- 1College of Humanity and Foreign Language, Xi’an University of Science and Technology, Xi’an, China

- 2Shaanxi Coal Industry Co., LTD, Xi’an, Shaanxi, China

- 3School of Political Science and International Relations, Tongji University, Shanghai, China

Introduction: In the context of the global shift toward a multi-level networked climate governance system, multinational enterprises (MNEs) and local firms’ collaboration on low-carbon technologies has become a critical pathway to address imbalances in emission reduction responsibilities and regional institutional conflicts. However, regional institutional differences and the risk of opportunism in technology transfer pose challenges to cooperation efficiency and market integration.

Methods: To tackle these issues, this paper constructs a tripartite evolutionary game model encompassing MNEs, local firms, and blockchain platforms. The research focuses on three core characteristics of blockchain technology: decentralisation, immutability, and the automated execution of smart contracts. These properties enable the transformation of divergent regional institutional frameworks into trustworthy, self-enforcing on-chain protocols. This mechanism aims to mitigate bilateral opportunism risks during collaboration while providing robust technical underpinnings for dynamic incentive mechanisms. The study specifically delves into how blockchain reshapes the competitive-collaborative equilibrium between MNEs and local firms.

Results: The findings indicate that enterprises’ cooperation willingness and blockchain platforms’ regulatory enthusiasm are key drivers of cross-border emission reductions. Specifically, blockchain can effectively reduce opportunistic behavior, thereby enhancing cooperation willingness. A higher reputation capital of blockchain platforms promotes cooperation, whereas excessive cost reductions may have the opposite effect. Furthermore, opportunistic gains and technology spillover effects significantly influence cooperation willingness. The analysis also reveals that dynamic reward-punishment strategies are more effective than static ones in promoting collaboration and optimizing the system.

Discussion: This research offers theoretical support and practical guidance for resolving cross-border emission reduction dilemmas, optimizing blockchain platform governance, and fostering the development of a global low-carbon technology innovation network.

1 Introduction

Since the 21st century, the global climate governance system has undergone a profound transformation from “state-centric” to “multi-level network governance.” According to the IPCC’s Sixth Assessment Report (2023), developing countries are projected to bear over 75% of the climate-related losses if global temperature increases exceed the 1.5 °C threshold, while developed nations face structural conflicts involving technological monopolies and the allocation of climate responsibilities [1–3]. The environmental impact of enterprises, particularly multinational enterprises (MNEs), has become a critical issue. The unequal ecological exchange between developed and developing countries, driven by trade relations, threatens emission reduction commitments. In this context, low-carbon technology cooperation between multinational and local enterprises is not only a key mechanism for technological diffusion but also a microcosm of the global climate governance and regional economic interest competition [4].

Regional economic studies indicate that the efficiency of low-carbon technology cooperation heavily depends on the institutional endowments of the host country. For example, within the EU’s “Carbon Border Adjustment Mechanism” (CBAM), enterprise cooperation must adapt to stringent carbon footprint certification standards, while the ASEAN “Green Technology Common Market” initiative prioritizes localization and cost control in cooperation [5]. However, regional institutional differences (e.g., intellectual property protection and environmental regulation intensity) and market fragmentation (e.g., carbon tariff barriers and competition for green subsidies) exacerbate “bilateral opportunism” in cooperation. MNEs may exploit their technological advantages to implement “strategic decoupling,” while local enterprises may face the risk of “reverse capture” in technology absorption [6]. This dilemma is particularly pronounced in the clean energy cooperation of emerging economies in East Asia, Eastern Europe, and Africa [7–9].

From the perspective of regional innovation systems theory, the low-carbon technology cooperation between multinational and local enterprises is essentially a process of coupling the “global knowledge network” with the “local production network” [10]. MNEs hold a technological advantage in the form of tacit knowledge (e.g., low-carbon process design) and explicit knowledge (e.g., carbon emission algorithms), while local enterprises contribute by embedding technologies into specific regional institutional environments. For instance, Chinese new energy vehicle companies, when collaborating with German suppliers, must navigate both the EU’s “Battery Passport” standard [11] and domestic “Dual Credit” policy compliance [12]. However, regional institutional heterogeneity significantly amplifies cooperation risks. In regions with weak intellectual property protection, MNEs face the risk of “reverse spillovers” due to technology leaks [13], while local enterprises in countries with stringent environmental regulations may be excluded from innovation networks due to prohibitively high technology verification costs [14]. This “bilateral vulnerability” forces enterprises into a “cooperation-defense” strategy dilemma, ultimately resulting in the fragmentation of the global low-carbon technology market.

To address the regional institutional divide in low-carbon research and development cooperation between multinational and local enterprises, blockchain technology has emerged as a potential solution. The programmable nature of blockchain’s smart contracts allows the transformation of regional institutional rules, such as the EU’s carbon audit standards and the African Union’s green subsidy policies, into automatically executable on-chain agreements [15–17]. For example, the Hyperledger Fabric consortium chain has already enabled mutual recognition and mapping of carbon accounting rules in transnational photovoltaic cooperation between China and Europe, reducing institutional friction in technology transfer [18, 19]. Furthermore, the role of blockchain platforms in transnational enterprise cooperation is becoming increasingly significant. Blockchain’s data transparency and traceability features enable platforms to implement emission reduction oversight and reward-punishment mechanisms [20, 21], such as the integration of carbon credits with blockchain technology [22], offering a new approach to reducing free-rider effects and promoting joint emission reductions.

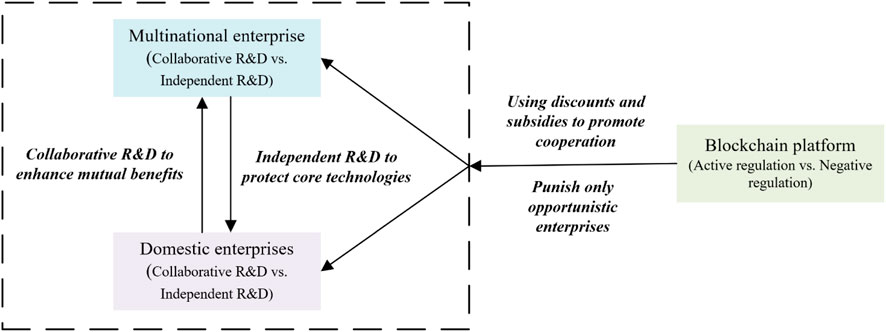

To overcome the joint emission reduction challenges posed by regional differences and to transcend the theoretical limitations of traditional binary static games, this paper constructs a tripartite evolutionary game model involving multinational enterprises, local enterprises, and blockchain platforms, considering random effects and dynamic reward-punishment mechanisms. It is worth noting that the theoretical model of this study is built upon the following core assumption: blockchain platforms, through their technical characteristics, play an irreplaceable role as a ‘trusted third party’ in transnational low-carbon technology cooperation. Specifically, we hypothesize that blockchain: provides a transparent and tamper-proof shared ledger, ensuring the authenticity of emission reduction outcomes and technology transaction records while resolving information asymmetry. By codifying institutional rules through smart contracts, it enables the automatic and unbiased execution of dynamic incentive mechanisms (such as subsidies and penalties), thereby avoiding the inefficiencies, rent-seeking, or default risks associated with centralized institutions and addressing the challenge of contract enforcement. It creates a decentralized trust environment where multinational corporations and local enterprises can collaborate without relying entirely on mutual trust or trust in a centralized platform. It is precisely these technological features that enable the incentive mechanism constructed in this paper to be practically feasible. Therefore, this model does not study an abstract ‘regulatory technology’ but specifically explores how a new governance model, using blockchain as its technological vehicle, reshapes competitive and cooperative relationships between enterprises. Subsequent model parameters—such as the reduction of technological spillover losses (w1/w2) and the curtailment of opportunistic gains (m1/m2)—fundamentally reflect blockchain’s optimization of the cooperative environment through these inherent properties. In summary, this paper aims to reveal: How does blockchain, through technological empowerment, reshape the competitive-collaborative equilibrium between multinational and local enterprises in diverse regional economic scenarios? How does the blockchain platform drive the long-term evolution of low-carbon technology cooperation through dynamic reward-punishment mechanisms? Compared to existing research, this paper’s innovation lies in bridging the theoretical gap between regional economic studies and digital governance, creating a tripartite dynamic reward-punishment game model with random shocks, addressing methodological gaps, and offering a parametric solution for the design of on-chain systems in transnational low-carbon cooperation. Additionally, it provides management insights for overcoming global emission reduction challenges (the research process for this paper is shown in Figure 1).

2 Literature review

2.1 Transnational emissions reduction

Foreign subsidiaries of MNEs play a critical role in global carbon dioxide emissions within the global production chain. Recent studies have confirmed this from various perspectives. López [23] found that U.S.-based multinational companies operating overseas require higher emissions per unit of added value compared to domestic firms. Ortiz [24] conducted an accounting analysis of the carbon footprints of MNEs in the EU and found that their carbon intensity is typically higher than that of domestic firms in the same industry, especially in OECD countries. Ortiz [25] used a multi-regional input-output model to track the CO2 emissions and value-added by MNEs, quantifying the trade-off between the economic benefits and environmental impacts along their global supply chains, revealing that emissions from MNEs surpass their added value. Yan [26] emphasized the role of MNEs in global emissions, resolving the issue of misalignment in value-added attribution and carbon emissions responsibility between developed and developing economies. Cosmi [27] proposed an optimal emissions reduction strategy using a multi-objective optimization model to maximize the marginal contribution of multinational chemical companies. While existing research largely focuses on the emissions reduction efforts of multinational enterprises, it neglects the collaboration between MNEs and domestic firms. Additionally, the methods primarily involve measurement and optimization, which limits understanding of the long-term evolutionary patterns of decision-making.

2.2 Blockchain and carbon emissions reduction

Blockchain technology, known for its decentralization [28], transparency [29], and traceability, has been widely applied in finance [30], supply chains, and carbon markets [31]. Su [32] proposed a global carbon trading system based on blockchain to solve data security issues, ensuring consistency in data protection during cross-border emissions reduction. Wang [33] developed a carbon credit management center utilizing blockchain to integrate power spot markets, power futures markets, and carbon trading markets into a coupled system, analyzing the economic and emissions reduction benefits for power suppliers and load users. Teng [34] highlighted energy blockchain as an effective innovation technology to accelerate the global energy transition, asserting that global cooperation and government leadership are crucial for large-scale deployment. Jiang [35] found that despite significant disparities in profits among enterprises along the supply chain, blockchain can harmonize profit distribution, reduce gaps between firms, and incentivize manufacturers to enhance carbon reduction when consumers exhibit strong environmental awareness. Zhang [36] developed a blockchain-based carbon emission trading model to achieve emissions reduction goals, incorporating reward and punishment mechanisms. Bai et al. [37] developed a layered enabling framework for blockchain technology to enhance supply chain transparency (SCT) in Africa’s cocoa industry based on the Technology-Organization-Environment (TOE) theoretical framework, identifying “technological characteristics” as the most critical driver. To address issues in carbon emissions trading systems—including carbon credit fraud, inadequate monitoring, verification, and reporting (MRV), participant reluctance, and opaque transactions—Muzumdar et al. [38] proposed a trustworthy and incentivized emissions trading system using Hyperledger (a permissioned blockchain) and smart contracts. This ensures transparent trading of carbon credits with improved MRV. Huang et al. [39] provide empirical evidence for developing region-specific and source-targeted carbon reduction policies. These studies emphasize the role of blockchain technology in global carbon emissions reduction through data security, emission-driven actions, and reward-punishment mechanisms. However, most of these studies adopt a static perspective, lacking exploration of the impact of blockchain on the emission reduction decisions of multiple stakeholders from the viewpoint of evolutionary game theory.

2.3 Evolutionary game theory

Existing carbon reduction studies have significant limitations in analyzing multi-win dilemmas in administrative systems, which arise from the incommensurability of interests among various stakeholders [40, 41]. To bridge this gap, evolutionary game theory, through the construction of dynamic strategic interaction frameworks, effectively deconstructs the nonlinear game relationships among hierarchical governance entities in collaborative emissions reduction [42]. Gui et al. [43] developed an evolutionary game model for carbon reduction decisions involving governments, manufacturers, and suppliers, analyzing the impact of government subsidies and free-riding behavior on supply chain decisions. The results indicated that government subsidies incentivize carbon reduction in supply chain enterprises, while free-riding behavior depends on the carbon reduction profits. Wang [44] used Stackelberg game theory to develop a carbon reduction supply chain decision model and analyzed the stable strategies for adopting blockchain through evolutionary game theory, concluding that blockchain adoption significantly promotes emissions reduction within the supply chain. Zhang [45] employed a three-player evolutionary game model to explore the impact of central environmental supervision (CEPI) on carbon reduction, finding that when the central government’s environmental supervision intensifies, local governments and enterprises opt for strategies that benefit emissions reduction, taking into account reward-punishment systems. Jiang [46] proposed a three-player random evolutionary game model involving central and local governments and enterprises to address the implementation dilemma of carbon policies in China’s fiscal decentralization, revealing that the incorporation of random factors disrupts the evolutionary paths of stakeholders, leading to deviations and volatility in expected patterns. It is evident that existing carbon reduction research overlooks the regional-national perspective and does not consider the impact of institutional differences on cross-border emissions reduction. Moreover, studies on random parameters and evolutionary pathways largely overlook the inclusion of blockchain-enabled reputation mechanisms in reward-punishment functions, which limits the potential to stimulate emissions reduction efforts.

2.4 Research gaps

Despite substantial research on multinational emissions reduction, several gaps remain. First, in the realm of cross-border emissions reduction, empirical studies have revealed the imbalance between carbon emissions rights and responsibilities in multinational enterprises. However, they overly focus on the emissions reduction efficiency of a single stakeholder, neglecting the dynamic interaction mechanisms of technology transfer and institutional adaptation within the multinational-local enterprise collaboration network. This limits the analysis of the “evolutionary cooperation path” and leads to methodological constraints. Second, blockchain-based carbon governance research is mainly limited to optimizing data credibility within static frameworks and lacks the development of an interactive dynamic reward-punishment model. Lastly, the application of evolutionary game theory in carbon reduction scenarios, while advancing beyond traditional equilibrium analyses, generally overlooks the influence of regional institutional heterogeneity on game parameters, and existing random evolutionary models fail to incorporate blockchain-enabled reputation mechanisms into reward-punishment functions. These theoretical blind spots contribute to the failure to resolve two core issues: (1) How can blockchain technology be integrated with the low-carbon initiatives of different enterprises to establish long-term stable low-carbon collaboration between multinational and domestic enterprises? (2) How can dynamic on-chain governance mechanisms in differentiated regional contexts drive multi-stakeholder cooperation from asymmetric games to Pareto improvements? To address these theoretical and practical challenges, this study constructs a random evolutionary game model with a dynamic reward-punishment mechanism.

3 Construction of the stochastic evolutionary game model

3.1 Problem description

In the context of the low-carbon economic transition, MNEs and local enterprises can leverage blockchain platforms for data sharing, resource pooling, and technological exchanges to foster the development of low-carbon emission reduction technologies, thereby forming beneficial collaborative relationships. However, the opportunistic behavior that generates betrayal benefits often hinders cooperation between enterprises. MNEs and local enterprises can choose either to cooperate in the development of low-carbon technologies or to engage in independent research and development (R&D). Meanwhile, the blockchain platform can either adopt an active or passive regulatory approach. Cooperative R&D through the blockchain platform’s data, technology, and resource-sharing capabilities can reduce costs and improve emission reduction outcomes, but it also carries the risk of technology leakage. Independent R&D protects core technologies but may incur higher costs. Active regulation by the blockchain platform incentivizes cooperation through subsidies and financial incentives, while passive regulation penalizes opportunistic behavior and constrains corporate actions. The interaction between these strategies determines the respective gains and costs for each player, thereby influencing their long-term evolutionary trends and ultimately resulting in a dynamic equilibrium.

3.2 Assumptions

This study primarily investigates two issues: how low-carbon emission reduction technologies are developed under the dynamic and static reward-punishment mechanisms of blockchain platforms, and the choice of management approach by the blockchain platform. The problem involves three key players: multinational enterprises, local enterprises, and the blockchain platform. The blockchain platform selects its regulatory strategy based on the cooperation willingness of both MNEs and local enterprises in R&D, while MNEs and local enterprises choose their strategies based on the regulatory approach of the blockchain platform and the willingness of the other party to cooperate. Based on the problem description, the following assumptions are made.

Assumption 1. Due to regional institutional differences (e.g., varying strengths of intellectual property protection and environmental regulation across countries), the emission reduction behaviors of firms are influenced. Additionally, all three players—MNEs, local enterprises, and the blockchain platform—are rational economic agents aiming to maximize their respective profits. Therefore, the strategy set for MNEs and local enterprises is (cooperative R&D, independent R&D), while the strategy set for the blockchain platform is (active regulation, passive regulation).

Assumption 2. Cooperative R&D can reduce both MNEs’ and local enterprises’ R&D costs and improve emission reduction efficiency through the sharing of data, technology, and resources via the blockchain platform. Independent R&D allows firms to protect their core technologies but may involve higher costs. Active regulation by the blockchain platform guides market behavior by reducing blockchain usage costs for enterprises, while passive regulation constrains the inappropriate behavior of MNEs and local enterprises in cooperation through penalties.

Assumption 3. Cooperative R&D between MNEs and local enterprises can enhance the low-carbon emission reduction level g1, leading to carbon credit benefits of (1 + g1)*R. Let α denote the profit-sharing coefficient for MNEs and β for local enterprises. As noted by Gonenc [4], MNEs generally have a higher capacity than local firms to develop technologies that help control environmental pollution and mitigate climate change. Furthermore, Meng and Ye [47], drawing on global value chain (GVC) theory and related research on innovation rent distribution, point out that MNEs typically leverage their technological standards, core patents, and brand advantages to occupy both ends of the value chain’s “smile curve.” This positions them with stronger bargaining power in collaborations, enabling them to capture a larger share of the collaborative surplus. Therefore, it is assumed that 0 ≤ β ≤ α ≤ 1 and α + β = 1, with MNEs earning higher returns than local enterprises. If one party chooses independent R&D, MNEs earn αR, while local enterprises earn βR.

Assumption 4. When both MNEs and local enterprises choose cooperative R&D for low-carbon technologies, both will receive additional benefits. Under the active regulatory strategy by the blockchain platform, the additional benefit v1 derived from cooperation will be greater than the additional benefit v2 under passive regulation, i.e., v1 ≥ v2.

Assumption 5. The R&D costs for MNEs and local enterprises are denoted as c1 and c2 (c1 ≤ c2), respectively. During cooperative R&D, both parties will reduce their R&D costs due to complementary advantages, with cost reduction factors s1 and s2. When local enterprises choose cooperative R&D and MNEs opt for independent R&D, MNEs reduce their costs by learning from the local enterprises’ technology, with a cost reduction factor of l1 (0 < l1 < 1), and vice versa for local enterprises, whose cost reduction factor is l2 (0 < l2 < 1).

Assumption 6. When MNEs choose cooperative R&D and local enterprises opt for independent R&D, MNEs suffer a loss w1 due to technology spillover, while local enterprises gain a benefit m2. Conversely, when local enterprises choose cooperative R&D and MNEs choose independent R&D, local enterprises incur a technology spillover loss w2, while MNEs gain a benefit m1. This paper posits that MNEs incur smaller technology spillover losses than domestic firms while reaping greater opportunistic gains. The validity of this assumption stems from two aspects: First, in terms of knowledge attributes, MNCs’ technological advantages typically manifest in highly codified, explicitly protected knowledge shielded by stringent intellectual property rights, rendering leakage risks relatively manageable [48]. In contrast, domestic firms’ strengths often derive from areas more susceptible to imitation, such as local market adaptation and tacit know-how. Second, in terms of absorptive capacity, MNEs generally possess stronger reverse-engineering and technology learning capabilities, enabling them to extract knowledge more effectively from local partners. Consequently, betrayal inflicts greater potential harm on local firms. Given multinationals’ superior low-carbon technology R&D capabilities, local firms have greater potential to learn new technologies, resulting in higher opportunistic gains for local firms. However, local firms also incur greater losses from technology spillovers [49]. Since MNEs generally have superior low-carbon technology development capabilities, local enterprises are more likely to learn from their technology, but local enterprises also face a higher loss due to technology spillover. It is assumed that w1 ≤ w2 and m1 ≥ m2.

Assumption 7. In the case of active regulation by the blockchain platform, the platform provides subsidies and financial incentives to the cooperating enterprises. Let T1 and T2 represent the usage costs for MNEs and local enterprises, respectively. Let k (0 < k < 1) be the cost reduction factor under active regulation by the blockchain platform. Let G1 and G2 represent the subsidies provided to the cooperating MNEs and local enterprises. In the case of passive regulation, the platform imposes penalties on opportunistic enterprises, where F is the penalty upper bound and f is the penalty coefficient.

Assumption 8. Let H1 represent the transaction benefits brought to the blockchain platform by the collaborative R&D between MNEs and local enterprises, and H2 represent the reputation benefits derived from active regulation by the platform. When MNEs choose cooperative R&D and local enterprises opt for independent R&D, the transaction benefits are reduced by a reduction factor γ2; when local enterprises choose cooperative R&D and MNEs opt for independent R&D, the transaction benefits are reduced by a reduction factor γ1. Since MNEs are stronger than local enterprises, their opportunistic behavior inflicts greater harm.

Assumption 9. The incentive mechanisms discussed herein comprise both static and dynamic modes. Static incentive mechanisms refer to subsidies and penalties provided by the blockchain platform as fixed constants, whose magnitude remains unchanged regardless of the game process or the proportion of cooperative strategies chosen by enterprises. Dynamic incentive mechanisms refer to subsidies and penalties provided by the blockchain platform as functions of enterprises’ cooperative strategies. Specifically: Dynamic subsidies are an increasing function of cooperation willingness. When an enterprise’s willingness to cooperate is low, the platform provides higher subsidies to incentivize cooperation; when cooperation willingness is high, subsidies are correspondingly reduced. In this paper, the dynamic subsidy function is defined as

3.3 Stochastic evolutionary game payoff functions

The payoff functions for MNEs, local enterprises, and the blockchain platform under eight different scenarios are as follows (Equations 3.1–3.8):

Scenario 1: (1, 1, 1) – When both MNEs and local enterprises choose cooperative R&D for low-carbon emission reduction, and the blockchain platform adopts active regulation, the payoffs for MNEs, local enterprises, and the blockchain platform are as follows:

Scenario 2: (1, 1, 0) – When MNEs choose to cooperate in the development of low-carbon emission reduction technologies, local enterprises also choose to cooperate in R&D, and the blockchain platform adopts passive regulation, the payoffs for MNEs, local enterprises, and the blockchain platform are as follows:

Scenario 3: (1, 0, 1) – When MNEs choose to cooperate in R&D for low-carbon emission reduction, local enterprises choose independent R&D, and the blockchain platform adopts active regulation, the payoffs for MNEs, local enterprises, and the blockchain platform are as follows:

Scenario 4: (1, 0, 0) – When MNEs choose to cooperate in R&D for low-carbon emission reduction, local enterprises choose independent R&D, and the blockchain platform adopts passive regulation, the payoffs for MNEs, local enterprises, and the blockchain platform are as follows:

Scenario 5: (0, 1, 1) – When MNEs choose independent R&D for low-carbon emission reduction, local enterprises choose cooperative R&D, and the blockchain platform adopts active regulation, the payoffs for MNEs, local enterprises, and the blockchain platform are as follows:

Scenario 6: (0, 1, 0) – When MNEs choose independent R&D for low-carbon emission reduction, local enterprises choose cooperative R&D, and the blockchain platform adopts passive regulation, the payoffs for MNEs, local enterprises, and the blockchain platform are as follows:

Scenario 7: (0, 0, 1) – When both MNEs and local enterprises choose independent R&D for low-carbon emission reduction, and the blockchain platform adopts active regulation, the payoffs for MNEs, local enterprises, and the blockchain platform are as follows:

Scenario 8: (0, 0, 0) – When MNEs choose cooperative R&D for low-carbon emission reduction, local enterprises choose independent R&D, and the blockchain platform adopts passive regulation, the payoffs for MNEs, local enterprises, and the blockchain platform are as follows:

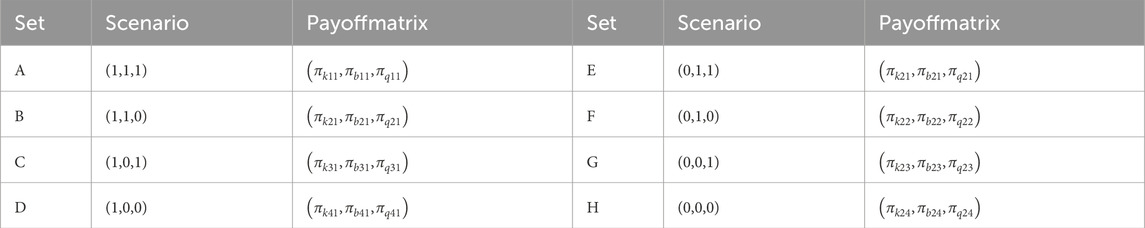

Based on these eight scenarios, the three-party evolutionary game payoff matrix for MNEs, local enterprises, and the blockchain platform is constructed, as shown in Table 1.

4 Analysis of the stochastic evolutionary game model

4.1 Replicator dynamics equations

The expected payoff for MNEs when they choose to cooperate in low-carbon emission reduction R&D is denoted as

The replicator dynamic equation for MNEs’ expected payoff is given by:

Similarly, the expected payoffs for local enterprises when choosing cooperative or independent R&D are denoted as

The replicator dynamic equation for local enterprises’ expected payoff is:

For the blockchain platform, the expected payoff for adopting active regulation is

The replicator dynamic equation for the blockchain platform’s expected payoff is:

4.2 Stochastic evolutionary game model analysis

Given that transnational low-carbon technology cooperation faces random shocks such as external market volatility, policy adjustments, and technological uncertainties, deterministic evolutionary game models struggle to fully capture the dynamic behavior of real-world systems. To address this, this paper introduces a random disturbance term into the replicator dynamics equation, transforming the system into a set of Itô-type stochastic differential equations to analyze the evolutionary stability of parties’ strategies under the influence of random factors.

Specifically, we define a one-dimensional standard Brownian motion (Wiener process)

Among these,

Based on this, a random disturbance term is introduced into the reproduction dynamics Equations 4.2, 4.3, 4.5 to construct the following three-dimensional stochastic differential equation system, as detailed in Equation 4.6:

The equation represents a system of nonlinear

4.3 Equilibrium solutions and stability analysis

Given the presence of uncertainty in the real world, the model aims to reflect the actual conditions of environmental credit regulation. Therefore, random disturbances are introduced to analyze and assess the stability of the stochastic evolution. The stability judgment theorem is as follows (Equations 4.7–4.9):

Given a one-dimensional stochastic differential equation:

Assume the existence of functions

If

If

Let

If the zero solution moment exponents of equations (a), (b), and (c) are stable, then the following equation holds:

Due to the lack of an explicit solution for the nonlinear

5 Numerical simulation analysis

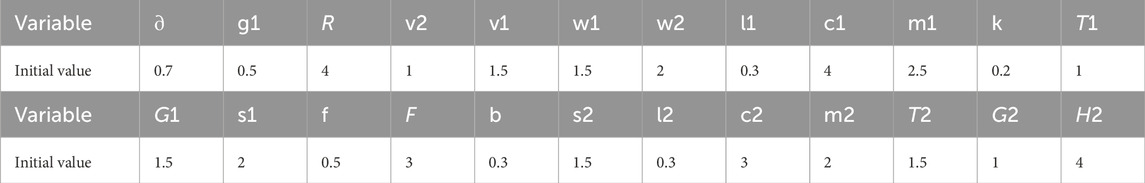

To reveal the key elements in the evolution process of highly uncertain events and all possible future development trends, this paper uses MATLAB to numerically simulate an evolutionary game model with random disturbances. The parameters are assigned values by referring to relevant national documents and expert consultations, as shown in Table 2. Considering the random perturbation, the participating subjects will exhibit fluctuations around a certain strategy, which is in line with the reality. The subsequent analysis mainly uses the time when the probability of the subject’s strategy selection first converges to 1 as the criterion for strategy selection.

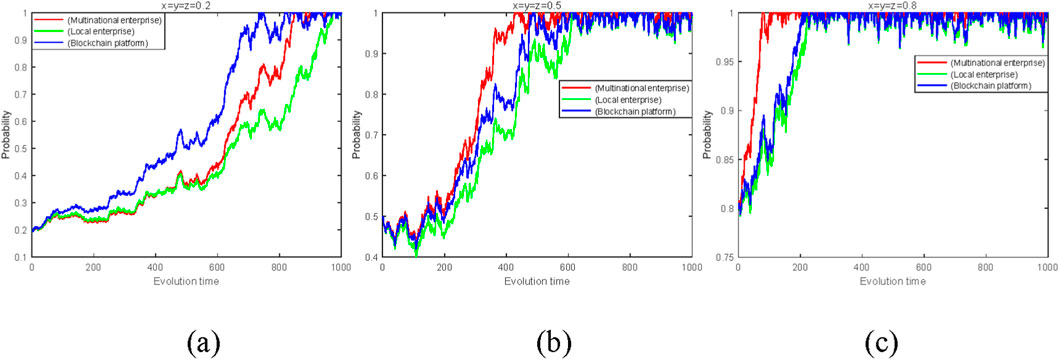

5.1 Strategy evolution trends of multinational enterprises, local enterprises, and blockchain platforms under different initial probability scenarios

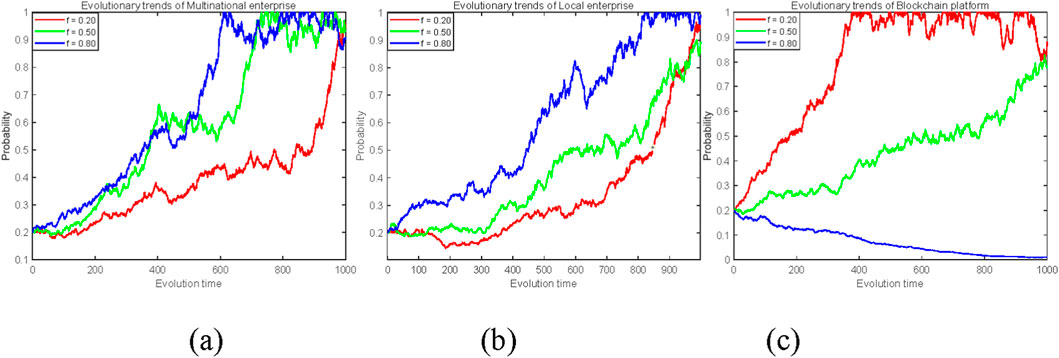

In cross-border low-carbon technology emission reduction, when the initial probability is low, as shown in Figure 2a, the strategy evolution speed of the three party game subjects is blockchain platform > multinational enterprises > local enterprises. During this period, the environment for cross-border economic cooperation was poor, and behaviors such as “free riding” were more serious. Due to the weak awareness of healthy development of cross-border low-carbon technology cooperation among various entities, the willingness of multinational and local enterprise platforms to cooperate in research and development was not strong. The blockchain platform plays a guiding role by actively regulating and promoting cross-border low-carbon emission reduction technology research and development cooperation. After effective incentives on blockchain platforms, multinational and local enterprises have accelerated their pace of collaborative research and development, reducing the occurrence of “free riding” behavior and promoting the transaction and reputation benefits of blockchain platforms, achieving maximum self-interest. As BMW Group and Indian supply chain companies collaborate on battery recycling technology research and development through the VeChain blockchain platform, the platform initially set up a $2 million default deposit pool, ultimately reducing free riding behavior by 37%.

Figure 2. Evolution of a three-party strategy (multinational corporation (x), local firm (y), blockchain platform (z)) under varying initial cooperation probabilities. (a) Low cooperation probability (x, y, z = 0.2). (b) Moderate cooperation probability (x, y, z = 0.5). (c) High cooperation probability (x, y, z = 0.8).

When the initial participation probability is moderate, as shown in Figure 2b, the strategy evolution speed of blockchain platforms and local enterprises is similar but slower than that of multinational enterprises. At this time, the willingness of multinational and local enterprises to cooperate in research and development is relatively moderate, while blockchain platforms adopt subsidy incentives and reduce platform usage costs. Collaborative research and development between multinational and local enterprises can obtain more benefits, thus accelerating the evolution towards collaborative research and development strategies. At the same time, the cooperation between multinational and local enterprises has increased the transaction revenue of blockchain platforms, promoting their adoption of active regulation.

When the initial participation probability is high, as shown in Figure 2c, multinational and local enterprises quickly evolve towards collaborative research and development, and blockchain platforms also quickly evolve towards active regulation. At this time, the environment for cross-border low-carbon technology and economic cooperation is favorable, and both parties can obtain more benefits and welfare through cooperation, with a lower probability of free riding behavior. Therefore, adopting active regulation on blockchain platforms can generate more transaction profits without the need for negative regulation to constrain multinational and local enterprises. Just as the Nordic Electricity Alliance applied the IBM blockchain platform to conduct cross-border clean technology transactions, with an initial participation rate of 82%, the efficiency of carbon quota trading was improved by 210% and the dispute rate was reduced to 1.2% through automatically executed smart contracts.

5.2 The impact of costs and benefits of multinational enterprises’ collaborative research and development of low carbon technology emission reduction strategies on their evolutionary trends

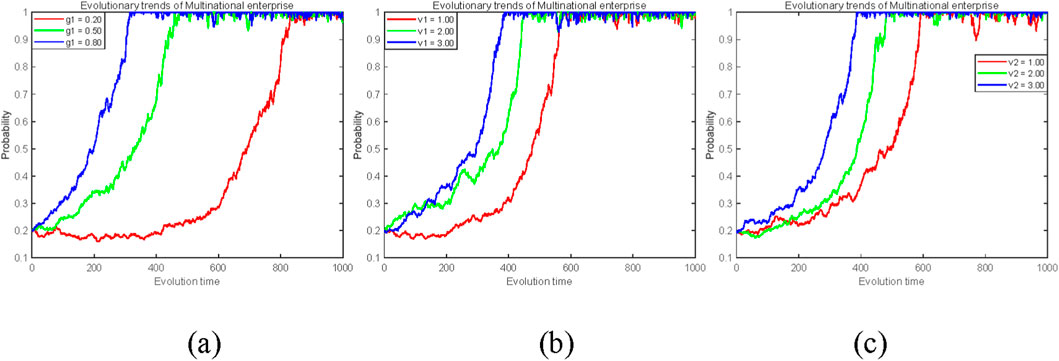

As shown in Figure 3, firstly, the economic benefits obtained by MNEs through collaborative research and development to enhance low-carbon technology levels exhibit a significant positive incentive effect, verifying the core driving role of economic incentives in low-carbon technology collaborative innovation. In addition, with the improvement of emission reduction levels and the increase in additional benefits brought by cross-border enterprise cooperation in research and development, the evolution speed towards cooperative research and development strategy has accelerated, indicating that technological upgrading and revenue appreciation jointly accelerate the evolution process through synergistic effects. Finally, the additional benefits generated by collaborative research and development between multinational and local enterprises under active regulation of blockchain platforms are greater than those generated under passive regulation. This institutional advantage makes active regulation an effective mechanism to break through the “innovation inertia trap”.

Figure 3. The influence of cooperative benefit parameters on the strategic evolution of MNEs’ strategies (x). (a) Low-carbon technology level g1 (0.2, 0.5, 0.8). (b) Additional benefits under proactive regulation v1 (1, 2, 3). (c) Additional benefits under passive regulation v2 (1, 2, 3).

As shown in Figure 4, firstly, the opportunity benefits obtained through technology imitation and the technology spillover losses faced during collaborative research and development by MNEs when conducting independent research and development jointly constitute the core resistance to suppressing cooperation willingness. Simulation trends indicate that the combined effect of these two types of short-term benefits will significantly delay the evolution process of cooperative strategies, and even trigger strategy reversal. That is, when the opportunity benefits or technology spillover losses exceed the critical threshold, MNEs will shift from cooperative research and development to independent research and development to avoid risks. Secondly, when local enterprises choose to cooperate in research and development while MNEs choose independent research and development, MNEs learn technology from local enterprises to reduce research and development costs and opportunity benefits. With the increase of research and development cost reduction coefficient and opportunity benefits, MNEs evolve from cooperative research and development strategy to independent research and development strategy. Finally, when MNEs choose to collaborate on research and development while local corporations choose independent research and development strategies, the losses incurred by MNEs due to technology spillover will inhibit their evolution towards collaborative research and development strategies. As technology spillover losses increase, MNEs will shift their research and development strategies towards low-carbon emission reduction technologies, from collaborative research and development to independent research and development strategies, thereby reducing technology spillover losses.

Figure 4. The influence of opportunism and spillover loss parameters on the strategic evolution of MNEs (x). (a) Independent R&D cost reduction coefficient l1 (0.2, 0.5, 0.8). (b) Opportunistic gains m1 (2, 4, 6). (c) Technological spillover loss w1 (2, 4, 6).

The key to breaking through this dilemma lies in restructuring the profit distribution mechanism, which can significantly enhance the attractiveness threshold of cooperation strategies by dynamically compensating for technology spillover losses, binding cooperation investment and long-term returns; The introduction of blockchain technology can resolve short-term game conflicts, such as automatically executing profit sharing and risk hedging through smart contracts, thereby suppressing opportunistic behavior while shaping a highly stable cooperative evolution trajectory. Research has shown that the sustainability of low-carbon technology cooperation not only depends on technological synergy, but also requires institutional innovation to balance short-term benefits and long-term value creation, ultimately achieving a paradigm shift from “zero sum game” to “symbiotic evolution” for cross-border R&D alliances.

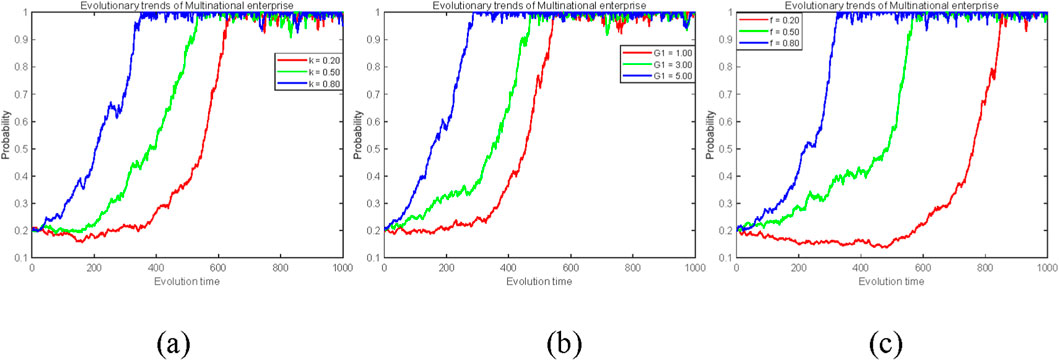

c) The impact of active regulation of blockchain platforms on the reduction coefficient and subsidy intensity of platform usage costs, as well as the punishment intensity for free riding behavior under negative regulation, on the strategic evolution trend of multinational enterprises.

The positive and negative regulations of blockchain platforms have a positive promoting effect on the evolution of multinational enterprises towards cooperative research and development strategies. Firstly, cost reduction directly lowers the threshold for collaborative innovation among enterprises, and the higher the cost reduction coefficient, the more significant the effect. Secondly, dynamic subsidies compensate for technology spillover losses through risk hedging mechanisms. As the subsidy intensity of blockchain platforms increases, multinational enterprises are accelerating their pace towards cooperative research and development strategies. Finally, the punishment mechanism of negative regulation exhibits a significant threshold effect, that is, although low-intensity punishment can temporarily suppress opportunism, it is prone to trigger strategy recurrence; When the punishment intensity exceeds the critical value, its deterrent effect can sustainably guide the evolution of cooperation, highlighting the necessity of “precise pressure”. Just as the EU pilot integrates blockchain technology into the carbon emissions trading system and automatically enforces penalty rules through smart contracts, initially setting lower fines for exceeding carbon emissions standards, companies generally choose to pay fines instead of upgrading their technology, resulting in unclear growth rates for initial cooperative emission reduction projects. However, in the later stages, the penalties will be increased and real-time monitoring of blockchain technology will be introduced, leading to a significant increase in emission reduction technology sharing agreements between multinational enterprises and a significant improvement in system stability.

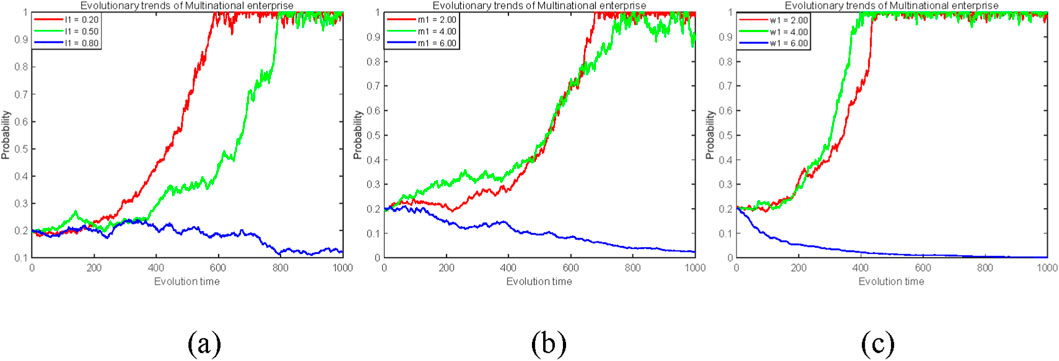

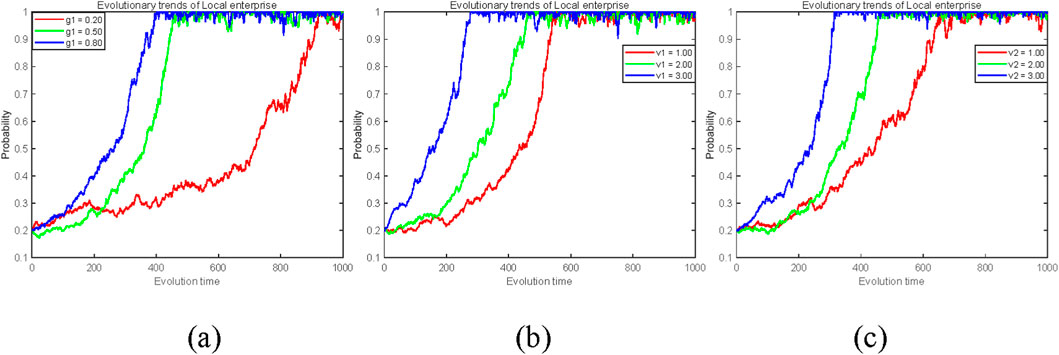

5.3 The impact of the costs and benefits of local enterprises’ collaborative research and development of low-carbon technology emission reduction strategies on their evolutionary trends

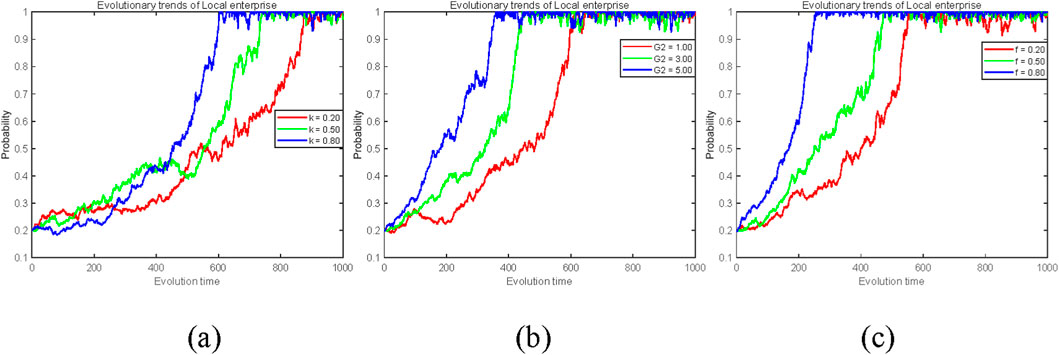

From Figure 5, it can be seen that firstly, the economic benefits obtained by local enterprises through collaborative research and development to improve emission reduction levels significantly promote their willingness to choose collaborative research and development. With the improvement of collaborative emission reduction efficiency and the continuous accumulation of additional benefits from cooperation, the convergence speed of local enterprises towards cooperative R&D strategies can be significantly improved, indicating that economic value creation is the core driving force to break the “cooperation inertia”. Secondly, the positive regulation of blockchain platforms promotes the evolution of local enterprises towards cooperative R&D strategies, which is more effective than the negative regulation strategy. In addition, when both parties choose to cooperate in the research and development of low-carbon emission reduction technology strategies, multinational enterprises, relying on their technological dominance and market advantages, obtain greater cooperation benefits than local enterprises. Therefore, the economic benefits obtained by improving emission reduction through cooperative research and development are more effective in promoting multinational enterprises to choose cooperative research and development strategies than local enterprises to choose cooperative research and development effects. Although local enterprises are in a subordinate position in the value chain, they can still achieve net profit growth through technology absorption and localized innovation.

Figure 5. Effects of cooperative benefit parameters on the strategy evolution of local firms (y). (a) Carbon reduction technology level g1 (0.2, 0.5, 0.8). (b) Additional benefit under active regulation v1 (1, 2, 3). (c) Additional benefit under passive regulation v2 (1, 2, 3).

As shown in Figure 6, firstly, when local enterprises choose independent research and development to obtain opportunities and benefits, and when choosing cooperative research and development, they are free riding and suffer losses due to technology spillover, which will inhibit their willingness to cooperate in research and development. Secondly, the strength of local enterprises is usually weaker than that of multinational enterprises, so their research and development costs in low-carbon emission reduction technology are relatively higher. When local enterprises choose independent research and development strategies, although learning low-carbon emission reduction technologies from MNEs can significantly reduce research and development costs, the opportunity benefits they obtain are less than those of MNEs. In addition, local enterprises face greater technology spillover losses in the process of technology learning than multinational enterprises. This difference reflects the disadvantage of local enterprises in terms of technological strength and resource allocation, making them face greater challenges in the independent research and development process. Finally, when local enterprises learn low-carbon emission reduction technologies from MNEs through independent research and development, if the R&D cost reduction coefficient reaches the critical value of l 2 = 0.5, the enterprise will tend to choose an independent R&D strategy to achieve cost reduction. Due to the significant technology spillover losses and lower opportunity returns of local enterprises, they tend to be more inclined towards independent research and development of low-carbon emission reduction technology strategies.

Figure 6. The impact of opportunism and spillover loss parameters on the evolution of local firms Strategies (y). (a) Independent R&D cost reduction coefficient l2 (0.2, 0.5, 0.8). (b) Opportunistic gains m2 (2, 4, 6). (c) Technological spillover loss w2 (2, 4, 6).

It is worth noting that due to the existence of technological barriers, the marginal efficiency of knowledge absorption for local enterprises in independent research and development decreases, while multinational enterprises can continuously obtain excess cooperation surplus through technological barriers. This dynamic game pattern reveals the Matthew Effect in the global low-carbon innovation system [51], where technology disadvantaged parties are forced to lock in independent research and development paths under short-term survival pressures, thereby exacerbating the technological intergenerational gap. To solve this dilemma, it is necessary to establish a differentiated compensation mechanism, which can transform the technology premium of multinational enterprises into dynamic subsidies for local partners through blockchain platforms, thereby achieving a rebalancing of cooperation risks and sustainability of technology transfer.

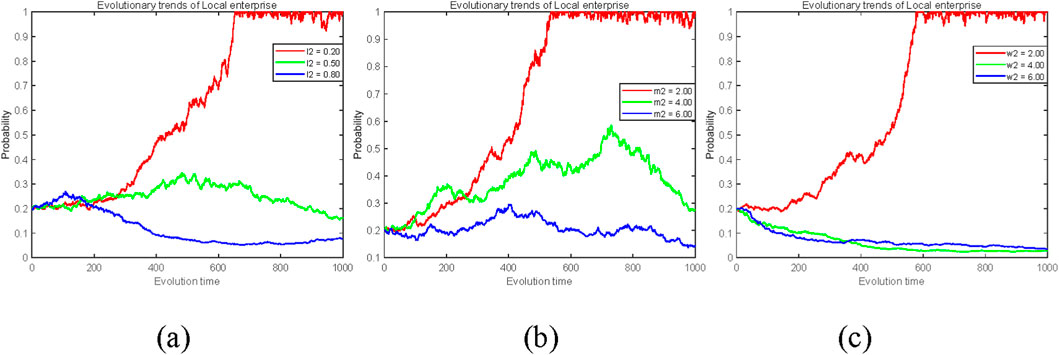

c) The impact of active regulation of blockchain platforms on the reduction coefficient and subsidy intensity of platform usage costs, as well as the punishment intensity under negative regulation on the strategic evolution trend of local enterprises.

As shown in Figure 7, firstly, under an active regulatory framework, blockchain platforms promote collaborative evolution through a dual leverage effect. On the one hand, by reducing the platform’s usage costs, the entry threshold for cross-border enterprise cooperation in research and development is lowered, and the higher the cost reduction coefficient, the more significant the effect; On the other hand, compensating for the technology spillover losses of local enterprises through subsidies, and the higher the subsidy intensity, the more significant the effect. Secondly, when blockchain platforms adopt negative regulations, supervision and punishment are adopted to constrain the “free riding” behavior of enterprises. Due to the weak strength of local enterprises, the opportunity benefits obtained from free riding are relatively small, but the punishment amount is relatively large. Therefore, local enterprises will choose to cooperate in the research and development of low-carbon emission reduction technologies to avoid punishment risks. Finally, the negative regulation of blockchain platforms has a more significant restraining effect on local enterprises than on multinational enterprises.

Figure 7. The Impact of platform regulatory mechanism parameters on the evolution of local firms (y) strategies. (a) Active regulatory cost reduction coefficient k (0.2, 0.5, 0.8). (b) Dynamic subsidy cap G2 (1, 3, 5). (c) Penalty intensity under passive regulation f (0.2, 0.5, 0.8).

This simulation result can be directly traced back to Assumption 6 in this paper. For domestic firms, the appeal of independent R&D is low (due to smaller m2), while the risk and cost of free-riding in collaborative R&D are substantial (due to larger w2). Thus, a moderately strong penalty (F) significantly alters their expected returns: choosing collaboration avoids both penalties and substantial technology spillover risks, making penalties highly effective for domestic firms. For MNEs: Independent R&D holds high appeal (due to large m1), while the risk of technology leakage is relatively manageable (due to small w1). Consequently, a low penalty level provides insufficient deterrence against opportunistic behavior, as the opportunistic gains m1 may far exceed the penalty amount F. Only when the penalty F is sufficiently large—enough to offset their substantial opportunistic gains (i.e., satisfying F > m1)—can it effectively reverse their decision. This explains why penalties have relatively weaker marginal effects on MNEs and require higher thresholds to take effect.

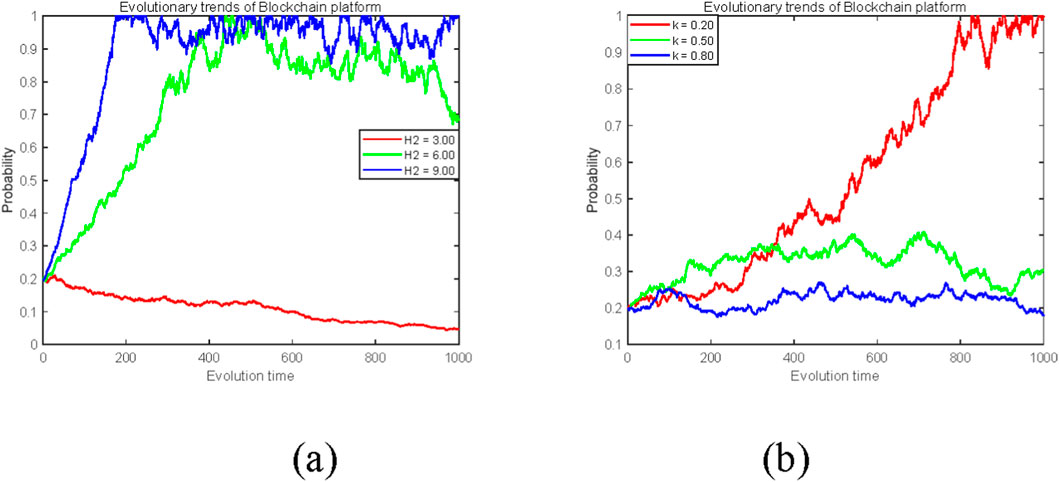

5.4 The impact of reputation revenue and platform usage cost reduction on the evolutionary trend of blockchain platforms under active regulation

The impact of subsidy intensity and punishment for free riding behavior under negative regulation on its evolutionary trend.

As shown in Figure 8, as reputation gains increase, blockchain platforms gradually evolve toward proactive regulatory strategies, indicating that high reputation capital can form a “trust buffer” by reducing information friction, effectively mitigating market volatility shocks. As the extent of cost reductions for platform usage increases, blockchain platforms tend to evolve toward passive regulation strategies. This occurs because when the cost reduction coefficient k increases, the revenue foregone by the platform under an active regulation strategy due to these reductions rises significantly. However, the reputation benefit H2 represents a relatively fixed short-term gain that cannot grow in tandem with increases in k. As k increases, the revenue under active regulation decreases linearly, while the revenue under passive regulation remains unchanged. Therefore, when k reaches a critical point where the revenue under active regulation becomes smaller than that under passive regulation, the platform, acting as a rational economic agent, will naturally shift its optimal strategy from ‘active regulation’ to ‘passive regulation’.

Figure 8. The influence of platform revenue and cost parameters on the evolution of platform (z) strategy. (a) Reputation revenue H2 (3, 6, 9). (b) Cost reduction coefficient k (0.2, 0.5, 0.8).

As reputation returns increase, blockchain platforms are gradually evolving towards active regulatory strategies, indicating that high reputation capital can form a “trust buffer zone” by reducing information friction, effectively resisting market volatility shocks. As the reduction of platform usage costs increases, blockchain platforms will choose to evolve towards negative regulatory strategies. At this time, the reputation benefits under active regulation of blockchain platforms are insufficient to support their subsidies, and the platform’s use of cost reduction for these expenses will rapidly evolve towards negative regulatory strategies. This discovery provides core insights for platform governance, which requires the construction of a cost reputation linkage model through smart contracts, so that cost incentives can gradually decrease along the reputation accumulation gradient, while converting user data contributions into quantifiable reputation points, ultimately achieving a sustainable development paradigm transition from “subsidy driven” to “trust driven”.

5.5 The impact of subsidy intensity under positive regulation and punishment intensity under negative regulation on the evolutionary trend of blockchain platforms

From Figure 9, it can be seen that subsidies under active regulation and penalties under negative regulation have the same impact on the strategic evolution of blockchain platforms. The subsidy incentives of active regulation and the punishment constraints of negative regulation are not simply substitutive relationships, but jointly shape the direction of platform evolution through a cost-benefit differentiation path. When the subsidy intensity increases, although the platform needs to bear higher direct costs, it can significantly enhance the cooperation stickiness between multinational and local enterprises; Increasing the severity of punishment will simultaneously increase the platform’s regulatory revenue, but excessive reliance on punishment will lead to a decrease in ecological participation. This discovery indicates that platform governance needs to avoid either or regulatory choices, and instead should build a gradient regulation system of “carrot and stick”, optimize the subsidy punishment ratio in real time through smart contracts, and ultimately achieve the dual goals of ecological prosperity and compliance control.

Figure 9. The impact of subsidy and penalty intensity on the evolution of platform strategies (z). (a) Subsidy ceiling for MNEs’ strategies G1 (1, 2, 3). (b) Subsidy ceiling for local firms G2 (1, 2, 3). (c) Penalty intensity under passive regulation f (0.2, 0.5, 0.8).

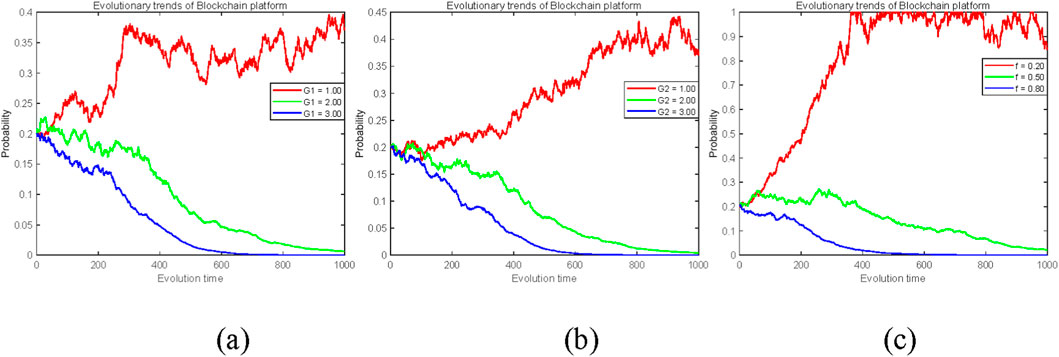

5.6 Strategic evolution trends of multinational enterprises, local enterprises, and blockchain platforms under dynamic rewards and punishments

Assuming that the rewards and subsidies provided by blockchain platforms to multinational and local enterprises for collaborative research and development of low-carbon technologies to reduce emissions are related to their strategies. In the initial stage, blockchain platforms provided rewards and subsidies to promote cooperation between multinational and local enterprises. As the cooperation between the two sides on low-carbon technology emission reduction gradually deepened, the rewards and subsidies were gradually reduced to alleviate financial pressure. At this time, the rewards and subsidies provided by the blockchain platform to multinational and local enterprises for collaborative research and development of low-carbon technologies to reduce emissions are

As shown in Figure 10, compared to the static subsidy model depicted in Figure 9, the dynamic subsidy strategy (evolutionary trajectory under subsidy

Figure 10. Evolution of three-party strategies under the subsidy mechanism. (a) MNEs’ Strategies under subsidy G1 (1, 2, 3). (b) Local firm’s strategies under subsidy G2 (1, 2, 3). (c) Blockchain platform’s strategies Under the subsidy mechanism.

Assuming that the punishment for free riding behavior of multinational and local enterprises in collaborative research and development of low-carbon technology emissions reduction by blockchain platforms is related to their strategies. In the early stages, blockchain platforms strengthened their supervision and management of multinational and local enterprises, with heavy penalties. As the willingness of multinational and local enterprises to cooperate in research and development increased and free riding behavior decreased, blockchain platforms began to reduce regulatory penalties for multinational and local enterprises. At this point, the punishment for free riding behavior in low-carbon technology emission reduction through collaborative research and development between multinational and local enterprises by blockchain platforms is

As shown in Figure 11, compared to the static penalty model depicted in Figure 9, the dynamic penalty strategy (i.e., the trajectory under penalty

Figure 11. Evolution of tripartite strategies under punishment Mechanisms. (a) MNEs’ strategies under punishment f (0.2, 0.5, 0.8). (b) Local firms’ strategies under punishment f (0.2, 0.5, 0.8). (c) Blockchain platforms’ strategies under punishment mechanisms.

6 Discussion and limitations

6.1 Discussion

This study is based on the background of empowering cross-border low-carbon technology cooperation with blockchain technology, constructing a dynamic evolution model, and exploring the impact of key factors on the evolution path of cooperation through simulation experiments. The research results indicate that the linkage between low-carbon technology cooperation and blockchain has the following aspects:

Firstly, this study operates under the premise that blockchain platforms utilize efficient consensus mechanisms. It is important to note, however, that the adoption of energy-intensive protocols such as Proof-of-Work in practice could result in substantial carbon footprints—contrary to the fundamental goal of low-carbon emission reduction—and thereby create a counterproductive scenario of “increasing emissions under the guise of reduction”. Thus, in future implementations, energy efficiency must be prioritized in the selection of blockchain platforms, and their carbon emissions over the full lifecycle should be integrated into holistic carbon accounting frameworks to guarantee net positive environmental outcomes. While one may argue that any rule-enforcing information technology could enhance collaborative efforts, the modeling approach adopted in this research underscores the distinctive value of blockchain in the context of cross-border low-carbon cooperation. Although centralized regulatory platforms are capable of administering rewards and penalties, they remain susceptible to issues such as data tampering, single points of failure, elevated operational costs, and jurisdictional interference. These vulnerabilities become particularly pronounced in transnational settings, where they may manifest in the model as heightened verification costs or increased probabilities of contractual default. By contrast, the blockchain platform conceptualized in this model capitalizes on its intrinsic features—transparency and automation—to effectively curb both exogenous risks and endogenous opportunistic behaviors. As a result, it facilitates a cooperative environment across borders that requires lower trust overhead and offers greater execution certainty. Hence, blockchain serves not as a mere optional instrument, but as an essential technological enabler for realizing efficient, adaptive, and dynamic governance systems.

Secondly, blockchain technology improves the information transparency of technology transactions and reduces the problem of information asymmetry in traditional cooperation models through features such as decentralization, immutability, and smart contracts. This increase in transparency enables companies to more accurately assess the credibility and contractual capabilities of potential partners in cross-border technology cooperation, thereby reducing opportunistic behavior and improving cooperation stability.

In addition, the study further revealed the role of government subsidies, carbon credit mechanisms, and reputation effects in the stability of cooperation. Policy incentives have a significant impact on corporate cooperation decisions, and reasonable financial subsidies and carbon credit mechanisms can reduce the cost of technology transfer for enterprises and increase the enthusiasm of technology recipients. In addition, the active regulation of blockchain platforms can bring reputation benefits to themselves, and the improvement of reputation benefits can promote cooperation willingness. However, we also need to be cautious of the negative cooperation willingness caused by excessive meeting of platform usage costs.

It is worth noting that technology spillover effects may have different impacts in different market environments. In mature markets, technology spillover can promote the improvement of the entire industry’s technological level and enhance market competitiveness; In emerging markets with high technological barriers, technology spillovers may lead to increased awareness of protecting their core technologies, thereby inhibiting technological openness and cooperation. Therefore, how to balance technology sharing and intellectual property protection in different countries and regions is still a problem worthy of in-depth research.

Finally, the study also suggests that if institutional regulation is inadequate or incentive policies are lacking, companies may be more inclined to adopt conservative strategies, limit technology sharing, and weaken the actual effectiveness of blockchain empowerment. For example, if there are loopholes or insufficient legal effectiveness in the execution of smart contracts, enterprises may have doubts about the security and reliability of blockchain technology, which in turn affects their willingness to cooperate. And the negative regulation of blockchain platforms has varying effects on different enterprises.

6.2 Limitations

Although this study reveals the immense potential of blockchain technology in facilitating transnational low-carbon technology cooperation, it must be noted that its practical deployment and application still face a series of technical and institutional challenges. These challenges may, to some extent, constrain the realization of its enabling effects.

First, this study assumes blockchain platforms employ efficient consensus mechanisms. However, if cooperative networks adopt energy-intensive mechanisms like Proof-of-Work, the substantial carbon footprint generated by their operation could contradict the original intent of low-carbon emissions reduction, creating a paradox of “emission reduction leading to increased emissions.” Therefore, future blockchain platform selections must prioritize energy efficiency, adopting green consensus algorithms and integrating their lifecycle carbon emissions into comprehensive carbon accounting systems to ensure net positive environmental benefits.

Second, cross-border low-carbon technology cooperation involves massive, high-frequency monitoring data requiring on-chain evidence storage. This poses severe challenges to blockchain networks’ transaction processing capacity (TPS) and data storage capabilities. Currently, many blockchain platforms experience network congestion, transaction delays, and surging fees under high-concurrency requests, potentially becoming technical bottlenecks hindering large-scale, wide-area collaboration. Future research should explore scaling solutions integrating sharding, state channels, and off-chain computation to balance the “impossible triangle” of decentralization, security, and efficiency.

Third, globally, MNEs, local enterprises, and regulators may adopt heterogeneous blockchain platforms based on differing technical standards, security requirements, or commercial considerations. The resulting data silos between these platforms hinder the free flow of cross-chain value and seamless information verification, fragmenting what should be a unified global low-carbon cooperation network. Developing standardized cross-chain protocols and universal data middleware to enable mutual recognition and transfer of carbon assets and credits across different chains is key to establishing a global digital carbon governance infrastructure.

Finally, there are legal validity and compliance risks associated with smart contracts. The “code is law” vision faces complex challenges in a multinational legal landscape. The logic of automated execution may vary across jurisdictions due to differing contract laws, data privacy regulations (e.g., EU GDPR), and carbon regulatory frameworks, potentially leading to conflicts. Should disputes arise, whether on-chain smart contract rulings can be recognized by offline judicial systems remains an unresolved issue. This necessitates that future on-chain cooperative governance mechanisms design robust “legal-technical” interfaces. They must explore “Oracles” not merely as data bridges but as compliance verification nodes, ensuring automated execution aligns with local legal frameworks.

7 Conclusion and suggestions for countermeasures

7.1 Conclusion

Firstly, the core value of blockchain technology lies in enhancing the information symmetry of all parties involved in cooperation, reducing opportunistic behavior, mitigating technology spillover risks and “free riding” behavior, thereby enhancing the willingness of technology providers to cooperate. Under the empowerment of blockchain, enterprises are more inclined to adopt open collaboration models rather than traditional closed patent protection strategies. The transformation of this model not only helps accelerate the diffusion of low-carbon technologies, but also promotes global technology sharing and collaborative innovation.

Secondly, policy incentives play an important role in cross-border low-carbon technology cooperation. Reasonable financial subsidies, carbon credit mechanisms, and reputation effects can effectively reduce transaction costs for enterprises in technology transfer and increase the participation enthusiasm of technology recipients. However, research has also found that a single fiscal incentive is not sufficient to ensure the sustainability of cooperation, and the improvement of carbon credits is equally crucial. It can provide additional economic returns for enterprises, thereby enhancing the motivation for cooperation. In addition, it is necessary to consider the level of cost reduction for the use of blockchain platforms to avoid the negative impact of excessive subsidies on cooperation willingness.

In addition, compared to the static subsidy model, the direct effect of dynamic subsidy strategy in promoting low-carbon technology cooperation and research and development between multinational and local enterprises has been weakened, but it can more effectively achieve collaborative optimization of the tripartite game system. Moreover, in the case of low initial willingness to cooperate, the dynamic subsidies and penalties based on blockchain smart contracts can adjust the incentive intensity in real time, improve cooperation stability and policy accuracy.

Finally, the impact of technology spillover effects varies depending on the market environment. In mature markets, technology spillover can promote the improvement of the entire industry’s technological level and enhance market competitiveness; However, in emerging markets with high technological barriers, excessive technology spillovers may actually inhibit cooperation.

7.2 Countermeasures and suggestions

Based on the research findings, this article proposes the following policy recommendations to further promote cross-border low-carbon technology cooperation under the empowerment of blockchain:

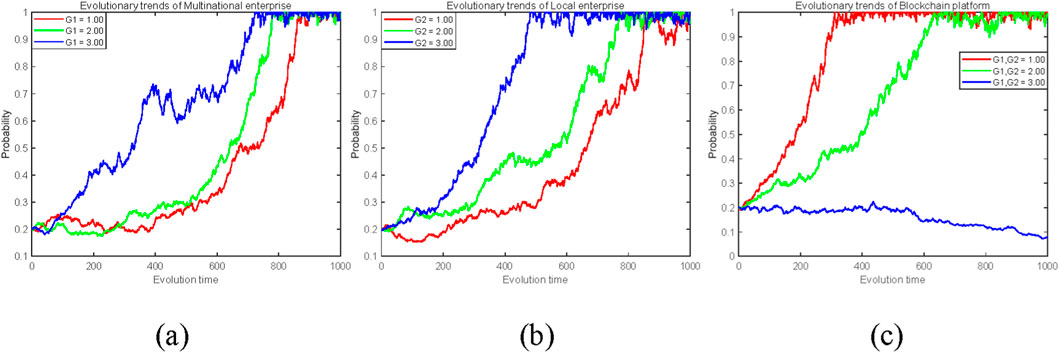

First, model simulation results indicate (see Figures 2, 12) that increasing subsidies can effectively promote corporate collaboration, but their incentive effect follows a law of diminishing marginal returns. Blindly raising subsidies not only increases fiscal burdens but may even dampen platform enthusiasm. Policymakers should set initial subsidy levels between 1.2 and 1.5 times the benchmark value to rapidly initiate cooperation. Simultaneously, drawing from the design logic of dynamic mechanisms, subsidies should be tied to quantifiable cooperation outcomes (e.g., emission reductions, technology sharing frequency) rather than provided indefinitely.

Figure 12. The impact of platform regulatory mechanism parameters on the evolution of MNEs’ strategies (x). (a) Active regulatory cost reduction coefficient k (0.2, 0.5, 0.8). (b) Dynamic subsidy cap G1 (1, 3, 5). (c) Penalty intensity under passive regulation f (0.2, 0.5, 0.8).

Second, establish an on-chain governance system combining “smart contracts + gradient regulation” to automate rewards and penalties. Platforms should automatically trigger corresponding reward/penalty tiers based on real-time monitoring of corporate cooperation status data. For instance: and when cooperation probability is high, switch to a “low-intensity incentive and low-intensity supervision” mode to optimize the allocation of governance resources.

Additionally, clarify the platform’s functional positioning to balance cost reduction and reputation building. When procuring blockchain services for low-carbon cooperation projects, governments should prioritize the platform’s reputation capital as a core evaluation metric. This will guide platforms to shift from “price competition” to “reputation competition,” fostering long-term oriented behavior.

Finally, international cooperation on blockchain-based MRV systems should be pursued to reduce institutional transaction costs. Drawing from simulation findings that blockchain reduces institutional friction, international organizations should spearhead the development of cross-border Monitoring, Reporting, and Verification (MRV) standard interfaces to lower corporate compliance costs. Priority should be given to piloting blockchain-based joint emission reduction projects, applying the on-chain governance mechanisms validated herein to practice, and compiling best practice guidelines for global dissemination.

7.3 Research shortcomings and future prospects

This study still has certain limitations. Firstly, there may be some simplification in the assumptions about corporate behavior during the model construction process. In future research, behavioral economics factors can be further introduced to enhance the practical applicability of the model. Secondly, simulation experiments are mainly based on theoretical parameter settings, and subsequent model calibration can be combined with empirical data to improve the external effectiveness of the research. Finally, future research may consider employing the SBM-DEA model [52] to address transnational emission reduction issues, or utilizing spatial network analysis to examine the driving factors behind transnational emission reduction actions [53, 54].

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

YL: Writing – original draft, Funding acquisition, Conceptualization, Data curation. JW: Investigation, Writing – original draft, Methodology. BL: Methodology, Formal Analysis, Software, Writing – review and editing, Visualization.

Funding

The authors declare that financial support was received for the research and/or publication of this article. This work is supported by the National Natural Science Foundation of China (grant number 42301341), the Fundamental Research Funds for the Central Universities, and the fund from the Research Center for the Theory of Socialism with Chinese Characteristics, Tongji University.

Acknowledgements

Thanks to Teacher Li and Teacher Wu for their work in the research.

Conflict of interest

Author JW was employed by Shaanxi Coal Industry Co., LTD.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Pirani A, Fuglestvedt JS, Byers E, O’Neill B, Riahi K, Lee JY, et al. Scenarios in IPCC assessments: lessons from AR6 and opportunities for AR7. Npj Clim Action (2024) 3(1):1. doi:10.1038/s44168-023-00082-1

3. Lee H, Calvin K, Dasgupta D, Krinmer G, Mukherji A, Thorne P, et al. Synthesis report of the IPCC sixth assessment report (AR6), longer report. Geneva, Switzerland: Intergovernmental Panel on Climate Change (IPCC) (2023).

4. Gonenc H, Poleska A. Multinationals, research and development, and carbon emissions: international evidence. Clim Pol (2023) 23(8):959–74. doi:10.1080/14693062.2022.2135484

5. World Bank. East Asia and the Pacific economic update October 2023: services for development (English). Washington, D.C.: World Bank Group (2023). Available online at: http://documents.worldbank.org/curated/en/099092923135515050.

6. Mazé D, Chailan C. A south-south perspective on emerging economy companies and institutional coevolution: an empirical study of Chinese multinationals in Africa. INTERNATIONAL BUSINESS REVIEW (2021) 30(4):101704. doi:10.1016/j.ibusrev.2020.101704

7. Han CM, Nam H, Waddi ST. Corporate philanthropy by foreign multinationals in developing countries in Asia: do local consumers truly matter? ASIA PACIFIC BUSINESS REVIEW (2024) 30(4):667–90. doi:10.1080/13602381.2022.2139949

8. Mendola M, Prarolo G, Sonno T. Curse or blessing? MNEs and labor market outcomes in Africa. REVIEW WORLD ECONOMICS (2024). doi:10.1007/s10290-024-00547-3

9. Vetráková M, Smerek LCOMPETITIVENESS OF SLOVAK ENTERPRISES IN CENTRAL AND EASTERN EUROPEAN REGION. E and M EKONOMIE A MANAGEMENT (2019) 22(4):36–51. doi:10.15240/tul/001/2019-4-003

10. Nyiri P, de Graaff N, McCaleb A, Szunomár A, Verver M, Ybema S. Truly a European company': a Chinese auto maker's strategies of europeanisation. ASIA PACIFIC BUSINESS REVIEW (2024) 30(2):300–21. doi:10.4324/9781003519270-5

11. Rufino CA, Sanseverino ER, Gallo P, Koch D, Diel S, Walter G, et al. Towards to battery digital passport: reviewing regulations and standards for second-life batteries. BATTERIES-BASEL (2024) 10(4):115. doi:10.3390/batteries10040115

12. Jun H, Jie W, Fei Z, Wang MZ. Contract selection for collaborative innovation in the new energy vehicle supply chain under the dual credit policy: cost sharing and benefit sharing. INTERNATIONAL JOURNAL INDUSTRIAL ENGINEERING COMPUTATIONS (2024) 15(1):209–22. doi:10.5267/j.ijiec.2023.10.003

13. Contractor FJ. Can a firm find the balance between openness and secrecy? Towards a theory of an optimum level of disclosure. JOURNAL INTERNATIONAL BUSINESS STUDIES (2019) 50(2):261–74. doi:10.1057/s41267-018-0204-2

14. Chen YX, Li ZT. Compensation incentive of executives under the situation of synergy or mutual exclusion of corporate profit and innovation tasks: based on incentive game model between principal and agent. COMPLEXITY (2023) 2023:1–19. doi:10.1155/2023/5626825

15. Luo Y, Shen J, Liang H, Sun L, Dong L. Supporting building life cycle carbon monitoring, reporting and verification: a traceable and immutable blockchain-empowered information management system and application in Hong Kong. RESOURCES CONSERVATION RECYCLING (2024) 208:107736. doi:10.1016/j.resconrec.2024.107736

16. Luo Y, Shen J, Liang H, Sun L, Dong L. Carbon monitoring, reporting and verification (MRV) for cleaner built environment: developing a solar photovoltaic blockchain tool and applications in Hong Kong's building sector. J Clean Prod. (2024) 471. doi:10.1016/j.jclepro.2024.143456

17. Woo J, Fatima R, Kibert CJ, Newman RE, Tian Y, Srinivasan RS. Applying blockchain technology for building energy performance measurement, reporting, and verification (MRV) and the carbon credit market: a review of the literature. Build Environ (2021) 205:108199. doi:10.1016/j.buildenv.2021.108199

18. Piao X, Ding H, Song H, Liu M, Gao S. A blockchain-enabled trading framework for distributed photovoltaic power using federated learning. Int J Energ Res. (2024) 2024:5950032. doi:10.1155/2024/5950032

19. Westphall J, Martina JE. Blockchain privacy and scalability in a decentralized validated energy trading context with hyperledger fabric. SENSORS (2022) 22(12):4585. doi:10.3390/s22124585

20. Talan K, Shishank S, Blockchain-centered business model in the context of the Indian automotive supply chain (2022).

21. Alsadi M, Arshad J, Ali J, Prince A, Shishank S. TruCert: blockchain-Based trustworthy product certification within autonomous automotive supply chains. Comput Electr Eng (2023) 109:108738. doi:10.1016/j.compeleceng.2023.108738

22. Tsai YC. Enhancing transparency and fraud detection in carbon credit markets through blockchain-based visualization techniques. ELECTRONICS (2025) 14(1):157. doi:10.3390/electronics14010157

23. López L-A, Cadarso M-Á, Zafrilla J, Arce G. The carbon footprint of the U.S. multinationals’ foreign affiliates. Nat Commun (2019) 10(1):1672. doi:10.1038/s41467-019-09473-7

24. Ortiz M, López L-A, Cadarso MÁ. EU carbon emissions by multinational enterprises under control-based accounting. Resour Conserv Recycl (2020) 163:105104. doi:10.1016/j.resconrec.2020.105104