- 1Department of Tropical Agriculture and International Cooperation, National Pingtung University of Science and Technology (NPUST), Pingtung, Taiwan

- 2Department of Agriculture Socio-Economic, Faculty of Agriculture, Universitas Brawijaya, Malang, Indonesia

Rooted in the Anthropogenic Global Warming (AGW) theory, which underscores the human-induced drivers of climate instability, this study responds to the mounting financial challenges smallholder farmers face in adapting to climate change. Adapting to climate change presents mounting financial challenges for smallholder farmers, especially in developing countries where climate variability threatens agricultural productivity and economic stability. Within this context, climate financing behaviour—defined as farmers’ financial decisions explicitly aimed at managing climate-related risks—plays a critical role in building resilience. This study examines how financial literacy influences climate financing behaviour among horticultural farmers in East Java, Indonesia, with a specific focus on two adaptive strategies: accessing formal climate credit to support climate-resilient investments, and allocating post-harvest income into precautionary savings to buffer against future climate shocks. Using an Instrumental Variable (IV) approach, this study employs IV-Probit models to evaluate the effect of financial literacy on farmers’ decisions to utilize formal climate-oriented credit and engage in adaptive savings behaviour. IV-Tobit models are applied to analyze the influence of financial literacy on the amount of climate credit obtained and the volume of climate-related savings. Results indicate that financial literacy significantly increases the likelihood of adopting both climate credit and adaptive savings behaviours, although it does not significantly affect the financial volume associated with either. A disaggregated analysis shows that financial literacy enhances credit access primarily among middle-income farmers and promotes savings accumulation particularly among low-income farmers, suggesting that climate financing behaviour is moderated by income level. These findings emphasize the importance of targeted financial education and accessible climate finance instruments—such as tailored agricultural credit products and incentivized climate savings schemes—in strengthening smallholder farmers’ adaptive capacity in the face of escalating climate-related financial risks. By aligning with the Sustainable Development Goals, this study contributes to SDG 13 (Climate Action) through promoting climate-resilient behaviours and to SDG 10 (Reduced Inequalities) by highlighting differentiated impacts across income groups, thereby supporting inclusive adaptation strategies.

1 Introduction

Climate change, driven by human-induced emissions and energy use as posited in the Anthropogenic Global Warming (AGW) theory, has emerged as a global crisis disrupting ecosystems, economies, and household livelihoods—particularly in the agricultural sector (Mehta, 2024; Rahman et al., 2025a). Agricultural productivity is increasingly threatened by extreme weather events such as droughts, floods, and tropical storms (Ali and Mujahid, 2025). Without adequate adaptation strategies, food security will remain at risk, especially for smallholder farmers in vulnerable regions (Rahman et al., 2022a). Prolonged droughts and unpredictable rainfall patterns have significantly reduced crop yields, jeopardizing the livelihoods of rural populations dependent on agriculture (Rahman et al., 2023b). These challenges are further exacerbated by slow governmental responses and inadequate infrastructure, demanding immediate adaptation measures by farmers.

Beyond ecological impacts, climate change also intensifies the financial vulnerability of smallholder farmers (Yang et al., 2022; Oosthuizen, 2014). Climate-induced harvest failures lead to sharp revenue fluctuations, destabilizing household financial flows (Rahman et al., 2021; Toiba et al., 2024; Hanani AR et al., 2024). Studies by Samuel et al. (2021); Lasco, Espaldon, and Habito (2016) reported that 70% of smallholder farmers experienced a 40% decline in income during prolonged droughts. This instability hampers farmers’ ability to invest in adaptive technologies (Touch et al., 2024). In Vietnam, for instance, farmers risk losing assets as they rely on high-interest informal loans, using land as collateral (Migheli, 2024). Limited access to agricultural insurance further compounds their vulnerability; in India, only 4% of farmers are covered by climate insurance (Biswal and Chandra, 2025). Consequently, financial pressures drive widespread migration and unsustainable farming practices that worsen environmental degradation.

In this context, AGW theory does not merely provide an ecological background but also frames smallholders’ financial vulnerability as a systemic risk constraint. Specifically, AGW underscores how human-induced climate instability generates uncertainty in agricultural returns, thereby shaping farmers’ utility-maximizing financial behavior under risk. This connection has been emphasized in recent literature linking AGW with rural financial decision-making (Letourneau and Davidson, 2022). Building on this foundation, our study extends AGW theory into the behavioral and financial domain by examining how financial literacy influences climate-adaptive credit and precautionary savings—two climate financing behaviors explicitly designed to buffer households against AGW-driven risks.

Structural barriers such as complex bureaucratic procedures, lack of collateral, and limited rural banking infrastructure further restrict farmers’ access to formal financial services (Saqib et al., 2018). Many farmers, prioritizing short-term financial needs, resort to informal lenders with exorbitant interest rates or forego investments in climate-resilient inputs such as improved seeds and irrigation systems (Shisanya and Mafongoya, 2016). This entrenches a cycle of financial instability, undermining smallholder resilience (Babatolu and Akinnubi, 2016).

To better conceptualize these financial responses, following Cui, Zhang, and Xia (2022); Jokinen (2018) we define climate financing behavior as farmers’ financial decisions that are explicitly aimed at managing climate-related risks. This includes two forms: 1) climate-adaptive credit—formal borrowing targeted to support climate-resilient agricultural investments, and 2) precautionary savings—allocating income to create buffers against future climate shocks. This definition differentiates climate financing behavior from ordinary agricultural financial practices by emphasizing its climate-specific orientation.

Financial literacy emerges as a crucial strategy to disrupt this cycle. Farmers with access to financial education—covering risk management, savings, and budgeting—are better equipped to make sound financial decisions (Amosah, Lukman, and Ghana, 2023). Empirical studies have shown that financial education fosters a greater propensity to save and invest in adaptive technologies (Amosah, Lukman, and Ghana, 2023; Mutaqin and Usami, 2019). Moreover, integrating financial literacy initiatives with accessible financial products, such as group-based microcredit programs, significantly enhances farmers’ ability to withstand climate-related risks (Donatti et al., 2017).

From a theoretical perspective, this study is guided by Random Utility Theory (RUT) (Putri et al., 2024; Rahman et al., 2025a), which provides a behavioral framework to understand farmers’ financial decision-making under risk. In this framework, farmers are assumed to choose between alternative financial actions (e.g., borrowing or saving) to maximize expected utility given climate uncertainty, financial literacy, and resource constraints. By adopting RUT, we establish a logical chain: financial literacy enhances farmers’ ability to evaluate options, which shapes behavioral intention and ultimately leads to adaptive financial actions.

Despite an expanding literature on financial inclusion and behavior, relatively few studies have explored how financial literacy shapes climate-related financial decisions among smallholder farmers in developing countries. Recent works applying IV-Tobit approaches (Drall and Mandal, 2024; Yang et al., 2024; Zhang Hepei et al., 2025; Zhang et al., 2024) have advanced our understanding of financial behavior in rural development and agricultural contexts, yet limited attention is given to the intersection between financial literacy, savings, credit, and climate adaptation. Moreover, previous studies rarely account for income heterogeneity or the systemic constraints of rural credit policies such as Indonesia’s KUR Tani program, both of which are crucial in shaping adaptive financial choices (Rahman et al., 2025c; Rahman et al., 2025a). This gap limits the policy applicability of earlier findings. Addressing this gap, this study examines how financial literacy affects smallholder farmers’ decisions regarding access to formal credit and the allocation of post-harvest income to savings—both critical steps toward adaptation in a changing climate. This study pursues three key objectives: 1) to investigate how financial literacy influences farmers’ access to formal credit; 2) to assess its effect on precautionary saving behavior; and 3) to examine how these relationships vary across different income groups.

This study makes two primary contributions to the literature. First, it provides empirical evidence on the role of financial literacy in enhancing farmers’ financial behaviors to build climate resilience. Second, it focuses on the financial vulnerabilities of smallholder farmers in rural Indonesia, aligning with the Sustainable Development Goals (SDG 13: Climate Action; SDG 10: Reducing Inequalities). By highlighting financial literacy as a key adaptation strategy, this research aims to inform policies that promote financial inclusion and long-term economic sustainability for farmers confronting climate-related challenges.

By incorporating AGW theory and Random Utility Theory, this study contributes twofold: First, it provides a theoretically grounded explanation of why financial literacy matters for climate financing behavior under systemic risk constraints. Second, it highlights income heterogeneity and rural policy contexts, particularly Indonesia’s smallholder finance environment, as key dimensions shaping adaptive financial behavior.

The remainder of the paper is structured as follows: Section 2 details the research setting, data collection, and variable construction. Section 3 outlines the empirical model and estimation strategy. Section 4 presents the key results and discussion. Section 5 concludes by offering policy implications, acknowledging study limitations, and suggesting directions for future research.

2 Materials and methods

2.1 Research location, sampling, and data collection

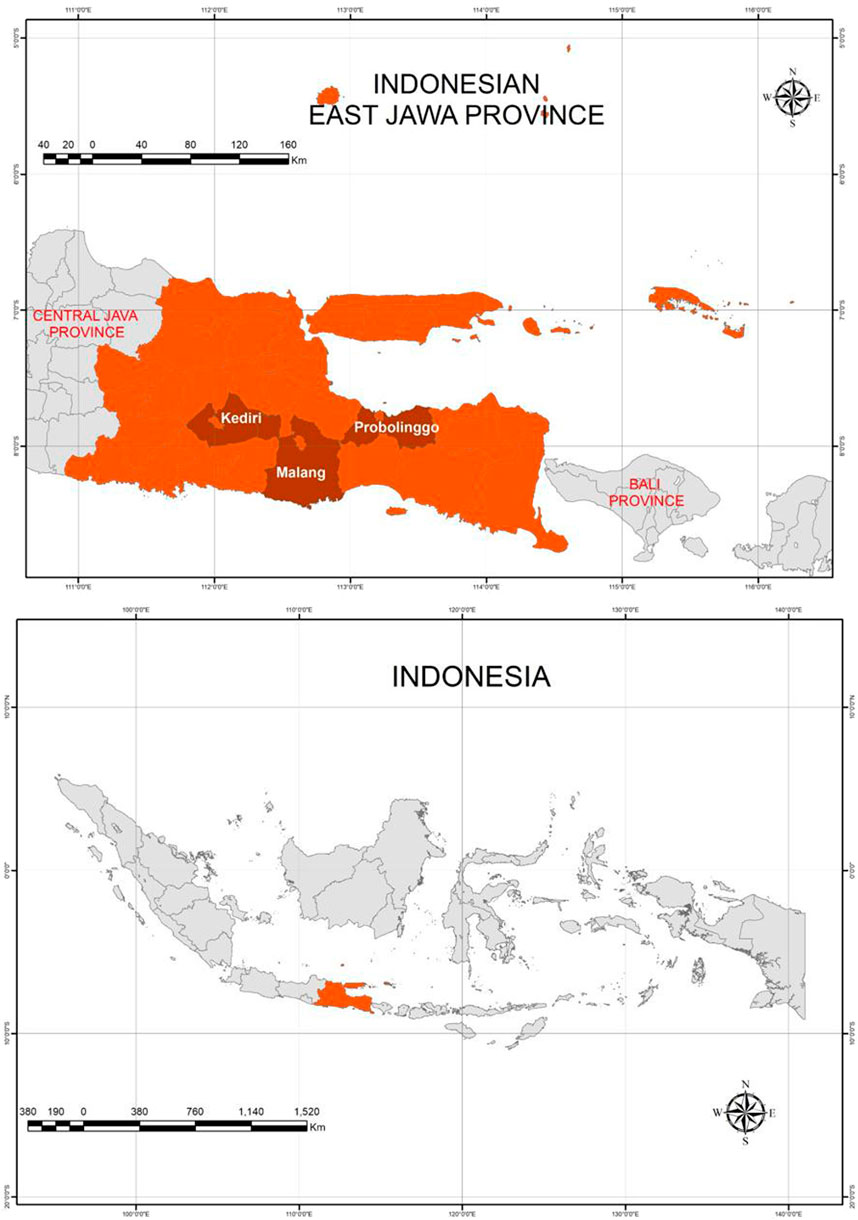

This study was conducted in East Java Province (Figure 1), a major contributor to Indonesia’s horticultural production. The selected regions—Malang, Probolinggo, and Kediri—were chosen due to their strategic role in horticulture and their increasing exposure to climate-induced challenges such as temperature variability, drought, and unpredictable rainfall patterns (Purwanti et al., 2022; Rahman et al., 2025b). To obtain a representative sample, a multi-stage purposive and stratified random sampling technique was applied. In the first stage, three regencies—Malang, Probolinggo, and Kediri—were purposively selected based on their relevance to horticultural production and their vulnerability to climate-related risks such as soil degradation and erratic cropping seasons. In the second stage, four sub-districts were randomly drawn from each regency using updated administrative records from the local agricultural offices. In the third stage, two rural villages were randomly selected from each sub-district, and a complete listing of horticultural farmers was compiled in coordination with local extension agents. From this sampling frame, 73 smallholder farmers were selected per village using simple random sampling, yielding a total sample of 584 respondents. Data collection occurred between August and December 2023. Data were gathered through enumerator-administered structured surveys. The questionnaire was developed based on an extensive review of relevant literature and validated through consultations with agricultural officers, farmer organizations, and local practitioners. Enumerator training was conducted prior to fieldwork to ensure consistency in administering the survey. All surveys were conducted in Bahasa Indonesia, the predominant local language, to ensure clarity, accuracy, and cultural appropriateness in capturing farmer responses.

Figure 1. Location of the study area (Geospasia, 2024).

It should be noted that the survey was intentionally designed to focus on horticultural smallholders in East Java, given their high exposure to climate risks and their strategic role in Indonesia’s food systems (Purwanti et al., 2022). As such, the results cannot be generalized to all farmer groups, including those engaged in staple crops or part-time non-farm employment. This scope limitation is explicitly acknowledged in the discussion section. Income grouping in this study was based on household net income distribution, with farmers classified into tertiles (low, middle, high) (Rahman et al., 2022b; Rahman et al., 2023b). This approach follows standard practice in rural household studies, but we recognize that alternative grouping strategies may yield different results. This issue of robustness is transparently discussed as a limitation of the study. While the survey covered key demographic and farm-related variables, it did not include certain dimensions such as social capital and household-specific climate shock history. We acknowledge this omission as a limitation and propose it as an avenue for future research.

2.2 The measurement of key variables

2.2.1 Financial literacy

The core explanatory variable in this study is financial literacy, defined as an individual’s ability to make informed financial decisions based on basic understanding of financial principles. Consistent with prior research (Lusardi and Mitchell, 2014), financial literacy was assessed using six multiple-choice items covering fundamental concepts: borrowing, saving, interest rates, funding options, time value of money, and basic numeracy (Lusardi and Mitchell, 2007; Meier and Sprenger, 2010). Each correct answer was assigned a value of 1, resulting in a composite financial literacy score ranging from 0 to 6.

While financial literacy is multidimensional, often distinguishing between basic numeracy and applied knowledge such as understanding of insurance or climate-linked financial products, our dataset is limited to the standardized six-question module. This module has been widely validated across international studies (Ephrem and Wamatu, 2021; Rehman and Mia, 2024) and is recognized as a reliable measure without requiring additional reliability tests such as Cronbach’s α. We acknowledge, however, that future research could benefit from a more comprehensive measurement that includes knowledge of climate-specific financial products.

2.2.2 Climate financial behaviour

This study captures climate financing behaviour using two key dependent variables: 1) access to formal credit, and 2) precautionary saving behavior. We explicitly define climate financing behaviour as financial decisions made by farmers with the primary purpose of adapting to climate-related risks (Zheng and Ma, 2025; Zhang Jialan et al., 2025). In this study, credit is coded as one if the farmer accessed credit from a formal institution (e.g., banks, cooperatives, or government-backed schemes such as KUR Tani) and 0 otherwise (Li et al., 2020). The total amount of credit accessed is also recorded as a continuous variable in local currency. Saving behavior is similarly measured using a binary variable: one indicates the farmer saved part of their post-harvest income, while 0 indicates no saving. The total value of savings is captured as a continuous variable in Indonesian Rupiah. This definition distinguishes climate financing behaviour from ordinary agricultural financial practices, as the focus is on borrowing or saving in ways that enhance resilience to climate variability. Examples include using credit to invest in irrigation systems or allocating savings for future shocks such as crop failures.

2.2.3 Controlled variables

To examine the impact of financial literacy on climate financial behavior, various farmer characteristics were incorporated into the model to control for heterogeneity among smallholder households (Tan et al., 2022). In addition to general demographic factors such as age, years of education, and marital status (Xu et al., 2020), several farm-related attributes were included: farming experience, land size, land ownership (Dzadze et al., 2012; Mazumder, Dastidar, and Bhandari, 2017; Motsoari, Cloete, and Van Schalkwyk, 2015), risk-seeking tendency (J. Verteramo Chiu, Verteramo Chiu et al., 2014), distance to the nearest formal financial institution (Lee and Sawada, 2010; Nguyen and Huyen, 2015; Okten and Una Okonkwo Osili, 2004; Petersen and Rajan 2002), and exposure to media (Hilgert, Hogarth, and Beverly, 2003).

Household size was also considered, defined as the total number of household members residing or legally entitled to reside in the same household unit. Previous studies suggest that larger households may exhibit lower saving propensity (Twumasi et al., 2020) and higher borrowing demand (Xu et al., 2020). Land size is also a key productive asset that may function as collateral, facilitating access to formal credit (Mazumder, Dastidar, and Bhandari, 2017). We acknowledge that some potentially important control variables, such as measures of social capital and household-specific climate shock history, were not collected in this survey. This omission limits the explanatory scope of the model and is explicitly recognized as a limitation in the discussion.

2.3 Model estimation

To investigate the impact of financial literacy on climate financial behavior, this study assumes that such behaviours are influenced by financial literacy along with farmers’ demographic and farm operation-related characteristics (Li et al., 2020). In this context, climate financial behavior specifically refers to farmers’ adaptive financial decisions to either access formal credit or allocate savings. Therefore, the functional relationship is expressed as follows:

where

In addition to assess the effect of financial literacy on credit and saving decisions, this study further explores its effect on the amounts of credit and savings being acquired. In this study, it assumes that the amount of credit and savings is a function of financial literacy individually, alongside farmers’ demographics and variables related to farm operations. It is formulated as follows:

where

Equation 1 is suitable to be assessed using a Probit model, considering that the dependent variables (credit and saving decisions) are represented by dichotomous values. On the other hand, Equation 2 will be determined by a Tobit model due to the fact that not all of the respondents have acquired credit and savings, leading to censored observations. However, farmers’ financial literacy may also be affected by some unobservable variables, such as mathematical skills and competency. These factors are potentially endogenous and cannot be neglected in the estimation if unbiased results are sought. To address the endogeneity issue, an instrumental variable (IV) estimation can be employed, as suggested by Lusardi and Mitchell (2014) and Rahman et al. (2022a).

The financial literacy in Equations 1, 2 can be assumed to be a function of at least one instrumental variable,

2.3.1 Justification of instrumental variable

Financial literacy may be affected by unobservable variables, such as innate mathematical skills, which in turn could bias estimations. To address this, farmers’ elementary school mathematics scores are used as the instrumental variable. Following Pesando (2018) mathematics skills are strongly correlated with the initial stock of financial literacy but are assumed to be exogenous to current climate financing decisions. To reinforce the validity of this instrument, we note that elementary math scores are predetermined long before current farming and borrowing/saving choices, reducing the likelihood of correlation with the error term. Nevertheless, we acknowledge in the discussion that full exogeneity cannot be guaranteed, and this remains a limitation.

2.3.2 Link to theoretical framework

The estimation strategy is consistent with Random Utility Theory (RUT) (Rahman et al., 2023a), under which farmers are modeled as rational decision-makers who maximize expected utility when choosing financial strategies (credit or savings) under climate uncertainty. Financial literacy enhances the ability to evaluate these options, thereby influencing adaptive financial behavior. Furthermore, the AGW theory highlights that systemic climate risks (e.g., extreme weather and yield variability) create financial instability, which this model captures through the inclusion of adaptive financial outcomes.

3 Results

3.1 Descriptive statistics

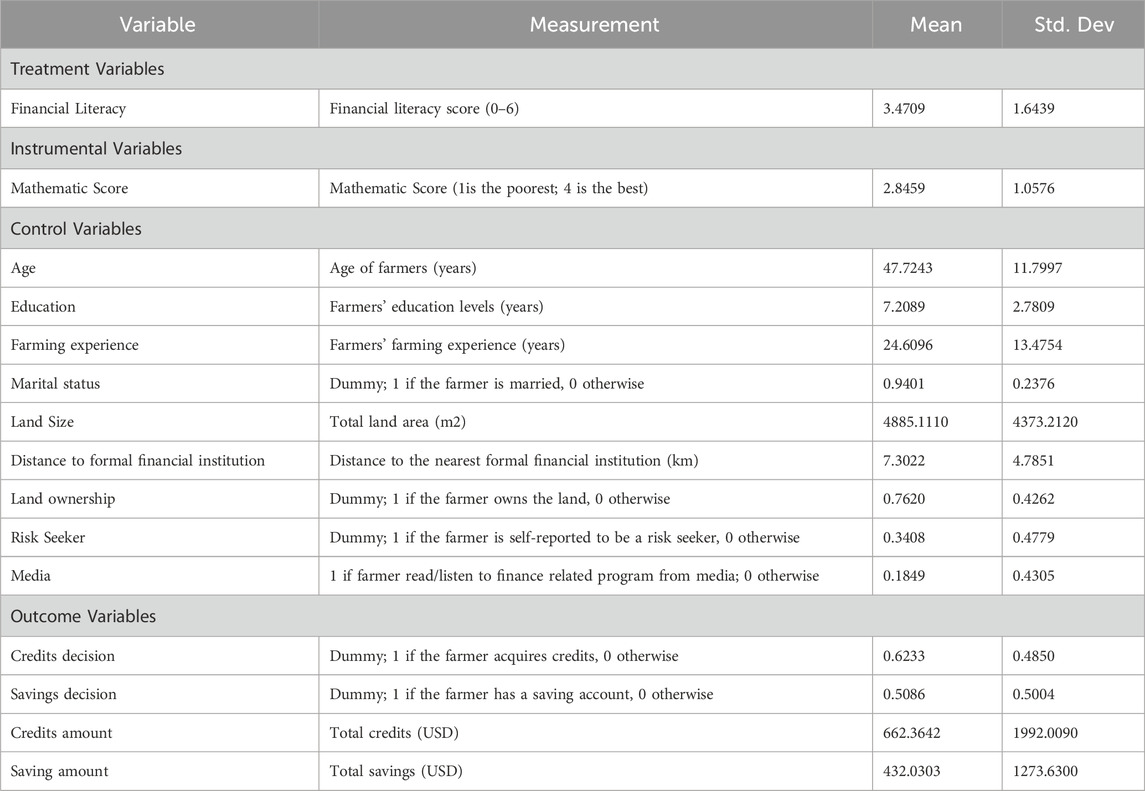

Table 1 summarizes the descriptive statistics and variable definitions. Regarding financial literacy, approximately 62.33% of farmers accessed credit from formal financial institutions, such as microfinance organizations, banks, or cooperatives, while 37.67% did not. In terms of saving behavior, 50.86% of farmers reported setting aside part of their income, whereas 49.14% did not.

Financial literacy was assessed using six questions, as detailed in Appendix A. The average financial literacy score was 3.47 out of a maximum of 6, indicating a relatively low level of financial understanding among respondents. Mathematical skills were evaluated using elementary-level mathematics scores, categorized using a Likert scale from one to 4: “Very Good” (score >8.0), “Good” (6.1–8.0), “Bad” (5.0–6.0), and “Poor” (<5.0), based on Indonesia’s 10-point grading system. The average mathematics score was 2.85, suggesting generally unsatisfactory numeracy skills within the sample.

The average amount of credit obtained was approximately US$ 662.36, while the average amount saved was around US$ 432.03. Demographic characteristics show that 94.01% of the farmers were married, with an average age of 47.72 years and an average education level of 7.21 years. Farmers had approximately 25 years of farming experience, and the average landholding size was relatively small, at less than 0.5 ha, with 76.20% of the farmers owning their land.

Additionally, 34.08% of the farmers self-identified as risk seekers. The average distance from farmers’ residences to the nearest formal financial institution was about 7.30 km. Only 18.49% of farmers reported accessing financial information through media sources such as radio, television, or printed materials.

Income heterogeneity was analyzed by dividing the sample into tertiles (low, middle, and high) based on household net income distribution. The first tertile represents the lowest 33% of households, the second tertile the middle 33%, and the third tertile the top 33% (Rahman et al., 2023a; Rahman et al., 2023b). While this approach is consistent with rural household studies, we recognize that the robustness of group differences could be further tested using alternative thresholds, which remains a limitation of this study. It is also important to note that the survey was limited to horticultural smallholders in East Java, which may restrict the generalizability of findings to other farmer groups, such as staple crop producers or households engaged in part-time non-farm employment. Moreover, key variables such as social capital and household-specific climate shock history were not included in the dataset, which we acknowledge as a limitation and suggest for future research.

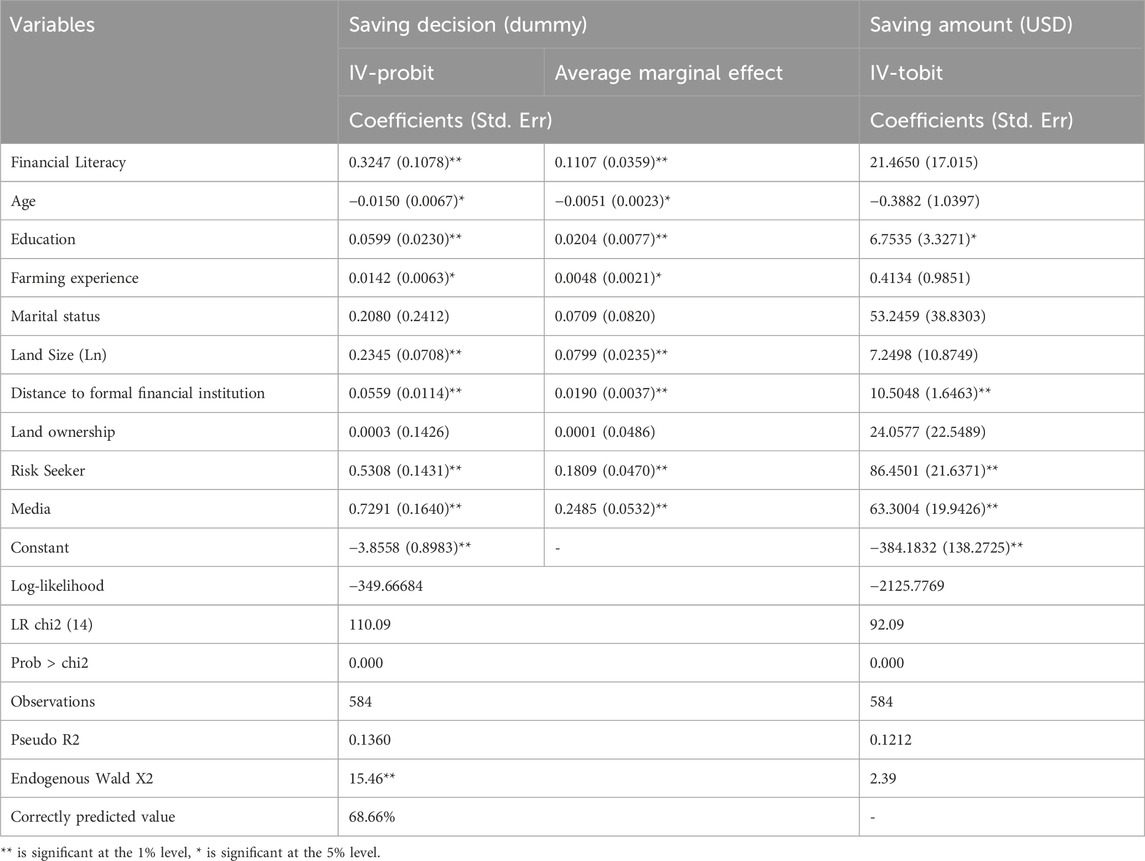

3.2 The effect of financial literacy on climate financing savings decisions

Table 2 presents the results of the IV-Probit and IV-Tobit models assessing the impact of financial literacy on savings. The IV-Probit model shows a statistically significant positive effect of financial literacy on the likelihood of engaging in savings behavior (p < 0.01). However, the IV-Tobit results suggest that financial literacy does not significantly affect the amount of savings, a finding consistent with prior studies in climate-vulnerable regions (Zhang Hepei et al., 2025). This implies that while financial knowledge enables saving initiation, budget constraints or structural barriers may limit accumulation levels.

This result is consistent with earlier studies by Grohmann (2018) and Gaurav and Singh (2012), who found a positive relationship between financial literacy and the likelihood of saving. In the context of climate financing, maintaining a savings account serves not only as a means of fund accumulation but also as a gateway to accessing climate credit products and financial assistance programs. Thus, savings behavior reflects both a financial decision and a strategic tool for building resilience against climate risks.

Several control variables also significantly influence saving decisions. Higher education levels are positively associated with savings behavior, supporting findings by (Bernheim, Garrett, and Maki, 2001; Isiorhovoja, Solomon, and Nwachi, 2020), who argue that education enhances financial knowledge and the ability to adopt new financial instruments—both critical for climate risk management.

Landholding size also exhibits a strong positive relationship with saving behavior. Farmers with larger land areas, often involved in more capital-intensive agriculture, are more likely to save (Mulatu, 2020). Greater financial stability from land ownership enables these farmers to allocate surplus income towards future-oriented financial goals, including climate adaptation investments.

Although farming experience positively influences saving decisions, the effect is relatively modest. While experienced farmers may recognize the need for financial preparedness, limited income streams or insufficient institutional support can constrain their ability to save meaningfully.

Interestingly, distance to financial institutions is positively associated with saving behavior. This finding suggests that physical distance is no longer a major barrier, likely due to the expansion of mobile banking and digital financial services in rural areas. Additionally, farmers who exhibit risk-tolerant behavior are more likely to engage in saving, perceiving it as a strategic move to capture future opportunities rather than merely as a precautionary measure.

Media exposure also plays a crucial role in shaping saving decisions. Farmers who frequently access financial information through media platforms are more aware of the benefits of formal savings and are more likely to take proactive steps toward establishing financial security.

Table 2 also presents the results of the IV-Tobit regression, revealing that financial literacy does not have a significant effect on the amount of savings accumulated by farmers. This finding contrasts with earlier studies, such as Gaurav and Singh (2012), who reported a positive relationship between financial knowledge and the volume of savings. One plausible explanation for this discrepancy lies in the structural and economic challenges faced by smallholder farmers. Despite possessing financial knowledge, these farmers often operate under tight budget constraints characterized by low, unstable incomes and high production costs, particularly in input-intensive agricultural systems. As suggested by Beverly and Sherraden (1999), limited financial resources can impede the ability of smallholders to accumulate meaningful formal savings.

It is also important to recognize that informal or non-institutional saving behaviors may still exist among these farmers. Many allocate portions of their income toward future agricultural investments or essential household needs, such as school fees, home repairs, or transportation maintenance. Consequently, savings behaviors may occur outside formal financial institutions, which helps explain the absence of a strong relationship between financial literacy and formally recorded savings amounts.

In contrast, several control variables significantly influence the amount of savings. Higher education levels, greater distance from financial institutions, risk-seeking behavior, and media exposure all show positive associations with savings accumulation.

Farmers with higher levels of education are more likely to accumulate greater savings, as education enhances financial planning skills and fosters a long-term investment perspective (Amponsah et al., 2023; Issahaku, 2011). Educated farmers are better equipped to manage risk and uncertainty through disciplined financial behavior.

Interestingly, greater distance from formal financial institutions is associated with higher savings amounts. Although counterintuitive, this finding may reflect the effects of targeted government outreach and financial inclusion programs, which have expanded access to financial services among rural farmers, particularly those with substantial landholdings (Mulatu, 2020).

Risk-tolerant farmers also tend to accumulate higher savings. Their proactive financial management and view of savings as a strategic reserve for future ventures support greater savings behavior compared to risk-averse individuals.

Finally, media exposure emerges as a crucial factor in promoting savings accumulation. Farmers who engage with financial literacy programs via radio, printed materials, or online platforms are more likely to prioritize saving behaviors. This finding aligns with Rahadiantino and Rini (2021), who noted that access to financial information through media significantly enhances individuals’ propensity to allocate income for productive uses and future financial security.

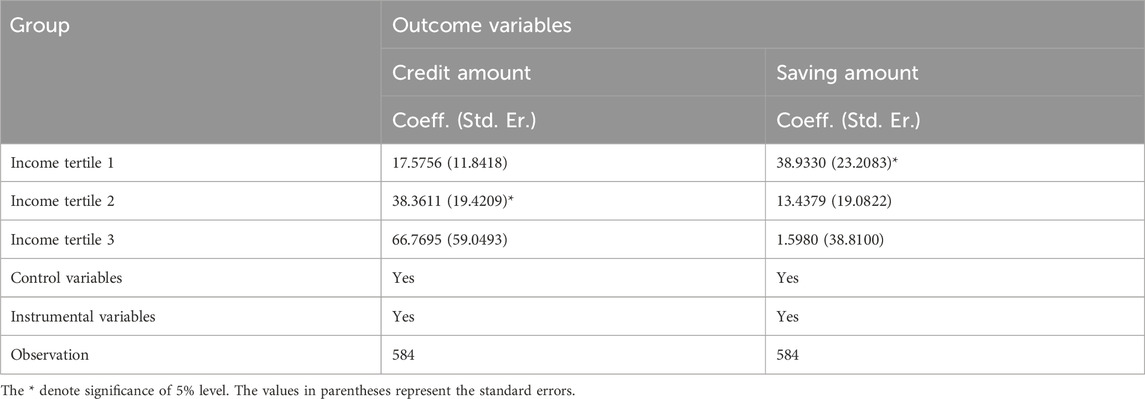

3.3 Disaggregated effects of financial literacy on climate financing behaviour

While the IV-Tobit results in Tables 2 provide average effects of financial literacy on credit and savings behavior, this study further investigates these relationships across different income groups (tertiles). Such disaggregation is critical, as farmers at varying income levels may respond differently to climate-related financial decisions, such as borrowing to invest in climate-resilient practices or saving to mitigate future risks.

The results in Table 3 reveal that financial literacy has a significant and positive effect on the amount of credit accessed only among middle-income farmers (tertile 2). This indicates that financially literate farmers within this group are more likely to secure higher credit amounts, potentially enabling them to invest in climate-smart technologies such as irrigation systems, drought-resistant seeds, or improved farming equipment.

In contrast, financial literacy does not significantly affect credit amounts among lower-income (tertile 1) or higher-income farmers (tertile 3). Lower-income farmers may continue to face structural barriers such as lack of collateral or fear of indebtedness, even when they understand financial products. Meanwhile, higher-income farmers may possess sufficient financial resources and thus rely less on financial knowledge when making borrowing decisions.

Regarding savings behavior, financial literacy exerts a significant positive effect only among the lowest-income farmers (tertile 1). Financially literate farmers in this group tend to save larger amounts, a crucial strategy in the context of climate change, where savings can provide a buffer against risks such as crop failure, extreme weather events, and rising input costs. As noted in previous studies, low-income farmers often prioritize setting aside income for essential needs or future agricultural investments, even if savings occur informally (Beverly and Sherraden, 1999).

4 Discussion

This study provides new empirical evidence on the role of financial literacy in influencing climate financing behaviors—namely credit access and savings—among smallholder farmers in East Java, Indonesia, and contributes to bridging the gap between climate change adaptation and rural household finance. Grounded in the Anthropogenic Global Warming (AGW) theory, our findings are interpreted in light of systemic climate risks that disrupt agricultural returns and household financial flows. AGW emphasizes how human-induced climate instability produces heightened uncertainty (Larminat, 2023), and our results show that financial literacy operates as a buffer, enabling farmers to make more informed financial choices under such uncertainty. By framing farmers’ credit and saving decisions as climate-specific adaptive responses rather than ordinary financial behaviors, this study advances the theoretical link between AGW and rural household economics (Yousafzai et al., 2022).

One of the key findings is that financial literacy significantly increases the probability of smallholder farmers engaging in precautionary savings. This has deep implications for rural households facing irregular incomes, uncertain yields, and lack of safety nets—conditions increasingly common under climate stress. Savings here are conceptualized as climate-adaptive buffers, not merely household liquidity management (Gikonyo et al., 2022). By setting aside income—even in small amounts—farmers can smooth consumption, finance emergency repairs, or reinvest in climate-resilient inputs, which aligns with climate adaptation objectives (Wieliczko, Kurdyś-Kujawska, and Sompolska-Rzechuła, 2020). However, the study also finds that financial literacy does not significantly affect the amount saved. This knowledge–behavior gap reflects systemic constraints. While farmers may be willing and knowledgeable, their ability to save is capped by low and unstable incomes, high input costs, and limited formal savings instruments. This aligns with prior evidence in emerging economies (Xu et al., 2023), but our finding diverges in that literacy in Indonesia promotes the decision to save but not the scale. This contradiction with earlier studies suggests that local financial ecosystems—such as weak savings products or mistrust in institutions—are decisive factors (Guja, 2022).

Equally important is the finding that financial literacy significantly increases the likelihood of accessing formal climate credit. Unlike savings, where structural constraints dominate, access to credit depends heavily on awareness, documentation, and compliance, all of which literacy facilitates. Yet, the fact that literacy does not expand the amount of credit obtained reveals another systemic barrier: collateral constraints, bureaucratic limits, and land size restrictions, with average holdings below 0.5 ha. This explains why even middle-income farmers cannot expand borrowing despite being literate. Such findings echo AGW’s emphasis on systemic constraints and highlight that literacy alone cannot overcome structural barriers. The disaggregated analysis further reveals heterogeneity, with middle-income farmers benefiting more from literacy in terms of credit access, likely because they possess collateral or stable income flows to meet lender requirements, while low-income farmers use literacy to strengthen precautionary saving behavior, since credit access remains restricted. This pattern supports Random Utility Theory (RUT), as different groups maximize utility within their feasible choice sets (Toiba et al., 2024). The heterogeneity is therefore not post hoc but reflects structural credit market segmentation: those with assets leverage literacy for borrowing, while those without turn to savings.

Interestingly, savings and credit behaviors also interact. For low-income households, savings serve as a substitute when borrowing is unattainable. For middle-income groups, savings may complement credit, providing liquidity to meet repayment schedules. Although not formally modeled in this paper, these substitution–complementarity dynamics between savings and credit are important and should be explicitly quantified in future research. Beyond individual behavior, policy context matters. Indonesia’s flagship rural financial program—Kredit Usaha Rakyat (KUR Tani)—provides subsidized loans for smallholders but remains underutilized due to lack of awareness and procedural complexity (Gunawan et al., 2021). Our findings imply that financial literacy, when combined with reforms to KUR delivery mechanisms, could substantially increase uptake. Similarly, programs such as kampung iklim could embed literacy modules to build resilience (Gilang Prasetyo, Wahyuni, and Solina, 2022). Without integration into national policy instruments, financial literacy programs risk being too generic to deliver impact.

From a theoretical standpoint, this study shows that financial literacy improves adaptive financial intentions but interacts with systemic and contextual constraints. This reinforces AGW’s perspective that resilience requires more than individual capability—it requires enabling institutions. The policy implications are clear: financial literacy programs must be content-specific, focusing not only on budgeting and numeracy but also on climate-linked products such as insurance, weather-indexed credit, and mobile savings. Delivery should be localized, using trusted channels such as extension services, farmer groups, and local media including radio and WhatsApp groups. Policies must also be differentiated by income group, with middle-income farmers requiring credit-linked training, while low-income farmers need savings-oriented literacy with incentives for small deposits.

The implications for the Sustainable Development Goals should also be interpreted cautiously. While the results contribute to SDG 13 (Climate Action) and SDG 1 (No Poverty), claims regarding SDG 10 (Reduced Inequalities) are limited, literacy improved saving decisions among low-income farmers, but the effect size is modest and not sufficient to quantify distributional impacts. This study is therefore better positioned as a contribution to adaptive capacity rather than direct inequality reduction.

Several limitations should be acknowledged. First, the use of a cross-sectional dataset restricts the ability to make strong causal inferences and does not eliminate the possibility of reverse causality, whereby improved financial outcomes may themselves enhance financial literacy. Second, the financial literacy measure is confined to basic numeracy and does not capture climate-specific literacy dimensions, such as awareness of weather-indexed insurance, credit products, or risk-related variables (e.g., risk perception and trust building). Third, omitted variables, such as social capital and household-specific histories of climate related variables, may bias the estimates and should be considered in future work. Finally, robustness checks—such as alternative instrumental variables, different econometric specifications, or subsample regressions—could not be conducted due to data limitations. Future research should address these gaps by employing panel datasets, incorporating richer behavioral variables, and applying multiple robustness strategies.

Despite these limitations, the study provides novel theoretical and empirical contributions by situating financial literacy within a systemic climate risk and behavioral decision-making framework. While the mechanisms could not be fully disentangled, the results highlight that financial literacy supports adaptive financial behaviors in rural households, yet its effectiveness is conditioned by resource endowments and institutional constraints. Importantly, the findings call for more climate-sensitive and context-specific financial literacy and policy interventions that move beyond generic inclusion programs, thereby empowering smallholders to navigate climate risks more effectively.

5 Conclusion

This study investigated the role of financial literacy in shaping climate financing behaviors—namely credit access and precautionary savings—among horticultural smallholders in East Java, Indonesia. Grounded in the Anthropogenic Global Warming (AGW) theory and Random Utility Theory (RUT), the results demonstrate that financial literacy significantly improves the likelihood of farmers accessing formal credit and engaging in savings, thereby supporting adaptive financial decisions under systemic climate risks. However, financial literacy does not significantly influence the amount of credit or savings, reflecting structural constraints such as limited collateral, small landholdings, low incomes, and restricted financial product design. This knowledge–behavior gap emphasizes that while literacy improves financial intentions, systemic barriers prevent it from translating into larger-scale financial outcomes.

The disaggregated results further highlight that the impact of financial literacy differs by income group. Middle-income farmers benefit more in terms of credit access, largely because they have collateral or relatively stable income flows, while low-income farmers rely more on savings as an adaptive mechanism in the absence of viable credit opportunities. These patterns reflect structural segmentation in rural credit markets and confirm that financial literacy interacts with existing resource endowments to shape adaptive strategies. Importantly, this differentiation implies that one-size-fits-all interventions are unlikely to be effective in strengthening financial resilience to climate risks.

The study also reveals important complementarities and substitutions between credit and savings. For low-income households, savings substitute for credit when borrowing is inaccessible, while for middle-income farmers, savings may complement credit by providing liquidity for repayments and future investments. This interaction underscores the need for integrated approaches that view credit and savings not as isolated financial actions but as interconnected strategies for climate adaptation.

From a policy perspective, the findings underscore the need to move beyond generic financial literacy campaigns toward tailored interventions that explicitly incorporate climate-sensitive content. Financial education should cover not only basic numeracy and household budgeting but also climate-specific financial products such as weather-indexed insurance, mobile savings, and climate-resilient credit schemes. Delivery channels must be localized through farmer groups, extension services, cooperatives, and accessible digital platforms such as radio or WhatsApp groups, which are trusted and widely used in rural communities. At the same time, national programs such as Kredit Usaha Rakyat (KUR Tani) should be simplified and paired with financial literacy modules to bridge the awareness and procedural barriers that currently limit uptake. Policies should also differentiate by income group, linking credit training to middle-income households with collateral capacity and savings promotion to low-income households where liquidity constraints dominate.

In terms of broader implications, the study contributes directly to SDG 13 (Climate Action) and SDG 1 (No Poverty) by demonstrating how financial literacy enhances adaptive capacity and financial resilience under climate change. However, the contribution to SDG 10 (Reduced Inequalities) should be interpreted cautiously, as the effect size on reducing income disparities through savings among low-income groups is modest and insufficient to quantify distributional impacts. Rather than claiming direct effects on inequality reduction, the study is better positioned as evidence of enhanced adaptive capacity that can indirectly support more equitable resilience pathways.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

Written informed consent was obtained from the individual(s) for the publication of any potentially identifiable images or data included in this article.

Author contributions

DR: Writing – original draft, Data curation, Methodology, Conceptualization, Software, Formal Analysis. RC: Validation, Methodology, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sector.

Acknowledgments

The authors wish to express their appreciation to ChatGPT from OpenAI for its valuable support in refining their manuscript. It was used only for language polishing (grammar, style, readability), and not for data analysis, theoretical framing, or interpretation of results. All substantive contributions remain the authors’ responsibility. Additionally, the authors express their sincere appreciation to the Ministry of Education, Taiwan for providing a fellowship to Dwi Retnoningsih, and to the Faculty of Agriculture, University of Brawijaya, Indonesia for supporting this research.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ali, S. R., and Mujahid, N. (2025). Agricultural productivity under climate change vulnerability: does carbon reduction paths matter for sustainable agriculture? Environ. Dev. Sustain., 1–25. doi:10.1007/s10668-025-06076-9

Amosah, J., and Lukman, T.Wa Ghana (2023). From adaptation to resilience: the capability of women smallholder farmers in the nabdam district of the upper east region. Int. J. Manag. and Entrepreneursh. Res. 5 (7), 483–502. doi:10.51594/ijmer.v5i7.510

Amponsah, D., Awunyo-Vitor, D., Abawiera Wongnaa, C., Prah, S., Sunday, O. A., and Acheampong, P. P. (2023). The impact of women groundnut farmers’ participation in Village Savings and Loans Association (VSLA) in Northern Ghana. J. Agric. Food Res. 11, 100481. doi:10.1016/j.jafr.2022.100481

Babatolu, J. S., and Akinnubi, R. T. (2016). Smallholder farmers’ perception of climate change and variability impact and their adaptation strategies in the upper and lower Niger river basin development authority areas, Nigeria. J. Petroleum and Environ. Biotechnol. 7 (3), 279. doi:10.4172/2157-7463.1000279

Bernheim, B. D., Garrett, D. M., and Maki, D. M. (2001). Education and saving:. J. public Econ. 80 (3), 435–465. doi:10.1016/S0047-2727(00)00120-1

Beverly, S. G., and Sherraden, M. (1999). Institutional determinants of saving: implications for low-income households and public policy. J. Socio-Economics 28 (4), 457–473. doi:10.1016/s1053-5357(99)00046-3

Biswal, D., and Chandra, S. B. (2025). Crop-insurance adoption and impact on farm households’ well-being in India: evidence from a panel study. J. Asia Pac. Econ. 30 (1), 19–38. doi:10.1080/13547860.2023.2266204

Cui, M., Zhang, J., and Xia, X. (2022). The relationship between child rearing burden and farmers’ adoption of climate adaptive technology: taking water-saving irrigation technology as an example. Agriculture 12 (6), 854. doi:10.3390/agriculture12060854

Donatti, C. I., Harvey, C. A., Ruth Martinez-Rodriguez, M., Vignola, R., and Rodriguez, C. M. (2017). What information do policy makers need to develop climate adaptation plans for smallholder farmers? The case of Central America and Mexico. Clim. Change 141 (1), 107–121. doi:10.1007/s10584-016-1787-x

Drall, A., and Mandal, S. K. (2024). Non-farm income and environmental efficiency of the farmers: evidence from India. Heliyon 10 (10), e30804. doi:10.1016/j.heliyon.2024.e30804

Dzadze, P., Osei, M. J., Aidoo, R., and Nurah, G. K. (2012). “Factors determining access to formal credit in Ghana: a case study of smallholder farmers in the Abura-Asebu Kwamankese district of central region of Ghana.” J. Dev. Agric. Econ. 4 (14):416–423. doi:10.5897/JDAE12.099

Fernandes, D., Lynch, J. G., and Netemeyer, R. G. (2014). Financial literacy, financial education, and downstream financial behaviors. Manag. Sci. 60 (8), 1861–1883. doi:10.1287/mnsc.2013.1849

Gaurav, S., and Singh, A. (2012). An inquiry into the financial literacy and cognitive ability of farmers: evidence from rural India. Oxf. Dev. Stud. 40 (3), 358–380. doi:10.1080/13600818.2012.703319

Geospasia, P.P.d.P.I.G.B.I. G. I. A. (2024). Indonesian landscape maps (RBI). Available online at: https://tanahair.indonesia.go.id/portal-web (Accessed February 28).

Gikonyo, N. W., Rono Busienei, J., Kamau Gathiaka, J., and George, N. K. (2022). Analysis of household savings and adoption of climate smart agricultural technologies. Evidence from smallholder farmers in Nyando Basin, Kenya. Heliyon 8 (6), e09692. doi:10.1016/j.heliyon.2022.e09692

Gilang Prasetyo, A. D. I., Wahyuni, S., and Solina, E. (2022). Masyarakat Petani Kampung parit Bugis Desa Bintan buyu kabupaten Bintan. Univ. Marit. Raja Ali Haji 13, 356. doi:10.26418/j-psh.v13i2.56234

Grohmann, A. (2018). Financial literacy and financial behavior: evidence from the emerging Asian middle class. Pacific-Basin Finance J. 48, 129–143. doi:10.1016/j.pacfin.2018.01.007

Guja, M. M. (2022). The role of financial institutions in smallholder agriculture development: ethiopian context. Eur. J. Bus. Manag. 14 (1), 31–54.

Gunawan, E., Ilham, N., Syukur, M., Pasaribu, S. M., and Suhartini, S. H. (2021). Farmers’ perceptions and issue of Kredit Usaha Rakyat in Indonesia. IOP Conf. Ser. Earth Environ. Sci. 892, 012017. doi:10.1088/1755-1315/892/1/012017

Hanani, A. R., Rahman, M. S., Fahriyah, F., Pranowo, D., Toiba, H., and Mahfudlotul, U. (2024). “Does the climate change adaptation affect technical efficiency? Empirical evidence from potato farmers in East Java, Indonesia.” Cogent Econ. and Finance 12 (1):2426528. doi:10.1080/23322039.2024.2426528

Hilgert, M. A., Hogarth, J. M., and Beverly, S. G. (2003). Household financial management: the connection between knowledge and behavior. Fed. Res. Bull. 89, 309. Available online at: https://heinonline.org/HOL/LandingPage?handle=hein.journals/fedred89&div=90&id=&page=.

Isiorhovoja, R. A., Solomon, O. E., and Nwachi, S. (2020). Farmers` attitude and behavior toward savings in Ika south local government area of delta state, Nigeria. Asian J. Agric. Rural Dev. 10 (1), 406–419. doi:10.18488/journal.1005/2020.10.1/1005.1.406.419

Issahaku, H. (2011). Determinants of saving and investment in deprived district capitals in Ghana-a case study of Nadowli in the upper west region of Ghana. Cont. J. Soc. Sci. 4 (1), 1. Available online at: https://d1wqtxts1xzle7.cloudfront.net/85790859/DETERMINANTS_20OF_20SAVING_20AND_20INVESTMENT_20IN_20DEPRIVED_20DISTRICT_20CAPITALS_20IN_20GHANA_20-A_20CASE_20STUDY_20OF_20NADOWLI_20IN-libre.pdf?1652165994=&response-content-disposition=inline%3B+filename%3Ddeterminants_of_saving_and_investment_in.pdf&Expires=1758387108&Signature=fZqU4wywQbeL-zgGluf-l8gPZTDIDITyxNW1MrKN6P3tGgl03fknjI42UfnUgLSM8VWcPkR27nGgW14wWueF1vqAbxp6pE-afPedamvt8AjCL7ZNe∼jB7sTNX8Xvq∼eiBGoAO0NsEq-i1mElkIUvUoJ-7WIl2xmxvJaoCHAoxwWzLGHTbHFiJhpQymmp8vCdyZhjm4B3Wi6qXlffbQ92Dz5FfB4CR2JVGyi6BlrtdOuO1dtPZE6Y0O3Av2TpjjW94ivxS∼ppoop6ZAQdII6U7Ue5oe6g2bPOHy977FF∼wE0Z6XPWNMYGhWKodDYGUVJWTZ81XGwiQ6DtJLvl9V4qig__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA.

Jappelli, T., and Padula, M. (2013). Investment in financial literacy and saving decisions. J. Bank. and Finance 37 (8), 2779–2792. doi:10.1016/j.jbankfin.2013.03.019

Jokinen, J. C. (2018). Migration-related land use dynamics in increasingly hybrid peri-urban space: insights from two agricultural communities in Bolivia. Popul. Environ. 40 (2), 136–157. doi:10.1007/s11111-018-0305-7

Larminat, P. D. (2023). From behavioral climate models and millennial data to AGW reassessment. Eart and Envi Scie Res Rev 6 (2), 410–424. Available online at: https://climate-science.press/wp-content/uploads/2024/01/from-behavioral-climate-models-and-millennial-data-to-agw-reassessment.pdf.

Lasco, R. D., Espaldon, M. L. O., and Habito, C. M. D. (2016). Smallholder farmers’ perceptions of climate change and the roles of trees and agroforestry in climate risk adaptation: evidence from Bohol, Philippines. Agrofor. Syst. 90 (3), 521–540. doi:10.1007/s10457-015-9874-y

Lee, J.-J., and Sawada, Y. (2010). Precautionary saving under liquidity constraints: evidence from rural Pakistan. J. Dev. Econ. 91 (1), 77–86. doi:10.1016/j.jdeveco.2009.05.001

Letourneau, A. M., and Davidson, D. (2022). Farmer identities: facilitating stability and change in agricultural system transitions. Environ. Sociol. 8 (4), 459–470. doi:10.1080/23251042.2022.2064207

Li, C., Ma, W., Mishra, A. K., and Gao, L. (2020). Access to credit and farmland rental market participation: evidence from rural China. China Econ. Rev. 63, 101523. doi:10.1016/j.chieco.2020.101523

Lusardi, A., and Mitchell, O. S. (2007). Baby boomer retirement security: the roles of planning, financial literacy, and housing wealth. J. monetary Econ. 54 (1), 205–224. doi:10.1016/j.jmoneco.2006.12.001

Lusardi, A., and Mitchell, O. S. (2014). The economic importance of financial literacy: theory and evidence. Am. Econ. J. J. Econ. Literature 52 (1), 5–44. doi:10.1257/jel.52.1.5

Mazumder, R., Dastidar, S., and Bhandari, A. K. (2017). Access to credit and microentrepreneurship: a gender comparison. Women's Entrepreneursh. microfinance, 191–210. doi:10.1007/978-981-10-4268-3_11

Mehta, P. (2024). The impact of climate change on the environment, water resources, and agriculture: a comprehensive review. Clim. Environ. Agric. Dev. A Sustain. Approach Towards Soc., 189–201. doi:10.1007/978-981-97-8363-2_12

Meier, S., and Sprenger, C. (2010). Present-biased preferences and credit card borrowing. Am. Econ. J. Appl. Econ. 2 (1), 193–210. doi:10.1257/app.2.1.193

Migheli, M. (2024). Land-use rights and informal credit in rural Vietnam. Italian Econ. J. 10 (1), 409–434. doi:10.1007/s40797-023-00227-5

Motsoari, C., Cloete, P. C., and Schalkwyk, H. D. V. (2015). An analysis of factors affecting access to credit in Lesotho's smallholder agricultural sector. Dev. South. Afr. 32 (5), 592–602. doi:10.1080/0376835X.2015.1044077

Mulatu, E. (2020). Determinants of smallholder farmers’ saving: the case of omo microfinance institution in gimbo district of Kaffa Zone, Southern Ethiopia. Int. J. Account. Finance Risk Manag. 5 (2), 93–105. doi:10.11648/j.ijafrm.20200502.14

Mutaqin, D. J., and Usami, K. (2019). Smallholder farmers’ willingness to pay for agricultural production cost insurance in rural West Java, Indonesia: a contingent valuation method (CVM) approach. Risks 7 (2), 69. doi:10.3390/risks7020069

Nguyen, T. C., and Le, T. H. (2024). inancial crises and the national logistics performance: evidence from emerging and developing countries. Int. J. Fin. Econ. 29 (2), 1834–1855. doi:10.1002/ijfe.2768

Okten, C.Una Okonkwo Osili (2004). Social networks and credit access in Indonesia. World Dev. 32 (7), 1225–1246. doi:10.1016/j.worlddev.2004.01.012

Oosthuizen, H. J. (2014). Modelling the financial vulnerability of farming systems to climate change in selected case study areas in South Africa. Stellenbosch: Stellenbosch University.

Pesando, L. M. (2018). Does financial literacy increase students’ perceived value of schooling? Educ. Econ. 26 (5), 488–515. doi:10.1080/09645292.2018.1468872

Petersen, M. A., and Rajan, R. G. (2002). Does distance still matter? The information revolution in small business lending. J. Finance 57 (6), 2533–2570. doi:10.1111/1540-6261.00505

Purwanti, T. S., Syafrial, S., Huang, W.-C., and Saeri, M. (2022). What drives climate change adaptation practices in smallholder farmers? Evidence from potato farmers in Indonesia. Atmosphere 13 (1), 113. doi:10.3390/atmos13010113

Putri, R. D., Rahman, M. S., Abdillah, A. A., and Huang, W.-C. (2024). Improving small-scale fishermen’s subjective well-being in Indonesia: does the internet use play a role? Heliyon 10, e29076. doi:10.1016/j.heliyon.2024.e29076

Rahadiantino, L., and Rini, A. N. (2021). Women access and awareness of financial inclusion in Indonesia. J. Ekon. Pembang. 19 (1), 39–50. doi:10.29259/jep.v19i1.12467

Rahman, M. S., Toiba, H., and Huang, W.-C. (2021). The impact of climate change adaptation strategies on income and food security: empirical evidence from small-scale fishers in Indonesia. Sustainability 13 (14), 7905. doi:10.3390/su13147905

Rahman, M. S., Andriatmoko, N. D., Saeri, M., Subagio, H., Malik, A., Triastono, J., et al. (2022a). Climate disasters and subjective well-being among urban and rural residents in Indonesia. Sustainability 14 (6), 3383. doi:10.3390/su14063383

Rahman, M. S., Huang, W.-C., Toiba, H., and Efani, A. (2022b). Does adaptation to climate change promote household food security? Insights from Indonesian fishermen. Int. J. Sustain. Dev. and World Ecol. 29 (7), 611–624. doi:10.1080/13504509.2022.2063433

Rahman, M. S., Huang, W.-C., Toiba, H., Aghniarahim Putritamara, J., Nugroho, T. W., and Saeri, M. (2023a). Climate change adaptation and fishers’ subjective well-being in Indonesia: is there a link? Regional Stud. Mar. Sci. 63, 103030. doi:10.1016/j.rsma.2023.103030

Rahman, M. S., Toiba, H., Nugroho, T. W., Hartono, R., Ilyas Shaleh, M., Sugiono, S., et al. (2023b). Does internet use make farmers happier? Evidence from Indonesia. Cogent Soc. Sci. 9 (2), 2243716. doi:10.1080/23311886.2023.2243716

Rahman, M. S., Nugroho, T. W., Toiba, H., Iqbal, M., Lestariadi, R. A., and Saeri, M. (2025a). Does internet-based climate information improve non-fishing employment opportunities? Insights from smallholder fishermen in Indonesia. Local Environ. 30, 377–393. doi:10.1080/13549839.2025.2450493

Rahman, M. S., Sujarwoto, S., Toiba, H., Nugroho, T. W., Fahriyah, F., Ilyas Shaleh, M., et al. (2025b). Exploring the impact of cooking fuel choices on household food security and healthy food consumption in Indonesia. Rev. Dev. Econ., rode.13220. doi:10.1111/rode.13220

Rahman, M. S., Ma, W., Toiba, H., and Widarjono, A. (2025c). Healthy diet choices: does internet use help promote healthy food consumption in Indonesia? Econ. Transition Institutional Change 33, 831–843. doi:10.1111/ecot.12450

Rehman, K., and Mia, Md A. (2024). Determinants of financial literacy: a systematic review and future research directions. Future Bus. J. 10 (1), 75. doi:10.1186/s43093-024-00365-x

Samuel, J., Rao, C. A. R., Raju, B. M. K., Reddy, A. A., Gopala Krishna Reddy, A., Kumar, R. N., et al. (2021). Assessing the impact of climate resilient technologies in minimizing drought impacts on farm incomes in drylands. Sustainability 14 (1), 382. doi:10.3390/su14010382

Saqib, S. E., Kuwornu, J. K. M., Ahmad, M. M., and Panezai, S. (2018). Subsistence farmers’ access to agricultural credit and its adequacy: some empirical evidences from Pakistan. Int. J. Soc. Econ. 45 (4), 644–660. doi:10.1108/ijse-12-2016-0347

Shisanya, S., and Mafongoya, P. (2016). Adaptation to climate change and the impacts on household food security among rural farmers in uMzinyathi District of Kwazulu-Natal, South Africa. Food Secur. 8, 597–608. doi:10.1007/s12571-016-0569-7

Tan, J., Cai, D., Han, K., and Zhou, K. (2022). Understanding peasant household’s land transfer decision-making: a perspective of financial literacy. Land Use Policy 119, 106189. doi:10.1016/j.landusepol.2022.106189

Toiba, H., Rahman, M. S., Nugroho, T. W., Priyanto, M. W., Noor, A. Y. M., and Shaleh, M. I. (2024). Understanding the link between climate change adaptation and household food security among shrimp farmers in Indonesia. Mar. Policy 165, 106206. doi:10.1016/j.marpol.2024.106206

Touch, V., Tan, D. K. Y., Cook, B. R., Liu, De Li, Cross, R., Tran, T. A., et al. (2024). Smallholder farmers’ challenges and opportunities: implications for agricultural production, environment and food security. J. Environ. Manag. 370, 122536. doi:10.1016/j.jenvman.2024.122536

Twumasi, M. A., Jiang, Y., Ameyaw, B., Danquah, F. O., and Acheampong, M. O. (2020). The impact of credit accessibility on rural households clean cooking energy consumption: the case of Ghana. Energy Rep. 6, 974–983. doi:10.1016/j.egyr.2020.04.024

Verteramo Chiu, J., Khantachavana, S. V., and Turvey, C. G. (2014). Risk rationing and the demand for agricultural credit: a comparative investigation of Mexico and China. Agric. Finance Rev. 74 (2), 248–270. doi:10.1108/AFR-05-2014-0011

Wieliczko, B., Kurdyś-Kujawska, A., and Sompolska-Rzechuła, A. (2020). Savings of small farms: their magnitude, determinants and role in sustainable development. example of Poland. Agriculture 10 (11), 525. doi:10.3390/agriculture10110525

Xu, N., Shi, J., Rong, Z., and Yuan, Y. (2020). Financial literacy and formal credit accessibility: evidence from informal businesses in China. Finance Res. Lett. 36, 101327. doi:10.1016/j.frl.2019.101327

Xu, H., Song, K., Li, Y., and Twumasi, M. A. (2023). The relationship between financial literacy and income structure of rural farm households: evidence from Jiangsu, China. Agriculture 13 (3), 711. doi:10.3390/agriculture13030711

Yang, S., Zou, K., Lei, T., Ni, Z., and Yang, J. (2022). Climate change and farmers’ household financial vulnerability: evidence from China. Front. Environ. Sci. 10, 908428. doi:10.3389/fenvs.2022.908428

Yang, N., Wang, Y., Jin, H., Qi, Qi, and Yang, Y. (2024). Impacts of internet information literacy on farmers’ relative poverty Vulnerability: evidence from CGSS Survey data in China. Soc. Indic. Res. 178, 1169–1200. doi:10.1007/s11205-024-03377-w

Yousafzai, M. T., Shah, T., Khan, S., Ullah, S., Nawaz, M., Han, H., et al. (2022). Assessing socioeconomic risks of climate change on tenant Farmers in Pakistan. Front. Psychol. 13, 870555. doi:10.3389/fpsyg.2022.870555

Zhang, R., Zhang, J., Zhang, K., Xu, D., Qi, Y., and Deng, X. (2024). Do clean toilets help improve farmers’ mental health? Empirical evidence from China’s rural toilet revolution. Agriculture 14 (1), 128. doi:10.3390/agriculture14010128

Zhang, H., Ma, W., and Sang, X. (2025a). Credit access and sustainable farm investments: a dual perspective on chemical and environmentally friendly inputs. Int. J. Sustain. Dev. and World Ecol. 32 (4), 485–497. doi:10.1080/13504509.2025.2488042

Zhang, J., Zhang, L., Zhang, K., and Deng, X. (2025b). Can internet use promote farmers’ diversity in green production technology adoption? Empirical evidence from rural China. Humanit. Soc. Sci. Commun. 12 (1), 485–13. doi:10.1057/s41599-025-04803-1

Zheng, H., and Ma, W. (2025). Decision-making in credit access and household welfare: a gender perspective. Econ. Model. 152, 107263. doi:10.1016/j.econmod.2025.107263

Appendix A

Financial Literacy Questions*

1. If you borrow IDR 2,000,000 from a bank and the bank charges an interest of 10% per year, what is the total interest you have to pay after a year?

(a) IDR 100,000 (c) IDR 400,000

(b) IDR 200,000 (d) I do not know

2. If you want to save money in a bank, and Bank A provides interest at 10% per year, while Bank B provides interest at 6% per 6 months, which bank will you choose?

(a) Bank A (c) The same

(b) Bank B (d) I do not know

3. If you have savings of IDR 1,000,000 in a bank and 2 years later your money increases to IDR 1,040,000, what percentage of interest did the bank give you?

(a) 0.2% (d) 4%

(b) 0.4% (e) I do not know.

(c) 2%

4. If you have savings of IDR 800,000 in a bank, but now you need money to pay for your child’s school fees of 500,000 IDR, what will you do?

(a) Withdraw IDR 500,000 from the savings.

(b) Take an IDR 500,000 credit from the bank without withdrawing the savings.

(c) Withdraw IDR 250,000 from the savings and take a credit of IDR 250,000.

(d) All the options above are the same.

(e) I do not know.

5. Suppose your friend had IDR 10,000,000 in 2020, while his sibling had IDR 10,000,000 in 2022. Which one is richer?

(a) My friend (c) No one, both had the same amount of money

(b) His sibling (d) I do not know

6. If you want to purchase a TV for IDR 1,000,000. Store A offers discount of IDR 150,000, while Store B provides a 10% discount. Which store will you choose?

(a) Store A (c) Both stores offer the same discount

(b) Store B (d) I do not know

*Correct answer in bold for the six questions.

Keywords: climate financing, financial literacy, financial behaviour, rural farmers, Indonesia

Citation: Retnoningsih D and Chung RH (2025) Climate financing for climate change adaptation: the impact of financial literacy on credit and savings behaviour of smallholder farmers in rural Indonesia. Front. Environ. Sci. 13:1622403. doi: 10.3389/fenvs.2025.1622403

Received: 03 May 2025; Accepted: 12 September 2025;

Published: 30 September 2025.

Edited by:

Juan Lu, Nanjing Agricultural University, ChinaReviewed by:

Muhammad Tariq Yousafzai, University of Swat, PakistanLi Gujie, Henan University of Economic and Law, China

Copyright © 2025 Retnoningsih and Chung. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rebecca H. Chung, cmViZWNjYUBtYWlsLm5wdXN0LmVkdS50dw==

Dwi Retnoningsih

Dwi Retnoningsih Rebecca H. Chung1*

Rebecca H. Chung1*