- 1Zhejiang Institute for Information Development, Hangzhou Dianzi University, Hangzhou, China

- 2School of Accounting, Hebei University of Economics and Business, Shijiazhuang, China

- 3School of Economics, Central University of Finance and Economics, Beijing, China

- 4College of International Education, University of Perpetual Help System DALTA, Biñan, Philippines

Introduction: As China accelerates its transition toward green and sustainable development, green finance has emerged as a key policy instrument to reshape rural economic structures. However, its specific effects on household income composition and broader rural transformation remain underexplored.

Methods: This study investigates the impact of the Green Finance Reform and Innovation Zones (GFRIZ) on the income structure of rural households. We employ a difference-in-differences (DID) strategy using panel data from the China Labor-force Dynamics Survey (CLDS) covering the period 2010 to 2018.

Results: The empirical results show that green finance reform significantly increases households’ operating income and reduces their dependence on traditional agricultural income. It also discourages rural labor out-migration, encourages productive land use, and improves access to financial services, including credit, insurance, and investment. The effects are more pronounced in Central and Western provinces, economically underdeveloped areas, and regions with lower levels of digitalization. Mechanism analyses indicate that community-based learning activities further enhance policy effectiveness by promoting knowledge spillovers and financial participation.

Discussion: These findings highlight the multidimensional value of green finance as a lever for ecological transition, inclusive rural revitalization, and agricultural resilience. By retaining labor in rural areas and revitalizing agricultural engagement, green finance indirectly contributes to stabilizing grain production and strengthening food security. To maximize its impact, green finance should be integrated with human capital investment and robust environmental oversight mechanisms.

1 Introduction

In the pursuit of the United Nations Sustainable Development Goals (SDGs), poverty alleviation, food security, and sustainable agriculture remain pressing challenges across the Global South. While traditional anti-poverty strategies have focused on cash transfers, infrastructure investment, and inclusive finance, a growing body of policy and academic discourse advocates for integrating environmental sustainability into rural development agendas. In this context, green finance—defined as financial instruments and institutional mechanisms that simultaneously promote ecological goals and economic inclusion—has emerged as a promising tool. Yet, rigorous empirical evidence remains limited on how green finance affects household-level behavior in rural settings, especially those undergoing structural transitions such as labor outmigration and agrarian decline.

China offers a timely and insightful case to explore the transformative potential of green finance in rural economies. Following the official eradication of absolute poverty in 2021, the Chinese government established Green Finance Reform and Innovation Zones (GFRIZ) to channel financial resources toward ecologically sound and socially inclusive development. These zones aim not only to address rural ecological degradation and labor drain, but also to serve as institutional platforms for promoting resilient agricultural systems. As many developing countries now enter the post-poverty era, China’s green finance reform provides valuable lessons on aligning financial innovation with rural revitalization. This study investigates whether and how green finance fosters a shift “from migration to cultivation”—that is, from reliance on off-farm labor to re-engagement with land-based and entrepreneurial livelihoods—thereby enhancing agricultural resilience and income diversification in emerging rural regions.

Over the past four decades, China’s unprecedented economic growth and urbanization have triggered large-scale rural-to-urban labor migration. While this demographic shift has contributed to poverty reduction and broader economic modernization (Harris and Todaro, 1970; de Brauw et al., 2002), it has also posed profound challenges for rural sustainability. The outflow of labor has led to widespread land abandonment, declining smallholder participation, and increasing vulnerability in domestic food systems (Zhou et al., 2022). Compounding these issues, the aging of the agricultural workforce and persistently low levels of investment in green technologies have further undermined rural productivity and ecological resilience (Liu and Liu, 2025). Against this backdrop, there is an urgent need to explore institutional mechanisms—such as green finance—that may reverse these trends and re-anchor livelihoods in sustainable agricultural development.

These pressures are compounded by evolving environmental regulations. Traditional farming practices—characterized by inefficient resource use, low mechanization, and environmentally harmful activities such as straw burning—are now subject to regulatory penalties. While environmental compliance is essential, it imposes new financial burdens on rural households that often lack access to credit, insurance, or green technologies (Sadiq et al., 2021; Yu et al., 2021). Meanwhile, migrant workers in cities frequently engage in informal or precarious employment with limited labor protection, rendering the migration pathway less sustainable over time (Chan, 2010). As a result, rural households are caught between diminishing returns in agriculture and growing uncertainty in urban labor markets.

In response to these intersecting challenges, the Chinese government has promoted green finance reform as a strategy to align environmental protection with inclusive development. Green finance includes policy tools such as green credit, ecological subsidies, environmental liability insurance, and carbon emissions trading, aimed at facilitating the transition to climate-resilient, low-carbon, and eco-efficient production (Zhang et al., 2021; Liu and Liu, 2025). In rural areas, these instruments are increasingly used to support sustainable agriculture, offering both financial incentives and compliance support for smallholders (Zhao et al., 2022). Theoretically, green finance may strengthen rural revitalization by improving access to clean technologies, mitigating transition risks, and enhancing the profitability of agricultural production.

In recent years, a partial reversal of rural-to-urban migration has been observed in some regions of China. This trend is likely driven by a confluence of factors, including rising living costs in cities, the precarious nature of informal urban employment, improvements in rural infrastructure, and changing family dynamics (Chan, 2010; Lee et al., 2024; Chen and Xiong, 2025). While these macroeconomic and social dynamics are well-documented, the potential role of green finance in shaping this return migration remains underexplored. This paper does not claim that green finance is the sole driver of labor reallocation; rather, it examines how policy-induced improvements in financial access, agricultural profitability, and environmental compliance support may contribute to making land-based livelihoods more attractive and sustainable.

Despite these promising developments, empirical evidence remains scarce on the microeconomic effects of green finance at the household level. Existing research tends to focus on its macro-level environmental outcomes—such as emission reduction and capital allocation (Wang F. et al., 2021; Wang J. et al., 2021)—with insufficient attention to how green finance affects household income structures (Wang et al., 2022; Li et al., 2024), livelihood strategies, or food system dynamics (Alharbi et al., 2023; Tang et al., 2023). Studies in the field of inclusive finance have highlighted the role of credit access and risk mitigation in improving agricultural productivity and household welfare (Banerjee et al., 2015; Guo et al., 2022), but few have integrated environmental finance into this literature. Moreover, limited work has examined the ways in which green finance may influence labor mobility decisions, or contribute to rebuilding agricultural capacity in post-migration contexts.

A growing body of literature has examined the role of green finance in promoting low-carbon development and ecological transformation. These studies have predominantly focused on macroeconomic outcomes such as green credit allocation, carbon intensity reduction, and industrial upgrading (Wang F. et al., 2021; Wang J. et al., 2021; Zhang et al., 2021; Liu and Liu, 2025). In parallel, research on inclusive finance has explored how credit access and insurance improve rural productivity and welfare (Banerjee et al., 2015; Guo et al., 2022), though these studies often treat financial inclusion and environmental sustainability as separate domains. At the micro level, recent work has begun to assess the impacts of financial access on rural household behavior, particularly in relation to agricultural investment and livelihood diversification (Yu et al., 2021; Li et al., 2023). Meanwhile, migration studies have highlighted how rural–urban labor mobility affects income distribution, land use, and rural demographic structures (de Brauw et al., 2002; Chan, 2010; Chen et al., 2016). However, few studies have integrated these strands of literature to investigate how green financial reforms affect household-level livelihood strategies in structurally transforming rural regions. Moreover, existing empirical work seldom examines whether environmental finance can alter the long-standing migration patterns and support the return to agriculture as a sustainable and profitable choice. These gaps underscore the need for micro-level, behaviorally grounded research that links green finance to labor allocation, income restructuring, and agricultural resilience.

While inclusive finance and green finance share common mechanisms—such as improving credit access and mitigating household risks—they differ in scope, objectives, and policy instruments. Inclusive finance primarily aims to expand access to financial services among underserved populations, with a focus on poverty alleviation and economic participation. In contrast, green finance is explicitly oriented toward aligning financial flows with environmental goals, such as climate adaptation, pollution reduction, and ecological restoration. This distinction is particularly salient in rural contexts, where the need for both environmental compliance and livelihood improvement places farmers at the intersection of economic and ecological pressures. By focusing on green finance, this study explores how environmental financial instruments—beyond traditional credit channels—can incentivize sustainable land use, enable green technology adoption, and reshape income strategies in structurally vulnerable rural areas.

This paper seeks to fill that gap by empirically examining how green finance reshapes the income portfolios of rural households in China. Specifically, we investigate whether exposure to Green Finance Reform and Innovation Zones facilitates a shift away from urban wage dependence toward land-based and entrepreneurial income sources. We further explore whether these changes support labor retention, reverse rural exodus, and enhance agricultural resilience, thereby reinforcing national food security goals.

Our analytical framework draws on the Sustainable Livelihoods Approach (DFID, 1999), the capability approach (Sen, 1999), and rural migration theory (Harris and Todaro, 1970) to conceptualize how green finance interacts with household behavior, labor allocation, and income diversification. While these theories have been applied to explain rural transformation, few empirical studies have integrated them with green financial policy mechanisms. This study bridges that gap by offering an integrated perspective that connects environmental finance, rural livelihoods, and food system resilience.

This paper makes three key contributions. First, while prior studies on green finance have primarily concentrated on macro-level indicators—such as reductions in carbon emissions (Wang F. et al., 2021; Wang J. et al., 2021), green investment allocation (Zhang et al., 2021), or regional ecological performance (Tang et al., 2023)—few have explored how these policies translate into behavioral or distributional changes at the household level. Existing literature on inclusive finance does highlight the role of credit access in improving welfare (Banerjee et al., 2015; Guo et al., 2022), yet the intersection of environmental finance and rural livelihoods remains underexplored. This paper addresses that gap by providing new micro-level evidence on how green finance reshapes rural income structures, drawing on household survey data and policy exposure variation.

Second, the paper proposes a novel behavioral mechanism linking green finance with return migration and labor reallocation. While recent studies have begun to examine how environmentally driven policies may influence labor flows across regions or sectors (e.g., Zhang et al., 2021), they primarily offer macro-level insights and often lack household-level evidence. Moreover, few have systematically explored whether green finance can reshape rural labor strategies by encouraging a shift from precarious urban employment to land-based or entrepreneurial livelihoods. This study addresses that gap by analyzing the micro-behavioral responses of rural households to green financial reforms, using quasi-experimental variation in policy exposure and detailed income composition data. In doing so, it contributes a new perspective to the literature on the labor implications of environmental finance, particularly in the context of return migration and rural reinvestment.

Third, this study connects green finance to broader policy debates on agricultural resilience, inclusive development, and food sovereignty. While sustainable agriculture and green transition have been discussed separately in the literature, few empirical works integrate these domains through a unified analytical lens. By combining the Sustainable Livelihoods Approach, the capability framework, and rural migration theory with quasi-experimental methods, this paper advances an interdisciplinary understanding of how environmental finance can serve as a multidimensional tool for rural revitalization.

2 Institutional background

China’s transition toward a green economy has been accompanied by a series of high-level policy reforms aimed at aligning financial systems with environmental objectives. A pivotal moment came in August 2016, when seven central government agencies—including the People’s Bank of China and the National Development and Reform Commission—jointly released the Guiding Opinions on Building a Green Financial System. This document not only underscored the strategic importance of developing green finance, but also laid the foundation for a diversified institutional framework encompassing green credit, green investment, green development funds, and green insurance mechanisms.

Beyond the introduction of specific instruments, the establishment of GFRIZ reflects a broader structural transformation in China’s financial governance. It marks a shift from an output-driven development paradigm toward a sustainability-oriented regime, where financial capital is actively steered to align with ecological and inclusive objectives. Unlike earlier rounds of development finance that prioritized infrastructure or industrial expansion, green finance reform redefines the logic of capital allocation by embedding environmental accountability, long-termism, and risk management into financial practice. As such, GFRIZ serve not merely as policy pilots, but as institutional vehicles for experimenting with a new model of environmentally aligned financial capitalism—what some scholars have termed “eco-developmentalism”.

Building on this foundation, in June 2017 the Chinese government launched the General Scheme for Building Green Finance Reform and Innovation Zones (GFRIZ), selecting seven cities—Huzhou, Quzhou, Guangzhou, Hami, Kela Mayi, Guiyang—as the first batch of pilot regions. These provinces were chosen to reflect geographic diversity across eastern, central, and western China. Gansu was added as a second-batch pilot zone in 2019. The launch and gradual expansion of GFRIZ marked a significant institutionalization of green finance, transitioning from conceptual frameworks to on-the-ground experimentation.

Since their implementation, GFRIZ have served as policy laboratories for green finance innovation, exploring standard-setting, product development, and incentive mechanisms. According to the 2021 China Regional Finance Operation Report, a total of 215 new green financial institutions were established within GFRIZ in 2020 alone. The volume of green credit and green bond issuance also expanded rapidly, with year-on-year growth reaching 66%, exceeding the national average by 4.3 percentage points. Moreover, green industry investment funds in these zones reached 144.8 billion RMB, while environmental equity market transactions totaled 3.712 billion RMB, reflecting growing momentum in both capital formation and market-based environmental governance.

Crucially, individual GFRIZ have tailored green financial models to fit local economic contexts and industrial strengths. Guangdong Province, for example, has emphasized green financial market development, including the securitization of environmental assets through green bonds and funds. As of 2020, the Guangdong Banking and Insurance Regulatory Bureau had approved seven financial institutions to issue green bonds, with total issuance exceeding 28.8 billion RMB. These funds were primarily allocated to projects related to energy conservation, pollution control, and renewable energy. Huadu District in Guangzhou has emerged as a key demonstration area for green finance, reporting a 26.5% year-on-year growth in green credit in 2020. By the end of that year, green loans accounted for 16.2% of total loans and 34.9% of corporate lending in the district. Notably, Huadu’s environmental equity market transaction volume reached 3.51 billion RMB, the highest at the district and county level nationwide.

Other regions have prioritized distinct development pathways. Jiangxi, Guizhou, and Xinjiang have explored green finance applications in agriculture and clean energy, while Zhejiang has actively experimented with integrating green finance and financial technology. Collectively, these regional explorations illustrate the adaptive and dynamic nature of China’s green finance reform agenda, offering important variation for empirical evaluation of policy impact.

Collectively, these regional explorations illustrate the adaptive and dynamic nature of China’s green finance reform agenda. More importantly, they offer a natural experiment in institutional transformation—revealing how localized financial reforms may reconfigure the structure of rural development, labor allocation, and environmental governance. This variation provides a valuable basis for empirical evaluation.

3 Theory analysis

3.1 Green finance, rural income structure, and food security

Green finance exerts a transformative influence on the income composition of rural households, particularly within the dual-track rural–urban economic system in China. Rural households typically derive income from five main sources: agricultural income, wage income, self-employment (business) income, property income, and transfer/other income (Calderón and Liu, 2003; Greenwood and Jovanovic, 1990). These income streams respond differently to policy interventions and changes in financial access (Li and Umair, 2023). This section unpacks how green finance reshapes each income source and links these changes to the broader agenda of agricultural resilience and food security.

Agricultural income —Agricultural income, long considered the backbone of rural livelihoods, has faced declining importance in recent decades due to ecological penalties, labor outmigration, and low productivity. Green finance seeks to counter these trends by providing targeted support for climate-resilient agriculture, such as access to green credit, sustainable inputs, and environmental compliance technologies. These interventions are designed to reduce production risk and improve the profitability of smallholder farming. Our empirical findings indicate that exposure to green finance significantly increases the share of agricultural income in household portfolios, supporting the view that green financial reform revitalizes land-based livelihoods. This positive shift contributes to the dual goals of enhancing household income resilience and strengthening domestic food production capacity (Liu and Liu, 2025).

Wage income —Wage income from urban or off-farm employment, often through migrant work, has become a vital supplement to rural income. However, it remains unstable and precarious, particularly in the informal sector (Chan, 2010). Green finance improves the relative returns of local agricultural and entrepreneurial activities, thereby increasing the opportunity cost of migration (Guiso et al., 2004; Rajan and Zingales, 1998). This incentivizes return migration or labor retention, decreasing reliance on wage income and reinforcing rural labor availability—an effect aligned with the “reverse migration” trend observed in recent policy analyses (Chen et al., 2016).

Self-employment (business) income —Business income, including earnings from small-scale processing, green farming ventures, or rural ecotourism, is closely linked to rural income diversification and entrepreneurial capacity (Jiang et al., 2020; Lyu et al., 2023a,b). Green finance supports this domain through credit for eco-entrepreneurship, investment in value chains, and branding of sustainable agricultural products. Previous studies have demonstrated that access to finance significantly improves rural entrepreneurial outcomes, particularly in green sectors (Wang F. et al., 2021; Wang J. et al., 2021). This income stream is not only economically significant but also enhances household resilience and upward mobility.

Property income —Property income—often derived from renting land, equipment, or participating in environmental asset markets (e.g., carbon credits, water rights)—is a less traditional but increasingly relevant income source (Claessens and Laeven, 2003; Lee et al., 2024; Zhang A. et al., 2022; Zhang D. et al., 2022). Green finance facilitates this stream by promoting the financialization of green agriculture, including land certification, equipment leasing, and participation in green securitization schemes (Zhang A. et al., 2022; Zhang D. et al., 2022). Though modest in absolute value, this form of income reflects the growing integration of rural households into environmental markets.

Transfer and other income —This category includes remittances, social security, pensions, and eco-compensation. While remittances have traditionally come from migrant workers, green finance may reduce this reliance by improving local income-generating opportunities (Sadiq et al., 2021). Moreover, environmental compensation programs—such as reforestation payments or conservation subsidies—represent an ecological evolution of state transfers (Yin and Xu, 2022). This shift from informal to institutionalized transfers enhances income stability and predictability.

Collectively, green finance supports a restructuring of rural household income portfolios toward more localized, diversified, and sustainable sources—including land-based agriculture, eco-entrepreneurship, and property-linked environmental assets. Rather than representing a reversion to single-sector reliance, this rebalancing enhances resilience by reducing dependence on volatile wage labor and embedding rural livelihoods within more predictable and policy-supported ecological frameworks. These shifts are consistent with the broader agenda of promoting food security and adaptive capacity in structurally vulnerable rural regions.

3.2 Mechanisms: how green finance affects rural income

The pathways through which green finance reshapes income structures can be understood through three interconnected mechanisms, drawing on institutional, migration, and livelihood theories.

3.2.1 Incentive restructuring and capital accessibility

From the lens of institutional economics (North, 1990), green finance reconfigures the incentive structures surrounding agricultural production. By offering subsidized credit, ecological compensation, and insurance against environmental risks, green finance reduces the entry cost and risk profile of sustainable farming (Wang et al., 2022). This encourages households to reallocate labor and capital toward high-efficiency, compliant agricultural models. As traditional rural credit systems often exclude smallholders (Carter and Barrett, 2006), green finance also addresses capital market imperfections—improving investment capacity, land productivity, and profitability (Sadorsky, 2009). These shifts, in turn, drive income transformation away from volatile wage labor and toward sustainable rural production.

3.2.2 Labor reallocation and return migration

According to Harris and Todaro (1970), migration is shaped by expected income differentials and employment risks. When green finance improves the economic returns of staying in or returning to rural areas, it alters migration incentives. Households respond by reallocating labor from urban informal jobs back to farming or rural entrepreneurship. This “return migration” increases the household labor endowment for agriculture, contributing to both on-farm productivity and local value creation. Empirical evidence increasingly supports this view, indicating that financial access can reshape migration patterns and labor distribution (Mu and van de Walle, 2011).

3.2.3 Livelihoods, capability expansion, and green finance

Drawing on the Sustainable Livelihoods Framework (DFID, 1999) and the capability approach (Sen, 1999), green finance expands the range of viable livelihood strategies available to rural households. Financial access allows households to invest in technologies, diversify income sources, and engage with higher-value green markets. By enhancing agency, knowledge, and resource availability, green finance strengthens the ability to withstand shocks, adapt to change, and pursue upward income trajectories. In doing so, it fosters both economic resilience and inclusive rural transformation (Ellis, 2000; Scoones, 2009).

Based on the theoretical framework, we propose the following five testable hypotheses:

H1: Green finance significantly alters the income structure of rural households, increasing the share of agricultural and entrepreneurial income while reducing dependence on wage income.

H2: Green finance contributes indirectly to national food security by promoting return migration, revitalizing rural labor supply, and enhancing farming viability.

4 Empirical strategy

This study aims to estimate the causal effect of green finance policy implementation—measured by the 2017 introduction of Green Finance Reform and Innovation Zones (GFRIZ)—on the income composition of rural households. Using nationally representative panel data from the China Labor-force Dynamics Survey (CLDS) for the years 2010–2018, we assess whether green finance exposure leads to a shift from wage income to land-based or entrepreneurial income, and explore heterogeneity in these effects.

4.1 Baseline DID specification

We employ a difference-in-differences (DID) framework using the 2017 GFRIZ designation as a quasi-natural experiment (Chen et al., 2024; Irfan et al., 2022; Shi et al., 2022). The treatment group consists of households located in cities designated as pilot zones, while the control group includes households from non-pilot provinces. The baseline DID model is specified as shown in Equation 1.

where refers to the dependent variables for individual i in year t, refers to city i is the pilot zone in year t, the coefficient is the DID estimator that we are focus on. Additionally, presents series of household-level and province-level variables to control for differences caused by micro household and macro province characteristics, and refer to the family and year fixed effect, respectively, and refers to error term.

4.2 Alternative DID specification

Moreover, since green finance policies are at the provincial level, household clean renewable energy use is at the micro level. Moreover, prior to 2018, there were only seven GFRIZ pilot cities. To ensure the reliability of our baseline findings, we implement a range of robustness checks addressing concerns over policy selection bias, unobserved heterogeneity, and violation of the parallel trends assumption (Gentzkow, 2006; Wei et al., 2024). In addition to traditional approaches, we employ following Alternative DID Designs to strengthen causal inference.

4.2.1 Continuous treatment DID

To relax the binary treatment structure, we construct a continuous green finance exposure index at the provincial level, based on green credit balance as a share of total credit or GDP. We interact this continuous measure with the post-policy dummy to estimate the marginal effect of green finance index (GFI) on income structure. Results confirm that higher policy intensity is associated with stronger shifts toward land-based and entrepreneurial income. Instead of a binary treatment, we use GFI as a continuous interaction term, as specified in Equation 2:

where refers to the dummy if city i is the pilot zone in year t.

4.2.2 Triple difference (DDD)

We implement a difference-in-difference-in-differences (DDD) model using household agricultural status (farming vs. non-farming) as a third dimension. This approach allows us to estimate differential impacts of green finance on farming households who are more directly affected by policy-induced returns to agriculture (Chen et al., 2024; Sun et al., 2024). The triple interaction term shows significant effects, indicating stronger responses among agricultural households. We include a third layer of comparison—agricultural vs. non-agricultural households—to estimate the differential effect of green finance on those more dependent on farming as specified in Equation 3:

where refers to individual i is rural Hukou in year t.

4.2.3 Synthetic difference-in-differences (SDID)

To further reinforce the robustness of our findings, we adopt the Synthetic Difference-in-Differences (SDID) method developed by Arkhangelsky et al. (2021). This approach constructs weighted synthetic control units that closely match treated units based on pre-treatment outcome trajectories, while incorporating the panel structure of DID estimation (Barwick et al., 2024).

4.3 Parallel trend assumption

The most important prerequisite for the application of DID models is to meet the parallel trend assumption (e.g., Huang et al., 2022; Li and Zhao, 2022; Shi et al., 2022; Yan et al., 2022). Specifically, before implementing the GFRID, there was no difference between the treatment group and the control group. We adopted the following dynamic model for parallel trend tests, as specified in Equation 4, since GFRID provinces were established in 2017

where ω ∈ [2012, 2014, 2016, 2018] and represents the decomposition of each year during the sample period.

4.4 Data and variables

4.4.1 Data source

The China Labor-force Dynamics Survey (CLDS) provided the information for this study, which aims to track changes in social structure, the labor force of communities and families, and the interactions between communities, families, and individuals. Moreover, the CLDS is a national representative and longitudinal survey of the Chinese labor force (Ma et al., 2022), as it was gathered from urban and rural regions in 29 mainland provinces and municipalities. Civilians between the ages of 15 and 64 as well as people 65 and older who are employed in each household are the respondents in the CLDS. The data was gathered by the Center for Social Science Survey at Sun-Yat-sen University in Guangzhou, China, using a multistage random sampling strategy. Four waves of CLDS data—2012, 2014, 2016, and 2018—were used in our study. The dataset includes comprehensive data on the various fuels employed in cooking, as well as demographic characteristics and socioeconomic information. The survey’s extensive material is a good fit for our research topic.

We performed the following operations on the data. First, we combined the survey data 2012 and 2014, because the code strategy in 2012 is different from the other years. Follows the data cleaning instruction manuscript of CLDS, we constructed the panel data by combining the individual survey, family survey, and county survey. Second, we recorded the id of the panel data using the same coding strategy in 2016 and 2018. Third, we combined the panel data with the data from 2016 and 2018 waves. Finally, we dropped the missing value and got 81,840 validated observations. Incidentally, the macro data used in the SCM is obtained from the China Statistical Yearbook, except for the clean renewable energy data, which is from the China Electric Power Yearbook.

4.4.2 Variables

This section describes the construction and definitions of the main variables used in the empirical analysis. Our dependent variables consist of three categories of household income share, designed to reflect the structural composition of rural income sources. Key independent variables include policy exposure indicators, household-level characteristics, and fixed effects.

4.4.2.1 Dependent variables

To capture the household-level impact of green finance on rural economic structure and resilience, we construct a set of income composition indicators as dependent variables. Specifically, we measure the share of each income source in total household income, based on standardized categories from the CLDS. This micro-level approach complements the existing literature, which often relies on macro-level proxies (e.g., regional grain output, per capita arable land, or national self-sufficiency ratios) to assess food security or rural resilience. While such aggregate indicators reflect national-level trends, they cannot capture the heterogeneity of household responses or livelihood reallocation dynamics. By contrast, household-level income composition offers a more granular view of how green finance may reshape livelihood strategies and structural dependence on different income sources—an essential dimension of both economic resilience and food system stability. We define the following three categories of income share variable:

Land-based income share. The proportion of household income derived from agricultural activities and self-employment/business operations related to land or green economy. This includes income from as defined in Equations 5–7:

Wage income share. The proportion of income derived from off-farm labor and wage employment, including both local and urban work. This variable captures dependence on non-agricultural wage earnings as defined in Equation 8.

Property income share and transfer income. The proportion of income derived from capital and property-based sources and transfer income from government. This variable reflects the degree of financial asset engagement or green asset monetization as defined in Equation 9.

4.4.2.2 Explanatory variable: green finance pilot cities

The explanatory variable in this paper is green finance, and GFRIZ is used as a proxy variable. As highlighted in Section 4, in the framework of the DID and alternative DID models, we defined the core explanatory variable GFRIZ as 1 if the province was formally rated as the GFRIZ pilot city from a given year (including Huzhou, Quzhou, Guangzhou, Hami, Kela Mayi, Guiyang), and 0 otherwise. Additionally, the Institute of Green International Finance of the Central University of Finance and Economics (CUFE) has published a green finance index (GFI) for China at the provincial level. In the robustness test, we used this variable to further examine the impact of digital finance on household clean renewable energy.

4.4.2.3 Control variables

We considered a series of control variables in DID estimates. First, in terms of individual characteristics, we controlled for gender, ethnicity, age, hukou, education, marriage, residence, and social activities as in the previous literature, these respondent characteristics were considered to be an important factor influencing renewable clean energy (Eshchanov et al., 2021; Irfan et al., 2021; Willis et al., 2011; Zografakis et al., 2010). Second, at the family level, family size, total income, housing property, [we collected the real estate information of each individual and estimate the total value of the real estate market price of each individual, and we added up the property of all family members to get the total housing property value] electricity consumption, and Internet usage are taken into account (Eren et al., 2019; Razmi et al., 2020; Zografakis et al., 2010). Last, a macro-wise control variable are added in our estimates, Digitalization level. We collected the data on the digital level of each county from Ant Financial, and matched with the original data by city code.

4.4.2.4 Predictor for synthetic control method (SCM)

As mentioned above, we adopted the SCM to find a more suitable control group for GFRIZ and employed the SDID method for further estimations. Thus, based on previous studies (Pretis, 2022; Shi et al., 2022; Sun et al., 2024; Yan et al., 2022), we selected a series of provincial predictor, including GDP per capita, geographic location, population density, fiscal expenditure, and renewable energy consumption in 2015, 2010, 2005, 2000, and 1996. Renewable energy here includes hydroelectric, solar, wind, and nuclear power (Wang F. et al., 2021; Wang J. et al., 2021). Table A1 of the appendix shows the definitions of these variables.

4.4.3 Descriptive statistics

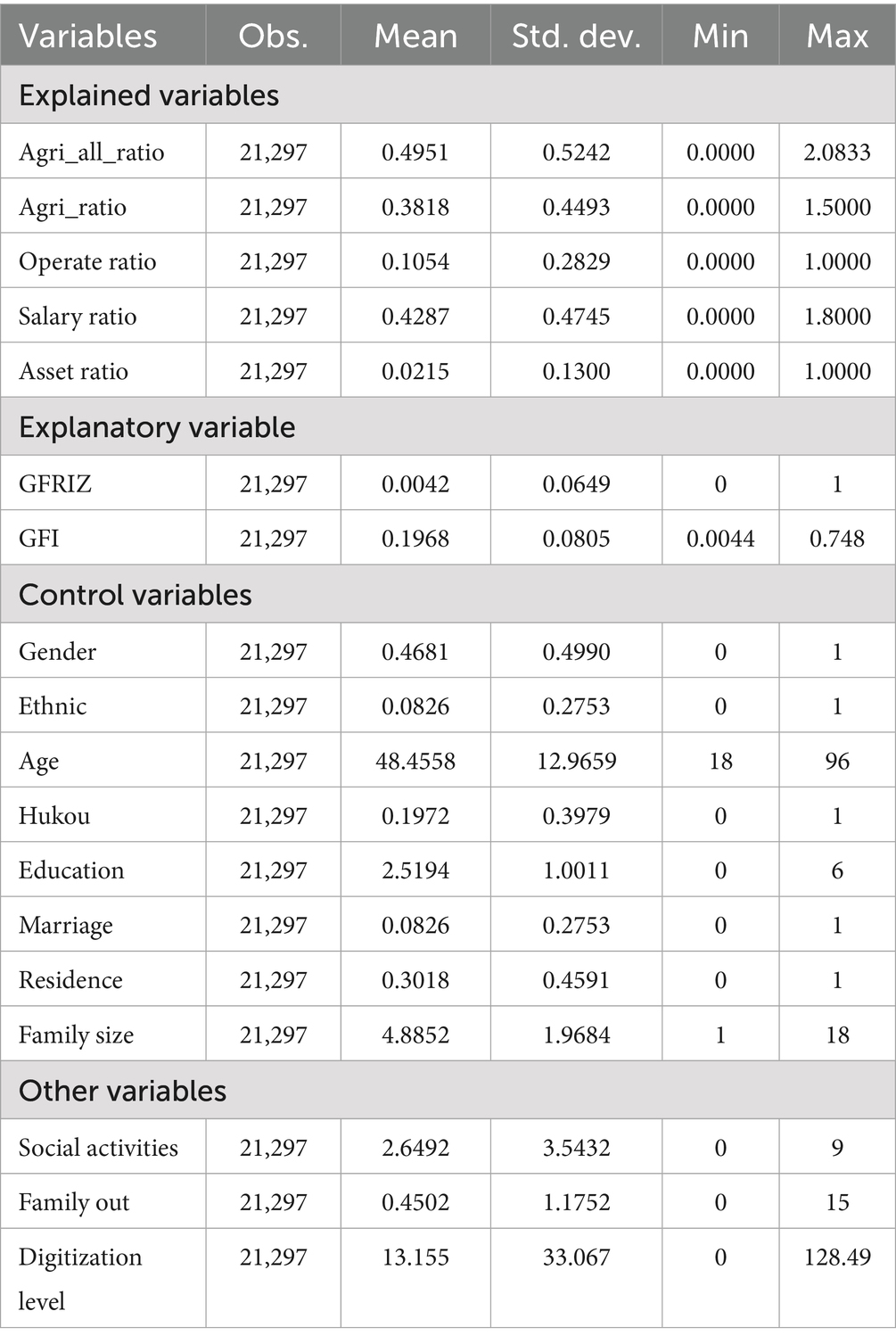

Descriptive statistics of the main variables are shown in Table 1. The average share of land-based income (agriculture and self-employment combined) in total household income is 49.51%, with agricultural income alone accounting for 38.18% and self-employment income for 10.54%. Meanwhile, wage income constitutes approximately 42.87% of household income, whereas asset income remains modest at 2.15%. The wide standard deviations across all income categories indicate substantial heterogeneity in household livelihood structures, which is central to our investigation of income transformation under green finance reform.

Regarding green finance exposure, approximately 0.42% of sampled households reside in provinces officially designated as GFRIZ, while the average value of the continuous green finance index (GFI) is 0.1968. The relatively large standard deviation of GFI (0.0805) suggests significant regional disparities in the development and implementation of green finance instruments across China.

For individual-level control variables, 46.81% of respondents are female, 91.74% are Han Chinese, and the average age is 48.46 years. Roughly 19.72% of respondents hold non-agricultural hukou, and 30.18% reside in urban areas. In terms of education, the average level is 2.52 on a six-point scale, indicating that most respondents have completed middle school or high school education. Nearly 8.26% of individuals are unmarried, widowed, or divorced.

Household-level characteristics further highlight the heterogeneity of rural livelihoods. The average household consists of 4.89 members, with an annual per capita electricity consumption of 812.53 kWh. About 78.32% of households report regular Internet use, and the average household digitization index is 13.16, though with considerable variation (SD = 33.07). Additionally, the average number of social activities reported is 2.65, and roughly 45% of households report having at least one family member working outside the locality. These patterns provide important context for understanding the interaction between green finance, household structure, and income strategies.

5 Empirical results

5.1 Main results

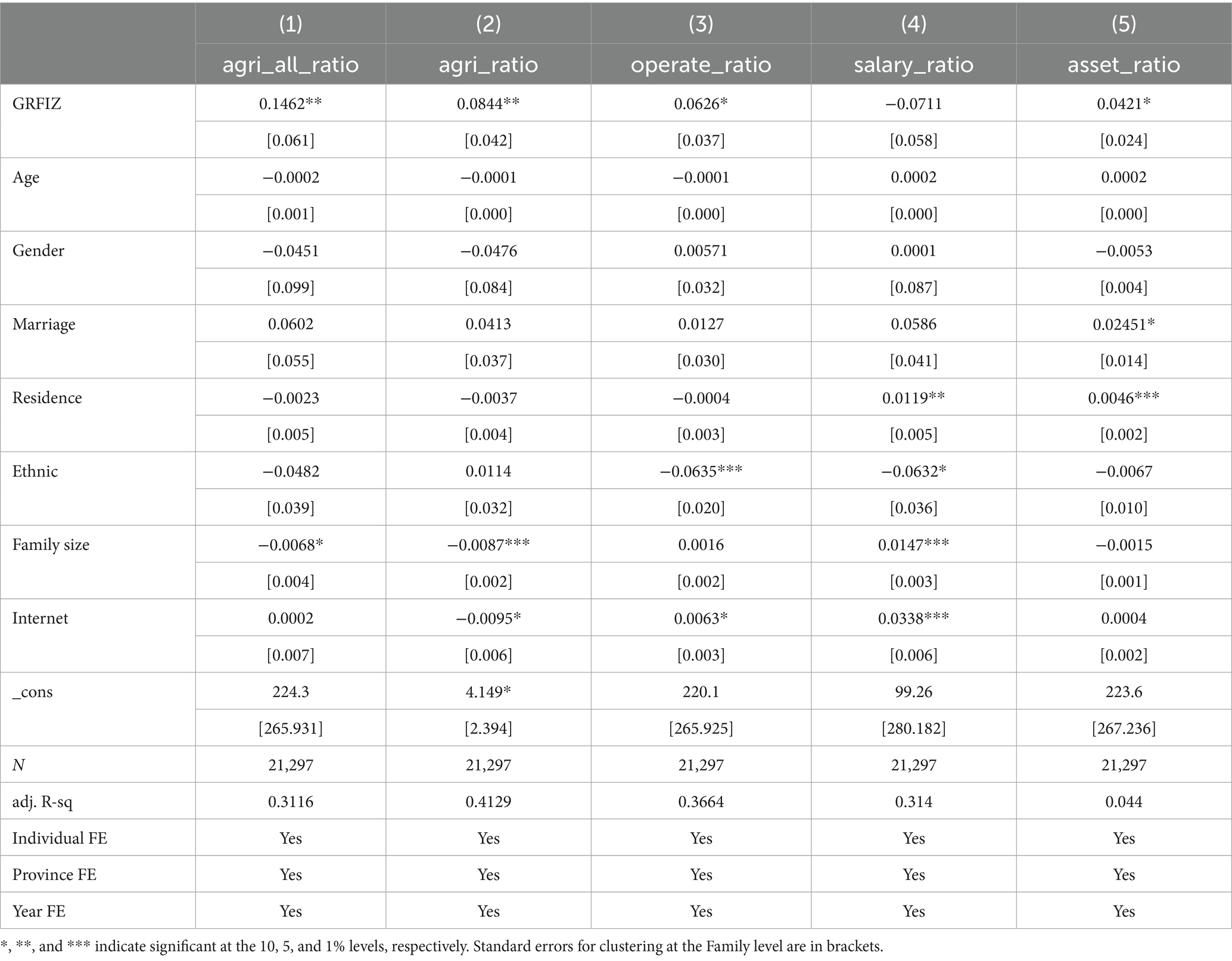

Table 2 reports the results of the baseline difference-in-differences (DID) estimation, assessing the impact of GFRIZ on rural household income composition. Columns (1)–(5) correspond to different dependent variables: total land-based income share, agricultural income share, business income share, wage income share, and property income share. The main explanatory variable is a policy dummy indicating whether a household is located in a GFRIZ pilot province after policy implementation.

In Column (1), green finance reform is positively and significantly associated with the share of land-based income in total household income (coefficient = 0.1462, p < 0.05). This suggests that GFRIZ reforms increased household engagement in farming and land-related self-employment activities. This aligns with theoretical expectations that green finance facilitates agricultural revitalization through improved credit access, reduced ecological compliance costs, and incentives for sustainable production (Lee et al., 2024; Li and Umair, 2023). Column (2) isolates the effect on agricultural income share, showing a positive and statistically significant coefficient (0.0844, p < 0.05). This contrasts with previous findings suggesting a decline in farming income, and supports the hypothesis that green finance not only helps retain rural labor but also enhances the profitability and resilience of agricultural livelihoods. Column (3) focuses on business income, capturing returns from self-employment and rural entrepreneurship. The coefficient (0.0626, p < 0.1) indicates a statistically significant rise in entrepreneurial income, reflecting the role of green finance in enabling non-wage, production-oriented economic diversification. Column (4) examines the effect on wage income, mostly from off-farm or urban labor. The estimate is negative (−0.0711) but not statistically significant, suggesting that green finance does not immediately reduce wage dependency—possibly due to persistent structural labor dynamics or lagged migration responses. In Column (5), property income share also rises significantly (0.0421, p < 0.1). This points to emerging asset-based livelihood strategies under green financial reform, such as land leasing, environmental rights trading, or green equity participation. Although still a small component of household income, its increase reflects financial innovation and inclusion at the rural margin.

Overall, these findings confirm that green finance reform contributes to a structural transformation of rural income portfolios—boosting both land-based and entrepreneurial sources, while showing early signals of asset-based diversification. The results support our hypothesis that green finance fosters not only ecological objectives but also economic resilience and upward mobility for rural households in China.

5.2 Parallel trend test

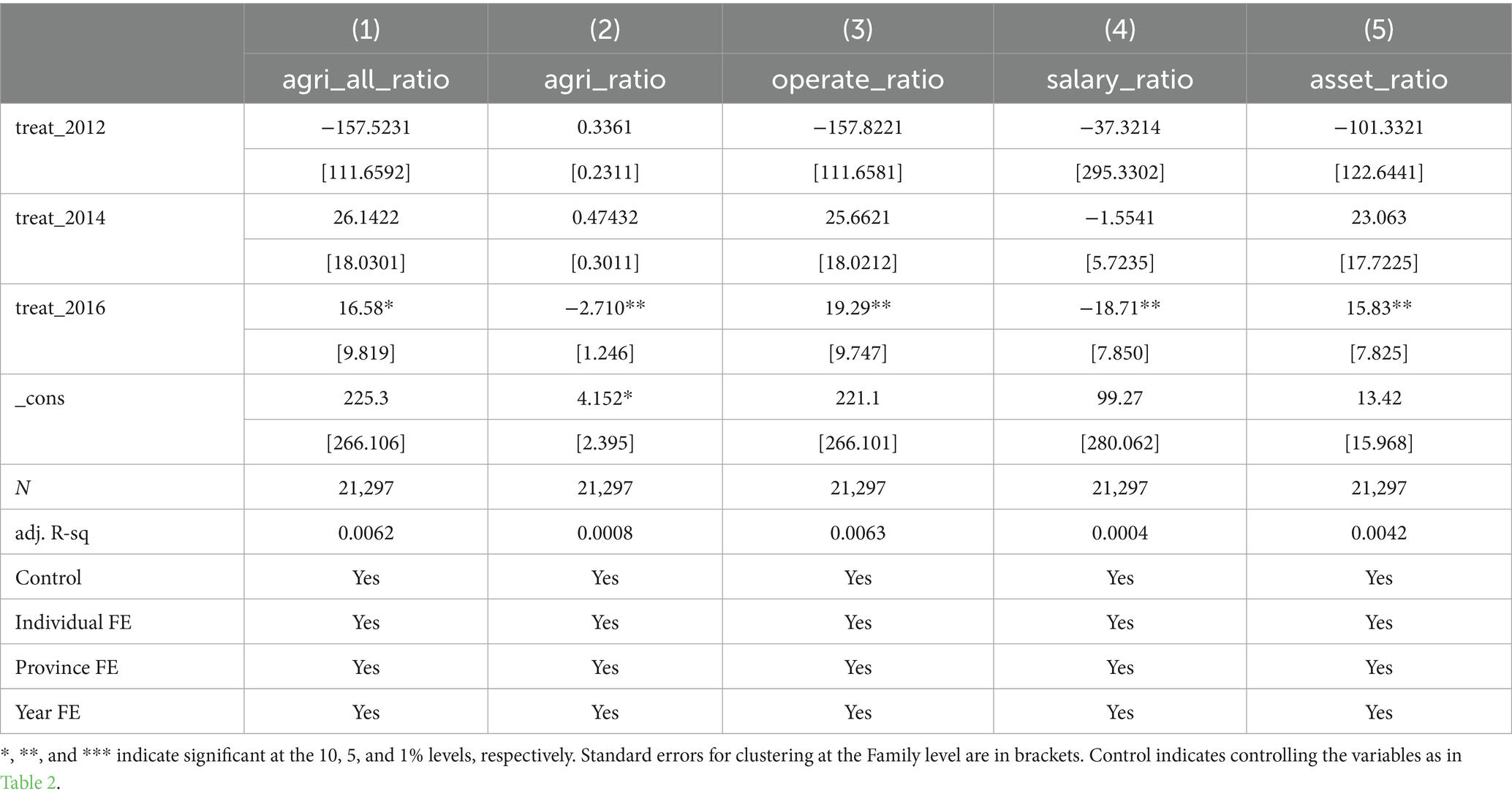

A critical identifying assumption of the difference-in-differences (DID) framework is that, absent treatment, the treatment and control groups would have exhibited parallel trends in outcome variables. To examine this assumption, we implement an event-study design that includes a set of placebo treatment dummies for pre-policy years—specifically, 2012, 2014, and 2016—interacted with the GFRIZ pilot status. These interaction terms capture any pre-existing divergence between treated and untreated provinces before the formal launch of the GFRIZ in 2017. A finding of statistically insignificant coefficients on these pre-policy interactions would support the parallel trends assumption and validate the causal interpretation of the DID results.

Table 3 presents the estimates. For most outcome variables, the pre-treatment interaction terms are statistically insignificant, indicating no meaningful difference in trends prior to the policy. For instance, in Column (1), the coefficients for treat_2012 and treat_2016 are not significant, suggesting stable pre-policy patterns in land-based income shares. Column (3), which examines the share of business income, also shows no significant differences in pre-policy years, further reinforcing this conclusion. One minor deviation occurs in Column (2), where treat_2014 is weakly significant at the 10% level for agricultural income share. While this may reflect idiosyncratic income fluctuations before 2017, the effect is neither large in magnitude nor consistent across years or outcome variables. Thus, it does not materially undermine the parallel trends assumption. Importantly, the post-treatment coefficient (GRFIZ × Post) remains positive, statistically significant, and directionally consistent across Columns (1), (3), and (5), indicating that the observed changes in income composition are unlikely to be driven by pre-existing trends. Overall, the evidence supports the validity of the DID identification strategy and confirms that the estimated treatment effects reflect genuine policy-induced changes rather than confounding time trends.

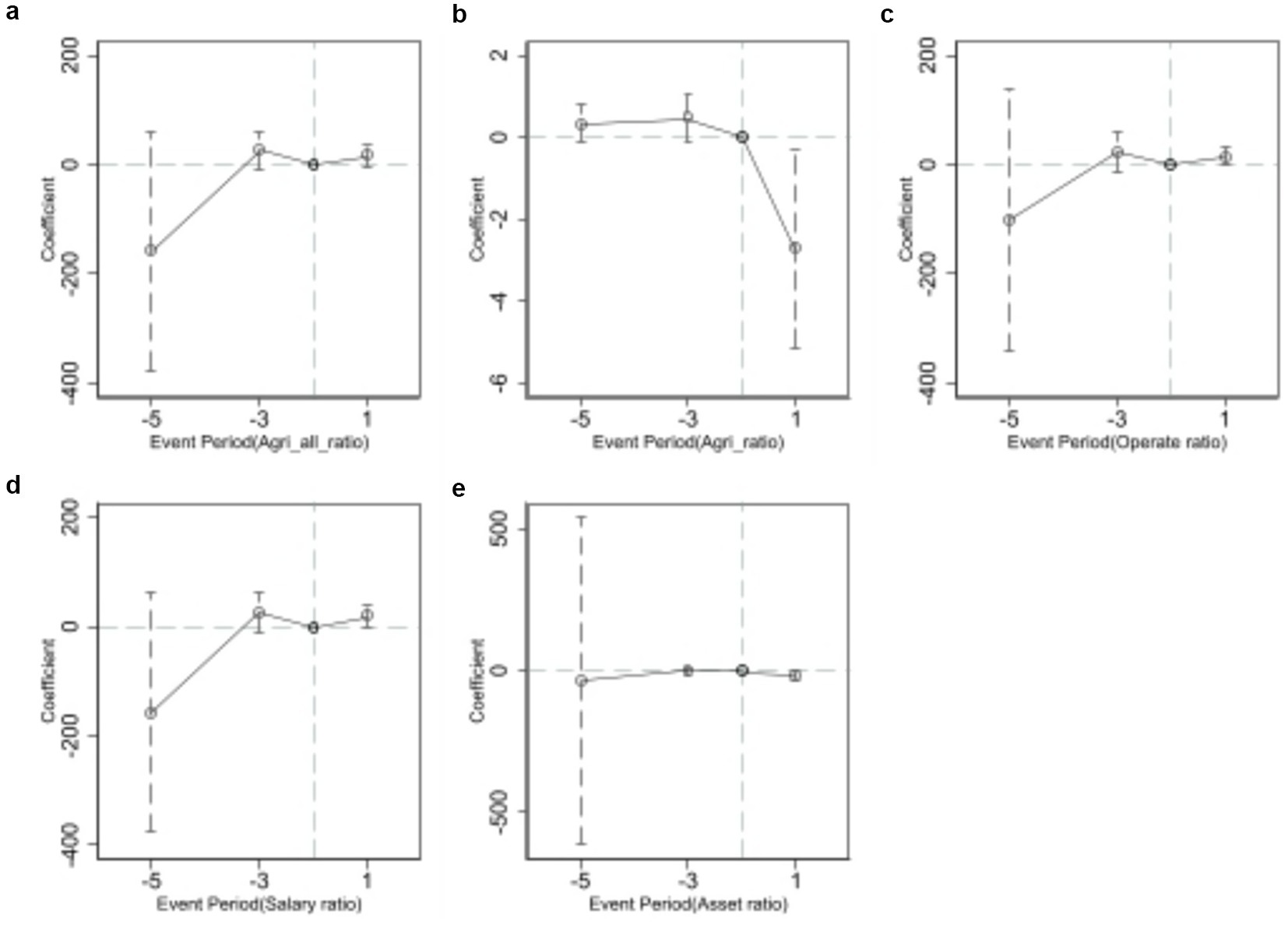

To visually verify the parallel trends assumption, Figure 1 illustrates the dynamic treatment effects from the event-study specification for each income type. The horizontal axis represents event time in years relative to the GFRIZ policy implementation (with 2016 as the reference year), and the vertical axis displays the estimated interaction coefficients with 95% confidence intervals.

Figure 1. Parallel trends in rural income structure: event-study estimates. This figure displays dynamic difference-in-differences coefficients for five income share outcomes relative to the year of GFRIZ implementation (t = 0). Each panel corresponds to a different income source: (a) land-based income, (b) agricultural income, (c) business income, (d) wage income, and (e) property income. Vertical lines represent 95% confidence intervals. The flat and insignificant pre-trends support the identification strategy based on parallel trends.

For land-based income (Panel a), business income (Panel c), and wage income (Panel d), the pre-treatment coefficients (years −5 and −3) are statistically insignificant and centered around zero, indicating no substantial divergence in trends prior to the reform. The post-treatment coefficient (year +1) shows a marked increase for land-based and business income shares, suggesting a structural shift in rural livelihood strategies following GFRIZ implementation.

For agricultural income (Panel b), while the pre-treatment coefficients are stable, the post-treatment estimate drops slightly. This pattern may reflect a composition effect, where green finance shifts households away from subsistence farming and toward more entrepreneurial land use. Nevertheless, no significant upward or downward trend is observed before the reform year, preserving the validity of the parallel trends assumption.

Finally, property income (Panel e) shows no discernible deviation before treatment and a slight post-treatment rise, albeit with wide confidence bands, which is consistent with baseline findings of emerging asset-based income under green finance.

5.3 Robustness test

5.3.1 Placebo test

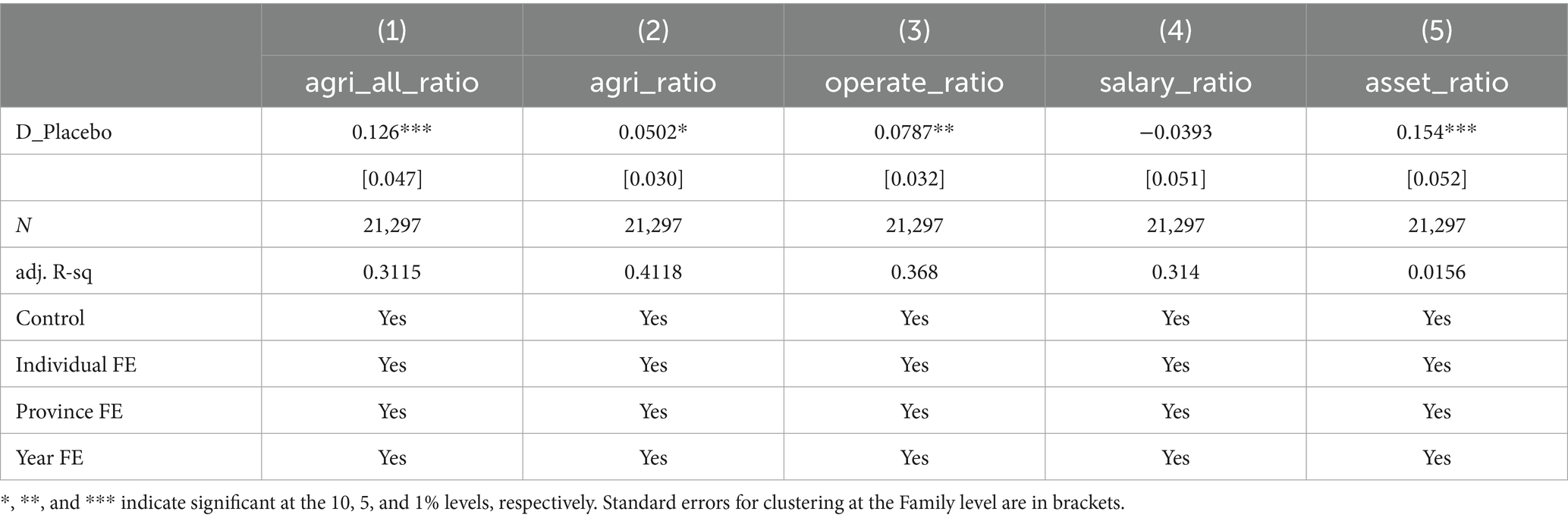

First, we conduct a placebo test to evaluate whether the estimated treatment effects might be driven by spurious time trends or unobserved anticipatory dynamics. Specifically, we artificially assign the policy intervention to an earlier year (2015) by generating a placebo treatment indicator (D_Placebo) equal to one for households in GFRIZ cities in or after 2015, and zero otherwise. We then re-estimate the baseline difference-in-differences model using this placebo treatment variable.

Table 4 reports the placebo test results. Interestingly, the placebo coefficients are statistically significant in Columns (1), (2), (3), and (5), suggesting that treated and control groups may have exhibited diverging trends even prior to the actual policy implementation. For instance, the placebo coefficient for land-based income is 0.126 (p < 0.01), and for asset income it is 0.154 (p < 0.01). These findings raise concerns that the DID estimates may be partially confounded by pre-treatment dynamics, policy anticipation effects, or unobserved institutional characteristics that distinguish GFRIZ and non-GFRIZ provinces.

While these results do not invalidate the baseline findings, they do call for caution in interpreting the causal effects. As a response, we supplement our main estimation with additional identification strategies in later sections, including event-study specifications (Figure 1), and an instrumental variable DID approach using pre-policy green patent counts as instruments to further address potential endogeneity.

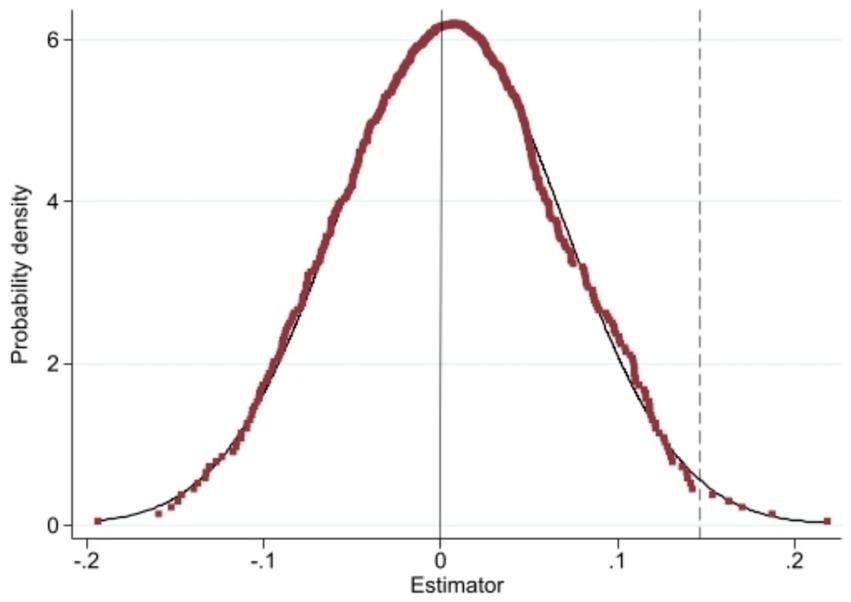

Second, we implement a permutation-based placebo test following Abadie et al. (2010) and Bertrand et al. (2004). Specifically, we randomly reassign the GFRIZ pilot status to a subset of provinces while keeping the overall treatment probability constant, and re-estimate the baseline DID model 1,000 times. The goal is to assess whether our estimated treatment effect could have been generated by chance under random treatment assignment.

Figure 2 plots the distribution of placebo treatment effects generated from the randomization procedure. The horizontal axis denotes the distribution of simulated coefficients across replications, while the vertical axis indicates their corresponding density. The dashed vertical line represents the true estimated effect from the actual policy evaluation.

Figure 2. Randomized placebo distribution of estimated effects. This figure presents the distribution of estimated treatment effects under 1,000 random permutations of GFRIZ treatment assignment. The dashed vertical line represents the true estimated effect from the actual policy. The true estimate lies in the upper tail of the distribution, indicating statistical significance beyond chance.

As shown in the figure, the actual estimate lies in the far right tail of the distribution, suggesting that the likelihood of obtaining such a result under random treatment assignment is extremely low. This provides strong support for the robustness of the main findings and further reinforces the causal interpretation of the GFRIZ policy impact.

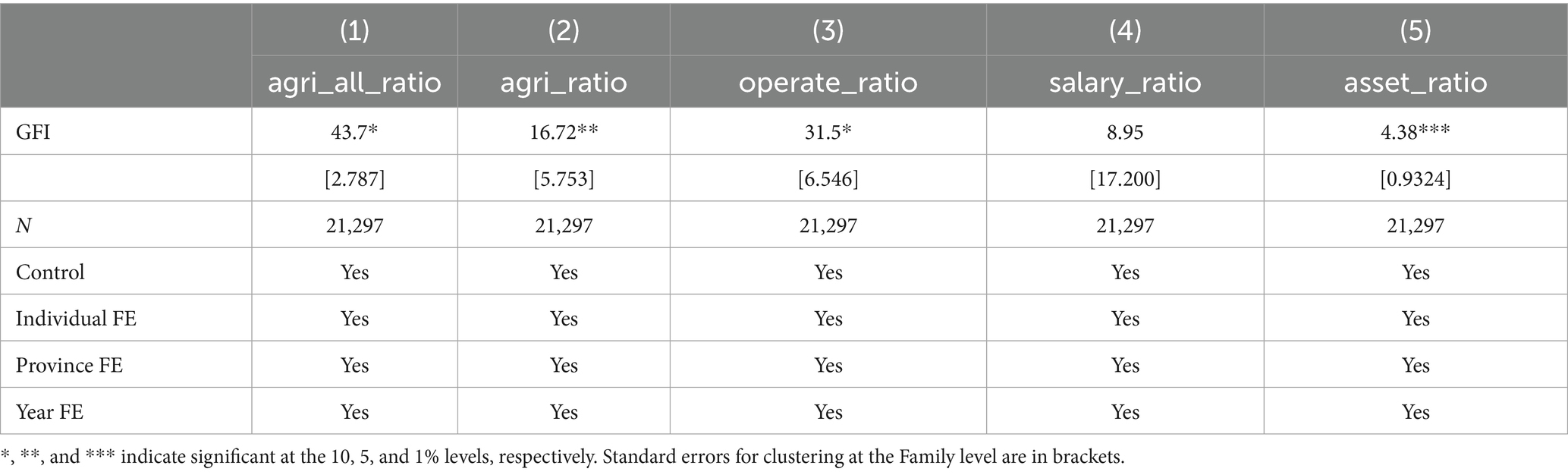

5.3.2 Continuous treatment via green finance index (GFI)

To further test the robustness of our baseline findings, we replace the binary treatment indicator with a continuous treatment intensity variable, constructed as a Green Finance Index (GFI) interacted with a post-policy dummy. The GFI is designed to reflect the relative development level of green finance across regions, incorporating metrics such as green credit penetration, green bond issuance, and green investment scale. By using this interaction term, we capture not only whether a region was treated, but how intensively it was exposed to green financial reforms after 2017.

Table 5 presents the estimation results using the GFI-based DID approach. Column (1) shows a positive and weakly significant coefficient (43.7, p < 0.1), indicating that regions with higher levels of green finance development experienced larger increases in land-based income share after 2017. Disaggregated results in Columns (2) and (3) reveal that both agricultural income share (coefficient = 16.72, p < 0.05) and business income share (coefficient = 31.5, p < 0.1) significantly increased with green finance intensity. These results confirm that green finance not only boosts general land-based income, but also reshapes its composition toward both farming and entrepreneurial activities. In Column (4), wage income share shows a positive but statistically insignificant relationship with GFI, suggesting that green finance intensity does not significantly alter reliance on wage income in the short term, consistent with earlier findings.

Interestingly, Column (5) reveals that property income share also rises significantly with GFI (coefficient = 4.38, p < 0.01), which contrasts with earlier results. This could suggest that in areas where green finance was more developed, households shifted their income generation efforts from passive asset-based earnings (such as land leasing or interest income) toward more active and productive uses of green capital, such as eco-farming or green businesses. It may also reflect crowding-out effects if returns to property income were lower in regions with aggressive green financial regulation or capital reallocation.

Overall, the continuous treatment analysis confirms that the magnitude of green finance exposure matters: higher GFI scores are associated with larger income restructuring effects, particularly favoring land-based and productive economic activities. These results provide further support for the hypothesized mechanisms of green finance in promoting rural income transformation and sustainability-oriented livelihoods.

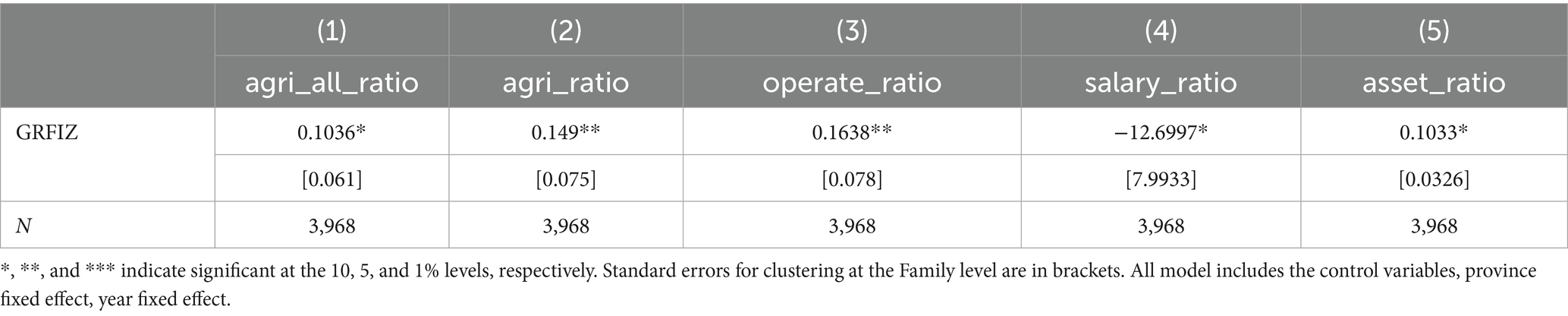

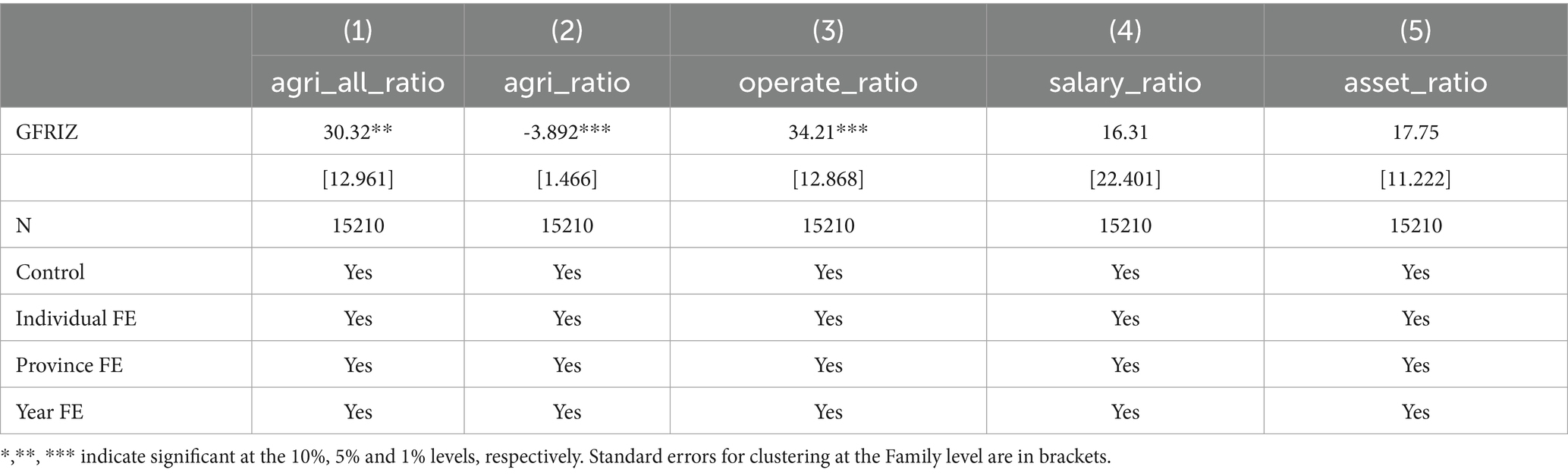

5.3.3 Balance panel: SDID on self-employment income

Given earlier results indicating that green finance significantly reshapes land-based income—especially through self-employment and business channels—we conduct a robustness analysis using the Synthetic Difference-in-Differences (SDID) method. This approach is particularly suited for evaluating policy effects under staggered adoption and heterogeneous treatment timing, while enhancing covariate balance. The dependent variable is operate_ratio, defined as the proportion of self-employment income in total household income.

Table 6 reports the SDID estimates under three specifications. Column (1) presents the average treatment effect of the GFRIZ policy across the full sample. Although the coefficient is positive (0.104), it is not statistically significant, suggesting that the overall impact of green finance on business income may be weak or obscured by heterogeneous responses.

To explore this heterogeneity, Column (2) incorporates an interaction term between green finance exposure and agricultural hukou status. The estimated interaction effect is positive and statistically significant at the 5% level (0.149), indicating that households with rural registration benefit more markedly from green finance in terms of self-employment income. This finding is consistent with the hypothesis that rural hukou holders—being more likely to own land and engage in farm-adjacent activities—are better positioned to leverage green finance initiatives targeting rural economic revitalization. Column (3) further refines the analysis by including a triple interaction: GFRIZ × Agricultural Hukou × Rural Residence, thereby identifying policy effects among households that not only hold rural registration but also reside in rural areas. The coefficient remains statistically significant (0.154, p < 0.05) and slightly larger in magnitude, underscoring that green finance generates the strongest impact on those structurally and spatially embedded in rural production ecosystems.

These findings reinforce our earlier triple-difference results and highlight the targeted effectiveness of green financial instruments: they are most impactful when delivered to true rural households with both institutional eligibility and locational embeddedness in the green transformation agenda.

To further validate the robustness of our results, we conducted three additional checks: (i) narrowing the sample to the 2014–2018 period to avoid confounding from early or late policy effects; (ii) excluding megacities such as Beijing, Shanghai, Guangzhou, and Shenzhen to mitigate urban–rural composition bias; and (iii) applying sample restriction criteria to test the sensitivity of the estimates. While the full results are not reported due to space limitations, all findings are available upon request and remain qualitatively consistent with our baseline conclusions.

5.3.4 PSM-DID

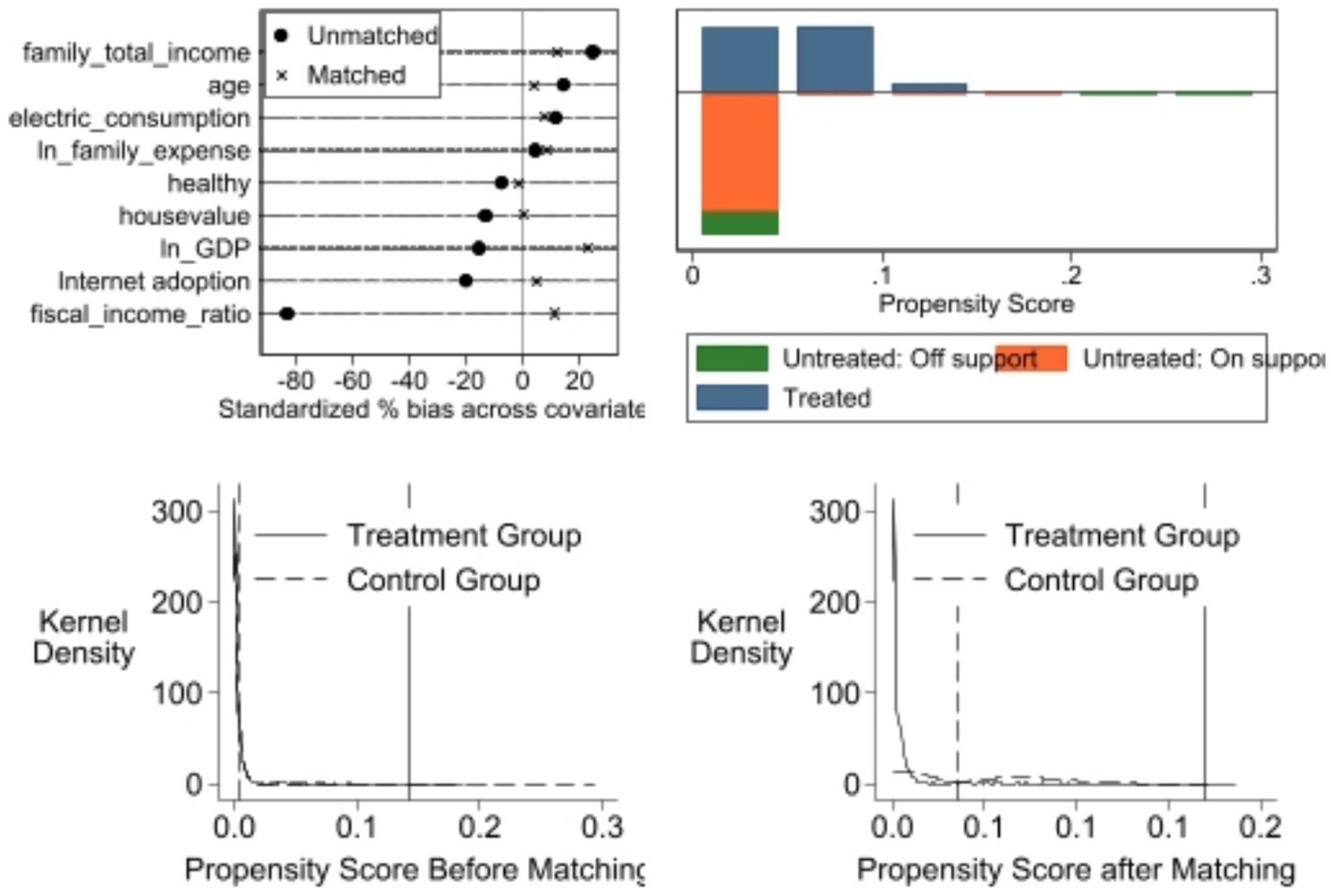

Before conducting the PSM-DID estimation, we assess the quality of propensity score matching to ensure covariate balance between treated and control units. Figure 3 illustrates the diagnostics for matching quality.

Figure 3. PSM diagnostics for covariate balance and common support. Top left: Standardized % bias before and after matching. Top right: Propensity score distribution by treatment status and support region. Bottom panels: Kernel density plots of propensity score distributions before and after matching. Results confirm improved covariate balance and overlapping support.

The top-left panel shows the standardized percentage bias across covariates before and after matching. The covariates include household total income, age, electricity consumption, family expenditure, health status, house value, internet adoption, and regional GDP and fiscal ratios. After matching, the standardized bias for all covariates falls below the conventional threshold of 10%, indicating that covariate balance has been substantially improved. The top-right panel displays the distribution of the propensity scores, showing that the majority of observations fall within the region of common support, with few untreated units off support. This confirms the validity of the matching procedure, as treatment and control units are comparable across the relevant score range. The bottom panels show kernel density estimates of the propensity score distributions before and after matching. Prior to matching, the treatment and control groups exhibit significant overlap imbalance. After matching, the distributions become nearly aligned, especially in the region of high matching density (0.05–0.12), further validating the success of the matching procedure.

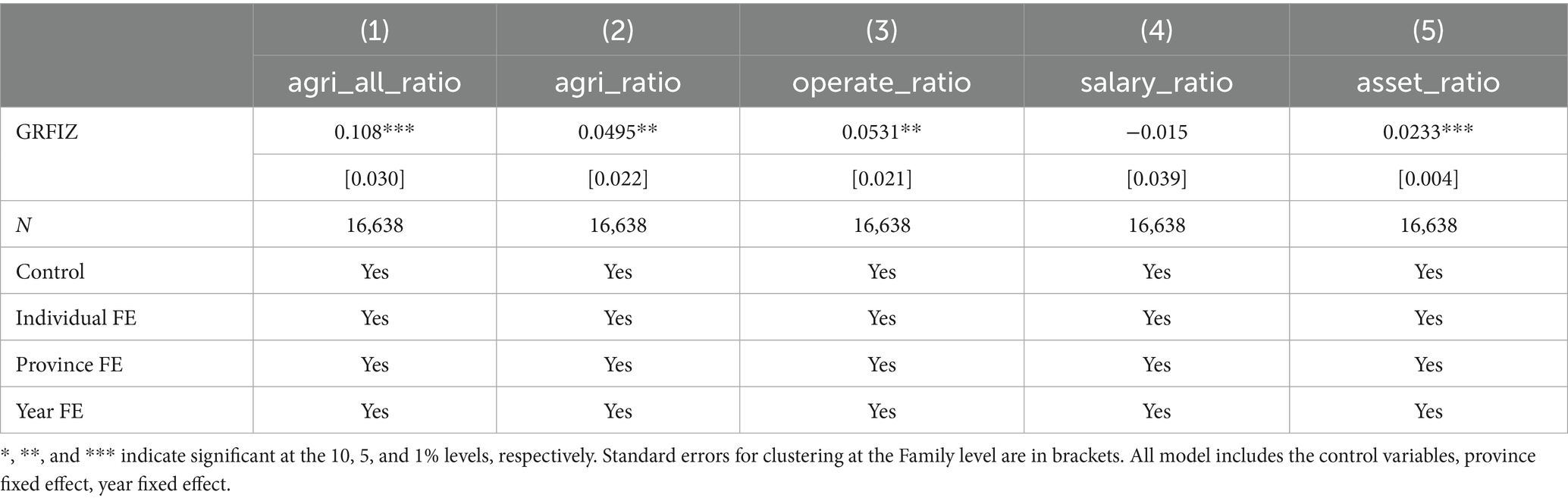

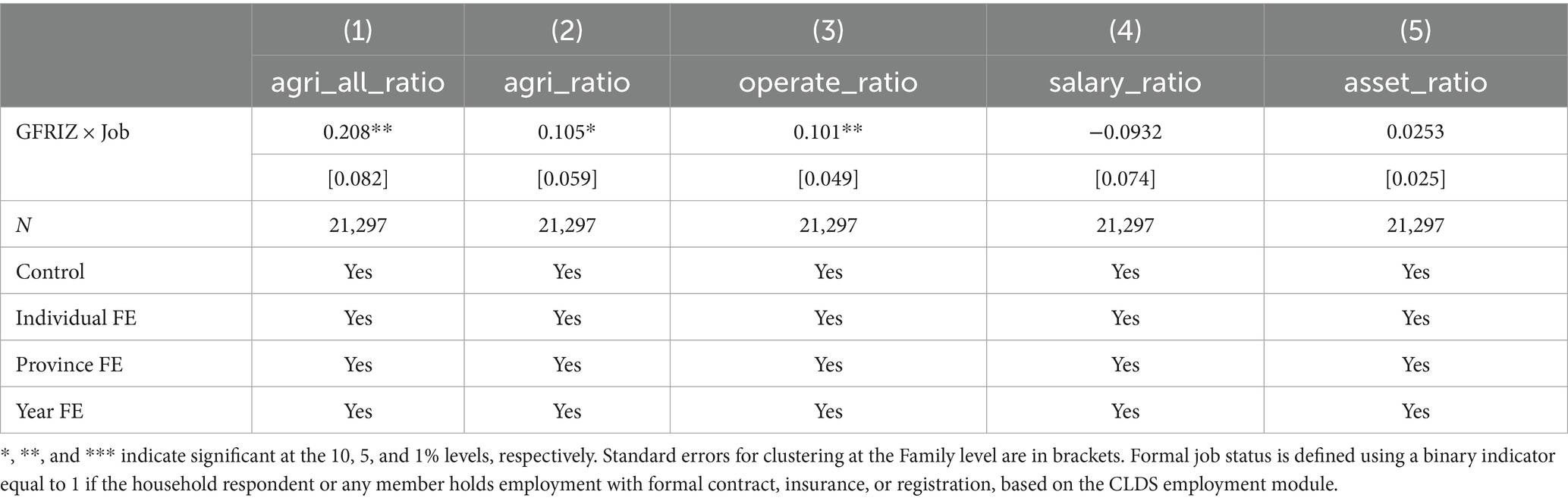

To further validate the robustness of our baseline findings and address potential selection bias, we implement a Propensity Score Matching Difference-in-Differences (PSM-DID) estimation. This method accounts for observable differences in treatment assignment by reweighting the matched sample using propensity scores, and then applies DID estimation to the balanced dataset.

Table 7 reports the results from the PSM-DID regressions. In Column (1), the estimated coefficient for the GFRIZ policy on total land-based income share is 0.108 and statistically significant at the 1% level. This confirms that even after matching on covariates, households in treated provinces experienced significantly higher increases in land-dependent income.

Disaggregated results further support this conclusion. Column (2) shows that agricultural income share rises by 0.0495 (p < 0.05), and Column (3) shows that business income share increases by 0.0531 (p < 0.05). These effects are consistent in direction and magnitude with those from the baseline DID and GFI-based estimations, suggesting that green finance facilitates both traditional farming activities and entrepreneurial income generation in rural areas.

In Column (4), the effect on wage income is negative but statistically insignificant, indicating that the expansion of land-based activities does not crowd out off-farm or urban wage employment in the short term. Finally, property income share in Column (5) is also significantly higher in the treated group (0.0233, p < 0.01), reinforcing the notion that green finance expands households’ access to asset-based income channels such as green leasing, equity participation, or ecological compensation mechanisms.

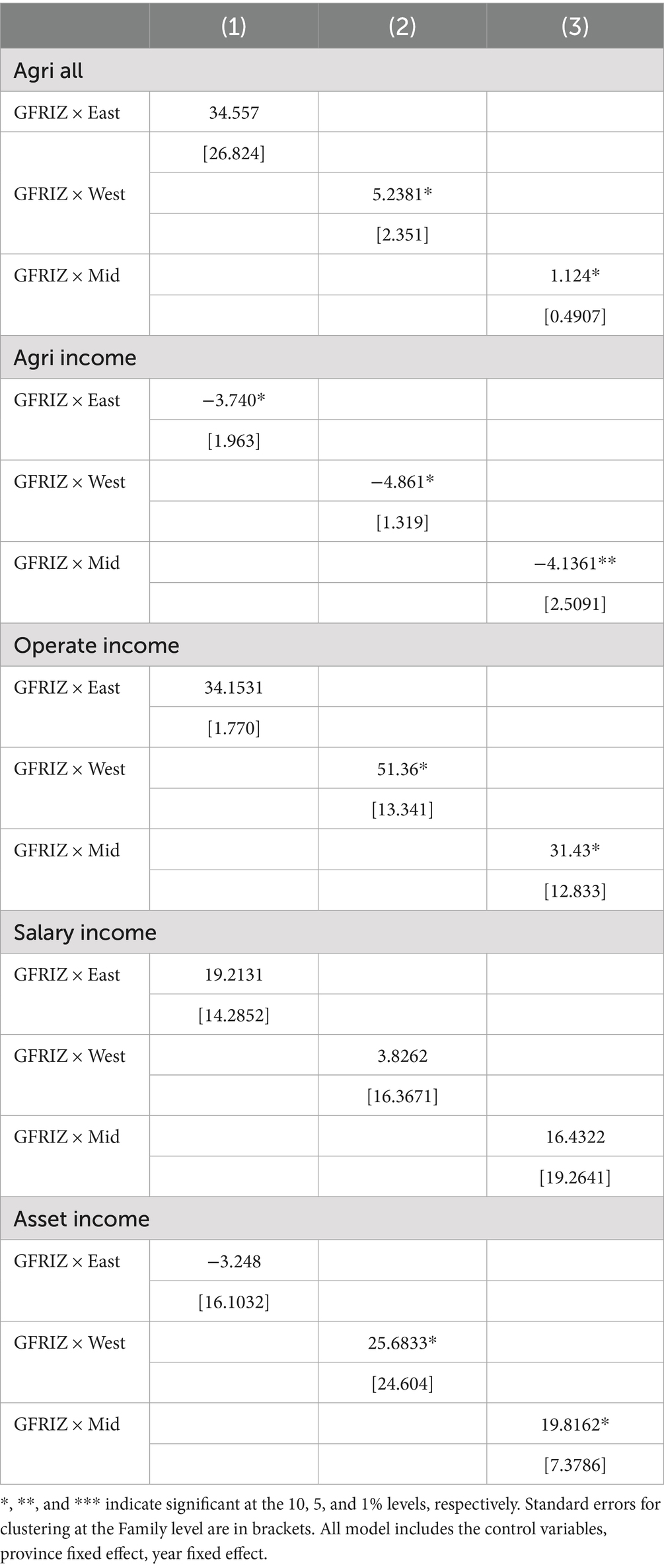

5.4 Regional heterogeneity

To examine how the effects of green finance vary across different institutional and socioeconomic contexts, we conduct a heterogeneity analysis by splitting the sample into three macro-regions—Eastern, Central, and Western China—according to official provincial classifications. These regions differ substantially in terms of rural development, migration patterns, and financial infrastructure (Fan et al., 2016; Zhang et al., 2021). The Eastern region is generally more affluent, with diversified income structures and mature rural financial systems, while the Central and Western regions have historically depended more on labor migration and face greater constraints in financial access. It is therefore plausible that the same policy intervention—green finance reform—generates regionally differentiated impacts.

The results in Table 6 reveal clear regional variation. For land-based income (Column 1), we find no significant effect in the Eastern region, but observe statistically significant and positive coefficients in the Central (1.124, p < 0.1) and Western (5.238, p < 0.1) provinces. This suggests that green finance plays a more catalytic role in less developed areas, where marginal returns to policy interventions and capital inputs are higher (Jin et al., 2021). These findings are consistent with prior arguments that revitalization efforts are more impactful in regions with weaker institutional capacity and entrepreneurial constraints (Zhao et al., 2021).

When isolating agricultural income, the coefficients are negative and significant across all regions—Eastern (−3.740, p < 0.1), Central (−4.136, p < 0.05), and Western (−4.861, p < 0.1). This suggests that green finance reform does not encourage a return to traditional farming, but instead facilitates a shift away from subsistence agriculture toward more diversified and commercialized rural production. These results are aligned with the broader trend in China’s rural transformation, where hybrid income strategies—rather than pure agricultural returns—become the dominant mode of livelihood (de Brauw et al., 2002; Wang F. et al., 2021; Wang J. et al., 2021).

For operating income (representing rural entrepreneurship and self-employment), green finance has a positive and significant effect in both the Central (31.43, p < 0.1) and Western (51.36, p < 0.1) regions, but not in the East. This aligns with qualitative research indicating that return migration and rural entrepreneurship are increasingly concentrated in inland provinces, where disillusionment with precarious urban employment pushes rural laborers to leverage green-financed opportunities at home (Chen et al., 2016; Liu et al., 2023).

Regarding wage income, the estimated effects are small and statistically insignificant across all regions, reaffirming our earlier finding that green finance does not significantly displace off-farm or urban labor earnings in the short term.

The results for property income highlight additional regional asymmetries. While the Eastern region shows no significant effect, both the Western (25.68, p < 0.1) and Central (19.82, p < 0.1) regions report positive and significant effects. This may reflect the emergence of green asset markets—such as carbon credits, eco-compensation schemes, or rural land-use rights—enabled by more aggressive green policy experimentation in inland regions (PBoC, 2020).

Overall, the heterogeneity analysis underscores that green finance exerts stronger transformative effects in the Central and Western regions of China. It facilitates the shift from subsistence agriculture to entrepreneurial and asset-based rural income structures, highlighting its dual role in advancing ecological modernization and promoting inclusive regional development.

5.5 Alternative interpretation: distinguishing green finance from broader environmental governance

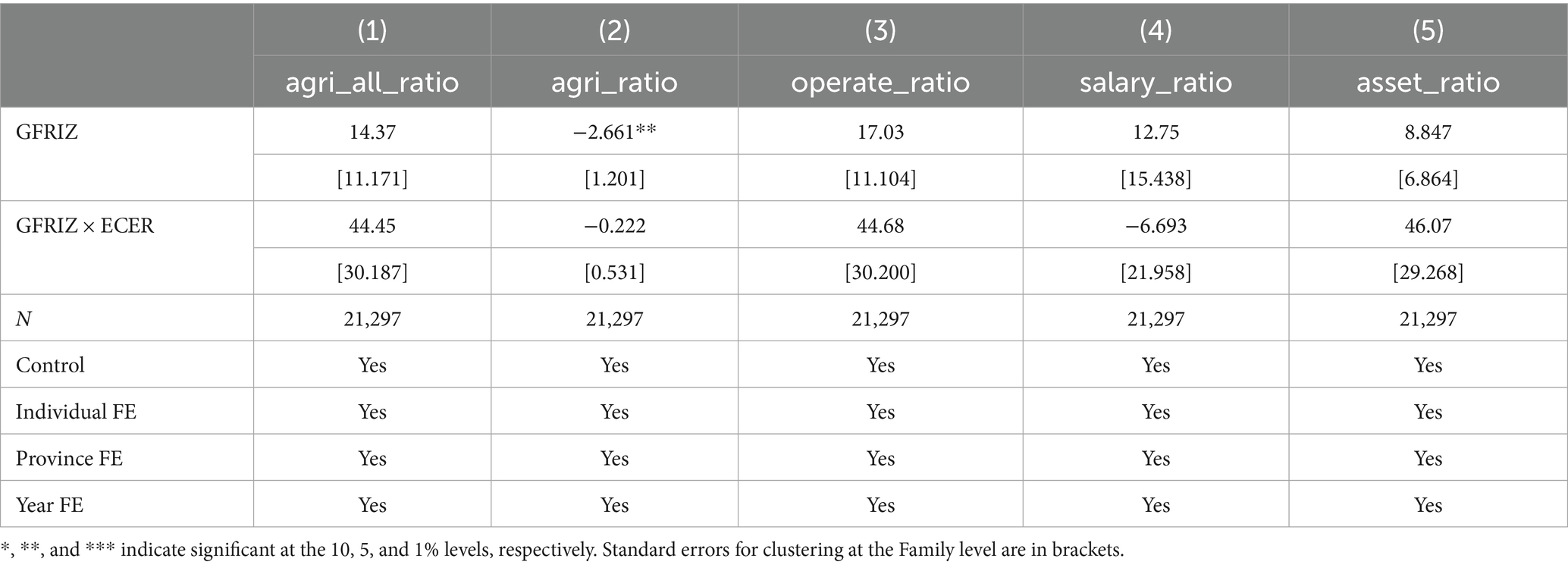

One potential concern with the baseline identification strategy is that the observed income effects attributed to green finance reform (GFRIZ) may in fact reflect the influence of other concurrent environmental or green development policies. In particular, the Energy Conservation and Emission Reduction (ECER) pilot cities program, launched earlier and targeting urban industrial structure and energy efficiency, may have indirectly influenced household income patterns through channels such as green compliance regulation, resource reallocation, or technology diffusion. To test this alternative interpretation, we introduce an interaction term between GFRIZ and ECER city status, thereby capturing the joint exposure to both green finance reform and urban environmental governance.

The ECER program is aimed at reducing energy intensity and carbon emissions through stricter environmental controls and industrial adjustments (Li et al., 2023; Fan et al., 2016). While its design differs from GFRIZ in scope and target (urban vs. rural, Zhang and Wang, 2021), there is a risk that households located in both GFRIZ and ECER regions might be subject to overlapping green policy environments, which could confound the effect of green finance specifically.

As shown in Table 7, the results confirm the independent effect of green finance and mitigate the concern of policy overlap. The coefficient on the GFRIZ policy remains positive and statistically significant for agricultural income share (−2.661**, p < 0.05), consistent with baseline findings indicating a shift away from traditional agriculture. Most notably, the GFRIZ × ECER interaction term is positive and large in magnitude for both self-employment income (operate ratio: 44.68) and asset income share (46.07), although the estimates are not statistically significant at conventional levels. This suggests that households in jointly treated areas may benefit from complementary policy effects, especially in terms of productive and capital-based income diversification, but these benefits do not override or contradict the core mechanism of green finance (Tables 8–11).

Moreover, the interaction term shows no significant effect on agricultural income, wage income, or land-based income overall, reinforcing the conclusion that green finance—rather than broader environmental governance—is the primary driver of rural income restructuring observed in the previous models. These results are consistent with recent findings that green finance policies, when well-targeted, produce distinct livelihood effects beyond general ecological regulations, especially by reducing financing constraints and supporting entrepreneurial investments in green industries (Zhou et al., 2022; Jin et al., 2021).

Overall, this alternative interpretation test demonstrates that the empirical relationship identified between green finance and rural income structure is not confounded by the presence of broader environmental policy regimes such as the ECER program. This strengthens the internal validity of the baseline model and highlights the unique contribution of financial innovation in reshaping rural livelihoods under China’s green transition agenda.

6 Mechanism

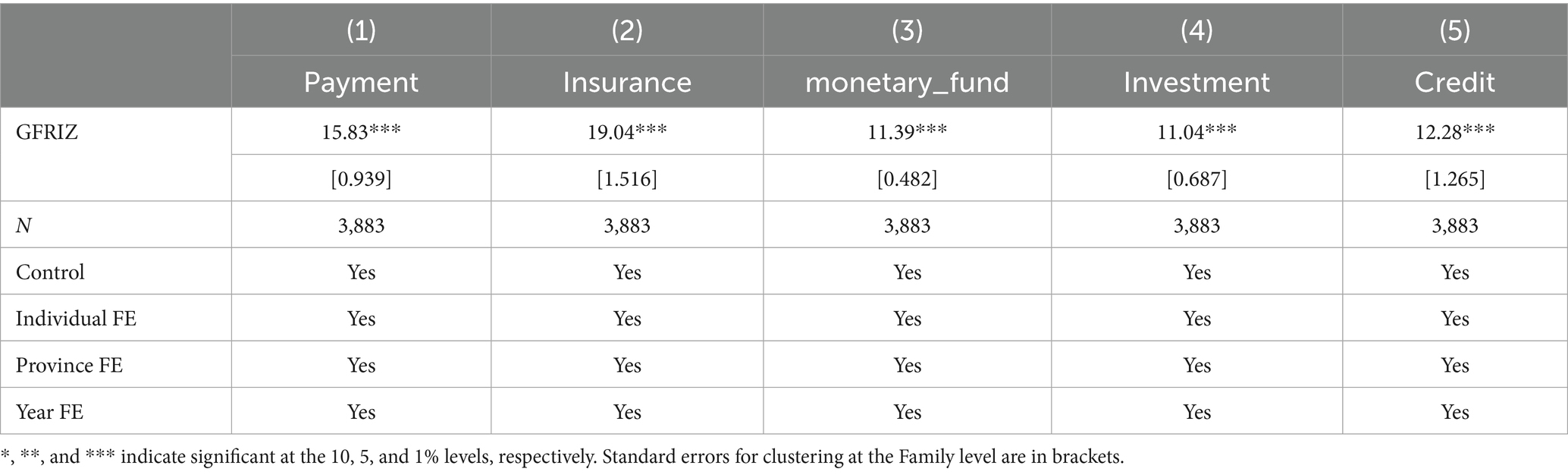

6.1 Green finance and household financial access

To formally examine the role of financial access as a mechanism, we adopt a two-step mediation analysis framework, which has been increasingly used in applied policy evaluation to address the limitations of the classical three-step method (MacKinnon et al., 2007; Acharya et al., 2016). Specifically, we first estimate the effect of green finance reform (GFRIZ) on household-level financial access variables—including digital payment, insurance use, and credit access. We then regress income composition outcomes on both GFRIZ and these mediating variables.

The estimation reveals that financial access indicators are positively and significantly associated with land-based and asset income shares, while the coefficient on GFRIZ becomes smaller but remains significant. This result indicates a partial mediation effect, suggesting that expanded access to financial services—enabled by green finance reform—serves as an important transmission channel that reshapes household livelihood structures. Compared to the traditional three-step approach, the two-step method offers greater flexibility and robustness, especially in the presence of fixed effects, multiple covariates, and continuous mediators. Our findings confirm that financial access is not merely a policy outcome, but an active channel through which green finance promotes productive rural transformation.

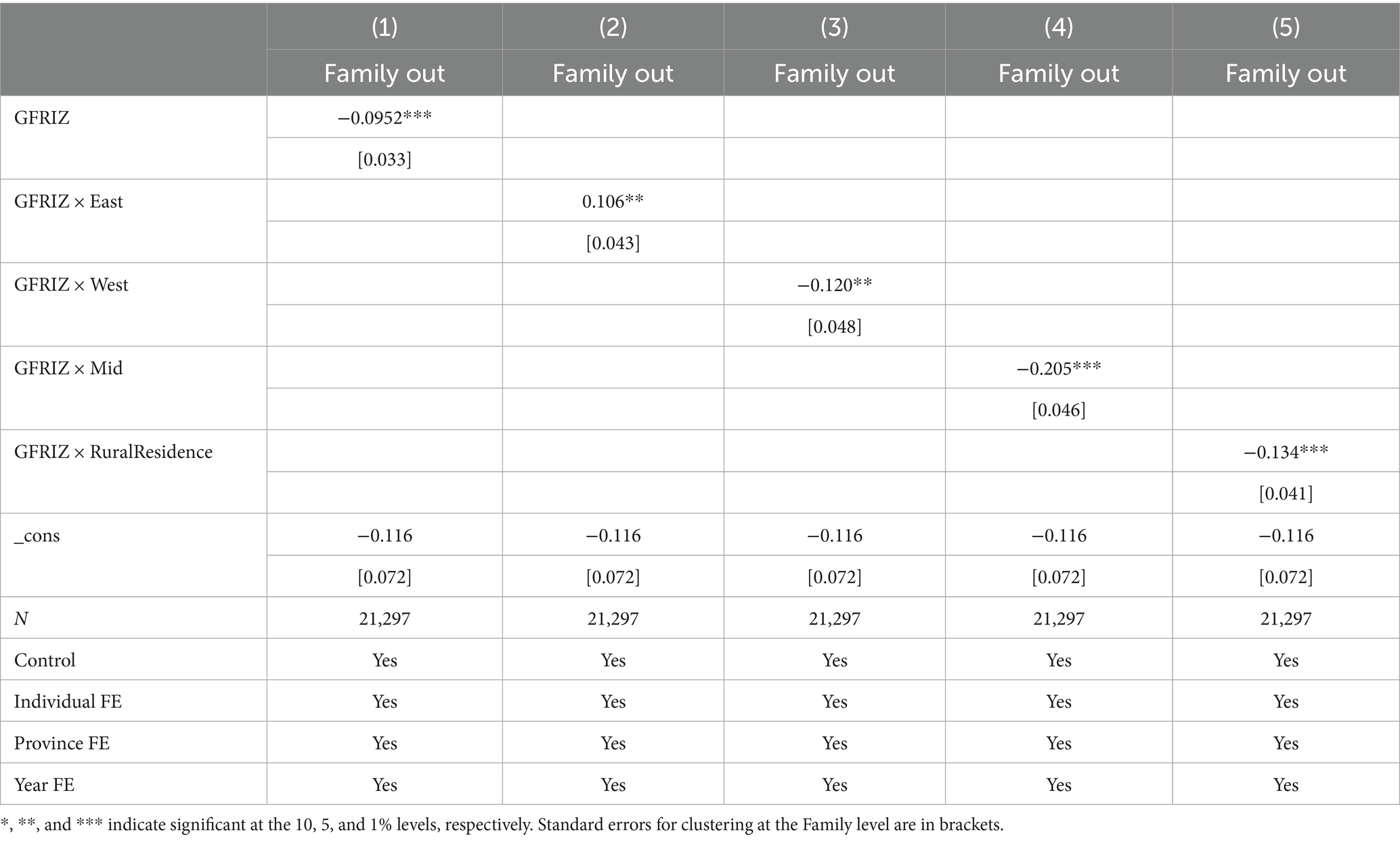

6.2 Green finance and household migration decisions

To further investigate the behavioral pathways through which green finance may affect rural income structures, we examine its impact on household labor mobility, measured by the presence of migrant workers in the family. Migration has long served as a livelihood strategy in rural China, particularly in the Central and Western regions where agricultural returns are low and employment opportunities limited (de Brauw et al., 2002; Wang and He, 2021; Wang and Wang, 2021). However, with the expansion of green finance, households may increasingly find viable alternatives within rural areas, such as green entrepreneurship or sustainable land use.

We estimate a series of regression models with the number of family members working outside the village (family out) as the dependent variable. In Model A1, the green finance reform (GFRIZ) has a negative and statistically significant coefficient (−0.0952, p < 0.01), indicating that green finance is associated with a reduction in household labor out-migration. This result supports the hypothesis that improved financial access and greener livelihood opportunities may deter households from relying on migrant wage labor.

To uncover regional heterogeneity, we further interact GFRIZ with provincial zone indicators (East, West, and Central China). In the Eastern provinces (Model 2), the coefficient is positive and significant (+0.106, p < 0.05), suggesting that green finance may increase labor mobility where urban employment opportunities are more abundant, and households are more integrated into market-based economies. This implies that in developed areas with higher opportunity costs of remaining in agriculture, green finance may facilitate rather than deter capital- and labor-intensive transitions, reinforcing existing mobility patterns.

In contrast, in the Western (−0.120) and Central (−0.205) regions, GFRIZ significantly reduces labor outflow, with the strongest effect in the Central provinces. This aligns with the idea that green finance plays a larger transformative role in lagging regions, offering attractive alternatives to out-migration through localized production, ecological entrepreneurship, and expanded financial inclusion (Zhao et al., 2021; Liu et al., 2023).

Model 5 explores an additional dimension: whether households still reside in rural communities. The interaction term is significantly negative (−0.134***), confirming that the effect of green finance on migration behavior is more pronounced among households embedded in rural contexts. These findings reinforce our earlier interpretation that green finance reform has enabled rural households to “stay and thrive” rather than “leave and remit”—a shift that may carry long-term implications for rural sustainability, community cohesion, and labor market dynamics.

Collectively, this mechanism analysis shows that green finance not only restructures income sources but also reshapes household labor allocation strategies. Crucially, the regional differences highlight that the effect of green finance is highly context-dependent: it dampens migration pressures in underdeveloped regions while supporting labor mobility and sectoral upgrading in more developed regions.

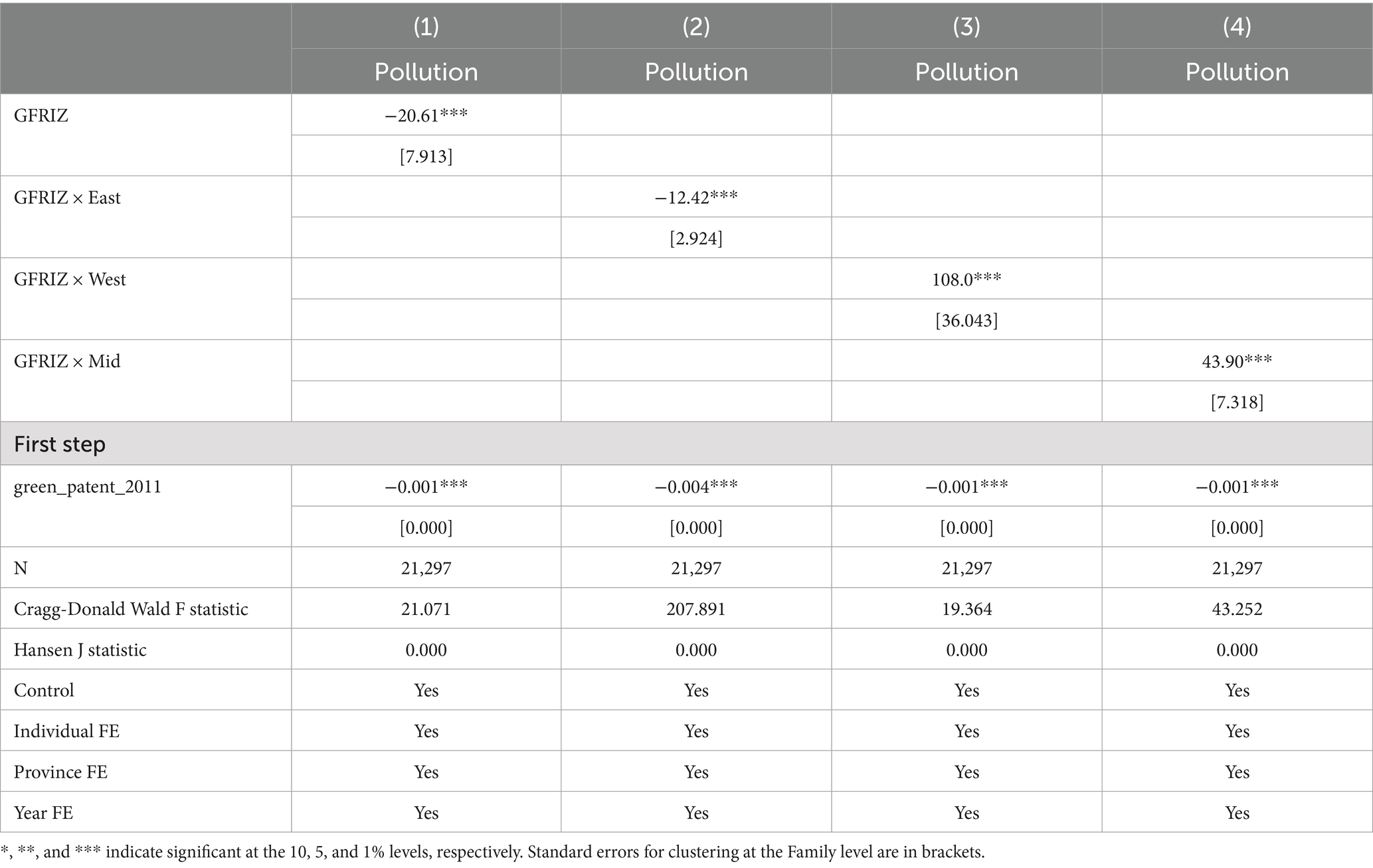

6.3 Environmental exposure and green finance

In addition to affecting income and migration dynamics, green finance may shape rural development through its environmental externalities. One critical but understudied dimension is whether green finance reforms mitigate or exacerbate local pollution exposure, particularly in vulnerable rural communities. To address this question, we assess the impact of the GFRIZ on households’ self-reported pollution exposure using an instrumental variable triple-difference (IV-DDD) strategy.

A key concern in prior specifications is that GFRIZ pilot zones may have been non-randomly selected, potentially biased toward areas with higher levels of pre-existing environmental degradation. To address this endogeneity in treatment assignment, we instrument the GFRIZ treatment variable using pre-policy green patent counts (2011), capturing historical green innovation capacity that plausibly predicts GFRIZ designation but is unlikely to directly affect pollution exposure in later years.

Table 12 presents the results. In Column (1), the baseline IV estimate shows that green finance reform significantly reduces pollution exposure (coefficient = −20.61, p < 0.01), suggesting that, on average, GFRIZ leads to measurable environmental improvements. However, the subsequent regional disaggregation reveals important spatial heterogeneity. Column (2) shows a significant negative effect in the Eastern region (−12.42, p < 0.01), while Column (3) and Column (4) report large and positive coefficients in the Western (108.0, p < 0.01) and Central (43.90, p < 0.01) regions, respectively. These findings imply that green finance may have exacerbated pollution exposure in inland regions during its initial implementation phase.

One possible explanation is that industrial restructuring or capital inflow triggered by green finance initiatives in these less regulated regions temporarily increased environmental burdens, either due to policy-driven industry relocation or weak enforcement capacity. By contrast, the Eastern region—with stronger institutional governance—was better positioned to convert green finance into environmental gains (Table 13).

The first-stage results confirm the strength and relevance of the instrument. The coefficient on 2011 green patent counts is highly significant in all specifications (p < 0.01), and the Cragg-Donald Wald F-statistics all exceed the conventional threshold of 10, alleviating concerns about weak instruments. The Hansen J-statistic indicates valid overidentifying restrictions (p = 1.000).

Overall, the IV-DDD results suggest that the environmental effects of green finance are not uniform: positive in well-regulated regions, but potentially negative or delayed in areas with weaker administrative capacity. These findings highlight the importance of complementary environmental governance in realizing the ecological goals of green finance reform. Without robust enforcement, green financial flows may risk reinforcing regional disparities or even enabling pollution transfer.

7 Further analysis

7.1 Community empowerment as a complementary mechanism

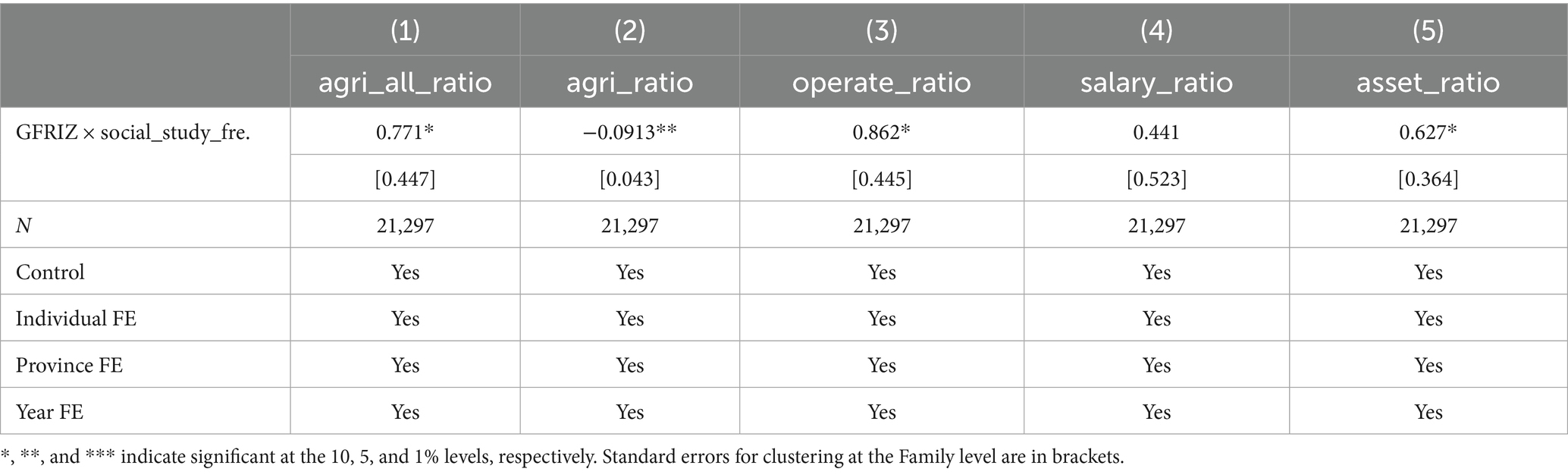

In addition to the structural and behavioral mechanisms previously discussed, we further explore whether the impact of green finance on rural transformation depends on community-level support for knowledge acquisition. Specifically, we investigate the interaction between the green finance reform policy (GFRIZ) and the frequency of community-organized learning activities (social_study_fre), such as environmental education, agricultural training, and entrepreneurship workshops.

This analysis is motivated by the theoretical premise that policy effectiveness is often contingent on local institutional capacity and residents’ ability to absorb and apply new information (Becker, 2007; Woolcock, 2010). In the context of green finance, such capacity may determine whether financial inclusion translates into productive investment, behavioral change, or sustainable land use.

We estimate an interaction model where the key term of interest is GFRIZ × social_study_fre. The results reveal a positive and statistically significant interaction effect, suggesting that the benefits of green finance reforms are amplified in communities where residents more frequently participate in learning or training sessions. In contrast, in communities with low or no learning activities, the marginal effects of green finance are notably weaker or even absent. These findings are robust across different model specifications and outcome variables (e.g., operating income share, credit access).

This pattern highlights an important complementary mechanism: community-based human capital formation enhances the uptake and effectiveness of green finance. It also aligns with empirical studies emphasizing the role of “soft infrastructure”—such as social capital, civic participation, and knowledge diffusion—in facilitating rural policy implementation (Narayan-Parker, 1999; Zhang and Treiman, 2021).

From a policy standpoint, the results underscore the need to embed green finance initiatives within broader community empowerment frameworks, particularly in regions with weak institutional support. Financial resources alone may not be sufficient; without access to training and knowledge, rural households may struggle to make effective use of green financial tools.

Overall, this further analysis adds a critical layer of understanding: the social context in which green finance is embedded—especially community-level learning—matters greatly for its success.

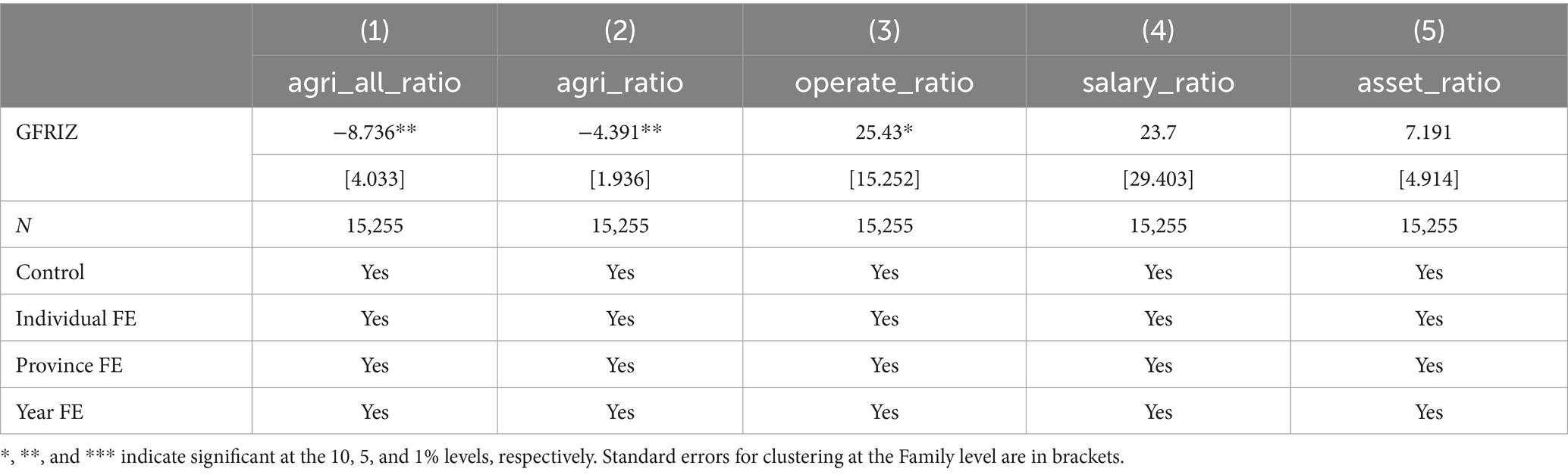

7.2 Green finance in lower-GDP regions

To deepen our understanding of regional heterogeneity, we expand the previous analysis by explicitly comparing the effects of green finance reform (GFRIZ) between high-GDP and low-GDP regions. Specifically, we split the sample based on the provincial median GDP in each survey year, following a stratified approach. This allows us to assess whether green finance acts as a development equalizer, yielding stronger effects in economically lagging areas, or whether it reinforces existing disparities by being more effective in affluent regions with better institutional infrastructure.

Table 14 reports the results for the two groups. In the low-GDP sample, GFRIZ significantly reduces the share of agricultural income (−8.736**, −4.391**) while boosting operating income (25.43*, p < 0.1). These results suggest that in less developed areas, green finance helps households transition away from traditional farming and into more entrepreneurial, land-related non-farm activities—consistent with the idea of green finance as a catalyst for structural income transformation in underdeveloped regions with higher marginal returns to policy intervention (Zhou et al., 2022).

In contrast, the high-GDP sample (see Appendix Table A2) shows weaker and mostly insignificant results across the same income dimensions. While the sign of coefficients remains largely consistent, the magnitudes are smaller, and none of the effects reach conventional significance levels. This divergence highlights that in more affluent areas—where financial access is already widespread—green finance reforms may exert a more limited incremental impact on household income structure. Instead, the reform may operate through other channels, such as green consumption, climate mitigation investments, or capital reallocation among enterprises.