- 1Department of International Trade and Logistics, Faculty of Economics, Administrative and Social Sciences, Hasan Kalyoncu University, Gaziantep, Türkiye

- 2Department of Economics, Faculty of Economics and Administrative Sciences, Near East University, Nicosia, Mersin, Türkiye

- 3North-West University Business School, Potchefstroom, South Africa

This study elucidates how fiscal decentralization affects environmental sustainability, moderating the role of environmental policy stringency in the selected European Union (EU) countries between 1995 and 2020. In addition, economic upturn, import diversification, and environmental protection expenditures are utilized as control variables. The empirical findings of the Method of the Moments Quantile Regression (MMQR) disclosed that the environmental policy stringency and environmental protection expenditures help the EU achieve ecological priorities. In addition, import diversification also spurs environmental sustainability, with more substantial impacts on less energy and carbon–efficient nations. Furthermore, the MMQR outcomes divulged that fiscal decentralization (all indicators) endorsed the environmental deterioration of EU members, undermining the achievement of ecological urgencies. Nonetheless, via the means of environmental policy stringency, fiscal decentralization positively influences environmental sustainability. These findings unveil that the harmful impact of fiscal decentralization on environmental sustainability can be curtailed if EU members impose more stringent environmental policies. Herein, to fulfil the targets of Sustainable Development Goals (SDGs), in particular, SDG7 and SDG13, EU members should consolidate fiscal decentralization initiatives and environmental policy stringency to ensure the achievement of ecological priorities.

1 Introduction

A major hazard to life on earth is the degradation of the environment. The environment is under more stress due to economic activities, global trade, and population growth (Essayem et al., 2024). More specifically, the global economy has further experienced different forms of instabilities since the pandemic. Instabilities created by COVID–19 shocks, geopolitical tensions, such as the Russian–Ukraine war, and a decline in the quality of institutions, which are major drivers of achieving a sustainable environment (Ahmed et al., 2024; Wahab et al., 2024). Achieving a sustainable environment, which is one of the core pillars of sustainable development, is central to global discussions. Sustainable development refers to using resources responsibly to meet the needs of the present generation, without jeopardizing the chances of meeting the needs of future generations. This involves preserving or protecting the environment or ecosystem. Thus, sustainable development is vital for improving social well–being, intergenerational justice, and maintaining the quality of life for future generations (Zhang and Xiang, 2023).

It is essential to state that environmental sustainability and climate change are linked. Climate change has emerged as one of the world’s most pressing and contentious issues in recent years, and there is increasing awareness that it requires immediate attention (Somoye et al., 2023). The issues associated with climate change threaten sustainable development. Unfavourable occurrences like droughts, floods, and storms cause climate change, which in turn causes mass migration, extreme poverty, low agricultural productivity, and food insecurity (United Nations, 2023). Natural and human factors primarily drive climate change. Natural causes, such as volcanic eruptions, solar radiation, tectonic shifts, and changes in orbit, while human factors through the emissions of greenhouse gases (GHGs) such as carbon dioxide emissions (CO2) (NRDC, 2022). Thus, continuing to investigate the drivers of ecological quality is essential.

Diverse factors can contribute to a sustainable environment, including fiscal decentralization (FIS) and environmental policy stringency (STR). Witzel (2001) opined that FIS is a system that incorporates a framework for decentralizing revenue, spending, and associated duties to a lower level of government. FIS entails fiscal revenue decentralization (FREV) and fiscal expenditure decentralization (FEXP). The FEXP component might boost economic growth as it shifts more jurisdictions over finance, empowering local authorities to decide on the tax base and tax rate. FREV, however, induces the transfer of control on fiscal expenditures from central to subnational governments. Witzel (2001) stated that FIS has become one of the key policy instruments that now significantly influences local economic and social development. DiPietro and Anoruo (2006) suggested that FIS promotes more accountability and ownership. Khan et al. (2023) argued that FIS is a non–economic policy indicator that can provide countries with the greatest option for reshaping environmental policies to maintain environmental quality. FIS can also help correct market failure linked to energy innovation and improve public service delivery (Oates, 2004; Sun and Razzaq, 2022). In this context, local governments or provinces maintain strong relationships with the populace while establishing their needs and preferences. If there is a positive connection between these provinces and their surrounding population, environmental goals can be easily achieved by lowering pollution–related activities (Liu et al., 2022). In summary, the main goals of FIS are to promote economic growth, better public service delivery, and strengthen local government (Khan et al., 2021).

One must consider that the stringency of environmental policies (STR) is important for FIS to work effectively. Mihai et al. (2023) defined stringency as the extent to which environmental policies impose a charge, either explicit or implicit, on actions that pollute or harm the environment. In other words, stringency simply means creating, establishing, and enforcing strict rules that will be beneficial to society to address the issue of negative externalities. In precision, negative externalities are connected to environmental deterioration; as a result, market mechanisms by themselves are unable to address these externalities. Thus, the state must create and enforce strict environmental laws and regulations with the primary goal of addressing ecological hazards (Wolde-Rufael and Weldemeskel, 2020). Examples of environmental policies that can curb this anomaly include taxes and tariffs.

As a result, this study investigates the nexus between fiscal decentralization and environmental sustainability in the European Union (EU) economies from 1995 to 2020, moderating the role of environmental policy stringency. In addition, for robust outcomes, control variables are employed, such as economic upturn, import diversification, and environmental protection expenditure. Given the economic significance and ongoing EU attempts to find workable ways to meet carbon neutrality goals, the importance of this study is corroborated. Such carbon neutrality goals are entrenched in the Green Deal of the EU. This deal lays out a comprehensive plan to make Europe the first climate–neutral continent by 2050, protect biodiversity, create an economy that is circular, and eradicate pollution—all while increasing European industry’s competitiveness and guaranteeing a fair transition for the impacted regions and workers (European Parliament, 2025).

Thus, the gaps observed and the innovation put forth by this study are as follows: First, though the empirical results on the determinants of environmental sustainability have been manifested with strong evidence, the literature on the environmental impact of fiscal decentralization is scarce. Second, as proposed by Satrovic et al. (2024), environmental sustainability is represented by twin proxies, namely, energy efficiency and carbon efficiency. This differs from prior studies that employed other forms of environmental sustainability measures such as CO2 and ecological footprint. These two proxies capture both environmental and economic facets of environmental sustainability. Thirdly, this study adopts three proxies to capture FIS, namely, expenditure decentralization (FEXP), revenue decentralization (FREV), and a composite indicator that integrates these two dimensions. This makes our investigations and findings more robust, rather than just using a single fiscal decentralization indicator employed by other studies. In addition, Satrovic et al. (2024) recommended in their previous study that environmental policy variables should be included in an economic model to grasp how to better attain ecological sustainability. Thus, a stringent environmental policy variable is included as an interaction term with fiscal decentralization. This is a major and significant contribution of this research. Lastly, a much more advanced econometric technique is employed, namely, Methods of Moments Quantile Regression (MMQR). This approach is more robust because it addresses several panel data–related issues including endogeneity constraints. The MMQR technique can also assess non–linear relationships, enabling the estimation against different quantiles of environmental sustainability. As such, it provides more appropriate results in comparison with traditional techniques that only capture mean effects. Furthermore, the Driscoll–Kraay econometric technique was employed to confirm the MMQR findings.

This study is divided into the following sections. Section 2 is the reviewed literature; Section 3 encompasses the theoretical framework, data and methods; Section 4 presents the results and discussions, while Section 5 concludes the study and makes recommendations for future investigations. In addition, the limitations of the study are included.

2 Literature review

In China, Kuai et al. (2019) concluded that fiscal decentralization improves the environment. However, the study further confirms that decentralizing fiscal revenue benefits the environment more than expenditure decentralization. In 9 EU economies, Satrovic et al. (2024) found that fiscal decentralization does not contribute to the sustainability of the environment, implying that reducing environmental harm to EU countries through fiscal decentralization is an ineffective strategy. This outcome supports the Race to Bottom Hypothesis, indicating the drive for economic growth at the expense of the environment. The study further established that green investments play a crucial role in moderating the harmful impact of fiscal decentralization on environmental sustainability. In 7 selected fiscal decentralized economies, Ji et al. (2021) found that fiscal decentralization—both linear and nonlinear—improves the environment by lowering CO2. Additionally, using renewable energy sources and eco–innovation lowers CO2, while GDP increases CO2 (Villanthenkodath et al., 2024). For OECD economies, the findings of Shan et al. (2021) demonstrate that while the non–linear term of fiscal decentralization reduces CO2, the linear term increases it. It confirmed the inverse U–shaped relationship between fiscal decentralization and CO2. In addition, enhancing the quality of institutions reduces CO2, but raising GDP has the reverse effect. Tufail et al. (2021) also confirmed that the long–term outcomes demonstrate that natural resource rent and fiscal decentralization enhance the atmosphere by lowering CO2.

Utilizing the moderating role of institutional governance in selected EU economies and employing the CS–ARDL approach, Liu et al. (2022) established that fiscal decentralization, institutional governance, and investments in renewable energy greatly enhance ecological sustainability in the long and short–run. In addition, the results verify that institutional governance has a noteworthy moderating effect on the relationship between investments in renewable energy, fiscal decentralization, and CO2. Also, employing a frequency domain causality technique, fiscal decentralization has a causal relationship with CO2 in the long–run. Adopting a STIRPAT framework, Qiao et al. (2022) concluded that fiscal decentralization and technological innovation contribute to environmental sustainability in Asia–Pacific Economic Corporation (APEC) economies. The findings also show that while fiscal decentralization does not affect ecological footprint through economic growth, it does improve environmental quality through technical innovation.

Wang et al. (2023) for 17 developed economies demonstrated how fiscal decentralization, innovative green technology, and institutional efficiency may reduce emissions. Fiscal decentralization does provide the greatest emissions mitigation impacts for higher quantiles of emissions and the lowest for lower quantiles. On the other hand, the impact of institutional efficiency and innovative green technologies on reducing emissions is greater for lower quantiles and lower for higher quantiles. The findings validate the asymmetric impact of fiscal decentralization, innovation in green technology, and institutional efficiency on CO2. The study also showed that the effects of these factors vary considerably at lower, middle, and higher quantiles and are not uniform across the distribution. According to Udeagha and Ngepah (2023a), the BRICS economies should exercise caution while implementing fiscal decentralization measures. This is because of the adverse exacerbating effect of fiscal decentralization on the environment.

In an editorial posited by Khan et al. (2023), financially decentralized countries with robust institutions and high–income levels will outperform fiscally non–decentralized countries in terms of reducing environmental pollution. This confirms the Race to the Top Approach (Lingyan et al., 2022; Sun and Razzaq, 2022). The Race to the Bottom viewpoint, on the other hand, contends that fiscal decentralization exacerbates environmental problems because of several factors, including luring foreign direct investment, a lack of technological advancement, non–robust institutions, weak coordination between the federal and local governments, and high energy costs (Shan et al., 2021). Making use of the CS–ARDL approach for 10 highly decentralized economies, Sun et al. (2023) found that decentralization of expenditures increases CO2, while that of revenue decreases CO2. These are direct effects. The indirect effects benefit the environment when channeled through the consumption of renewable energy. In addition, composite decentralization and its interaction with clean energy reduce CO2. Thus, the study asserts that if financial authority (revenue or composite) is delegated to local government, it will improve resource efficiency and raise the use of renewable energy. In the USA, Ahmed et al. (2023) established that fiscal decentralization, which gives local governments more financial independence, has a positive but insignificant impact on CO2. In the EU 27 economies, Gariba et al. (2024) confirmed that while fiscal decentralization significantly improves the environmental and social SDGs, it significantly worsens economic sustainability.

According to Gao et al. (2025), fiscal decentralization encourages heavy polluting companies to improve the quality of green innovations in technology, the efficiency of green technological research and development, and the efficiency of green outcomes transformation, all of which contribute to the low–carbon transition. Cai et al. (2025) opined that fiscal decentralization has a major role in reducing carbon emissions, yet stricter environmental laws have not been able to stop the increase of emissions, leading to a “green paradox”, where short–term financial advantages are given priority under relaxed restrictions, which results in underinvestment and dispersed regulatory efforts that erode emissions control. In 53 economies, Choudhury and Sahu (2025) found that fiscal decentralization can reduce ecological footprint. However, when the threshold is exceeded, the relationship becomes positive. The study further asserted that fiscal decentralization has a major drawback in that it could be less successful in using scale economies in the production and distribution of services, as well as in controlling externalities or ripple effects beyond administrative boundaries.

Effective government policies, whether at the federal, state, regional, or local levels, are critical in helping diverse economies accomplish their aim of a sustainable environment. These policies influence and steer economic activity. It has also been established that government policies are often undertaken to limit negative externalities. As a result, findings from diverse studies have demonstrated that environmental policy stringency encourages environmental sustainability. Such studies include Wang et al. (2022) for BRICS economies, Li et al. (2022) for OECD economies, Xie et al. (2023) for high–income economies, Liu et al. (2023) for the Asia Pacific region, and Satrovic et al. (2025a) for European Union. Mihai et al. (2023) found positive and insignificant findings for OECD countries.

2.1 Knowledge gap

First, few studies have looked at the possible trade–offs and synergies between ecological sustainability and fiscal decentralization in the EU. This disparity makes it more difficult to comprehend the best practices and regulations for distributing funds to assist ecological projects at the municipal/local or regional level. Second, there are significant gaps in the literature on ecological sustainability and environmental policy stringency in the EU. Studies explicitly examining environmental policy stringency’s effects on ecological sustainability in the EU are scarce, even though it is widely acknowledged as a key force behind sustainable development. This disconnect makes it more challenging to fully utilize environmental policy stringency to solve environmental issues and advance sustainable practices. Third, the MMQR econometric technique is employed as opposed to other methods utilized by prior studies, such as NARDL, CS–ARDL, ARDL, FMOLS, and DOLS.

3 Theoretical basis, model, data and research methods

3.1 Theoretical basis

This section clarifies the theoretical foundation of this analysis, unveiling the interplay between fiscal decentralization, environmental policy stringency, import diversification, expenditure on environmental protection, and twin indicators of environmental sustainability. Fiscal decentralization refers to redefining the competencies of the central and subnational governments in conducting fiscal policy. More specifically, it is the process of shifting the expenditure and revenue–based responsibilities from central to the lower authorities. As expenditure and revenue decentralization are the two dissimilar indicators of fiscal decentralization, their distinct interplay with environmental sustainability is expected. Herein, the evidence on the fiscal decentralization–environment nexus is divided into two contrasting mechanisms, namely, “race to the top” and “race to the bottom.” The first strand of evidence induces a favourable environmental impact under the “race to the top” mechanism, unveiling that growing fiscal decentralization permits local authorities to rigorously follow–up dirty industries and, forcefully displace them abroad, when necessary. Local governments are imposing more stringent environmental regulations rather than relaxing them, and thus provoke a betterment of environmental sustainability. Fiscal decentralization empowers local authorities to consider the unique characteristics and diversities of the particular region in formulating more efficient environmental policies. The “race to the top” also supposes that local authorities act more effectively than central officials in organizing public services free from negative externalities. In essence, local officials may acknowledge the necessity to maximize the welfare of the population by optimizing the environmental advantages of fiscal decentralization. On the contrary, “race to the bottom” mechanism suggests that local officials might prioritize the improvement of economic well–being over environmental sustainability. A growing fiscal decentralization can induce competition, pushing local officials to relax environmental standards to attract foreign investors, which may exacerbate environmental sustainability. Such practices may attract investments in dirty industries that rely on unclean energy sources, translating into environmental deterioration. Following the “race to the bottom” mechanism, a growing fiscal decentralization is regarded as a key driver of environmental challenges.

Trading activities are the essential determinants of environmental sustainability, as these are among the most substantial emitters of anthropogenic gases. Considering their vitality, trade factors (trade openness, import and export diversification) sparked growing attention from researchers. The reason for this is that trade activities boost energy use and may potentially cause appreciably greater environmental pressure (Sadiq et al., 2022; Zhou et al., 2024). Trading activities increase the variety of goods available and help strengthen the relationships between distant countries. However, one should not overlook the environmental impact of trade activities. Among trade factors, particular emphasis is placed on import diversification, as it is not only the critical determinant of economic upturn but also represents a prominent instigator of pollution. Import diversification measures the extent to which the pattern of imports of an economy deviates from the rest of the world. The sign of the environmental impact of import diversification unriddles the basic economic country conditions. Specifically, introductory stages of growth may be accompanied by dirty industries that consume more energy, reflecting an upswing in pollution. However, at later stages of growth, nations may be provoked to transition the industry to a low–carbon state. The movement towards lower carbon industries directs advanced nations to shift towards green energy and to specialize in the manufacturing of eco–friendly products. To accelerate environmental sustainability, advanced nations introduce modern technology and innovations in production activities. Notwithstanding the efforts of advanced nations to make their economies cleaner, it may be recalled that these nations mobilize significant funds to implement their environmental policies. Accordingly, advanced nations prioritize the low–carbon manufacturing over dirty industries, inclining towards the import of eco–unfriendly products from developing nations. Given these arguments, the beneficial environmental impacts of import diversification is likely to occur in advanced nations. On the other hand, developing countries might be importing energy–intensive intermediate products and machinery, causing an escalation of pollutant emissions. The ultimate objective of developed countries is to reduce energy intensity in favour of energy efficiency via the channel of technological advancement. As developed countries are among the most technologically advanced nations, they are attempting to enhance technological capacity through technology transfer. Moreover, the developing countries’ existing technology might be modernized via the means of imported technology to sustain the environmental quality. The advantageous environmental impact of import diversification is prominently associated with the imposition of stringent environmental policies. If there is a lack of environmental regulations, the advantageous environmental impact of import diversification will fade out.

Central and subnational officials develop policies to impose a higher price on environmentally harmful behaviour, regarded as stringent environmental policies. These policies unveil the degree to which environmental rules, laws, and regulations peg a price on eco–unfriendly conduct. Thus, the purpose of stringent environmental regulation is to make unsustainable production and consumption unaffordable, affirming the behavioural changes in both the business sector and households. As such, rigorous environmental policy paves the way towards anthropogenic emissions mitigation for a sustainable future. It also encourages the business sector to use modern machinery that curtails pollutants and affirms eco–innovations. By fostering low–carbon machinery, stringent environmental policies can alleviate the harmful effects of pollutants. Consequently, these can promote the shift from unsustainable consumption and production towards an environmentally beneficial one. An effective environmental policy benefits the environment in two ways; firstly, it fosters green innovation, and secondly, it enhances eco–friendly products. Herein, rigorous environmental standards are not only effective in instigating the development of low–carbon technologies but also in preventing the utilization of eco–unfriendly raw materials and intermediate products. On the flip side, the business sector might be unwilling to invest in green machinery as it may cause extra costs. Acknowledging that the implementation of rigorous environmental legislation is expensive, the business sector may rather shift their carbon–intensive production to developing countries that impose less strict environmental standards. However, environmental awareness strengthens as income rises, insinuating that after reaching a threshold level of income, developing nations will enforce environmental regulation to boost green production and consumption trajectories. Herein, in the introductory stages of growth, environmental regulations may be too weak to impose an environmental betterment effect, but at later stages, these regulations may be effective in amplifying environmental sustainability.

The Gross Domestic Product (GDP) incorporates consumption, government spending, and the difference between exports and imports (net exports) of a country, among other economic factors. Consumption is an essential component of GDP, and its rising trend may explain the intensification of environmental pressure. The expected harmful environmental impact of GDP, especially in the early stages of growth, can be justified in the sense that this study incorporates countries that have a sharp economic acceleration. The economic upturn is accompanied by rising energy demand, with fossil fuels being the most sizeable source of energy in the EU. Although countries have inaugurated various policies to curb environmental deterioration, they still import emissions via the channels of trade and consumption. Government expenditure on environmental protection is among the essential instruments of environmental policy in the EU and is assumed to curb anthropogenic emissions. It can be defined as government spending dedicated towards pollution mitigation, maintenance of biodiversity, and waste reduction. Environmental protection expenditure prompts the industrial sector to affirm eco–innovations and low–carbon technology that will help in attaining the targets of energy efficiency. The advantageous environmental impact of environmental protection expenditure can be gauged on the ground that it encourages producers to shift towards the production of eco–friendly commodities. In addition, environmental protection expenditure may help the business sector to manage waste more efficiently and to combat pollution (Yıldız, 2025). On the flip side, expenditures for environmental protection impose additional costs, boost burdens, and present a new set of enterprise challenges. Environmental policy stringency is a vital tool that may be employed directly or indirectly to curtail environmental issues. Indeed, the alliance of stringent environmental rules and strong institutions contends the propulsive force of environmental sustainability (Imran et al., 2024; Wahab et al., 2024). This is because strict environmental regulations aspire to repair the negative environmental externalities, including soil, water, and air pollution. Empowering subnational governments with stringent environmental rules, laws, and regulations is expected to reduce the adverse ecological impact of fiscal decentralization (Zhang and Xiang, 2023). This can be explained on the ground that in authorities with stricter environmental regulations, public spending may be directed to support renewable energy solutions and green innovations, and reduce tax burdens for eco–friendly enterprises. The imposition of efficient environmental policies might affirm subnational governments to invest in pollution treatment and pollution prevention to induce the modification in the production process towards green and eco–friendly manufacturing. As a result, rigorous environmental policies oil the wheel of environmental sustainability, advocating the opinion that subnational governments can ameliorate the environmental cost of economic upturn and harmonize economic and environmental objectives. In this context, this study prompts the assessment of the moderating role of environmental policy stringency in eliminating the harmful effects of fiscal decentralization on energy and carbon efficiency as proxies for environmental sustainability. These two proxies are selected to capture not only the environmental but also the economic facet of environmental sustainability. Energy efficiency (units of output produced per unit of energy used) is accommodated to comprehensively assess the environmental sustainability of the EU in the sense that lower energy efficiency means higher energy intensity (price of turning energy into output) and vice versa. Carbon efficiency (units of output produced per unit of carbon dioxide emissions) prompts that a cut in carbon efficiency often enlarges carbon–intensity (carbon dioxide emissions per unit of output), being a threat to the environmental sustainability of the EU.

3.2 Model construction

Based on the aforementioned theoretical interplays between variables, this study makes use of the esteemed EKC (Environmental Kuznets Curve) framework to assess the associations between fiscal decentralization, environmental policy stringency, import diversification, economic upturn, environmental protection expenditure, and environmental sustainability (Bergougui and Satrovic, 2025; Villanthenkodath et al., 2024; Musah et al., 2024). This empirical setting examines whether environmental policy stringency helps in mitigating environmental deterioration and is specified as follows (Equation 1):

We have transformed panel data into logarithmic form to cope with outliers. Accordingly, the logarithm function is applied to Equation 1, to specify a log-linear regression form that is seen below (Equation 2):

In the above equation,

As a dependent variable, this study adopts energy efficiency to capture both economic and environmental patterns of environmental sustainability (Ma et al., 2022). For the sake of robustness, an alternative dependent variable is accommodated, namely, carbon intensity. Previous empirical evidence mainly opted for greenhouse gas emissions or ecological footprint to measure environmental sustainability, overlooking the economic perspective (Villanthenkodath et al., 2024; Musah et al., 2024). To close this gap, this study sets out to answer the question of how selected independent variables interrelate with units of output produced per unit of energy used or units of output produced per unit of carbon dioxide emissions. As far as the independent variables are considered, the interplay between economic upturn and the environment is frequently assessed in mainstream studies under the shadow of the EKC. The authenticity of inverted U–type nonlinear behaviour that verifies the EKC phenomenon is validated if economic upturn yields worsening environmental impact in the introductory stages of growth, whereas later stages set out the advantageous environmental impact of economic upturn as discovered by Ansari (2022), Musah et al. (2024). The environmental impact of fiscal decentralization is getting far more attention in empirical studies with inconclusive findings. According to the literature opting for the “race to the top” pattern, fiscal decentralization is beneficial for environmental sustainability in a manner that subnational governments are carefully monitoring heavy pollution businesses to direct them towards greener production processes (Fang and Fang, 2023; Hu et al., 2023; Liu et al., 2022). On the other hand, “race to the bottom” specification indicates that local governments favour economic upturn over environmental protection, causing a relaxation of environmental standards that give rise to environmental concerns (Sun et al., 2023; Udeagha and Ngepah, 2023b; Zhang and Xiang, 2023). Along these lines, fiscal decentralization might aggravate or amplify the environmental sustainability of the EU (i.e.,

This study aims to assess the moderating role of environmental policy stringency in curbing the disadvantageous environmental impact of fiscal decentralization in the EU countries. Therefore, the model specified in Equation 2 is augmented to capture the joint effect of three indicators of fiscal decentralization and environmental policy stringency on environmental sustainability as shown below (Equation 3):

Based on Equation 3, Mod refers to the combined effect of FIS and environmental policy stringency. Given the potential of stringent environmental policies to foster subnational governments to assist the business sector in a transition towards cleaner production, it is projected that the coefficient of Mod will be positive (i.e.,

3.3 Data description

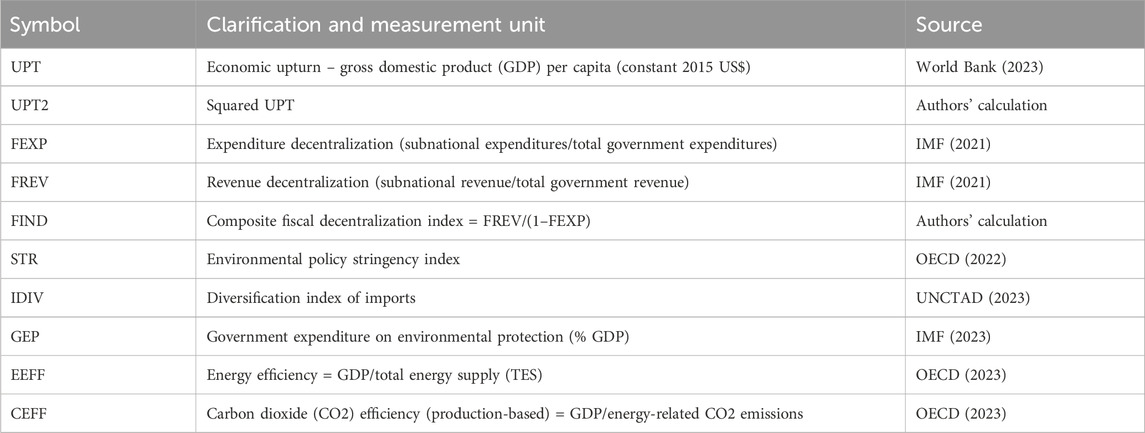

This study incorporates seven EU members (Austria, Belgium, Germany, Hungary, the Netherlands, Spain, and Sweden) in the period from 1995 to 2020. Sample period selection was primarily based on the data availability to ensure a balanced panel data set. Notably, the data for import diversification index were available from 1995, whereas the data on environmental policy stringency were not available after 2020. It is worth noting that fiscal decentralization proxies were available in a balanced form for Austria, Belgium, Canada, Estonia, Georgia, Germany, Hungary, Japan, Latvia, Netherlands, Peru, Spain, Sweden, Switzerland, and the United Kingdom. As the majority of the countries are members of the EU, it justifies the selection of this bloc to analyze the driving forces of energy and carbon efficiency. The selected countries unveil a substantial progress in STR (OECD, 2022) in the sample period (i.e., Austria from 1.61 to 3.31, Belgium from 1.11 to 3.44, Germany from 1.50 to 3.47, Hungary from 0.53 to 2.81, Netherlands from 1.44 to 3.47, Spain from 1.11 to 2.50, and Sweden from 1.25 to 3.83). Moreover, the selected countries contain the value of carbon efficiency far above the OECD average of 5.50 in 2020, whereas all countries but Belgium report the value of energy efficiency to outpace the OECD average of 11,283.13 US$ (2015) per tonne of oil equivalent in 2020 (OECD, 2023). In addition, viable reasons to select these countries can be summarized as: they enacted an environmental policy framework that comprises the world’s most rigorous environmental standards and regulations. Next, even though fiscal decentralization processes vary between the selected nations, these are strongly decentralized countries regarded as developed. EU members allocate sizable funds to comply with strict environmental standards, and thus stimulate specialization in manufacturing of green products, whereas the demand for eco–unfriendly products is met from imports. Lastly, the environmental sustainability of the EU is strongly attributable to trade factors as these boost energy demand, which may aggravate environmental harm. Table 1 covers the description of the chosen variables and their measurement units.

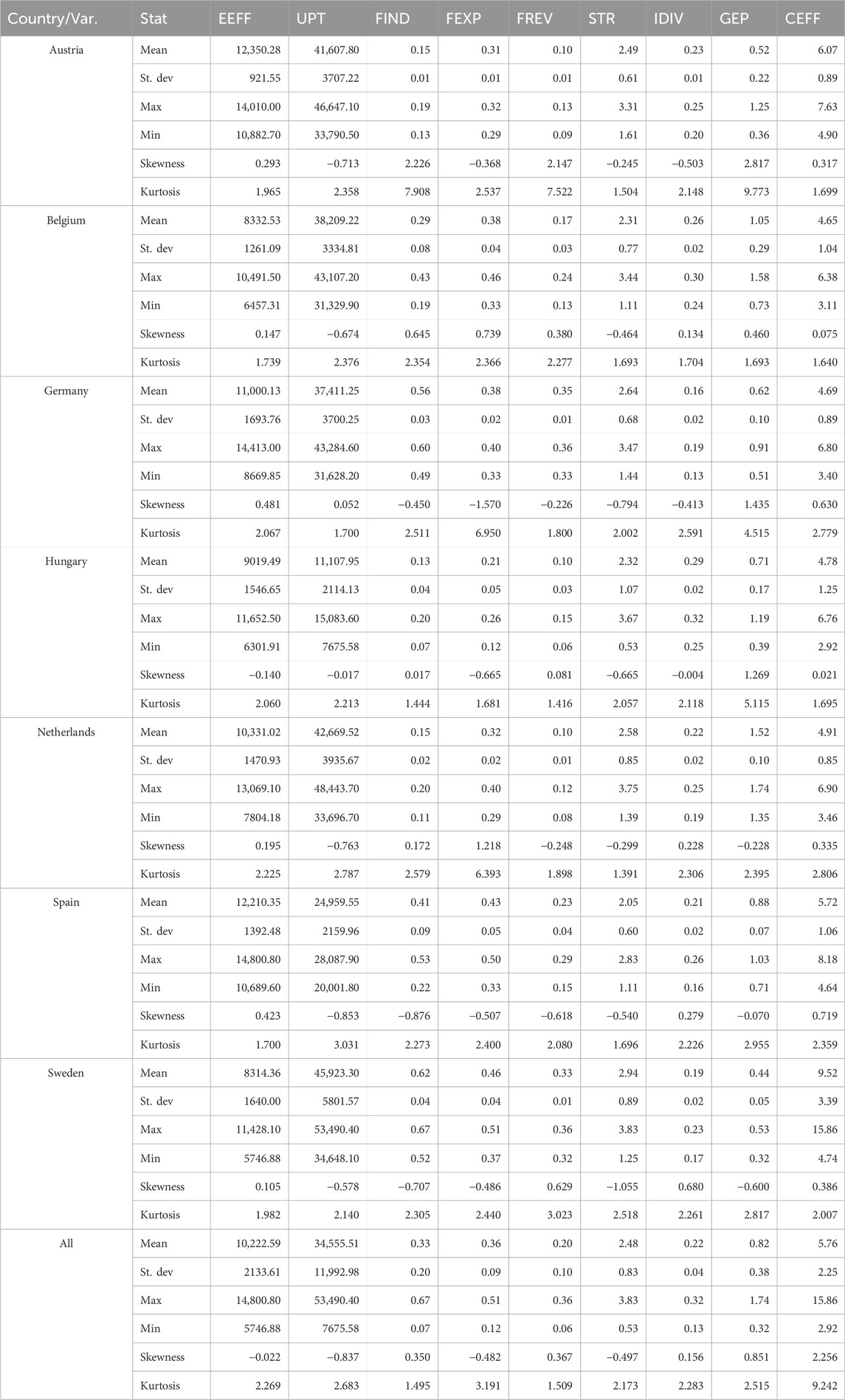

Energy efficiency has been utilized as a primary dependent variable to adapt economic and environmental features of environmental sustainability. Energy efficiency surpasses the traditional environmental indicators (i.e., greenhouse gas emissions or ecological footprint) based on a single environmental dimension, as it opts to cover economic components as well. It is calculated as units of output produced/energy used, and is taken from the statistics collected by the Organisation for Economic Co–operation and Development (OECD, 2023). This study employs the alternative dependent variable for the sake of robustness measured by dividing units of output produced with carbon dioxide emissions gathered from (OECD, 2023). The independent variable economic upturn is the fundamental agent that enlarges pollutant emissions, resulting in environmental harm (Ahmad and Satrovic, 2024). Gross domestic product per capita in constant 2015 US$ compiled from the (World Bank, 2023) is chosen to measure the economic upturn of EU members. This study encompasses three essential proxies for fiscal decentralization, namely, expenditure decentralization, revenue decentralization, and the composite fiscal decentralization index. The data on fiscal decentralization were gathered from the International Monetary Fund (IMF, 2021). Furthermore, environmental standards are regulations that might be the ultimate agents in ascertaining the environmental sustainability of the EU. To capture the vitality of the environmental impact of these regulations, our study opts for the environmental policy stringency index collected from the OECD Environmental Policy Stringency Index database (OECD, 2022). Import diversification might also be harmful to environmental sustainability as it strongly interrelates with energy use. Herein, to unveil the environmental impact of import diversification, this study used the diversification index of imports gleaned from the United Nations Conference on Trade and Development (UNCTAD, 2023). Expenditure on environmental protection is used to probe the environmental impact of government spending. The data on GEP is gathered from the statistics gathered by the International Monetary Fund (IMF, 2023). The information on summary statistics is detailed in Table 2.

According to outcomes presented in Table 2, all average values are above zero in the sample of seven EU members. Economic upturn yields the highest standard deviation, with the diversification index of imports displaying a minimum. Kurtosis coefficients slightly reject the notion of normal distribution, where energy efficiency, economic upturn, expenditure decentralization, and environmental policy stringency unveil the negative skewness. Other panel data are opting for positive skewness. In the sample of seven EU nations, Austria portrays the highest average energy efficiency, with Sweden spotlighting the minimum value. However, Sweden seems to have the highest average carbon efficiency, with Belgium yielding minimum mean carbon efficiency. Although Sweden reported the highest average expenditure decentralization, the maximum average revenue decentralization is calculated for Germany. Hungary is characterized by the maximum average import diversification, whereas Germany seems to have the minimum average import diversification. On average, Sweden is the most stringent economy in terms of environmental policies, with Spain having less rigorous environmental regulations. Although Sweden seems to have the least average government spending on environmental protection, the Netherlands displays the highest score.

3.4 Estimation techniques

Before calculating the regression coefficients, it is of principal significance to deploy various econometric techniques. As the EU has established economic integration, the member states are substantially interrelated being subject to global events prone to cause cross–section dependency (CRDP). Disregarding the presence of cross-sectional dependence in panel data may entail biased findings. Aiming to unveil the presence of CRDP concern, this study opts for the test by (Pesaran, 2004) delineated in the form of an equation as shown below (Equation 4):

The analytical period is denoted as

Additionally, the slope heterogeneity test by Pesaran and Yamagata (2008) is performed to verify the existence of slope heterogeneity (SLPHR) issues to provide accurate and unbiased empirical outcomes. The following equations serve to mathematically formulate delta tilde value (

While Equation 7 mathematically expresses adjusted delta tilde value (

Based on the abovementioned equations,

In Equation 8, cross–sectional averages are expressed by CD as below (Equation 9):

Further, Equation 10 specifies the SGUR test is as follows:

where

In Equations 11–14,

In the next stage, the impacts of the independent variables on environmental sustainability are assessed by deploying the Method of the Moments Quantile Regression (MMQR) by Machado and Santos Silva (2019). The selection of the MMQR model is justified since it tackles various concerns associated with panel data, including endogeneity constraints. An additional advantage of the MMQR econometric technique is its ability to assess non–linear relationships. It does not only capture linear interconnections but also reflects non–linear enabling the estimation against different quantiles of environmental sustainability. As such, it provides more appropriate results in comparison with traditional techniques that only capture mean effects of economic upturn, fiscal decentralization, environmental policy stringency, import diversification, and GEP on dependent variables (Satrovic et al., 2025b). In addition, MMQR gets through the variables that do not follow the normality pattern. An additional motivation for selecting MMQR as an estimation strategy in the present study is that it accommodates the fixed effects and is adequate for assessing the heterogeneous estimates across low, middle, and upper quantiles of ENST. It also furnishes trustworthy outcomes in the case of outliers and location asymmetries. Following (Dai and Du, 2023; Fang and Fang, 2023; Hu et al., 2023; Lingyan et al., 2022), the present study adopts the MMQR procedure that can be formalized as (Equation 15):

where

where Mod1 = STR*FIND; Mod2 = STR*FEXP; Mod3 = STR*FREV.

The Driscoll–Kraay estimator (RDIS) is used to check for robustness and to juxtapose our baseline outcomes (MMQR technique) with those of RDIS. The motivation behind selecting the RDIS estimation strategy is that it allows for CRDP and heteroscedasticity issues. Moreover, it addresses the autocorrelation issue and allows for country–specific diversity. Given the appreciable heterogeneity among EU members, it is of vital importance to check the robustness of MMQR outcomes by adopting an estimator resistant to country–specific heterogeneity. In this vein, the present study opts for the RDIS as an ideal strategy for robustness checks by Essayem et al. (2024), Hossain et al. (2024), Islam et al. (2025). As a final step, the present study dives into the causal linkage of independent variables with ENST. Since CRDP and SLPHR issues are likely to occur, the present study opts for the Dumitrescu and Hurlin (2012)– DH test to safeguard the valid empirical outcomes. Unlike the traditional Granger causality test, DH yields trustworthy outcomes in the case of heterogeneity pattern.

Moreover, our study includes an additional proxy for environmental sustainability, i.e., carbon efficiency to look into the robustness of our models from the angle of alternative dependent variable. The amended model specifications are illustrated as under (Model 7 – Equation 22; Model 8 – Equation 23; Model 9 – Equation 24; Model 10 – Equation 25; Model 11 – Equation 26; Model 12 – Equation 27):

Based on Equations 22–27, CEFF stands for carbon efficiency.

4 Results and discussions

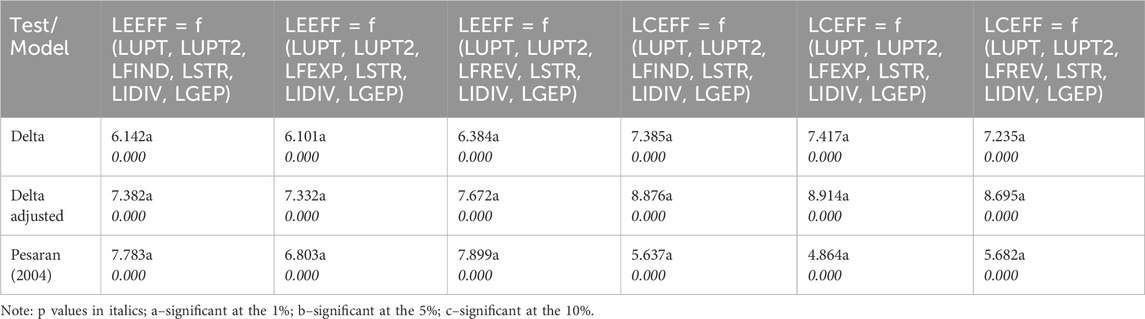

Initially, this section opts for slope heterogeneity (SLPHR) and cross–section dependency (CRDP) tests to unveil the features of the retrieved panel data. In this respect, our study grounds on the Pesaran (2004) CRDP test (Pesaran and Yamagata, 2008), delta and adjusted delta tilde tests as furnished in Table 3.

The empirical outcomes shown in Table 3 helped us to unveil whether slope heterogeneity concern emerges in the sample of EU members in the period from 1995 to 2020. The empirical outcomes revealed that the H0 on the homogeneous slope parameters cannot be accepted at the 1% significance level, considering both delta and adjusted delta tilde tests. Thus, our models are confronting the issue of heterogeneous slope parameters. Moreover, our study checks for the emergence of the CRDP concern in panel data, depicting the outcomes in Table 3. These results affirm the existence of CRDP concern established on the statistically significant values of the Pesaran (2004) test. The status of cross–sectional dependence is declared in all models as H0 on no CRDP is rejected significant at the 1% level. Given that the EU has its origin in economic integration, its members are greatly interrelated not only on economic but also on political, economic, legal and other grounds. Therefore, the accomplishment of one EU member in environmental protection, import diversification or fiscal decentralization may induce the shift of this success to other EU members. This can be referred to as a positive spillover effect.

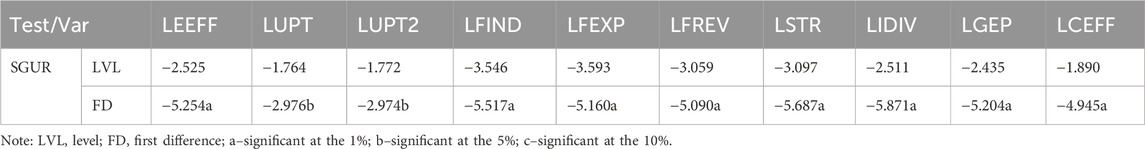

Given that our data confront the issue of SLPHR and CRDP, the first–generation unit root tests are expected to yield misleading results, inspiring us to opt for the second–generation stationarity tests. To this end, this study employs the SGUR test by Pesaran (2007) and exhibits the findings for all model variables in Table 4.

Table 4 demonstrates that all variables are I (1). In particular, energy efficiency, economic upturn, squared economic upturn, fiscal decentralization, environmental policy stringency, import diversification, government expenditure on environmental protection, and carbon efficiency fail to reject the null hypothesis of unit root in levels. However, all model variables refuse to accept the emergence of a unit root in favour of H1, which assumes no unit root at first difference. The confirmation of stationary properties of our variables at their first difference affirms the assessment of the long–run interplay among the determinants of environmental sustainability. Subsequently, this study further uses the cointegration test by Westerlund (2007). Table 5 depicts the outcomes of the cointegration test.

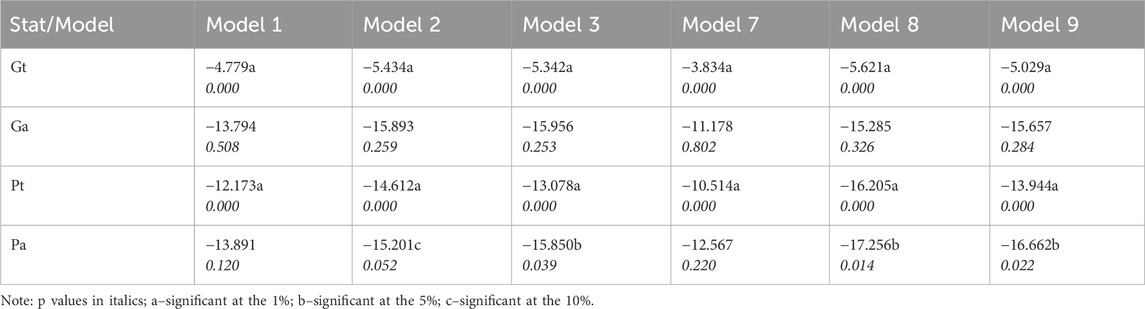

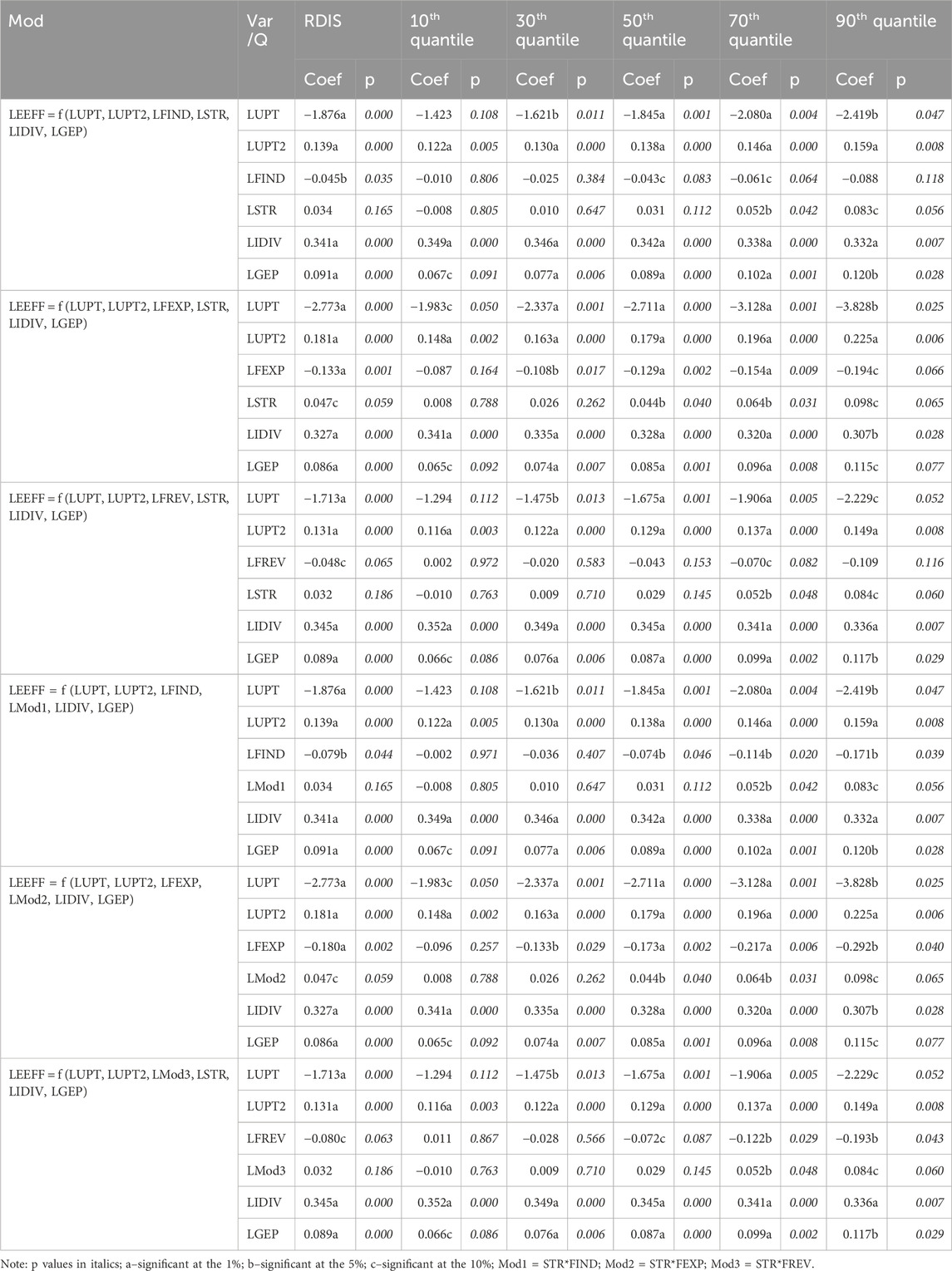

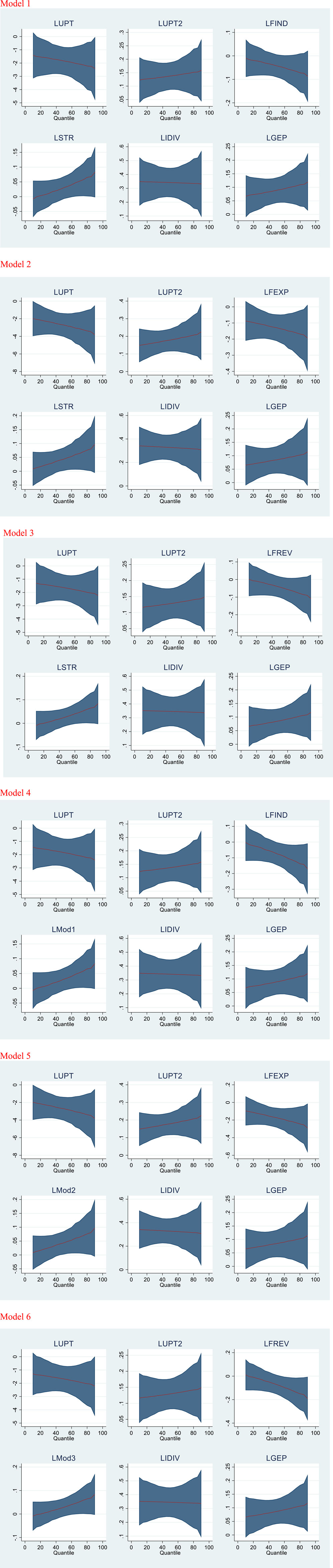

Table 5 spotlights the long–run nexus between our variables. Gt and Pt are both significant at the 1% level for all models while Pa is significant for Models 2, 3, 8, and 9 insinuating that the possibility of cointegration cannot be rejected. In particular, Westerlund (2007) deals with SLPHR and CRDP concerns affirming that our variables are cointegrated in the long run. The outcome of Table 5 verified the long-term association between our study variables and allowed us to advance towards calculating elasticity coefficients through MMQR and RDIS econometric techniques. The outcomes of MMQR at odd quantiles are reported in Table 6 whereas Figure 1 graphically inspects the impact of independent variables on environmental sustainability at the even quantiles.

In Table 6, Model 1 divulges the advantageous impact of stringent environmental policies on energy efficiency insinuating that the imposition of more rigorous environmental legislation encourages the environmental efficiency of the EU. The coefficients of environmental policy stringency are significant from quantiles 0.6 to 0.9 in Models 1 and 3, whereas Model 2 reports the statistically significant coefficients for the 0.4 to 0.9 quantiles. The coefficient of environmental policy stringency portrays an increasing trend, implying that the contribution of LSTR to energy efficiency is more sizable in EU members with higher energy efficiency. The business sectors and individuals that do not behave in an ecologically friendly manner are expected to bear an increased burden in countries with more rigorous environmental policies. Subsequently, environmental legislation is adopted to address environmental concerns by fostering economic agents to spend more on green projects and to shift towards environmentally friendly manufacturing. To achieve the net–zero targets, environmental policy stringency fosters green innovation and thus plays the carbon–mitigating role in manufacturing via the means of clean technology. Ultimately, stricter environmental policy generates an advantageous environmental impact through the channels of environmental innovations and the implementation of cleaner technology. Notwithstanding these channels, it is worth mentioning that stricter environmental policies prevent the use of environmentally unfavourable inputs and intermediate products. Wang et al. (2022) drew a similar conclusion divulging that environmental policy stringency palliates the anthropogenic emissions of emerging countries. As a possible justification, the authors spotlighted that pollution is alleviated via the means of research and development expenditure and green energy patterns that are established by stricter environmental norms. Another study that validates the efficient role of environmental policy stringency in curbing harmful emissions is asserted by Xie et al. (2023). The authors claimed that more stringent environmental legislation discourages environmentally harmful consumption and production by imposing higher prices on environmentally unfriendly practices in OECD members. By means of more stringent environmental policies, economic agents are encouraged to prefer green over fossil fuel energy, contributing to the environmental sustainability of emerging countries (Li et al., 2023). The logic behind this is that using more renewable energy is attributable to the stricter environmental norms. In this fashion, Dai and Du (2023) also highlighted the negative association between environmental policy stringency and ecological footprint, insinuating that more stringent environmental norms boost the cost of environmentally harmful processes, provoking the transition towards cleaner consumption and production.

Our study also acknowledges the environmental deterioration mitigating effect of import diversification that plays a favourable role in increasing the energy efficiency of EU members in models without moderation (Models 1–3). According to the outcomes displayed in Table 6; Figure 1, a rise in import diversification brings a rise in energy efficiency. The positive link between import diversification and energy efficiency is strongly significant across all quantiles, portraying that the effect of LIDIV declines while moving from lower to higher quantiles. These findings postulate that an increase in import diversification brings about energy efficiency with a stronger impact in EU members with relatively low energy efficiency. Environmental sustainability is attributable to technological advancement and environmental innovations in developed countries. To ensure compliance with environmental norms, developed countries are importing eco–friendly intermediate products and raw materials, which aid in their environmental sustainability. The pollution–mitigating effect of import diversification is attributable to the adoption of strict environmental norms, and these jointly act in accomplishing the environmental sustainability of the EU. Further, Meng et al. (2022) highlighted that import diversification encourages emerging countries to reduce their environmentally unfriendly activities. The rationale explanation for this positive environmental impact of import diversification is that it accelerates green innovation and the import of green products and inputs, and consequently diminishes energy intensity. In another intriguing study for developed countries, Wang et al. (2024) proposed that import diversification minimizes carbon dioxide emissions. The logic behind this is that the import of products from environmentally friendly countries empowers the reduction of consumption–related anthropogenic emissions.

Regarding fiscal decentralization, models without moderation estimate the negative fiscal decentralization coefficient significant for quantiles 0.5–0.8 in Model 1, 0.2–0.9 in Model 2 and 0.6–0.8 in Model 3. The outcomes of Table 6; Figure 1 claimed that expenditure decentralization negatively influences energy efficiency exhibiting a decreasing trend across all quantiles in Model 2. The coefficient of revenue decentralization demonstrates the more substantial adverse environmental impact of FREV in countries with relatively lower energy efficiency in Model 3. The impact of composite FIS is evaluated in Model 1 demonstrating a decreasing fiscal decentralization coefficient from lower to higher quantiles. The outcomes insinuate that composite FIS executes a more substantial effect on energy efficiency in comparison with proxies that take into account a single dimension of fiscal decentralization (i.e., LFEXP and LFREV). Subsequently, to scale down the adverse environmental impact of fiscal decentralization, it is essential to combine both, expenditure and revenue decentralization. Our empirical evidence supports the idea of “race to the bottom” insinuating that local governments in EU countries are still prioritizing economic targets over environmental protection. Herein, local governments in EU countries allocate funds to support infrastructural and developmental projects through fiscal decentralization, overlooking the vitality of green energy projects. In such circumstances, the targets to sustain the environment are taken for granted, believing that environmental concerns will fix themselves, which in turn boosts behaviour in an environmentally unfriendly fashion. Fiscal decentralization aggravates the environmental deterioration of emerging countries as affirmed by Udeagha and Ngepah (2023b). The rationale behind this finding is that emerging nations have relatively less rigorous environmental norms, aiming to attract foreign investors. Subsequently, to avoid the cost rise associated with the implementation of strict environmental norms in their home countries, industries in developed countries often move their production sites abroad, causing an upswing in anthropogenic emissions in the host countries. Furthermore, Zhang & Xiang (2023) discovered that expenditure decentralization results in environmental destruction, suggesting that a rise in FEXP affirms infrastructural development to encourage dirty industries that are heavily dependent on energy use and emit more greenhouse gases. In the same pursuit, Sun et al. (2023) reported that fiscal decentralization encourages environmental harm in highly decentralized countries.

In Models 4–6, interaction terms of environmental policy stringency and fiscal decentralization are introduced to assess the impact of fiscal decentralization on energy efficiency through rigorous environmental norms. Fiscal decentralization is discovered to have a harmful impact on environmental sustainability. However, by establishing a moderating variable, this study aims to assess whether the joint impact of fiscal decentralization and environmental policy stringency works to preserve the environment of the EU. Our empirical findings highlighted the positive coefficient of the moderator, demonstrating that the harmful impact of composite fiscal decentralization is curtailed when EU members adopt more rigorous environmental norms. By facilitating clean energy sources via subsidies, local governments are meant to alleviate energy intensity and boost the energy efficiency of EU members. Local governments in the EU play a vital role in monitoring economic development under rigorous environmental norms dedicated to supporting sustainable infrastructure projects. Subsequently, local governments will be encouraged to empower sustainable urbanization through higher expenditure decentralization that will benefit the environmental sustainability of the EU. Local governments might subsidize green jobs and encourage the business sector to use sustainable factors of production. Under the strict environmental norms, fiscal decentralization discourages the use of non–renewable energy and encourages the subsidization of green energy projects, which exemplifies an inhibiting impact on the environmental deterioration of the EU. Similar outcomes are yielded by Zhang and Xiang (2023), reporting that the hazardous impact of fiscal decentralization on energy efficiency is scaled down if EU members adopt more rigorous environmental norms.

Economic upturn demonstrates a negative interplay with energy efficiency in models without moderation, whereas the elasticity of economic upturn squared emerged positively significant across all quantiles in all models. Models 1 and 3 elucidate the decreasing extent of the impact of economic upturn from lower to higher quantiles, statistically significant for 0.2–0.9 quantiles. The interplay between economic upturn and energy efficiency is negative in Model 2, but statistically significant across low, medium, and upper quantiles. Economic upturn parameter is negative, whereas the parameter of its squared term is positive, authenticating the non–linear interplay between economic upturn and energy efficiency. These findings signal that EU members engaged in infrastructure projects in introductory developmental stages, challenging the environment through carbon emissions from industrial processes. However, as the standard of living increases with the rising income, the environmental protection paradigm gains in importance at later stages of growth. With the technique effect in place at higher levels of economic growth, the harmful environmental consequences of composition effects are nullified in favour of environmental protection agreeing with (Ansari, 2022; Musah et al., 2024; Villanthenkodath et al., 2024). Our findings elucidated that environmental protection expenditure upsurges energy efficiency. The coefficients of LGEP exhibit an increasing trend, statistically significant across quantiles 0.1–0.9, spotlighting that environmental protection expenditure is advantageous for the environmental sustainability of EU members, with more sizeable impacts in countries with relatively higher levels of energy efficiency. The reason behind this is that environmental protection expenditure may be directed to encourage the business sector towards the implementation of modern technologies based on green innovations that will help reduce energy intensity and accompanying carbon emissions. In addition, the business sector may be empowered to manufacture green products that will help EU members to tackle environmental concerns. Besides, environmental protection expenditure might aid in environmental sustainability by supporting enterprises to manage their waste in a more effective manner. Our findings match previous results of Fan et al. (2022) who discovered that environmental protection expenditure assists in palliating industrial emissions in Chinese cities. Similarly, Carmona et al. (2023) spotlighted that high government spending on environmental protection works in favour of a low ecological footprint, safeguarding the environment. Models with moderation (Models 4–6) demonstrate the statistically significant positive impacts of import diversification, environmental protection expenditure, economic upturn squared, and interaction terms, whereas economic upturn and fiscal decentralization posited a negative coefficient.

For a robustness analysis, this study adopts carbon efficiency as a plausible indicator of environmental sustainability. The regression results are displayed in Supplementary Table A1; Supplementary Figure A1. The alternative model specifications affirm a negative interplay between economic upturn and carbon efficiency in all models, statistically significant across quantiles 0.1–0.9. Economic upturn squared has a positive impact on carbon efficiency, signalling that economic upturn upsurges carbon intensity of EU members against carbon efficiency in introductory stages of growth. However, the trade–off between environmental sustainability and the economic upturn is nullified at higher stages of growth, where economic emancipation works to upgrade the environmental quality. Analogous to our baseline findings, environmental policy stringency maintains the advantageous environmental impact in the sense that it boosts the carbon efficiency of EU members in models without moderation. Similarly, import diversification and environmental protection expenditure are displayed to positively relate to carbon efficiency in all models. Our empirical outcomes further certified that fiscal decentralization promotes carbon intensity against carbon efficiency in EU members in models without moderation. However, models with moderation (Models 4–6) reflected a positive coefficient with the interaction term of FIS and STR, signalling that environmental policy stringency positively moderates the contribution of fiscal decentralization to carbon efficiency.

Our study further uses the Driscoll–Kraay (RDIS) econometric technique for robustness analysis with the results displayed in Table 6; Supplementary Table A1. The outcomes endorsed that economic upturn and its squared term postulate a non-linear association with energy and carbon efficiency, indicating that in the early stages of growth, economic upturn curtails energy/carbon efficiency, whereas higher levels of economic upturn are pertaining to the higher levels of energy/carbon efficiency. Environmental policy stringency upsurges the energy/carbon efficiency signalling that a 1% rise in STR is linked to 0.034% (Model 1), 0.047% (Model 2), 0.032% (Model 3), 0.065% (Model 7), 0.082% (Model 8), and 0.067% (Model 9) rise in energy/carbon efficiency. We discovered that a 1% increase in import diversification corresponds to 0.341% (Models 1 and 4), 0.327% (Models 2 and 5), 0.345% (Models 3 and 6), 0.614% (Models 7 and 10), 0.585% (Models 8 and 11), and 0.628% (Models 9 and 12) increase in energy/carbon efficiency. The elasticity of environmental protection expenditure amplifies energy/carbon efficiency by 0.091% (Models 1 and 4), 0.086% (Models 2 and 5), 0.089% (Models 3 and 6), 0.183% (Models 7 and 10), 0.167% (Models 8 and 11), and 0.182% (Models 9 and 12). Similar to our baseline findings, the RDIS estimator demonstrated the positive coefficients of the interactive term, highlighting that fiscal decentralization upgrades environmental sustainability via the channel of environmental policy stringency.

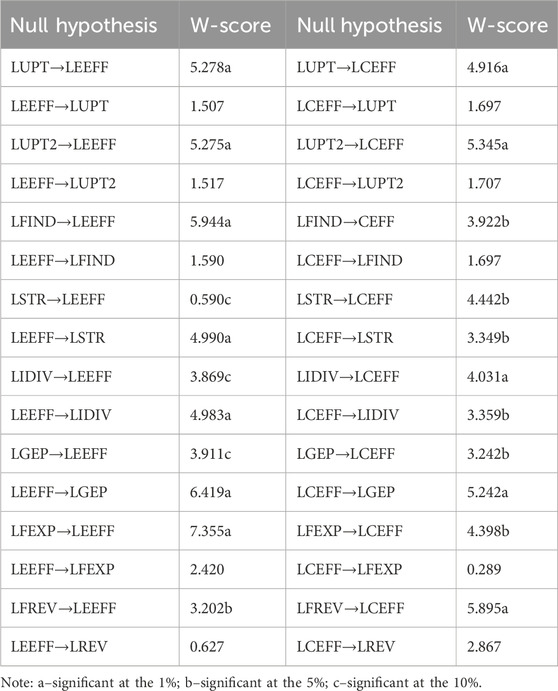

Finally, the present study utilizes the DH test to identify the causal associations between the selected dependent variables and their respective predictors. The outcomes reported in Table 7 test the null hypothesis of no causal relationship.

Given the outcomes of Table 7, it can be observed from our baseline models that there is bidirectional causality between STR, IDIV, GEP, and EEFF. However, unidirectional causality is demonstrated from UPT, UPT2, and all indicators of fiscal decentralization towards energy efficiency. Considering our alternative model specification, it is plausible to note that economic upturn, its squared term, expenditure, revenue, and composite fiscal decentralization cause carbon efficiency but cannot be instigated by CEFF. The significant values of W–score imply that the remaining predictors have a bidirectional link with carbon efficiency.

5 Conclusion, policy recommendations, implications, limitations, and suggestions for future research

This study elucidates how fiscal decentralization affects environmental sustainability, moderating the role of environmental policy stringency in the selected European Union (EU) countries between 1995 and 2020. In addition, economic upturn, import diversification, and environmental protection expenditures are utilized as control variables. The empirical findings of the Method of the Moments Quantile Regression (MMQR) disclosed that the environmental policy stringency and environmental protection expenditures help the EU achieve ecological priorities. In addition, import diversification also spurs environmental sustainability, with more substantial impacts on less energy and carbon–efficient nations. Furthermore, the MMQR outcomes divulged that fiscal decentralization (all indicators) endorsed the environmental deterioration of EU members, undermining the achievement of ecological urgencies. Nonetheless, via the means of environmental policy stringency, fiscal decentralization positively influences environmental sustainability. These findings unveil that the harmful impact of fiscal decentralization on environmental sustainability can be curtailed if EU members impose more stringent environmental policies. In addition, the signs and magnitudes of the regression parameters are affirmed through the Driscoll–Kraay econometric technique, asserting the robustness of baseline outcomes.

5.1 Policy recommendations and implications

To fulfil the targets of SDGs, in particular, SDG7 and SDG13, EU members should consolidate fiscal decentralization initiatives and environmental policy stringency to ensure the achievement of ecological priorities. This consolidation is an attestation to sustainable development practices because it can contribute to economic progress, as well as improve the well–being of the society (Ge et al., 2024). Tang and Imran (2024) also highlighted the importance of governance in solving problems related to the environment. Thus, some outstanding recommendations and implications are as follows.

1. Clear and strict environmental regulations should be implemented, with quantifiable goals, legally enforceable standards, and efficient enforcement systems in place for all sectors. This will serve as a safeguard against the race to the bottom situation. In addition, this can assist member states in designing better environmental policies to their unique circumstances, local preferences, and economic structures.

2. The central government can utilize the green fiscal transfer mechanism to reward sub–national governments that meet their targets based on the stringent environmental policies that have been established. This will increase the flow of funds to the concerned sub–national governments, and thus, enable them to continue to meet their ecological needs.

3. The policy integration between all arms of government should be vertical and coordinated. This involves collaborative deliberation, frequent communication, and clearly defined roles on environmental issues. This will ensure that the decentralized government’s efforts will be in line with the objectives of the EU, thus preventing fragmentation and boosting the coherence and effectiveness of policies.

4. It is important to promote openness and public involvement in environmental decision–making. This guarantees that decentralized authorities are attentive to citizens’ environmental concerns, and it increases public support for strict policies and sustainable practices.

5. Green technology transfer (such as renewable energy deployment) and capacity building should be encouraged. According to Wang et al. (2022), renewable energy can lessen adverse environmental events. Building capacity also includes financing research and development, assisting with training initiatives, and encouraging cooperation between areas with varying degrees of experience. This will make it possible for the EU Green Deal to be implemented more uniformly and successfully in each of the member states.

In summary, although the political landscape of the selected EU economies may slightly differ, these policies can still be applicable to the member states because they are highly interdependent and they have some fundamental things in common, such as a single market, single currency, common policies, supranational institutions, and shared sovereignty. However, one must also take into account that the results of this research might slightly differ if individual member states have been investigated. Thus, this can be investigated further.

5.2 Limitation of the study

Although this study is timely and will be of great benefit to the EU in terms of policy formulation, it is limited to examining how fiscal decentralization and environmental policy stringency are used to achieve ecological sustainability in the EU. Ecological sustainability may, however, be influenced by a wide range of additional elements, including geopolitical risks and institutional quality. Including geopolitical risk in further studies will help to determine the EU’s policy priorities and the contextualization of domestic policies. In addition, including institutional quality deepens the understanding of policy effectiveness. Lastly, future studies could adopt a further theoretical approach that goes beyond the context of the EU and employ advanced econometric approaches.

Data availability statement

Data will be made available on request from the authors.

Author contributions

ES: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Project administration, Software, Supervision, Validation, Writing – original draft, Writing – review and editing, Visualization. OS: Supervision, Writing – original draft, Writing – review and editing. BO: Funding acquisition, Supervision, Writing – review and editing. JL: Funding acquisition, Supervision, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research is funded by North-West University Business School, Potchefstroom, South Africa.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2025.1600303/full#supplementary-material

References

Ahmad, M., and Satrovic, E. (2024). How does monetary policy moderate the influence of economic complexity and technological innovation on environmental sustainability? The role of green central banking. Int. J. Finance and Econ. 29 (4), 4197–4224. doi:10.1002/ijfe.2872

Ahmed, B., Wahab, S., Rahim, S., Imran, M., Khan, A. A., and Ageli, M. M. (2024). Assessing the impact of geopolitical, economic, and institutional factors on China’s environmental management in the Russian-Ukraine conflicting era. J. Environ. Manag. 356, 120579. doi:10.1016/j.jenvman.2024.120579

Ahmed, N., Hamid, Z., Rehman, K. U., Senkus, P., Khan, N. A., Wysokińska-Senkus, A., et al. (2023). Environmental regulation, fiscal decentralization, and agricultural carbon intensity: a challenge to ecological sustainability policies in the United States. Sustainability 15 (6), 5145. doi:10.3390/su15065145

Ansari, M. A. (2022). Re-visiting the Environmental Kuznets curve for ASEAN: a comparison between ecological footprint and carbon dioxide emissions. Renew. Sustain. Energy Rev. 168, 112867. doi:10.1016/j.rser.2022.112867

Aydin, M., Sogut, Y., and Altundemir, M. E. (2023). Moving toward the sustainable environment of European Union countries: investigating the effect of natural resources and green budgeting on environmental quality. Resour. Policy 83, 103737. doi:10.1016/j.resourpol.2023.103737

Bergougui, B., and Satrovic, E. (2025). Towards eco-efficiency of OECD countries: how does environmental governance restrain the destructive ecological effect of the excess use of natural resources? Ecol. Inf. 87, 103093. doi:10.1016/j.ecoinf.2025.103093

Caglar, A. E., and Yavuz, E. (2023). The role of environmental protection expenditures and renewable energy consumption in the context of ecological challenges: insights from the European Union with the novel panel econometric approach. J. Environ. Manag. 331, 117317. doi:10.1016/j.jenvman.2023.117317

Cai, Z., Ding, X., Zhou, Z., Han, A., Yu, S., Yang, X., et al. (2025). Fiscal decentralization’s impact on carbon emissions and its interactions with environmental regulations, economic development, and industrialization: evidence from 288 cities in China. Environ. Impact Assess. Rev. 110, 107681. doi:10.1016/j.eiar.2024.107681

Carmona, P., Stef, N., Ben Jabeur, S., and Ben Zaied, Y. (2023). Climate change and government policy: fresh insights from complexity theory. J. Environ. Manag. 338, 117831. doi:10.1016/j.jenvman.2023.117831

Choudhury, A., and Sahu, S. (2025). The asymmetric impact of fiscal decentralization on ecological footprint-accounting for methodological refinements and globalization facets. J. Econ. Asymmetries 31, e00400. doi:10.1016/j.jeca.2024.e00400

Dai, S., and Du, X. (2023). Discovering the role of trade diversification, natural resources, and environmental policy stringency on ecological sustainability in the BRICST region. Resour. Policy 85, 103868. doi:10.1016/j.resourpol.2023.103868

DiPietro, W. R., and Anoruo, E. (2006). Creativity, innovation, and export performance. J. Policy Model. 28 (2), 133–139. doi:10.1016/j.jpolmod.2005.10.001

Doğan, B., Ferraz, D., Gupta, M., Duc Huynh, T. L., and Shahzadi, I. (2022). Exploring the effects of import diversification on energy efficiency: evidence from the OECD economies. Renew. Energy 189, 639–650. doi:10.1016/j.renene.2022.03.018

Dumitrescu, E.-I., and Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels. Econ. Model. 29 (4), 1450–1460. doi:10.1016/j.econmod.2012.02.014

Essayem, A., Gormus, S., Guven, M., Erdal, F., and Uygun, U. (2024). The global risk trinity of hydrocarbon economies: evidence from the method of moments quantile regression. Energy Rep. 12, 3412–3421. doi:10.1016/j.egyr.2024.09.022

European Parliament (2025). The European green deal. Available online at: https://www.europarl.europa.eu/legislative-train/theme-a-european-green-deal/file-european-green-deal#:∼:text=On%2011%20December%202019%2C%20the%20Commission%20presented%20a,just%20transition%20for%20the%20regions%20and%20workers%20affected.

Fan, W., Yan, L., Chen, B., Ding, W., and Wang, P. (2022). Environmental governance effects of local environmental protection expenditure in China. Resour. Policy 77, 102760. doi:10.1016/j.resourpol.2022.102760

Fang, S., and Fang, W. (2023). How fiscal decentralization and trade diversification influence sustainable development: moderating role of resources dependency. Resour. Policy 84, 103750. doi:10.1016/j.resourpol.2023.103750

Feng, T., Wu, X., and Guo, J. (2023). Racing to the bottom or the top? Strategic interaction of environmental protection expenditure among prefecture-level cities in China. J. Clean. Prod. 384, 135565. doi:10.1016/j.jclepro.2022.135565

Gao, Y., Li, Z., and Wang, Z. (2025). Fiscal decentralization, green innovation and low-carbon transition of heavily polluting firms. J. Environ. Manag. 380, 124897. doi:10.1016/j.jenvman.2025.124897

Gariba, M. I., Odei, S. A., Febiri, F., and Provazníková, R. (2024). Exploring the mediating role of digital economy in the relationship between fiscal decentralization and the SDGs dimensions in the EU. Cogent Econ. and Finance 12 (1), 2367219. doi:10.1080/23322039.2024.2367219

Ge, X., Imran, M., and Ali, K. (2024). Natural resource-driven prosperity: unveiling the catalysts of sustainable economic development in the United States. Nat. Resour. Forum 49, 1823–1841. doi:10.1111/1477-8947.12456

Hossain, M. R., Dash, D. P., Das, N., Ullah, E., and Hossain, Md. E. (2024). Green energy transition in OECD region through the lens of economic complexity and environmental technology: a method of moments quantile regression perspective. Appl. Energy 365, 123235. doi:10.1016/j.apenergy.2024.123235

Hu, B., Guo, M., and Zhang, S. (2023). The role of fiscal decentralization and natural resources markets in environmental sustainability in OECD. Resour. Policy 85, 103855. doi:10.1016/j.resourpol.2023.103855

IMF (2021). International monetary fund: fiscal decentralization dataset. Available online at: https://climatedata.imf.org/pages/go-indicators.

IMF (2023). International monetary fund: government expenditure on environmental protection. Available online at: https://climatedata.imf.org/pages/go-indicators.

Imran, M., Khan, M. K., Alam, S., Wahab, S., Tufail, M., and Jijian, Z. (2024). The implications of the ecological footprint and renewable energy usage on the financial stability of South Asian countries. Financ. Innov. 10 (1), 102. doi:10.1186/s40854-024-00627-1

Islam, Md. M., Mahmudul Alam, Md., and Sohag, K. (2025). Recycling through technology diffusion for circular economy in Europe: a decomposed assessment. Technol. Forecast. Soc. Change 214, 124052. doi:10.1016/j.techfore.2025.124052

Ji, X., Umar, M., Ali, S., Ali, W., Tang, K., and Khan, Z. (2021). Does fiscal decentralization and eco-innovation promote sustainable environment? A case study of selected fiscally decentralized countries. Sustain. Dev. 29 (1), 79–88. doi:10.1002/sd.2132

Khan, Z., Ali, S., Dong, K., and Li, R. Y. M. (2021). How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 94, 105060. doi:10.1016/j.eneco.2020.105060

Khan, Z., Taimoor, H., Kirikkaleli, D., and Chen, F. (2023). Editorial: the role of fiscal decentralization in achieving environmental sustainability in developing and emerging economies. Front. Environ. Sci. 10, 1102929. doi:10.3389/fenvs.2022.1102929

Kuai, P., Yang, S., Tao, A., Zhang, S., and Khan, Z. D. (2019). Environmental effects of Chinese-style fiscal decentralization and the sustainability implications. J. Clean. Prod. 239, 118089. doi:10.1016/j.jclepro.2019.118089

Li, S., Samour, A., Irfan, M., and Ali, M. (2023). Role of renewable energy and fiscal policy on trade adjusted carbon emissions: evaluating the role of environmental policy stringency. Renew. Energy 205, 156–165. doi:10.1016/j.renene.2023.01.047

Li, Z., Kuo, Y.-K., Mahmud, A. R., Nassani, A. A., Haffar, M., and Muda, I. (2022). Integration of renewable energy, environmental policy stringency, and climate technologies in realizing environmental sustainability: evidence from OECD countries. Renew. Energy 196, 1376–1384. doi:10.1016/j.renene.2022.07.084