- College of Management and Economics, Tianjin University, Tianjin, China

This study examines the impact of non-financial enterprises’ shadow lending activities on the survival of small and micro enterprises (SMEs) in China. Utilizing panel data from 243 prefecture-level cities from 2012 to 2021 and applying the Spatial Durbin Model (SDM), we explore both direct and spatial spillover effects of shadow lending on SME mortality. Our empirical findings suggest that non-financial enterprises’ shadow lending significantly reduces the local SME mortality rate, while spatial econometric analysis reveals positive spillover effects, whereby shadow lending in one region enhances SME survival in neighboring areas through cross-regional financial linkages. Heterogeneity analyses indicate that these effects are more prominent in the economically developed southeastern regions, while being relatively weaker in less-developed northwestern areas, reflecting disparities in financial accessibility. Robustness checks and lagged effect analyses confirm the consistency and persistence of our findings. While shadow banking improves SME resilience through regional transmission, it may also carry potential financial risks. This study innovatively focuses on the spatial spillover effects of shadow lending by non-financial enterprises on SME survival, an area largely overlooked by previous studies. By integrating spatial econometric analysis and examining systemic vulnerabilities, this paper provides new insights into the regional complexity of informal finance.

1 Introduction

Small and micro enterprises (SMEs) play an integral role in economic systems worldwide, significantly contributing to employment generation, innovation diffusion, and sustained economic growth. In the context of China, SMEs form the backbone of the private economy and are closely linked to the nation’s overall economic resilience and structural vitality [1]. According to the Fourth National Economic Census Series Report released by the National Bureau of Statistics, SMEs represent approximately 99.8% of all corporate legal entities in China1, underscoring their vital role in the national economic structure. Notably, micro enterprises alone account for 85.3%. These firms are instrumental in employment absorption, accounting for 79.4% of the total workforce employed by enterprises as of the end of 2018, thereby mitigating unemployment pressures and enhancing labor market inclusivity.

Moreover, SMEs are essential for promoting regional economic development and expanding production capacity. Together, they contribute 77.1% of corporate assets and 68.2% of enterprise revenue, underscoring their significance in capital formation and income generation. Despite their limited individual scale, SMEs demonstrate high responsiveness to market conditions, efficient utilization of localized resources, and adaptive organizational structures. These characteristics enable SMEs to act as dynamic agents within regional production systems, stabilizing output and facilitating industrial upgrading. Consequently, SMEs not only inject dynamism into the economy through operational flexibility and innovation but also serve as critical risk transmission nodes in the broader economic and production network.

However, SMEs often face elevated operational risks and long-term survival challenges due to inherent limitations in organizational resources, financing access, technological adoption, and managerial capabilities [2, 3]. Among these constraints, limited access to formal financing channels remains one of the most significant barriers to their sustainable development. In the traditional banking system, strict collateral requirements, credit evaluation standards, and information asymmetry frequently hinder SMEs from securing formal credit, driving them to seek alternative and informal financing channels which may carry higher level of financial risks. Access to finance for SMEs is not uniform across regions. [4] demonstrate that during the financial crisis in the United Kingdom, SMEs in regions distant from bank headquarters experienced more significant credit constraints due to a “flight to headquarters” effect. Similarly, [5] identify a “low SME equity equilibrium” in Wales, characterized by both low demand and supply of equity, with a concentration of deals in urban centers like Cardiff. These studies underscore the spatial disparities in SME financing, justifying our geographical approach to examining shadow banking’s role in SME survival.

In practice, many SMEs struggle to obtain loans from commercial banks, primarily due to inadequate collateral and limited financial transparency [3, 6]. To address short-term liquidity needs, these firms often rely on informal financing sources, including trade credit, private lending, and underground finance. Within this context, shadow banking has emerged as a crucial alternative financing mechanism [7]. Unlike traditional financial institutions, shadow banking entities operate with greater flexibility, more complex intermediation structures, and less stringent regulatory oversight, thus offering SMEs an important, though risky, channel for capital access.

The involvement of non-financial enterprises in shadow banking activities adds further complexity to the financing ecosystem. In particular, when non-financial listed companies engage in credit intermediation through entrusted loans, entrusted financing, or off-balance-sheet instruments, they contribute to the formation of non-traditional financial linkages within the corporate sector. These practices can partially alleviate the financing constraints faced by SMEs, especially as larger, state-affiliated firms typically have preferential access to formal banking credit [8]. As a result, non-financial enterprises may function as informal financial intermediaries, redistributing capital across enterprises in ways that are not captured by conventional financial intermediaries. While this type of credit intermediation could improve liquidity for constrained SMEs and enhance their survival prospects, it also introduces new systemic risks. The shadow banking system lacks formal risk assessment frameworks and prudential controls, and the credit it extended is often characterized by higher costs and shorter maturities. These factors can create adverse financial incentives and exacerbate the debt burden of SMEs, potentially increasing the likelihood of firm exit. Furthermore, due to the inter-enterprise nature of shadow credit flows, financial stress in one segment of the production system may be transmitted to other firms through capital linkages, thereby generating contagion effects within the regional economy.

This study addresses two key research questions: (1) How does shadow lending by non-financial enterprises influence the survival rates of SMEs within a region? (2) Are there spatial spillover effects through which shadow lending activities affect SME survival in neighboring regions? Following this, we examine the implications of shadow lending activities by non-financial enterprises on the survival dynamics of SMEs at the regional level. Specifically, we examine how informal credit flows originating from non-financial listed companies influence the mortality rate of SMEs within the same region. In addition, the study explores the presence of spatial spillover effects, assessing whether credit diffusion through shadow banking channels affects SME survival in neighboring regions via interregional financial linkages. To capture these dynamics, the study employs spatial econometric techniques, which are particularly well-suited to identify geographically distributed effects and interdependencies. By analyzing spatial correlation patterns in SME mortality, this paper uncovers how the informal financial system contributes not only to localized economic outcomes but also to broader systemic phenomena such as regional risk transmission, financial contagion, and structural vulnerability. The empirical results suggest that shadow banking provides vital liquidity support to financially constrained SMEs, particularly in regions underserved by formal financial institutions. While this financing channel appears to alleviate immediate funding pressures and enhance firm survival, the potential long-term implications remain ambiguous. Given the higher cost and lower regulatory oversight associated with shadow credit, concerns about financial fragility persist. Furthermore, the spatial spillover effects identified in the analysis imply that localized financial dynamics may propagate through interregional linkages, warranting further investigation into their systemic implications.

By integrating insights from the literature on financial intermediation, financial networks, and spatial spillover, this study contributes to a deeper understanding of the complex interdependencies between informal finance and enterprise dynamics. It emphasizes that shadow banking should be viewed not merely as a supplementary financing channel, but as a structurally embedded component of the production system with both stabilizing and destabilizing potential. Accordingly, the findings carry important policy implications for improving the governance of informal financial activity, managing systemic risk, and fostering the long-term resilience of SMEs in an increasingly networked financial environment.

The remainder of this paper is structured as follows. Section 2 reviews the relevant literature and develops the corresponding research hypotheses. Section 3 describes the dataset, which includes annual data from 2012 to 2022 on shadow lending activities by non-financial enterprises and the SME mortality across 243 prefecture-level cities in China. This section also outlines the data processing procedures, definitions of key variables, and the specification and diagnostic testing of the spatial econometric models employed. Section 4 presents the empirical analyses of the impact of non-financial enterprise shadow banking on regional SME mortality rates, employing the Spatial Durbin Model (SDM) as the primary estimation approach. Section 5 conducts robustness checks to verify the consistency of the findings. Section 6 provides additional analyses, including heterogeneity tests and an exploration of the spatial effects of policy shocks. Section 7 concludes the paper with a summary of key findings and policy implications.

2 Literature and hypotheses

From the perspective of financial intermediation theory, shadow banking functions as a non-traditional financial intermediary and plays a critical role in broadening credit supply and diversifying sources of financing [9]. In contrast to the traditional banking sector, which operates under stringent regulatory oversight and risk management protocols, shadow banking is characterized by greater operational flexibility. This flexibility enables it to provide supplementary liquidity during periods of credit contraction. Consequently, shadow banking has become particularly instrumental in supporting firms that are unable to secure financing through formal banking institutions, especially micro and small enterprises. These enterprises frequently face significant barriers to accessing affordable credit, and shadow banking serves as an alternative financing channel that effectively alleviates their funding constraints [7]. Recent evidence based on the TENET framework suggests that financial risk may spread more rapidly within shadow banking networks during tail events [10].

A substantial gap exists between the financing needs of SMEs and the supply capacity of the traditional financial system. Due to a lack of sufficient collateral and pronounced information asymmetries with banks, SMEs are often excluded from formal credit markets [2, 11]. As a result, many SMEs are compelled to rely on non-traditional financing channels, such as informal lending and trade credit, to sustain their daily operations. Shadow banking, functioning as a financing mechanism similar to trade credit, provides short-term liquidity to these firms, thereby helping them navigate temporary cash flow shortages and reducing the risk of business failure arising from disruptions in the capital chain. As a supplementary source of financing, shadow banking plays an especially important role when traditional financial institutions are unable to meet the funding needs of SMEs. It thus emerges as a critical alternative channel through which financially constrained firms can access much-needed capital [12, 13]. Network-based models show that incorporating inter-firm relationships can improve credit risk prediction for SMEs with limited data [14].

The diversification of financing channels plays a significant and positive role in the survival of SMEs. [15] emphasize that SMEs require different types of financing at various stages of their development, and that access to a diversified set of financing options is essential for their sustained growth. [3] further demonstrate that SMEs are subject to more severe financial and legal constraints compared to larger firms, and that the diversification of financing channels can help alleviate these constraints and facilitate enterprise growth. The effect of financing diversification on systemic risk depends on the structure of financial networks [16].

Although part of the credit demand of SMEs has been met, a substantial portion of latent demand remains unmet and has not been translated into actual financing. This further underscores the role of shadow banking in filling the gaps left by the traditional financial system by providing flexible financing mechanisms. Shadow banking can offer an alternative source of capital for SMEs, helping them overcome liquidity constraints and reducing the risk of bankruptcy caused by financing difficulties. Shadow banking activities exhibit significant regional disparities. [17] find that in China, the impact of collateral monetary policy on shadow banking by non-financial firms varies across regions, influenced by local financial development levels. [18] further reveal that regional advancements in financial technology are positively associated with increased shadow banking activities among non-financial firms. These findings highlight the necessity of considering regional contexts when analyzing shadow banking phenomena. In addition to regional factors, macro-level economic policies and regulations have significant effects on the growth of shadow banking. [19] argue that fintech innovations and regulatory arbitrage contribute to the rise of shadow banks, highlighting how less regulated financial activities can thrive in the gaps left by formal banking systems. Furthermore, [20] demonstrate that collateral monetary policy and its impact on shadow banking vary significantly across firms and regions, emphasizing the importance of considering broader financial stability measures when examining shadow banking dynamics.

Accordingly, existing literature suggests that when non-financial enterprises provide financing to SMEs through shadow banking channels, it may alleviate their funding constraints, enhance their capacity to survive, and ultimately reduce firm exit rates. Based on this reasoning, the following hypothesis is proposed.

H1a. Non-financial enterprises’ shadow lending activities reduce local SMEs’ mortality rate.

However, although shadow banking may to some extent alleviate short-term liquidity constraints and expand financing channels for SMEs, its high interest rates and elevated financing costs may also exert adverse effects on the long-term financial health of these firms. [21] points out that while informal financing can facilitate access to capital, it does not exhibit a significant positive correlation with long-term firm growth or productivity.

Furthermore, although the financing terms offered by shadow banking institutions are generally more flexible than those of traditional banks, they are often associated with higher interest rates and less transparent contractual conditions. [22] argue that while borrowing from multiple lenders may increase short-term liquidity, such dispersed lending relationships often result in higher overall financing costs. For SMEs that rely on shadow banking, the inherent risks and opaque lending terms further exacerbate financial pressures and may undermine their long-term viability.

Moreover, the study by [23] indicates that although increased competition in the credit market may lead to lower lending rates, such rate reductions do not significantly expand the credit available to SMEs, particularly in the presence of persistent financing constraints. This suggests that even when shadow banking provides an alternative source of financing, firms may still face considerable financial burdens arising from high costs and elevated risks, which could ultimately increase their probability of default. Based on the above theoretical and empirical insights, it can be inferred that while shadow banking offers short-term liquidity support, its high-risk and high-cost nature may intensify financial stress for firms. This effect is likely to be more pronounced in unstable financial environments, potentially exacerbating the failure rates of SMEs. Therefore, the following hypothesis is proposed.

H1b. Non-financial enterprises’ shadow lending activities improve local SMEs’ mortality rate.

When examining the mortality of SMEs, it is essential to consider both region-specific factors and spatial interdependence, which refers to the mutual influences across geographic areas. The mortality of SMEs in one region may be shaped by economic activity in neighboring regions. The interregional flow of financial resources, spillover effects along industrial and supply chains, and the spatial diffusion of economic activity can all influence the business environment and the survival prospects of firms in adjacent areas [24]. Studies in spatial econometrics have shown that regional economic activities exhibit significant spatial spillover effects [25]. The survival or failure of firms is often affected by surrounding economic conditions. For example, [26] find that the emergence of new firms within a region can indirectly affect regional employment and economic development by enhancing competition and improving supply conditions.

Second, the flow of funds within the shadow banking system may also generate spatial spillover effects. Financing activities conducted by non-financial enterprises through shadow banking channels may not only affect SMEs within the local region but may also influence the financing environment and survival conditions of SMEs in neighboring areas through interregional financial linkages. Existing studies have shown that entrusted loans, as a component of shadow banking activities, can facilitate the cross-regional allocation of capital and thereby influence the distribution of financial resources and financing conditions across regions [27]. This effect is particularly pronounced in regions with a high degree of economic integration, where the flow and allocation of shadow banking capital may exert either positive or negative spillover effects on nearby SMEs. [21] find that the extent of dependence on shadow banking varies across regions, with firms in coastal areas being more reliant on shadow banking compared to those in central regions. Such disparities in capital flows may result in uneven financing capacities among SMEs across different regions, thereby influencing their mortality.

These findings suggest that the flow of shadow banking capital may produce spatial spillover effects through interregional financial interactions, ultimately shaping the survival prospects of SMEs. Therefore, it is necessary to account for the spatial correlation of SME mortality and the spatial spillover effects arising from non-financial enterprises’ shadow lending activities. Based on the above analysis, the following hypothesis is proposed.

H2. The mortality of SMEs exhibits spatial dependence, and non-financial enterprises’ shadow lending activities generate spatial spillover effects on SME mortality across regions.

3 Empirical design

3.1 Sample data

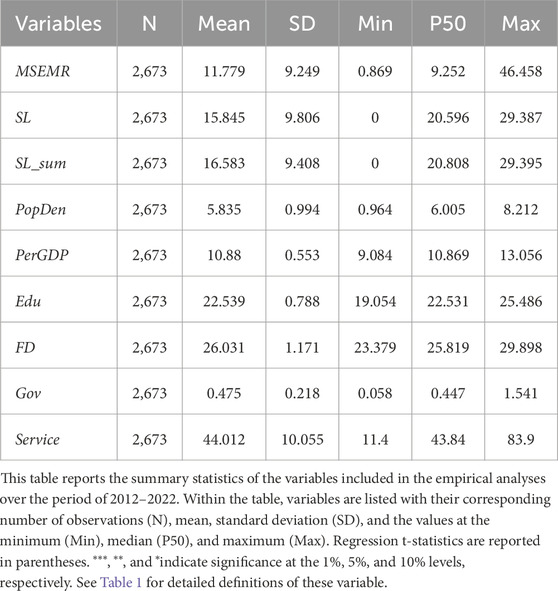

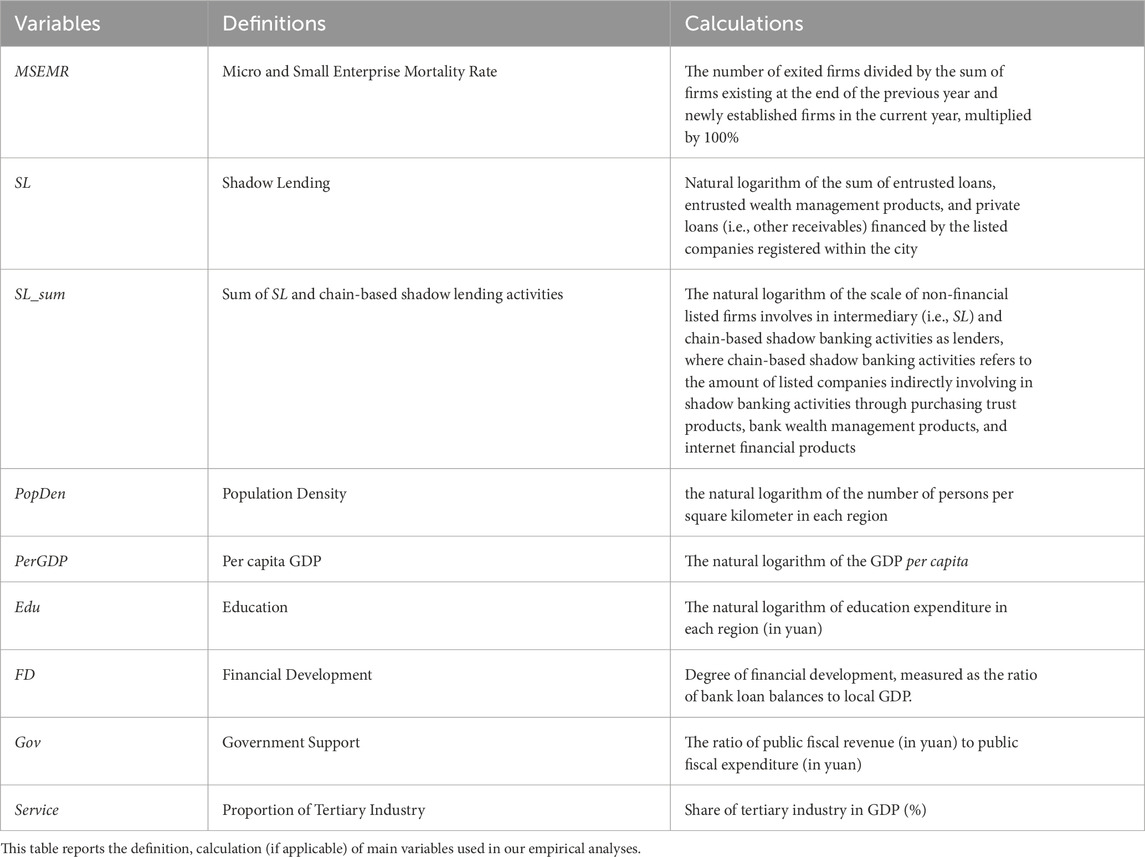

To examine the impact of shadow lending of non-financial enterprises on the regional survival environment of SMEs, our study focuses on a sample of 243 prefecture-level cities in China over the period from 2012 to 2022. The empirical analysis relies on three main types of data. First, data on non-financial enterprises’ shadow lending activities are obtained from the CNRDS database. Second, data used to measure SME mortality are derived from the industrial and commercial enterprise registration records available through AiQicha. Following the classification criteria proposed in the Opinions of the State Administration for Industry and Commerce on Further Improving the Development of the Micro and Small Enterprise Directory (Gongshanggezi [2015] No. 172), enterprises with registered capital of 5 million RMB or less are classified as micro and small enterprises. Third, data used to construct the spatial weight matrices and regional-level control variables are drawn from the China Statistical Yearbook and the CNRDS database. To minimize the influence of outliers, all continuous variables are winsorized at the 1% level. After data cleaning and processing, the final balanced panel includes 2,673 city-year observations. Descriptive statistics of all variables are presented in Table 1.

3.2 Testing the applicability of the spatial econometric model

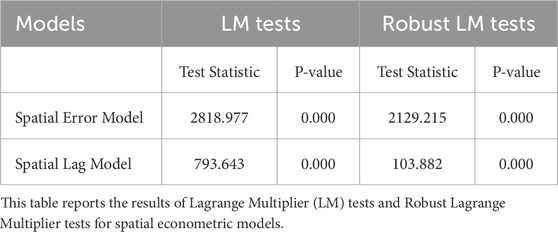

Before selecting an appropriate spatial econometric model, it is standard practice to conduct a series of specification tests to assess model suitability. Commonly used spatial econometric models include the Spatial Lag Model (SLM), the Spatial Error Model (SEM), and the Spatial Durbin Model (SDM). To determine the most appropriate model for this study, this section first applies the Lagrange Multiplier (LM) test and the Robust LM test to the data. If the results indicate the presence of only spatial error dependence, the SEM is considered more appropriate. If only spatial lag dependence is significant, the SLM is preferred. However, if both effects are found to be statistically significant, the SDM is deemed the most suitable specification [28, 29]. The SDM allows for more complex spatial interactions, making it more suitable for analyzing spatially dependent data in our study.

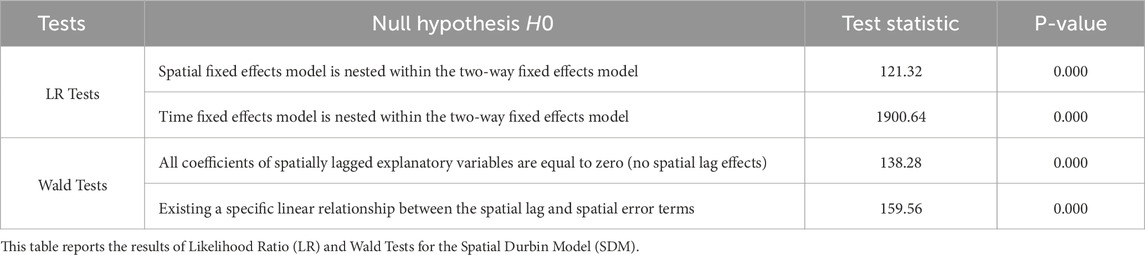

According to the LM and Robust LM test results presented in Table 2, both spatial error dependence and spatial lag dependence are statistically significant (P < 0.01), indicating that the SDM is more appropriate for the analysis in this study. Subsequently, a Hausman test is conducted to determine whether to adopt a random effect or fixed effect specification. The test yields a statistic of 29.1858 with a p-value of 0.0001, leading to the rejection of the null hypothesis. Therefore, the fixed effects SDM is selected. Finally, post-estimation diagnostic tests including the Wald test and the Likelihood Ratio (LR) test are employed to examine whether the SDM can be simplified to either the SLM or SEM specification.

As shown in Table 3, the results of the LR tests reject the null hypothesis, indicating that the two-way fixed effects model is more appropriate. The Wald test further confirms the significance of spatial lag effects and suggests that there is no simple linear relationship between the spatial lag term and the spatial error term. Therefore, the SDM is better suited to capture spatial dependence and spatial spillover effects, making it a more appropriate choice for the empirical analysis in this study.

3.3 Specification of the spatial durbin model and variable definitions

Given the complexity of capital flows involved in the non-financial enterprises’ shadow lending activities, and the difficulty in tracing the destination of such funds at the individual level within the sample of listed firms, it is plausible that these activities generate spatial spillover effects on SMEs in neighboring regions. To capture these cross-regional financial interactions and economic fluctuations, we constructs a spatial weight matrix to reflect the spatial interdependence across regions. Based on the applicability tests conducted in the previous section, the SDM is selected as the appropriate framework for analyzing both the direct impact of shadow banking by non-financial enterprises on regional SME mortality and its potential spillover effects on adjacent areas. The model is specified in Equation 1:

where

To mitigate the influence of spurious correlations on the empirical results, we select a set of regional-level control variables. Specifically, the following variables that may affect the volume of credit disputes are included: population density (

In conventional non-spatial regression models, the magnitude of the regression coefficients can be directly interpreted as the marginal effects of explanatory variables on the dependent variable. However, as discussed earlier, due to the presence of spatial dependence in spatial econometric models, explanatory variables in a given region may not only influence the local dependent variable but also exert indirect effects on neighboring regions through spatial interaction mechanisms. Therefore, once spatial lag terms are included in the model, the estimated coefficients cannot be directly interpreted as the total effects of the explanatory variables on the dependent variable [28, 29]. To address this issue, spatial effects are decomposed following the methodology proposed by [28]. A significantly positive direct effect indicates that non-financial enterprises’ shadow lending activities increase the mortality of SMEs within a region, thereby supporting Hypothesis H1b. Conversely, a significantly negative direct effect implies that such activities reduce SME mortality, supporting Hypothesis H1a.

If the spatial autoregressive coefficient

4 Empirical results

4.1 Test for spatial correlation

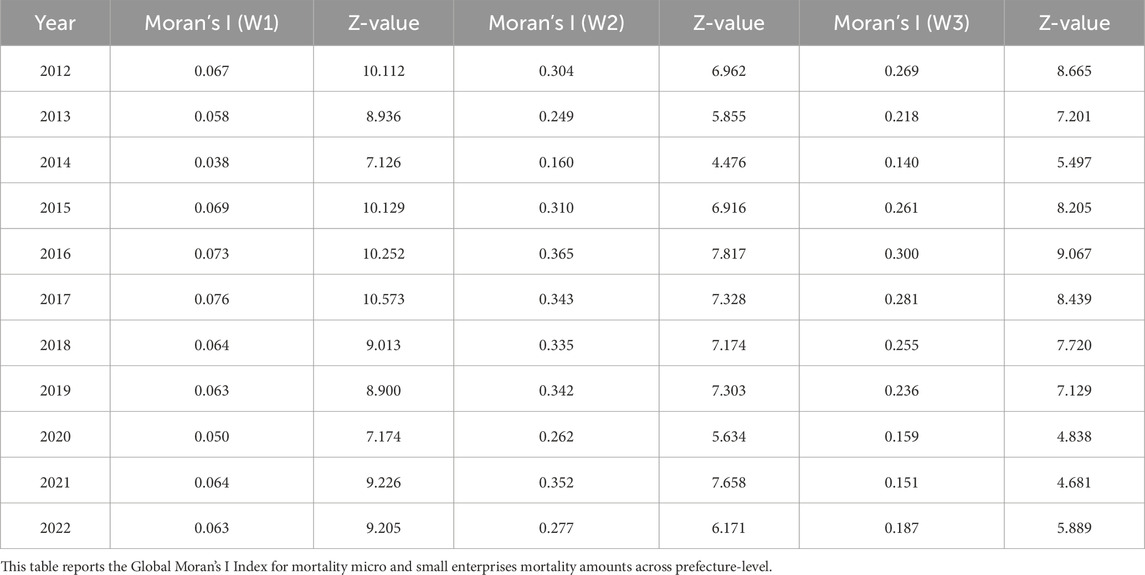

Before implementing Spatial Durbin Model (SDM), we conduct spatial correlation tests using the Global Moran’s I Index [30] and the Local Moran’s I Index [31] as part of a spatial exploratory analysis. These tests assess whether regional credit risks exhibit spatial dependence, justifying the use of spatial econometric models in subsequent analyses. The Global Moran’s I Index is used to test global spatial correlation, measuring the overall spatial distribution of regional credit risks. The formula for the Global Moran’s I Index is as follows:

where in Equation 2,

The significance of the spatial correlation is tested using the standardized Z-statistic, calculated as:

where in Equation 3,

In other words, if the business environment for SMEs is favorable in a given city, neighboring regions also tend to exhibit similarly favorable conditions for SME survival, and vice versa. This spatial clustering effect implies that the analysis of SME mortality should not be confined to individual cities but should instead account for cross-regional transmission mechanisms and interdependencies. Therefore, based on the results of the spatial correlation tests, it is both reasonable and necessary to adopt a spatial econometric approach to examine the impact of shadow lending of non-financial enterprises on SME mortality.

To further examine the spatial spillover effects of regional credit risks, we compute the Local Moran’s I Index for each city, assessing the statistical significance of spatial clustering patterns [31]. The Local Moran’s I Index is given by (see Equation 4):

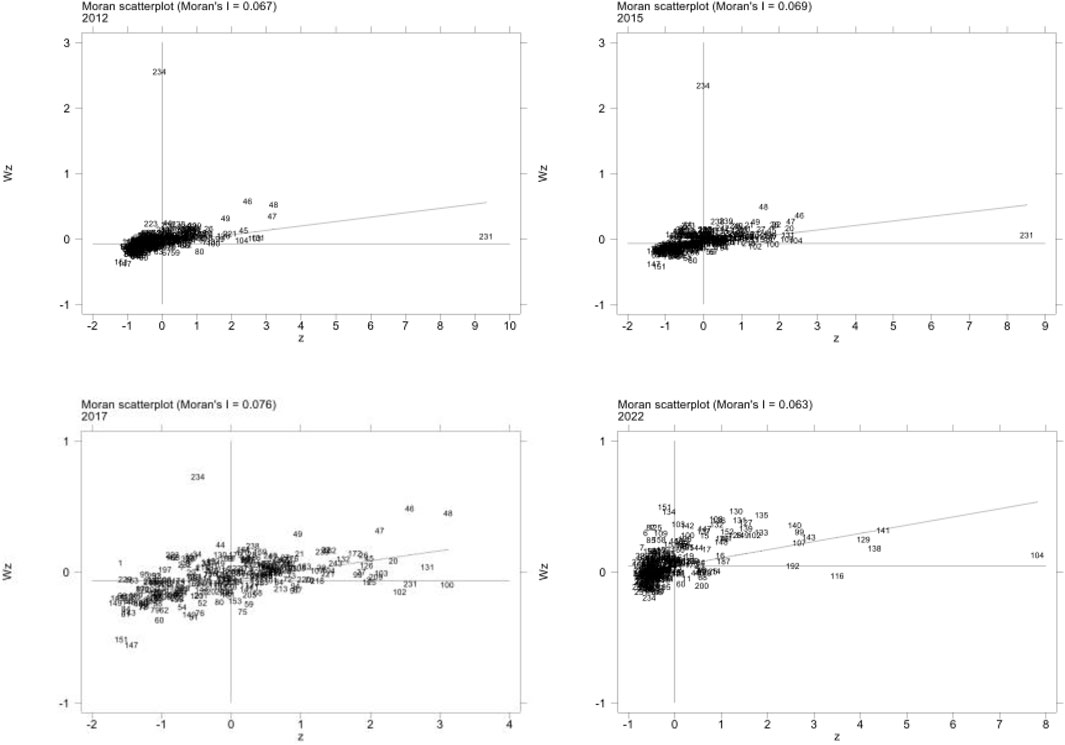

Using a distance-based spatial weight matrix (

4.2 Analysis of total effects

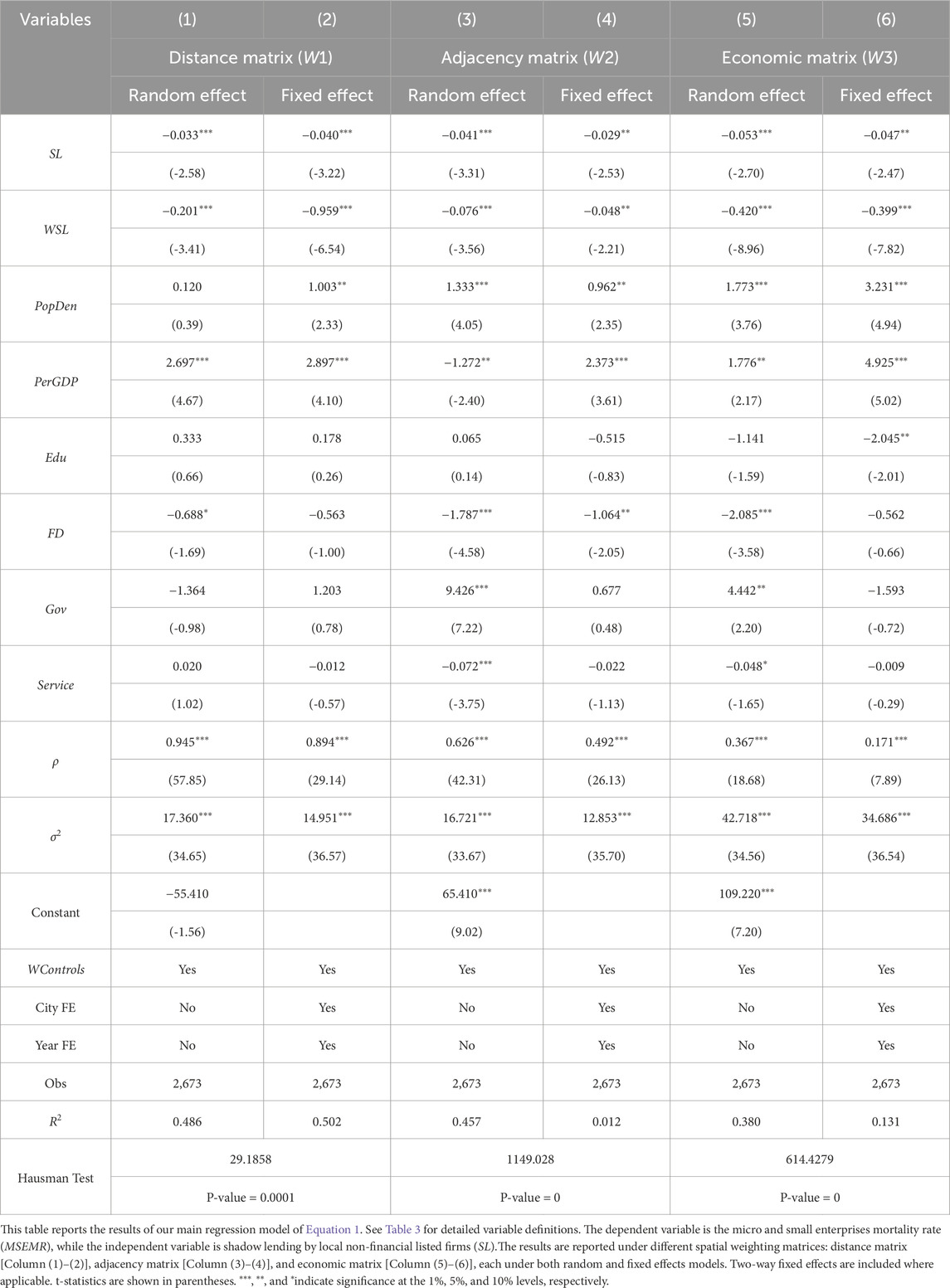

Based on Equation 1, this section analyzes the total effects of shadow lending of non-financial enterprises on the survival of SMEs, covering both local and neighboring regions. The estimation results of the SDM under three spatial weight matrices are presented in Table 6. The distance matrix (

As shown in Table 6, the estimation results from the SDM under all three spatial weight matrices indicate that the null hypothesis is rejected at the 1% significance level in the Hausman test. This finding is consistent with the results reported in Section 3.1, suggesting that the fixed effects SDM provides a better fit for the data and is therefore adopted for interpretation. Furthermore, the coefficient of the spatially lagged dependent variable (

With respect to the core explanatory variable, the coefficient of shadow banking by non-financial enterprises (

4.3 Analysis of decomposed effects

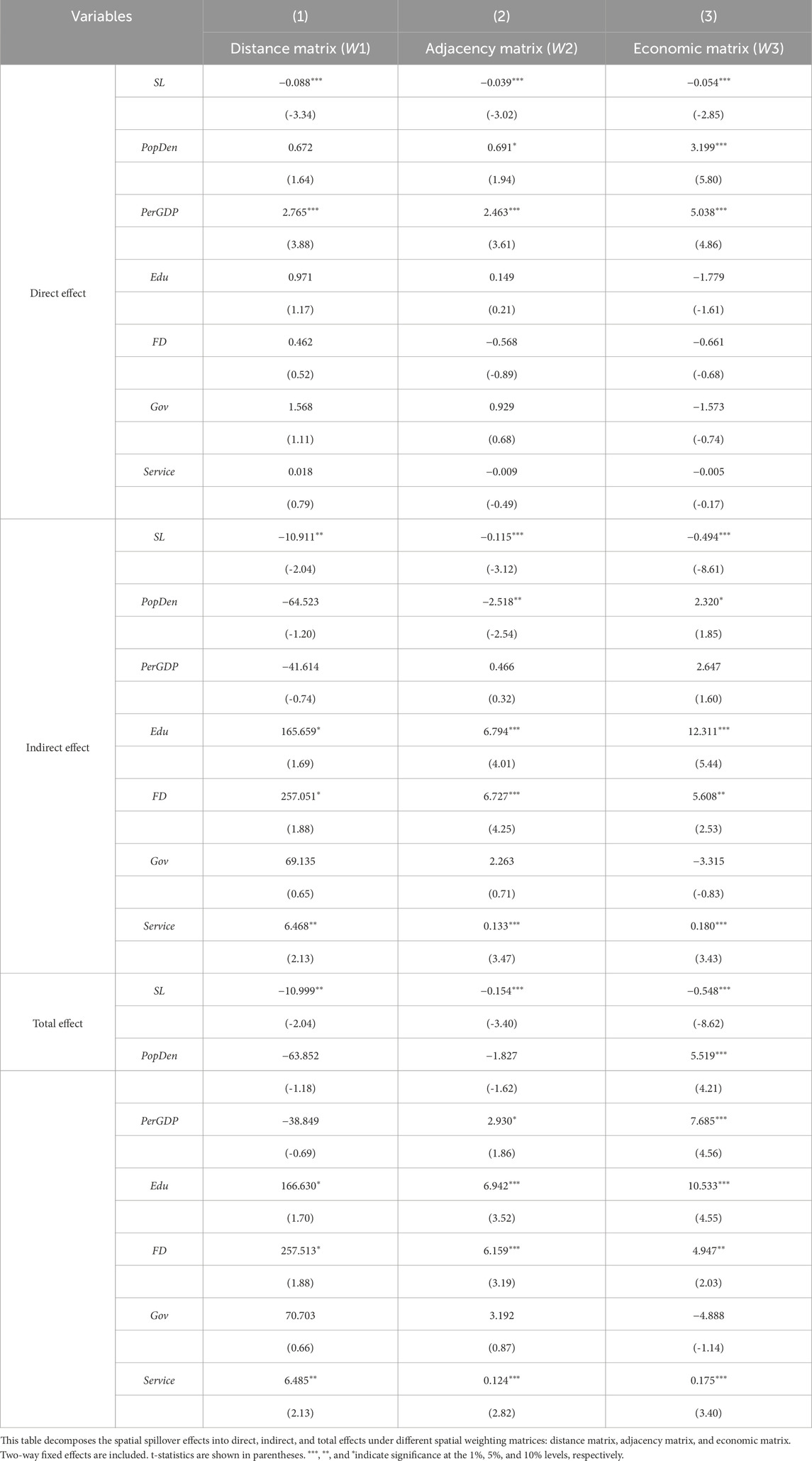

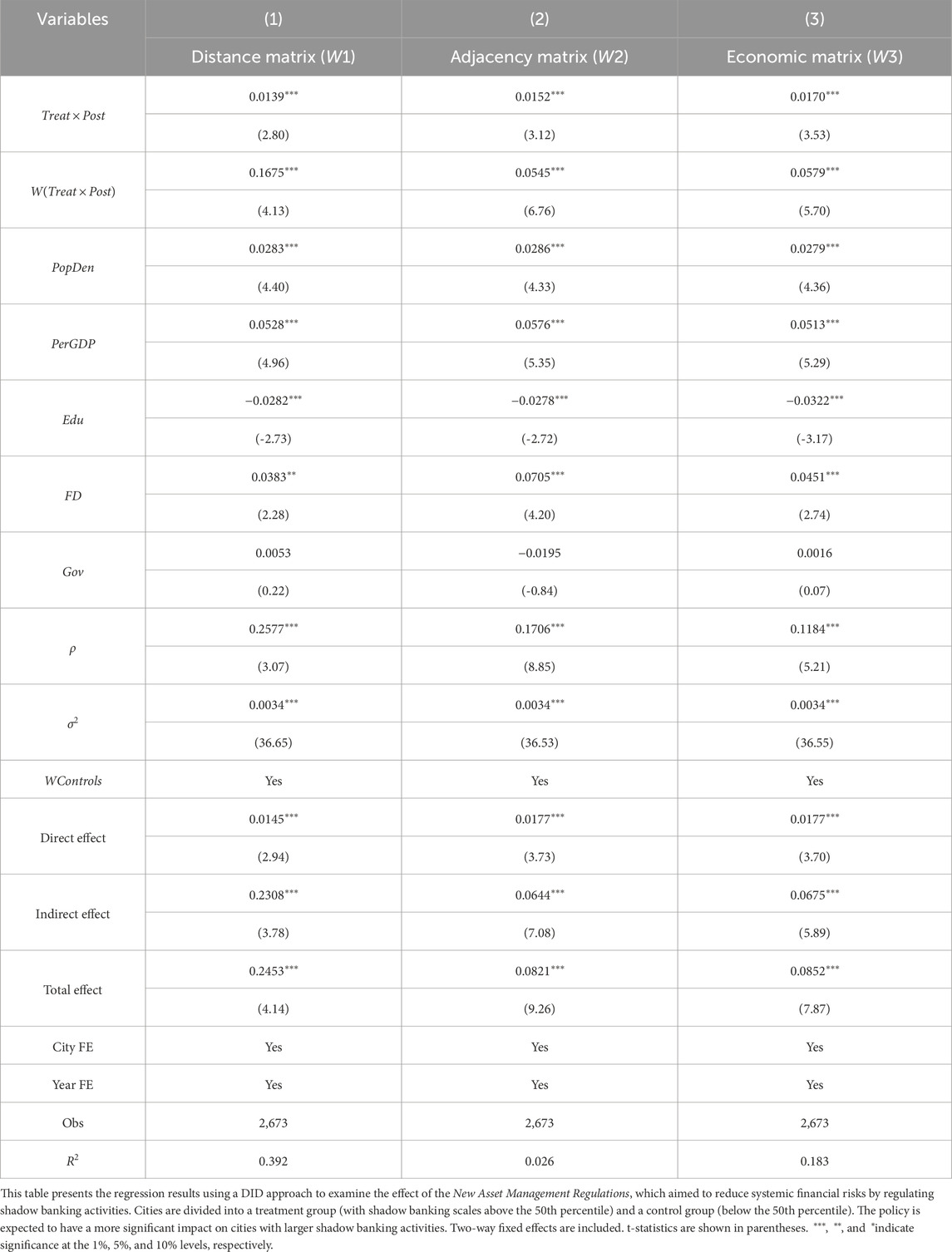

As discussed in Section 3.2, regional credit risk exhibits spatial contagion. When shadow lending by non-financial enterprises in one city affects the credit risk in other cities, the resulting spillover effects may in turn influence the originating city. Therefore, although the regression coefficients reported in Table 6 provide useful insights, they cannot be directly interpreted as the total or spillover effects of the explanatory variables on the dependent variable. To more accurately assess the spatial spillover effects of shadow lending of non-financial enterprises on both local and neighboring SME mortality, this section adopts the methodological framework proposed by [28]. Specifically, the SDM estimation results under the two-way fixed effects specification reported in Table 6, including Models (2), (4), and (6), are decomposed into direct effects, indirect effects, and total effects. The decomposition results for each variable are presented in Table 7.

Regarding the direct effects, the non-financial enterprises’ shadow lending activities exhibit significantly negative direct effects under all three spatial weight matrices (

Interestingly, among the control variables, educational expenditure (

Regarding the total effects, shadow banking by non-financial enterprises exhibits significantly negative total effects under all three spatial weight matrix specifications. This finding further confirms that shadow banking not only directly improves the local survival environment of SMEs but also benefits SMEs in neighboring regions through spatial spillover effects. Among the control variables, the significantly positive total effects of educational expenditure and financial development reinforce their role in increasing the survival pressure faced by SMEs.

In summary, both the direct and indirect effects of shadow banking by non-financial enterprises are significantly negative. This indicates that such activities not only enhance the survival environment for local SMEs but also improve the survival conditions of SMEs in neighboring regions through spatial spillovers. These results suggest that shadow lending helps alleviate financing constraints faced by SMEs, strengthens their resilience against risk, and enhances their competitiveness in the market. The shadow banking system provides a more flexible source of financing for these firms, especially in contexts where formal financial institutions are unable to fully meet their funding needs. As a result, shadow banking contributes to extending the life cycle of SMEs and reducing their mortality. Our findings align with prior research indicating that shadow banking activities can alleviate financing constraints for SMEs, thereby reducing their mortality rates [7, 12]. Additionally, the observed spatial spillover effects are consistent with studies highlighting the role of informal financial channels in facilitating inter-regional capital flows and influencing neighboring regions’ economic dynamics [26, 27].

From a spatial perspective, the flow of capital and the allocation of financial resources through shadow banking are not confined to individual regions but can cross administrative boundaries, producing significant spatial spillover effects. This reinforces the role of shadow banking in supporting the continuity and development of SMEs. The empirical findings validate Hypotheses H1a and H2, indicating that shadow banking by non-financial enterprises significantly reduces SME mortality within a given region and simultaneously enhances the survival environment of SMEs in adjacent areas through spillover mechanisms. Furthermore, the statistical significance of the distance, adjacency, and economic matrices suggests that the influence of shadow banking activities on regional economies is both extensive and complex. Shadow banking not only plays a positive role in improving the survival prospects of SMEs in the originating region but also generates meaningful indirect effects on neighboring regions through spatial network interactions. Overall, shadow banking has significant direct and indirect effects on SME survival, and these effects extend beyond geographic boundaries.

5 Robustness tests

To ensure the validity of the empirical findings, several robustness checks are conducted in this study. First, by using the distance matrix (

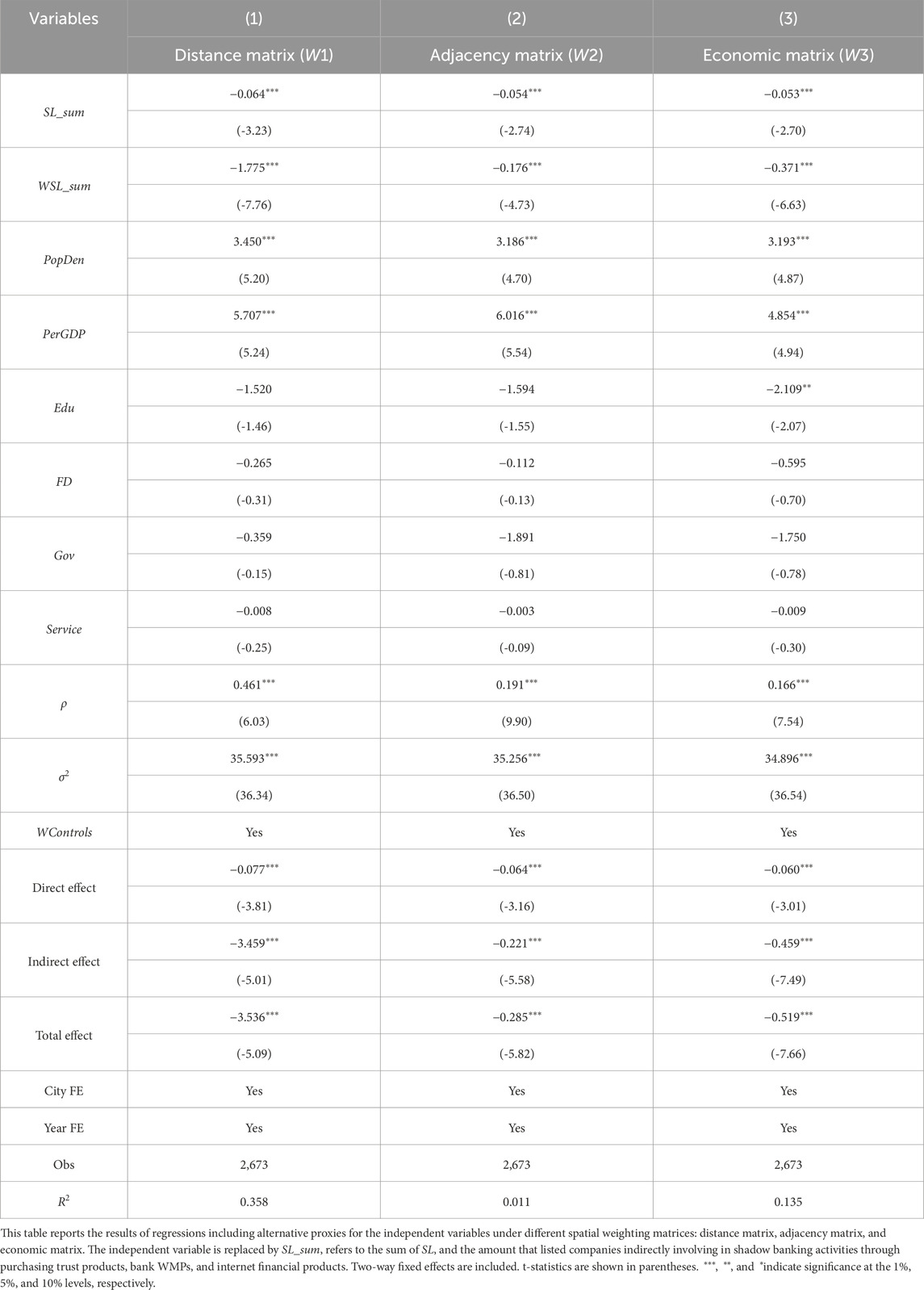

Next, to further test the robustness of the results, the explanatory variable is replaced with the natural logarithm of the sum of credit intermediation-type and credit chain-type shadow banking activities (

The results for the indirect and total effects further demonstrate that the expanded measure of shadow banking activity (

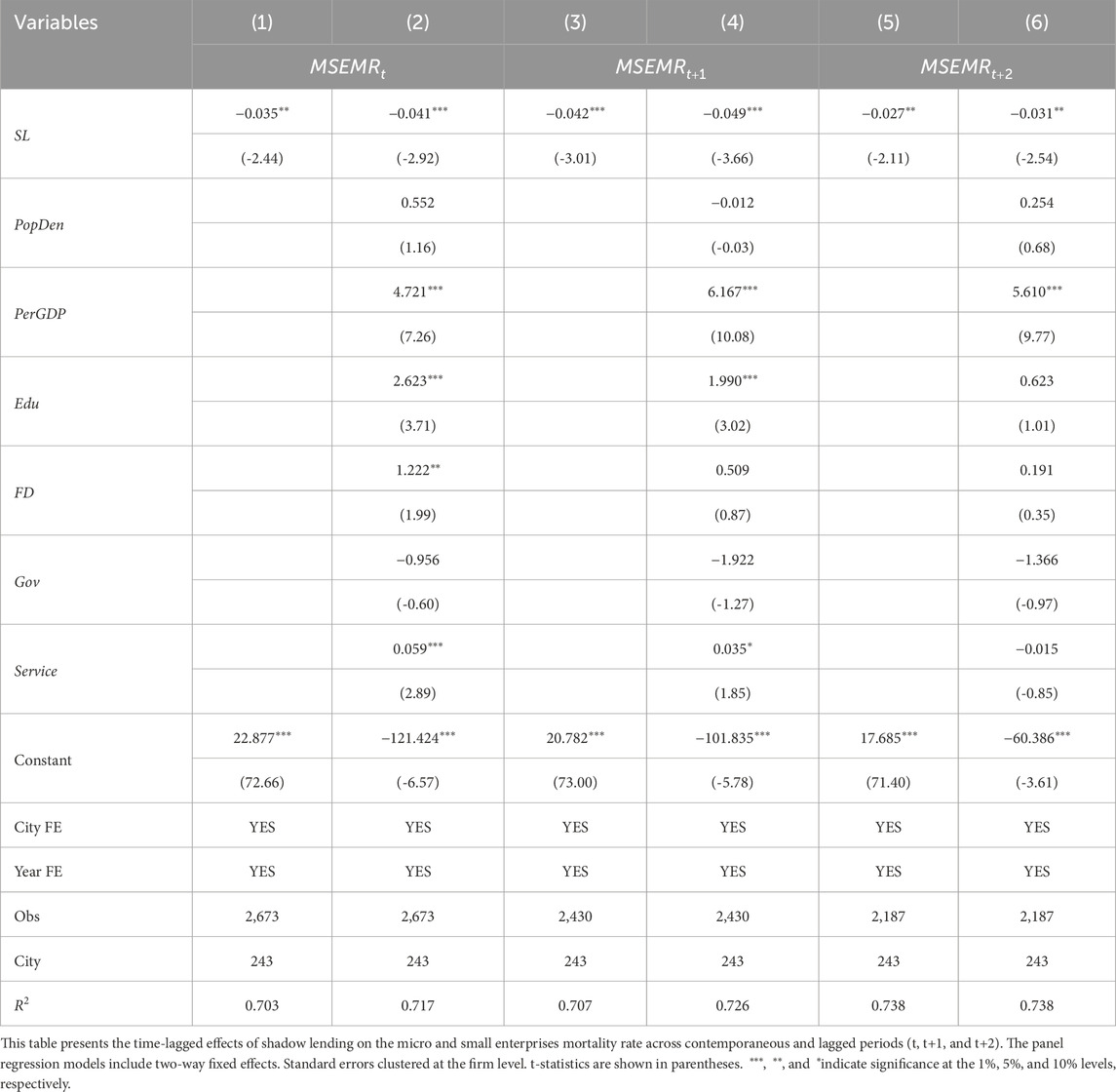

In addition, to further examine the long-term impact of shadow lending of non-financial enterprises on the survival of SMEs, a two-way fixed effects panel regression is employed to assess the effect of shadow banking on local SME mortality in periods

The regression coefficients of shadow lending are consistently and significantly negative across the models estimating its impact on SME mortality in periods

6 Further analysis

6.1 Regional heterogeneity analyses

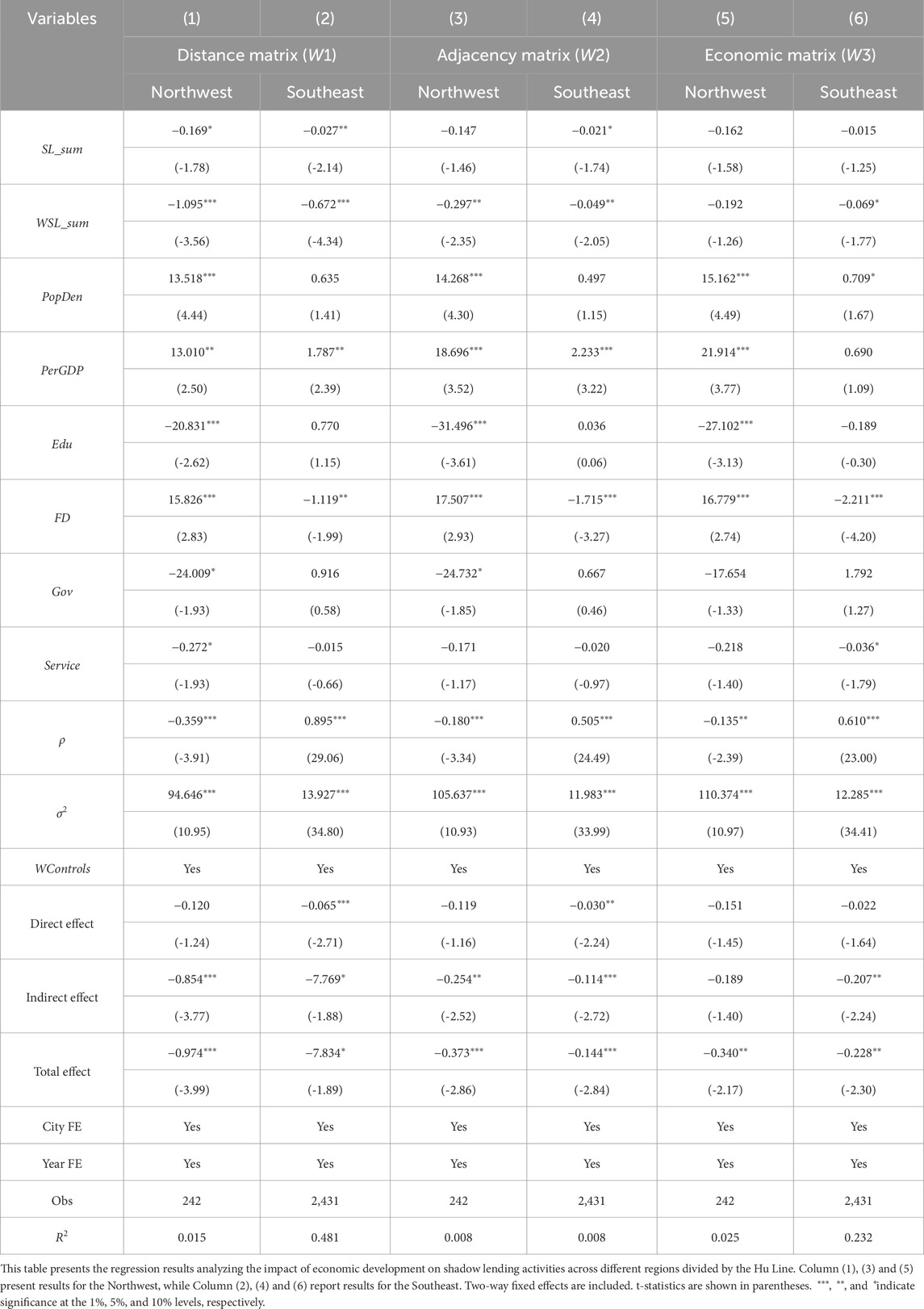

To examine whether the impact of shadow banking by non-financial enterprises on regional SME mortality varies across different regions, we further divide the sample of 243 cities into two groups based on the “Hu Huanyong Line”2 (“Hu line”), which geographically separates China into the southeastern and northwestern regions. The southeastern region is characterized by higher population density, greater urbanization, and more dynamic financial markets and business activities. In contrast, the northwestern region features lower population density, slower economic development, and relatively unbalanced financial growth.

As shown in the subgroup regression results in Table 10, the impact of shadow banking by non-financial enterprises on SME mortality is more pronounced in southeastern regions, while it is relatively insignificant in northwestern regions. In the southeast, the coefficient of shadow lending (

Moreover, the spatial lag term of shadow lending (

6.2 The impact of shadow banking by non-financial enterprises on regional firm survival

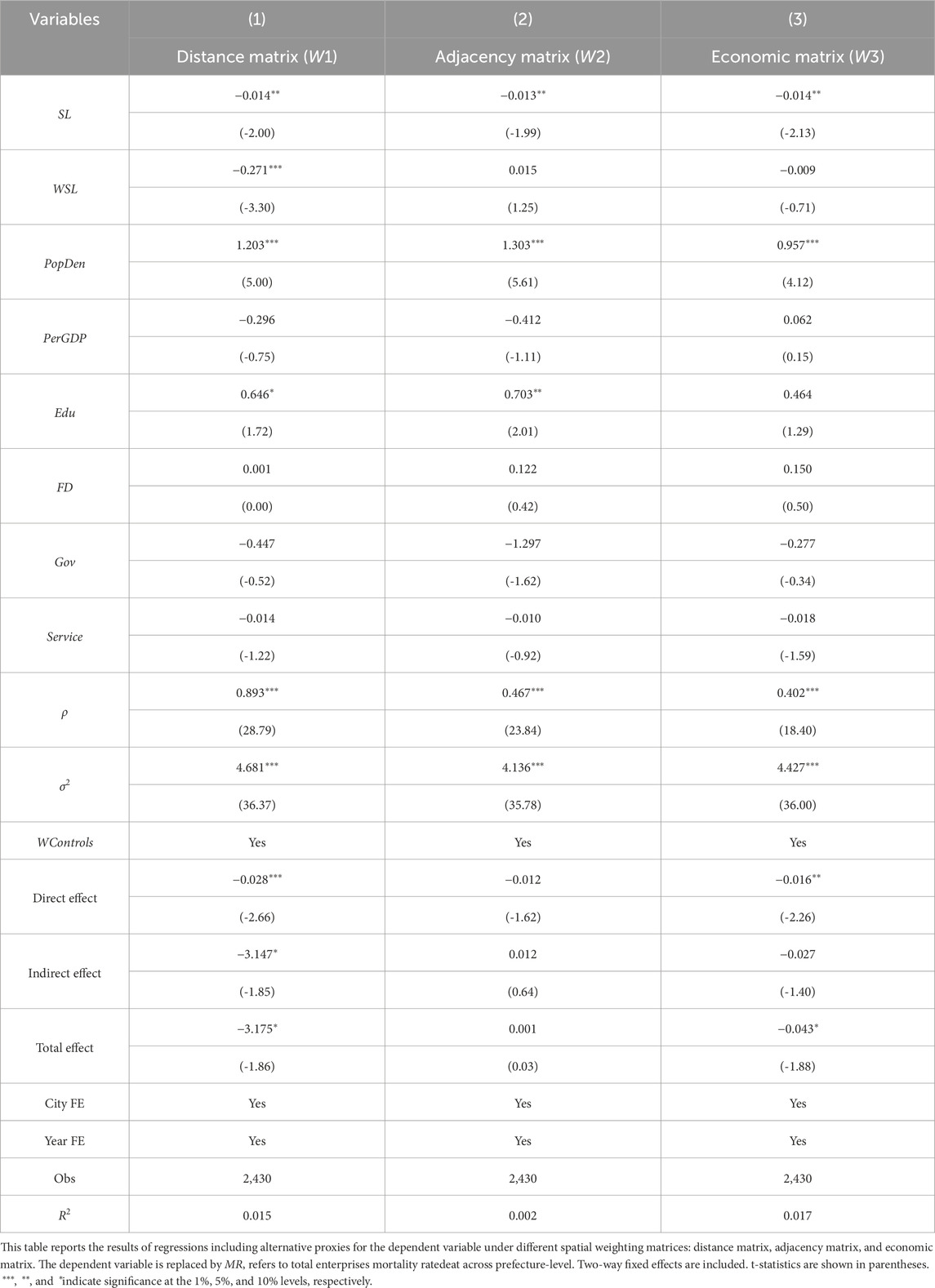

To further investigate the impact of shadow lending of non-financial enterprises on the regional business environment and its spatial spillover effects, this section expands the sample to include all enterprises. The estimation results of the SDM with two-way fixed effects under the three spatial weight matrix specifications are reported in Table 11.

The regression results indicate that shadow lending of non-financial enterprises continue to have a statistically significant effect on the mortality of all firms. The coefficient for shadow lending is negative and significant at the 5 percent level under all three spatial weight matrix specifications, suggesting that shadow banking significantly reduces overall firm mortality. This finding is consistent with the earlier results based on the SMEs subsample and further supports the positive role of shadow banking in enhancing firm survival and reducing firm exits. However, the decomposition of spatial effects reveals that the impact of shadow banking on overall firm mortality resembles that of SMEs only under the distance matrix (

Overall, the effect of shadow banking by non-financial enterprises on the survival of all firms appears to be less pronounced than its effect on SMEs. Both the direct effects on local firms and the indirect effects on firms in neighboring regions are relatively limited in magnitude.

6.3 Mechanism analysis: the impact of shadow banking by non-financial enterprises on the survival of micro and small enterprises

This section employs a difference-in-differences (DID) approach to evaluate the impact of the 2018 New Asset Management Regulations3, which sought to curb systemic financial risks by regulating shadow banking activities. The policy serves as an exogenous shock, allowing us to causally evaluate its effectiveness in reducing regional credit risks associated with shadow lending by non-financial enterprises.

As an informal financing channel, shadow banking serves as an important source of capital for SMEs that face difficulties in accessing traditional credit. However, the tightening of financial regulation directly affects the scale and liquidity of shadow banking. In particular, the implementation of the New Asset Management Rules had a direct impact on both the volume and flow of funds within the shadow banking system. While the primary objective of the policy tightening was to curb high-risk activities in shadow banking, which may have constrained credit supply in the short term, it also aimed to enhance long-term financial stability by reducing systemic risk through stricter oversight of risk-prone financial operations. To explore the underlying mechanism in greater depth, this section adopts a difference-in-differences (DID) approach combined with the Spatial Durbin Model (SDM) to examine the effects of the New AM Rules on shadow banking activities and their subsequent influence on SME survival. The SDM-DID model is specified as shown in Equation 5:

Using the shadow banking scale of non-financial enterprises at the prefecture-level as a benchmark, this section divides the sample into a treatment group (regions with shadow banking scale above the 50th percentile) and a control group (regions below the 50th percentile). This classification allows for a clearer assessment of how changes in shadow banking activity, before and after the policy implementation, influence SME mortality and provides a theoretical foundation for understanding the underlying mechanism through which shadow banking affects SME survival.

Table 12 reports the regression results from the SDM-DID model estimating the effects of the New Asset Management Rules. The key explanatory variable in this section is the interaction term

These results suggest that following the implementation of the New Asset Management Rules, SME mortality increased significantly in regions with larger shadow banking activity (the treatment group). As shown in the earlier sections of this study, shadow banking by non-financial enterprises plays a positive role in supporting the survival of SMEs by alleviating their financing constraints. However, the primary aim of the regulatory tightening was to reduce high-risk operations within the shadow banking system and to mitigate potential systemic financial risks. In the short term, such regulatory tightening may lead to the contraction of certain shadow banking channels, thereby reducing the scale of shadow banking and the volume of capital flowing to SMEs. As a result, SMEs that previously relied on these informal financing sources may face increased financial pressure due to diminished credit availability, ultimately contributing to a rise in their mortality.

Moreover, the impact of the policy is not limited to prefecture-level cities with larger shadow banking activity. It can also extend to neighboring regions through interregional financial linkages. The spatial spillover effect is preliminarily captured by the spatially lagged interaction term (

Overall, the New Asset Management Rules reduced the scale of shadow banking financing by strengthening regulatory oversight of high-risk activities. In the short term, this policy exerted considerable pressure on the survival environment of SMEs in regions with a high concentration of shadow banking activity and their neighboring areas, leading to increased financing costs and heightened financial stress for affected firms. However, the long-term objective of the policy is to safeguard the stability of the financial system by curbing excessive risk-taking and preventing systemic financial risks. As the policy continues to advance, the financial environment is gradually being cleansed, creating a healthier and more stable market foundation for the sustainable development of SMEs. In addition, the policy has effectively guided SMEs to reduce their dependence on shadow banking and to transition toward more sustainable and transparent financing channels. It has also contributed to a more efficient market selection process, enabling firms with sounder financial structures and stronger adaptive capacity to survive and grow. Although the mortality rate of SMEs has increased in the short term, the surviving firms are generally more resilient and competitive, thereby promoting sustained development within a more regulated financial system. In the long run, the New Asset Management Rules have laid an institutional foundation for the healthy growth of SMEs and the high-quality development of the sector as a whole.

7 Conclusion

This study empirically examines the critical role of non-financial enterprises’ shadow lending in shaping small and micro enterprises’ (SMEs) survival across Chinese regions by adopting the Spatial Durbin Model (SDM). Our findings show that shadow lending by non-financial enterprises significantly reduces local SME mortality, while also generating substantial spatial spillover effects, where credit diffusion through shadow banking activities improves SME survival in neighboring regions. This demonstrates that shadow banking not only supports SMEs in their originating regions but also creates favorable externalities across interconnected regional economies.

Our findings provide significant implications for both academic inquiry and policy design. By revealing that shadow banking significantly lowers SME mortality both locally and through regional spillovers, we provide empirical support to existing theoretical perspectives on the financial intermediation role of non-financial enterprises. Moreover, our results expand upon prior studies that have focused on the spatial distribution of shadow banking activities [17, 18] by demonstrating how such geographic patterns translate into measurable impacts on SME resilience. Our analysis further complements macro-level studies (e.g., [19, 20]) that highlight the role of regulatory arbitrage and systemic risk in shadow banking development. Integrating these insights, our research bridges micro-level firm dynamics with macro-level financial policy debates, offering a geographically grounded understanding of informal finance. These findings underscore the necessity for spatially differentiated regulatory strategies that reflect the uneven role and risks of shadow banking across regions.

In addition, the heterogeneity analysis reveals that the effects of shadow lending by non-financial enterprises are more pronounced in economically developed southeastern regions, with relatively weaker effects observed in the less developed northwest. This highlights the role of regional economic development in shaping the effectiveness of shadow banking as a financing tool for SMEs. Furthermore, robustness checks confirm the persistence of these positive effects over time, with shadow banking continuing to alleviate financing pressures for SMEs over two periods.

However, the informal nature of shadow banking introduces significant systemic vulnerabilities. The unregulated flow of credit can generate financial fragility, particularly in regions where SMEs heavily depend on informal financing channels. As these credit flows deepen, financial stress in one region can spread to others through inter-regional capital linkages, heightening the risk of financial contagion.

Based on these findings, we recommend that financial regulators develop a differentiated regulatory approach. While stricter regulations are needed in economically developed regions to manage the potential risks arising from shadow banking, less developed regions may benefit from more flexible policies that support SME financing. Moreover, cross-regional financial regulatory coordination is essential to manage systemic risks and prevent the propagation of financial stress between regions. Strengthening regional risk monitoring and establishing early warning systems are critical for mitigating the broader effects of financial contagion.

Overall, this study contributes to the understanding of shadow banking’s dual role in supporting SME survival while also exacerbating systemic risks. It highlights the need for tailored regulatory frameworks that consider both regional economic disparities and the cross-regional transmission of financial risks [32, 33].

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.cnrds.com/Home/Login.

Author contributions

CW: Software, Writing – original draft, Methodology. WZ: Writing – review and editing, Supervision. YM: Conceptualization, Writing – review and editing, Project administration. XX: Funding acquisition, Supervision, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work is supported by the National Natural Science Foundation of China (72141304, 72201190), and Key Program of the Ministry of Science and Technology, China (2022YFC3303304).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that Gen AI was used in the creation of this manuscript. During the preparation of this work, the authors used ChatGPT to assist in ONLY language refinement. The authors take full responsibility for the content of this publication.

Correction notice

This article has been corrected with minor changes. These changes do not impact the scientific content of the article.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1See: https://www.stats.gov.cn/sj/zxfb/202302/t20230203_1900574.html for more information.

2The Hu Huanyong Line, first proposed by Chinese demographer Hu Huanyong in 1935, is a demographic and economic dividing line that runs diagonally from Heihe in Heilongjiang province to Tengchong in Yunnan province. The southeastern side of the line contains approximately 94% of China’s population and economic activity, while the northwestern side is sparsely populated and less economically developed [34].

3The New Asset Management Regulations is short for the “Guiding Opinions on Regulating the Asset Management Business of Financial Institutions” (Yinfa [2018] No. 106) was issued by the People’s Bank of China, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and the China Banking and Insurance Regulatory Commission on 27 April 2018. (please refer to http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/3529600/index.html for more details)

References

1. Lin A, Peng Y, Wu X. Digital finance and investment of micro and small enterprises: evidence from China. China Econ Rev (2022) 75:101846. doi:10.1016/j.chieco.2022.101846

2. Carpenter RE, Petersen BC. Capital market imperfections, high-tech investment, and new equity financing. The Econ J (2002) 112(477):F54–F72. doi:10.1111/1468-0297.00683

3. Beck T, Demirgüç-Kunt ASLI, Maksimovic V. Financial and legal constraints to growth: does firm size matter? The J Finance (2005) 60(1):137–77. doi:10.1111/j.1540-6261.2005.00727.x

4. Degryse H, Matthews K, Zhao T. SMEs and access to bank credit: evidence on the regional propagation of the financial crisis in the UK. J Financial Stab (2018) 38:53–70. doi:10.1016/j.jfs.2018.08.006

5. Kapitsinis N, Munday M, Roberts A. Exploring a low SME equity equilibrium in Wales. Eur Plann Stud (2021) 29:1777–97. doi:10.1080/09654313.2021.1882945

6. Jin S, Wang W, Zhang Z. The real effects of implicit government guarantee: evidence from Chinese state-owned enterprise defaults. Management Sci (2023) 69(6):3650–74. doi:10.1287/mnsc.2022.4483

7. Lu Y, Guo H, Kao EH, Fung HG. Shadow banking and firm financing in China. Int Rev Econ & Finance (2015) 36:40–53. doi:10.1016/j.iref.2014.11.006

8. Du J, Li C, Wang Y. Shadow banking of non-financial firms: arbitrage between formal and informal credit markets in China. J financial intermediation (2023) 55:101032. doi:10.1016/j.jfi.2023.101032

9. Pozsar Z, Adrian T, Ashcraft A, Boesky H. Shadow banking. Econ Policy Rev (2013) 19(2):1–16. Available online at: www.newyorkfed.org/research/staff_reports/sr458.html.

10. Wang G-J, Feng Y, Xiao Y, Zhu Y, Xie C. Connectedness and systemic risk of the banking industry along the Belt and Road. J Management Sci Eng (2022) 7(3):303–29. doi:10.1016/j.jmse.2021.12.002

11. Bester H. The role of collateral in credit markets with imperfect information. Eur Econ Rev (1987) 31(4):887–99. doi:10.1016/0014-2921(87)90005-5

12. Agostino M, Trivieri F. Does trade credit play a signalling role? Some evidence from SMEs microdata. Small Business Econ (2014) 42:131–51. doi:10.1007/s11187-013-9478-8

13. Andrieu G, Staglianò R, Van Der Zwan P. Bank debt and trade credit for SMEs in Europe: firm-, industry-, and country-level determinants. Small Business Econ (2018) 51:245–64. doi:10.1007/s11187-017-9926-y

14. Li S, Wang C. Network structure, portfolio diversification and systemic risk. J Management Sci Eng (2021) 6(2):235–45. doi:10.1016/j.jmse.2021.06.006

15. Berger AN, Udell GF. The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J banking & Finance (1998) 22(6-8):1–69. doi:10.17016/feds.1998.15

16. Wang J, Liu G, Xu X, Xing X. Credit risk prediction for small and medium enterprises utilizing adjacent enterprise data and a relational graph attention network. J Management Sci Eng (2024) 9(1):177–92. doi:10.1016/j.jmse.2023.11.005

17. Yuan C, Jiang H, Ren J, Kapitsinis N. Collateral monetary policy, regional financial development, and nonfinancial firms’ shadow banking activities. China & World Economy (2024) 32:166–96. doi:10.1111/cwe.12552

18. Zhang Q, Que J, Qin X. Regional financial technology and shadow banking activities of non-financial firms: evidence from China. J Asian Econ (2023) 86:101606. Article No. 101606. doi:10.1016/j.asieco.2023.101606

19. Buchak G, Matvos G, Piskorski T, Seru A. Fintech, regulatory arbitrage, and the rise of shadow banks. J Financial Econ (2018) 130(3):453–83. doi:10.1016/j.jfineco.2018.03.011

20. Yuan C, Zhu Y, Kapitsinis N. Collateral monetary policy, shadow banking and bank risk: evidence from China. China Finance Rev Int (2025). doi:10.1108/cfri-07-2024-0423

21. Ayyagari M, Demirgüç-Kunt A, Maksimovic V. Formal versus informal finance: evidence from China. The Rev Financial Stud (2010) 23(8):3048–97. doi:10.1093/rfs/hhq030

22. Petersen MA, Rajan RG. The benefits of lending relationships: evidence from small business data. The J Finance (1994) 49(1):3–37. doi:10.1111/j.1540-6261.1994.tb04418.x

23. Rice T, Strahan PE. Does credit competition affect small-firm finance? The J Finance (2010) 65(3):861–89. doi:10.1111/j.1540-6261.2010.01555.x

24. Porter ME. Location, competition, and economic development: local clusters in a global economy. Econ Dev Q (2000) 14(1):15–34. doi:10.1177/089124240001400105

25. Anselin L. Spatial econometrics: methods and models. Dordrecht: Kluwer Academic Publishers (1988).

26. Fritsch M, Mueller P. Effects of new business formation on regional development over time. Reg Stud (2004) 38(8):961–75. doi:10.1080/0034340042000280965

27. Allen F, Qian Y, Tu G, Yu F. Entrusted loans: a close look at China’s shadow banking system. J Financial Econ (2019) 133(1):18–41. doi:10.1016/j.jfineco.2019.01.006

28. LeSage JP, Pace RK. Spatial econometric models. In: MM Fischer, and A Getis, editors. Handbook of applied spatial analysis: Software tools, methods and applications. Berlin, Heidelberg: Springer (2009). p. 355–76.

29. Elhorst JP. Applied spatial econometrics: raising the bar. Spat Econ Anal (2010) 5(1):9–28. doi:10.1080/17421770903541772

30. Moran PA. Notes on continuous stochastic phenomena. Biometrika (1950) 37(1/2):17–23. doi:10.2307/2332142

31. Anselin L. Local indicators of spatial association—LISA. Geographical Anal (1995) 27(2):93–115. doi:10.1111/j.1538-4632.1995.tb00338.x

32. Yang L, Hong Y, Zhang X, Zhang Q. Can FinTech alleviate the long-term use of short-term debts? Evidence from China. China Finance Rev Int (2024). doi:10.1108/cfri-06-2024-0329

33. Jiang K, Xie X, Xiao Y, Ashraf BN. The value of corporate digital transformation: evidence from bond pricing. China Finance Rev Int (2024) 15(1):43–66. doi:10.1108/cfri-05-2024-0241

Keywords: shadow banking, non-financial enterprises, spatial spillover, regional financial stability JEL classification: G23, G32, R12, C31, small and micro enterprises

Citation: Wang C, Zhang W, Meng Y and Xiong X (2025) Non-financial enterprises’ shadow lending and SME survival: the role of spatial spillovers in regional financial stability. Front. Phys. 13:1612653. doi: 10.3389/fphy.2025.1612653

Received: 16 April 2025; Accepted: 05 May 2025;

Published: 21 May 2025; Corrected: 28 May 2025.

Edited by:

Ze Wang, Capital Normal University, ChinaReviewed by:

You Zhu, Hunan University, ChinaNikos Kapitsinis, University of Copenhagen, Denmark

Esat Durguti, University of Mitrovica “Isa Boletini”, Kosovo

Copyright © 2025 Wang, Zhang, Meng and Xiong. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yongqiang Meng, eXFtZW5nQHRqdS5lZHUuY24=

Chen Wang

Chen Wang Wei Zhang

Wei Zhang Yongqiang Meng

Yongqiang Meng Xiong Xiong

Xiong Xiong