- 1National Academy of Financial and Economic Strategy, Central University of Finance and Economics, Beijing, China

- 2School of Economics, Central University of Finance and Economics, Beijing, China

Most existing studies have overlooked the role of green budgeting systems in channeling government and market resources toward environmentally sustainable sectors, thereby fostering sustainable economic development. In this study, we employ panel data from 107 global economies to examine the impact of green budget revenues (GBRs) on sustainable economic development and the mechanisms through which this relationship operates. The results indicate that GBRs significantly promote sustainable economic development across countries. In the short term, green budgeting exerts supervisory and demonstrative effects on firms’ production behavior. In the medium and long term, it enhances total factor productivity (TFP) by stimulating innovation compensation and by reshaping the allocation of traditional and green production factors, thus driving structural transformation in firms’ development models. Moreover, the positive impact of GBRs is stronger in non-OECD countries and in economies with lower fiscal pressure or varying levels of governance capacity. In this study, we reveal the medium- and long-term transmission mechanisms and cross-country heterogeneity of green budget policies, providing important theoretical and practical implications for governments seeking to design context-specific and targeted policy measures that jointly advance global sustainable development goals.

1 Introduction

The escalating ecological and environmental crises necessitate a critical re-evaluation of traditional growth models, particularly those defined by high consumption and industrial practices that are heavily dependent on fossil fuels. Predicated on the pursuit of unlimited material accumulation, this industrial paradigm has delivered unprecedented material prosperity while concurrently pushing against, and in many instances exceeding, the planet’s ecological carrying capacity. Persisting in such a resource-intensive production mode without due regard for environmental constraints inevitably leads to catastrophic consequences (Daly and Farley, 2011; Rifkin, 2011). Consequently, nations worldwide must shift from conventional growth strategies driven predominantly by quantitative resource inputs toward a sustainable development trajectory (Yu et al., 2025). This new trajectory necessitates guidance by green innovation, leveraging renewable energy, advanced materials, and efficient resource allocation. Within this context, green budget revenues (GBRs) emerge as a critical macroeconomic instrument. By reshaping societal resource allocation and modifying the short-, medium-, and long-term decision-making functions of microeconomic agents, these revenues can facilitate the green transformation that is essential for fostering national sustainable development.

Economic sustainability transcends mere quantitative expansion of gross domestic product (GDP). It fundamentally emphasizes the integration of economic efficiency, structural transformation, and social welfare—representing a process that balances both scale and quality dimensions. Early theoretical frameworks posited that sustaining an economy requires maintaining or enhancing its productive base—the foundation of human welfare (Arrow et al., 1996). This approach further mandates non-negative changes in produced, human, and natural capital stocks (Arrow et al., 2003). However, this faces dual constraints. Finite natural resources impose an inherent limit on the capacity for perpetual factor input growth. Simultaneously, diminishing marginal returns imply that extensive reliance on traditional inputs such as capital and labor cannot indefinitely sustain productivity gains (Krugman, 1993; Young, 2003). Consequently, sustainable economic growth can only be achieved through advances in new technologies—such as digital transformation (He et al., 2025) or photovoltaic power generation (Şahin et al., 2025)—that drive shifts in production methods (Peneder, 2003; Greunz, 2004; Brock and Taylor, 2004).

Solow’s (1956) seminal work operationalized this by introducing total factor productivity (TFP) as the primary driver of long-run growth. This perspective has profoundly influenced sustainability research, where TFP growth is now recognized as critical for enhancing resource efficiency and enabling sustainable economic development (Chow and Li, 2002; Guo et al., 2024). Accordingly, contemporary scholarship widely employs TFP as a core metric for assessing technological dynamism and optimized resource allocation. Reflecting this consensus, in this paper, we adopt TFP growth as the proxy indicator for analyzing national sustainable development performance.

As productive capacities expand in major global economies, societies have reached a threshold of material affluence. This advancement has simultaneously raised public expectations concerning both production standards and the quality of life. Concurrently, rising environmental threats, which are manifested in escalating climate disasters and geological disturbances, have brought green development and ecological civilization to the forefront of sustainable development agendas. In response, GBRs have gained prominence as a critical macroeconomic instrument for effective resource allocation and policy implementation. Functionally, green budgeting represents an evolutionary advancement over traditional government budgeting systems. Building on conventional monetary valuation frameworks, it incorporates governmental environmental accountability and performance-management principles (Connelly, 2014; Caglar and Yavuz, 2023). By systematically assessing environmental outcomes throughout budgetary processes, this approach seeks to enhance human welfare while minimizing ecological costs.

The concept of green budgeting originated from the recommendations of the Brundtland Commission in the 1987 United Nations report. The International Conference on Green Budget Reform held in July 1997 further discussed the fundamental concept of green budgeting, as well as its macroeconomic and technological innovation impacts. In 2017, the Organization for Economic Co-operation and Development (OECD) launched the “Paris Collaborative on Green Budgeting,” aiming to achieve environmental and sustainable development goals through the application of budgetary decision-making tools. According to the latest OECD data, as of 2022, 24 OECD member countries had implemented systematic green budgeting practices, accounting for nearly two-thirds of the total membership. Beyond OECD countries, several non-OECD economies—such as Nepal, Indonesia, and the Philippines—have also begun to integrate climate and sustainability objectives into specific components of their budget frameworks even though comprehensive green budgeting systems have not yet been established. Collectively, these developments demonstrate that the concept of green budgeting has generated widespread global influence.

In terms of country-level implementation, Ireland has evaluated central budget expenditures related to climate since 2019, incorporating green budgeting into The Revised Estimates Volumes for the Public Service. Italy has adopted the United Nations’ Classification of Environmental Protection Activities (CEPA) and the Classification of Resource Management Activities (CReMA) to label budget items, legally requiring that green budget reports be published as annexes to budget execution statements. Finland conducts budget assessments focusing on renewable energy, carbon emission reduction, biodiversity, and environmental protection, and its regulations mandate that the Ministry of Finance include a chapter on climate change and sustainable development in the national budget. In the Asia–Pacific region, Nepal became the first country to adopt climate budget tagging, followed by Indonesia and the Philippines. Since 2016, Indonesia has implemented climate budget tagging across eight central ministries, using the outcomes to strengthen performance management in budgeting, broaden the informational basis for both national and international reporting, and support innovative green bond financing. Mongolia initiated its green budgeting reform in 2019 and formally incorporated the United Nations Sustainable Development Goals (SDGs) into its budget framework in 2020. Starting with SDG 3, Mongolia progressively expanded the integration of all SDGs into the budget process, reflecting a result-oriented and goal-driven reform approach.

As an important institutional arrangement for environmental regulation, GBRs not only promote a favorable market environment by enhancing green development awareness and institutional transparency but also strengthen factor substitution effects and resource allocation efficiency, thereby fostering high-quality economic growth (Wang and Yu, 2021; Pindiriri and Kwaramba, 2024). In practice, unlike the direct positive incentives associated with green budget expenditures, GBRs—particularly green taxation—operate primarily through the top-level macroeconomic design, using market mechanisms to influence resource allocation decisions of various actors over time, ultimately promoting green transformation. Evidence from France, Italy, Sweden, and Norway demonstrates that incorporating environmental objectives into budget performance management significantly enhances policy effectiveness (He et al., 2019; Lin and Li, 2011).

In the short term, GBRs alter firms’ external environments and internal cost structures. On the one hand, they internalize the social benefits of green transformation as corporate operational advantages; on the other hand, they convert the social costs of energy-intensive and high-emission activities into firm-level burdens (Gray and Shadbegian, 2003; Kemp and Pontoglio, 2011). Firms, thus, adjust the relative weights of parameters within their decision functions to maximize profits, leading to an internal reallocation of resources toward green and sustainable development (Ghazouani et al., 2021). In the medium term, the competitive advantages and internalized costs associated with GBRs encourage firms to engage in technological innovation to reduce dependence on fossil fuels (Porter and Linde, 1995; Song et al., 2020). This process reshapes firms’ resource allocation structures, prompting both human and physical capital to flow toward R&D activities (Li et al., 2018; Sabherwal et al., 2019), thereby enhancing TFP through the adoption of cleaner energy and more efficient production processes. In the long term, firms unable to capitalize on external competitive advantages or mitigate internalized costs tend to experience declining productivity and rising production costs. Under market competition, such firms are gradually forced out (Hopenhayn, 1992; Melitz and Polanec, 2015), allowing resources to reallocate toward more productive enterprises and continuously improving the overall social TFP.

In this study, we contribute to the literature in three ways. First, building upon the triple-bottom-line paradigm, which integrates the ecological, economic, and social welfare dimensions (Elkington, 1997), it examines the globally distributed socioeconomic benefits arising from innovations in environmental governance. Although existing scholarship has largely focused on environmental outcomes, in this study, we highlight how green fiscal revenues can stimulate TFP growth, revealing critical synergies between environmental governance and sustainable economic development. Second, it examines the innovation compensation effects in the medium term and resource allocation effects in the long term associated with GBRs. Medium-term technological innovation facilitated by GBRs enhances factor allocation efficiency, thus boosting TFP; long-term effects involve reallocating societal resources away from inefficient producers, thus raising aggregate productivity. Third, we expands the analytical scope of this paper to the global level. Utilizing cross-country data, in the study, we assess the overall performance of diverse economies concerning sustainable development, conduct heterogeneity analyses across different economic typologies, and offer targeted policy recommendations.

2 Theory and hypotheses

2.1 Green budget revenues and economic sustainability

As an environmental policy instrument embedded within a nation’s fiscal framework, green budgeting primarily fosters national awareness of green and sustainable development, enhances the coordination of green resource allocation, and promotes a market environment conducive to improving the enterprise-level TFP. Second, the incorporation of green principles into budgeting philosophies and institutions sends positive signals to firms, incentivizing them to pursue productivity improvements through green transformation. Finally, by imposing green taxes, governments raise the operational costs of resource-intensive and polluting production methods, thus encouraging firms to adopt more efficient production methods by substituting environmentally harmful inputs with sustainable alternatives.

GBRs constitute a comprehensive institutional framework designed to generate broad and complex environmental impacts. This framework is focused on strategic planning, innovative tools, and enhanced institutional coordination, thereby improving governance effectiveness. Wang and Yu (2021) argue that supporting green industries, particularly energy-saving and eco-protection sectors, is crucial for tackling resource and environmental challenges. They further suggest that GBRs can significantly drive industrial advancement, ultimately leading to the harmonization of economic, social, and ecological development. Functioning as a vital policy instrument, green budgeting raises public awareness of the link between budget revenues and national environmental goals, enhances budgetary transparency, and facilitates synergies among financial oversight, audit monitoring, and public scrutiny (Pindiriri and Kwaramba, 2024). Using panel ARDL models, He et al. (2019) analyzed the economic and environmental impacts of energy taxes in G7 and Nordic countries over the period 1994–2016. Their findings indicate that the enhanced transparency facilitated by green budgeting not only contributes to sustainable economic growth but also alleviates ecological funding shortfalls. Lin and Li (2011) further demonstrated that green taxes are effective in reducing per capita carbon emissions while also examining how differences in national green taxation practices shape the determination of tax rates, the design of exemption policies, and the mechanisms for revenue allocation. Accordingly, in this study, we propose the following hypothesis:

Hypothesis 1. GBRs exert a positive effect on the TFP.

2.2 Mechanisms of green budget revenues in advancing economic sustainability

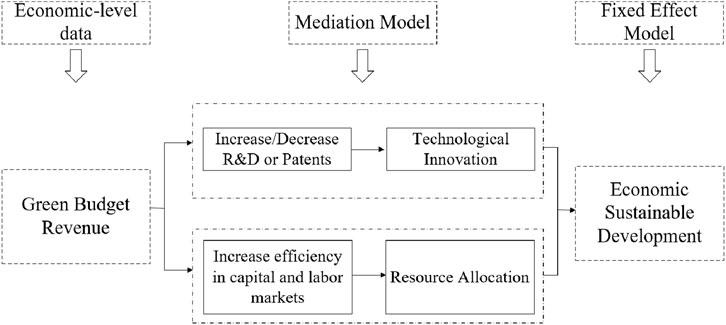

GBRs may influence sustainable economic development through two main channels—technological innovation and resource allocation—each operating over different time horizons and within distinct domains, as illustrated in Figure 1. The technological innovation effect primarily manifests in the medium term through intra-firm factor adjustments. When faced with the exogenous shock of green budget policies, firms can, in the medium run, modify the input structure of their production functions and engage in technological innovation to meet green requirements, thereby reducing operational costs. The resource allocation effect, by contrast, unfolds over the long term, as market factors flow across firms. In the long run, both physical and human capitals tend to shift toward enterprises that align with green budget objectives, whereas technologically backward firms are gradually eliminated. In other words, under the influence of GBRs, physical and human capital are initially reallocated within firms—from core production units to R&D divisions—and subsequently, over time, they flow beyond firm boundaries toward more policy-compliant enterprises. Both types of reallocation, occurring across different periods and scopes, can enhance the TFP and thereby foster sustainable economic growth.

Figure 1. Schematic diagram of the mechanism through which green budget revenues affect sustainable economic development.

2.2.1 Technological innovation effect

Technological innovation—particularly green technology advancement—serves as a critical pathway for reconciling productivity growth with ecological sustainability (Zhang and Ma, 2021). Economies committed to such innovation typically achieve systemic optimization of production processes by deploying advanced equipment while simultaneously developing human capital and expanding knowledge assets. These synergistic improvements enable firms to maintain the output level while reducing resource inputs and shortening production cycles. At the same time, they help minimize quality defects and lower aggregate costs, ultimately translating into enhanced market competitiveness through differentiated product innovation. Green taxation structurally alters firms’ cost structures through targeted fiscal levers, generating sustained incentives for technological innovation. As a cornerstone environmental policy instrument, its efficacy lies in the logic of cost internalization: by altering relative factor prices, it compels economies to fundamentally reassess production paradigms and technological pathways. This price signal mechanism consequently induces bidirectional innovation effects—stimulating eco-innovation while rendering pollution-intensive technologies economically untenable.

In the short run, heightened environmental tax pressures may impose acute compliance costs that potentially suppress innovation incentives, thereby hampering sustainable economic development. First, the global proliferation of green budgeting since 2017 has compelled nations to allocate substantial resources toward end-of-pipe pollution controls or emission permits, diverting funds from productive R&D investments (Gray and Shadbegian, 2003; Kemp and Pontoglio, 2011). This crowding-out effect traps economies in technologically stagnant production paradigms. Second, rising green tax burdens constrain domestic industries through increased operational costs and eroded competitiveness. Firms may respond by engaging in regulatory arbitrage, relocating their operations to jurisdictions with less stringent environmental enforcement. Such spatial redistribution not only triggers technological hollowing-out but also generates pollution havens, further depleting the home-country innovation capacity. Concurrently, targeted fiscal incentives, such as tax credits for environmental equipment, may distort the allocation of innovation resources. By disproportionately channeling capital toward green innovation, they risk systematically underfunding conventional technology upgrades. Crucially, given the inherent time lags and uncertain returns in converting environmental R&D into productivity gains (Li et al., 2018), this reallocation could significantly diminish overall R&D efficiency. The resulting substitution effect between green and conventional innovation may, therefore, lead to net-curtailed aggregate technological advancement.

In the medium term, GBRs stimulate technological innovation through market signal transmission. First, when environmental taxation exceeds marginal abatement costs of firms, it triggers a forced innovation mechanism. As Porter and Linde (1995) posited, well-designed environmental policies can yield dual dividends by spurring innovation to offset compliance costs, ultimately boosting competitiveness and productivity. Second, green taxation reshapes markets through price signals: taxes on polluting goods raise consumer prices, thereby shifting the demand toward green alternatives and compelling firms to reorient innovation strategies. At the same time, awareness campaigns on green budgeting policies steer market consumers and supply-chain enterprises toward purchasing green innovative products. This synergy accelerates the dynamic alignment between market demand and national technological innovation (Song et al., 2020), simultaneously strengthening both technological innovation capacity and market demand. Consequently, technological advancements can be rapidly translated into production efficiency, thereby driving high-quality development of the national economy. Third, coordinated fiscal tools facilitate global technology transfers. Instruments such as carbon tariffs (e.g., EU’s CBAM taxing embedded emissions) exert pressure on exporters to adopt low-carbon technologies. Concurrently, compensatory tax incentives enhance the corporate reputation, attracting investments that enable environmental upgrades and scale economies (Sabherwal et al., 2019), thus sustaining innovation-driven productivity growth. Hence, in this study, we propose two competing hypotheses:

Hypothesis 2a. GBRs suppress national TFP via innovation crowding-out effects.

Hypothesis 2b. GBRs stimulate national TFP through innovation-driven pathways.

2.2.2 Resource allocation effect

GBRs reconfigure market resource allocation through cost-internalizing tax designs, thus redirecting capital and labor toward greener and more efficient sectors. The interplay between tax constraints and resource reallocation emerges as a key channel for aggregate productivity enhancement. Crucially, whereas the factor substitution effect operates through intra-firm adjustments, the resource allocation effect manifests via inter-firm resource mobility. In line with dynamic theories (Hopenhayn, 1992; Melitz and Polanec, 2015), policy-induced cost constraints reshape market selection mechanisms by influencing firm entry and exit decisions, thereby enhancing aggregate TFP through more efficient factor reallocation. Accordingly, green budgeting facilitates resource allocation across firms, sectors, and countries, fostering structural optimization and long-term productivity growth.

At the firm level, pollution-intensive and resource-depleting processes signal inefficient factor utilization, indicating significant potential for productivity improvements. Escalating green budget pressures compel firms to reassess their internal resource allocation as amplified tax burdens reduce profit margins in environmentally intensive production stages. This induces resource reallocation away from inefficient operations toward clean technology development and green process innovation. Such strategic shifts simultaneously achieve dual objectives: reducing environmental damage intensity per unit of output and enhancing productivity through technological equipment upgrades and enhanced energy conversion efficiency. Collectively, these transformations serve to expand the production possibility frontier.

At the macroeconomic level, GBRs reconfigure relative factor prices, triggering cross-sectoral capital and labor mobility through competitive market-selection dynamics. Heightened environmental taxation alters firms’ cost structures, compelling carbon-intensive industries to reassess factor efficiency. Within capital markets, elevated environmental risks for emission-intensive assets accelerate capital reallocation toward low-carbon production sectors. Simultaneously, labor markets experience structural transformation as skilled workers migrate to emerging clean industries, whereas displaced laborers in traditional sectors acquire new skills to integrate into green supply chains. This dual-factor reallocation improves labor–technology matching efficiency, consolidating resources into high-productivity sectors to establish a virtuous cycle that elevates aggregate TFP. Hence, in this study, we propose the following hypothesis:

Hypothesis 3. GBRs exert a positive effect on the national TFP by enhancing factor allocation efficiency in capital and labor markets, thus redirecting production factors toward greener, high-efficiency sectors.

3 Methodology

3.1 Empirical strategy

To systematically evaluate the impact of GBR policies on sustainable economic growth, it is necessary to effectively control for unobservable individual heterogeneity across countries and temporal trend interferences. Leveraging the strengths of panel data models in accounting for multidimensional fixed effects and heterogeneity biases, in this study, we adopt the methodology of Jia et al. (2023) by employing a widely used two-way fixed effects model, which is common in economic research, for empirical analysis. Specifically, by controlling for country-specific and year-specific effects, the following model (Equation 1) is constructed to examine the sustainable economic effects of GBR:

Specifically,

3.2 Variable selection

Generally, a country’s green budget consists of two components: GBR and green budget expenditure. In this study, we focus on the economic effects of countries’ green budget policies at the revenue end. GBR primarily consists of green tax revenue and green non-tax revenue, with the latter encompassing administrative and institutional fees, penalty income, and other related sources. In terms of magnitude, green non-tax revenue is relatively lower than green tax revenue. According to data from the International Monetary Fund (IMF), the global average share of non-tax revenue in the total government revenue was only 36% in 20211. Given the limited sources of green non-tax revenue, its share within the GBR is correspondingly lower. In terms of economic impacts, green non-tax revenue is predominantly penalty income. Against the backdrop of rising global government fiscal deficit ratios, such penalty income functions as an exogenous force that can readily disrupt the normal functioning of competitive markets.

Thus, in this study, we designate green tax revenue as the core explanatory variable. In line with the IMF’s environmental tax classification framework and the OECD environmental tax database, green tax revenue encompasses environmental taxes, energy taxes, pollution taxes, resource taxes, and transport taxes across countries (Aydin et al., 2023). Environmental taxes are imposed on pollutant emissions or environmental harm to mitigate negative externalities through cost internalization. Energy taxes cover taxes on fossil fuel extraction and consumption, excluding the transport fuel taxes, which are classified separately as transport taxes. Pollution taxes are imposed based on specific pollutant emissions or treatment costs, whereas resource taxes are levied on the extraction or use of natural resources to reflect resource scarcity rents. Transport taxes target environment-related behaviors in vehicle acquisition and usage, complementing energy taxes to regulate carbon emission intensity in transportation. Given the significant heterogeneity in national economic scales, in this study, we employ a relative metric—the ratio of GBR to GDP—as the core explanatory variable. This approach controls for scale biases associated with aggregate indicators and improves the comparability of cross-country data, effectively mitigating the interference of economic size differences on policy effects.

The dependent variable in this study is the TFP of countries worldwide. It is widely recognized in academic circles that economic growth primarily stems from factor inputs and TFP. The core of sustainable economic development lies in breaking through the factor-dependent growth model. As the core indicator for measuring technical efficiency and the optimization of resource allocation, TFP serves as the key proxy variable for assessing the sustainability of economic growth. According to Solow’s (1956) pioneering research, the sole source of long-term economic growth is the improvement of the TFP rather than mere factor accumulation. This assertion has laid a theoretical foundation for the measurement of sustainable economic development: the extensive growth model that relies on the expansion of factor inputs such as capital and labor is unsustainable due to diminishing marginal returns (Krugman, 1993). Only by enhancing the resource utilization efficiency driven by TFP growth can intergenerational welfare equilibrium be achieved (Chow and Li, 2002).

Current macro-level studies generally assess a country’s sustainable development potential by quantifying TFP’s contribution rate to economic growth. Based on the Cobb–Douglas production function, Duval and de la Maisonneuve (2010) decomposed cross-country differences in per capita GDP in 2005 into four types of factors: physical capital, labor, human capital, and TFP, and projected sustainable growth paths driven by the TFP catch-up effect for the period 2025–2050. Johansson-Sköldberg et al. (2013) adopted the same framework to verify the regulatory role of TFP convergence speed in addressing global economic imbalances, revealing that TFP improvement can alleviate unsustainable risks caused by excessive resource consumption. Cette et al. (2017) further extended this to long-term scenario simulations up to 2,100, emphasizing that TFP growth must be coordinated with education investment and institutional optimization to support the goal of low-carbon transition.

From the perspective of this study’s analytical scope and policy transmission logic, the core reason for selecting national-level TFP instead of firm-level TFP lies in the differences in their adaptability to the research objectives and data scenarios. In this study, we focus on the impact of GBR at the economic aggregate level on sustainable economic development. As a macro-fiscal tool, green budget exhibits cross-industry and cross-entity synergy in its mechanism of action, and such impact must be measured by improvements in the overall efficiency of the economy rather than by changes in the efficiency of individual firms. Firm-level TFP can only capture technological progress at the micro-entity level and fails to reflect macro-level synergistic effects triggered by policies, such as inter-industry factor reallocation and inter-firm technology spillovers. In contrast, national-level TFP integrates the combined effects of micro-level efficiency, meso-level structural optimization, and macro-level institutional environment, directly aligning with the core research focus of this study: how GBR drives improvements in the macro-efficiency of various economies to ultimately achieve sustainable economic development. In addition, TFP has been widely applied in the fields of agricultural and regional economics (Jin et al., 2018; Guo and Jin, 2025).

Three primary methodologies exist for TFP estimation: parametric, semi-parametric (Olley and Pakes, 1992; Levinsohn and Petrin, 2003; Wooldridge, 2009; Ackerberg, 2015), and nonparametric approaches. Among these, parametric and semi-parametric methods may yield biased results due to endogeneity issues, whereas nonparametric methods (DEA and index methods) avoid specifying functional forms but incorporate all heterogeneity including measurement errors into TFP without accounting for stochastic noise. Given that macroeconomic data inherently smooth out micro-level idiosyncrasies, in this study, we leverage global production factor data and employ a nonparametric three-factor (capital, energy, and labor) macroeconometric model developed by Fouré et al. (2013) and Fontagné et al. (2022): the Macro-Model of the Global Economy (MaGE). Rooted in the conditional convergence theory (Barro and Sala-i Martin, 2003), MaGE captures long-term growth dynamics by endogenizing energy alongside capital and labor within a nested production function framework. Specifically, the model inherits the multi-factor technological change framework proposed by David and van de Klundert (1965), adopting a two-tier constant elasticity of substitution (CES) function. The production function structure is formalized in Equation 2:

where

In Equation 3, the energy price is derived from the U.S. Energy Information Administration’s (EIA) crude oil price forecast series (1960–2030), and population data are sourced from the United Nations’ medium fertility scenario. Notably, for oil-producing countries, the model deducts oil rents from the GDP series (using data on oil rent shares from the World Bank, 1970–2017) to eliminate the distorting effects of resource rents on TFP measurement. The adjusted TFP (Equation 4) is obtained by back-calculating the residual of the production function:

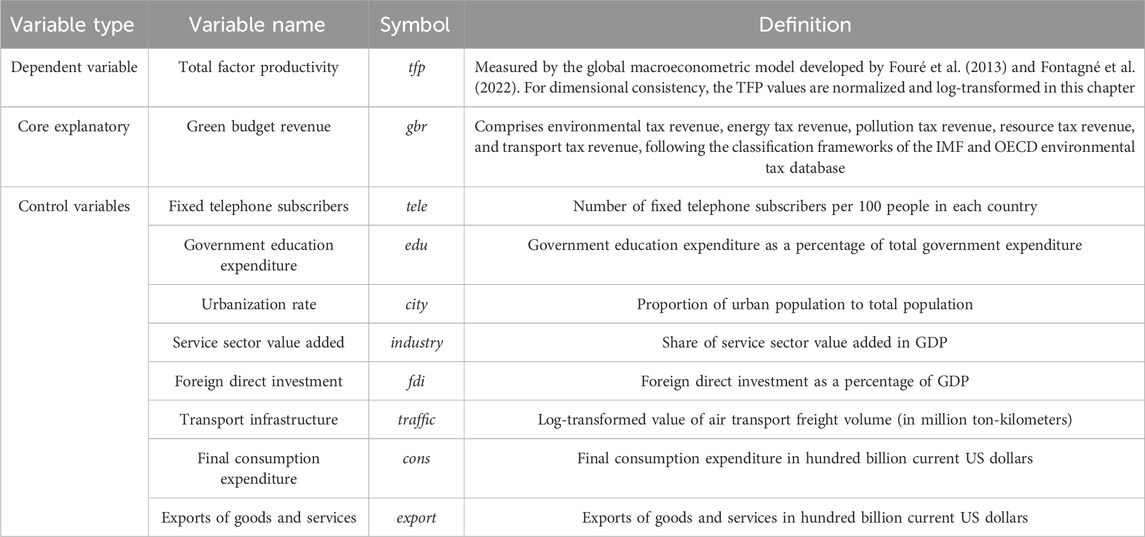

To systematically control for the external determinants of the TFP, in this study, we select control variables spanning four dimensions: infrastructure development, policy intervention intensity, structural transformation drivers, and open-economy effects. The variables include fixed telephone subscribers, government education expenditure, urbanization rate, service-sector value added, foreign direct investment (FDI), transport infrastructure, final consumption expenditure, and exports of goods and services. The theoretical rationale behind these variables is as follows: fixed telephone subscribers serve as a proxy for the sophistication of the information infrastructure, which demonstrates positive spatial spillover effects on urban TFP growth (Zou et al., 2024); the government education expenditure ratio serves as a proxy for human capital accumulation, as increases in education, R&D, and public service spending robustly incentivize TFP growth (Wu et al., 2017); the urbanization rate captures the agglomeration-driven dynamics of capital accumulation, with urbanization facilitating capital deepening (Shang et al., 2018); the service-sector value-added ratio measures the depth of structural transformation, as the integration of services and data factors enhances TFP (Wu and Zhu, 2025); the FDI ratio reflects technological spillovers from open-economy policies, with cross-border mergers and technology transfers along the Belt and Road Initiative significantly boosting TFP (Zhang and Ji, 2024); the air freight volume represents transport infrastructure quality, which improves market accessibility and, thereby, TFP (Arbués et al., 2015); and final consumption expenditure and exports of goods and services capture domestic market integration and export-driven technological diffusion, respectively. These variables control for heterogeneity in technological progress, resource allocation, and institutional environments, ensuring methodological rigor in isolating the net effect of GBR policies on sustainable economic growth. The definitions of key variables are presented in Table 1.

3.3 Data sources

In this study, we examine the economic effects of GBR on a global scale. Data on the independent variable GBR are sourced from the IMF’s Climate Change Dashboard, whereas the dependent variable country-level TFP is obtained from the global macroeconometric model developed by Fouré et al. (2013) and Fontagné et al. (2022). Country-level control variables are obtained from the World Bank’s World Development Indicators (WDI) database. Prior to regression analysis, the data undergo the following treatments: (1) samples with substantial missing values in GBR or economic sustainability indicators are excluded; (2) continuous variables are Winsorized at the 1% and 99% levels to mitigate the impact of outliers. Following these procedures, the final dataset comprises 2,095 annual observations across 107 countries for the period 2000–2021.

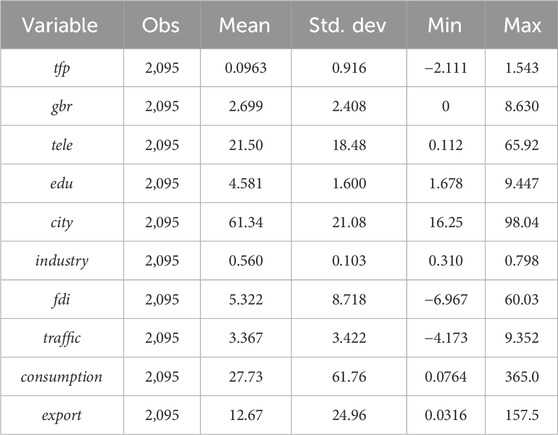

Descriptive statistics for key variables are presented in Table 2. The dependent variable TFP has a mean of 0.0963, standard deviation of 0.916, minimum of −2.111, and maximum of 1.543, indicating significant heterogeneity in TFP across sample countries, with some below the benchmark and others demonstrating strong growth momentum. The core explanatory variable GBR ratio has a mean of 2.699%, ranging from 0% to 8.630%, reflecting substantial cross-country variation in GBR shares. The control variables exhibit substantial cross-country variation in infrastructure development, policy intervention intensity, structural transformation drivers, and open-economy effects. The descriptive statistics for all variables are consistent with the findings of previous studies.

4 Empirical results analysis

4.1 Basic results

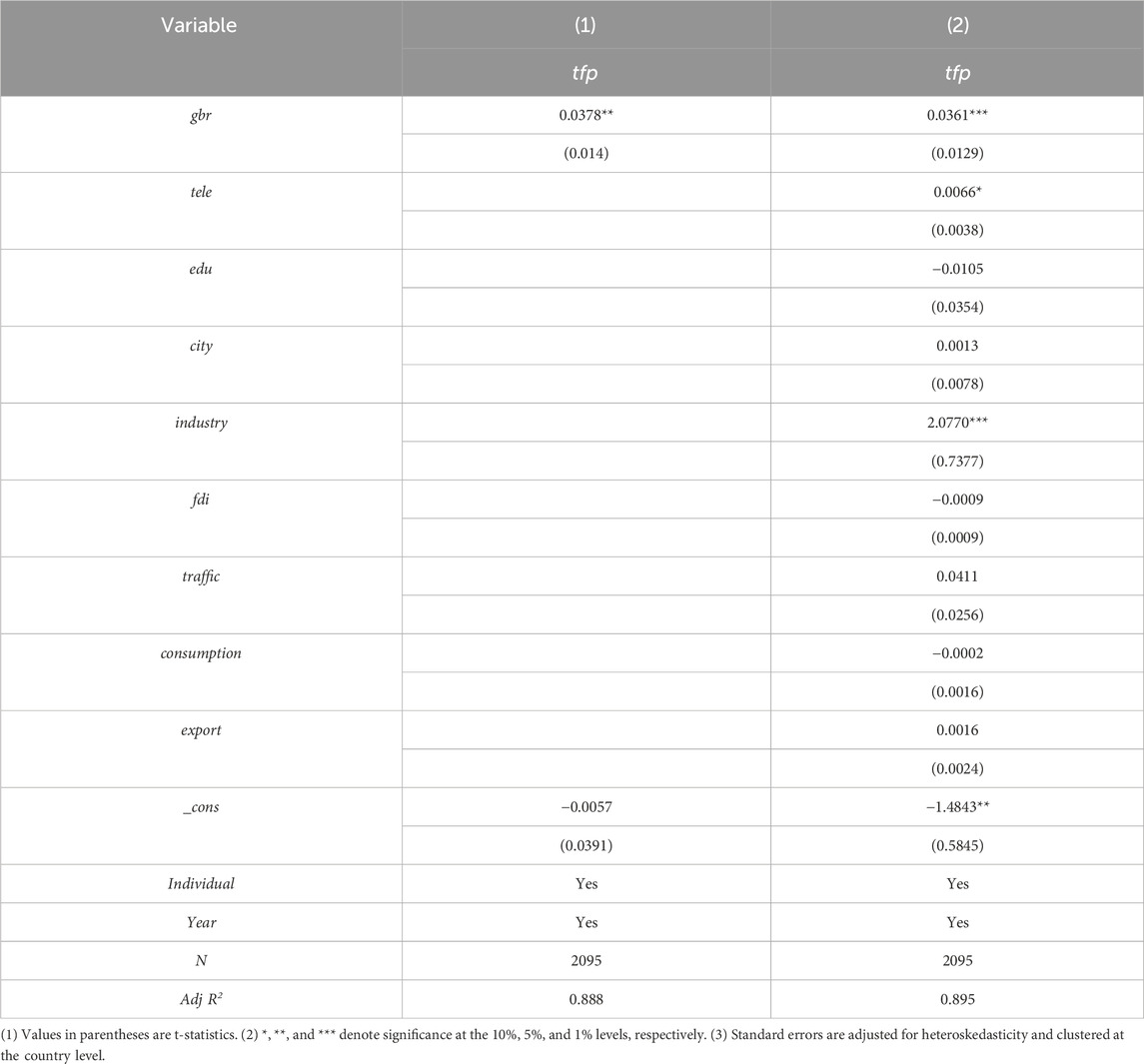

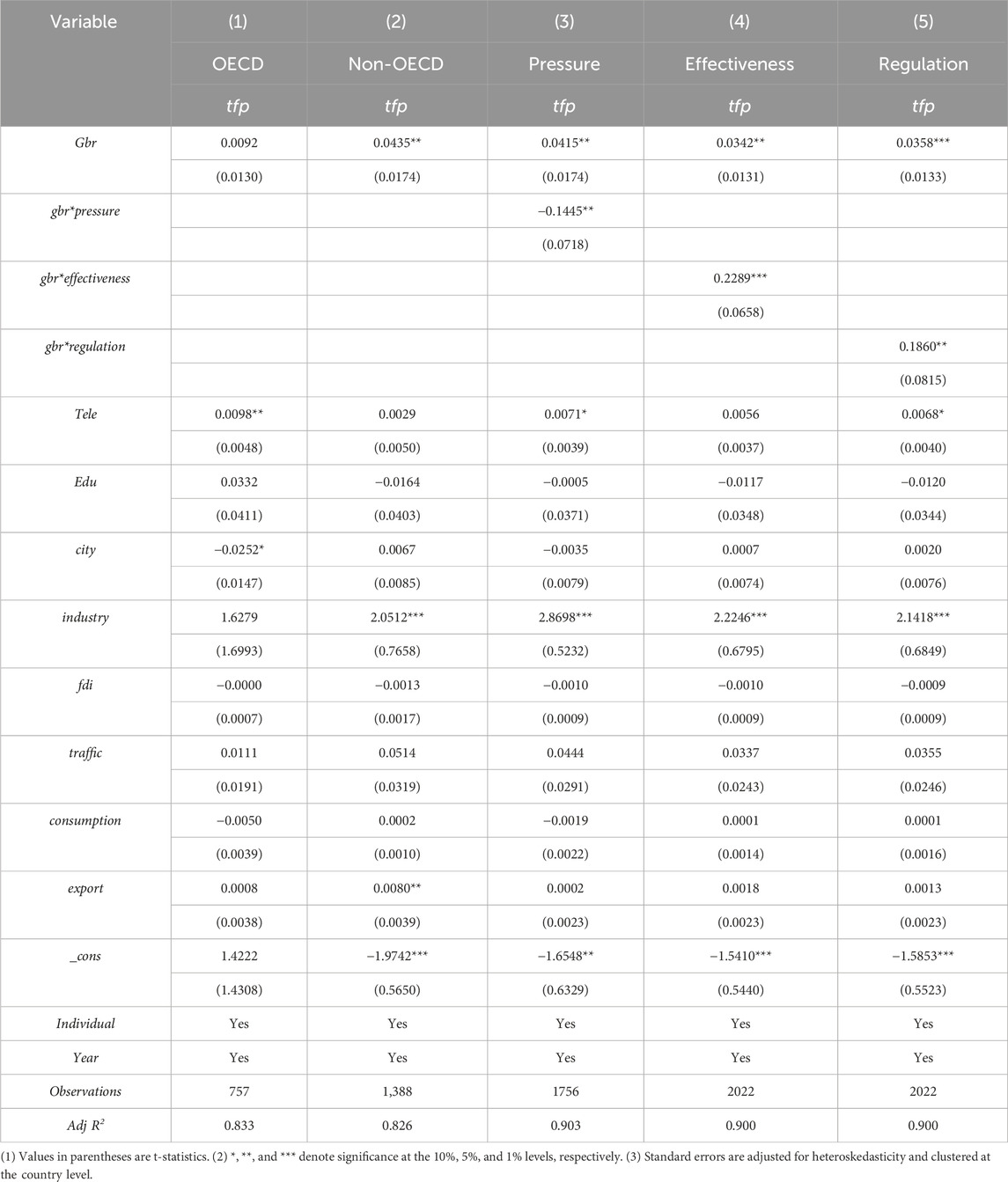

Table 3 presents the baseline regression results investigating the effect of GBR on countries’ sustainable economic growth. Both regressions use country-clustered standard errors and control for country-fixed and year-fixed effects. Specifically, column (1) includes only the core explanatory variable, showing that the regression coefficient of GBR is statistically significant and positive at the 5% level, indicating that GBR significantly promotes countries’ sustainable economic growth. Column (2) further incorporates control variables to more accurately assess the impact of GBR on sustainable economic growth. The results show that the GBR coefficient is 0.0361, which is statistically significant and positive at the 1% level, suggesting that a one-unit increase in GBR leads to an average 0.0361 increase in sustainable economic growth when other conditions remain constant. These findings validate the positive promoting effect of GBR on sustainable economic growth, further supporting research Hypothesis 1.

4.2 Robustness test

4.2.1 Alternative dependent variable

In this study, we substitute the traditional TFP with the energy productivity index, developed by Fontagné et al. (2022), as the dependent variable. The substitution is grounded in the theoretical framework of production function reconstruction under energy constraints. This index endogenously defines energy productivity as a composite function of energy efficiency, GDP, and oil prices derived from the first-order conditions of firm profit maximization, as detailed in Equation 5:

Here,

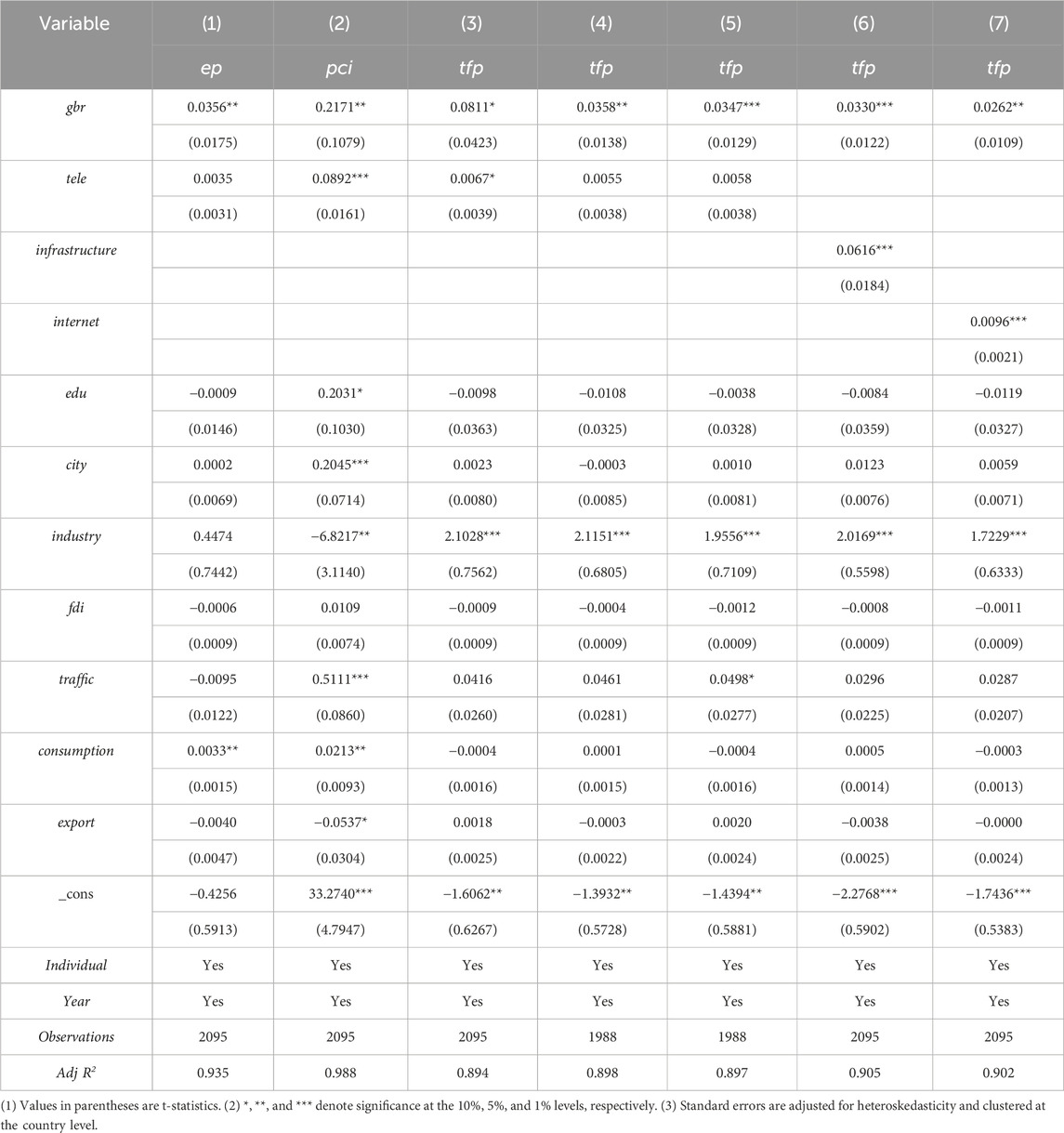

In addition, apart from TFP and EP, there are other quantitative indicators for measuring the level of economic sustainable development of various economies. To enhance the robustness of the conclusions given above, in this study, we attempt to reconstruct the explained variable by replacing the TFP with the productive capacity index (PCI) of countries worldwide released by the United Nations Conference on Trade and Development as the new explained variable. The regression results of the productive capacity index and energy productivity of various economies are presented in column (2) of Table 4. The coefficient of GBR remains significantly positive at the 5% significance level, which proves that GBR has a significant positive promoting effect on the productive capacity of various economies. Therefore, the regression results after replacing the dependent variable reaffirm Hypothesis 1; as a national governance tool, green budget can promote economic sustainable development, and the conclusions of this study remain robust.

4.2.2 Alternative independent variable

To strengthen the robustness of findings, this chapter further replaces the core explanatory variable from broad-based GBR to narrow-based GBR. The measurement of narrow-based GBR follows the “environmental protection taxes” category in the OECD environmental tax database, covering special taxes levied on atmospheric pollutants, water pollutants, and solid waste emissions. Column (3) of Table 4 shows that the GBR coefficient is 0.0811, which is significantly positive at the 10% level, indicating that a one-unit increase in the revenue of green budget policies raises countries’ TFP by 8.11% under otherwise identical conditions, revalidating Hypothesis 1. Therefore, the finding that GBR significantly promotes countries’ sustainable economic growth remains robust following the substitution of the explanatory variable.

4.2.3 Lagged variable regression

The impact of GBR on sustainable economic growth may exhibit dynamic time-lag effects, as policy transmission involves multistage processes such as market participants’ cognitive adjustment, technological iteration cycles, and industrial structure restructuring. Referencing Taylor and Wilson’s (1964) time-lag analysis method, in this study, we replace the dependent variable with one-period lagged TFP and rerun the regression to test the baseline results’ robustness and capture the policy effect’s dynamic trajectory. Column (4) of Table 4 shows that when the dependent variable is lagged by one period, the GBR coefficient is 0.0358, which is significant at the 5% level, consistent with the expected time-lag in sustainable economic growth.

4.2.4 Narrowed sample interval

To test the robustness of the positive effect of GBR on sustainable economic growth under extreme exogenous shocks, in this study, we conduct a sample sensitivity analysis for the structural breakpoint potentially induced by the COVID-19 pandemic, a global public health crisis. The pandemic impacted countries’ production functions through three channels: supply chain disruptions, labor shortages, and demand shrinkage (Guerrieri et al., 2022), potentially distorting the normal transmission path of policy effects: on the one hand, pandemic lockdowns led to relaxed environmental regulations, creating a “regulatory holiday” effect on corporate pollution emissions; on the other hand, economic stimulus packages might redirect green budget funds to livelihood relief, weakening policy intensity. To isolate pandemic interference, in this study, we exclude samples from 2020 and the subsequent years, restrict the research window to 2000–2019, re-estimate the model, and compare coefficient stability. The regression results are presented in column (5) of Table 4. The GBR coefficient remains statistically significant at the 1% level, indicating that research findings are robust to the effect of the COVID-19 pandemic.

4.2.5 Replacement of control variables

With the in-depth global penetration of the digital economy, the core connotation of information infrastructure has expanded from traditional communication facilities to dimensions such as digital access capability and network penetration rate. To more accurately control the potential interference of information infrastructure on empirical results and ensure the compatibility between variable measurement and current economic characteristics, in this study, we update the proxy variables of information infrastructure to “internet user ratio” and “digital infrastructure index” with reference to the research by Wang et al. (2025). Under the premise of keeping other model specifications unchanged, the two-way fixed effects regression is re-conducted, and the results are shown in columns (6) and (7) of Table 4.

As can be seen from column (6) of Table 4, when the “internet user ratio” is used as the control variable, the estimated coefficient of GBR is 0.0330, which is significantly positive at the 1% statistical significance level. From column (7) of Table 4, when the control variable “fixed-line telephone subscribers” is replaced with the “digital infrastructure index,” the estimated coefficient of GBR is 0.0262, which is significantly positive at the 5% statistical significance level. By comparing the estimated coefficient of GBR in the benchmark regression, it can be observed that after the introduction of the new control variables, although the coefficient of the core explanatory variable exhibits minor fluctuations, it remains within a reasonable range, and its positive significance remains unchanged. This further verifies the rationality of the model specification.

4.3 Endogeneity test

While green budget policies are considered external shocks (Pojar, 2023), endogeneity issues such as reverse causality and omitted variables may exist between GBR and countries’ sustainable economic growth. Countries exhibiting higher sustainable economic growth often demonstrate greater commitment to environmental governance and stronger fiscal capacity. This may enable them to proactively strengthen green budget policies, such as by increasing carbon tax rates or broadening the scope of environmental taxes, thereby generating a cumulative “high growth–strong policy” effect. Conversely, economically sluggish countries may ease green budget policies to stimulate short-term growth, leading to a negative correlation between policy intensity and growth quality. Furthermore, omitted variables such as unobserved political institutions or sociocultural factors may simultaneously influence green budget policy implementation and sustainable economic growth. To address these endogeneity issues, in this study, we employ the instrumental variable (IV) method to identify the causal effect of GBR on sustainable economic growth.

Building upon the methodological frameworks of Bartik (2006) and Shen and Zhang (2022), in this study, we develop an IV system that integrates temporal dimensions and policy dynamic adjustment features to mitigate estimation bias. The IV design must satisfy the dual conditions of relevance and exogeneity: first, IVs must be strongly correlated with the endogenous explanatory variable GBR to capture exogenous variations in policy intensity; second, IVs must be independent of the error term, that is, the dependent variable should not be influenced through any channels other than GBR. The core IV is a Bartik-type instrument constructed by integrating policy lag terms and difference terms based on the time-series dynamics of GBR, stripping the endogenous components of policy formulation disturbed by current economic growth. Specifically, the interaction term of the first-order lag and first-order difference of countries’ GBR (IV1) is used as the Bartik instrument (Equations 6, 7). This design captures policy inertia through lag terms and exogenous policy adjustments through difference terms, thereby isolating exogenous policy shock components. Meanwhile, to prevent weak IV problems, the second-order lag of GBR is employed as the second instrument (IV2).

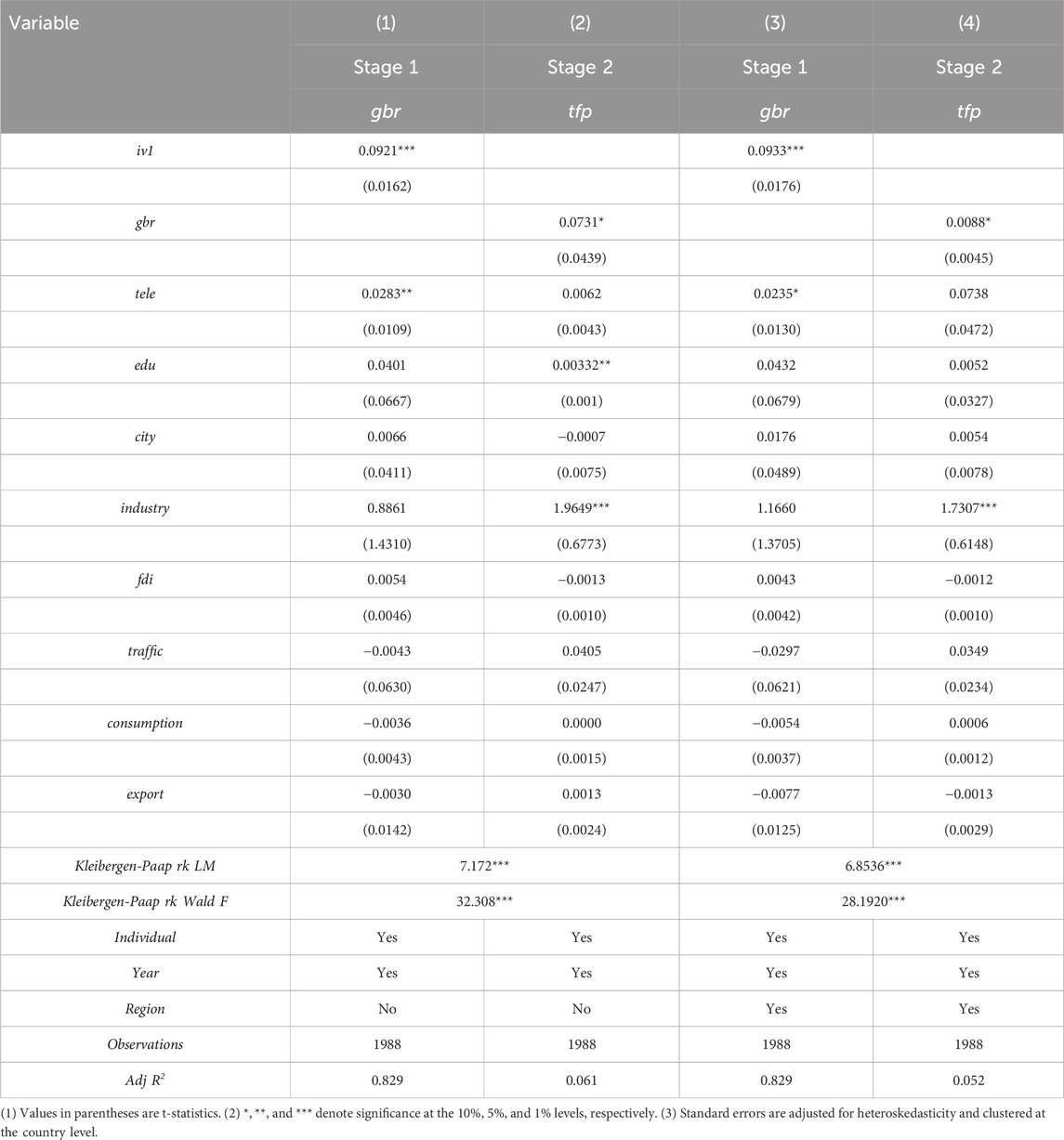

To mitigate the reverse causality and omitted variable bias between GBR and sustainable economic growth, in this study, we first construct a Bartik-type instrumental variable (IV1), which takes the interaction term of the first-order lag term and first-order difference term of GBR across countries as the instrumental variable. The regression results are presented in columns (1)–(4) of Table 5. Considering that there may be systematic differences across different geographical regions in the cross-country panel, and these inherent regional characteristics may simultaneously affect the adoption of green budget policies and TFP levels, in this study, we incorporate regional fixed effects in the regression to absorb the static differences among the six continents (Europe, Asia, Africa, North America, South America, and Oceania).

As shown in columns (1) and (3) of the first-stage regression, regardless of whether regional fixed effects are controlled or not, IV1 and GBR are both significantly and positively correlated at the 1% significance level, with coefficients of 0.0921 and 0.0933, respectively. This proves that the correlation between the instrumental variable and the endogenous variable is stable, satisfying the relevance condition. The second-stage regression results in columns (2) and (4) show that the coefficient of GBR on the TFP remains significantly positive at the 10% significance level, which is consistent with the conclusion of the main regression, indicating that the growth effect of GBR is robust. The results of the instrumental variable validity test show that the Kleibergen–Paap rk LM statistics are all significant at the 1% significance level; the Kleibergen–Paap rk Wald F statistics are all greater than the critical value of 16.38 under the 10% significance level from Stock-Yogo (2022). The weak identification test is passed, indicating that the instrumental variable has sufficient strength.

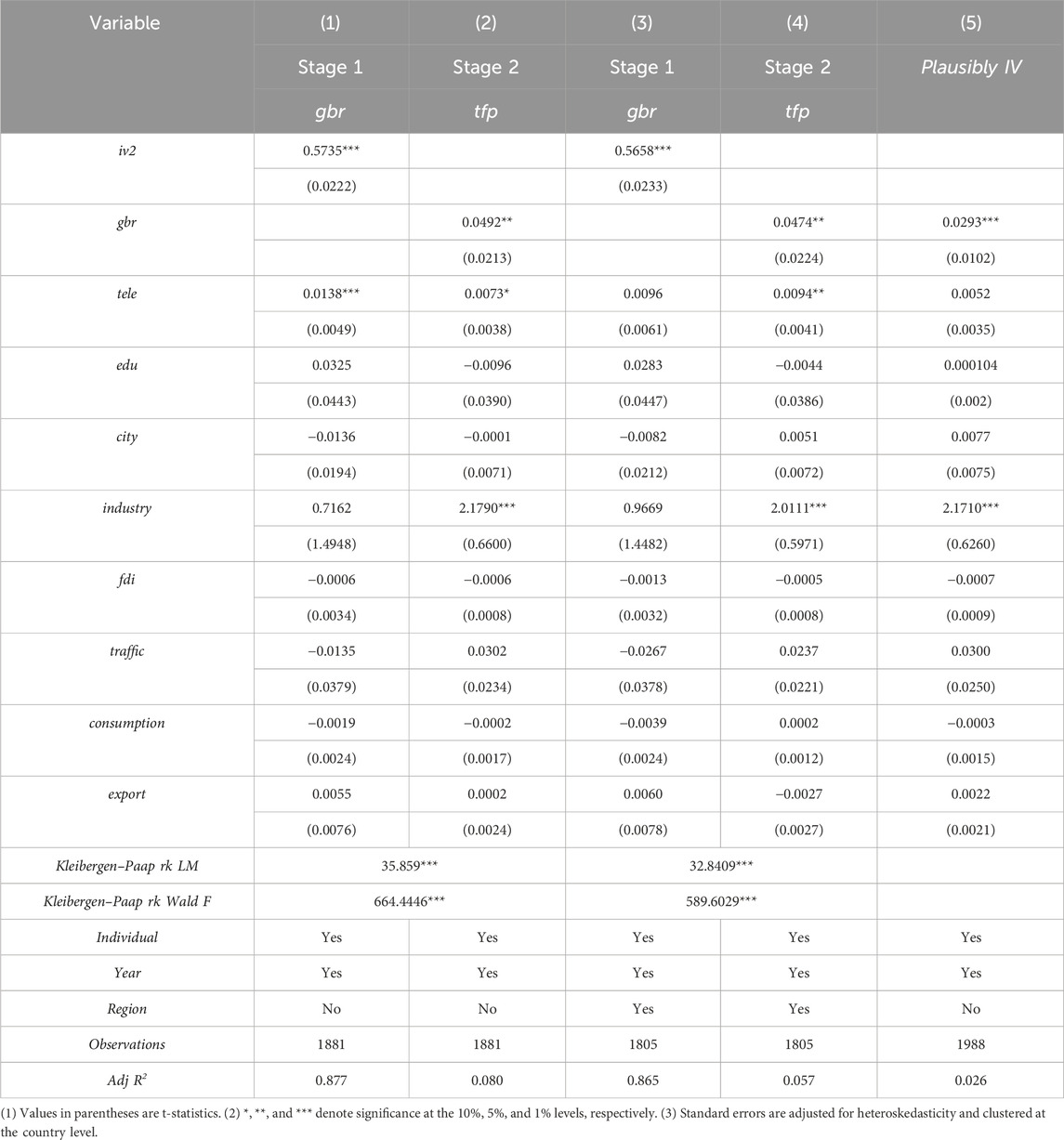

To further verify the reliability of the conclusions, in this study, we supplement a second-order lag instrumental variable (IV2), which takes the second-order lag term of GBR of various countries as the instrumental variable. The regression results are presented in columns (1)–(4) of Table 6. The first-stage regression results in columns (1) and (3) show that IV2 has a strong correlation with GBR; when regional fixed effects are not controlled, the coefficient is 0.5735; when regional fixed effects are controlled, the coefficient is 0.5658, and both coefficients are significant at the 1% significance level. In the second-stage regression results in columns (2) and (4), the coefficient of GBR on TFP is significantly positive at the 5% significance level, with coefficients of 0.0492 and 0.0474, respectively. This indicates that the core conclusion is not affected by the selection of instrumental variables. For the validity test of the instrumental variable, the Kleibergen–Paap rk LM statistics are all significant at the 1% significance level, rejecting the null hypothesis of insufficient instrument identification. Meanwhile, the results of the weak identification test show that the Kleibergen–Paap rk Wald F statistics are all greater than the 10% critical value provided by Stock–Yogo, meaning the instrumental variable passes the weak identification test.

In addition, in empirical economic research, the strict exogeneity assumption of instrumental variables is often questioned, as the condition that instrumental variables must be completely uncorrelated with the error term is usually difficult to satisfy in real-world data. To address this dilemma, in this study, we introduce the near-exogenous instrumental variable method proposed by Conley et al. (2012), which relaxes the strict exogeneity constraint and allows for limited correlation between the instrumental variable and the error term, thus better meeting the needs of policy evaluation in real scenarios. Specifically, it is assumed that the correlation between the instrumental variable (Bartik instrumental variable) and the error term does not exceed a preset threshold, and the robustness of the results is tested by constructing a plausibility parameter space estimator. Column (5) of Table 6 reports the estimation results of the near-exogenous instrumental variable: the coefficient of GBR on sustainable economic growth (TFP) is 0.0293, which is significant at the 1% significance level. This further confirms the reliability of the two-stage least squares (2SLS) estimation results.

4.4 Mechanism analysis

As a guiding environmental policy globally, green budgeting emphasizes soft constraints and policy guidance on the environmental performance of global economic entities. In this study, we focus on whether and how the constraint-guidance function of GBR influences countries’ sustainable economic growth (TFP). The implementation of green budgeting intensifies constraints on countries’ green development within the production process, compelling adjustments in factor input structures and in production and operational behaviors, thereby inevitably influencing the overall production efficiency. Li et al. (2022), in this study, we explore the mechanisms through which GBR promotes sustainable economic growth from two perspectives: medium-term effects (innovation compensation) and long-term effects (resource reallocation). We construct the following model as shown in Equation 8

4.4.1 Innovation compensation effect

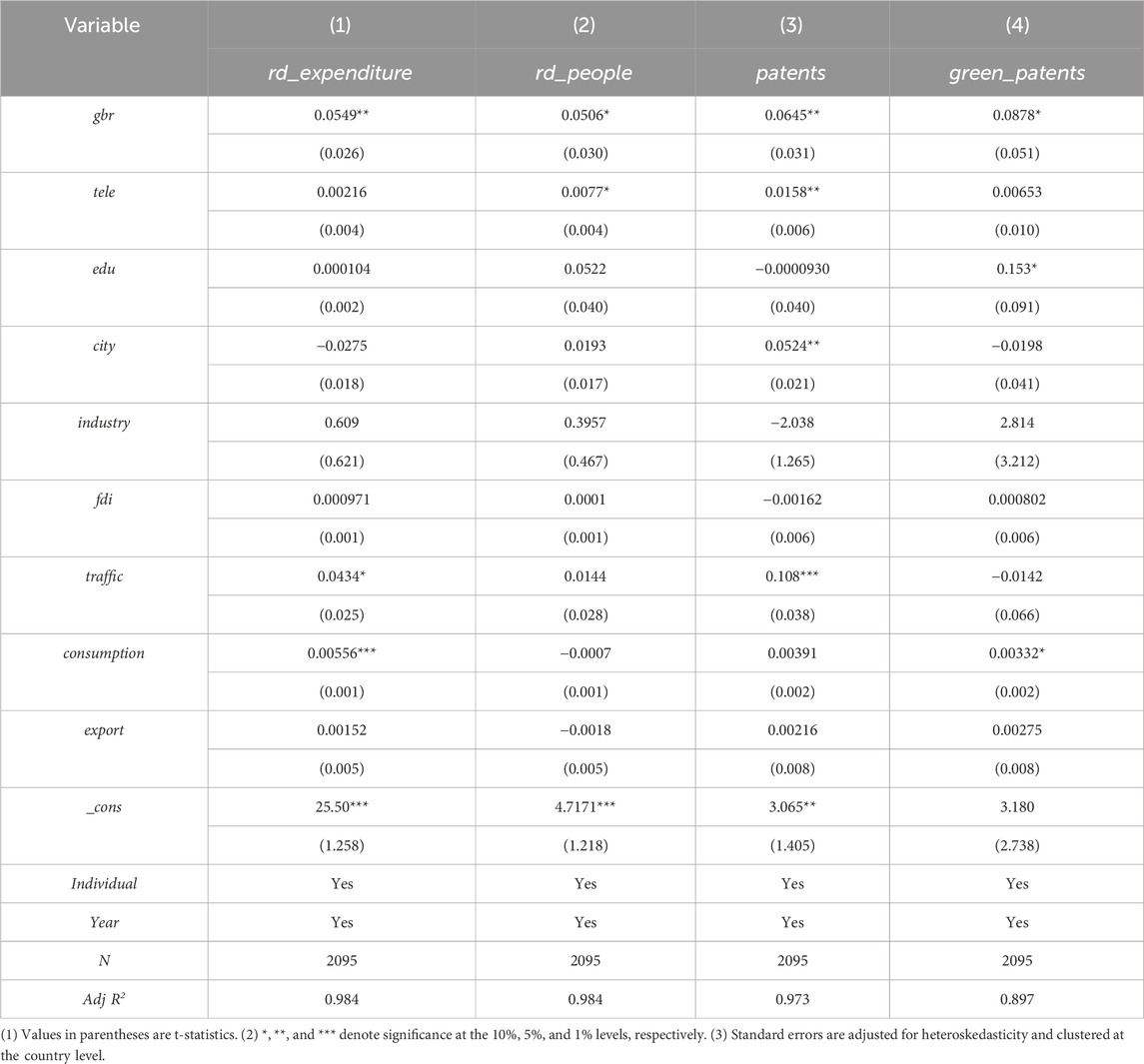

The design of the GBR tax system influences the innovation compensation effect through a bidirectional analysis of input and output factors, with its core mechanism rooted in directing R&D resource allocation toward green technology sectors via cost internalization. Existing literature often employs R&D investment and the number of patent applications as key indicators for a country’s level of innovation (Yu et al., 2021). On the one hand, increasing R&D investment is a necessary condition for realizing the innovation compensation effect. However, greater emphasis should be placed on the efficiency and output of innovation during the transformation of R&D investment into economic and environmental benefits. On the other hand, beyond conventional measures such as total patent applications, the revenue component of green budgeting affects national economic growth primarily through the greening of production processes. In this context, the innovation compensation effect stems predominantly from advances in renewable and sustainable technologies. Therefore, to examine the input dimension of the innovation compensation effect, in this study, we adopt a dual input framework of “human-capital–money” in national R&D. Specifically, the logarithm of R&D expenditure and the number of R&D personnel (R&D people) are used to capture the impact of GBR on national innovation inputs.

To assess the output dimension of the innovation compensation effect, in this study, we employ the logarithm of total patent applications (patents) and patent applications related to renewable and sustainable technologies (green patents)2 to capture the impact of GBR on national innovation output. The regression results are presented in Table 7. For the input dimension of the innovation compensation effect, columns (1) and (2) show that GBR coefficients are significantly positive at the 5% and 10% levels, respectively, indicating that the revenue component of green budget policies significantly promotes countries’ R&D expenditure (R&D expenditure) and R&D personnel input (R&D people). Specifically, the regression results in columns (1) and (2) show that a one-unit increase in GBR leads to a 5.49% and 5.06% increase in countries’ R&D expenditure and R&D personnel input, respectively. For the output dimension of the innovation compensation effect, columns (1) and (2) show that the GBR coefficients are significantly positive at the 5% and 10% levels, respectively, indicating that the revenue component of green budget policies significantly promotes countries’ total patent applications (patents) and patent applications related to renewable and sustainable technologies (green patents). The regression results in columns (3) and (4) show that a one-unit increase in GBR leads to a 6.45% and 8.78% increase in countries’ total patent applications and renewable/sustainable technology patents, respectively. In summary, this chapter provides empirical evidence that the revenue component of green budget policies improves countries’ sustainable economic growth by fostering technological innovation, thereby supporting the validity of research Hypothesis 2b.

4.4.2 Resource allocation effect

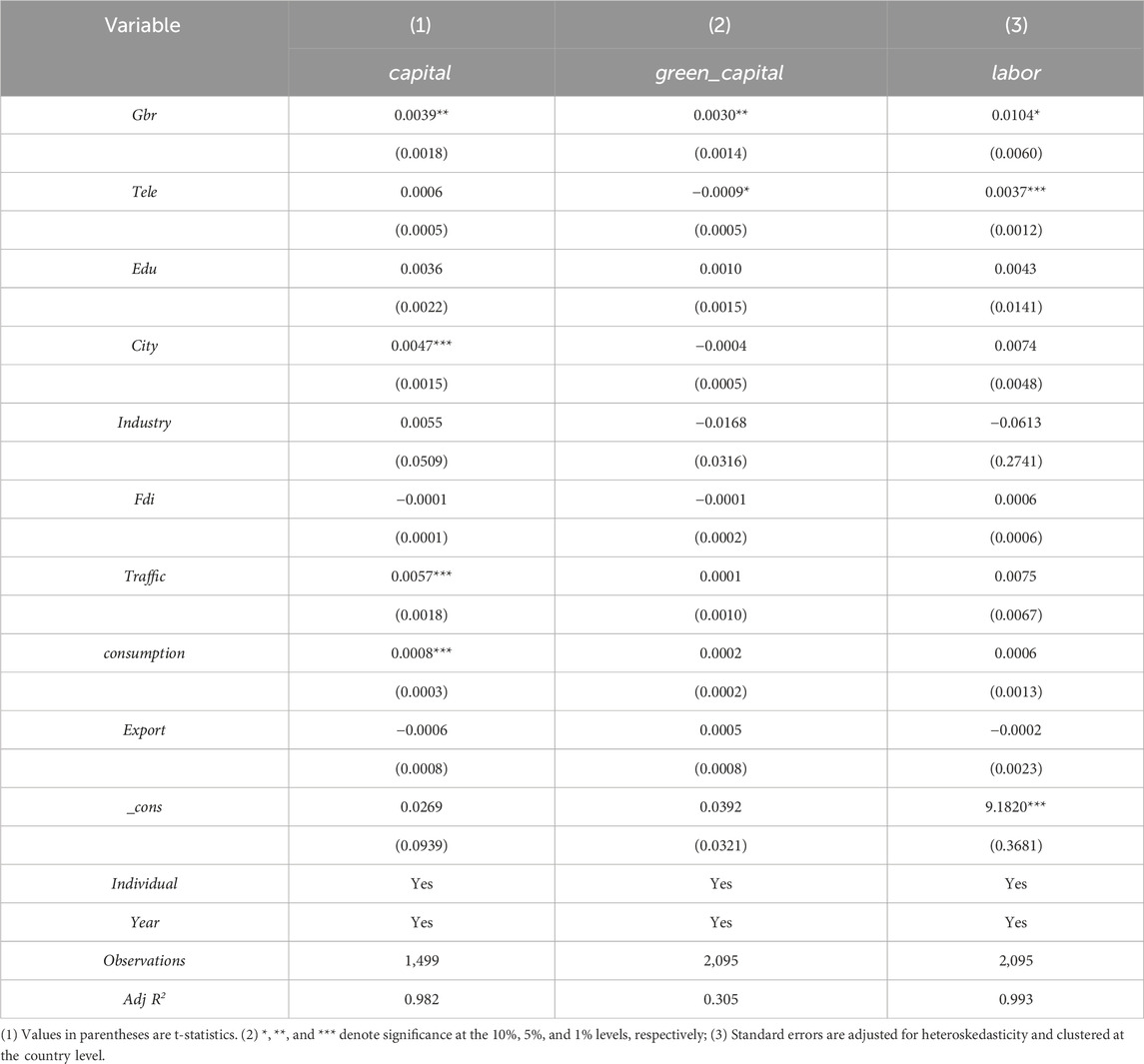

GBR drives the flow of capital and labor to efficient sectors by reconstructing factor price signals, with its resource allocation effect systematically deconstructed into dual optimization paths of capital markets and labor markets. The Porter hypothesis posits that the essence of environmental regulation is to guide production factors to break through inefficient lock-in states by correcting market failures. GBR amplifies the cost gap between green and high-carbon production through tax burden differences, forcing market entities to reassess factor allocation strategies, enhance resource allocation efficiency at the enterprise and industry levels, gradually optimize national industrial structures, and thereby improve countries’ productivity levels. Based on this, in this study, we use national capital market allocation efficiency and labor market allocation efficiency as dependent variables for mechanism testing3, with estimation results presented in Table 8. Column (1) shows the regression results of GBR on national capital market allocation efficiency, where the GBR regression coefficient is significantly positive, indicating that GBR significantly improves national capital market allocation efficiency.

To further focus on the green-oriented resource reallocation logic, in this study, we select the clean energy financing volume of various countries disclosed in the Database of Indicators for the Sustainable Development Goals of the United Nations Department of Economic and Social Affairs as a more direct mechanism variable for supplementary testing. To unify the dimension, in this study, we conduct normalization on this variable, and the regression results are presented in column (2) of Table 8. The regression coefficient of GBR is 0.0030, which is statistically significant at the 5% significance level. This result directly proves that GBR can guide the agglomeration of capital into green sectors such as clean energy, verifying the green-oriented resource reallocation path.

Regarding labor market allocation efficiency, Song et al. (2021) argue that the flow efficiency of labor factors between green and high-efficiency sectors and high-carbon and low-efficiency sectors is the core dimension for measuring the quality of labor market resource allocation. Green policies can promote labor transfer to high-efficiency sectors by expanding the employment demand of green sectors and increasing the skill premium for green jobs. Column (3) of Table 8 further analyzes the impact of GBR on the labor market allocation efficiency of various countries; the regression coefficient is significantly positive, indicating that as the GBR of various countries increases, their labor market allocation efficiency becomes higher. Thus, it can be concluded that the GBR of various countries can promote the sustainable economic growth of these countries by improving the allocation efficiency of their capital and labor markets, and research Hypothesis 3 is valid.

4.5 Heterogeneity analysis

4.5.1 Heterogeneity analysis based on OECD membership

The impact of GBR on countries’ sustainable economic growth may exhibit significant heterogeneity, which is rooted in systematic differences in economic development stages, institutional foundations, and industrial structures across nations. In this study, we divide the sample into two groups—OECD and non-OECD countries—based on fundamental differences in key nodes of the policy transmission mechanism, as this grouping effectively captures the conditional dependence of green budget policy effects on development levels and institutional environments. Columns (1) and (2) of Table 9 present the group regression results for OECD and non-OECD countries, respectively. Column (1) shows that GBR has a statistically significant positive effect on sustainable economic growth in non-OECD countries, whereas the effect is not statistically significant for OECD countries.

The policy effects of GBRs in OECD countries are generally insignificant, primarily because of structural contradictions between the design of policy instruments and the surrounding institutional environment (Webb, 2004). In other words, OECD countries face a first-mover disadvantage when adopting emerging green budget tools. Having undergone earlier development, these economies have already established mature systems of environmental legislation, regulatory oversight, fiscal frameworks, and entrenched interest structures. As a result, stakeholders often lack the incentive to pursue reforms that might undermine their existing benefits. Moreover, such reforms are inherently systemic undertakings; limited technical adjustments tend to reduce GBRs to a mere “patchwork” instrument, which is insufficient to generate the momentum necessary for structural transformation. A similar conclusion is drawn by Lin and Li (2011) in their analysis of the emission-reduction effects of carbon taxes. Due to resource endowment constraints, countries such as Denmark, Sweden, and the Netherlands have introduced extensive tax exemptions for energy-intensive industries, thereby diminishing the overall effectiveness of carbon taxation policies.

In contrast, non-OECD countries whose environmental governance systems are largely in the formative stage are unconstrained by historical burdens in the selection and configuration of policy instrument, allowing for the direct integration of green budget concepts aligned with development needs. Countries such as Nepal have adopted light institutional designs such as separate climate budget items and simplified tax incentive approval processes (Pindiriri and Kwaramba, 2024), allowing policy tools to quickly adapt to local industrial structures and resource endowments while avoiding the “legislative perfectionism” trap that is often observed in OECD countries.

4.5.2 The moderating effect of fiscal pressure

Fiscal pressure significantly constraints the effective implementation of government budget policies, leading to deviation in policy execution intensity from social optimal levels. In the heterogeneity analysis, in this study, we employ the ratio of national expenditure to total revenue as a proxy for fiscal pressure (pressure). Specifically, by introducing fiscal pressure as a moderating variable, an interaction term between GBR and national fiscal pressure (GBR × pressure) is constructed to examine how the economic effects of GBR vary under different fiscal pressure conditions.

As indicated by the regression results in column (3) of Table 9, the statistically significant negative coefficient of the interaction term GBR × pressure suggests that GBR exerts a more pronounced promoting effect on sustainable economic growth in countries experiencing lower fiscal pressure. The inhibitory effect of fiscal pressure on the effectiveness of GBR essentially stems from the structural conflict between fiscal sustainability goals and environmental governance goals in policy implementation. When a country’s fiscal balance is disrupted, the government faces trade-offs under hard budget constraints. In the short term, rigid expenditure obligations, such as maintaining public service stability and servicing debt principal and interest, take absolute priority, As a result, green budgets, as medium-to-long-term-oriented policy instruments, often experience a decline in implementation intensity and fund allocation, yielding to immediate fiscal stabilization objectives.

4.5.3 The moderating effect of institutional quality

Institutional quality is a key boundary condition affecting the effectiveness of policy implementation, among which government effectiveness and regulatory quality directly determine the allocation efficiency of government green budget funds and the effectiveness of policy implementation. Based on the World Bank’s Worldwide Governance Indicators (WGI), in this study, we select government effectiveness and regulatory quality as moderating variables: the former measures the government’s ability to formulate and implement policies, whereas the latter reflects the government’s level of establishing a fair regulatory framework. By constructing interaction terms between GBR and these two types of institutional variables, in this study, we examine how the institutional environment moderates the effect of GBR on sustainable economic growth. The regression results are presented in columns (4) and (5) of Table 9.

Column (4) of Table 9 reports the moderating effect of government effectiveness: the main effect of GBR is significantly positive, indicating that when government effectiveness is at the mean level, GBR already exerts a significant promoting effect on TFP. The coefficient of the interaction term GBR × effectiveness is 0.2289 and significantly positive at the 1% statistical significance level, which shows that in economies with higher government effectiveness, the promoting effect of GBR on sustainable economic growth is stronger. Column (5) further demonstrates the moderating role of regulatory quality: the main effect of GBR remains significantly positive at the 1% statistical significance level, and the coefficient of the interaction term GBR × regulation is 0.1860 and significantly positive at the 5% statistical significance level. This indicates that the regulatory quality also exerts a positive moderating effect on the growth effect of green budget. The heterogeneity analysis based on the institutional quality dimension of various economies shows that the effect of GBR on sustainable economic growth has significant institutional dependence. Economies with higher government effectiveness and regulatory quality are more capable of releasing the policy potential of the green budget. This provides empirical evidence for various countries to improve the effectiveness of green fiscal policies through institutional optimization.

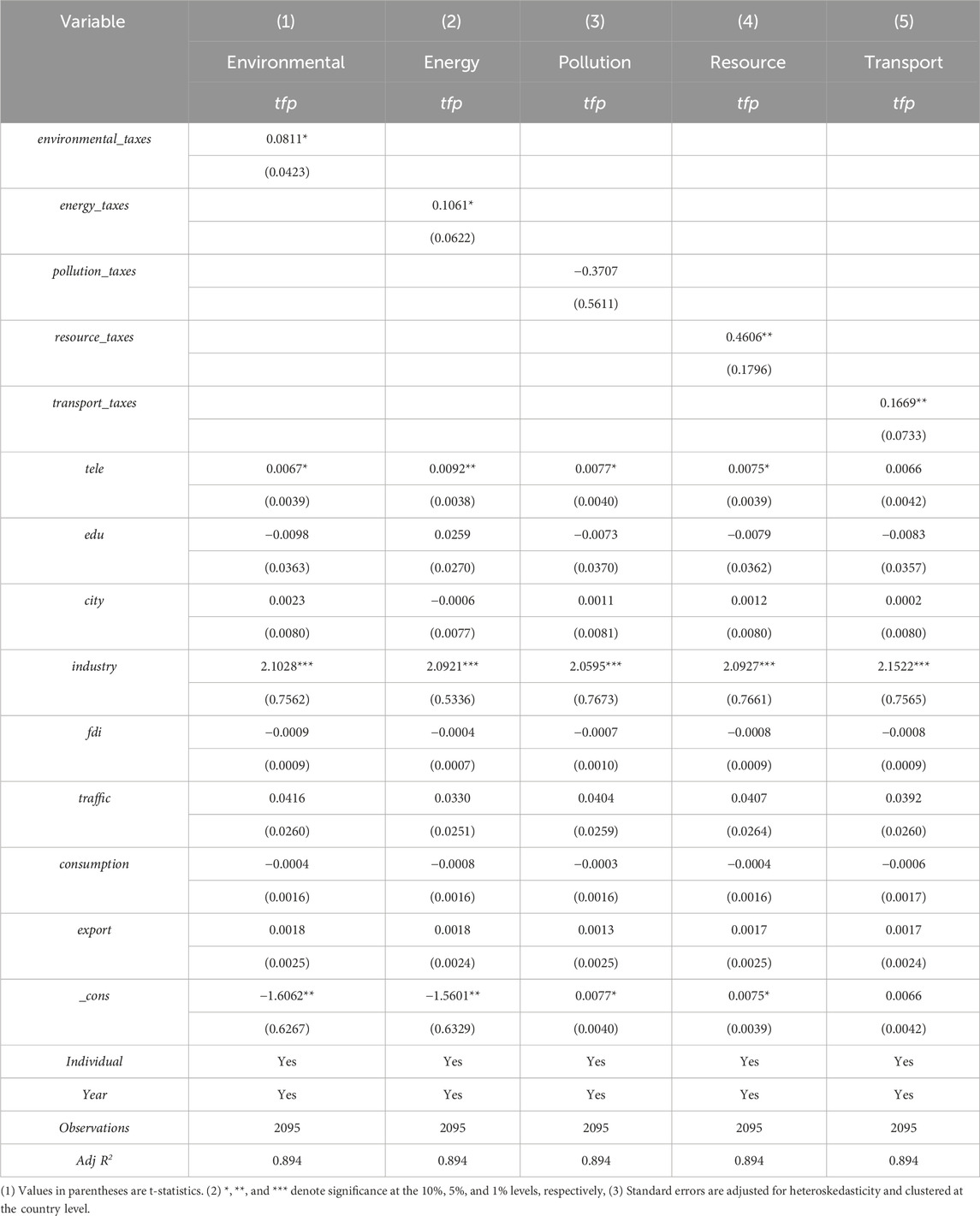

4.5.4 Heterogeneity analysis based on different green budget revenue items

Due to differences in tax bases and policy orientations among different types of GBR items, there may be significant variations in their mechanism of action and the effect intensity on TFP. In this study, we subdivide GBR into environmental taxes, energy taxes, pollution taxes, resource taxes, and transport taxes, and it examines the heterogeneous impacts of different green budget items on sustainable economic growth by incorporating each type of item as a core explanatory variable into the regression model. The regression results are presented in Table 10.

The regression results show that the effects of different green budget items exhibit obvious differences. Column (1) of Table 10 indicates that the coefficient of environmental taxes on TFP is 0.0722, which is significantly positive at the 10% significance level. Column (2) of Table 10 shows that the coefficient of energy taxes is 0.106*, which is also significantly positive at the 10% significance level. As a tax levied on energy production and consumption links, energy taxes raise the cost of fossil energy use, forcing enterprises to improve energy utilization efficiency or switch to clean energy, thereby encouraging energy-saving technological innovation and forming a positive driving force for TFP. Column (3) of Table 10 reveals that the coefficient of pollution taxes is −0.371, but it fails to pass the significance test. This result stems from the policy-oriented nature of pollution taxes: in some countries, pollution taxes focus more on compensating for the costs of existing pollution rather than directly incentivizing the upgrading of production technologies. Meanwhile, if enterprises find it difficult to bear the tax burden in the short term and lack funds for transformation, this may temporarily inhibit the improvement of production efficiency, leading to an insignificant effect. Column (4) of Table 10 demonstrates that the coefficient of resource taxes is 0.461, which is significantly positive at the 5% significance level, and its effect intensity is the most prominent among all the types of items. Resource taxes are levied on the extraction and use of natural resources; their core role is to correct the externality of excessive resource consumption and promote enterprises to shift from relying on resource inputs to improving technological levels, thereby significantly enhancing TFP. Column (5) of Table 10 shows that the coefficient of transport taxes is 0.167, which is significantly positive at the 5% significance level.

In summary, the effects of different GBR items on sustainable economic growth are differentiated: resource taxes and transport taxes have the most significant promoting effects; the total items of energy taxes and environmental taxes exhibit marginally significant effects, whereas the effect of pollution taxes is not obvious for the time being.

5 Conclusion and implications

With mounting global emphasis on sustainable development, the focus of green strategies has progressively shifted from the adoption of specific measures such as renewable energy and green materials toward the establishment of comprehensive macroeconomic management frameworks. In this context, green budgeting, specifically GBRs, has gained prominence.

Global production factor data are drawn on in this study, primarily following methodologies developed by Fouré et al. (2013) and Fontagné et al. (2022). These scholars employed a nonparametric approach that integrates capital, labor, and energy inputs to construct the MaGE model for estimating the TFP across countries. By linking the resulting TFP measures with national green budget data sourced from the International Monetary Fund (IMF), in this study, we apply a fixed-effects model to empirically assess the impact of green budgeting on sustainable development. The findings demonstrate that the implementation of green budgeting has a statistically significant positive effect on the national TFP. Specifically, a one-unit increase in GBR is associated with an approximate 0.0361-unit rise in the TFP. Furthermore, following the methodologies pioneered by Bartik (2006) and advanced by Shen and Zhang (2022), a Bartik-type instrumental variable strategy was implemented to address concerns over potential reverse causality, thereby enhancing the confidence in the robustness of the core findings and their policy implications.

The analysis further identifies and empirically tests two primary mechanisms underpinning the enhancement of national TFP by GBRs: innovation compensation and resource allocation efficiency. Robust empirical evidence supports these channels. First, GBRs exert a statistically significant positive effect on key innovation metrics—specifically, national R&D expenditures and R&D personnel investments; aggregate patent applications; and, notably, patent filings specifically related to renewable energy and sustainability technologies. This pattern provides strong support for the mechanism through which GBRs contribute to TFP growth by innovation inputs and outputs. Second, the results show that GBRs significantly enhance the allocation efficiency of key production factors, particularly capital and labor, highlighting a distinct channel through which enhanced resource allocation efficiency contributes to overall productivity gains.

The analysis further investigates two primary mechanisms through which GBRs enhance national TFP: innovation compensation and resource allocation efficiency. First, empirical evidence shows that GBRs significantly increase national R&D expenditures, investment in R&D personnel, total patent applications, and renewable and sustainability-related patent filings. These findings indicate that GBRs promote TFP growth by increasing innovation inputs and outputs. Second, GBRs significantly improve the allocation efficiency of capital and labor, and guide capital flows toward green industrial sectors, suggesting another pathway through which resource allocation efficiency boosts overall productivity.

Finally, in this study, we conduct a heterogeneity analysis of the effects of GBRs. The results show that green budgeting significantly promotes sustainable economic growth in non-OECD countries, whereas its impact is insignificant in OECD economies. At the macro-level, the institutional and industrial maturity of OECD countries creates a first-mover disadvantage, leading to inertia and slower adjustment when adopting green budgeting. At the micro level, traditional production systems involve large sunk costs, making short-term reform difficult and generating resistance to change. Heterogeneous effects are observed across different categories of GBRs; resource and transport taxes exert the most significant positive impact on the TFP, whereas the effects of energy and environmental taxes are weaker, and pollution taxes show no significant influence.

Regarding fiscal pressure, the interaction term between fiscal pressure and GBRs is negative, indicating that the positive effect of green budgeting is stronger in countries with lower fiscal pressure. Fiscal constraints narrow governments’ policy space and may force firms to adopt short-term strategies that hinder sustainable development. Moreover, higher government effectiveness and stronger regulatory quality amplify the positive effects of green budgeting, confirming the favorable moderating role of institutional quality.

Based on the findings above, in this paper, we propose the following policy recommendations:

First, countries should actively employ green budgeting as an institutional tool to enhance the TFP and achieve sustainable economic development. Macroeconomic governance forms an integral part of the broader production system, and the pursuit of high-quality growth must be accompanied by the greening of fiscal and budgetary frameworks. Governments need to strengthen their capacity to coordinate green development resources and foster an enabling external environment—through improvements in legal frameworks, market institutions, and the business climate—to reduce barriers to corporate transformation. Such reform should not be limited to minor technical adjustments but should constitute a comprehensive, system-wide transformation. Specifically, legal systems should clearly define green budgeting requirements and gradually phase out fiscal support for traditional production modes. Transparent procedures for budget formulation, supervision, and evaluation should be institutionalized to ensure that green budgets safeguard legitimate business interests. Simplifying tax declaration and payment processes can further promote a more sustainable and business-friendly environment. In addition, governments should enhance the signaling and demonstration effects of GBRs to motivate enterprises to pursue low-carbon transformation proactively. Finally, strengthening the stabilizing function of green taxation—by strictly penalizing high energy-consuming and polluting enterprises—can help internalize environmental externalities and prevent the resurgence of outdated production patterns.

Second, technological innovation should be used to restructure the allocation of market resources. In the medium term, the tax pressure resulting from green budget policies encourages enterprises to adjust their internal factor structures, directing more capital and human resources toward research and development to reduce operational costs through cleaner production. Increased innovation investment not only enhances the likelihood of technological breakthroughs but also improves the efficiency and quality of green innovation outputs. Governments should, therefore, build strong systems for talent cultivation and promote closer integration among industry, academia, and research to improve the transformation efficiency of innovation outcomes. In the long run, innovation enhances market competitiveness, leading to the exit of inefficient firms and a natural reallocation of market resources toward green enterprises. Policymakers should facilitate orderly exit mechanisms and avoid subsidies that artificially sustain traditional industries, allowing market mechanisms to play a decisive role in resource reallocation.

Third, policy design should follow the principle of “adapting measures to local conditions” to jointly advance global sustainable development goals. OECD countries, with their abundant physical and human capital, should leverage these advantages to promote the reallocation of resources toward R&D within firms and guide capital toward enterprises aligned with green budget objectives. However, their mature institutional structures may hinder the effectiveness of policy implementation; breaking through institutional rigidity is, therefore, essential for realizing the full potential of green budgeting. Non-OECD countries, by contrast, can rapidly establish modern green budgeting systems, thanks to greater institutional flexibility; however, they often face shortages of physical and human capital. These countries should introduce policies that facilitate foreign investment and attract international talent, thereby encouraging inflows of green capital and innovation-oriented expertise. Moreover, all countries should recognize the heterogeneous effects of different tax categories on TFP. Resource and transport taxes demonstrate the strongest positive effects, whereas energy and environmental taxes are comparatively weaker, and pollution taxes show no significant impact. Policymakers should, therefore, increase the relative share of resource and transport taxes while moderately expanding the scope of energy and environmental taxation to maximize the overall effectiveness of GBRs.

Regarding the moderating effects, governments should make full use of the positive moderating roles of government effectiveness and regulatory quality while mitigating the suppressing influence of fiscal pressure. OECD countries, which generally enjoy higher administrative and regulatory capacities, should leverage these advantages to offset their institutional first-mover disadvantages. Non-OECD countries should strengthen governance capacity through international cooperation, knowledge exchange, and talent introduction. Meanwhile, fiscal pressure—although a systemic challenge—should not be directly transferred to enterprises. Governments facing fiscal constraints must avoid using environmental protection or sustainability goals as pretexts to raise revenues through excessive fines or confiscatory measures.

Finally, due to data and practical constraints, the long-term effects of GBRs on resource allocation efficiency are not yet fully observable. Continuous monitoring and data updates are, therefore, necessary to refine future policy design and ensure that green budgeting remains an effective instrument for promoting both economic and environmental sustainability.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

YL: Conceptualization, Formal analysis, Methodology, Validation, Writing – original draft, Writing – review and editing. AM: Data curation, Software, Validation, Writing – original draft. CW: Formal analysis, Supervision, Validation, Visualization, Writing – review and editing. GZ: Formal analysis, Funding acquisition, Project administration, Resources, Validation, Visualization, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by the Program for Innovation Research at the Central University of Finance and Economics (No. 2025030), the Program for Innovation Research and “Double First-Class” Program at the Central University of Finance and Economics and the Key Laboratory of Quality Infrastructure Efficacy Research, the National Natural Science Foundation of China (No. 72373172), and the National Social Science Foundation of China (No. 19CGL048).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.