- 1Department of Basic Teaching and Research, Party School of the Fujian Committee of C.P.C (Fujian Administrative College), Fuzhou, China

- 2School of International Economics and Trade, Fujian Business University, Fuzhou, China

Digital transformation plays an important role in promoting green development. As a key tool for digital transformation, the intra-industry impacts and inter-industry spillover effects of digital inputs on industrial green transformation are topics worthy of further study. Based on a unique Chinese enterprise panel data set, this paper employs a high-dimensional fixed effects model to empirically analyze both the intra-industry impacts and the inter-industry spillovers effect of digital inputs on industrial green transformation. The results show that, digital inputs exert a significant intra-industry impact, it can effectively drive industrial enterprises to achieve green transformation, and this driving effect exhibits heterogeneity across different enterprise sizes, ownership structures, and pollution emission intensities. At the same time, enterprise entry and enterprise exit are the mechanisms that generate intra-industry impacts, digital inputs are conducive to the entry of new enterprises with high efficiency and low pollution into the market, and force inefficient and highly polluting enterprises to exit the market, thereby effectively optimizing the market structure and promoting the green transformation within the industry. In terms of inter-industry spillover effects, there are obvious differences between forward and backward inter-industry spillover effects of digital inputs driving industrial green transformation. It cannot effectively promote the green transformation of downstream related industries through a “supply-led” approach, but it can spillover the promotional effect of digital inputs on green transformation to upstream industries through a “demand-driven” approach. The mechanism analysis results of the inter-industry spillover effects further show that, in a “demand-driven” scenario, capital renewal and technological progress in upstream related industries are the key mechanisms for realizing the inter-industry spillover effects of digital inputs on industrial green transformation. These conclusions provide empirical evidence and policy references for developing countries to use digital inputs for reducing industrial pollution emissions and promoting industrial green transformation.

1 Introduction

Promoting digital transformation is an important way to reduce environmental pollution emissions and promote industrial green transformation. In many developing countries, industrialization has historically been accompanied by significant environmental costs. Taking China as an example, since the reform and opening-up, its industrial sector has experienced rapid growth largely driven by an extensive development model characterized by massive inputs of labor and capital. While this model has contributed markedly to economic expansion, it also inevitably leads to environmental shortcoming, such as industrial pollution (Chen, 2010). However, traditional environmental governance approaches exhibiting path dependence on command-based environmental regulations struggle to achieve a win-win outcome for both industrial production performance and environmental performance in the short term. Therefore, in the process of promoting the industrial green transformation, finding the green transformation power beyond regulation has become a realistic issue to be solved urgently.

At the same time, with the continuous progress of digital technology, digital transformation provides opportunity to promote industrial green transformation and achieve a win-win situation for economic and environmental benefits in developing countries. Particularly in China, the Chinese government has proposed to accelerate the industrial green transformation through digitalization. As a crucial tool for digital transformation, digital inputs that include digital hardware equipment and digital software services are recognized as having significant impacts on driving industrial upgrading (Bai et al., 2023), promoting technological innovation (Qiao, 2025), and enhancing TFP (Liang and Zhang, 2024). Concurrently, these factors have been identified in existing literature as key drivers of China’s industrial development (Yuan and Zhang, 2020; Ji, 2020).

Against this background, in addition to its economic benefits such as promoting industrial upgrading and technological innovation, whether digital inputs can drive green industrial transformation has also become a focus of academic attention. Overall, existing literature on digital inputs driving industrial green transformation has followed a clear evolutionary trajectory. It has progressed from examining specific cases like digital finance to focusing on the overall dimension of digital economy, and subsequently focusing on digital inputs. This evolutionary trajectory is closely linked to the continuous improvement of digital economy measurement methods.

Since the publication of China’s Digital Inclusive Financial Development Index (CDIFDI) compiled by Guo et al. (2020), some scholars have begun to recognize that the digital economy, represented by digital finance, plays a crucial driving role in the industrial green transformation. And they believe that digital finance can drive China’s industrial sector toward a green transformation by promoting technological innovation and the development of technology-intensive manufacturing (Fang et al., 2023; Zhong et al., 2023). However, as a typical case in digital economy, empirical research on digital finance cannot effectively reflect the entire environmental effects of the total digital economy. In this context, some scholars based on the research results of Wu and Wang (2021) and Liu et al. (2021) regarding the statistical definition, industrial classification, and production accounting of the digital economy, aimed to examine its specific impact on industrial green transformation from a total digital economy perspective. They basically formed a consensus that digital economy can reduce pollution emissions such as industrial sulfur dioxide and industrial wastewater, which is conducive to promoting the green transformation of China’s economy, especially China’s industrial sector (Qi et al., 2022; Han et al., 2022; Zhang X. et al., 2023). The above literature has explored the impact of digital finance or the digital economy on industrial green transformation, without directly addressing the driving effect of digital inputs on industrial green transformation.

With the deepening of industrial digital transformation, as a crucial tool for digital transformation, academia has begun shifting its research focus toward digital inputs and analyzing their role in industrial green transformation. In particular, some scholars have begun to pay attention to the unique role of input-output tables in measuring the utilization of digital economy sectors by other sectors (Yang and Fan, 2020; Zhang and Yu, 2021; Chen and Yang, 2022). They began using input-output tables to measure the level of digital inputs, and further explore the specific impact of digital inputs on industrial green transformation. Yin et al. (2022), Li et al. (2023), Tang et al. (2023), Zhang W. et al. (2023) and Lin and Teng (2024) used input-output tables at different levels to reveal the effect of digital inputs in promoting green technology innovation and carbon emission reduction. On this basis, recent empirical studies further show that digital inputs can not only effectively reduce the embodied carbon emissions of China’s industrial sector, but also significantly reduce the main pollutant emissions of China’s manufacturing sector (Dai and Yang, 2022).

In addition to the above literature focusing on Chinese practices, from a global perspective, most countries have also recognized the critical role of information and communications technology (ICT), particularly digital technologies, in driving sustainable growth (OECD, 2024a; OECD, 2024b). As early as 2010, an OECD report had already highlighted the significant environmental impact of information and communication technologies (ICT) (OECD, 2010). With the rapid development of the digital economy, academia has further analyzed the green effects of digital technologies. Gale et al. (2017) emphasized the crucial role of digital hardware technologies in promoting sustainable development in agriculture and industry. The reason is that digital technology can accelerate industrial upgrading, particularly by driving the manufacturing sector’s shift from an extensive development model characterized by “high pollution, high emissions, and high energy consumption” to an intensive model, thereby reducing environmental pollution (Arik, 2009). Recent empirical research has also confirmed the above points. Mangina et al. (2020) examined the role of new digital technologies—particularly the Internet of Things—in advancing the sustainability of global supply chains using EU data. Ramona et al. (2025) systematically estimated the synergistic effects of digitalization and green transformation across different developmental stages. Compared to research focused on China, the research that focus on other economies primarily examines the effects of specific digital technologies—such as the Internet of Things and digital hardware—on driving economic green transformation. In contrast, China-focused studies increasingly analyze the role of digital inputs in China’s economic transformation, particularly in industrial green transformation. On one hand, this may be because the industrial sector continues to hold a pivotal position within China’s industrial structure, which makes the industrial green transformation as a key focus field in China’s industrial policy. On the other hand, the Chinese government is actively advancing the development of a “digital power” and has introduced a series of national-level digital economy development plans, such as the “14th Five-Year Plan for Digital Economy Development.” These policy frameworks establish clear quantitative targets for digital infrastructure development and digital inputs. Consequently, guided by these targets, Chinese industrial enterprises—particularly state-owned enterprises—are more likely to increase the intensity of their digital inputs. Although research focuses differently, both Chinese-focused researches and studies on other economies generally agree that digital technologies or digital inputs play a crucial role in driving industrial green transformation.

The above literature has begun to discuss the driving effect of digital inputs on industrial green transformation. But in fact, as an intermediate input represented by digital hardware equipment and digital software services, digital inputs contain rich digital technologies, and the spillover characteristics of digital technologies mean that digital inputs not only strengthen the economic links between regions in the spatial dimension, but also help to enhance the correlation between industries in the industry dimension. Therefore, in addition to examining the intra-industry impacts of digital inputs on industrial green transformation, it is also necessary to further introduce industrial correlation factors to discuss the inter-industry spillover effect in the digital inputs driving industry green transformation.

The significance of this research is that, on the one hand, resolving the conflict between economic growth and environmental pollution, and promoting the industrial sector to achieve a win-win outcome in both economic and environmental performance, is a critical issue that developing countries must address. For a long time, developing countries such as China have tended to rely on command-based environmental regulations to reduce pollution emissions. However, this approach is difficult to improve both economic and environmental performance simultaneously in the short term. Against the background of accelerating digital transformation, identifying the specific impact of digital inputs on industrial green transformation can help developing countries discover green transformation tools that transcend regulation, that is, using digital inputs to achieve a win-win situation for both economic and environmental performance. This holds significant importance for developing countries. On the other hand, under the goal of industrial green transformation, this paper’s analysis of inter-industry spillover effects not only complements existing research on the environmental impacts of digital inputs but also provides important policy implications for assisting developing countries in formulating appropriate digital input strategies based on their industrial structures and development stages.

In view of this, this paper discusses the driving effect of digital inputs on industrial green transformation based on the dual perspectives of intra-industry impacts and inter-industry spillover effects. Specifically, in terms of intra-industry impacts, based on a unique micro enterprise panel data set, that combining “Chinese Industrial Enterprise Database—China’s Input-output Table—Chinese Industrial Enterprise Pollution Emissions Database”, this paper uses a high-dimensional fixed effects model to empirically test the intra-industry impacts and mechanisms of digital inputs on industrial green transformation. The results show that digital inputs can effectively drive the industrial green transformation of the intra-industry. At the same time, this driving effect exhibits heterogeneity across different enterprise sizes, ownership structures, and pollution emission intensities. The driving effects of digital inputs on industrial green transformation are more obvious in large enterprises, non-foreign-invested enterprises, and high-pollution-emission industries. The enterprise entry and enterprise exit are the mechanisms that generate intra-industry impacts of digital inputs driving industrial green transformation, digital inputs is conducive to the entry of new enterprises with high efficiency and low pollution into the market, and force inefficient and highly polluting enterprises to exit the market, thereby effectively optimizing the market structure and promoting the green transformation within the industry. In terms of inter-industry spillover effects, based on a relatively robust construction of forward and backward industrial correlation coefficients, this paper further empirically tests the inter-industry spillover effects of digital inputs on industrial green transformation. The results show that, there are obvious differences between forward and backward inter-industry spillover effects of digital inputs driving industrial green transformation. The use of digital inputs in this industry cannot effectively promote the green transformation of downstream related industries through a “supply-led” approach, but it can spillover the promotional effect of digital inputs on green transformation to upstream industries through a “demand-driven” approach. On this basis, this paper further identifies the mechanism of inter-industry spillover effects, in a “demand-driven” scenario, capital renewal and technological progress in upstream related industries are the key mechanisms for realizing the inter-industry spillover effects of digital inputs on industrial green transformation. From the perspective of capital renewal, the use of digital inputs in this industry can force upstream related industries to renew their capital, thereby realizing the driving force of digital inputs for industrial green transformation to spillover to upstream related industries. From the perspective of technological progress, the use of digital inputs in this industry can force upstream related industries to achieve technological progress. On the one hand, digital inputs, including digital hardware and software inputs, has a significant driving effect on neutral technological progress in upstream related industries. On the other hand, digital inputs, especially digital software inputs, can effectively reduce the proportion of industrial pollution and capital inputs in upstream related industries, which means that it can drive upstream related industries to achieve biased technological progress in replacing industrial pollution with capital. These conclusions provide empirical evidence and policy references for using digital inputs to reduce industrial pollution emissions and promote industrial green transformation.

The contributions of this paper to the existing literature are as follows: (1) In terms of marginal contribution from the research perspective, this paper breaks through the single perspective of existing literature focusing on intra-industry impacts. Most of the existing literature on digital input driving industrial green transformation focuses on intra-industry effects (Zhang and Yu, 2023; Hu and Yang, 2024), but fails to fully consider the inter-industry spillover effects caused by enhanced industrial correlation factors in the context of digital economic development. This paper not only examines the intra-industry impact of digital inputs on industrial green transformation but also introduces industrial correlation factors to explore and test the inter-industry spillover effects of digital inputs on the upstream and downstream industries’ green transformation. Therefore, this paper complements existing literature in its research perspective. (2) In terms of the marginal contribution of the research content, this paper deepens the academia’s understanding of the mechanisms and heterogeneous effects in digital inputs driving industrial green transformation. On the one hand, existing literature often focuses on mechanisms such as technological innovation to explain intra-industry impacts (Hu and She, 2022; Xiao et al., 2023). This paper focuses on market mechanisms involving enterprise entry and exit to explain the mechanisms of intra-industry impacts of digital inputs, which deepens the existing literature’s understanding of the mechanisms of digital inputs in driving industrial green transformation. Meanwhile, the results of the heterogeneity analysis in this paper also reveal the asymmetric driving effect of digital inputs on industrial green transformation, which also enriches the findings of existing literature. On the other hand, regarding inter-industry spillover effects, this paper first identifies the heterogeneity between the forward and backward spillover effects of digital inputs driving industrial green transformation, and then, focusing on the capital renewal and technological progress, discusses the transmission paths of inter-industry spillover effects. This provides a new explanation for the generation of environmental effects in the digital economy. (3) In terms of marginal contribution to policy reference, the findings on inter-industry spillover effects in this paper provide a basis for developing countries to formulate rational digital input strategies. Under the analysis framework of industrial connection, this paper identifies the difference between the forward and backward spillover effects of digital inputs driving industrial green transformation. It was found that the use of digital inputs in this industry cannot effectively promote the green transformation of downstream related industries through a “supply-led” approach, but it can spillover the promotional effect of digital inputs on green transformation to upstream industries through a “demand-driven” approach. This finding provides a basis for developing countries to formulate differentiated digital input strategies and digital transformation approaches according to their own industrial structures under the goal of industrial green transformation.

The remainder of this study is organized as follows: Section 2 provides a theory analysis, and Section 3 details the research design, including the model design, the core variable selection, and the data and sample selection. Section 4 presents the empirical analysis results and discussion. Finally, Section 5 summarizes the main conclusions and proposes policy recommendations for using digital inputs to promoting industrial green transformation.

2 Theoretical analysis

Digital inputs is a specialized concept derived from the digital economy, how to define the concept of digital input has received extensive attention from the academia. The existing literature generally defines digital inputs as the aggregate of digital intermediate products utilized by the industrial sector in production, encompassing both digital hardware equipment and digital software services (CAICT, 2017; Zhang and Yu, 2020; Zheng, 2020). Specifically, it covers digital hardware equipment such as communication devices, computers, and servers, while also including digital software services like information technology services and computer software (Wang et al., 2020; Chen and Yang, 2021). Therefore, this paper follows the representative approach adopted in existing literature and defines digital inputs as: digital intermediate products used in industrial production, including digital hardware such as communication equipment, computers, and servers, as well as digital software services such as information technology services and computer software.

This paper aims to examine the impact of digital inputs on industrial green transformation from two perspectives: intra-industry impacts and inter-industry spillover effects. Figure 1 illustrates the analytical framework of this study. Based on this framework, five hypotheses are proposed.

2.1 The intra-industry impact of digital inputs on industrial green transformation

As a digital intermediate product represented by digitized production equipment and technical services used in industrial production, digital inputs are rich in digital technologies, which are characterized by high technology content and low environmental costs (Lyu et al., 2024). This implies that digital inputs generate relatively limited pollution emissions during the production process, thereby enabling increased productivity while reducing environmental impact.

From the viewpoint of the connotative requirements of industrial green transformation and the characteristics of digital inputs, the theoretical logic of intra-industry impact of digital inputs driving industrial green transformation can be explained from the perspectives of enterprise inputs and enterprise outputs. On the one hand, in terms of enterprise inputs, the increased utilization of digital inputs by micro enterprises within the industrial sector will change the allocation structure of primary and advanced factors in the production process. This implies a relative increase in the proportion of advanced factors, which is undoubtedly in line with the overall logic of industrial transformation and upgrading. At the same time, the information-intensive and technology-intensive characteristics of digital inputs their ability to drive the transformation of the industrial sector from the traditional production mode of high input, high energy consumption and high pollution to the low pollution, low energy consumption and high efficiency production mode (Dai and Yang, 2022). On the other hand, in terms of enterprise output, the information-intensive and technology-intensive characteristics of digital inputs mean that they can effectively improve the efficiency of information collection and integration in industrial enterprises, thereby facilitating the development of new products with higher technological complexity (Zhang et al., 2018). At the same time, traditional industrial production methods mainly rely on engineers to manually control and coordinate various subsystems, which cannot avoid problems such as slow response and control delays, thus resulting in energy wastage and pollution emissions during scheduling intervals. The use of the digital inputs represented by digital hardware equipment and digital software can reverse the traditional manually control mode into standardized and precise control, while the improvement of data transmission and data processing capability means faster response speed and shorter control interval, which ultimately realizes efficiency enhancement, energy saving and pollution control.

The mechanism of intra-industry impact in digital inputs driving industrial green transformation is also a key focus of this paper. In a competitive market, enterprise entry and enterprise exit are important feature of the market mechanism (Hopenhayn, 1992). Under intense market competition, the turnover of old and new enterprises enabled efficient enterprises to survive, while inefficient enterprises are eliminated, and this enterprises entry and exit mechanism provides the source and power for economic growth (Jaef, 2018; Asturias et al., 2023). In fact, in addition to the above growth mechanisms, the entry and exit of enterprises are also the key reasons for the changes in the level of green development of enterprises and even the total industry (Cherniwchan, 2017). Logically, the entry-exit mechanism can force high polluting enterprises, high energy-consuming enterprises, and low productivity enterprises to leave the market through the “low-pollution screening effect”, while allowing new enterprises with higher productivity and lower energy-consumption and pollution to enter the market, thus increasing the proportion of high productivity, low energy-consuming and low polluting enterprises in the market.

In terms of the enterprises entry and exit mechanism of intra-industry impacts of digital inputs driving industrial green transformation. On the one hand, digital inputs can provide entrepreneurial opportunities through knowledge spillovers and optimize the allocation of factors, and enrich entrepreneurial resources by accelerating the dissemination of information and ideas, which in turn is conducive to new enterprises’ innovative entrepreneurship and entry into the market (Zhao et al., 2020). Specifically, based on big data and other digital technologies, digital inputs provide a convenient information exchange platform for start-up enterprises, which is conducive to the collection of market demand information before enterprises start their businesses (Jensen, 2007), and thus provides a source and basis of information for decision-making in entrepreneurial activities. At the same time, the traditional production and management model face challenges in matching market supply and demand due to factors such as information redundancy. Digital inputs relying on emerging digital technologies such as cloud computing and big data provide an optimization path for the matching market supply and demand (Wang et al., 2024). Therefore, from the perspective of information search and supply-demand matching in entrepreneurship, digital inputs reduce the threshold of new enterprises entering the market, which is conducive to promoting entrepreneurial activities and enabling enterprises to accelerate their entry into the market.

On the other hand, the use of digital inputs will also lead to inefficient enterprises exit market (Zhao et al., 2023). When industrial enterprises increase the utilization of digital inputs, the knowledge spillover and information communication channels of digital inputs will increase the internal management efficiency of enterprises, which will give them an advantage in the market competition, and this process will put industrial enterprises that do not utilize digital inputs at a competitive disadvantage. At the same time, the utilization of digital inputs by enterprises makes the marginal cost lower (Peng and Tao, 2022), and industrial enterprises tend to expand the production scale to continuously reduce the long-term average cost and realize the increasing returns to scale (Chen et al., 2022), which further squeezes the survival space of inefficient enterprises and forces them to exit market. Therefore, in the era of digital economy, digital inputs can promote high productivity, low energy-consuming and low polluting enterprises entry market and force low productivity enterprises to exit market through the “selection effect” of the entry and exit mechanism, so as to optimize the market structure and drive industrial green transformation.

Based on the above analysis, this paper puts forward the following theoretical hypotheses.

Hypothesis 1. In terms of intra-industry impacts, digital inputs can promote intra-industry green transformation.

Hypothesis 2. In terms of intra-industry impacts, enterprise entry and exit is the mechanism that digital inputs drive the industrial green transformation.

2.2 The inter-industry spillover effect of digital inputs on industrial green transformation

From the perspective of industrial correlation theory, with the gradual development of social division of labor, economic and technical links between different industrial sectors are becoming increasingly close. Each industrial sector needs to use the output of other sectors as intermediate inputs for production, while providing its own output as intermediate inputs to other sectors. This input-output relationship undoubtedly strengthens the economic and technical links between various industrial sectors, thereby leading to inter-industry spillover effects. The existence of inter-industry spillover effects also means that changes in the production methods and processes of a particular industrial sector will have an impact on other industrial sectors (Dai and Yang, 2022). Therefore, digital input not only improves the production processes of the industry itself, but also affects the production processes of enterprises in other upstream and downstream industries through inter-industry spillover effects, thereby promoting the green transformation of upstream and downstream industries.

Depending on the direction of spillover, inter-industry spillover effects can be categorized into forward inter-industry spillover effects and backward inter-industry spillover effects. Specifically, on the one hand, from the perspective of forward inter-industry spillover effects, upstream industrial sectors utilize digital inputs to improve production processes, greatly improving their own production efficiency. At this time, the intermediate products and services it provides to downstream industries will incorporate richer digital technologies. This “supply-led” approach will further encourage downstream industries to enhance their production processes, thereby advancing their own green transformation while simultaneously promoting the green transformation of downstream industries. Meanwhile, it is important to note that from the analytical framework of technology spillovers and technology absorption, when upstream industries use digital inputs to improve production processes, the intermediate products they supply to downstream industries will be rich in digital technologies. This creates direct digital technology and knowledge spillovers to downstream industries (Gao et al., 2022), thereby empowering their digital transformation and energy conservation and pollution reduction efforts (Gu, 2022). However, this “supply-led” process may be disrupted by the technological absorption capacity of downstream industries (Wang and Li, 2024). When downstream industries have low technological absorption capacity, even if they utilize intermediate products rich in digital technology from upstream industries, they will be unable to effectively transform digital technology into enterprise productivity due to their own lack of technological absorption capacity and thereby achieve a green transformation. Therefore, whether digital inputs can generate forward inter-industry spillover effects for industrial green transformation remains to be empirically verified.

On the other hand, from the perspective of backward inter-industry spillover effects, downstream industrial sectors may also spill over the green transformation effects of digital inputs to upstream industries through “demand-driven” means. If downstream industries make full use of digital inputs to transform their production processes and achieve a green transformation, their demand for green intermediate products and services should increase accordingly. At this point, upstream industries that supply intermediate products and services will be forced to renew their capital and innovate their technologies in order to meet the demand for green intermediate inputs and services from downstream industries, thereby improving production processes and achieving a green transformation. Therefore, the impact of digital inputs on industrial green transformation may spillover to upstream industries through “demand-driven” forces.

Based on the above analysis, this paper proposes the following theoretical hypothesis.

Hypothesis 3. In terms of inter-industry spillover effects, the impact of digital inputs on industrial green transformation may spillover to downstream and upstream industries through “supply-led” and “demand-driven” approaches.

Meanwhile, as mentioned in the earlier analysis of backward industrial spillover effects, under a “demand-driven” scenario, upstream industries that supply intermediate inputs and services will be forced to renew their capital and innovate their technologies in order to meet the new demand for intermediate products and services from downstream industries, thereby improving their own production processes and achieving a green transformation. Therefore, digital input drives capital renewal and technological innovation in upstream related industries, which may constitute the mechanism for generating backward industrial spillover effects.

Specifically, from the perspective of digital inputs driving capital renewal in upstream industries, digital inputs are rich in digital technologies. When an industry increases its digital inputs, it inevitably optimizes its production processes, that is replacing traditional production methods with more advanced technologies to make production processes greener and more sustainable. In this process, the industry’s demand for intermediate products from upstream related industries should also change accordingly. At this point, if upstream related industries still fail to upgrade their machinery and equipment, their product upgrade speed may be affected by outdated production equipment, making them unable to meet the new demands for digitalization and greening of intermediate products from downstream related industries that have already used digital inputs to transform their production processes. Therefore, upstream related industries will be forced by “demand pressure” to continuously update their production equipment, which will not only meet the new demand for intermediate products from downstream related industries, but also help them improve production efficiency and reduce energy consumption and emissions, thereby spillover the promotional effect of digital inputs on industrial green transformation to upstream related industries.

Based on the above analysis, this paper proposes the following theoretical hypothesis.

Hypothesis 4. In the context of “demand-driven”, the capital renewal in upstream industry is one of the mechanisms that generates backward industrial spillover effects.

At the same time, from the perspective of digital input promoting technological progress in upstream related industries, when an industry increases its digital inputs, its production processes will change accordingly, and at this point, the demand for intermediate products supplied by upstream related industries will also change. In this “demand-driven” scenario, upstream related industries will be forced to develop new products to meet the new demand for intermediate products from downstream industries, and this process will be accompanied by technological progress in upstream related industries. Therefore, technological progress may also be one of the mechanisms by which digital input achieves inter-industry spillover effects.

Based on the above analysis, this paper proposes the following theoretical hypothesis.

Hypothesis 5. In the context of “demand-driven,” the technological progress in upstream industry is one of the mechanisms that generates backward industrial spillover effects.

3 Research design

3.1 Model design

3.1.1 Regression model for the intra-industry impacts

In order to identify the intra-industry impacts of digital inputs on industrial green transformation, this paper draws on Chen (2020) to construct the following high-dimensional fixed effects model (as shown in Equation 1):

In Equation 1, the subscript

It should be specifically noted that these fixed effects at different levels include: individual fixed effects, year fixed effects, industry category fixed effects, province fixed effects, industry subcategory fixed effects, and their interaction fixed effects. We included the province fixed effect because extensive research indicates that regional endowment characteristics influence enterprise production and operations (Zhou and Fang, 2019; Liu and Tao, 2021). Additionally, we observed instances where some enterprises changed their registered locations during the sample period. Therefore, introducing the province fixed effect is needed to eliminate the potential interference of these factors on the regression results (Zhao et al., 2021; Yuan et al., 2021). From the difference between industry category fixed effects and industry subcategory fixed effects, under China’s industry classification standards, industry categories generally refer to two-digit industries, while industry subcategories typically denote three-digit industries under two-digit industries. Industry category fixed effects and industry subcategory fixed effects correspond to the fixed effects of two-digit industries and three-digit industries, respectively.

3.1.2 Regression model for the inter-industry spillover effects

Referring to Wang and Dong (2020), this paper designs the following regression model to identify the inter-industry spillover effect of digital inputs on industrial green transformation (as shown in Equations 2, 3).

Equation 2 is used to estimate the forward inter-industry spillover effect of digital inputs on industrial green transformation; Equation 3 is used to verify the backward inter-industry spillover effect of digital inputs on industrial green transformation.

In Equations 2, 3,

3.2 Core variable selection

3.2.1 Core explanatory variable: digital inputs

Existing literature mostly measures the level of digital inputs from two perspectives: the overall industry in each region and the two-digit industries in China’s industry. These measures only reflect the average level of digital inputs in a particular region or industry, and cannot reflect the heterogeneous characteristics of micro enterprises in terms of digital inputs utilization. In view of this, this paper draws on the approach of Dai and Yang (2022) to estimate the level of digital inputs at the micro enterprise level.

Specifically, first, we follow the representative approach in existing literature by using China’s input-output tables and their extended tables as the basic data to calculate the complete consumption coefficient of digital inputs for each two-digit industry in China (Yang and Fan, 2020; Wang and Cheng, 2023; Li and Zhang, 2024; Yang and Jiang, 2025). It is important to note that, how to accurately define the digital industry is the basis for calculating the complete consumption coefficient of digital inputs. However, China’s input-output tables do not explicitly identify the digital industry. By reviewing the literature on digital inputs, it can be found that, existing literature generally defines the concept of digital inputs as: digital intermediate products used in industrial production (CAICT, 2017; Zhang and Yu, 2020; Zheng, 2020), including digital hardware such as communication equipment, computers, and servers, as well as digital software services such as information technology services and computer software (Wang et al., 2020; Chen and Yang, 2021). Meanwhile, existing literature argues that under Chinese industry classification standards (GB/T 4754-2002), digital hardware equipment such as communication devices, computers, and servers typically come from the “manufacturing of communication equipment, computers, and other electronic equipment”, while digital software services like information technology services and computer software come from the “information transmission, software, and information technology services” (Wang et al., 2020). Therefore, following the general approach in existing literature, this paper defines the digital industry as encompassing “manufacturing of communication equipment, computers, and other electronic devices” and “information transmission, software, and information technology services.” Based on this, the complete consumption coefficient for digital inputs for each industry can be calculated. In addition, missing values for intermediate years are filled in using the “equalization assumption”. The “equalization assumption” is a widely adopted assumption in industrial economics. Chen et al. (2017) and Wang and Dong (2020) argue that the input-output relationships between industries are relatively fixed in the short term, so it is reasonable to use the “equalization assumption” to fill in the gaps in the intermediate years for which China’s Input-output Table have not been published.

On this basis, we match the calculated complete consumption coefficient data with micro enterprise data according to the industry code, and refer to the representative practices of Zhang and Yu (2021) and Dai and Yang (2022) to approximately measure the heterogeneity of digital input levels among enterprises based on the per capita capital level of enterprises (as shown in Equation 4), thereby obtaining the digital input data at the enterprise level. The logic behind this approach is that digital transformation requires significant upfront investment. Zhang and Yu (2021) argue that for enterprises in the same industry, the larger the per capita capital stock, the stronger the foundation for digital transformation, which is more conducive to increasing digital inputs.

In Equation 4,

3.2.2 Explained variable: industrial green transformation

In order to characterize the industrial green transformation at the enterprise level, this paper draws on Chen (2020) and uses the SO2 emission intensity of industrial enterprises to measure industrial green transformation at the enterprise level. The reason is that the industrial green transformation emphasizes balancing industrial output and pollution emissions in the production process, that is, emphasizing the reduction of undesirable outputs such as SO2 emissions while increasing desired outputs. Therefore, it is logically consistent with the SO2 emission intensity of industrial enterprises.

At the same time, micro enterprise data contains relatively rich data relevant to calculating the SO2 emission intensity of industrial enterprises, which is conducive to empirical research. Therefore, this paper calculates the SO2 emission intensity of industrial enterprises based on Equation 5 and uses it as a proxy variable for the industrial green transformation at the enterprise level.

In Equation 5,

3.2.3 Forward and backward industrial correlation coefficients

How to clearly characterize industrial correlation coefficients is the basis and difficulty of identifying the inter-industry spillover effects of digital inputs on industrial green transformation.

Existing literature argues that, based on the direction of transmission to downstream and upstream industries, inter-industry spillovers can be further divided into forward inter-industry spillovers and backward inter-industry spillovers (Yang and Fan, 2020).

Forward inter-industry spillovers refer to the digital transformation of an industry, which can lead to changes in the production behavior of downstream industries by providing intermediate products. Backward inter-industry spillovers refer to the digital transformation of an industry, which can lead to changes in the production behavior of upstream industries by increasing the demand for intermediate products.

Drawing on the methods of Acemoglu et al. (2016) and Autor and Salomons (2018), this paper separately sets the forward industrial correlation coefficient

Equations 6, 7 respectively describe the calculation methods for the forward industrial correlation coefficient

It should be specifically noted that the time span of the research sample in this paper covers the period from 2001 to 2013, encompassing five annual Chinese input-output tables from 2002, 2005, 2007, 2010, and 2012. Since China’s input-output tables are not published annually, this paper follows the common practice in existing literature by employing the “equalization assumption” to fill in the industrial correlation coefficients for missing years. Specifically, following the methodology of Chen and Liu (2014), 2001–2002 data were supplemented using industrial interconnection coefficients calculated based on China’s 2002 input-output tables, while 2003–2005 data were supplemented using coefficients calculated based on China’s 2005 input-output tables. for 2006–2007, the industrial correlation coefficients were supplemented using calculations based on the 2007 China Input-Output Table; for 2008–2010, the industrial correlation coefficients were supplemented using calculations based on the 2010 China Input-Output Table; and for 2011–2013, the industrial correlation coefficients were supplemented using calculations based on the 2012 China Input-Output Table.

Admittedly, during the sample period, input-output relationships between industries may undergo changes, and the “equalization assumption” cannot fully capture such variations. However, it is worth noting that this paper only uses the “equalization assumption” to fill in the industrial correlation coefficients during the short-term interval when China’s input-output tables are unavailable. Moreover, based on existing literature, on the one hand, Ping (2005), Chen and Liu (2014), and Chen et al. (2017) argue that input-output relationships between industries remain relatively fixed in the short term. Therefore, the “equalization assumption” can be used to approximate and supplement short-term data gaps. On the other hand, Acemoglu et al. (2016), Wang and Dong (2020), and Zhao and Gu (2023) proposed in their inter-industry spillover analyses that, in the short term, fixed industrial correlation coefficients are more conducive to clearly identifying the impact of economic variable’s intra-industry fluctuations on upstream and downstream sectors. Applied to this paper, this means it is more conducive to identifying the impact of changes in digital inputs within the industry on the industrial green transformation of upstream and downstream sectors. Therefore, the “equalization assumption” is acceptable for this paper, and it is also a widely accepted practice in academia.

Based on this, this paper adopts the methodology of the above literature, employing the “equalization assumption” in the analysis of inter-industry spillover effects.

3.3 Data and sample

The enterprise-level production and operation data used in the empirical analysis in this paper are from the Chinese Industrial Enterprise Database from 2001 to 2013. At the same time, we refer to the approach of Brandt et al. (2012) to clean up the Chinese Industrial Enterprise Database: ① Remove observation samples with industrial sales output value less than 10 million yuan and fewer than 30 employees at the end of the year; ② Observation samples with fixed assets less than 0, total assets less than current assets, and total assets less than fixed assets were excluded; ③ Observation samples with accumulated depreciation less than current depreciation were excluded; ④ Observation samples of enterprises established before 1949 and after 2013 were excluded.

On this basis, based on China’s two-digit industry codes, the digital inputs data calculated from China’s Input-output Table for 2002, 2005, 2007, 2010, and 2012 was matched with the Chinese Industrial Enterprise Database to obtain the “Chinese Industrial Enterprise Database—China’s Input-output Table” panel dataset.

Furthermore, in order to observe the industrial green transformation at the enterprise level, this paper further introduces the Chinese Industrial Enterprise Pollution Emission Database, match with “Chinese Industrial Enterprise Database—China’s Input-output Table” panel data set. The Chinese Industrial Enterprise Pollution Emission Database covers industrial enterprises that account for more than 85% of the total pollution emissions in various regions of China. It records basic information on each enterprise, including the enterprise legal person code and enterprise name, as well as detailed pollutant emission indicators, and is considered to be the most comprehensive and reliable micro environmental data in China at present (Chen and Chen, 2019).

Specifically, this paper draws on the approach of Chen (2020) and combines the “Chinese Industrial Enterprise Database—China’s Input-output Table” panel data with the Chinese Industrial Enterprise Pollution Emission Database based on the unique identification code formed by the enterprise identity information, thereby obtaining a micro enterprise panel data set of “Chinese Industrial Enterprise Database—China’s Input-output Table—Chinese Industrial Enterprise Pollution Emissions Database”,that can empirically test the intra-industry impacts and inter-industry spillover effects of digital inputs on industrial green transformation.

4 Empirical analysis

4.1 Empirical analysis of intra-industry impacts

To examine the intra-industry impacts of digital inputs on industrial green transformation, this paper uses the “Chinese Industrial Enterprise Database—China’s Input-output Table—Chinese Industrial Enterprise Pollution Emissions Database” micro enterprise panel data set for empirical testing.

4.1.1 Basic results

Table 1 reports the basic regression results based on Equation 1, which are used to identify the intra-industry impacts of digital inputs on industrial green transformation. Columns (1) to (4) in Table 1 report the regression results of digital inputs and SO2 emission intensity, the SO2 emission intensity here is calculated based on industrial output value. First, following the approach of Dai and Yang (2022), we added only industry fixed effects and year fixed effects to the regression equation [as shown in Column (1)] to more directly examine the intra-industry impacts. It can be found that, the estimated coefficient of digital inputs (DIG) is significantly negative at the 1% statistical significance level, indicating that the use of digital inputs by industrial enterprises effectively reduces the SO2 emission intensity of industrial enterprises, that is, digital inputs will drive enterprises within the industry to achieve industrial green transformation. After that, to further control for potential unobserved factors associated with changes in year, region, and industry, column (2) to (3) retains the above fixed effects and introduces individual fixed effects, provincial fixed effects and industry subcategory fixed effects. At this point, the estimated coefficient of digital inputs (DIG) is significantly negative, and its statistical significance is not reduced. Column (4) introduces interaction fixed effects between year and province, province and industry category, and year and industry category. Under these stricter controls, the estimated coefficient of digital inputs (DIG) did not change significantly, further indicating that the intra-industry impact of digital inputs driving industrial green transformation is clearly significant.

To enhance the robustness of the basic results, we re-estimated by recalculating the explained variable, which uses industrial added value to calculate SO2 emission intensity, columns (5) to (8) in Table 1 further report the regression results. The results show that under the introduction of fixed effects at different levels, the estimated coefficient of digital inputs (DIG) is still significantly negative, which further illustrates that digital inputs have a real effect on reducing the SO2 emission intensity of industrial enterprises, indicating that digital inputs can effectively drive industrial enterprises to achieve green transformation.

4.1.2 Robustness test

To further enhance the robustness of the basic results, this paper conducts robustness tests in the following aspects: sensitivity analysis, re-estimation of industry-level data, endogeneity treatment, exclude outliers, and sample selection bias treatment.

4.1.2.1 Sensitivity analysis: replacing the explained variable

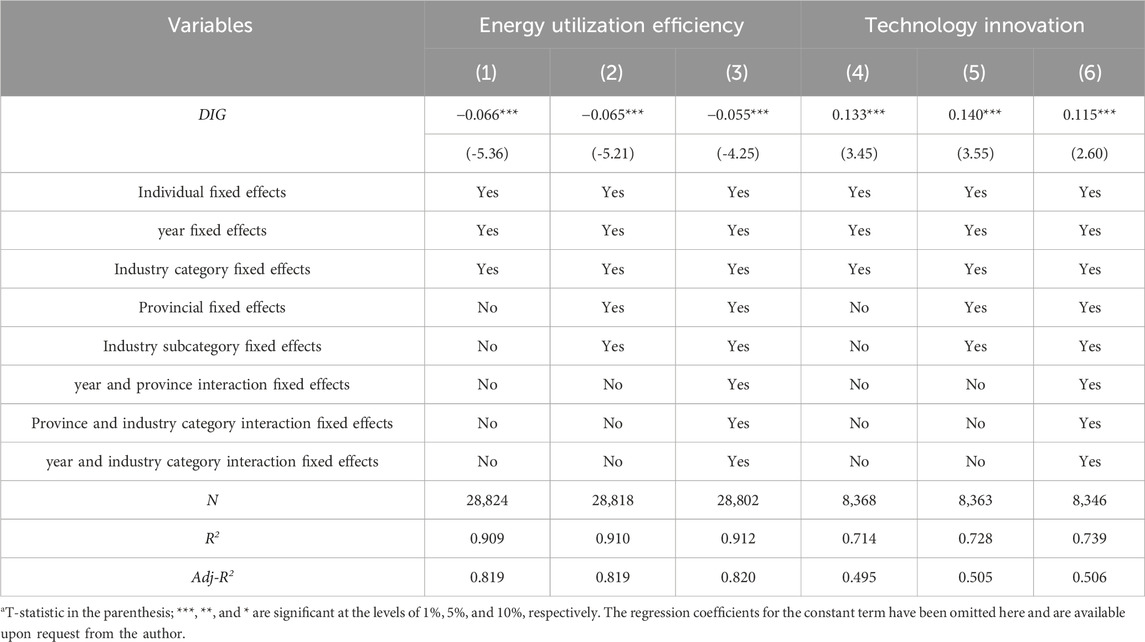

Energy utilization efficiency improvement and technology innovation are important evaluation dimensions for industrial green transformation. To enhance the robustness of empirical results, this paper conducts sensitivity analysis by regressing energy utilization efficiency and technological innovation as new explained variables.

In terms of energy utilization efficiency, the scarcity of indicators measuring energy utilization in the Chinese Industrial Enterprise Pollution Emissions Database poses a challenge for characterizing enterprise-level energy utilization efficiency in the robustness test. From the perspective of China’s industrial development, the dependency and consumption of fossil fuels—particularly coal resources—have been major contributors to industrial pollution emissions. Industrial green transformation, which takes energy efficiency improvement as a key evaluation dimension, requires industrial enterprises to efficiently utilize coal and other fossil fuels in their production processes. Based on the above logic, this paper employs coal consumption per unit of industrial output as the explained variable to conduct sensitivity analysis, thereby enhancing the robustness of the empirical results. Column (1) to Column (3) in Table 2 report the sensitivity analysis results with energy utilization efficiency as the explained variable. It can be observed that, under the condition of adding fixed effects at different levels, digital inputs significantly reduce coal consumption per unit of industrial output in industrial enterprises. This indicates that digital inputs can effectively enhance the energy utilization efficiency of industrial enterprises.

In terms of technology innovation, since Panayotou’s (1993) pioneering research, the existing literature has fully affirmed the positive role of technology innovation in industrial green transformation. On this basis, Acemoglu et al. (2012) further distinguished the heterogeneous effects of technology progress on environmental quality. The results indicate that both neutral technology innovations and environmentally friendly technology innovations play a significant role in industrial green transformation (Dong et al., 2014). Therefore, to verify the intra-industry impacts of digital inputs on industrial green transformation from multiple dimensions, this paper conducts a sensitivity analysis using technology innovation as a new dependent variable. Considering the limitations of available indicators in the Chinese Industrial Enterprise Database, this paper uses the proportion of new product output value to total output value as a proxy variable for technology innovation and regresses it against digital input. Columns (4) to (6) in Table 2 report regression results with technology innovation as the explained variable. It can be observed that digital inputs significantly increase the proportion of new product output value in the total output value of industrial enterprises. This indicates that digital inputs significantly promote technology innovation in industrial enterprises, further reflecting the robustness of the basic results.

4.1.2.2 Extending the sample time span: re-estimation of industry-level data

The previous empirical analysis primarily relied on the “Chinese Industrial Enterprise Database—China’s Input-Output Table—Chinese Industrial Enterprise Pollution Emissions Database” micro enterprise panel dataset. However, because of the Chinese Industrial Enterprise Database and Chinese Industrial Enterprise Pollution Emissions Database have not released relevant enterprise-level data beyond 2014, and the quality of 2014 enterprise data has been questioned by scholars. Therefore, the empirical analysis in this paper primarily focuses on the period from 2001 to 2013, following China’s accession to the WTO. This approach aims to ensure the highest possible data quality while minimizing the impact of significant external shocks. It is worth noting that China’s digital economy entered a period of rapid development after 2014, and the impact of digital inputs on industrial green transformation may also have significantly changed. Therefore, extending the sample time span is necessary to enhance the timeliness and robustness of the empirical results in this paper.

Due to the lack of enterprise-level data after 2014, this paper constructs an industry-level panel dataset to compensate for the problem of sample time span shortage. Considering the matching degree and completeness of industry-level data for each indicator, and excluding the overall impact of COVID-19 on industrial production after 2019, this study selects panel data from 22 two-digit industrial sectors in China from 2006 to 2019 as the research sample. Here, industry-level digital input indicators are measured by the complete consumption coefficient of digital inputs across various two-digit industries. The basic data is sourced from China’s Input-Output Tables for the years 2007, 2010, 2012, 2015, 2017, and 2018. In terms of industrial green transformation, this paper selects SO2 emission intensity as a proxy variable for industrial green transformation at the sector level. The basic data are sourced from the China Environmental Statistics Yearbook and the China Emissions Accounting Database (CEADs). To mitigate the interference of omitted variables on empirical results, this study incorporates the following control variables: (1) Per capita output, measured by dividing the value added of each industrial sector by the average annual number of employees in that sector. (2) Factor structure, measured by the ratio of capital to labor factors. (3) Industry scale, measured by the ratio of the industry’s main business income to the number of enterprises within the industry. (4) Ownership structure, measured by the proportion of main business income from state-owned enterprises within the industry relative to the industry’s total main business income. (5) Foreign capital entry, measured by the proportion of main business income from foreign-funded enterprises within the industry relative to the industry’s total main business income. (6) R&D intensity, measured by the ratio of R&D equivalent to the number of enterprises within the industry. The foundational data for relevant control variables is sourced from the Chinese Industrial Economic Statistical Yearbook and the Chinese Labor Statistical Yearbook.

On this basis, this paper constructs a “industry-time” two-way fixed effects model for empirical testing. In Equation 8, the subscript

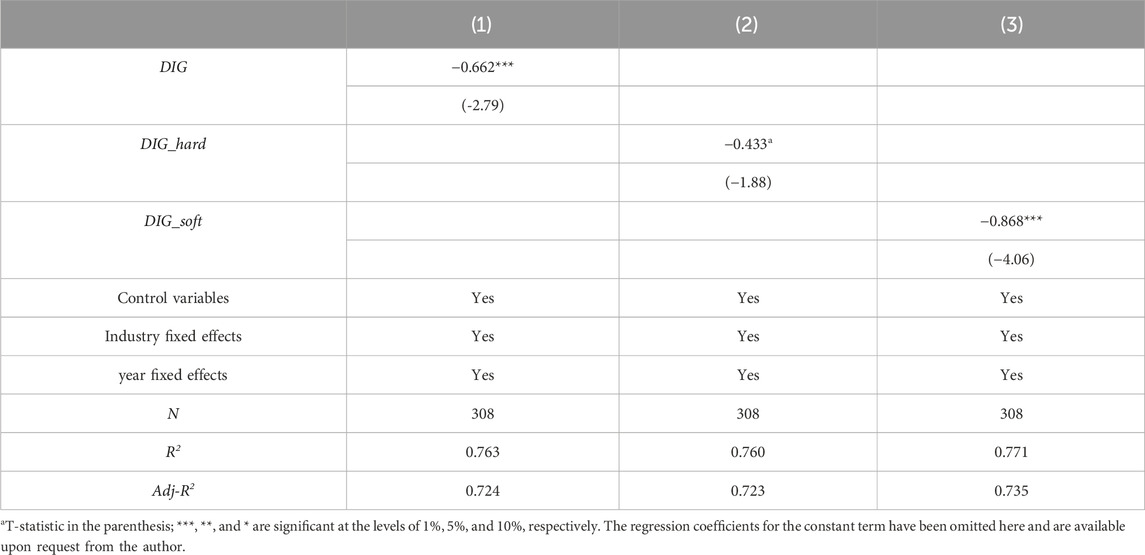

Table 3 reports the re-estimation results for industry-level data. It can be observed that the estimated coefficient for digital inputs (DIG) in Column (1) is significantly negative, indicating that digital inputs still significantly promote industrial green transformation even when extending the sample time span.

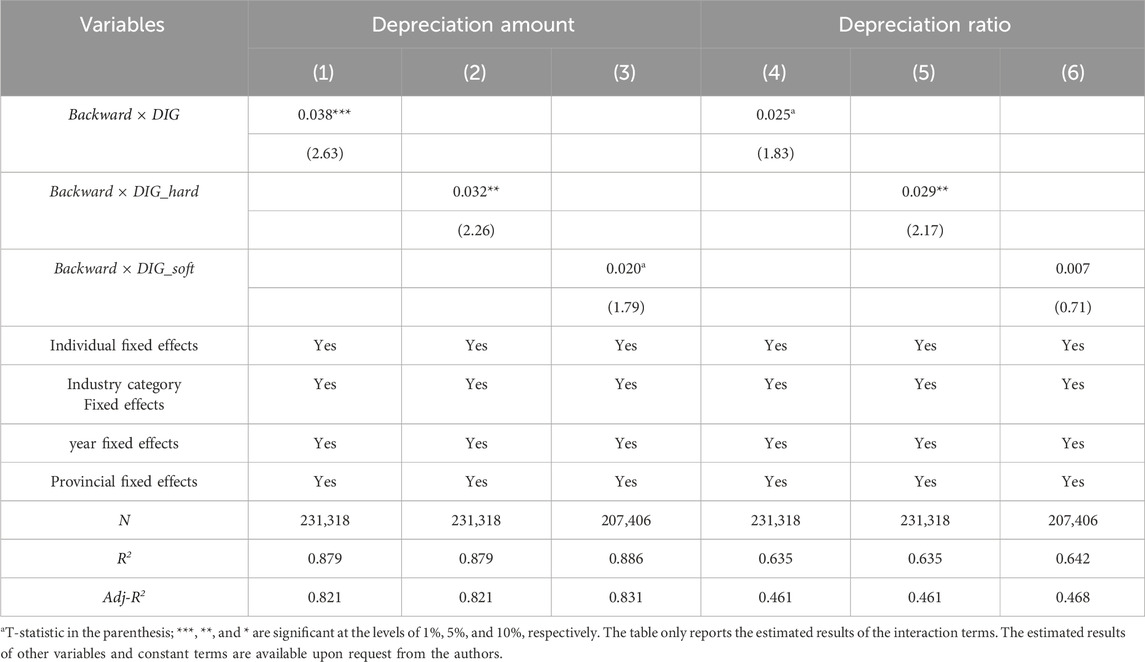

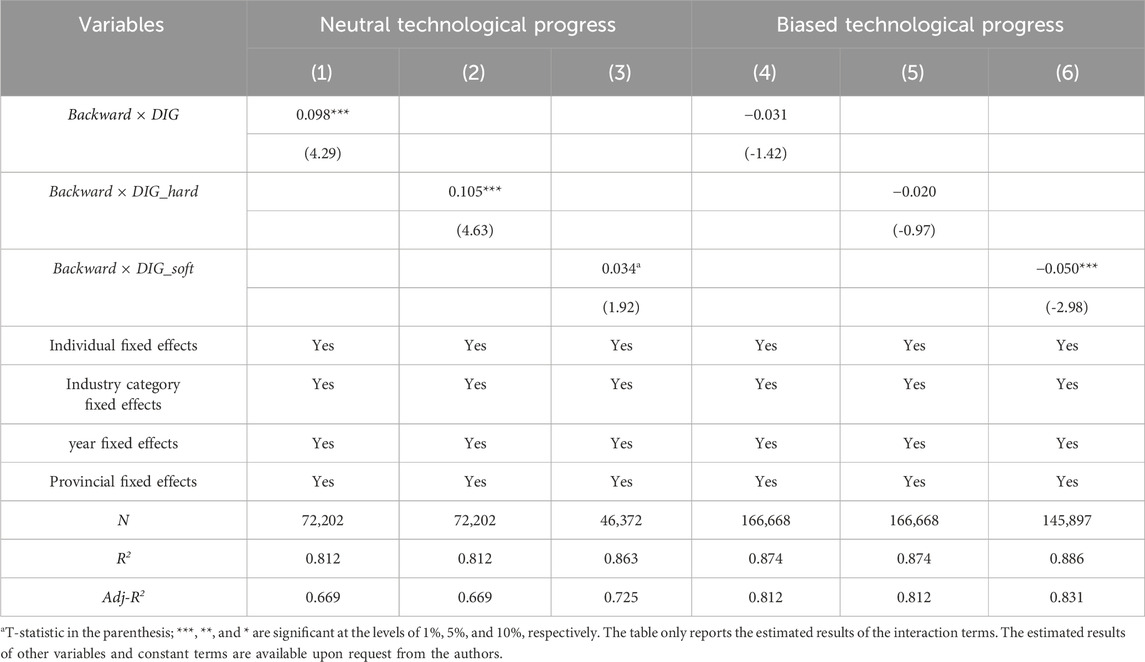

To further enhance the robustness of these results, this paper decomposes digital inputs into digital hardware inputs (DIG_hard) and digital software inputs (DIG_soft), conducting separate regressions for each. According to the definition of the digital industry outlined earlier, digital hardware inputs are measured by the complete consumption coefficient of each industry for “manufacturing of communication equipment, computers, and other electronic devices.” Digital software inputs are measured by the complete consumption coefficient of each industry for “information transmission, software, and information technology services.”

Column (2) and Column (3) report the regression results. It can be observed that both digital hardware inputs (DIG_hard) and digital software inputs (DIG_soft) contribute to promoting industrial green transformation. Moreover, compared to digital hardware inputs, digital software inputs exert a stronger driving effect on industrial green transformation. This finding may indicate that following China’s rapid development in the digital economy, the traditional input model of industrial enterprises—which prioritizes hardware over software—is undergoing a change (Pang and Liu, 2022). This is because, compared to digital hardware input, digital software input is more conducive to enhancing corporate value. On one hand, it can provide digital technology application support by mining and analyzing data; on the other hand, it can also enhance hardware functionality and expand the scope of hardware usage, thereby releasing digital dividends (Xu and Zhou, 2024).

4.1.2.3 Endogeneity treatment: instrumental variable methods

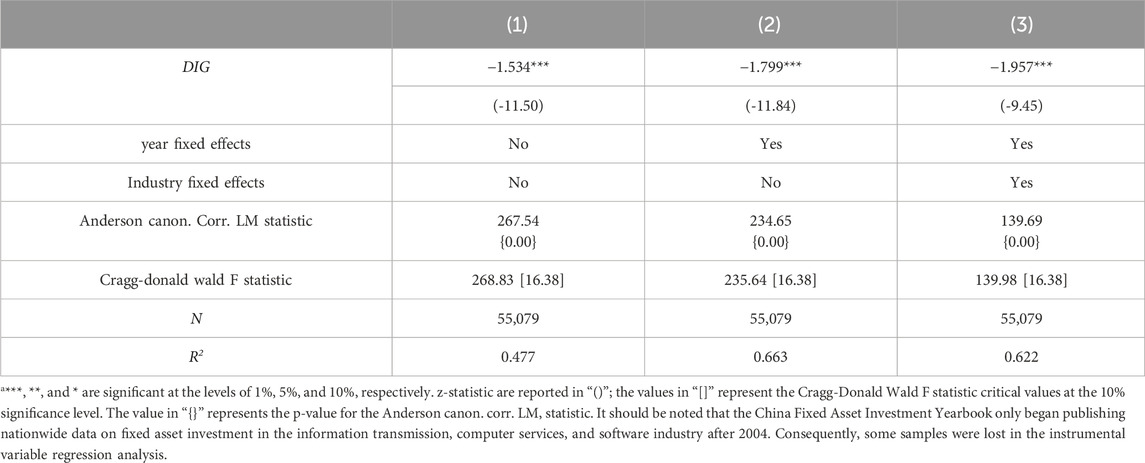

The above analysis has enhanced the robustness of the empirical results through sensitivity analysis and extending the sample time span, but it still cannot completely exclude the negative impact of endogeneity issues on the regression results. Therefore, this paper employs the instrumental variables method to further treat the endogeneity issue. However, selecting suitable instrumental variables is fundamental to treating endogeneity, and existing literature often constructs instrumental variables based on geographic characteristics, weather data, and historical data. Generally speaking, geographic characteristics, as observable variables independent of economic systems, do not change with economic development and exhibit strong exogenous properties. In line with the focus of this paper, we follow the approach of Bo and Zhang (2021) by selecting relief degree of land surface (RDLS) as an instrumental variable, which can measure regional geographic characteristics, and using a 2SLS model for estimation.

Here, the relief degree of land surface (RDLS) for each province was calculated using the measurement method provided by Feng et al. (2007). It should be noted that the relief degree of land surface (RDLS) for each province is the cross-sectional data that does not change over time, whereas the empirical research in this paper utilizes panel data that varies both across regions and over time. Consequently, there exists a challenge in matching these two types of data. To overcome this issue, Nunn and Qian (2014) proposed further constructing interactions term between time-series variables and cross-sectional instrumental variables, enabling the instrumental variables to capture dynamic characteristics across time and regions. Based on this, this paper adopts the indicator selection method proposed by Yang and Jiang (2021), interacting the relief degree of land surface (RDLS) with the time-series data of the previous year’s total fixed-asset investment in the national “information transmission, computer services, and software industry.” This approach compensates for the time-varying characteristics of cross-sectional instrumental variables. After the above processing, this paper matches and merges the instrumental variable data with the “Chinese Industrial Enterprise Database—China’s Input-Output Table—Chinese Industrial Enterprise Pollution Emissions Database” micro enterprise panel dataset based on the province where the enterprises are registered.

At the same time, it is important to note that an appropriate instrumental variable must be strictly exogenous to the explained variable while also being correlated with the core explanatory variable. Based on the theme of this paper, under strictly exogenous conditions, relief degree of land surface (RDLS) as a naturally occurring geographical characteristic, it just varies only across regions and not over time. Therefore, logically, it is unlikely to exert a direct impact on the current level of industrial green transformation. From the perspective of correlation conditions, relief degree of land surface (RDLS) will impact the cost of constructing digital infrastructure such as network base stations (Zhang and Fu, 2021). The lower the relief degree of land surface (RDLS) in a region, the more conducive it is to digital infrastructure development and digital economic growth (Bo and Zhang, 2021). In particular, this paper further introduced time-series data on total fixed-asset investment in the national “information transmission, computer services, and software industry,” which further enhances the correlation characteristics of the instrumental variables. Based on this, the relief degree of land surface (RDLS) instrumental variable constructed in this paper should satisfy the requirements for instrumental variable selection.

Table 4 reports the estimation results obtained using the 2SLS model with relief degree of land surface (RDLS) as the instrumental variable. It can be observed that, after controlling for fixed effects at different levels, the estimated coefficient for digital inputs (DIG) remains significantly negative. Furthermore, the validity test for the instrumental variable indicates that it meets the requirements. It indicates that after controlling for endogeneity issues such as reverse causality and omitted variables, digital inputs still exert a significant driving effect on the industrial green transformation.

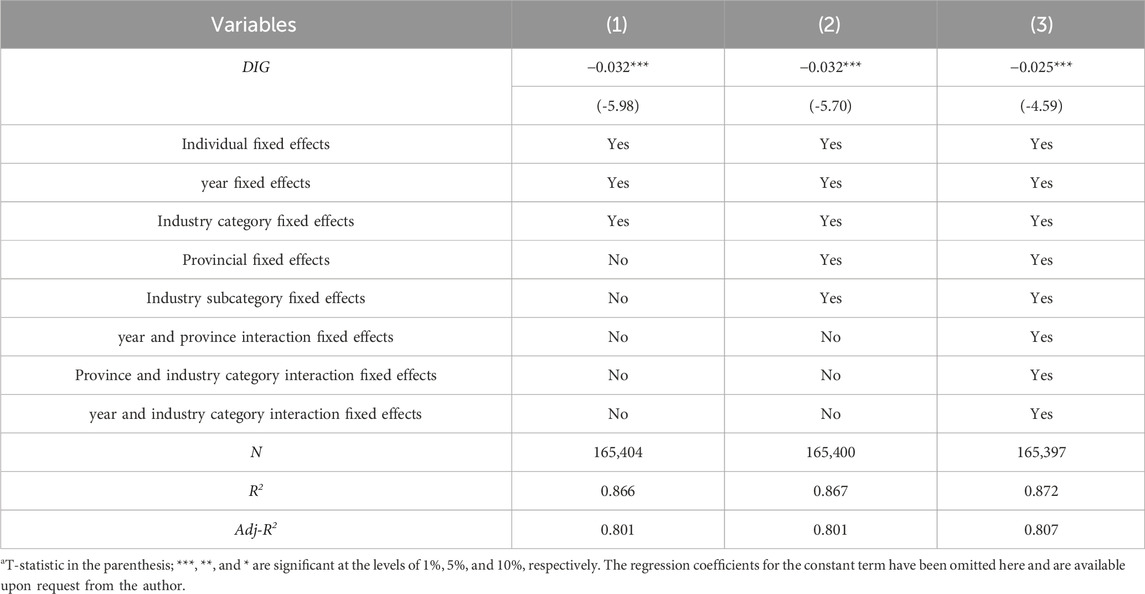

4.1.2.4 Exclude outliers: 1% and 99% quantile trimming methods

To exclude the interference of outliers on the empirical results of this paper, the quantile trimming method was employed to remove the top and bottom 1% of outliers in both the explained variable and the core explanatory variables. Columns (1) to (3) in Table 5 report the re-estimation results. It can be observed that after excluding outliers, the estimation results are not significantly changed. Digital inputs still significantly reduce the SO2 emission intensity of industrial enterprises, indicating that digital inputs contribute to achieving industrial green transformation.

4.1.2.5 Treatment of sample selection bias: heckman two-step model

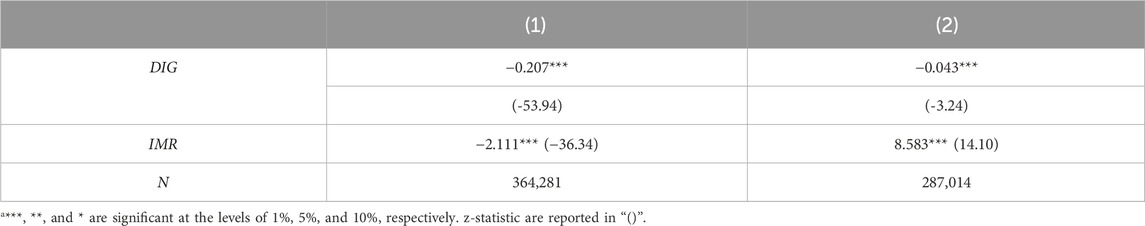

Sample selection bias may lead to endogeneity issues, causing biased model estimates, particularly when the pollution dataset may only cover large enterprises. To address this, this paper adopts the approach of He et al. (2022) to generate dummy variables Treat1 and Treat2. Based on the indicators that can measure enterprise size—the number of employees and the stock of fixed assets—the top 50% of enterprises in terms of employees and fixed assets are assigned to the treatment group (Treat1 = 1, Treat2 = 1), while the bottom 50% form the control group (Treat1 = 0, Treat2 = 0). The Heckman two-stage model is used for adjustment, with the results shown in columns (1) of Table 6. The inverse Mills ratio (IMR) is found to be significant at the 1% level, indicating the existence of sample selection bias. After controlling for this bias, the core explanatory variable digital inputs (DIG) are significantly negative. To further enhance robustness, this paper directly selects the number of employees and fixed asset stock as matching variables, which can measure enterprise size.

The Heckman two-stage model is again employed for adjustment. Column (2) in Table 6 reports the estimation results, and it can be observed that the results are not significantly changed. This indicates that after addressing sample selection bias, the driving effect of digital inputs on industrial green transformation remains significant.

Based on the analysis of the above basic results and robustness tests, Hypothesis 1 is proved.

4.1.3 Heterogeneity analysis of intra-industry impacts

To further examine the heterogeneity of the driving effect of digital inputs on industrial green transformation across different enterprise characteristics and industry characteristics, this paper conducts a heterogeneity analysis based on four dimensions: enterprise size, industry pollution intensity, enterprise ownership, and whether the enterprise is capital-intensive.

4.1.3.1 Heterogeneity in enterprise size

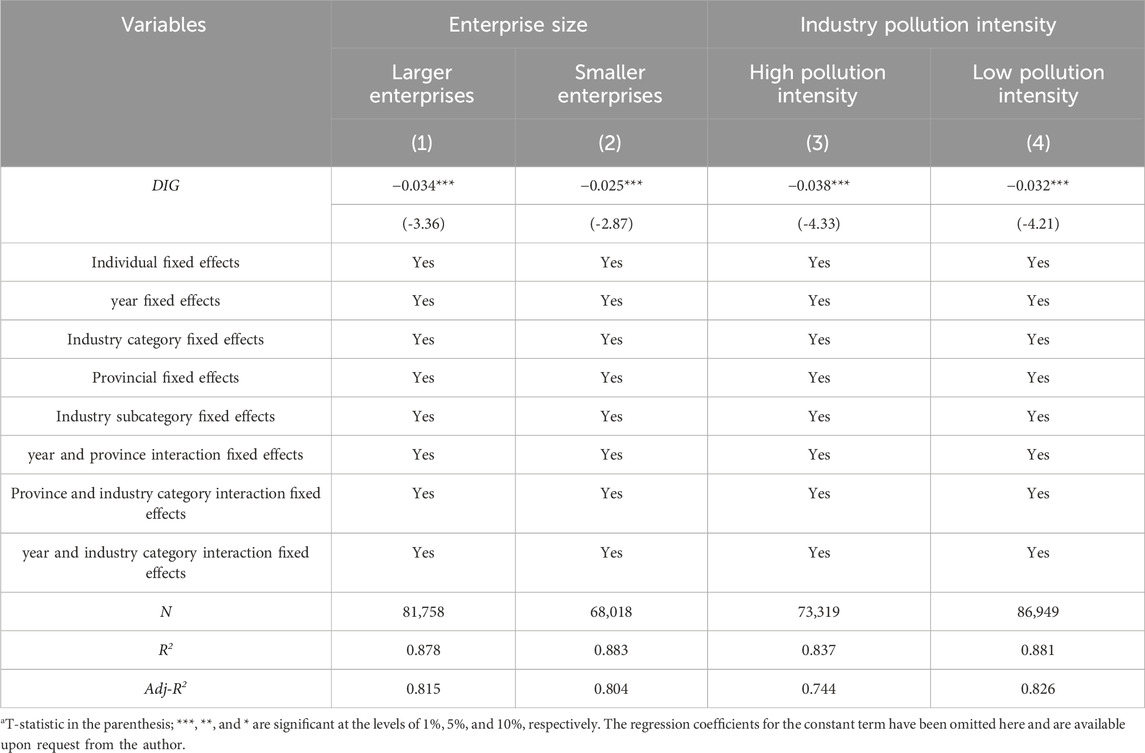

Considering that the green effects of digital inputs may have differences across enterprises of different sizes, this paper uses the median number of employees as the grouping criterion, dividing the sample into “Larger enterprises” and “Smaller enterprises” for separate regression analyses. Columns (1) and (2) in Table 7 report the regression results. It can be observed that the estimated coefficients for digital inputs (DIG) are significantly negative in both groups, indicating that digital inputs significantly promote industrial green transformation regardless of whether the enterprise is larger or smaller in size. At the same time, through comparison, it was found that the green effects of digital inputs are more obvious in larger enterprises than in smaller ones. This may be due to two reasons: on the one hand, in larger enterprises, digital inputs are more likely to achieve scale effects, thereby realizing a stronger green transformation effect. On the other hand, from the perspective of China’s digital transformation practices, large enterprises often lead smaller ones in digital transformation progress due to their advantages in capital and talent, which facilitates the release of the green effects of their digital inputs.

Table 7. Regression results of the heterogeneity in enterprise size and industry pollution intensity.

4.1.3.2 Heterogeneity in industry pollution intensity

To examine the difference in the driving effect of digital inputs across industries with different pollution intensities, this paper calculates the average pollution emission intensity for each industry, and using the median of each industry’s average pollution emission intensity as the grouping basis, the sample is divided into two groups: “High pollution intensity” and “Low pollution intensity”. Columns (3) and (4) in Table 7 report the regression results, respectively. The results indicate that the green effect of digital inputs is more obvious in high pollution intensity industries compared to low pollution intensity industries. This finding may indicate that highly polluting industries are more inclined to utilize digital inputs to achieve pollution reduction in order to meet the environmental protection requirements set by the Chinese government. At the same time, this result also suggests that digital inputs serve as an effective tool for promoting the green transformation of highly polluting industries.

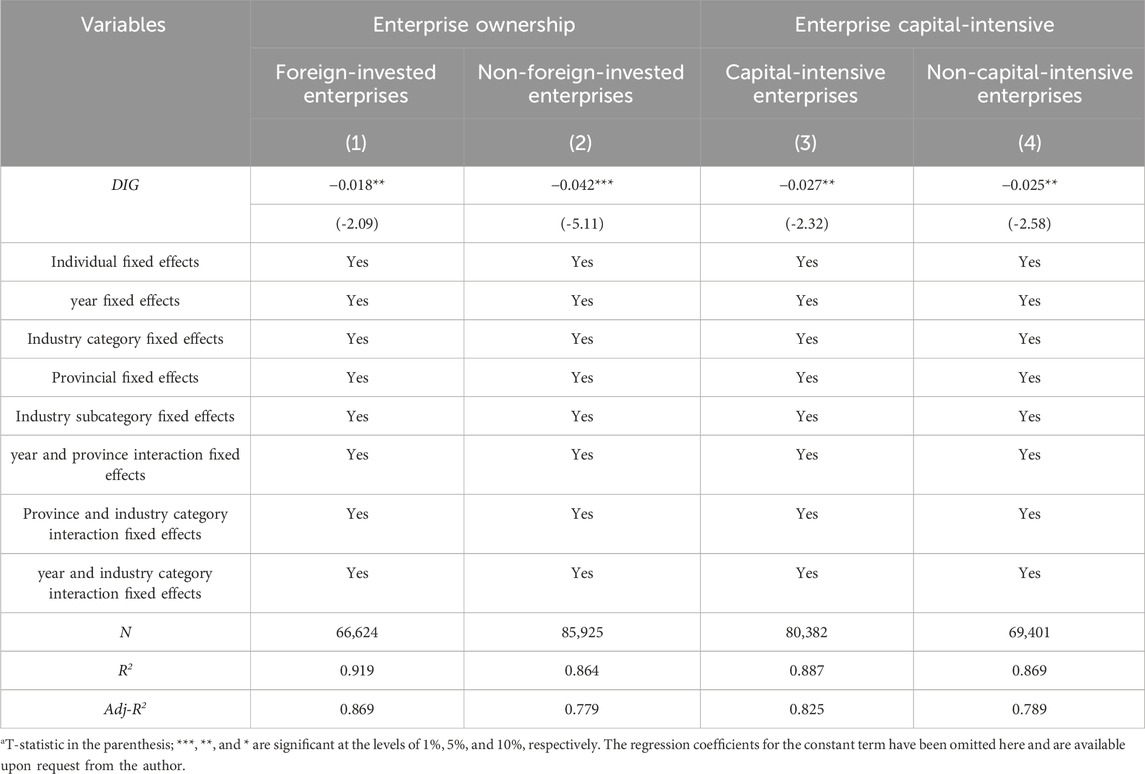

4.1.3.3 Heterogeneity in enterprise ownership

For a long time, the environmental effects of foreign investment have received significant attention from scholars (Chichilnisky, 1994; Cherniwchan, 2017). To examine differences in the green effects of digital inputs under different enterprise ownership, this paper based on whether foreign capital is involved, divides the total sample into two groups: “Foreign-invested enterprises” and “Non-foreign-invested enterprises”, and conducts separate regressions for each group. Column (1) and Column (2) in Table 8 report the regression results. It is found that compared to foreign-invested enterprises, the green effect of digital inputs is more obvious in non-foreign-invested enterprises. This finding may provide new evidence for the “pollution havens” hypothesis. This hypothesis argues that while FDI effectively increases capital endowment in host countries, it may also lead to a decline in environmental quality (Copeland and Scott, 1994). Therefore, when enterprises introduce foreign capital, it may weaken the green effect of digital inputs.

4.1.3.4 Heterogeneity in enterprise capital-intensive

For enterprises with different capital intensities, the driving effect of digital inputs on industrial green transformation may also be different. To address this question, this paper uses the median per capita capital as the grouping criterion, dividing the sample into two groups: “Capital-intensive enterprises” and “Non-capital-intensive enterprises”, and conducting separate regressions for each. Columns (3) and (4) in Table 8 report the regression results. It can be observed that the estimated coefficients for digital inputs (DIG) are both significantly negative and exhibit relatively small differences. This indicates that digital inputs exert a significant impact on industrial green development regardless of whether the enterprise is capital-intensive or non-capital-intensive.

4.1.4 Mechanism analysis of intra-industry impacts

The previous theoretical analysis proposes that, in terms of intra-industry impacts, digital inputs can promote the industrial green transformation through the enterprises entry and exit mechanism. In order to verify this hypothesis, this paper based on the panel data set of “Chinese Industrial Enterprise Database—China’s Input-output Table—Chinese Industrial Enterprise Pollution Emissions Database”, further examines whether the enterprises entry and exit is an important mechanism for intra-industry impact of digital inputs on industrial green transformation.

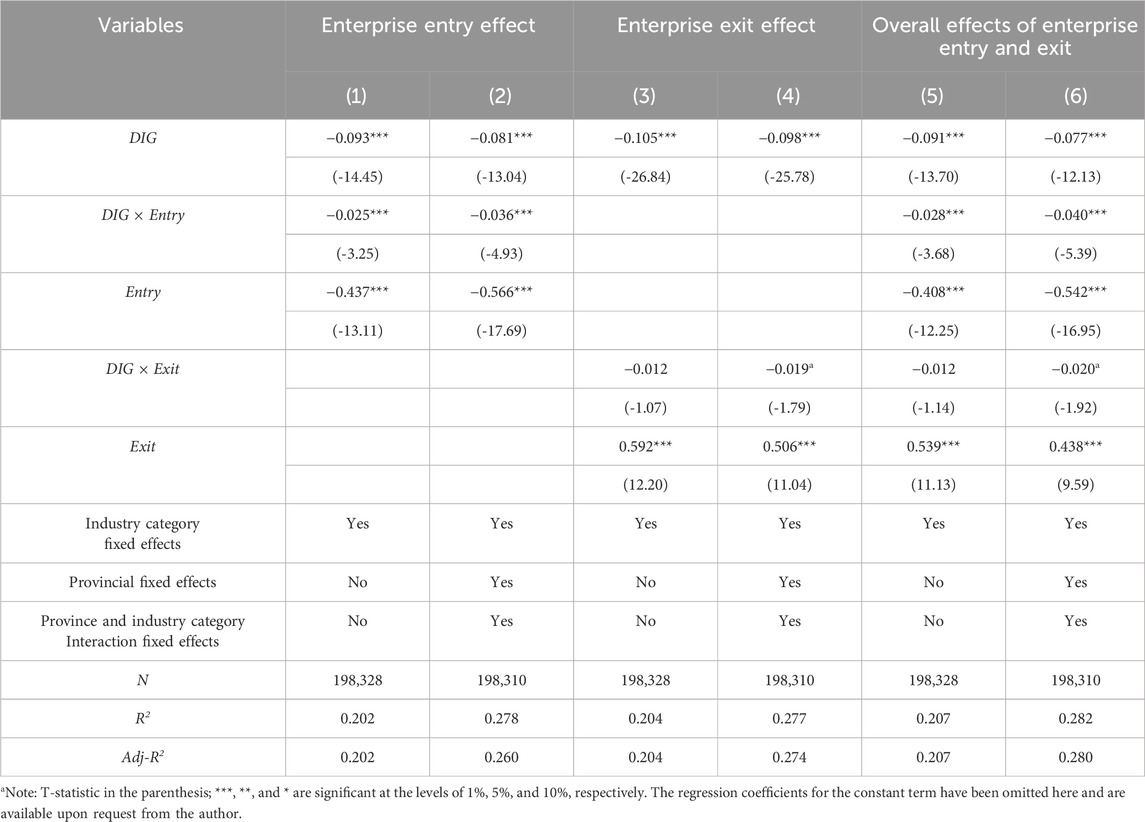

For the characterization of enterprise entry and enterprise exit, this paper refers to the setting of Zhou et al. (2016), defines the new entry enterprise as the enterprise that did not appear in the sample in the previous year but appeared in the next year, and defines the exit enterprise as the enterprise that appeared in the sample in the previous year but no longer appeared in the next year, and thus generates the enterprise entry dummy variable (Entry) and the enterprise exit dummy variable (Exit). On this basis, the following mechanism test model is constructed by referring to Brandt et al. (2017):

Equation 9 is used to capture the enterprise entry effect in the intra-industry impacts of digital inputs on industrial green transformation, where

Table 9 reports the regression results of the mechanism of intra-industry impacts. Columns (1) and (2) show that under the condition of introducing fixed effects at different levels, the estimated coefficient of the enterprise entry dummy variable (Entry) is significantly negative, indicating that compared with other enterprises, the pollution emission intensity of new enterprises entering the market is relatively low. At the same time, the estimated coefficients of the interaction term (DIG × Entry) between digital inputs and enterprise entry dummy variables are significantly negative, indicating that when the level of digital inputs utilization is high, the average pollution emission intensity of new entrants is relatively low, which indicates that the enterprise entry mechanism of digital inputs can effectively drive industrial green transformation. Correspondingly, columns (3) and (4) report the regression results of the enterprise exit mechanism in the intra-industry impact of digital inputs on industrial green transformation. It can be found that the estimation coefficient of the enterprise exit dummy variable (Exit) is significantly positive, indicating that the pollution emission intensity of the exit enterprise is relatively high compared with other enterprises. In the regression of adding industry fixed effect, province fixed effect and province-industry interaction fixed effect, the estimation coefficient of the interaction term (DIG × Exit) between digital inputs and enterprise exit dummy variable is significantly negative, indicating that the enterprise exit mechanism of digital inputs effectively reduces the average pollution emission intensity of industrial enterprises.

On this basis, Column (5) and Column (6) introduce the interaction term of digital inputs and enterprise entry dummy variable (DIG × Entry), and the interaction term of digital inputs and enterprise exit dummy variable (DIG × Exit), which are used to jointly reflect the total effect of enterprise entry and exit mechanism in the intra-industry impacts of digital inputs on industrial green development. The results show that under the condition of controlling industry, province and their interaction fixed effects, the interaction terms (DIG × Entry, DIG × Exit) of digital inputs, enterprise entry and enterprise exit are significantly negative, which further indicates that the enterprise entry and exit mechanism of digital inputs can effectively reduce the pollution emission intensity of industrial enterprises, that is, effectively drive industrial enterprises to achieve green transformation.

Based on the above empirical analysis, it can be inferred that digital inputs can effectively optimize the market structure. On the one hand, it is conducive to the entry of high-efficiency and low-pollution new enterprises into the market. On the other hand, it can also force low-efficiency and high-pollution enterprises to withdraw from the market. The enterprise entry and exit mechanism of digital inputs can further drive the industrial green transformation.

Based on this, Hypothesis 2 is proved.

4.2 Empirical analysis of inter-industry spillover effects

The above empirical analysis has robustly identified the intra-industry impact of digital inputs on industrial green transformation and the mechanism of intra-industry impacts. It is found that digital inputs can promote the industrial green transformation by promoting the high-efficiency and low-pollution new enterprises entry market and forcing low-efficiency and high-pollution enterprises to exit market.

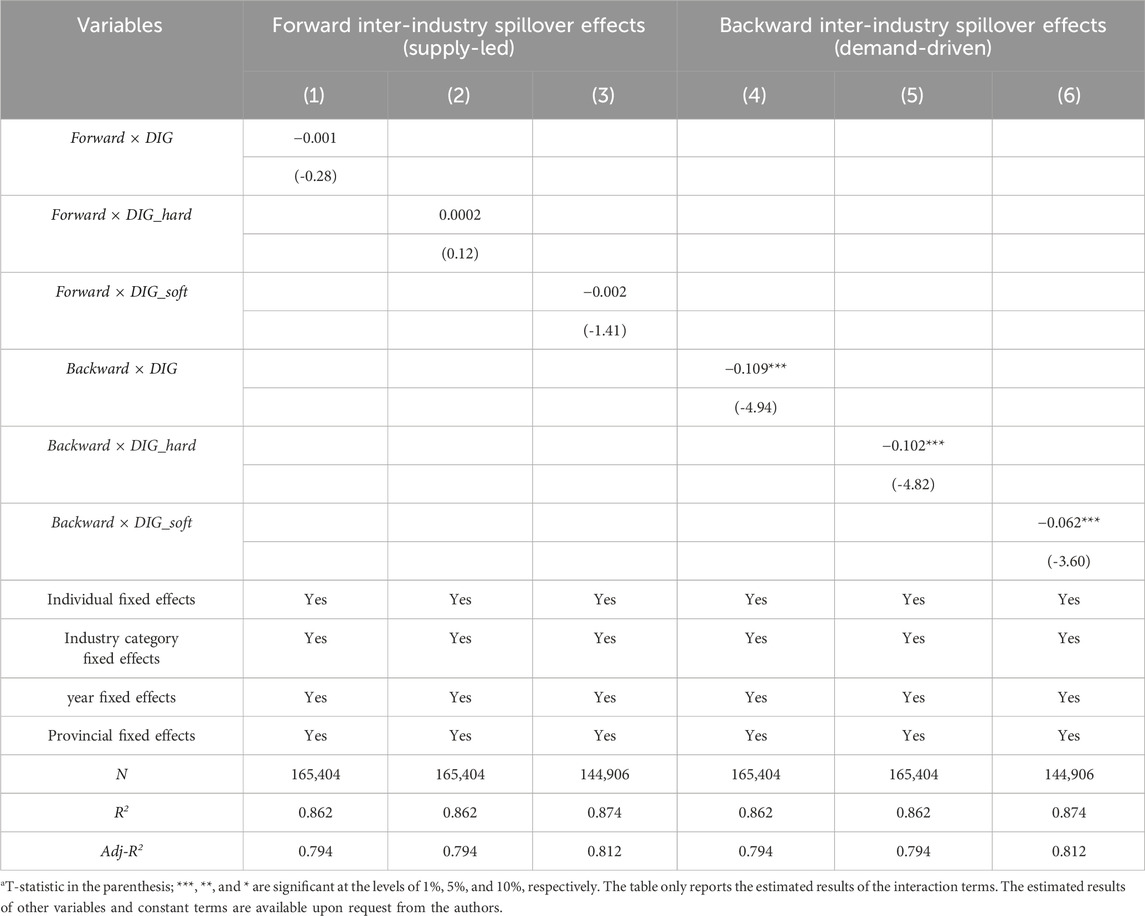

The theoretical analysis of this paper proposes that in addition to the intra-industry impacts, digital inputs may also have inter-industry spillover effects on industrial green transformation. That is, in terms of inter-industry spillover effects, the impact of digital inputs on industrial green transformation can spillover to downstream and upstream industries through “supply-led” and “demand-driven” approaches. In order to verify the theoretical hypothesis, this paper further uses the micro enterprise panel data set of “Chinese Industrial Enterprise Database—China’s Input-output Table—Chinese Industrial Enterprise Pollution Emissions Database” for empirical test.

4.2.1 Basic results of inter-industry spillover effects

This paper is based on the “Chinese Industrial Enterprise Database—China’s Input-Output Table—Chinese Industrial Enterprise Pollution Emissions Database” micro enterprise panel data and uses Equations 2, 3 to regression estimation. Table 10 reports the regression results.