- 1School of Information Engineering, Hangzhou Dianzi University, Hangzhou, Zhejiang, China

- 2Jiyang College, Zhejiang A&F University, Zhuji, Zhejiang, China

- 3Research Academy for Rural Revitalization of Zhejiang Province, Zhejiang A&F University, Hangzhou, Zhejiang, China

Financial technology (fintech) is the application of cutting-edge technology in the financial sector, with potential value for the low-carbon economic transition. In the context of intensified global warming, using fintech to promote energy saving and carbon reduction innovation (ESCRI) presents a thought-provoking practical challenge. This study utilizes data from 30 Chinese provinces spanning 2011 to 2022 to empirically examine whether fintech can improve ESCRI. Results revealed that first, fintech significantly promotes ESCRI, a conclusion supported by a series of robustness tests. Second, the main pathways through which fintech affects ESCRI are industrial scale, investment expansion, and R&D expenditure. Third, in provinces with poor environmental quality, lagging industrial upgrading, and in the central and western regions, fintech’s positive effect on ESCRI is more significant. Fourth, fintech demonstrates a significant impact on reducing carbon emissions. The results of this study provide strong evidence for actively utilizing fintech to promote ESCRI on a global scale and offer empirical insight into the underlying logic of green and low-carbon development.

1 Introduction

As the global greenhouse effect intensifies and energy challenges become increasingly prominent, energy saving and carbon reduction have emerged as critical drivers for achieving a low-carbon energy transition and sustainable development worldwide (Udeagha and Muchapondwa, 2023; Dai et al., 2025). Over the past few decades, China has prioritized rapid economic expansion, yet this growth trajectory has resulted in significant challenges, including widespread energy inefficiency and severe environmental degradation (Xu and Lin, 2017; Feng S et al., 2022). China’s total energy consumption has steadily increased, surging from 1.555 billion tons of standard coal equivalent in 2001 to 5.720 billion tons in 2023. Recent data from the International Energy Agency (IEA) reveal that China accounted for 29.14% of global carbon emissions in 2021, making it the world’s largest emitter (Cheng et al., 2023).

In recent years, China has demonstrated a strong commitment to energy conservation and carbon reduction (Gao et al., 2022; Zhao et al., 2024; Feng and Xie, 2024), actively pursuing energy decarbonization to enhance environmental quality and achieve sustainable development. In May 2024, the Chinese government launched the “2024–2025 Energy Conservation and Carbon Reduction Action Plan,” a strategic policy designed to satisfy the binding targets of the 14th Five-Year Plan while fostering innovation in energy-saving and carbon-reduction industries, ultimately advancing the nation’s dual-carbon objectives. Given that innovation serves as a crucial driver of productivity and low-carbon transformation (Tao et al., 2022), identifying effective pathways to implement energy saving and carbon reduction innovation (ESCRI) has become pivotal for achieving China’s ambitious climate goals.

Given the substantial externalities associated with ESCRI, its advancement requires considerable financial backing. Theoretically, financial technology (fintech) offers a viable solution to the financing challenges confronting ESCRI initiatives. Fintech is the fusion of finance and technology (Goldstein et al., 2019). The emergence of disruptive technologies, particularly internet-based platforms and artificial intelligence, has catalyzed the evolution of fintech (Shim and Shin, 2016). Distinct from conventional financial innovation, fintech represents a paradigm shift in technological innovation within the financial sector (Deng et al., 2019). Through integrating advanced technologies such as artificial intelligence, big data analytics, and blockchain into financial systems, fintech has facilitated the development of innovative financial models (Goldstein et al., 2019), enabling more precise and targeted financial services for the energy conservation and carbon reduction industry. This study addresses three critical research questions: Does fintech effectively promote ESCRI? What are the underlying mechanisms driving this relationship? What heterogeneous effects exist across different contexts? To investigate these questions, we employ a double fixed-effects model, using balanced panel data from 30 Chinese provinces spanning 2011 to 2022.

This study makes several significant contributions. First, although previous research has extensively examined the carbon emission reduction effects of fintech from macro and micro perspectives, the relationship between fintech and ESCRI remains underexplored. This study fills this critical gap by providing novel insights and empirical evidence. Second, it identifies and empirically validates several key transmission mechanisms through which fintech influences ESCRI, including the industrial scale effect, investment expansion effect, and R&D expenditure effect. Furthermore, we systematically examine the heterogeneous effects across different environmental quality levels, stages of industrial upgrading, and regional differences. Finally, through further analysis, this study empirically explores the carbon emission reduction effect of fintech and derives targeted policy implications. These findings not only offer valuable insights for fintech innovation and regulatory reform but also make a substantive contribution to advancing China’s dual-carbon objectives during this critical implementation phase.

2 Literature review and hypotheses development

Extensive research has explored the economic implications of fintech across macro and micro levels. At the macroeconomic level, fintech has emerged as a crucial driver of sustainable development (Deng et al., 2019). Empirical evidence suggests that proactive fintech initiatives at the regional level significantly help mitigate environmental pollution in BRICS nations, thereby enhancing ecological sustainability (Zhang, 2024). Furthermore, fintech demonstrates substantial potential to improve urban carbon emission efficiency by accelerating the implementation of green financial policies (Teng and Shen, 2023; Xu et al., 2023; Wan et al., 2025).

At the microeconomic level, fintech applications have become integral to corporate operations and production processes, facilitating low-carbon energy transitions (Li H. et al., 2023) and reducing enterprise-level carbon emissions (Wang et al., 2024). A growing body of literature consistently demonstrates that fintech development contributes to environmental protection and enhances environmental quality (Muganyi et al., 2021; Muhammad et al., 2022; Ali et al., 2024; Li R. et al., 2024). Within this context of environmental improvement, ESCRI plays a pivotal role, delivering substantial benefits through reduced energy waste and minimized environmental pollution (Xie et al., 2023; Li Y. et al., 2024). However, despite these advancements, current research has yet to thoroughly investigate the direct effects and underlying mechanisms through which fintech influences ESCRI.

Based on ecological modernization theory (Jänicke, 2008), the widespread application of fintech may facilitate the promotion of ESCRI. First, fintech provides essential financial support for the development of the energy saving and carbon reduction industry. The advancement of ESCRI typically requires substantial capital investment and involves extended payback periods (Lv et al., 2021). Prior to fintech’s widespread adoption, financial institutions were often reluctant to extend credit to energy conservation and emission reduction enterprises due to perceived risks. Contrary to conventional financial systems, fintech revolutionizes the credit evaluation process by implementing comprehensive risk management frameworks that span pre-loan assessment to post-loan monitoring, significantly mitigating default risks (Fuster et al., 2019; Chiu and Lee, 2020). This technological advancement enables financial institutions to more accurately assess the risk–return profile of energy-saving projects, thereby lowering financing barriers and facilitating ESCRI development. Moreover, fintech inherently possesses “green attributes” (Liu et al., 2023), manifested through its ability to drive innovation in green financial instruments and enhance the resource allocation efficiency of financial institutions (Wan et al., 2025). Fintech significantly contributes to advancing ESCRI initiatives by fostering the development of diverse green financial products and creating multiple financing channels for the energy conservation sector.

Second, fintech plays a pivotal role in mitigating information asymmetry and reducing transaction costs within the energy-saving and carbon reduction sectors. The development of energy-efficient and low-carbon industries requires complex innovation processes, which are often hindered by significant information gaps in investment and financing activities (Ni et al., 2023). From the perspective of information asymmetry theory and transaction cost theory, fintech integrates advanced technologies to enable comprehensive analysis of the energy conservation industry’s potential and challenges, thereby reducing information asymmetry among stakeholders and significantly lowering transaction costs. Fintech facilitates intelligent data management systems for the energy-saving sector, providing investors with accurate, real-time insights into industry trends and market demands. Given the substantial investment potential of ESCRI, fintech platforms incentivize capital allocation toward sustainable projects (Cheng et al., 2023), accelerating ESCRI development. Furthermore, the adoption of blockchain technology ensures complete traceability of funds, guaranteeing that financial resources are exclusively used for their intended ESCRI purposes.

Finally, fintech has significantly accelerated the broad dissemination of energy-saving and carbon reduction concepts across society, thereby greatly benefiting ESCRI. By leveraging fintech platforms, regional development in energy conservation and carbon reduction can be effectively advanced (Li et al., 2020). These platforms encourage public participation in energy-saving and carbon-reducing activities, fostering the spread of these principles and garnering wider support for ESCRI. For example, fintech platforms can facilitate crowdfunding campaigns that engage the public in financing energy-efficient and low-carbon projects. Moreover, fintech drives digital transformation within financial institutions, with online operations increasingly becoming the dominant mode of business. By offering green consumer financial products, fintech guides the public toward selecting low-carbon goods and services (Vu et al., 2024). This approach not only boosts demand for energy-saving and carbon-reducing practices but also provides strong momentum for advancing ESCRI. Based on this analysis, Hypothesis 1 is proposed:

H1. Ceteris paribus, fintech can promote ESCRI significantly.

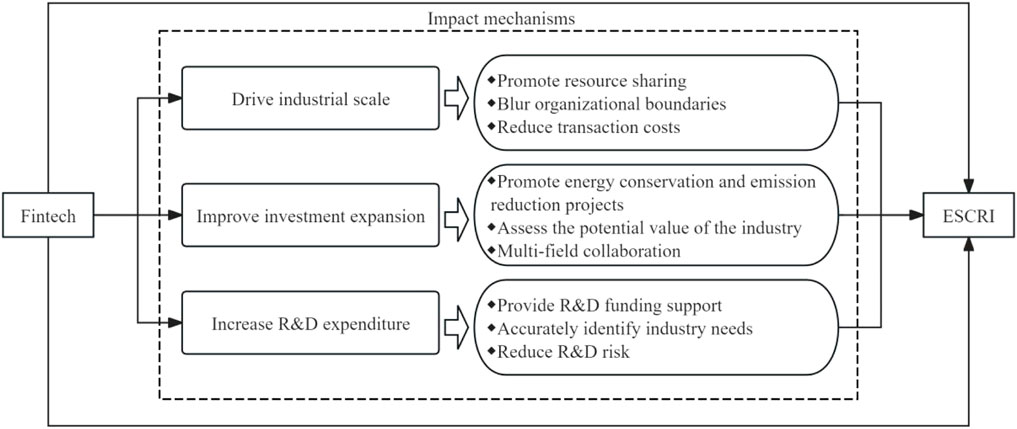

Although existing studies have confirmed the carbon reduction effects of fintech (Cheng et al., 2023; Teng and Shen, 2023; Wan et al., 2025), they have largely overlooked the mechanisms through which fintech influences ESCRI. This study addresses this gap by thoroughly examining the critical roles of industrial scale, investment expansion, and R&D expenditure in shaping the relationship between fintech and ESCRI. For a detailed theoretical framework, refer to Figure 1.

First, the industrial scale effect. Fintech drives the modernization and digital transformation of financial institutions, enabling faster and more efficient allocation of financial resources (Li et al., 2020). From the perspective of information asymmetry theory, fintech leverages technologies such as artificial intelligence, blockchain, and big data to reduce information asymmetry between financial institutions and industrial entities (Li Y. et al., 2024). This reduction facilitates optimized resource allocation (Deng et al., 2019) and enhances overall industrial efficiency. Drawing on industrial organization theory, fintech contributes to scaling up of the energy-saving and carbon reduction industry. In terms of organizational collaboration, the widespread adoption of fintech has fostered the creation of dedicated platforms for this industry. These platforms enable supply and demand stakeholders to share resources more effectively, foster knowledge dissemination, and blur organizational boundaries. These platforms open new opportunities to advance ESCRI by reducing transaction costs and promoting economies of scale.

Second, the investment expansion effect. The energy-saving and carbon reduction industry possesses significant investment potential and demand, but its continued growth requires substantial financial support involving collaboration across multiple sectors. Fintech enables financial institutions to accurately identify the value potential of this industry, assess investment needs and risks (Zhu, 2019), and provide targeted financial support. For example, green bond platforms such as the European Investment Bank (EIB) leverage fintech to issue green bonds, securing investments for energy-saving and carbon-reducing projects. Evidently, accelerating investment in these projects plays a crucial role in advancing ESCRI.

Third, the R&D expenditure effect. Given the widespread societal emphasis on energy efficiency and carbon reduction, local governments and financial institutions have actively supported the energy-saving and carbon reduction industry by allocating substantial R&D funding. From the perspective of technological innovation theory, fintech may serve as a key driver of innovation. Fintech equips local governments, financial institutions, and other stakeholders with advanced data analysis tools, enabling more precise and efficient allocation of R&D funds to ESCRI (Aid et al., 2017; Breidbach et al., 2020). Furthermore, fintech assists governments address challenges within the real economy. For example, fintech enables governments to accurately identify the specific needs of energy-saving and carbon reduction industries, facilitating timely financial subsidies or identifying investment opportunities (Arner et al., 2020; Teng and Shen, 2023). This proactive approach helps safeguard and promote ESCRI. Based on this analysis, Hypotheses 2–4 are proposed:

H2. Ceteris paribus, fintech promotes ESCRI by driving industrial scale.

H3. Ceteris paribus, fintech promotes ESCRI by improving investment expansion.

H4. Ceteris paribus, fintech promotes ESCRI by increasing R&D expenditure.

3 Methods

3.1 Econometric model specification

Following the approach of Wang et al. (2024), this study establishes a double fixed effects model to examine the impact of fintech on ESCRI. The model is specified as follows:

where the dependent variable,

Constructing a testing approach that aligns with characteristics of empirical economic research is essential (Jiang, 2022). A widely accepted practice involves identifying path variables that, based on theory, logically and directly exhibit a causal relationship with the dependent variable, and then using econometric methods to verify only the causal relationship between these path variables and the explanatory variables (Dell, 2010). This study adopts the argumentation framework proposed by Jiang (2022) and Feng and Zhou (2024), focusing solely on testing the front end of the influence pathway, while relying on existing literature to support and explain the back end. To validate the mechanism through which fintech impacts ESCRI, we further constructed Equation 2 as follows:

The mediating variables comprise primarily industrial scale (Scale), investment expansion (Invest), and R&D investment (Rd).

To further explore the external factors that moderate fintech’s influence on ESCRI, this study constructs Equation 3, incorporating an interaction term, as follows:

The moderator variables comprise primarily environmental quality (EQ) and industrial upgrading (IU).

3.2 Main variables

3.2.1 Energy saving and carbon reduction innovation

ESCRI is a key dependent variable in this study. Existing research generally measures innovation levels by the number of patent applications (Huang and Ma, 2024; Zhao et al., 2024). Therefore, this study measures ESCRI as the natural logarithm of one plus the number of patent applications in the energy-saving and carbon reduction industry. The total number of patent applications is the sum of applications submitted by energy-saving and carbon-reducing enterprises within each province.

3.2.2 Fintech

The search for online data is driven by public demand and serves as a valuable tool for tracking current situations and predicting trends (Ripberger, 2011). This study adopts the research approach of Wang et al. (2024) and Chen et al. (2024), using web crawling and text analysis techniques to extract fintech-related keywords from the Baidu index1. The sum of keyword search volumes is then added by one using the natural logarithm measurement. The specific keywords include “Fintech”, “Internet finance”, “Artificial intelligence”, “Big data”, “Cloud computing”, “Blockchain”, “Biometrics”, “Mobile payment”, “Online payment”, “Third-party payment”, “Online loan”, “Online banking”, “E-banking”, “Internet banking”, and “Direct selling bank”.

3.2.3 Mediator variables

Based on the impact pathway proposed earlier, this study selected three mediator variables. First, industrial scale (Scale), measured as the natural logarithm of the number of energy-saving and carbon-reducing enterprises in each province plus one. A greater number of such enterprises indicates more advanced scale development; hence, a higher value on this indicator reflects better scale expansion. Second, investment expansion (Invest), measured as the ratio of investment in the energy conservation and carbon reduction industry to GDP. A higher investment ratio signals greater expansion in this sector; therefore, a higher value indicates stronger investment growth. Third, R&D expenditure (Rd), measured by the natural logarithm of allocated R&D funds. Larger R&D funding corresponds to greater scale of innovation expenditure within each province. Accordingly, a higher value signifies more extensive R&D investment.

3.2.4 Moderator variables

To delve deeper into the external factors impacting fintech’s influence on ESCRI, this study investigates the disparities between the two through the lenses of environmental quality, industrial upgrading, and regional differences. (1) EQ is quantified using the natural logarithm of SO2 emissions per province, serving as an inverse indicator where higher values correspond to worse environmental conditions. (2) IU is measured by the ratio of the tertiary industry’s value added to the secondary industry’s value, functioning as a positive indicator where higher values reflect more progressive industrial structures. (3) Regional differences is measure based on standard geographical classifications. In this study, the sample is divided into eastern and midwestern regions.

3.2.5 Control variables

Wu et al. (2021) and Zhang et al. (2023) integrated the following control variables, which affect ESCRI, to the double fixed effects model: (1) Regional economic development (Pgdp), measured by the natural logarithm of regional per capita GDP; (2) Financial development (Fd), measured by the ratio of the sum of financial deposits and loan balances to GDP; (3) Fiscal self-sufficiency rate (Fcr), measured by the ratio of fiscal revenue to fiscal expenditure of local governments; (4) Openness to the outside (Open), measured by the proportion of foreign trade volume to GDP; (5) Insurance development (Insur), measured by the natural logarithm of insurance density, which is determined using per capita insurance expenditure.

3.3 Sample and data

This study uses data from 30 Chinese provinces (excluding Tibet, Hong Kong, Macao, and Taiwan) spanning 2011 to 2022 to empirically examine whether fintech can enhance ESCRI. Ultimately, a dynamic equilibrium panel comprising 360 observations is obtained. Fintech data are collected from the Baidu index. ESCRI data are gathered from the China Public Policy and Green Development Database (CPPGD). Data on mediator and moderator variables are obtained from CPPGD and Express Professional Superior data platform (EPS). Other data sources include China Statistical Yearbook, China Financial Yearbook, statistical yearbooks of various provinces, and Center for Global Environmental Research (CGER).

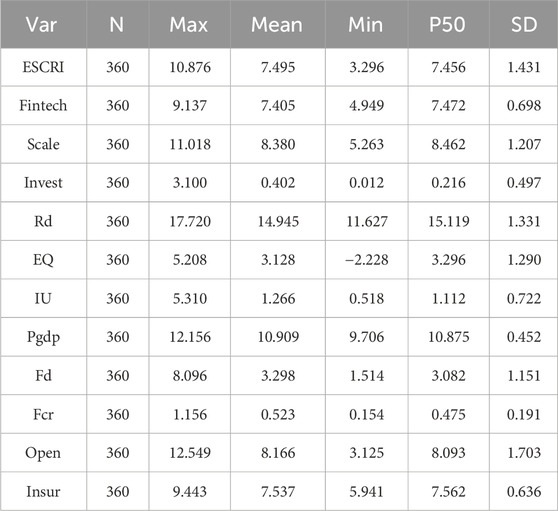

Table 1 presents the descriptive statistical results of the variables. The maximum value of ESCRI is 10.876, with a mean of 7.495 and a median of 7.456, indicating that the ESCRI of most samples is at a relatively high level. This finding is consistent with the reality of China, encouraging energy conservation and carbon reduction in recent years. However, the standard deviation is 1.431, suggesting the significant differences between provinces. At the same time, the descriptive results of fintech show synchronicity, providing a foundation for further tests on the relationship between fintech and ESCRI. The overall levels of industrial scale (Scale) and R&D expenditure (Rd) in the sample are relatively high, but significant differences exist within the sample. On the contrary, the overall level of investment expansion (Invest) in most provinces is still relatively low. Other variables are consistent with existing research. In addition, tests for multicollinearity have been conducted in this study, results of which indicate that the mean value of variance inflation factor is 5.19, implying the absence of multicollinearity.

4 Empirical results

4.1 Baseline regression results

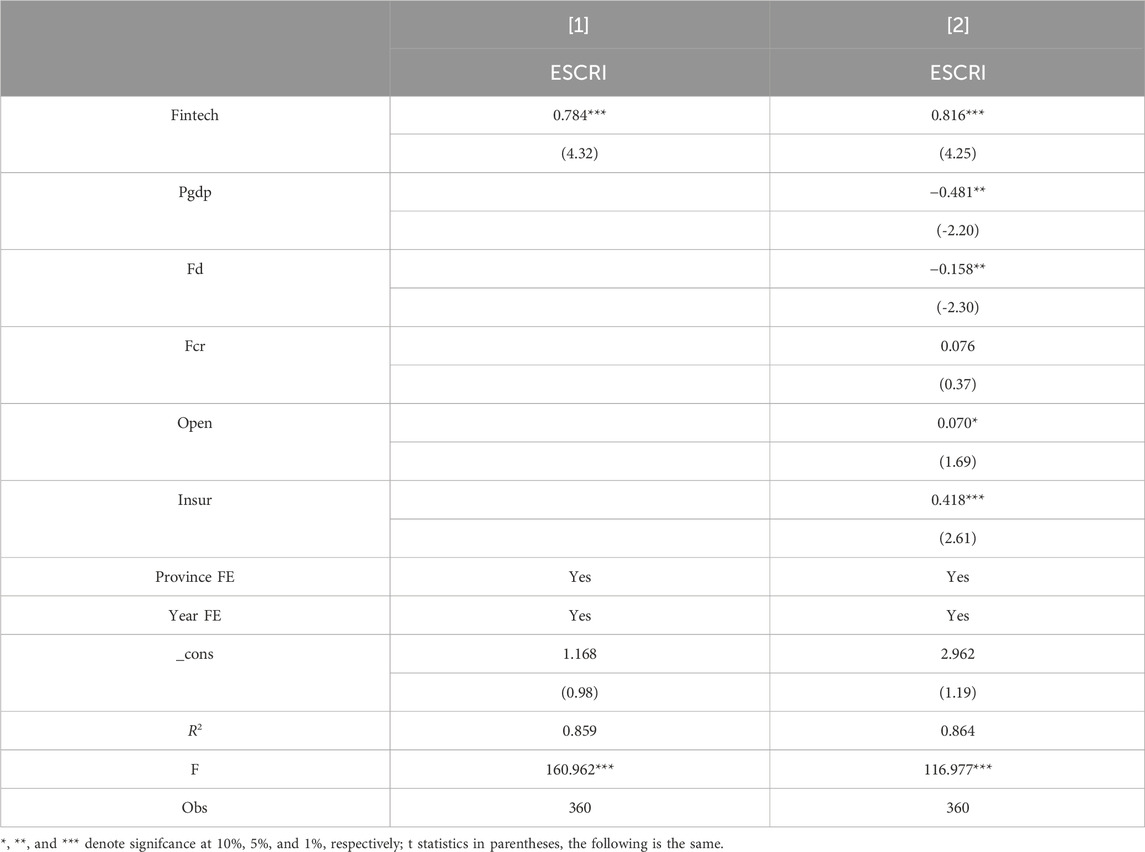

Table 2 demonstrates the baseline regression results for fintech and ESCRI. Column [1] illustrates the regression result without control variables. The results show that the regression coefficient of fintech is significantly positive. After adding control variables, the regression coefficient of fintech in Column [2] becomes 0.816 and significantly positive at the 1% statistical level. This finding indicates that fintech significantly promotes ESCRI, confirming Hypothesis 1. Previous studies have investigated the positive effect of fintech on green innovation from the enterprise level (Huang and Ma, 2024; Li Y. et al., 2024). The results obtained from the macro level in this study are mutually corroborative.

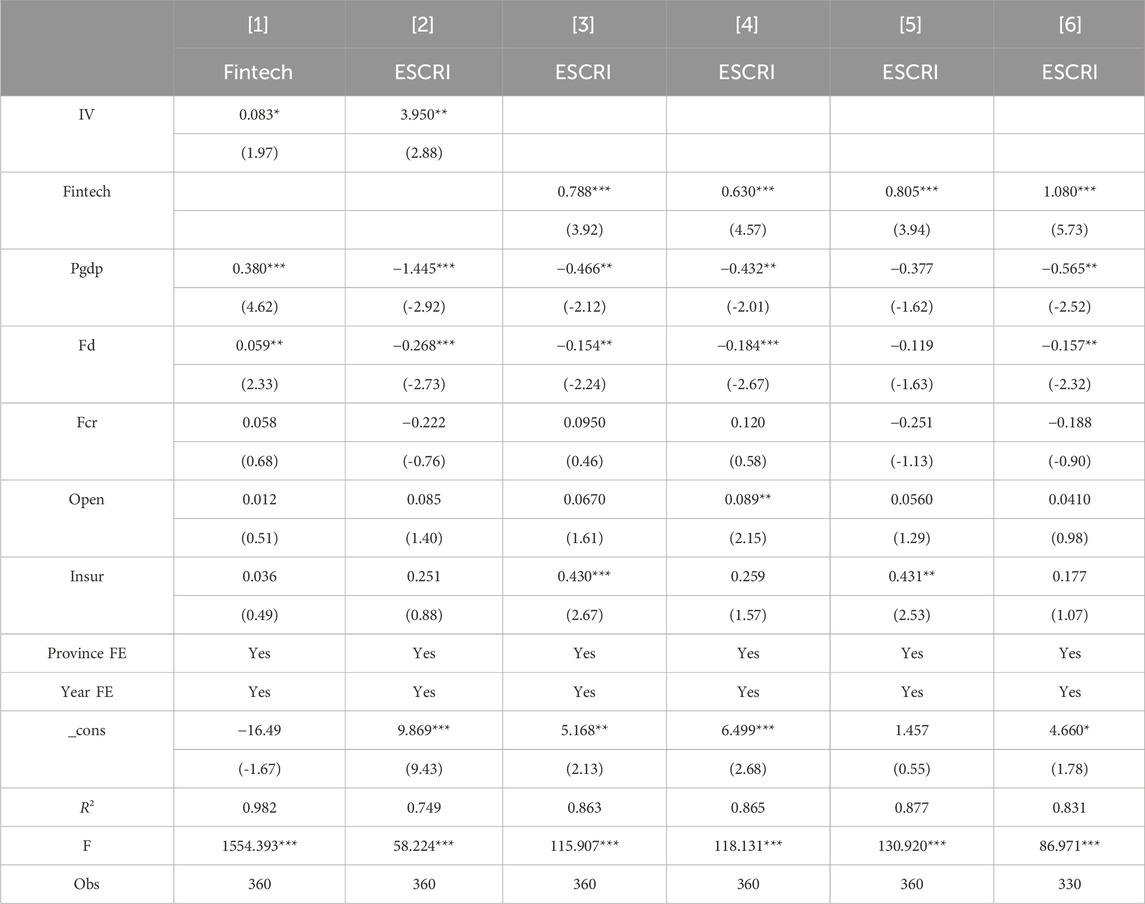

4.2 Robustness checks

To ensure the robustness of our findings, a series of robustness tests was conducted, including endogeneity tests. Following the methodology of Li R. et al. (2024), this study uses the spherical distance from each provincial capital to Hangzhou city multiplied by the year, as an IV for fintech. This IV satisfies the requirements of correlation and exogeneity in the selection of instrumental variables and has passed the weak instrumental variable test. The results of regression using the two-step least squares (2SLS) method are shown in columns [1]–[2] of Table 3. The results of the first stage indicate that the regression coefficient of IV is 0.083, which is significant at the 10% statistical level. The results of the second stage suggest that the regression coefficient of IV is 3.950, which is significant at the 5% statistical level. These findings further confirm Hypothesis 1.

Second, the explanatory variable is replaced. This study measures fintech by considering the natural logarithm of the arithmetic mean of word frequency. The results of column [3] indicate that the regression coefficient of fintech is 0.788, which is significantly positive at the 1% statistical level, further confirming the robustness of the above conclusion. Furthermore, this study employs the digital inclusive finance index provided by Peking University to measure fintech, with the specific results shown in [4] remaining robust.

Third, the dependent variable is replaced. This study measures ESCRI by regarding the natural logarithm of the number of patent authorizations. The results of column [5] indicate that the regression coefficient of fintech is 0.805, which is significantly positive at the 1% statistical level, further confirming the robustness of the above conclusion.

Fourth, the core variable lags behind by one period. This study regresses the results after lagging fintech by one period. The results of column [6] still support the above conclusion.

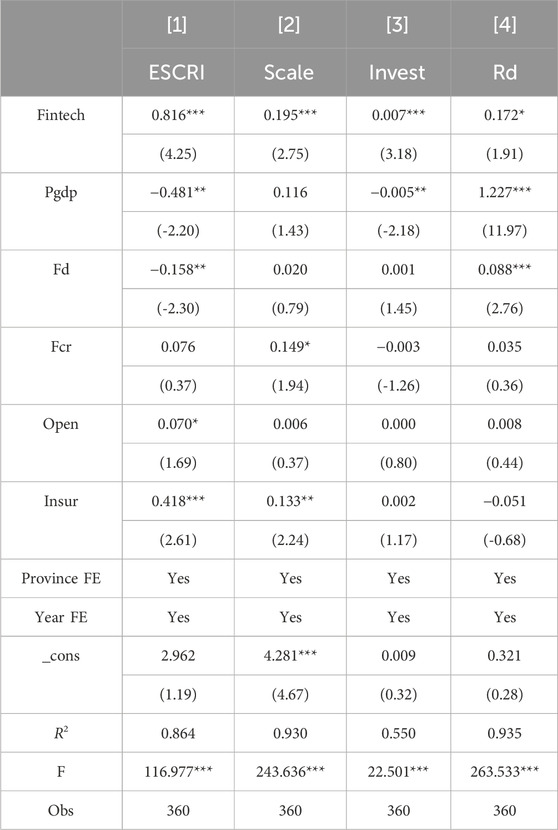

4.3 Mechanism analysis

Table 4 presents the results of the impact mechanisms through which fintech influences ESCRI. Column [1] displays the empirical results for Hypothesis 1, indicating that fintech exhibits a positive and significant effect on ESCRI. Column [2] illustrates the results for fintech’s impact on industrial scale. The regression coefficient for fintech is 0.195, which is statistically significant at the 1% level, suggesting that it exerts a significant industrial scale effect. Previous studies have established a direct relationship between rapid industrial development and the enhancement of innovation levels (Liu and Zhang, 2021). Expanding industrial scale creates opportunities for improving ESCRI (Zeng et al., 2021), thereby confirming Hypothesis 2.

Column [3] presents the results of fintech’s impact on investment expansion. The regression coefficient for fintech is 0.007, which is statistically significant at the 1% level, indicating that fintech exhibits a significant investment expansion effect. Fintech’s support enables financial institutions and other investors to more accurately identify and capitalize on investment opportunities in energy-saving and carbon-reducing projects (Zhu, 2019). This approach contributes to the advancement of ESCRI, thereby confirming Hypothesis 3.

Column [4] illustrates the results of fintech’s impact on R&D expenditure. The regression coefficient for fintech is 0.172, which is statistically significant at the 10% level, indicating that it exhibits a significant R&D expenditure effect. Fintech guarantees the orderly implementation of ESCRI by ensuring that R&D funds are effectively allocated to energy-saving and carbon-reduction programs (Lee et al., 2022). This outcome can be attributed to fintech’s ability to accurately identify and monitor funding needs (Aid et al., 2017; Breidbach et al., 2020), thereby confirming Hypothesis 4.

4.4 Heterogeneity analysis

To delve deeper into the external factors impacting fintech’s influence on ESCRI, this study investigates the disparities between the two through the lenses of environmental quality, industrial upgrading, and regional differences.

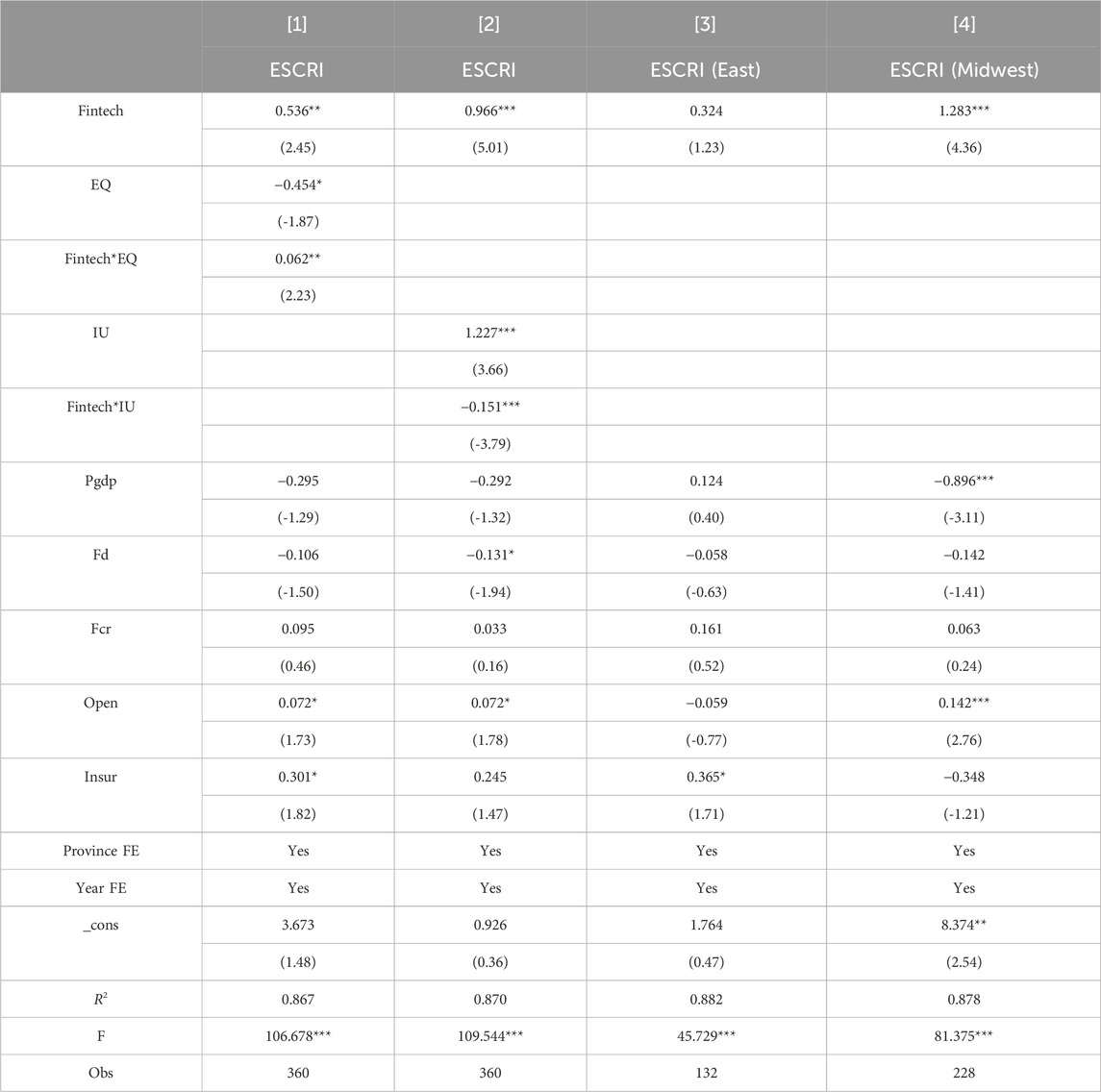

4.4.1 Environmental quality

Variations in regional environmental quality may influence the relationship between fintech and ESCRI. Regions with poorer environmental conditions may face greater urgency to improve their environment than areas with better environmental quality. Consequently, fintech adoption in these regions is more likely to accelerate in energy-saving and carbon-reduction industries and related projects, thereby fostering ESCRI. We developed an interaction term between fintech and environmental quality (Fintech*EQ) to analyze this relationship. As shown in Column [1] of Table 5, the regression coefficient for the interaction term is 0.062, statistically significant at the 5% level. This finding suggests that fintech’s contribution to ESCRI is significantly stronger in regions with inferior environmental quality.

4.4.2 Industrial upgrading

The regional industrial structure plays a crucial role in facilitating innovation activities (Feng T et al., 2022). Typically, regions with more advanced industrial structures demonstrate a greater demand for ESCRI development. In such contexts, fintech is likely to exert a more substantial positive influence on ESCRI advancement. We constructed an interaction term between fintech and industrial upgrading (Fintech*IU) to examine this relationship. As presented in Column [2] of Table 5, the regression coefficient for the interaction term is −0.151, statistically significant at the 1% level. This result indicates that fintech’s contribution to ESCRI is particularly significant in regions with less developed industrial structures.

4.4.3 Regional differences

In China, the central and western regions experience relatively slower economic growth than their eastern counterparts, primarily due to disparities in regional endowments (Bi et al., 2024). The traditional financial system has often been less accommodating to these less developed areas (Du, 2017). However, the advent of fintech has effectively addressed these gaps, significantly benefiting the economic development of the central and western regions (Jin, 2017; Ye et al., 2022). In this study, the sample is divided into eastern and midwestern regions based on standard geographical classifications. Columns [3]–[4] of Table 5 present the findings on regional disparities. The regression coefficients for fintech in the eastern region sample do not exhibit statistical significance. On the contrary, in the midwestern sample, the regression coefficient for fintech is 1.283, which is significant at the 1% level. These results indicate that fintech plays a more crucial role in enhancing ESCRI in the Midwest than in the East.

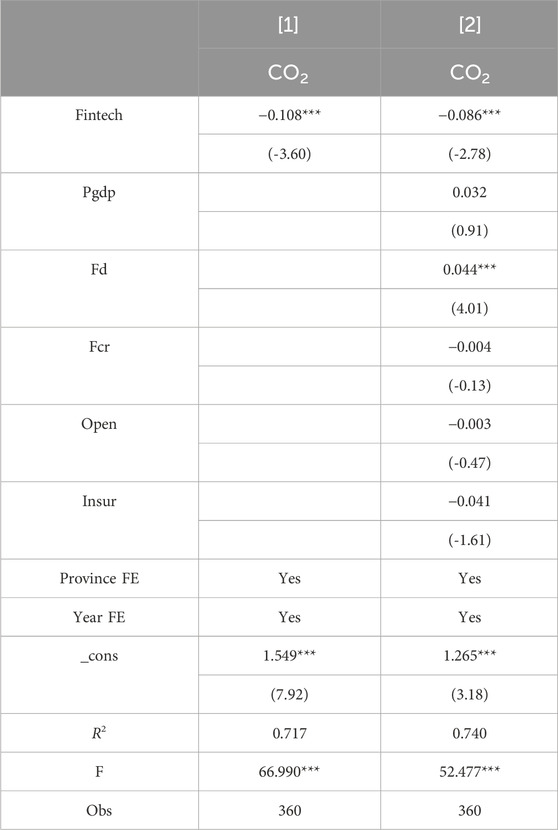

5 Further analysis: fintech’s carbon reduction effect

Fintech offers financial support for green and low-carbon initiatives, thereby playing a pivotal role in improving environmental quality (Udeagha and Muchapondwa, 2023). In addition, it drives technological innovation within the financial sector and increases the share of clean energy consumption in economic activities, further aiding in the carbon reduction (Li G. et al., 2023; Xu et al., 2023). This study delves deeper into the carbon emission reduction effects of fintech, the findings of which are presented in Table 6. Column [1] displays the regression results without control variables, revealing a significantly negative regression coefficient for fintech. Upon incorporating control variables, the regression coefficient in Column [2] is −0.086, which remains significantly negative at the 1% statistical level. This finding underscores that fintech effectively curbs carbon emissions, demonstrating a clear carbon abatement effect. Our findings are consistent with the results reported by Tao et al. (2022) and Xu et al. (2023). Building on these insights, we conclude that fintech significantly contributes to carbon emission reduction by enhancing ESCRI levels.

6 Conclusions and policy implications

Promoting ESCRI is widely recognized as a crucial strategy for advancing carbon reduction efforts in the current climate, with fintech playing a pivotal role in driving this progress. This study empirically examines whether fintech enhances ESCRI using data from 30 Chinese provinces spanning 2011 to 2022. The findings reveal that fintech significantly promotes ESCRI, a conclusion further supported by a series of robustness tests. The primary pathways through which fintech affects ESCRI are industrial scale, investment expansion, and R&D expenditure. Moreover, fintech’s impact on ESCRI is particularly pronounced in provinces characterized by poor environmental quality, lagging industrial upgrading, and those located in central and western regions. Finally, fintech demonstrates a significant impact on reducing carbon emissions.

The findings presented not only align with and enrich the existing research but also hold substantial academic value. Building on these insights, this study proposes several policy recommendations to harness the potential of fintech for environmental and economic benefits. First, fintech demonstrates a strong capacity to enhance ESCRI and to effectively reduce carbon emissions. Thus, the government must integrate fintech’s role in supporting energy conservation and carbon reduction into future strategic frameworks, clearly delineating developmental objectives. Concurrently, regulatory policies and frameworks must be refined, ensuring a coordinated approach to fintech application management to mitigate resource wastage.

Second, the adoption and implementation of fintech must be promoted, alongside fostering innovation in green financial products to bolster industries focused on energy efficiency and carbon reduction. Establishing a robust data-sharing platform that connects the government, financial institutions, and real enterprises is crucial. This platform would serve as a foundational data repository, facilitating the broader application of fintech. Furthermore, the government should incentivize financial institutions to harness fintech in developing green financial products, thereby channeling financial resources into energy-saving and carbon-reducing sectors at reduced costs. In addition, financial institutions are encouraged to utilize fintech in crafting insurance products tailored for ESCRI, aimed at risk mitigation.

Third, proactive steps must be taken to develop a cross-regional fintech collaboration network. The adoption levels of fintech vary significantly given the disparities in regional economic development. Establishing a provincial cooperation network would foster mutual benefits and drive overall ESCRI growth. For example, leading cities, such as Beijing and Shanghai, could partner with less developed regions in central and western China, offering fintech guidance and support to stimulate ESCRI advancements.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

BY: Conceptualization, Methodology, Writing – original draft. FZ: Conceptualization, Data curation, Formal Analysis, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

The authors thank all the editors and reviewers for their insightful comments and suggestions.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

References

Aid, G., Eklund, M., Anderberg, S., and Baas, L. (2017). Expanding roles for the Swedish waste management sector in inter-organizational resource management. Resour. Conservation Recycl. 124, 85–97. doi:10.1016/j.resconrec.2017.04.007

Ali, J., Wu, X., Alam, M. A., Rehman, M., Jahanger, A., Kakar, S. K., et al. (2024). Impacts of Fintech and natural resources on environmental quality: the role of renewable energy and carbon taxes: a panel QARDL approach. Nat. Resour. Forum, 1477-8947.12534–18. doi:10.1111/1477-8947.12534

Arner, D. W., Buckley, R. P., Zetzsche, D. A., and Veidt, R. (2020). Sustainability, FinTech and financial inclusion. Eur. Bus. Organ. Law Rev. 21, 7–35. doi:10.1007/s40804-020-00183-y

Bi, S., Zhang, W., Yan, Z., and Appolloni, A. (2024). Impact of energy saving and emission reduction policy: empirical evidence from regional and local business in China. Bus. Strategy Environ. 33 (8), 8815–8832. doi:10.1002/bse.3944

Breidbach, C. F., Keating, B. W., and Lim, C. (2020). Fintech: research directions to explore the digital transformation of financial service systems. J. Serv. Theory Pract. 30 (1), 79–102. doi:10.1108/JSTP-08-2018-0185

Chen, W., Wang, J., and Ye, Y. (2024). Financial technology as a heterogeneous driver of carbon emission reduction in China: evidence from a novel sparse quantile regression. J. Innovation and Knowl. 9 (2), 100476. doi:10.1016/j.jik.2024.100476

Cheng, X., Yao, D., Qian, Y., Wang, B., and Zhang, D. (2023). How does fintech influence carbon emissions: evidence from China's prefecture-level cities. Int. Rev. Financial Analysis 87, 102655. doi:10.1016/j.irfa.2023.102655

Chiu, Y. B., and Lee, C. C. (2020). Effects of financial development on energy consumption: the role of country risks. Energy Econ. 90, 104833. doi:10.1016/j.eneco.2020.104833

Dai, B., Zhang, J., and Hussain, N. (2025). Policy pathways through FinTech and green finance for low-carbon energy transition in BRICS nations. Energy Strategy Rev. 57, 101603. doi:10.1016/j.esr.2024.101603

Dell, M. (2010). The persistent effects of Peru's mining mita. Econometrica 78 (6), 1863–1903. doi:10.3982/ECTA8121

Deng, X., Huang, Z., and Cheng, X. (2019). FinTech and sustainable development: evidence from China based on P2P data. Sustainability 11 (22), 6434. doi:10.3390/su11226434

Du, X. S. (2017). Inclusive finance’s internal need: serving vulnerable people. Strateg. Change 26 (2), 73–82. doi:10.1002/jsc.2111

Feng, T., and Xie, Z. (2024). Does China's green finance reform and innovation pilot policy reduce carbon emissions? Analyzing the role of financial decentralization. Pol. J. Environ. Stud. 33 (5), 5087–5099. doi:10.15244/pjoes/182906

Feng, T., and Zhou, Q. (2024). Can green finance policy improve public health? Glob. Public Health 19 (1), 2406480. doi:10.1080/17441692.2024.2406480

Feng S, S., Zhang, R., and Li, G. (2022). Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. Dyn. 61, 70–83. doi:10.1016/j.strueco.2022.02.008

Feng T, T., Liu, M., and Li, C. (2022). How does vertical fiscal imbalance affect CO2 emissions? The role of capital mismatch. Sustainability 14 (17), 10618. doi:10.3390/su141710618

Fuster, A., Plosser, M., Schnabl, P., and Vickery, J. (2019). The role of technology in mortgage lending. Rev. Financial Stud. 32 (5), 1854–1899. doi:10.1093/rfs/hhz018

Gao, W., Wang, M., and Ye, T. (2022). Is China's carbon neutrality commitment truly credible? Evidence from a natural experiment. Finance Res. Lett. 50, 103284. doi:10.1016/j.frl.2022.103284

Goldstein, I., Jiang, W., and Karolyi, G. A. (2019). To FinTech and beyond. Rev. Financial Stud. 32 (5), 1647–1661. doi:10.1093/rfs/hhz025

Huang, J., and Ma, L. (2024). Substantive green innovation or symbolic green innovation: the impact of fintech on corporate green innovation. Finance Res. Lett. 63, 105265. doi:10.1016/j.frl.2024.105265

Jänicke, M. (2008). Ecological modernisation: new perspectives. J. Clean. Prod. 16 (5), 557–565. doi:10.1016/j.jclepro.2007.02.011

Jiang, T. (2022). Mediating effects and moderating effects in causal inference. China Ind. Econ. 5, 100–120. doi:10.19581/j.cnki.ciejournal.2022.05.005

Jin, D. (2017). The inclusive finance have effects on alleviating poverty. Open J. Soc. Sci. 5 (3), 233–242. doi:10.4236/JSS.2017.53021

Lee, C. C., Qin, S., and Li, Y. (2022). Does industrial robot application promote green technology innovation in the manufacturing industry? Technol. Forecast. Soc. Change 183, 121893. doi:10.1016/j.techfore.2022.121893

Li, J., Wu, Y., and Xiao, J. J. (2020). The impact of digital finance on household consumption: evidence from China. Econ. Model. 86, 317–326. doi:10.1016/j.econmod.2019.09.027

Li, H., Luo, F., Hao, J., Li, J., and Guo, L. (2023a). How does fintech affect energy transition: evidence from Chinese industrial firms. Environ. Impact Assess. Rev. 102, 107181. doi:10.1016/j.eiar.2023.107181

Li, G., Wu, H., Jiang, J., and Zong, Q. (2023b). Digital finance and the low-carbon energy transition (LCET) from the perspective of capital-biased technical progress. Energy Econ. 120, 106623. doi:10.1016/j.eneco.2023.106623

Li, R., Zhang, S., Wang, Q., and Hu, S. (2024a). Fintech and urban environmental sustainability: exploring the impact of financial technology on urban carbon emissions. Sustain. Dev. 33, 2118–2136. doi:10.1002/sd.3212

Li, Y., Chu, E., Nie, S., Peng, X., and Yi, Y. (2024b). Fintech, financing constraints and corporate green innovation. Int. Rev. Financial Analysis 96, 103650. doi:10.1016/j.irfa.2024.103650

Liu, X., and Zhang, X. (2021). Industrial agglomeration, technological innovation and carbon productivity: evidence from China. Resour. Conservation Recycl. 166, 105330. doi:10.1016/j.resconrec.2020.105330

Liu, J., Zhang, Y., and Kuang, J. (2023). Fintech development and green innovation: evidence from China. Energy Policy 183, 113827. doi:10.1016/j.enpol.2023.113827

Lv, C., Shao, C., and Lee, C. C. (2021). Green technology innovation and financial development: do environmental regulation and innovation output matter? Energy Econ. 98, 105237. doi:10.1016/j.eneco.2021.105237

Muganyi, T., Yan, L., and Sun, H. P. (2021). Green finance, fintech and environmental protection: evidence from China. Environ. Sci. Ecotechnology 7, 100107. doi:10.1016/j.ese.2021.100107

Muhammad, S., Pan, Y., Magazzino, C., Luo, Y., and Waqas, M. (2022). The fourth industrial revolution and environmental efficiency: the role of fintech industry. J. Clean. Prod. 381, 135196. doi:10.1016/j.jclepro.2022.135196

Ni, L., Yu, Y., and Wen, H. (2023). Impact of fintech and environmental regulation on green innovation: inspiration from prefecture-level cities in China. Front. Ecol. Evol. 11, 1265531. doi:10.1016/j.jclepro.2022.135196

Ripberger, J. T. (2011). Capturing curiosity: using internet search trends to measure public attentiveness. Policy Stud. J. 39 (2), 239–259. doi:10.1111/j.1541-0072.2011.00406.x

Shim, Y., and Shin, D. H. (2016). Analyzing China’s fintech industry from the perspective of actor–network theory. Telecommun. Policy 40 (2-3), 168–181. doi:10.1016/j.telpol.2015.11.005

Tao, R., Su, C. W., Naqvi, B., and Rizvi, S. K. A. (2022). Can Fintech development pave the way for a transition towards low-carbon economy: a global perspective. Technol. Forecast. Soc. Change 174, 121278. doi:10.1016/j.techfore.2021.121278

Teng, M., and Shen, M. (2023). The impact of fintech on carbon efficiency: evidence from Chinese cities. J. Clean. Prod. 425, 138984. doi:10.1016/j.jclepro.2023.138984

Udeagha, M. C., and Muchapondwa, E. (2023). Green finance, fintech, and environmental sustainability: fresh policy insights from the BRICS nations. Int. J. Sustain. Dev. and World Ecol. 30 (6), 633–649. doi:10.1080/13504509.2023.2183526

Vu, N. T., Bui, H. Q., Pham, T. A., and Vo, D. H. (2024). Fintech development and environmental sustainability: does income inequality matter? Aust. Econ. Pap. 63 (2), 350–369. doi:10.1111/1467-8454.12328

Wan, J., Niu, Z., and Li, B. (2025). Does Fintech improve the carbon reduction effect of green credit policy? Evidence from China. Econ. Analysis Policy 85, 1258–1269. doi:10.1016/j.eap.2025.01.016

Wang, C. A., Wang, L., Zhao, S., Yang, C., and Albitar, K. (2024). The impact of Fintech on corporate carbon emissions: towards green and sustainable development. Bus. Strategy Environ., 33(6), 5776–5796. doi:10.1002/bse.3778

Wu, H., Xue, Y., Hao, Y., and Ren, S. (2021). How does internet development affect energy-saving and emission reduction? Evidence from China. Energy Econ. 103, 105577. doi:10.1016/j.eneco.2021.105577

Xie, J., Chen, L., Liu, Y., and Wang, S. (2023). Does fintech inhibit corporate greenwashing behavior? Evidence from China. Finance Res. Lett. 55, 104002. doi:10.1016/j.frl.2023.104002

Xu, B., and Lin, B. (2017). Does the high–tech industry consistently reduce CO2 emissions? Results from nonparametric additive regression model. Environ. Impact Assess. Rev. 63, 44–58. doi:10.1016/j.eiar.2016.11.006

Xu, J., Chen, F., Zhang, W., Liu, Y., and Li, T. (2023). Analysis of the carbon emission reduction effect of Fintech and the transmission channel of green finance. Finance Res. Lett. 56, 104127. doi:10.1016/j.frl.2023.104127

Ye, Y., Chen, S., and Li, C. (2022). Financial technology as a driver of poverty alleviation in China: evidence from an innovative regression approach. J. Innovation and Knowl. 7 (1), 100164. doi:10.1016/j.jik.2022.100164

Zeng, W., Li, L., and Huang, Y. (2021). Industrial collaborative agglomeration, marketization, and green innovation: evidence from China’s provincial panel data. J. Clean. Prod. 279, 123598. doi:10.1016/j.jclepro.2020.123598

Zhang, C. (2024). Digital governance leveraging urbanization and fintech synergies for sustainable development in BRICS. Sci. Rep. 14 (1), 31677. doi:10.1038/s41598-024-81712-4

Zhang, Z., Wang, J., Feng, C., and Chen, X. (2023). Do pilot zones for green finance reform and innovation promote energy savings? Evidence from China. Energy Econ. 124, 106763. doi:10.1016/j.eneco.2023.106763

Zhao, F., Feng, T., Liu, M., and Xie, Z. (2024). Does financial decentralization improve energy efficiency? evidences from China. Environ. Eng. Manag. J. 23 (2), 345–358. doi:10.30638/eemj.2024.028

Keywords: fintech, energy saving and carbon reduction innovation, scale effect, investment effect, R&D

Citation: Yu B and Zhao F (2025) Revealing the impact of fintech on energy saving and carbon reduction innovation. Front. Environ. Sci. 13:1669416. doi: 10.3389/fenvs.2025.1669416

Received: 19 July 2025; Accepted: 16 September 2025;

Published: 29 September 2025.

Edited by:

Walid Bakry, Western Sydney University, AustraliaReviewed by:

Behnaz Saboori, Sultan Qaboos University, OmanShinta Amalina Hazrati Havidz, Western Sydney University, Australia

Copyright © 2025 Yu and Zhao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Fuming Zhao, emhhb2Z1bWluZ0B6YWZ1LmVkdS5jbg==

†ORCID: Bingbing Yu, orcid.org/0009-0006-2034-0848; Fuming Zhao, orcid.org/0009-0009-2078-1661

Bingbing Yu1†

Bingbing Yu1† Fuming Zhao

Fuming Zhao