- 1School of Economics and Management, China University of Geosciences, Wuhan, China

- 2Department of Economics, King Saud University, Riyadh, Saudi Arabia

- 3College of Business, Alasala Colleges, Dammam, Saudi Arabia

The connection between natural resource use, renewable energy adoption, and achieving carbon neutrality has sparked extensive debate in recent years. In response, many countries are implementing policies aimed at transitioning to low-carbon, sustainable economies. The Shanghai Cooperation Organization (SCO), representing 42% of the global population and 25% of its landmass, wields considerable geopolitical influence. However, limited empirical studies have explored the interplay between natural resource rents, renewable energy use, and territorial CO2 emissions (TCO2) within its member states. This study employs the Method of Moments Quantile Regression (MMQR) to analyze disaggregated resource rents and renewable energy adoption effects on TCO2 across SCO nations from 2000 to 2021, addressing a critical research gap with policy-relevant insights. The results align with prior research, indicating that countries rich in natural resources generally exhibit higher CO2 emissions, primarily driven by their dependence on fossil fuels. The statistically insignificant coefficients for renewable energy across all quantiles indicate its limited and inconsistent influence on TCO2 emissions. This underscores the challenge posed by sluggish renewable adoption, particularly in oil-dependent economies, in mitigating carbon output. The continued prevalence of non-renewable energy sources remains a substantial obstacle. To overcome this challenge, it is essential for policies to focus on expediting the transition to renewable energy by investing in infrastructure, technology, and innovation. This research adds to the broader conversation on achieving a balance between energy-resource consumption and environmental sustainability.

1 Introduction

Climate change has become a pressing worldwide concern, drawing significant attention worldwide. The rise in greenhouse gas emissions, primarily driven by industrial growth and economic development, is intensifying this crisis. Despite the growing awareness, many nations continue to prioritize economic gains over environmental sustainability. Consequently, reducing CO2 emissions has become a societal imperative, requiring collaborative efforts across various sectors. The increasing emissions not only threaten human health but also jeopardize the stability of ecosystems. International accords like the Kyoto Protocol aim to mitigate worldwide CO2 emissions, predominantly stemming from anthropogenic sources notably fossil fuel combustion and large-scale deforestation. In 2019, atmospheric CO2 emissions reached 37.1 gigatons (Friedlingstein et al., 2022), intensifying the greenhouse effect and hastening global warming, which underscores the critical need for immediate, large-scale climate mitigation efforts.

Resource-rich nations hold vital responsibility in confronting pressing environmental challenges during this critical juncture. The extraction of natural resources often involves fossil fuel-dependent machinery, leading to higher carbon emissions. Some research suggests natural resource rents may benefit environmental protection, though perspectives vary (Hussain et al., 2023; Voumik et al., 2023), others view them as a “curse” due to their negative environmental impacts (Alhassan and Kwakwa, 2023). Despite high carbon emissions, many resource-rich nations are aware of the need to transition toward sustainable practices. The extraction and utilization of oil and natural gas, though economically essential, significantly endanger the environment. Combusting fossil fuels especially coal, oil, and gas are a primary contributor to greenhouse gas emissions, exacerbating global warming and climate instability. While renewable energy adoption grows, petroleum and natural gas continue to dominate global energy systems, particularly for industrial and transport needs (Tawiah et al., 2021). Crude oil extraction and trade significantly exacerbate carbon outputs, as heightened energy demands perpetuate emission-intensive consumption patterns (Huang et al., 2023). The oil extraction process itself releases substantial greenhouse gases, primarily methane and carbon dioxide, through activities such as drilling, flaring, and venting. Moreover, the refining and transportation of oil products exacerbate emissions, with refining contributing to 61% of emissions in the petroleum industry (Lancon and Hascakir, 2018). Methane-rich natural gas significantly impacts climate change, with a global warming potential far exceeding CO2. The fuel lifecycle from extraction to distribution accounts for approximately 15% of anthropogenic greenhouse emissions. Although promoted as a transitional fuel, empirical studies confirm its continued substantial climate footprint (Mahmood et al., 2023; Shahbaz et al., 2024). Fugitive emissions from the extraction, processing, and transportation stages are a key source of methane leakage (Lancon and Hascakir, 2018). This study examines the underexplored relationship between hydrocarbon rents and carbon emissions in SCO nations, addressing a critical gap in sustainable development research. It analyzes how oil and gas revenues influence environmental outcomes across these strategically important economies.

Empirical evidence indicates that renewable energy adoption (e.g., wind, solar, hydro) significantly mitigates carbon emissions, unlike fossil fuels which exacerbate them. These clean energy sources produce negligible direct greenhouse gases, underscoring their critical role in decarbonization efforts. Additionally, renewable energy systems often offer greater efficiency, lower long-term costs, and enhanced sustainability compared to traditional fossil fuel systems (Chen F.-f. et al., 2023). The sluggish advancement in energy efficiency within Shanghai Cooperation Organization (SCO) member states stems primarily from their continued reliance on fossil fuels, with China being a key contributor to this delay. In 2004, coal constituted 67.7% of China’s energy mix, whereas renewables represented merely 9.6%, highlighting the persistent imbalance in sustainable energy adoption. Despite some advancements, coal use remains prevalent, significantly contributing to carbon emissions (Wang and Lee, 2022). Ahmed et al. (2023) report that coal dominates electricity generation in China (71%) and India (74%), reflecting persistent reliance on fossil fuels. In contrast, Uzbekistan aims to achieve 25% renewable energy by 2030 (Mirziyoyeva and Salahodjaev, 2022), while Iran, Kazakhstan, and Pakistan continue to heavily depend on fossil fuels, exacerbating CO2 emissions.

The Shanghai Cooperation Organization (SCO), founded on 15 June 2001, includes nine members: China, Russia, Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan, India, Pakistan, and Iran. However, this study excludes Kyrgyzstan and Tajikistan due to missing data for these countries. Collectively, SCO nations encompass roughly 42% of the world population (3.3 billion) and occupy nearly 25% of the planet landmass. By 2021, the organization’s aggregate GDP stood at USD 23.3 trillion (24% of global output), with purchasing power parity (PPP) estimates reaching USD 44.2 trillion (Andreichyk and Tsvetkov, 2023). These nations possess vast natural resource wealth, with substantial oil and natural gas reserves, yet they also face a critical challenge in balancing economic development with environmental sustainability (Xue and Makengo, 2021; Li and Yan, 2024). The SCO countries control around 18.37% of global oil reserves and 44.44% of global natural gas supplies. Despite this, they are significant contributors to global carbon emissions, with China, India, and Pakistan alone accounting for about 28% of global energy consumption (Ozturk et al., 2021). At the same time, the SCO countries have consistently emphasized the “green agenda,” championing sustainable development since the organization inception. Given this commitment, it is crucial to assess whether the developmental trajectories of these nations align with low-carbon objectives.

This study, therefore, aims to explore the relationship between disaggregated natural resource rents and renewable electricity consumption and their impact on decarbonization efforts in selected SCO countries, particularly in reducing TCO2 emissions, to support the achievement of SDG 13. The main research question is: How do these factors influence carbon dioxide emissions in SCO countries? Specific sub-questions include:

RQ1. How do oil rents affect territorial carbon emissions (TCO2) in SCO countries?

RQ2. How do natural gas rents affect territorial carbon emissions (TCO2) in SCO countries?

RQ3. Does renewable electricity consumption reduce territorial carbon emissions (TCO2) in SCO countries?

This study offers three key contributions. First, prior studies have primarily assessed the aggregate effects of resource rents on emissions, overlooking the distinct roles of key resources rent such as oil and natural gas. This study addresses these gaps by analyzing disaggregated resource rents and their influence on emissions across seven resource-rich SCO countries. Second, it addresses a gap in existing literature by examining the relationships among natural resources, renewable electricity consumption and carbon emissions within Shanghai Cooperation Organization (SCO) member states, a region underrepresented in current research (Opoku-Mensah et al., 2023; Kumar et al., 2024; Li and Yan, 2024). In contrast, more extensive analyses have been conducted in other developing and developed nations (Sicen et al., 2022; Olaniyi and Odhiambo, 2024), significant gaps remain, particularly concerning SCO nations. Notably, the non-linear dynamics between disaggregated natural resource rents and carbon emissions in these countries have yet to be empirically investigated, despite their critical policy implications. Methodologically, it employs the Method of Moments Quantile Regression (MMQR) to assess how different factors impact emissions across varying distribution levels, offering a more nuanced understanding of these relationships. Additionally, Bootstrap Quantile Regression (BSQR) enhances result robustness by addressing data variability through nonparametric resampling.

Section 2 critically reviews existing literature, followed by Section 3, which details the theoretical framework, data sources, and methodology. Section 4 analyzes empirical results, while Section 5 concludes with key findings and policy implications.

2 Literature review

This review examines the interplay between natural resource rents, renewable energy adoption, and their differential impacts on carbon emissions. While natural resources such as minerals, fossil fuels, and timber serve as critical drivers of economic growth, their extraction and utilization frequently contribute to environmental degradation (Gu et al., 2023; Işık et al., 2024). The nexus between resource exploitation and CO2 emissions remains a contested topic, with scholarly opinions diverging on the extent of its ecological consequences (Sibanda et al., 2023; Anas et al., 2024; Qamruzzaman, 2024; Soni and Manogna, 2025). Natural resources including forests, minerals, and oil are vital for economic growth; however, excessive extraction and utilization often result in significant ecological harm. Researchers have increasingly focused on these challenges. For instance (Sicen et al., 2022), analyzed the pollution halo and resource curse dynamics across BRICS nations from 1995 to 2018. Using advanced panel techniques, the study found that total natural resource rents reduced CO2 emissions, while rents from minerals, forests, and oil increased emissions. Similarly (Bilgili et al., 2023), employed quantile regression to assess natural resource rents in MENA nations, revealing that forest rents enhanced ecological conditions, whereas mineral and oil revenues adversely affected environmental sustainability.

Further research on the BRICS nations by Zhou et al. (2024) employed second-generation estimators, including CCEMG and AMG, to analyze the effects of disaggregated rents (coal, gas, oil, forest, and minerals) on CO2 emissions and PM2.5 pollution from 1995 to 2019. This study confirmed that natural resource wealth is linked to an increase in emissions. In Saudi Arabia (Ben-Salha and Zmami, 2023) found that found that rents from oil and natural gas contribute to environmental degradation. In a similar vein (Aladejare, 2022), examined role of rents from resource and globalization in driving environmental harm across five resource-rich African nations, highlighting the significant contribution of these rents to environmental harm. In Malaysia during 1980–2021 (Ehigiamusoe et al., 2024), showed that rents derived from oil, natural gas, and coal exacerbate carbon emissions, while mineral and forest rents have no comparable effect. This study addresses the gap in research regarding the distinct impacts of oil and natural gas rents on emissions in the (SCO) countries, where vast natural resource reserves coexist with high carbon emissions.

Scholars universally agree that without urgent climate interventions, global warming will cause catastrophic environmental impacts. To minimize harm, experts stress the critical need to cap temperature increases at 1.5 °C and attain net-zero carbon emissions through coordinated global efforts. However, CO2 emissions are largely driven by human activities aimed at economic growth, particularly through the burning of fossil fuels (Obobisa, 2022). Academic research demonstrates that fossil fuel dependence significantly worsens ecological degradation, particularly in developing economies (Li and Haneklaus, 2022). This reality highlights the urgent requirement for renewable alternatives including solar, wind, hydroelectric, and bioenergy systems to satisfy growing global energy needs driven by industrialization (Khan et al., 2020). Current sustainability studies confirm these clean energy sources substantially mitigate atmospheric carbon levels, supporting climate change mitigation efforts (De La Peña et al., 2022). To meet carbon reduction targets under the Paris Agreement, shifting from fossil fuels to renewable energy is critical for mitigating emissions (Adekoya et al., 2021). Empirical research, including a study by Iqbal et al. (2021), confirms that renewable energy integration and technological advancements significantly contribute to achieving carbon neutrality, particularly in industrialized economies. Similarly (Bekun, 2022), concluded that increased renewable electricity consumption significantly reduces CO2 emissions, making renewable energy essential for sustainable development. For BRICS nations (Zhu et al., 2024), emphasized the urgent need for a shift to renewable energy sources to address climate change risks and lower CO2 emissions.

This research makes three significant contributions to the extant literature on natural resource economics and environmental sustainability. First, it expands the geographical scope of analysis by focusing on Shanghai Cooperation Organization (SCO) member states, a region that has received scant attention compared to the extensively studied OECD, G7, BRICS, and African contexts. The investigation specifically examines how disaggregated natural resource rents and renewable electricity consumption interact to influence carbon emissions patterns in these emerging economies. Second, the study provides novel insights by differentiating between various types of natural resource rents, with particular emphasis on oil and natural gas revenues a distinction often overlooked in prior research. This granular approach yields more precise understanding of how specific resource endowments affect environmental outcomes in carbon-intensive, resource-dependent economies. Third, methodologically, the research employs the Method of Moments Quantile Regression (MMQR) to capture heterogeneous effects across the conditional distribution of emissions, complemented by Bootstrap Quantile Regression (BSQR) to ensure statistical robustness. This dual-method approach not only addresses potential data variability but also produces more reliable estimates that can inform both academic discourse and policymaking. These methods ensure the reliability and validity of the findings, making them valuable for both academic and policy discussions. By integrating these innovative dimensions, the study advances theoretical understanding while offering practical implications for sustainable resource management in selected SCO economies.

3 Data, theoretical underpinning, and methodology

3.1 Data description

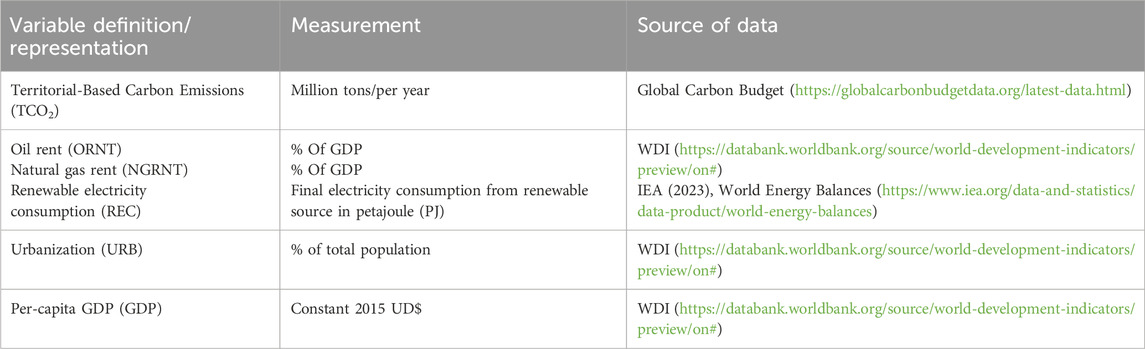

This research examines how distinct natural resource rents particularly from oil and gas affect carbon emissions in Shanghai Cooperation Organization (SCO) member states. The SCO, a prominent regional alliance, includes nine nations: China, Russia, Kazakhstan, India, Pakistan, Iran, Uzbekistan, Kyrgyzstan, and Tajikistan. However, this study excludes Kyrgyzstan and Tajikistan due to missing data for these countries. The analysis spans 2000–2021, assessing the environmental impact of resource-derived revenues. The study uses five key variables, with Territorial-Based Carbon Emissions (TCO2) as the dependent variable, as CO2 is the primary greenhouse gas driving environmental degradation. TCO2 reflects emissions within a given territory, including exports but excluding imports, thereby attributing emissions to the producer. The data for TCO2 is taken from the global carbon budget. This measure is essential for assessing regional contributions to global climate change and devising targeted mitigation strategies. Natural resource rents, particularly oil and natural gas rents, are significant contributors to TCO2, impacting national economies and environmental outcomes, especially in resource-dependent regions. To account for potential omitted variable bias, additional control variables, including renewable electricity consumption (REC), urbanization (URB), and per capita GDP growth, were incorporated. This study utilizes World Development Indicators (WDI) data for oil and gas rents, urbanization, and GDP, supplemented by renewable electricity consumption statistics from the International Energy Agency (IEA). TCO2 emissions figures were sourced from the Global Carbon Budget. Logarithmic transformations were applied to all variables. Complete data specifications are provided in Table 1.

3.2 Theoretical framework and model specification

This study examines the interplay among natural resource rents (primarily oil and gas), Renewable electricity consumption, and carbon emissions within a theoretical framework. Oil and gas reserves play a pivotal role in driving economic development, particularly in SCO nations, yet their exploitation generates significant environmental consequences, notably CO2 emissions. Although essential for growth, resource extraction exacerbates ecological footprints, reflecting the detrimental effects of human activity on ecosystems and finite natural resources. Furthermore, the transportation and processing of these resources exacerbate the emission of carbon and other pollutants (Joshua and Bekun, 2020; Awosusi et al., 2022; Zhang et al., 2023).

Oil serves as a major energy source and a key contributor to carbon emissions. The economic gains derived from oil extraction and exports often lead to increased energy demand, which consequently raises carbon emissions. The extraction and production of oil result in greenhouse gas (GHG) emissions, primarily methane and CO2, released during drilling, flaring, and venting. Refining, which accounts for 61% of emissions in the petroleum industry, and the transportation of oil products also contribute significantly to GHG emissions (Lancon and Hascakir, 2018). This study posits a positive correlation between oil rents and CO2 emission, expressed as:

Similarly, Natural gas, predominantly methane, significantly contributes to global warming due to its high greenhouse potential. Methane leakage during extraction, processing, and transportation of natural gas are major contributors to GHG emissions, accounting for 15% of total anthropogenic emissions globally (Xu and Chen, 2016). While comparatively cleaner than coal or petroleum, natural gas operations still produce substantial GHG emissions, undermining its climate benefits (Mahmood et al., 2023; Shahbaz et al., 2024). Fugitive emissions, resulting from leaks during extraction and transportation, are a key source of methane emissions (Lancon and Hascakir, 2018). This analysis hypothesizes that natural gas rents positively correlate with carbon emissions, expressed as:

Empirical studies demonstrate that renewable energy adoption effectively reduces carbon emissions, whereas non-renewable sources exacerbate them (Ali et al., 2022). Compared to fossil fuels, renewables including wind, solar, and hydropower generate minimal pollutants while offering superior long-term energy efficiency. The shift toward renewable energy fosters sustainability by reducing carbon footprints, lowering energy costs, and enhancing system resilience (Chen S. et al., 2023; Liu et al., 2023; Mohamed et al., 2024). This study proposes that rising renewable energy usage inversely relates to carbon emissions, expressed as:

This study examines the impact of disaggregated natural resource rents and REC on carbon emissions while consider the impact of URB and GDP in the context of the SCO member countries, using two models: Model 1 analyzes oil rent (ORNT), while Model 2 focuses on natural gas rent (NGRNT). These models allow for a clearer evaluation of each each resource effect on emission, as shown in Equations 1, 2.

In both models, TCO2 represents territorial-based carbon emissions, ORNT is oil rent, NGRNT is natural gas rent, REC is renewable electricity consumption, URB is urbanization, and GDP denotes economic growth. To enhance result reliability and minimize volatility, the variables are transformed into natural logarithms, yielding the following log-linear Equations 3, 4.

Here,

3.3 Econometric framework

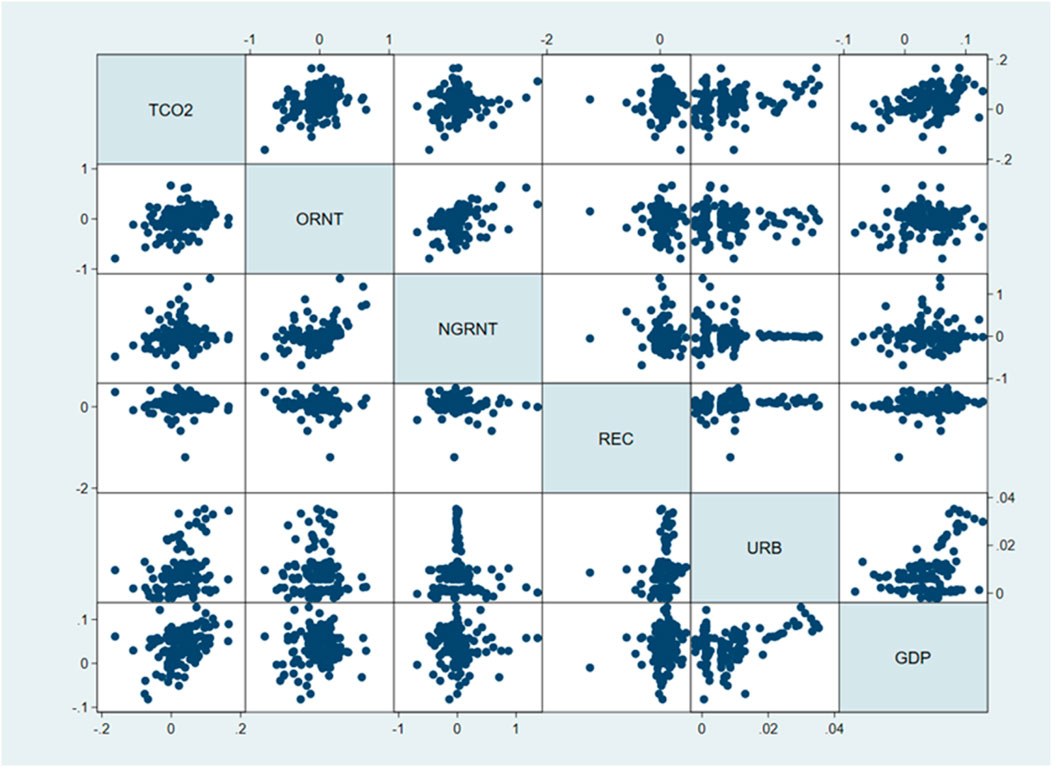

Prior to estimating long-term coefficients, comprehensive panel diagnostics must be conducted to evaluate variable properties, including cross-sectional dependence, heterogeneity, unit root behavior, cointegration relationships, and potential multicollinearity issues. The analysis begins with descriptive statistics, highlighting the range of observations, minimum and maximum values, and calculating standard deviations to assess volatility. Normality is examined using skewness and kurtosis measures, supported by relevant statistical tests. A correlation matrix serves as a tool to examine the linear relationships between variables, offering valuable insights that inform subsequent statistical modeling and hypothesis testing.

This study focuses on two critical aspects of panel data analysis: cross-sectional dependence (CSD) and heterogeneity in slope coefficients. Ignoring these factors can distort results (Shu et al., 2023). The Industrial Revolution played a pivotal role in shaping global trade, leading to industrial dominance and fostering international cooperation. These interdependencies often result in policy standardization, a concept known as ‘slope homogeneity.’ Failing to account for these dynamics may lead to misleading conclusions (Breitung, 2005; Bao, 2020). To address this, we use the SCH test developed by Pesaran and Yamagata (2008), which accounts for both standard and adjusted slope coefficient heterogeneity (SCH and ASCH). This study also tackles CSD, which can bias empirical estimations when shocks in one unit affect others (Pata et al., 2023). To mitigate this, we employ a series of diagnostic tests, including the LM test Breusch and Pagan (1980), bias-adjusted LM test Pesaran et al. (2008), and the CD-LM test (Pesaran, 2004). The null hypothesis posits no cross-sectional dependence; rejection occurs if results are statistically significant.

To address cross-sectional dependence, the second-generation CIPS unit root test is employed. This method accounts for interdependencies and heterogeneity across units by conducting individual unit root tests and aggregating the t-statistics to derive the composite CIPS statistic (Pesaran, 2007). These characteristics make the CIPS test more robust and effective compared to earlier first-generation tests.

After assessing unit root properties, cointegration analysis is conducted to evaluate long-run equilibrium relationships among variables. Panel cointegration tests primarily adopt two methodologies: residual-based and maximum-likelihood-based techniques. Kao (1999), residual-based approach, extended by Pedroni, applies Dickey-Fuller (DF) and Augmented Dickey-Fuller (ADF) frameworks. The Kao test assumes no cointegration under the null hypothesis, with significant ADF statistics leading to its rejection, thus confirming cointegration. This approach provides enhanced flexibility by permitting varying constants and trend coefficients across cross-sectional units. The (Pedroni, 1999; Pedroni, 2004) methodology first estimates residuals from the cointegrating equation, accounting for spatial dependence while accommodating heterogeneous intercepts and slope parameters. Such panel cointegration tests effectively assess long-run equilibrium relationships by testing the null of no cointegration against its alternative.

Prior to analyzing MMQR regression results, it is crucial to assess multicollinearity among independent variables (Sultana et al., 2023). Multicollinearity arises when independent variables are highly correlated, obscuring their distinct effects on the dependent variable. The Variance Inflation Factor (VIF) quantifies this issue by measuring how much multicollinearity increases coefficient variance in regression analysis. A VIF above 10 signals significant correlation, undermining coefficient reliability (Alofaysan et al., 2024). A VIF between 5 and 10 suggests moderate correlation, while a VIF above 10 implies poor coefficient estimation due to multicollinearity (Saidi et al., 2023).

To assess the magnitude of effects, we employed Machado and Silva (2019) Method of Moment Quantile Regression (MMQR), which provides a comprehensive approach for examining predictor influences across various response variable quantiles. This technique proves particularly valuable for panel data analyses incorporating fixed effects and endogenous regressors. By integrating moment estimation with quantile regression, the MMQR effectively addresses endogeneity concerns, enabling accurate estimation of individual effects (Barut et al., 2025). This approach is flexible, resilient to outliers, and offers insights into how variables interact at different points of the data distribution (Zhang et al., 2024). Unlike ordinary regression, MMQR considers data variability, offering a more comprehensive understanding of variable relationships at various quantiles (Akpınar et al., 2025; Chen et al., 2025b). The strength of this method lies in its capacity to effectively address asymmetric and nonlinear relationships, providing more reliable and robust estimates when compared to other quantile regression approaches (Hossain et al., 2024). The conditional quantile

In Equation 5,

With this, Equations 5 and 6 can be combined into one as shown in Equation 7:

Here,

In the above equations,

To evaluate the robustness of the MMQR results, this study employs the Bootstrap Quantile Regression (BSQR) method (Hahn, 1995). BSQR utilizes resampling techniques to generate repeated random samples, better approximating the true distribution of regression estimates. This method enhances statistical inference by addressing variability in p-values and quantile estimates, mitigating the influence of distributional assumptions or sample irregularities. BSQR offers more reliable parameter estimates, especially in the presence of outliers or non-normal errors (Kilinc-Ata and Barut, 2024; Pilatin et al., 2025). Additionally, while MMQR predicts outcomes for each regressor, it lacks causal insights. To address this, the Granger panel causality approach (reference) is applied to explore causal relationships between the key variables (ORNT, NGRNT, REC, URB, GDP, and TCO2).

4 Results and discussion

Table 2 presents the descriptive statistics, highlighting significant variability across the examined variables. The mean, median, and range values emphasize this heterogeneity, with some variables deviating notably from normality. For instance, TCO2 shows a positive skew (0.415) and high kurtosis (2.005), indicating a slight rightward asymmetry and heavy tails in its distribution. Its variance of 2.061 further supports this dispersion. In contrast, ORNT and NGRNT exhibit negative skewness (−0.097 and −0.182, respectively), with moderate kurtosis values (1.665 and 2.015), suggesting left-skewed distributions and potential outliers. The REC variable also shows a positive skew (0.488) and high variance (3.11), indicating an asymmetric distribution with a tendency towards higher values. URB displays minimal variance (0.097) and slight leftward skew (−0.281), while GDP has moderate variability and negative skew (−0.18). Given these distributional complexities, the Method of Moments Quantile Regression (MMQR) is employed to capture conditional heterogeneity, offering deeper insights into non-linear relationships across emission quantiles.

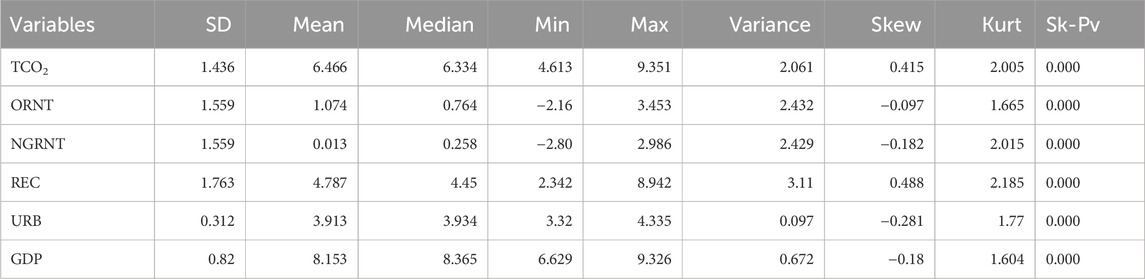

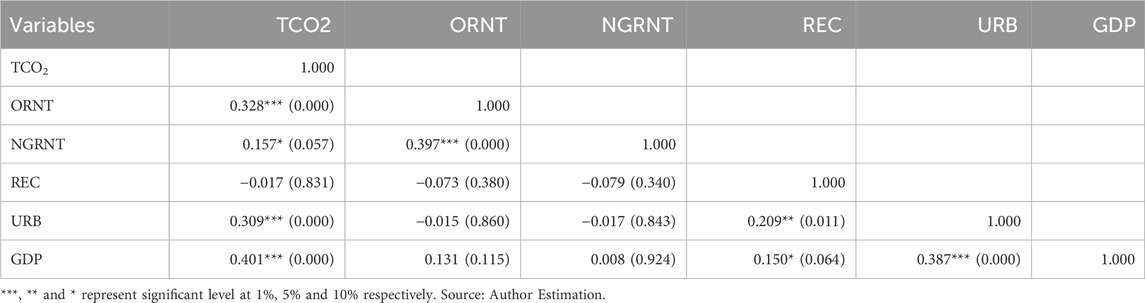

Table 3 and Figure 1 display the pairwise correlation analysis among territorial carbon emissions (TCO2), oil rent (ORNT), natural gas rent (NGRNT), Renewable electricity consumption, urbanization (URB), and GDP growth (GDP). The analysis reveals that TCO2 is positively correlated with ORNT, NGRNT, URB, and GDP growth, indicating that higher oil and natural gas rents, as well as economic growth, contribute to increased carbon emissions. In contrast, the relationship between TCO2 and REC is weak and statistically insignificant.

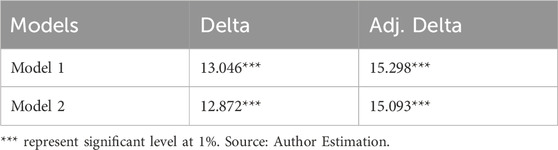

Table 4 displays the results of the slope heterogeneity analysis for Models 1 and 2, highlighting substantial variation in slope coefficients. These results indicate that while SCO member states exhibit some structural similarities, they diverge notably in their economic frameworks, levels of globalization, and socio-political contexts. The statistically significant p-values decisively reject the null hypothesis of slope homogeneity, demonstrating significant cross-national heterogeneity in variable relationships.

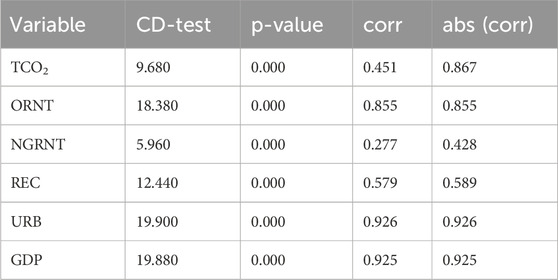

Table 5 presents the results of the Cross-Sectional Dependence (CD) test across five estimation models, with the null hypothesis consistently rejected at the 1% significance level indicates strong interconnections among the countries. These results imply that the variables in the panels are not independent but rather significantly correlated. Consequently, decisions made by one country, whether economic, social, or environmental, can impact others. Therefore, it is crucial to apply econometric methods that properly address these interdependencies for accurate and context-sensitive analysis.

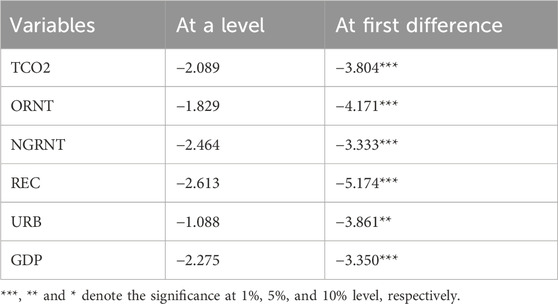

Table 6 presents the CIPS panel unit root test results, examining the null hypothesis of non-stationarity. All examined variables (TCO2, ORNT, NGRNT, REC, URB, and GDP) demonstrate non-stationarity in levels but achieve stationarity after first differencing, indicating they follow I (1) processes. These results inform the necessary data treatment for subsequent econometric analysis, ensuring compliance with stationarity requirements prior to applying long-run estimation techniques.

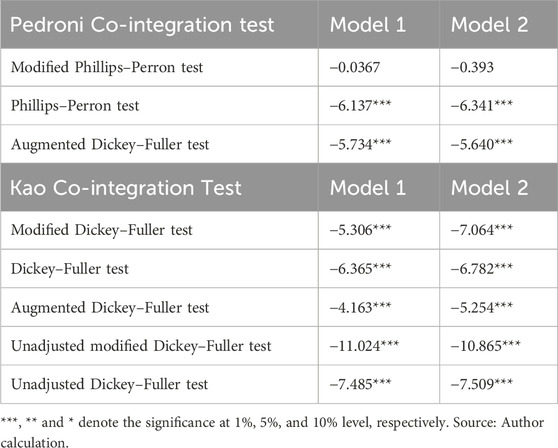

Following the confirmation of unit roots in the time series data, co-integration tests were conducted following the methodologies by Pedroni (2004) and Kao (1999). The results, presented in Table 7, indicate long-term equilibrium relationships among the variables. Specifically, the co-integration test by Pedroni (2004) rejects the null hypothesis of no co-integration for two of the three test statistics, while the method by Kao (1999) provides stronger validation, confirming co-integration across all five test statistics. These findings establish a robust foundation for estimating long-run elasticities, providing valuable insights into the variables’ interrelationships.

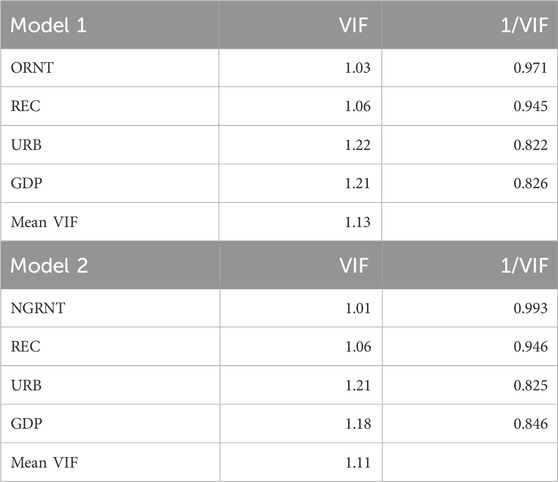

Table 8 presents the results of the Variance Inflation Factor (VIF) test for Models 1 and 2. The mean VIF values of 1.13 and 1.11, well below the threshold of 10, indicate no multicollinearity. VIF values ranged from 1.01 to 1.22 for all individual predictors, suggesting minimal correlation. This confirms the robustness and reliability of the regression estimates, with the VIF test serving as an essential diagnostic tool to ensure valid coefficient estimations.

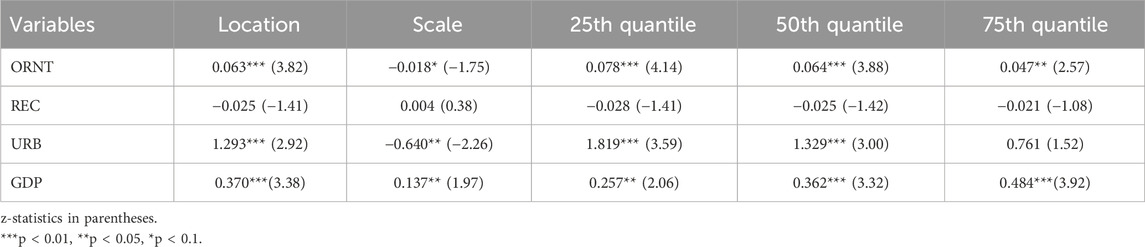

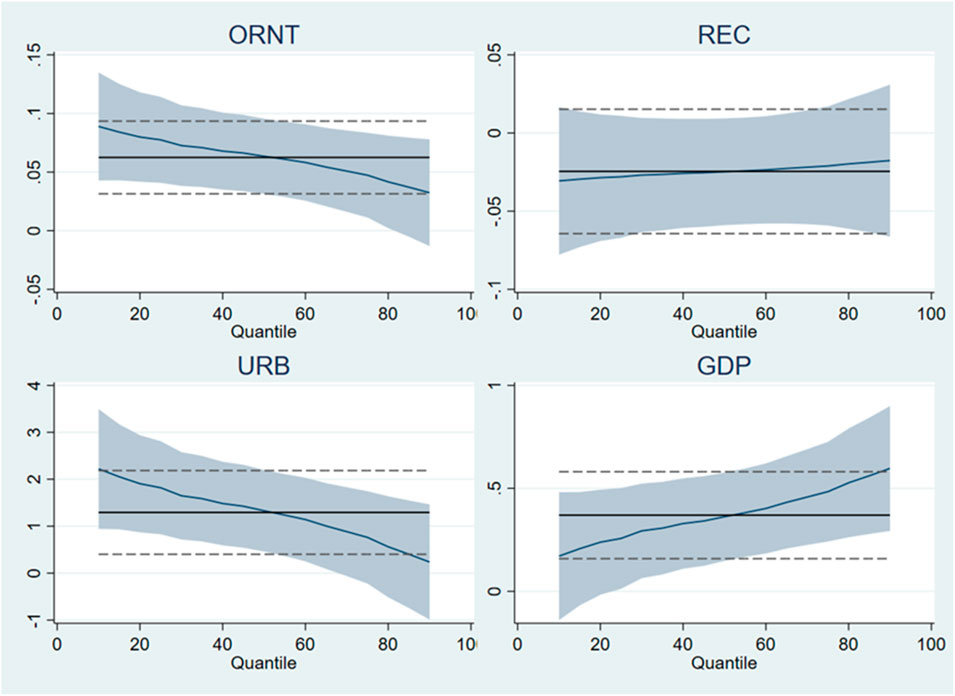

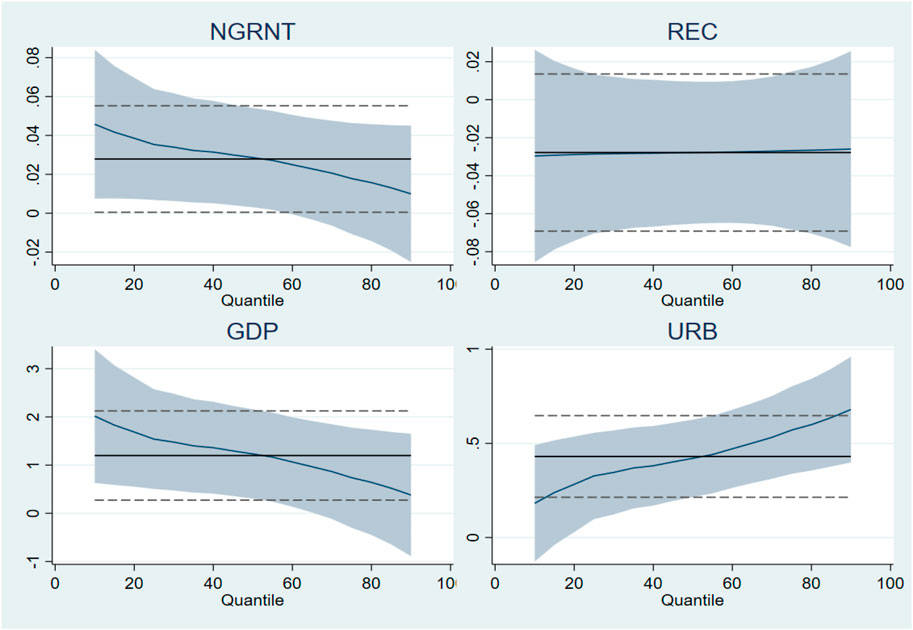

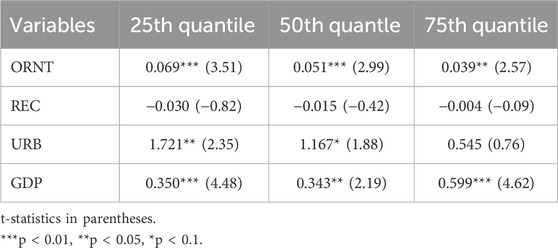

The results from Model 1, estimated using the MMQR approach, are summarized in Table 9 and visually depicted in Figure 2. The coefficient for ORNT is consistently positive and statistically significant across all quantiles, suggesting that increased reliance on oil revenues contributes to higher CO2 emissions. This finding aligns with the resource curse hypothesis (Auty, 1994), which suggests that resource-rich economies face weaker environmental regulations due to rent-seeking behaviors and delayed energy transitions. At the 25th quantile, the coefficient of 0.078 shows that countries with lower CO2 emissions experience a noticeable increase in emissions as oil rent rises. This suggests that oil dependency contributes to higher emissions in nations with relatively lower energy consumption or emission levels, aligning with the hypothesis that oil rent leads to increased CO2 emissions due to greater energy consumption and insufficient investment in cleaner energy sources (Mahmood and Furqan, 2021).

At the 50th quantile, the ORNT coefficient of 0.064 demonstrates a substantial correlation between oil rents and CO2 emissions in nations exhibiting median levels of emissions. This suggests that governments in these countries are not sufficiently investing oil revenue into clean energy technologies or environmental sustainability research, reflecting the heterogeneous effects of oil rent based on economic structure, energy policies, and technological capacity. At the 75th quantile, the coefficient of 0.047 confirms that oil rent contributes positively to CO2 emissions in countries with higher emissions, further exacerbated by outdated oil extraction technologies and weak environmental regulations. These results align with recent studies (Agboola et al., 2021; Mahmood and Furqan, 2021; Mahmood and Saqib, 2022; Kahia and Omri, 2024), which underscores oil dual role as a major driver of carbon emissions and a crucial energy source. Nations with substantial oil rents generally experience higher levels of oil production and consumption, resulting in greater carbon emissions from oil-dependent activities (Huang et al., 2023).

The Shanghai Cooperation Organization (SCO) member countries face a critical dilemma: their substantial economic dependence on oil revenues hinders meaningful CO2 emission reductions. While these nations collectively account for a considerable portion of global resource-derived wealth, they must simultaneously address the environmental consequences of their carbon-intensive economic activities. For instance, Russia and China have high crude oil demands, with Russia producing 10.5 million barrels per day, representing 14% of the world’s supply (Li and Yan, 2024). Furthermore, SCO member countries collectively hold 619 billion barrels of oil reserves, or 40% of the planet’s proven oil reserves (Andreichyk and Tsvetkov, 2023). These findings emphasize that countries with high emissions are more vulnerable to exacerbated environmental impacts from oil rents, underscoring the need for policies that decouple fossil fuel reliance from environmental harm and direct oil rent revenues toward cleaner energy technologies.

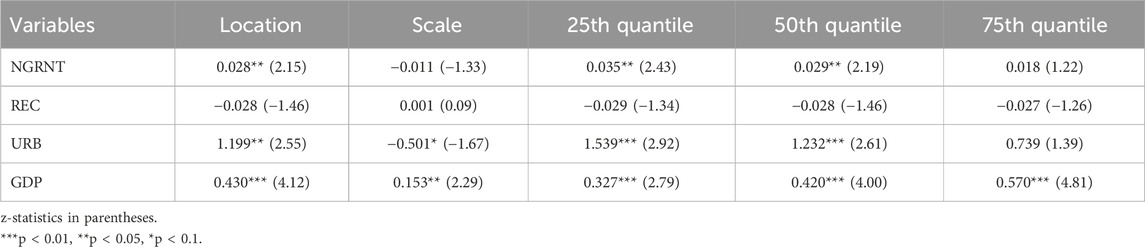

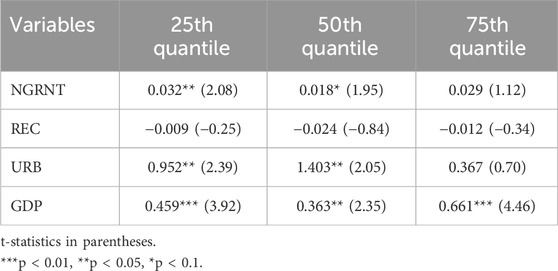

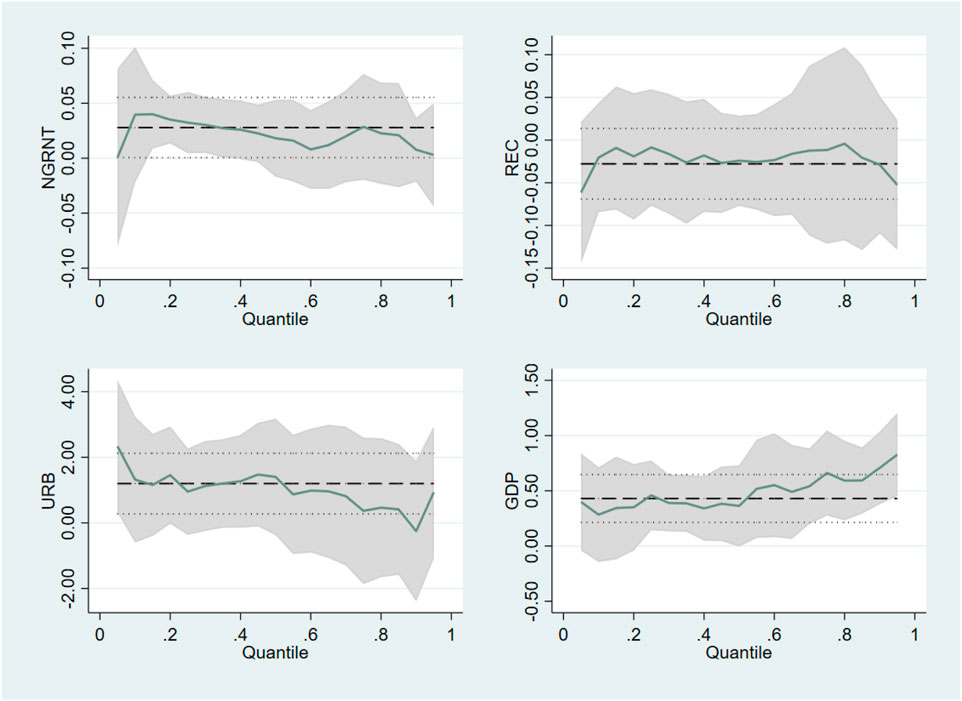

The results of the Method of Moments Quantile Regression (MMQR) for Model 2 are shown in Table 10 and Figure 3. This analysis explores the influence of natural gas rent (NGRNT) on CO2 emissions among the member countries of the Shanghai Cooperation Organization (SCO). The relationship between NGRNT and CO2 emissions differs across various quantiles of emissions. Specifically, at the 25th and 50th quantiles, the coefficients for NGRNT are 0.035 and 0.29, respectively, both of which are statistically significant at the 5% level. These findings suggest that in countries with lower and median emissions, higher natural gas rent does not lead to sufficient investment in clean energy or environmental protection initiatives. Despite natural gas being a cleaner alternative to coal, its extraction and consumption still contribute to emissions in these nations. Extraction practices often lack environmental safeguards, exacerbating degradation, while reliance on fossil fuels, including natural gas, due to underdeveloped renewable energy infrastructure, increases emissions (Zhang and Li, 2023; Shahbaz et al., 2024) its extraction and consumption still contribute to emissions in these nations. This is especially relevant for SCO countries that rely on natural gas for energy production, where extraction practices often fail to meet environmental protection standards, thus exacerbating environmental degradation. The utilization of pollution-intensive and energy-inefficient methods for extracting natural gas contributes to higher carbon dioxide emissions (Ehigiamusoe et al., 2024). Additionally, the insufficient development of renewable energy infrastructure in some of these lower-emission countries may lead to greater reliance on fossil fuels like natural gas, further intensifying emissions.

At the 75th quantile, the coefficient for NGRNT becomes −0.018 and is not statistically significant, suggesting that in high-emission countries, the effect of natural gas rent on CO2 emissions is minimal. This indicates that such countries likely mitigate emissions through the implementation of cleaner technologies, the increased use of renewable energy, and the enforcement of more stringent environmental regulations. This observation is consistent with findings from studies conducted in high-emission countries (Shahbaz et al., 2024), E7 nations (Gyamfi and Adebayo, 2023), OECD countries (Ni, 2023) and Malaysia (Ehigiamusoe et al., 2024). Therefore, it is essential to prioritize increased investment in renewable energy infrastructure alongside the advancement of carbon capture technologies to effectively mitigate emissions linked to natural gas consumption. Additionally, policies that allocate natural gas rent towards cleaner technologies and energy-efficient systems can contribute to reducing the carbon intensity of natural gas usage.

Tables 9 and 10 present results for additional variables in the models, including renewable electricity consumption (REC), urbanization (URB), and economic growth (GDP). The coefficients for REC are not statistically significant across all quantiles in both models, indicating a weak and inconsistent impact on CO2 emissions within the SCO countries. This suggests that the limited adoption of renewable energy in the region, especially in oil-dependent economies, is a key factor. Although renewable energy shows promise for emission reduction (Altın, 2024), its present contribution remains inadequate to counterbalance conventional energy emissions. This aligns with existing research (Jia et al., 2022; Hasanov et al., 2023), demonstrating that clean energy currently lacks significant carbon mitigation effects.

The Shanghai Cooperation Organization (SCO) slow progress in reducing energy consumption stems largely from persistent dependence on fossil fuels. China dominant role is particularly evident, with coal accounting for 67.7% of its 2004 energy use, while renewables represented only 9.6% of total consumption. Despite some progress, coal consumption continues to grow, contributing significantly to carbon emissions. China renewable energy share remains far below that of developed nations (Wang, 2022). China and India derive 71% and 74% of their electricity from coal respectively, while Russia ranks fifth and sixth worldwide in both coal production (423 million tons) and consumption (230.3 million tons) (Ahmed et al., 2023), highlighting SCO members continued fossil fuel dependence. Conversely, Uzbekistan aims to increase renewable energy to 25% of its total electricity generation by 2030 (Mirziyoyeva and Salahodjaev, 2022). Iran energy consumption is almost entirely fossil fuel-based, with oil and gas accounting for nearly 97%, contributing heavily to CO2 emissions (Karimi et al., 2021). Kazakhstan energy mix is predominantly coal, with coal, oil, and gas making up 63.02%, 19.76%, and 17.21% of total consumption (Raihan and Tuspekova, 2022). Pakistan continues to rely on fossil fuels, with the energy sector responsible for 46% of its total CO2 emissions in 2012 (Qudrat-Ullah, 2022). To address these challenges, policies must focus on accelerating the transition to renewable energy through investments in infrastructure, technology, and innovation. A regional approach to energy cooperation could help enhance the adoption of cleaner alternatives.

The analysis reveals a consistent positive relationship between GDP and CO2 emissions across all quantiles in both models, indicating that economic expansion tends to elevate emission levels. This observation supports the Environmental Kuznets Curve (EKC) theory, which suggests that early economic development exacerbates emissions due to heightened industrial activity and energy demand (Grossman and Krueger, 1995). Within SCO nations, stronger economic performance correlates with intensified resource utilization and energy consumption, further driving CO2 output. The escalating coefficient across quantiles implies that GDP’s impact on emissions grows more pronounced in highly polluting economies, reinforcing the link between growth and environmental degradation. This challenges the EKC turning point in the region, implying that SCO countries are still in the growth phase where emissions have not yet been offset by cleaner technologies or stricter environmental regulations. As economies grow, demand for goods and services intensifies, putting additional pressure on natural resources and ecosystems, which expands their ecological footprint (Mohsin et al., 2022; Chen et al., 2025a). This underscores the reliance on carbon-intensive industries, particularly energy and manufacturing, calling for green industrial policies.

The urbanization coefficient exhibits a statistically significant positive impact at the 25th and 50th percentiles in both models, though its effect diminishes to insignificance at the 75th percentile. These results corroborate urban environmental transition theory, which identifies urbanization and industrialization as key contributors to ecological degradation, including water pollution, air contamination, and greenhouse gas emissions (Yang et al., 2023). Additionally, the findings resonate with ecological modernization theory, positing that early-phase industrialization exacerbates environmental harm. Urban expansion fosters greater reliance on transport systems, fossil fuel dependency, and manufacturing activity, thereby amplifying carbon output (Wei et al., 2023; Boateng et al., 2024). Additionally, population urbanization, especially in smaller cities and megacities, amplifies energy and transportation demands, further escalating TCO2 emissions (Song et al., 2024). These outcomes corroborate prior studies linking urbanization to increased carbon emissions (Mahmood et al., 2022; Lee et al., 2023; Chen et al., 2025a). Figures 2, 3 provide visual representations of the additional variables incorporated in the MMQR Models 1 and 2, specifically renewable electricity consumption (REC), urbanization (URB), and economic growth (GDP).

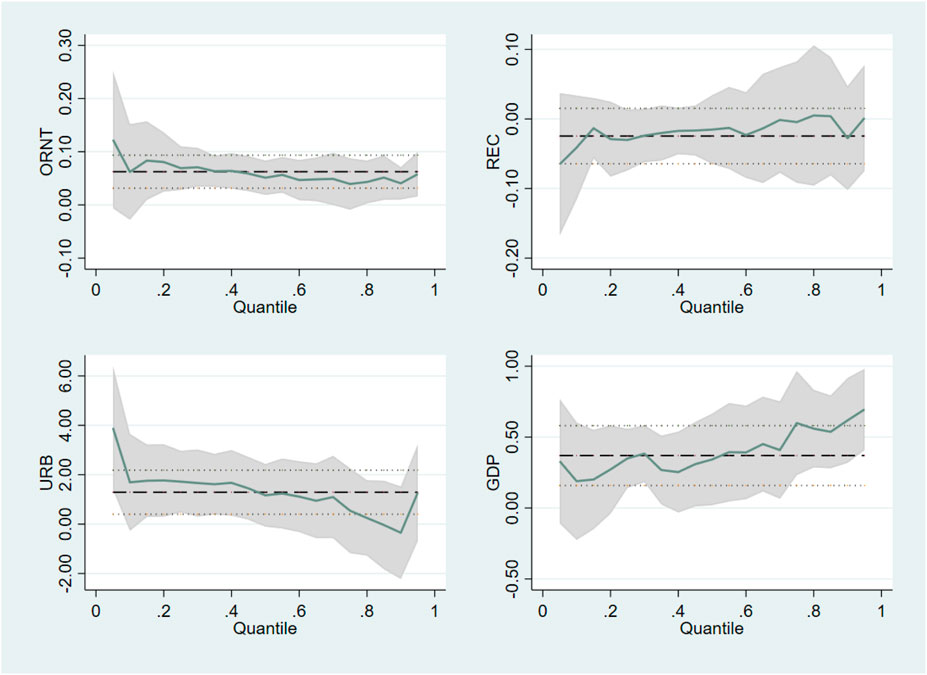

Table 11 validates the robustness of the primary quantile regression findings using Bootstrap Quantile Regression (BSQR), a nonparametric technique that addresses heteroskedasticity and distributional irregularities, enhancing inference reliability. Results for Models 1 and 2, presented in Tables 11 and 12, confirm the distributionally heterogeneous effects of key explanatory variables on territorial CO2 emissions in SCO countries. The consistently positive relationship between ORNT and TCO2 across different quantiles supports the baseline MMQR model, indicating that increased government revenue from oil rents is not sufficiently invested in clean energy or environmental sustainability initiatives. The larger coefficient at lower quantiles suggests that oil dependency has a more pronounced effect on emissions in low-emitting SCO countries, possibly due to weaker pollution controls or recent industrial development. Figure 4 visualizes the BSQR regression results for Model 1.

Furthermore, the consistent positive relationship between NGRNT and TCO2 across various quantiles in Table 12 strengthens the baseline MMQR model 2 findings, suggesting that increased government revenue from natural gas rents is not sufficiently allocated to clean energy or sustainability initiatives. This relationship indicates that higher natural gas rents correlate with increased CO2 emissions, despite natural gas being a cleaner alternative to coal (Zhang and Li, 2023). The extraction and consumption of natural gas still contribute to emissions in these countries. Figure 5 illustrates the BSQR regression results for Model 2.

Tables 11 and 12 of the BSQR display results for additional variables in the models: renewable electricity consumption (REC), urbanization (URB), and economic growth (GDP). REC’s coefficients are generally not statistically significant across all quantiles in both models, indicating a weak and inconsistent effect on CO2 emissions in SCO countries. This limited impact may reflect the low adoption of renewable energy in the region, supporting findings from MMQR models 1 and 2. In contrast, urbanization and economic growth consistently show a significant positive association with CO2 emissions across all quantiles in both BSQR models. This aligns with the MMQR results, suggesting that expanding urban populations and economies drive higher energy consumption and carbon emissions. Figures 4, 5 visually present the BSQR regression outcomes for these variables.

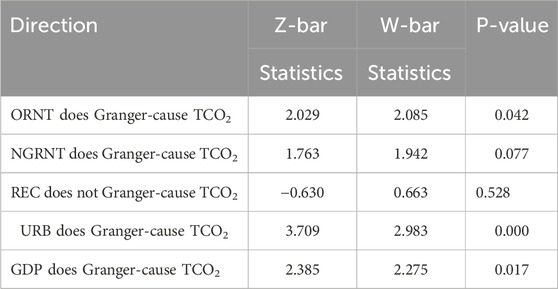

Table 13 presents Granger Causality results, highlighting significant predictive causality between TCO2 and the independent variables ORNT, NGRNT, REC, URB, and GDP. Specifically, the analysis reveals a significant causal relationship between ORNT, NGRNT, and TCO2, as well as between REC, URB, GDP, and TCO2. However, REC was found to be non-significant. These findings align with previous studies, emphasizing the complex interactions among these variables and TCO2. The insights gained are pivotal for evidence-based policymaking, aiding in the promotion of environmental sustainability and emission reduction in Shanghai Cooperation Organization (SCO) member countries.

5 Conclusion

The growing ecological burden has led to severe environmental impacts, including storms, flooding, droughts, wildfires, and resource depletion, emphasizing the urgent need for sustainable policies and actions to address these challenges. This study examines how disaggregated natural resource revenues and renewable electricity consumption (REC) influence territorial carbon emissions (TCO2) across Shanghai Cooperation Organization (SCO) member states from 2000 to 2021. Applying Method of Moments Quantile Regression (MMQR) and Bootstrap Quantile Regression (BSQR) methodologies, the analysis demonstrates that oil and gas rents consistently correlate with higher TCO2 emissions. Conversely, REC exhibits minimal and statistically insignificant effects on emission reductions, potentially due to the region’s underdeveloped renewable energy infrastructure. These findings suggest that while fossil fuel dependence drives emissions, current renewable energy integration remains insufficient to meaningfully mitigate environmental impacts in SCO nations. Additionally, urbanization and GDP growth were identified as factors contributing to the escalation of carbon emissions, highlighting the necessity for integrated strategies that align with sustainable development goals to effectively address environmental degradation.

5.1 Policy recommendations

This research proposes targeted policy measures to mitigate environmental degradation and carbon emissions in SCO nations. The analysis particularly emphasizes how oil and gas revenues significantly contribute to regional CO2 output, suggesting these sectors require urgent regulatory attention to facilitate sustainable development. The findings reveal a dual challenge: while natural resources rent contribute to economic growth and provide essential revenues, their extraction and consumption exacerbate environmental degradation, especially through increased carbon emissions. To mitigate this, a transition towards sustainable energy practices is crucial for long-term environmental health in the SCO region.

To mitigate this environmental burden and encourage sustainability, the study suggests several policy recommendations. To accelerate decarbonization, SCO members should strategically reinvest oil and gas revenues into clean energy transitions. Prioritizing funding for renewable infrastructure (solar, wind, hydro), energy efficiency upgrades, and carbon capture technologies would enable these nations to systematically reduce fossil fuel dependence while minimizing their energy sector’s environmental impact. Additionally, establishing dedicated green funds financed by oil and natural gas rents would ensure that these resources are transparently allocated to initiatives aimed at decarbonizing the energy sector. Ultimately, this approach provides SCO member countries with an opportunity to leverage their resource wealth to drive a green energy transition, reduce carbon emissions, and contribute meaningfully to global climate goals.

Although renewable electricity consumption shows potential for mitigating emissions, it remains statistically insignificant in this analysis. Therefore, increasing the share of renewable energy in the energy mix is vital. SCO countries should implement policies to stimulate renewable energy investment, eliminate barriers to adoption, and promote cross-border cooperation to capitalize on economies of scale and enhance energy security. By adopting these measures, the SCO countries can foster a sustainable future where economic development and environmental protection support each other, helping to meet global climate objectives.

Regarding the control variables in the study, several policy recommendations can be put forward to mitigate the adverse impacts of environmental degradation and reduce territorial-based carbon emissions in SCO member countries. Firstly, as urbanization accelerates, sustainable urban development policies must be prioritized. Urban expansion directly contributes to higher emissions; therefore, integrating green urban planning, low-carbon technologies, public transport, and smart city initiatives is critical. Promoting green building practices, such as energy-efficient housing and commercial buildings, should be incentivized to prevent further environmental damage. Secondly, while GDP growth is vital for economic progress, it must be decoupled from carbon emissions. SCO countries should adopt green growth strategies that foster sustainable economic development by investing in clean technologies and expanding green sectors like renewable energy. This approach will reduce reliance on fossil fuels and help minimize emissions, ensuring a balance between economic and environmental objectives.

This study has several limitations. It primarily focuses on selected SCO member countries and relies on data available up to 2021. Recent geopolitical events, such as the Russia-Ukraine war and COP agreements, could potentially alter the results. Future research could include post-2021 data and apply advanced econometric methods like CS-ARDL and PQARDL. Incorporating time-series analyses and additional carbon reduction indicators may provide more comprehensive insights and reveal variations across countries.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: The datasets used in this study are sourced from several reputable organizations, Global Carbon Budget, WDI and IEA.

Author contributions

MA: Conceptualization, Formal Analysis, Methodology, Software, Visualization, Writing – original draft. TA: Data curation, Funding acquisition, Visualization, Writing – review and editing. LA: Data curation, Supervision, Validation, Writing – review and editing. RA: Data curation, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. Research Funding program (ORF-2025-1222), King Saud University, Riyadh, Saudi Arabia.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adekoya, O. B., Olabode, J. K., and Rafi, S. K. (2021). Renewable energy consumption, carbon emissions and human development: empirical comparison of the trajectories of world regions. Renew. Energy 179, 1836–1848. doi:10.1016/j.renene.2021.08.019

Agboola, M. O., Bekun, F. V., and Joshua, U. (2021). Pathway to environmental sustainability: nexus between economic growth, energy consumption, CO2 emission, oil rent and total natural resources rent in Saudi Arabia. Resour. Policy 74, 102380. doi:10.1016/j.resourpol.2021.102380

Ahmed, M., Shuai, C., and Ahmed, M. (2023). Analysis of energy consumption and greenhouse gas emissions trend in China, India, the USA, and Russia. Int. J. Environ. Sci. Technol. 20 (3), 2683–2698. doi:10.1007/s13762-022-04159-y

Akpınar, B., Barut, M., Akpınar, E. N., and Balıkçı, H. C. (2025). Lifelong learning supported by artificial intelligence and technology for sustainable development goals: an OECD perspective. Sustain. Dev., sd.3537. doi:10.1002/sd.3537

Aladejare, S. A. (2022). Natural resource rents, globalisation and environmental degradation: new insight from 5 richest African economies. Resour. Policy 78, 102909. doi:10.1016/j.resourpol.2022.102909

Alhassan, H., and Kwakwa, P. A. (2023). The effect of natural resources extraction and public debt on environmental sustainability. Manag. Environ. Qual. Int. J. 34 (3), 605–623. doi:10.1108/MEQ-07-2022-0192

Ali, U., Guo, Q., Kartal, M. T., Nurgazina, Z., Khan, Z. A., and Sharif, A. (2022). The impact of renewable and non-renewable energy consumption on carbon emission intensity in China: fresh evidence from novel dynamic ARDL simulations. J. Environ. Manag. 320, 115782. doi:10.1016/j.jenvman.2022.115782

Alofaysan, H., Radulescu, M., Dembińska, I., and Si Mohammed, K. (2024). The effect of digitalization and green technology innovation on energy efficiency in the European Union. Energy Explor. Exploitation 42 (5), 1747–1762. doi:10.1177/01445987241253621

Altın, H. (2024). The impact of energy efficiency and renewable energy consumption on carbon emissions in G7 countries. Int. J. Sustain. Eng. 17 (1), 134–142. doi:10.1080/19397038.2024.2319648

Anas, M., Zhang, W., Bakhsh, S., Ali, L., Işık, C., Han, J., et al. (2024). Moving towards sustainable environment development in emerging economies: the role of green finance, green tech-innovation, natural resource depletion, and forested area in assessing the load capacity factor. Sustain. Dev. 32 (4), 3004–3020. doi:10.1002/sd.2833

Andreichyk, A., and Tsvetkov, P. (2023). Study of the relationship between economic growth and greenhouse gas emissions of the shanghai cooperation organization countries on the basis of the environmental Kuznets curve. Resources 12 (7), 80. doi:10.3390/resources12070080

Auty, R. M. (1994). Industrial policy reform in six large newly industrializing countries: the resource curse thesis. World Dev. 22 (1), 11–26. doi:10.1016/0305-750X(94)90165-1

Awosusi, A. A., Mata, M. N., Ahmed, Z., Coelho, M. F., Altuntaş, M., Martins, J. M., et al. (2022). How do renewable energy, economic growth and natural resources rent affect environmental sustainability in a globalized economy? Evidence from Colombia based on the gradual shift causality approach. Front. Energy Res. 9, 739721. doi:10.3389/fenrg.2021.739721

Bao, H. H. G. (2020). Renewable and nonrenewable energy consumption, government expenditure, institution quality, financial development, trade openness, and sustainable development in Latin America and Caribbean emerging market and developing economies. Int. J. Energy Econ. Policy 10(1), 242–248. doi:10.32479/ijeep.8506

Barut, A., Alofaysan, H., Akpınar, E. N., Adıgüzel, S., and Magazzino, C. (2025). The impact of democracy and happiness on environmental degradation in OECD countries. Nat. Resour. Forum, 1477-8947.12592. doi:10.1111/1477-8947.12592

Bekun, F. V. (2022). Mitigating emissions in India: accounting for the role of real income, renewable energy consumption and investment in energy. Int. J. Energy Econ. Policy 12 (1), 188–192. doi:10.32479/ijeep.12652

Ben-Salha, O., and Zmami, M. (2023). Analyzing the symmetric and asymmetric effects of disaggregate natural resources on the ecological footprint in Saudi Arabia: insights from the dynamic ARDL approach. Environ. Sci. Pollut. Res. 30(21), 59424–59442. doi:10.1007/s11356-023-26683-1

Bilgili, F., Soykan, E., Dumrul, C., Awan, A., Önderol, S., and Khan, K. (2023). Disaggregating the impact of natural resource rents on environmental sustainability in the MENA region: a quantile regression analysis. Resour. Policy 85, 103825. doi:10.1016/j.resourpol.2023.103825

Boateng, E., Annor, C. B., Amponsah, M., and Ayibor, R. E. (2024). Does FDI mitigate CO2 emissions intensity? Not when institutional quality is weak. J. Environ. Manag. 354, 120386. doi:10.1016/j.jenvman.2024.120386

Breitung, J. (2005). A parametric approach to the estimation of cointegration vectors in panel data. Econ. Rev. 24 (2), 151–173. doi:10.1081/ETC-200067895

Breusch, T. S., and Pagan, A. R. (1980). The lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 47 (1), 239–253. doi:10.2307/2297111

Chen, F.-f., Wang, Q.-S., Umar, M., and Zheng, L. (2023a). Towards sustainable resource management: the role of governance, natural resource rent and energy productivity. Resour. Policy 85, 104026. doi:10.1016/j.resourpol.2023.104026

Chen, S., Zhang, C., and Lu, X. (2023b). “Energy conversion from Fossil fuel to renewable energy,” in Handbook of air quality and climate change (Springer), 1–44.

Chen, J., Wu, W., and Nguea, S. M. (2025a). Combining the effects of industrialization and oil prices on CO2 emissions: what role do renewable energy, urbanization and financial crisis play? Sustain. Dev. 33 (2), 2780–2796. doi:10.1002/sd.3264

Chen, J., Zhao, C., Liu, S., and Li, Y. (2025b). How do digitalizing ICT and supply chain globalization affect renewable energy in ASEAN nations? The mediating role of sustainable environmental practices using the MMQR and PCSEs model. Energy Econ. 142, 108166. doi:10.1016/j.eneco.2024.108166

De La Peña, L., Guo, R., Cao, X., Ni, X., and Zhang, W. (2022). Accelerating the energy transition to achieve carbon neutrality. Resour. Conservation Recycl. 177, 105957. doi:10.1016/j.resconrec.2021.105957

Ehigiamusoe, K. U., Dogan, E., Ramakrishnan, S., and Binsaeed, R. H. (2024). How does technological innovation moderate the environmental impacts of economic growth, natural resource rents and trade openness? J. Environ. Manag. 371, 123229. doi:10.1016/j.jenvman.2024.123229

Friedlingstein, P., O'sullivan, M., Jones, M. W., Andrew, R. M., Gregor, L., Hauck, J., et al. (2022). Global carbon budget 2022. Earth Syst. Sci. Data 14 (11), 4811–4900. doi:10.5194/essd-14-4811-2022

Grossman, G. M., and Krueger, A. B. (1995). Economic growth and the environment. Q. J. Econ. 110 (2), 353–377. doi:10.2307/2118443

Gu, X., Shen, X., Zhong, X., Wu, T., and Rahim, S. (2023). Natural resources and undesired productions of environmental outputs as green growth: EKC in the perspective of green finance and green growth in the G7 region. Resour. Policy 82, 103552. doi:10.1016/j.resourpol.2023.103552

Gyamfi, B. A., and Adebayo, T. S. (2023). Do natural resource volatilities and renewable energy contribute to the environment and economic performance? Empirical evidence from E7 economies. Environ. Sci. Pollut. Res. 30 (7), 19380–19392. doi:10.1007/s11356-022-23457-z

Hahn, J. (1995). Bootstrapping quantile regression estimators. Econ. Theory 11 (1), 105–121. doi:10.1017/S0266466600009051

Hasanov, F. J., Mukhtarov, S., and Suleymanov, E. (2023). The role of renewable energy and total factor productivity in reducing CO2 emissions in Azerbaijan. Fresh insights from a new theoretical framework coupled with autometrics. Energy Strategy Rev. 47, 101079. doi:10.1016/j.esr.2023.101079

Hossain, M. R., Dash, D. P., Das, N., Ullah, E., and Hossain, M. E. (2024). Green energy transition in OECD region through the lens of economic complexity and environmental technology: a method of moments quantile regression perspective. Appl. Energy 365, 123235. doi:10.1016/j.apenergy.2024.123235

Huang, B., Huang, H., Xiang, X., and Xu, X. (2023). Dual issue of resources and emissions: resources richness and carbon emissions with oil rents, trade, and mineral rents exploration. Resour. Policy 86, 104066. doi:10.1016/j.resourpol.2023.104066

Hussain, M., Lu, T., Chengang, Y., and Wang, Y. (2023). Role of economic policies, renewable energy consumption, and natural resources to limit carbon emissions in top five polluted economies. Resour. Policy 83, 103605. doi:10.1016/j.resourpol.2023.103605

Iqbal, N., Abbasi, K. R., Shinwari, R., Guangcai, W., Ahmad, M., and Tang, K. (2021). Does exports diversification and environmental innovation achieve carbon neutrality target of OECD economies? J. Environ. Manag. 291, 112648. doi:10.1016/j.jenvman.2021.112648

Işık, C., Ongan, S., Ozdemir, D., Yan, J., and Demir, O. (2024). The sustainable development goals: theory and a holistic evidence from the USA. Gondwana Res. 132, 259–274. doi:10.1016/j.gr.2024.04.014

Jia, W., Jia, X., Wu, L., Guo, Y., Yang, T., Wang, E., et al. (2022). Research on regional differences of the impact of clean energy development on carbon dioxide emission and economic growth. Humanit. Soc. Sci. Commun. 9 (1), 25–29. doi:10.1057/s41599-021-01030-2

Joshua, U., and Bekun, F. V. (2020). The path to achieving environmental sustainability in South Africa: the role of coal consumption, economic expansion, pollutant emission, and total natural resources rent. Environ. Sci. Pollut. Res. 27 (9), 9435–9443. doi:10.1007/s11356-019-07546-0

Kahia, M., and Omri, A. (2024). Oil rents and environmental sustainability: do green technologies and environmental technological innovation matter? J. Open Innovation Technol. Mark. Complex. 10 (3), 100366. doi:10.1016/j.joitmc.2024.100366

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. J. Econ. 90 (1), 1–44. doi:10.1016/S0304-4076(98)00023-2

Karimi, M., Ahmad, S., Karamelikli, H., Dinç, D., Khan, Y., Sabzehei, M., et al. (2021). Dynamic linkages between renewable energy, carbon emissions and economic growth through nonlinear ARDL approach: evidence from Iran. Plos one 16 (7), e0253464. doi:10.1371/journal.pone.0253464

Khan, Z., Ali, S., Umar, M., Kirikkaleli, D., and Jiao, Z. (2020). Consumption-based carbon emissions and international trade in G7 countries: the role of environmental innovation and renewable energy. Sci. Total Environ. 730, 138945. doi:10.1016/j.scitotenv.2020.138945

Kilinc-Ata, N., and Barut, A. (2024). The influence of tourism on the UAE’s energy-related climate goals: cointegration analysis. J. Hosp. Tour. Educ., 1–13. doi:10.1080/10963758.2024.2433060

Kumar, P., Radulescu, M., Sharma, H., Belascu, L., and Serbu, R. (2024). Pollution haven hypothesis and EKC dynamics: moderating effect of FDI. A study in Shanghai Cooperation Organization countries. Environ. Res. Commun. 6 (11), 115032. doi:10.1088/2515-7620/ad9381

Lancon, O., and Hascakir, B. (2018). “Contribution of oil and gas production in the us to the climate change,” in SPE annual technical conference and exhibition? SPE.D031S035R006.

Lee, C.-C., Zhou, B., Yang, T.-Y., Yu, C.-H., and Zhao, J. (2023). The impact of urbanization on CO2 emissions in China: the key role of foreign direct investment. Emerg. Mark. Finance Trade 59 (2), 451–462. doi:10.1080/1540496X.2022.2106843

Li, B., and Haneklaus, N. (2022). The role of clean energy, fossil fuel consumption and trade openness for carbon neutrality in China. Energy Rep. 8, 1090–1098. doi:10.1016/j.egyr.2022.02.092

Li, F., and Yan, J. (2024). How do e-government and green technology innovation affect carbon emissions: evidence from resource-rich countries in the Shanghai Cooperation Organization. Energy Rep. 12, 4026–4033. doi:10.1016/j.egyr.2024.09.078

Liu, X., Niu, Q., Dong, S., and Zhong, S. (2023). How does renewable energy consumption affect carbon emission intensity? Temporal-spatial impact analysis in China. Energy 284, 128690. doi:10.1016/j.energy.2023.128690

Machado, J. A., and Silva, J. S. (2019). Quantiles via moments. J. Econ. 213 (1), 145–173. doi:10.1016/j.jeconom.2019.04.009

Mahmood, H., and Furqan, M. (2021). Oil rents and greenhouse gas emissions: spatial analysis of Gulf Cooperation Council countries. Environ. Dev. Sustain. 23 (4), 6215–6233. doi:10.1007/s10668-020-00869-w

Mahmood, H., and Saqib, N. (2022). Oil rents, economic growth, and CO2 emissions in 13 OPEC member economies: asymmetry analyses. Front. Environ. Sci. 10, 1025756. doi:10.3389/fenvs.2022.1025756

Mahmood, H., Asadov, A., Tanveer, M., Furqan, M., and Yu, Z. (2022). Impact of oil price, economic growth and urbanization on CO2 emissions in GCC countries: asymmetry analysis. Sustainability 14 (8), 4562. doi:10.3390/su14084562

Mahmood, H., Saqib, N., Adow, A. H., and Abbas, M. (2023). Oil and natural gas rents and CO2 emissions nexus in MENA: spatial analysis. PeerJ 11, e15708. doi:10.7717/peerj.15708

Mirziyoyeva, Z., and Salahodjaev, R. (2022). Renewable energy and CO2 emissions intensity in the top carbon intense countries. Renew. Energy 192, 507–512. doi:10.1016/j.renene.2022.04.137

Mohamed, E. F., Abdullah, A., Jaaffar, A. H., and Osabohien, R. (2024). Reinvestigating the EKC hypothesis: does renewable energy in power generation reduce carbon emissions and ecological footprint? Energy Strategy Rev. 53, 101387. doi:10.1016/j.esr.2024.101387

Mohsin, M., Naseem, S., Sarfraz, M., and Azam, T. (2022). Assessing the effects of fuel energy consumption, foreign direct investment and GDP on CO2 emission: new data science evidence from Europe and Central Asia. Fuel 314, 123098. doi:10.1016/j.fuel.2021.123098

Ni, X. (2023). Natural resources and COP26 targets of developed countries: pandemic perspective of natural resources extraction. Resour. Policy 83, 103712. doi:10.1016/j.resourpol.2023.103712

Obobisa, E. S. (2022). Achieving 1.5 C and net-zero emissions target: the role of renewable energy and financial development. Renew. Energy 188, 967–985. doi:10.1016/j.renene.2022.02.056

Olaniyi, C. O., and Odhiambo, N. M. (2024). Do natural resource rents aid renewable energy transition in resource-rich African countries? The roles of institutional quality and its threshold. Nat. Resour. Forum 49, 1330–1375. doi:10.1111/1477-8947.12430

Opoku-Mensah, E., Chun, W., Tuffour, P., Chen, W., and Agyapong, R. A. (2023). Leveraging on structural change and ISO 14001 certification to mitigate ecological footprint in Shanghai cooperation organization nations. J. Clean. Prod. 414, 137542. doi:10.1016/j.jclepro.2023.137542

Pata, U. K., Alola, A. A., Erdogan, S., and Kartal, M. T. (2023). The influence of income, economic policy uncertainty, geopolitical risk, and urbanization on renewable energy investments in G7 countries. Energy Econ. 128, 107172. doi:10.1016/j.eneco.2023.107172

Pedroni, P. (1999). Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Statistics 61 (S1), 653–670. doi:10.1111/1468-0084.0610s1653

Pedroni, P. (2004). Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econ. theory 20 (3), 597–625. doi:10.1017/S0266466604203073

Pesaran (2004). General diagnostic tests for cross section dependence in panels. Cambridge Working Papers. Economics 1240 (1), 1.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. 22 (2), 265–312. doi:10.1002/jae.951

Pesaran, M. H., and Yamagata, T. (2008). Testing slope homogeneity in large panels. J. Econ. 142 (1), 50–93. doi:10.1016/j.jeconom.2007.05.010

Pesaran, M. H., Ullah, A., and Yamagata, T. (2008). A bias-adjusted LM test of error cross-section independence. Econ. J. 11 (1), 105–127. doi:10.1111/j.1368-423X.2007.00227.x

Pilatin, A., Radulescu, M., Barut, A., Görgün, M. R., Çiftçi, H., and Alofaysan, H. (2025). Global supply chain distribution and natural resources in the era of digitalization. Sustainability 17 (13), 5843. doi:10.3390/su17135843

Qamruzzaman, M. (2024). Do natural resources bestow or curse the environmental sustainability in Cambodia? Nexus between clean energy, urbanization, and financial deepening, natural resources, and environmental sustainability. Energy Strategy Rev. 53, 101412. doi:10.1016/j.esr.2024.101412

Qudrat-Ullah, H. (2022). A review and analysis of renewable energy policies and CO2 emissions of Pakistan. Energy 238, 121849. doi:10.1016/j.energy.2021.121849

Raihan, A., and Tuspekova, A. (2022). Role of economic growth, renewable energy, and technological innovation to achieve environmental sustainability in Kazakhstan. Curr. Res. Environ. Sustain. 4, 100165. doi:10.1016/j.crsust.2022.100165

Saidi, Y., Ochi, A., and Maktouf, S. (2023). FDI inflows, economic growth, and governance quality trilogy in developing countries: a panel VAR analysis. Bull. Econ. Res. 75 (2), 426–449. doi:10.1111/boer.12364

Shahbaz, M., Patel, N., Du, A. M., and Ahmad, S. (2024). From black to green: quantifying the impact of economic growth, resource management, and green technologies on CO2 emissions. J. Environ. Manag. 360, 121091. doi:10.1016/j.jenvman.2024.121091

Shu, H., Wang, Y., Umar, M., and Zhong, Y. (2023). Dynamics of renewable energy research, investment in EnvoTech and environmental quality in the context of G7 countries. Energy Econ. 120, 106582. doi:10.1016/j.eneco.2023.106582

Sibanda, K., Garidzirai, R., Mushonga, F., and Gonese, D. (2023). Natural resource rents, institutional quality, and environmental degradation in resource-rich Sub-Saharan African countries. Sustainability 15 (2), 1141. doi:10.3390/su15021141

Sicen, L., Khan, A., and Kakar, A. (2022). The role of disaggregated level natural resources rents in economic growth and environmental degradation of BRICS economies. Biophysical Econ. Sustain. 7 (3), 7. doi:10.1007/s41247-022-00102-4

Song, S., Tan, H., Zhang, Y., and Ma, Y. (2024). A multiscale analysis of the relationship between urbanization and CO2 emissions using geo-weighted regression model. Discov. Sustain. 5 (1), 113. doi:10.1007/s43621-024-00298-z

Soni, S., and Manogna, R. (2025). Does natural resource rent and financial inclusion curb carbon emissions? Empirical evidence from E7 and G7 economies. Humanit. Soc. Sci. Commun. 12 (1), 459–10. doi:10.1057/s41599-025-04786-z

Sultana, T., Hossain, M. S., Voumik, L. C., and Raihan, A. (2023). Democracy, green energy, trade, and environmental progress in South Asia: advanced quantile regression perspective. Heliyon 9 (10), e20488. doi:10.1016/j.heliyon.2023.e20488

Tawiah, V. K., Zakari, A., and Khan, I. (2021). The environmental footprint of China-Africa engagement: an analysis of the effect of China–Africa partnership on carbon emissions. Sci. Total Environ. 756, 143603. doi:10.1016/j.scitotenv.2020.143603

Voumik, L. C., Mimi, M. B., and Raihan, A. (2023). Nexus between urbanization, industrialization, natural resources rent, and anthropogenic carbon emissions in South Asia: CS-ARDL approach. Anthropocene Sci. 2 (1), 48–61. doi:10.1007/s44177-023-00047-3

Wang, L. (2022). Research on the dynamic relationship between China's renewable energy consumption and carbon emissions based on ARDL model. Resour. Policy 77, 102764. doi:10.1016/j.resourpol.2022.102764

Wang, E.-Z., and Lee, C.-C. (2022). The impact of clean energy consumption on economic growth in China: is environmental regulation a curse or a blessing? Int. Rev. Econ. and Finance 77, 39–58. doi:10.1016/J.IREF.2021.09.008

Wei, G., Bi, M., Liu, X., Zhang, Z., and He, B.-J. (2023). Investigating the impact of multi-dimensional urbanization and FDI on carbon emissions in the belt and road initiative region: direct and spillover effects. J. Clean. Prod. 384, 135608. doi:10.1016/j.jclepro.2022.135608

Xu, X., and Chen, Y. (2016). Air emissions from the oil and natural gas industry. Int. J. Environ. Stud. 73 (3), 422–436. doi:10.1080/00207233.2016.1165483

Xue, Y., and Makengo, B. M. (2021). Twenty years of the Shanghai Cooperation Organization: achievements, challenges and prospects. Open J. Soc. Sci. 9 (10), 184–200. doi:10.4236/jss.2021.910014

Yang, S., Yang, J., Shi, S., Song, S., Luo, Y., and Du, L. (2023). The rising impact of urbanization-caused CO2 emissions on terrestrial vegetation. Ecol. Indic. 148, 110079. doi:10.1016/j.ecolind.2023.110079

Zhang, X., and Li, J.-R. J. G. E. (2023). Recovery of greenhouse gas as cleaner fossil fuel contributes to carbon neutrality. Green Energy and Environ. 8 (2), 351–353. doi:10.1016/j.gee.2022.06.002

Zhang, X., Ji, C. E., Zhang, H., Wei, Y., and Jin, J. (2023). On the role of the digital industry in reshaping urban economic structure: the case of Hangzhou, China. J. Econ. Analysis 2(4), 123–139. doi:10.58567/jea02040007

Zhang, W., Han, J., Kuang, S., Işık, C., Su, Y., Ju, G. L. N. G. E., et al. (2024). Exploring the impact of sustainable finance on carbon emissions: policy implications and interactions with low-carbon energy transition from China. Resour. Policy 97, 105272. doi:10.1016/j.resourpol.2024.105272

Zhou, F., Bin Samsurijan, M. S., Ibrahim, R. L., and Al-Faryan, M. A. S. (2024). An assessment of the aggregated and disaggregated effects of natural resources rents on environmental sustainability in BRICS economies. Int. J. Sustain. Dev. World Ecol. 31 (4), 375–394. doi:10.1080/13504509.2023.2291135

Keywords: territorial-based CO2 emissions, natural resources, renewable electricity consumption, Shanghai cooperation organization (SCO), MMQR

Citation: Anas M, Alsabhan TH, Ali L and Alshagri R (2025) Reliance on natural resources, renewable energy adoption, and their impact on carbon emissions in selected SCO member countries. Front. Environ. Sci. 13:1684368. doi: 10.3389/fenvs.2025.1684368

Received: 12 August 2025; Accepted: 25 September 2025;

Published: 09 October 2025.

Edited by:

Kamel Si Mohammed, Université de Lorraine, FranceReviewed by:

Abdulkadir Barut, Harran University, TürkiyeNadia Arfaoui, IDRAC Business School, France

Copyright © 2025 Anas, Alsabhan, Ali and Alshagri. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Muhammad Anas, YW5hc0BjdWcuZWR1LmNu, YW5hc2h1c3QxMjM3QHlhaG9vLmNvbQ==

Muhammad Anas

Muhammad Anas Talal H. Alsabhan

Talal H. Alsabhan Liaqat Ali

Liaqat Ali Reem Alshagri2

Reem Alshagri2