- 1Commercial Factoring (Shanghai) Co., Yunnan Communications Investment and Construction Group Co., Ltd., Kunming, China

- 2School of Accounting, Zhejiang University of Finance and Economics Dongfang College, Haining, China

- 3School of Statistics and Mathematics, Shanghai Lixin University of Accounting and Finance, Shanghai, China

- 4School of Finance and Economics, Jiangsu University, Zhenjiang, Jiangsu, China

Against the background of a unified national market, the interaction between cross-regional operating enterprises and local governments involves factors such as investment scale, policy preferences, and industrial collaboration and has a profound impact on the innovation activities of enterprises and the improvement of regional innovation ecosystems. This study employs evolutionary game theory to construct a bilateral game model, elucidating the dynamic game–theoretic relationships between cross-regional operating enterprises and cross-entry local governments. Establishing interest interaction and government-enterprise gaming mechanisms was found to effectively promote the two sides from short-term gaming to stable cooperation and reduce strategic uncertainty. The aim is to explore in depth how cross-regional operations can further promote the improvement of innovation performance and even the high-quality development of enterprises through the strategic interaction with the governments of cross-regional places.

1 Introduction

In an innovation ecosystem based on cross-regional operations, self-organization is an important mechanism that drives the co-evolution of cross-regional operating enterprises, local enterprises in target areas, and target regions. From a micro perspective, cross-regional operating enterprises show the characteristics of self-emergence and self-adaptation in the process of integrating resources, technology, and knowledge across regions. By continuously acquiring new market information and absorbing external talents and technologies, the internal management methods and innovation strategies of enterprises gradually adapt to the external environment and form new synergy models. While pursuing the maximization of their own interests, micro-subjects often give rise to innovative behaviors that benefit the system as a whole in dynamic games and cooperation networks, thereby achieving efficient utilization and integration of heterogeneous resources [1]. From a meso perspective, the industrial clusters formed in the same region are like organisms of “innovation populations.” These clusters will continuously interact with local policies, industrial systems, technological atmosphere, and other environmental factors, and at the same time, they will show ups and downs and non-linear evolution due to the relationship between government and enterprises. When an enterprise achieves a first-mover advantage through cross-regional development or forms a new technological breakthrough, the entire innovation population will experience a ripple effect, promoting the reflow and reallocating resource elements within the cluster [2,3]. In this process, both win-win cooperation and joint expansion of new value chains between cross-regional enterprises and local governments of cross-entry places may occur. New industrial restructuring may be spawned due to the break-up of market competition patterns. From a macro perspective, the formation and evolution of innovation clusters result from mutual synergy among cross-regional resources, policies, and industrial environments. At the macro level, the formation and evolution of innovation clusters result from mutual synergy among cross-regional resources, policies, and industrial environments. In the ecosystem of cross-regional operations, the governments, industry associations, and various social resource networks of cross-regional regions constitute the external environment that supports the evolution of clusters. While exchanging information and energy in the macro-environment, the innovation community will continuously break the original equilibrium state and move towards a more advanced and orderly structure. Along with the fluctuation of market demand and the adjustment of policy support, non-linear effects such as competition, learning, and imitation will be generated among innovation subjects, which will provide endogenous power for the rise and fall of the system, thus accelerating the realization of new synergies and upgrading of enterprises [4,5].

In this process of self-organized evolution, the choices and strategies of each innovation subject may have an impact on the system. When a new technology or business model changes the original competition–cooperation pattern, the equilibrium state of the system is broken [6]. Subsequently, under the dominance of core technology, financial support, market potential, etc., the innovation cluster will form a new order that is more advanced and stable. It is in the rise and fall and reorganization over and over again that the innovation ecosystem operating across districts develops the robustness of self-adaptation, self-sustenance, and self-development, which continuously spawns the interactive game between advantageous cross-district firms and the government of the cross-entry place [7,8]. Through continuous self-organized evolution, innovation agents in the cross-regional context jointly promote economic growth as well as collaborative innovation, providing solid support for the overall sustainable competitiveness of the system.

2 Introduction of models

The formation of cross-regional business strategies is closely related to the upgrading of the enterprise’s own industrial structure, the regional competition pattern, the regional economic environment, and the local policy orientation, and its decision-making motivation mainly comes from the integration of external resources and the need for complementarity of advantages, as well as the incentives of the local government for attracting investment and upgrading industry [9,10]. Therefore, the interaction between firms and the governments of cross-entry regions not only involves elements such as the scale of investment, policy incentives, and industrial synergies but also profoundly affects the innovation activities of the firms and the regional innovation ecosystem improvements.

Specifically, when choosing whether to conduct cross-regional operations and selecting target regions, cross-regional enterprises usually hope to obtain favorable conditions such as tax incentives, supporting resources and high-quality R&D environments, to reduce the overall risks and costs of innovation [11] and accelerate the connection with the local industrial chain and relevant public research institutions. Meanwhile, the government of the trans-boundary region expects enterprises to transfer their rich practical experience and cutting-edge technologies to inject new R&D impetus and innovation concepts into the local area and to drive the related industries and enterprises in the region to follow up through the knowledge spillover effect, to form the diffusion of innovation effect, enhance the technological innovation capability of the region or industry as a whole, further optimize the regional industrial structure, and improve the overall competitiveness and sustainable development capability. If the two sides can form an effective incentive mechanism between cross-region operations and policy support, cross-region enterprises will have more incentives to plough into the local innovation ecosystem, and the government will reap the double benefits of economic growth and regional innovation. In contrast, if the two sides fail to reach a reasonable balance, not only can the innovation potential of enterprises not be fully released, but it may also lead to resource mismatch and competitive imbalance. Based on the above analyses, a suitable mutual participation model is constructed, as shown in Figure 1.

The formation of cross-regional business strategies is closely related to the upgrading of the enterprise’s own industrial structure, the regional competition pattern, the regional economic environment, and the local policy orientation. Its decision-making motivation mainly comes from the integration of external resources and the need for complementarity of advantages, as well as the incentives of the local government for investment attraction and industrial upgrading [9,10]. Therefore, the interaction between firms and the governments of cross-entry regions not only involves elements such as the scale of investment, policy incentives, and industrial synergies but also profoundly affects the innovation activities of the firms as well as the improvement of the regional innovation ecosystem. Specifically, when choosing whether to conduct cross-regional operations and selecting target regions, cross-regional enterprises usually hope to obtain favorable conditions such as tax incentives, supporting resources and high-quality R&D environments, so as to reduce the overall risks and costs of innovation [11], and accelerate the connection with the local industrial chain and relevant public research institutions. Meanwhile, the government of the trans-boundary region expects enterprises to transfer their rich practical experience and cutting-edge technologies to inject new R&D impetus and innovation concepts into the local area and to drive the related industries and enterprises in the region to follow up through the knowledge spillover effect, so as to form the diffusion of innovation effect, enhance the technological innovation capability of the region or industry as a whole, further optimize the regional industrial structure, and improve the overall competitiveness and sustainable development capability.

If the two sides can form an effective incentive mechanism between cross-region operations and policy support, cross-region enterprises will have more incentives to plough into the local innovation ecosystem, and the government will be able to reap the double benefits of economic growth and regional innovation. In contrast, if the two sides fail to reach a reasonable balance, not only can the innovation potential of enterprises not be fully released, but it may also lead to resource mismatch and competitive imbalance. Based on the above analyses, a suitable model of mutual participation is constructed, as shown in Figure 1.

3 Model assumptions

The specific assumptions made to construct the game model of cross-region enterprises and cross-entry place government follow.

Assumption 1: Participating subject 1 is the enterprise, and participating subject 2 is the local government. Both parties are limited-rational, information-limited economic players who will adjust their strategies in response to external changes [12]. Firms may choose to operate across regions and set up subsidiaries in the target region to seek external heterogeneous resources to enhance their innovation capabilities, or they may not operate across regions and concentrate their resources locally to enhance their innovation capabilities through existing resources [13]. Therefore, the firm’s strategy choice space

Assumption 2: Firms choose with probability

Assumption 3: For enterprises, it is their choice whether or not to operate across regions. If it chooses to operate across regions, its ability to access resources and the extent to which it can do so may be affected by resource conditions in the target region, government support, and local market expansion. The basic innovation investment cost for local development is

Assumption 4: An inbound government that chooses active support must provide policy support such as financial subsidies and tax incentives to attract external enterprises to operate in the region and increase their investment, and the cost of this is

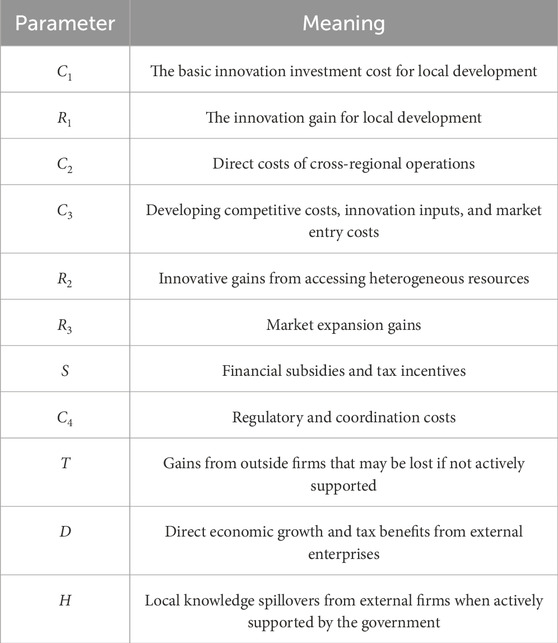

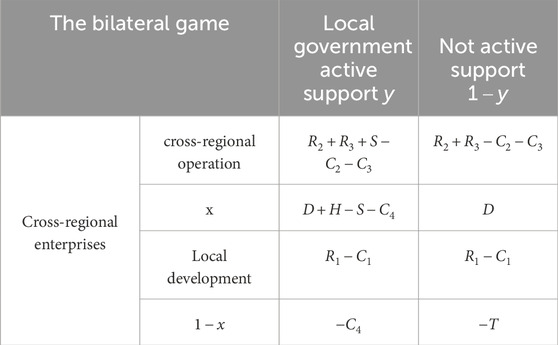

The corresponding parameters are shown in Table 1, and the payoff matrix is shown in Table 2.

4 Model solution and evolutionary stability analysis

Based on the above game analysis between cross-region enterprises and local government, the behavioral strategy choices are suitable for further analysis using the dynamic replication equation in evolutionary game theory. Therefore, this section constructs the dynamic replication equations of cross-district enterprises and local government to further describe the strategy evolution process of both sides of the game.

The firm’s expected return from choosing to operate across the region is

The expected return from not choosing to operate across the region is

The average expected return for a firm adopting a mixed strategy is

Therefore, the dynamic replication equation for a firm undertaking a cross-regional business strategy is

The expected payoff of the local government’s choice of active support is

The expected payoff for a local government that chooses not to actively support is

The average expected return of a mixed strategy by a local government is

Therefore, the dynamic replication equation for the trans-entry local government is

The union of the above two replicated dynamic equations leads to a two-dimensional dynamical system

The essential properties of a system are determined by the system’s stationary state, which is often portrayed by the equilibrium point equation of the system, which consists of the points in the system where the derivatives of all state variables with respect to time are zero. When the system is in a stationary state, the state of the system no longer changes; that is, the system is in equilibrium. Therefore, the equilibrium point equation of the system is

From Equations 6–10, the points

Because both

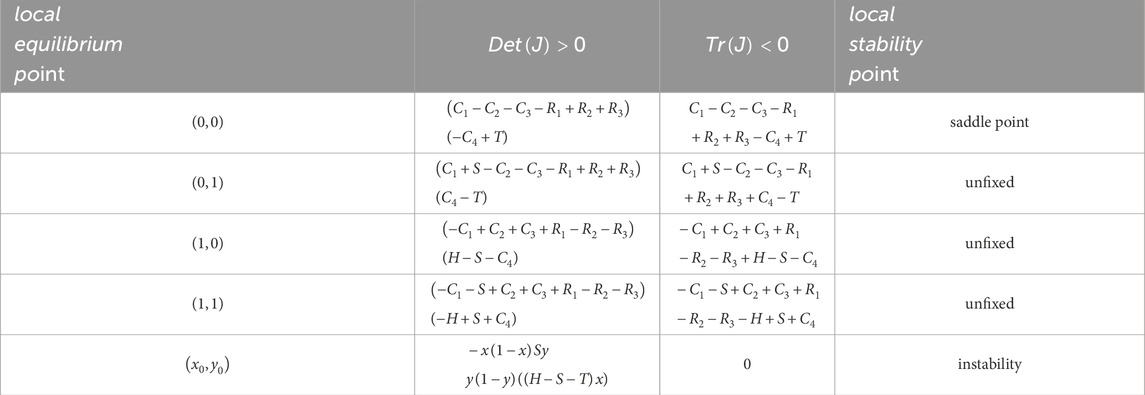

According to Friedman’s findings, it is known that the equilibrium point of the system is not necessarily the stable point of the system, and the local stability of the equilibrium point can be judged by the Jacobian matrix. Taking

An equilibrium point is an evolutionarily stable strategy for the system only if the Jacobian matrix corresponding to the equilibrium point simultaneously satisfies the determinant

According to the calculation results in Table 3 and the judgment conditions of the evolutionary stability strategy, it can be seen that the signs of the equilibrium points

4.1 Analysis of stable case 1 of the evolutionary game system

Because

4.2 Analysis of stable case 2 of the evolutionary game system

When

4.3 Analysis of stable case 3 of the evolutionary game system

When

5 Simulation analysis

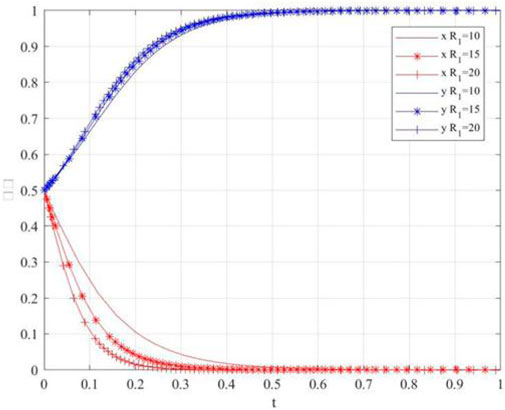

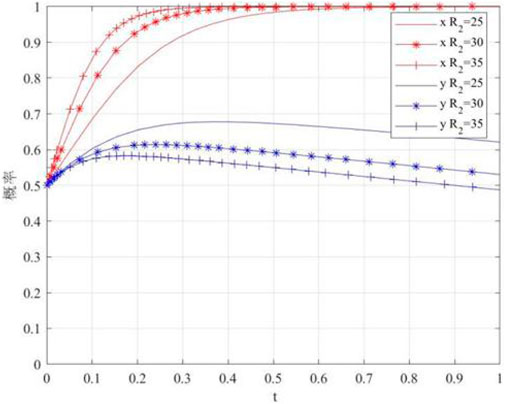

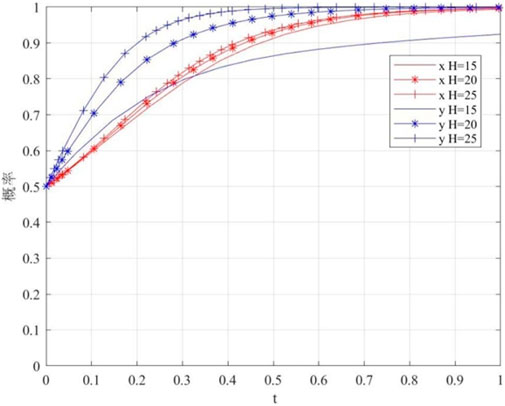

In order to reflect more intuitively the influence of the changes of each decision variable on the evolution process and the results of the game between the enterprise and the government of the trans-entry place, MATLAB is used to carry out the simulation analysis. In case 1, the following values are assigned to each parameter: the basic innovation input cost of local development is 8, the direct cost of inter-regional operations is 15, the competition, innovation and market entry costs of inter-regional operations are 12, the innovation gain from accessing heterogeneous resources is 6, the market expansion gain is 9, the financial subsidies and tax incentives are 5, the government regulation and coordination cost is 4, the potential loss of gains when the government is not active is 15, the gain from external firms to local knowledge spillovers when the government is active is 8.5, and the innovation gain from local development is

In case 2, the following values are assigned to each parameter: the basic innovation input cost of local development is 8, the direct cost of inter-regional operations is 15, the competition, innovation and market entry costs of inter-regional operations are 12, the market expansion gain is 9, the financial subsidies and tax incentives are 5, the cost of government regulation and coordination is 4, the gain that may be lost if the government does not actively support it is 15, the gain in local knowledge spillovers from external firms if the government actively supports it is 8.5, the innovation gain from local development is 10, and the innovation gain from accessing heterogeneous resources is

In case 3, the following values are assigned to each parameter: the basic innovation input cost of local development is 8, the innovation gain of local development is 10, the direct cost of inter-regional development is 15, the competition, innovation, and market entry costs of inter-regional development are 12, the innovation gain from accessing heterogeneous resources is 21, the market expansion gain is 9, the fiscal subsidy and tax incentives are 5, the government regulation and coordination costs are 4, the potential loss of gains when the government is not active is 15, and the gain in local knowledge spillovers from external firms when the government is active is

6 Conclusion

This paper explores the formation and dynamic evolution process of the interaction mechanism between cross-regional operating enterprises and local government based on evolutionary game theory. The study shows that the strategic choices of both parties are influenced by multiple factors such as benefit distribution, policy environment, risk cost, and cooperation expectation, and their interactive behavior shows significant dynamic adaptability and path dependence. The strategic evolution between cross-regional enterprises and local government is stable only if their respective returns are in line with their rational decision-making, and the choice of strategy is strongly influenced by each party’s own net returns. In the long run, enterprises tend to invest more in regions with high policy support and low institutional costs, while local governments balance the goals of economic growth and the preservation of public interest by adjusting the intensity of regulation and incentives. It is found that the establishment of interest interaction and government-enterprise gaming mechanisms can effectively promote the two sides from short-term gaming to stable cooperation and reduce strategic uncertainty. In addition, the optimization of the external institutional environment (e.g., regional synergy policy and cross-regional governance framework) plays a key role in promoting the realization of cooperative equilibrium. Future research can further combine case validation and multi-subject simulation to deepen the exploration of the dynamic law of the interaction mechanism in the context of differentiated regions, so as to provide theoretical support for the design of cross-region governance policies.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material; further inquiries can be directed to the corresponding author.

Author contributions

JZ: Data curation, Formal Analysis, Methodology, Writing – original draft. SL: Writing – original draft, Writing – review and editing. JiZ: Writing – review and editing. LZ: Funding acquisition, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. China Postdoctoral Program 2024M752437 Major project of philosophy and social sciences in colleges and universities, Jiangsu Provincial Department of Education 2024SJZD059 Basic Science (Natural Science) Research Program of Jiangsu Provincial Universities 23KJB630005) Zhenjiang Soft Science (RK2024010).

Conflict of interest

Author JZ was employed by Commercial Factoring (Shanghai) Co., Yunnan Communications Investment and Construction Group Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Wu M, Zhu Y, Yang T, Xu Y. Game-theoretic approach to understanding status transition dynamics and employee performance enhancement in organizations. Front Phys (2023) 11:1307672. doi:10.3389/fphy.2023.1307672

2. Sarkar A, Wang H, Rahman A, Azim JA, Memon WH, Qian L. Structural equation model of young farmers’ intention to adopt sustainable agriculture: a case study in Bangladesh. Renew Agric Food Syst (2022) 37:142–54. doi:10.1017/s1742170521000429

3. Zhu Y, Wu M, Lu J. “zero-sum game” or “win-win cooperation”: an analysis of the evolution effect of competition neutrality based on the participation of four parties. Front Phys (2024) 12:1429728. doi:10.3389/fphy.2024.1429728

4. Xiao L, Liu J, Ge J. Dynamic game in agriculture and industry cross-sectoral water pollution governance in developing countries. Agric Water Management (2021) 243:106417. doi:10.1016/j.agwat.2020.106417

5. Berthinier-Poncet A, Dubouloz S, Ruiz É, Thévenard-Puthod C. Innovation communities’ contributions throughout firms’ innovation processes: an outdoor sports industry case study. Eur Management J (2023) 41:575–89. doi:10.1016/j.emj.2023.01.007

6. Wang W, Liu Y. Does university-industry innovation community affect firms’ inventions? the mediating role of technology transfer. The J Technology Transfer (2022) 47:906–35. doi:10.1007/s10961-021-09887-w

7. Khalifa I, Li Z, Nawaz A, Walayat N, Sobhy R, Jia Y, et al. Recent innovations for improving the techno-functional properties of plant-based egg analogs and egg-mimicking products to promote their industrialization and commercialization. Compr Rev Food Sci Food Saf (2025) 24:e70086. doi:10.1111/1541-4337.70086

8. Jimenez A, Pansera M, Abdelnour S. Imposing innovation: how ‘innovation speak’maintains postcolonial exclusion in Peru. World Development (2025) 189:106914. doi:10.1016/j.worlddev.2024.106914

9. Yu X, Gao X, Wang L, Wang X, Ding Y, Lu C, et al. Cooperative multi-uav task assignment in cross-regional joint operations considering ammunition inventory. Drones (2022) 6:77. doi:10.3390/drones6030077

10. Zhang W, Zhao B, Zhou L, Qiu C, Wang J, Niu K, et al. Development of a resource optimization platform for cross-regional operation and maintenance service for combine harvesters. Appl Sci (2022) 12:9873. doi:10.3390/app12199873

11. Liu P, Chen S. The effect of banking deregulation on r&d investment: evidence from the cross-regional operation of city banks. J Innovation and Knowledge (2023) 8:100451. doi:10.1016/j.jik.2023.100451

12. Serafeim G, Yoon A. Stock price reactions to esg news: the role of esg ratings and disagreement. Rev Account Stud (2023) 28:1500–30. doi:10.1007/s11142-022-09675-3

Keywords: cross-regional operation, local government, evolutionary game theory, innovation ecosystem, knowledge spillover

Citation: Zhao J, Li S, Zhang J and Zhang L (2025) Research on the interaction mechanism between cross-regional operating enterprises and local government: perspective based on evolutionary game. Front. Phys. 13:1611590. doi: 10.3389/fphy.2025.1611590

Received: 14 April 2025; Accepted: 28 April 2025;

Published: 23 May 2025.

Edited by:

Dun Han, Jiangsu University, ChinaReviewed by:

Yan Tan, Yangzhou University, ChinaZhou Hong, Anhui University of Finance and Economics, China

Copyright © 2025 Zhao, Li, Zhang and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shuqi Li, MTcxMDA2MUBxcS5jb20=

Jin Zhao1

Jin Zhao1 Shuqi Li

Shuqi Li Linrong Zhang

Linrong Zhang