- College of Economics and Trade, Hunan University, Changsha, China

This study investigates the impact of China's Environmental Protection Tax on corporate investment in artificial intelligence (AI), with a particular focus on listed firms in the agri-food and food processing industries. Using the 2018 implementation of the Environmental Protection Tax Law as a quasi-natural experiment, the analysis employs a difference-in-differences (DID) approach based on panel data from 2010 to 2022. The findings demonstrate that the tax reform significantly promotes AI investment, especially among state-owned enterprises, manufacturing firms, and those located in resource-based regions. The study further reveals that the mechanism underlying this effect lies in the alleviation of financing constraints and increased research and development input. These results highlight the important role of environmental regulation in driving digital transformation and green innovation, providing both empirical evidence and practical guidance for policymakers and industry stakeholders seeking to align environmental governance with technological progress.

1 Research background

With the rapid advancement of the economy, environmental pollution has become increasingly severe in China, with its degradation affecting many aspects of people's lives, particularly within the food industry. Ecological issues have emerged as a major bottleneck restricting sustainable development, and public demand for stronger government intervention in environmental governance has risen significantly. This study selects the agri-food and food processing industries as case examples due to their strategic significance. First, these industries form the foundation of China's economy, characterized by long industrial chains, strong inter-industry links, and the participation of numerous SMEs and large listed companies. Their production activities impose heavy environmental burdens, such as significant energy consumption and emissions of volatile organic compounds (VOCs), as well as difficulties in wastewater treatment (Bhatia et al., 2023; Asgharnejad et al., 2021). The Environmental Protection Tax directly increases operational costs, particularly under the dual pressures of pollution permits and taxation, thereby compelling enterprises to explore green and intelligent innovation.

Second, the supply chain of this sector is highly representative in terms of digital and intelligent transformation. In recent years, firms in this industry have actively pursued smart production lines, intelligent warehouses and supply chain management systems. AI technologies are increasingly adopted in areas such as the inspection of raw material safety, quality control, and energy efficiency optimization, significantly accelerating green industrial upgrading (Sgarbossa et al., 2022; Mustafa et al., 2024). These practical advances offer rich empirical cases for analyzing the impact of environmental taxation on AI investment.

Moreover, this industry faces dual pressures of environmental compliance and food safety. While addressing stricter environmental constraints, it must also meet exceptionally high food safety standards (Kabato et al., 2025; Reza and Sabau, 2022). The introduction and diffusion of AI not only facilitate environmental compliance but also enhance food safety oversight. The green-intelligent transformation in this industry exemplifies cross-sectoral integration and highlights the multi-dimensional interactions between environmental regulation and AI investment. Additionally, due to its clear industrial structure and transparent financial disclosures of listed companies, the industry provides high-quality data for combined quantitative and qualitative analysis. Case studies of representative firms help uncover how traditional industries respond to environmental tax shocks, offering insights into digital transformation pathways and investment logic, which may serve as valuable references for other manufacturing sectors undergoing green transitions.

In the past, China relied predominantly on administrative regulation to control pollution, which was marked by considerable enforcement flexibility (Guo et al., 2022) and lacked strong legislative constraints, thus limiting progress in environmental improvement. To enhance governance efficiency, the Environmental Protection Tax Law came into effect on January 1, 2018, replacing the pollutant discharge fee with a tax scheme based on the “polluter pays” principle. This reform marked a major institutional shift in China's regulatory framework (Gao et al., 2022). Scholars have increasingly focused on the economic consequences of environmental regulation, such as its impact on innovation (Du et al., 2021), employment (Zhong et al., 2021), industrial restructuring (Song et al., 2021), and total factor productivity (Cheng and Kong, 2022). However, limited attention has been paid to how this market-based environmental policy influences digital technology adoption, particularly AI investment.

In recent years, AI has become a central driver of the new wave of technological and industrial transformation (Ramazanov, 2022). Existing studies show that AI significantly enhances productivity, scale, and profitability (Wang et al., 2024b,a), and improves total factor productivity through reduced managerial costs (Li et al., 2024c), better asset efficiency (Li et al., 2024b), and labor restructuring (Yang et al., 2025). Governments worldwide have issued policy initiatives to support AI development. For instance, the U.S. launched a national AI strategy and established institutions like the National AI Research Resource Task Force and DARPA. Similarly, China has made substantial progress; according to the 2020 China AI Development Report, the country filed over 389,000 AI patents, accounting for 74.7% of global filings. Nevertheless, challenges such as funding gaps, technological bottlenecks, and talent shortages persist (Yu et al., 2022).

As an economic tool to “control quantity through price” the Environmental Protection Tax not only imposes cost burdens but also incentivizes green innovation and technological advancement (Han et al., 2024). Under such pressure, enterprises often respond by increasing R&D, adopting cleaner technologies, and optimizing processes to reduce emissions (Li et al., 2024a). In this context, AI plays the role of a strategic enabler. Through smart production adjustments, refined management, and energy optimization, AI helps enterprises meet compliance targets while improving economic outcomes (Xiangling and Qamruzzaman, 2024). The corporate response to environmental taxation is therefore not merely passive cost adaptation but includes proactive technological innovation. However, internal constraints, information asymmetries, and innovation risks may limit responsiveness. In environments lacking strong market incentives or regulatory enforcement, firms may resort to 'strategic innovation' for compliance avoidance rather than 'substantive innovation' to raise technical capacity (Qin and Xiong, 2022). Thus, understanding the mechanisms by which environmental taxes stimulate AI investment requires deeper exploration of firm heterogeneity, industry characteristics, and the policy implementation context.

China serves as an ideal context for this study for two reasons. First, China is a global leader in AI development. According to the 2023 Global AI Development Report, China ranks among the top in industrial scale, R&D investment, and application penetration, with the AI industry exceeding RMB 400 billion and growing at over 30% annually. Studying China provides valuable insights into AI development in emerging economies. Second, as the world's largest developing and manufacturing country, China has long struggled with severe environmental issues. The 2019 China Environmental Status Bulletin reported that only 46.6% of 338 cities met national air quality standards. In response, China launched a series of regulatory reforms. The Environmental Protection Tax Law, as the first dedicated tax legislation in this domain, represents a landmark policy innovation. Investigating its impact on AI development offers lessons for countries seeking to balance environmental governance and technological progress. Exploring the interplay between environmental policy and digital innovation also holds unique policy significance, potentially guiding developing countries toward a win-win path of economic growth and environmental protection.

To address the above questions, this study employs comprehensive data and a rigorous empirical design. Based on 2010-2022 panel data of China's A-share listed companies from the CSMAR database (after trimming the top and bottom 1% of outliers), we construct a balanced panel of 4,870 firm-year observations from the agriculture and food processing industry and 33,952 firm-year observations from other sectors. Using the 2018 Environmental Protection Tax Law as a quasi-natural experiment, we apply a difference-in-differences (DID) approach to assess the law's impact on AI investment.

The case of green-intelligent transformation in the agriculture and food processing industry offers practical models for industry regulators and firms, supporting ESG performance enhancement and environmental governance capacity. This transformation has important implications for upgrading industrial supply chains and promoting high-quality development. The study contributes new empirical evidence and theoretical reference for evaluating and optimizing the spillover effects of environmental regulation and aligning green and digital transformation.

Theoretically, this study expands the understanding of factors influencing corporate AI applications. While prior research has emphasized innovation capacity, human capital, digital infrastructure, and IP protection, few have examined how environmental regulation drives AI adoption, especially in traditional sectors like food processing. By incorporating environmental taxation into the analytical framework, we show how policy signals–through cost pressures, innovation incentives, and compliance requirements–affect AI-related R&D and adoption. This provides both theoretical enrichment and explanatory mechanisms for understanding green-digital convergence. Unlike existing studies that attribute digital transformation barriers to tangible resource limitations, we highlight institutional variables, such as environmental regulation, as external drivers of technological application, offering conceptual innovation in understanding AI investment behavior.

Finally, the study offers direct policy and practical relevance. Results demonstrate that environmental tax reform significantly promotes AI investment, primarily via easing financial constraints and boosting R&D, with varying effects across ownership types, industries, and regions. Based on these findings, we recommend that policymakers advance market- and law-based environmental governance while supporting enterprises' digital and intelligent transformation under compliance pressure. Complementary fiscal and financial tools, policy guidance, and innovation incentives should be employed to unlock firms' internal motivations for green-intelligent upgrading. Enterprises, in turn, should embrace the dual trend of green and smart development by transforming environmental pressure into strategic digital opportunities. Overall, this study, by examining how the Environmental Protection Tax influences AI investment, particularly in agriculture and food sectors, contributes both theoretical insight and empirical evidence at the intersection of environmental regulation and technological innovation, aligning with current research priorities in green economics and digital policy.

The remainder of this paper is structured as follows: Section 2 provides a literature review and research hypotheses; Section 3 outlines the theoretical framework and research design; Section 4 details the empirical methodology; Section 5 presents empirical analysis for other industries; Section 6 focuses on case analysis of the agriculture and food processing sector; and the final section discusses the results and offers policy recommendations.

2 Literature review

2.1 Environmental regulation and business innovation

As an important policy tool for promoting green development, the mechanism of environmental regulation's impact on corporate innovation has traditionally been a hotspot of academic concern. Traditional economic theory suggests that environmental regulation weakens the incentive to innovate by increasing compliance costs (Zhou et al., 2023). However, studies represented by Porter's Hypothesis emphasize that environmental regulation may stimulate corporate innovation, thus achieving the so-called “innovation compensation” effect, which not only reduces the cost of environmental governance, but also promotes corporate competitiveness (Zhou et al., 2023; Guo and Zhang, 2023; Lv et al., 2021). This view has been further explored and verified in the practice and research of China's environmental protection tax policy in recent years.

Since 2018, with the formal implementation of the Environmental Protection Tax, China has shifted from a previously fragmented sewage fee system to a more standardized and transparent tax framework, promoting the market-oriented and legalized advancement of environmental protection policies (Lin et al., 2024). By imposing direct levies on pollutant emissions from enterprises, the environmental protection tax strengthens the internalization of environmental costs and theoretically enhances firms' economic motivation to engage in green innovation activities (Wang et al., 2024c). Empirical evidence shows that following the introduction of the environmental protection tax, firms in heavily polluting industries significantly increased their investment in green research and development (R&D), highlighting the policy's positive role in stimulating enterprise innovation output (Du et al., 2021).

In addition, the relevant literature points to the heterogeneity of the impact of environmental regulation on firms' innovation. On the one hand, the pollutant emission characteristics of different industries determine the degree of policy influence, and heavily polluting industries are subject to greater environmental tax pressure and stronger incentives to innovate (Zhou et al., 2023). On the other hand, different levels of regional economic development, enterprise resource endowment and technological basis also lead to differences in innovation effects (Wang and Wu, 2022). In terms of the policy transmission mechanism, environmental protection tax not only prompts enterprises to green innovation through direct cost pressure, but also may enhance their scientific and technological innovation and long-term development momentum by improving their environmental image and social reputation (Wang et al., 2024c). As a result, the relationship between environmental regulation and corporate innovation has evolved from a single static model in the early days to a dynamic understanding of multiple mechanisms and levels.

In summary, environmental protection tax, as a new type of environmental regulation policy, plays an important role in improving enterprises' green innovation inputs, but its impact mechanism is complex and needs to be analyzed in depth in combination with industry characteristics and enterprise heterogeneity.

2.2 Artificial intelligence and business development

2.2.1 Development status of China's artificial intelligence industry and AI investment trends of listed companies

Amid the accelerating wave of digitalization, informatization, and intelligence, artificial intelligence (AI) has been recognized as a central engine driving the new era of technological and industrial transformation. The Chinese government has placed strong emphasis on the strategic development of AI, introducing key initiatives such as the “(State Council of China, 2017)” and the “Three-Year Action Plan for the Development of Artificial Intelligence Industry”. These efforts have significantly promoted AI technological innovation, industrial applications, and talent cultivation. Under the leadership of major enterprises, China's AI sector has established a relatively complete industrial ecosystem encompassing algorithm design, chip production, data services, and industry-specific applications (Yu et al., 2022).

In terms of infrastructure, China benefits from an extensive data resource base and a vast number of Internet users, providing a solid foundation for enterprise-driven AI innovation. Recent years have witnessed a notable surge in AI investment among Chinese listed firms. Studies based on corporate disclosures, R&D expenditures, and patent records indicate that industries such as finance, manufacturing, information technology, and retail are leading the way in AI deployment, with both the number of AI-related patent filings and the proportion of R&D personnel experiencing significant increases (Lundvall and Rikap, 2022). From a regional perspective, AI technology research and applications are concentrated in the Yangtze River Delta, Pearl River Delta, and Beijing-Tianjin-Hebei regions, where policy support and industrial clustering have accelerated regional economic development (Cui et al., 2024). Moreover, AI adoption has substantially improved firms' overall production efficiency and innovation capabilities, particularly through advancements in data-driven decision-making, intelligent automation of manufacturing processes, and the enhancement of service experiences (Sahoo and Lo, 2022).

However, the effectiveness of AI investment is also limited by the size of the enterprise, technological capabilities and applicability of industry scenarios. Small and medium-sized enterprises, despite their expectations for the digital economy, have relatively limited AI investment and transformation effectiveness due to insufficient capital, talent and technology accumulation (Yu et al., 2022). Therefore, the internal resource endowment of enterprises and the external policy environment play a key role in AI development. Due to the different characteristics of the industry itself, there are also large differences in AI investment effects. High-technology-intensive and capital-intensive industries are more inclined to increase investment in R&D and application in the field of AI, while labor-intensive industries are constrained by financial and technological conditions, and the application of AI is relatively lagging behind (Liu et al., 2022). At the same time, regional economic development imbalance also affects the scale and effectiveness of enterprise AI investment. Due to the advantages of infrastructure and talent concentration in economically developed regions, enterprises' AI vision and investment are broader (Wang et al., 2025); economically underdeveloped regions face many constraints.

Combined with the special situation of the food processing industry, which is a traditional industry that is both labor-intensive and capital-intensive, AI investment has a strong practical demand and policy orientation. As the environmental protection tax policy continues to deepen, listed companies in this industry are investing more and more in the field of intelligent green technology, showing the typical characteristics and trends of the industry's digital transformation (Sharma et al., 2021).

2.2.2 Characteristics of artificial intelligence development in the food processing industry

As an important part of China's national economy, the agri-food and food processing industry has ushered in a critical window of technological upgrading and intelligent transformation in recent years. The industry has traditionally been a key area for environmental protection and technological innovation due to its high resource consumption, heavy pollution emissions and high product safety requirements. Actual data show that the agri-food and food processing industry is more sensitive to environmental protection tax policies, and there is an urgent need for its green technology innovation and intelligent transformation (Mustafa et al., 2024).

In terms of AI applications, the industry mainly focuses on production process optimization, quality and safety monitoring, supply chain management and energy saving. Specifically, first, the introduction of intelligent production lines continues to improve processing efficiency and product consistency, including automated sorting, baking and packaging and other aspects of the application of robots (Sgarbossa et al., 2022); second, through computer vision and big data analysis, to achieve real-time monitoring of the source of raw materials and the processing process, to protect food safety and preventing emissions violations (Mu et al., 2024); thirdly, energy management and waste treatment are optimized with the help of artificial intelligence to reduce overconsumption and pollutant emissions (Andeobu et al., 2022); and fourthly, intelligent supply chain management achieves demand forecast and inventory optimization, and improves resource utilization (Pasupuleti et al., 2024). It is worth noting that different types of enterprises within the agri-food and food processing industries show significant differences in their AI development paths. There is a large difference in the development of intelligence between industry leaders and SMEs (Nagy et al., 2023). This differential development situation reflects the resource and capacity bottlenecks of AI investment in the industry, and also affects the driving effect of the environmental protection tax policy on their intelligent investment. Sensitivity to environmental protection tax further promotes AI-related green innovation in the agri-food and food processing industry.

Unlike existing studies that generally focus on the overall trend of enterprise digitalization, this paper emphasizes the unique role of artificial intelligence in responding to environmental tax policies. Compared to conventional digital tools such as ERP or MIS systems, AI integrates advanced perception, autonomous decision-making, and adaptive control, enabling firms to collect real-time environmental data, dynamically adjust emissions strategies, and optimize pollution control under complex operational scenarios. For example, AI-enriched ERP platforms have incorporated machine learning and anomaly detection to support proactive emissions management and predictive compliance, extending beyond static data processing capabilities of legacy systems (Li et al., 2024c,b; Wang et al., 2025). These capabilities allow firms to respond adaptively to shifting regulatory thresholds and environmental signals. Furthermore, AI's predictive learning functionalities enable strategic forecasting under long-term regulatory pressure, thus enhancing capital investment efficiency and overall green innovation responsiveness (Ramazanov, 2022; Wang et al., 2024b; Yu et al., 2022). In contrast, conventional systems are limited in their capacity for autonomous regulatory adaptation and lack real-time optimization mechanisms.

As argued by Sharma et al. (2021), the integration of predictive learning and autonomous control fundamentally differentiates AI from traditional digitalization tools, particularly in dynamic regulatory contexts. AI-driven decision support systems, often coupled with IoT sensors and big data analytics, enable real-time emissions regulation, adaptive energy use, and operational forecasting under highly complex and nonlinear constraints (Liu et al., 2022; Mu et al., 2024). Moreover, AI demonstrates heightened applicability in heavily regulated sectors such as food processing, which face dual compliance pressures from environmental regulation and stringent food safety standards. AI-enabled systems have been applied for early hazard detection, automated traceability, food risk prediction, and real-time regulatory reporting (Sharma et al., 2021; Mu et al., 2024; Andeobu et al., 2022; Mustafa et al., 2024). In such contexts, AI's integration of environmental data, compliance logic, and continuous learning confers a competitive advantage that surpasses conventional MIS or ERP systems.

3 Theoretical framework and research design

3.1 Theoretical extension: from porter hypothesis to AI-specific mechanisms

While the Porter Hypothesis provides a foundational lens to understand how environmental regulation can stimulate innovation, our study extends this framework in two critical directions. First, we focus specifically on artificial intelligence (AI), which differs fundamentally from other digital technologies such as ERP systems or automated machinery. AI investment is not merely an upgrade of existing tools–it requires intensive organizational learning, deep integration with data infrastructure, and long-term strategic alignment. Therefore, we argue that AI adoption under environmental tax pressure constitutes a distinct form of strategic transformation rather than tactical compliance.

Second, we incorporate the theory of dynamic capabilities (Teece, 2007) to explain how firms convert regulatory pressure into technological opportunity. Specifically, the environmental tax acts as an external shock that activates a capability-building process in three stages: sensing regulatory opportunities, seizing AI as a transformative tool, and reconfiguring internal resources such as financing and R&D portfolios. This perspective allows us to better capture the heterogeneous responses across firm types and industries, which cannot be fully explained by cost-push mechanisms alone.

3.2 Environmental regulation and AI investment in agri-food and food processing companies

Since the 1970s, environmental regulation has been widely explored for its impact on firms' technological innovation, especially in promoting green transformation and enhancing firms' competitiveness. Among them, Porter's Hypothesis, as a widely cited theoretical basis in this field, argues that moderately stringent environmental regulations not only do not weaken firms' competitiveness, but also stimulate innovation and bring about the so-called “innovation compensation effect” (Porter and Linde, 1995). This hypothesis emphasizes that environmental regulation provides incentives for innovation, which can lead to lower pollution emissions through technological innovation, thus achieving the dual goals of compliance and cost optimization (Wang et al., 2024c). In China, with the implementation of the environmental protection tax, the impact of environmental regulation on enterprises has been further highlighted, especially in the agri-food and food processing industries, where the production process has a greater impact on the environment, and thus enterprises face greater tax pressure. As a market-based environmental policy tool, the environmental protection tax, by exerting price pressure on polluting behaviors, prompts enterprises to introduce more green technologies and innovative paths in their production processes.

The agri-food and food processing industries have particularly stringent environmental protection requirements. These industries not only have to cope with increasingly stringent emission standards, but also face the dual pressures of green transformation and sustainable development. Against this backdrop, companies are adopting AI technologies to optimize production processes, improve energy efficiency, reduce emissions, and enhance food safety and quality control, thereby boosting competitiveness and complying with environmental policy requirements. For example, the application of AI in the fields of intelligent production, packaging, logistics management, and waste treatment has helped food processing companies achieve optimal use of resources and reduction of pollutant emissions (Du et al., 2021).

Although environmental regulation provides an incentive for firms to innovate, some studies have also shown that overly stringent environmental regulatory burdens may put greater pressure on cash-strapped small and medium-sized enterprises (SMEs), particularly in the agri-food and food-processing industries, where many firms, when confronted with high levels of environmental investment, may limit research and development expenditures, thus reducing the development of technological innovation activities (Zhou et al., 2023). Therefore, the relationship between environmental taxes and technological innovation may exhibit non-linear and heterogeneous characteristics, especially across industries and firms of different sizes.

Overall, the environmental protection tax policy creates a strong incentive for companies in the agri-food and food processing industries to promote the application and investment in AI technology. Based on this, Hypothesis 1: Environmental protection tax policy can effectively promote AI investment in enterprises in the agri-food and food processing industries.

3.3 Environmental regulation and corporate AI investment

As a key factor in promoting technological innovation and green transformation of enterprises, environmental regulation has received widespread attention since the 1970s, especially under the influence of Porter's hypothesis, which has had a profound impact on innovation and technological investment of enterprises. According to the hypothesis, moderately stringent environmental regulation can stimulate the innovation drive of enterprises, especially in technology-intensive and pollution-emitting industries, the “innovation compensation effect” brought by environmental regulation is particularly significant (Porter and Linde, 1995). As a market-based environmental policy tool, the environmental protection tax, by exerting price pressure on polluting behaviors, prompts enterprises to reduce pollution emissions through technological innovation, which not only meets the requirements of environmental protection compliance, but also optimizes production costs (Wang et al., 2024c).

Scholars find that the environmental protection tax policy exerts direct pressure on the production costs of enterprises, prompting them to accelerate the application and innovation of green technologies (Du et al., 2021). In addition, environmental regulation may prompt firms to rethink their existing technologies, thus incentivizing them to seek breakthrough innovation paths, especially in energy-intensive and more polluting industries (Wang et al., 2024c). However, it has also been pointed out that an excessive environmental tax burden may put greater financial pressure on SMEs, especially in the context of financing difficulties, and such pressure may limit the R&D investment of enterprises, which in turn may inhibit technological innovation (Zhou et al., 2023).

In the field of AI investment, studies have shown that corporate R&D investment and a stable financing environment are key factors in driving AI technology innovation (Lundvall and Rikap, 2022). Digital transformation, as an important way to enhance the competitive advantage of enterprises and cope with external pressures, has become one of the core strategies for many enterprises to improve efficiency and innovation (Ramazanov, 2022). In the process of digital transformation, enterprises need a large amount of capital investment, technology accumulation and support for organizational change, and financing constraints are an important bottleneck for enterprises to promote this transformation (Xu et al., 2023). Therefore, alleviating financing constraints and optimizing the financing environment can significantly increase the willingness of enterprises to invest in AI technology, thus enhancing the sustainability of technological innovation.

Taken together, the relationship between environmental regulation, digital transformation and AI investment is close and complex, and the enterprises' financing environment, technological research and development capability, and transformation process are the key factors affecting AI investment. Based on this, hypothesis 2 is proposed: environmental protection tax policy can effectively increase enterprise AI investment.

3.4 Environmental protection tax affects AI investment transmission mechanism

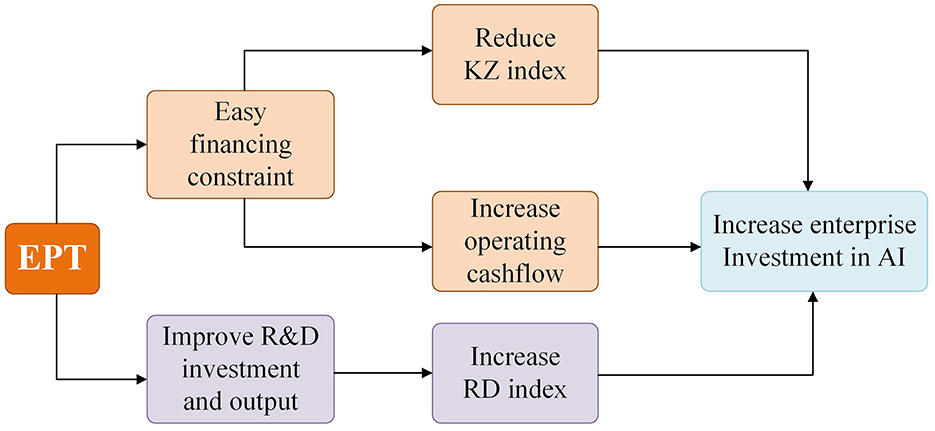

Based on the above theories and studies, this paper proposes that environmental protection tax influences enterprises' investment in AI technology through the following two core mechanisms, as shown in Figure 1.

1. Mechanisms for easing financing constraints. As an endogenous adjustment factor for environmental compliance costs, environmental protection taxes prompt enterprises to optimize their capital structure and improve the convenience of external financing. Empirical studies have shown that green finance policies and environmental regulation policies tend to improve corporate financing conditions and reduce the KZ financing constraint index (i.e., a decline in the KZ index reflects the easing of financing constraints) (Liu et al., 2021). Increased pressure on environmental protection tax pushes enterprises to seek green financing and diversified capital market resources, thus easing financing constraints and releasing the potential of corporate R&D investment. At the same time, the improvement of operating cashflow (Sasaki, 2016) also helps to enhance the level of corporate AI investment. Then, this paper adopts two indicators, KZ Index and operating cashflow, to measure the level of corporate financing constraints. Based on this, hypothesis 3 is proposed: Environmental protection tax policy can effectively reduce corporate financing constraints and release corporate economic vitality.

2. Mechanism for upgrading R&D technology. The environmental protection tax incentivizes enterprises to increase R&D expenditure and enhance technological innovation. R&D expenditure, as the core input variable (RD) of the enterprise's technological innovation process, directly promotes the development and application of new technologies (Zheng et al., 2024). Through the regulation of environmental protection tax, enterprises are forced to accelerate the pace of technological upgrading, thus increasing the intensity of R&D and improving the quality of R&D, especially in the field of artificial intelligence, where innovation investment grows significantly. Based on this, hypothesis 4 is proposed: Environmental protection tax policy can effectively improve the level of R&D science and technology of enterprises and enhance technological innovation.

4 Research design

4.1 Research background and data sources

On 1 January 2018, the Environmental Protection Tax Law was formally implemented, marking the entry of China's environmental governance system into a new stage centered on economic means. The environmental protection tax replaces the previous sewage fee system and promotes the implementation of corporate environmental governance responsibilities through a mandatory tax incentive mechanism, stimulating the motivation for green technological innovation. This policy is not only of great significance in the field of environmental protection, but also an important policy background for studying the path of green transformation of enterprises, because of its impact on their production cost structure and innovation activities.

In this study, Chinese listed companies are selected as the research object, the sample period is 2010-2022, the data are mainly from the Cathay Pacific (CSMAR) database, the financial industry enterprises, ST and ST enterprises, and the missing items of financial indicators are excluded, and at the same time, the continuous variables are Winsorized with the upper and lower 1% pole end values, and after the above processing, the final formation contains 4,870 firms in the agri-food and food industry - annual observations of balanced panel data (according to the industry code published by the China Securities Regulatory Commission, this paper classifies the firms with industry codes A01, A02, A03, A04, A05, C13, C14, C15, C16, C27, G60, F52 as the agri-food, food industry and related industries) and 33,952 other firms - annual observations of balanced panel data, to lay a solid sample foundation for the empirical analysis.

4.2 Variable construction

4.2.1 Artificial intelligence applications

Enterprise AI application is the explanatory variable of this paper, for enterprise AI, most of the existing literature adopts text analysis to calculate and measure (Mah et al., 2022; Wang et al., 2024b; Yang et al., 2025), however, measuring enterprise AI based on the frequency of AI words application has some drawbacks, for example, to attract investors' favor and cater to the government's policy needs, enterprises may over-disclose AI information, resulting in a gap between enterprise AI word frequency and real AI practices. To address this, we obtain corporate AI investment data from the Cathay Pacific database from an asset perspective and add a logarithmic treatment to this data, denoted by AI.

4.2.2 Environmental protection tax law

The environmental protection tax law is our core explanatory variable, obtained by interacting the policy time dummy variable(Postt) and the treatment dummy variable(Treati). Since the environmental protection tax was officially implemented from 1 January 2018, the time dummy variable is set to 1 for observations from 2018 to 2022 and 0 for observations from 2013 to 2017. Referring to Zhang (2017), we define the treatment dummy variable as assigning a value of 1 when the firm belongs to the heavy pollution industry, and assigning a value of 0 to the rest of the listed firms. In this paper, we define the interaction term in the model as the product of the time dummy variable and the treatment dummy variable to obtain the interaction term of the policy shock variable of the environmental protection tax law (didit).

4.2.3 Control variables

Referring to Shi et al. (2023) and Zhang (2017), the control variables in this paper mainly include the gearing ratio (Lev), which is measured by the ratio of total assets to total liabilities. Profitability (ROA); Enterprise Size (Size); Cashflow Ratio (Cashflow); Enterprise Growth Rate (Growth); Equity Concentration (Top1); Proportion of Independent Directors (Indep); and Firm Age (FirmAge): the chairman of the board of directors is also the CEO (Dual), and the dual is 1, and vice versa.

4.2.4 Modeling

The environmental protection tax policy variable uses the implementation of the Environmental Protection Tax Law in 2018 as the policy shock point, and a quasi-natural experiment double difference model is used. Specifically, as follows, the

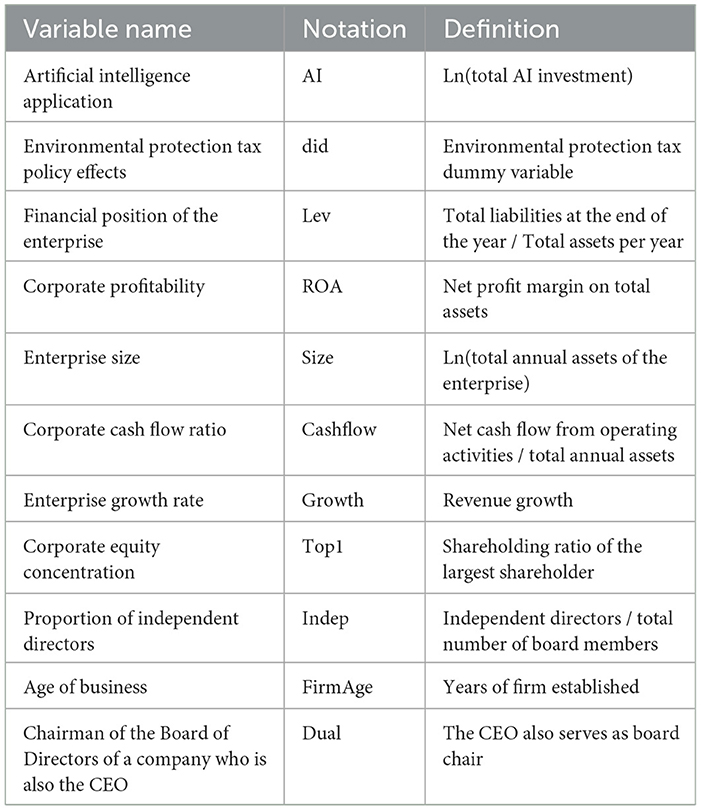

Where AIit denotes the level of AI investment by firms i in the year t; didit is the interaction term of the policy shock variable. For the experimental group, didit is set to 1 after the implementation of the policy; for the control group, the didit variable is set to 0 before and after the implementation of the policy, which is the main explanatory variable of interest in this paper. Controlssit is the control variable. μi are firm fixed effects, controlling for time-invariant individual characteristics. θt are year fixed effects, accounting for macroeconomic time effects. δk are industry fixed effects, controlling for industry heterogeneity. εit is the error term, considering the standard error of the enterprise industry clustering adjustment. To fully understand the sample characteristics, the core variables are defined in this paper (Table 1).

5 Empirical analysis of other industries

5.1 Benchmark regression analysis

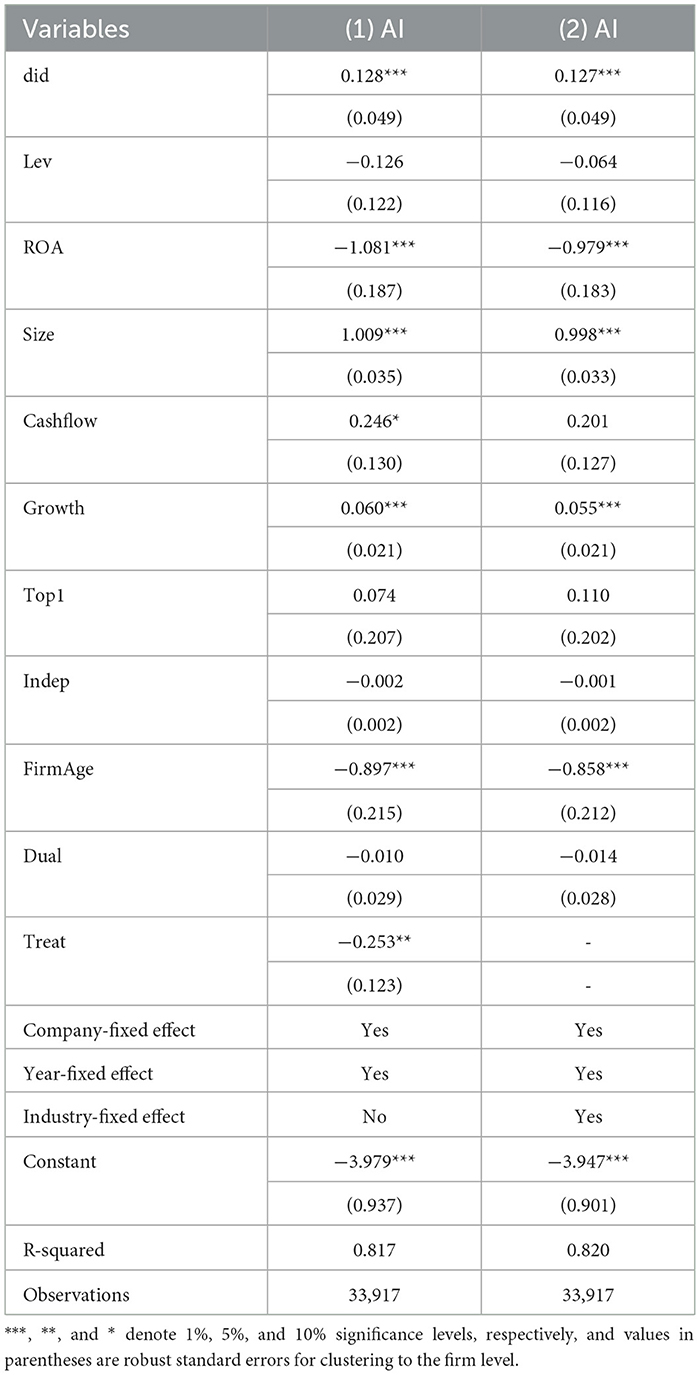

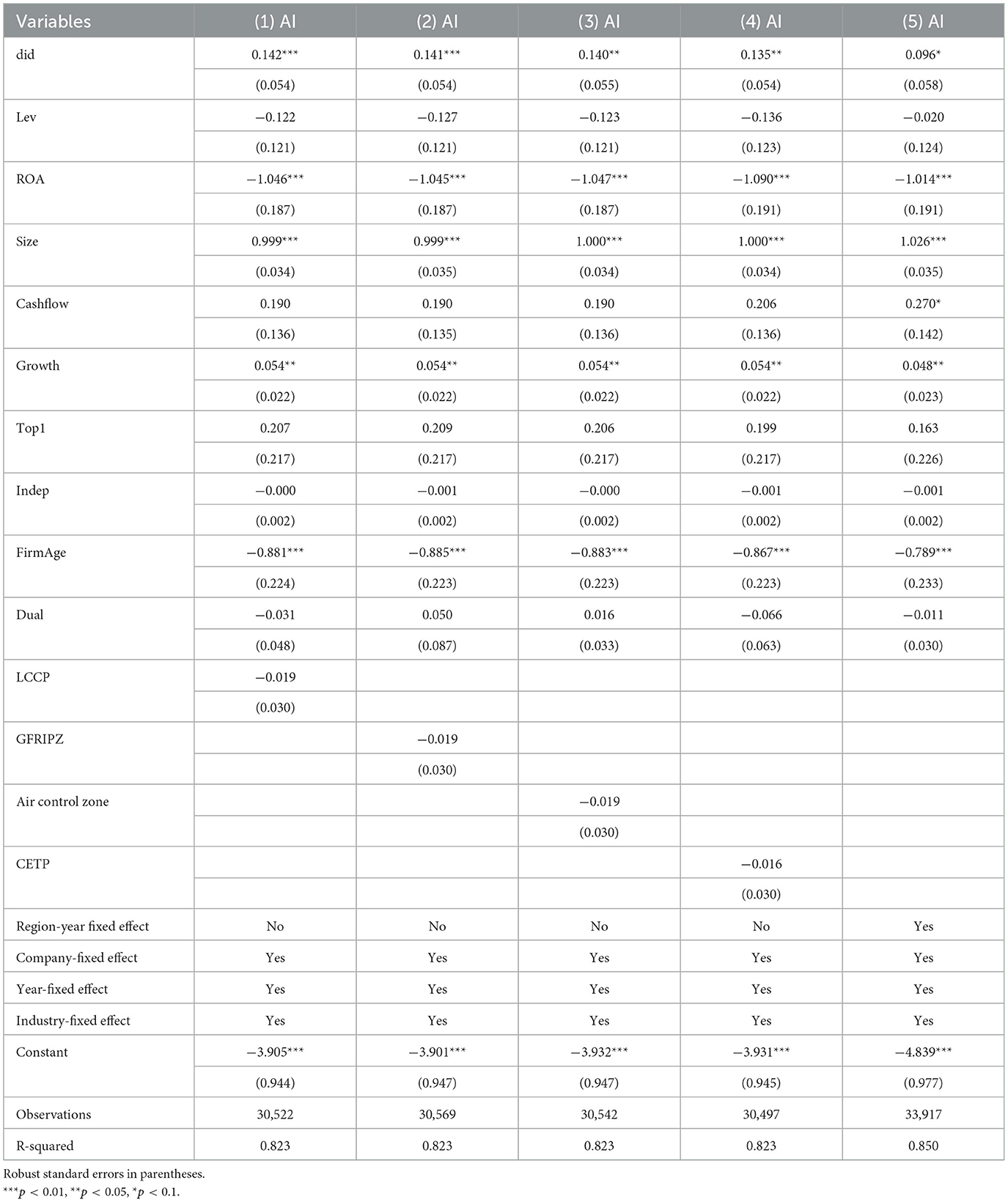

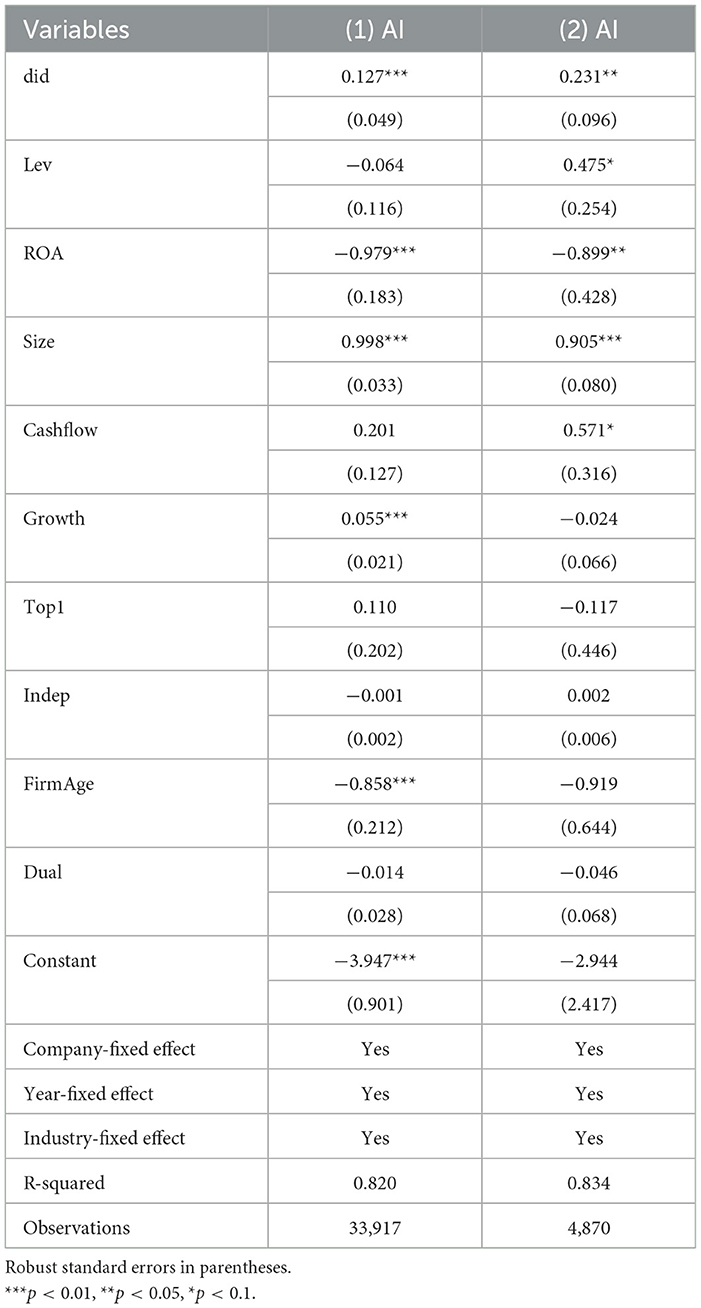

The benchmark regression obtained according to model 1 is shown in Table 2. Column (1) of Table 2 results in a 12.8 per cent impact of environmental protection tax on AI investment of listed Chinese firms, controlling for firm-individual and year effects and no industry fixed effects. The result in column (2) of Table 2 is that controlling for individual firm, year and industry fixed effects, the impact of environmental protection tax on AI investment of listed Chinese firms is 12.7%, which is significantly effective at the 1% level of significance. By increasing firms' environmental protection costs, the environmental protection tax induces firms to respond to environmental protection pressures by favoring technological innovations such as AI to improve efficiency and reduce pollution, thus achieving sustainable development. This result verifies Hypothesis 2 of this paper: Environmental protection tax has a significant positive impact on AI investment of listed firms in China. This is similar to the findings of Du et al. (2021), Zhong et al. (2021), Song et al. (2021), and Cheng and Kong (2022) that environmental protection policies can stimulate technological innovation and adoption of environmentally friendly technologies.

5.2 Dealing with sample selection bias

Sample selection bias challenges the baseline conclusions of this paper, and to address this issue, we introduce propensity score matching-DID (PSM-DID). Propensity score matching (PSM) is a non-experimental causal inference method for assessing treatment effects by calculating the probability that an individual receives the treatment (propensity score) and matching the treatment group to individuals with similar propensity scores in the control group. This method is effective in controlling for potential covariate bias, resulting in more reliable causal effect estimates (Stuart et al., 2014). Column (1) of Table 3 uses kernel matching followed by an empirical analysis based on model 1, which shows essentially the same results as the baseline regression and is valid at the 1% significance level. Column (2) of Table 3 is matched using the neighbor matching method with the matching criterion of 1:2, and then do the model 1 test; the test result is 16.6%. These two methods indicate that the benchmark regression passes the endogeneity test, and the results of this test do not suffer from endogeneity problems.

5.3 Robustness testing

5.3.1 Parallel trend test

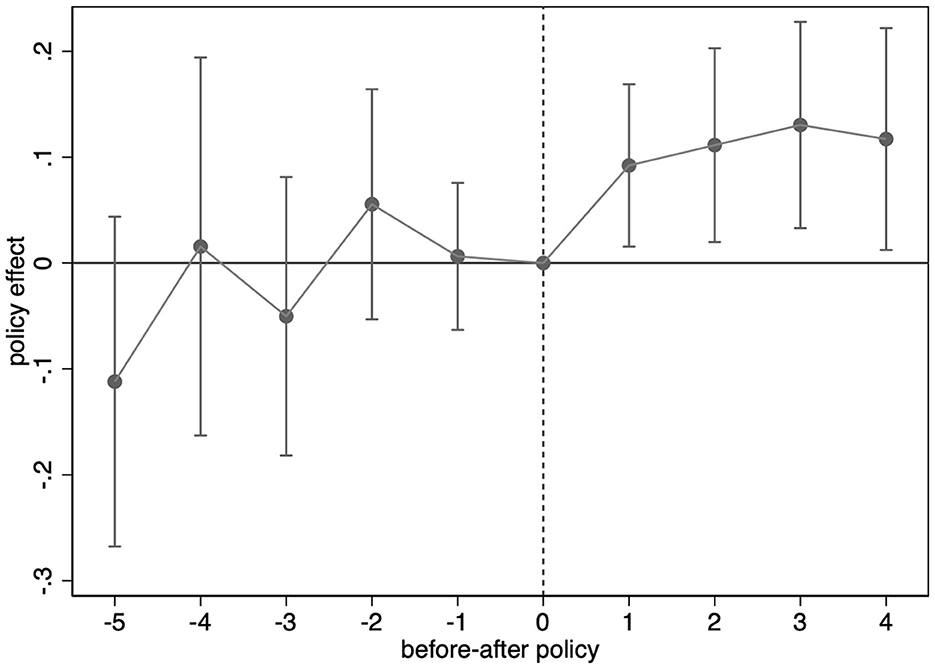

A core identifying assumption of the difference-in-differences (DID) model is the parallel trend assumption–i.e., prior to policy implementation, the treatment and control groups should exhibit similar trends in AI investment. To test this assumption, we adopt the event-study approach proposed by Jacobson et al. (1993), which enables a dynamic evaluation of policy effects over time. Specifically, we estimate the following dynamic specification:

Here, Dit denotes a set of year-specific dummy variables interacting with treatment status. The omitted category (i.e., baseline period) is set as t = 0, corresponding to the policy implementation year (2018). Coefficients δt thus capture the relative difference in AI investment between the treatment and control groups in year t, with respect to 2018.

Figure 2 presents the estimated δt coefficients and their 95% confidence intervals as an event-study plot. As shown, the pre-treatment coefficients (t < 0) are statistically insignificant and close to zero, suggesting no significant difference in trends prior to the policy. This supports the validity of the parallel trend assumption. Post-treatment, the coefficients become significantly positive, indicating that the environmental protection tax exerted a positive and time-varying effect on AI investment. This result confirms that our baseline findings are not driven by pre-existing trends.

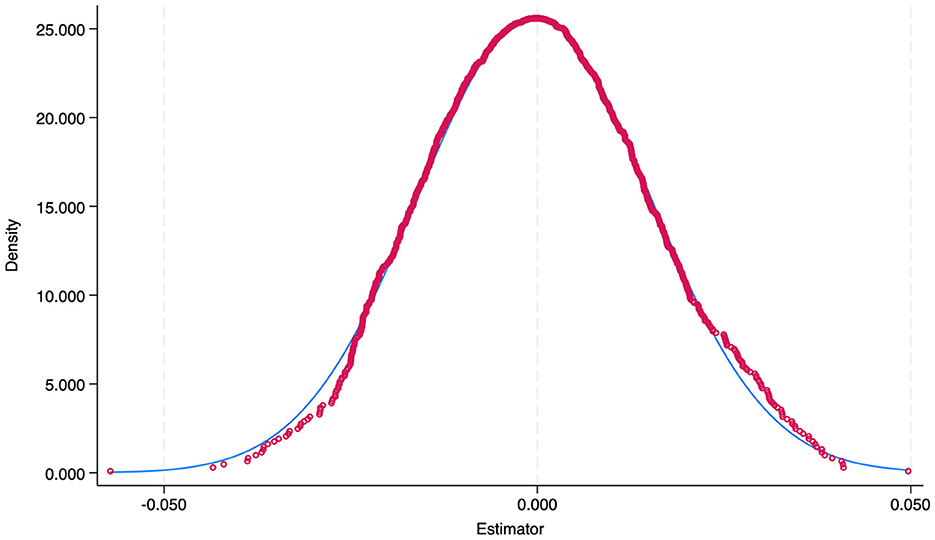

5.3.2 Placebo test

The use of the DID model to assess the impact of environmental protection tax policy on firms' AI investment may suffer from the following pseudo-regression problem, i.e., the growth of AI investment by firms in the experimental group may be unrelated to the implementation of environmental protection tax policy due to its advantages. To verify the robustness of the results, this paper conducts a placebo test along the lines of Abadie et al. (2010). Specifically, a sample of firms affected by the environmental protection tax is randomly generated by randomizing the experimental group and constructing dummy policy variables for regression analysis on the sample. The above process is repeated 1,000 times and re-estimated using model 1. Figure 3 presents the results of the simulated regression coefficients for the randomized experimental and control groups. The results show that the regression coefficients of the core explanatory variables obtained by randomization are normally distributed with means close to zero, indicating that the empirical results are less likely to be affected by random factors. This means that the positive impact of the environmental protection tax policy on corporate AI investment is not accidental, and the results of this placebo test are credible and consistent with the principle of randomness, providing strong support for the validity of the conclusions.

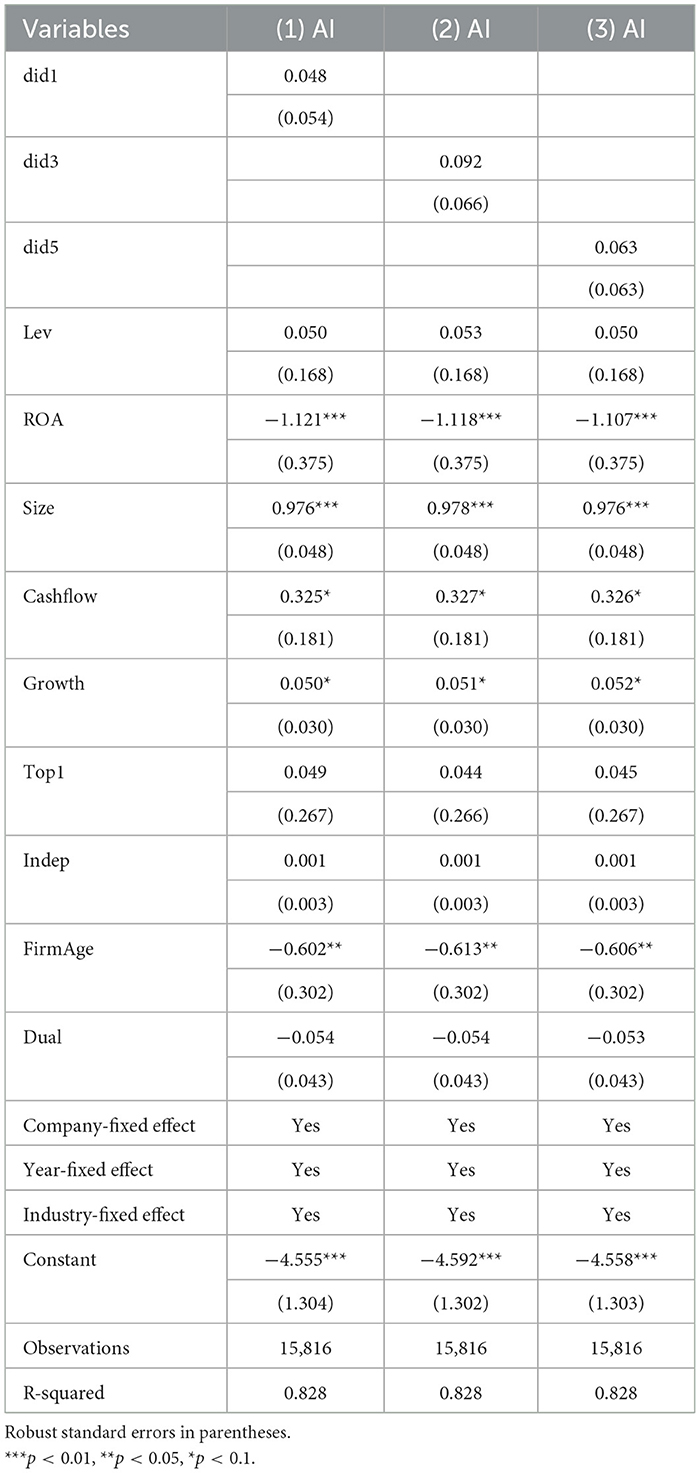

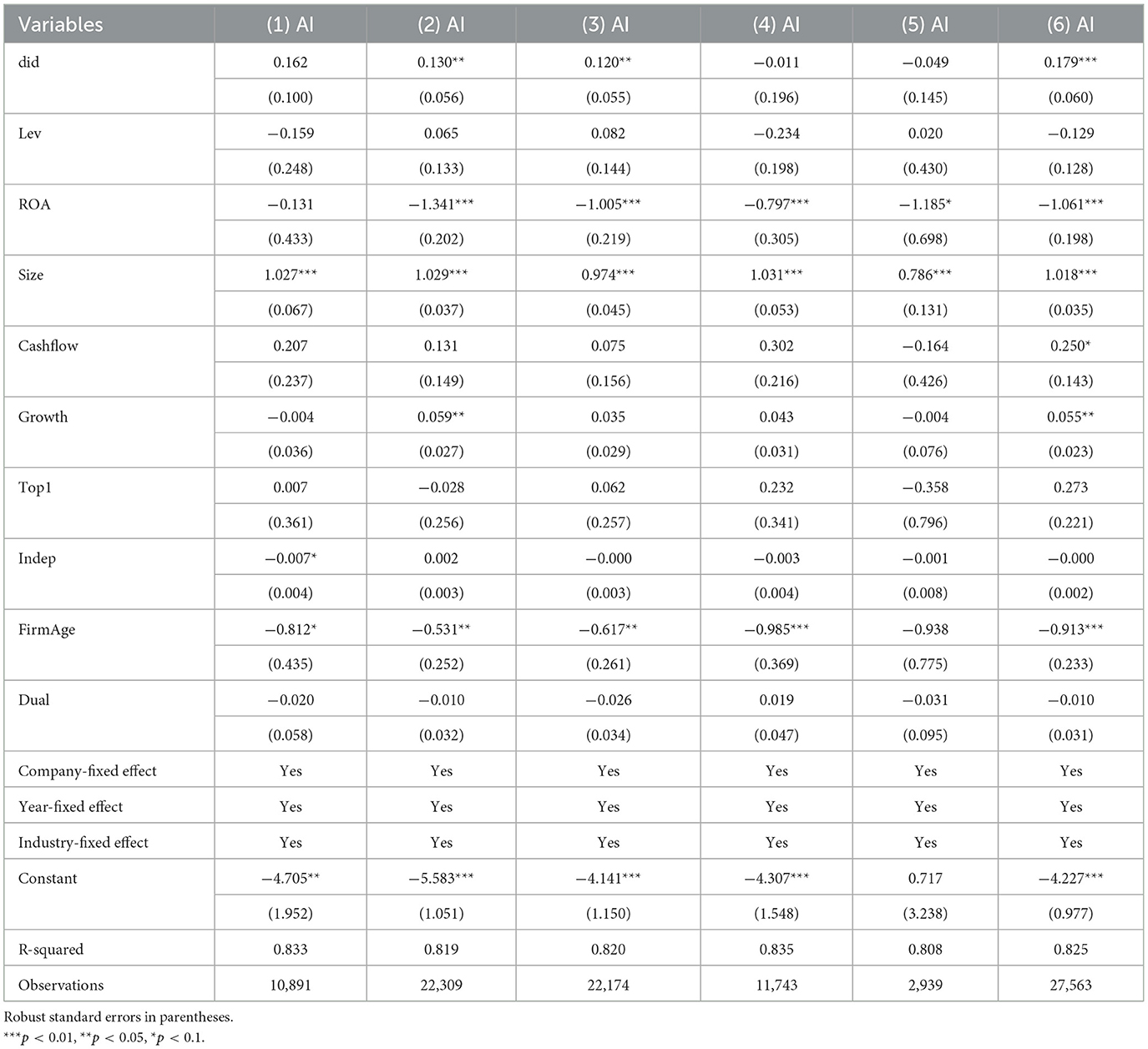

At the same time, to further verify the reliability of the identification of policy effects, this paper refers to Becker et al. (2013), and employs the method of time placebo test to conduct robustness analyses. Specifically, the actual policy implementation time point is artificially “advanced”, with column (1) of Table 4 advanced to one year before policy implementation, column (2) advanced to three years before policy implementation and column (3) advanced to five years before policy implementation, respectively, to construct the dummy did variables and conduct regressions, and the results are shown in Table 4. The regression results show that the coefficients of the policy dummy variable did do not pass the significance test under the three dummy treatment period settings, indicating that the difference in the trend of AI investment between firms in the treatment group and the control group is not significant before the actual policy is introduced. This result effectively rules out the possibility of misidentification as a policy effect due to changes in underlying trends or other external events, and further confirms that the policy impacts identified in the DID model do indeed stem from the implementation of the environmental protection tax, rather than being driven by time trends or expectancy effects.

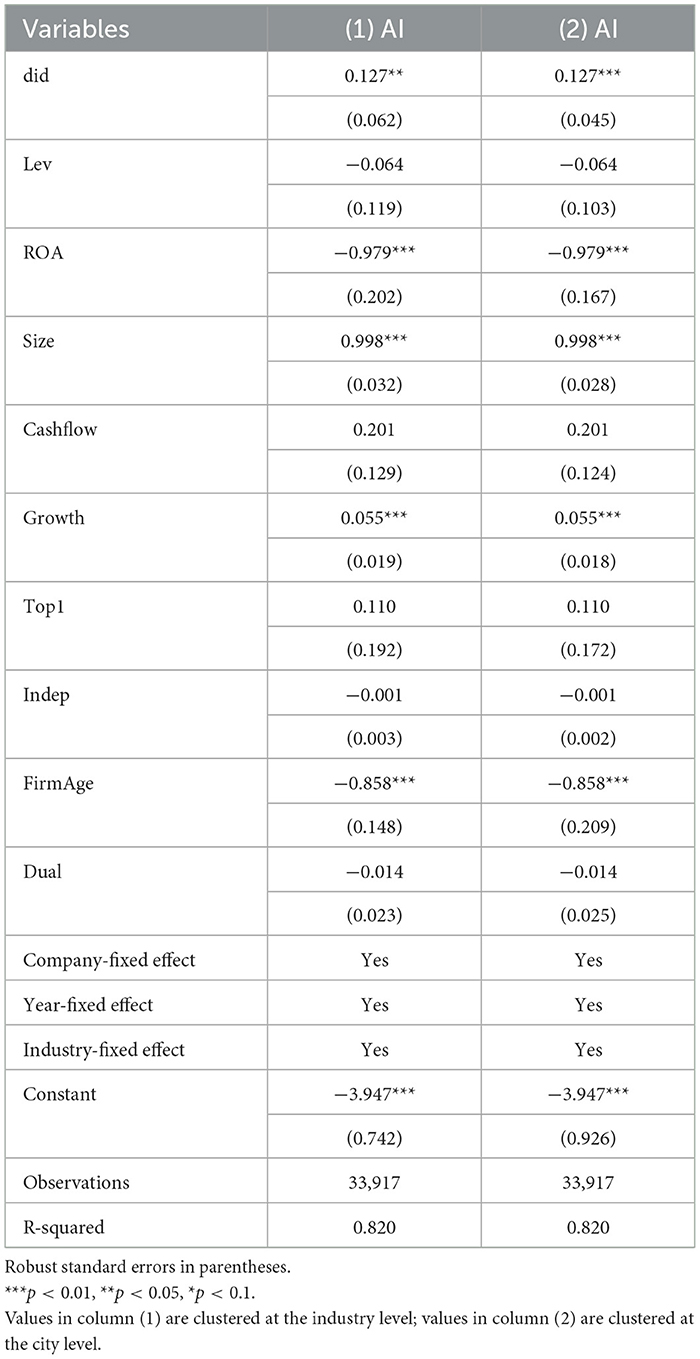

5.3.3 Adjusting the clustering hierarchy

To test the robustness of the benchmark regression results, this paper further adjusts the clustering of the standard errors by expanding them from firm-level clustering to industry-level and city-level clustering, respectively, to cope with the impact of potential intra-group correlation on the estimation results. Column (1) of Table 5 presents the results when the standard errors are adjusted to industry-level clustering, showing that the did coefficients remain unchanged, with significance dropping to the 5 per cent level, but the direction of the estimation remains unchanged, suggesting that potential intra-industry correlations do not significantly weaken the policy effects. Further clustering the standard errors to the city level, column (2) of Table 5 shows similarly robust results, with a did coefficient of 0.127 and significance restored to the 1 per cent level, suggesting that differences in the external environment at the city level have a lesser impact on the estimation results. In summary, the coefficients and significance levels of the policy variables remain stable across the different clustering approaches, suggesting that the conclusions of this paper's benchmark test are robust and valid.

5.3.4 Control of other environmental policies and competitive policy effects in the same period

To further verify whether the impact of environmental protection tax on corporate AI investment is interfered by other contemporaneous environmental policies or regional institutional reforms, this paper introduces four representative environmental policies as control variables, namely: the Low Carbon City Pilot Programme (LCCP), the Green Financial Reform and Innovation Pilot Zone (GFRIPZ), the Key Air Pollution Control Zone (Air Control Zone) and Carbon Emission Trading Pilot (CETP). The specific regression results are shown in Table 6. After including the above policies in the model, the coefficients of the policy variable did all remained significantly positive, and the values are highly consistent with the baseline regression results. Columns (1) and (2) of Table 6 show the results after controlling for the low-carbon city policy and after controlling for the pilot green financial reform zone, respectively, and the coefficient of did remains significantly positive. Column (3) of Table 6 shows that the did coefficients remained consistent with the baseline regression after the introduction of the key air pollution control zones and the pilot carbon emissions trading variables in Column (4) of Table 6, respectively. After test four competing policies, this paper controlled region × year fixed effects in Column (5) to eliminate noise from other untested green policies, the result shows that the policy effect still positive. In addition, the estimated coefficients of the above four policy variables themselves are insignificant in each model, indicating that they do not directly interfere with the estimation results of the environmental protection tax on AI investment, avoiding possible policy confounding or identification bias. After controlling for other environmental protection policies implemented during the same period, the positive incentive effect of environmental protection tax on firms' AI investment still exists robustly, which further strengthens the credibility of the empirical identification and the independence of the policy conclusions.

5.3.5 Other robustness tests

To further validate the robustness of the benchmark results, we also add the following types of robustness tests. First, the results in column (1) of Table 7 show that the policy variable did remains significantly positive after shrinking the continuous variables by 5% up and down, indicating that the benchmark test conclusions are not affected by the outliers, and that the estimation results are robust and valid. Second, column (2) of Table 7 reports the results after excluding the sample of municipalities, and the policy effect is still significantly positive, suggesting that the special governance structure and resource allocation that municipalities have did not create a driving bias in the overall estimation. Third, the regression using the complete data sample from 2010 to 2022 shows a did coefficient of 0.206 (column (3) of Table 7), with significance still maintained at the 5 per cent level, further confirming that the positive effect of environmental protection tax on firms' AI investment remains significant under the extended observation period condition. Fourth, the results in Column (4) of Table 7 indicate that the policy impact still exists under the scenario of narrowing the observation period to three years before and after the policy implementation (2015-2021), albeit with a slightly weakened effect, but in the same direction. In summary, the regression results under different sample treatments and time window settings robustly support the benchmark findings, further enhancing the reliability and policy explanatory power of the empirical results.

5.4 Mechanism analyses

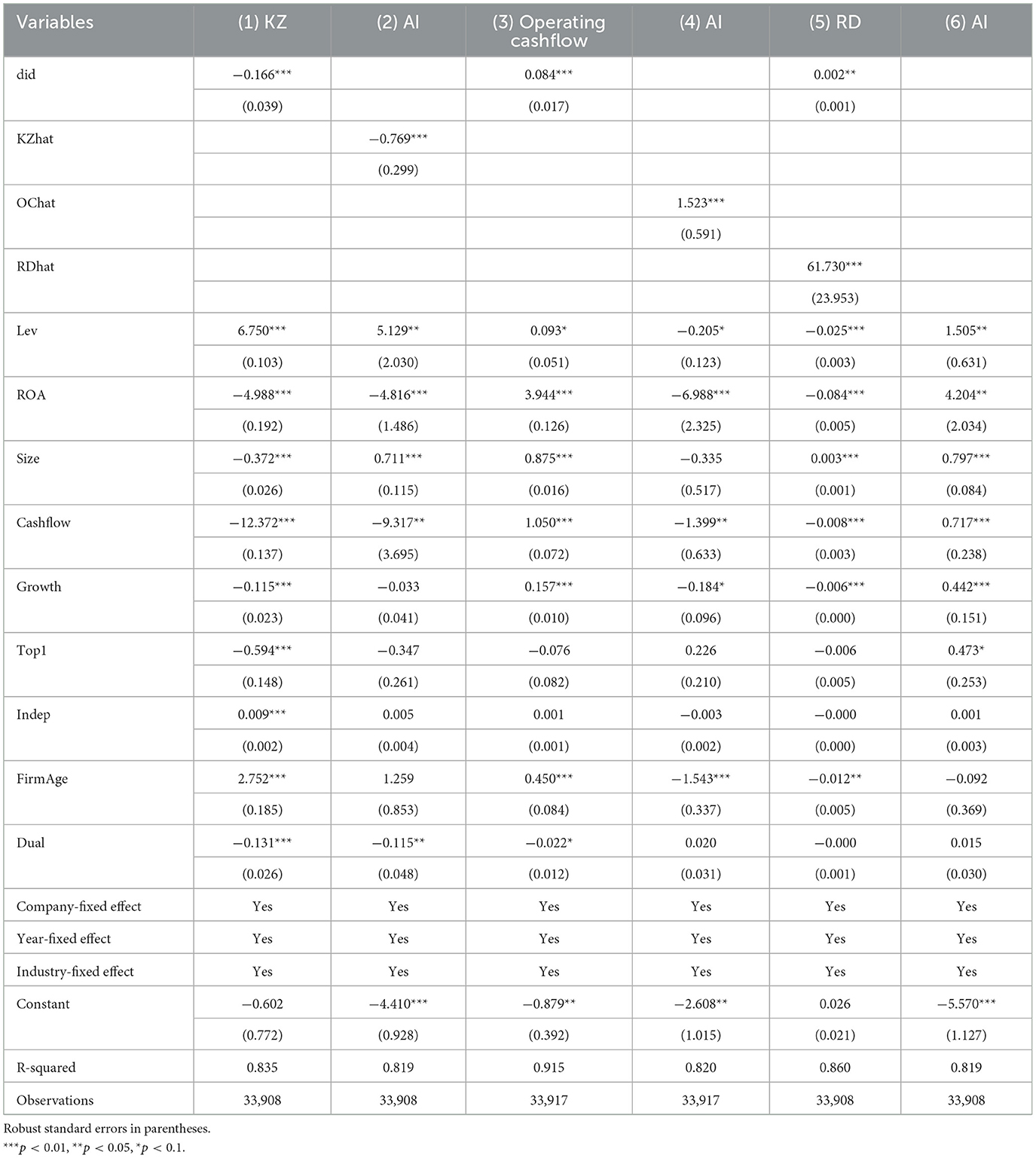

To deeply explore the impact of the environmental fee to tax policy on firms' artificial intelligence (AI) investment, drawing on Di Giuli and Laux (2022)'s methodology, we use a two-stage regression method to obtain the estimation results of the transmission mechanism of the impact of the environmental protection tax on the level of firms' AI investment. The basic principle of this method is the same as that of the instrumental variables method, which can overcome the unfavorable interference of confounding variables in identifying causal mediating effects (MacKinnon and Pirlott, 2015). In a two-stage regression, the first stage consists of M (the mediating amount) on X (independent variable) to obtain the predicted value of M. In the second stage, the predicted value of M is regressed by Y (dependent variable), and the regression coefficient between the predicted value of M and Y represents the causal estimation of M and Y. Specifically, we hypothesize that the environmental fee reform tax policy affects AI investment through two channels: financing constraints and innovation output, where X represents the environmental fee reform tax policy, M is the mediating variable of the financing constraints and the innovation input-output mechanism, and Y is the firm's AI investment.

The steps of the two-stage regression method are as follows: the first stage tests the effect of did on the mediating variable by constructing the following model

where M denotes the mediating variables, financing constraints and innovation inputs and outputs. Controls denotes the control variables in model 1.

Based on the regression results of model 3, the predicted value of M can be obtained (). Replacing did with in model 1, the estimated model of the second stage can be obtained:

Where the coefficient γ1 estimates the effect on firms' AI investment due to the mediating variable.

5.4.1 Financing constraints test

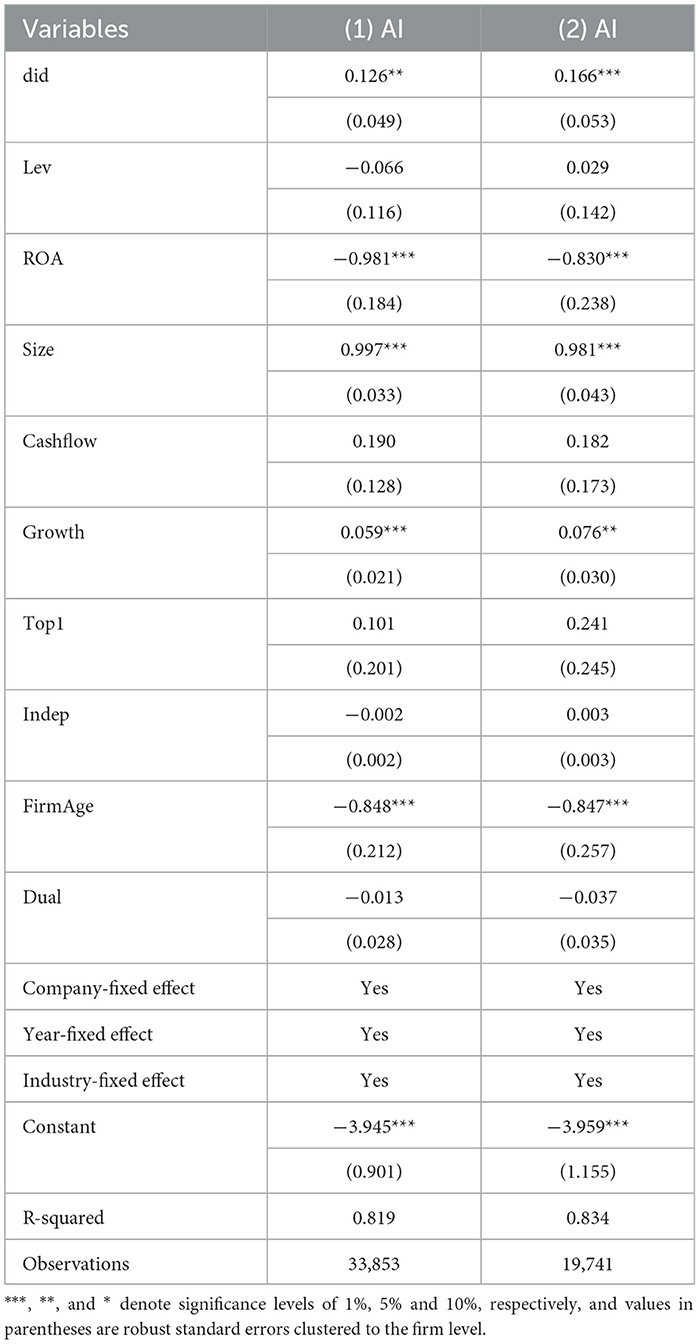

We first examine how the environmental fee-to-tax policy affects firms' AI investment through financing constraints. The variables of the financing constraint mechanism include the KZ index and the internal cash flow (OC) index of the enterprise, for the KZ index, while for OC, the sum of profit and depreciation is used to measure it, in the analysis of the financing constraint mechanism, the effect of the environmental fee reform tax policy on the KZ and the OC is demonstrated by the regression results in Column (1) of Table 8 and Column (3) of Table 8. The regression results in column (1) of Table 8 show that the environmental fee to tax policy significantly reduces the value of KZ, suggesting that the policy reduces the financing difficulties of firms by alleviating the financing constraints. Based on this regression, we further obtain the predicted value of KZ, KZhat. Table 8 column (2) shows that KZhat has a positive effect on AI investment, which implies that the environmental protection tax law stimulates firms' AI investment by alleviating financing constraints. Similarly, the regression results in column (3) of Table 8 show that the impact of the environmental fee-to-tax policy through the OC mechanism also has a positive effect on corporate AI investment. Specifically, the regression results of OChat in column (4) of Table 8 show that its effect on AI investment is significantly positive, indicating that the increase in cash flow helps firms to increase AI investment. Taken together, the above conclusions, hypothesis 2 of this paper is verified, and the environmental tax policy is effective in alleviating corporate financing constraints, thus increasing AI investment.

5.4.2 Testing of technological innovation mechanisms

In the analysis of the innovation input-output mechanism, we assume that firms' research and development (RD) investment is an important channel of action for policies to influence AI investment. In columns (5) and (6) of Table 8, the impact of environmental fee tax reform policies on innovation input-output mechanisms is demonstrated. The regression results in column (5) of Table 8 show that the environmental fee to tax policy significantly increases RD inputs. This result suggests that the policy promotes technological innovation by incentivizing firms to increase RD investment, which in turn promotes AI investment. On this basis, we obtain the predicted value of RDhat for RD investment, and the results in column (6) of Table 8 show that RDhat significantly promotes AI investment. Taking the above results together, we are confident to believe in the important mechanism effect of technological innovation, which verifies the hypothesis 3. It has also been pointed out that environmental policies can motivate firms to promote new technological means to enhance productivity and efficiency by increasing R&D efforts (Yang et al., 2012).

5.5 Heterogeneity test

5.5.1 Heterogeneity of enterprise ownership

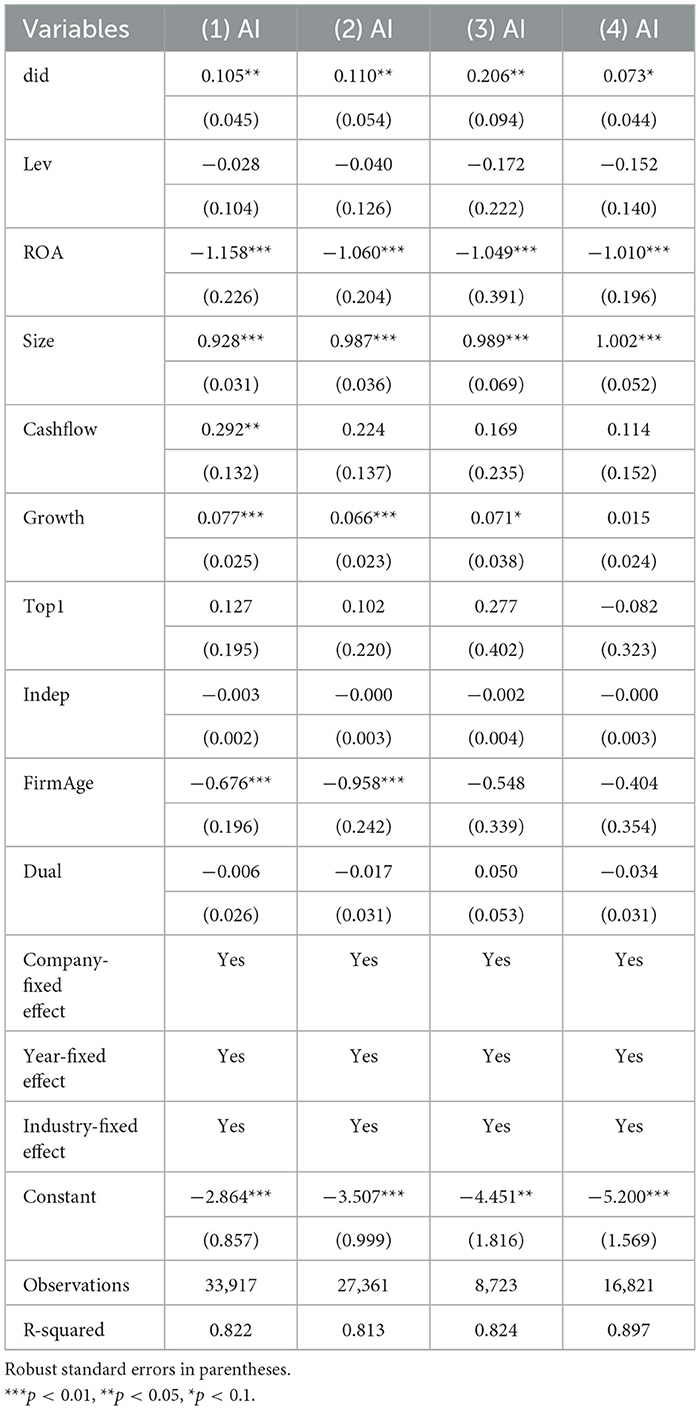

First, from the perspective of the nature of the firm, private firms are likely to show greater responsiveness in AI investment, distinguishing them from state-owned enterprises. Private firms have higher market flexibility and innovation dynamics, and they are more inclined to improve their competitiveness by increasing AI investment in the face of environmental tax and fee reforms. SOEs, on the other hand, may be more rigid in their resource allocation and decision-making mechanisms, and are slower to respond in the face of policy changes. To test this speculation, we group the sample by firm nature and conduct model 1 regression analysis. Columns (1) and (2) of Table 9 show the effect of the environmental tax policy on AI investment in the sample of SOEs vs. the sample of non-SOEs, respectively. The effect of environmental tax policy on AI investment is positive and significant in the sample of non-state-owned enterprises. This indicates that private enterprises have stronger resilience and innovation drive in the face of environmental tax burden reform, and therefore are more inclined to increase AI technology investment. In summary, private enterprises are more active in AI investment than state-owned enterprises, and our speculation is verified.

5.5.2 Heterogeneity of industry characteristics

Second, in terms of industry type, manufacturing companies may rely more on AI technology to improve productivity and reduce environmental costs, distinguishing them from non-manufacturing companies. Manufacturing firms are more sensitive to technological innovation and cost control, and thus may be driven by policies to increase AI investment. Non-manufacturing firms, on the other hand, are influenced by other industry factors and may fail to significantly increase AI investment. To test this hypothesis, we grouped the industry categories and performed model 1 regression analysis. The regression results, as shown in column (3) of Table 9, indicate that in the sample of manufacturing firms, the environmental tax policy has a positive and significant effect on AI investment, suggesting that manufacturing firms rely more on AI technology to improve productivity and reduce environmental costs. On the contrary, Column (4) shows a negative and insignificant effect of environmental tax policy on AI investment in the sample of non-manufacturing firms, indicating that non-manufacturing firms may be constrained by other factors under the influence of the policy and fail to significantly increase AI investment. This result is consistent with findings in the existing literature that manufacturing firms tend to be more sensitive to technological change and cost control (Rounaghi et al., 2021). In summary, manufacturing firms perform more positively in terms of policy-driven AI investment.

5.5.3 Heterogeneity of city characteristics

Third, from the perspective of city type, firms in non-resource-based cities may rely more on AI technology to enhance industrial competitiveness, distinguishing them from resource-based cities. Resource-based cities have a more homogeneous economic structure and over-reliance on the resource extraction industry, with relatively low demand for the application of AI technology, and thus a weaker response to AI investment in the face of environmental tax policies. While non-resource cities rely more on high-value-added industries and high-tech technologies in the process of industrial transformation, the environmental tax policy has a more significant role in promoting AI investment. To verify this speculation, we group the cities based on whether they are resource-based or not, and perform model 1 regression analysis. The regression results show that in column (5), resource-based city sample analysis results, the effect of environmental protection tax policy on AI investment is negative and insignificant. While in Column (6) non-resource-based city sample results, the effect of environmental protection tax policy on AI investment is positive and significant, indicating that enterprises in non-resource-based cities rely more on AI technology to enhance industrial competitiveness in the process of transitioning to high-value-added industries. In summary, the results of the heterogeneity test indicate that the impact of the environmental fee-to-tax policy on AI investment exhibits significant heterogeneity across different types of enterprises, industries and cities. Our conjecture is validated that the type of firm, nature of industry and urban context are key determinants of the effect of the policy. Overall, the effects of policies are subject to firm characteristics and the economic structure and development stage of the region in which they are located, a finding that is consistent with the relationship between technological innovation and policy incentives proposed by Jiang and Xu (2023), which suggests that the effectiveness of policy changes in promoting firm innovation is profoundly affected by firm type and regional economic structure.

6 Case study: artificial intelligence development in listed companies in the agri-food and food processing industries

6.1 Current status of artificial intelligence development in agri-food and food processing enterprises

As an important part of the national economy, the agri-food and food processing industry is characterized by a long industrial chain, complex production processes and significant pollution emissions (Asgharnejad et al., 2021). Against the backdrop of increasing environmental pressure, the pace of digital and intelligent transformation of the industry has accelerated, and artificial intelligence (AI) technology is gradually changing the traditional mode of production and management. In this paper, based on the industry classification standard of the China Securities Regulatory Commission (CSRC), this study defines 4,870 listed company samples with industry codes corresponding to agriculture, food manufacturing, and related sectors as belonging to the agriculture, food, and food processing industries. The regression model is established based on model 1 to analyze, and the empirical results are shown in Table 10.

The regression results show that the coefficient of the policy dummy variable did is 0.231, which is significantly positive at the 5% significance level, indicating that the environmental protection tax policy effectively promotes the AI investment of agri-food and food processing enterprises. Regarding the control variables, enterprise size (Size) has a significant positive impact on AI investment, indicating that larger agri-food and food processing enterprises have stronger resource integration and technology absorption ability, and have more advantages in intelligent transformation. Profitability (ROA) is significantly negatively correlated with AI investment, which may reflect the lower urgency of transformation and upgrading of highly profitable enterprises in the short term. Other variables such as Cashflow, Growth and Major Shareholder Shareholding (Top1) are not significant but in a reasonable direction, further validating the robustness of the model setup.

Overall, the agri-food and food processing industry, in the face of the pressure of environmental protection tax policy, not only helps to cope with the increasingly stringent environmental protection requirements, but also enhances the production efficiency and green competitiveness by increasing the investment in AI technology. This result verifies Hypothesis 1 of this paper: environmental protection tax has a significant positive impact on AI investment in Chinese agri-food and food processing companies. This finding confirms the theoretical hypothesis that digital technology empowers the green transformation of traditional industries, and also provides empirical support for the future green and intelligent development path of the agri-food and food processing industry.

6.2 Mechanisms of artificial intelligence to promote the level of AI investment in agri-food and food processing enterprises explored

This paper explores the intrinsic mechanism of AI to promote the green transformation of agri-food and food processing enterprises from four dimensions: management empowerment, investment empowerment, operation empowerment and labor empowerment. In terms of management empowerment, AI technology effectively reduces the internal management costs of enterprises through big data analysis and intelligent monitoring systems, and improves the transparency of environmental information in the production process (Sgarbossa et al., 2022), such as intelligent sensing equipment that can monitor real-time emission indicators, assisting management to optimize the decision-making process, and significantly enhancing environmental compliance. At the same time, the AI-driven supply chain management system also optimizes upstream and downstream environmental risk control and improves overall green synergy efficiency (Pasupuleti et al., 2024). In terms of investment empowerment, the AI-assisted prediction model and risk assessment mechanism improves the efficiency of capital allocation, enabling agri-food and food processing enterprises to more accurately identify high-potential green innovation projects (Mustafa et al., 2024), and the financial pressure brought about by the environmental protection tax policy further incentivizes enterprises to prioritize investment in the field of intelligent and green technologies, releasing more Technology innovation power. In terms of operational empowerment, AI technology improves the efficiency of energy and raw material utilization and reduces resource wastage by optimizing production process parameters. The application of intelligent robots and automated assembly lines also reduces the risk of human intervention and pollution emissions. In terms of labor empowerment, AI technology replaces repetitive and high-risk tasks in traditional labor-intensive jobs, which not only significantly improves labor productivity, but also optimizes the labor structure, improves the quality of human capital, and further strengthens the enterprise's green innovation capability (Sgarbossa et al., 2022). In summary, AI, as an enabling tool, plays a multi-dimensional and systematic facilitating role in the green transformation process of the agri-food and food processing industries.

6.3 Discussion of heterogeneity in the level of smart investment in agri-food and food processing firms promoted by artificial intelligence

It has been shown that the application of AI technology in the agri-food and food processing industry presents significant heterogeneous characteristics (Misra et al., 2020). This part will systematically analyze the differentiated impact of AI in promoting the green transformation process of the industry from the dimensions of enterprise size, profitability, and geographical location, with a view to providing targeted policy recommendations for different types of enterprises.

In terms of enterprise size, Chuang et al. (2009) found a positive correlation between enterprise size and technology adoption, specifically, large agri-food enterprises have an advantage in AI-driven green transformation. The AI technology adoption rate of large enterprises (with annual revenue of more than 5 billion yuan) reaches 73.6%, significantly higher than that of small and medium-sized enterprises (48.2%). This may stem from the fact that large enterprises have more adequate capital investment and technical talent reserves. At the same time, the AI application of large enterprises usually presents the characteristics of the whole chain, from raw material procurement, production and processing to logistics and distribution, and the promotion of green transformation is more comprehensive. From the perspective of corporate profitability, Rahmandad (2012) indicate that the trade-off between short-term profits and long-term technological development was found. Low and medium profitability firms preferred AI as a dual tool for improving viability and meeting environmental requirements. In terms of geographic location, the research of Sun et al. (2024) on regional imbalances in digital development concludes that the AI adoption rate of the sample firms in the East Coast region is significantly higher than that in the Midwest. The AI applications of the eastern enterprises focus more on intelligent production management and whole-chain carbon emission monitoring, while the enterprises in the central and western regions focus more on AI applications in raw material procurement and primary processing.

Further analyses show that firms located in regions with strict environmental regulation (grouped by frequency of environmental inspections) have a higher proportion of AI applications in environmental monitoring and pollution control than firms in other regions, reflecting the role of the institutional environment in guiding firms' technology choices and suggesting that environmental regulation may be an important external driver of firms' adoption of green AI technologies (Sun et al., 2024). Meanwhile, within the agri-food and food processing industries, AI adoption in different sub-industries showed significant differences: the AI adoption rate in the dairy and beverage manufacturing industry was significantly higher than that in the grain and oil processing industry and the meat processing industry. The former has more in-depth AI application in production process control and quality management, and contributes more significantly to energy efficiency improvement and waste reduction. It is worth noting that the heterogeneity of AI application among different sub-sectors is also reflected in the specific path of contribution to green transformation. For example, in meat processing enterprises, AI is mainly used to reduce energy consumption by optimizing cold chain logistics and processing techniques, while in grain and oil processing enterprises, AI is more often applied to raw material selection and processing parameter optimization to reduce resource waste. This path difference reflects the deep integration of AI technology with industry production characteristics (Addanki et al., 2022).

In summary, AI technology presents multi-dimensional heterogeneous characteristics in promoting the green transformation of the agri-food and food processing industries. Future policy formulation should take these heterogeneities into full consideration, and adopt differentiated support measures for enterprises of different sizes, profitability levels, locations and technological bases, so as to improve the prevalence and effectiveness of AI technology application. At the same time, for the diversity within the industry, cross-industry sharing of AI application experience and technology diffusion should be encouraged to promote the green and synergistic transformation of the overall industry.

7 Conclusion

This paper evaluates the impact of the 2018 Environmental Protection Tax Law on corporate AI investment by exploiting a quasi-natural experiment and constructing a difference-in-differences model using panel data from 2010 to 2022. Empirical results confirm that the policy significantly increases AI investment, primarily by alleviating financing constraints and stimulating R&D input. These effects are more pronounced in state-owned enterprises, manufacturing firms, and enterprises located in resource-based cities.

Particular attention is devoted to the agri-food and food processing sector, which plays a dual role in China's green transformation. On one hand, it is traditionally associated with high pollution levels, including organic wastewater, VOC emissions, and packaging waste; on the other, it is essential to national food security and supply chain resilience. Our analysis reveals that firms in this sector are highly sensitive to environmental regulation and exhibit strong responsiveness to AI-driven upgrading. For instance, Yili Group has deployed AI-based microbial detection systems and automated disinfection equipment to enhance both food safety and emission control, while Three Squirrels Co., Ltd. has adopted AI in intelligent warehousing and logistics routing to reduce energy consumption and minimize operational carbon footprints. These cases demonstrate how environmental taxes can catalyze substantive innovation in traditionally low-tech, high-burden sectors.

Building on these findings, this paper offers three sets of policy recommendations:

1. Refine tax policy design: Environmental tax mechanisms should be optimized to enhance the synergy between regulation, innovation, and transformation. Differentiated tax rates and incentive schemes should guide high-emission sectors–especially traditional industries such as agriculture and food processing–toward smart green upgrading. Agri-processing zones may serve as pilot areas for tax-based digital retrofitting programs.

2. Strengthen support for SMEs: Targeted fiscal and financial support should be directed to non-state-owned and small to medium-sized enterprises. Policies may include accelerated depreciation for green-AI assets, subsidized innovation loans, and credit guarantees. In rural areas, tax relief should be paired with investments in digital infrastructure and workforce upskilling to ensure inclusive transformation.

3. Promote regional coordination: Environmental taxation should be integrated into broader green development strategies in resource-based cities. Tools such as AI-supported pollution monitoring, digital agriculture platforms, and low-carbon logistics systems can accelerate the shift toward low-emission, high-value-added industrial structures.

In sum, this study contributes new empirical evidence on how environmental tax policy shapes firms' AI investment, with particular emphasis on sectors that combine ecological risk and industrial strategic importance. It also demonstrates that the agri-food industry–often overlooked in digital transformation discussions–can serve as a vanguard for policy experimentation. Future research should extend the observation window to capture post-2022 developments in generative AI and investigate whether similar mechanisms hold for other emerging technologies such as blockchain or IoT in agriculture. Cross-national comparisons will further enrich our understanding of how environmental and digital agendas can be effectively aligned in diverse institutional settings.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

GH: Writing – original draft. BL: Writing – review & editing. JL: Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abadie, A., Diamond, A., and Hainmueller, J. (2010). Synthetic control methods for comparative case studies: estimating the effect of California's tobacco control program. J. Am. Stat. Assoc. 105, 493–505. doi: 10.1198/jasa.2009.ap08746

Addanki, M., Patra, P., and Kandra, P. (2022). Recent advances and applications of artificial intelligence and related technologies in the food industry. Appl. Food Res. 2:100126. doi: 10.1016/j.afres.2022.100126

Andeobu, L., Wibowo, S., and Grandhi, S. (2022). Artificial intelligence applications for sustainable solid waste management practices in Australia: a systematic review. Sci. Total Environm. 834:155389. doi: 10.1016/j.scitotenv.2022.155389

Asgharnejad, H., Khorshidi Nazloo, E., Madani Larijani, M., Hajinajaf, N., and Rashidi, H. (2021). Comprehensive review of water management and wastewater treatment in food processing industries in the framework of water-food-environment nexus. Compre. Rev. Food Sci. Food Safety 20, 4779–4815. doi: 10.1111/1541-4337.12782

Becker, S. O., Egger, P. H., and Von Ehrlich, M. (2013). Absorptive capacity and the growth and investment effects of regional transfers: a regression discontinuity design with heterogeneous treatment effects. Am. Econ. J. 5, 29–77. doi: 10.1257/pol.5.4.29

Bhatia, L., Jha, H., Sarkar, T., and Sarangi, P. K. (2023). Food waste utilization for reducing carbon footprints towards sustainable and cleaner environment: a review. Int. J. Environ. Res. Public Health 20:2318. doi: 10.3390/ijerph20032318

Cheng, Z., and Kong, S. (2022). The effect of environmental regulation on green total-factor productivity in China's industry. Environ. Impact Assess. Rev. 94:106757. doi: 10.1016/j.eiar.2022.106757

Chuang, T.-T., Nakatani, K., and Zhou, D. (2009). An exploratory study of the extent of information technology adoption in smes: an application of upper echelon theory. J. Enterprise inform. Managem. 22, 183–196. doi: 10.1108/17410390910932821

Cui, S., Wang, Y., Xu, P., and Li, L. (2024). Ecological welfare performance, industrial agglomeration and technological innovation: an empirical study based on beijing-tianjin-hebei, yangtze river delta and pearl river delta. Environm. Dev. Sustainab. 26, 1505–1528. doi: 10.1007/s10668-022-02772-y

Di Giuli, A., and Laux, P. A. (2022). The effect of media-linked directors on financing and external governance. J. Financ. Econ. 145, 103–131. doi: 10.1016/j.jfineco.2021.07.017

Du, K., Cheng, Y., and Yao, X. (2021). Environmental regulation, green technology innovation, and industrial structure upgrading: the road to the green transformation of chinese cities. Energy Econ. 98:105247. doi: 10.1016/j.eneco.2021.105247

Gao, X., Liu, N., and Hua, Y. (2022). Environmental protection tax law on the synergy of pollution reduction and carbon reduction in China: evidence from a panel data of 107 cities. Sustain. Prod. Consumpt. 33, 425–437. doi: 10.1016/j.spc.2022.07.006

Guo, K., Cao, Y., Wang, Z., and Li, Z. (2022). Urban and industrial environmental pollution control in China: an analysis of capital input, efficiency and influencing factors. J. Environ. Manage. 316:115198. doi: 10.1016/j.jenvman.2022.115198