- 1Faculty of Economics and Business, Universitas Indonesia, Jakarta, Indonesia

- 2Caucus of Indonesian Mental Health Care Community (Kaukus Masyarakat Peduli Kesehatan Jiwa), Jakarta, Indonesia

- 3Faculty of Psychology, Universitas Indonesia, Jakarta, Indonesia

- 4Occupational Medicine Study Program, Department of Community Medicine, Faculty of Medicine, Universitas Indonesia, Jakarta, Indonesia

- 5Health Collaborative Center (HCC), Jakarta, Indonesia

- 6Dentons HPRP Law Firm, Jakarta, Indonesia

This study examines work stress in the Indonesian financial sector by analyzing the prevalence of negative vigor, work fatigue, and the imbalance between work and personal life. Using a cross-sectional survey design, data were collected from employees across various financial institutions. Bivariate analysis revealed significant associations between work stress and key risk factors, with over 20% of employees reporting loss of work spirit (negative vigor) and fatigue. The results showed that younger employees (under 40 years old) are 2.5 times more likely to experience fatigue compared to older workers. Additionally, staff-level employees exhibited higher incidences of fatigue and vigor loss. The analysis also found a significant link between poor work-life balance and elevated stress levels, highlighting the lack of boundaries between personal and professional life as a key contributor to stress. These findings mirror global trends in the financial sector, where vigor loss and fatigue are significant factors in job dissatisfaction and productivity loss. The study underscores the need for targeted mental health interventions and organizational policies to address work stress and improve employee well-being.

Introduction

Financial services is one of the most crucial sectors in the world economy, including in Indonesia, and plays a vital role in driving economic expansion, maintaining financial stability, and facilitating capital flow. However, employees in this sector are among those who face the greatest amounts of stress related to their jobs (1, 2). A 2019 survey by the American Institute of Stress found that 83% of workers in this industry said they were stressed out because of their jobs, and 60% said that their workload was a major source of stress.

Indonesia’s financial sector represents a particularly important context for studying workplace stress due to several distinctive factors. As Southeast Asia’s largest economy, Indonesia has experienced rapid financial sector growth with increasing complexity, regulatory pressures, and digital transformation demands (3). The financial sector contributes significantly to Indonesia’s GDP, employing hundreds of thousands of individuals across banking, insurance, and investment services (4). Despite its economic significance, studies examining occupational health in this sector remain limited, with most research focusing on Western contexts or manufacturing industries (5). The unique cultural dynamics of Indonesia’s work environment, characterized by hierarchical structures and collective orientation, further necessitate context-specific research as these factors may influence stress manifestations differently than in Western settings (6).

In the financial industry, stress at work can have a number of detrimental effects, such as lower productivity, higher absenteeism, and a wider economic impact (7, 8). Additionally, chronic stress is a known risk factor for the development of mental health disorders, such as anxiety and depression (9, 10), further exacerbating the challenges faced by employees in this sector. Research on high-stress professions, though in different contexts, offers valuable insights into the relationship between workplace environments and psychological wellbeing. For instance, Amorim-Gaudêncio et al. (11) found that professionals in high-stress occupations often experience compromised quality of life across multiple domains, with particular vulnerabilities in environmental satisfaction and elevated anxiety levels, patterns that may have parallels in financial sector employees exposed to prolonged work stress.

Vigor and fatigue represent opposing yet interconnected psychological states that significantly impact workplace outcomes. Vigor, characterized by high levels of energy, mental resilience, and a willingness to invest effort in work, serves as a critical component of work engagement and a predictor of productivity (12, 13). According to the Conservation of Resources theory, vigor represents a positive resource state that enables employees to effectively manage job demands and maintain performance even under pressure (14). In contrast, fatigue manifests as a state of depleted cognitive and physical resources, resulting from sustained effort expenditure without adequate recovery (15, 16).

Recent research demonstrates that these constructs operate along a continuum rather than as mere opposites, with unique antecedents and consequences (17). Vigor positively correlates with productivity metrics including task performance, creative problem-solving, and organizational citizenship behaviors, while fatigue shows robust negative associations with cognitive functioning, decision quality, and error rates (18). Importantly, the temporal relationship between these states is complex; sustained periods of high vigor without adequate recovery often lead to fatigue, creating a cyclical pattern that threatens long-term performance sustainability (19).

These dynamics are particularly pronounced in high-pressure sectors like financial services, where the combination of cognitive demands, emotional labor, and time pressure creates unique vulnerability to both vigor depletion and fatigue accumulation (20). Studies specifically examining Indonesian workforce have found that psychological factors and work environments significantly affect performance and contribute to turnover intention, highlighting the negative impacts of prolonged stress exposure (5, 21). Preventing long-term stress-related health problems, improving employee resilience, and creating a healthy work environment all depend on addressing elements that encourage vigor while reducing weariness.

The problem of workplace mental health is still not well understood in Indonesia. In the workplace, mental health is not well understood or supported, especially in the financial services industry (22). Furthermore, a lack of precise data and case studies unique to this profession frequently impedes efforts to reduce and address mental health difficulties. There is a substantial information and data gap about the Indonesian financial industry because the majority of current research concentrates on other industries or looks at these issues from an international viewpoint.

This research gap is particularly concerning given several context-specific challenges. First, Indonesia’s financial sector has undergone significant structural changes following regulatory reforms in recent years, creating novel stressors not captured in previous studies (3). Second, the sector faces acute talent retention challenges, with high turnover rates compared to the national average across industries, highlighting the need for evidence-based interventions (23). Third, cultural factors influencing help-seeking behaviors and stigma around mental health issues create barriers to implementing effective interventions without locally-relevant research (22). These contextual elements underscore the need for Indonesia-specific research rather than relying on findings from Western or even neighboring Asian countries.

In light of these difficulties, the purpose of this research is to assess how the work environment, job attributes, and mental health of workers in Indonesia’s financial services industry interact. Three main questions are addressed by this study using a cross-sectional design: (1) How common are mental health problems among workers in this industry? (2) Are work qualities and mental health outcomes significantly correlated? (3) What are some possible mitigation techniques that might be used to deal with these problems? By answering these questions, the project hopes to advance knowledge of the variables affecting mental health in the Indonesian financial industry and offer evidence-based suggestions for enhancing treatments and support for workplace mental health.

Methods

To assess the association between the work environment, job characteristics, and mental health among employees in Indonesia’s financial services industry, this study used a cross-sectional survey design. As stated in Registration Number KEPK/UMP/01/IX/2024, the Health Research Ethics Committee of Universitas Muhammadiyah Purwokerto granted ethical approval for this study. Prior to participating, each subject gave their informed consent. Employees in the financial services industry comprising the study’s target audience were selected through purposive sampling to ensure participation from various financial institutions. Participants had to be between the ages of 20 and 55, full-time employees with at least 1 year of work experience.

The data collection utilized the Indonesian version of the New Brief Job Stress Questionnaire (SV-NBJSQ) (24), which was selected over other instruments like the Job Content Questionnaire (JCQ) due to its validation specifically for the Indonesian context. The SV-NBJSQ was developed based on the original Brief Job Stress Questionnaire (BJSQ), which has been widely used in occupational health research in Asia. According to Adi et al. (24), the Indonesian version underwent a rigorous translation and cultural adaptation process, and demonstrated acceptable reliability and validity for measuring workplace stress in Indonesian populations. The original BJSQ, on which the SV-NBJSQ is based, has shown good internal consistency with Cronbach’s alpha values ranging from 0.74 to 0.85 in previous studies (25, 26).

A mixed-mode data collection approach was implemented, with most participants completing the survey online through a secure platform, while printed questionnaires were provided for those with limited internet access or who preferred paper formats. Several strategies were employed to enhance the response rate, including institutional endorsement, strategic reminders, and clear communication about the study’s relevance to workplace well-being. Data collection occurred during September–October 2024, allowing for representation across different workload cycles in the financial sector.

Both descriptive and inferential statistics were used to examine the data. Demographic details and frequencies of various forms of work-related stress were compiled using descriptive statistics, while the associations between employment qualities, work environment, and mental health outcomes were investigated using inferential analyses including multiple regression and correlation. The SV-NBJSQ assessed nine different forms of occupational stress, including workload, conflict with coworkers, job control, and physical demands, along with 25 employment stressors such as time constraints, job uncertainty, and interpersonal connections that contribute to workplace stress.

Results

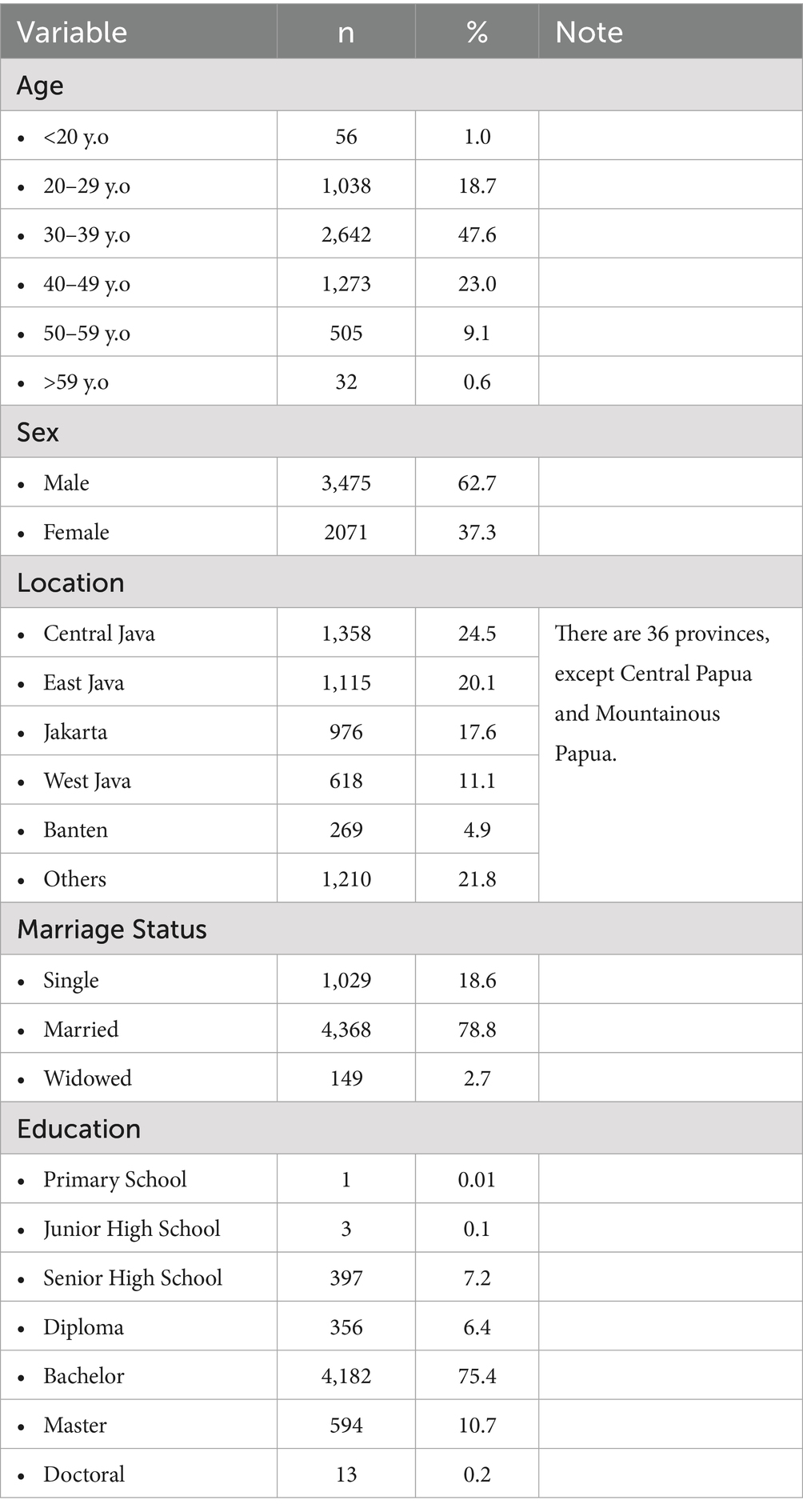

The demographic profile of participants in this study highlights key characteristics of employees in the Indonesian financial services sector. In terms of age, the majority of respondents (47.6%) were between 30 and 39 years old, followed by 23.0% aged 40 to 49, while those aged 20 to 29 accounted for 18.7%. Younger employees under 20 years and older individuals over 59 years represented the smallest groups, with 1.0 and 0.6%, respectively. The sample also showed a gender imbalance, with 62.7% of participants being male and 37.3% female. Geographically, the largest proportion of participants were based in Central Java (24.5%), followed by East Java (20.1%) and Jakarta (17.6%), while West Java (11.1%), Banten (4.9%), and other provinces (21.8%) also contributed to the sample. Notably, the study covered all provinces except Central Papua and Mountainous Papua, ensuring a diverse regional representation (Table 1).

The demographic profile of participants reveals important patterns with implications for targeted stress management in Indonesia’s financial sector. The predominance of employees aged 30–39 (47.6%) and male employees (62.7%) indicates a workforce at a career stage often balancing increasing professional responsibilities with family obligations, potentially contributing to work-life tensions. The geographical concentration in Central Java (24.5%), East Java (20.1%), and Jakarta (17.6%) reflects Indonesia’s financial industry distribution, with densely populated urban centers likely experiencing higher-pressure work environments compared to less represented regions. The high proportion of married participants (78.8%) suggests that family responsibilities may compound workplace stressors, requiring interventions that acknowledge the dual demands faced by employees. Educational data showing most employees hold Bachelor’s degrees (75.4%) indicates a highly educated workforce that may respond well to evidence-based stress management approaches, while potentially experiencing stress from educational investment and corresponding career expectations.

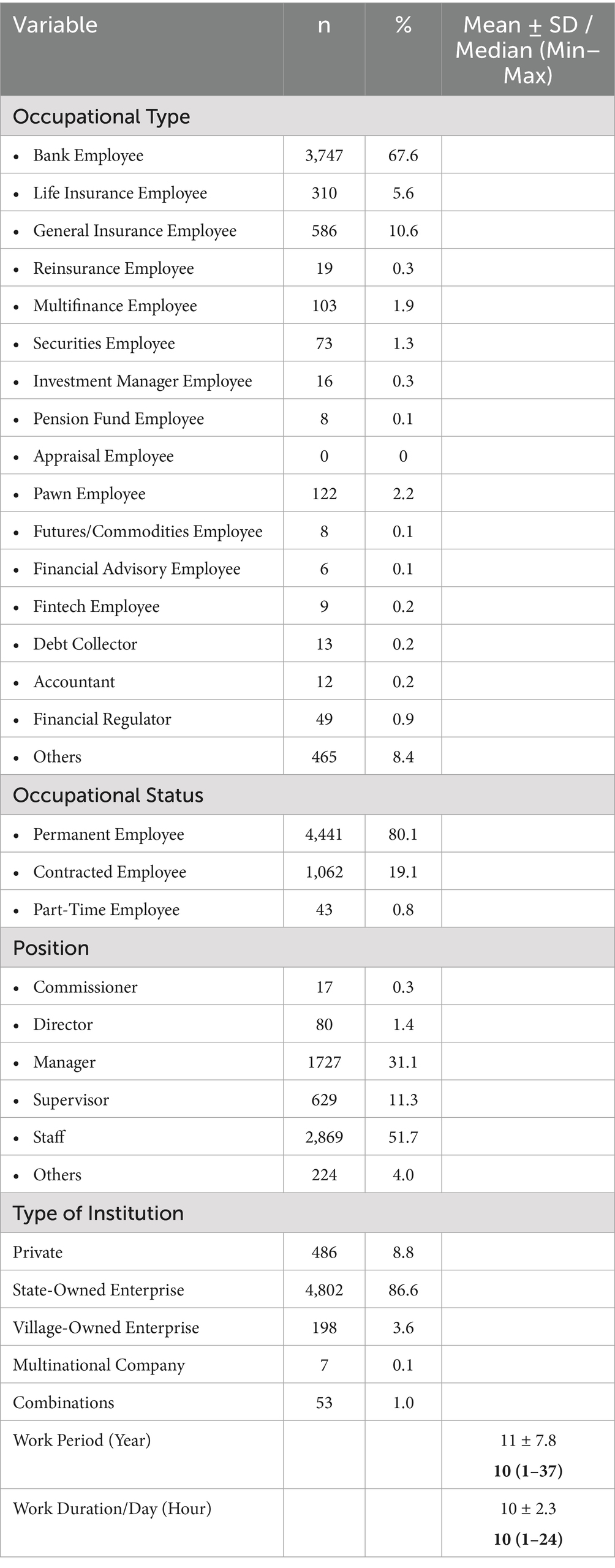

In terms of marital status, a significant majority of participants were married (78.8%), with 18.6% being single and 2.7% widowed, indicating a workforce largely composed of individuals managing both work and family responsibilities. Educational attainment among the participants was notably high, with 75.4% holding a Bachelor’s degree, 10.7% a Master’s degree, and 0.2% a Doctoral degree. In contrast, only a small percentage had completed education at the senior high school level (7.2%) or below, including primary school, junior high school, and diploma holders, who collectively accounted for 6.5%. This demographic overview underscores the diverse age distribution, regional representation, and high educational background of employees in the financial services sector, providing a comprehensive basis for analyzing job-related stress and mental health within this workforce (Table 2).

Occupational characteristics reveal that bank employees (67.6%) constitute the majority of participants, indicating that interventions should prioritize banking-specific stressors such as customer-facing pressure and transaction accuracy demands. The prevalence of permanent employees (80.1%) suggests organizational interventions could have sustainable impact due to workforce stability, while the high proportion of staff-level employees (51.7%) indicates that front-line stress management deserves particular attention. The predominance of state-owned enterprises (86.6%) points to potential for standardized interventions across these institutions, leveraging their similar organizational cultures. The average 11-year work tenure alongside 10-h workdays reveals a workforce experiencing substantial cumulative stress exposure while navigating extended workdays that exceed standard hours, suggesting interventions should address both acute daily fatigue and chronic stress accumulation (Table 3).

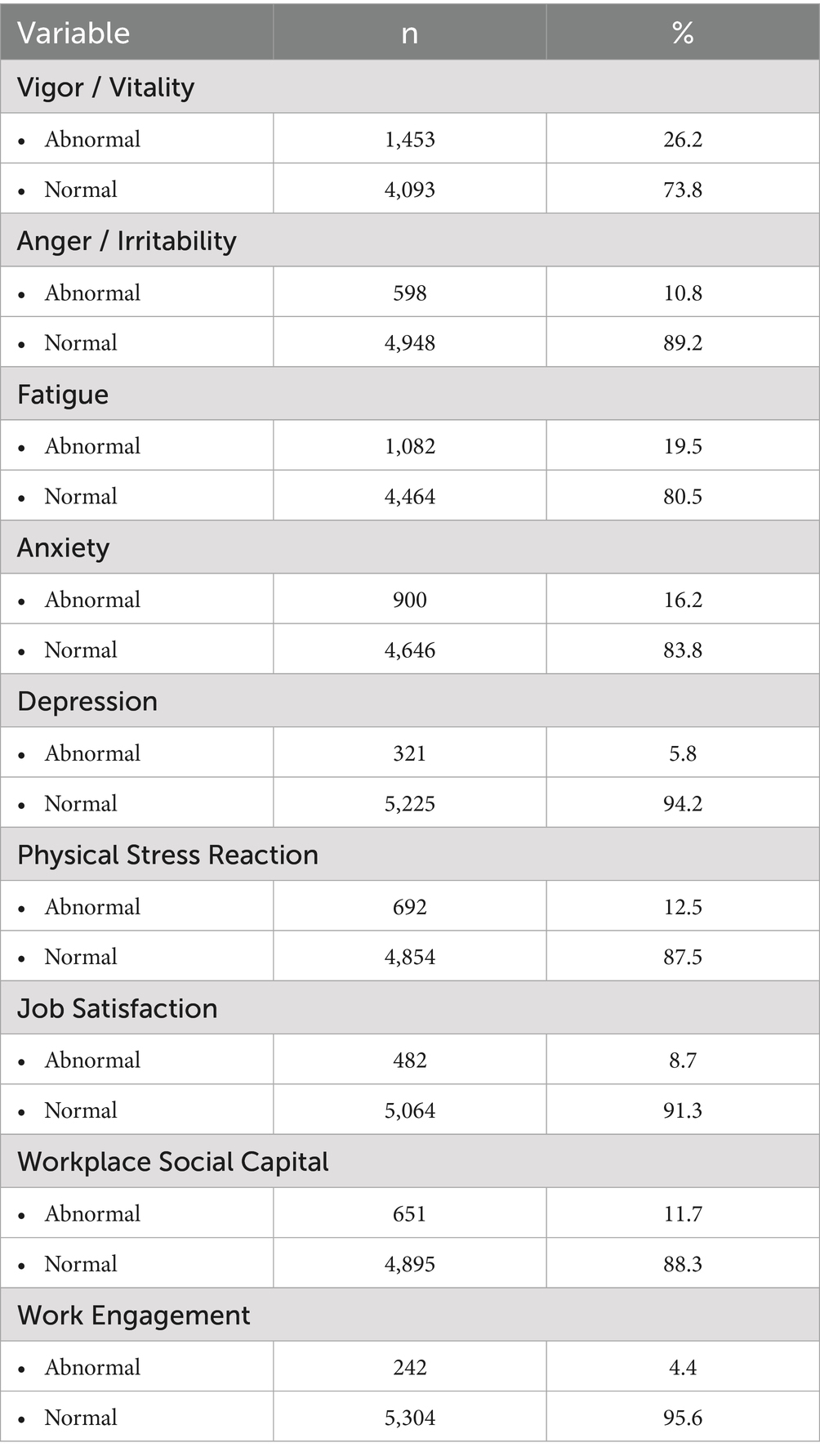

The prevalence of stress factors among participants provides crucial insight for intervention prioritization. With 26.2% of employees experiencing reduced vigor or vitality, 19.5% reporting fatigue, and 16.2% showing anxiety symptoms, these three conditions represent the most common manifestations of workplace stress requiring immediate attention. Physical stress reactions (12.5%) and workplace social capital challenges (11.7%) indicate additional areas for intervention. The relatively low levels of dissatisfaction (8.7%), depression (5.8%), and disengagement (4.4%) suggest that despite stress indicators, most employees maintain fundamental connection to their work. This pattern suggests early-stage intervention could prevent progression to more severe conditions, as employees appear to maintain basic job satisfaction and engagement despite experiencing energy depletion and stress symptoms. Overall, the majority of respondents exhibited normal levels of anger/irritability (89.2%) and anxiety (83.8%), indicating relatively positive mental health outcomes for a significant portion of the sample.

Bivariate analysis for vigor

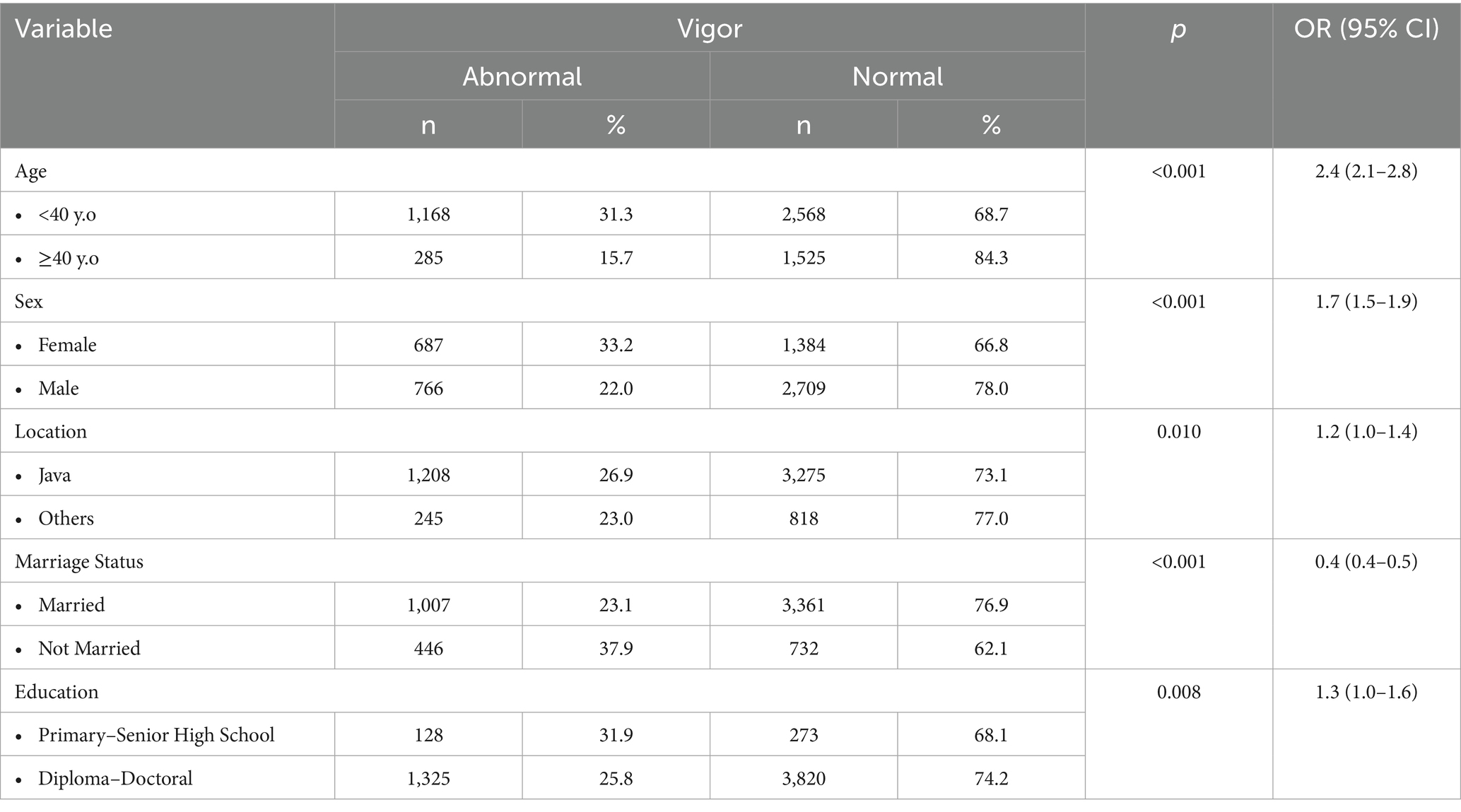

Bivariate analysis reveals that younger employees under 40 are 2.5 times more likely to experience fatigue, suggesting that organizational interventions should include specialized support for early-career professionals, such as workload management training and resilience-building programs tailored to this age group. Female employees, with 1.3 times higher fatigue risk, would benefit from gender-specific programs addressing unique stressors they face in Indonesia’s financial sector, where women often navigate both traditional gender expectations and professional demands. The regional differences indicating that employees in Java experience nearly twice the fatigue risk compared to other regions calls for regionally-tailored approaches that address the faster pace and higher demands of financial centers in densely populated areas. Married individuals showing lower fatigue risk suggests that family support may serve as a protective factor, indicating potential benefit from work-family integration programs that leverage this strength rather than treating family solely as a competing demand (Table 4).

Respondents living in Java were slightly more likely to report abnormal vigor (26.9%) compared to those from other regions (23.0%), with an odds ratio of 1.2 (OR: 1.2, 95% CI: 1.0–1.4, p = 0.010). Marital status also influenced vigor levels, as unmarried individuals exhibited a higher prevalence of abnormal vigor (37.9%) compared to married respondents (23.1%), with an odds ratio of 0.4, indicating that married individuals were less likely to experience reduced vitality (OR: 0.4, 95% CI: 0.4–0.5, p < 0.001).

In terms of educational background, respondents with a primary to senior high school education had a higher prevalence of abnormal vigor (31.9%) compared to those with a diploma to doctoral degree (25.8%), with an odds ratio of 1.3 (OR: 1.3, 95% CI: 1.0–1.6, p = 0.008). This suggests that higher educational attainment may be associated with better vitality in the workplace (Table 5).

Staff-level employees exhibit significantly higher rates of both fatigue (24.8%) and vigor loss (32.9%) compared to management positions, likely reflecting their limited decision authority combined with high customer-facing responsibilities. For instance, tellers in regional bank branches often describe managing long queues of customers while simultaneously maintaining transaction accuracy and security protocols, with minimal ability to control their work pace. Debt collectors face particularly acute stress, with 53.8% reporting vigor loss, as they navigate challenging client interactions while meeting collection targets. As one debt collector described: “I regularly face hostile reactions while also meeting strict performance metrics, and the emotional labor is overwhelming by mid-week.” These front-line realities suggest interventions should address both the practical aspects of workload management and the psychological dimensions of emotional labor specific to each role.

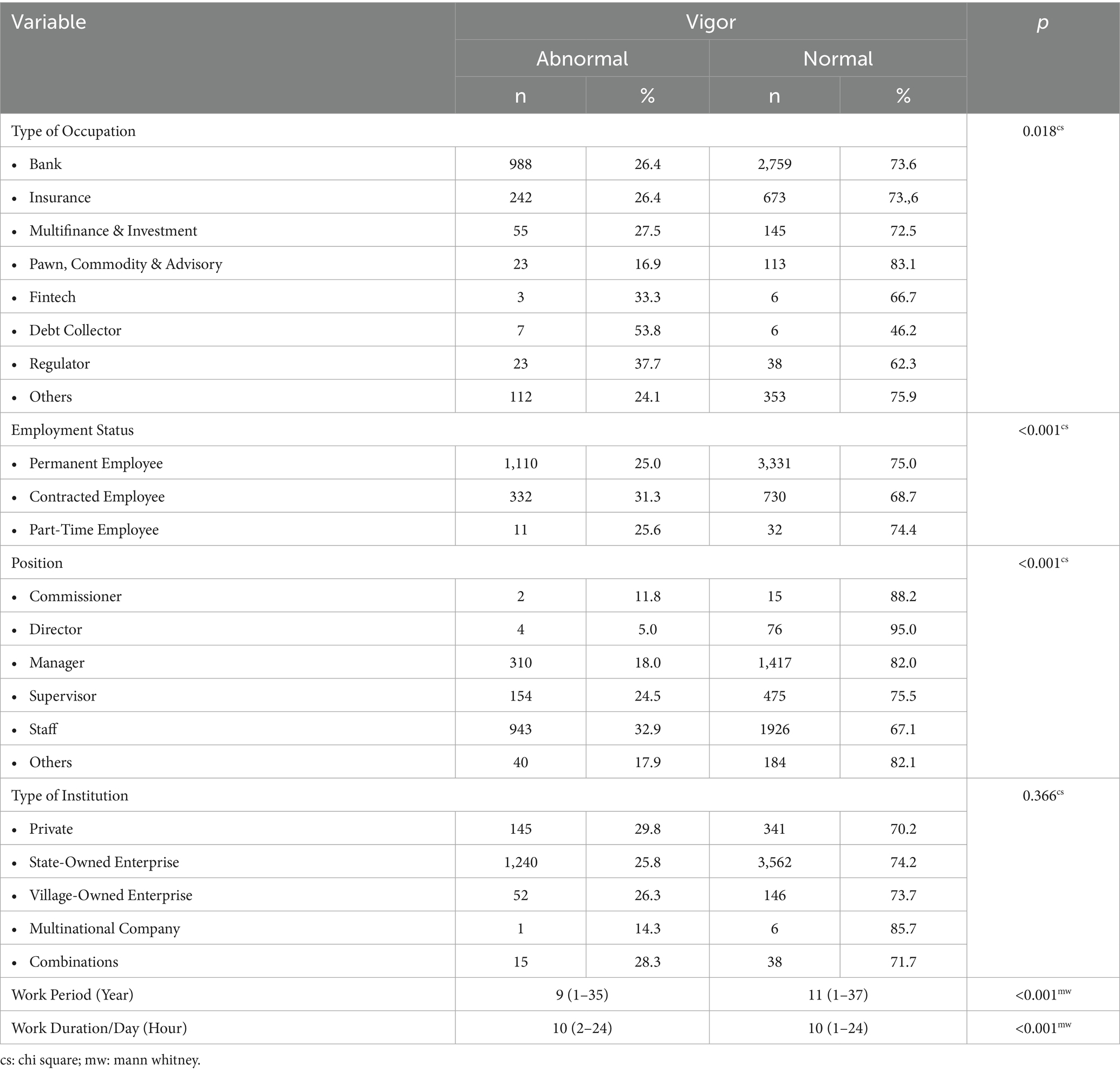

Among bank and insurance employees, 26.4% reported abnormal vigor, while employees in multifinance and investment sectors showed a similar rate of 27.5%. Conversely, workers in pawn, commodity, and advisory roles had a lower prevalence of abnormal vigor at 16.9%.

Employment status also plays a critical role in vigor levels. Contracted employees experienced higher rates of abnormal vigor (31.3%) compared to permanent employees (25.0%). In terms of job positions, staff-level employees reported the highest prevalence of reduced energy at 32.9%, making them more vulnerable to stress compared to supervisors (24.5%), managers (18.0%), and directors (5.0%). Notably, 33% of staff-level employees and nearly 30% of private-sector financial workers reported reduced vigor due to workplace stress.

Institutional type showed less variation in vigor levels, with private-sector employees reporting a slightly higher prevalence of abnormal vigor (29.8%) compared to those in state-owned enterprises (25.8%) and village-owned enterprises (26.3%). Employees in multinational companies reported the lowest rates of abnormal vigor at 14.3%, suggesting a potentially more supportive work environment.

Younger employees, particularly those under 40, were 2.4 times more likely to experience reduced vigor compared to their older counterparts. Additionally, workers with shorter tenure and longer daily work hours were more prone to experiencing reduced energy levels, emphasizing the impact of work duration and experience on employee vitality. Specifically, employees with abnormal vigor had a median work period of 9 years and worked an average of 10 h per day, compared to 11 years and 10 h for those with normal vigor levels (Table 6).

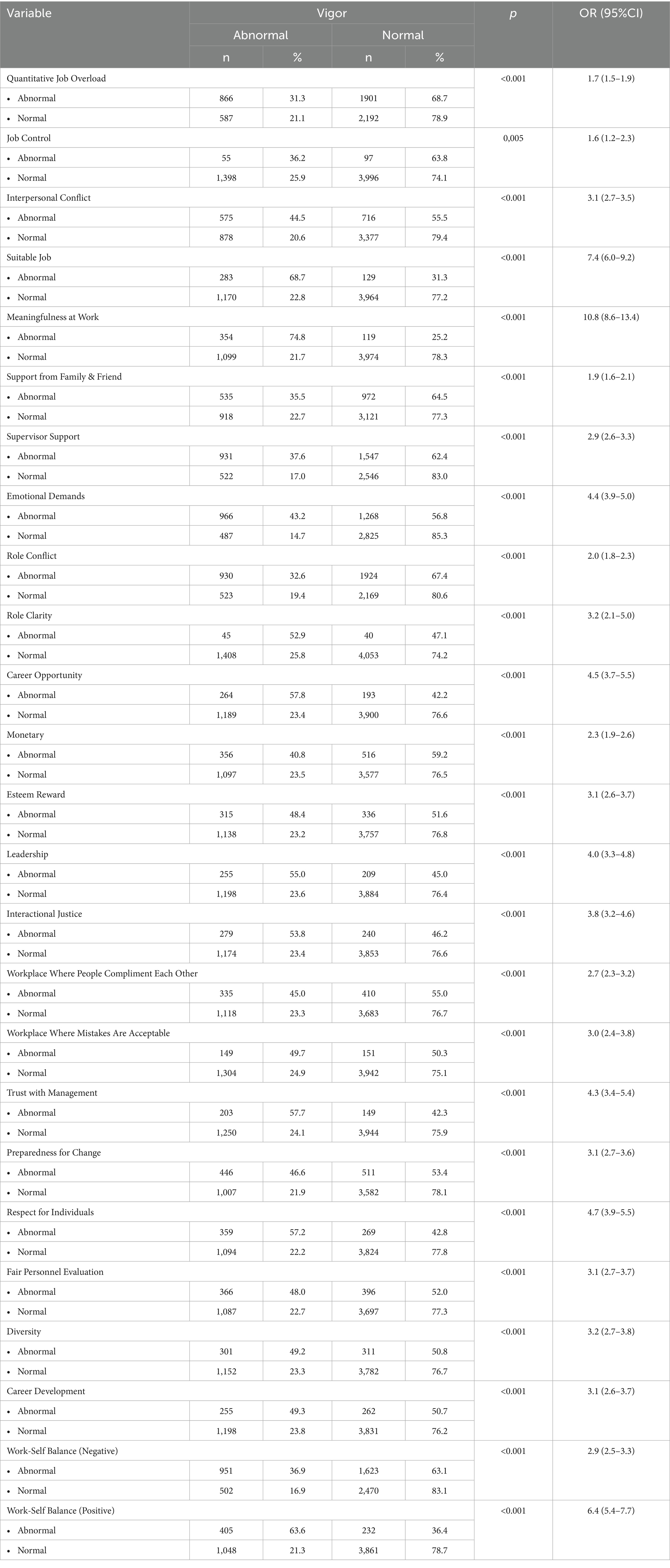

The results reveal significant associations between various workplace factors and abnormal vigor, indicating reduced energy and vitality among employees. Quantitative job overload is a notable predictor, with employees experiencing abnormal workloads being 1.7 times more likely to report reduced vigor compared to those with manageable workloads (31.3% vs. 21.1%, p < 0.001). Similarly, low job control is associated with a 1.6 times higher likelihood of reduced vigor (36.2% vs. 25.9%, p = 0.005).

Interpersonal conflict emerged as a critical factor, increasing the odds of reduced vigor by 3.1 times (44.5% vs. 20.6%, p < 0.001). Additionally, employees who found their jobs unsuitable were 7.4 times more likely to experience abnormal vigor (68.7% vs. 22.8%, p < 0.001). Lack of meaningfulness at work had the strongest association, with employees facing this issue being 10.8 times more likely to report reduced energy levels (74.8% vs. 21.7%, p < 0.001).

Support systems also play a significant role. Insufficient family and friend support increased the likelihood of reduced vigor by 1.9 times (35.5% vs. 22.7%, p < 0.001), while poor supervisor support raised the odds by 2.9 times (37.6% vs. 17.0%, p < 0.001). High emotional demands further increased the risk of abnormal vigor by 4.4 times (43.2% vs. 14.7%, p < 0.001).

Job-related stressors, such as role conflict and role clarity, were significant predictors, with abnormal clarity increasing the odds of reduced vigor by 3.2 times (52.9% vs. 25.8%, p < 0.001). Similarly, employees reporting limited career opportunities were 4.5 times more likely to experience reduced vigor (57.8% vs. 23.4%, p < 0.001).

Workplace culture also plays a critical role. Lack of leadership increased the likelihood of reduced vigor by 4.0 times (55.0% vs. 23.6%, p < 0.001), while low trust in management raised the odds by 4.3 times (57.7% vs. 24.1%, p < 0.001). A lack of respect for individuals and unfair personnel evaluations were also significant, with both factors increasing the odds of abnormal vigor by more than three times (57.2% vs. 22.2%, p < 0.001; 48.0% vs. 22.7%, p < 0.001, respectively).

Finally, negative work-self balance doubled the odds of reduced vigor (36.9% vs. 16.9%, p < 0.001), while positive work-self balance had a protective effect, with employees experiencing this reporting significantly better energy levels. However, a negative work-life balance increased the odds of reduced vigor by 6.4 times (63.6% vs. 21.3%, p < 0.001). These findings underscore the critical importance of improving workplace conditions, support systems, and job design to enhance employee well-being and vigor.

Bivariate analysis for fatigue

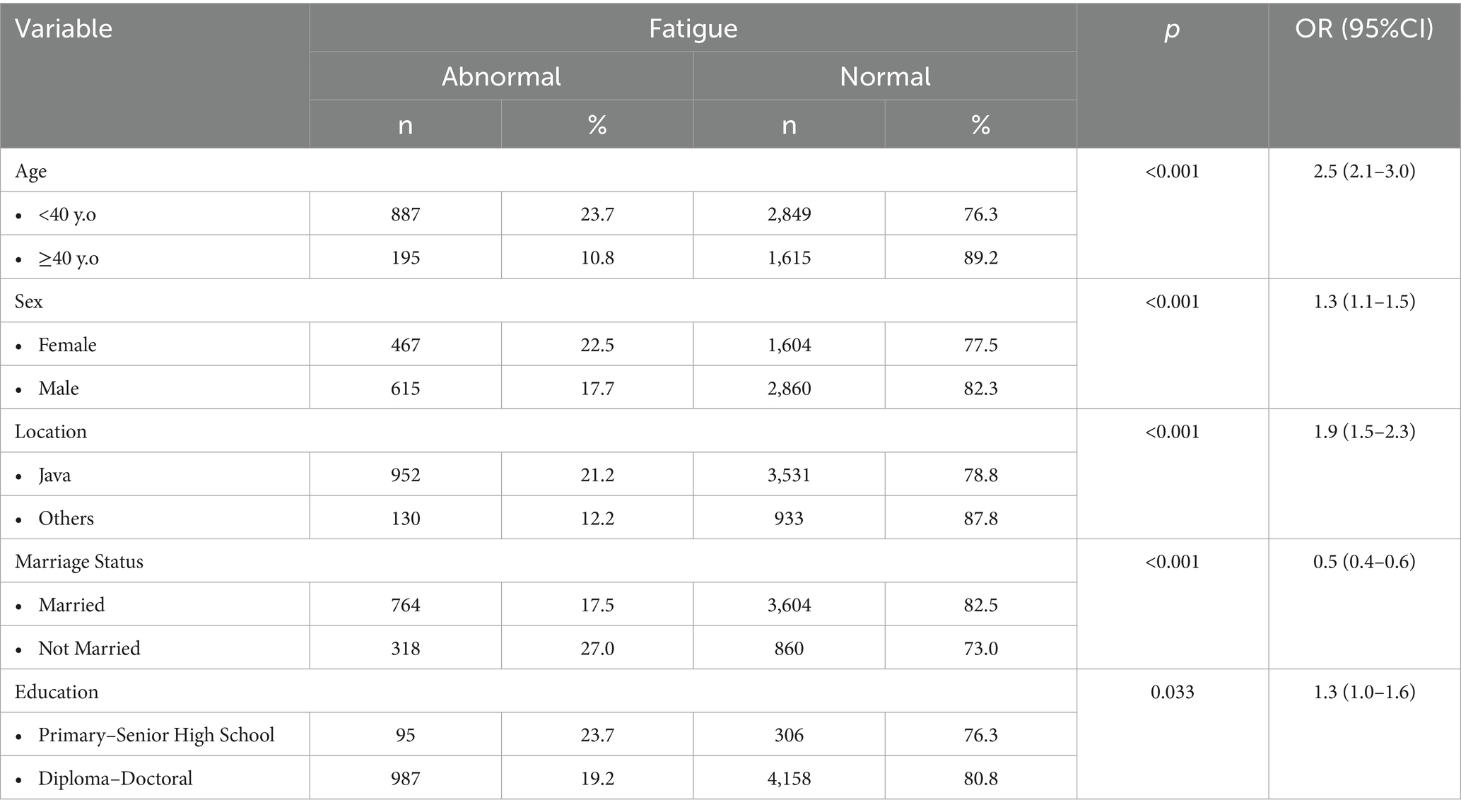

The results indicate significant associations between demographic factors and the prevalence of abnormal fatigue. Individuals under the age of 40 are 2.5 times more likely to experience fatigue compared to those aged 40 and above (23.7% vs. 10.8%, p < 0.001). Similarly, female employees report higher fatigue levels than males, with a 1.3 times increased likelihood (22.5% vs. 17.7%, p < 0.001; Table 7).

Geographic location also plays a role, as workers in Java have a 1.9 times higher chance of experiencing fatigue compared to those in other regions (21.2% vs. 12.2%, p < 0.001). Marital status is inversely associated with fatigue, with married individuals showing a significantly lower likelihood of abnormal fatigue (17.5% vs. 27.0%, p < 0.001, OR 0.5).

Lastly, educational attainment shows a moderate association, where individuals with lower education levels (primary to senior high school) have a 1.3 times higher likelihood of fatigue compared to those with higher education (diploma to doctoral; 23.7% vs. 19.2%, p = 0.033). These findings underscore the influence of age, gender, location, marital status, and education on employee fatigue levels (Table 8).

The analysis highlights several critical factors influencing fatigue among financial sector employees. Younger workers under 40 years old are 2.5 times more likely to experience work-related fatigue, primarily driven by stress. Additionally, employees based in Java face nearly double the risk of fatigue compared to those in other regions, reflecting regional stress disparities.

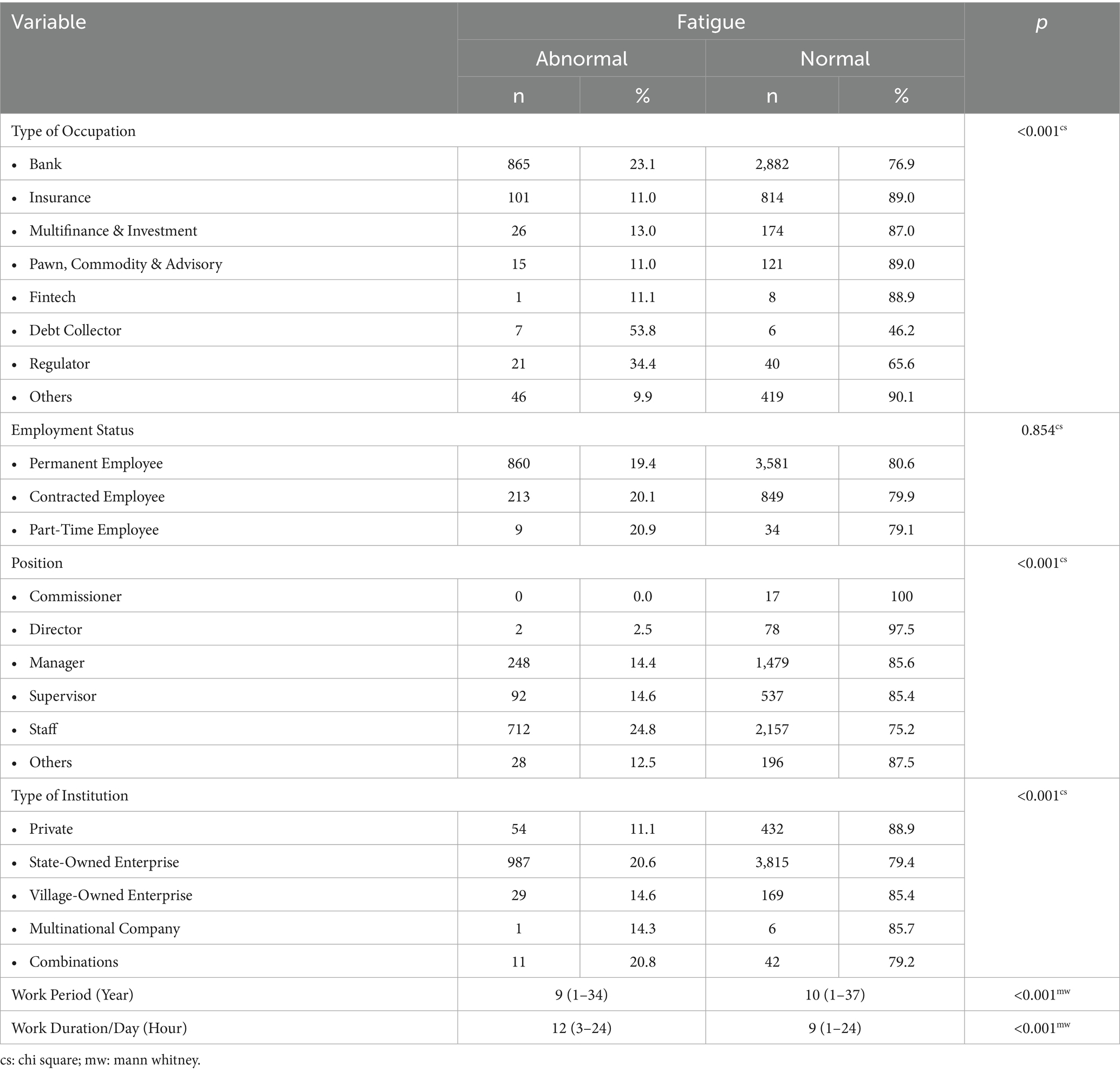

In terms of job roles, debt collectors report the highest fatigue prevalence, with 53.8% experiencing stress-related exhaustion. In contrast, commissioners are the only position with no significant fatigue cases, suggesting their lower exposure to job-related stressors. Among different types of institutions, employees in state-owned enterprises (SOEs) show a higher prevalence of fatigue (20.6%), while those in private companies report the lowest (11.1%).

Employment status shows no significant differences, with fatigue levels being similar across permanent (19.4%), contracted (20.1%), and part-time employees (20.9%). However, fatigue risk increases with longer working hours, as fatigued employees report a median work duration of 12 h per day, compared to 9 h among those without fatigue. Similarly, fatigued employees have a shorter average work period (9 years) compared to their non-fatigued counterparts (10 years), indicating that prolonged exposure to stress may eventually lead to adaptation or exit from stressful roles.

These findings underscore the importance of managing stress and workload, particularly for younger employees, frontline roles like debt collectors, and those working extended hours in Java and SOEs (Table 9).

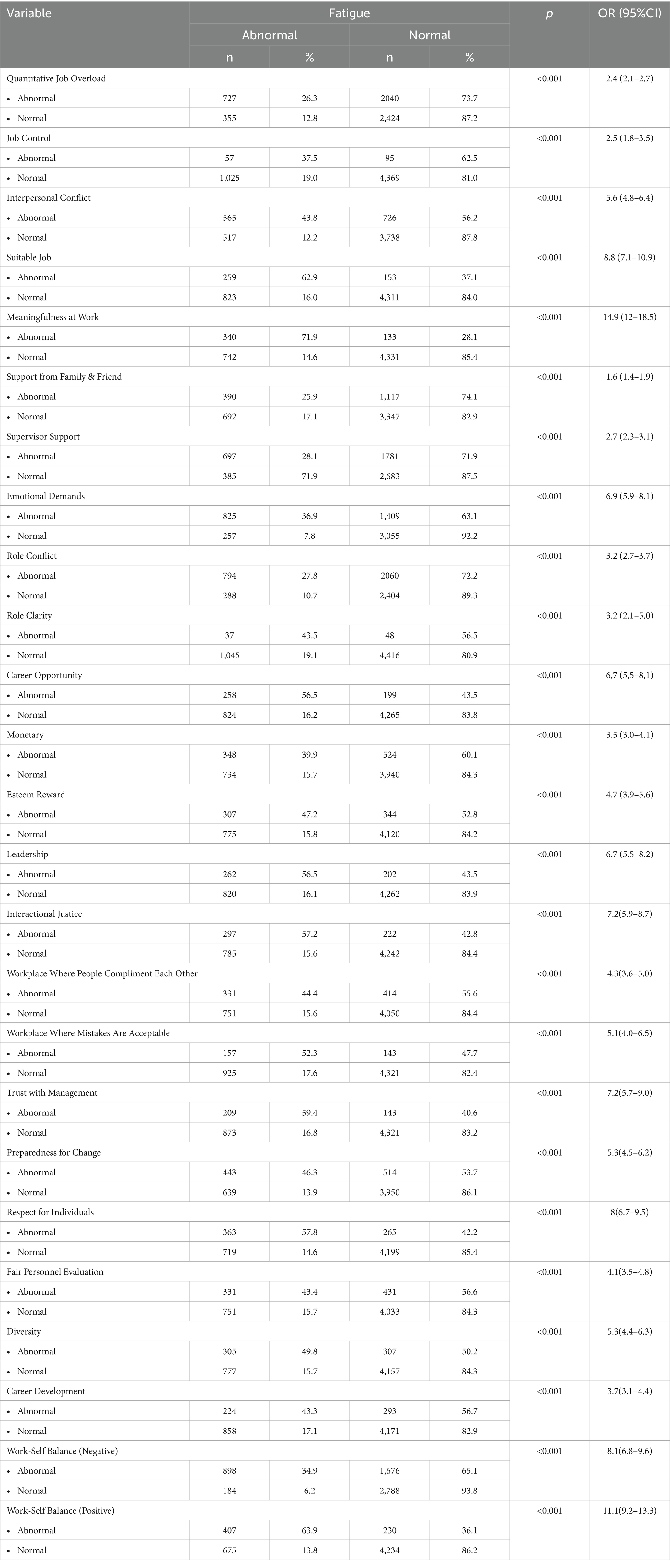

The relationship between stressors and fatigue reveals that lack of meaningfulness at work represents the highest risk factor (OR 14.9), manifesting when employees perceive their tasks as purely transactional without connection to broader purpose. As one investment advisor explained: “Processing paperwork all day with no visibility of how my work helps clients achieve their goals makes every task feel draining.” Similarly, poor work-self balance (OR 11.1) emerges when boundaries collapse, exemplified by a bank manager who reported: “I’m expected to respond to messages until midnight, and my children now associate me with always being on my phone.” The significant impact of unsuitable job placement (OR 8.8) appears when employees’ skills misalign with their roles, as when analytically-trained staff are placed in sales positions requiring different competencies. These workplace realities highlight the need for interventions addressing both structural issues like job design and cultural factors like after-hours communication expectations.

The analysis reveals significant factors associated with work-related fatigue in financial sector employees. Quantitative job overload doubles the likelihood of fatigue, with employees experiencing abnormal workload having an odds ratio (OR) of 2.4. Low job control further exacerbates fatigue risk (OR 2.5), while interpersonal conflict poses an even greater threat, increasing fatigue risk nearly sixfold (OR 5.6).

The nature of the job plays a critical role, as employees with unsuitable job roles have an OR of 8.8 for developing fatigue, whereas the lack of meaningfulness at work leads to the highest risk, with an OR of 14.9. Emotional demands (OR 6.9) and role conflict (OR 3.2) are also significant contributors to fatigue.

Support systems significantly impact fatigue levels. Employees lacking supervisor support have a 2.7 times higher risk of fatigue, and insufficient family and friend support increases the risk by 1.6 times. Similarly, perceived interactional injustice (OR 7.2) and poor trust with management (OR 7.2) are strongly associated with higher fatigue levels.

Workplace culture also plays a critical role. In environments where mistakes are not accepted (OR 5.1) or compliments are rare (OR 4.3), fatigue prevalence rises. A lack of respect for individuals (OR 8.0) and inadequate preparedness for change (OR 5.3) further compound the risk of fatigue.

Moreover, career-related factors such as limited career development (OR 3.7), poor career opportunities (OR 6.7), and unfair personnel evaluation (OR 4.1) significantly increase fatigue risk. Finally, the inability to maintain a work-self balance poses a critical risk, with negative balance showing an OR of 8.1, while a positive imbalance yields an OR of 11.1, highlighting the critical importance of balancing professional and personal life for overall well-being.

A multivariate analysis would strengthen these findings by controlling for the potential interaction between demographic factors, particularly as age, position, and work experience often correlate. Such analysis would clarify whether the higher fatigue among younger employees remains significant when controlling for their typically lower positions in organizational hierarchies. Similarly, multivariate techniques would reveal whether gender differences in stress levels persist when controlling for position level and work tenure. Future research employing such analyses would provide more nuanced guidance for intervention design, ensuring resources target the most influential factors rather than their correlates.

Discussion

This study sheds light on a frequently disregarded area of occupational health by presenting significant data on the prevalence and risk variables linked to work stress in Indonesia’s finance sector. Even if it seems to be less common than the global average, work stress is still a serious problem that needs to be addressed (27). In particular, the study finds that job fatigue and a decline in work spirit or negative vigor are two important markers of work-related stress that more than 20% of employees suffer. These results are consistent with research conducted globally, which has identified comparable indicators as the main causes of occupational stress in the banking sector (13, 28). Another study also found that stress levels in the banking workplace have reached critical levels, with detrimental psychological and physical effects on employees, as well as negative impacts on organizations (20). These issues ranged from anxiety and depression to maladaptive behaviors and, ultimately, job burnout. The limitations of the reviewed studies were discussed, and potential directions for future research were considered.

Indonesia’s unique work culture significantly shapes how stress manifests in the financial sector. The predominant hierarchical management style, or “bapakism,” creates stress patterns distinct from Western contexts. As noted by Mukhlis et al. (29), Indonesian workplace culture often emphasizes power distance and hierarchical relationships that can affect how employees experience and report stress. This cultural dynamic helps explain our finding that staff-level employees experience significantly higher fatigue rates (24.8%) compared to management positions. The concept of “rubber time” (jam karet) in Indonesian business culture, while offering flexibility, often translates into unpredictable working hours for financial sector employees, contributing to the poor work-self balance that our study identified as a major stressor (OR 11.1). Additionally, Indonesia’s strong collectivist orientation creates implicit expectations to participate in work-related social activities outside office hours, further blurring work-life boundaries in ways not typically seen in more individualistic Western work cultures (29).

Compared to global data, the stated prevalence of stress in Indonesia’s banking sector is noticeably lower. For example, a 2020 survey by the Financial Services Authority (OJK) revealed a 70% prevalence rate in Indonesia, whereas a Deloitte (30) global report found that 77% of financial sector professionals experienced stress. This study, on the other hand, emphasizes a lower overall prevalence while highlighting the importance of fatigue and negative vigor as important risk variables. This finding can be attributed to the fact that this study divides work stress into 9 types, and each of these types has a prevalence around 5 to 25%. These results highlight the necessity of focused interventions that deal with these problems in order to reduce stress and enhance workers’ general well-being.

Systematically compared to global studies, these findings reflect a nuanced picture. For example, Giorgi et al. (31) conducted a multicountry survey and reported that banking employees frequently experience emotional exhaustion, depersonalization, and reduced personal accomplishment, with prevalence rates exceeding 75% in some regions, particularly during the COVID-19 pandemic. Similarly, Hassard et al. (32) found through a cross-national study in the United Kingdom, Germany, and Japan that job demands, lack of control, and work–family conflict were key predictors of stress. Interestingly, the Indonesian context in this study reveals lower aggregate stress, possibly due to cultural coping mechanisms, organizational structures, or underreporting related to stigma, as noted by Chen et al. (33) in their study on Asian workplace mental health.

In Indonesia, two to three out of 10 employees in the banking sector suffer from low work morale, often known as negative vigor. This result is marginally less than global data from the Journal of Occupational Health Psychology (2020), which found that 40% of workers in the banking sector globally experience negative vigor. Even though it is less common, negative vigor is still a serious problem because it is linked to lower levels of job satisfaction and productivity. However, according to research from around the world, 20% of Indonesian financial workers suffer from fatigue. Fatigue is a crucial component of stress management techniques since it is the primary indication of work stress among employees in the financial sector worldwide, according to Deloitte (34). Applying theoretical models such as the Job Demand–Control (JDC) model (35) and the Job Demands–Resources (JD-R) model (36), the findings gain further explanatory depth. The JDC model posits that high job demands coupled with low job control predict high strain and poor health outcomes. The identification of fatigue and negative vigor aligns with the strain predicted under this framework. The JD-R model, which emphasizes the balance between job demands and available resources, also helps explain these results even if overall stress prevalence is lower, specific demands such as cognitive fatigue or emotional exhaustion become critical when resources like supervisor support or recovery opportunities are insufficient.

A study reported that poor employee morale and negative attitudes toward work might be caused by low pay, long hours, lack of motivation, understaffed and unskilled labor, high physical workload, and inadequate supervision (37). This fact is happening in the workplace of financial sector. Therefore, feedback from managers revealed that employees had limited understanding of the company’s mission and vision, and there was also a noticeable disconnect between workers and managers. Potential interventions, such as increasing employee-supervisor interactions, promoting positive behavior, offering non-monetary benefits, providing training, ensuring wage rate and employee selection consistency, and redesigning jobs, were recommended to management to improve the existing conditions.

The study also shows that young workers under 40 are especially likely to experience negative vigor and exhaustion. Compared to their elder colleagues, these workers are 2.5 times more likely to feel fatigued. This conclusion is important since the financial sector’s long-term productivity and sustainability are directly impacted by the well-being of its younger workers, who frequently makes up the majority of the workforce. Negative vigor, exhaustion, and boredom can be caused by changes in work functions or environment (38). Additionally, up to 30% of staff-level employees report experiencing weariness and vigor, suggesting that lower-level jobs may be more susceptible to stress-related issues. Specifically, in terms of vigor, this study agrees with the fact that public firms have lower level of employee stress compared to private firms (39), but that is not the case in terms of fatigue. Meta-analyses by Koutsimani et al. (40); Salvagioni et al. (41) consistently demonstrated that burnout components particularly emotional exhaustion are universal across sectors, but their expression and intensity vary by cultural, organizational, and individual factors. The relatively lower stress rates in Indonesia compared to global data may thus reflect cultural resilience or collectivistic workplace norms, which prioritize harmony and social support, acting as buffering resources, as outlined in the COR theory (14). This perspective suggests that interventions should not only target individual stressors but also enhance systemic resources that mitigate stress reactions.

Based on our findings, we propose several concrete interventions tailored to Indonesia’s financial sector context. First, financial institutions should implement mandatory “electronic sunsets” that disable work-related communications between 8 PM and 7 AM, directly addressing the work-self balance issues identified as major stressors. Second, organizations should develop age-stratified mental health programs targeting younger employees through digital platforms, acknowledging both their higher risk status (2.5 times more likely to experience fatigue) and their technological preferences. Third, financial institutions should establish formalized “pembinaan programs” that adapt traditional Indonesian mentorship approaches to specifically address stress management, leveraging cultural familiarity while targeting modern workplace challenges. Fourth, given the significantly higher stress levels among staff-level employees (32.9% experiencing vigor loss), organizations should implement rotation policies limiting customer-facing work to 4-h blocks, allowing recovery periods between high-intensity interactions. Finally, regional differences in stress prevalence suggest the need for location-specific interventions, with higher-intensity support programs in Java-based operations where fatigue risk is nearly doubled compared to other regions.

The disparity between personal and professional obligations is another important element causing stress at work in the finance industry. This result is in line with international research that identifies a major occupational health concern as the blurring of the lines between personal and work obligations (42-45). According to Deloitte (34), a lack of work-life balance is a major source of stress for workers in the financial sector globally, which can have long-term health effects and impair job performance. Improving employee retention rates and creating a better work environment require addressing this imbalance.

While this study provides valuable insights into work stress in Indonesia’s financial sector, several limitations should be acknowledged. First, despite our sampling from multiple provinces, certain regions were underrepresented, particularly eastern Indonesia, including Maluku, Papua, and surrounding islands. Otherwise, this purposive sampling introduces the risk of selection bias due to regional imbalance may affect the generalizability of findings to the entire Indonesian financial sector. The concentration of respondents in Java (over 70%) potentially overrepresents urban banking experiences while underrepresenting conditions in less developed regions where different stressors may predominate. Second, our cross-sectional design, while appropriate for prevalence assessment, limits causal inference regarding the relationships between workplace factors and stress outcomes. Third, self-report nature of the data may be influenced by cultural tendencies in Indonesian workplace contexts, where employees might underreport stress due to concerns about job security or social desirability bias, particularly in hierarchical organizations where expressing difficulty might be perceived as weakness.

Given the limitations of the current study, longitudinal studies would better capture how Indonesia’s rapidly evolving financial sector and changing work practices affect employee well-being over time. Future studies should examine successful interventions that are tailored to the particular requirements of Indonesian financial sector employees, emphasizing the development of a supportive corporate culture, better work-life balance, and mental health promotion strategies that account for Indonesia’s unique cultural context and regional diversity.

In summary, the influence of negative vigor, fatigue, and work-life imbalance cannot be disregarded, even though the prevalence of job stress in Indonesia’s banking sector may be lower than global averages. These elements have a big impact on workers’ general job happiness, productivity, and well-being. This study offers practical recommendations for organizational interventions, making the results highly relevant for practitioners and policymakers seeking to improve employee well-being and productivity.

Conclusion

The study demonstrates the complex relationship between work-related energy and exhaustion among workers in Indonesia’s financial services industry. Employee energy levels are greatly influenced by demographic variables including age, gender, and marital status as well as occupational positions, job status, and institutional type. Women, younger workers, and those in front-line positions like debt collectors are especially susceptible to fatigue and diminished vitality. Furthermore, these problems are made worse by regional differences and workplace culture, which emphasizes the necessity of targeted interventions to enhance worker well-being.

Financial institutions in Indonesia should implement comprehensive stress management strategies with specific action points: develop age-specific intervention programs for younger employees who demonstrated 2.5 times higher risk of fatigue; create women’s professional support networks to address gender disparities; establish clear policies limiting after-hours communication to address Indonesia’s blurred work-life boundaries; institute regular workload assessments during high-stress periods; design career advancement pathways that incorporate well-being metrics alongside performance indicators; and develop evidence-based training programs customized to reflect Indonesian cultural values. Additionally, industry associations such as Asosiasi Bank Indonesia and Otoritas Jasa Keuangan should establish sector-wide mental health standards and monitoring mechanisms to ensure stress management becomes an integral part of organizational governance across Indonesia’s financial sector, thereby enhancing employee well-being while contributing to long-term institutional stability and competitiveness.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

The studies involving humans were approved by Health Research Ethics Committee of Universitas Muhammadiyah Purwokerto (KEPK/UMP/01/IX/2024). The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

RR: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Software, Visualization, Funding acquisition, Project administration, Resources, Supervision, Validation, Writing – review & editing. BT: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Writing – review & editing. RB: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft. DS: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Project administration, Resources, Supervision, Validation, Writing – review & editing. AR: Conceptualization, Funding acquisition, Investigation, Project administration, Resources, Supervision, Validation, Visualization, Writing – review & editing. ME: Conceptualization, Funding acquisition, Investigation, Project administration, Resources, Supervision, Validation, Writing – review & editing. KS: Conceptualization, Data curation, Funding acquisition, Investigation, Methodology, Project administration, Resources, Supervision, Validation, Writing – review & editing. NM: Conceptualization, Data curation, Formal analysis, Funding acquisition, Methodology, Supervision, Validation, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. The data used in this study are available upon request.

Conflict of interest

Author AR was employed by company Dentons HPRP Law Firm.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Dartey-Baah, K, Quartey, SH, and Osafo, GA. Examining occupational stress, job satisfaction and gender difference among bank tellers: evidence from Ghana. Int J Product Perform Manag. (2020) 69:1437–54. doi: 10.1108/ijppm-07-2019-0323

2. Sime, Y, Hailesilassie, H, and Alenko, A. Work-related stress and associated factors among employees of Hawassa industrial park, southern Ethiopia: an institutional based cross-sectional study. BMC Psychiatry. (2022) 22:387. doi: 10.1186/s12888-022-04032-9

3. Nasution, D, and Östermark, R. The impact of social pressures, locus of control, and professional commitment on auditors' intention to blow the whistle: Indonesian evidence. Int J Account Audit Perform Eval. (2019) 15:57–80. doi: 10.1504/IJAAPE.2019.096748

5. Irawanto, DW, Novianti, KR, and Roz, K. Work from home: measuring satisfaction between work–life balance and work stress during the COVID-19 pandemic in Indonesia. Economies. (2021) 9:96. doi: 10.3390/economies9030096

6. Hofstede Insights. (2021). Country comparison: Indonesia. Available online at: https://www.hofstede-insights.com/country-comparison/indonesia/ (accessed November 30, 2024).

7. Sanchez-Gomez, M, Giorgi, G, Finstad, GL, Alessio, F, Ariza-Montes, A, Arcangeli, G, et al. Economic stress at work: its impact over absenteeism and innovation. Int J Environ Res Public Health. (2021) 18:5265. doi: 10.3390/ijerph18105265

8. Yacoub, L, Abou Ibrahim, S, Achy, E, and Nicolas, E. Mental health in the midst of economic turmoil: case study of Lebanese commercial bank employees. Int J Organ Anal. (2023) 31:3372–92. doi: 10.1108/ijoa-06-2022-3304

9. Liu, X, Cao, H, Zhu, H, Zhang, H, Niu, K, Tang, N, et al. Association of chronic diseases with depression, anxiety and stress in Chinese general population: the CHCN-BTH cohort study. J Affect Disord. (2021) 282:1278–87. doi: 10.1016/j.jad.2021.01.040

10. Qi, T, Hu, T, Ge, Q-Q, Zhou, X-N, Li, J-M, Jiang, C-L, et al. COVID-19 pandemic related long-term chronic stress on the prevalence of depression and anxiety in the general population. BMC Psychiatry. (2021) 21:380. doi: 10.1186/s12888-021-03385-x

11. Amorim-Gaudêncio, C, and Pereira da Silva, S. Assessment of psychological needs and quality of life of penitentiary security agents in the state of Paraíba. J Psychol Perspective. (2023) 5:45–8. doi: 10.47679/jopp.515522023

12. Bakker, AB, and Demerouti, E. Multiple levels in job demands-resources theory: implications for employee well-being and performance In: E Diener, S Oishi, and L Tay, editors. Handbook of well-being. Saltlake City: DEF Publishers (2018)

13. Cortés-Denia, D, Lopez-Zafra, E, and Pulido-Martos, M. Physical and psychological health relations to engagement and vigor at work: a PRISMA-compliant systematic review. Current Psychol. (2023) 42:765–80. doi: 10.1007/s12144-021-01450-y

14. Hobfoll, SE, Halbesleben, J, Neveu, JP, and Westman, M. Conservation of resources in the organizational context: the reality of resources and their consequences. Annu Rev Organ Psych Organ Behav. (2018) 5:103–28. doi: 10.1146/annurev-orgpsych-032117-104640

15. Caldwell, JA, Caldwell, JL, Thompson, LA, and Lieberman, HR. Fatigue and its management in the workplace. Neurosci Biobehav Rev. (2019) 96:272–89. doi: 10.1016/j.neubiorev.2018.10.024

16. Sonnentag, S, and Fritz, C. Recovery from job stress: the stressor-detachment model as an integrative framework. J Organ Behav. (2015) 36:S72–S103. doi: 10.1002/job.1924

17. Bakker, AB, and Oerlemans, WG. Daily job crafting and momentary work engagement: a self-determination and self-regulation perspective. J Vocat Behav. (2019) 112:417–30. doi: 10.1016/j.jvb.2018.12.005

18. Taris, TW, Leisink, PLM, and Schaufeli, WB. Applying occupational health theories to educator stress: contribution of the job demands-resources model In: TM McIntyre, SE McIntyre, and DJ Francis, editors. Educator stress: An occupational health perspective. Cham: Springer International Publishing (2017). 237–59.

19. Steffey, MA, Risselada, M, Scharf, VF, Buote, NJ, Zamprogno, H, Winter, AL, et al. A narrative review of the impact of work hours and insufficient rest on job performance. Vet Surg: VS. (2023) 52:491–504. doi: 10.1111/vsu.13943

20. Giorgi, G, Arcangeli, G, Perminiene, M, Lorini, C, Ariza-Montes, A, Fiz-Perez, J, et al. Work-related stress in the banking sector: a review of incidence, correlated factors, and major consequences. Front Psychol. (2017) 8:2166. doi: 10.3389/fpsyg.2017.02166

21. Mustika, H, Eliyana, A, and Agustina, TS. The effect of leadership behavior on knowledge management practices at the PT. Bank Mandiri (Persero) Tbk Jurnal Ekonomi dan Bisnis. (2020) 23:29–52. doi: 10.24914/jeb.v23i1.2482

22. Praharso, NF, Pols, H, and Tiliopoulos, N. Mental health literacy of Indonesian health practitioners and implications for mental health system development. Asian J Psychiatr. (2020) 54:102168. doi: 10.1016/j.ajp.2020.102168

23. Takahashi, M, Morita, S, and Ishidu, K. Stigma and mental health in Japanese unemployed individuals. J Employ Couns. (2017) 54:1–13. doi: 10.1002/joec.12046

24. Adi, NP, Da Lopez, AAVP, Diatri, H, Werdhani, RA, Soemarko, DS, and Fitriani, DY. Validity and reliability of the Indonesian version of the new brief job stress questionnaire (short version) for work-related stress screening among office workers. Medical J Indonesia. (2022) 31:193–201. doi: 10.13181/mji.oa.226316

25. Inoue, A, Kawakami, N, Shimomitsu, T, Tsutsumi, A, Haratani, T, Yoshikawa, T, et al. Development of a short questionnaire to measure an extended set of job demands, job resources, and positive health outcomes: the new brief job stress questionnaire. Ind Health. (2014) 52:175–89. doi: 10.2486/indhealth.2013-0185

26. Shimomitsu, T, Haratani, T, Nakamura, K, Kawakami, N, Hayashi, T, Hiro, H, et al. Final development of the brief job stress questionnaire mainly used for assessment of the individuals In: M Kato, editor. The Ministry of Labor sponsored grant for the prevention of work-related illness: The 1999 report. Tokyo: Tokyo Medical University (2000). 126–64.

27. Cassar, V, Bezzina, F, Fabri, S, and Buttigieg, SC. Work stress in the 21st century: a bibliometric scan of the first 2 decades of research in this millennium. Psychologist Manager J. (2020) 23:47–75. doi: 10.1037/mgr0000103

28. de Jonge, J, and Huter, FF. Does match really matter? The moderating role of resources in the relation between demands, vigor and fatigue in academic life. Aust J Psychol. (2021) 155:548–70. doi: 10.1080/00223980.2021.1924603

29. Mukhlis, H, Harlianty, RA, and Madila, L. Job stress and its influence on university staff's quality of life: the importance of work-life balance and coworker support. Majalah Kesehatan Indonesia. (2024) 5:71–80. doi: 10.47679/makein.2024213

30. Deloitte,. Connect for impact: 2019 Global Impact Report. Deloitte Global. Available at: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/about-deloitte-global-report-executive-message-2019.pdf

31. Giorgi, G, Lecca, LI, Alessio, F, Finstad, GL, Bondanini, G, Lulli, LG, et al. COVID-19-related mental health effects in the workplace: a systematic review. Int J Environ Res Public Health. (2021) 18:235. doi: 10.3390/ijerph18010235

32. Hassard, J, Teoh, KRH, Cox, T, and Dewe, P. Managing work-related stress in the banking sector. J Occup Health Psychol. (2022) 27:126–38. doi: 10.1007/s10869-021-09751-6

33. Chen, L, Wong, JP, and Lee, CH. Stigma and help-seeking for mental health in Asia: a cross-national study. Stress Health. (2023) 39:55–67. doi: 10.1002/smi.3185

34. Deloitte,. Mental health and employers: Refreshing the case for investment. London: Deloitte UK. (2020) Available from: https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/consultancy/deloitte-uk-mental-health-and-employers.pdf

35. Karasek, RA. Job demands, job decision latitude, and mental strain: implications for job redesign. Adm Sci Q. (1979) 24:285–308. doi: 10.2307/2392498

36. Demerouti, E, Bakker, AB, Nachreiner, F, and Schaufeli, WB. The job demands–resources model of burnout. J Appl Psychol. (2001) 86:499–512. doi: 10.1037/0021-9010.86.3.499

37. Nur, F, Harrison, D, Deb, S, and Burch, RF. Identification of interventions to improve employee morale in physically demanding, repetitive motion work tasks: a pilot case study. Cogent Eng. (2021) 8:1914287. doi: 10.1080/23311916.2021.1914287

38. Harju, LK, Seppälä, P, and Hakanen, JJ. Bored and exhausted? Profiles of boredom and exhaustion at work and the role of job stressors. J Vocat Behav. (2023) 144:103898. doi: 10.1016/j.jvb.2023.103898

39. George, E, and Zakkariya, E. Job related stress and job satisfaction: a comparative study among bank employees. J Manag Dev. (2015) 34:316–29. doi: 10.1108/jmd-07-2013-0097

40. Koutsimani, P, Montgomery, A, and Georganta, K. The relationship between burnout, depression, and anxiety: a systematic review and meta-analysis. Stress Health. (2019) 35:219–25. doi: 10.1002/smi.2877

41. Salvagioni, DAJ, Melanda, FN, Mesas, AE, González, AD, Gabani, FL, and Andrade, SM. Physical, psychological and occupational consequences of job burnout: a systematic review of prospective studies. Occup Environ Med. (2017) 74:494–500. doi: 10.1136/oemed-2016-104015

42. Park, Y, Liu, Y, and Headrick, L. When work is wanted after hours: testing weekly stress of information communication technology demands using boundary theory. J Organ Behav. (2020) 41:518–34. doi: 10.1002/job.2461

43. Pluut, H, and Wonders, J. Not able to lead a healthy life when you need it the most: dual role of lifestyle behaviors in the association of blurred work-life boundaries with well-being. Front Psychol. (2020) 11:607294. doi: 10.3389/fpsyg.2020.607294

44. Borowiec, AA, and Drygas, W. Work-life balance and mental and physical health among Warsaw specialists, managers and entrepreneurs. Int J Environ Res Public Health. (2022) 20:492. doi: 10.3390/ijerph20010492

Keywords: work stress, financial sector, negative vigor, fatigue, work-life balance, employee well-being

Citation: Rokhim R, Takwin B, Basrowi RW, Soemarko DS, Rahadian A, Ekowati M, Samah K and Moeloek NDF (2025) Fatigue and lack of vigor’s as a frequent work stress among financial workers in Indonesia. Front. Public Health. 13:1563563. doi: 10.3389/fpubh.2025.1563563

Edited by:

Biagio Solarino, University of Bari Aldo Moro, ItalyReviewed by:

Syed Sajid Husain Kazmi, Amity University, IndiaHamid Mukhlis, STKIP AL Islam Tunas Bangsa, Indonesia

Copyright © 2025 Rokhim, Takwin, Basrowi, Soemarko, Rahadian, Ekowati, Samah and Moeloek. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ray Wagiu Basrowi, cmF5LmJhc3Jvd2lAZ21haWwuY29t; cmF5d2FnaXUzMUBhbHVtbmkudWkuYWMuaWQ=

Rofikoh Rokhim

Rofikoh Rokhim Bagus Takwin

Bagus Takwin Ray Wagiu Basrowi

Ray Wagiu Basrowi Dewi Soemaryani Soemarko2,4

Dewi Soemaryani Soemarko2,4