- School of Management, Shenyang University of Technology, Shenyang, China

Introduction: In the e-commerce supply chain, many risk-averse suppliers face the dilemma of capital constraints. Bank financing helps to alleviate these financing difficulties, and blockchain trust mechanisms can optimize bank financing strategies.

Methods: To address the issue of capital constraints for suppliers, based on the two operating modes of Consignment and Direct Selling in the e-commerce supply chain, using the Stackelberg game, considering the company’s risk-averse behavior and consumers’ green preferences, a game model is constructed to explore the impact of factors such as blockchain, risk aversion, product greenness, guarantee interest rates, and information verification efforts on bank financing strategies.

Results and discussion: When the blockchain technology is adopted within a certain threshold, the supplier can obtain higher financing income by adopting consideration than Direct Selling. Compared with the Direct Selling mode, the blockchain trust mechanism under consideration mode can play a better role and improve the financing efficiency of suppliers. The financing efficiency of suppliers will also decrease with the increase of risk aversion coefficient, and the impact of risk aversion on suppliers will be greater in the case of blockchain, but the trust of blockchain will increase with the increase of risk aversion coefficient. Product greenness will increase the sales price of e-commerce supply chain under consideration mode, and improving product greenness will help improve enterprise cash flow. However, under the Direct Selling mode, the impact on the price is not great, and the impact on the financing strategy will be different. Although the guaranteed interest rate will increase the financing cost, it will make banks more willing to provide financing for suppliers with financial constraints. In practice, managers should comprehensively consider the balance between guaranteed interest rate and financing return. Information verification efforts will increase product greenness and green preference coefficient, and the improvement of information transparency will make e-commerce platforms more willing to provide guarantees for suppliers. This study is expected to provide decision-making references for the managers of e-commerce supply chain.

1 Introduction

The e-commerce market is growing rapidly, and the market size of e-commerce supply chains is expanding, leading to an increasing demand for Supply Chain Financing (SCF) and growing concerns about financing constraints. According to the “2023 Global E-commerce Platform Report” published by Webretailer, global green e-commerce sales $6.3 trillion, with an annual growth rate of 9% in 2023. It is expected to reach $8.1 trillion by 2025. The continued growth of the green e-commerce market has made the operation of e-commerce green supply chains a key area of focus [1]. Consumer green preferences are driving suppliers to focus more on producing green and low-carbon products. To meet market demands, e-commerce supply chains have adopted two sales models: Direct Selling and Consignment. In the Direct Selling model, which is platform-led, inventory funding is high, and financing demand is rapidly increasing. In the Consignment model, which is supplier-led, the operation cycle is longer, and cash flow is insufficient. With market expansion, the demand for funding in e-commerce supply chains continues to grow. According to Market Research Future, the global supply chain financing demand was valued at $235 billion in 2023. According to the World Bank’s report on “Financing Gaps for Small and Medium Enterprises,” the financing demand of Small and Medium-sized Enterprises (SMEs) accounted for 40% of global supply chain financing demand in 2023. The financing needs of e-commerce supply chains are enormous, but existing funds cannot fully meet operational requirements, with about 35% of businesses facing severe financing constraints.

Bank financing is the most widely used financing model, and finance strategies can address the financing constraints of e-commerce green supply chains. In bank financing, suppliers with financial constraints are guaranteed by the e-commerce platform and apply for loans from banks to solve their own financial problems [2]. For funding-constrained suppliers, bank finance is preferred due to its simple process and comprehensive audit measures [3]. In the bank financing model, higher interest rates increase financing costs, and seller competition is detrimental to improving financing efficiency. Higher product pricing can generate more cash flow, better alleviating funding constraints [4]. Operating capital levels also affect financing strategy formulation. A higher guaranteed interest rate encourages e-commerce platforms to provide more guarantees. The platform’s service fee rate should not be too high, as this could affect the financing willingness of funding-constrained firms [5]. Both interest rates and product pricing affect financing costs, and the platform’s sales model also influences financing strategies, making it crucial to choose the right sales model to improve financing efficiency.

In e-commerce supply chain bank financing, there are many risk-related issues, and businesses are increasingly focusing on risk aversion. Bank financing relies on e-commerce platforms to provide guarantees for suppliers to resolve their funding constraints. However, suppliers are often SMEs with low credit ratings and significant credit and moral risks [6]. Information asymmetry between enterprises leads to barriers in the finance review process, and the information obtained cannot guarantee its authenticity, resulting in a lack of trust mechanisms and the risk of fraudulent transaction data [7]. E-commerce supply chain enterprises are generally risk-averse, and risk-averse suppliers tend to adopt conservative, preventive measures in financing decisions to reduce potential risks and ensure operational stability [8]. Risk-averse e-commerce platforms assess supplier credit by reviewing the transaction data within the e-commerce supply chain, a data-based risk control approach that allows the platform to effectively reduce potential risks and meet its own risk aversion preferences [9].

Blockchain technology holds great potential for improving bank financing strategies in e-commerce supply chains. Blockchain’s trust mechanism enhances the credibility between enterprises, reduces the risks faced during financing, and improves the financing efficiency of suppliers. According to Grand View Research, the application market for blockchain in e-commerce green supply chain financing is expected to reach $26.4 billion by 2027, primarily benefiting from the transparency blockchain provides, which reduces fraud risk, alleviates financial constraints, and improves liquidity. Blockchain automates the recording of transaction data, reducing the cost of information collection and enabling real-time dynamic credit ratings based on blockchain data. Especially in multi-level e-commerce supply chains, blockchain’s trust mechanism better facilitates trust transmission, reducing credit risks and moral hazards related to adverse selection. The SAS platform of Ping An Bank uses the distributed ledger technology of blockchain to transfer and manage accounts receivable, which solves the problem of information sharing and trust transfer between transaction parties, and improves the financing efficiency of banks. In various power structures within the e-commerce supply chain, blockchain can better protect the interests of followers. According to JD.com’s statistics, JD Finance utilizes blockchain to enhance supply chain financial services, shortening the financing cycle by 30%–40% and reducing financing costs by 15%–25%. Blockchain enhances trust in financing data, reduces reliance on intermediaries, simplifies financing processes, lowers financing costs, and increases financing returns [10]. The “Double Chain Link” platform launched by Ant Financial takes advantage of the immutability and transparency of blockchain to enhance financial institutions’ trust in transaction information, reduce financing costs and risk levels, and optimize bank financing strategies.

To solve the funding constraints in e-commerce supply chains and better help enterprises avoid risks, this study uses blockchain technology to optimize bank financing strategies and improve financing efficiency. The study constructs a bank financing model for e-commerce supply chains before and after adopting blockchain, considering Direct Selling and Consignment sales models, and explores how blockchain and risk aversion affect bank financing strategies. The study addresses the following key questions: (1) Will bank financing differ under different power structures in the e-commerce supply chains with Direct Selling and Consignment models? How can the sales model be chosen to seek the optimal bank financing strategy? (2) What is the difference between the bank financing strategies of e-commerce supply chain before and after the adoption of blockchain? How to optimize bank financing strategy by using blockchain trust mechanism? The contributions are as follows: First, from the perspective of blockchain trust, it discusses the impact of trust between enterprises and between enterprises and the market on bank financing strategies, providing new insights into the study of factors affecting bank financing. Second, using game theory analysis, it investigates the impact of enterprises’ risk aversion on bank financing strategies before and after blockchain adoption, finding that higher risk aversion does not necessarily lead to improved financing efficiency, which contradicts common assumptions. Finally, Consignment the Direct Selling and consideration of e-commerce supply chain, this paper explores the choice of sales methods to seek the best bank financing strategy. The traditional two-level e-commerce supply chain is extended to a three-level deep-level e-commerce supply chain, and the bank financing strategies under different power structures of the supply chain are analyzed. With different sales methods and power structures, the bank financing strategies will be different, and appropriate sales methods should be chosen to improve financing efficiency.

The structure is as follows: Section 2 summarizes existing literature. Section 3 is the practical issues of the research, defines relevant symbols, and presents research hypotheses. Section 4 builds three models: the baseline bank financing model, risk-averse e-commerce green supply chain bank finance model, and blockchain-enabled risk-averse e-commerce green supply chain bank finance model, followed by comparative analysis. Section 5 conducts numerical analysis of the models using MATLAB, examining the effects of blockchain, blockchain trust, risk aversion, product greenness, guarantee interest rates, and information collection efforts on e-commerce supply chain bank financing strategies. Section 6 concludes the paper, discussing its limitations and proposing future directions.

2 Literature review

2.1 Bank financing strategies in E-commerce supply chain

Research on banking financing strategies in e-commerce supply chains mainly focuses on financing influencing factors, financing risks, financing strategy models, and strategy optimization.

Regarding the influencing factors of financing, interest financing impacts the willingness of constrained supply chains to take loans. Supply chain companies can achieve Pareto optimality and better financing benefits when financing rates fall within a certain threshold. When the rate is smaller, the order quantity increases, and the expected profit for online retailers also rises. Additionally, initial working capital also affects the choice of financing strategies [11]. Under the Direct Selling model, when the unit costs of products with different qualities are the same, and the differences in e-commerce service fees and product evaluations are minimal, manufacturers constrained by funds are more likely to opt for bank financing [12]. Other scholars have analyzed various factors that influence bank financing, exploring the operational mechanisms and internal influences of SCF. They found that government subsidies and third-party guarantees also affect e-commerce supply chain bank financing strategies [13]. The financing loan contract and corporate decision-making also influence financing effectiveness, determining the expected profit of both parties with the optimal decision based on game model calculation [14]. Additionally, under the Consignment model, product greenness affects the financing strategy of carbon-dependent manufacturers [15].

Regarding financing risks, the rapid expansion of the e-commerce market has intensified risk issues, with rising uncertainties and risks in e-commerce supply chain bank financing. Therefore, risk identification methods should be actively explored. Scholars have applied Deep Convolutional Neural Networks (DCNN) to predict risks in financing decisions, and DCNN has been shown to provide better predictions than traditional neural networks and support vector machines, with an accuracy rate of 95.36% [16]. Some researchers have utilized game theory to explore the risks in financing decisions and found that higher expected output coefficients result in lower production inputs but increase the purchase price, thus mitigating the impact of risks on financing strategies [17]. Introducing core enterprises into bank financing can leverage their advantageous position and provide guarantees to reduce the overall credit risk in e-commerce supply chains. Game theory analysis, based on the Consignment model, has been used to study financing strategies considering credit guarantees and default risks [18]. Case study research has also shown that risks can be reduced from the perspectives of banking, business, and legal aspects, helping enterprises to take timely measures to mitigate risks.

In terms of financing strategy models, some scholars have constructed game models under the Consignment model to explore the optimal financing strategies for SMEs facing financial constraints [19]. Other researchers have validated financing mechanisms using a cash-to-cash flow sensitivity model [20] and assessed the factors influencing supply chain performance through a comprehensive evaluation method [1]. Additionally, an interpretive structural model has been used to simulate the relationships between financing factors [21]. Bank financing can improve financing efficiency by alleviating information asymmetry. Other researchers have proposed a new cooperation method using a network perspective to trigger capital flows between customers, which better alleviates funding constraints [22]. The integration of artificial intelligence (AI) into e-commerce supply chain bank financing has promising research prospects, with some scholars examining optimal financing strategies using emerging technologies. Under the Direct Selling model, when the regret cost are lower, but the platform’s commission is higher, SMEs facing financial constraints are more likely to choose bank financing [23]. Evolutionary game models have been used to study green financing firms, promoting green innovation to achieve balanced finance [24]. Some scholars use Stackelberg game to explore the financially constrained retailers by considering the impact of joint pricing and quality level [25]. When manufacturers and logistics providers are free riders in financing decisions, the game analysis method can be used to obtain the financing equilibrium point and find the optimal financing strategy [26]. In the low-carbon supply chain, considering the impact of low-carbon performance, Stackelberg game is used to explore the optimal financing strategy [27].

Regarding financing strategy optimization, guarantee-based financing solutions have become increasingly popular as they help enterprises more easily access financing and optimize financing strategies. In the Consignment model, in addition to bank financing, alternative finance products and services such as retailer credit finance and hybrid finance are used to offer SMEs more diverse financing options, optimizing the financing strategies [28]. Because the loan limits provided by commercial banks are relatively high, financing costs are also higher, and credit combination financing can broaden the funding channels for constrained enterprises to optimize their financing strategies [29]. In uncertain conditions, creating value from the perspective of sustainable development can improve corporate credibility and optimize financing strategies [30]. Strengthening green innovation helps attract more consumers and improves financing efficiency [31].

Overall, e-commerce supply chain bank financing has a promising research outlook, bringing more opportunities and advantages for alleviating financing constraints, and can effectively improve financing efficiency. Existing research on the factors influencing bank financing strategies in e-commerce supply chains has paid limited attention to the impact of emerging technologies. This study innovatively explores the effect of blockchain trust mechanisms on bank financing strategies. While existing studies have considered the issue of financing risk when formulating bank financing strategies, there has been little research on how risk attitudes affect financing strategies. Therefore, it is necessary to incorporate the risk aversion attitude of firms into the analysis. Based on social preference theory, this paper introduces the behavioral management of business decision-makers and examines the impact of risk aversion on bank financing strategies, grounded in the real operational scenarios of e-commerce supply chains such as Direct Selling and Consignment. Among various bank financing models, this study mainly adopts the Stackelberg game analysis method, which is different from previous studies in that this study considers the risk aversion and green preference of enterprises and other influencing factors to explore the optimal bank financing strategy. Regarding financing strategy optimization, most existing literature on bank financing strategies has been based on traditional supply chain structures. This paper innovatively investigates optimal financing strategies from the perspective of sales channel choice, closely aligning with the characteristics of e-commerce supply chains and consumer green preferences. It comprehensively considers the two sales models, Consignment and Direct Selling, and different supply chain power structures to explore how different power structures and sales methods impact bank financing strategies.

2.2 Blockchain-based supply chain financing strategy

Research on blockchain-based SCF strategies mainly focuses on the role of blockchain, finance influencing factors under blockchain, the effects of blockchain on financing, and the optimization of financing strategies in blockchain contexts.

Regarding the role of blockchain, blockchain, as a decentralized and secure technology, has injected new vitality and possibilities into SCF, significantly impacting the formulation of financing strategies. Smart contracts can be automatically executed, strengthening trust between enterprises, while consensus mechanisms allow for information sharing and enhance traceability [32]. The coupling of blockchain with SCF enhances the effectiveness of financing strategies within supply chains, breaking through the bottlenecks of traditional financing mechanisms, improving information exchange between enterprises, and assisting banks in better assessing credit levels, thereby providing financing support to financially constrained companies [33]. Using blockchain’s smart contracts and other technological tools, the automation of contracts and funds flow, as well as real-time detection, simplify financing processes, reduce human intervention, and mitigate moral hazards such as adverse selection. Machine learning algorithms, applied in blockchain, improve the prediction of corporate credit risks, better preventing risks faced by enterprises and enhancing the security and transparency of blockchain transaction systems [34]. The advantages of blockchain effectively address issues such as difficulty in information sharing and lack of trust mechanisms in the financing process, improving financing efficiency. Through its decentralized and immutable properties, blockchain allows all participants to achieve transparent information sharing and real-time updates, reducing credit risk and increasing the reliability of financing information [35].

Regarding the influencing factors of financing under blockchain, blockchain-based SCF has attracted significant attention. Game-theoretical models are constructed with different blockchain structures to analyze the financing equilibrium and decision-making problems of the participants. It is found that when the number of receivables exceeds a threshold, it becomes more difficult for enterprises to repay loans, and delayed payment financing strategies can help enterprises achieve higher financing benefits. When the loss from financing defaults is relatively low, the likelihood of defaults by financially constrained companies is higher. However, when the default loss is large and reliable income is more substantial, enterprises are more likely to fulfill their commitments, minimizing credit risk and optimizing the financing strategy [36]. In multi-period two-level supply chains, considering the impact of bank insurance on financing strategies, scholars have proposed BCT-SCF platforms that can convert receivables into online bills for transfer payments. With the support of bank insurance, blockchain-driven accounts receivable factoring improves the accessibility of financing. This method is widely applied in business settings. Case studies confirm that the introduction of blockchain technology, higher product pricing, and lower factoring fees all help alleviate financing constraints [37]. A certain degree of product greenness may increase manufacturing costs but boosts overall returns and increases cash flow, thereby alleviating financial constraints. When blockchain investment efficiency is high, trade credit finance is more advantageous than bank finance in improving finance efficiency [38]. The introduction of blockchain enables better tracing of green information, driving green investment, and improving financing availability. Thus, green innovation and investment also influence financing strategies [34]. In the sustainable green supply chain, green investment has attracted much attention. Although the introduction of blockchain technology will increase business costs, it will also increase the level of green sensitivity of consumers and reduce tax costs [39]. Applying blockchain technology to the accounts receivable financing model of green supply chain, Stackelberg was used to explore the optimal financing conditions, and the setting of pledge rate and loan interest rate had a great impact on financing strategies [24]. In the dual-channel green supply chain, financially constrained manufacturers can choose two combination financing strategies: bank financing and platform financing (EB) and prepayment financing and platform financing (EP). Before and after the adoption of blockchain technology, EP is the optimal strategy. When the green degree difference of dual-channel products is large, the offline sales price is higher than the online sales price. When blockchain costs reach a certain threshold, adoption of blockchain technology should be reduced [40].

In terms of the effects of blockchain on financing, blockchain technology addresses frequent issues such as fraud and high financing costs. It simplifies SCF transaction process and offers solutions to collaborative financing dilemmas. Blockchain can effectively reduce financing risks, and higher blockchain technology and credit costs help improve overall financing returns [41]. Blockchain technology can reshape financing processes, and the new technical architecture based on blockchain’s underlying design can resolve trust and default issues within supply chains, perfecting the credit breakdown mechanism, reducing risks, and improving overall efficiency. By providing trustworthy data records and transparent transaction processes, blockchain offers a more reliable and efficient solution to risk reduction [42]. Blockchain helps to strengthen the trust among enterprises in multi-level supply chain. Based on the intuitionistic fuzzy set theory, it implements a reward and punishment mechanism for enterprises through dynamic weight allocation to achieve trust aggregation and credit transmission [43]. The comprehensive trust value of the enterprise can be calculated by using the cloud function in the blockchain, stored in the blockchain and can be split, and the transfer of trust can be realized by the split warrant [44]. In order to alleviate the trust crisis, blockchain technology is used to realize credit information sharing, and a credit evaluation model is built in combination with Funk-SVD to improve the trust framework of supply chain financing [45]. Blockchain’s smart contracts have excellent applications in the flow of information and capital operations, better meeting enterprises’ funding needs, enhancing financing system transparency and trust, and effectively reducing fraud risks while extending payment deadlines. Blockchain’s advanced technologies should be fully leveraged in SCF risk management to improve the effectiveness and feasibility of financing strategies [46]. Financing risks are a major focus for many scholars. In deep-tiered supply chains, upstream suppliers often have small sizes and high financing demands. Limited visibility in multi-tiered supply chains exacerbates financing difficulties. Game analysis shows that blockchain enhances the traceability of on-chain information, optimizes financing decision-making, and mitigates risk-taking by companies. When secondary suppliers face severe financial constraints and their daily operating costs fall below a certain threshold, financing can ensure the interests of tertiary suppliers with lower risks. Cross-level financing based on blockchain can achieve a win-win, reducing financing risks and improving financing efficiency [29].

Regarding the optimization of finance strategies under blockchain, blockchain-powered supply chain financing is widely applied across various industries, significantly promoting innovations in SCF strategies. Some scholars have explored the stable financing equilibrium strategies of supply chain enterprises through a three-party evolutionary game model, analyzing collusion behaviors in enterprises within bank financing, and innovating financing structures and business logic to optimize financing strategies [47]. Other scholars, using case studies of blockchain financing platforms, propose optimization suggestions for financing strategies under blockchain-driven SCF models. By utilizing blockchain’s immutability, consensus mechanisms, smart contracts, and other features, transaction processes are effectively simplified, information sharing and transparency are enhanced, trust costs are reduced, and financing difficulties faced by SMEs are alleviated [48]. Blockchain financing platforms accelerate capital flow and integrate supply chain resources based on trustworthy data, providing better solutions to ease enterprises’ financing constraints and optimize SCF. As the underlying technology of digital currencies such as Bitcoin, blockchain optimizes financing models and improves liquidity among enterprises on the blockchain. After the introduction of blockchain, issues of distrust between enterprises are resolved, bank loan risks are reduced, the credibility of financing increases, and financing efficiency is significantly improved. To protect corporate privacy data during the financing process, homomorphic encryption can be used to better meet the needs of financing entities, helping financially constrained enterprises secure funding more effectively [49]. In blockchain-enabled SCF, financial institutions’ and enterprises’ multiple decision-making factors should be comprehensively considered to explore stable equilibrium strategies for financing platforms, solve supply chain distrust and risk issues, assist companies in better managing risks, and optimizing financing strategies [50].

Blockchain technology has a good application in many industries and has an important impact on bank financing strategies. From the existing research, in terms of the role of blockchain, most of them explore its application in financing strategy based on the traditional characteristics of blockchain, such as smart contract. From the perspective of blockchain trust, there are few studies on improving blockchain trust mechanism to optimize financing strategy, while higher trust between e-commerce supply chain and banks can better optimize financing strategy. From the perspective of blockchain trust, this paper explores the influence of blockchain trust mechanism between supply chain and banks, and between supply chain and green consumers on financing strategy. In the aspect of financing influencing factors, although existing scholars have considered risk factors, it is rare to explore its influence on financing strategy from the aspect of risk aversion behavior of enterprises. In terms of financing impact, blockchain can simplify the financing process, reduce the problem of default, better alleviate financing risks and improve financing efficiency. On this basis, this paper introduces contract coordination mechanisms to coordinate interest conflicts and reduce credit risk. Blockchain can improve the trust between enterprises and realize the splitting and transmission of credit. The existing research considers the application of blockchain in green supply chain financing; based on this, this study considers the green preference of consumers and the green investment of suppliers to explore the optimal bank financing strategy. In terms of strategy optimization, most scholars discuss the influence of blockchain on financing strategy based on theory, and some scholars analyze blockchain financing platforms in the form of cases. In this paper, quantitative analysis is used to explore the optimal financing strategy, and at the same time, the influence of risk aversion and sales mode selection on financing strategy is considered to explore how to coordinate the supply chain to optimize financing strategy.

3 Problem description and research hypothesis

3.1 Problem description and notation definition

In an e-commerce green supply chain consisting of suppliers, manufacturers, and green e-commerce platforms, enterprises are risk-averse, two sales methods are considered: Direct Selling and Consignment. These two sales methods are the most common and representative, with significant differences in inventory management, risk taking, capital liquidity and decision-making right allocation, which can cover the typical operation scenarios of different subjects in the supply chain. Under the Direct Selling Mode, suppliers process green products and sell them to market consumers via the e-commerce platform at a price

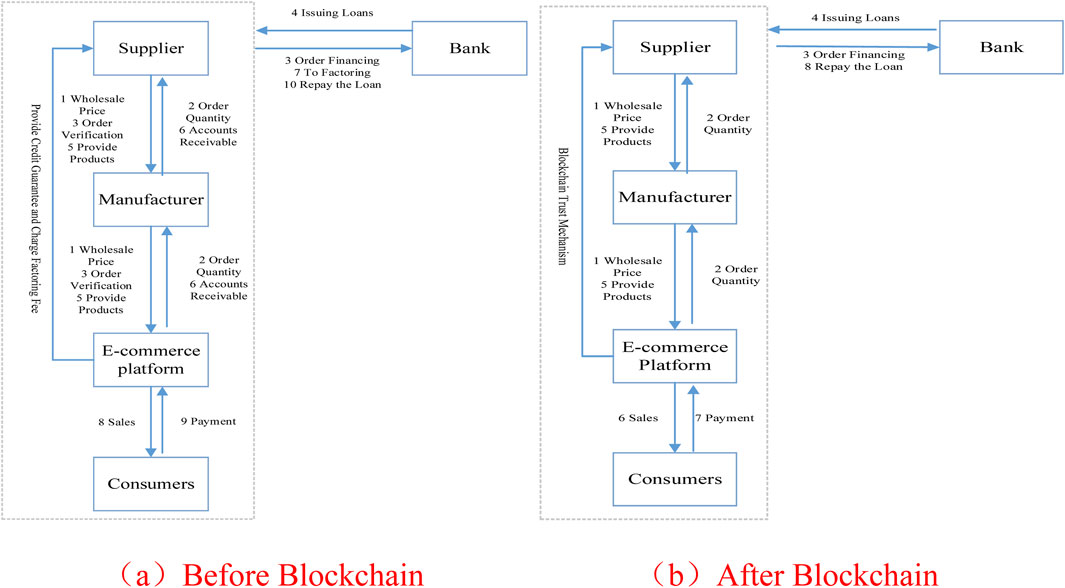

In traditional bank financing models, banks provide loans to financially constrained suppliers based on guarantees from the e-commerce platform, the financing process is shown in Figure 1a. Most suppliers are SMEs with high credit risk and a lack of trust mechanisms, leading to limited loan amounts from banks. Consequently, risk-averse suppliers rely on the e-commerce platform for credit guarantees, paying a guaranteed fee rate

Figure 1. Financing processes of E-commerce supply chains before and after blockchain. (a) Before Blockchain. (b) After Blockchain

Under the blockchain trust mechanism, the bank financing process differs, the financing process is shown in Figure 1b. While blockchain adoption incurs additional financing costs, suppliers must pay these costs under both Consignment and Direct Selling Modes. Blockchain improves the authenticity and reliability of information, reducing information verification costs and increasing the bank’s trust in e-commerce supply chain enterprises. The industrial and commercial bank of China to launch “ICBC e letter” platform, through intelligent automatically perform contract, reduces the financing cost of upstream suppliers, increasing the utilization of funds. Smart contracts automate loan execution, enabling banks to provide loans to suppliers without guarantees and foster trust transfer. Consensus mechanisms effectively regulate funds, mitigate credit risk during financing, and better accommodate firms’ risk-averse preferences. Tencent Cloud combines blockchain technology with financing scenarios. Through multi-party rights confirmation and coordination, the platform helps financial institutions monitor financing risks and effectively solve the financing problems of small and medium-sized enterprises. At the start of the sales period, suppliers sign sales contracts with the green e-commerce and apply for finance from banks using the orders obtained. Banks leverage blockchain to assess the credit information, verify transaction authenticity, repayment capacity, and creditworthiness. Blockchain enhances suppliers’ credibility, enabling banks to grant loans. Suppliers then use the funds to process green products and sell them through green e-commerce. After product sales generate returns, funds are promptly allocated to repay the bank. Both members and bank are risk-averse, aiming to maximize supply chain profits while minimizing credit risk. Thus, we explore the impact of blockchain on bank finance in e-commerce green supply chains, considering firms’ risk aversion. The bank financing process before and after adopting blockchain is shown in Figure 1.

Based on this, this study constructs a Stackelberg game to explore the optimal bank financing strategy under different sales methods and power structures. Because the e-commerce supply chain usually presents a clear hierarchical structure, enterprises play different roles in the entire process, and each has different decision-making rights and information advantages. Stackelberg game model is based on the “leader-follower” relationship, which can clearly depict the sequential decision-making process of each body in the supply chain. In the e-commerce supply chain composed of suppliers, manufacturers and e-commerce platform, the game analysis method is used to construct the bank financing strategy model under two sales methods of Consignment and Direct Selling. This paper explores the optimal bank financing strategy of e-commerce supply chain enterprises with risk avoidance behavior and consumers with green preference behavior. The two sales methods have different power structures. In Consignment, because the supplier first determines the wholesale price to be sold to the manufacturer, the e-commerce platform then determines the retail price to be sold to the consumer. Therefore, the supplier is the leader, the manufacturer is the follower, and the e-commerce platform is the second follower. Under Direct Selling, the e-commerce platform determines the platform service price, and the supplier determines the selling price on this basis. Therefore, the e-commerce enterprise is the leader, and the supplier is the follower. Through the Consignment model, we can discuss how to coordinate the game between suppliers as price makers, manufacturers and e-commerce platforms. The Direct Selling model reflects the dominant position of the platform in pricing and financing decisions. This hierarchical structure is exactly consistent with the premise of Stackelberg game model, which provides a solid theoretical foundation for the construction of the model.

In the e-commerce supply chain, in addition to the basic supply and demand relationship, it also involves a variety of factors such as blockchain adoption, risk avoidance behavior, product greenness, consumer green preferences, and guarantee rates. Stackelberg model has high flexibility, which can simultaneously consider multiple influencing factors in the decision-making process of leaders and followers and provide decision support for managers in the face of complex and changeable market environment. The construction model of this study first analyzes the benchmark model of bank financing under Direct Selling and Consignment selling methods and explores the optimal bank financing strategy under supplier financing constraints. Secondly, it analyzes the optimal financing strategy of e-commerce supply chain when enterprises have risk avoidance behavior. Introduce the enterprise’s attitude towards risk, explore the optimal bank financing strategy of e-commerce supply chain under risk avoidance. Finally, the introduction of blockchain technology, numerous advantages of blockchain can optimize bank financing strategy, explore the optimal bank financing strategy of risk avoidance e-commerce supply chain under blockchain.

The definitions of the symbols used in this study are shown in Table 1.

3.2 Research hypothesis

Based on the two sales methods, Consignment and Direct Selling, in green e-commerce supply chains, this study considers corporate risk aversion and consumers’ green preferences to explore the impact of blockchain on bank finance strategies. The hypotheses are proposed:

1. Referring to Tian et al. [51] and Li et al. [52], the market demand follows a random distribution, and consumers have green products’ preference, satisfying

2. Considering that members are risk-averse, the CVaR risk measurement method, adopted by Choi et al. [53] and Gupta and Ivanov [54], is used. The risk-averse utility function is:

3. Referring to Jiang et al. [43] and Liu et al. [55], the blockchain trust cost is expressed as

4 Model construction

4.1 Bank financing baseline model

In e-commerce supply chains, there are two sales methods: Direct Selling and Consignment. In Direct Selling mode, green e-commerce acts as a service provider and charges platform service fees during sales. In Consignment, the platform is a retailer, purchasing goods from manufacturers and selling to consumers. During the supply chain operation, upstream suppliers face financial constraints and apply for bank financing with guarantees provided by Green E-commerce. Optimal finance strategies under both sales methods are explored.

4.1.1 Direct selling mode

In the Direct Selling mode, suppliers produce products at cost

For suppliers, the inflow of funds is the total revenue from product sales minus the service fee paid to the platform. Outflows include production costs, guarantee fees paid to the platform, and interest expenses paid to the bank. The financing utility function of the supplier is:

For the e-commerce platform, inflows are platform service fees and factoring fees from financing, while outflows are platform operating costs. The platform’s financing utility function is:

For banks, the overall financing income is mainly interesting income, and the expected income function is as follows:

Here,

Proposition 1. According to Equations 1–3, it can be calculated that, the optimal retail price for a financially constrained supplier is:

Proof: Using the backward induction method of Stackelberg theory, the optimal solutions for the decision variables are calculated. According to the supplier’s profit, the first and second derivatives of

Inference 1 The expected profit

4.1.2 Consignment mode

Under the Consignment model, the supplier produces goods at

For the supplier, the primary cash inflow is the total revenue from product sales. The cash outflows include production costs, financing guarantee fees, and loan interest payments. The financing utility of supplier is:

For the manufacturer, the main operation involves processing the purchased products into finished goods. The cash inflow is the revenue from selling to the green e-commerce platform, while the cash outflows include the costs of purchasing products and further processing. The financing utility of manufacturers is:

For green e-commerce, the primary cash inflows are revenues from product sales and guarantee fee income. The main cash outflows are the costs of purchasing products from the manufacturer. The financing utility of green e-commerce is:

For banks, the capital inflow is mainly interesting income, and the expected income function is as follows:

Here,

Proposition 2. Under the Consignment method of bank financing, according to Equations 4–7, it can be calculated that, the supplier’s optimal wholesale price is

Proof: The backward induction method of Stackelberg game is used. First, the first and second derivatives of

Inference 2 The profit

4.2 Risk-averse E-Commerce supply chain bank financing

Consumers generally have green preferences, and suppliers tend to produce green and low-carbon products when making operational decisions. When suppliers produce green products, the cost of green technology input is

4.2.1 Direct selling mode

For the financially constrained supplier, the cash inflow under the Direct Selling model is the total revenue of product sales minus the service fees paid to green e-commerce. The cash outflows include the costs of purchasing and processing raw materials, guarantee fees paid to green e-commerce, interest expenses on bank loans, and costs incurred in providing documentation for financing. The financing utility of supplier is:

For e-commerce platforms, the main services provided are for suppliers to sell products and obtain financing. The primary source of funding inflow is the platform service fees charged for providing a platform to sell products and the factoring fees charged for providing guarantees to suppliers. The resulting cash outflows include the operating costs of green e-commerce and the costs of reviewing loan documentation, among others. In addition, there are risk-sharing contracts between enterprises. If a supplier fails to repay the funds upon maturity, the e-commerce enterprise must repay the funds on their behalf. The probability of supplier defaulting is denoted by θ, so the green e-commerce’s financing utility is:

For banks, capital inflow is an interest income, and the income function is as follows:

Here,

Considering that enterprises are risk aversion, the CVaR risk measurement method is used to characterize the risk behavior. Based on the function, the utility functions of suppliers and e-commerce platforms considering risk aversion can be obtained as:

Proposition 3. According to Equations 8–10, it can be calculated that, the optimal price of the supplier is

The optimal financing utility of the supplier is

Proof: Using the backward induction method of Stackelberg, the verification process is the same as Proposition 1.

Inference 3 Under the high market demand

4.2.2 Consignment mode

The main source of funding inflow for the supplier is the sales revenue obtained from selling products to the manufacturer, while the funding outflows include the production cost of raw materials, green investment costs, factoring fees required for guarantees, interest expenses for applying for financing from the bank, and costs for providing information certification. The supplier’s financing utility function is:

For the manufacturer, the primary sources of funding inflow mainly include the income obtained from selling products, while the funding outflows incurred include the product procurement cost, production and operation costs, and information verification costs. The financing utility function of the manufacturer is:

For the green e-commerce platform, the sources of funding inflow include the revenue from selling products and the factoring fees obtained. The funding outflows incurred include the costs of purchasing products and the expenses for information review. To coordinate the interest relationships, a risk-sharing contract is introduced. If the supplier does not repay the loan upon maturity, the green e-commerce needs to pay the default amount according to the ratio

For banks, capital inflow is the interest earned, and the income function is:

Here,

Since the firms are risk-averse, the CVaR risk measurement method is used to introduce the mean - standard deviation to characterize the risk-averse behavior of suppliers and e-commerce platforms. According to the profit function, the financing utility of the supplier and the green e-commerce are:

Proposition 4. According to Equations 11–14, it can be calculated that, the optimal retail price is

Proof: According to the backward induction method of Stackelberg game, the calculation process of the optimal solution of variables is like Theorem 2, so I will not repeat it here.

Inference 4 The optimal selling price

4.3 Risk-averse e-commerce supply chain bank financing under blockchain

Under the blockchain, enterprises upload transaction and financing information to the chain in time, which saves the cost of information verification, ensures the authenticity and reliability of information, and effectively reduces financing risks. The introduction of blockchain has increased the technical cost

4.3.1 Direct selling mode

Under blockchain technology, financially constrained suppliers need to adopt blockchain, which increases blockchain-related costs. Cash inflows primarily consist of the total revenue from product sales minus the service fees paid to the green e-commerce platform. Cash outflows include the costs of purchasing and processing materials, the costs of blockchain technology, green investment costs, and a blockchain trust cost of

An e-commerce platform that adopts blockchain technology needs to incur certain technical introduction costs to enhance the reliability of financing information. Suppliers selling products on the platform can obtain product sales service fees. The cash outflows include the introduction costs of blockchain, the operating costs of the platform, and the blockchain trust costs. Therefore, the financing utility of the green e-commerce platform is:

For banks, capital inflow is mainly interest earned, and the income function is as follows:

Here,

Since all enterprises are risk-averse, the mean−standard deviation method is used to characterize the risk-averse, that is

Proposition 5. Under the e-commerce supply chain bank financing model driven by blockchain technology, according to Equations 15–17, it can be calculated that, the supplier’s optimal retail price is

Proof: The solution is obtained by the reverse induction method of Stackelberg game. The calculation process is the same as the derivation process of Theorem 1 and will not be repeated here.

Inference 5 The supplier’s optimal retail price

4.3.2 Consignment mode

For the supplier, cash inflows primarily consist of the total revenue from product sales. Cash outflows include the cost of procuring raw materials, the cost of introducing blockchain technology, green investment costs, and blockchain trust costs. Additionally, suppliers must pay bank loan interest expenses. The supplier’s financing utility function is:

For the manufacturer, cash inflows are mainly derived from revenue generated by selling products. Cash outflows include the cost of purchasing and processing products, the cost of adopting blockchain technology, and blockchain trust costs. The manufacturer’s financing utility function is:

In the process of SCF, the green e-commerce platform generates cash inflows from the revenue earned by selling products to consumers. Cash outflows include the cost of procuring products, the cost of introducing blockchain technology, and blockchain trust costs. Green e-commerce’s financing utility function is:

For banks, capital inflow is an interest income, and the income function is as follows:

Here,

Suppliers and e-commerce platforms are both risks averse. By using the mean - standard deviation to characterize the risk-averse behavior of enterprise managers, we can get the utility functions of suppliers and e-commerce platforms as follows:

Proposition 6. Under blockchain technology, according to Equations 18–21, it can be calculated that, the optimal retail price of the green e-commerce platform to green preference consumers satisfies

Proof: The optimal solution of each variable is solved by backward induction of Stackelberg game, and the derivation process is like Theorem 2.

Inference 6 Under the blockchain, technology can reduce the credit risk as much as possible. Smart contracts and consensus mechanisms can effectively ensure that suppliers repay loans on time and meet the risk aversion of financial institutions. The optimal retail price

4.4 Comparative analysis

Blockchain technology facilitates collaboration between different actors, allowing all parties in the e-commerce supply chain to exchange information in a shared, trusted network. This helps break down information silos, form blockchain trust, and improve overall operational efficiency. With blockchain technology, a faster and more transparent financing process can be achieved. Using blockchain smart contracts to automate many steps in the financing process not only reduces wait times but also reduces the risk of human intervention. The use of blockchain technology can reduce intermediaries and the reliance on traditional paper documents, reduce financing costs while improving the speed of financing, which not only reduces processing time and costs, but also improves the accuracy of data. In general, after the introduction of blockchain, the income level of suppliers, manufacturers and e-commerce enterprises has been significantly improved. Although the introduction of blockchain will increase the cost of blockchain adoption compared to the situation without the introduction of blockchain technology, it will also save part of the cost of information review and improve the financing efficiency of e-commerce supply chain banks. The introduction of blockchain technology has further deepened the degree of information sharing and promoted the transfer of trust. The introduction of blockchain technology helps enterprises better avoid risks.

By analyzing the previous model, we can further draw conclusions.

Proposition 7. Under Direct Selling, when the supplier’s production cost is met

Proof: According to the optimal solution of decision variables in theorem 3 and theorem 5, it can be seen that under Direct Selling:

The adoption of blockchain has fundamentally alleviated the financing constraints of enterprises. Under blockchain technology, e-commerce enterprises are more willing to provide guarantees for cash-strapped suppliers, financial institutions are more willing to provide chain financial services, and loan services have greatly solved the funding problem. In the process of supply chain operation, when the cost meets certain conditions under Direct Selling, compared with the non-blockchain technology, the introduction of blockchain technology improves the greenness of the product, helps attract more consumers who prefer green, and quickly alleviates their own financial constraints.

Proposition 8. In Consignment consignment, when the supplier’s production cost meets

Proof: According to theorem 4 and theorem 6, we know

The introduction of blockchain technology is crucial to the financing decision of the e-commerce supply chain, which can better allow financial constraint suppliers to make scientific and reasonable decisions. Blockchain increases trust in the e-commerce supply chain sales process and enhances the traceability of information. In Consignment, blockchain technology has improved the transparency of information. In order to attract consumers, it will reduce the selling price, improve the competitiveness of enterprises and ease the financial constraint.

5 Numerical analysis

To further validate the model, MATLAB is used to analyze the expressions and explore the impact of blockchain, blockchain trust mechanisms, risk avoidance, product greenness, guarantee rates, and information verification efforts on bank finance. Based on Wu et al. [38] and An et al. [56], the parameters for each decision variable are follows:

5.1 Influence of blockchain technology

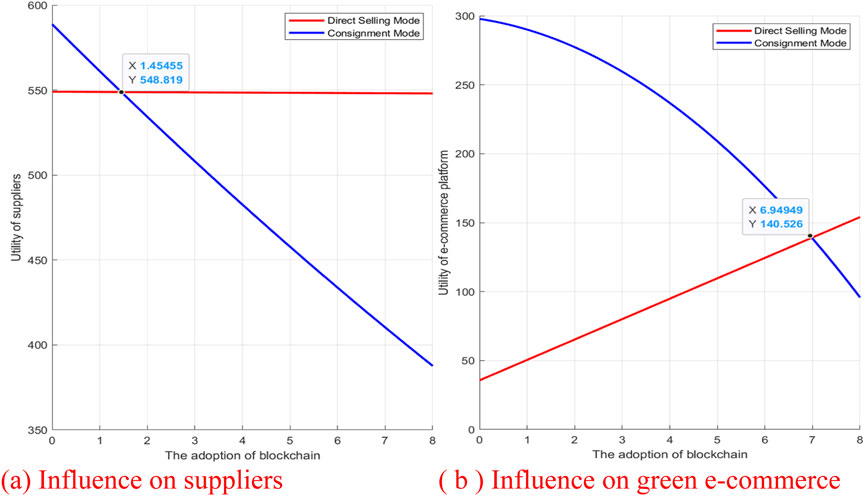

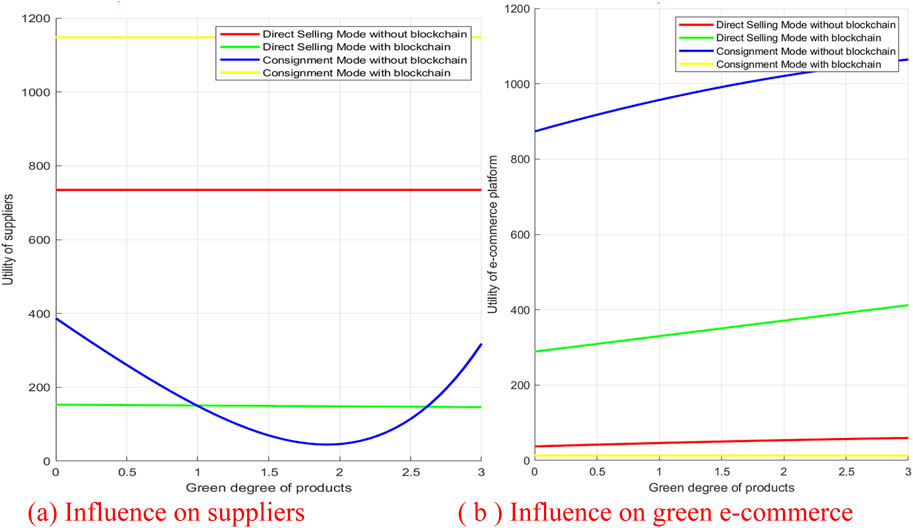

The impact of blockchain on green e-commerce supply chain bank financing strategies is shown in Figure 2. Figure 2a illustrates the change in supplier profits with the blockchain under the Direct Selling and Consignment sales models. Figure 2b shows the impact on green e-commerce.

For suppliers, the financing benefits under both the Direct Selling and Consignment sales models decrease as the blockchain adoption cost increases, with a larger reduction under the Consignment model. The impact on the Direct Selling model is relatively small. In the Direct Selling model, supplier utility decreases with the increase in blockchain adoption, but the change is not significant, indicating that blockchain has a small impact. In the Consignment model, the introduction of blockchain causes a significant drop in supplier benefits because it increases the financing costs, which negatively affects the financing returns. However, when the cost of blockchain technology

For e-commerce platforms, the impact of blockchain on platforms varies greatly between the Direct Selling and Consignment models. In the Direct Selling model, the introduction of blockchain technology can attract more consumers, increase sales, and improve the platform’s overall profitability. The platform charges a percentage of service fees, and the increased sales offset the increased blockchain adoption cost, has a positive effect on profits. In the Consignment model, however, the platform’s profits decrease as the blockchain technology cost rises, and the decline is more pronounced. When the blockchain technology cost

Overall, when blockchain costs are low, both suppliers and green e-commerce platforms are likely to choose the Consignment sales model, as it better alleviates the supplier’s financial constraints and provides better returns for both parties. When the blockchain technology cost is high, the Direct Selling model becomes the better option.

5.2 Influence of blockchain trust

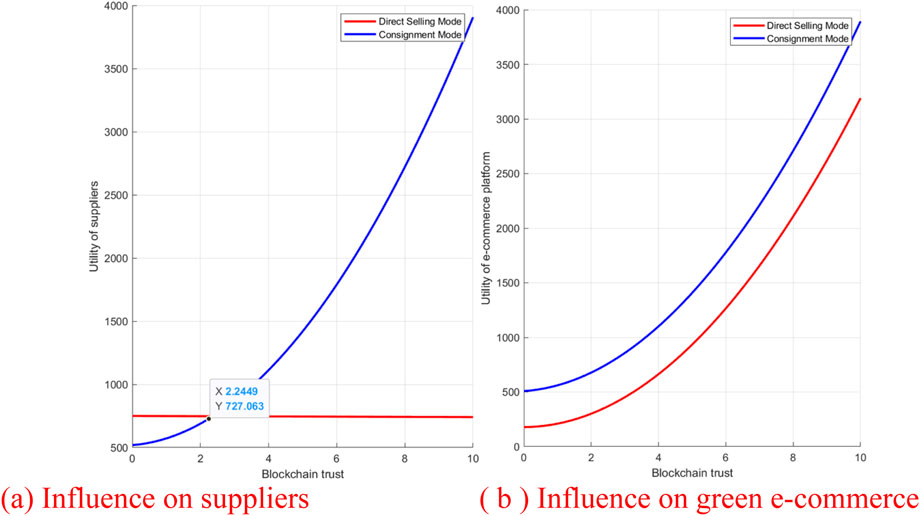

The impact of blockchain trust on bank financing strategies is shown in Figure 3. Figure 3a illustrates the trend of supplier benefits as blockchain trust increases, while Figure 3b shows the impact on the green e-commerce platform.

Figure 3. Influence of blockchain trust. (a) Influence on suppliers. (b) Influence on green e-commerce.

For suppliers, blockchain trust has a very different impact on supplier efficiency under Direct Selling and Consignment. Under Direct Selling, the vendor’s revenue will decrease slightly as the blockchain trust increases. Blockchain trust has less impact on suppliers and has a limited effect on easing financial constraints. In Consignment, blockchain trust has a great impact on the profit of suppliers, so it can better obtain more profits and obtain a good profit level, which helps to alleviate the fund problem of the supply chain. With the increase of blockchain trust, the revenue of suppliers shows a good growth trend, and the rise is large, and there is a good room for development. When the blockchain trust level a<2.24, Direct Selling can bring better returns to suppliers. However, when the blockchain trust exceeds a certain threshold, suppliers will be more willing to introduce the blockchain trust in the Consignment consignment to improve their overall income. In practice, with a high degree of blockchain trust, enterprises should actively adopt the Consignment selling method to better play the role of blockchain trust mechanism in financing strategy optimization.

For e-commerce platforms, the impact of blockchain trust on platform profits shows little difference between the Direct Selling and Consignment models. In the Direct Selling model, platform profits increase significantly with the increase in blockchain trust, with considerable fluctuation. The higher the blockchain trust, the higher the platform’s profitability. In the Consignment model, as blockchain trust increases, the platform’s profits show a clear upward trend, and blockchain trust helps enhance platform profits and fosters better development. In both sales models, the Consignment model generates better benefits for e-commerce platforms compared to the Direct Selling model.

At a certain level of blockchain trust, both suppliers and e-commerce platforms tend to choose the Consignment model. In this model, when blockchain trust is low, the effect of blockchain trust on supplier and platform benefits is minimal, and the difference between the two sales models is small. However, as blockchain trust increases, the impact grows, and the benefits brought to e-commerce supply chain enterprises become more significant.

5.3 Influence of risk aversion

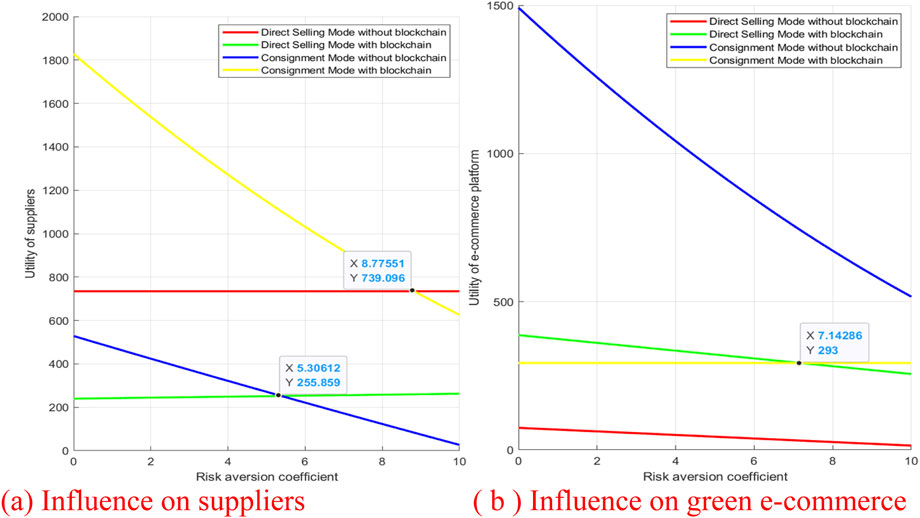

The impact of the risk aversion on suppliers and green e-commerce platforms is shown in Figure 4. This analysis compares the effects of risk aversion on bank finance strategies before and after adopting blockchain in the Direct Selling and Consignment sales models. Figure 4a shows the impact on suppliers, and Figure 4b shows the impact on green e-commerce platforms.

Figure 4. Influence of risk aversion. (a) Influence on suppliers. (b) Influence on green e-commerce.

For suppliers, under Direct Selling and before the adoption of blockchain technology, the risk avoidance coefficient has little impact on suppliers. After the adoption of blockchain technology, the financing returns of suppliers will increase slightly with the increase of risk aversion coefficient. The profit before the adoption of blockchain is higher than that after the adoption of blockchain, indicating that blockchain has a greater effect on the relationship between risk avoidance and supplier benefits. In Consignment consignment, before the use of blockchain, the benefit of suppliers will gradually decrease with the increase of risk avoidance coefficient. After the adoption of blockchain, the risk avoidance coefficient will also cause the supplier’s income to decline, and the decline is large. In the case of blockchain, the supplier benefit decreases more with the risk avoidance coefficient than without blockchain, and blockchain increases the impact of risk avoidance behavior on supplier financing. Suppliers should control their risk avoidance behavior within a reasonable range. At a low risk aversion factor, Direct Selling should be actively adopted when not using blockchain technology. When using blockchain technology, suppliers should use Consignment. When suppliers have high risk aversion, they should give priority to Direct Selling, and use blockchain technology to enhance credit transparency and reduce additional financing costs caused by information asymmetry.

For the e-commerce platform, in the Direct Selling mode, before the adoption of blockchain technology, the utility of the e-commerce platform will decrease with the increase of risk avoidance coefficient, and a high-risk avoidance coefficient is not conducive to the development of the e-commerce platform. After the adoption of blockchain, the high-risk avoidance coefficient will also lead to the reduction of the utility of the e-commerce platform. Before and after the adoption of blockchain, the utility of e-commerce platforms has a small variation with the risk avoidance coefficient. In Consignment consignment, before the use of blockchain, the risk avoidance coefficient will cause the utility of e-commerce platform to decline sharply, and the change range is larger than that of Direct Selling. After the adoption of blockchain, the risk avoidance coefficient has little impact on the financing utility of e-commerce platforms. Compared to the non-blockchain scenario, the adoption of blockchain reduces the impact of risk avoidance coefficient on the utility of e-commerce platforms. Under the lower risk avoidance coefficient, when the block chain technology is not used, the level desk is more inclined to use Consignment, which can obtain higher financing returns. With the adoption of blockchain technology, Direct Selling will be a better option. Under the high-risk avoidance coefficient, before and after the use of blockchain technology, Consignment can bring better returns to the e-commerce platform.

In the green e-commerce supply chain, a higher risk aversion coefficient does not necessarily contribute to increasing financing utility for suppliers and e-commerce platforms. Managers should appropriately reduce their risk aversion tendencies in order to better assist suppliers in obtaining financing.

5.4 Influence of product greenery

The impact of product greenery on bank financing strategies is shown in Figure 5. Figure 5a shows the impact on suppliers, and Figure 5b shows the impact on e-commerce platforms.

Figure 5. Influence of product greenness. (a) Influence on suppliers. (b) Influence on green e-commerce.

For suppliers, in the Direct Selling model, prior to the blockchain, product greenery has a minimal effect on supplier financing utility. After adopting blockchain technology, a certain degree of product greenery leads to a slight decrease in supplier utility, as higher product greenery increases the supplier’s green investment costs. In the Consignment model, prior to blockchain adoption, supplier financing utility decreases initially with the increase in product greenery but later increases. After adopting blockchain, the effect of product greenery on supplier financing utility becomes less significant. The introduction of a blockchain increases supplier financing benefits in the Consignment model but reduces them in the Direct Selling model. Companies should actively improve the greenness of their products and increase the adoption of blockchain technology.

For e-commerce platforms, in the Direct Selling model, prior to adopting blockchain technology, platform profits increase as product greenery increases, as higher product greenery attracts more consumers and increases platform profits. After blockchain adoption, product greenery continues to boost platform profits. Compared to the non-blockchain scenario, the blockchain increases the influence of product greenery on platform profits. In the Consignment model, prior to blockchain adoption, platform financing profits increase significantly as product greenery increases. After adopting blockchain, the impact of product greenery on platform profits becomes limited. The adoption of blockchain reduces the influence of product greenery on platform profits.

A certain level of product greenery attracts more green-preference consumers, helping to increase platform profits, but it increases costs for suppliers. Only after exceeding a certain threshold does the non-blockchain-based Consignment model boost supplier financing benefits.

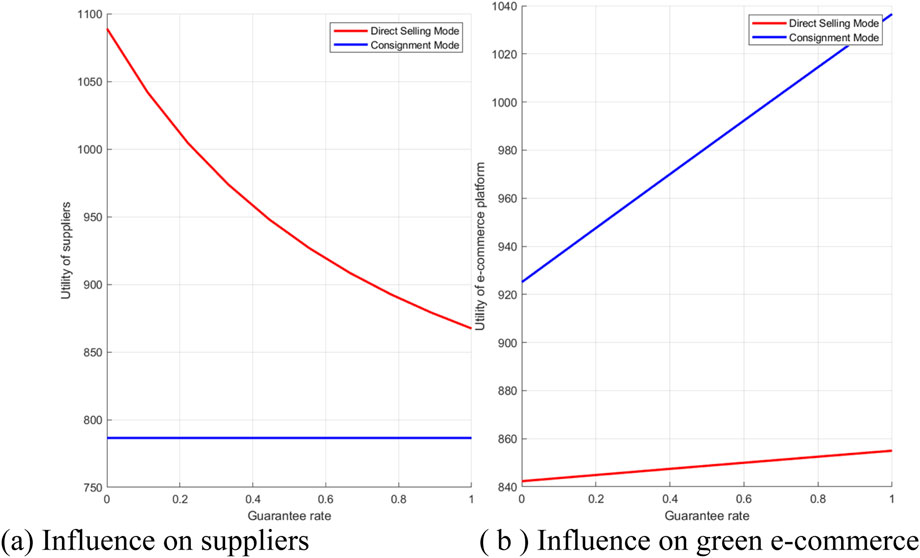

5.5 Influence of guarantee rate

The impact of the guaranteed rate on suppliers and green e-commerce is shown in Figure 6. Figure 6a is the influence on suppliers, and Figure 6b is the influence on green e-commerce.

Figure 6. Influence of guaranteed rate. (a) Influence on suppliers. (b) Influence on green e-commerce.

For suppliers, in the Direct Selling model, supplier financing benefits decrease as the guaranteed rate increases. A higher guaranteed rate raises the supplier’s costs, and while it helps solve funding issues, it also increases the financing cost burden. However, in the Consignment model, the guaranteed rate has a minimal influence on the overall revenue and does not reduce supplier utility while helping alleviate funding constraints. Although the Direct Selling model leads to a decrease in supplier financing benefits, overall, the revenue level remains higher than that in the Consignment model.

For green e-commerce, an increase in the guaranteed rate promotes an increase in platform profits in both the Direct Selling and Consignment models. In the Consignment model, the effect of the guaranteed rate on platform profits is significant, with a large growth margin. In the Direct Selling model, platform utility also increases with an increase in the guaranteed rate, but the growth is slower, and the increase is smaller. E-commerce is likely the Consignment model, which yields higher profits compared to the Direct Selling model.

The impact of the guaranteed rate on suppliers and e-commerce platforms is quite different. An increase in the guaranteed rate increases supplier financing costs but promotes the increase of e-commerce platform profits. The guaranteed rate also influences the choice of sales model. Suppliers are more likely to choose the Direct Selling model, while e-commerce platforms prefer the Consignment model.

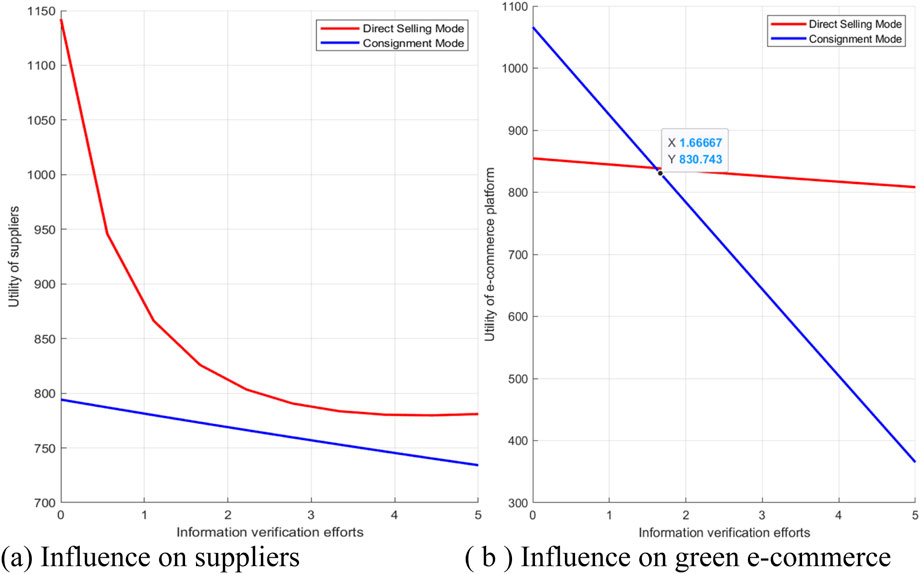

5.6 Influence of information verification effort

The impact of corporate information verification efforts on e-commerce supply chain bank financing strategies is shown in Figure 7. Figure 7a represents the impact on suppliers, and Figure 7b represents the impact on green e-commerce.

Figure 7. Influence of information verification efforts. (a) Influence on suppliers. (b) Influence on green e-commerce.

For suppliers, information verification efforts increase costs, and in both the Direct Selling and Consignment models, supplier benefits decrease as information verification efforts increase. Supplier benefits are higher in Direct Selling than in Consignment. When information verification efforts are within a certain threshold, the decrease in supplier benefits is larger in Direct Selling compared to the Consignment.

For e-commerce platforms, utility decreases as information verification efforts increase. In the Consignment model, the impact of information verification efforts on platform utility is larger, and the decrease is more noticeable compared to the Direct Selling model. At lower levels of information verification efforts, the Consignment model creates more profit for the e-commerce platform.

Information verification efforts lead to a decrease in financing benefits for both suppliers and e-commerce platforms. For suppliers, the decrease is more significant in the Direct Selling model, while for e-commerce platforms, the decrease is larger in the Consignment model. Considering the impact of information verification efforts, the choice of sales model will differ for the two parties.

6 Conclusion

Blockchain opens up new pathways for optimizing e-commerce supply chain bank financing strategies, overcoming the financing difficulties faced by enterprises in practice, and effectively solving the financing challenges encountered by suppliers, improving financing efficiency. To solve the challenges of difficult and expensive financing, this study explores the influence of blockchain, blockchain trust, risk aversion, product greenery, guarantee rates, and information verification efforts on bank financing strategies in e-commerce supply chains, combining the Direct Selling and Consignment sales models, and considering enterprise risk aversion behavior and consumer green preferences. The research shows that when blockchain technology is within a certain threshold, suppliers are more likely to choose the Consignment model, which helps alleviate their funding constraints. Blockchain trust mechanisms have a limited impact on financing strategies in the Direct Selling model, but they can provide better financing benefits to suppliers in the Consignment model. A higher risk aversion coefficient does not necessarily contribute to improving finance efficiency, and its impact on suppliers is greater with blockchain adoption than without, a higher risk aversion coefficient will improve the trust of blockchain. A certain degree of product generator increases supplier costs but helps attract more consumers and boosts overall revenue. Information verification efforts and higher guarantee rates increase supplier financing costs, with different impacts on the Direct Selling and Consignment sales models.

In the e-commerce supply chain, our work provides some targeted management implications and novel insights for the financially constrained e-commerce supply chain. In the process of bank financing, blockchain technology can effectively improve information transparency, and the e-commerce supply chain should actively introduce blockchain technology. When the adoption cost of blockchain technology is low, the proportion of Consignment sales products should be increased as much as possible, which helps to withdraw funds quickly to alleviate capital constraints. Suppliers can increase the market scale of Consignment method, to better exert the influence of blockchain trust mechanism on financing strategy, increase the trust between enterprises and between enterprises and consumers, and help suppliers obtain more profits to improve financing efficiency. E-commerce supply chain enterprises can appropriately reduce their risk avoidance tendency, and higher risk avoidance is not conducive to the increase of financing returns. Blockchain technology will expand the impact of risk avoidance coefficient, when the enterprise has a high-risk aversion tendency, should be careful to choose to adopt blockchain technology. High risk aversion means that enterprises are more conservative in the financing process, which may lead to less efficient use of funds, so when adopting new technologies or adjusting product strategies, they need to make a trade-off between reducing risks and obtaining higher returns. Suppliers should actively produce green and low-carbon products. Increasing green investment in products may increase production costs, but at the same time, it can obtain higher market premium and consumer trust, thus improving financing efficiency. Considering the impact of guaranteed interest rate and information verification efforts on suppliers’ financing returns, Direct Selling is more helpful to ease suppliers’ financial constraints.

Although this study provides in-depth research on blockchain-based financing, it is important to acknowledge its limitations. Specifically, the influence of blockchain may involve multiple layers of mechanisms, and the application of different blockchain characteristics in financing deserves further exploration. Additionally, our study only utilizes simple random market demand, which may not fully capture the real market environments. Future research can explore more market-specific random demand that reflects market uncertainties. Future studies may also examine the influence of enterprise behavior on e-commerce supply chain financing efficiency, combining more comprehensive enterprise decision-making behavior to expand related research. This study only considers a single bank financing model, and platform financing of the future e-commerce supply chain can be used as an alternative financing scheme. The selection of multiple financing methods is also a topic worthy of study.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

LY: Methodology, Writing–original draft, Writing–review and editing. QH: Conceptualization, Project administration, Supervision, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. Liaoning Provincial Department of Education’s basic scientific research project in 2023, “Research on the path of matching supply and demand of smart pension industry under government subsidy mechanism” (JYTMS20231228).

Acknowledgments

We acknowledge all those who contributed to this manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Zhang L, Cui L, Chen L, Dai J, Jin Z, Wu H. A hybrid approach to explore the critical criteria of online supply chain finance to improve supply chain performance. Int J Prod Econ (2023) 255:108689. doi:10.1016/j.ijpe.2022.108689

2. Wuttke DA, Rosenzweig ED, Heese HS. An empirical analysis of supply chain finance adoption. J Operations Manage (2019) 65(3):242–61. doi:10.1002/joom.1023

3. Jia F, Zhang T, Chen L. Sustainable supply chain Finance: towards a research agenda. J Clean Prod (2020) 243:118680. doi:10.1016/j.jclepro.2019.118680

4. Mandal P, Basu P, Choi T-M, Rath SB. Platform financing vs. bank financing: strategic choice of financing mode under seller competition. Eur J Oper Res (2024) 315(1):130–46. doi:10.1016/j.ejor.2023.11.025

5. Chang S, Li A, Wang X, Wang X. Joint optimization of e-commerce supply chain financing strategy and channel contract. Eur J Oper Res (2022) 303(2):908–27. doi:10.1016/j.ejor.2022.03.013

6. Yu H, Zhao Y, Liu Z, Liu W, Zhang S, Wang F, et al. Research on the financing income of supply chains based on an E-commerce platform. Technol Forecast Soc Change (2021) 169:120820. doi:10.1016/j.techfore.2021.120820

7. Chen Z, Chen J, Zhang Z, Zhi X. Does network governance based on banks’e-commerce platform facilitate supply chain financing? China Agric Econ Rev (2019) 11(4):688–703. doi:10.1108/caer-06-2018-0132

8. Zhou L, Wang J, Li F, Xu Y, Zhao J, Su J. Risk aversion of B2C cross-border e-commerce supply chain. Sustainability (2022) 14, 8088. doi:10.3390/su14138088

9. Lan C, Zhu J. New product presale strategies considering consumers’ loss aversion in the E-commerce supply chain. Discrete Dyn Nat Soc (2021) 2021(1):1–13. doi:10.1155/2021/8194879

10. Du J, Shi Y, Li W, Chen Y. Can blockchain technology be effectively integrated into the real economy? Evidence from corporate investment efficiency. China J Account Res (2023) 16(2):100292. doi:10.1016/j.cjar.2023.100292

11. Yang H, Zhen Z, Yan Q, Wan H. Mixed financing scheme in a capital-constrained supply chain: bank credit and e-commerce platform financing. Int Trans Oper Res (2022) 29(4):2423–47. doi:10.1111/itor.13090

12. Shi P, Wang J, Hu Y, Yin H, Chen Z, Xu B, et al. Heterogeneous products operation decisions of online dual-channel supply chain considering online reviews under different financing modes. RAIRO-Operations Res (2024) 58(5):4013–33. doi:10.1051/ro/2024144

13. Zhao S, Lu X. Accounts receivable financing and supply chain coordination under the government subsidy. In: Paper presented at the 2021 11th International Conference on information science and technology (ICIST) (2021).

14. Hagendorff J, Lim S, Nguyen DD. Lender trust and bank loan contracts. Manage Sci (2023) 69(3):1758–79. doi:10.1287/mnsc.2022.4371

15. Peng Q, Wang C, Goh M. Green financing strategies in a low-carbon e-commerce supply chain under service quality regulation. Environ Sci Pollut Res (2023) 30(2):2575–96. doi:10.1007/s11356-022-22329-w

16. Tang Q, Lu Y, Wang B, Li Z. A deep Convolutional neural network based risk identification method for E-commerce supply chain finance. Scientific Programming (2022) 2022(1):1–10. doi:10.1155/2022/6298248

17. Bai S, Jia X. Agricultural supply chain financing strategies under the impact of risk attitudes. Sustainability (2022) 14(14):8787. doi:10.3390/su14148787

18. Yan N, Sun B, Zhang H, Liu C. A partial credit guarantee contract in a capital-constrained supply chain: financing equilibrium and coordinating strategy. Int J Prod Econ (2016) 173:122–33. doi:10.1016/j.ijpe.2015.12.005

19. Yan B, Chen Z, Yan C, Zhang Z, Kang H. Evolutionary multiplayer game analysis of accounts receivable financing based on supply chain financing. Int J Prod Res (2024) 62(22):8110–28. doi:10.1080/00207543.2021.1976432

20. Lou Z, Xie Q, Shen JH, Lee C-C. Does supply chain finance (SCF) alleviate funding constraints of SMEs? Evidence from China. Res Int Business Finance (2024) 67:102157. doi:10.1016/j.ribaf.2023.102157

21. Ma H-L, Wang Z, Chan FT. How important are supply chain collaborative factors in supply chain finance? A view of financial service providers in China. Int J Prod Econ (2020) 219:341–6. doi:10.1016/j.ijpe.2019.07.002

22. Bordino I, Gullo F, Legnaro G. Advancing receivable financing via a network-based approach. IEEE Trans Netw Sci Eng (2020) 8(2):1328–37. doi:10.1109/tnse.2020.3005612

23. Yao X, Li X, Mangla SK, Song M. Roles of AI: financing selection for regretful SMEs in e-commerce supply chains. Transportation Res E: Logistics Transportation Rev (2024) 189:103649. doi:10.1016/j.tre.2024.103649

24. Liu L, Peng Q. Evolutionary game analysis of enterprise green innovation and green financing in platform supply chain. Sustainability (2022) 14(13):7807. doi:10.3390/su14137807

25. Cao B-B, You T-H, Ou CX, Zhu H, Liu C-Y. Optimizing payment schemes in a decentralized supply chain: a Stackelberg game with quality investment and bank credit. Comput and Ind Eng (2022) 168:108077. doi:10.1016/j.cie.2022.108077

26. Zhou W, Lin T, Cai G. Guarantor financing in a four-party supply chain game with leadership influence. Prod Operations Manage (2020) 29(9):2035–56. doi:10.1111/poms.13196

27. Wang L, Zhang L, Zhang X. Optimal financing strategies for low-carbon supply chains: a Stackelberg game perspective. Managerial Decis Econ (2025) 46(1):666–80. doi:10.1002/mde.4394

28. Zhang Z-c, Xu H-y, Chen K-b. Operational decisions and financing strategies in a capital-constrained closed-loop supply chain. Int J Prod Res (2021) 59(15):4690–710. doi:10.1080/00207543.2020.1770356

29. Dong G, Liang L, Wei L, Xie J, Yang G. Optimization model of trade credit and asset-based securitization financing in carbon emission reduction supply chain. Ann Operations Res (2023) 331:35–84. doi:10.1007/s10479-021-04011-5

30. Abdel-Basset M, Mohamed R, Sallam K, Elhoseny M. A novel decision-making model for sustainable supply chain finance under uncertainty environment. J Clean Prod (2020) 269:122324. doi:10.1016/j.jclepro.2020.122324