- 1School of Management Science and Engineering, Nanjing University of Information Science and Technology, Nanjing, China

- 2School of Politics, Economics and International Relations, University of Reading, Reading, United Kingdom

Introduction: Under global integration, banking system stability is paramount for financial market stability. While subordinated debt enhances bank capital stability, it poses capital loss risks to creditor banks upon issuer bankruptcy. This paper examines the transmission mechanism of systemic risk arising from banks’ mutual holdings of subordinated debt, specifically from a risk preference perspective.

Methods: We construct a multi-channel risk contagion model that comprehensively incorporates the effects of interbank lending, investment coupling, and mutual holdings of subordinated debt, explicitly integrating bank risk preference. The model’s dynamics and systemic risk implications are analyzed through simulation.

Results: Simulation analysis reveals that bank systemic risk is significantly influenced by savings rates and their volatility, reserve requirements, and investment returns and their volatility. In contrast, the impact of interbank lending rates is found to be relatively small.

Discussion: These findings provide crucial theoretical support for regulatory agencies in identifying key risk contagion pathways and formulating effective preventive strategies. Furthermore, the study outlines important future research directions, including calibrating model parameters with real-world data and introducing more heterogeneous bank behavior assumptions.

1 Introduction

As the global economy continues to become more integrated, national financial markets are becoming increasingly interconnected. As the nucleus of the financial system, the banking system’s business activities penetrate deeply at all levels, and once systemic risk occurs, it will not only trigger the crisis of the bank itself, but also quickly transmit it to the entire financial market like dominoes. The Bank for International Settlements defines systemic risk in financial markets as the risk that a substantial part of the financial system will be unable to fulfil its function of providing credit and collapse [1]. This paper defines systemic risk based on the perspective of bank failure risk. Risk contagion is a key issue in the financial system. The theory of risk contagion suggests that the interconnectedness of financial institutions can lead to the rapid spread of distress in one institution to others, thereby triggering systemic risk. Risk contagion in this paper refers to the process by which the risk of one bank is transmitted to other banks through channels such as interbank lending and investment coupling, resulting in other banks also facing risk.

Current research on systemic risk in the banking system primarily focuses on analysis from the perspective of the interbank market. One category of research emphasizes the construction of financial network models to analyze the risk contagion resulting from direct credit relationships between banks [2–7]. For example, Qi et al. [4] used network topology theory to analyze the transmission mechanisms of credit shocks and liquidity shocks, as well as their impact on risk propagation within the banking network. The study found that liquidity shocks have a greater impact than credit shocks; Liu [5] analyzed the interactions between financial institutions and interbank lending, as well as the effects of leverage and market liquidity. The results emphasized the importance of understanding and controlling risk channels for maintaining banking stability; Macchiati [6] constructed an interbank market model using European banks’ balance sheet information to assess systemic liquidity risk; Yanquen and Livan [7] found that credit provided by banks to the real sector exhibits a certain degree of overlap, thereby creating systemic risk. Another category of research focuses on the dynamic evolution of interbank lending activities and their dynamic impact on systemic risk [8–15]. For example, Capponi et al. [8] developed a dynamic model of interbank lending activities to reflect the dynamic changes in systemic risk; Ding et al. [10] used a multi-agent approach to model the interbank lending network, conducting an in-depth study of the risk contagion process among banks; Fan and Sheng [11] constructed a dynamic evolution model for assessing systemic risk in the banking sector under dual risk exposure, with results indicating that the evolution of contagion risk exceeds that of credit risk; Jin et al. [13]conducted stress tests on China’s interbank lending network to study the risk contagion capacity of financial networks; Krause and Giansante [14] established an interbank lending network and found that the initial scale of bank failures is the dominant factor in whether contagion occurs.

The extant studies primarily analyze systemic risk from the interbank lending perspective, and some scholars also consider banks’ common asset holdings [16, 17] and investment-related behaviors [18–21]. Wang and Li [16] found that the redistribution of assets within the two networks, namely, interbank loans and mutual asset holdings, significantly reduced the systemic risk; Zou et al. [19] developed a two-tiered network model of China’s financial system, which included the interbank lending network and the cross-stockholding network. Their findings indicated that the contagion losses within the two-tiered network exceeded the total losses from the independent interbank credit network and the cross-stockholding network. Gao and Fan [20] introduced risk appetite coefficient and systemic shocks to construct a quantitative portfolio strategy model. Nguyen [22] found that subordinated debt mitigates bank risk-taking; Cappeni and Weber [23] studied the portfolio selection problem of banks through the losses caused by the spillover effect of price reductions; Shen and Li [24] found that risk contagion was also significant due to the combined effect of counterparty risk and common asset holding risk when there was no overlap in portfolios. Weber and Weske [25] examined the individual and combined effects of interbank liabilities, bankruptcy costs, markups, and cross-shareholdings on systemic risk; Wang et al. [26] found that the risk of contagion caused by excessive similarity of investment assets is the main cause of systemic risk. Jiang and Fan [27] considered the effects of interbank loans, portfolio overlap, and subordinated debt mutual ownership on bank stability; Yan et al. [28] established a multi-tier banking network structure with three channels: interbank loans, mutual ownership, and common asset holding.

The aforementioned models consider the impact of interbank lending, jointly held assets, or investment-related behaviors on systemic risk in the banking system, but most studies are based on single-channel or dual-channel approaches. Jiang and Fan [27] were the first to propose a multi-channel model that integrates interbank loans, overlapping investment portfolios, and cross-holdings of subordinated debt. However, their method assumes that the interest rates on all subordinated debt issued by banks are fixed, and the allocation process of debt holdings is random. This overlooks two key realities in financial markets: (1) Subordinated debt interest rates are inherently risk-sensitive, reflecting the financial health of the issuer; (2) Banks’ investment choices (including debt holdings) are strategically driven by their risk preferences. To bridge this gap, our model introduces a risk-preference-based dynamic mechanism: (1) Debt issuance rates are differentiated based on the relative equity strength of the issuer; (2) Debt holdings are not random; according to risk premium theory, banks with lower risk preferences (risk-averse) tend to hold lower-yielding (safer) debt, while banks with higher risk preferences (risk-seeking) pursue higher-yielding (riskier) debt.

2 Model

2.1 Bank market structure with mutual holding of subordinated debt

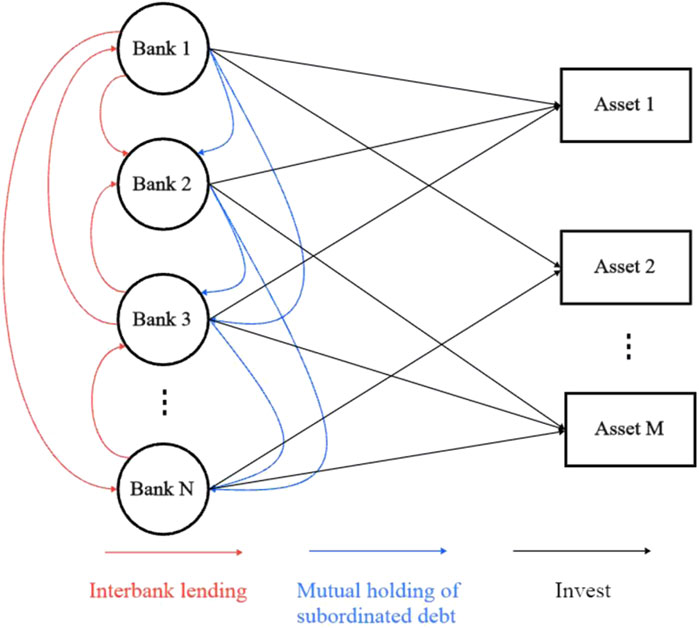

In the banking system, bank bankruptcy is frequently due to insufficient liquidity and a bank’s liquidity is closely correlated with its savings, investment, as well as other behaviors [29]. To examine the specific factors affecting bank systemic risk, this paper establishes a multi-channel risk transmission model on the basis of interbank holdings of subordinated debt with risk preferences, as illustrated in Figure 1. This model comprehensively considers the effects of interbank loans, investment in ordinary assets, and mutual holdings of subordinated debt on bank systemic risk. Different from previous studies, this paper further considers the heterogeneity of banks, setting different risk preference parameters for each bank to reflect the bank’s preference for risk. Capital structure theory states that the cost of financing a firm is closely related to its capital structure. A bank’s owner’s equity is an important part of its capital structure, and higher owner’s equity means that the bank’s financial position is more robust and better able to absorb potential losses, thus reducing the cost of its debt financing. Therefore, this paper sets different subordinated debt interest rates based on the ratio of each bank’s owner’s equity to the average owner’s equity of all banks. At the same time, Subordinated debt is selected for holding based on the size of the risk preference parameters; banks with smaller risk preference parameters (i.e., more risk-averse) hold subordinated debt with smaller interest rates, while the opposite holds subordinated debt with larger interest rates.

In the actual banking system, banks usually hold subordinated debt with each other as a long-term capital replenishment mechanism to meet capital adequacy requirements. Subordinated debt can be traded in the secondary market, while interbank lending is mainly used to meet the short-term funding needs of banks and serves to manage liquidity, and is generally not transferred. In addition, the interrelation of interbank investment assets plays a critical part in the banking system’s stability. Multiple banks may invest in the same asset, and once one bank goes bankrupt and conducts an asset liquidation, the price of the asset will fluctuate, affecting the other banks holding the asset. In addition to causing asset price volatility, the failure of a bank may result in the bank’s inability to meet its loan and subordinated debt obligations, causing losses to the assets of creditor banks. In severe cases, it may even trigger a domino effect of consecutive bank failures. Insufficient liquidity of banks, which is closely correlated with factors such as investment, savings and lending, is the major factor of instability in the banking system. This article will use the model to analyze how these factors affect systemic risks in the banking system.

2.2 Model construction of multi-channel risk transmission among entities holding subordinated debt

In the actual banking system, the relationships between banks are complex and intertwined, involving not only direct relationships arising from interbank lending and holding subordinated debt, but also indirect relationships arising from joint investments in certain assets. In a random banking network, the interbank lending and the issuance and holding of subordinated debt are a process of random allocation. When banks have insufficient liquidity, they can borrow from other banks, with the link matrix represented by

Under the random banking network scenario, it is assumed that at time

where

At each time, the bank will carry out savings, dividends and investment operations, these operations will make the bank’s liquidity to alter, at time

where

where

where

When the bank’s liquidity is inadequate, it will choose to liquidate some assets to make up for the liquidity. At time

where

where

where

2.3 Multichannel risk contagion model analysis of mutual subordinated debt holdings based on risk appetite

Within the framework of the banking system’s network, if a bank holds liquid funds after completing its dividend distribution and investment activities, it is considered to be a potential lender of funds, capable of providing financing support to other banks. When a bank is illiquid, it will need to incorporate funds from the interbank market to continue operating as usual. In case of the indebted bank, when the funds received from other banks are able to cover the preceding debt, the repayment operation will be carried out, and at the same time, the liquidity of this bank will be reduced to nil. If the bank is unable to raise sufficient funds to repay its debts and interest on deposits, it will have to dispose of its assets until the funds from the sale of assets can cover its debts. If the bank is unable to pay its debts after selling its assets, it will face bankruptcy and start the process of liquidation of assets. The proceeds of the liquidation will be applied first to pay off deposits and the remainder will be repaid to creditor banks on a pro rata basis.

During the process of issuing subordinated debt, the interest rate

where

In the dynamic development of the banking system, selling assets tends to cause asset prices to fall. Since a number of financial intermediaries invest in the same asset at the simultaneous time, financial intermediaries are indirectly connected to each other through the assets in which they invest. Movements in asset prices can influence multiple institutions holding the asset at the same time, and changes in the assets of one financial institution can have an effect on other financial institutions through the assets jointly held. When banks are illiquid and unable to access loans, they sell assets to cover the liquidity gap. Furthermore, when a bank fails, the failing bank will liquidate its portfolio of assets, and the assets sold will decline in value. Banks holding the identical assets will be hit by the devaluation of their assets, leading to a loss of equity, which in turn may lead to insolvency, triggering bank bankruptcy, which can further damage the assets of creditor banks. Through this evolutionary process, the initial shock of the interbank network continues to propagate through the system. When a bank sells an asset due to illiquidity, or a bank goes into liquidation due to bankruptcy, the asset is sold at a depreciated value. Here, a market effect function is modeled through the price impact function in Equation 9:

where

3 Model analysis

In the banking system evolutionary process, banks receive various ownership interests, liquid assets, dividends, etc., depending on their business conditions and strategies, and some banks go bankrupt due to poor business strategies. Due to systemic risk, the failure of one or a few banks may trigger a domino effect of more consecutive bank failures. In order to more clearly characterize systemic risk, we define systemic risk as in Equation 11:

where

In this paper, the largest simulation time step is 2000, 200 banks are used in the simulation, and the simulation is performed 10 times, which can adequately represent the dynamic features of the banking system. At each time step, the bank can randomly recover 35% of its assets. There are 150 assets in which the bank can invest. The initial equity capital of the owner follows a normal curve with a mean of 200. The deposit interest rate is less than the investment return rate, i.e.,

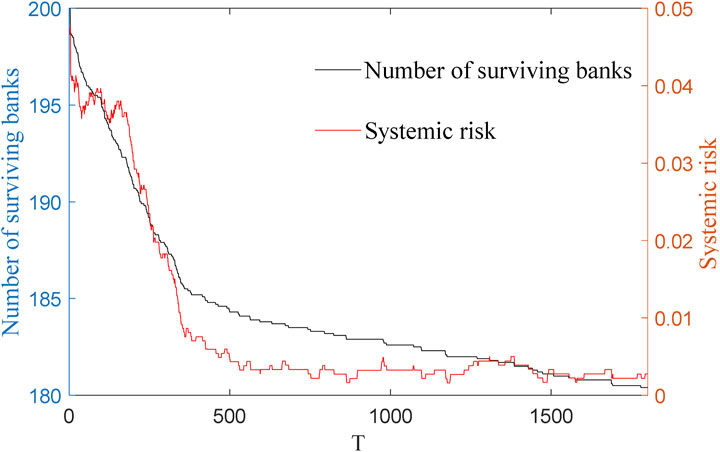

Figure 2 shows the change in the amount of banks in the banking system and the associated systemic risk, and the parameter is set to

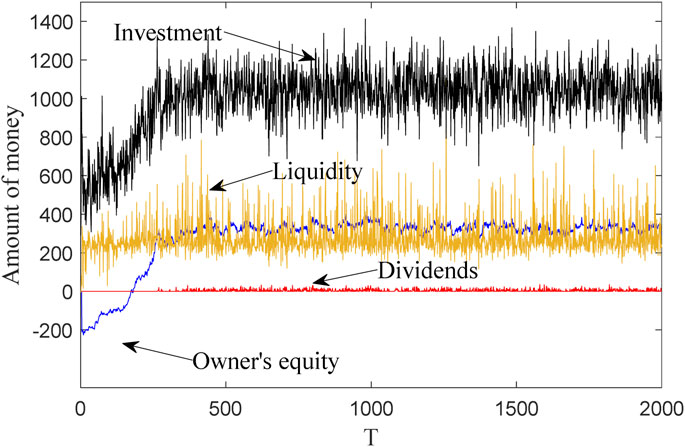

Figure 3 shows the evolution process of various parameters of a bank based on the risk contagion model constructed in this article. The parameter settings are consistent with Figure 2. As shown in the figure, the parameters of the bank’s ownership equity, investment, dividends and liquidity change with the changes of internal and external factors in the banking system, and are in a state of dynamic change. When the ownership equity of the bank is greater than 0, the bank’s investment and dividends begin to increase, which is consistent with the actual operation of the bank.

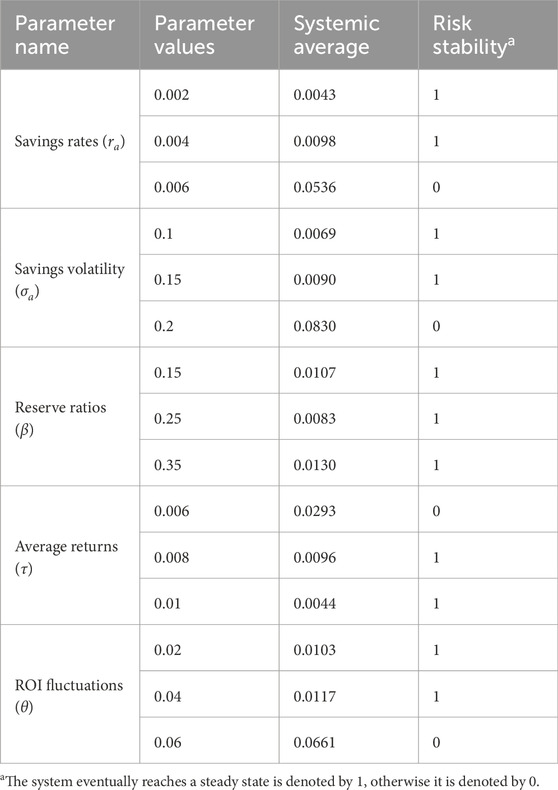

This paper will further validate the validity of the model by analyzing the impact of parameters such as savings interest rate, savings volatility, reserve ratio, interbank lending rate, investment yield and volatility on systemic risk.

3.1 The impact of savings-related factors on systemic risk

Savings are essential for banks, not only as they are the main source of funding for banks, but also provide liquidity support to banks and are the basis for banks to make loans and other investment activities. Banks increase the value of their funds by paying interest on their savings to attract deposits, which are then used to make loans. The level of savings interest rate directly affects the bank’s cost of funds, which in turn affects the bank’s profitability and risk management.

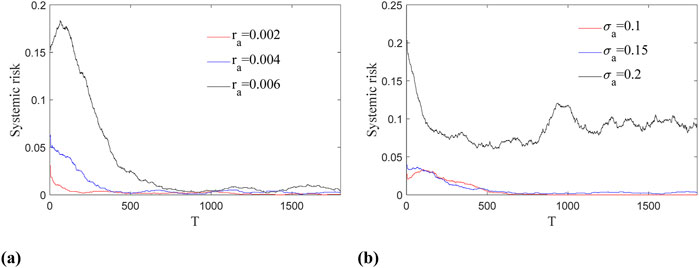

Figure 4a illustrates the development of banks’ systemic risk under different savings interest rate conditions. The parameter settings are consistent with Figure 2 except for

Figure 4. Evolution of systemic risk under different savings-related parameters: (a) Evolution of systemic risk under different savings rates; (b) Evolution of systemic risk under different savings volatility.

Figure 4b illustrates the evolution of systemic risk under different savings volatility conditions. The parameter settings are consistent with Figure 2 except for

3.2 The impact of the reserve requirement ratio on systemic risk

The reserve requirement ratio is the lowest ratio of reserves that the central bank demands to be held by commercial banks and is main tools of monetary policy. In the early days of the statutory reserve system, its main function was risk management. By setting a statutory reserve ratio, the central bank mandates that commercial banks retain a fixed percentage of cash reserves to meet the withdrawal needs of depositors. This system has effectively reduced the incidence of bank runs and preserved the banking system’s stability [31]. Typically, a higher reserve requirement ratio (RRR) can enhance a bank’s resilience to risk, as a higher reserve deposit means that the bank has more funds to deal with possible depositor withdrawals and liquidity pressures, reducing the likelihood of a run on the bank.

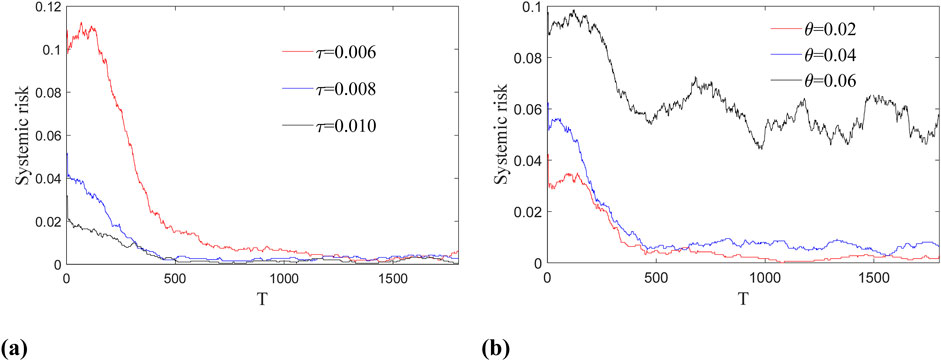

Figure 5 shows the evolution of systemic risk in various RRR states. The parameter settings are consistent with Figure 2 except for

3.3 The impact of interbank lending rates on systemic risk

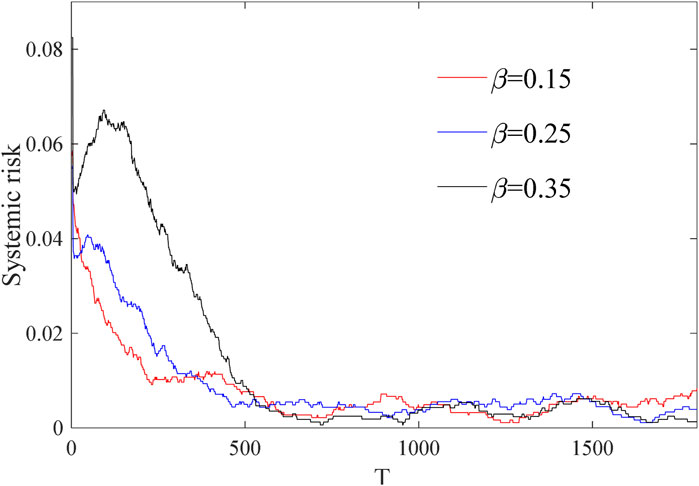

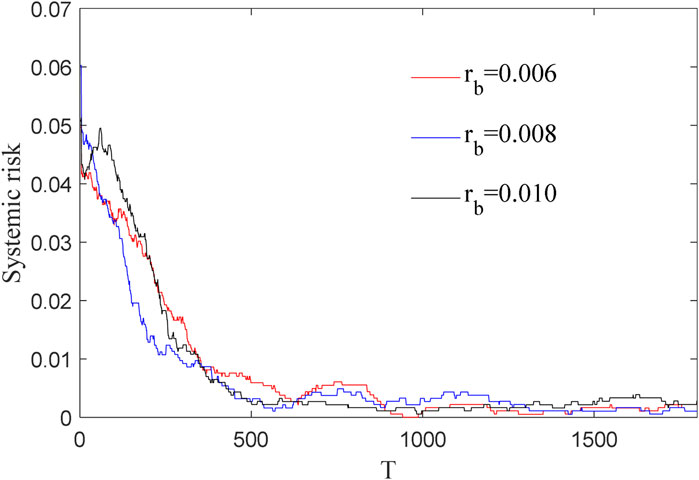

The lending rate is a major factor influencing the liquidity and stability of banks. In financial markets, banks manage their short-term funding needs through lending markets to ensure they can meet customer withdrawal needs and other short-term obligations. Figure 6 shows the evolution of banks’ systemic risk at different lending rates. The parameter settings are consistent with Figure 2 except for

In the real financial market, the rate of return on investment is an important indicator to measure the profitability of a bank’s investment activities. It reflects the ratio between the income that a bank earns through its investment activities and the cost of its investment. A higher yield usually means that the bank’s investment activities are more successful, which can lead to a more stable source of income for the bank, thereby enhancing the bank’s profitability and stability. Conversely, a lower yield means that the bank’s investment activities are subject to higher risk, which may affect the stability of the bank.

Figure 7a shows the evolution of banks’ systemic risk under various average rates of return. The parameter settings are consistent with Figure 2 except for

Figure 7. Evolution of systemic risk under different investment-related parameters: (a) Evolution of systemic risk under different average returns; (b) Evolution of systemic risk under different ROI fluctuations.

Figure 7b illustrates banks’ systemic risk under different ROI fluctuations. The parameter settings are consistent with Figure 2 except for

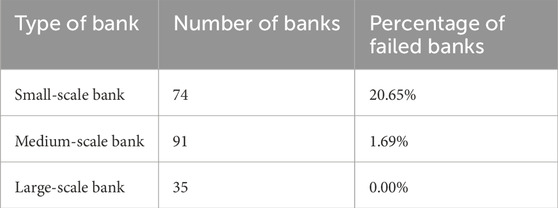

3.4 The impact of bank size on systemic risk

In complex financial networks, bank size is not only a measure of the size of a single institution, but also a key hub for the propagation of systemic risk. In this paper, banks are categorized into different types according to their size, where those with an initial ownership interest of less than 100 are small-sized banks, those with an initial ownership interest between 100 and 500 are medium-sized banks, and those with an initial ownership interest greater than 500 are large-sized banks. The number of different types of banks and the percentage of failed banks are given in Table 1. From the table it can be seen that small scale banks have the highest number of failures followed by medium scale banks and large-scale banks have almost no failures. This phenomenon is consistent with the “too big to fail” hypothesis. In fact, large banks are highly systemically important due to their size and influence [33], and are unable to cope with the negative knock-on effects of failure, so they will tide over the difficulties with government support. 2008 financial crisis, Lehman Brothers, due to over-investment in financial derivatives related to subprime bonds in the real estate market bubble, has become a major player in the financial crisis. Subprime debt-related financial derivatives, and suffered huge losses when the real estate market collapsed, and eventually filed for bankruptcy protection on September 15, 2008. Therefore, despite the low rate of large-scale bank failures, cross-asset investments and subprime exposures need to be monitored. On the other hand, the likelihood of a financial crisis depends on the liquidity position of banks in the system [34], so small and medium-sized banks need improved liquidity support to reduce the likelihood of outright bankruptcy.

3.5 Impact of falling asset prices on systemic risk

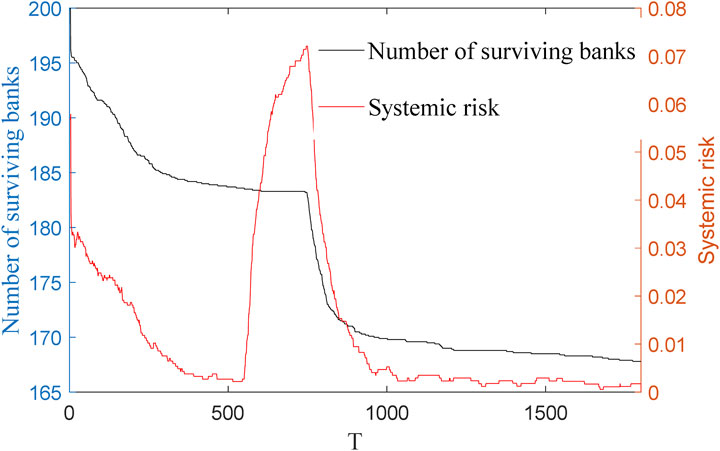

In order to assess the robustness of the banking system to extreme shocks, this study designs an asset price crash scenario with reference to historical financial crisis characteristics. Figure 8 presents the evolutionary results of the banking network suffering a 40% fall in asset prices at step 750, with the same parameter settings as in Figure 2. From the figure, it can be seen that the number of insolvent banks increases rapidly after suffering an asset price fall, and due to the high degree of correlation in the banking system, the asset price fall transmits risk among banks through multiple channels, which leads to a domino effect of a large number of banks failing one after another.

The results in Figure 8 show that systemic risk, after a short-term sharp rise, gradually decreases to a steady state, the number of bank failures gradually decreases, and the banking system stabilizes, indicating that the banking network is able to gradually absorb systemic risk.

On the basis of the foregoing analysis, it may be concluded that the banking system’s stability is related to a variety of factors. Table 2 demonstrates the impact of several key parameters on systemic risk, and here we analyze it in the context of the specific economic situation. When the economy is growing steadily, the banking system is generally exposed to low systemic risk. In this environment, investor yields are usually higher and less volatile, helping banks maintain stable profitability and thus enhancing their stability. In times of increased economic uncertainty or economic downturn, banks may be exposed to higher systemic risks, especially when the reserve requirement ratio is high, which may limit banks’ lending capacity and affect their profitability and liquidity. At this juncture, an appropriate reduction in the reserve requirement ratio and the savings interest rate is conducive to replenishing banks’ liquidity and improving their ability to withstand risks. Therefore, banks and policymakers need to pay close attention to changes in these factors and take appropriate risk control measures to preserve the banking system’s stability.

4 Discussion

The financial system is a complicated network structure consisting of diversified financial entities and their interactions, which include not only the direct relationship between interbank loans and cross-ownership of subordinated debt, but also the indirect coupling effect caused by the convergence of asset allocation. It is of great significance for regulators and bank policymakers to study the impact of bank savings interest rates and their fluctuations, interbank lending rates, reserve requirement ratios, and investment yields and fluctuations on bank stability. Previous studies have mostly focused on the coupling of interbank lending and investment, and few have taken into account cross-subordinated debt holdings. In addition, it is difficult for the existing model to truly reflect the dynamic development of the banking system because some assumptions in the existing model are not realistic, such as the same interest rate on subordinated bonds issued by each bank, and the risk appetite of the bank is not taken into account. To better reflect the development of the banking system, this paper establishes a multichannel risk contagion model from the risk appetite perspective, which comprehensively considers interbank loans, investment coupling, and the holding of subprime bonds with different interest rates according to different risk appetite levels. Based on multi-dimensional simulation and theoretical deduction, this paper draws the following conclusions.

(1) The savings interest rate can directly affect the bank’s cost of funds, which in turn affects the profitability and stability of the bank. The higher the savings interest rate of the bank, the higher the fluctuations of savings and the higher the systemic risk. Appropriately lowering the interest rate on savings and reducing the fluctuation of savings is conducive to improving the stability of banks.

(2) A reserve requirement ratio that is too high or too low will raise the systemic risk of banks. If the reserve requirement ratio is too high, it will reduce the interest rate spread between investment and savings, and concurrently limit the bank’s lending ability, affect the bank’s profitability, and increase systemic risk. The smaller the interest rate on deposits, the more money the bank uses for investment, and the higher the bank’s risk.

(3) The interbank lending rate is not a significant factor in the systemic risk of banks.

(4) The higher the average return on investment, the more stable the bank will be. If the bank’s investment return is too low, the bank will not be able to make sufficient profits, which will have the effect of reducing liquidity and weakening the ability of the bank to resist risks. The less volatile the investments, the lower the bank’s systemic risk. A sound investment strategy is also essential to improve the stability of the bank.

Based on the above conclusions, we propose the following policy recommendations: For regulatory authorities, it is necessary to improve the monitoring indicator system for banking system stability, fully considering the impact of factors such as savings interest rates, reserve ratios, investment returns, and volatility on systemic risk, closely monitoring trends in these indicators, and promptly identifying potential risks. When formulating and adjusting reserve requirement ratio policies, the dual impact on systemic risks in the banking system should be carefully balanced. Differentiated reserve requirement ratio policies can be implemented based on the scale and risk characteristics of different types of banks. Additionally, an emergency mechanism for the interbank lending market should be established and improved, with enhanced monitoring of the flow of interbank lending funds. For banks themselves, savings products should be priced reasonably, with savings interest rates determined scientifically and reasonably based on their cost structures, risk preferences, and market competition conditions. Banks should also optimize their asset allocation strategies, focusing on diversification and balancing risk and return, while reasonably controlling the volatility of investment assets. Furthermore, banks should strengthen liquidity risk management, reasonably arrange funding sources and usage, ensure sufficient liquidity to address funding shortages, and enhance communication and coordination with the central bank and other financial institutions.

This study constructs a dynamic evolution model framework, which aims to quantitatively measure and analyze the mechanism of bank systemic risk in the context of macroeconomic cyclical fluctuations, and provides methodological support for regulators to identify risk contagion paths and formulate forward-looking prevention and control strategies. Future research directions can focus on the following aspects: first, calibrating model parameters based on real transaction data to improve the empirical adaptability of risk prediction; Second, more heterogeneous bank behavior assumptions (such as differentiated liquidity management strategies) are introduced to enhance the explanatory power of the model to the complex financial ecology. This will further improve the dynamic monitoring framework for systemic risks and provide a science-based foundation for the precise implementation of macroprudential policies.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://github.com/knochen336/Risk-Contagion-of-Banks-Holding-Subordinated-Debt/.

Author contributions

SC: Data curation, Writing – original draft, Methodology, Software. SJ: Project administration, Writing – review and editing, Conceptualization, Funding acquisition, Supervision. YZ: Investigation, Formal Analysis, Data curation, Writing – review and editing. LM: Writing – review and editing, Visualization, Investigation, Validation.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work is funded by Ministry of Education, Humanities and social science projects (21YJC790054) and National Natural Science Foundation of PR China (72101121).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Poledna S, Martínez-Jaramillo S, Caccioli F, Thurner S. Quantification of systemic risk from overlap portfolios in the financial system. J Financial Stab (2021) 52:100808. doi:10.1016/j.jfs.2020.100808

2. Jackson MO, Pernoud A. Systemic risk in financial networks: a survey. Annu Rev Econ (2021) 13(1):171–202. doi:10.1146/annurev-economics-083120-111540

3. Craig B, Ma Y. Intermediation in the interbank lending market. J Financial Econ (2022) 145(2):179–207. doi:10.1016/j.jfineco.2021.11.003

4. Qi M, Shi D, Feng S, Wang P, Nnenna AB. Assessing the interconnectedness and systemic risk contagion in the Chinese banking network. Int J Emerging Markets (2022) 17(3):889–913. doi:10.1108/ijoem-08-2021-1331

5. Liu X. Unraveling systemic risk transmission: an empirical exploration of network dynamics and market liquidity in the financial sector. J Knowledge Economy (2024) 16:6629–64. doi:10.1007/s13132-024-01861-9

6. Macchiati V, Brandi G, Di Matteo T, Paolotti D, Caldarelli G, Cimini G. Systemic liquidity contagion in the European interbank market. J Econ Interaction Coord (2022) 17(2):443–74. doi:10.1007/s11403-021-00338-1

7. Yanquen E, Livan G, Montañez-Enriquez R, Martinez-Jaramillo S. Measuring systemic risk for bank credit networks: a multilayer approach. Latin Am J Cent Banking (2022) 3(2):100049. doi:10.1016/j.latcb.2022.100049

8. Capponi A, Sun X, Yao DD. A dynamic network model of interbank Lending—Systemic risk and liquidity provisioning. Math Operations Res (2020) 45(3):1127–52. doi:10.1287/moor.2019.1025

9. Gao Q, Lv D, Jin X. Systemic risk of multi-layer financial network system under macroeconomic fluctuations. Front Phys (2022) 10:943520. doi:10.3389/fphy.2022.943520

10. Ding Z, Yan H, Chen Y, Jiang C. Risk contagion in interbank lending networks: a multi-agent-based modeling and simulation perspective. Expert Syst Appl (2024) 256:124847. doi:10.1016/j.eswa.2024.124847

11. Fan H, Sheng W. Research on dynamic evolution of systemic risk in Chinese banking system. Front Phys (2020) 8:199. doi:10.3389/fphy.2020.00199

12. Zou J, Fu X, Yang J, Gong C. Measuring bank systemic risk in China: a network model analysis. Systems (2022) 10(1):14. doi:10.3390/systems10010014

13. Jin S, Song L, Shu L, Gao Q, Chen Y. Systemic risk in Chinese interbank lending networks: insights from short-term and long-term lending data. Empirical Econ (2024) 67:2539–64. doi:10.1007/s00181-024-02617-9

14. Krause A, Giansante S. Interbank lending and the spread of bank failures: a network model of systemic risk. J Econ Behav and Organ (2012) 83(3):583–608. doi:10.1016/j.jebo.2012.05.015

15. Li S, Liu M, Wang L, Yang K. Bank multiplex networks and systemic risk. Physica A: Stat Mech Its Appl (2019) 533:122039. doi:10.1016/j.physa.2019.122039

16. Wang H, Li S. Optimization of systemic risk: reallocation of assets based on bank networks. J Risk (2021). doi:10.21314/JOR.2020.449

17. Huang Y, Liu T. Diversification and systemic risk of networks holding common assets. Comput Econ (2023) 61(1):341–88. doi:10.1007/s10614-021-10211-9

18. Ma J, He J, Liu X, Wang C. Diversification and systemic risk in the banking system. Chaos, Solitons and Fractals (2019) 123:413–21. doi:10.1016/j.chaos.2019.03.040

19. Zou L, Xie L, Yang Y. A double-layer network and the contagion mechanism of China's financial systemic risk. J Artif Societies Soc Simulation (2019) 22(4). doi:10.18564/jasss.4122

20. Gao Q, Fan H. Systemic risk caused by the overlapping portfolios of banks under a bilateral network. Front Phys (2021) 9:638991. doi:10.3389/fphy.2021.638991

21. Caccioli F, Barucca P, Kobayashi T. Network models of financial systemic risk: a review. J Comput Soc Sci (2018) 1:81–114. doi:10.1007/s42001-017-0008-3

22. Nguyen T. The disciplinary effect of subordinated debt on bank risk taking. J empirical Finance (2013) 23:117–41. doi:10.1016/j.jempfin.2013.05.005

23. Capponi A, Weber M. Systemic portfolio diversification. Operations Res (2024) 72(1):110–31. doi:10.1287/opre.2022.0290

24. Shen P, Li Z. Financial contagion in inter-bank networks with overlapping portfolios. J Econ Interaction Coord (2020) 15(4):845–65. doi:10.1007/s11403-019-00274-1

25. Weber S, Weske K. The joint impact of bankruptcy costs, fire sales and cross-holdings on systemic risk in financial networks. Probab Uncertainty Quantitative Risk (2017) 2:9–38. doi:10.1186/s41546-017-0020-9

26. Wang C, Liu X, He J. Does diversification promote systemic risk? North Am J Econ Finance (2022) 61:101680. doi:10.1016/j.najef.2022.101680

27. Jiang S, Fan H. Systemic risk in the interbank market with overlapping portfolios and cross-ownership of the subordinated debts. Physica A: Stat Mech its Appl (2021) 562:125355. doi:10.1016/j.physa.2020.125355

28. Yan C, Ding Y, Liu W, Liu X, Liu J. Multilayer interbank networks and systemic risk propagation: evidence from China. Physica A: Stat Mech its Appl (2023) 628:129144. doi:10.1016/j.physa.2023.129144

29. Fan H, Pan H. The effect of shadow banking on the systemic risk in a dynamic complex interbank network system. Complexity (2020) 2020(1):1–10. doi:10.1155/2020/3951892

30. Caccioli F, Shrestha M, Moore C, Farmer JD. Stability analysis of financial contagion due to overlapping portfolios. J Banking and Finance (2014) 46:233–45. doi:10.1016/j.jbankfin.2014.05.021

31. Pan H, Fan H. The stability of banking system with shadow banking on different interbank network structures. Discrete Dyn Nat Soc (2021) 2021(1):1–15. doi:10.1155/2021/6650327

32. Chen B, Li L, Peng F, Anwar S. Risk contagion in the banking network: new evidence from China. North Am J Econ Finance (2020) 54:101276. doi:10.1016/j.najef.2020.101276

33. Zhang X, Zhang X, Lee CC, Zhao Y. Measurement and prediction of systemic risk in China’s banking industry. Res Int Business Finance (2023) 64:101874. doi:10.1016/j.ribaf.2022.101874

Keywords: systemic risks, subordinated debt, risk preference, banking network, dynamic evolution

Citation: Chen S, Jiang S, Zhuang Y and Meng L (2025) Research on the risk contagion of banks holding subordinated debt from the perspective of risk preferences. Front. Phys. 13:1614995. doi: 10.3389/fphy.2025.1614995

Received: 20 April 2025; Accepted: 15 July 2025;

Published: 07 August 2025.

Edited by:

Ze Wang, Capital Normal University, ChinaReviewed by:

Can-Zhong Yao, South China University of Technology, ChinaNaixi Chen, Donghua University, China

Pristanto Silalahi, Atma Jaya University, Yogyakarta, Indonesia

Copyright © 2025 Chen, Jiang, Zhuang and Meng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shanshan Jiang, anNzQG51aXN0LmVkdS5jbg==

Shuting Chen1

Shuting Chen1 Shanshan Jiang

Shanshan Jiang