- School of Management, Shenyang University of Technology, Shenyang, China

Introduction: In e-commerce supply chains, suppliers generally face funding constraints, and the guaranteed financing provided by logistics providers can effectively improve the capital liquidity of suppliers. Blockchain helps alleviate the information silos in the financing process, strengthen cooperation between enterprises, and enhance the quality of financing. Cooperative and non-cooperative decisions have significant impacts on the formulation of financing strategies, and contract design helps coordinate the interest conflicts between enterprises and optimize financing strategies.

Methods: Addressing the financial constraints for suppliers, this study employs game theory analysis to construct a guarantee financing model under blockchain technology where logistics providers offer guarantees to suppliers. It considers the risk-averse of managers and first analyzes the financing equilibrium strategies before and after blockchain in a non-cooperative game setting. Then, under a cooperative game framework, it explores the financing equilibrium strategies in three modes: cooperation between suppliers and logistics providers, cooperation between logistics providers and e-commerce platforms, and cooperation among all three parties. It also compares and analyzes the influence of blockchain on cooperative and non-cooperative game strategies in terms of financing decisions. To coordinate the interest conflicts among various risk-averse members, the study introduces revenue-sharing and cost-sharing to formulate coordination strategies.

Results and discussion: Through comparative analysis, it is found that information verification costs can impair the financing gains of suppliers but help ensure the financing gains of logistics providers. Supplier defaults are detrimental to the development of supply chain financing (SCF). The financing gains of suppliers and logistics providers will initially decrease and then increase with the adoption of blockchain, which can better optimize financing strategies once they exceed a certain threshold. A higher risk aversion can harm the financing gains of suppliers and logistics providers but benefit the gains of ecommerce platforms and financial institutions. Compared to non-cooperative modes, cooperative models are more effective in enhancing the financing efficiency, and under cooperative modes, blockchain is more conducive to promoting the improvement of corporate financing gains. The Shapley value can effectively allocate the financing gains among supply chain members, and risk-sharing contracts can increase the financing gains of suppliers and logistics providers. This research aims to provide theoretical references for the financing decisions of supply chain enterprises.

1 Introduction

In the e-commerce supply chain, the guarantee financing provided by logistics providers can primely relieve the financial trouble of suppliers. Most suppliers are small and medium-sized enterprises (SMEs), and their funding constraints are becoming increasingly prominent. Logistics providers, offering transportation services, have a thorough understanding of logistics, commerce flows, and other aspects based on their transactions with suppliers. They are more willing to provide guarantees to help suppliers obtain working capital in advance, thereby effectively easing their financial constraints. Under the guarantee of logistics providers, suppliers do not need to wait for the sale of goods to recover funds; instead, they can obtain short-term funds to pay for raw material procurement, production operations, and other expenses, significantly shortening the capital turnover cycle [1]. Logistics providers, leveraging their real-time supervision capabilities of goods and credit endorsements, reduce the lending risks for financial institutions, enabling suppliers to access financing at lower costs while assuring the stability of the supply chain’s upstream and downstream segments [2]. Through the guarantee of logistics providers, banks would provide loans to suppliers. This model not only optimizes the cash flow management of suppliers but also activates assets and enhances overall operational efficiency. Through cooperation among various members, it strengthens communication and interest coordination between enterprises, improves the efficiency of the use of funds, and optimizes financing strategies [3].

In the financing decisions, enterprises are increasingly focusing on risk avoidance. Although the financing model provided by logistics providers alleviates the financial pressure on suppliers, its potential risks still require high vigilance. The value of products is easily affected by market price fluctuations, product obsolescence, or damage, which may lead to delayed sales and the inability to timely recover funds, the supplier lacks sufficient funds to repay the loan [4]. Enterprises have a strong tendency towards risk avoidance, and managers should strengthen risk control through multiple means to address these risks. By introducing third-party evaluation agencies to dynamically monitor enterprise value, combining the Internet of Things (IoT) to achieve real-time tracking and data transparency of commerce and capital flows, and establishing dynamic adjustment mechanisms to set flexible financing limits based on market supply and demand and product characteristics to effectively avoid the risks faced by enterprises [5]. Supply chain enterprises are collaborating to build mechanisms for shared benefits and shared risks and using big data analysis to predict industry risks and develop contingency strategies in advance. These measures aim to balance financing efficiency with controllable risks, assuring the steady running of SCF ecosystem [6].

Blockchain technology can optimize financing strategies and coordinate interest conflicts among enterprises. Blockchain technology, through the construction of a trustworthy distributed ledger and smart contract mechanisms, can deeply optimize financing strategies and strengthen collaborative cooperation among supply chain enterprises. In the financing process, blockchain records the status and flow of funds in real time, ensuring information transparency and traceability, reducing trust costs for all parties, and providing precise data support for dynamic adjustments of guaranteed rates, financing limits, and other strategies, improve the availability of information [7]. Smart contracts can automatically execute pre-set rules for shared benefits and shared costs, automatically allocating the profits of logistics providers and suppliers according to predetermined ratios, and triggering risk compensation mechanisms based on market price fluctuations to balance interest conflicts among all parties, it helps to better alleviate the financial constraints of enterprises [8]. This technology-empowered contract coordination strategy not only avoids information games and execution lags in traditional negotiations but also promotes enterprises to actively maintain asset security and supply chain stability through incentive-compatible designs, improve financing and operational efficiency. A blockchain-driven financing ecosystem integrates dispersed participants into a community of shared interests, enhancing financing efficiency while building a new paradigm of supply chain finance characterized by controllable risks and win-win cooperation [9].

Based on this, we construct non-cooperative and cooperative game models, consider the risk-averse behavior of managers, and introduce revenue-sharing and risk-sharing as coordination mechanisms to explore the equilibrium and coordination strategies of guarantee financing provided by logistics providers under blockchain. The main issues addressed are: (1) What are the financing equilibrium strategies before and after the adoption of blockchain? (2) How to coordinate the interest conflicts among various supply chain enterprises? The contributions are mainly reflected as follows: Firstly, applying blockchain to the guarantee financing model provided by logistics providers, it compares and analyzes non-cooperative and cooperative games for the first time, exploring financing equilibrium strategies under different scenarios. Previous studies mostly considered applying blockchain technology to traditional supply chain financing models and were largely based on case studies or qualitative analyses. This study applies blockchain to a specific financing area and uses game models to explore optimal financing equilibrium strategies. Secondly, in the financing decision-making process, it considers the risk-averse behavior of enterprises and analyzes the best finance strategies from the managerial behavior. Previous scholars, when studying financing strategies, would consider the financing risk issues faced by enterprises but rarely approached it from the perspective of managerial behavior, considering the risk-averse behavioral preferences of enterprises. This study incorporates the risk-averse of managers into the financing model to analyze the impact of risk-averse behavior. Finally, it introduces revenue-sharing and risk-sharing to harmonize the conflicts of risk-averse supply chain enterprises under blockchain. Previous research mostly introduced contract coordination strategies in the study of supply chain management, and coordination strategies also have big impacts on the finance decisions. This study introduces revenue-sharing and risk-sharing in the analysis of financing strategies to coordinate interest conflicts among enterprises.

The subsequent structure arrangement is as follows: The second part elaborates on the current research status of existing literature. The third part describes the background of the research problem and proposes relevant hypotheses. The fourth part constructs a non-cooperative game before and after blockchain. The fifth part constructs a cooperative game model after blockchain. The sixth part analyzes the coordination strategies after cooperation. The seventh part investigates the impact of various factors through numerical analysis. The eighth part is the summary and outlook.

2 Literature review

2.1 Guarantee financing in SCF

Logistics provider guaranteed financing, as a crucial component of SCF, plays a great role in addressing capital constraints.

In terms of influencing factors, the guaranteed financing by logistics providers can effectively alleviate the funding constraints of enterprises. The scale of 3PL significantly affects banks’ willingness to grant credit and the financing decision mechanism. Large-scale 3PLs can enhance the willingness to grant credit to SMEs, whereas small-scale 3PLs lead to higher perceived risks. Data results show that smaller scales induce larger N2, while larger scales trigger larger LPP [10]. Through interviews, the study explores how TPL companies with different strategic orientations leverage market practices to gain competitive advantages. The results indicate that scale-oriented enterprises focus on market expansion and view SCF as the best tool to enhance benefits; scope-oriented enterprises regard SCF as a core business and improve financial performance through SCF empowerment [11]. In a SCF system consisting of manufacturers, retailers, and 3PLs, demand is influenced by logistics service levels and retail prices. Stackelberg games are constructed separately for retailer or manufacturer funding constraints, revealing that when the retailer is constrained, the manufacturer’s price keeps steadfast, while other participants’ strategy and gain rise with higher logistics service sensitivity and decrease with improved cost efficiency. When the manufacturer is constrained, the strategy and gain of all parties similarly increase with higher logistics service susceptibility and decrease with improved cost efficiency. The study recommends that retailers and manufacturers should prioritize 3PL’s service decisions under the 3PL financing model [12]. To investigate financing risks, an order financing risk assessment index system is established, combining letters and expert interviews to establish five dimensions: financing enterprises, downstream core enterprises, logistics enterprises, supply chain running, and environment. The indicators are perfected through questionnaires and statistical analysis and validated with an order finance project jointly undertaken by banks and logistics [13].

In terms of strategy selection, scholars have studied the equilibrium decisions of e-commerce platforms and 3PLs in providing guarantee financing and sales model choices for small and medium-sized suppliers. It was found that under different market risks and service costs, SMEs tend to opt for platform or 3PL guarantee financing, and guarantee financing influences the platform’s choice between resale and market modes [1]. 3PLs provide credit to budget-constrained retailers through a financial integration model, which can strengthen the gain of 3PLs, suppliers, retailers, and the supply chain compared to supplier credit and the no-budget constraint model. When the marginal profit of 3PLs is higher than that of suppliers, this control model is superior to supplier credit, and this model can surpass the no-budget constraint model [14]. For capital-constrained retailers, a bankruptcy guarantee insurance contract is designed, and third-party insurance institutions are introduced to bear bankruptcy losses. Under two financing mechanisms—trade credit and bank credit—the optimal decisions for all parties are provided, and the impact of parameters on decisions and profits is analyzed, offering references for formulating scientific policies and advancing supply chain financing [15].

In terms of model optimization, 3PLs leverage their information advantages to provide guarantees and direct financing for capital-constrained SMEs, but the default risks brought by demand fluctuations affect the choice of financing models. Studies compare the preferences of 3PLs, manufacturers, and retailers under guarantee financing, direct 3PL financing, and trade credit, finding that 3PL financing strategies depend on the manufacturer’s costs and the retailer’s initial funds. Financing equilibrium may damage the interests of all parties due to inconsistent strategies, necessitating coordination mechanisms to enhance the overall profit of the whole chain and provide guidance for 3PLs in selecting financing models under resilience considerations [16]. The study compares three 3PL financing models: bank financing, EPF, and 4PF. It shows that EPF improves commission rates and enhances logistics services, while 4PF is determined by 4PL fees; the three models complement each other, and when capital opportunity costs are homogeneous, platforms and 4PLs tend to self-finance [17]. A dual-channel supply chain game model is constructed to compare the finance models of e-commerce platforms and 3PLs. Increasing ECP interest rates reduces profits but increases total revenues; 3PL financing incurs lower direct operating costs than ECPs engaging in price competition through distribution; ECP financing is superior to 3PL financing; 3PLs need to lower interest rates or differentiate freight charges to compete [18]. Using fsQCA and interview methods, the study explores the cost-reduction effects of SCF and traditional finance combinations. It shows that cost reduction effects are constrained by traditional financing methods, and enterprises using credit guarantee financing are more likely to reduce costs compared to guarantee financing. The study provides references for policymakers and practitioners to simplify applications [19]. Addressing the two financing options for manufacturers, bank credit financing (BCF) and supplier green investment (SGI), this study analyzes the optimal strategy choices and examines the effects of various supply chain coordination contracts. In terms of coordination mechanisms, a revenue-sharing cannot coordinate enterprises, but both cost-sharing and quantity discount can effectively coordinate them when appropriate cost-sharing ratios or quantity discount rates are set [20].

Scholars studying the guarantee financing strategies provided by logistics providers have mainly focused on analyzing influencing factors, strategy selection, and model optimization. There are multiple factors affecting the optimal financing strategy, with risk being the primary influencing factor. Contemporary research mostly considers the influence of external risks on finance strategies. Building on this, this study analyzes the company’s own attitude towards risk avoidance and explores the influence of risk-averse on optimal finance decisions from the perspective of managerial behavior. In terms of strategy selection, scholars point out that different financing strategies should be chosen for different financing scenarios to optimize financing when formulating financing strategies. This study further introduces blockchain technology on this basis, utilizing its technological advantages to optimize financing strategies. It conducts a detailed analysis of the financing equilibrium before and after blockchain, exploring the optimal finance strategy. In terms of mode comparison, scholars compare the financing services provided by logistics providers with those offered by e-commerce platforms and other supply chain financing models, finding that logistics provider financing has better advantages. This study further analyzes the guarantee financing services provided by logistics providers, exploring the financing equilibrium strategies before and after the adoption of blockchain, and introduces a cooperative game model to investigate the influence of collaboration between logistics providers, e-commerce platforms, and other supply chain members on financing strategies. To optimize the financing model, this study introduces revenue-sharing and cost-sharing based on existing research to coordinate the interest conflicts among e-commerce supply chain members.

2.2 SCF under blockchain

Many advantages of blockchain have a good application in supply chain financing, which can effectively optimize the finance strategy.

In terms of operational mechanisms, scholars have proposed blockchain-based SCF models to address issues such as information asymmetry and cybersecurity risks in traditional platforms. The decentralized, transparent, and immutable nature of blockchain helps enhance transaction transparency and trust, protect the rights of SMEs, and optimize the efficiency of cash flow [21]. Blockchain can solve problems related to financing coverage, cost, efficiency, and risk control in SCF. Before implementation, it requires joint platform construction by multiple parties and organizational adjustments, with pilot feedback driving restructuring; to achieve scaled application, it needs to incentivize more participants and improve regulations. Based on the innovation theory, an implementation frame is put to provide guidance for system [22]. A blockchain logistics prototype system based on Hyperledger was designed and tested in real logistics enterprises, building a tracing platform based on logistics service flows to implement supplier responsibilities, improve LSP performance, and promote the development of Logistics 4.0, revealing the transformative benefits of blockchain in logistics services [23]. The supply chain payment process is cumbersome, and information is isolated, making it difficult to associate transportation with payments. A blockchain platform based on Ethereum smart contracts was constructed to achieve automatic authorization and information sharing. Suppliers can reduce the risk of consignment sales, buyers can track in real-time to ensure receipt of goods, and 3PLs can reduce paperwork and tracking costs, improving efficiency; the solution is secure and transparent [24]. E-commerce improves supply chain efficiency but leads to cash shortages for small retailers; existing logistics finance relies heavily on large 3PLs, with high thresholds. A blockchain-driven logistics finance platform is proposed, adopting a cross-layer architecture and smart contracts, combined with multi-agent systems, to achieve dynamic collateral management, and the feasibility is verified through case studies [25]. Integrating blockchain into transportation capacity supply chain financing, analyzing its impact on credit access, limits, and regulation. Through credit transmission decay, credit assessment, and closed-loop supervision, the mechanisms by which blockchain optimizes financing in three scenarios are revealed, indicating that it can enhance the participation of financial institutions and provide better credit to transportation enterprises [26].

In terms of strategy optimization, scholars have proposed a blockchain-based e-commerce logistics financing network physical traceability system, achieved logistics information visualization and shared through digital asset tokenization, promoting logistics financing operations using shared ledgers and smart contracts, and demonstrating system design and application, reducing upfront investment, enhancing flexibility, and supporting supply chain development [27]. Internet + policies have promoted the development of internet finance, with banks serving SMEs through SCF, combining logistics technology and edge computing to achieve real-time, secure data processing. A blockchain-based financing management system is studied, analyzing cash flow and risk control, and optimizing costs and efficiency through shared data and advanced processing, reducing risks [28]. Globalization and deepening production division have led to complex supply chain networks, making traditional models difficult to cope with. A blockchain-empowered SCF risk assessment and behavior prediction algorithm is proposed, constructing a dual-chain management system and architecture, with weighted risk control indicators based on homogeneity of variance testing, testing and comparing the performance of TPR, FPR, etc., for data from five companies, aiming to improve financing efficiency and prevent risks [29]. Small manufacturing enterprises are constrained by large financing needs and low trustworthiness. Traditional supply chain finance only benefits first-tier suppliers, while blockchain-driven innovations establish a trust transmission model through electronic payment vouchers, introducing dynamic weight incentives to expand multi-layer financing, alleviating finance trouble for SMEs, and the model’s rationality is verified through numerical analysis [30]. Case studies explore how blockchain drives the reconstruction of financial platform models. The study finds that blockchain empowers information, funds, logistics, and value flows, with model reconstruction driven by internal (content, governance, transaction structure) and external (industry, region, technology) factors, and enhances value proposition, network expansion, and value creation and distribution [31]. Scholars have also explored the value creation process of blockchain-empowered SCF. Based on service-dominant logic and social exchange theory, the roles, motivations, resources, and practices of participants are analyzed, and through case studies of blockchain platforms, it is verified that it meets needs through key resources and practices, creating value for all parties in the supply chain. It provides empirical evidence and implications [32].

In terms of financing model, a three-tier supply chain model for blockchain platform finance (BPF) is constructed, and through decision-making and parameter sensitivity analysis, the optimal strategy is identified. Compared to independent financing, it is found that when the retailer has insufficient capital and high costs, BPF is superior for manufacturers, distributors, and retailers. Risk sharing can enhance financing efficiency, providing theoretical basis for the selection of three-party financing models [33]. A three-tier supply chain game model is constructed to compare the effect of traditional and blockchain-visualized prepayment financing on risk mitigation and financial decision-making. The results show that blockchain improves visibility and refines financing decisions; consignment financing only achieves win-win for all parties when the second-tier supplier is severely capital-constrained; cross-layer direct financing achieves win-win for all three parties [34]. Based on the credibility of blockchain, SMEs can self-guarantee financing. A four-party model compares PUG with CUG, finding that CUG can bring Pareto improvement, but if the customer’s opportunity cost is bigger than the platform’s, the platform will be disadvantaged. The platform can adopt a high advance payment, low service fee strategy to reduce the risk of low-credit customers, and the advance payment ratio does not affect costs [35].

For blockchain-based supply chain financing, scholars have explored the impact mechanisms and optimization paths of blockchain on financing decisions, analyzing the factors influencing the financing profits of supply chain members. Comparative analyses of traditional financing decisions and blockchain-based financing decisions have found that blockchain helps to reduce financing risks. However, regarding the guarantee financing provided by logistics providers, fewer scholars have integrated the characteristics of the financing model, introducing the guarantee provided by logistics providers to investigate the financing equilibrium strategies before and after the adoption of blockchain. In studying blockchain-driven financing strategies, most existing scholars have adopted case studies or qualitative analyses; this study introduces the Stackelberg game model and considers both non-cooperative and cooperative games to explore the financing equilibrium strategies where logistics providers offer guarantees. Although some research has combined blockchain technology with the risk management of suppliers or financial institutions, and scholars have discussed the role of logistics providers in SCF, including their guarantees and profit distribution, very few papers have incorporated the risk preferences of logistics providers as on-chain guarantors and participants into systematic game analyses. This study, from the perspective of managerial behavior, considers the risk-averse behavior of enterprises and investigates its impact on financing strategies. Current research has paid attention to how blockchain reduces trust costs and improves transparency, but in multi-party cooperation scenarios, contract designs addressing how to fairly distribute the additional value generated on the chain and how to reasonably allocate the costs of blockchain construction and maintenance remain scarce. This paper, for the first time, explores, from the perspectives of game theory and contract design, how to design revenue-sharing and cost-sharing mechanisms under the background where blockchain nodes are jointly maintained by suppliers, logistics providers, e-commerce platforms, and financial institutions, and provides a detailed argumentation of their stability and incentive compatibility. Supply chain coordination strategies are commonly used in supply chain management, but few scholars have introduced revenue-sharing contracts and cost-sharing contracts when studying SCF strategies. Such contracts can effectively coordinate the interest conflicts of financing enterprises, and it is necessary to consider coordination strategies within the research.

3 Problem description and research hypothesis

3.1 Problem description

In an e-commerce supply chain composed of suppliers, logistics providers, and e-commerce platforms, suppliers face funding constraints, and traditional bank loans cannot fully meet their financial needs. Most suppliers are SMEs with weak credit foundations, resulting in limited loan amounts when applying to financial institutions. As an important member of the e-commerce supply chain, logistics providers can offer transportation services and financial services. Therefore, suppliers can seek guarantees from logistics providers to borrow from financial institutions, increase their financing amounts, and alleviate their own funding constraints. Considering the hierarchical nature of enterprise decision-making processes in financing and the characteristics of information asymmetry and strategic interdependence among parties, this paper selects the Stackelberg game model to depict the mutual influences among parties in decisions such as guarantee fees, financing interest rates, and product pricing. Using game analysis to build a financing model and explore the optimal financing strategy. There is a clear hierarchical relationship among e-commerce supply chain enterprises: suppliers first determine their financing needs and product wholesale prices; logistics providers then provide guarantees based on the suppliers’ credit and mandates and are responsible for transporting products; e-commerce platforms determine retail prices based on wholesale prices and logistics costs; and banks decide loan interest rates and amounts. The Stackelberg game model can effectively depict the strategic interactions, the leader-follower relationship in the financing scenario, and is highly consistent with the hierarchical setting of the Stackelberg game model.

E-commerce suppliers are focusing on risk aversion. Due to uncertainties in the financing process such as financing interest rates, the value of collateral, and market selling prices, participants need to balance the pursuit of maximum returns with the avoidance of return volatility. This study selects the mean - standard deviation model to express the risk-averse of all participants. The utility of participants depends not only on expected returns but is also affected by return fluctuations. The mean - standard deviation method intuitively depicts the trade-off between pursuing high returns and avoiding volatility risks by combining expected returns with the standard deviation of returns into a weighted utility function. This method is widely adopted in supply chain finance and investment fields and can condense complex risk characteristics into a single indicator, facilitating analysis and solution. Compared with other risk measurement models, the mean - standard deviation can directly use the variance of returns as a risk measure while retaining second-order information, improving the clarity of the model.

Blockchain technology has significant applications in the field of guarantee financing decisions, effectively improving the transparency of financing information and optimizing financing strategies [36]. The consortium blockchain architecture in blockchain technology can sufficiently protect the legitimate interests of all participating entities, safeguard data privacy, and improve transaction efficiency and governance controllability. Based on the consensus mechanism of blockchain, participants can read, write, and verify transaction information only under authorization, achieving controlled participation, data isolation, and high-performance consensus. The consortium blockchain nodes are pre-designated suppliers, logistics providers, e-commerce platforms, and banks. The maintenance costs mainly include hardware, operations, and smart contract development, without the need to purchase external Gas, and with minimal external attack risks. Costs can be quantified as relatively stable enterprise-level budgets, facilitating subsequent analyses of cost sensitivity in the model. Decision-making entities are concentrated at known nodes, and operations such as protocol upgrades, node additions, and deletions can be executed quickly through multi-party consensus, without the lengthy community discussions and voting required by public blockchains and avoiding risks. Since all nodes are core participants, the financing demands, logistics inspections, credit ratings, and other information shared on the chain have inherent credibility and do not require third-party verification, increasing trust among enterprises [37].

Under blockchain, to ensure the accuracy of data on the chain, it is usually necessary for multiple parties to collaboratively build a credible data chain [38]. In production or shipping stages, inventory change data is instantly synchronized to edge servers through integration with traditional ERP/WMS systems. In warehousing and logistics stages, Internet of Things (IoT) sensing devices are used to conduct real-time inventory counts, and collected weight, volume, and timestamp information for entry and exit from warehouses is uploaded to local gateways. Blockchain nodes are jointly maintained by suppliers, logistics providers, and core e-commerce/financial institutions. All nodes run lightweight clients, accept signed data packages sent by edge gateways, verify the digital signatures of producers/warehouse managers, and then package, consensus, and write inventory status to the blockchain. Based on smart contracts and consensus mechanisms, the authenticity and reliability of product transaction information are verified. If physical goods are tampered with, switched, or miscounted, the chain records will be inaccurate, leading to financial risks. Therefore, dual, dynamic cross-verification of product data on-chain and off-chain is needed to reduce financing risks.

Smart contracts automatically execute terms on the blockchain network, but to make them legally binding as contracts, all parties must explicitly agree to the contract terms through electronic signatures. Smart contract code must correspond to the hash of on-chain transactions, and contract terms must be saved either off-chain or on-chain in a human-readable form to meet subsequent judicial review needs. Smart contracts should clearly specify the conditions under which they automatically execute and send on-chain notifications to all parties before and after execution to ensure full awareness. Once deployed, smart contracts are executed automatically; if assets are incorrectly released or frozen due to technical vulnerabilities or hacker attacks, emergency arbitration or manual intervention mechanisms must be reserved. Given that the smart contract code itself is a legal document, any modifications to the code must go through on-chain upgrade proposals. Although blockchain inherently possesses anti-tampering and traceability features, during disputes, original off-chain sensor data or manual signature records should also be synchronously archived as evidence.

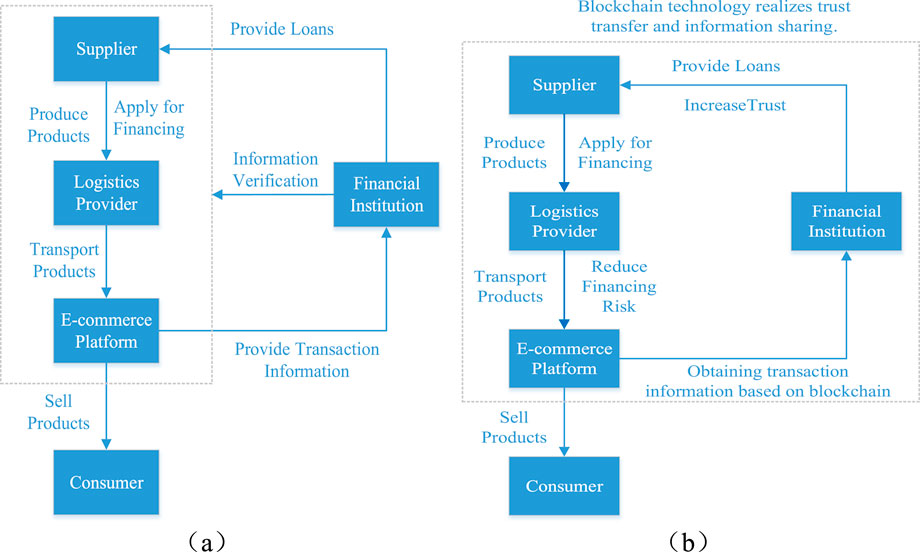

The financing and operation processes before and after the blockchain are shown in Figure 1.

Under the N mode without adopting blockchain, the credit cannot be transmitted. When suppliers apply for loans from internet financial institutions, they need third-party logistics companies to provide guarantees and must pay certain information verification costs. In financing and operation, suppliers produce products at a cost of

Under the B mode driven by blockchain technology, e-commerce supply chains upload relevant transaction information to the blockchain during operations, and enterprises and financial institutions with permission can access this information. Blockchain’s encryption algorithms, and other features help promote trust transmission among firms. Internet financial institutions can effectively evaluate the credit situation of capital-constrained suppliers based on data on the blockchain and blockchain trustworthiness without charging related information verification costs. In financing and operation, suppliers sell products with a production cost of

In a chain composed of vendors, logistics companies, and e-commerce, and guarantee financing model is constructed. Capital-constrained suppliers apply for guarantee financing, guaranteed by logistics companies, with internet financial institutions providing loans. The risk-averse behavior of managers is measured using the Conditional Value at Risk (CVaR) method, and a Stackelberg game model is built to analyze the guarantee financing strategies considering risk aversion before and after adopting blockchain. We also compare and analyze the non-cooperative game model where members make separate determination and the cooperative game model where members make centralized determination. To coordinate the conflicts between various members, revenue-sharing and risk-sharing are used to harmonize the firms.

The definitions of symbols are in Table 1.

3.2 Research hypothesis

The research hypotheses proposed are:

(1) Reference scholars Tian et al. [39] and Li et al. [40], assume the market random function is

(2) The firms are all risk averse. Financial institutions are risk-neutral and have ample funds. Reference scholars Choi et al. [41] and Gupta and Ivanov [42], the mean-standard is used to represent risk-averse behavior, with the formula:

4 Non-cooperative game financing equilibrium before and after the adoption of blockchain

In the non-cooperative game, enterprises tend to avoid risks. Considering the N mode without blockchain and the B mode with blockchain, we explore the financing equilibrium in different scenarios.

4.1 Non-cooperative game in mode N

The goods produced by the supplier are delivered to e-commerce by the logistics company, and the e-commerce purchases and sells them. The vendor faces a capital dilemma and subscribes to financing. The logistics company provides a guarantee and charges the corresponding guaranteed fee. Internet financial institutions provide loans and charge interest fees. During the financing process, it is necessary to verify the transaction information and the credit level of the vendor, and the vendor needs to bear the corresponding information verification costs. If the vendor does not repay the loan on time at the end of the period (with a probability

where

Following the approach of Choi et al. [41] and Gupta and Ivanov [42], the mean-standard method is used to represent the risk-averse, and the function is expressed as:

Theorem 1. Using Stackelberg game, the best equilibrium for each variable can be obtained respectively. The supplier’s best wholesale price is

Substituting the above top solutions into the profit functions, and after rearranging, the top financing profits for the supplier, logistics company, e-commerce and financial institutions can be shown in Equations 5–8:

4.2 Non-cooperative games in mode B

After the introduction of blockchain, although the blockchain cost (node deployment and operation and maintenance costs under the alliance chain architecture) is increased, the sharing degree of transaction information is improved and the trust transfer between enterprises is promoted. Based on the technical characteristics of instant consensus and reliable nodes in the alliance chain in the blockchain, each participant does not need to bear the extra cost of information verification under the chain and does not need to worry about the delay of transaction confirmation on the chain. Logistics providers and internet banks are more willing to provide finance services for suppliers. In the financing process, suppliers pay guarantee fees to logistics companies and interest fees to internet financial institutions. All members need to pay blockchain costs, and the finance profit function is shown in Equations 9–12:

where

According to the utility function, the expected profits of the enterprises are respectively:

Theorem 2. According to Stackelberg, the top equilibrium for each variable can be obtained respectively. The supplier’s best wholesale price is

Substituting the top solutions into the expected profit functions, the best finance profits for enterprises and financial institutions can be obtained in Equations 13–16 respectively:

4.3 Comparative analysis

By analyzing the top equilibrium solutions of various decision variables and the top financing profit functions of various decision-making entities, this paper explores the conditions and constraints for enterprises to introduce blockchain from the financing income. Before and after the blockchain, the changes in the intensity of various decision variables of risk-averse members are compared and analyzed, and the effect of the risk aversion is investigated.

Proposition 1. When the decision variables satisfy certain conditions

Proof: Before blockchain, the top financing profit of the vendor is

The cost of blockchain technology is a critical factor in whether supply chain members adopt blockchain; both capital-constrained suppliers and well-funded financial institutions focus on maximizing their own interests. When the condition is met

Proposition 2. When

Proof: Based on the optimal solutions of each decision variable, the supplier’s optimal wholesale prices before and after blockchain adoption are

When blockchain technology satisfies condition

Proposition 3. The effect of risk aversion coefficient on guaranteed rates under both non-blockchain and blockchain scenarios is as follows:

In an environment of uncertain market demand, a company’s risk attitude has a significant influence on finance decisions. The guaranteed interest rate of logistics providers increases with the rise in risk aversion. Under a higher risk aversion attitude, logistics providers, to ensure their own level of returns, will set higher guarantee interest rates. In traditional financing models, the guaranteed interest rate is jointly determined by the value of collateral, liquidity, and market risk. A high-risk aversion coefficient typically manifests as a conservative financial strategy, leading to a rise in the guaranteed interest rate as the risk aversion coefficient rises. After blockchain, blockchain, through the transparency of collateral information, it reduces information asymmetry and decreases information verification costs. Although technology reduces operational risks, logistics providers with high risk aversion still require stringent guarantee terms to enhance trust between enterprises. Blockchain does not eliminate market risks, and the guaranteed interest rate still reflects the risk preference of logistics providers, thus maintaining a positive correlation with the risk aversion. Under the traditional model, the negative correlation between the financing interest rate and the risk aversion means that suppliers with a high-risk aversion tend to adopt conservative operational strategies and pursue stable cash flows. For financial institutions, high-risk-averse suppliers, due to their lower probability of default, are considered better credit customers. Financial institutions reward high-credit customers with lower interest rates to attract low-risk, capital-constrained suppliers and optimize their risk asset portfolios. Under the blockchain model, the positive correlation between the finance interest rate and the risk aversion coefficient indicates that blockchain changes the risk assessment mechanism, and transparent data allows financial institutions to accurately evaluate the true risk status of borrowers. Conservative strategies under risk aversion may reflect business stability, but excessive risk aversion may suppress growth potential. For financial institutions, high-risk-averse suppliers may be interpreted as lacking growth momentum or insufficient risk resistance capabilities. In a blockchain environment, financial institutions prefer suppliers with moderate risk-taking and therefore charge higher interest rates to overly risk-averse suppliers to compensate for potential low growth expectations.

5 Cooperative game financing equilibrium after the adoption of blockchain

When blockchain is low, members can achieve higher financing returns. Blockchain technology enhances trust among vendors, logistics, and e-commerce, forming an alliance through information sharing. When e-commerce supply chain members cooperate, a cooperative game model under blockchain is constructed to compare and analyze the financing equilibrium strategies. Partial cooperation and collective cooperation among members are conducive to improving the overall financing returns. Members write information into blockchain technology can regulate the decision-making behaviors of enterprises, improving transaction quality and financing efficiency. In the cooperative game, different cooperation modes are considered separately, including cooperation between suppliers and logistics, cooperation between logistics and e-commerce, and tripartite cooperation among suppliers, logistics, and platforms, to explore the financing equilibrium decisions of risk-averse firms under different modes.

5.1 Cooperative game of alliance between supplier and logistics company

When the supplier and logistics company form an alliance, the supplier and logistics company are the leaders, and the platforms are the followers. The financing profit of members is shown in Equations 17–19:

According to the financing profit, the expected profits are respectively:

Theorem 3. According to Stackelberg, the top equilibrium solutions for each variable can be obtained respectively When suppliers and logistics providers cooperate, the optimal product sales price is

Substituting the top solutions into the financing gain function, the top profits for each entity can be obtained in Equations 20–22 respectively:

5.2 Cooperative game of alliance between logistics company and E-commerce platform

When the logistics company and e-commerce form an alliance, the supplier remains the leader, and the logistics and e-commerce are the followers. The financing function is shown in Equations 23–25:

Using the mean-standard to rundown the risk attitude, the expected profits and variances are respectively:

Theorem 4. According to Stackelberg, the top equilibrium solutions for each variable can be obtained respectively. The optimal wholesale price of suppliers is

Substituting the top solutions into the financing profit function, and after rearranging, we can obtain in Equations 26–28:

5.3 Cooperative game of alliance among suppliers, logistics company and E-commerce platform

When the vendor, logistics company, and e-commerce form an alliance, the members act, and the top decision is to seek the maximization of overall benefits. According to the Stackelberg game, the financing profit function currently is shown in Equations 29, 30:

The risk-averse expected financing profit and variance are respectively:

Theorem 5. According to Stackelberg, the top equilibrium solution is:

Substituting the top solution into the expected financing profit function, we obtain Equations 31, 32:

5.4 Comparative analysis

After solving the model using the Stackelberg game, the top variables and top financing profits are get. A comparative analysis of the relationships between the prices, market demand, and financing profits under different alliances is conducted.

Proposition 4. When certain conditions are met

Proof: The optimal retail prices under different cooperative game modes are

When the cost of blockchain and the supplier’s selling price meet certain conditions, from the perspective of cost-profit, the more companies join the supply chain alliance, the more effectively they can reduce the intermediate operating costs through cooperation between enterprises. When pursuing profit maximization, e-commerce platforms, due to the reduction of intermediate costs between enterprises, are prompted to lower the price at which they sell to market consumers. Lower selling prices will attract more consumers to buy, leading to a rise in market demand. Greater market demand helps the e-commerce supply chain quickly recover funds, alleviating the supplier’s financial constraints. The number of members and role divisions in different alliance structures directly affect the profit distribution model, which in turn shapes the retail pricing strategy. When suppliers and logistics providers form an alliance, the profit distribution is relatively concentrated. Suppliers transfer part of the costs by raising wholesale prices, while logistics providers reduce operating costs by optimizing logistics efficiency. With fewer members, the coordination costs within the alliance are low, and both parties may opt for value-based pricing, i.e., using blockchain technology to improve product quality or service reliability, resulting in higher retail prices. When logistics providers and e-commerce platforms form an alliance, the platform faces market competition pressure, forcing it to lower retail prices to attract consumers. E-commerce platforms rely on traffic and user scale to generate revenue and tend to lower per-transaction prices through subscription models or cost-plus pricing to expand market share. When all three parties form an alliance, there are the most members, and the profit distribution chain is the longest. Although blockchain technology improves overall efficiency, the cost-sharing mechanism leads to intensified competition for profits among the parties. E-commerce platforms may further compress retail prices. Additionally, suppliers and logistics providers, needing to share data and technical benefits with e-commerce platforms, may be forced to accept lower wholesale prices, indirectly lowering retail prices. Blockchain technology, by reducing information asymmetry and improving supply chain efficiency, reshapes the pricing logic of different alliances. When the cost of blockchain is below the threshold, the application of the technology is economically feasible. If the cost of blockchain is too high, the alliance may abandon the technology investment, causing retail prices to revert to traditional models. Higher wholesale prices reflect the dominant position of suppliers in the alliance. Blockchain technology may enhance suppliers’ control over prices through dynamic pricing models. The effectiveness of blockchain technology applications is profoundly influenced by the alliance structure. The more members there are, the more complex the profit distribution becomes, and the marginal diminishing effect of technical benefits becomes more significant, ultimately leading to a decrease in retail prices as the alliance size expands.

Proposition 5. When

Proof: Under cooperation, the financial institution’s financing profits are

Comparative analysis of the overall gains of financial institutions under different alliances reveals that when the blockchain cost satisfies

Proposition 6. Under cooperative game,

E-commerce supply chain enterprises, under risk-averse conditions, tend to adopt conservative strategies. To better maintain their profit levels, e-commerce platforms are inclined to set lower product selling prices to attract more customers, obtain larger cash flows, and enhance their ability to cope with uncertain risks. Under the cooperation model between suppliers and logistics providers, suppliers may transfer the conservative pricing pressure of retailers by lowering wholesale prices, ultimately leading to a decrease in retail prices. In the alliance model between logistics providers and e-commerce platforms, the economies of scale of e-commerce platforms enable them to quickly respond to risk-averse behaviors through dynamic pricing models, thereby lowering retail prices. In the model of a three-party alliance, the reduced intermediate costs between e-commerce supply chain enterprises lead to lower sales prices. Highly risk-averse retailers may use blockchain technology to enhance the credibility of product quality, but consumers’ willingness to pay for “safety premiums” is limited, and the final retail prices still tend to decline. The adoption of blockchain will increase the transparency of information, providing financial institutions with a clearer understanding of the market. Under risk-averse conditions, enterprises will set lower interest rates to better alleviate financing risks. Financial institutions attract suppliers with higher credit ratings by lowering interest rates, reducing the probability of bad loans. Conservative financial institutions focus more on short-term liquidity and tend to provide short-term, low-interest loans. The high risk-averse behavior of suppliers and logistics providers may force financial institutions to lower financing interest rates to maintain cooperation, but this also compresses the profit margins of financial institutions. The data transparency of e-commerce platforms reduces information asymmetry, allowing financial institutions to offer lower interest rates based on transaction data recorded on the blockchain. During periods of high economic uncertainty, financial institutions may stabilize market confidence through interest rate cuts, further reinforcing the negative correlation between interest rates and the risk aversion coefficient.

6 Financing coordination strategy under the cooperative game after adopting blockchain

Through the above analysis, in the non-cooperative game without participating in the alliance, each member aims at maximizing their own interests, which will damage all gain levels. Some members will get higher profits, but the profit level of other members will be damaged. Through the alliance, we can integrate resources, lower the overall price and increase sales, thus increasing all gain level. Therefore, in the decision-making process, it is necessary to join a coordination mechanism to encourage members to cooperate and make joint decisions to achieve Pareto to pity. To promote e-commerce supply chain members to achieve top decision-making, it is the key to setting up reasonable coordination strategies.

6.1 Revenue sharing contract

The Shapley value, introduced by scholar Shapley in 1953, is employed to coordinate financing benefits. In cooperative game theory, the Shapley value method enables equitable profit distribution according to each member’s contribution, thereby achieving supply chain coordination. Following Shapley [43], the Shapley value is calculated in Equation 33:

Where,

Under the cooperative game, the income function satisfies the convex assumption, which can effectively ensure the stability of income distribution. S Satisfy

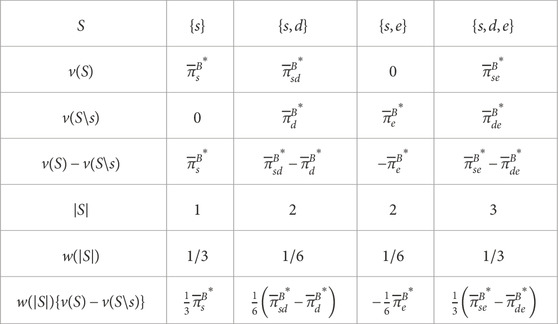

Based on the calculation formula, the Shapley for the vendor can be calculated in Table 2.

Substituting the calculation formula, the Shapley value method yields the allocation coefficients for the supplier, logistics company, and e-commerce regarding all gain as (0.385, 0.448, 0.167). We varied each coalition’s value within ±20% around the baseline values while maintaining core properties such as super additivity and efficiency. For each set of adjusted payoffs, we recalculated the Shapley values using the standard formula, ensuring that the sensitivity analysis aligns with the theoretical framework of cooperative game theory. We conducted 100 Monte Carlo simulations, perturbing the payoffs with random noise to assess the distribution of Shapley values. The results show that the allocation (0.386, 0.458, 0.156) falls within the 95% confidence interval of the simulated values. The sensitivity analysis demonstrates that the Shapley allocation is not arbitrary but robust to reasonable fluctuations in the coalition’s payoffs. This aligns with the economic principle that stable allocations require minimal deviations from baseline assumptions. The calculated Shapley values satisfy individual rationality and collective efficiency.

6.2 Cost sharing contract

To coordinate the relationships between e-commerce supply chain enterprises, referring to research of scholars such as Chu et al. [44], Ghosh et al. [45] and He et al. [46], a cost-sharing contract has been introduced. To promote cooperation among e-commerce supply chain enterprises, logistics providers propose corresponding financing solutions. Logistics providers are willing to share the financing costs of suppliers to attract them to choose themselves as their long-term partners responsible for transporting the products produced by the suppliers. The proportion of financing costs that the logistics provider bears for the supplier is

At this point, the financing profit functions for the supplier, the logistics provider, e-commerce and banks are shown in Equations 34–37:

where

According to the financing profit function, the expected profits and variances are respectively:

Proposition 7. According to Stackelberg, the best wholesale price of suppliers is

The top financing profits for each member are shown in Equations 38–41 respectively:

7 Numerical analysis

The introduction of blockchain technology provides significant convenience for financing. For the guarantee financing model, blockchain can achieve the transmission of credit and information sharing, thereby improving financing efficiency. We explore the influencing factors of financing decisions, referring to the research of scholars such as Wu et al. [47], An et al. [48] and Qin et al. [49], setting

7.1 Influence of information verification

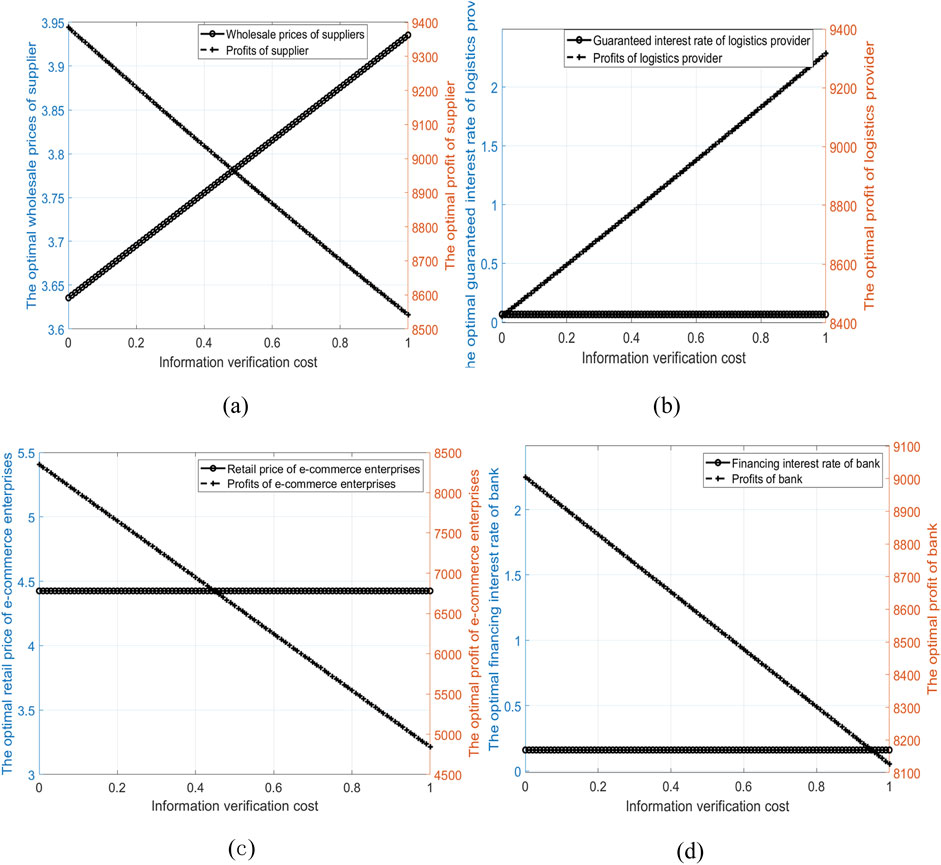

To explore the influence of information verification cost on the financing equilibrium strategy, sensitivity analysis is carried out, and the results are shown in Figure 2.

Figure 2. Influence of information verification. (a) Influence on suppliers. (b) Influence on logistics providers. (c) Influence on e-commerce enterprise. (d) Influence on bank.

For suppliers, financing returns decrease with the rise in information verification costs, but the wholesale price raises with the rise in information verification costs. Higher information verification costs are detrimental to the improvement of suppliers’ financing returns because they increase the intermediate costs of suppliers, leading to a reduction in financing returns. With higher information verification costs, suppliers will also set higher wholesale prices, making the price at which they sell to downstream enterprises relatively higher. Managers should appropriately reduce information verification costs during operations, as lower information verification costs are more beneficial to the development of suppliers.

For logistics providers, information verification costs indirectly contribute to the increase in their financing returns but have little impact on the guaranteed interest rate. With higher information verification costs, transaction information and logistics information become more transparent, and logistics providers are more willing to provide guarantees for suppliers, thereby increasing their own financing returns. However, the guaranteed interest rate of logistics providers is not affected by the cost of information verification efforts; as information verification costs increase, the guaranteed interest rate remains unchanged. Managers should reasonably formulate financing decisions in practice.

For e-commerce platforms, financing returns decrease with the increase in information verification effort costs, but retail prices are not affected by information verification costs. Higher information verification efforts increase the intermediate costs of e-commerce platforms, thereby affecting the improvement of profit levels. However, retail prices are not influenced by the information verification effort costs incurred by suppliers during the financing process. Managers should focus on actively leveraging technological advantages to reduce information verification effort costs.

For financial institutions, financing returns decrease with the increase in information verification effort costs, but the financing interest rate is not affected by the information verification effort costs. Higher information verification effort costs lead to increased costs for enterprises during the finance process, weakening the enthusiasm for financing and resulting in reduced financing amounts, which bring limited financing returns to financial institutions. The financing interest rate is influenced by various market factors and is less affected by the degree of enterprise information verification efforts; it does not change with the increase in information verification costs.

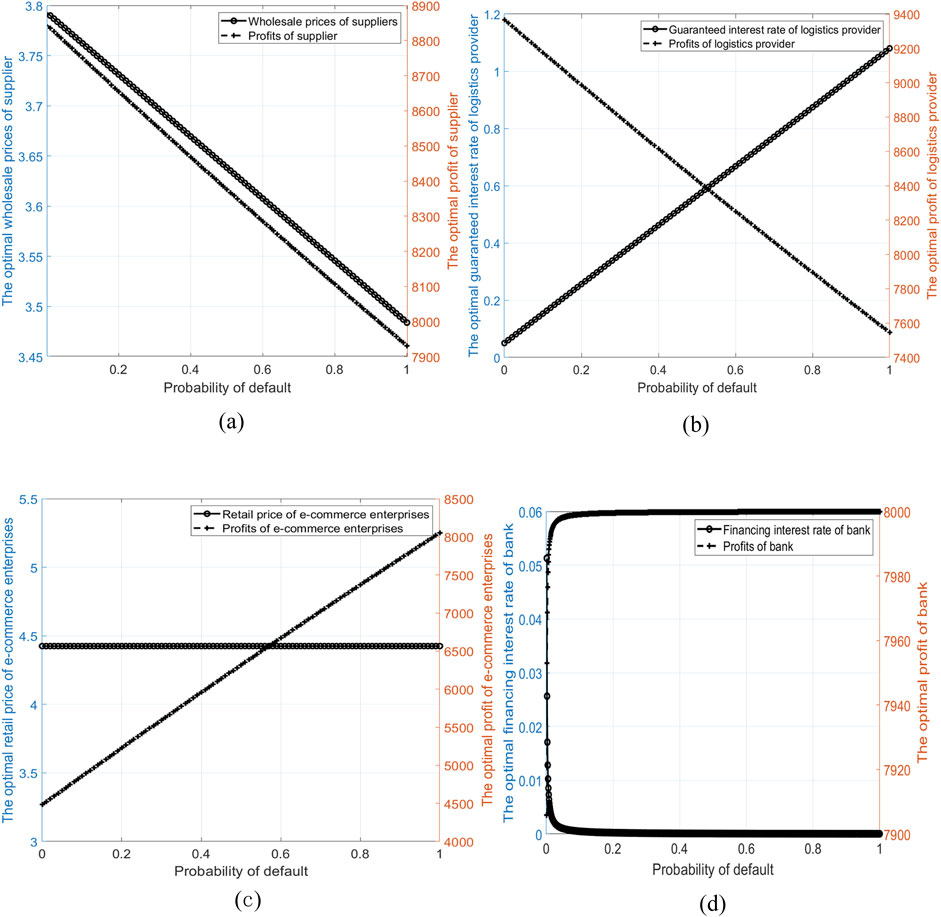

7.2 Influence of default probability

The default probability of suppliers has significant implications for e-commerce supply chain financing decisions. A sensitivity analysis was conducted on this factor, and the results are shown in Figure 3.

Figure 3. Influence of default probability. (a) Influence on suppliers. (b) Influence on logistics providers. (c) Influence on e-commerce enterprise. (d) Influence on bank.

For suppliers, financing returns decreases with the raise in the supplier’s default probability, and a higher default probability also leads to a decrease in the supplier’s wholesale price. A higher default probability is detrimental to the improvement of suppliers’ financing returns and affects their reputation, leading to logistics providers being unwilling to provide guarantees for them, and thus failing to better alleviate their financial constraints. The wholesale price of suppliers also decreases with the raise in the default probability. Under a higher default probability, the cooperation between suppliers and e-commerce platforms is impaired, and suppliers can only adopt a price-cutting strategy to achieve better sales volumes and quickly recover funds.

For logistics providers, financing returns decrease with the rise in the default probability, but the guaranteed interest rate rises with the rise in the default probability. Under a higher default probability of suppliers, the financing returns of logistics providers are impaired. If logistics providers provide guarantees for suppliers and the suppliers fail to pay the principal and interest on time, the logistics providers need to cover the remaining payments. Under a higher default probability, the risks faced by logistics providers intensify, and the guaranteed interest rate will further increase to better protect their legitimate rights and interests.

For e-commerce platforms, financing returns paradoxically raise with the increase in the default probability, but retail prices are not affected by the default probability. Under higher default probability, suppliers set relatively lower wholesale prices, thereby reducing the procurement costs of e-commerce platforms and prompting an increase in returns. Regardless of the default probability, the sales prices of e-commerce platforms are not affected. Lower procurement costs will drive up the profit levels of e-commerce platforms.

For financial institutions, financing returns paradoxically raise with the rise in the default probability, but the finance interest rate decreases with the rise in the default probability. Under a higher default probability, after logistics providers provide guarantees for capital-constrained suppliers, they substitute in repaying the amounts not paid by suppliers, effectively safeguarding the rights and profit levels of financial institutions. To protect the interests of e-commerce supply chain enterprises, financial institutions also set relatively lower financing interest rates.

7.3 Influence of Blockchain’s adoption

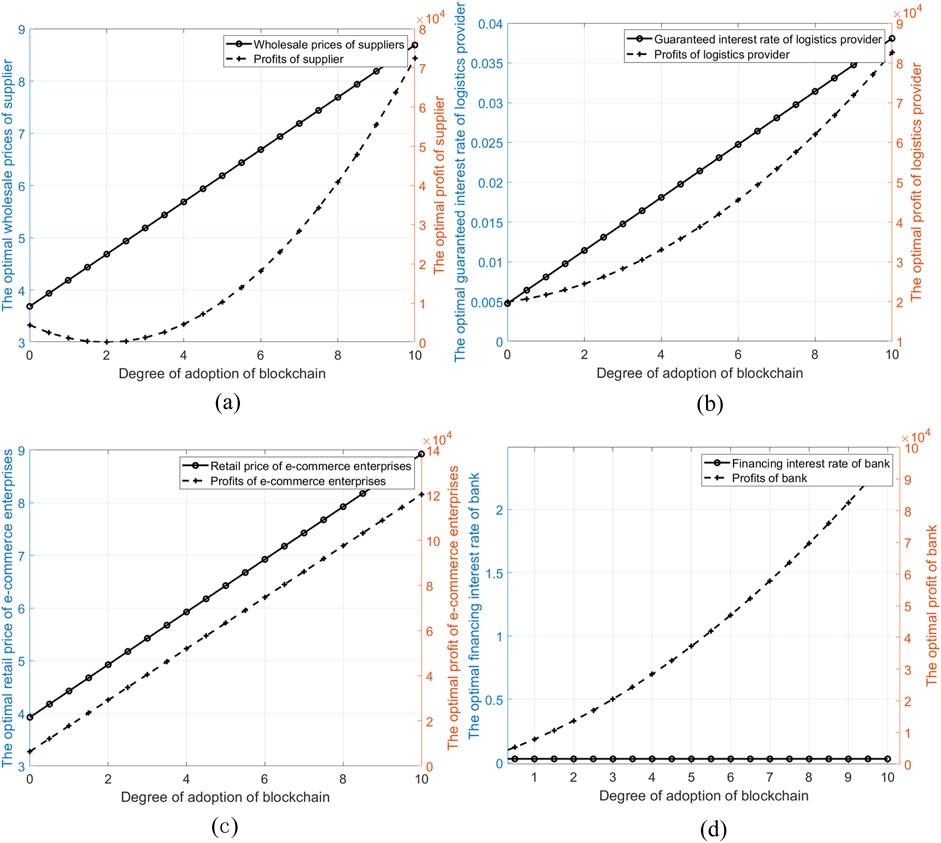

The cost of blockchain technology refers to the node deployment and maintenance costs under the consortium blockchain architecture. To study the influence of adopting blockchain on the finance returns of e-commerce supply chains, a sensitivity analysis is conducted. The effects of adopting blockchain are shown in Figure 4.

Figure 4. Influence of blockchain. (a) Influence on suppliers. (b) Influence on logistics providers. (c) Influence on e-commerce enterprise. (d) Influence on bank.

For suppliers, the adoption of blockchain increases their own costs, leading to higher wholesale prices. A lower cost of adopting blockchain technology helps improve the finance returns of suppliers. However, as the cost of blockchain increases, the profit of suppliers shows a trend of first decreasing and then increasing. At a higher level of blockchain adoption, blockchain effectively improves information transparency, increases trust among enterprises, simplifies the financing process, reduces intermediary costs, and enhances financing returns. When the blockchain cost is within a certain threshold range, the cost burden effect is significant, and returns gradually decrease. When the cost exceeds a certain threshold, the trust premium effect dominates, and the increase in trust effectively boosts financing returns.

For logistics providers, the introduction of blockchain technology prompts them to increase guarantee fees. Under blockchain, logistics providers incur more costs when providing guarantees to suppliers, leading to higher guarantee fees. However, the financing returns of logistics providers increase with the degree of blockchain adoption, and the higher the degree of blockchain adoption, the greater the impact on the financing returns of logistics providers. Managers should actively introduce blockchain and raise the degree of adoption.

For e-commerce enterprises, the adoption of blockchain increases operating costs. Risk-averse e-commerce platforms typically consider adopting conservative operating strategies and therefore raising retail prices appropriately when costs increase, leading to higher retail prices for consumers. Blockchain promotes trust transmission and sharing along the supply chain, helping to attract more consumers and thus increase overall returns. Returns increase with the increased degree of blockchain technology adoption. Managers should actively adopt blockchain technology, increase technological investment, and gain more returns.

For financial institutions, the finance interest rate does not change with the degree of blockchain adoption; the rate remains constant. However, overall returns rise with the increased degree of blockchain adoption because, under the influence of blockchain, the market demand of suppliers increases correspondingly, the demand for funds gradually grows, loan demand intensifies, and thus the financing returns of financial institutions increase. Financial institutions should actively introduce blockchain technology and use technological advantages to boost returns.

7.4 Influence of risk aversion coefficient

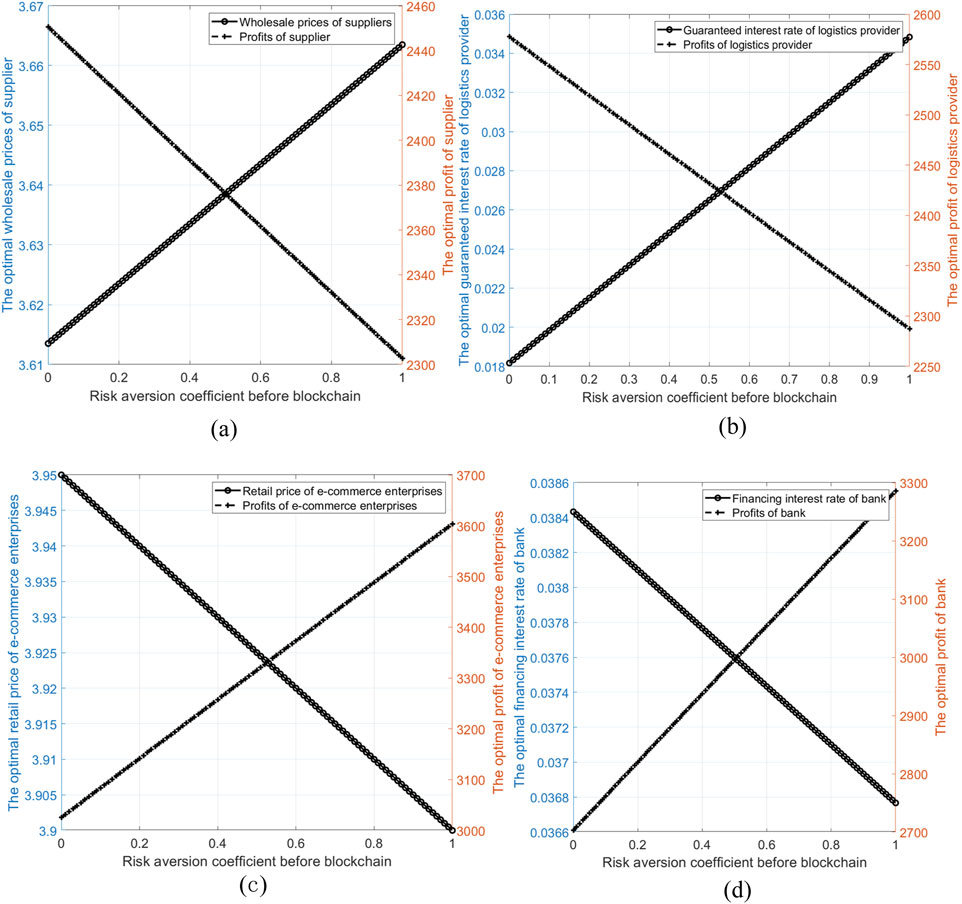

To investigate how risk aversion before the adoption of blockchain affects financing decisions, a sensitivity analysis was conducted, and the results are shown in Figure 5.

Figure 5. Influence of the risk aversion coefficient before blockchain adoption. (a) Influence on suppliers. (b) Influence on logistics providers. (c) Influence on e-commerce enterprise. (d) Influence on bank.

For suppliers, before the adoption of blockchain, financing returns decrease with the rise in the risk aversion coefficient, while the wholesale price rises with the rise in the risk aversion coefficient. Under a higher risk aversion coefficient, suppliers, to protect their own interests, will set relatively higher wholesale prices to better cope with uncertain risks. However, higher sales prices will also weaken consumers’ purchasing enthusiasm, leading to a decrease in market demand, which in turn reduces the overall financing returns of suppliers.

For logistics providers, financing returns decrease with the rise in the risk aversion before the blockchain, while the guaranteed interest rate rises with the rise in the risk aversion coefficient. When logistics providers exhibit risk-averse behavior, they will set relatively higher guarantee interest rates to better avoid the default risk of suppliers and protect their own legitimate rights and interests. However, higher financing guarantee rates also lead to a reduction in the guaranteed amount requested by suppliers; risk-averse suppliers are unwilling to apply for more loans, resulting in a decrease in the overall financing returns of logistics providers.

For e-commerce platforms, returns raise with the rise in the risk aversion before blockchain adoption, while retail prices decrease with the rise in the risk aversion. When enterprises are risk-averse, they will appropriately lower sales prices to attract more buyers, which helps them to quickly recover funds. At the same time, this brings more revenue to e-commerce.

For financial institutions, financing returns rise with the rise in the risk aversion before blockchain adoption, while the finance interest rate decreases with the rise in the risk aversion coefficient. Under a higher risk aversion coefficient of enterprises and financial institutions, to better alleviate the financial constraints of suppliers, will moderately lower the finance interest rates, but the reduction is small because the financing interest rate is influenced by various factors. Meanwhile, suppliers are more willing to apply for financing, increase loan amounts, and financial institutions will obtain higher financing returns.

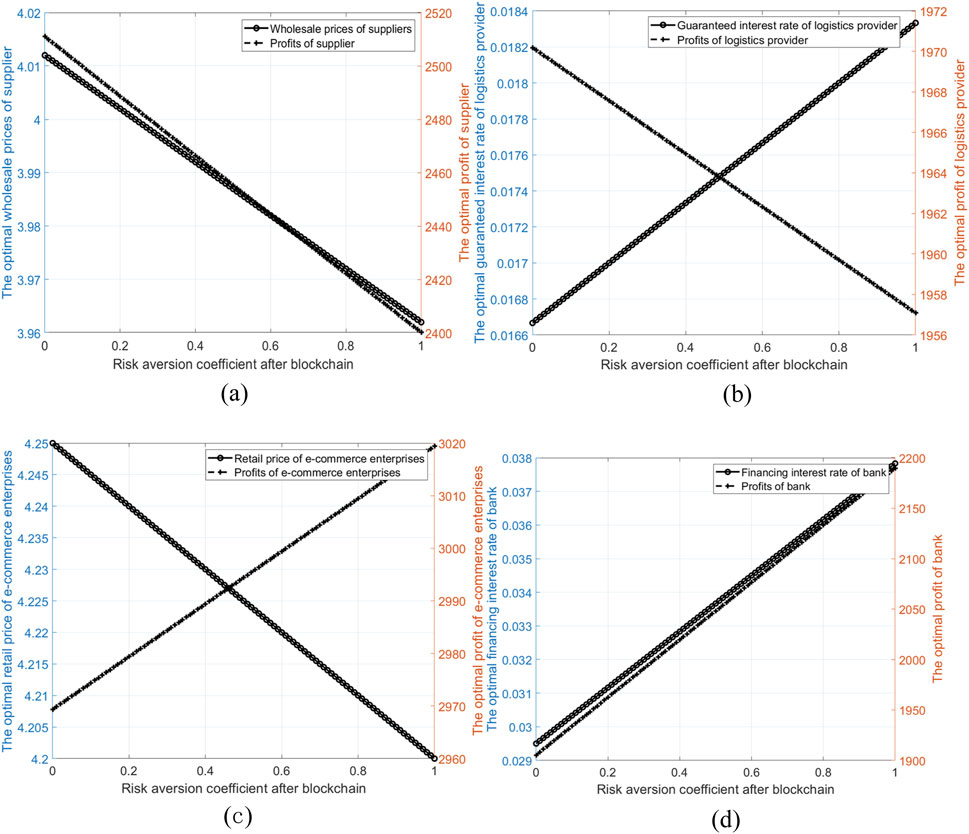

To analyze the influence of risk aversion, a analysis is conducted on the impact of risk aversion on the finance returns after blockchain. The results are shown in Figure 6.

Figure 6. Influence of risk aversion. (a) Influence on suppliers. (b) Influence on logistics providers. (c) Influence on e-commerce enterprise. (d) Influence on bank.

For suppliers, when the degree of risk aversion is high, they tend to adopt more conservative sales strategies and appropriately lower wholesale prices to attract more consumers and maintain a certain sales volume. Blockchain enhances supply chain visibility and data sharing, thereby improving the accuracy of demand forecasting and prompting companies to adopt low-price sales strategies to quickly recover funds. A higher risk aversion does not necessarily help improve suppliers’ finance returns; financing returns decrease with the rise in risk aversion. The higher the degree of risk aversion, the higher the guaranteed interest rates are set by logistics providers. Suppliers, to quickly recover funds, adopt low-price sales strategies, lower sales prices to attract more consumers, and expedite fund recovery, but this can, to some extent, impair the suppliers’ returns. In practice, managers should moderately control the tendency towards risk aversion.

For logistics providers, when the degree of risk aversion is high, they will set higher guarantee interest rates to better protect their own legitimate rights and interests. However, higher guarantee interest rates can impair the enthusiasm of capital-constrained suppliers to apply for guarantees from logistics providers, reduce the number of guarantees applied for, and thus lead to a decrease in the financing returns of logistics providers. More risk aversion harms the returns of logistics providers; managers should strive to reduce their own risk aversion and set relatively lower acceptable guarantee interest rates to attract suppliers to apply for financing. Smart contracts can trigger automatic adjustments to production or procurement plans based on real-time demand signals. This reduces the possibility of excess inventory or stockouts, stabilizes product demand patterns, and better meets the company’s risk aversion. The tamper-proof nature of blockchain establishes trust between supply chain partners. When companies trust the accuracy of shared data, they are more likely to adopt collaborative forecasting methods, better predict market demand, and further reduce risks.

For e-commerce platforms, the higher the risk aversion, the more inclined they are to set lower sales prices. By recording all transactions, logistics events, and inventory movements on an immutable ledger, blockchain achieves real-time visibility across the entire supply chain. This enables companies to access more granular historical and current data for more accurate demand forecasting. Under a higher risk aversion, suppliers’ wholesale prices will be relatively lower, reducing the purchase costs for e-commerce platforms, and consequently, the retail prices sold to consumers will also decrease. Lower sales prices can attract more consumers to buy products, leading to higher financing returns for e-commerce platforms. While maintaining risk aversion in daily operations, managers can set lower sales prices to attract more consumers and increase market demand.

For financial institutions, under a higher degree of risk aversion of enterprises, financial institutions will set relatively higher interest financing rates, but the variation in interest rates is not significant. When the risk aversion of enterprises is high, suppliers and logistics providers will adopt relatively conservative strategies, leading to lower financing returns and reduced cash flow. To maintain their own returns and reduce the risks faced, financial institutions will increase guarantee interest rates. Under higher loan interest rates, the returns of financial institutions will also be higher. Traditional supply chains suffer from fragmented data, leading to biased or incomplete predictions. The decentralized ledger of blockchain ensures that all stakeholders share consistent data access, thereby reducing prediction variance, increasing transparency, and making financial institutions more willing to provide funds to suppliers.

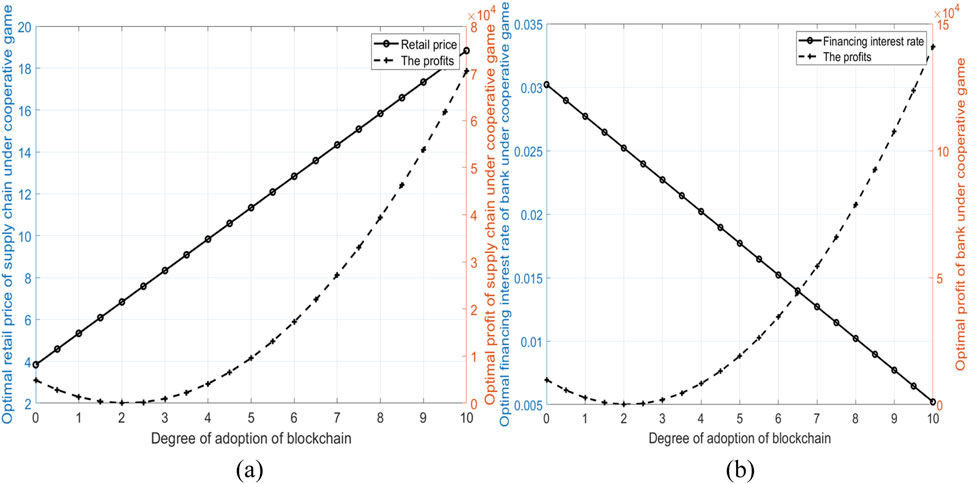

7.5 Influence of blockchain and risk aversion under cooperative game

Under cooperative game theory, cooperation among suppliers, logistics providers, and e-commerce platforms is more helpful in increasing the profit.

First, we analyze the influence of blockchain on members under cooperative game theory. The results are shown in Figure 7.

Figure 7. Influencing of blockchain under cooperative game. (a) Influence on supply chain. (b) Influence on bank.

For supply chain enterprises, under the three-party cooperation model, retail prices increase with the increased degree of blockchain adoption. The blockchain increases the financing costs and operating costs of enterprises, leading to relatively higher retail prices sold to consumers. The financing returns show a trend of first drop and then rise with the introduction of blockchain. Although blockchain technology increases costs in the short term, it also improves the traceability of information. Consumers trust enterprises more and are more willing to purchase products on the supply chain, thereby increasing the returns.

For financial institutions, under the cooperation model, financing interest rates decrease with the increased degree of blockchain adoption. Under higher blockchain, information transparency improves, allowing financial institutions to better review the qualifications of suppliers and increase their trust in suppliers. Therefore, they are more willing to provide financial support to suppliers. The financing returns of financial institutions show a trend of first drop and then rise with the increased degree of blockchain technology adoption. Under the blockchain background, financial institutions should increase the degree of blockchain adoption.

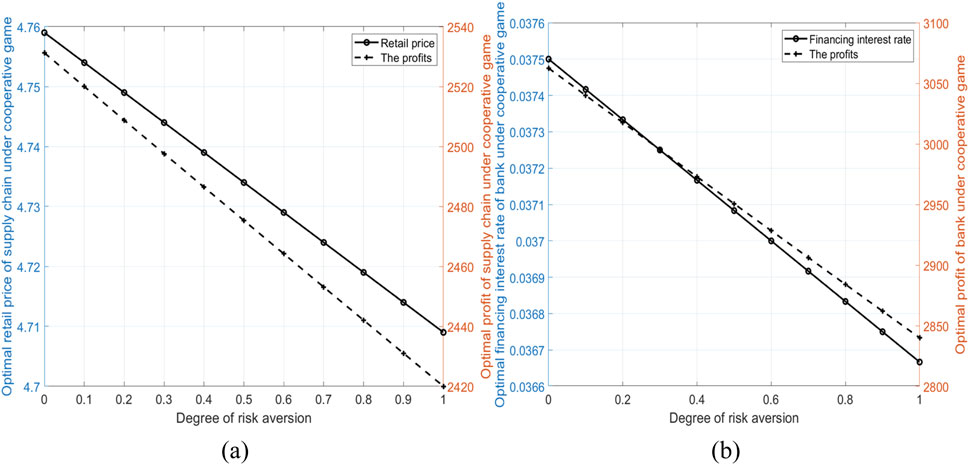

Next, we investigate the influence of risk aversion. The results are shown in Figure 8.

Figure 8. Influence of risk aversion under cooperative game. (a) Influence on supply chain. (b) Influence on bank.

For e-commerce supply chain enterprises, under cooperative game theory, financing returns and sales prices both drop with the rise in risk aversion. Under a higher risk aversion, e-commerce supply chain enterprises set lower prices to attract more consumers and increase product sales. However, under a higher risk aversion coefficient, financing returns also drop with the rise in the risk aversion. Managers should reasonably control their own risk aversion behavior, as a higher risk aversion does not necessarily benefit the improvement of financing returns. It is also necessary to actively introduce blockchain to improve the transparency of the financing process and alleviate the risk avoidance of enterprises.

For financial institutions, in cooperative games, the greater the degree of risk aversion of enterprises, the lower the financing interest rate they will set, and at the same time, it will also lead to a decline in financing returns. When the risk aversion of an enterprise is relatively high, the enterprise will adopt a relatively conservative financing strategy. To attract suppliers with capital constraints, financial institutions will set a lower interest financing rate. The immutability of blockchain helps to improve the trust level of financial institutions in enterprises, and financial institutions reduce interest rates to ease the financial constraints of suppliers.

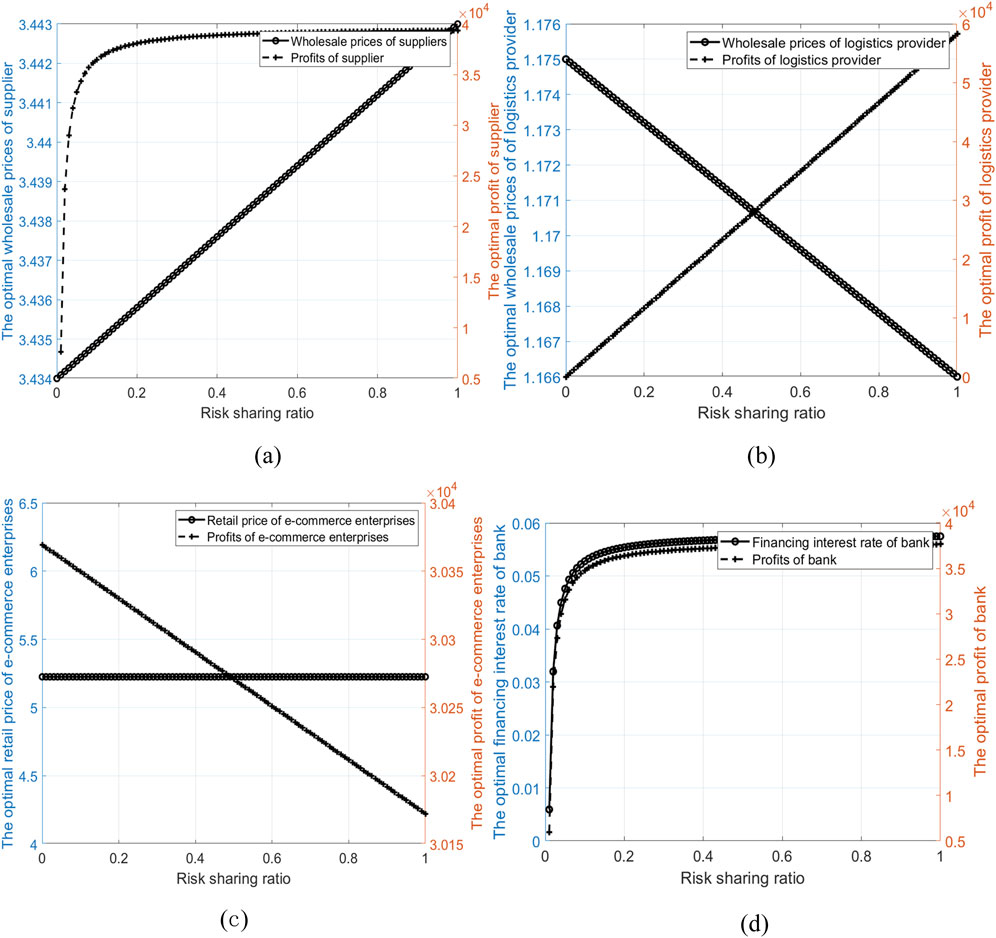

7.6 Influence of cost sharing coefficient

In supply chain coordination strategies, the risk-sharing coefficient affects the finance returns. The sensitivity analysis results are shown in Figure 9.

Figure 9. Influence of cost sharing. (a) Influence on suppliers. (b) Influence on logistics providers. (c) Influence on e-commerce enterprise. (d) Influence on bank.

For suppliers, the bigger the risk-sharing coefficient, the more inclined suppliers are to set higher sales prices. Meanwhile, financing returns also rise with the rise in risk-sharing. Within a lower range of risk-sharing coefficients, the variation in financing returns is larger. As risk-sharing increases, the variation gradually decreases. In practice, managers should actively introduce risk-sharing mechanisms to alleviate their own financing constraints and improve financing returns.

For logistics providers, a certain degree of risk-sharing coefficient prompts logistics providers to reduce logistics costs and pass benefits to other enterprises. Under a higher risk-sharing coefficient, the financing returns of logistics providers also increase. Risk-sharing contracts help coordinate conflicts, better promote development, and improve financing returns. Certain incentive measures should be adopted to encourage managers to sign cost-sharing contract agreements and achieve the optimal results.

For e-commerce enterprises, the risk-sharing coefficient has no impact on retail prices. However, it leads to a decrease in returns. Under a certain risk-sharing mechanism, suppliers set higher sales prices, leading to reduced market consumer demand. The retail prices sold to consumers by e-commerce platforms do not increase, resulting in a decrease in their own returns.

For financial institutions, the financing interest rate will rise with the increase of risk sharing, and at the same time, the financing income will also raise with the raise of risk sharing. Under a higher cost-sharing ratio, financial institutions will set higher financing interest rates to increase their own financing returns.

8 Conclusion