- College of Management and Economics, Tianjin University, Tianjin, China

In this paper, we examine the dynamic correlations between mass-media news and new-media news as well as their reprints in the Chinese stock market. We mainly find that: (1) there is a significant positive correlation between the four types of news and the correlation between reprints and their congener media news is stronger; (2) both the mass-media news and new-media news have significant positive autocorrelation. The new-media news and the reprints rely more on mass-media news. (3) both mass-media news and new-media news will make a positive response to the corporate events, but the reaction of new-media news including the new-media reprints is stronger than mass-media; (4) the results of dynamic correlation analysis indicate that there is a significant correlation between the four types of news over time. The correlation between mass-media news and new-media news is stronger when the stock market performs well. We attribute these results to the symbiotic relationship between mass media and new media in the Chinese stock market, where mass media devotes to provide original news with high quality and new media transfers these numbers of news to more readers to attract more attention and discussion.

Introduction

To figure out how the investors obtain the information will help us to understand the financial market [1]. Media, as the information intermediary, plays an important role in the process of information transmission in the stock market. With the development of the Internet, new media becomes one of the main platforms for investors to get financial information. Unlike traditional media, the large portals collect and provide a large number of, even all, news from the various news source for the investors. Investors need not subscribe to the newspaper or watch the TV to get information like before and they can get the information from the internet easily and quickly. On the other hand, the reprints on the internet could disseminate financial information to broad investors. So the internet brings a great challenge for mass media. Although the internet provides these advantages for the new media, the mass media still co-exist with media and provides information for investors. The existing literature indicates that how investors obtain information is important to understand the financial market [1]. Facing the status quo of the co-exist of mass media and new media in such an internet age, to study the correlation between mass media and new media is of importance to figure out the role of media played in the process of the information transmission and will help us to furtherly understand the financial market.

A strand of literature has examined the role of the media in the financial market [1–3]. But they are all concentrated on one specific media, either mass media or new media [4–6]. However, the correlation between mass media and new media as well as the different roles they played in the finical market is not studied. How they co-exist and what impact on the process of information transmission that they have in the financial market are not clear, especially considering the reprints. In this paper, we examine the correlation between mass-media news and new-media news considering the reprints simultaneously. We find that mass media and new media exhibit a symbiotic relationship in the stock market, where mass media devotes to provide original news with high quality and new media transfers these numbers of news to more readers to attract more attention and discussion. And we also find that mass-media news and new-media news maintain a positive correlation over time and the correlation becomes stronger when the stock market performs well. These results will help us to comprehend the role of the information intermediary of media. Therefore, we add to the literature on the role of the media in the financial market. On the other hand, there are some studies about the correlation between mass media and new media [7–12]. But fewer of them are about the financial market and take reprint into account. Hence, we also add to the literature on the correlation between mass media and new media for the financial market. The closest research is our previous work [11, 12], which we used the sample data of stocks of CSI 300 and SSE index, respectively, to explore the correlation between mass-media news and new-media news. Comparing their work, the contributions of this paper are 3-fold. Firstly, we consider the reprint when we studying the correlation between mass-media news and new-media news. Secondly, we improve the classification criteria for mass-media news and new-media news and provide a more objective and reasonable classification criterion. Thirdly, The larger samples, the stocks of the full Chinese stock market, and the new methodology used in this paper could provide more comprehensive and effective results.

The remainder of this paper is organized as follows. Section Literature review gives the literature review of the role of the media in the financial market and the correlation between mass media and new media. Section Data and sample describes the sample data using in this paper and its' statistical properties. Section Result and discussions reports the empirical results and section conclusions provides the conclusions.

Literature Review

The Role of Media in the Financial Market

Our paper related to the literature about the role of media played in the stock market and this research problem has attracted a lot of attention from the researchers. In the earlier literature, researchers have concentrated the role of either mass media [2, 13–16] or new media [4, 6, 17–22] play in the financial market.

For the mass media, Klibanoff et al. [23] investigate the effect of the country-specific news appearing on the front page of The New York Times on the reaction of closed-end country fund prices to the asset value. They found that the prices react more when there is news on the front page of the New York Times. Chan [15] used the data of news headlines to study the reaction of stock price to news and no-news and they found different patterns of reversal and momentum for stocks accompanied by or unaccompanied by the news. Tetlock [2] explored the interaction between the media and the stock market by analyzing the content of the column of the Wall Street Journal. By constructing the pessimistic factor as the measure of media content, they found the predictability of the media content for market prices and market trading volume. Tetlock et al. [24] quantified the language used in all Wall Street Journal and Dow Jones News Service stories of finance and found that the quantifying language provides the firms' fundamental information. Fang and Peress [3] used the number of the newspaper as the measure of media coverage to explore the effect of media coverage on stock returns and found that there will be higher returns for the stocks with no media coverage than the stocks with high media coverage. Peress [1] investigate the national newspaper strikes to study the influence of media and diffusion of information on trading and price formation. They found that the media could improve the dissemination of information in the stock market.

For the new media, Tumarkin and Whitelaw [17] explored the effect of postings on the stock prices and indicated that the number of postings could not predict the return and trading volume of the stocks. Antweiler and Frank [6] studied the effect of the postings from Yahoo! Finance and Raging Bull on the stocks and found that the stock messages could help to predict the market volatility. Das and Chen [18] build the sentiment index by exacting the text of the postings on Yahoo's message board and found it is related to the stock index levels, volume and volatility. Zhang et al. [25] found that the number of Baidu News could explain the volatility persistence of SME PRICE INDEX in China. Shen et al. [26] used the number of Baidu News as the proxy for internet information flow to provide the evidence for the Mixture of Distribution Hypothesis.

The Correlation Between Mass Media and New Media

Our study is also related to the literature about the relationship between mass media and new media. The argument of the relationship between mass media and new media has existed since the birth of new media. There are some studies support the competitive relationship between the two types of media [7, 27–29]. Dimmick et al. [7] used the survey data of telephone to explore the relationship between mass media and new media and found that the new media has a competitive displacement effect on the mass media. Lee and Leung [27] study the “medium-centric” and “user-centric” approaches by using a random sample and the result indicated that the internet could displace the use of traditional media. Ha and Fang [28] explores the displacement effect of new media on mass media using the survey data of consumer time spent on media. They found that the new media indeed has a replacement effect on the mass media. On the other hand, some researchers argue that there is a complementary relationship between mass media and new media [8, 10]. Chyi and Lasorsa [10] used a random-sample telephone survey of the public's response to the print and online newspaper to study the substantial overlap between online and print readerships and found a complementary relationship between them. Nguyen and Western [8] also found that mass media exist to complement new media to meet the needs of people to get information. Furthermore, Jang and Park [9] indicated there the substitutability and complementary relationship between mass media and new media exist simultaneously and the magnitudes of these relationships exhibit different for the different purposes of users.

Data and Sample

News Classification Criteria

We classified the news into two types of news according to the data field of news sources provided by Wisers. And we called the two types of news as the mass-media news and new-media news. In prior researches, the news has been classified into mass-media news and new-media news according to the news' sources of the communication media [7–9, 11, 12]. They referred the news transferred on the internet as the new-media news and the news transferred through traditional channels, such as the newspaper, is regarded as the mass-media news. But the traditional media is also seeking the new developmental pattern in the internet era. They provided their news on the internet for the readers. And they can provide high-quality news relied on their professional interviewing and editing team. The prior literature found that the news category, reader gender and interest in a particular topic have greater influences on the readers' news consumption than whether the news appears in print or online after studying the news consumption of readers of the news presented in online and print versions of newspapers [30].

On the other hand, the relationship between print and Internet media is symbiotic in China [31]. Hassid and Repnikova indicated that Internet portal sites in China are enormously powerful to attract the attention or discussion of readers, but they couldn't provide their own news for the barrier of legal rights to interview and edit. And the portal sites have to rely on reprints from newspapers and wire services [31]. So Hassid and Repnikova argued that “portals need newspapers to provide content, and the newspapers, in turn, need portals to publicize their articles, attract readership, and pay subscription fees in China.”

Considering these facts, we argue that the online news provided by the traditional media plays a similar role to the news in print. So we improve the methodology introduced by Zhang et al. [11] to categorize the news coming from the online traditional media into the mass-media news. There are two reasons for our classification criteria. Firstly, the online news provided by the traditional media shares the same interviewing and editing team with the news in print. So the online news and the news in print of traditional news are homogeneous. Secondly, for the legal rights to interview and edit, the traditional media and the new media play different positions during the transfer of information, even for the online news provided by the traditional media and the new media. According to this classification criteria, we classified our news data into two types of news, i.e., the mass-media news and new-media news. And the detailed definitions of mass-media news and new-media news are as follows:

(1) We regard the news provided by mass-media including the online news of them as the mass-media news. Such as the news provided by the newspapers, the TV, the radio, and the magazine.

(2) The new-media news is the news that is only provided by the Internet. Such as the news provided by the portal, the blog, and social media.

Furthermore, there is a large number of reprints with the development of the internet. Generally, there is a statement of the copyright for the original news on the website. So the website is not allowed to modify the content of news even for the headlines when it reprints one news. Based on this, we defined the directed reprint news as the news with the same headlines. For one news, we chose the first one appeared in the Wisers as the original news and the number of directed reprint news equal to the number of the news with the same headline minus one. Then we classified the reprint news into mass-media news and new-media news based on the classification criteria introduced in this paper.

Sample Select

The news data used in this paper comes from the database of Wisers which is provided by the Wisers Information Limited. Wisers is one of the largest databases of Chinese media including all the Chinese news of the Chinese stock market. We focus on the news sample of all A-share in the Chinese stock market dropping the stocks in special treatment. According to the illustration of the Wisers database, the news is crawled from the Internet based on keywords such as the names of the company, the names of the companies in the financial sector are often mentioned in the financial reports. These reports are not the news of these companies, but the Wisers may crawl them from the Internet. Therefore, the news of financial stocks may contain noise. And we drop the financial stocks in our sample. Our sample period spans from 1 January 2015 to 31 December 2018 with daily observations, and we get a sample including 3,067 stocks. Based on the classification criteria introduced in this paper, we get 726 types of mass-media sources and 1,488 types of new-media sources in our sample period. In this paper, we also used the trading data and financial data, such as the close price, the market value, the announcement and so on. And we get these data from the database of CSMAR and Wind, which are both the professional financial database in China.

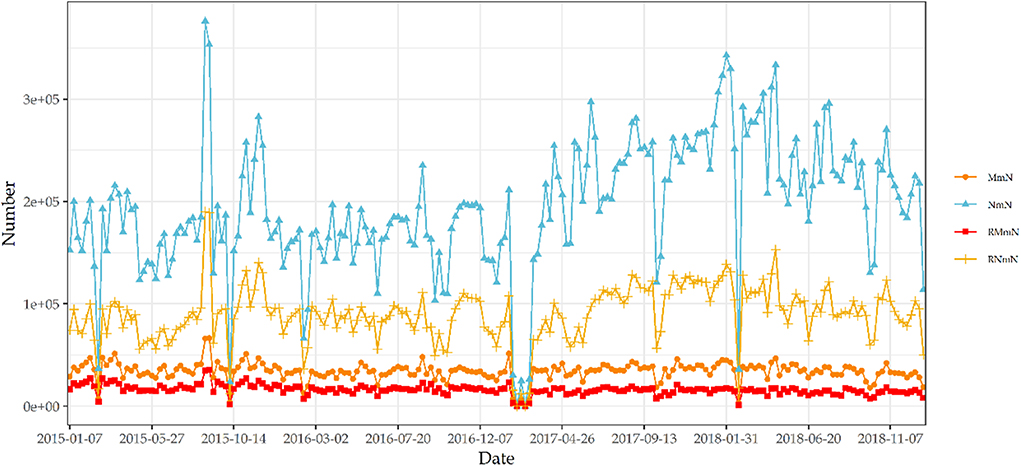

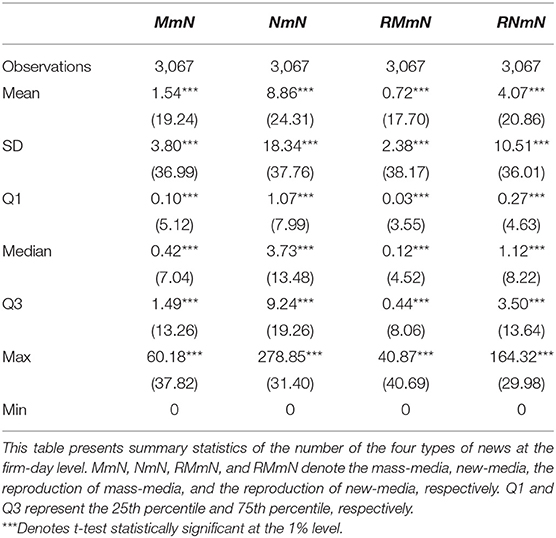

Figure 1 illustrates the weekly number of four types of news. From top to bottom in Figure 1, the line represents the number of new-media news, new-media reprints, mass-media news, and mass-media reprints. As we can see from Figure 1, the number of new-media news, no matter for the total news or the reprints, is significantly larger than the mass-media news and the trend of the four types of news is similar. This implies that the new-media news provides a richer information environment for us and there is a strong correlation between the mass-media news and new-media news. Table 1 reports the summary statistics for the mean daily number of the four types of news for our sample. We calculate the statistical property of the news' number for every stock, and then, report the mean of these statistical properties in Table 1. From Table 1, we can find that the standard deviation of the new-media news is larger than the mass-media news, which implies that the new-media news is more likely to be influenced by the shocks.

Result and Discussions

In this section, we investigate the relationship between the four types of news defined in this paper. Firstly, we investigate the contemporaneous correlation between the four types of news. Secondly, we compare the reaction of the four types of news to different corporate events. Third, we conduct the Panel Var Model to explore the lead-lag relationship between the four types of news.

The Contemporaneous Correlation Between the Four Types of News

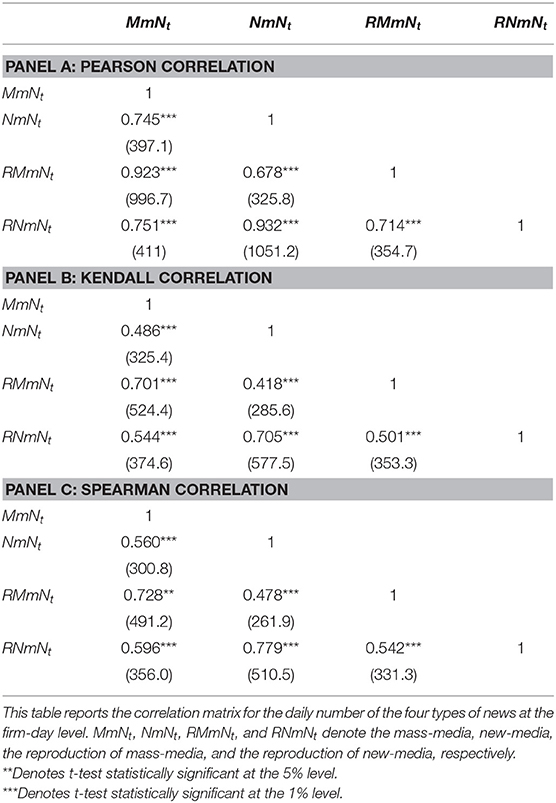

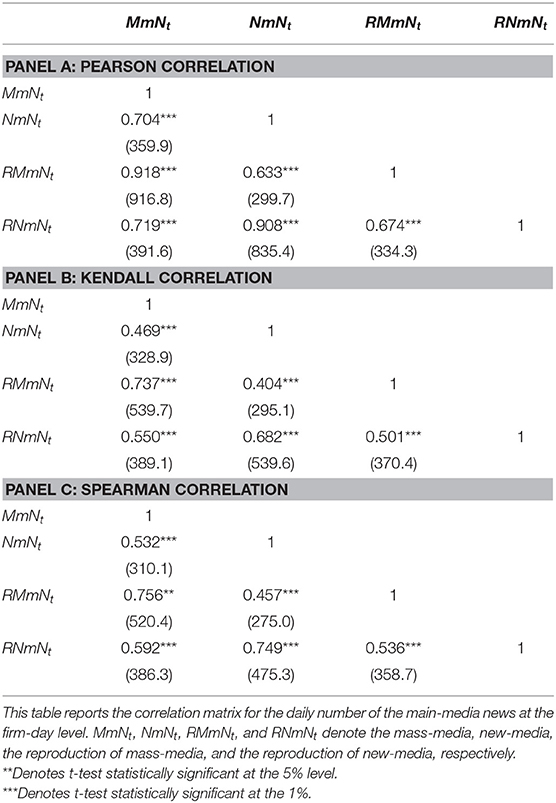

In this section, we calculate the Pearson correlation coefficient, Kendall correlation coefficient, and the Spearman correlation coefficient to investigate the contemporaneous correlation among the four types of news for every stock in our sample. And then we get the mean of these correlations for all stocks. Table 2 reports the results of the correlation matrix for the four types of news. Panel A of Table 2 shows the mean Pearson correlation coefficient among the four types of news. We can find that the correlation coefficients are all larger than 0.6 with a significant level of 0.01. These results indicate that there is a significant correlation among the four types of news defined in this paper and imply that the mass media and new media may pay attention to the same event every day although there is a big difference in the quantity of news that their provide. For these mean correlation coefficients, the correlation coefficient between the new-media reprints and new-media news is the largest which is larger than 0.9 with a significant level of 0.01 and the correlation coefficient between the mass-media news and the mass-media news reprints is also larger than 0.9 at a significant level of 0.01. On the other hand, the correlation coefficient between mass-media news and new-media reprints as well as the one between new-media news and mass-media reprints are around 0.7. The difference between these results shows that the two media both pay more attention to their congener media when they reprint news from other media. The larger correlation coefficient between mass-media news and new-media reprints than the one between new-media news and mass-media reprints implies that the mass media is paid more attention to when one media reprint news from other media. And we get similar conclusions from the results of Kendall correlation and Spearman correlation in Panel B and C in Table 2. We attribute these results that the mass media provides a large number of original news because of their advantage of interviewing and editing team. So the new media depend more on the mass media to some extent.

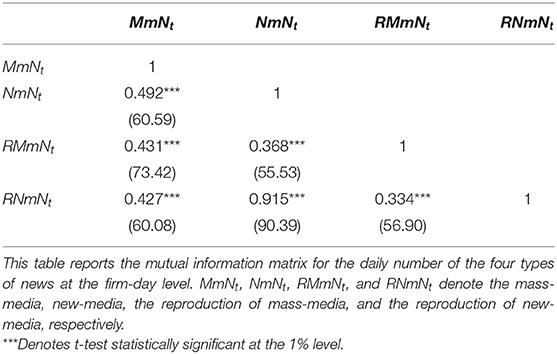

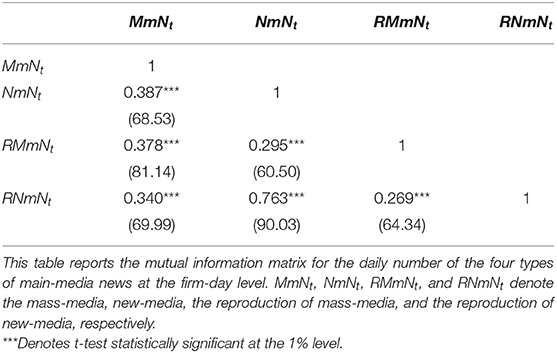

Then we calculate the Mutual Information to further study the relationship between the four types of news. In probability and information theory, the Mutual Information is a useful measure of interdependence between two variables. Table 3 reports the result of Mutual Information among four news and we report the mean of Mutual Information for all stock. As we can see from Table 3, the Mutual Information is all larger than 0.3 with a significant level of 0.01 implying a significant positive correlation among the four types of news. Similarly, the Mutual Information between mass-media news and mass-media reprints (0.431) is larger than the one between new-media news and mass-media reprints (0.368) as well as the Mutual Information between new-media news and new-media reprints (0.915) is larger than the one between mass-media news and new-media reprints (0.427), which indicate that the two media both pay more attention to their congener media when they reprint news from other media. Also, the Mutual Information between new-media reprints and mass-media news (0.427) is larger than the one between mass-media reprints and new-media news (0.368) implying that mass-media news is paid more attention when the media choose which news to reprint.

The Lead-Lag Relation for the Four Types of News

In this section, we investigate the lead-lag relation among the mass-media news, new-media news, mass-media reprints, and new-media reprints with the following Panel Vector Autoregression (VAR) Model with one-period delay.

where and are the vector of endogenous variables for the model (1) and model (2), respectively.

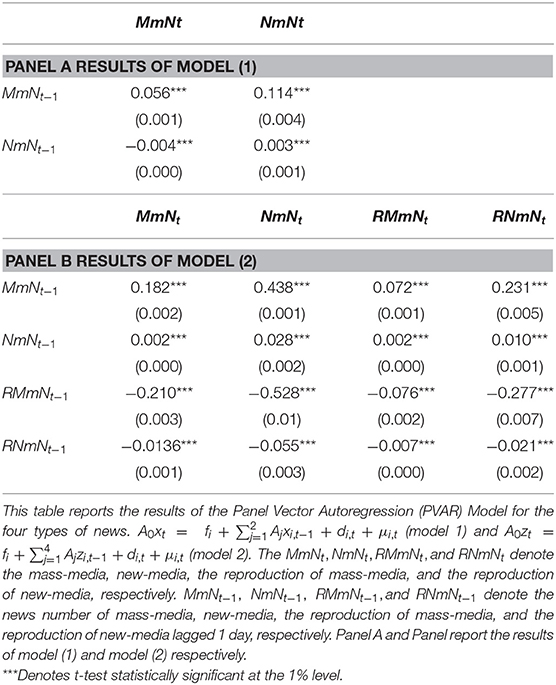

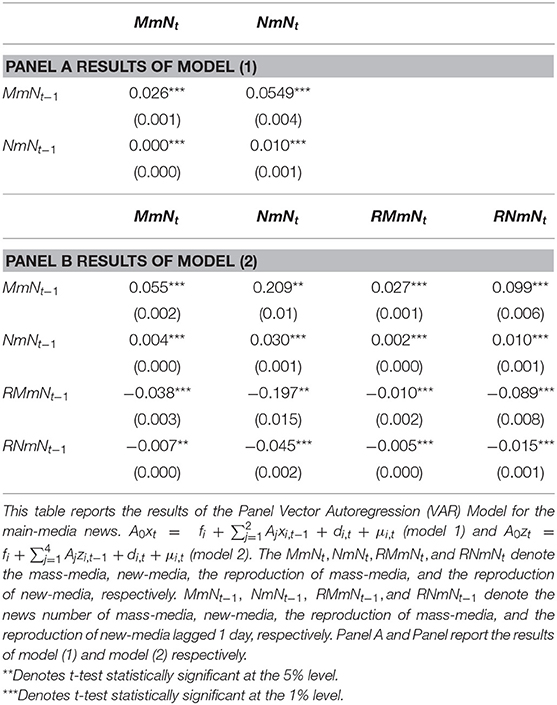

Table 4 reports the coefficients of the PVAR model. Panel A shows the result of the model (1). We can see that the coefficient of the lagged number of mass-media news is positive and statistically significant, while the coefficient of the lagged number of new-media news is negative and statistically significant in column 1 of panel A. This indicates that the daily number of mass-media news has a significant auto-correlation and relies on less on the lagged number of new-media news. In column 2 of panel A, the coefficients of the lagged number of mass-media news and new-media news are both positive and statistically significant, implying that there is an auto-correlation for the daily number of new-media news and the number of mass-media news could lead the number of new-media news. Considering the reprints in panel B of Table 4, the coefficients of the lagged number of mass-media news are all positive and statistically significant when we use the current daily number of mass-media news, new-media news, mass-media reprints, and new-media reprints as the dependent variables. This implies that the number of mass-media news keeps the significant auto-correlation and could lead the number of new-media news, mass-reprints as well as new-media reprints when considering the reprints. At the same time, the coefficients of the lagged number of new-media news are also positive and statistically significant, which indicating that the lagged number of new-media news could lead the all the current number of all four types of media news including itself. Panel B of Table 4 shows that the coefficients of the lagged number of mass-media news are all larger than the corresponding coefficient for the lagged number of new-media news. We can conclude that the number of four types of news relies more on the mass-media news including the mass media itself. We attribute this result to the different role that the mass media and new media play when they transfer the information. As we discussed above, the mass media is engaged to provide original news with high quality while the new media devotes to transfer to the readers. So the number of new-media news will increase when there is more mass-media news that could be chosen and transferred by the new media. At the same time, the journalists will seek “inspiration of creation” on the internet. So the number of new-media news may lead the mass-media news to some extent.

The last two columns of Panel B show that there is no autocorrelation for the mass-media reprints and new-media reprints. And the significant positive coefficients of lagged number mass-media news and new-media indicate that they rely more on the mass-media news and new-media news. The coefficients of the number of lagged mass-media reprints and new-media news are all negative and statistically significant. When the number of reprints is large, there may be a hot event in the stock market and the media will pay more attention to this event even overreact to it. So the negative coefficients are more likely due to mean-reversion.

Factors Drive the Coverage of News

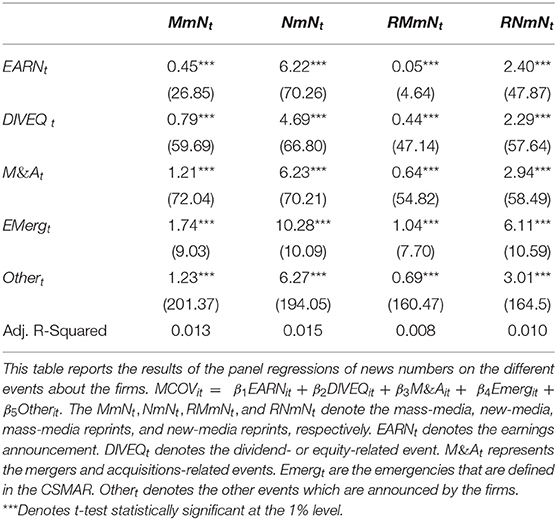

In this section, we investigate the different reactions for the four types of news defined in this paper to the different shocks. We analyze the influence of corporate events on the coverage and reprints of the mass media and new media.

Following the work introduced by Drake et al. [32], we defined 5 corporate event indicator variables to investigate the reactions of the mass media and new media to these events. The first indicator, EARN is the indicator of the earnings announcement. When there is earning announcement for stock in one day, the value of the day, as well as the following day, is set to one for this stock and to zero otherwise. The second indicator, DIVEQ, is about the dividend- and equity-related event. When one firm issue a dividend- or equity-related announcement, the value of the DIVIEQ of the day, as well as the following day, is set to one and to zero otherwise. The third indicator, M&A, is the mergers and acquisitions-related events. The value of M&A on the day, as well as the following day, of the mergers or acquisition-related announcement, is set to one, and to zero otherwise. The fourth indicator, Emerg, represents the emergencies defined by the database of CSMAR. Similarly, on the days 0 and +1 of this events, the value of Emerg equal to one, and to zero otherwise. Our last indicator, Other, denotes the other corporate events included in the database of CSMAR In addition to the above four types of events.

Then we conducted the panel regression with a fixed effect to explore the reaction of the mass media and new media to these corporate events. Our model is as follows:

where MCOVit is the news number of firm i in day t which include mass-media news, new-media news, mass-media reprints, and new-media reprints. And the other variables are defined above.

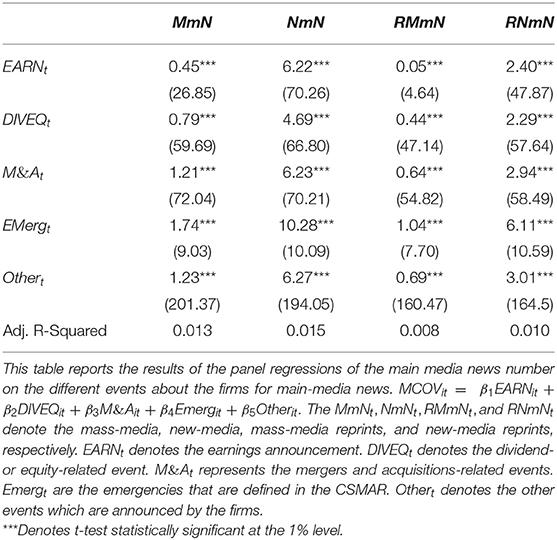

Table 5 reports the results of Model (3). From Table 4, we can see that the coefficients of all the events for the four types of news are significantly positive. This indicates that both the mass media and new media will increase the number of coverage to the firm when there appears a corporate event. And the coefficient of the Emerg is larger than the other coefficients of the event indicator implied that the emergences are more likely to attract the media to cover. The coefficients for new-media news are larger than the ones for mass-media news and the coefficients for new-media reprints are also larger than mass-media reprints, even larger than the one for mass-media news, which indicates that the reactions to corporate events of new media are stronger than the mass media. When there appears an event, there will be a large number of new-media news to cover it. It could make more investors aware of this event. So this result could provide a piece of evidence that the new media could improve the information environment for investors.

Dynamic Correlation for the Four Types of News

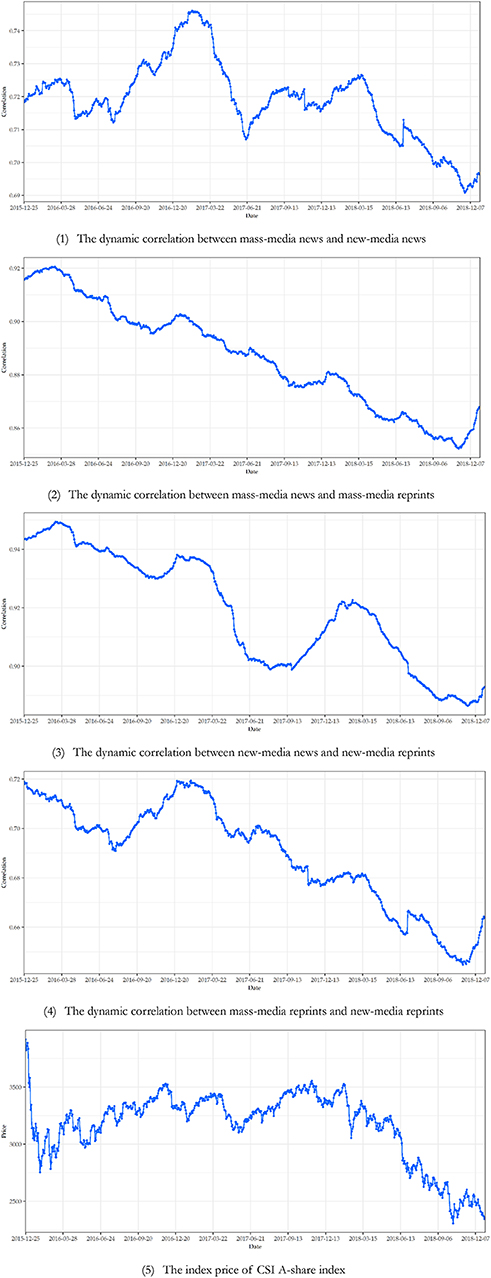

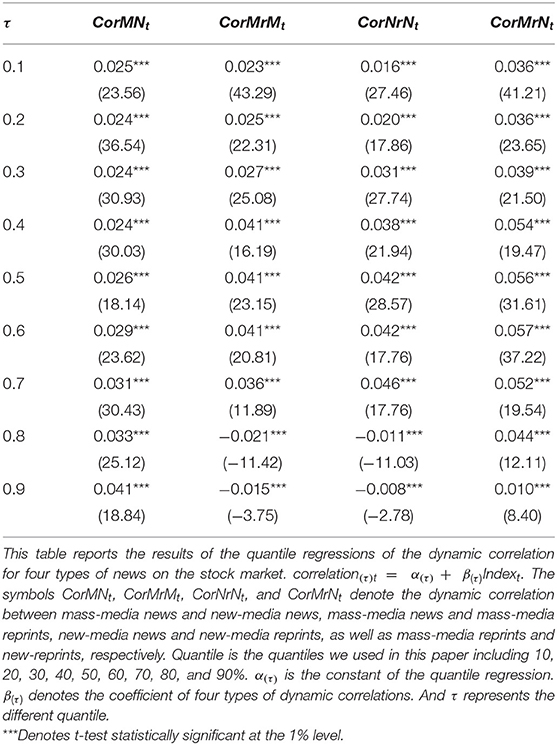

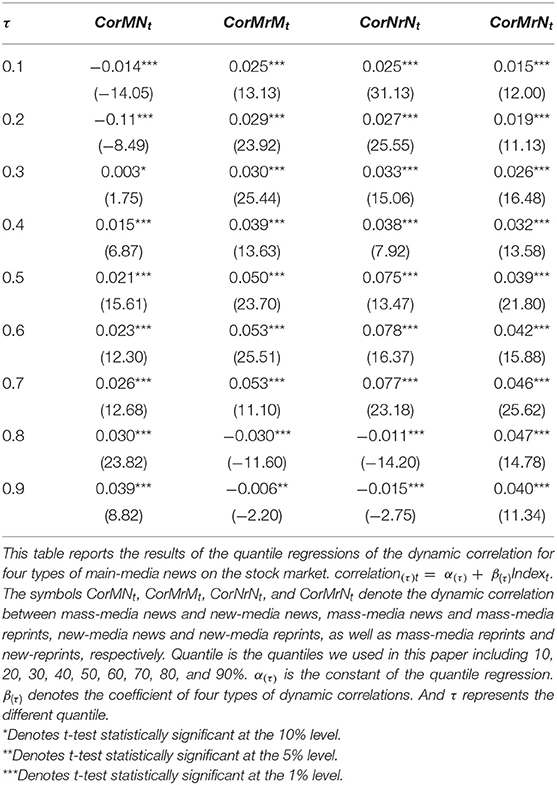

To investigate the dynamic correlation between the four types of news, the rolling window analysis is conducted in this section. We choose 240 business days (~1 year) as the length of the rolling windows selected in this paper. Figures (1) and (4) in Figure 2 shows the dynamic correlation between mass-media news and new-media news, mass-media news and mass-media reprints, new-media news and new-media reprints, as well as mass-media reprints and new-media reprints, respectively. Figure (5) in Figure 2 shows the varieties of the Chinese stock market in the corresponding time. And we choose the index price of the CSI A-share index as the indicator of the performance of the Chinese stock market. The CSI A-share index is compiled by the CSI company and could reflect the performance of Chinese performance well. As we can see in Figure 2, there are significant positive correlations between the four types of news over time and there is a decreasing trend for all four types of dynamic correlation in this paper. There is also a decreasing trend for the Chinese stock market in the corresponding time, which can be seen in (5) of Figure 2. We attribute the decreasing trend of the dynamic correlation to the decreasing media attention when there is a poor performance of the market, especially for the new-media news. And we provide further evidence of this by conducting the quantile regression of the dynamic correlation on the index price of the CSI A-share index as well as the number of news on the CSI A-share index:

where correlation(τ)t is the correlation of the four types of news in time t at τ, Indext is the index price of the CSI A-share index in time t, α(τ) is the constant of the quantile regression. β(τ) denotes the coefficient of four types of dynamic correlations. And τ represents the different quantile.

Table 6 reports the results of the quantile regression of the dynamic correlation for the four types of news on the index price of the CSI A-share index and we report the coefficients only. To ensure the readability of the table, all coefficients in Table 6 are multiplied 1000. For the dynamic correlation between mass-media news and new-media news, the coefficients in the first column in Table 6 are all significant positive for all quantile levels. And there is an increasing trend with the increase of the quantile level. This result indicates that there is a stronger correlation between mass-media news and new-media news when the stock market performs well. From the other three columns in Table 6, we can also see the similar increasing trend of the coefficients of different quantile levels except for the 0.8 and 0.9 percentile. For the model of dynamic correlation between mass-media news and mass-media reprints as well as the model of dynamic correlation between new-media news and new-media reprints, the coefficients of 0.8 and 0.9 percentile are negative. Besides, the coefficients of the corresponding quantile levels are smaller than the other quantile levels. These results imply that the correlations between reprints and their corresponding media news become weak when the stock market performs well. We attribute these results to that the bullish market attracts more attention of the media, especially for new media. According to the results above, we can see that the number of new-media news has larger volatility, which has a larger standard deviation, than the mass-media news and the new media makes larger reactions to the shocks. Considering the purpose of mass media, which provides objective and balanced information for the investors, and the ability to interview and editing, the mass media are more likely to provide a more stable quantity of news for the investors than new media every day. So when the market performs well, the new media will provide more news to the investors and shows a stronger correlation with mass-media news. On the other hand, both the mass media and new media are attracted by the extremely good performance of the stock market, they will both provide a larger quantity of news for the investors. So when the stock market performs extremely well, the reprinted media will have more news to choose from and reprint. In this condition, the reprinted media will choose the essence new to reprint. Therefore, the correlation between the reprints and the media-news becomes smaller when the stock market performs extremely well.

Robust Test

In this section, we conduct robust tests of the results above. Firstly, we add financial stocks into our sample to repeat the analysis discussed above. Secondly, we choose the main media source of mass-media news and new-media news instead of all media sources to conduct the robust test. We choose the media sources as well as sub-sources of them that provide eighty percent of the number of news for mass media and new media, respectively, as the main media. We get similar results for the two robust tests, so we report the results of the main media only in this section.

Table 7 reports the correlation matrix for the four types of news of the main media. Although the value of the correlation coefficients is not the same, we can also find a significantly positive contemporaneous correlation between the four types of news. The correlation between mass-media news and mass-reprints as well as the one between new-media news and new-media reprints are larger than others. And the correlation between mass-media news and new-media reprints is larger than the one between new-media news and mass-media reprints. These results are consistent with the analysis for the sample of all news sources. Table 8 reports the Mutual Information between the four types of news for main media. Also, the significant positive Mutual Information indicates the positive correlation between the four types of news. The Mutual Information about the reprints also indicates that the two media both pay more attention to their congener media when they reprint news from other media and mass-media news is paid more attention when the media choose which news to reprint. These results are all consistent with the ones of all media samples.

Table 9 shows the results of lead-lag correlation analysis for the main-media news. We also could find that the number of mass-media news could lead to the number of new-media news, new-media reprints, as well as mass-media reprints. The number of new-media news could lead the mass-media news, mass-media reprints, and new-media reprints, but the coefficients of the lagged number of new-media news are all smaller than the corresponding coefficients of the lagged number of mass-media news. Also, the coefficients of the number of lagged mass-media reprints and new-media reprints indicate a mean-reversion of the news coverage. Table 10 reports the results of the panel regressions of main media news numbers on the different events about the firms for main-media news. From Table 10, we can see that there are significantly positive reactions to the corporate events and the new media has a more significantly positive response to these shocks, which are consistent with the results of the sample of all news sources.

For the analysis of the dynamic correlation between the four types of news for the main media, there is also a positive correlation over time. Table 11 reports the results of the quantile regression of the dynamic correlation on the index price for the CSI A-share Index for main-media news. Also, the results indicate that the correlation between mass-media news and new-media news becomes stronger and the coefficients related to the reprints are also weak when the market performs well. And these are consistent with the above.

Table 11. The results of the quantile regression of the dynamic correlation on the stock market for main-media news.

Conclusions

In this paper, we investigated the roles of mass media and new media play in the process of information transmission in the Chinese stock market. Firstly, we conducted the contemporaneous correlation analysis among the mass-media news, new-media news, mass-media reprints, and new-media reprints. We found that there are significant positive correlations among these four types of news and the reprints have a stronger correlation with the same type of media news. The results also show that the correlation between mass-media news and new-media reprints is larger than the one between new-media news and mass-media reprints. Secondly, we studied the lead-lag relationship between mass-media news and new-media news. We found that mass-media news and new-media news exhibit high positive autocorrelation, but the results of mass-media reprints and new-media reprints are reverses. The mass-media reprints and new-media reprints rely more on the mass-media news and new-media news. The lagged number of mass-media news could lead the number of new-media news, mass-media reprints, as well as new-media reprints and the lagged number of new-media news, could also lead the number of mass-media news, mass-media reprints, as well as new-media reprints. But the coefficients of the lagged number of new-media news are smaller than the corresponding ones of the number of lagged mass-media news, which implies that new media relies more on mass media and mass media relying more on themselves may seek inspiration on the internet to some extent. Thirdly, we explored the reactions of mass-media news and new-media news to corporate events. We found that all four types of news positively react to these shocks, but the new media exhibits a stronger positive reaction to these shocks. Finally, we studied the dynamic correlation between the four types of news. We found that there are significant positive correlations between the four types of news over time. And the correlation between mass-media and new-media news becomes stronger when the stock market performs well. The correlation between the reprints and the corresponding media news becomes smaller when the stock market performs extremely well.

We attribute these results to the different roles that the mass media and new media play in the process of information transmission in the Chinese stock market. The mass media has the advantages of the interviewing and editing ability and the legal rights of interviewing and editing. While the new media, especially for the larger portals could attract more attention and discussion of readers. So mass media and new media exhibit a symbiotic relationship, where mass media devotes to provide original news with high quality and new media transfers these numbers of news to more readers to attract more attention and discussion. So the number of new-media news relies on more mass-media news. On the other hand, the higher autocorrelation for these four types of news as well as the higher contemporaneous correlation between reprints and the same type of news indicates that the competition relation also exists between mass media and new media.

Admittedly, we only focus on the number of news in this paper. And this paper didn't combine with the stock market completely. It is promising to further investigate the roles of mass media and new media in the content of news and to compare the different effects on the stock market of the two types of media based on their different roles. We leave these for future research.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation, to any qualified researcher.

Author Contributions

ZZ: data curation, investigation, methodology, software, validation, visualization, roles, and writing—original draft. YZ: conceptualization, funding acquisition, project administration, supervision, writing—review, and editing. DS: conceptualization, formal analysis, funding acquisition, project administration, resources, roles/writing—original draft, writing—review, and editing.

Funding

This work is supported by the National Natural Science Foundation of China (71771170, 71790594, and 71701150) and the Young Elite Scientists Sponsorship Program by Tianjin (TJSQNTJ-2017-09).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

1. Peress J. The media the diffusion of information in financial markets: evidence from newspaper strikes. J Financ. (2014) 69:2007–43. doi: 10.1111/jofi.12179

2. Tetlock PC. Giving content to investor sentiment: the role of media in the stock market. J Financ. (2007) 62:1139–68. doi: 10.1111/j.1540-6261.2007.01232.x

3. Fang L, Peress J. Media coverage the cross-section of stock returns. J Financ. (2009) 64:2023–52. doi: 10.1111/j.1540-6261.2009.01493.x

4. Zhang YJ, Song WX, Shen DH, Zhang W. Market reaction to internet news: information diffusion and price pressure. Econ Model. (2016) 56:43–9. doi: 10.1016/j.econmod.2016.03.020

5. Dougal C, Engelberg J, García D, Parsons CA. Journalists and the stock market. Rev Finan Stud. (2012) 25:639–79. doi: 10.1093/rfs/hhr133

6. Antweiler W, Frank MZ. Is all that talk just noise? The information content of internet stock message boards. J Financ. (2004) 59:1259–94. doi: 10.1111/j.1540-6261.2004.00662.x

7. Dimmick J, Chen Y, Li Z. Competition between the internet traditional news media: the gratification-opportunities niche dimension. J Media Econ. (2004) 17:19–33. doi: 10.1207/s15327736me1701_2

8. Nguyen A, Western M. The complementary relationship between the internet and traditional mass media: the case of online news and information. Inform Res. (2006) 11:151–83. Available online at: http://informationr.net/ir/11-3/paper259.html

9. Jang S, Park M. Do new media substitute for old media? A panel analysis of daily media use. J Media Econ. (2016) 29:73–91. doi: 10.1080/08997764.2016.1170021

10. Chyi HI, Lasorsa DL. An explorative study on the market relation between online print newspapers. J Media Econ. (2002) 15:91–106. doi: 10.1207/S15327736ME1502_2

11. Zhang Y, Zhang Z, Liu L, Shen D. The interaction of financial news between mass media and new media: evidence from news on Chinese stock market. Phys A. (2017) 486:535–41. doi: 10.1016/j.physa.2017.05.051

12. Zhang Z, Zhang Y, Shen D, Zhang W. The dynamic cross-correlations between mass media news, new media news, and stock returns. Complexity. (2018) 2018:7619494. doi: 10.1155/2018/7619494

13. Mitchell ML, Mulherin JH. The impact of public information on the stock market. J Financ. (1994) 49:923–50. doi: 10.1111/j.1540-6261.1994.tb00083.x

14. Liang B. Price pressure: evidence from the dartboard column. J Bus. (1999) 72:119–34. doi: 10.1086/209604

15. Chan WS. Stock price reaction to news no-news: drift reversal after headlines. J Finan Econ. (2003) 70:223–60. doi: 10.1016/S0304-405X(03)00146-6

16. Zhang Y, Zhang Y, Shen D, Zhang W. Investor sentiment and stock returns: evidence from provincial TV audience rating in China. Phys A. (2017) 466:288–94. doi: 10.1016/j.physa.2016.09.043

17. Tumarkin R, Whitelaw RF. News or noise? Internet postings and stock prices. Financ Anal J. (2001) 57:41–51. doi: 10.2469/faj.v57.n3.2449

18. Das SR, Chen MY. Yahoo! for Amazon: sentiment extraction from small talk on the web. Manage Sci. (2007) 53:1375–88. doi: 10.1287/mnsc.1070.0704

19. Zhang W, Li X, Shen D, Teglio A. Daily happiness and stock returns: some international evidence. Phys A. (2016) 460:201–9. doi: 10.1016/j.physa.2016.05.026

20. Jin X, Shen DH, Zhang W. Has microblogging changed stock market behavior? Evidence from China. Phys A. (2016) 452:151–6. doi: 10.1016/j.physa.2016.02.052

21. Zhang W, Shen D, Zhang Y, Xiong X. Open source information, investor attention, and asset pricing. Econ Model. (2013) 33:613–19. doi: 10.1016/j.econmod.2013.03.018

22. Shen DH, Li X, Zhang W. Baidu news coverage and its impacts on order imbalance and large-size trade of Chinese stocks. Financ Res Lett. (2017) 23:210–16. doi: 10.1016/j.frl.2017.06.008

23. Klibanoff P, Lamont O, Wizman TA. Investor reaction to salient news in closed-end country funds. J Financ. (1998) 53:673–99. doi: 10.1111/0022-1082.265570

24. Tetlock PC, Saar-Tsechansky M, Macskassy S. More than words: quantifying language to measure firms' fundamentals. J Financ. (2008) 63:1437–67. doi: 10.1111/j.1540-6261.2008.01362.x

25. Zhang Y, Feng L, Jin X, Shen D, Xiong X, Zhang W, et al. Internet information arrival and volatility of SME PRICE INDEX. Phys A. (2014) 399:70–74. doi: 10.1016/j.physa.2013.12.034

26. Shen DH, Zhang W, Xiong X, Li X, Zhang YJ. Trading and non-trading period internet information flow and intraday return volatility. Phys A. (2016) 451:519–24. doi: 10.1016/j.physa.2016.01.086

27. Lee PSN, Leung L. Assessing the displacement effects of the internet. Telemat Inform. (2008) 25:145–55. doi: 10.1016/j.tele.2006.08.002

28. Ha L, Fang L. Internet experience and time displacement of traditional news media use: an application of the theory of the niche. Telemat Inform. (2012) 29:177–86. doi: 10.1016/j.tele.2011.06.001

29. Gentzkow M. Valuing new goods in a model with complementarity: online newspapers. Amer Econ Rev. (2007) 97:713–44. doi: 10.1257/aer.97.3.713

30. D'Haenens L, Jankowski N, Heuvelman A. News in online and print newspapers: differences in reader consumption and recall. New Media Soc. (2004) 6:363–82. doi: 10.1177/1461444804042520

31. Hassid J, Repnikova M. Why Chinese print journalists embrace the internet. Journalism. (2016) 17:882–98. doi: 10.1177/1464884915592405

Keywords: mass-media news, new-media news, contemporaneous correlation, mutual information, PVAR, dynamic correlation

Citation: Zhang Z, Zhang Y and Shen D (2020) The Dynamic Correlations Between Mass Media News and New Media News in Stock Market. Front. Phys. 8:179. doi: 10.3389/fphy.2020.00179

Received: 23 February 2020; Accepted: 27 April 2020;

Published: 25 May 2020.

Edited by:

Wei-Xing Zhou, East China University of Science and Technology, ChinaReviewed by:

Yang Hu, University of Waikato, New ZealandBin Liu, University of Wollongong, Australia

Copyright © 2020 Zhang, Zhang and Shen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Dehua Shen, ZGhzQHRqdS5lZHUuY24=

Zuochao Zhang

Zuochao Zhang Yongjie Zhang

Yongjie Zhang Dehua Shen

Dehua Shen