023.113482

Chel, A., and Kaushik, G. (2018). Renewable energy technologies for sustainable development of energy efficient building. Alexandria Eng. J. 57 (2), 655–669. doi:10.1016/j.aej.2017.02.027

Christoforidis, T., and Katrakilidis, C. (2025). Assessing the impacts of economic complexity and economic freedom on the energy-induced environmental performance: new evidence from a panel of EU countries. J. Knowl. Econ. doi:10.1007/s13132-025-02672-2

Cisneros Chavira, P., Shamsuzzoha, A., Kuusniemi, H., and Jovanovski, B. (2023). Defining green innovation, its impact, and cycle – a literature analysis. Clean. Eng. Technol. 17, 100693. doi:10.1016/j.clet.2023.100693

Cole, M. A. (2004). Trade, the pollution haven hypothesis and the environmental kuznets curve: examining the linkages. Ecol. Econ. 48 (1), 71–81. doi:10.1016/j.ecolecon.2003.09.007

Dabbous, A., Aoun Barakat, K., Ben Arfi, W., and Nammouri, H. (2025). The impact of environmental policy stringency and economic complexity on nations' energy transitions: the mediating role of fintech financing. Energy Econ. 147, 108540. doi:10.1016/j.eneco.2025.108540

Daga, S., Yadav, K., Lakshmi, V., and Singh, P. (2024). Growth vs. green: unpacking the economic–environmental dilemma in major carbon emitters with panel ARDL analysis. Discov. Environ. 2 (1), 143. doi:10.1007/s44274-024-00173-8

Dash, A. K., Panda, S. P., Sahu, P. K., and Jóźwik, B. (2024). Do green innovation and governance limit CO2 emissions: evidence from twelve polluting countries with panel data decision tree model. Discov. Sustain. 5 (1), 198. doi:10.1007/s43621-024-00418-9

Doğan, B., Driha, O. M., Balsalobre Lorente, D., and Shahzad, U. (2021). The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain. Dev. 29 (1), 1–12. doi:10.1002/sd.2125

Doğan, B., Ghosh, S., Dung, H., and Chu, L. (2022). Are economic complexity and eco-innovation mutually exclusive to control energy demand and environmental quality in E7 and G7 countries? Technol. Soc. 68, 101867. doi:10.1016/j.techsoc.2022.101867

El Khoury, R., Min Du, A., Nasrallah, N., Marashdeh, H., and Atayah, O. F. (2025). Towards sustainability: examining financial, economic, and societal determinants of environmental degradation. Res. Int. Bus. Finance 73, 102557. doi:10.1016/j.ribaf.2024.102557

Fatima, N., Xuhua, H., Alnafisah, H., and Akhtar, M. R. (2024). Synergy for climate actions in G7 countries: unraveling the role of environmental policy stringency between technological innovation and CO2 emission interplay with DOLS, FMOLS and MMQR approaches. Energy Rep. 12, 1344–1359. doi:10.1016/j.egyr.2024.07.035

Gao, Y., Chen, H., Tauni, M. Z., Alnafrah, I., and Yu, J. (2024). Unpacking the impact of financialization and globalization on environmental degradation in BRICS economies. Resour. Policy 88, 104497. doi:10.1016/j.resourpol.2023.104497

Ghazouani, T., and Hamdi, M. A. (2025). Income inequality, fintech innovation, and CO2 emissions: evidence from OECD countries. Int. J. Sustain. Dev. and World Ecol. 32, 650–670. doi:10.1080/13504509.2025.2528228

Glover, J. L., Champion, D., Daniels, K. J., and Dainty, A. J. D. (2014). An institutional theory perspective on sustainable practices across the dairy supply chain. Int. J. Prod. Econ. 152, 102–111. doi:10.1016/j.ijpe.2013.12.027

Green, F., and Healy, N. (2022). How inequality fuels climate change: the climate case for a Green new deal. One Earth 5 (6), 635–649. doi:10.1016/j.oneear.2022.05.005

Guo, L., Tang, L., Cheng, X., and Li, H. (2023). Exploring the role of fintech development in reducing firm pollution discharges: evidence from Chinese industrial firms. J. Clean. Prod. 425, 138833. doi:10.1016/j.jclepro.2023.138833

Gyawali, R., Ju, Y., Durrani, S. K., and Binh, P. A. (2025). Unveiling the complexities of economic, development and governance factors in belt and road countries: a leap forward towards environmental management. J. Environ. Manag. 373, 123823. doi:10.1016/j.jenvman.2024.123823

Ha, L. T. (2023). Is economic complexity an enabler of environmental innovation? Novel insightful lessons from European region. Manag. Environ. Qual. An Int. J. 34 (2), 331–350. doi:10.1108/MEQ-08-2022-0244

Habib, Y., Abd Rahman, N. R., Hashmi, S. H., and Ali, M. (2025). Green finance and environmental decentralization drive OECD low carbon transitions. Sci. Rep. 15 (1), 28140. doi:10.1038/s41598-025-11967-y

Halim, M. A., and Moudud-Ul-Huq, S. (2024). Green economic growth in BRIC and CIVETS countries: the effects of trade openness and sustainable development goals. Heliyon 10 (9), e30148. doi:10.1016/j.heliyon.2024.e30148

Hasan, M., Hoque, A., Abedin, M. Z., and Gasbarro, D. (2024). FinTech and sustainable development: a systematic thematic analysis using human- and machine-generated processing. Int. Rev. Financial Analysis 95, 103473. doi:10.1016/j.irfa.2024.103473

Hashem Pesaran, M., and Yamagata, T. (2008). Testing slope homogeneity in large panels. J. Econ. 142 (1), 50–93. doi:10.1016/j.jeconom.2007.05.010

Hidalgo, C. A., and Hausmann, R. (2009). The building blocks of economic complexity. Proc. Natl. Acad. Sci. 106 (26), 10570–10575. doi:10.1073/pnas.0900943106

Hoa, P. X., Xuan, V. N., and Thu, N. T. P. (2024). Factors affecting carbon dioxide emissions for sustainable development goals – new insights into six Asian developed countries. Heliyon 10 (21), e39943. doi:10.1016/j.heliyon.2024.e39943

Hossain, M. R., Rao, A., Sharma, G. D., Dev, D., and Kharbanda, A. (2024). Empowering energy transition: green innovation, digital finance, and the path to sustainable prosperity through green finance initiatives. Energy Econ. 136, 107736. doi:10.1016/j.eneco.2024.107736

Islam, M. S. (2024). Rethinking climate justice: insights from environmental sociology. Climate 12 (12), 203. doi:10.3390/cli12120203

Jangid, H., Rao, N. V. M., and Bal, D. P. (2025). Analysing the role of fintech and resource use in shaping environmental outcomes using load capacity factor in G20 countries. Discov. Sustain. 6 (1), 625. doi:10.1007/s43621-025-01511-3

Jarque, C. M., and Bera, A. K. (1987). A test for normality of observations and regression residuals. Int. Stat. Review/Revue Int. Stat. 55, 163–172. doi:10.2307/1403192

Javaid, M., Haleem, A., Singh, R. P., Suman, R., and Khan, S. (2022). A review of blockchain technology applications for financial services. BenchCouncil Trans. Benchmarks, Stand. Eval. 2 (3), 100073. doi:10.1016/j.tbench.2022.100073

Jiang, L., and Hassan, A. (2025). Eco-tourism, FinTech, and resource governance as strategic drivers of CO2 mitigation in emerging economies: insights from quantile regression analysis. Front. Environ. Sci. 13–2025. doi:10.3389/fenvs.2025.1571854

Khan, F. U., Zhang, J., Saeed, I., and Ullah, S. (2024). Do institutional contingencies matter for green investment?An institution based view of Chinese listed companies. Heliyon 10 (1), e23456. doi:10.1016/j.heliyon.2023.e23456

Khan, A., Sattar, A., Alnafisah, H., and Fatima, N. (2025). Do environmental taxes and green technological innovation represent the crux of environmental sustainability? Insights from OECD region with MMQR approach. Front. Environ. Sci. 13, 1537535. doi:10.3389/fenvs.2025.1537535

Khezri, M., Heshmati, A., and Khodaei, M. (2022). Environmental implications of economic complexity and its role in determining how renewable energies affect CO2 emissions. Appl. Energy 306, 117948. doi:10.1016/j.apenergy.2021.117948

Koenker, R. (2004). Quantile regression for longitudinal data. J. Multivar. Analysis 91 (1), 74–89. doi:10.1016/j.jmva.2004.05.006

Koenker, R., and Bassett, G. (1978). Regression quantiles. Econometrica 46 (1), 33–50. doi:10.2307/1913643

Kou, G., and Lu, Y. (2025). FinTech: a literature review of emerging financial technologies and applications. Financ. Innov. 11 (1), 1. doi:10.1186/s40854-024-00668-6

Kumar, P., Kaur, R., Radulescu, M., Kalaš, B., and Hagiu, A. (2025). Drivers of environmental sustainability, economic growth, and inequality: a study of economic complexity, FDI, and human development role in BRICS+ nations. Sustainability 17 (9), 4180. doi:10.3390/su17094180

Kwilinski, A., Dacko-Pikiewicz, Z., Szczepanska-Woszczyna, K., Lyulyov, O., and Pimonenko, T. (2025). The role of innovation in the transition to a green economy: a path to sustainable growth. J. Open Innovation Technol. Mark. Complex. 11 (2), 100530. doi:10.1016/j.joitmc.2025.100530

Leddin, D. (2024). The impact of climate change, pollution, and biodiversity loss on digestive health and disease. Gastro Hep Adv. 3 (4), 519–534. doi:10.1016/j.gastha.2024.01.018

Li, Z., and Chen, P. (2024). Sustainable finance meets FinTech: amplifying green credit’s benefits for banks. Sustainability 16 (18), 7901. doi:10.3390/su16187901

Li, Z., and Qamruzzaman, M. (2023). Nexus between environmental degradation, clean energy, financial inclusion, and poverty: evidence with DSUR, CUP-FM, and CUP-BC estimation. Sustainability 15 (19), 14161. doi:10.3390/su151914161

Li, C., and Zhang, S. (2025). Do innovation policies and fintech create synergistic effects for the sustainability of urban green innovation?an empirical test based on a triple difference approach. Sustain. Futur. 9, 100696. doi:10.1016/j.sftr.2025.100696

Li, X., Qin, Q., and Yang, Y. (2023). The impact of green innovation on carbon emissions: evidence from the construction sector in China. Energies 16 (11), 4529. doi:10.3390/en16114529

Lukonga, I. (2018). Fintech, inclusive growth and cyber risks: focus on the MENAP and CCA regions (USA: International Monetary Fund, 2018.

Machado, J. A. F., and Santos Silva, J. M. C. (2019). Quantiles via moments. J. Econ. 213 (1), 145–173. doi:10.1016/j.jeconom.2019.04.009

Marić, J. J., Kračun-Kolarević, M., Kolarević, S., Sunjog, K., Kostić-Vuković, J., Deutschmann, B., et al. (2020). Selection of assay, organism, and approach in biomonitoring significantly affects the evaluation of genotoxic potential in aquatic environments. Environ. Sci. Pollut. Res. 27 (27), 33903–33915. doi:10.1007/s11356-020-09597-0

Martins, J. M., Adebayo, T. S., Mata, M. N., Oladipupo, S. D., Adeshola, I., Ahmed, Z., et al. (2021). Modeling the Relationship Between Economic Complexity and Environmental Degradation: Evidence From Top Seven Economic Complexity Countries [Original Research]. Front. Environ. Sci., 9–2021. doi:10.3389/fenvs.2021.744781

Mavlutova, I., Spilbergs, A., Romanova, I., Kuzmina, J., Fomins, A., Verdenhofs, A., et al. (2025). The role of green digital investments in promoting sustainable development goals and green energy consumption. J. Open Innovation Technol. Mark. Complex. 11 (2), 100518. doi:10.1016/j.joitmc.2025.100518

Mealy, P., Farmer, J. D., and Teytelboym, A. (2019). Interpreting economic complexity. Sci. Adv. 5 (1), eaau1705. doi:10.1126/sciadv.aau1705

Meral, Y. (2019). High technology export and high technology export impact on growth. Int. J. Bus. Ecosyst. Strategy (2687-2293) 1, 32–38. doi:10.36096/ijbes.v1i3.283

Mertzanis, C. (2023). FinTech finance and social-environmental performance around the world. Finance Res. Lett. 56, 104107. doi:10.1016/j.frl.2023.104107

Min, J., Yan, G., Abed, A. M., Elattar, S., Amine Khadimallah, M., Jan, A., et al. (2022). The effect of carbon dioxide emissions on the building energy efficiency. Fuel 326, 124842. doi:10.1016/j.fuel.2022.124842

Montagna, S., Huang, L., Long, Y., and Yoshida, Y. (2025). Sectoral economic complexity and environmental degradation: a sectoral perspective on the EKC hypothesis. Humanit. Soc. Sci. Commun. 12 (1), 764. doi:10.1057/s41599-025-04820-0

Müller, V. P., and Eichhammer, W. (2023). Economic complexity of green hydrogen production technologies - a trade data-based analysis of country-specific industrial preconditions. Renew. Sustain. Energy Rev. 182, 113304. doi:10.1016/j.rser.2023.113304

Musa, M., Rahman, T., deb, N., and Rahman, P. (2025). Harnessing artificial intelligence for sustainable urban development: advancing the three zeros method through innovation and infrastructure. Sci. Rep. 15 (1), 23673. doi:10.1038/s41598-025-07436-1

Navarro Zapata, A., Arrazola, M., and de Hevia, J. (2023). Determinants of high-tech exports: new evidence from OECD countries. J. Knowl. Econ. 15, 1103–1117. doi:10.1007/s13132-023-01116-z

Nawaz, F., Kayani, U., ElRefae, G. A., Hasan, F., and Bazai, H. S. K. (2025). Economic growth and carbon emissions nexus: environmental sustainability a case of Japan from east Asia. Discov. Sustain. 6 (1), 177. doi:10.1007/s43621-025-00941-3

Neagu, O. (2020). Economic complexity and ecological footprint: evidence from the Most complex economies in the world. Sustainability 12 (21), 9031. doi:10.3390/su12219031

Neagu, O., and Teodoru, M. C. (2019). The relationship between economic complexity, energy consumption structure and greenhouse gas emission: heterogeneous panel evidence from the EU countries. Sustainability 11 (2), 497. doi:10.3390/su11020497

Ni, L., Yu, Y., and Wen, H. (2023). Impact of fintech and environmental regulation on green innovation: inspiration from prefecture-level cities in China [Original Research]. Front. Ecol. Evol. 11 - 2023. doi:10.3389/fevo.2023.1265531

Nuta, A. C. (2024). The significance of economic complexity and renewable energy for decarbonization in eastern European countries. Energies 17 (21), 5271. doi:10.3390/en17215271

Okere, K. I., Dimnwobi, S. K., and Fasanya, I. O. (2024). Do fintech, natural resources and globalization matter during ecological crises? A step towards ecological sustainability. J. Open Innovation Technol. Mark. Complex. 10 (3), 100371. doi:10.1016/j.joitmc.2024.100371

Olaniyi, C. O., and Odhiambo, N. M. (2025). Modelling asymmetric and nonlinear features in the natural resource wealth-economic complexity nexus: empirical insights from Nigeria. Mineral. Econ. 38 (1), 177–201. doi:10.1007/s13563-024-00470-x

Olarewaju, O. O., Fawole, O. A., Baiyegunhi, L. J. S., and Mabhaudhi, T. (2025). Integrating sustainable agricultural practices to enhance climate resilience and food security in Sub-Saharan Africa: a multidisciplinary perspective. Sustainability 17 (14), 6259. doi:10.3390/su17146259

Omri, A., and Ben Jabeur, S. (2024). Climate policies and legislation for renewable energy transition: the roles of financial sector and political institutions. Technol. Forecast. Soc. Change 203, 123347. doi:10.1016/j.techfore.2024.123347

Osei-Assibey Bonsu, M., Guo, Y., Wang, Y., and Li, K. (2025). Does fintech lead to enhanced environmental sustainability? The mediating role of green innovation in China and India. J. Environ. Manag. 376, 124442. doi:10.1016/j.jenvman.2025.124442

Pasupuleti, M. K. (2024). Strategies for bridging the digital divide in rural and low-income communities 106–135. doi:10.62311/nesx/9029

Perez-Saiz, H., and Sharma, P. (2019). FinTech in sub-saharan African countries: a game changer? Dep. Pap. 2019 (004), A001. doi:10.5089/9781484385661.087.A001

Pesaran, H. (2004). General diagnostic tests for cross section dependence in panels. CESifo Work. Pap. 69. doi:10.2139/ssrn.572504

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74 (4), 967–1012. doi:10.1111/j.1468-0262.2006.00692.x

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. 22 (2), 265–312. doi:10.1002/jae.951

Pesaran, M. H. (2021). General diagnostic tests for cross-sectional dependence in panels. Empir. Econ. 60 (1), 13–50. doi:10.1007/s00181-020-01875-7

Pesaran, H. H., and Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Econ. Lett. 58 (1), 17–29. doi:10.1016/S0165-1765(97)00214-0

Priya, A., Rajamanickam, S., Sivarethinamohan, S., Gaddam, M. K. R., Velusamy, P., R, G., et al. (2023). Impact of climate change and anthropogenic activities on aquatic ecosystem – a review. Environ. Res. 238, 117233. doi:10.1016/j.envres.2023.117233

Qamruzzaman, M., and Karim, S. (2024). Green energy, green innovation, and political stability led to green growth in OECD nations. Energy Strategy Rev. 55, 101519. doi:10.1016/j.esr.2024.101519

Rabbani, M. R., and Kiran, M. (2025). The nexus of FinTech, environmental sustainability, and climate change: insights from OIC emerging economies. Sustain. Futur. 10, 100986. doi:10.1016/j.sftr.2025.100986

Raman, R., Ray, S., Das, D., and Nedungadi, P. (2025). Innovations and barriers in sustainable and green finance for advancing sustainable development goals. Front. Environ. Sci. 12, 1513204–2024. doi:10.3389/fenvs.2024.1513204

Richardson, R. B. (2010). Ecosystem services and food security: economic perspectives on environmental sustainability. Sustainability 2 (11), 3520–3548. doi:10.3390/su2113520

Sachan, A., Pradhan, A. K., Mohindra, V., and Menegaki, A. (2025). A bibliometric analysis of key drivers, trends, and research collaboration on environmental degradation. Discov. Sustain. 6 (1), 350. doi:10.1007/s43621-025-01033-y

Saqib, N., Radulescu, M., Usman, M., Balsalobre-Lorente, D., and Cilan, T. (2023). Environmental technology, economic complexity, renewable electricity, environmental taxes and CO2 emissions: implications for low-carbon future in G-10 bloc. Heliyon 9 (6), e16457. doi:10.1016/j.heliyon.2023.e16457

Saxena, A., Prakash Gupta, J., Tiwary, J. K., Kumar, A., Sharma, S., Pandey, G., et al. (2024). Innovative pathways in carbon capture: advancements and strategic approaches for effective carbon capture, utilization, and storage. Sustainability 16 (22), 10132. doi:10.3390/su162210132

Srholec, M. (2007). High-tech exports from developing countries: a symptom of technology spurts or statistical illusion? Rev. World Econ. (Weltwirtschaftliches Archiv) 143, 227–255. doi:10.1007/s10290-007-0106-z

Tabash, M. I., Farooq, U., Aljughaiman, A. A., Wong, W.-K., and AsadUllah, M. (2024). Does economic complexity help in achieving environmental sustainability? New empirical evidence from N-11 countries. Heliyon 10 (11), e31794. doi:10.1016/j.heliyon.2024.e31794

Tabrizi, A., Yousefi, H., Abdoos, M., and Ghasempour, R. (2025). Evaluating renewable energy adoption in G7 countries: a TOPSIS-Based multi-criteria decision analysis. Discov. Energy 5 (1), 2. doi:10.1007/s43937-025-00064-w

Tang, X., Wang, Q., Noor, S., Nazir, R., Nasrullah, M. J., Hussain, P., et al. (2024). Exploring the impact of green finance and green innovation on resource efficiency: the mediating role of market regulations and environmental regulations. Sustainability 16 (18), 8047. doi:10.3390/su16188047

Teng, M., and Shen, M. (2023). The impact of fintech on carbon efficiency: evidence from Chinese cities. J. Clean. Prod. 425, 138984. doi:10.1016/j.jclepro.2023.138984

Tut, D. (2023). FinTech and the COVID-19 pandemic: evidence from electronic payment systems. Emerg. Mark. Rev. 54, 100999. doi:10.1016/j.ememar.2023.100999

Usman, O. (2023). Renewable energy and CO(2) emissions in G7 countries: does the level of expenditure on green energy technologies matter? Environ. Sci. Pollut. Res. Int. 30 (10), 26050–26062. doi:10.1007/s11356-022-23907-8

Wang, H. (2025). Green finance and foreign investment: catalysts for sustainable prosperity in emerging economies. Front. Environ. Sci. 13, 1561838. doi:10.3389/fenvs.2025.1561838

Wang, J., and Huang, Q. (2025). The impact of digital transformation on the export technology complexity of manufacturing enterprises: based on empirical evidence from China. Sustainability 17 (6), 2596. doi:10.3390/su17062596

Wang, B., and Xu, R. (2025). How industrial output, economic growth, environmental technology, and globalization impact load capacity factor in E7 nations. Sustainability 17 (4), 1419. doi:10.3390/su17041419

Wang, Q., Yang, T., and Li, R. (2023). Economic complexity and ecological footprint: the role of energy structure, industrial structure, and labor force. J. Clean. Prod. 412, 137389. doi:10.1016/j.jclepro.2023.137389

Wang, C., Wang, L., Zhao, S., Yang, C., and Albitar, K. (2024). The impact of fintech on corporate carbon emissions: towards green and sustainable development. Bus. Strategy Environ. 33 (6), 5776–5796. doi:10.1002/bse.3778

Wei, H., Yue, G., and Khan, N. U. (2024). Uncovering the impact of fintech, natural resources, green finance and green growth on environment sustainability in BRICS: an MMQR analysis. Resour. Policy 89, 104515. doi:10.1016/j.resourpol.2023.104515

Westerlund, J. (2007). Testing for error correction in panel data. Oxf. Bull. Econ. Statistics 69 (6), 709–748. doi:10.1111/j.1468-0084.2007.00477.x

Xian, M. (2025). Impact of inclusive growth, environmental policy incentives, fintech and globalization on environmental sustainability in G20 countries. Sustainability 17 (1), 50. doi:10.3390/su17010050