- Department of Finance and Accounting, Transilvania University of Brașov, Brașov, Romania

Russia’s war against Ukraine, which originated in the midst of the COVID-19 pandemic, is undoubtedly one of the defining events of this current period, expected to exert a significant impact on the entire world’s economies. This study aims to determine whether the conflict between Russia and Ukraine has a significant impact on European Union (EU) Member States, particularly on the economic output of the EU countries, in the post-pandemic context. Difference-in-difference methodology alongside panel data econometric techniques are used to study the relationship between the effects of war, reflected in the deepening energy crisis, inflation, limited trade relations, restructuring of governmental expenditures, and the migrant crisis, together with economic freedom and governance quality as elements of neoliberal doctrine, and the economic wealth of EU Member States for the 1995–2021 period. In light of current research, the results prove that war has a significant impact on the economic output of the European Union structure, especially for the EU countries that rely the most on Russia’s energy imports. Using the difference in difference analysis, the impact of war on gdp_cap is evaluated as a drop in economic output of −405.08 euros per capita in the considered European countries. Applying panel regression analysis, defense and military expenditures, inflation, lack of trade openness, and increased levels of energy dependence negatively impact economic growth in the EU economies. In addition, this study provides essential information for public officials in order to prepare the EU economy for the recovery from war shocks in the forthcoming period, taking into account the study’s policy recommendations regarding energy reliance, restructuring public expenditure, prioritizing investment, and improving governance quality.

1 Introduction

Russia’s invasion of Ukraine and the ensuing conflict, which started in February 2022 and is still running, has numerous negative direct and indirect effects upon the economies of many countries, especially the ones which imposed sanctions on Russia and obviously upon the latter.

The effects manifested upon international trade, foreign investments, prices, multinational companies, and supply and distribution chains. Russia and Ukraine are important players on the international markets, exporting significant volumes of oil, natural gas, coal, cereals, neon, titanium, palladium, ammonium, nitrates, and other products.

As such, the military conflict-induced crisis significantly impacted the global supply chain. Immediately after the start of the war, the oil price rose above 100 USD per brail, as Russia is an important international oil supplier, covering in excess of 10% of the global oil demand. The price of cereal also increased by more than 5%. The increase in oil, natural gas, raw materials, and food prices has boosted global inflation and hindered the recovery of the global and EU’s economy after the COVID-19 pandemics. This was caused by the numerous and strong commercial relations the European Union (EU) countries had with Russia, with many of them being energy dependent on Russia. The living standards of the EU population have dropped, and the constant fear of war escalation affects the wellbeing of the citizens, already shaken by the COVID-19 pandemic.

The true dimension of the Russia-Ukraine conflict’s consequences has not yet been fully evaluated as the war continues, with the literature on this topic requiring a permanent update.

The current paper helps enhance knowledge of this topic using a data panel analysis, for a sample of EU countries, considered to be among the most affected by this crisis.

This study aims to determine whether the conflict between Russia and Ukraine significantly impacts the economic output and economic costs incurred by EU countries, in the post-pandemic context.

Both difference-in-difference regression, as well as panel data econometric techniques, are used to study the effects of war on economic wealth. In the panel data analysis, the effects of war on EU Member States’ economic wealth are captured through its main consequences, such as the deepening of the energy crisis, inflation, reduced trade relations, restructuring of governmental expenditures, and the migrants’ crisis, together with economic freedom and governance quality as elements of the neoliberal doctrine.

Thus, the present work has the following research tasks:

• A short review of literature on the same topic;

• Performing a difference-in-difference regression to quantify the impact of war on energy dependent EU countries, in the short term;

• Applying specific panel regression econometric techniques to better understand the relation between war consequences, focusing on increasing inflation rates, defense expenditures, energy dependency together with renewable energy sources, trade, migration phenomena, investment and governance quality, and economic output in the EU sample.

The novelty and originality of this research lie both in the methodological approach and in the results obtained, highlighting the importance of urgently addressing energy dependency within the European Union and targeting investments in local and renewable energy sources in line with the Union’s environmental objectives, considering the significant impact of renewable sources on the economy and the environment. Although the quality of governance and its link to economic welfare have been topics of interest in the field of finance, especially from a neoliberal perspective (Rindermann et al., 2015; Alam et al., 2017; Liu et al., 2018; Dincă et al., 2021), their implications for welfare and economic progress in the context of war have not often been addressed in the literature studied, as far as we have been able to determine. Thus, taking into consideration the above remark, this paper employs a different approach to analyzing the economic impact of the Russia–Ukraine war compared to the current literature, accounting for variables specific to the neoliberal doctrine, such as quality of governance and economic freedom, filling the gap and further exploring the link between war effects, good governance, and economic growth. The main results of the paper can be useful not only for academics and researchers, but also for policymakers.

The rest of the paper is organized as follows: Section 2 presents the literature review; materials and methods are addressed in Section 3; in Section 4 are presented the obtained results; Section 5 is dedicated to discussions, whilst conclusion and recommendations are presented in Section 6.

2 Literature review

The Russian aggression’s induced crisis and its consequences upon national, regional, and global economy are a subject that requires permanent attention from political leaders, and international organizations, as well as from the academic and research environment.

There are a number of studies that approach the Russia-Ukraine war either from the perspective of the negative effects that impact the global economy, or from ideological and political perspectives.

The Russia-Ukraine conflict and its negative consequences are approached from both cost- and human-loss perspectives and from ideological perspectives. Drawing attention to the war’s escalation into a new cold war, or even worse, into World War III, Raj and Singh (2023) explain this crisis from the perspective of the two current dominant theories of international policies, respectively realism and liberalism. The authors state that for realists, one of the main causes of war is their perceived threat of NATO expansion for their national security, whereas for liberals, the danger stems from an illiberal Russia.

The literature has highlighted the implications of Russia’s declaration of war from a variety of viewpoints, ranging from the impact on the country’s economy, international trade, food and energy prices, to the impact on financial systems, the environment, and the effects on the population’s mental health, among others.

From a global viewpoint, considering the analysis of a series of risk indicators, including the Geopolitical Risk (GPR) index, Caldara et al. (2022) anticipated in 2022 that the Russian conflict will diminish the global gross domestic product (GDP) by at least 1.5%, while inflation is forecasted to rise by roughly 1.3 percentage points.

To assess the impact of the negative effects generated by this conflict upon national economies and upon international trade, the researchers use various quantitative and qualitative methods. Benson (2023) applied the Generalized Method of Moments (GMM) methodology to evaluate the impact of the Russia–Ukraine war on international trade and net foreign investments. The results of his study show a significant increase in military expenditures, respectively decrease in net foreign investments (FDI), as well as a deterioration of international trade relations and traditional supply chains that existed prior to the crisis. Moreover, the paper of Mansury et al. (2023) demonstrates that an increase in trade openness reduces conflict involvement. The study of Borin et al. (2022) goes in the same direction of analysis, quantifying the impact of the restrictive measures and sanctions imposed on Russia upon international trade. In the first stage, the authors apply the general equilibrium trade model created by Antràs and Chor (2018), whereas in the second stage, they use the Bachmann et al. (2022) model. Their results show that Russia will be the most affected, however, even the countries that imposed or applied sanctions upon Russia will experience repercussions and losses, having problems diversifying their energy sources away from Russia.

Several studies approached the impact of the war upon commodity prices and the global market (Alam et al., 2022; Mbah and Wasum, 2022; Darmayadi and Megits, 2023), revealing the strong links between commodities and markets and the challenges for the political decision factors to find alternative sources for the merchandise previously supplied by Russia. The EU countries find themselves as one of the most affected economies by this war started by Russia against Ukraine, facing the management of the 10 million Ukrainian refugees, spiking costs of energy, and identifying new suppliers of natural gas and other raw materials at costs much higher compared to the ex-ante crisis period.

Ali et al. (2022) examine the impact of the Russian-Ukraine conflict on African countries, focusing on the detrimental consequences of the war on the energy and food sectors, considering the high imports of the African states. Providing an inflation-related approach, when analyzing the impact of the Russian war on the European regions, Sohag et al. (2022a) demonstrate that political conflict significantly impacts food prices, and together with rising energy costs, it triggers long-term inflation. Using a sectoral panel model, Hutter and Webber (2022) study the consequences of the Russian conflict and the energy sector in Germany, alongside the effects it produced in the labor market in the short run. Eetayib (2022) analyzes the impact of oil and gas prices on industrial production in the G7 countries in the context of the 2022 Russian-Ukrainian war, stressing both favorable and undesirable effects on industrial output in the selected states. As Darmayadi (2023), Prohovos (2022), Liadze et al. (2022), and Celi et al. (2022) explain, the European countries are most affected by the conflict considering the proximity and the disrupted trade relations with Russia in the context of a dependency in terms of gas, oil, and food supply, which translates into a deepening energy and resource crisis that puts pressure on budgets and on the public efficiency of the European member states.

However, the long-term repercussions will be felt in the majority of economies. In regard to the crisis faced, the paper of Anghel and Jones (2022), focusing on concepts such as actorness, solidarity, and resilience, points to the discrepancies between the two as regards the management of exceptional situations by the EU institutions, stressing the need for adaptability and improvement to uncertainty among the European institutions.

Moreover, in the contemporary economic context, the effects of the armed conflict, such as human casualties, state positions on trade openness, tied-up resources, and the opportunity costs of war as a whole (Khudaykulova et al., 2022), overlap with those caused by the pandemic crisis, pushing European states deeper into an aggravated economic situation. In regard to the energy crisis, the European leadership’s and Western states’ short-term response and measures are also directed towards fossil energy sources, which may pose a threat to environmental policies (Zakeri et al., 2022). Furthermore, as Brasilli et al. (2022) emphasize, the change of focus from green and digital investments to gas supply diversification definitely changes the EU investment plans, which, despite the challenges of rising costs, are expected to expand. Outcomes in terms of trade have been outlined in Steinbach’s paper (2023). Also, in relation to trade, authors Cui et al. (2023), using a computable general equilibrium model, argued that both the EU states as well as the United States will also suffer from the sanctions imposed on Russia, especially the European countries. The same model was used by authors Liu et al. (2023) in analyzing the effects on energy embargoes. On the same note, Wiertz et al. (2023) argue that in the case of Germany, the political context puts pressure on the energy transition, which can be generalized for most states. When analyzing the impact of Russian sanctions, Chepeliev et al. (2022) explain that on the short term the cost can be higher for the EU states, while on the long term the cost of the restrictions will become less significant and burdensome and, moreover, lead to environmental benefits by reducing CO2 emissions, in line with the work of Liu et al. (2022).

Exploring the same topic, Steffen and Patt (2022), on the other hand, take a more optimistic view of the problem, seeing the shift away from reliance on Russian resources as an opportunity to implement revolutionary and radical new energy policies in Europe, solely aimed at accelerating clean, local, and renewable technologies. Analyzing the link between geopolitical risks and green investments, authors Sohag et al. (2022b), employing both a Cross-Quantilogram and a quantile-on-quantile methodology, find that green investments serve as a secure form of investment in times of geopolitical uncertainty.

Expanding the effects on the worldwide economy, Ali et al. (2022), Prohorovs (2022), and Brasili et al. (2022) highlight the uncertainty that all individuals face, alongside the high volatility from financial markets and a rapidly increasing inflation rate. Inflation and supply problems caused by the sanctions imposed upon Russia add to the aforementioned issues (Straus, 2022). Qureshi et al. (2022) look at the phenomenon from a systematic risk perspective of the financial system, demonstrating negative effects on European countries and the United States. The impact on the stock market was also studied by Ahmed et al. (2022) and Kumari et al. (2022). The authors argue that the Russian-Ukraine conflict has had a significant and negative impact on European investor confidence and share prices. According to Bougias et al. (2022), the war affected the valuation of European companies, especially those with strong connections to the Russian Federation.

In addition, Guenette et al. (2022) in the World Bank’s Report, and Celi et al. (2022), emphasize the refugee crisis, in line with Darmayadi (2023), Zatonatska et al. (2022) and Stukalo and Simakhova (2018), the fragile global trade and commodity markets, particularly those of energy and grains, and the unstable financial markets, as the key repercussions of the armed conflict.

Focusing on the 2014 Russo-Ukrainian war and using a difference-in-difference approach, the authors Coupe and Obrizan (2016) proved that the average level of population happiness significantly decreased in areas affected by the conflict. Analyzing the conflict from an ecological standpoint, Rawtani et al. (2022) demonstrated that the Russia-Ukraine war has massive implications for the environment and ecosystems, which will be felt in the long term.

Not least, another immediate effect of the armed conflicts is related to increased military spending, which directly affects the performance of the public sector, impacting the level of other public expenditures such as education and health and economic growth in the long run (d’Agostino et al., 2020). Moreover, during times of conflict, military spending hinders private investment and exports (Barro, 2009; Prasetyo, 2013). Using a GMM methodology, Ali and Solarin (2020) suggest that military expenditures tend to be higher in countries with more perceived corruption, pointing to the rent-seeking activities and bribes associated with contractors in the military sector. However, on the other hand, when analyzing the case of Romania, authors Lobont et al. (2019) imply that military expenditures are positively associated with economic growth and the efficiency of the public sector. Moreover, Bardakas et al. (2023) underline that defense expenditures impact Greece’s public debt, but not as notably as the previous literature suggests.

3 Materials and methods

This research paper has two main goals. The first goal is to study the impact of the Russian-Ukraine war on the European Union’s wealth, more precisely the impact it had on the European countries that are dependent on Russian imports of gross available energy, while the second is to determine the impact of the effects of the war on economic output, with a focus on increasing inflation rates, defense expenditures, energy dependency together with renewable energy sources, trade, migration phenomena, investment, and most importantly, if governance quality can make a difference, improving economic output in this scenario.

A mixed-method approach comprising of quantitative methodologies has been employed in this research to investigate in depth the impact of war on economic wealth. Thus, after reviewing the main concepts considering the implications of the war on societies, the research framework of this study aims to the following steps:

• Establishing the treatment group and the control group, accounting for the Russian energy dependency rate, the pretreatment period, and the posttreatment period, relative to the invasion of Ukraine by Russian troops, along with the independent and dependent variables for the difference-in-difference regression. The results of this first part of the methodology aim to quantify the impact of war on energy-dependent EU countries.

• For the second stage of the analysis, building a panel regression model to explore the link between variables that reflect the consequences of armed conflict, such as inflation rate, military expenditures, economic freedom, migration phenomena, the changes in trade openness and gross fixed capital formation, import dependency, renewable energy consumption, together with economic freedom and quality of governance variables, and economic wealth, measured by the real GDP per capita. After accounting for the dataset’s validity through analysis of the correlation between the variables, performing unit root tests for stationarity, as well as a cointegration test, a series of panel approaches were presented together with a dynamic panel data model, considering the statistical tests,

• Examination of the obtained results, as well as discussion of their economic consequences and their relation to the existing literature.

3.1 Difference-in-difference

The proposed methodology is used to quantify the effect of the Russian-Ukraine war on EU wealth, especially for the top EU dependent countries in terms of Russian imports of gross available energy.

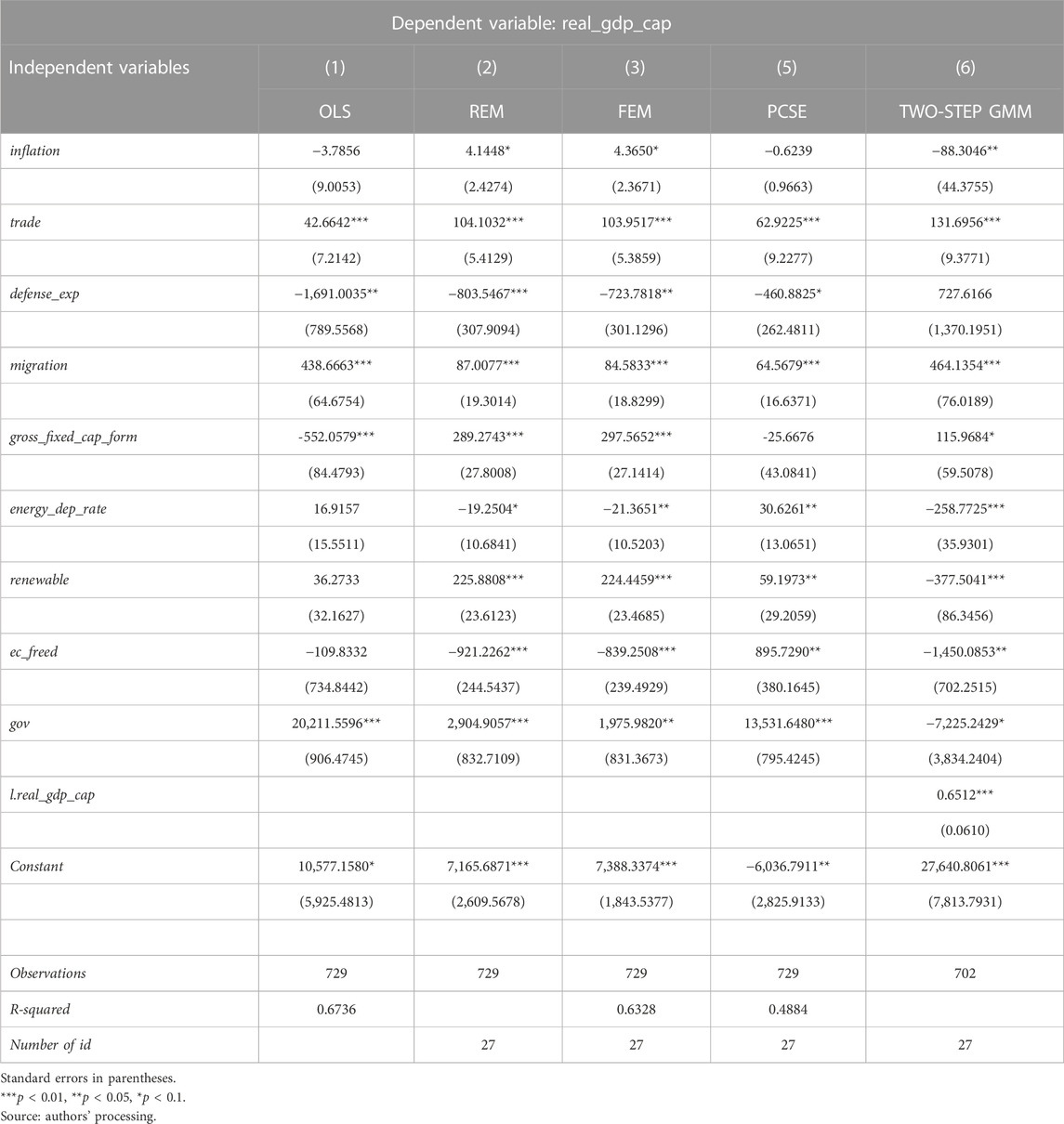

The European Union 27 sample has been split into two main groups: the treatment group, with European countries that have a higher dependency rate than the EU average according to 2020 statistics (Figure 1), namely, Lithuania, Slovakia, Hungary, Netherlands, Greece, Finland, Poland, Germany, and Latvia, while the other 18 EU countries form the control group.

FIGURE 1. EU 27 Countries’ imports from Russia in gross available energy, 2020. Source: authors’ processing using the Eurostat Database.

The considered period for analysis is the second quarter of 2020 until the last quarter of 2022, consisting of 11 quarters. The pretreatment period thus consists thus of the quarters between the outbreak of the COVID pandemic and the start of the war in the first quarter of 2022, while the post-treatment period takes into account the other three-quarters of 2022. The considered period was selected in order to fit the assumption that no other event has significantly impacted the economic output of the EU countries in both the treatment and control groups (Dincă, 2022), therefore, it was essential that the quarter in which the COVID-19 pandemic outbreak occurred not be included, so that the results are not biased.

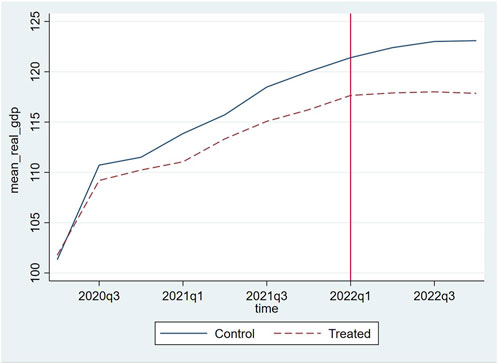

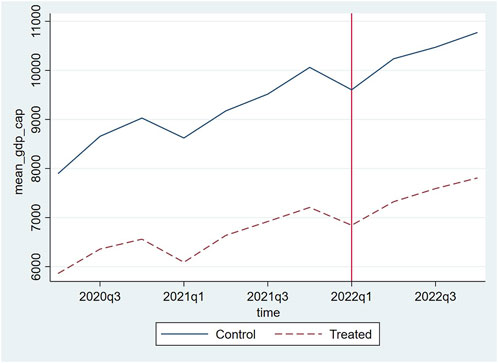

The economic wealth (dependent variable) is measured by both real GDP as well as GDP per capita variables. The parallel trend assumption is tested using the graphical evolution of economic output in the EU sample (Figures 2, 3), for both the control and the treatment groups. Further, the assumption will also be validated in the results section of the paper, using specific statistical tests.

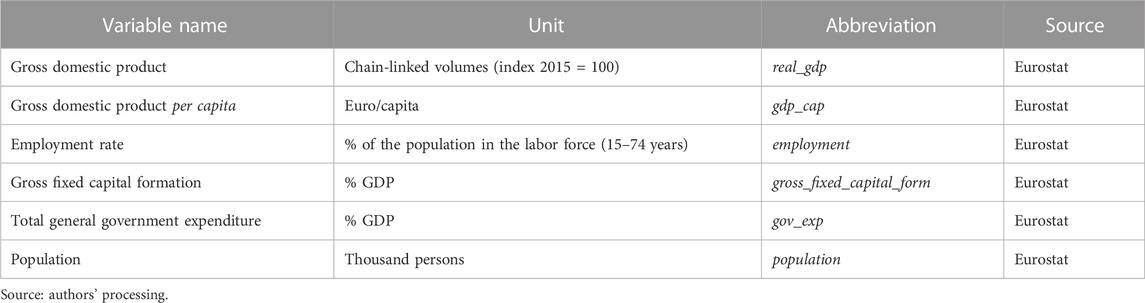

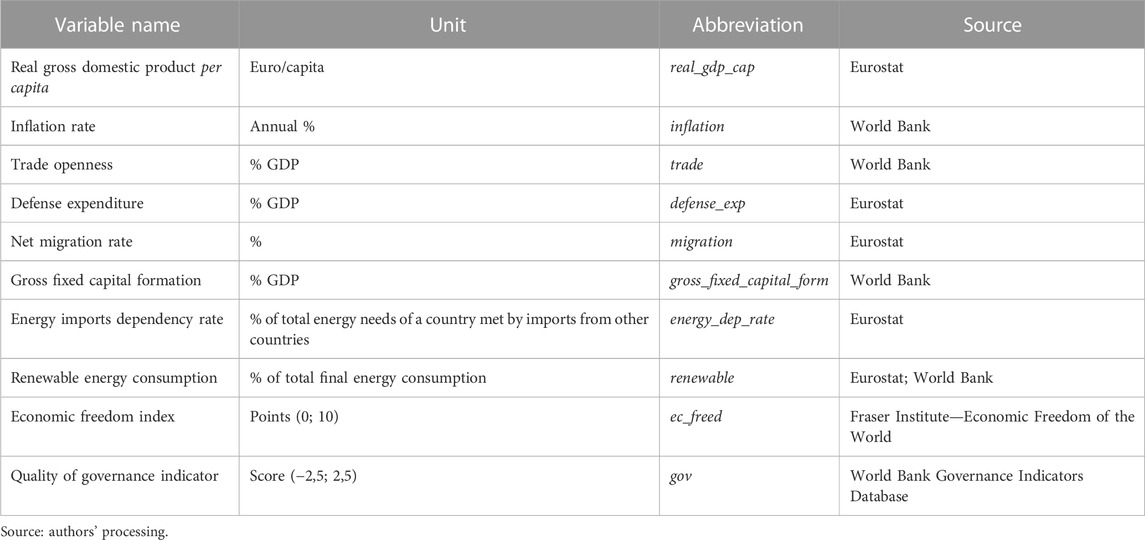

The variables addressed in this part of the study are summarized in Table 1.

The specific difference-in-difference panel regression equation reads as follows:

Yit = ß0 + ß1 * Time i + ß2 * Treatment i + ß3 * Time i * Treatment i + ß4 * employmentit + ß5 * gross_fixed_capital_form it + ß6 * gov_exp it + ß7 * population it + εit

The difference-in-difference (DiD) model with panel data characteristics has been used to estimate the impact of the Russian war on the EU treatment group. According to Tamuly and Mukhopadhyay (2022), the fixed effects DiD model presents more advantages compared to the classic DiD model, such as controlling for unobserved time-invariant country specifications as well as controlling for unobserved endogeneity.

Table 2 provides the important summary statistics for the quarterly variables taken into consideration for the EU27 sample, taking the 2020q2-2022q4 time frame into account. The independent variables used for the extended versions of the DiD regressions are chosen in line with their relevance in the literature. Employment, as well as human capital, are considered important predictors of economic wealth, as demonstrated by the papers of Chlebisz and Mierzejewski (2020); Stoica et al. (2020); Pekarčíková et al. (2022); Simionescu et al. (2017), and Teixeira and Queiros (2016). Gross fixed capital formation is also positively associated with economic growth (Fetahi-Vehapi et al., 2015; Darma, 2020; Das and Titiksha, 2020; Poku et al., 2022), while government expenditures present mixed results in the literature when analyzing their relationship to GDP. Stoica et al. (2020) and Poku et al. (2022) prove a positive link between government expenditures, while Nguyen and Bui (2022) demonstrate the negative impact of government expenditures on economic growth, however, if corruption is controlled, the effects can prove positive.

3.2 Panel data regression

As mentioned before, the second aim of this research paper is to demonstrate the link between economic wealth, measured by the real GDP per capita, and variables that reflect the consequences of an armed conflict, such as inflation rate, military expenditures, economic freedom, migration phenomena, the changes in trade openness and gross fixed capital formation, as well as import dependency, renewable energy consumption, and furthermore, to highlight whether increased governance quality can counteract the effects of war and contribute to economic performance.

The panel analysis was conducted for the 27 European Union member states, for the 1995–2021 period. The model proposes a development of the original model of Thies and Baum (2020), while also considering the particularities of the models built by the authors Hou and Chen (2013) and Yakovlev (2007), in terms of military expenditures and investment. With methodological bases in the models proposed by the aforementioned authors, the present research aims at establishing a research framework taking into account the particularities of the 2022 event, such as increased inflation rate, trade restrictions, and an energy crisis. Moreover, as a further contribution to the existing literature, the model also focuses on the impact of governance alongside economic freedom on economic growth, to assess if increased levels of institutional quality and economic freedom can counteract the effects of war on economic wealth, in the outlined context. The variables used in the econometric model are presented in Table 3.

Taking into account the aforementioned variables, the panel regression has the following structure:

real_gdp_cap it = α + ß1 inflation it + ß2 trade it + ß3 defense_exp it + ß4 migration it + ß5 gross_fixed_capital_form it + ß6 energy_dep_rate it+ ß7 renewable it + ß8 ec_freed it + ß9 gov it + µi + εit;

where µi captures the constant effect and particularities of EU countries, i = 1,2 … 27, t represents the time t = 1,2 … 27 and εit is the error term.

The variables are collected from the World Bank and Eurostat websites. The good governance indicator is composed as an average of the six dimensions of governance quality provided by the World Bank: Voice and Accountability, Political Stability and Absence of Violence/Terrorism, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption, in line with the methodological approach proposed by Tarek and Ahmed (2017) and Law and Azman-Saini (2012).

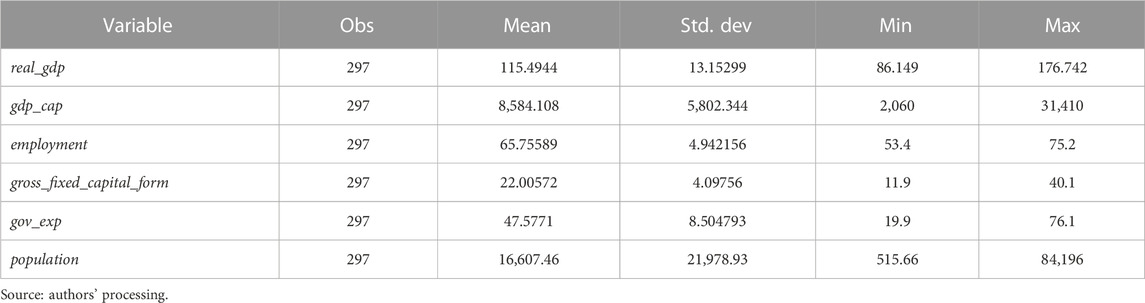

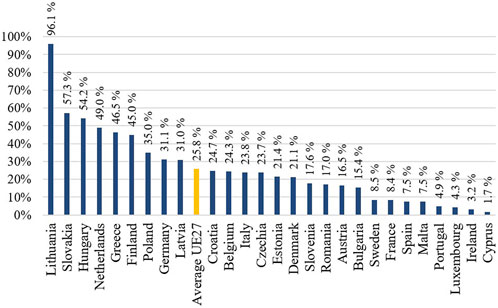

As it can be seen from Table 4, which captures the descriptive statistics, a limitation of the study, which can significantly affect the results and the significance of the regressions, can be considered the lack of values for certain variables in the period under consideration. In order to eliminate this limitation, following the methodology used by Craciun et al. (2023) and Marcu et al. (2018), the database was completed using the mathematical technique of extrapolation.

TABLE 4. Descriptive statistics of the panel data regression variables EU27, for the 1995–2021 period.

The selected independent variables capture the particularities of the war that began in early 2022, grounded in and in accordance with the analyses of the European Commission (2022) and The Organization for Economic Cooperation and Development (OECD) (2023).

Since the beginning of the war, the European Union has decided on reducing the dependency on Russian resources, which, together with the other sanctions imposed on the Russian Federation (Straus, 2022), led to one of the most felt consequences of the armed conflict: the rapid rise in the inflation rate, due to the increased prices in both the energy and food sectors. As the European Commission (2022) states, inflation, together with the uncertainty it produces, is the price that Europeans must pay for the future of freedom in Europe. Thus, inflation as a direct consequence of war is expected to manifest a negative impact on economic output, in line with the literature in the field (Caporale et al., 2015; Tien, 2021; Olamide et al., 2022).

Trade openness is another key variable that is worthy of the current analysis, considering the changes in international markets that occurred in connection with the sanctions imposed on Russia. The 2022 conflict has reportedly increased strain on the COVID-19 pandemic-affected global supply networks, hindering the movement of commodities internationally, according to the OECD (2023). A decline in trade openness is thus expected to negatively affect the economic performance of the EU countries, considering that the literature has demonstrated several times the importance of trade openness as a determinant of wealth (Khadid, 2016; Keho, 2017; Hobbs et al., 2021; Dogan et al., 2022).

As mentioned by the European Commission (2022), the war in proximity has also led towards strengthening the EU’s defense. In times of war, military expenditure is an element of public spending that is expected to increase, hindering other categories of governmental expenditures such as education and health (Hou and Chen, 2013). As mentioned before, it is expected to produce negative externalities upon economic wealth, in line with the results of Desli and Gkoulgkoutsika (2021), Korkmaz (2015), Khalid and Razaq (2015), and d’Agostino et al. (2020).

The effect of the war is felt in neighboring countries also through the refugee crisis and the migration phenomenon. Of course, the impact of this mobilization, with around 7.6 million people crossing the Ukrainian border to European countries according to the OECD (2023), has significantly impacted Ukraine’s economy, but it is also important to analyze the impact that such a significant influx of refugees has on the European economy. The migration phenomenon is captured over the years by the net migration rate indicator. According to studies in the field, net migration is associated with higher economic growth (Bernskiöld and Perman, 2015; Brunow et al., 2015), being thus expected to positively influence economic growth. Moreover, the authors Bove and Elia (2017) emphasize in their study that cultural heterogeneity positively contributes to economic growth in the long run.

The nearby armed conflict also pointed to the necessity and importance of cutting the energy dependency rate of the EU, through investments in the energy sector, especially in renewable sources of energy (European Commission, 2022). Thus, in the regression model, three independent variables have been considered: gross fixed capital formation, energy dependency rate, and renewable energy sources. According to Meyer and Sanusi (2019), gross capital formation accelerates economic growth, while Štreimikienė et al. (2016) demonstrate, using the case of Estonia, that an increase in energy security through investments in renewable energy is positively correlated to economic performance. Moreover, Sevencan (2018) demonstrated that energy productivity in the European Union significantly stimulates economic output, pointing to the EU’s dependency on imported energy as one of the main problems that the EU structure faces. Shahbaz et al. (2020) illustrate that a higher share of renewable energy sources is positively and significantly associated with increased economic growth, in line with Ivanonski et al. (2021). Thus, gross fixed capital formation and renewable energy are expected to positively impact economic growth in the EU sample, while the lack of energy security, manifested through a higher energy dependency rate, is expected to decrease economic output.

The last variables considered in the dataset include the Index of Economic Freedom, in line with the paper of Thies and Baum (2020), and the Quality of Governance indicator, as reflections of the neoliberal doctrine. The economic freedom index is expected to be positively associated with increased economic growth (Doucouliagos and Ulubasoglu, 2006; Williamson and Mathers, 2011; Hussain and Haque, 2016; Brkic et al., 2020), with the same remark being made for the quality of governance indicator (Cooray, 2009; Bayar, 2016; Alam et al., 2017; Liu et al., 2018).

4 Results

4.1 Difference-in-difference regression results

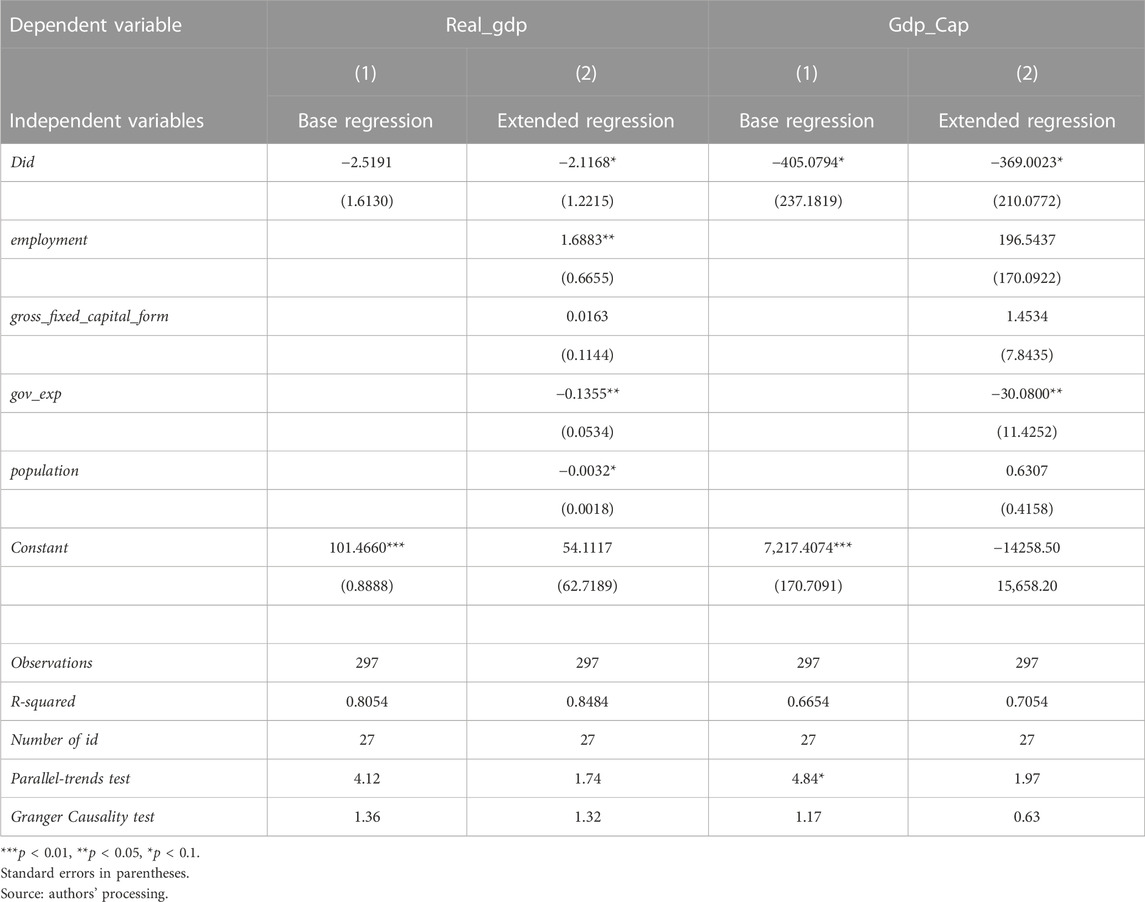

The impact of Russia’s war against Ukraine on the EU economy is analyzed in a panel difference-in-difference regression, using both real_gdp and gdp_cap as dependent variables. Table 5 presents the difference-in-difference panel data regression results.

When using real_gdp as the dependent variable, the impact of the Russian-Ukrainian war resulted in a decrease of 2.52 chain-linked volumes of real_gdp in the top energy-dependent EU countries, in the base regression scenario, however, not at a statistically significant level. However, when considering the extended regression, which takes into account the effects of employment, investments, government expenditures, and population, the negative effect of the war on the EU’s economic wealth becomes significant at the 10% level of significance. Negative significant impacts are also exerted by increased governmental expenditures and slightly by population levels, while employment significantly increases the level of economic growth in the European sample.

The second difference in difference analysis takes into account the impact of war on gdp_cap, translating into a drop in economic output of −405.08 euros per capita in the considered European countries, significantly at a level of 10% in the baseline regression. In the extended regression, the impact of the war remains negative and significant on the wealth of EU countries dependent on natural resources provided by Russia, in line with the impact of government spending, significant at 5% significance level.

The validity of both extended regressions has been tested with the help of parallel test trends as well as the Granger causality test, evaluating the assumption of parallel trends in the EU country groups, prior to the Russian war. Both tests, for the extended regressions, register prob > f values greater than 0.05, proving there is not enough evidence to reject the null hypothesis of parallel trends as well as the null hypothesis of no behavior change prior to treatment, supporting the parallel trends assumption. Moreover, the tests’ results support the validity of the did estimate (Statacorp, 2021).

4.2 Panel data regression results

The dataset’s validity had been verified prior to the panel data regression findings, through analysis of the correlation between the variables, performing unit root tests for stationarity, as well as a cointegration test.

Supplementary Table S1 indicates the type and degree of correlation among the considered variables. According to the correlation table, the main effects of the armed conflict, such as inflation and increased defense expenditures, are significantly and negatively correlated with economic output, the latter being the most pronounced among the variables. The other variables considered for analysis, such as trade openness, a positive net migration rate, economic freedom, and quality of governance, are positively and significantly correlated to real GDP per capita in the European Union structure.

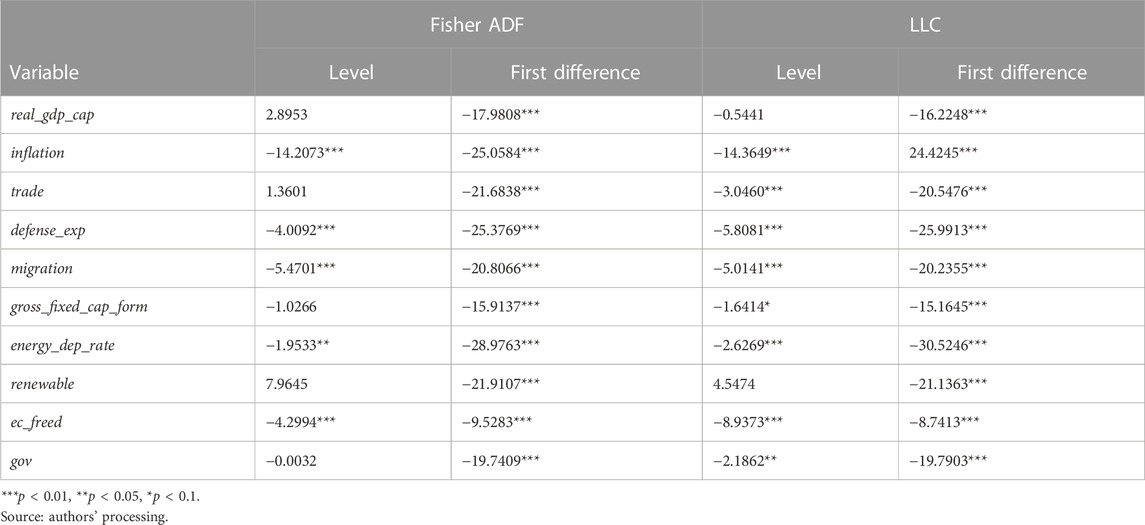

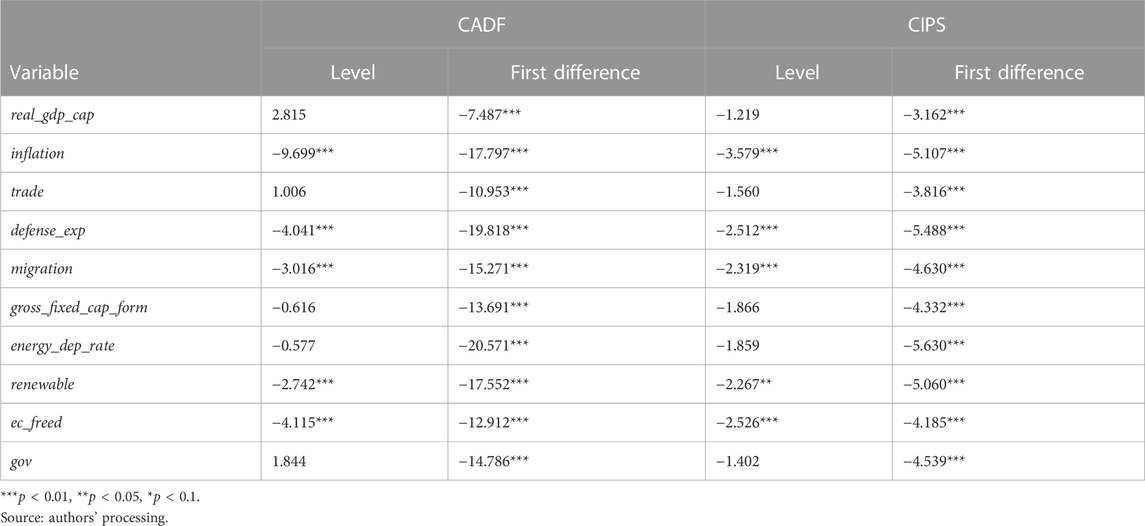

In order to analyze the stationarity and the existence of unit root in the dataset, both the first-generation unit root tests, such as the Levin–Lin–Chu (LLC) test and Fisher Augmented Dickey Fuller (Fisher ADF) test, and the second-generation unit root tests, such as the Pesaran cross-sectionally ADF (CADF) and cross-sectionally augmented panel unit root test (CIPS) tests, were performed, in line with the work of Jan et al. (2021), Zaidi et al. (2021), and Mburamatare et al. (2022). The results of both first-generation panel unit root tests show that variables real_gdp_cap and renewable are non-stationary at level, the same observation can be made for trade and gov under the Fisher ADF unit root test, while the rest of the variables are stationary at level (Table 6). However, all variables proved stationary at the first difference at 1% significance level. The same conclusion is also drawn by the second-generation unit root tests (Table 7), even if at the level analysis more variables than in the first-generation scenarios are non-stationary: real_gdp_cap, trade, gross_fixed_cap_form, energy_dep_rate and gov.

Cointegration is analyzed with the help of the Kao panel cointegration test (Kocak et al., 2022; Singh et al., 2023). The findings support the rejection of the null hypothesis of no cointegration and demonstrate the variables’ long-term relationship (Modified Dickey-Fuller t and Unadjusted modified Dickey–Fuller t with p-values < 0.01, and both Dickey–Fuller t and Augmented Dickey–Fuller t significant at 10%.)

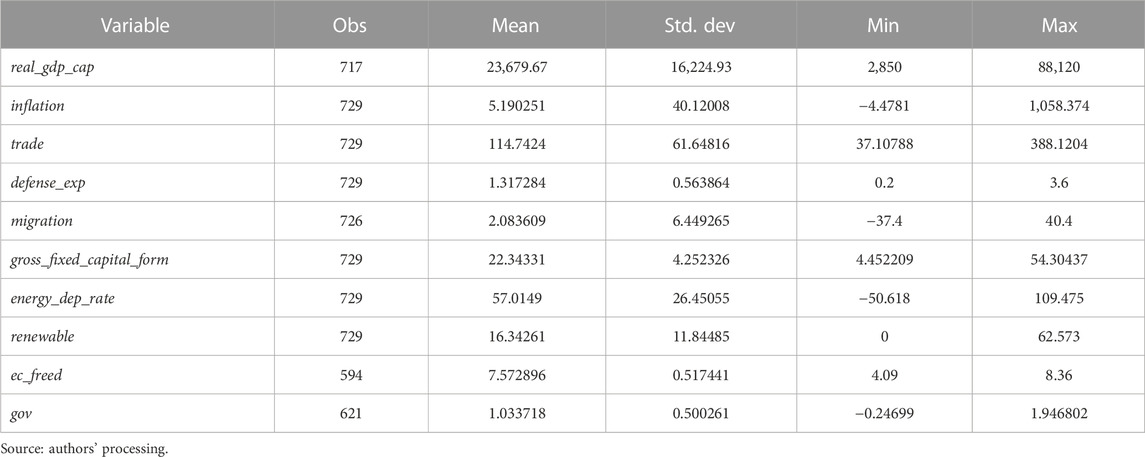

Different types of specific panel data models were applied to analyze the impact of war effects upon economic wealth. The results of all regressions employed are presented in Table 8, starting from the classic Pooled Ordinary Least Squares (OLS) regression, panel data specific regressions such as the Random Effects Model (REM) and the Fixed Effects Model (FEM), as well as Panel Corrected Standard Errors regression (PCSE), while the last model accounts for endogeneity by applying a Two-Step GMM model. The validity of the regression model was also checked by determining the variance inflation factor, which accounts for multicollinearity. The findings resulted in a mean variance inflation factor (VIF) of 1.46, demonstrating that the chosen independent variables are valid, while the model features no multicollinearity.

The analysis of the impact of war consequences on economic progress starts by presenting the results of the Pooled OLS regression, which does not take into account the characteristics of the panel database. In this regression, the main conclusion that can be drawn are that defense expenditure is a significant impediment to economic welfare, a 1% increase in defense expenditure in total government expenditure leads to a decrease of 1,691 euros per capita in gross domestic product, at a 5% significance level. Significant negative effects are also found for investment (p-values < 0.01), while in the OLS scenario, openness to trade, a positive migration rate, as well as a high quality of governance significantly and positively impact economic output levels. Moreover, the value of the R-squared coefficient shows that the model explains 67.36% of the variation in GDP per capita.

However, a series of statistical tests have been proposed in order to choose the best model, taking into account the particularities of each one, which have been detailed in Supplementary Table S2.

In order to test the validity of the OLS model, the results of the Breusch-Pagan/Cook-Weisberg test for heteroskedasticity and the White test show that a limitation of this model is the presence of heteroscedasticity. Moreover, when the Breusch-Pagan Lagrangian test is performed to choose between the OLS model and the random effects model, the significant result with a p-value < 0.05 shows that the random effects model (REM), which takes into account panel characteristics, is more appropriate for the performed analysis.

In the case of REM regression, the variables that cause a decrease in economic output are defense spending, energy dependency, and economic freedom. On the other hand, however, openness to trade, migration, investment, renewable energy, government quality, and inflation have significant positive effects on economic growth at the EU27 level.

Similar results in terms of the impact and significance of variables are also found in FEM regression. However, the significant results at the 1% threshold of the Hausman and Sargan tests reveal that the FEM model performs better than the random effects model. Both the classical fixed effects model and the fixed effects regression with dummy variables for each EU country are proposed for analysis. The latter was performed to determine the pure impact of each variable on economic growth, taking into account the particularities of each country and unobserved heterogeneity (Torres-Reyna, 2007). The impact and significance of the independent variables are the same as for the FEM model, however the R-squared increased to 97.99%.

The significant results (p-values < 0.01) of the Breusch-Pagan LM test of independence, Wald, Pesaran, and Wooldridge tests reveal the limitations of the FEM model: the presence of cross-sectional dependence, heteroscedasticity, and autocorrelation. To address all these limitations, a Panel Corrected Standard Errors (PCSE) regression was performed (Kashem and Rahman, 2020).

The PCSE model’s findings indicate that seven independent factors related to war have an impact on economic growth. The variables that deter economic growth are inflation and gross capital formation, although not at a significant level, and defense expenditures at a significance threshold of 10%. In this scenario, an increase in the share of defense expenditures in the total governmental expenditures in the context of an armed conflict decreases economic wealth by 461 euros per capita. The other variables, such as trade, migration, energy_dep_rate, renewable, ec_freedom and gov significantly and positively impact real_gdp_capita. Considering the PCSE model, promoting investments, particularly in renewable energy sources, trade openness, and human capital, can lead to increased economic wealth. At the same time, in times of conflict, increased economic freedom and the quality of public institutions can contribute to the development of policies that alleviate the harmful repercussions of war, through open, transparent, and objective collaboration. Differences between the expected influence and the obtained influence are found in the case of investments and the energy dependency rate.

To complete the analysis, the last model performed accounts for endogeneity through the two-step difference General Method of Moments Technique (GMM), considering the control of both heteroscedasticity and serial correlation (Paleologou, 2022), as an alternative to the PCSE model. In this dynamic model, effects of the war, such as increased inflation, energy dependency rate, renewable energy, economic freedom, and governance indicators, manifest a negative impact on economic output, while trade, migration, investments, and the lagged version of economic growth positively impact economic growth. The statistics of the Arellano and Bond tests for autocorrelation (p-values > 0.05), together with the Sargan and Hansen tests for over-identifying restrictions (p-values > 0.05), emphasize the lack of serial correlation for both the first and second order correlation of the residuals, as well as the validity of the model and its instruments.

5 Discussions

The results presented above highlight the fact that the Russian invasion of Ukraine, which started in early 2022, has had a significant impact on the level of economic wealth in EU member states. The difference-in-difference methodology has shown that countries dependent on Russian energy imports have been significantly affected by the start of the war compared to the group of less dependent European countries, which raises an alarm about the importance of establishing autonomous and independent energy policies towards the European Union. The issue of energy dependence on Russia and the importance of energy autonomy were also highlighted by authors Surwillo (2023), Prisecaru (2022), Korosteleva (2022), and Sevencan (2018), while the effects of dependence on Russian commodities were also demonstrated by authors Lo et al. (2022), showing their negative impact on financial markets.

Although it is a significant challenge, that requires additional costs and investment, as the European Commission (2022) states, the cost of reducing energy dependence is the cost that Europeans will pay for the triumph of democracy and freedom. Surwillo (2023), Prisecaru (2022), and the European Commission (2022) highlight the importance of transitioning to renewable local sources of energy, however, in the short term this is not immediately possible, and relying on local sources of conventional energy will negatively impact climate policy. Furthermore, according to Lasse and Benjamin’s (2023) study for the European Parliament, as the first year after the beginning of the war passed by, now is the time for a transition from a policy devoted to managing a crisis situation, to a policy for future long term energy security.

Regarding the second part of the methodology, the results of the panel regression reveal that, in most cases, the results and the impact of the independent variables are consistent with their expected influence. The most significant observation that can be made is the fact that defense and military expenditures negatively impact economic growth in the classic panel regressions, including the PCSE scenario. The results are in line with the work of Desli and Gkoulgkoutsika (2021), Korkmaz (2015), Khalid and Razaq (2015), and d’Agostino et al. (2020). Moreover, using a first order dynamic model, Dunne and Tian (2016) proved that increased military spending exerts a negative significant effect upon economic output, in both the long and short term. Thus, it is expected that in the context of economic pressures caused by the proximity of war, the need or temptation to increase Member States’ defense spending will contribute to sacrificing economic welfare for a sense of security.

Migration and trade openness manifest a positive and significant impact upon economic wealth in all the proposed regression models, highlighting the importance of relying, when possible, on trade advantages for implementing efficient public policies, as well as the advantages that a positive migration rate, through ethnic diversity and workforce experience and qualification, can bring to economic growth for the European countries, even in times of conflict, with increased military spending, uncertainty, and inflation. The results regarding both trade openness and migration are in line with their expected influence, and the reviewed literature. Through a dynamic panel regression, Caporale et al. (2015) proved that human capital as well as trade significantly improve economic development. Moreover, Fetahi-Vehapi et al. (2015) conclude that developed countries benefit more from trade openness, when analyzing ten South East European countries. Bernskiöld and Perman (2015), using panel data FEM, demonstrated a significant and positive effect of the net migration rate on economic wealth per capita for the same sample of the UE 27 member states.

When it comes to the impact inflation has upon economic growth, as a consequence of war, it is positively and significantly associated with economic growth in the REM and FEM models, while in the GMM model, where we account for endogeneity, it hinders economic wealth, with 1 unit increase in the inflation rate decreasing economic growth by 88.31 euros per capita. The results are thus in line with the debate in specialty literature. Using a fixed effects model, Mencinger et al. (2014) demonstrated that inflation negatively affects economic growth per capita in the case of veteran EU member states, in line with the study of Bibi et al. (2014), who applied a dynamic OLS for Pakistan. However, the paper of Obradovic et al. (2017) presents the conclusion that an increased inflation rate is positively associated with economic growth in the short term when applying an autoregressive distributed lag (ARDL) approach for Serbia. Similar results are reported in the research of Kryeziu and Durguti (2019), who, with the help of a least square multiple linear regression model, demonstrated that inflation contributes to increased economic growth in the euro area.

Investments represented by the gross fixed capital formation indicator are positively and significantly correlated with economic development in the panels that account for panel data characteristics as well as in the GMM model, at 1% respectively 10% levels of significance, stressing the importance of productive fixed capital investment to promote economic development. Similar findings are reported in the paper of Gibescu (2010), who argued the positive relationship between investment and economic growth for Central and Eastern European countries, in line with the results of Meyer and Sanusi (2019), while Mitic et al. (2020) point to the positive long-run relationship between investment and increased carbon emissions. However, in line with the energy policy targets proposed by the European Commission, investments in green energy should benefit both economic growth and environmental policies in the long run, as also stated by Al-Darraji and Bakir (2020) and Ntanos et al. (2018).

The mixed results regarding the effects of energy dependency and renewable policies on economic development are also in accordance with the literature. Energy dependency is negatively and significantly associated with economic growth in the classic panel data regressions and the GMM model, however, it manifests a positive effect in the PCSE regression. Considering the particular case of EU structure, the shift to a more local energy source will stimulate economic output (Sevencan, 2018). Moreover, Novelli (2022) finds that countries with a more balanced energy dependency policy are not affected in terms of economic growth by energy price volatility in the long run. Furthermore, according to Borin et al. (2022), the increased cost of energy dependency reduces purchasing power, private consumption, affecting economic development in the end. On the other hand, however, Pehlivanoglu et al. (2021) demonstrated the positive relationship between energy dependency and economic growth for the EU countries. Renewable energy consumption significantly contributes to economic growth in all panel data specific models, in accordance with Shahbaz et al. (2020), Ntanos et al. (2018), Apergis and Danuletiu (2014), and Pao and Fu (2013), with the exception of the dynamic one, where renewable sources impediment economic growth, in line with the results of Oh et al. (2020), however, we argue that this effect is expected to manifest just in the short term.

In line with the expected influence, an increase in both economic freedom and governance efficiency significantly and positively impacts economic development in the PCSE model for freedom and PCSE and other specific panel data regressions for quality of governance, in accordance with the results of Thies and Baum (2020), Brkic et al. (2020), Hussain and Haque (2016), Williamson and Mathers (2011), Liu et al. (2018), Alam et al. (2017), and Bayar (2016). Thus, looking at the results from a more economic perspective, it can be stated that increased levels of governance quality and increased levels of perceived democracy can counteract and compensate for the negative effects of war manifested through increased military expenditures and inflation when analyzing economic growth. Thus, economies should seek reforms in public institutions, in order to achieve both the public performance and the transparency needed to back up the economic environment. Counterintuitive results regarding the lack of conflict and increased governance quality are found in the dynamic model. The paper of Ockey (2011) highlights the fact that an increase in economic freedom does not necessarily affect economic wealth, sharing the same view as the papers of Asatryan and De Witte (2015) and Roessler (2019), which argue that more economic freedom can be associated with a lack of efficiency in public policies, thus affecting growth. Furthermore, authors Emara and Chiu (2016) and Almohammed and Ibrahim (2021) stressed the lack of contribution governance has in relation to economic growth, while Quibria (2006) even discussed the advantage countries with reduced levels of governance have in relation to growth.

6 Conclusion and recommendations

As undoubtedly one of the most major events of the currently crossed period, Russia’s invasion of Ukraine continues to impose detrimental direct and indirect consequences on the economies of many nations around the world.

The present research paper aimed at exploring the impact the ongoing Russian-Ukraine war has on the European Union’s wealth, in the post-pandemic context. The study proposed two types of analyses to better understand the impact the armed conflict had upon the EU’s economy.

The difference-in-difference regression applied for the post-pandemic period proved the significant and negative impact the war had upon the European Union’s countries that rely the most on Russia’s energy imports.

Panel data analysis was used to study the relationship between the effects of war, reflected in the deepening energy crisis, inflation, trade restrictions, limited trade relations, restructuring of governmental expenditures, and the migrant crisis, together with economic freedom and governance quality as elements of neoliberal doctrine, and the economic wealth of EU Member States.

The results of both analyses show that the countries of the European Union have been significantly affected by the outbreak of war, especially those with an energy dependency rate above the EU average, but not limited to them. The difference-in-difference methodology shows that economic wealth has declined as a result of the beginning of the war.

The effects of the military conflict, such as increased military spending, inflation, hindering openness to trade, and the problem of energy dependence, significantly impact economic growth across the EU27 panel.

Using a panel data regression methodology, we found that an increase in military expenditures, inflation, and energy dependency rate negatively impacts economic output in the European Union, restricting trade openness has significant consequences on real GDP per capita, considering the significant impact that openness to trade has on economic welfare, while refugee flows, materialized in an increase in the net migration rate, significantly and positively impacts economic welfare. The same remark made for trade openness can be applied for the gross fixed capital formation: decreasing investment, especially in the sector of renewable energy, as an effect of war has significant negative implications on economic growth, considering that investments as well as renewable energy sources are important predictors of economic growth. Furthermore, the paper answers the question of whether economic freedom and governance are determinants for economic development, hypotheses that are validated in the panel corrected standard errors regression.

The main limitation of the study can be considered the relatively short time horizon in the difference-in-difference analysis, however, this specific limitation can be justified based on the proximity of the war’s outbreak to the time of the analysis. A future analysis validating the impact of the war in Ukraine using the same difference-in-difference methodology and at multiple time points would be recommended in order to validate the model and the results. Furthermore, it is important for future studies to strengthen the link between freedom and economic development, especially in times of uncertainty. Nevertheless, we hope that the current analysis can be considered a starting point for future research regarding the impact of the Russian war on the world’s economies.

The obtained results from the statistical processing show that solving the issue of energy dependency within the European Union must be a priority point of interest on the agenda of the leadership of the European states. The EU structure should invest in a reliable and wide-ranging energy source, taking into account the specificities of each Member State. At the same time, investments in energy must target local and renewable energy sources in the long term, in line with the Union’s environmental objectives, considering the significant impact of renewable sources on the economy and the environment. Further, economic policies should strive to restructure public expenditure in order to facilitate investments, especially in areas that promote economic value (for example, in research and development, education, and infrastructure), and avoid locking up public resources on defense spending, given the long run negative externalities they produce on the economy, while also maintaining healthy trade relations with partner states and supporting the mobility of human capital.

The extent of the long-term economic consequences of the war between Russia and Ukraine is yet to be completely determined. Countries are affected differently based on their degree of dependence on imports from Russia and Ukraine, on the one hand, and their proximity to the countries involved in the conflict, on the other. Economic signals and estimates presented in this study show that the conflict will affect global economic growth and pose difficult challenges for policymakers in managing rising inflation and rethinking government expenditure structures. Increased military spending has become a necessity amid rising final government consumption as a share of GDP, which will lead to fiscal consolidation measures. In these times of profound national and global challenges, the quality of governance can lead to the development of policies that will help economies in managing the crisis more effectively and ensuring the conditions for a return to sustainable growth.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

Conceptualization, CN and GD; methodology, CN; software, CN; validation, GD; formal analysis, CN and GD; investigation, CN; resources, CN; data curation, CN; writing—original draft preparation, CN and GD; writing—review and editing, GD and CN; visualization, CN; supervision, GD and CN; project administration, CN and GD. All authors contributed to the article and approved the submitted version.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1225793/full#supplementary-material

References

Ahmed, S., Hasan, M. M., and Kamal, M. R. (2022). Russia–Ukraine crisis: The effects on the European stock marketEur. Financ. Manag Hoboken, New Jersey, United States: Wiley.

Al-Darraji, H. H. M., and Bakir, A. (2020). The impact of renewable energy investment on economic growth. J. Soc. Sci. (COES&RJ-JSS) 9 (2), 234–248. doi:10.25255/jss.2020.9.2.234.248

Alam, M. K., Tabash, M. I., Billah, M., Kumar, S., and Anagreh, S. (2022). The impacts of the Russia–Ukraine invasion on global markets and commodities: A dynamic connectedness among G7 and BRIC markets. J. Risk Financial Manag. 15 (8), 352. doi:10.3390/jrfm15080352

Alam, M. R., Kiterage, E., and Bizuayehu, B. (2017). Government effectiveness and economic growth. Econ. Bull. 37 (1), 222–227.

Ali, A. A., Azaroual, F., Bourhriba, O., and Dadush, U. (2022). The economic implications of the war in Ukraine for africa and Morocco. Rocade de Rabat, Salé, Morocco: Policy Center for the New South.

Ali, H. E., and Solarin, S. A. (2020). Military spending, corruption, and the welfare consequences. Def. peace Econ. 31 (6), 677–691. doi:10.1080/10242694.2019.1567181

Almohammed, H., and İbrahim, E. K. Ş. İ. (2021). Is governance effective in economic growth? Evidence from MSCI countries. Hitit Sos. Bilim. Derg. 14 (1), 41–55. doi:10.17218/hititsbd.926999

Anghel, V., and Jones, E. (2022). Is Europe really forged through crisis? Pandemic EU and the Russia–Ukraine war. J. Eur. Public Policy 30, 766–786. doi:10.1080/13501763.2022.2140820

Antràs, P., and Chor, D. (2018). “On the measurement of upstreamness and downstreamness in global value chains,” in World trade evolution: Growth, productivity and employment. Editors Lili Yan Ing, and Miaojjie Yu (London, UK: Routledge).

Apergis, N., and Danuletiu, D. C. (2014). Renewable energy and economic growth: Evidence from the sign of panel long-run causality. Int. J. Energy Econ. Policy 4 (4), 578–587.

Asatryan, Z., and De Witte, K. (2015). Direct democracy and local government efficiency. Eur. J. Political Econ. 39, 58–66. doi:10.1016/j.ejpoleco.2015.04.005

Bachmann, R., Baqaee, D., Bayer, C., Kuhn, M., Löschel, A., Moll, B., et al. (2022). What if? The economic effects for Germany of a stop of energy imports from Russia. Wirtschaftsdienst 102, 251–255.

Bardakas, I., Doulos, D., and Zombanakis, G. A. (2023). Defence expenditure and public debt in Greece: A non-linear relationship. Secur. Def. Q. 41 (1). doi:10.35467/sdq/155960

Bayar, Y. (2016). Public governance and economic growth in the transitional economies of the European Union. Transylv. Rev. Adm. Sci. 12 (48), 5–18.

Benson, A. K. (2023). Does the Russia-Ukraine war affects trade relations and foreign Direct investment flows from Europe into Asia and Africa? Int. J. Res. Bus. Soc. Sci. 12 (2), 287–300. doi:10.20525/ijrbs.v12i2.2403

Bernskiöld, E., and Perman, M. (2015). Free movement; the economic effects of net migration within the European union. http://hdl.handle.net/2077/39768.

Bibi, S., Ahmad, S. T., and Rashid, H. (2014). Impact of trade openness, FDI, exchange rate and inflation on economic growth: A case study of Pakistan. Int. J. Account. Financial Report. 4 (2), 236. doi:10.5296/ijafr.v4i2.6482

Borin, A., Conteduca, F. P., Di Stefano, E., Gunnella, V., Mancini, M., and Panon, L. (2022). Quantitative assessment of the economic impact of the trade disruptions following the Russian invasion of Ukraine. Rome, Italy: Banca d’Italia.

Bougias, A., Episcopos, A., and Leledakis, G. N. (2022). Valuation of European firms during the Russia–Ukraine war. Econ. Lett. 218, 110750. doi:10.1016/j.econlet.2022.110750

Bove, V., and Elia, L. (2017). Migration, diversity, and economic growth. World Dev. 89, 227–239. doi:10.1016/j.worlddev.2016.08.012

Brasili, A., Kolev, A., Revoltella, D., and Schanz, J. (2022). 1. Challenges for public investment in the EU: The role of policy, energy security and climate transition. Cambridge, United Kingdom: Open Book Publishers.

Brkić, I., Gradojević, N., and Ignjatijević, S. (2020). The impact of economic freedom on economic growth? New European dynamic panel evidence. J. Risk Financial Manag. 13 (2), 26. doi:10.3390/jrfm13020026

Brunow, S., Nijkamp, P., and Poot, J. (2015). The impact of international migration on economic growth in the global economy. Handb. Econ. Int. Migr. 1, 1027–1075. doi:10.1016/B978-0-444-53768-3.00019-9

Caldara, D., Conlisk, S., Iacoviello, M., and Penn, M. (2022). The effect of the war in Ukraine on global activity and inflation. Washington, D.C., USA: Federal Reserve System.

Caporale, G. M., Rault, C., Sova, A. D., and Sova, R. (2015). Financial development and economic growth: Evidence from 10 new European Union members. Int. J. Finance Econ. 20 (1), 48–60. doi:10.1002/ijfe.1498

Celi, G., Guarascio, D., Reljic, J., Simonazzi, A., and Zezza, F. (2022). The asymmetric impact of war: resilience, vulnerability and implications for EU policy. Intereconomics 57 (3), 141 –147. doi:10.1007/s10272-022-1049-2

Chepeliev, M., Hertel, T., and van der Mensbrugghe, D. (2022). Cutting Russia's fossil fuel exports: Short-term economic pain for long-term environmental gain. World Econ. 45 (11), 3314–3343. doi:10.1111/twec.13301

Chlebisz, A., and Mierzejewski, M. (2020). Determinants of GDP growth in Scandinavian countries with special reference to scientific progress. Int. Entrepreneursh. Rev. 6 (3), 21–35. doi:10.15678/ier.2020.0603.02

Cooray, A. (2009). Government expenditure, governance and economic growth. Comp. Econ. Stud. 51, 401–418. doi:10.1057/ces.2009.7

Coupe, T., and Obrizan, M. (2016). The impact of war on happiness: The case of Ukraine. J. Econ. Behav. Organ. 132, 228–242. doi:10.1016/j.jebo.2016.09.017

Crăciun, A. F., Țăran, A. M., Noja, G. G., Pirtea, M. G., and Răcătăian, R. I. (2023). Advanced modelling of the interplay between public governance and digital transformation: New empirical evidence from structural equation modelling and Gaussian and mixed-markov graphical models. Mathematics 11 (5), 1168. doi:10.3390/math11051168

Cui, L., Yue, S., Nghiem, X. H., and Duan, M. (2023). Exploring the risk and economic vulnerability of global energy supply chain interruption in the context of Russo-Ukrainian war. Resour. Policy 81, 103373. doi:10.1016/j.resourpol.2023.103373

d’Agostino, G., Dunne, J. P., Lorusso, M., and Pieroni, L. (2020). Military spending, corruption, persistence and long run growth. Def. Peace Econ. 31 (4), 423–433. doi:10.1080/10242694.2020.1751503

Darma, D. C. (2020). Determinants of the gross regional domestic product of east kalimantan province: Macroeconomic variable review. Rev. Integr. Bus. Econ. Res. 9, 232–241.

Darmayadi, A., and Megits, N. (2023). The impact of the Russia-Ukraine war on the European Union economy. J. East. Eur. Central Asian Res. 10 (1), 46–55. doi:10.15549/jeecar.v10i1.1079

Darmayadi, A., and Megits, N. (2023). The impact of the Russia-Ukraine war on the European Union economy. J. East. Eur. Central Asian Res. (JEECAR) 10 (1), 46–55. doi:10.15549/jeecar.v10i1.1079

Das, M. K., and Das, T. (2020). Determinants of economic growth in India: A time series perspective. Theor. Appl. Econ. 2 (623), 263–280.

Desli, E., and Gkoulgkoutsika, A. (2021). Military spending and economic growth: A panel data investigation. Econ. Change Restruct. 54, 781–806. doi:10.1007/s10644-020-09267-8

Dinca, D. (2022). An Assessment of institutional improvements in Romania and Bulgaria following EU accession. Sci. Ann. Econ. Bus. 69 (2), 293–316. doi:10.47743/saeb-2022-0015

Dincă, G., Dincă, M. S., Negri, C., and Bărbuță, M. (2021). The impact of corruption and rent-seeking behavior upon economic wealth in the European Union from a public choice approach. Sustainability 13 (12), 6870. doi:10.3390/su13126870

Doğan, B., Balsalobre-Lorente, D., and Nasir, M. A. (2020). European commitment to COP21 and the role of energy consumption, FDI, trade and economic complexity in sustaining economic growth. J. Environ. Manag. 273, 111146. doi:10.1016/j.jenvman.2020.111146

Doucouliagos, C., and Ulubasoglu, M. A. (2006). Economic freedom and economic growth: Does specification make a difference? Eur. J. political Econ. 22 (1), 60–81. doi:10.1016/j.ejpoleco.2005.06.003

Dunne, J. P., and Tian, N. (2016). Military expenditure and economic growth, 1960–2014. Econ. Peace Secur. J. 11 (2). doi:10.15355/epsj.11.2.50

Eetayib, M. (2022). How do natural gas and oil prices affect industrial production in G7 countries during the Russian-Ukrainian war. J. Smart Econ. Growth 7 (1), 105–123.

Emara, N., and Chiu, I. (2016). The impact of governance environment on economic growth: The case of middle eastern and north african countries. Emara, N. And Chiu, I-ming (2016). The impact of governance environment on economic growth: The case of middle eastern and north african countries. J. Econ. Libr. 3 (1), 24–37.

European Commission, (2022). The war in Ukraine and its implications for the EU. https://www.eeas.europa.eu/eeas/war-ukraine-and-its-implications-eu_en.

Fetahi-Vehapi, M., Sadiku, L., and Petkovski, M. (2015). Empirical analysis of the effects of trade openness on economic growth: An evidence for South East European countries. Procedia Econ. Finance 19, 17–26. doi:10.1016/s2212-5671(15)00004-0

Gibescu, O. (2010). “Does the gross fixed capital formation represent a factor for supporting the economic growth?,” in MPRA paper (Munich, Germany: University Library of Munich).

Guenette, J. D., Kenworthy, P. G., and Wheeler, C. M. (2022). Implications of the war in Ukraine for the global economy. https://thedocs.worldbank.org/en/doc/5d903e848db1d1b83e0ec8f744e55570-0350012021/related/Implications-of-the-War-in-Ukraine-for-the-Global-Economy.pdf.

Hobbs, S., Paparas, D., and AboElsoud, E. M. (2021). Does foreign direct investment and trade promote economic growth? Evidence from Albania. Economies 9 (1), 1. doi:10.3390/economies9010001

Hou, N., and Chen, B. (2013). Military expenditure and economic growth in developing countries: Evidence from system GMM estimates. Def. peace Econ. 24 (3), 183–193. doi:10.1080/10242694.2012.710813

Hussain, M. E., and Haque, M. (2016). Impact of economic freedom on the growth rate: A panel data analysis. Economies 4 (2), 5. doi:10.3390/economies4020005

Hutter, C., and Weber, E. (2022). Russia-Ukraine war: Short-run production and labour market effects of the energy crisis. https://doku.iab.de/discussionpapers/2022/dp1022.pdf.

Ivanovski, K., Hailemariam, A., and Smyth, R. (2021). The effect of renewable and non-renewable energy consumption on economic growth: Non-parametric evidence. J. Clean. Prod. 286, 124956. doi:10.1016/j.jclepro.2020.124956

Jan, I., Ashfaq, M., and Chandio, A. A. (2021). Impacts of climate change on yield of cereal crops in northern climatic region of Pakistan. Environ. Sci. Pollut. Res. 28 (42), 60235–60245. doi:10.1007/s11356-021-14954-8

Kashem, M. A., and Rahman, M. M. (2020). Environmental phillips curve: OECD and asian NICs perspective. Environ. Sci. Pollut. Res. 27, 31153–31170. doi:10.1007/s11356-020-08620-8

Keho, Y. (2017). The impact of trade openness on economic growth: The case of Cote d’Ivoire. Cogent Econ. Finance 5 (1), 1332820. doi:10.1080/23322039.2017.1332820

Khalid, M. A., and Razaq, M. A. J. A. (2015). The impact of military spending on economic growth: Evidence from the US economy. catalyst 6 (7), 183–190.

Khalid, M. A. (2016). The impact of trade openness on economic growth in the case of Turkey. Res. J. Finance Account. 7 (10), 51–61.

Khudaykulova, M., Yuanqiong, H., and Khudaykulov, A. (2022). Economic consequences and implications of the Ukraine-Russia war. Int. J. Manag. Sci. Bus. Adm. 8 (4), 44–52. doi:10.18775/ijmsba.1849-5664-5419.2014.84.1005

Kocak, E., Okumus, F., and Altin, M. (2022). Global pandemic uncertainty, pandemic discussion and visitor behaviour: A comparative tourism demand estimation for the US. Tour. Econ., 135481662211006. doi:10.1177/13548166221100692

Korkmaz, S. (2015). The effect of military spending on economic growth and unemployment in Mediterranean countries. Int. J. Econ. Financial Issues 5 (1), 273–280.

Korosteleva, J. (2022). The implications of Russia's invasion of Ukraine for the EU energy market and businesses. Br. J. Manag. 33 (4), 1678–1682. doi:10.1111/1467-8551.12654

Kryeziu, N., and Durguti, E. A. (2019). The impact of inflation on economic growth: The case of Eurozone. Int. J. Finance Bank. Stud. 8 (1), 01–09. doi:10.20525/ijfbs.v8i1.297

Kumari, V., Kumar, G., and Pandey, D. K. (2023). Are the European Union stock markets vulnerable to the Russia–Ukraine war? J. Behav. Exp. Finance 37, 100793. doi:10.1016/j.jbef.2023.100793

Lasse, B. O. E. H. M., and Benjamin, W. A. (2023). EU energy security and the war in Ukraine: From sprint to marathon. https://www.europarl.europa.eu/RegData/etudes/BRIE/2023/739362/EPRS_BRI(2023)739362_EN.pdf.

Law, S. H., and Azman-Saini, W. N. W. (2012). Institutional quality, governance, and financial development. Econ. Gov. 13, 217–236. doi:10.1007/s10101-012-0112-z

Liadze, I., Macchiarelli, C., Mortimer-Lee, P., and Sanchez Juanino, P. (2022). Economic costs of the Russia-Ukraine war. World Econ. 46, 874–886. doi:10.1111/twec.13336

Liu, J., Tang, J., Zhou, B., and Liang, Z. (2018). The effect of governance quality on economic growth: Based on China’s provincial panel data. Economies 6 (4), 56. doi:10.3390/economies6040056

Liu, L. J., Jiang, H. D., Liang, Q. M., Creutzig, F., Liao, H., Yao, Y. F., et al. (2023). Carbon emissions and economic impacts of an EU embargo on Russian fossil fuels. Nat. Clim. Change 13 (3), 290–296. doi:10.1038/s41558-023-01606-7

Lo, G. D., Marcelin, I., Bassène, T., and Sène, B. (2022). The Russo-Ukrainian war and financial markets: The role of dependence on Russian commodities. Finance Res. Lett. 50, 103194. doi:10.1016/j.frl.2022.103194

Lobont, O. R., Glont, O. R., Badea, L., and Vatavu, S. (2019). Correlation of military expenditures and economic growth: Lessons for Romania. Qual. Quantity 53, 2957–2968. doi:10.1007/s11135-019-00910-9

Mansury, Y., Kim, W., and Li, J. (2023). Militarized conflict, trade, and economic development in a structural equation model with spatial considerations. Int. Regional Sci. Rev., 016001762311604. doi:10.1177/01600176231160495

Marcu, N., Siminică, M., Noja, G. G., Cristea, M., and Dobrotă, C. E. (2018). Migrants’ integration on the European labor market: A spatial bootstrap, sem and network approach. Sustainability 10 (12), 4543. doi:10.3390/su10124543

Mbah, R. E., and Wasum, D. F. (2022). Russian-Ukraine 2022 war: A review of the economic impact of Russian-Ukraine crisis on the USA, UK, Canada, and Europe. Adv. Soc. Sci. Res. J. 9 (3), 144–153. doi:10.14738/assrj.93.12005

Mburamatare, D., Gboney, W. K., Hakizimana, J. D. D., and Mutemberezi, F. (2022). Effects of industrialization, technology and labor efficiency on electricity consumption: Panel data experience of Rwanda, Tanzania and Kenya. Int. J. Energy Econ. Policy 12 (2), 349–359. doi:10.32479/ijeep.12551

Mencinger, J., Aristovnik, A., and Verbic, M. (2014). The impact of growing public debt on economic growth in the European Union. Amfiteatru Econ. J. 16 (35), 403–414.

Meyer, D. F., and Sanusi, K. A. (2019). A causality analysis of the relationships between gross fixed capital formation, economic growth and employment in South Africa. Stud. Univ. Babes-Bolyai Oeconomica 64 (1), 33–44. doi:10.2478/subboec-2019-0003

Mitić, P., Kostić, A., Petrović, E., and Cvetanovic, S. (2020). The relationship between CO2 emissions, industry, services and gross fixed capital formation in the Balkan countries. Eng. Econ. 31 (4), 425–436. doi:10.5755/j01.ee.31.4.24833

Nguyen, M. L. T., and Bui, N. T. (2022). Government expenditure and economic growth: Does the role of corruption control matter? Heliyon 8 (10), e10822. doi:10.1016/j.heliyon.2022.e10822

Novelli, G. (2022). Energy dependency and long-run growth. Working Paper, No. 042.2022. Milano, Italy: Fondazione Eni Enrico Mattei FEEM.

Ntanos, S., Skordoulis, M., Kyriakopoulos, G., Arabatzis, G., Chalikias, M., Galatsidas, S., et al. (2018). Renewable energy and economic growth: Evidence from European countries. Sustainability 10 (8), 2626. doi:10.3390/su10082626

Obradović, S., Šapić, S., Furtula, S., and Lojanica, N. (2017). Linkages between inflation and economic growth in Serbia: An ARDL bounds testing approach. Eng. Econ. 28 (4), 401–410. doi:10.5755/j01.ee.28.4.14003

Ockey, J. R. (2011). Economic freedom and fiscal performance: A regression analysis of indices of economic freedom on per capita gdp. Undergrad. Econ. Rev. 8 (1), 9.

Oecd, (2023). Assessing the impact of Russia’s war against Ukraine on eastern partner countries. Paris, France: OECD Publishing. doi:10.1787/946a936c-en

Oh, I., Yoo, W. J., and Kim, K. (2020). Economic effects of renewable energy expansion policy: Computable general equilibrium analysis for Korea. Int. J. Environ. Res. Public Health 17 (13), 4762. doi:10.3390/ijerph17134762

Olamide, E., Ogujiuba, K., and Maredza, A. (2022). Exchange rate volatility, inflation and economic growth in developing countries: Panel data approach for SADC. Economies 10 (3), 67. doi:10.3390/economies10030067

Paleologou, S. M. (2022). Happiness, democracy and socio-economic conditions: Evidence from a difference GMM estimator. J. Behav. Exp. Econ. 101, 101945. doi:10.1016/j.socec.2022.101945

Pao, H. T., and Fu, H. C. (2013). Renewable energy, non-renewable energy and economic growth in Brazil. Renew. Sustain. Energy Rev. 25, 381–392. doi:10.1016/j.rser.2013.05.004

Pehlivanoglu, F., Kocbulut, O., Akdag, S., and Alola, A. A. (2021). Toward a sustainable economic development in the EU member states: The role of energy efficiency-intensity and renewable energy. Int. J. Energy Res. 45 (15), 21219–21233. doi:10.1002/er.7174

Pekarčíková, K., Vaněk, M., and Sousedíková, R. (2022). Determinants of economic growth: Panel data analysis of OPEC. Resour. Policy 79, 103129. doi:10.1016/j.resourpol.2022.103129

Poku, K., Opoku, E., and Agyeiwaa Ennin, P. (2022). The influence of government expenditure on economic growth in Ghana: An Ardl approach. Cogent Econ. Finance 10 (1), 2160036. doi:10.1080/23322039.2022.2160036

Prasetyo, A. D., and Pudjono, A. N. S. (2013). Measuring government expenditure efficiencies towards peace and human development. asian J. Technol. Manag. 6 (2), 82. doi:10.12695/ajtm.2013.6.2.3

Prisecaru, P. (2022). The war in Ukraine and the overhaul of EU energy security. Glob. Econ. Obs. 10 (1), 16–25.

Prohorovs, A. (2022). Russia’s war in Ukraine: Consequences for European countries’ businesses and economies. J. risk financial Manag. 15 (7), 295. doi:10.3390/jrfm15070295

Quibria, M. G. (2006). Does governance matter? Yes, no or maybe: Some evidence from developing asia. Kyklos 59 (1), 99–114. doi:10.1111/j.1467-6435.2006.00322.x

Qureshi, A., Rizwan, M. S., Ahmad, G., and Ashraf, D. (2022). Russia–Ukraine war and systemic risk: Who is taking the heat? Finance Res. Lett. 48, 103036. doi:10.1016/j.frl.2022.103036

Rawtani, D., Gupta, G., Khatri, N., Rao, P. K., and Hussain, C. M. (2022). Environmental damages due to war in Ukraine: A perspective. Sci. Total Environ. 850, 157932. doi:10.1016/j.scitotenv.2022.157932

Rindermann, H., Kodila-Tedika, O., and Christainsen, G. (2015). Cognitive capital, good governance, and the wealth of nations. Intelligence 51, 98–108. doi:10.1016/j.intell.2015.06.002

Roessler, M. (2019). Political regimes and publicly provided goods: Why democracy needs development. Public Choice 180 (3-4), 301–331. doi:10.1007/s11127-019-00638-y

Sevencan, A. (2018). Energy dependence and economic growth. Contemp. Res. Econ. Soc. Sci. 2 (1), 189–210.

Shahbaz, M., Raghutla, C., Chittedi, K. R., Jiao, Z., and Vo, X. V. (2020). The effect of renewable energy consumption on economic growth: Evidence from the renewable energy country attractive index. Energy 207, 118162. doi:10.1016/j.energy.2020.118162