Abstract

Greenhouse gas emissions have contributed to climate change, resulting in significant environmental and socioeconomic consequences, including rising sea levels and more frequent extreme weather events. The urgency to mitigate these effects has motivated governments and industries to seek innovative solutions that reduce carbon footprints and promote sustainability. Sustainable forest management practices, which aim to maximize carbon storage in both forests and forest products, offer a powerful strategy to reduce atmospheric CO₂. This study explores how market-based mechanisms, such as forest carbon programs, can help meet greenhouse gas reduction targets in accordance with international agreements, including the Kyoto Protocol. By examining corporate timber companies’ participation in carbon markets, the study highlights how sustainable forestry practices align with economic goals while reducing atmospheric CO₂ levels. Through a strategic assessment of literature and interviews with decision-makers in corporate forestry, this research study examines the motivations, barriers, and opportunities for carbon market integration, climate policy priorities, and the potential to scale up corporate involvement in carbon projects.

1 Introduction

Carbon markets offer a market-based solution to address greenhouse gas emissions, the primary drivers of global warming and climate change (Choi, 2025). In 2011, their global value reached approximately $175 billion (Kossoy and Guigon, 2012). These markets incentivize companies to lower emissions by giving a monetary value to carbon dioxide (CO₂) and other greenhouse gases (Conejero and Farina, 2003; Burke and Gambhir, 2022). The United Nations Framework Convention on Climate Change (UNFCCC) introduced the concept of carbon markets in 1992, and the Kyoto Protocol formalized it in 2005 (Calel, 2013). Carbon markets enable companies to either reduce emissions directly or purchase carbon credits to offset excess emissions, thereby encouraging financial and environmental accountability (Chen et al., 2022). Forest carbon projects form the fundamental core of carbon markets and play a dynamic role in sequestering CO₂ from the atmosphere (Li et al., 2022). Forest-based initiatives such as afforestation, reforestation, and improved forest management (IFM) actively increase carbon sequestration and promote sustainable forestry (Griscom and Cortez, 2013). Afforestation projects plant trees on previously unforested land, while reforestation efforts restore trees on deforested land both actions improve forest cover, biodiversity, and ecosystem services (Cvjetković and Mataruga, 2020; Rohatyn et al., 2021). Improved forest management boosts forest practices to enhance carbon storage by reducing harvest intensity, extending harvest rotations, and regenerating forests (Boscolo et al., 2025; Li et al., 2025).

Family forest landowners (FFLs) and large-scale corporate timberland companies, including Timber Investment Management Organizations (TIMOs) and Real Estate Investment Trusts (REITs), can increase their income by participating in carbon markets while maintaining forest productivity (Piao et al., 2016). These forest management practices support global efforts to mitigate climate change through carbon sequestration and sustainable forestry (Ontl et al., 2020).

Carbon credits serve as a core component of carbon markets (Newell et al., 2014; Gorain et al., 2021). These credits authorize companies to emit a specified amount of CO₂, with each credit typically representing one ton of CO₂ emissions (Trouwloon et al., 2023). In contrast, companies generate carbon offsets by actively reducing or removing CO₂ or other greenhouse gases from the atmosphere through initiatives such as reforestation, renewable energy projects, or carbon capture technologies. Companies that exceed their emissions targets can purchase these offsets to compensate for their excess and neutralize their carbon footprint (Helppi et al., 2023; Aldy and Halem, 2024).

Carbon markets include two primary types: compliance and voluntary markets (Guigon, 2010). Government frameworks typically regulate compliance carbon offset programs, using mechanisms like cap-and-trade systems to control emissions (Kollmuss et al., 2010). These programs set emission limits for companies; those that exceed the cap must purchase carbon credits to support emission reduction projects elsewhere. In contrast, voluntary carbon markets allow businesses and individuals to buy credits outside of regulatory obligations to offset their emissions. Voluntary standards uphold the integrity of these markets by applying strict guidelines for generating, measuring, and verifying carbon credits (Mansanet-Bataller and Pardo, 2008).

Key players in both compliance and voluntary carbon markets include registries, project developers, buyers, and producers (Shockley and Snell, 2021). Registries such as the Verified Carbon Standard (VCS), American Carbon Registry (ACR), and Climate Action Reserve (CAR) manage the registration, validation, and issuance of carbon credits (Espenan, 2023). These organizations build transparency and trust in the carbon market by verifying that carbon reduction projects meet essential criteria, including additionality, permanence, and non-leakage (Hamrick and Gallant, 2017). Project developers design and implement carbon reduction initiatives, while buyers and producers participate in the transaction of carbon credits. Buyers may include companies aiming to meet regulatory requirements or voluntarily offset their emissions to support corporate sustainability goals.

The Verified Carbon Standard (VCS), a leading voluntary carbon framework, defines four primary forest carbon project types: Reforestation (R), Avoidance of Conversion (AC), Improved Forest Management (IFM), and Deferred Harvest (DH) (VCS, n.d.). These projects support emissions reductions and promote long-term forest sustainability. Reforestation and afforestation efforts restore tree cover on previously deforested or non-forested lands. Avoidance of Conversion projects preserve forests at risk of being cleared for non-forest land uses a key criterion for generating carbon offset credits (Maggard and VanderSchaaf, 2022). IFM projects increase carbon stocking in existing forests by applying sustainable practices that enhance forest growth and health (Kerchner and Keeton, 2015). These approaches help reduce deforestation rates and boost carbon sequestration, aligning with the requirements of both voluntary and compliance markets.

However, forest landowners face several challenges when participating in carbon markets. Barriers such as minimum landholding requirements, long contract durations, high upfront costs, ongoing monitoring expenses, and potential conflicts with existing land management practices reduce accessibility for many (Wade and Moseley, 2011; Dargusch et al., 2010; Kerchner and Keeton, 2015). Landowners who actively manage their land for timber production often find these constraints especially restrictive (Mason and Plantinga, 2013). To promote broader participation, program designers can introduce more flexible requirements, offer financial incentives, and implement streamlined monitoring protocols.

Despite these challenges, growing emphasis on reducing carbon footprints and meeting sustainability goals has shifted the way carbon markets operate. This shift has made carbon markets more applicable and attractive, particularly for large corporate timberland entities, including TIMO’s, REIT’s, and other corporate forestry organizations. As of 2017, family forest ownerships accounted for the largest share of U. S. forestland, totaling approximately 110 million hectares (272 million acres). Federal ownerships followed with around 78 million hectares (193 million acres). Corporate ownerships encompassed about 55 million hectares (135 million acres) in total. Within this group, 28 million hectares (70 million acres) were held by small corporate owners with less than 18,000 hectares (45,000 acres) each. Institutional investors—namely TIMOs and REITs—with holdings exceeding 400,000 hectares (1 million acres) controlled 17 million hectares (41 million acres). The remaining 10 million hectares (24 million acres) were managed by large corporate owners not classified as TIMOs or REITs (Sass et al., 2021; Smith et al., 2016). These companies actively contribute to carbon sequestration and climate change mitigation by applying sustainable forest management practices. Strategies such as afforestation, improved forest management (IFM), and avoided deforestation remain central to their efforts.

This study aims to examine how corporate timberland companies including, but not limited to, TIMO’s and REIT’s integrate carbon market programs into their forest management practices. To address this objective, we interviewed decision-makers from a range of timber management organizations to capture their perspectives on carbon market participation, including their motivations, perceived barriers, and enabling conditions. The findings provide a detailed assessment of how corporate forestry is responding to the emergence of forest carbon markets and highlight its potential role in advancing large-scale climate change mitigation through sustainable forest management. This study is needed because corporate actors manage a substantial share of U. S. forests yet their decision rules for carbon participation remain under-characterized. Prior work typically examined landowner intentions or program design in isolation; few studies synthesize the perspectives of TIMOs/REITs alongside other corporate owners. By documenting motivations, barriers, and enabling conditions, our interviews establish a some groundwork with which future policy or market changes can be assessed.

2 Methodology

2.1 Virtual one-on-one interviews

To assess perspectives on carbon market programs, we conducted interviews with decision-makers from four types of organizations involved in U. S. commercial forestry: TIMOs, REITs, forest industry firms (companies primarily engaged in processing and manufacturing timber, paper, and other wood-based products for commercial use), and forest management companies (organizations focused on the sustainable oversight of forestlands, including timber harvesting, conservation practices, and land stewardship). We developed an interview protocol using guidance from Qualitative Inquiry (Charmaz, 2006) and Research Design (Creswell and Poth, 2016). Following a semi-structured format, we asked qualitative and open-ended questions focused on familiarity with carbon programs, current participation or interest, perceived benefits and challenges, and strategies for integrating sustainable forest management into timber operations (Blandford, 2013).

We designed the questions to capture qualitative data by combining yes/no items for clarity with open-ended questions for deeper exploration. This approach enabled a comprehensive understanding of the companies’ perspectives. A thorough literature review on forest carbon markets informed the development of the interview questions. Some questions explored general awareness of carbon markets, while others addressed specific gaps identified in the literature. This structure allowed us to examine both broad themes and targeted issues. We identified participating companies through industry directories and online databases. We obtained Institutional Review Board (IRB) approval to ensure ethical compliance and protect participants’ rights (Table 1).

Table 1

| Topic | Question |

|---|---|

| Carbon Markets Awareness | Are you currently aware of carbon markets and their potential benefits for corporate timberland companies? |

| Climate Policy Priorities | What is your business’s current climate policy priorities on the following mechanisms/actions: understanding climate change, carbon incentives, mitigation activities, carbon/climate tax and subsidy, revenue allocation, regulations, and mandates? |

| Consideration of Carbon Markets | Have you ever considered participating in carbon markets to monetize carbon sequestration or offsetting efforts on your land? |

| Opportunities for Participation | Are you aware of any current opportunities for industrial forestland and companies like yours to participate in carbon offset programs? |

| Motivation for Participation | What factors would motivate you to participate in carbon markets (e.g., financial incentives, environmental conservation, reputation enhancement, regulatory compliance)? |

| Barriers to Participation | What barriers or concerns might prevent you from participating in carbon markets (e.g., uncertainty about regulations, transaction costs, impacts on land use)? |

| Government Incentives | If there were incentives or financial aid from the government, would you be more likely to participate in carbon markets? |

| Current Carbon Sequestration Practices | What types of carbon sequestration or offsetting practices are currently implemented on your land (e.g., reforestation, improved forest management, deferred harvest)? |

| Commitment to Sustainability | How crucial is it for your company to participate in carbon markets to show your commitment to sustainability and environmental stewardship? |

| Impact on Brand Image | Do you believe that participating in carbon markets would positively impact your company’s brand image and reputation? |

Topics and questions used to guide one-on-one interviews.

During interviews, each organization was asked each question in an open-ended format.

We contacted timber management companies including TIMOs, REITs, forest industry firms, and forest management organizations and invited them to participate in the interview process. In total, 14 companies participated: 5 TIMOs, 3 REITs, 5 forest industry firms, and 1 forest management organization.

In January 2024, we initiated contact via email, explaining the research objectives, the importance of their participation, and the confidentiality of the data collected. We included contact information for the research team to facilitate communication. To ensure informed consent, we attached an information letter outlining the study’s objectives, potential benefits, risks and discomforts, voluntary nature of participation, and strict confidentiality protocols. The letter also included the Institutional Review Board (IRB) protocol number and approval details.

2.2 Data analysis

We categorized the participating companies into four groups: TIMOs, REITs, forest industry companies, and forest management companies. To maintain clarity and consistency while protecting the anonymity of organizations, we assigned a unique participant identification (ID) to each interviewee based on their organization type. The coding system used the following structure: T for TIMOs (e.g., T1, T2, T3), R for REITs (e.g., R1, R2, R3), F for forest industry companies (e.g., F1, F2, F3), and FM for forest management companies (e.g., FM1) (see Table 2).

Table 2

| Organization type | Number of participants |

|---|---|

| TIMOs | 5 |

| REITs | 3 |

| Forest Industry | 5 |

| Forest Management | 1 |

Participants’ organizations represented in one-on-one interviews, and number of participants from each organization type.

Organization types represented include Timber Investment Management Organizations (TIMOs), Real Estate Investment Trusts (REITs), Forest Industry, and Forest Management Organizations.

We used NVivo version 14 (Lumivero, Denver, CO, USA) to manage and code interview transcripts for this qualitative study. We developed codes inductively, drawing directly from the language and ideas expressed by participants rather than relying on a predefined codebook. Within NVivo, we labeled recurring themes, generated word frequency queries, and created word clouds to highlight key terms and topic areas emerging from the data. We also used Microsoft Excel and R version 4.3.1 (R Core Team, Vienna, Austria) to compile and summarize coded data, which enabled us to generate most of the visual graphs and summary tables.

Our analysis followed an inductive content analysis approach, in which we derived codes and themes directly from the raw data without applying preexisting theoretical frameworks or fixed categories. This approach is particularly effective in exploratory qualitative research, as it allows researchers to remain open to the data and let patterns, categories, and themes emerge naturally (Williams and Moser, 2019). This strategy helped ground our findings in the actual experiences and perspectives of the participants, rather than shaping them through researcher assumptions.

To conduct the analysis, we reviewed transcripts multiple times to develop a deep understanding of participant responses. During this iterative process, we identified recurring ideas, phrases, and concerns and assigned them descriptive codes within NVivo. We then grouped related codes into broader themes that captured key issues related to corporate engagement in carbon markets. Each theme remained closely tied to participant responses, reflecting their motivations, perceived barriers, and views on climate policy, carbon programs, and sustainable forest management practices. With each round of coding and refinement, we ensured the analysis preserved the complexity and nuance of the data.

3 Results

3.1 Climate policy priorities of organizations

We discussed climate policy priorities with all participants. Their responses addressed a broad range of topics, including their understanding of climate change, participation in carbon markets, implementation of mitigation strategies on company lands, navigation of regulatory frameworks, and considerations for revenue allocation. Table 3 presents a summary of these priorities and perspectives.

Table 3

| Themes | Participant IDs | Key points |

|---|---|---|

| Understanding climate change in general | T1, T3, T4, R1, F3 | Strong awareness of climate policies, risk assessment, long-term reduction goals. |

| Carbon incentives | T1, T3, R1, FM, F4 | Carbon incentives are viewed as important revenue streams and market opportunities. |

| Mitigation activities on company lands | T2, T3, F1, F2, F3, R3 | Reforestation, Carbon sequestration, emissions, reduction, Carbon capture. |

| Carbon or climate tax and subsidy | T4, F3, R2 | Varied focus, some prioritize carbon removal over taxes or subsidies. |

| Revenue allocation | T3, T4, F2, R1 | Revenue allocation toward carbon sequestration projects and offsets. |

| Regulations and mandates | T4, R1, F2, F1 | Compliance with regulations (e.g., SEC, SFI), engagement with national policy. |

Climate policy priority themes and key points discussed for each theme by participants from each organization type in regard to climate change, carbon incentives, mitigation activities, carbon and climate tax and subsidies, revenue allocation, regulations, and mandates.

T1-5 = TIMO participants, R1-3 = REIT participants, F1-5 = Forest Industry participants, FM – Forest Management participant (n = 14).

TIMOs demonstrated strong awareness of climate policies and emphasized their role in carbon credit investments. Participant T1 described a deep understanding of climate change issues and policies, which they actively integrated into operational planning. T2 discussed the challenge of balancing client investment goals with the need to ensure long-term financial feasibility for projects, highlighting post-harvest reforestation as a key component of their mitigation strategy. T3 emphasized forestry’s role in climate change mitigation and viewed carbon incentives as a promising opportunity to diversify income, though they placed less emphasis on tax incentives or subsidies. T4 stressed the importance of assessing climate risks and called for national-level engagement to standardize greenhouse gas accounting, while also advocating for flexible regulations to avoid one-size-fits-all approaches. Similarly, T5 prioritized the use of strong climate data and relied heavily on resources from the United States Department of Agriculture (USDA) and Forest Service to guide their decision-making.

REIT participants also showed a strong focus on climate policy, particularly through regulatory compliance and aligning climate initiatives with business objectives. R1 emphasized the company’s commitment to achieving net-zero targets, especially in their sawmills and plywood mills, and reported participation in both compliance and voluntary carbon offset programs. R1 also underscored full compliance with U. S. Securities and Exchange Commission (SEC) regulations. R2 highlighted the importance of natural climate solutions and emphasized forests’ critical role in both reducing emissions and removing atmospheric carbon. R3 noted that while they engage in carbon markets, they prioritize the quality of carbon projects over financial returns. They pointed out that voluntary carbon credit prices often fail to match the profitability of timber sales, which limits their level of engagement.

Participants from the forest industry expressed a more mixed approach, balancing regulatory compliance with practical business considerations. F1 emphasized the importance of maintaining certifications such as the Sustainable Forestry Initiative (SFI) but noted that proactive restoration efforts like longleaf pine reforestation were not a major focus. F2 operated under California’s stringent environmental regulations and described the legal challenges associated with carbon offset implementation. Their timber harvest plans included detailed assessments of carbon impacts. F3 established ambitious emissions reduction targets for 2030 and 2050, prioritizing direct emissions reductions and carbon capture while viewing offsets as a last resort. F4 had monitored developments in the carbon market but had not yet identified a feasible strategy for engagement. F5 approached carbon markets primarily from a financial perspective, focusing on whether participation would prove economically viable.

The forest management company (FM) explained that their role involves guiding landowner clients through climate-focused solutions. They aim to align carbon market participation with each client’s long-term land management and business objectives.

3.2 Motivations for participation in carbon markets

Participants across sectors indicated that no single factor drives participation in forest carbon markets; instead, decisions stem from a combination of economic, environmental, and social motivations. Although financial returns and market incentives emerged as dominant drivers, many participants also acknowledged the role of environmental stewardship and corporate responsibility (Figure 1). For TIMOs, financial incentives played the most significant role. Participant T1 explained that fluctuations in timberland and carbon market prices directly influence decision-making. When carbon prices justify delaying harvests or investing in carbon projects, those options take priority highlighting TIMOs’ strong focus on profitability and their reliance on carbon markets meeting financial expectations. T2 reinforced this emphasis on economic benefit, noting that dependable income from carbon programs attracts landowners. T3 and T4 echoed this sentiment, pointing to customer interest and new revenue streams as key motivators. T4 further noted that companies seeking to diversify income find the potential returns from carbon markets especially compelling.

Figure 1

Word cloud illustrating the primary motivations for participating in carbon markets. The prominence of certain words reflects their frequency and significance in responses by study participants (n = 14).

REITs (R) are motivated not only by financial incentives but also by environmental and reputational considerations. According to R1, recent developments such as the flexibility of voluntary markets with shorter project durations (as little as 40 years or less) have increased the attractiveness of carbon markets for commercial landowners. While R1 emphasized the importance of financial returns, they also acknowledged concerns about reputational risks. Their participation in carbon markets remains cautious due to the complexity of meeting program requirements and the potential for stakeholder criticism, although anticipated financial gains may justify the effort. R2, representing one of the largest private timberland owners in the U. S., emphasized that forests play a vital role in combating climate change. For R2, engaging in carbon markets is not solely a financial strategy but a way to leverage large forest holdings to deliver meaningful climate benefits. R3 noted that although carbon credit sales generate revenue, participation in climate initiatives also enhances their brand and public image. For REITs, involvement in carbon markets requires balancing financial returns, environmental responsibility, and reputation management.

Forest industry firms (F) expressed a blend of financial motivation and growing commitment to environmental stewardship. F1 highlighted that future regulatory changes could increase compliance-related participation. F1 also expressed interest in expanding carbon markets to include carbon-storing products, such as processed lumber, which could further incentivize participation. F2, a family-owned company, viewed long-term investment strategies as well-suited to carbon market participation. They emphasized that longer project timelines are essential for maximizing both carbon storage and timber harvest value, indicating that sustainability plays a central role in their profit-oriented approach.

F3 raised concerns about whether current carbon programs meaningfully reduce emissions. While recognizing the importance of public perception and shareholder expectations, F3 remained hesitant to participate in programs that may enable companies to continue emitting without making real progress on climate goals.

For the forest management company (FM), strong market demand and service expansion opportunities drive engagement. FM observed that the high demand for carbon credits, coupled with limited supply, creates favorable conditions for offering value-added forest management services. Expanding services to support more landowners serves as a major motivation, along with the potential to generate jobs and increase profitability for foresters across various regions. FM views carbon markets to grow their business while advancing forest sustainability and contributing to climate change mitigation.

3.3 Barriers for participation in carbon markets

The inductive analysis of interview transcripts identified several key barriers that participants face when considering or engaging in forest carbon markets (Figure 2). A word cloud visualization highlights these recurring challenges. The most frequently cited barrier is a lack of sufficient incentives, indicating that many companies do not perceive enough financial or strategic benefit to justify participation. Participants also emphasized high costs, particularly those related to implementation, monitoring, and verification, as a major deterrent.

Figure 2

Word cloud illustrating key barriers to participation in forest carbon markets. The most prominent phrases include ‘lack of incentives,’ ‘uncertainty,’ ‘costs,’ ‘management,’ ‘complexity,’ ‘lack of standardization,’ ‘market instability,’ and ‘price volatility.’ The relative size of each phrase reflects its frequency in participant responses.

Uncertainty emerged as another dominant theme, reflecting concerns about market stability, unpredictable carbon pricing, and evolving regulatory frameworks. Many organizations, especially those with limited operational capacity, reported management challenges that complicate their ability to engage in carbon programs. Participants also pointed to the administrative complexity of meeting regulatory requirements and navigating unfamiliar program protocols as discouraging factors. Additional concerns included market instability, price volatility, the risk of carbon reversal, and the absence of standardized guidelines across programs or projects, all of which contribute to hesitancy in market participation.

Among TIMOs, T1 identified pricing as a major obstacle, particularly when traditional silvicultural practices do not align with carbon project requirements. T1 explained that timberland values often exceed the potential financial returns from carbon credits, and demonstrating additionality, a fundamental requirement for carbon projects, remains difficult, thereby limiting the development of credible, high-quality offsets. Similarly, T2 raised concerns about financial risks and contractual uncertainties, especially regarding the division of responsibilities if a project were terminated by a grantor or lessor. These legal and financial ambiguities make landowners hesitant to commit to carbon agreements. T3 and T4 also emphasized the importance of financial viability. T3 noted that carbon credit prices often fail to justify the effort required for participation, while T4 described carbon investments as riskier and less stable than traditional timberland assets. T4 also highlighted internal company challenges, such as limited administrative capacity, reputational risks, and uncertainty surrounding evolving regulations and market structures.

REIT participants echoed many of these concerns. R1 described the significant time commitment and complexity involved in developing a carbon project, including audits, regulatory approvals, and administrative burdens. While large corporate landowners can typically manage these demands, R1 observed that they can be overwhelming for smaller stakeholders. R1 also pointed to reputational risks, noting that scrutiny from environmental organizations over the validity of carbon offsets could harm a company’s public image. R2 underscored the importance of maintaining high-quality carbon credits to protect corporate reputation, while R3 highlighted inconsistencies in certification systems, stating that the rejection of some standards for inadequacy further complicates participation.

Forest industry participants reported similar barriers. F1 emphasized that the relative novelty of carbon markets makes it difficult for companies with smaller landholdings to achieve meaningful returns. F2 pointed out that small project size presents a significant challenge, with difficulties in achieving economies of scale and penalties incurred when growth thresholds are exceeded. F2 also criticized the rigidity of outdated protocols, which limit flexibility in project design. F3 noted that companies are reluctant to invest in carbon initiatives without regulatory mandates driving participation. F4 and F5 identified monitoring and measurement costs as major deterrents. F4 added that companies already practicing sustainable forestry struggle to meet additionality criteria, while F5 expressed concern that future political changes could alter the trajectory of carbon markets, adding another layer of uncertainty. The forest management participant (FM) explained that non-industrial private forest owners face distinct challenges, as carbon market structures often favor large industrial landowners, making meaningful participation more difficult for smaller owners.

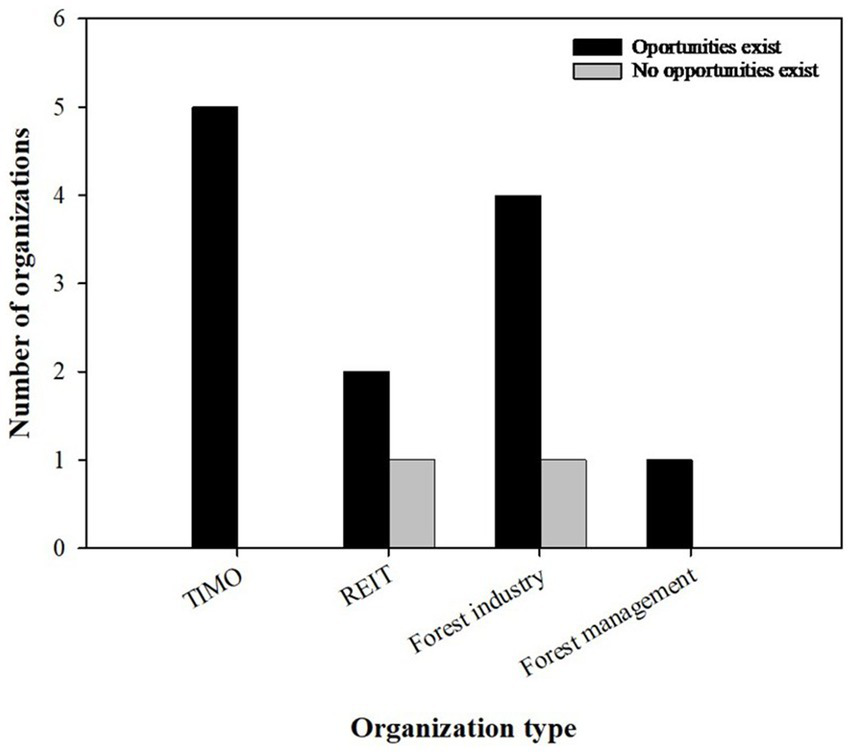

Most participants indicated that opportunities currently exist for them to engage in forest carbon markets, a perspective shared across all organizational types (Figure 3). TIMOs and forest industry firms expressed particularly optimistic views, while REITs conveyed more mixed responses. Although underrepresented, the forest management organization also reported a positive outlook. These findings suggest a generally favorable perception of carbon market opportunities among commercial forestry organizations. However, the variation in responses highlights how organizational context and strategic priorities influence whether companies view carbon market participation as feasible or advantageous.

Figure 3

Bar chart displaying the number of organizations, by type (TIMO, REIT, Forest Industry, Forest Management), that report current opportunities to participate in forest carbon markets. TIMOs and forest industry organizations report the greatest number of opportunities, REITs provide mixed responses, and forest management organizations indicate generally positive outlooks.

3.4 Verification and reporting process

Verification and reporting processes play a critical role in maintaining the credibility and integrity of forest carbon projects. Participants described a variety of experiences and challenges related to the rigor, effectiveness, and efficiency of these procedures. Their responses reflected both practical operational concerns and suggestions for future improvements. A summary of these insights is presented in Table 4.

Table 4

| Themes | Participant IDs | Key points |

|---|---|---|

| Critical role of verifications | T1, F3, R1 | Verification is essential for ensuring the credibility of carbon projects and preventing reputational damage. Third-party validation and oversight are key to maintaining project integrity. |

| Operational challenges | T2, T4, F2 | Managing project boundaries, expertise mismatches, and delays in receiving offsets due to project size are significant operational hurdles. Additionally, the reliance on satellite imagery creates potential discrepancies in verification. |

| Bureaucratic and regulatory challenges | T5, R1, F2 | The slow, bureaucratic nature of verification, combined with overwhelmed regulatory bodies and lack of experienced staff, creates significant delays. Regulatory inefficiencies in states like California compound these issues for landowners. |

| Time-intensive nature | T4, T5, R1 | The verification process is time-consuming, affecting net revenue from projects. Running multiple inventory processes is difficult for teams, and large organizations like VERRA are overwhelmed by project volumes, further slowing progress. |

| Future improvements | R2, F4, T3, R3 | Streamlining and standardizing methodologies, improving document transmission, and aligning verifiers with project needs would improve the efficiency of the verification process and lead to better market outcomes. |

| Technological and AI potential | F5 | Advancements in spatial algorithms, AI, and better imagery solutions could revolutionize the verification process, making it more accurate and less reliant on costly ground-level inspections, though implementation costs remain a barrier. |

Verification and reporting process themes and key points discussed for each theme by participants from each organization type regarding carbon sequestration practices on forest lands.

T1-5 = TIMO participants, R1-3 = REIT participants, F1-5 = Forest Industry participants, FM – Forest Management participant (n = 14).

While participants recognized verification as essential for protecting a project’s credibility and reputation, many expressed concerns about the operational difficulties, bureaucratic hurdles, and time-intensive nature of current systems. Several also suggested that emerging technologies, particularly artificial intelligence (AI), could improve the efficiency and accuracy of verification processes in the future.

Participant T1 emphasized that verifying the validity of carbon credits is critical to a project’s long-term success. T2 explained that verification becomes especially difficult when carbon-sequestered land lies in rugged or remote terrain and lacks proper verification infrastructure, often resulting in confusion and added complexity. T3 echoed these concerns, stressing that although third-party verification is vital, finding qualified independent experts remains a challenge. T2 further noted difficulties in physically marking project boundaries, adding that many verification platforms rely heavily on satellite imagery, which can lead to spatial inaccuracies. T4 raised similar concerns, pointing out that external verifiers often lack the forestry expertise possessed by in-house specialists, making accurate assessments more difficult.

Forest industry participants shared similar frustrations regarding verification processes. F2 noted that the small scale of some carbon projects led to significant delays in receiving verified offsets. F3 added that while remote sensing and periodic measurements are essential, applying these techniques consistently across diverse projects remains a challenge. Bureaucratic complexity was a recurring theme. T5 described the carbon market’s verification protocols as overly bureaucratic and poorly aligned with traditional forest management practices, which creates unnecessary friction. R1 pointed out that organizations like Verra (Verified Carbon Standard) and ACR (American Carbon Registry) are overwhelmed by the volume of project verifications, contributing to widespread delays. R2 emphasized that the verification process often involves such complex infrastructure requirements that it becomes inaccessible for smaller-scale projects.

Participants also underscored the time-consuming nature of verification. T4 acknowledged the necessity of rigorous standards but noted that the high costs and time investments significantly reduce project profitability. T5 echoed these concerns, describing multiple rounds of forest inventory data collection as a heavy burden on operational teams. R1 stressed that even major registries like Verra face administrative bottlenecks, while R3 explained that their organization’s familiarity with Measurement, Reporting, and Verification (MRV) systems, thanks to data-driven forest management, helps them cope with the time demands, though this is not typical across the industry.

Looking ahead, many participants proposed streamlining and standardizing verification protocols to improve efficiency. R2 recommended strengthening document submission systems and internal capacity to maintain quality verification outcomes. F4 emphasized that verification procedures must become more credible to gain wider industry acceptance. T3 suggested that verification bodies should better align with companies’ operational realities to reduce friction. Several participants also called for clearer policies and more supportive regulations to enable easier and more confident engagement in carbon markets.

Technology emerged as a key area of promise. F5 discussed the potential of AI-driven tools, such as spatial algorithms developed by NCX (Natural Capital Exchange), to enhance landscape-level verification. Although current AI technologies and high-resolution imagery remain costly and out of reach for many smaller projects, F5 expressed optimism that continued technological development could lower verification costs and broaden access to carbon markets.

In summary, while participants agreed that robust verification and reporting are essential to maintaining credibility in carbon markets, they also recognized that current systems are burdened by operational inefficiencies, bureaucratic delays, and prohibitive costs. They emphasized the need for more streamlined methods, standardized protocols, and the integration of emerging technologies like AI and remote sensing to create a more accessible, cost-effective, and scalable verification framework for landowners and organizations of all sizes.

3.5 Views on support needed

Participants across TIMO, REIT, the forest industry, and forest management organizations expressed varied perspectives on the types of support needed to participate in forest carbon market programs. However, all emphasized the importance of a well-rounded support system that includes technical assistance, financial incentives, regulatory guidance, and improved market access.

Among TIMO participants, market transparency and financial clarity emerged as top priorities. T1 and T5 stressed the importance of stable, long-term policy frameworks to encourage investment in carbon markets. T2 highlighted concerns about pricing transparency and called for greater visibility into who the major carbon credit buyers are, noting that working with third-party brokers often feels ambiguous and risky. T3 emphasized the need for better education and outreach, asserting that broader participation requires improved access to both financial and educational resources. Similarly, T4 recommended developing a standardized carbon accounting system—ideally recognized by agencies like the USDA to streamline participation and reduce the high consultancy costs that discourage many landowners.

REIT participants prioritized regulatory and policy improvements. R1 described the current carbon market landscape as fragmented and advocated for a centralized reporting system to improve consistency. R1 also pointed out that existing REIT tax codes complicate participation, as income from carbon offsets is not currently classified as “good” REIT income. R2 emphasized the need for clearer and more user-friendly documentation, explaining that current carbon program materials are often too technical. R3 called for enhanced capacity-building tools, such as improved GIS and data analytics systems, and noted that small projects often lack the scale to absorb the fixed costs of participation.

Forest industry participants restated many of these concerns but also emphasized the importance of market access and strategic partnerships. F1 proposed the creation of a centralized credit trading platform, potentially managed by the USDA, while advising against the formation of a government-sanctioned monopoly. F2 asked for better technical support, consistent training opportunities, and financial incentives to stabilize participation within regulatory and economic uncertainty. F3 advised federal agencies to provide updated research and forest science that suggests modern management practices. F4 suggested that greater recognition of the carbon sequestration potential of wood products would help engagement, while F5 highlighted the need for standardized methodologies and centralized data access to make participation more efficient and accessible.

The forest management company (FM) placed particular emphasis on education and outreach. FM participants proposed workshops and educational resources to help landowners understand cost-sharing opportunities and available financial aid. They believed that informed landowners would be more empowered to participate, and that increased awareness would also allow FM companies to deliver more direct services rather than relying on third-party developers.

Across all organization types, financial support and incentives emerged as a consistent and unifying theme. TIMO participants T3 and T4, along with R1 from the REIT group, noted that smaller landowners would benefit greatly from financial assistance to offset consultancy and entry costs. F2 stressed the need for economic buffers to mitigate market volatility, while FM participants emphasized cost-sharing mechanisms as vital to easing financial burdens for private landowners.

3.6 Views on government incentives

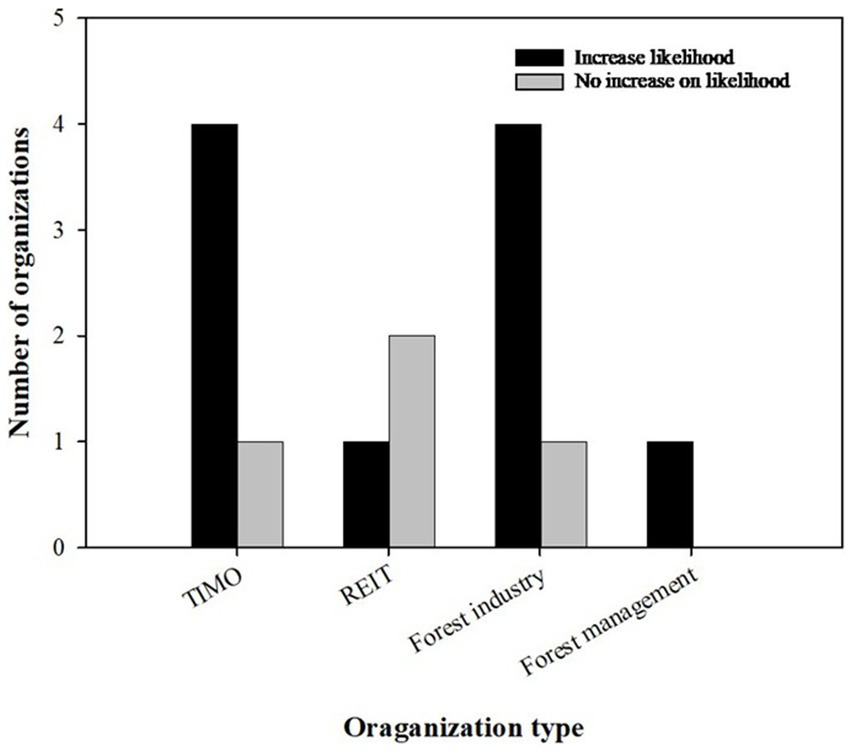

Across all organizational types, participants consistently indicated that government incentives would likely enhance their participation in forest carbon markets. Responses were generally similar within each organization type, except for REITs, which showed more variability in their perspectives (Figure 4).

Figure 4

Bar chart showing the influence of government incentives on the likelihood of organizations participating in forest carbon markets, broken down by organization type. TIMO and forest industry groups report increased likelihood with incentives, while some REIT and forest management groups indicate no increase.

Among TIMO participants, four out of five companies (T1, T2, T3, T5) indicated that government incentives would increase their likelihood of participating in forest carbon markets. These companies viewed financial support as a key motivating factor in their decision-making processes. In contrast, T4 stated that government incentives would not influence their participation, explaining a preference for operating independently without relying on public-sector support.

Responses from REITs were more mixed. R1 and R2 reported that government incentives would not affect their engagement, noting that they do not rely on financial assistance or policy-driven encouragement to participate in carbon markets. However, R3 expressed that such incentives would positively influence their participation, demonstrating that perspectives on government support can vary significantly even within a single organizational category.

Within the forest industry group, most companies (F1, F3, F4, F5) indicated that government incentives would encourage participation in carbon markets. These firms viewed public financial support as a valuable tool for lowering the economic barriers to entry. In contrast, F2, operating under California’s stringent regulatory framework, reported that such incentives would not influence their decision. This response may reflect a perception that existing regulations already guide their activities, reducing the need for additional support. The forest management company (FM) also stated that government incentives would increase their likelihood of participation, aligning with the broader trend observed across most organization types.

In summary, while most participants across organizational categories viewed government incentives as a key motivator for carbon market engagement, notable exceptions exist. Some organizations, particularly select REITs and those operating in heavily regulated environments, expressed a preference for limited government involvement. Nevertheless, financial incentives remain a critical policy tool for promoting broader participation in forest carbon offset programs.

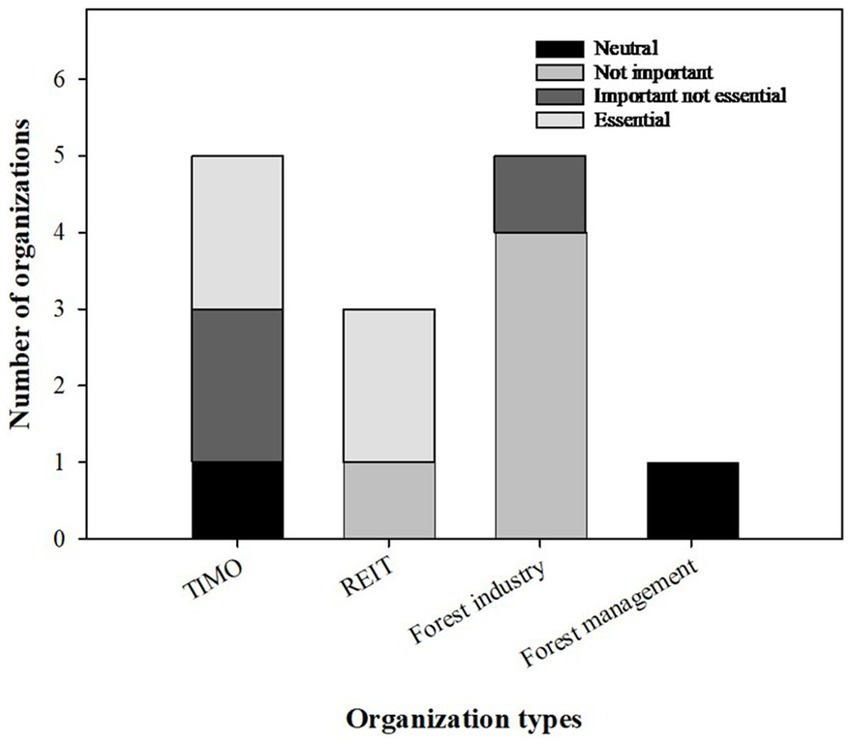

3.7 Importance of carbon market participation to show commitments to sustainability

The importance of forest carbon market participation to show commitment to sustainability and environmental stewardship varies across organization types (Figure 5).

Figure 5

Stacked bar chart displaying the number of organizations by type and their rating of how essential forest carbon market participation is for demonstrating sustainability commitment. Categories include Neutral, Not Important, Important but Not Essential, and Essential.

Responses from TIMOs and REITs generally reflected a more favorable view of carbon market participation as a marker of sustainability and environmental stewardship. Many TIMOs viewed involvement in carbon markets as a significant indicator of climate responsibility, with the sale of carbon credits serving both as a key revenue stream and a visible demonstration of proactive climate action. REITs also acknowledged the value of participating in carbon markets to signal environmental commitment; however, they tended to see it as important but not essential, often weighing participation against broader compliance obligations and operational priorities.

In contrast, most forest industry participants expressed a more limited view. Many within this group prioritized direct emissions reductions or traditional revenue streams and exhibited greater skepticism toward carbon credits or offsets, which they regarded as less central to their sustainability efforts. Similarly, the forest management company (FM) adopted a more neutral stance. While FM participants assist landowners in accessing carbon markets, they do not necessarily consider participation a critical component of their own business strategy unless it aligns with long-term organizational objectives.

4 Discussion

The analysis of corporate timberland companies’ participation in forest carbon markets reveals a complex and evolving landscape shaped by financial motivations, environmental objectives, and regulatory challenges. This multifaceted engagement underscores the potential of carbon markets to align profit-driven interests with climate mitigation goals. A central finding of this study is the key role of financial incentives. Many corporate timberland entities view forest carbon markets to diversify revenue streams (Francis and Zhang, 2024). Participation is strongly influenced by how well carbon credit revenues compare with traditional timber harvest returns (Mei, 2023). Moser et al. (2022) similarly observed that timber prices often yield larger financial returns, a dynamic echoed by our findings, which indicate that timber markets remain more attractive than carbon offset initiatives for many companies. These financial considerations are further constrained by high costs associated with data collection methods such as LiDAR (light detection and ranging), inconsistent carbon pricing, and skepticism toward long-term market commitments.

Global research supports these findings. Lou et al. (2023), in a study of corporate carbon investments, noted that many companies treat carbon markets as supplementary income sources, citing unstable pricing and the greater profitability of timber production. However, our research, along with Lou et al. (2023), emphasizes that financial motivations are not the sole drivers. Regulatory challenges such as navigating differing carbon accounting standards, complex verification protocols, and jurisdiction-specific approval processes significantly influence participation in voluntary carbon markets (Battocletti et al., 2024). Schmitz et al. (2016) highlights how the administrative burden of these evolving frameworks often deters engagement, particularly among organizations unfamiliar with compliance procedures. Wang et al. (2022) further connected regulatory opacity with pricing volatility, pointing to increased risks for long-term investments.

Participants in our study echoed these concerns, particularly regarding inconsistent methodologies and unpredictable approval timelines. These findings suggest that regulatory uncertainty not only discourages new entrants but also hinders scalability and strategic planning among current participants. Even experienced actors reported difficulties adapting to proliferating verification standards across different registries, indicating a need for greater harmonization and policy clarity.

Beyond financial and regulatory considerations, reputational concerns also shape participation decisions. While Lohmann (2009) critiques carbon trading as a mechanism that can delay substantive emissions reductions, his analysis draws attention to the scrutiny faced by companies perceived to lack environmental integrity in their offset strategies. Lou et al. (2023) reported that many corporate actors pursue carbon market involvement to strengthen public image and align with sustainability commitments. However, these engagements are often selective, favoring projects with strong reputational and financial benefits, such as forestry initiatives and renewable energy investments with local co-benefits (Lovell et al., 2009; Goldstein, 2016; Anderson and Bernauer, 2016).

Participants in our study emphasized that only large-scale efforts, such as deferred harvest or intensive forest management (IFM), are likely to produce substantial carbon sequestration. Lou et al. (2023) similarly observed that the scale and cost of carbon projects limit access for smaller landowners, reinforcing the market’s current bias toward large corporate participants with sufficient financial and operational capacity. Despite these barriers, many participants expressed optimism about the future of carbon markets. They anticipated that regulatory stabilization, increased market transparency, and growing climate awareness would contribute to broader adoption. This aligns with projections by Redmond and Convery (2015), who forecasted significant global growth in carbon markets driven by expanding demand for emissions reductions and carbon offsetting.

Several participants also pointed to government incentives as a critical mechanism for expanding engagement. Financial assistance was viewed to offset participation costs, particularly for smaller entities, an observation supported by Stephan and Paterson (2012), who identified government support as a key enabler of market entry. At the same time, some participants expressed concern that increased government involvement could force additional regulatory burdens, creating further complexity in already cumbersome market structures.

Beyond credits and offsets, there is increasing interest in integrating sustainable wood products into carbon market strategies. Participants noted that this approach enhances both financial viability and environmental performance, aligning forest management practices with long-term climate goals. Previous studies have highlighted the potential of wood products to contribute to emissions reductions through substitution and long-term carbon storage (Sathre and O’Connor, 2010; Schlamadinger and Marland, 1996; Lippke et al., 2011). Malmsheimer et al. (2011) similarly emphasized the value of incorporating wood products into forest carbon projects, framing sustainable forest management as a legitimate and measurable component of climate mitigation.

5 Conclusion

This study investigated the participation of corporate timberland entities in forest carbon markets, focusing on climate policy priorities, motivations, barriers, verification challenges, and perspectives on enabling mechanisms, such as government incentives. Financial returns emerged as the primary factor influencing participation across organization types. TIMOs demonstrated the highest level of engagement, integrating carbon market activities, particularly carbon credit sales and reforestation, into broader investment strategies. REITs expressed interest in carbon markets but evaluated participation in relation to regulatory obligations and reputational risks. Forest industry firms reported limited engagement, citing uncertain revenue potential, while forest management companies attributed their involvement to client demand rather than internal strategic priorities. Volatility in carbon pricing, high transaction costs, and administrative burdens related to verification and reporting were consistently identified as barriers. Participants highlighted the need for technical assistance, stable policy frameworks, and increased transparency in credit valuation. While most TIMOs and forest industry participants considered government incentives essential for broader adoption, REITs presented more diverse perspectives. These findings indicate that integrating carbon market mechanisms into corporate forest management is uneven and highly context dependent. Addressing structural barriers, particularly those related to pricing, regulation, and verification, is critical for enabling broader and more effective participation. Additional empirical research is required to assess the impact of evolving policy instruments, incentive structures, and technological innovations on corporate engagement with forest carbon markets. With adequate support, such as stable policy frameworks, financial and government incentives, and streamlined verification systems, corporate timberland managers could make a more significant contribution to climate mitigation objectives while maintaining economically viable land use systems.

Statements

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

The studies involving humans were approved by Auburn University Institutional Review Board (IRB). The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

SP: Writing – review & editing, Formal analysis, Software, Project administration, Writing – original draft, Resources, Conceptualization, Validation, Visualization, Methodology, Data curation, Investigation. AM: Visualization, Conceptualization, Software, Funding acquisition, Writing – original draft, Resources, Writing – review & editing, Investigation, Project administration, Methodology, Validation, Supervision, Formal analysis, Data curation. LN: Writing – review & editing. YP: Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This project was funded by USFS 22-JV-11330180-064.

Acknowledgments

We sincerely thank all industry professionals who participated in interviews and shared insights. Appreciation is also extended to the College of Forestry, Wildlife and Environment at Auburn University for their support.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1

Aldy J. E. Halem Z. M. (2024). The evolving role of greenhouse gas emission offsets in combating climate change. Rev. Environ. Econ. Policy18, 212–233. doi: 10.1086/730982

2

Anderson B. Bernauer T. (2016). How much carbon offsetting and where? Implications of efficiency, effectiveness, and ethicality considerations for public opinion formation. Energy Policy94, 387–395. doi: 10.1016/j.enpol.2016.04.016

3

Battocletti V. Enriques L. Romano A. (2024). The voluntary carbon market: market failures and policy implications. U. Colo. L. Rev.95:519. doi: 10.2139/ssrn.4380899

4

Blandford A. E. (2013). Semi-structured qualitative studies. London: Interaction Design Foundation.

5

Boscolo M. Lehtonen P. Di Girolami E. Duong G. (2025). Enhancing the sustainability and financing of forest-based value chains. Rome, Italy: Food and Agriculture Orgd.

6

Burke J. Gambhir A. (2022). Policy incentives for greenhouse gas removal techniques: the risks of premature inclusion in carbon markets and the need for a multi-pronged policy framework. Energy and Climate Change3:100074. doi: 10.1016/j.egycc.2022.100074

7

Calel R. (2013). Carbon markets: a historical overview. Wiley Interdiscip. Rev. Clim. Chang.4, 107–119. doi: 10.1002/wcc.208

8

Charmaz K. (2006). Constructing grounded theory: A practical guide through qualitative analysis. London: Sage.

9

Chen L. Liu S. Liu X. Wang J. (2022). The carbon emissions trading scheme and corporate environmental investments: a quasi-natural experiment from China. Emerg. Mark. Finance Trade58, 2670–2681. doi: 10.1080/1540496X.2021.2009338

10

Choi C. (2025). Trading carbon, trading justice: ethical dimensions of market-based climate solutions. EAJBE13, 1–16. doi: 10.20498/EAJBE.2025.13.1.1

11

Conejero M. A. Farina E. M. M. Q. (2003). Carbon market: business incentives for sustainability. Int. Food Agribus. Manag. Rev.5:4. doi: 10.22004/ag.econ.34415

12

Creswell J. W. Poth C. N. (2016). Qualitative inquiry and research design: Choosing among five approaches. London: Sage Publications.

13

Cvjetković B. Mataruga M. (2020). Afforestation and its climate change impact Life on land. Cham: Springer International Publishing, 13–26.

14

Dargusch P. Harrison S. Thomas S. (2010). Opportunities for small-scale forestry in carbon markets. Small-Scale For.9, 397–408. doi: 10.1007/s11842-010-9142-y

15

Espenan N. P. (2023). Improving voluntary carbon markets through standardization and blockchain technology. Wyo. Law Rev.23, 141–177. doi: 10.59643/1942-9916.1473

16

Francis J. C. Zhang G. (2024). Investing in US timberland companies. J. Risk Financial Manag.17:220. doi: 10.3390/jrfm17060220

17

Goldstein A. (2016). Buying in: Taking stock of the role of carbon offsets in corporate carbon strategies.

18

Gorain S. Malakar A. Chanda S. (2021). An analysis of carbon market and carbon credits in India. Asian J. Agric. Ext. Econ. Sociol.39, 40–49. doi: 10.9734/ajaees/2021/v39i230528

19

Griscom B. W. Cortez R. (2013). The case for improved forest management (IFM) as a priority REDD+ strategy in the tropics. Trop. Conserv. Sci.6, 409–425. doi: 10.1177/194008291300600307

20

Guigon P. (2010). Voluntary carbon markets: how can they serve climate policies? Paris, France: OECD Publishing. doi: 10.1787/5km975th0z6h-en

21

Hamrick K. Gallant M. (2017). Fertile ground: State of forest carbon finance 2017. Washington, DC: FAO.

22

Helppi O. Salo E. Vatanen S. Pajula T. Grönman K. (2023). Review of carbon emissions offsetting guidelines using instructional criteria. Int. J. Life Cycle Assess.28, 924–932. doi: 10.1007/s11367-023-02166-w

23

Kerchner C. D. Keeton W. S. (2015). California's regulatory forest carbon market: viability for northeast landowners. Forest Policy Econ.50, 70–81. doi: 10.1016/j.forpol.2014.09.005

24

Kollmuss A. Lazarus M. Lee C. LeFranc M. Polycarp C. (2010). Handbook of carbon offset programs: Trading systems, funds, protocols and standards. London: Routledge.

25

Kossoy A. Guigon P. (2012). State and trends of the carbon market 2012. Washington, D.C., USA: The World Bank.

26

Li X. Bi C. Wu J. Zhang C. Yan W. Xiao Z. et al . (2025). Maximum carbon uptake potential through progressive management of plantation forests in Guangdong Province, China. Commun. Earth Environ.6:9. doi: 10.1038/s43247-024-01977-5

27

Li X. Ning Z. Yang H. (2022). A review of the relationship between China's key forestry ecology projects and carbon market under carbon neutrality. Trees Forests People9:100311. doi: 10.1016/j.tfp.2022.100311

28

Lippke B. Oneil E. Harrison R. Skog K. Gustavsson L. Sathre R. (2011). Life cycle impacts of forest management and wood utilization on carbon mitigation: knowns and unknowns. Carbon Manag.2, 303–333. doi: 10.4155/cmt.11.24

29

Lohmann L. (2009). Regulation as corruption in the carbon offset markets. Upsetting the offset: The political economy of carbon markets, 175–191.

30

Lou J. Hultman N. Patwardhan A. Mintzer I. (2023). Corporate motivations and co-benefit valuation in private climate finance investments through voluntary carbon markets. NPJ Clim. Action.2:32. doi: 10.1038/s44168-023-00063-4

31

Lovell H. Bulkeley H. Liverman D. (2009). Carbon offsetting: sustaining consumption. Environ. Plan. A41, 2357–2379. doi: 10.1068/a40345

32

Maggard A. VanderSchaaf C. (2022). Forest carbon markets and programs, FOR-2131. Auburn, Alabama: Alabama Cooperative Extension System.

33

Malmsheimer R. W. Bowyer J. L. Fried J. S. Gee E. Izlar R. L. Miner R. A. et al . (2011). Managing forests because carbon matters: integrating energy, products, and land management policy. J. For.109, S7–S50. doi: 10.1093/jof/109.s1.S7

34

Mansanet-Bataller M. Pardo Á. (2008). What you should know about carbon markets. Energies1, 120–153. doi: 10.3390/en1030120

35

Mason C. F. Plantinga A. J. (2013). The additionality problem with offsets: optimal contracts for carbon sequestration in forests. J. Environ. Econ. Manag.66, 1–14. doi: 10.1016/j.jeem.2013.02.003

36

Mei B. (2023). Carbon offset as another driver of timberland investment returns in the United States. J. For. Bus. Res.2, 1–19. doi: 10.62320/jfbr.v2i1.20

37

Moser R. L. Windmuller-Campione M. A. Russell M. B. (2022). Natural resource manager perceptions of forest carbon management and carbon market participation in Minnesota. Forests13:1949. doi: 10.3390/f13111949

38

Newell R. G. Pizer W. A. Raimi D. (2014). Carbon markets: past, present, and future. Annu. Rev. Resour. Econ.6, 191–215. doi: 10.1146/annurev-resource-100913-012655

39

Ontl T. A. Janowiak M. K. Swanston C. W. Daley J. Handler S. Cornett M. et al . (2020). Forest management for carbon sequestration and climate adaptation. J. For.118, 86–101. doi: 10.1093/jofore/fvz062

40

Piao X. Mei B. Xue Y. (2016). Comparing the financial performance of timber REITs and other REITs. Forest Policy Econ.72, 115–121. doi: 10.1016/j.forpol.2016.06.022

41

Redmond L. Convery F. (2015). The global carbon market-mechanism landscape: pre and post 2020 perspectives. Clim. Pol.15, 647–669. doi: 10.1080/14693062.2014.965126

42

Rohatyn S. Rotenberg E. Yakir D. Carmel Y. (2021). Assessing climatic benefits from forestation potential in semi-arid lands. Environ. Res. Lett.16:104039. doi: 10.1088/1748-9326/ac29e9

43

Sass E. M. Markowski-Lindsay M. Butler B. J. Caputo J. Hartsell A. Huff E. et al . (2021). Dynamics of large corporate forestland ownerships in the United States. J. For.119, 363–375. doi: 10.1093/jofore/fvab013

44

Sathre R. O’Connor J. (2010). Meta-analysis of greenhouse gas displacement factors of wood product substitution. Environ. Sci. Pol.13, 104–114. doi: 10.1016/j.envsci.2009.12.005

45

Schlamadinger B. Marland G. (1996). The role of forest and bioenergy strategies in the global carbon cycle. Biomass Bioenergy10, 275–300. doi: 10.1016/0961-9534(95)00113-1

46

Schmitz M. Olander L. Trianosky P. BedellLoucks A. (2016). Engaging large forest owners in All-Lands conservation: All-Lands and large ownerships—A onservation to Advance Engagement Workshop, May 8, 2016, Durham, NC: Duke University. Available online at:http://nicholasinstitute.duke.edu/publications

47

Shockley J. Snell W. (2021). Carbon markets 101. Econ. Policy dUpdate21:4.

48

Smith E. Olander L. Trianosky R. Bedell-Loucks A. . (2016). Engaging Forest Owners in All-Lands Conservation. Workshop Proceedings. 8 March 2016. Washington, D.C: Newtown Square.

49

Stephan B. Paterson M. (2012). The politics of carbon markets: an introduction. Environ. Polit.21, 545–562. doi: 10.1080/09644016.2012.688353

50

Trouwloon D. Streck C. Chagas T. Martinus G. (2023). Understanding the use of carbon credits by companies: a review of the defining elements of corporate climate claims. Glob. Chall.7:2200158. doi: 10.1002/gch2.202200158

51

Wade D. Moseley C. (2011). Foresters' perceptions of family forest owner willingness to participate in forest carbon markets. North. J. Appl. For.28, 199–203. doi: 10.1093/njaf/28.4.199

52

Wang M. Zhu M. Tian L. (2022). A novel framework for carbon price forecasting with uncertainties. Energy Econ.112:106162. doi: 10.1016/j.eneco.2022.106162

53

Williams M. Moser T. (2019). The art of coding and thematic exploration in qualitative research. Int. Manag. Rev.15, 45–55.

Summary

Keywords

forest carbon markets, corporate timberland management, sustainable forestry, forest carbon projects, market-based climate solutions

Citation

Pullalarevu STR, Maggard A, Narine LL and Peng Y (2025) A qualitative assessment of corporate timberland companies’ participation in Forest carbon programs. Front. For. Glob. Change 8:1655443. doi: 10.3389/ffgc.2025.1655443

Received

27 June 2025

Revised

04 November 2025

Accepted

05 November 2025

Published

24 November 2025

Volume

8 - 2025

Edited by

Yashwant Singh Rawat, Federal Technical and Vocational Education and Training Institute (FTVETI), Ethiopia

Reviewed by

Peter William Clinton, New Zealand Forest Research Institute Limited (Scion), New Zealand

Robert Jandl, Federal Research and Training Centre for Forests, Natural Hazards and Landscape (BFW), Austria

Updates

Copyright

© 2025 Pullalarevu, Maggard, Narine and Peng.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Adam Maggard, adm0074@auburn.edu

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.