- Harbin University of Commerce, School of Management, Harbin, Heilongjiang, China

At present, accelerating the transformation of China’s traditional agricultural industry into modern agriculture and upgrading the agricultural planting structure from a low-value chain to a high-value chain is of utmost importance. Exploring the relationship between the retail market system and the price and scale of agricultural product has critical practical significance and long-term value for precisely guiding and effectively promoting the optimization and upgrading of the agricultural industry structure. Based on the analysis of the impact mechanism of the retail market on the agricultural planting structure through the price transmission mechanism, this study collected relevant data from 31 provinces over the past 10 years. Using the interval number expansion DEMATEL method and differential evolution algorithm, a structural equation model was constructed to study how the retail market system influences the agricultural planting structure through the mediating role of price transmission. The results show that the retail market has a primarily negative impact on prices, a significant positive impact on the agricultural planting structure, and that price plays an evident mediating role between the retail market and the agricultural planting structure. Based on the empirical results, this paper suggests that the government should formulate targeted policies according to market characteristics during the initial, developmental, and rapid transformation stages of the retail market to guide the transformation and upgrading of the agricultural planting structure in each province.

1 Introduction

In the context of the new situation, the strategic adjustment of the agricultural planting structure has been endowed with new connotations. With the vigorous promotion of China’s comprehensive deepening of reforms and the rise of the global agricultural science and technology revolution, it has become urgent to accelerate the transformation of China’s traditional agricultural industry into modern agriculture and to upgrade the agricultural planting structure from a low-value chain to a high-value chain in the process of promoting coordinated urban–rural development and the synchronized advancement of industrialization, urbanization, and agricultural modernization. Since 1984, China’s agricultural planting structure has undergone significant spatial distribution changes. In the early stages, the evolution of China’s agricultural planting structure was mainly determined by natural resources and soil conditions. However, as economic growth improved overall living standards, the evolution of agricultural planting structures became increasingly influenced by regional population and economic conditions, exhibiting clear characteristics of networked distribution. The evolution of agricultural planting structure is an economic behavior, and the idea of optimal allocation of resources occupies an increasingly important position in the evolution of agricultural planting structure (Li et al., 2024). In previous studies, scholars have analyzed market data for agricultural products and used synthetic aperture radar to observe the agricultural planting structure over a long period of time, resulting in the conclusion that the market system affects the evolution of agricultural planting structure (Whelen and Siqueira, 2017). Therefore, research on agricultural planting structure is an important component of social resource allocation and economic forecasting (Guo et al., 2022). From the perspective of the agricultural industry system, in the construction of the agricultural industrial system, we must pay attention to the functions that agriculture has already developed, ensure the stable development of the grain industry, and improving the service and security functions of modern agriculture (Pensieroso and Sommacal, 2019). The market is the main way and the limited government support is the best way to guide it (Alizamir et al., 2019). The change of China’s agricultural planting structure reflects the change of economic conditions (Guo et al., 2022). In addition to the impact of price changes (Jiang et al., 2024), the market concentration of the planting structure in main grain-producing areas and non-main-producing areas has a greater impact on the agricultural planting structure (Tang et al., 2021). There is a time lag in the feedback of agricultural planting structure to the market, which is mainly caused by the mismatch between the characteristics of agricultural production and market dynamics. Agricultural production has a long cycle, poor adjustment flexibility, delayed market information transmission, and time-consuming supply chain links. Planning the planting structure in advance based on market scale and density can match the scale of supply and demand, avoid resource misallocation, optimize spatial layout, hedge against the risk of time lag, and improve resource utilization efficiency. Therefore, planning the planting structure in advance based on indicators such as market scale and density, and offsetting the lag effect through scientific prediction and resource optimization can ensure the stability of agricultural income.

The agricultural product market system, the agricultural social service system, and the national support and protection system for agriculture together constitute the three major systems driving rural economic development in China (Zhang et al., 2023). Agricultural product retail market is a crucial component of the agricultural product market system (Nie et al., 2020). Demand is fundamental to production, with the retail market serving as the vehicle, foundation, and core of agricultural product distribution and marketing. It is not merely a single market or a simple transaction place but an integrated system of interconnected agricultural product markets. This system typically encompasses the circulation, management, and service system related to transaction objects, venues, rules, and relationships, enabling the independent operation of various markets within the agricultural product market system through the distribution, management, and provision of services (Dokic and Jovic, 2017). Regarding the relationship between the retail market and the agricultural planting structure, Garrone et al. (2019) and Liao et al. (2019) believe that the agricultural product retail market includes both the retail market and the corresponding intangible market, as well as the associated service system and infrastructure. The retail market is a vital component of the market system and plays a role in moderately guiding market development (Hu et al., 2019). Market concentration and market structure can be used to describe the market system (O’Sullivan et al., 2019). Market circulation factors such as traffic condition and market location will also affect agricultural planting structure. The commercialization of agricultural product has a significant positive stimulating effect on the agricultural planting structure (Perez et al., 2017). An unreasonable layout of the market system, insufficient market network coverage, and uneven distribution between regions have affected the normal circulation of agricultural product, thereby restricting agricultural development and further improving agricultural product competitiveness (Chen and Li, 2024). The retail market system should enhance and improve the structural integrity of the market system and cultivate the main entities of the agricultural product market. Agricultural market system is a complex organized by multiple departments, forming an organic whole that achieves coordinated agricultural development through the interaction and connection of various agricultural production links (Chouvy and Macfarlane, 2018).

In summary, research on the agricultural product retail market system has primarily focused on aspects such as the circulation of agricultural products, the current state of the market, and the analysis of influencing factors, with most studies adopting theoretical analysis methods. There has been relatively little research on the mechanisms by which the retail market system affects the agricultural planting structure, and studies on how to construct an agricultural retail market system to promote the optimization of the agricultural planting structure are particularly scarce.

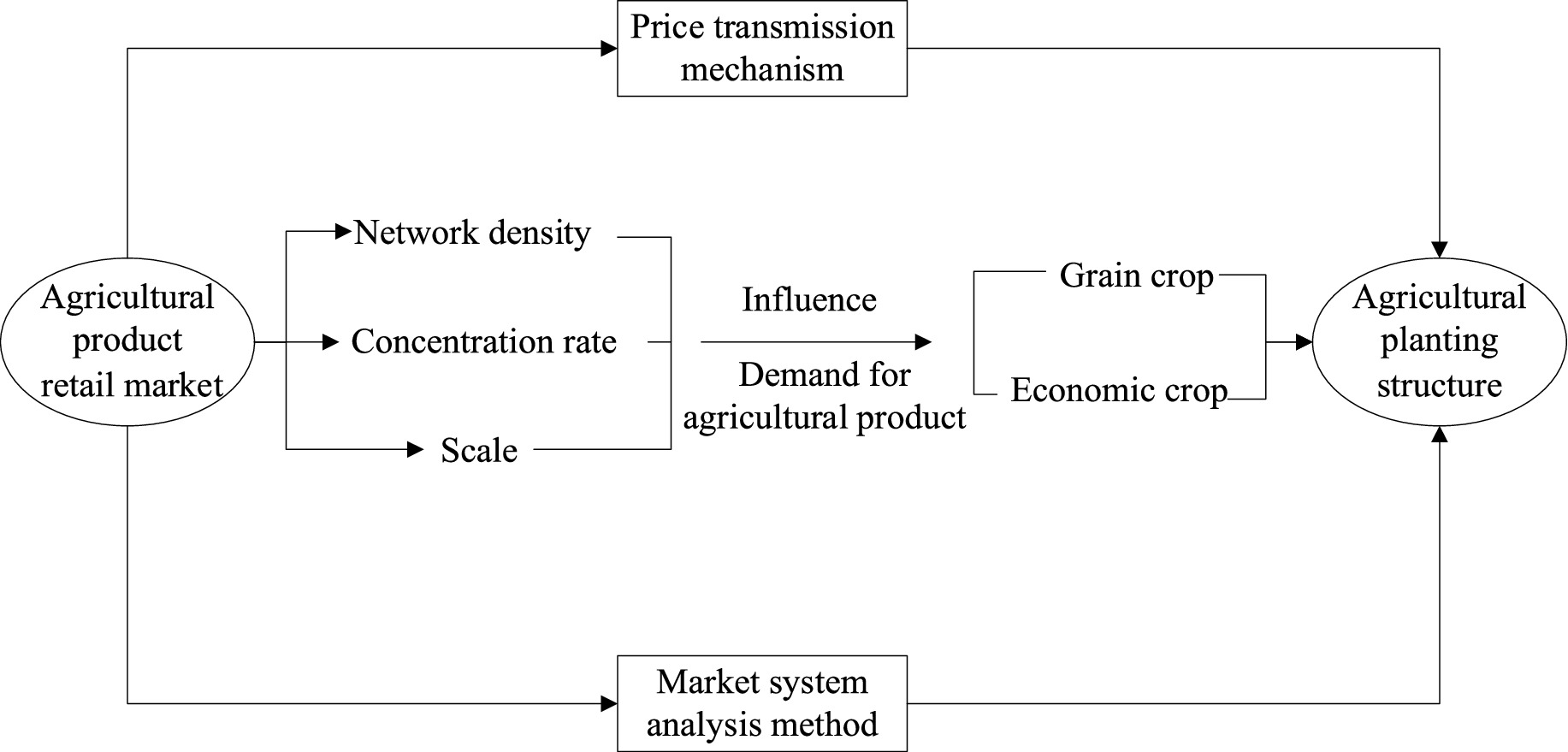

Therefore, this study adopts the research approach of “theoretical review – model construction – empirical testing – policy recommendations.” The specific research route is as follows: First, review the relevant theories and literature on the evolution of agricultural planting structure and the retail market of agricultural products, and clarify the research gap and core variables. Second, design the quantification methods for the density, concentration, and scale of the retail market network, and construct the theoretical hypothesis framework of “retail market characteristics – agricultural planting structure.” Third, based on the data from the China Statistical Yearbook, complete the data preprocessing and descriptive statistics, and use the interval number expansion DEMATEL method to identify the core influence path. Fourth, combine the differential evolution algorithm to construct the structural equation model and empirically test the intensity and direction of the impact of retail market characteristics on planting structure. Finally, based on the empirical results, put forward policy recommendations for optimizing the retail market system of agricultural products and promoting the upgrading of planting structure.

2 Theoretical analysis framework and research hypotheses

The impact of the agricultural product retail market on the agricultural planting structure depends on the structural characteristics of the agricultural product market system. Based on market system analysis method (Erbaugh et al., 2019), this study selects three main market system characteristic variables—retail market network density, market concentration rate, and market scale—as observed variables to describe the latent variable of the agricultural product retail market. Among these, retail market network density reflects the degree of market competition within the agricultural product retail market region (Nie et al., 2020); market concentration rate reflects the degree of market agglomeration and dispersion, indicating spatial agglomeration and rationality (Cechura et al., 2024); and market scale reflects the level of development and the breadth of influence of the agricultural product market, partially indicating sales capacity (Lv et al., 2024).

The upgrading of the agricultural planting structure is essentially about the demand for and occupation of resources. China’s agricultural planting structure has undergone significant changes over time (Yuan and Xu, 2024). Since the reform and opening-up, with the continuous development of the economy, the planting area of non-grain crops has grown significantly. Specifically, the planting area of grain crops such as wheat and corn have gradually decreased, while the planting area of economic crops such as oilseed have expanded. Rong et al. (2019) conducted an empirical analysis of the reasons for changes in the planting structure of major crops in China by analyzing the planting structure of key agricultural products such as rice and oilseed. The impact of agricultural product retail market on agricultural planting structure depends on the functional perfection of the whole market system. A well-functioning market system should be able to effectively transform market demand into signals that producers can understand and respond to, so as to prompt the agricultural planting structure to adjust in the direction of meeting market demand. Therefore, in this study, the planting ratio of grain and oilseed crops was used as observed variables to describe the agricultural planting structure variable.

2.1 Agricultural product retail market and agricultural product price transmission

Regarding prices, higher network density means more retail points, which often leads to stronger competition, and retailers may keep prices low in order to attract customers (Guchhait et al., 2024). The expansion of retail market network density can easily lead to information redundancy, increasing the difficulty for participants such as farmers, intermediaries, production and processing enterprises, and exchanges to select and identify price information. This may result in valuable information and new knowledge being wasted, which is detrimental to the smooth operation of the market system and increases the operational costs for market participants (Ma et al., 2019). The rapid flow of price information that is difficult to discern leads to a higher probability of selecting homogeneous price information. Such homogenization of information intensifies competition within the agricultural industry, increasing competitive pressure and causing a continuous rise in the overlap of agricultural planting structures. If the network density is low, that is, there are few retail points, consumers may have to pay higher transportation costs to buy produce, in which case retailers may set higher prices. Dense networks may also facilitate the flow of information, make prices more transparent, and help consumers compare prices, thus curbing excessive price increases.

The agricultural product retail market exhibits significant network agglomeration characteristics. Barge-Gil (2010) suggests that a certain degree of network agglomeration is beneficial for the dissemination of information and knowledge. When the market concentration rate is high, a few companies control most of the market share, and they have greater bargaining power and pricing power. This can lead to higher prices as consumers have fewer choices (Albayrak, 2010). In a low concentration rate of market, there are a number of small operators compete against each other, which will help to maintain the stability of prices or lower. High concentration rate can also bring more efficient supply chain management, reduce costs and may reduce the final price, but it depends on whether companies choose to save the cost of transfer to the consumer (Dong et al., 2023). Appropriate market agglomeration is conducive to the propagation and growth of price transmission mechanisms among farmers, intermediaries, production and processing enterprises, and exchanges within the market system. Moderately increasing the concentration of the retail market can enhance the willingness of farmers, intermediaries, production and processing enterprises, and exchanges to share risks, benefits, and resources, and to establish alliances. This would provide crucial support for the production, development, and innovation of agricultural product, ensuring the smooth operation of price transmission mechanism, thereby promoting the upgrading of the agricultural planting structure. This is reflected in the increased proportion of oilseed crop planting and the reduced proportion of grain crop planting (Liu et al., 2019b).

Market scale refers to the overall capacity of the agricultural retail market, including trading volume and value (Peng et al., 2024). Large markets are often able to support more sophisticated distribution channels and lower unit costs because economies of scale can be achieved through bulk purchasing and bulk shipping (Ma, 2022). A larger market scale may also attract more players into the market, increasing competition and helping to keep prices competitive (Li et al., 2023). As the market scale expands, there is a significant variation in the resource distribution among information nodes, with certain nodes occupying more resources, making them more likely to play a leading role. As the retail market scale continues to expand, the frequency of information gathering, flow, and integration tends to decrease, leading to a less flexible price information flow mechanism (Iqbal et al., 2010). The construction of information-sharing principles and behavior norms among farmers, intermediaries, production and processing enterprises, and exchanges encounters barriers related to the scale of the system. This reduces the efficiency of information transfer among market participants, thereby affecting the price transmission mechanism. And small-scale markets may face higher operating costs, which may be reflected in higher retail prices of agricultural products (Minten and Kyle, 2000; Qi et al., 2023).

Therefore, the increase in market concentration has a negative effect on the diffusion of agricultural product price information. Based on this, the following hypotheses are proposed:

H1: The network density of the agricultural product retail market affects grain prices.

H2: The network density of the agricultural product retail market affects oilseed prices.

H3: The concentration rate of the agricultural product retail market affects grain prices.

H4: The concentration rate of the agricultural product retail market affects oilseed prices.

H5: The scale of the retail market affects grain prices.

H6: The scale of the retail market affects oilseed prices.

2.2 Agricultural product retail market and agricultural product planting structure under price transmission

The network density, concentration rate and market scale of agricultural product retail market under the price transmission mechanism not only affect the price of agricultural product, but also affect the upstream planting structure (Liu et al., 2019a). This is because the characteristics of the retail market will affect the demand pattern of agricultural product, and thus affect farmers’ planting decisions. The network density of the agricultural product retail market refers to the degree of closeness in the connections between trading entities, trading venues, trading information, and even trading rules within the retail market. It represents the number of participants and the level of competition in the agricultural product retail market. If the network density of the retail market is high, it means that there are more retail points, which usually means stronger competition and more flexible pricing mechanisms (Hagberg and Kjellberg, 2015). In this environment, the variety and freshness of agricultural products are required to be high, and farmers may be inclined to grow more varieties of crops to meet diversified needs. Conversely, if the network density is low and there are fewer retail points, consumers may value convenience and price stability more than diversity. This could lead farmers to prefer crops that have stable demand and are easy to store and transport. According to the network closure theory (Grosser et al., 2023), higher network density is more conducive to innovation. When network density is low, the asymmetry in the quantity, quality, and feedback channels of agricultural product information is higher (Bononi et al., 2016), leading to lower levels of trust among participants in the retail market, such as farmers, intermediaries, production and processing enterprises, and exchanges (Assis et al., 2023; Giganti et al., 2024). The essence of information asymmetry under low network density is the contradiction between the lag of agricultural modernization and the increase in market complexity (Cho and Blandford, 2019; Gangopadhyay et al., 2019). The essence of information asymmetry under low network density is the contradiction between the lag of agricultural modernization and the increase in market complexity (Giua et al., 2021). This hinders information exchange, especially the establishment and communication of feedback channels between farmers and trading venues. Since the agricultural planting structure is significantly influenced by product prices, the flow and dissemination efficiency of price information in the retail market affects the optimal allocation of resources in the agricultural planting structure. Therefore, low network density in the retail market will inhibit adjustment in the agricultural planting structure, limit the development of the agricultural planting market itself, and restrict the expansion, development, and adjustment of the planting structure market system. Specifically, when the network density of agricultural product is low, it positively impacts the proportion of grain planting while inhibiting the planting of economic crops such as oilseed. However, as the network structure gradually increases, this promoting effect becomes more apparent. In view of this, moderately increasing the network density of the retail market structure, increasing the number of nodes and the frequency of connections in the retail market network, will encourage the establishment of widespread connections among participants such as farmers, intermediaries, production and processing enterprises, and exchanges. This will lead to the formation of shared rules and standardized behavioral models based on agricultural product price information. Consequently, through the self-organizing nature of the groups within the retail market structure, an efficient mechanism for transferring the quantity, quality, and feedback channels of price information will be formed. This will promote the smooth operation of the market system and even the emergence of innovations, thereby gradually increasing the planting density of oilseed crops and reducing the planting area of grain crops. This ensures the depth and breadth of the overall agricultural product planting structure.

When the market concentration rate is high, a few large retailers occupy the main market share (Willekens et al., 2023). These large companies tend to have strong bargaining power and may demand specific types of agricultural products, or those that can be produced on a large scale. This may result in farmers preferring to grow those crops that match the needs of large retailers to ensure a stable sales channel. However, if the concentration rate of the retail market exceeds a certain limit, it will affect the organizational structure of the price transmission networks formed by different communities within the agricultural planting structure, leading to excessive concentration and homogenization of price information. This, in turn, will promote the convergence of agricultural planting structure, thereby affecting agricultural product market price. In the case of low market concentration rate, many small retailers to compete against each other, it may encourage more diverse crops, so as to adapt to different market demand. In addition, small-scale retailers may be more willing to accept non-standardized products, thus increasing the possibility of growing special varieties or organic products. From the perspective of information types, the flow and absorption of price information across different communities encourage the emergence of differentiated agricultural planting structures, thereby promoting the upgrading of the agricultural planting structure. Liu and Wang (2024) argue that excessive agglomeration accelerates information homogenization and path dependence. This leads to the isolation of agricultural planting structure communities, causing their forms to become closed off and lacking exposure to novel and heterogeneous information, resulting in highly similar planting structures. Consequently, this weakens their ability to respond to and adjust to changes in the external agricultural product market.

The difference between retail market scale and market network density lies in that retail market scale emphasizes the scale expansion around certain fixed points among farmers, intermediaries, production and processing enterprises, and exchanges within the market system, while network density emphasizes the overall level of cohesion. The development of the retail market is a direct choice for improving the agricultural value chain model, enhancing the driving force of large retail enterprises on agriculture and agricultural product value chains, promoting the increase in agricultural value, and improving the value acquisition capacity of participants in the agricultural industry chain. Under the larger the scale of the market, due to large volume and value, may be more likely to support the specialized and diversified production patterns (Zhang et al., 2019). Farmers may adjust their planting structure according to the segmented needs of the market, planting those crops with high market demand and high returns. In contrast, in a smaller market scale, farmers are likely to focus more on crops that guarantee basic living needs, such as food crops, as opposed to pursuing diversity and specialization due to smaller transactions. When the retail market scale is small, the resource distribution differences among farmers, intermediaries, production and processing enterprises, and exchanges are minimal, and the differences in the distribution of information connection points are also small. The variation in resource occupation is not significant, leading to poor communication of price information. As a result, market participants are likely to continue their previous planting habits, favoring grain crops while planting fewer economic crops such as oilseed. However, as the retail market scale expands, the market’s capacity to absorb increases, and price information flows more freely, resulting in a decrease in the proportion of grain crop planting and an increase in the planting of economic crops such as oilseed. In conclusion, the characteristics of agricultural product retail market indirectly affect farmers’ planting decisions by influencing the demand and price of agricultural product. Understanding these dynamic relationships is essential for developing effective agricultural policies and supporting sustainable agricultural practices. The conceptual framework of the paper is shown in Figure 1.

Based on this, the following hypotheses are proposed:

H7: The network density of the agricultural product retail market affects grain planting.

H8: The network density of the agricultural product retail market affects oilseed planting.

H9: The concentration rate of the agricultural product retail market affects grain planting.

H10: The concentration rate of the agricultural product retail market affects oilseed planting.

H11: The scale of the agricultural product retail market affects grain planting.

H12: The scale of the agricultural product retail market affects oilseed planting.

3 Model, variables, and data

3.1 Sample description

The research sample focuses on 31 provinces in China, with sample data derived from relevant data over the past 10 years from these provinces. The data is primarily obtained from the China Statistical Yearbook.

3.2 Measurement of variables

(1) Agricultural planting structure: Land is the fundamental element in the evolution of the agricultural planting structure, and crop output is the most essential factor determining the planting structure. The ratio of the planting area of major crops such as grain and oilseed to the total land output can be understood as the number of resource types that the agricultural planting structure possesses. The greater the land output of the relevant crops, the larger the proportion of resources occupied by the planting structure. The calculation formulas are as follows:

(2) Price transmission mechanism: The foundation of the price transmission mechanism for agricultural product lies in the price discovery function of a market economy, with free trade serving as the basis for forming the price transmission mechanism. The price transmission relationships and paths between agricultural product are influenced by various factors in the market, leading to the process of price transmission or interaction. In recent years, the government’s influence on agricultural product prices has become increasingly important, with a particular focus on the price fluctuations of grain and oilseed, which are essential to people’s livelihood. Therefore, drawing on the research conclusions of Zhang et al. (2019), this study uses grain price fluctuation and oilseed price fluctuation as observed variables for the price transmission mechanism.

(3) Agricultural product retail market network density: The network density of the agricultural product retail market reflects the relative extent of differences in market system structure scale or changes in scale. This study uses two observed variables to represent the network density of the agricultural product retail market: the ratio of the number of stalls in commodity trading markets with over 100 million yuan in transactions to the total retail sales of goods, and the ratio of the sales of chain retail enterprises to the total retail sales of goods. The first observed vector (RMND1) is calculated by using the number of stalls in commodity trading markets with over 100 million yuan in transactions in each province as the input variable and the corresponding retail sales of goods in each province as the output variable. The second observed vector (RMND2) is calculated as the ratio of the sales of chain retail enterprises to the total retail sales in each province.

(4) Market concentration rate: The agricultural product retail market exhibits significant network agglomeration characteristics and has a high market agglomeration coefficient. Drawing on the analysis of agglomeration coefficients by Wen et al. (2018), which can reflect the concentrated operations, scale, and competition level of the market system, this study examines the impact on the agricultural planting structure. In this study, market concentration rate is represented by two observed variables. The first indicator (RMCR1) is the ratio of the number of stalls to the number of employees, which refers to the ratio of the number of stalls in commodity markets with over 100 million yuan in transactions to the number of employees in the relevant provinces, yielding the market concentration rate of agricultural product in those provinces. The second indicator (RMCR2) is the proportion of transactions over 100 million yuan to the total market transactions, which refers to the ratio of transactions over 100 million yuan to the total transactions in the relevant provinces.

(5) Market system scale: The scale of the agricultural product market system is represented by two observed variables. The first indicator (RMSS1) is the ratio of retail market transactions in markets with over 100 million yuan in commodity transactions to the total transactions in those markets. The second indicator (RMSS2) is the scale of retail employment, calculated as the ratio of the number of retail employees to the population aged 15 and above in each province.

3.3 Data preprocessing

To ensure the robustness and reliability of the empirical results, we conducted strict quality control and preprocessing on the original data. First, we diagnosed the data missing situation. For the missing data in individual years and provinces, we filled them in. Since the missing rate was less than 5%, we used linear interpolation for filling to maximize the utilization of sample information and maintain the balance of panel data. Second, we used a combination of box plot method and quantile method to detect outliers in each continuous variable. For the identified extreme outliers, we did not simply delete them but adopted a more robust two-sided 1% quantile winsorization, that is, replacing the values less than the 1% quantile and greater than the 99% quantile with the values of the 1% and 99% quantiles, respectively. This method can retain all samples while effectively controlling the distortionary impact of extreme values on parameter estimation. Finally, to eliminate the influence of the different dimensions and magnitudes of individual variables on model estimation and facilitate subsequent comparison of coefficient sizes, we standardized all continuous variables with Z-score before building the model, the formula is , so that the mean of the processed data is 0 and the standard deviation is 1. After the above preprocessing process, we finally obtained a balanced panel dataset containing 31 provinces and 10 years, with a total of 310 valid observations, for subsequent empirical modeling.

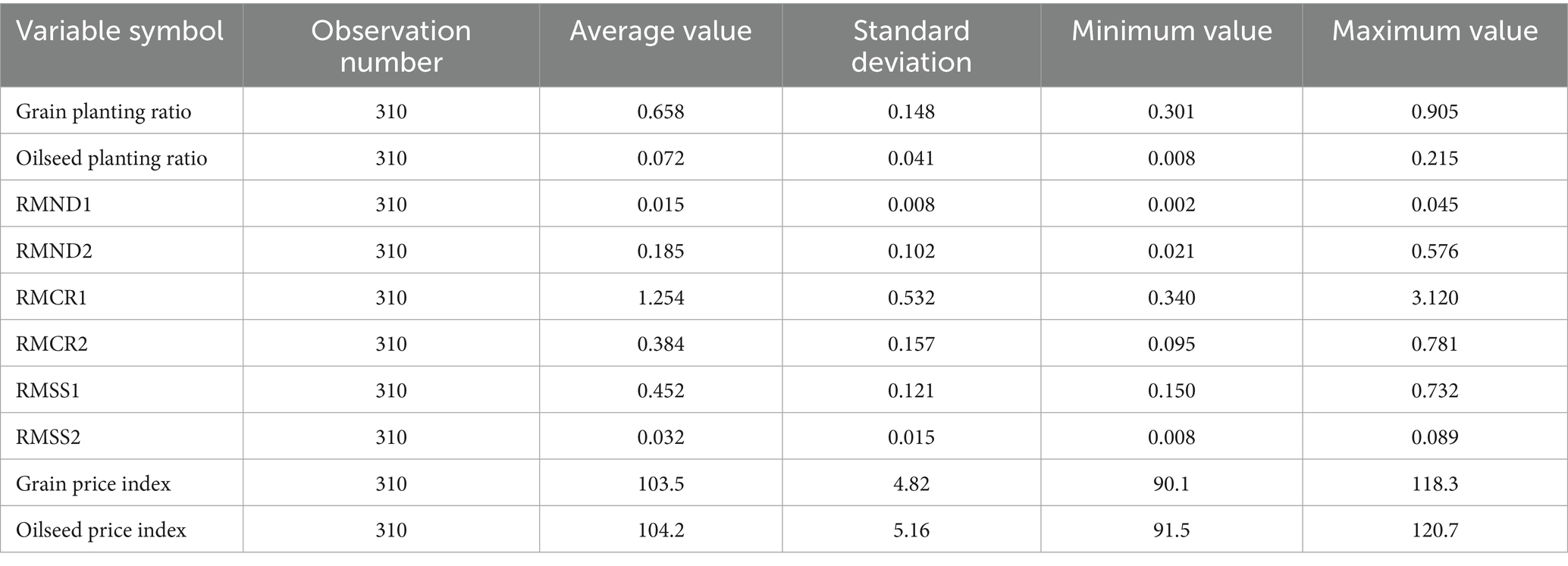

Table 1 lists the descriptive statistics of all main variables before standardization, including the number of observations, mean, standard deviation, minimum and maximum values, to show the original distribution characteristics of the data. From the descriptive statistics, it can be seen that the average proportion of grain planting in each province is relatively high, but there are significant differences (standard deviation 0.148), indicating that there is a large differentiation in the agricultural production structure among different regions. Each retail market characteristic variable, such as network density (RMND1, RMND2) and market concentration rate (RMCR1, RMCR2), shows considerable variability, which provides a good data basis for identifying their impact on the planting structure. The price index fluctuates around 100, which is in line with expectations.

4 Model construction

4.1 Interval number expansion DEMATEL method

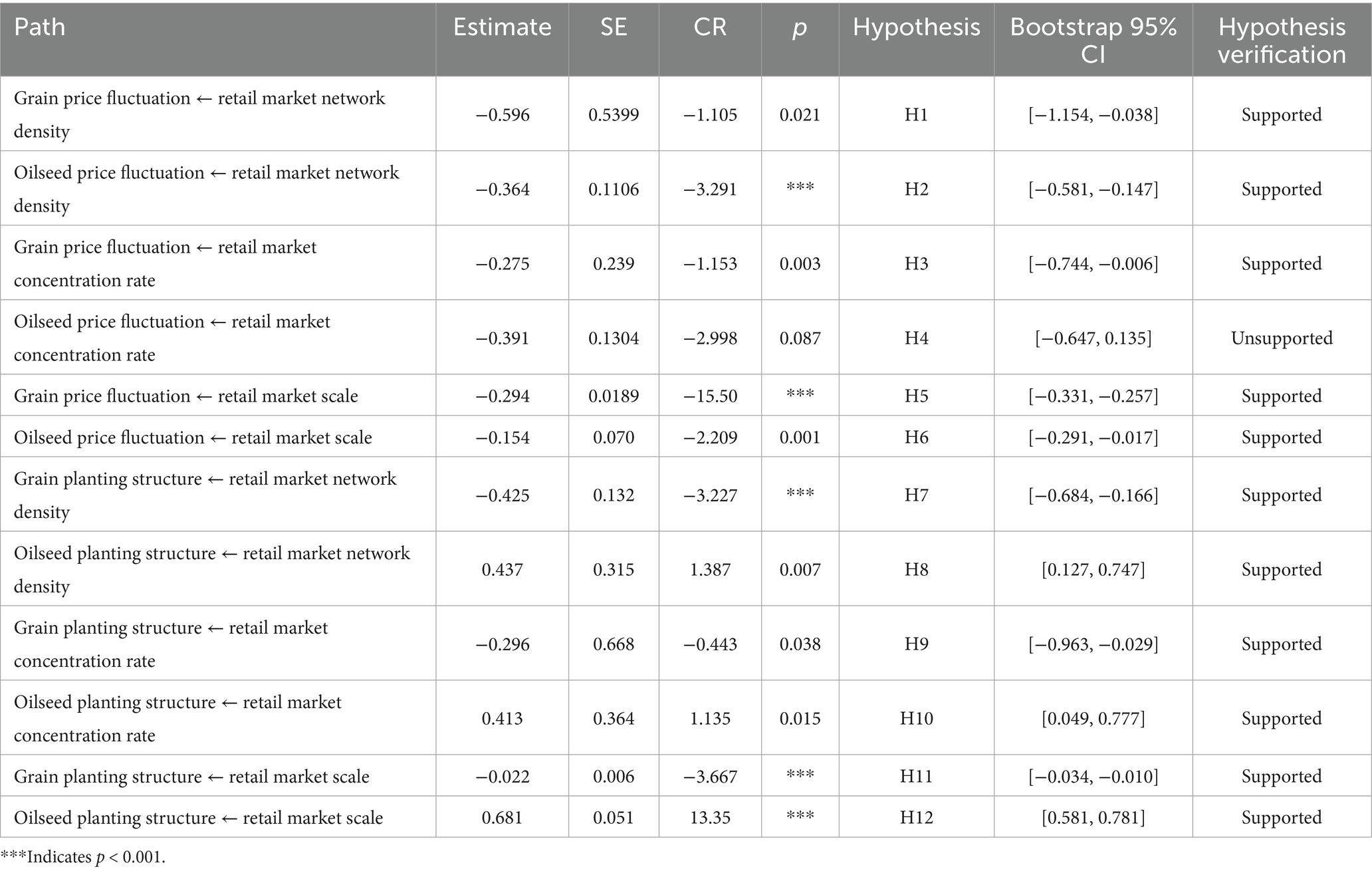

First, the interval number expansion DEMATEL method is adopted to determine the interactions and causal relationships among the variables in the theoretical framework (Altuntas and Gok, 2021). Using MATLAB simulation software, the causal relationships among the three variables—agricultural product retail market (including network density, concentration rate, and scale), price transmission mechanism (including grain price fluctuations and oilseed price fluctuations), and agricultural planting structure (including grain planting structure and oilseed planting structure)—and the interactions between their corresponding construct dimensions and evaluation indicators are preliminarily determined. This process identifies which variables are central variables and which are cause variables and result variables. From a qualitative perspective, it analyzes the agricultural product retail market and its three construct dimensions, corresponding evaluation index and price transmission mechanism and its two construct dimensions, the causal relationship between corresponding evaluation indicators; the agricultural retail market and its three construct dimensions, corresponding evaluation index and agricultural planting structure and its two construct dimensions, the causal relationship between corresponding evaluation indicators; the causal relationship among three variables: agricultural product retail market, price transmission mechanism and agricultural planting structure. In other words, it is further clarified which variable is the central variable, which is the cause variable, and which is the result variable, providing a preliminary mathematical and statistical foundation for the subsequent differential evolution algorithm and structural equation modeling.

The specific steps of the interval number expansion DEMATEL method mainly include:

(1) The construction of the interval number direct influence matrix.

Assume that the system indicator system is , and the interval number represents the direct influence of the ith variable on the jth variable. The constructed interval number direct influence matrix A is shown in Equation 1:

(2) The construction of the interval number comprehensive direct influence matrix.

First Step: Standardize matrix A to obtain the standardized interval number direct influence matrix , where , , , .

Second Step: Obtain the standardized interval number comprehensive direct influence matrix. .

Third Step: Calculate the centrality ( ) and the causality ( ) between variables. The sum of each row in matrix T gives , and the sum of each column in matrix T gives . The centrality and causality between variables are then obtained.

Fourth Step: According to the probability ranking steps, compare ( ) with 0. If is greater than 0, then variable is a cause factor; if is less than 0, then variable is a result factor.

(3) The steps corresponding to probability ranking are as follows:

First Step: Calculate the probability . , , , , .

Second Step: Construct the complementary probability matrix . The complementary probability matrix: , .

Third Step: Based on the relationship between the ranking of and its components ( ), as well as the ranking results, calculate the ranking vector , where the ranking vector is determined by the size relationship , .

Using the expert scoring method, 30 experts in the relevant field were invited to assign values and make predictions about the strength of the direct influence relationships between variables in the theoretical analysis framework, in the form of interval ranges. The expert-assigned values fluctuated between [0,0] (weakest) and [1,1] (strongest). To ensure the credibility of the interval number DEMATEL analysis results, this study first conducted an inter-rater reliability test on the assessment opinions of 30 experts before integrating their scores. The Kendall’s coefficient of concordance was used to quantify the consistency of the scores given by the 30 experts. Specifically, we asked the experts to directly rate the initial importance of the influencing factors in the entire system. Subsequently, we calculated the Kendall’s W coefficient for the ranking of the scores given by these 30 experts to these factors. The calculation results showed that the Kendall’s coefficient of concordance W = 0.816, and the chi-square test reached a significant level (p < 0.001). This statistical result strongly indicates that the expert group hired in this study has a high degree of consensus on the relative importance of the influencing factors, and the subsequent DEMATEL analysis based on the scores of this group of experts has a solid reliability foundation. After verifying the good consistency of the expert opinions, MATLAB software was used to calculate the causal relationships between variables in the theoretical analysis framework, obtaining the centrality and causality results of the interval number expansion DEMATEL method. The calculation results of centrality, causality, and causal relationships between variables are detailed in Table 2. The results in Table 2 preliminarily validate the theoretical hypotheses, initially proving that there are certain logical causal relationships between the variables. Specifically, the agricultural product retail market can influence the agricultural planting structure to a certain extent, the agricultural product retail market can impact the price transmission mechanism to some extent, and the agricultural product retail market can indirectly influence the agricultural planting structure by affecting the price transmission mechanism.

Table 2. Calculation results of causal relationships between variables based on the interval number expansion DEMATEL method.

4.2 Differential evolution algorithm

The interval number expansion DEMATEL method has preliminarily validated that there is a certain degree of interaction, mutual influence, and causal relationship among the three variables in the theoretical framework. Due to the global optimization ability, efficiency, robustness and wide applicability of the differential evolution algorithm compared with other algorithms (Luo et al., 2025), this study further adopts the traditional differential evolution algorithm on this basis (Deb, 2000). Using the objectively obtained overall sample of seven variables—agricultural product retail market network density, agricultural product retail market concentration rate, agricultural product retail market scale, grain price fluctuations, oilseed price fluctuations, grain planting structure, and oilseed planting structure (with the research sample comprising 31 provinces in China, and data derived from the past 10 years mainly obtained from the China Statistical Yearbook)—the study sets the overall objective sample as the search range. By using MATLAB simulation and search software, the algorithm conducts a global search and optimization for superior individual samples, reflecting the attributes and dynamic changes of these superior samples. The superior individual samples with strong learning and evolutionary abilities that enter the next generation population will serve as valid, objective empirical analysis samples for the subsequent structural equation model. This enhances the data processing efficiency and internal validity of the structural equation model, facilitating the accurate determination of the causal relationships among the agricultural product retail market, the price transmission mechanism, and the agricultural planting structure. The relevant parameter settings for the differential evolution algorithm are as follows (Deb, 2000): The test function consists of 17 benchmark functions with global minimum values, including unimodal functions, basic multimodal functions, expanded multimodal functions, and hybrid composition functions. The dimensionality for benchmark function testing is 30; the population scale is 50; the variation factor is 0.5; the crossover probability is 0.9. the maximum number of generations for each function is 1,000; and each function is independently run 25 times. To obtain robust superior individual samples and samples with strong learning abilities that enter the next generation population, the relevant parameters in the differential evolution algorithm are averaged.

The differential evolution algorithm mainly includes four basic operations: initialization of the population, mutation, crossover, and selection. The specific steps are as follows:

(1) Encoding.

(2) Determine and optimize the individual structure. Let NP represent the population size, D represent the dimension contained within an individual, and let the ith individual in the Gth generation of the population be denoted as .

(3) Initialize and optimize the population. , where represents the value of the jth dimension of the ith individual in the G = 0 generation; is a random value generated uniformly between 0 and 1. The lower bound of the jth dimension in the search space is , and the upper bound is . and are vector representations of the lower and upper bounds of the search space, respectively.

(4) Mutation processing. where represents the kth individual in the current population to be mutated; X m , G , Xi,G, Xj,G represent randomly selected individuals from the current population, with k ≠ m ≠ i ≠ j; represents the mutated individual; and F ∈ [0,1] is the scaling factor. DE/x/y/z represents different mutation modes: DE stands for the differential evolution algorithm, x represents the base vector before the difference vector, and z represents the crossover mode.

(5) Crossover processing. The crossover probability Cr ∈ [0,1]. Crossover includes exponential and binomial modes.

(6) Selection processing. The individual obtained after crossover is compared sequentially with the target individual by substituting them into the objective function. The calculation of the relevant selection process is shown in Equation (2):

4.3 Sensitivity analysis and model robustness test

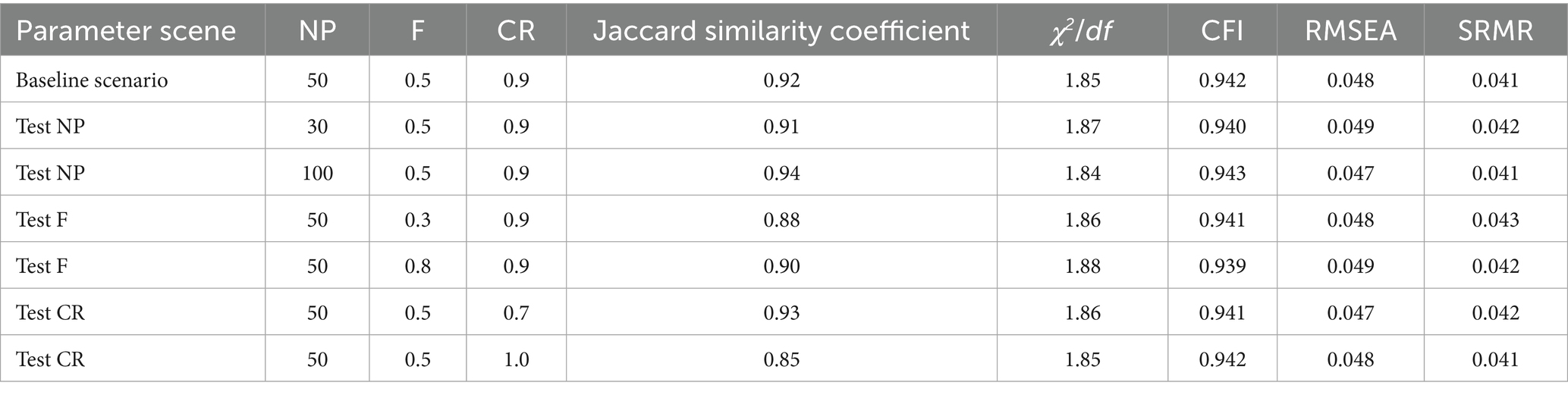

To ensure the robustness of the structural equation model estimation results based on the differential evolution algorithm and to avoid the accidental influence of parameter settings on the conclusion, this study conducted a systematic parameter sensitivity analysis. We focused on three core parameters of the differential evolution algorithm: population size, mutation factor, and crossover probability. We took the parameter combination used in the main text (NP = 50, F = 0.5, CR = 0.9) as the benchmark scenario and then successively rotated one parameter to form multiple test scenarios. Under different parameter settings, we re-estimated the structural equation model and focused on the stability of the model fit. The results of the parameter sensitivity and model fit analysis are shown in Table 3.

The sensitivity analysis indicates that under different algorithm parameters, the excellent sample sets selected are highly similar (Jaccard coefficients are all greater than 0.85), and the statistical characteristics of their key variables are very stable. This proves that the process of sample selection through the DEMATEL algorithm in this study is robust, providing a reliable data basis for subsequent analysis. Under different parameter combinations, the key fit indicators of the model (χ2/df, CFI, RMSEA, SRMR) are all stable, with very small fluctuations (for example, CFI is always above 0.93, RMSEA is always below 0.05), and all meet the ideal discrimination standards. This indicates that the overall structure of the model can fit the data well under different parameter settings. It is proved that the model has good generalization ability and effectively alleviates the concern of overfitting. This analysis strongly proves that our empirical results are not dependent on a specific set of parameters, thereby enhancing the robustness and scientific nature of the research conclusion.

4.4 Structural equation model construction

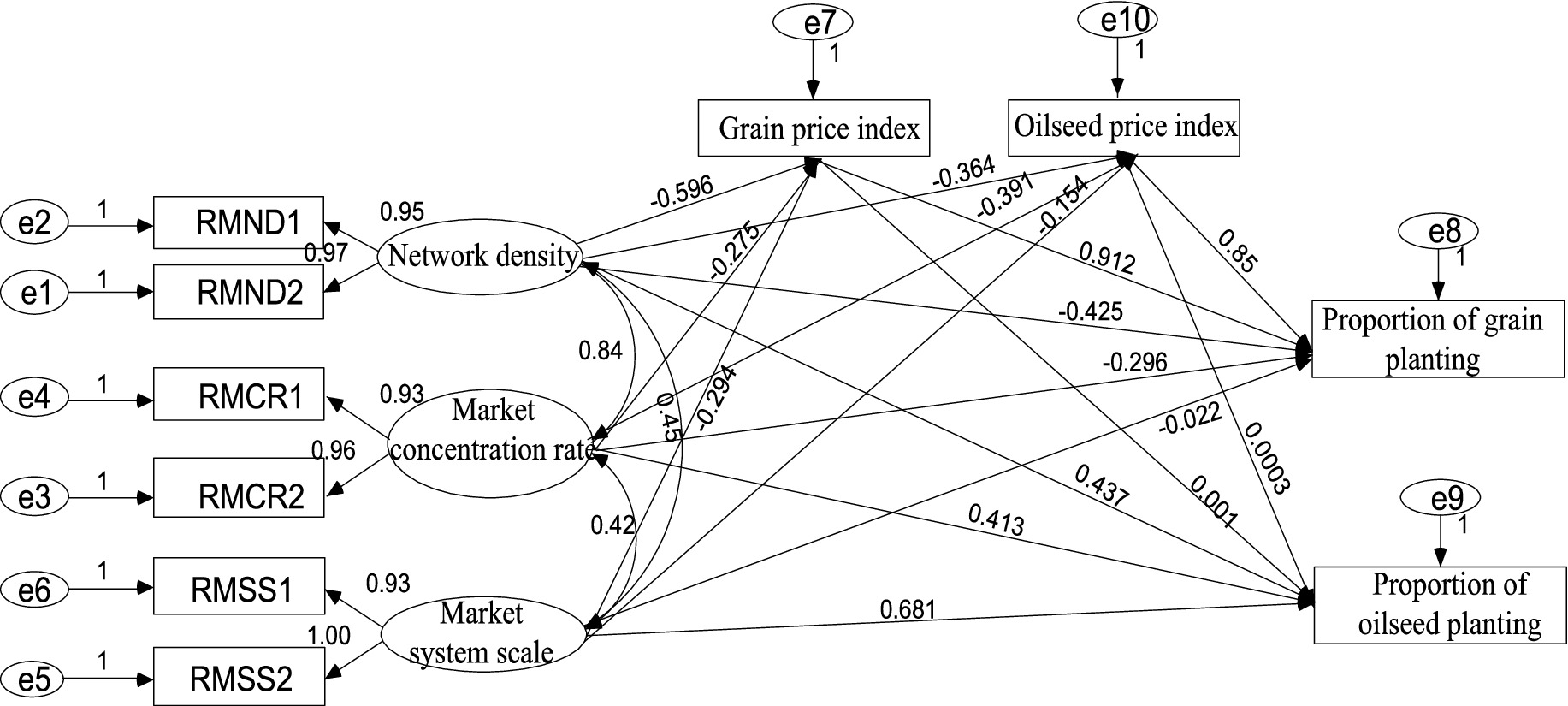

Based on the results of the interval number expansion DEMATEL method and the differential evolution algorithm, to further explore how the agricultural product market system influence the agricultural planting structure through the price transmission mechanism and to uncover the intrinsic mechanism of the agricultural product market system on the agricultural planting structure, the study considers retail market network density, market concentration, and market system scale as the three dimensions of the agricultural product market system. The agricultural product price transmission mechanism is divided into two dimensions: grain price transmission and oilseed price transmission. The agricultural planting structure is divided into two dimensions: grain planting structure and oilseed planting structure. Based on the theoretical hypotheses, a structural equation model is constructed. The constructed structural equation model and the calculation results are shown in Figure 2. It can be seen in Figure 2 that retail market network density, market concentration rate, and market system scale form the latent variables, which are measured by two observed variables each.

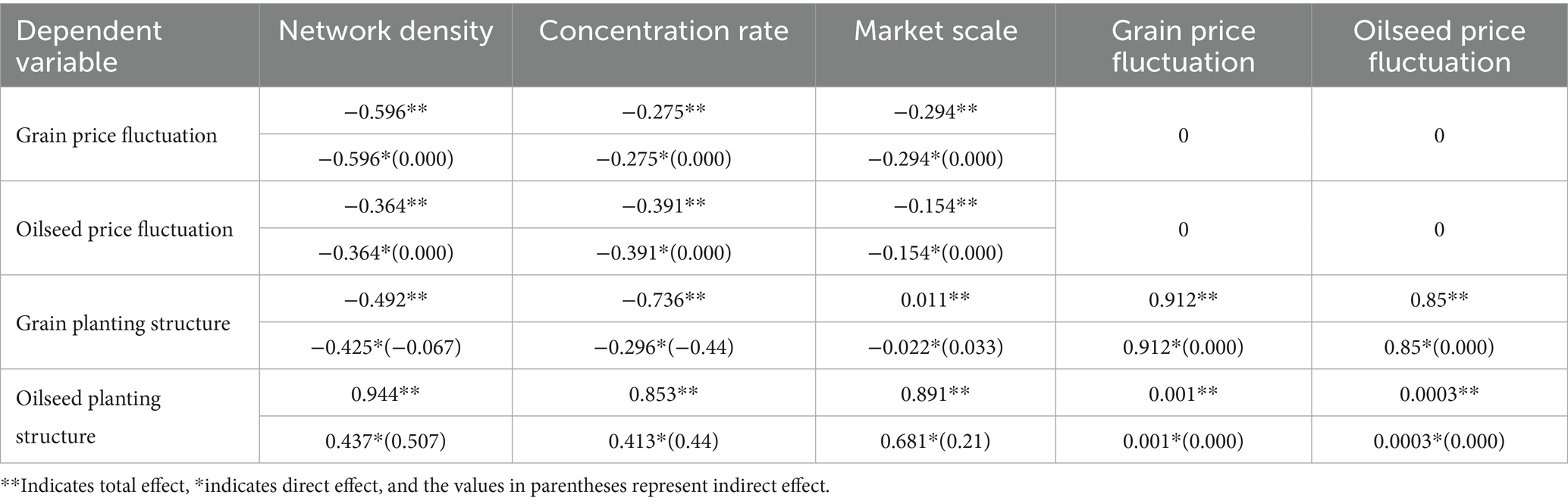

4.5 Path analysis of the structural equation model

The structural parameters of the model yield the path coefficients between variables. By analyzing these paths, the relationships between latent variables can be examined, thereby testing the hypotheses presented earlier. Furthermore, to further verify the statistical stability of the internal path coefficients of the structural equation model, this study adopts the Bootstrap method for formal verification. The results showed that for all the paths that were significant at the p < 0.05 level, their Bootstrap 95% confidence intervals did not contain zero values. This provides consistent support for the parameter estimation of the core hypothesis of this study and confirms the statistical reliability of the research conclusion. The specific details are shown in Table 4.

Based on the AMOS path testing results, the following conclusions can be drawn: (1) The path coefficient of retail market network density on grain price fluctuation reaches the 0.05 significance level, and the path coefficient on oilseed price fluctuation is significant at the 0.001 level. Therefore, it can be assumed that hypotheses H1 and H2 are supported. (2) The path coefficient of retail market concentration rate on grain price fluctuation at the 0.01 level is significant, while the path coefficient on oilseed price fluctuation is not significant. The regression coefficient is not supported, which can be taken as evidence that Hypothesis H3 is supported and Hypothesis H4 is not supported. (3) The path coefficient of retail market scale on grain price fluctuation reaches the significant level at the level of 0.001, and the path coefficient on oilseed price fluctuation reaches the significant level at the level of 0.01. Therefore, the hypothesis H5 and H6 are supported. (4) The path coefficient of retail market network density on the structure of grain planting reaches a significant level at the 0.001 level, and the path coefficient of retail market network density on the structure of oilseed planting reaches a significant level at the 0.01 level, which can be concluded that hypotheses H7 and H8 are supported. (5) The path coefficient of retail market concentration rate on the structure of grain planting and oilseed planting reach a significant level at the 0.05 level, which can be concluded that hypotheses H9 and H10 are supported. (6) The path coefficient of retail market scale on grain planting structure and oilseed planting structure reach the significance level of 0.001, and it can be concluded that hypotheses H11 and H12 are supported.

The empirical results show that the “Retail Market Concentration Rate→Oilseed Price Fluctuation” (H4) failed the significance test. This finding itself has profound policy and theoretical implications. The underlying reasons mainly stem from two aspects: First, strong policy intervention has covered market forces. Compared with grains, oilseed crops have higher strategic sensitivity and greater import dependence, and thus are subject to strong regulation by policies such as temporary purchase and storage and target price subsidies. These measures have set a “policy bottom line” for oil prices, creating a macro “pressure stabilizer” and significantly weakening the ability of the retail market concentration to shape prices. Second, there are differences between product features and the industrial chain structure. Grain is an absolute necessity with strong demand rigidity, while edible oilseed has a wide variety of types and strong substitutability. The demand-side constraints have curbed the space for price manipulation. In addition, oilseed crops need to go through a longer processing and distribution industrial chain. The concentration of the terminal retail market is diluted in multiple layers of transmission, making it difficult to effectively influence the upstream production prices. In conclusion, this result indicates that in the field of oilseed crops, policy factors are more dominant price determinants than the structure of the retail market. This provides a key basis for implementing classified agricultural market policies: that is, monopoly risks should be prevented in the grain market, while strong macro-control should be maintained in the oilseed market.

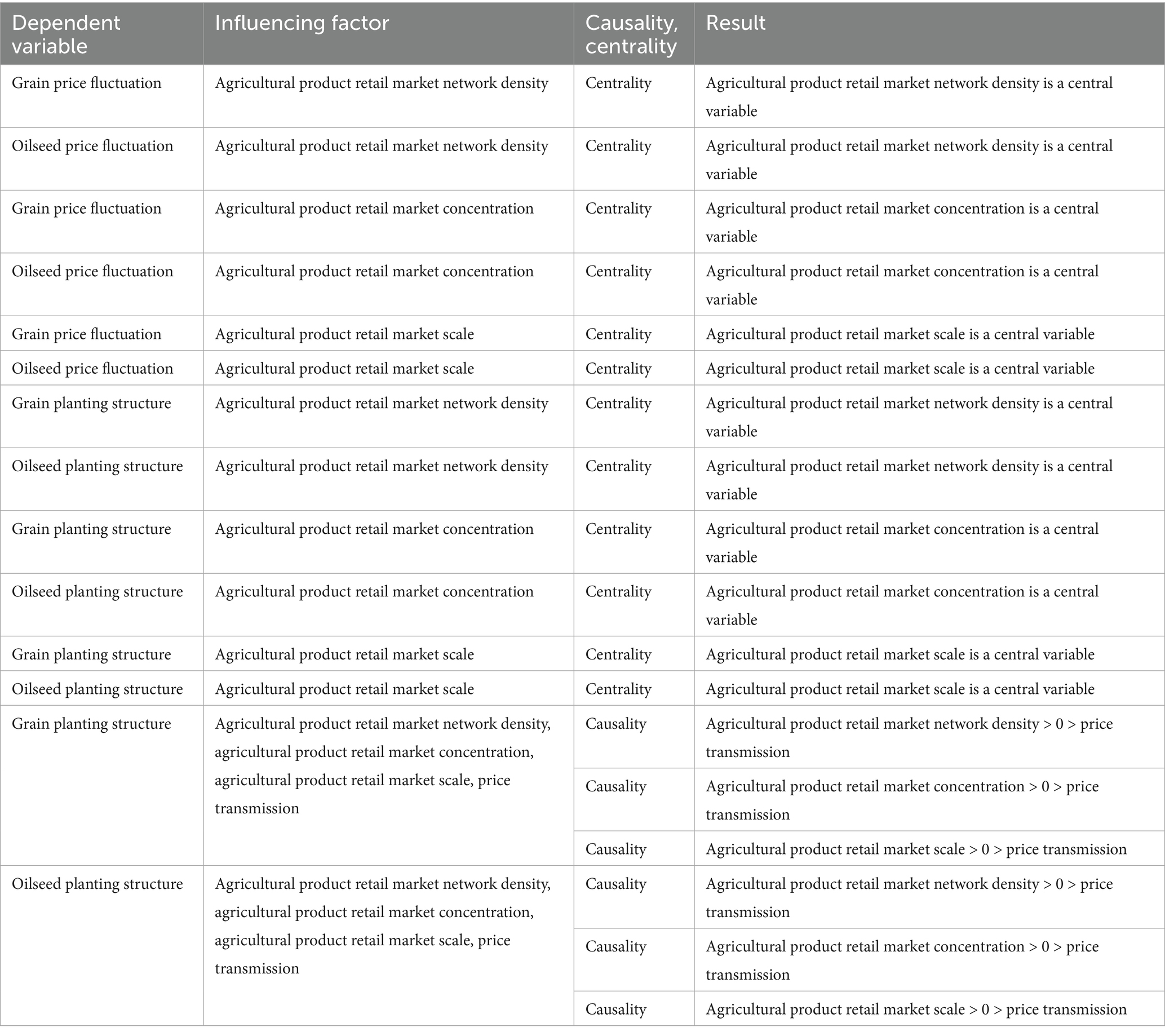

4.6 Effect analysis between variables in the structural equation model

To further investigate how the agricultural product retail market influence the agricultural planting structure through the agricultural product price transmission mechanism, and to avoid the limitation of path analysis in only understanding direct relationships between variables, an effect analysis is conducted to study the direct and indirect relationships between variables as well as the total effect. The total effect is the sum of the indirect effect and the direct effect. The direct effect is the path coefficient discussed earlier, while the indirect effect is the product of the relevant path coefficients. The calculation of the indirect effect is shown in Equation (3):

Where n represents the number of paths through which a variable reaches the final variable via a mediator, and represents the ith path coefficient of the Kth path. By organizing these, the total effect, direct effect, and indirect effect of the structural equation model are obtained. The specific results are detailed in Table 5.

4.7 Results and discussion

This paper analyzes the impact of China’s agricultural product retail market on the agricultural planting structure’s ecological niche, using the price transmission mechanism as the research intermediary. Based on relevant agricultural data from 31 provinces in China, the study employs the interval number expansion DEMATEL method and the differential evolution algorithm and applies a structural equation model to empirically analyze the relationships between the retail market system, price transmission mechanism, and agricultural planting structure. The results indicate:

1. The agricultural product retail market primarily has a negative impact on price fluctuation. According to this study, an increase in network density actually reduces price volatility, preventing prices from experiencing rapid and significant changes, providing a further explanation of the relationship between market density and price. As shown in Tables 1, 2, the total effect of network density in the agricultural product retail market on grain price fluctuation and oilseed price fluctuation is −0.596 and −0.364, respectively, indicating that network density has a significant negative impact on both grain and oilseed price fluctuations. The total effect of the concentration rate of agricultural product retail market on the grain price fluctuation is −0.275, which is significant. The total effect on oilseed price fluctuation is −0.391, but not significant; It shows that the concentration rate of agricultural product retail market has a negative effect on the transmission mechanism of grain price. The total effect of the retail market scale of agricultural product on grain price fluctuation is −0.294, which means that the market scale has a significant negative impact on the transmission mechanism of grain price, and it is significant. The total effect on oilseed price fluctuation is −0.154, which is significant, which means that the market scale has a significant negative impact on the oilseed price transmission mechanism. In addition, the negative influence of network density on price transmission mechanism is greater than that of concentration rate and market scale.

2. The agricultural product retail market has a significant impact on the agricultural planting structure. This research further expands the theoretical studies on the relationship between the market system and industrial development. Increasing the scale of large retail enterprises can enhance agricultural productivity, thereby promoting agricultural development, which to some extent reflect the relationship between market concentration and agriculture. However, studying the relationship between the agricultural planting structure and the market from the three perspectives of concentration rate, scale, and density provides a more systematic and accurate understanding. The total effect of agricultural product retail market network density on grain planting structure and oilseed planting structure is −0.492 and 0.944, respectively, with direct effects of −0.425 and 0.437, respectively. The retail market network density has a significant negative impact on the grain planting structure and a significant positive impact on economic crops represented by oilseed. This indicates that as the retail network expands, the planting structure will gradually shift towards economic crops, and the proportion of grain crop planting will gradually decrease. The total effect of market concentration rate on grain planting structure and oilseed planting structure is −0.736 and 0.853, respectively, with direct effects of −0.296 and 0.413, respectively. Although the retail market concentration rate has a significant impact on the planting structure, its influence on oilseed crops is much greater, while the impact on grain crops is relatively weaker. As mentioned above, the expansion of market concentration rate will lead to an increase in the planting area of oilseed crops and a reduction in the planting area of grain crops. The total effect of market scale on grain planting structure and oilseed planting structure is 0.011 and 0.891, respectively, with direct effects of −0.022 and 0.681, respectively. Market scale is significantly negatively correlated with the grain planting structure and significantly positively correlated with the planting structure of economic crops.

3. The price transmission mechanism has a clear mediating role between the agricultural product retail market and the agricultural planting structure. The total effect of retail market network density on the grain planting structure is −0.492, with a direct effect of −0.425. The total effect of retail market concentration rate on the grain planting structure is −0.736, with a direct effect of −0.296. The total effect of market scale on the grain planting structure is 0.011, with a direct effect of −0.022. These data indicate that the price transmission mechanism has mitigated the negative impact of the retail market system on the grain planting structure, reducing the shock to the grain planting structure. The current market development inevitably leads to a reduction in the grain planting structure, but the price mechanism can significantly smooth this downward trend, ensuring a stable transition, which is beneficial for China’s overall grain strategy. The total effect of retail market network density on the oilseed planting structure is 0.944, with a direct effect of 0.437. The total effect of market concentration rate on the oilseed planting structure is 0.853, with a direct effect of 0.413. The total effect of market scale on the oilseed planting structure is 0.891, with a direct effect of 0.681. This means that through the price transmission mechanism, the retail market’s network density, concentration rate, and market scale have a greater and more direct positive impact on the economic crops represented by oilseed, with some effects exceeding 50%. The impact of the retail market system on the agricultural planting structure clearly demonstrates the mediating role of the price transmission mechanism, which not only amplifies the positive impact but also smooths downward trends, ensuring the steady upgrading of the overall agricultural planting structure.

5 Conclusion

5.1 Significance

This paper provides a new research perspective on the impact of the retail market system on the agricultural planting structure, offering valuable practical insights for the theoretical study of agricultural planting structure. It can provide scientific basis for the government to formulate agricultural policies and help the government to better adjust the agricultural planting structure to promote the development of agricultural economy. By understanding the price transmission mechanism of the retail market, the government can take effective market control measures to protect the interests of farmers and stabilize the agricultural product market. By analyzing the impact of retail market on agricultural planting structure, it can promote the development of agriculture in the direction of higher added value and promote the upgrading of agricultural industry. The influence path from retail market to agricultural planting structure is established, which enriches the theoretical framework of agricultural economics and helps to deepen the understanding of the operation law of agricultural market. By studying the structure of agricultural cultivation, it is possible to ensure the safety and diversity of the food supply, thereby improving the overall level of well-being of society. In conclusion, this study is critical to understanding the complex relationship between retail agricultural market and the structure of agricultural cultivation, and has important implications for policy makers, agricultural practitioners, and academia.

5.2 Suggestions

Based on the empirical test results, this study proposes the following more targeted policy recommendations to optimize the retail market system of agricultural products and promote the strategic adjustment of agricultural planting structure:

1. Implement differentiated retail market structure regulation strategies and precisely manage price signals. This study confirms that the network density, concentration, and scale of the retail market all have significant negative impacts on price fluctuations (the coefficients of paths H1–H6 are negative), and have differentiated effects on planting structure. (1) Optimize network density and smooth the price transmission channels. Network density has a significant stabilizing effect on price fluctuations (H1, H2), but excessive density may lead to information redundancy. Therefore, the policy focus should shift from “increasing quantity” to “improving quality” and “enhancing efficiency,” promoting high-quality information flow between market nodes, such as through digital transformation and information platform construction to optimize information flow quality and ensure accurate price signals reach producers. (2) Reduce market concentration and break the risk of price distortion. Market concentration has a significant negative overall effect on the planting structure of grains (H9), and is an important cause of the failure of oilseed price transmission (H4 is not significant). Therefore, anti-monopoly and fair competition reviews should be implemented to prevent a few large retailers from manipulating the market and prices. In particular, support should be given to small and medium-sized retail enterprises and farmers’ cooperatives to directly enter the market, increase the diversity of market entities, weaken channel monopolies, and thereby enhance the authenticity and sensitivity of price signals. (3) Guide the orderly expansion of market scale and focus on information quality. An expanded market scale can bring more information, but it may also increase information noise (H5, H6 are negative). Therefore, while encouraging the expansion of market scale, a supporting system for agricultural product quality standards and traceability should be built to ensure that the expansion of market scale is accompanied by an improvement in information quality and feedback symmetry, rather than simply a quantitative accumulation, avoiding the situation where farmers are overwhelmed by “information overload” and unable to make decisions.

2. strengthen the core position of the price transmission mechanism in policy-making. Empirical analysis results show that price fluctuations are the key mediating variables connecting the retail market and planting structure (paths H1–H6, H9–H12 are all significant). The government should take the establishment of an efficient and transparent mechanism for the formation of agricultural product prices as the core of agricultural policies. An authoritative platform for the release and early warning of agricultural product prices should be established, integrating retail price data, and providing producers with real-time and accurate market trend analysis. Policy goals should shift from direct “price protection” to more “income protection” and “stabilizing expectations.” By enhancing the market regulation function of price signals, farmers should be guided to adjust their planting structures spontaneously and develop differentiated and high-value-added agricultural products.

3. Implement differentiated policies based on regional development stages. There is significant heterogeneity in the development of retail markets and planting structures across China’s provinces. (1) In the primary stage regions (such as the western agricultural provinces): “Build networks and increase scale.” Through infrastructure construction subsidies and policy incentives, rapidly enhance the density of the retail market network and basic scale to address the issue of market existence and smooth the “first mile” for agricultural products to leave villages and enter cities. (2) In rapidly developing regions (such as the major agricultural provinces in the central region): “Optimize structure and prevent monopolies.” While expanding the market scale, it is particularly important to be vigilant against the rising market concentration. Encourage various circulation model innovations (such as direct supply from farms to supermarkets, direct procurement by e-commerce platforms), prevent reliance on a single channel, ensure a diverse planting structure, and avoid homogenized competition. (3) In upgrading and transforming regions (such as the eastern coastal provinces): “Reduce density and promote diversity.” The core of market construction is to control excessive concentration and develop diversified niche markets (such as organic agricultural product and specialty brand agricultural product dedicated markets). By reducing centrality, encourage innovation and differentiated competition, thereby guiding the planting structure towards high quality and high efficiency, and meeting the diversified consumption demands.

5.3 Future research

Based on the achievements and limitations of this study, future research can be deepened and expanded in the following directions: First, from static to dynamic: Introduce dynamic panel models or time-varying parameter models, and use higher-frequency data to capture the time lag effect and dynamic adjustment process of price transmission, revealing the complex relationship between short-term fluctuations and long-term equilibrium. Second, from internal mechanisms to open systems: Incorporate key external variables such as climate fluctuations, policy subsidies, and technological progress into the analytical framework, quantify their direct and interactive impacts on the market system and planting structure, and construct a more comprehensive theoretical model.

Data availability statement

The datasets presented in this article cannot be publicly shared due to privacy restrictions. Requests to access the datasets should be directed to Xueying Sun, eHVleWluZ19zdW4wNTE4QDE2My5jb20=.

Author contributions

KL: Writing – review & editing. XS: Writing – original draft. XJ: Writing – original draft. HZ: Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Albayrak, M. (2010). Organizing against market exploitation in Turkey: an analysis of wholesale markets, trade exchanges and producer organizations. Sci. Res. Essays 5, 2432–2440. Available online at: http://www.academicjournals.org/SRE

Alizamir, S., Iravani, F., and Mamani, F. (2019). An analysis of price vs. revenue protection: government subsidies in the agriculture industry. Manag. Sci. 65, 32–49. doi: 10.1287/mnsc.2017.2927

Altuntas, F., and Gok, M. S. (2021). The effect of COVID-19 pandemic on domestic tourism: a DEMATEL method analysis on quarantine decisions. Int. J. Hosp. Manag. 92:102719. doi: 10.1016/j.ijhm.2020.102719

Assis, M. T. Q. M., Lucas, M. R. D. P. V., and Rainho, M. M. (2023). The influence of trust for sustainable Agri-food production: empirical evidence of a mariculturist supply chain in southern Brazil. Br. Food J. 125, 4268–4290. doi: 10.1108/BFJ-08-2022-0734

Barge-Gil, A. (2010). Cooperation-based innovators and peripheral cooperators: an empirical analysis of their characteristics and behavior. Technovation 30, 195–206. doi: 10.1016/j.technovation.2009.11.004

Bononi, M., Quaglia, G., and Tateo, F. (2016). Preliminary LC-IRMS characterization of Italian pure lemon juices and evaluation of commercial juices distributed in the Italian market. Food Anal. Methods 9, 2824–2831. doi: 10.1007/s12161-016-0479-5

Cechura, L., Samoggia, A., and Jaghdani, T. J. (2024). Concentration, market imperfections, and interbranch organization in the Italian processed tomato supply chain. Agric. Econ. 55, 603–620. doi: 10.1111/agec.12835

Chen, N., and Li, H. (2024). Agricultural economic security under the model of integrated agricultural industry development. Qual. Assur. Saf. Crop. Foods. 16, 25–41. doi: 10.15586/qas.v16i3.1470

Cho, W., and Blandford, D. (2019). Bilateral information asymmetry in the design of an Agri-environmental policy: an application to peatland retirement in Norway. J. Agric. Econ. 70, 663–685. doi: 10.1111/1477-9552.12313

Chouvy, P.-A., and Macfarlane, J. (2018). Agricultural innovations in Morocco’s cannabis industry. Int. J. Drug Policy 58, 85–91. doi: 10.1016/j.drugpo.2018.04.013

Deb, K. (2000). An efficient constraint handling method for genetic algorithms. Comput. Methods Appl. Mech. Eng. 186, 311–338. doi: 10.1016/S0045-7825(99)00389-8

Dokic, A., and Jovic, S. (2017). Evaluation of agriculture and industry effect on economic health by ANFIS approach. Phys. A 479, 396–399. doi: 10.1016/j.physa.2017.03.022

Dong, X., Balagtas, J. V., and Byrne, A. T. (2023). A closer look at the relationship between concentration, prices, and market power in food retail-a monopolistic competition and differentiated products approach. Appl. Econ. Perspect. Policy 45, 2161–2182. doi: 10.1002/aepp.13344

Erbaugh, J., Bierbaum, R., Castilleja, G., da Fonseca, G. A. B., and Hansen, S. C. B. (2019). Toward sustainable agriculture in the tropics. World Dev. 121, 158–162. doi: 10.1016/j.worlddev.2019.05.002

Gangopadhyay, P. K., Khatri-Chhetri, A., Shirsath, P. B., and Aggarwal, P. K. (2019). Spatial targeting of ICT-based weather and agro-advisory services for climate risk management in agriculture. Clim. Chang. 154, 241–256. doi: 10.1007/s10584-019-02426-5

Garrone, M., Emmers, D., Olper, A., and Swinnen, J. (2019). Jobs and agricultural policy: impact of the common agricultural policy on EU agricultural employment. Food Policy 87:101744. doi: 10.1016/j.foodpol.2019.101744

Giganti, P., Borrello, M., Falcone, P. M., and Cembalo, L. (2024). The impact of blockchain technology on enhancing sustainability in the agri-food sector: a scoping review. J. Clean. Prod. 456:142379. doi: 10.1016/j.jclepro.2024.142379

Giua, C., Materia, V. C., and Camanzi, L. (2021). Management information system adoption at the farm level: evidence from the literature. Br. Food J. 123, 884–909. doi: 10.1108/BFJ-05-2020-0420

Grosser, T. J., Sterling, C. M., Piplani, R. S., Cullen-Lester, K. L., and Floyd, T. M. (2023). A social network perspective on workplace inclusion: the role of network closure, network centrality, and need for affiliation. Hum. Resour. Manag. 62, 477–490. doi: 10.1002/hrm.22131

Guchhait, R., Bhattacharya, S., Sarkar, B., and Gunasekaran, A. (2024). Pricing strategy based on a stochastic problem with barter exchange under variable promotional effort for a retail channel. J. Retail. Consum. Serv. 81:103954. doi: 10.1016/j.jretconser.2024.103954

Guo, X.-X., Li, K.-L., Liu, Y.-Z., Zhuang, M.-H., and Wang, C. (2022). Toward the economic-environmental sustainability of smallholder farming systems through judicious management strategies and optimized planting structures. Renew. Sust. Energ. Rev. 165:112619. doi: 10.1016/j.rser.2022.112619

Hagberg, J., and Kjellberg, H. (2015). How much is it? Price representation practices in retail markets. Mark. Theory 15, 179–199. doi: 10.1177/1470593114545005

Hu, K., Liu, J., Li, B., Liu, L., Gharibzahedi, S. M. T., Su, Y., et al. (2019). Global research trends in food safety in agriculture and industry from 1991 to 2018: a data-driven analysis. Trends Food Sci. Technol. 85, 262–276. doi: 10.1016/j.tifs.2019.01.011

Iqbal, J., Brooks, R., and Galagedera, D. U. A. (2010). Testing conditional asset pricing models: an emerging market perspective. J. Int. Money Finance 29, 897–918. doi: 10.1016/j.jimonfin.2009.12.004

Jiang, S., Yu, J., Li, S., Liu, J., Yang, G., Wang, G., et al. (2024). Evolution of crop planting structure in traditional agricultural areas and its influence factors: a case study in alar reclamation. Agronomy 14:580. doi: 10.3390/agronomy14030580

Li, W., Liu, C., Yang, Q., You, Y., Zhuo, Z., and Zuo, X. (2023). Factors influencing farmers’ vertical collaboration in the agri-chain guided by leading enterprises: a study of the table grape industry in China. Agriculture 13:1915. doi: 10.3390/agriculture13101915

Li, T., Lu, H., Luo, Q., Li, G., and Gao, M. (2024). The impact of rural population aging on agricultural cropping structure: evidence from China’s provinces. Agriculture 14:586. doi: 10.3390/agriculture14040586

Liao, L., Long, H., Gao, X., and Ma, E. (2019). Effects of land use transitions and rural aging on agricultural production in China’s farming area: a perspective from changing labor employing quantity in the planting industry. Land Use Pol. 88:104152. doi: 10.1016/j.landusepol.2019.104152

Liu, Y., Chen, X., and Rabinowitz, A. N. (2019a). The role of retail market power and state regulations in the heterogeneity of farm-retail price transmission of private label and branded products. Agric. Econ. 50, 91–99. doi: 10.1111/agec.12468

Liu, X., Pan, F., Yuan, L., and Chen, Y. (2019b). The dependence structure between crude oil futures prices and Chinese agricultural commodity futures prices: measurement based on Markov-switching GRG copula. Energy 182, 999–1012. doi: 10.1016/j.energy.2019.06.071

Liu, K., and Wang, G. (2024). How does the spatial structure of innovation agglomeration affect energy efficiency? From the role of industrial structure upgrading. Energies 17:3977. doi: 10.3390/en17163977

Luo, Y., Li, J., Yang, J., Bai, Y., and Zhang, X. (2025). Adaptive filtering algorithm based on beta fluctuation and fractional order differential evolution in noise. Eng. Appl. Artif. Intell. 142:109937. doi: 10.1016/j.engappai.2024.109937

Lv, X., Lin, W., Meng, J., and Mo, L. (2024). Spillover effect of network public opinion on market prices of small-scale agricultural products. Mathematics 12:539. doi: 10.3390/math12040539

Ma, Q. (2022). Calculation method of logistics energy consumption in agricultural product supply chain based on structural equation model. Math. Probl. Eng. 2022, 1–9. doi: 10.1155/2022/7760056

Ma, M., Saitone, T. L., Volpe, R. J., Sexton, R. J., and Saksena, M. (2019). Market concentration, market shares, and retail food prices: evidence from the US women, infants, and children program. Appl. Econ. Perspect. Policy 41, 542–562. doi: 10.1093/aepp/ppy016

Minten, B., and Kyle, S. (2000). Retail margins, price transmission and price asymmetry in urban food markets: the case of Kinshasa (Zaire). J. Afr. Econ. 9, 1–23. doi: 10.1093/jae/9.1.1

Nie, W., Li, T., and Zhu, L. (2020). Market demand and government regulation for quality grading system of agricultural products in China. J. Retail. Consum. Serv. 56:102134. doi: 10.1016/j.jretconser.2020.102134

O’Sullivan, C. A., Bonnett, G. D., McIntyre, C. L., Hochman, Z., and Wasson, A. P. (2019). Strategies to improve the productivity, product diversity and profitability of urban agriculture. Agric. Syst. 174, 133–144. doi: 10.1016/j.agsy.2019.05.007

Peng, Y., Wang, W., Zhen, S., and Liu, Y. (2024). Does digitalization help green consumption? Empirical test based on the perspective of supply and demand of green products. J. Retail. Consum. Serv. 79:103843. doi: 10.1016/j.jretconser.2024.103843

Pensieroso, L., and Sommacal, A. (2019). Agriculture to industry: the end of intergenerational coresidence. Rev. Econ. Dyn. 34, 87–102. doi: 10.1016/j.red.2019.03.007

Perez, M. P., Ribera, L. A., and Palma, M. A. (2017). Effects of trade and agricultural policies on the structure of the US tomato industry. Food Policy 69, 123–134. doi: 10.1016/j.foodpol.2017.03.011

Qi, Y., Zhang, J., Chen, X., Li, Y., Chang, Y., and Zhu, D. (2023). Effect of farmland cost on the scale efficiency of agricultural production based on farmland price deviation. Habitat Int. 132:102745. doi: 10.1016/j.habitatint.2023.102745

Rong, Q., Cai, Y., Su, M., Yue, W., Dang, Z., and Yang, Z. (2019). Identification of the optimal agricultural structure and population size in a reservoir watershed based on the water ecological carrying capacity under uncertainty. J. Clean. Prod. 234, 340–352. doi: 10.1016/j.jclepro.2019.06.179

Tang, Y. H., Luan, X. B., Sun, J. X., Zhao, J. F., Yin, Y. L., Wang, Y. B., et al. (2021). Impact assessment of climate change and human activities on GHG emissions and agricultural water use. Agric. For. Meteorol. 296:108218. doi: 10.1016/j.agrformet.2020.108218

Wen, F., Yang, Z., Ou, Y., Zou, X., and Duan, J. (2018). “Government-industry-university-research-promotion” collaborative innovation mechanism construction to promote the development of agricultural machinery technology. IFAC Papersonline, 51:552–559. doi: 10.1016/j.ifacol.2018.08.147

Whelen, T., and Siqueira, P. (2017). Use of time-series L-band UAVSAR data for the classification of agricultural fields in the San Joaquin Valley. Remote Sens. Environ. 193, 216–224. doi: 10.1016/j.rse.2017.03.014

Willekens, M., Dekeyser, S., Bruynseels, L., and Numan, W. (2023). Auditor market power and audit quality revisited: effects of market concentration, market share distance, and leadership. J. Account. Audit. Finance 38, 161–181. doi: 10.1177/0148558X20966249

Yuan, Y., and Xu, B. (2024). Can agricultural insurance policy adjustments promote a “grain-oriented” planting structure?: measurement based on the expansion of the high-level agricultural Insurance in China. Agriculture 14:708. doi: 10.3390/agriculture14050708

Zhang, B., Jin, P., Qiao, H., Hayat, T., Alsaedi, A., and Ahmad, B. (2019). Exergy analysis of Chinese agriculture. Ecol. Indic. 105, 279–291. doi: 10.1016/j.ecolind.2017.08.054

Keywords: agricultural product retail market, price transmission, agricultural planting structure, interval number expansion algorithm, differential evolution algorithm (DE algorithm)

Citation: Liu K, Sun X, Jin X and Zhou H (2025) The driving effect of the retail market system on the evolution of agricultural planting structure under price transmission: a structural equation model based on the interval number expansion algorithm. Front. Sustain. Food Syst. 9:1527436. doi: 10.3389/fsufs.2025.1527436

Edited by:

Priyanka Lal, Lovely Professional University, IndiaReviewed by: