- 1Clinical Psychology and Behavioural Health Program, Faculty of Health Sciences, Universiti Kebangsaan Malaysia, Kuala Lumpur, Malaysia

- 2Psychology and Human Wellbeing Research Centre (PsiTra), Faculty of Social Sciences and Humanities, Universiti Kebangsaan Malaysia, Bangi, Malaysia

- 3Faculty of Leadership and Management, Universiti Sains Islam Malaysia, Nilai, Malaysia

- 4Pusat Permata Pintar Negara, Universiti Kebangsaan Malaysia, Bangi, Malaysia

Background: This article aims to review research manuscripts in the past 5 years that focus on the effects of debt on depression, anxiety, stress, or suicide ideation in Asian countries.

Methods: A search for literature based on the PRISMA guidelines was conducted on Medline, PubMed, Web of Science, Scopus, and ScienceDirect, resulting in nine manuscripts meeting inclusion criteria. The studies were conducted in Thailand, Korea, Singapore, Pakistan, India, Cambodia, and China.

Results: The findings of the studies show that there is evidence to support that being in debt is related to Asian participants experiencing depression, anxiety, stress, or suicide ideation. However, the studies are limited to quantitative studies only. The definition of debt is also unclear in most manuscripts. Few manuscripts also examined how other factors influence the relationship between debt and mental illness.

Conclusion: There are limited studies on the psychological effects of debt on the Asian population. Future studies should focus on the relationship between debt and psychological well-being among this population.

Introduction

The term debt can be understood in two different but related concepts, one as a specific legal instrument that connects lenders to debtors, and the other as having less assets to liabilities (Charron-Chénier and Seamster, 2018). The prevalence of debt is widespread among the youths and those of low-income groups. In Britain, younger individuals are more likely than older individuals to live in a household with debt with 60–70% of those aged 20–30 living in a household with debt compared to only 39% of those aged 60–64 and only 11% for those aged 80 to 84 (Hood et al., 2018). As income increases, so does the prevalence of debt; research shows among among individuals in the lowest income decile, 7% live in households with debts higher than 10,000 euros, and this value increases to 18% among those of the highest income decile, where more than 60% of unsecured debt are held by above-average incomes (Hood et al., 2018). Some studies that relate age to debt found that credit card debt peaks among individuals aged 40–49 (Drentea, 2000). A more recent finding indicates that among individuals aged 18–30, the amount of debt increases with age (Hoeve et al., 2014). In an Asian context, studies from Malaysia find individuals aged below 40 make up the largest number of borrowers with debt at risk (Siti et al., 2018) while most professionals aged 30 to 40 are faced with credit card defaults (Ahmad and Omar, 2013). The Malaysian Department of Insolvency in 2016 reported a total of 101,958 cases of bankruptcy from 2012 to 2016, with individuals aged 25–34 making up 23.38% of the total bankruptcy cases (Malaysian Department of Insolvency, 2019). There is a need to understand the effects of debt on humans as research finds that individuals can be affected physically and mentally by their debts.

Arandjelovic et al. (2016) drew attention to the disparity in mental health care in Asia compared to Australia, and even calls for Australia's involvement in improving the mental health outcomes in the Asian region. World Health Organization (2018) estimates that South-East Asia has the second highest suicide rate compared to other regions. Evidence of this prevailing issue can be seen in Malaysia, whereby 31.3% of adolescents have suicide ideation (Ibrahim et al., 2019) which correlates positively with depression, anxiety, and stress (Ibrahim et al., 2014). Hence, a deeper understanding of the factors that contribute to these mental health issues is needed, especially debt.

In terms of depression, the amount of debt is not the sole predictor of depression. It is found that among the older adults in Japan, having debt was significantly related to the increase in mild–moderate and severe depression; this is attributed to the obligation to repay debt results in psychological pain or reduced quality of living conditions (Tatsuhiko et al., 2010). Bridges and Disney (2010) found that person-specific effects are important in the relationship between self-reported debts and depression. Hojman et al. (2016) reported that over-indebtedness is positively associated with depression; more specifically, the duration of over-indebtedness predicts depressive symptoms.

In studies of anxiety, Dackehag et al. (2019) reported that debt was significantly associated with anxiety. Additionally, among indebted Union Cross members in low-income households, the rate of anxiety was higher compared to the Northern Ireland average, with 11.5% of the participants describing themselves as anxious or depressed, and 23.5% receiving treatment for anxiety or depression (Keatley, 2014). Qualitatively, a study using 14 focus groups of low- to middle-income house threatened with foreclosure and foreclosure intervention professionals reports changes in mental health as a result of stress and anxiety due to their financial hardship, their efforts to manage the financial problem, and loss of ontological support (Libman et al., 2012).

Additionally, there have been numerous past studies on the effect of debt on stress. Norvilitis et al. (2006) reported that debt (in the form of credit card and store debt) among individuals aged 18 and above and college students predicted overall stress. Head of homes with outstanding credit either at the household or individual level also report significant lower psychological well-being, and the presence of household debt lowers the chances of scoring full marks on the General Health Questionnaire 12 by 6% (Brown et al., 2005). In a diverse sample of Internet users, it was found that those that fall in the foreclosure or default group experienced greater psychological distress than other groups (Cannuscio et al., 2012).

In terms of suicide behavior, although not observed as a statistically significant pattern, debt was mentioned as a relevant factor for suicide behavior in 11% of men by inquest witnesses (Scourfield et al., 2012). In Hong Kong, a study of suicide by gassing from 2005 to 2013 reported that those that employed suicide by helium were more likely to have debt, and debt was associated with charcoal suicide as well (Chang et al., 2016). Hopelessness acts as a partial mediator between debt and suicide and ideation. However, Kidger et al. (2011) noted that suicide attempts were more strongly associated with bankruptcy within 2 years compared to preinjury bankruptcy; nonetheless, the weaker association is still significant for preinjury bankruptcy and suicide.

Higher debt/income ratio is significantly related to worsening health and self-reported health with health behaviors and risk explaining part of the association between debt, stress about debt, and health (Drentea and Lavrakas, 2000). According to Angel (2016), among several European countries, those living in households with debt for the past 12 months significantly increase the chances of reporting bad health by 22.6% compared to those living without debt, and there is evidence that debt collection costs strengthen the relationship between debt and health, while the evidence of the effect of social stigma is weak.

From these past studies, there is evidence to support a need for a deeper understanding of how debt affects the mental health of individuals. One such method is through a systematic review, a form of review that involves a thorough and comprehensive plan using a search strategy with the aim of lowering bias by locating, evaluating, and synthesizing all relevant studies on the studied topic (Uman, 2011). There have been systematic reviews on the effects of debt. One is Richardson et al. (2013) meta-analysis of research manuscripts on the effects of debt, which found that there is a significant relationship between the presence of mental disorders, suicide attempts and completion, depression, neurotic disorders, psychotic disorders, drug dependence, and problematic alcohol use. In their study, however, only 10 manuscripts were found that were conducted in countries in Asia. Turunen and Hiilamo (2014) also reviewed the effects of debt and concluded that indebted individuals suffered from suicide ideation and depression more than those without debt; in their research, the authors did not include any manuscripts conducted in the Asian region.

Based on previous literature, it can be derived that debt plays an important part in the mental and physical health of humans. However, there are conceptual and cultural issues to be addressed in reviewing literature on debt and mental health across cultures. First, in terms of conceptual definitions of debt and measurements of debt—the use of clear definition of debts and measures of multidimensional domains of debt may facilitate the accuracy in measuring debt or loan. The use of multidimensional domains of debt are better compared to the use of single-item response to measure debt (Roth et al., 2008). The comprehensive measure of debt potentially leads to meaningful data especially in understanding the relationship between debts and mental health. Second, cultural roles are important in explaining the relationship between debts and mental health in societies and mental health differences across cultures. Therefore, examining ethnicity, culture, and cultural background in a systematic review may offer a cultural explanation on the relationship between debts and mental health (Gopalkrishnan and Babacan, 2015). To our knowledge, few studies on the effects of debt have been done in Asia. It would add to the body of knowledge to see if these patterns of psychological effects on indebted individuals apply for Asian participants. Conducting a review on the effects of debt specifically in Asia will enhance knowledge about how research into debt has changed among Asian countries, and if there is potential to enhance the research methodology. Therefore, this review aims to investigate the relationship between debt, depression, anxiety, stress, and suicide ideation in Asia.

Methods

Systematic Review Protocol

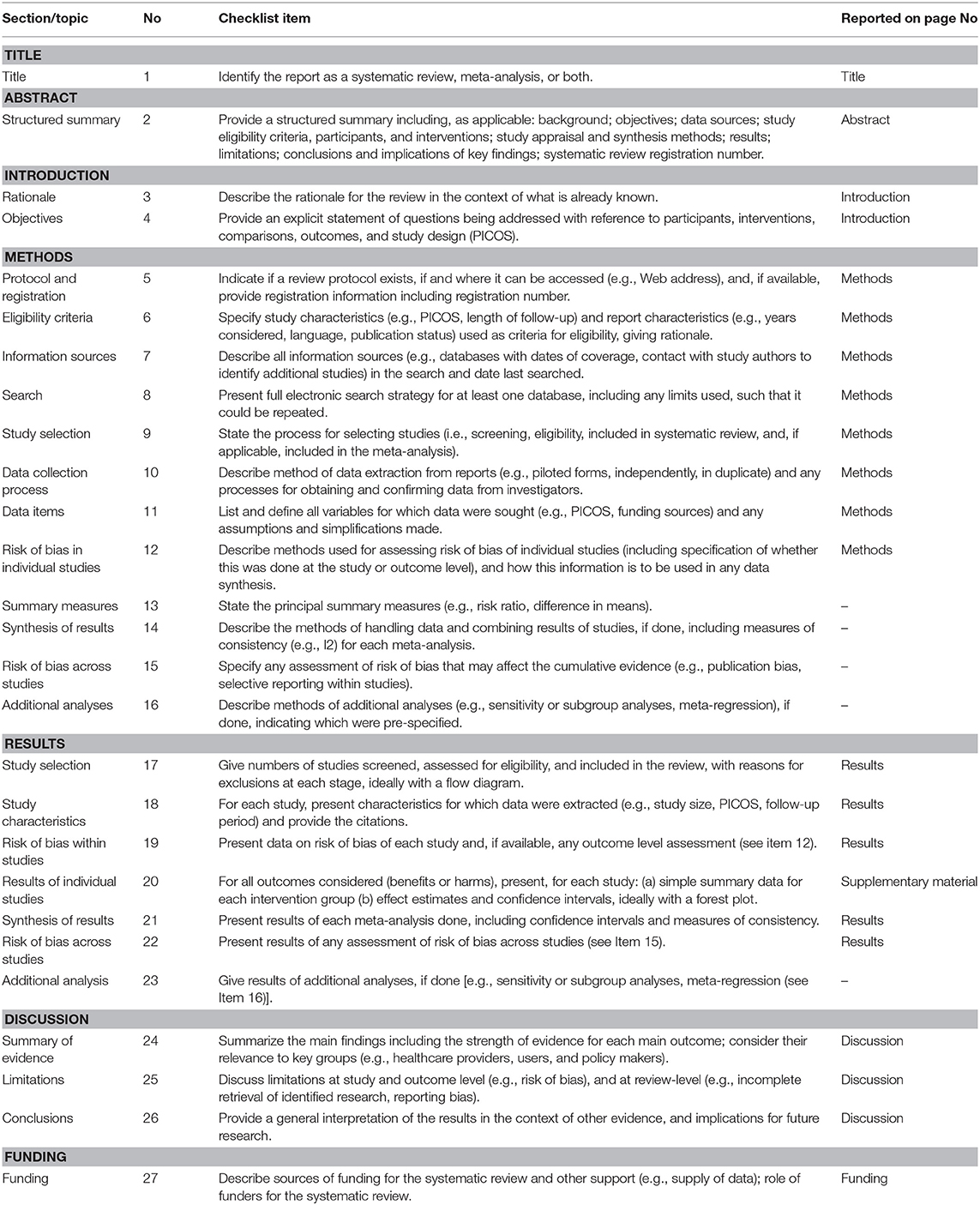

This review follows the PRISMA guidelines, and the PRSIMA flowchart was also adapted to summarize the search process (Moher et al., 2009). PRISMA is the revised version of the Quality of Reporting of Meta-analyses (QUAROM) guideline, consisting of a 27-item checklist and flowchart (Moher et al., 2009). PRISMA's strong endorsement has resulted in an increase in adherence in PRISMA's guidelines within systematic reviews and meta-analysis, and it also found an increase in qualities in manuscripts that endorse PRISMA regardless of their declaration of adopting its methods or not (Panic et al., 2013).

Search Strategy

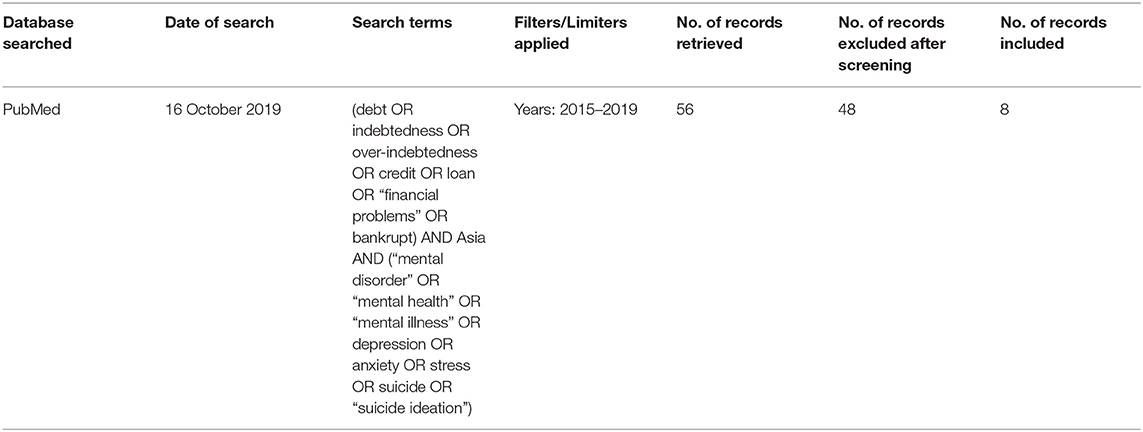

Five databases were searched. These are Medline, PubMed, Web of Science, Scopus, and ScienceDirect. Generally, a systematic review requires the use of more than two databases and should go beyond the use of MEDLINE database (Charrois, 2015). In Bramer et al. (2017) manuscript, Medline appears in 97% of systematic reviews identified via PubMed. Medline contains more than 25 million references on the topics related to biomedicine and life science (U.S. National Library of Medicine, 2019a). Similarly, PubMed archives biomedical and life science journals literature and is available as a free resource (U.S. National Library of Medicine, 2019b). Web of Science covers numerous records on social, biomedical, life science, natural sciences, engineering, computer science, material sciences, and health sciences (Web of Science Group, 2019). Scopus is a free-to-use database of peer-reviewed literature with content in the field of science, social science, technology, medicine, and arts and humanities (Elsevier, 2017). ScienceDirect provides access to journals and books on the field of social sciences, business, health sciences, life sciences, physical sciences, and engineering (Harnegie, 2013).

The search terms used were debt* or indebtedness or over-indebtedness or credit or loan or “financial problems” or bankrupt and Asia and “mental disorder” or “mental health” or “mental illness” or depression or anxiety or stress or suicide or “suicide ideation.”

The EBSCOhost search engine was used for the MEDLINE database search, and the following limiters were used as they were ready-made and to enhance accuracy of search results: Age set to 19–44 years old, and geography set to India, China, Malaysia, Japan, Thailand, Bangladesh, and Republic of Korea.

Third, the published journal article discusses the relationship between problematic and non-problematic debt on depression, anxiety, suicide or suicide ideation, or stress. The study includes studies on participants from Asia only.

The following exclusion criteria were followed. First, the manuscript was excluded if the content was not available in English. This limiter is considered acceptable as research finds no bias in systematic reviews of meta-analysis of conventional medicine that apply the language restriction (Morrison et al., 2012). Second, if the manuscript's study was not conducted in a country in Asia. Third, the manuscript was a review manuscript. The reasoning to reject review manuscripts is because as a form of secondary research, the use of secondary data would limit the quality of the data as the data originally would have been used for other purposes that may not be aligned with the current research (Allen, 2017). Hence, the present review chooses to focus on primary research data.

It was decided that the review would focus on published journal articles, as it was judged to be biased if books and thesis or dissertations on the subject matter were selected over the other due to their unavailability via online search and written language.

Data Analysis

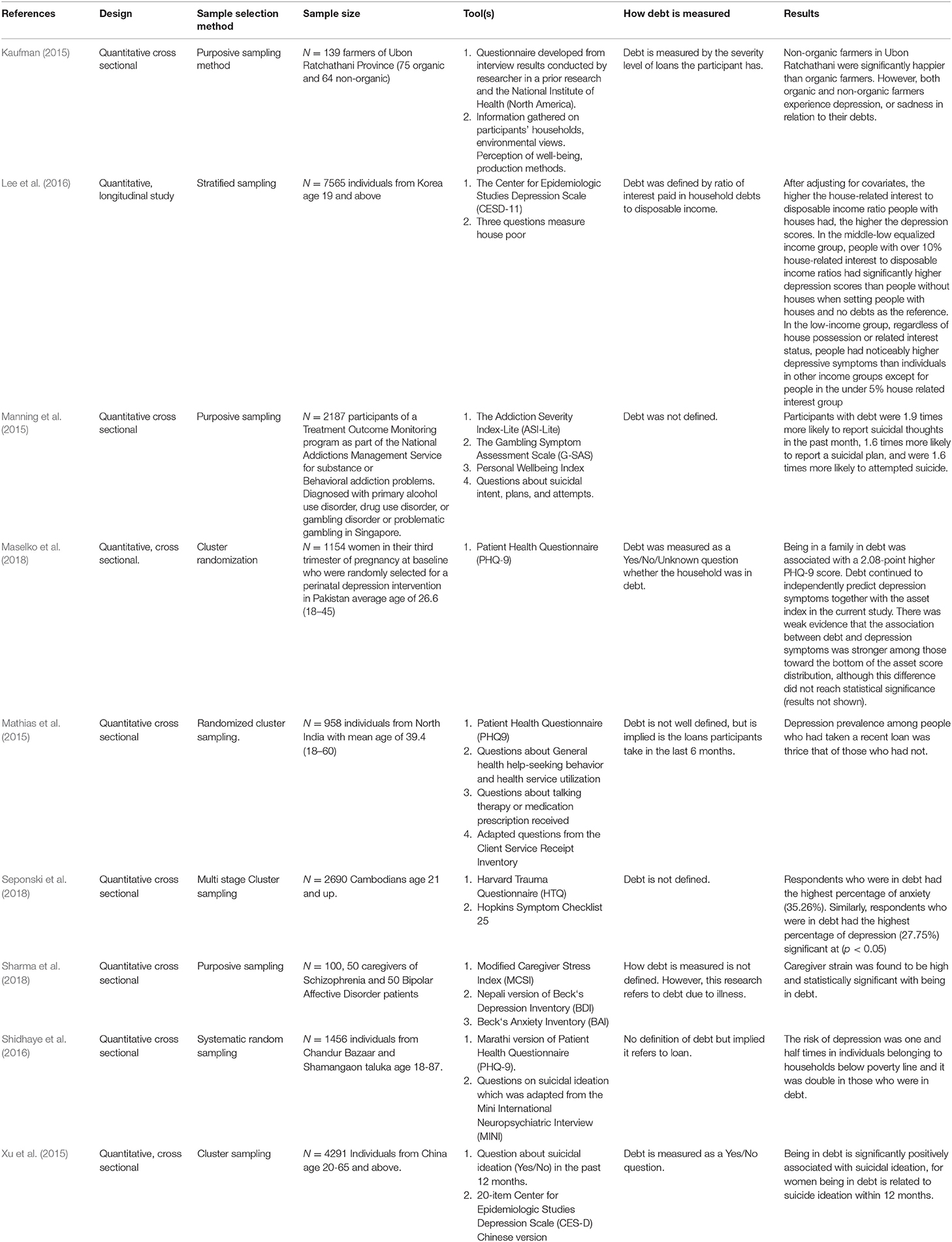

Each accepted manuscript for review was analyzed through a systematic and careful process. The full text of the articles was read, exploring their methodology and results. Information on the study's design, sampling method, sample size, psychological tools used, and definition of debt was recorded. Additionally, results on the relationship between debt and depression, anxiety, suicide, and suicide ideation were noted. All relevant findings are categorized and presented in a descriptive method in Tables 1–3. A risk of bias analysis was carried out for each individual study as well and summary of risk of bias analysis is presented in Table 4. The summary of the PRISMA checklist and a sample for electronic search strategy for the present systematic review are presented in Tables 5, 6, respectively.

Results

Flow Diagram

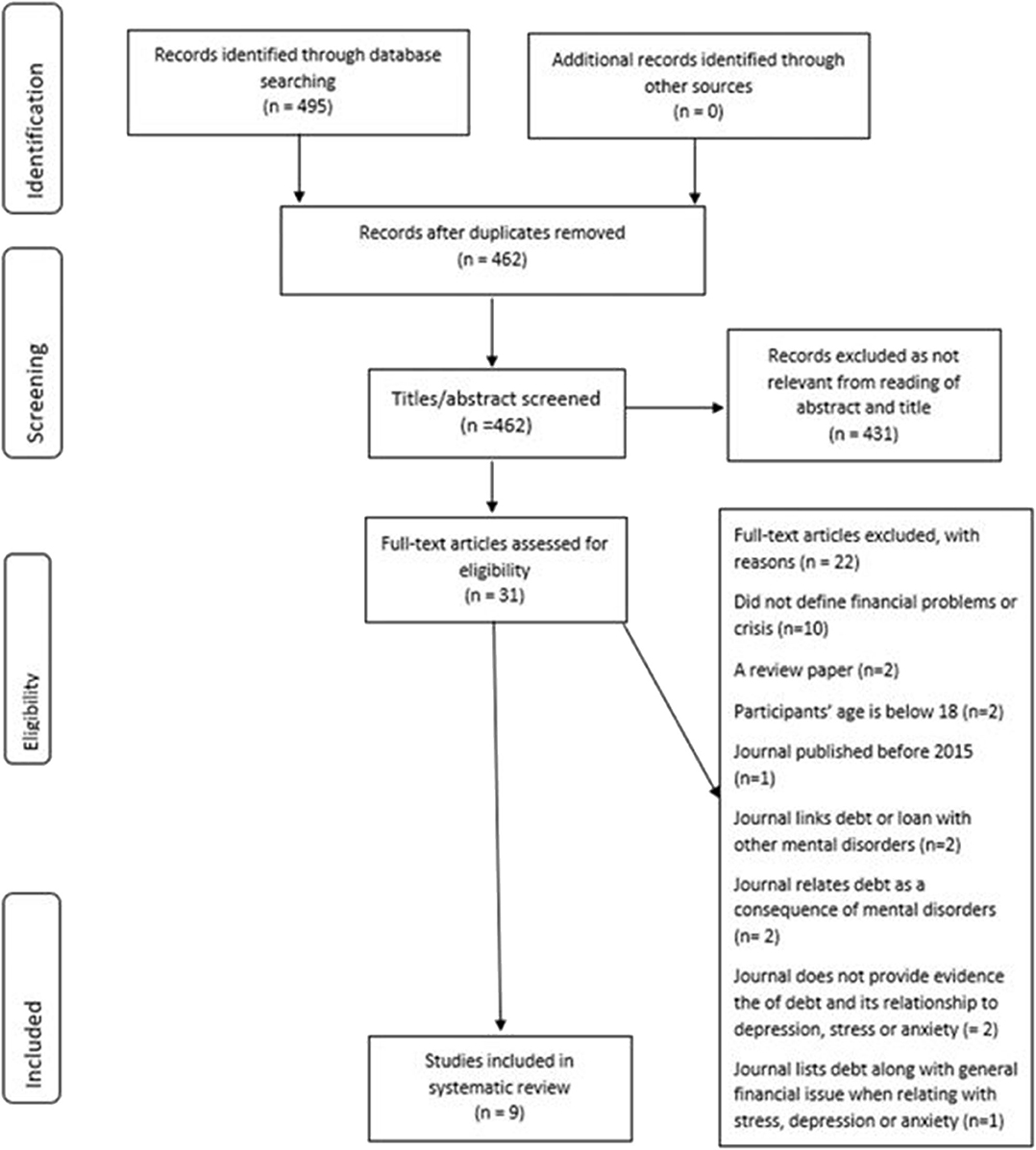

See Figure 1 for the flow diagram of study selection.

Study Selection and Characteristics

The identification search process was conducted from October 9, 2019 to October 10, 2019 for the Medline, PubMed, Scopus, and Web of Science database. ScienceDirect was searched on October 25, 2019. Using the search terms, a total of 462 articles were found from all five databases after excluding duplicates. During the first screening process, the title and abstract of each manuscript were screened for relevance and 431 titles were omitted.

Studies that were deemed acceptable were then screened for eligibility via the full text for their methodology and their findings. From the reading of the full text, several manuscripts were excluded with various reasons. These included manuscripts that discussed the effects of debt on other mental illnesses such as gambling addiction and post-traumatic embitterment, manuscripts that relate debt as a consequence of mental illnesses, manuscripts that mention a relationship between debt and depression, anxiety, suicide, or suicide ideation via citing other sources or presenting sample characteristics alone, manuscripts with participants below the age of 18, manuscripts that do not define the term financial problems or crisis, manuscripts that are review manuscripts as these are secondary sources, and manuscripts that combine debt with other financial problems to relate with mental disorders.

The number of manuscripts included and deemed suitable for review was nine. See Figure 1 for the PRISMA flow diagram.

Synthesized Findings

A total of nine studies were selected for review. All studies (100%) utilized a qualitative design, with only 11.11% using longitudinal data while the remaining 88.88% used cross-sectional data.

Overall, the most studied relationship is between debt and depression, with six out of nine manuscripts measuring depression as part of their study, accounting for 66.67% of the total manuscripts (Kaufman, 2015; Mathias et al., 2015; Lee et al., 2016; Shidhaye et al., 2016; Maselko et al., 2018; Seponski et al., 2018).

Four out of nine or 44.44% explored the relationship between debt and depression alone. One study or 11.11% of the found manuscripts examined the relationship between debt depression, anger, and sadness. The found manuscripts reported that those in debt experience depression, and there is evidence that those in debt experience greater debt than those without.

Only one study, or 11.11% of the found manuscripts explored the relationship between debt and depression and anxiety. Seponski et al. (2018) reported that participants who reported being in debt had the highest level of anxiety.

Two manuscripts or 22.22% of the manuscripts studied the relationship between debt and suicide ideations and behavior. Manning et al. (2015) found that patients with addictive disorders were almost twice as likely to have suicidal thoughts and were 1.6 times more likely to have suicidal plans or attempted suicide. Xu et al. (2015) found that being in debt was positively related to suicide ideation.

Lastly, only one manuscript or 11.11% of the nine manuscripts discussed the relationship between debt and stress. The participants of this study are highly specific and limited to caregivers of inpatients in a hospital, and the manuscript's findings found that being in debt was statistically significant with caregiver stress.

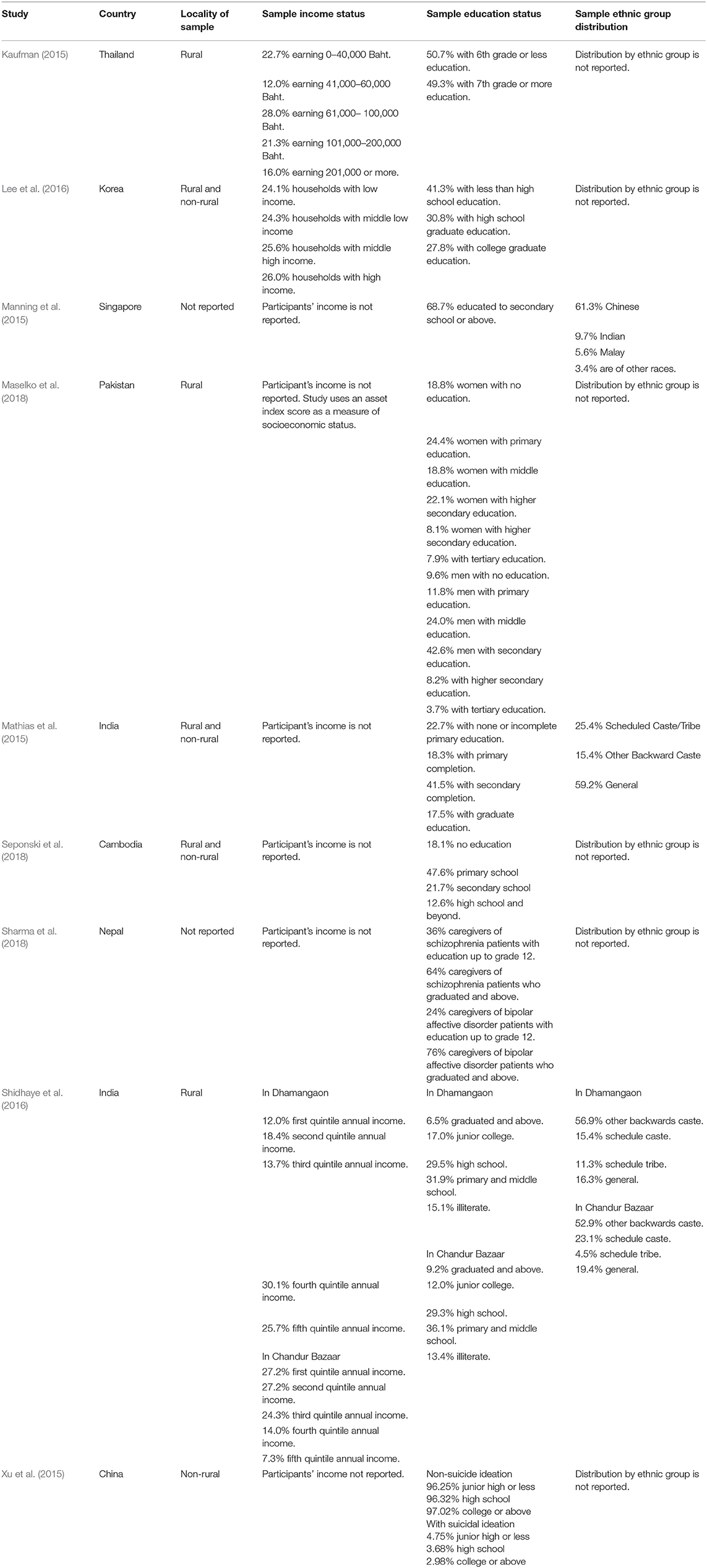

In addition, this review examines the characteristics and culture background of participants reported by the studies. Table 2 indicates that, in terms of the geographic location of the studies, 33.33% were conducted with participants from rural locations (Kaufman, 2015; Shidhaye et al., 2016; Maselko et al., 2018), 33.33% were conducted with participants from rural and non-rural locations (Mathias et al., 2015; Lee et al., 2016; Seponski et al., 2018), 11.11% were conducted with participants from non-rural locations only (Xu et al., 2015), and 22.22% did not report the geographical location the participant was recruited from (Manning et al., 2015; Sharma et al., 2018). In terms of income status, only 33.33% of the found manuscripts provide information on the participant's income status and majority of the participants are of middle- to low-income groups (Kaufman, 2015; Lee et al., 2016; Shidhaye et al., 2016). In terms of education status, 100% of the manuscripts provided information on the participants' education status (Kaufman, 2015; Manning et al., 2015; Mathias et al., 2015; Xu et al., 2015; Lee et al., 2016; Shidhaye et al., 2016; Maselko et al., 2018; Seponski et al., 2018; Sharma et al., 2018). Majority of the participants are of low education status. With regard to ethnic group distribution, only 33.33% of the manuscripts reported on the samples ethnic group distribution (Manning et al., 2015; Mathias et al., 2015; Shidhaye et al., 2016). This may limit the understanding of the cultural background of study participants in the present review and potentially limits knowledge on cultural explanation on the relationship between debts and mental health.

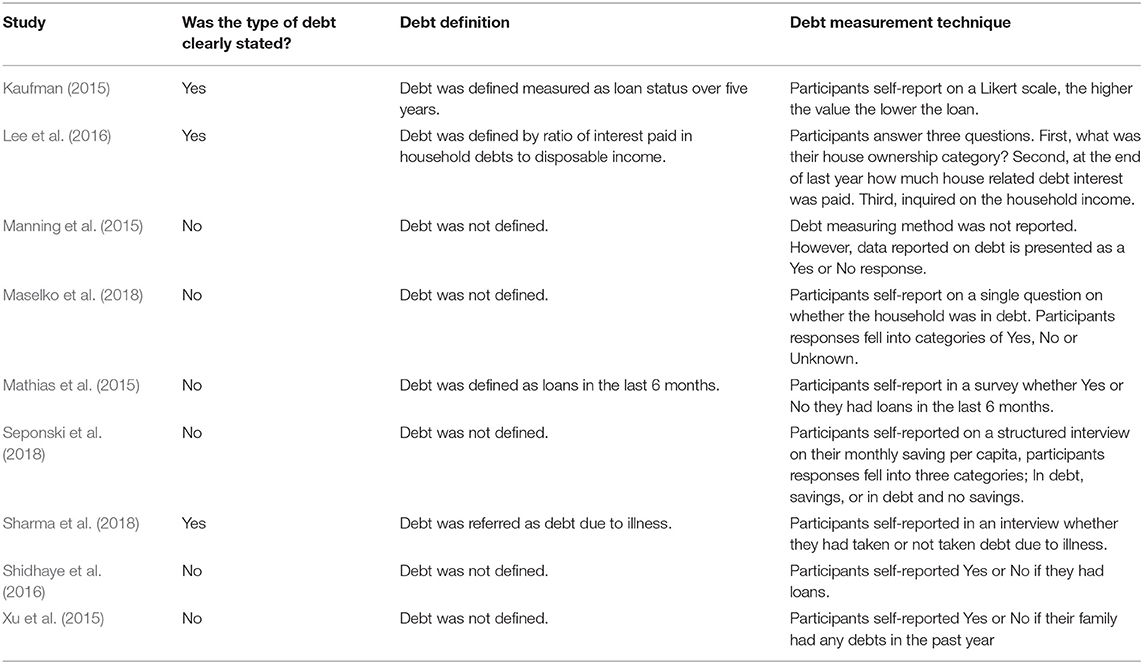

Besides that, this present review identifies types of debts, definition of debts, and methods of measuring debt in order to understand the variability in defining and measuring debts as indicated in Table 3. First, with regard to reporting the type of debt, only 33.33% of studies provide a clear statement of what type of debt is referred to in the study (Kaufman, 2015; Lee et al., 2016; Sharma et al., 2018), while 66.66% of studies do not state what type of debt they refer to or in the writing require readers to infer the type of debt from later sections of the manuscript (Manning et al., 2015; Mathias et al., 2015; Xu et al., 2015; Shidhaye et al., 2016; Maselko et al., 2018; Seponski et al., 2018). Second, in terms of definitions of debts, only 44.44% of studies provide a definition of the type of debt the study looks into (Kaufman, 2015; Mathias et al., 2015; Lee et al., 2016; Sharma et al., 2018). For instance, while Kaufman (2015) defined debt as loan status over 5 years, Lee et al. (2016) defined debt as house-related interest to disposable income ratios. The other studies defined debt as loans in the last 6 months (Mathias et al., 2015) and debt due to illness (Sharma et al., 2018). Thirdly, in terms of how debt was measured, all manuscripts used self-report measures. In addition, 55.55% of the found manuscripts obtained information on debt by asking Yes or No type questions (Manning et al., 2015; Mathias et al., 2015; Xu et al., 2015; Shidhaye et al., 2016; Maselko et al., 2018). Other studies measured debt on a Likert scale, indicating how severe the loans were (Kaufman, 2015), and one study measured savings per capita (Seponski et al., 2018); each of these studies account for 11.11% of the nine manuscripts included in this review. With regard to the method the studies used to define debt, this systematic review finds that there are variabilities in defining and measuring debts.

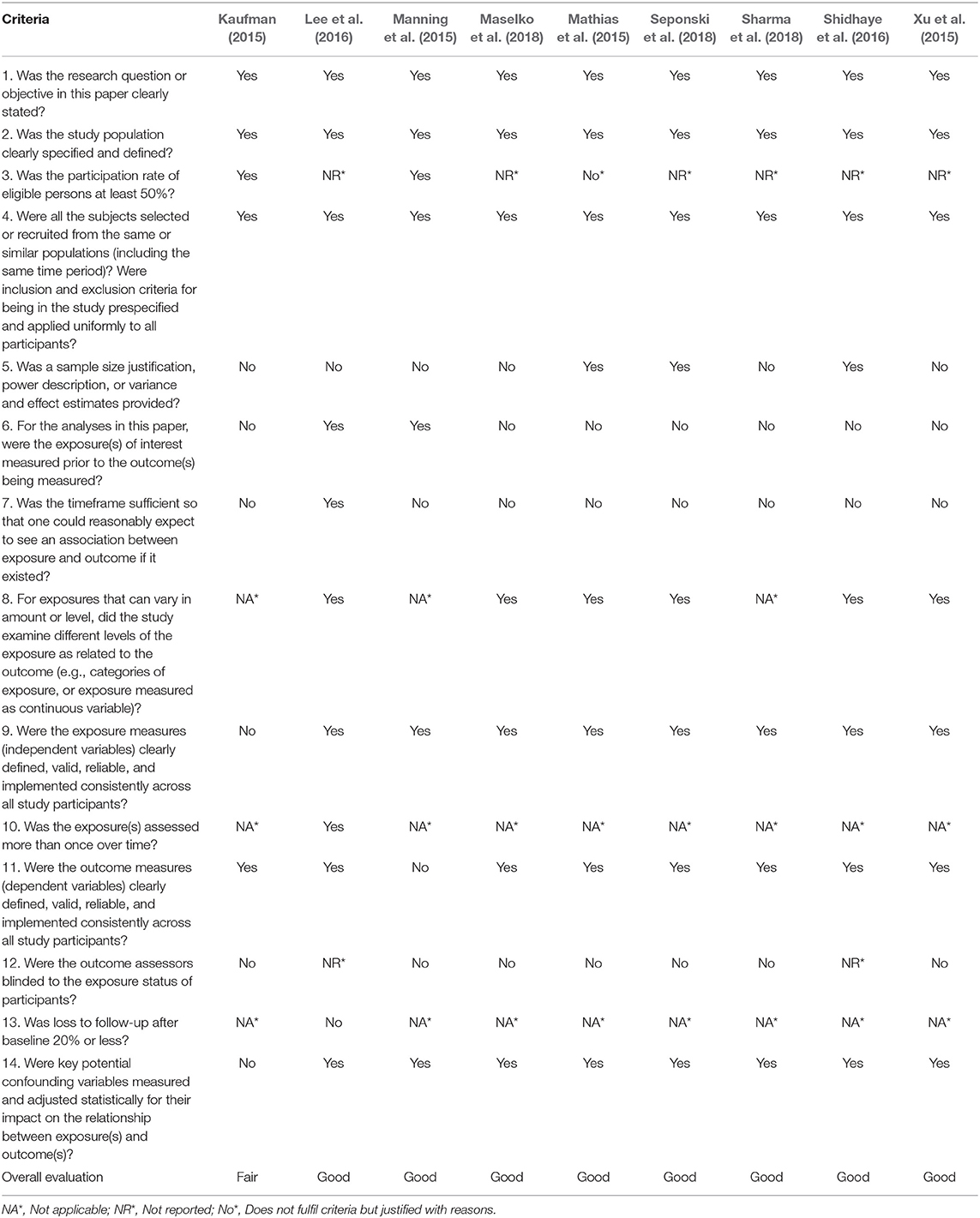

Risk of Bias

Risk of bias of each individual study is determined using the National Heart, Lung, and Blood Institute (2019) Quality Assessment Tool for Observational Cohort and Cross-Sectional Studies. This guideline has been used in previous reviews (Harris et al., 2016; Koppen et al., 2016; Connolly et al., 2017; Carbia et al., 2018).

The information from this risk of bias assessment aims to evaluate the quality of the research manuscripts included in the present review; regardless of the manuscript's evaluation, its strengths and weaknesses are used to generate methods to enhance future studies and to inform on the current state of research on the psychological effects of debt.

From the nine manuscripts, a noticeable trend is seen in the reporting of sample size. Only 25% of the found studies reported how the sample size was justified while others did not; this calls into question whether the sample used is reflective of the population as only 22.22% of the studies reported the participation rate of eligible participants.

The use of cross-sectional designs also results in an increase in bias due to the nature of the design itself. One of the limitations that is seen across all the cross-sectional studies is that causation cannot be established. This is seen in 77.78% of the total found manuscripts. Due to the nature of cross-sectional analyses, these studies do not allow enough time for an independent variable to have an effect or to occur or to be observed (National Heart, Lung, and Blood Institute, 2019).

A strength of the found manuscripts is that 88.88% of the found manuscripts used reliable, valid, or objective means of measure for their independent or dependent variable in line with the objectives of their study. However, this is not reflective of how specifically debt is measured in these studies. A few manuscripts define debt clearly and use self-reports or measure debt as a dichotomous variable, which may not accurately reflect the experience of debt. The most used tool is the Patient Health Questionnaire-9 (PHQ-9) in the study of depression; the PHQ-9 has been shown to have good internal consistency and acceptable inter-item correlations, and strong convergent validity with the PHQ-2 (Maroufizadeh et al., 2019). Evidence also shows acceptable evidence of validity and reliability in translated versions of the PHQ-9 (Lupascu et al., 2019). However, from the two studies of debt and suicide ideation, one employed a Yes/No question in the measure of suicide ideation; a concern that can be raised is that the context of the suicide ideation is lost in the dichotomous choice. It can be argued that there is no gold standard for the measure of suicide ideation; however, there are numerous tools with reported validity and reliability that can be used to enhance the results of such research and should be considered in the future (Ghasemi et al., 2015).

See Table 4 for a summary of the bias table.

Discussion

Summary of Main Findings

This review finds that few researches on the topic of debt and depression, anxiety, stress, or suicide were carried out in Asian countries. All the reviewed manuscripts use a quantitative design and a majority use cross-sectional data. The relationship between debt and depression is studied most frequently. The majority of the manuscripts did not define debt in their manuscripts. From these findings, a few points need to be addressed in terms of the methodology and findings of these manuscripts.

First, there is a need for more research into how debt impacts the mental health of the Asian population as there are very few recent manuscripts that explore this current topic. Simultaneously, focus on the studies of the psychological impact of debt should extend beyond depression, as the current manuscript finds a majority of the studies with Asian population mostly relate debt to depression (Kaufman, 2015; Mathias et al., 2015; Lee et al., 2016; Shidhaye et al., 2016; Maselko et al., 2018; Seponski et al., 2018).

Second, there is a need for more research into the roles of culture in understanding the relationship between debt and mental health. In the present review, there was lack of evidence on understanding the cultural explanation on the relationship between debts and mental health. This review finds that more research is needed in understanding of how cultural background such as socioeconomic factors impact the psychological effects of debt among Asians. The current manuscripts show some support that being in lower socioeconomic status increases the risk of depression due to debt (Lee et al., 2016; Shidhaye et al., 2016; Maselko et al., 2018). However, the majority of the found manuscripts do not report on this association. This is cause for concern as there is evidence that those in the lower socioeconomic group are more vulnerable to incurring debt (Kim et al., 2017). Besides that, in terms of education, majority of participants are from low education levels. Although the studies are of Asian culture, there was no indication that specific ethnic groups were reported in the reviewed manuscripts.

Although culture might play a role, there are limited information regarding this, and this might limit the interpretation on the role of culture in explaining the relationship between debts and mental health. In general, it might be difficult to attribute the findings to a specific ethnicity. Although there is an intention to explore the cultural explanations on the relationship between debts and loans, this is limited due to the limited cultural information provided in these reviewed manuscripts. From the current manuscripts, none specifically address how their specific culture encourages or discourages debt and explains the relationship between mental health and debt. This is important as indebtedness and the type of debt are found to be related to individuals who hold the value that money leads to prestige and power (Henchoz et al., 2019), or in other words, materialism.

It is argued that materialistic values in some Asian cultures hold more strongly compared to the West. For example, one study finds Singaporean women put greater emphasis on partner status and greater materialism-related happiness compared to American women (Li et al., 2015). However, a study by Awanis et al. (2017) with participants from China, Thailand, India, and the United States extends this understanding of materialism in Asia as a collective-oriented materialism, a belief system that places value on possessions for how they symbolize and signal the capability to grant oneself and others status, how they help the individual comply with social expectations, and how it shows belongingness to a preferred reference group and fulfills their perceived social responsibilities. It is shown that participants in Asia hold this collective-oriented materialism more highly than those in the United States. Hence, it can be argued that the risk of debt in Asia is driven by the pressure of having possessions to show one belongs in that society. Combined with the negative perception some Asian countries have about mental illnesses (Venkatesh et al., 2015; Pang et al., 2017; Huang et al., 2019), this hypothetically may further discourage individuals facing mental health problems with their debt to seek assistance in time, which requires further extensive research. Hence, more research is needed to explore the influence of culture toward debt and the psychological consequences of debt.

Third, in terms of methodology, the use of quantitative methods in these studies incurs several strengths and limitations. Quantitative research is defined by how things are measured or counted, the distribution of the subject matter, how large an object is, how many of the thing is available, and how likely it is to meet the object that is discussed (Lune and Berg, 2017). Quantitative research is argued to be more reliable than qualitative research as it aims to eliminate external variables (Carr, 1994). From the understanding that debt is a widespread phenomenon, the quantitative method provides access to a large sample as a majority of the found manuscripts use a large number of participants. However, one of the limitations of confining to only quantitative methods is that it leaves out the meaning and explanations as to the relationship between debt and mental illness. For example, through interviews with self-harm victims, it is found that debt elicits feelings of fear of repayment and fears of benefit changes increased despair and self-harm (Barnes et al., 2016). Among student parents who reported feeling anxious or depressed, it is understood that these conditions stem from feelings of not being able to contribute properly as a parent to manage their debt (Gerrard and Roberts, 2006). Therefore, both qualitative and quantitative data are required to obtain a more holistic view of the phenomenon of debt and mental illness. More studies in the future may consider the application of mixed methods to achieve this goal.

Fourth, it is observed that few manuscripts report types of debts. Sweet et al. (2013) also noted that different types of debt may have different psychological, social, and material meanings and may occur in different contexts. Hence, their call to action to investigate the different types of debts and the context with which these debts occur. Besides that, few manuscripts report the operational definitions of debts that are used in the individual studies of debt and mental illness. According to Heppner et al. (2007), operational definitions serve as the primary constructs of a study. Issues arise when different operational constructs are formed, which may lead to different results. Defining key concepts becomes more important in research due to the different ways the definitions and concepts are understood due to the background of the readers such as their language, education, and cultural differences (Van Mil and Henman, 2016). Defining operations becomes more critical in the study of debt as there are different types of debt, such as credit card debt, student loans, personal loans from friends of family, and general debt (Hoeve et al., 2014). However, the studies found either do not define debt or use self-reported measures of debt, which poses a risk to the accuracy of the measurement of debt. Currently, there is evidence among participants in England that the type of debt may have little effect on common mental disorders such as depression, anxiety, and obsessive–compulsive disorder, but the number of debts does have an effect (Meltzer et al., 2012). This highlights the need for research articles to be clear in how many types of debts are being explored; this raises the limitations of Yes and No responses as it lacks information to provide a more holistic view of the effects of debt on mental health. In an Asian context, it would be informative to explore if debt types also have specific effects on mental health. Overall, it is recommended to apply standard measures of debt that have been used in other research such as calculating debt-to-income ratio, which can be defined as the ratio of monthly debt payments to monthly pretax income (Kim et al., 2017); the use of debt payment-to-income ratio has been shown to be effective as a measure of borrowing constraints (Johnson and Li, 2010).

In terms of results among the studies that relate debt to depression, the found research supports that individuals in debt experience greater depression (Kaufman, 2015; Mathias et al., 2015; Lee et al., 2016; Shidhaye et al., 2016; Maselko et al., 2018; Seponski et al., 2018). These findings are in line with many findings of previous studies. One study found that being in debt increased symptoms of depression beyond the effects of other socioeconomical factors such as income, wealth, education, occupational status, employment, and earlier mental health (Drentea and Reynolds, 2012). Berger et al. (2015) found that specifically short-term debt was associated with depression among adults in the United States, and this effect is most concentrated among adults age 51–64. Among Finnish participants, debt has a small but significant effect on the anxiety and depression as a 1% increase in debt related to 0.04 increase in probability of having anxiety or depression (French and McKillop, 2017). A class effect is also seen as individuals in low- and middle-income groups, despite having the least amount of debt, experience greater distress over debt; among middle-income groups, the higher the level of debt, the higher the level of depression and anxiety (Hodson et al., 2014).

In addition, only one manuscript found that self-reported anxiety is higher among those in debt (Seponski et al., 2018). Despite the low number of studies in the Asian context, its findings are reflected in other studies. Controlling for generalized anxiety disorder (GAD) symptoms at baseline, and adjusting for sociodemographic factors, exposure to financial stressors after baseline but before follow-up, and history of mood or anxiety disorders, foreclosure increases symptoms of GAD (McLaughlin et al., 2011). UK students not being able to pay bills predicted higher anxiety as explained by financial stress (Richardson et al., 2016). Through interviews, Nissen et al., 2019 reported that students with high debt expressed anxiety about their loans, and despite flourishing at the university, they are terrified about their future with regard to their debt, describing the debt as something that would negatively impact their salaries, house ownership, or ability to repay the debt.

In the study of stress and debt, high levels of stress were significantly related to caregiver's debt burden (Sharma et al., 2018). The population of this study is highly specific; hence, more research is needed regarding how the general population is affected in terms of stress due to debt. The influence of debt on stress has been shown in the general population in previous research. Controlling for self-related health, parental help, and net worth increase in debt amount increases stress in young adults, and it was found that scores on the six-item Kessler Scale increase by 0.08 if total debt is raised by 1000 USD, and credit card debt raises K6 sum of score by 0.22 for every 1,000 USD (Zhang and Kim, 2018). Among college students, it has been reported that increasing student loans had a significant impact on financial stress, and comparing students without debts with those with debts, those who reported having debt within the range of 12,000 to 30,000 USD reported an increase in stress by 0.74 (Britt et al., 2015). Young adults with high debt even after liquidating all assets are associated with higher perceived stress (Sweet et al., 2013).

Two manuscripts found higher suicide ideation among females in debt (Manning et al., 2015; Xu et al., 2015). The risk of suicide ideation among those individuals is supported by previous findings (Turunen and Hiilamo, 2014). In England, having debt increased the odds of suicide ideation alongside being female, belonging in a younger age group, single or widowed, separated or divorced, having problems with alcohol or drugs, and being unemployed or economically inactive (Meltzer et al., 2012). Furthermore, those with several debts compared to those with just one debt were more likely to report suicide ideation; this relationship between debt and suicide ideation is found to be partially mediated by hopelessness.

From manuscripts included in this review, the main findings revolve around establishing a relationship between debt and the mental health issue studied with only one study exploring how income levels affect the relationship between debt and depression (Lee et al., 2016). Hence, more research is needed to explore how certain sociodemographic variables affect the relationship between debt and mental health issues. This would be a topic of interest as it is known that debt experience can differ by age. Besides that, in terms of gender, male and females are found to respond differently toward debt in terms of perceived financial or emotional stress, subjective evaluation of the financial situation, and feelings toward their partners and themselves (Callegari et al., 2019). Even income class affects the experience of debt differently; middle-income Americans are reported to experience high depression and anxiety from having consumer balances, which further increased following the Great Recession, but lower-income consumers saw less of this effect until after the recession, which can be attributed to the lower access and use of credit (Hodson et al., 2014).

Although a conclusion about the state of debt and its effects in Asia cannot be drawn from these few studies, the trend that is observed from these findings is that among these Asian participants, there is evidence that being in debt is positively related to depression, anxiety, stress, and suicide ideation. The study on the effects of debt also needs to be made a primary objective as majority of these manuscripts do not look into debt as a primary factor of mental illness. This calls for research with more precise methodology especially in defining and measuring debt. In addition, other factors that influence the relationship between debt and mental illness need to be explored.

Limitations

The findings of this study are restricted by several limitations. First, the choice to omit unpublished literature may incur some bias on the findings of this study. The use of highly specific participants studied in these research manuscripts also limits the generalizability of these findings.

Conclusion

Overall, the present review finds that there is lack of research on the effects of debt on mental health issues such as depression, anxiety, stress, and suicide. Methodologically, there is a need to understand the context behind the relationship between debt and mental health issues and clearer definitions of debt.

Author Contributions

NA, ET, NI, and NC contributed to conception and design of the study. NA and ET organized the databases and wrote the first draft of the manuscript NA, ET, and NI performed the statistical analysis. MM, AZ, RI, TT, ET, and NA revised the manuscript. All authors contributed to manuscript revision, and read and approved the submitted version.

Funding

This manuscript was funded by Regional Cluster for Research and Publication Grant (RCRP-2016-003) from the Universiti Kebangsaan Malaysia (UKM).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

Ahmad, R., and Omar, N. (2013). Credit card debt management: a profile study of young professionals. Asia Pac Manage Account J. 8, 1–17.

Allen, M. (2017). Secondary Data in The SAGE Encyclopedia of Communication Research Methods. Thousand Oaks: SAGE Publications.

Angel, S. (2016). The effect of over-indebtedness on health: comparative analyses for Europe. Kyklos. 69, 208–227. doi: 10.1111/kykl.12109

Arandjelovic, K., Eyre, H. A., Forbes, M. P., Bauer, R., Aggarwal, S., Singh, A. B., et al. (2016). Mental health system development in Asia: does Australia have a role? Aust N Z J Psychiatry. 50, 834–841. doi: 10.1177/0004867416647798

Awanis, S., Schlegelmilch, B. B., and Cui, C. C. (2017). Asia's materialists: reconciling collectivism and materialism. J. Int. Bus. Stud. 48, 964–991. doi: 10.1057/s41267-017-0096-6

Barnes, M. C., Gunnell, D., Davies, R., Hawton, K., Kapur, N., Potokar, J., et al. (2016). Understanding vulnerability to self-harm in times of economic hardship and austerity: a qualitative study. BMJ Open. 6:131. doi: 10.1136/bmjopen-2015-010131

Berger, L. M., Collins, J. M., and Cuesta, L. (2015). Household debt and adult depressive symptoms in the United States. J. Fam. Econ. Issues 37, 42–57. doi: 10.1007/s10834-015-9443-6

Bramer, W. M., Rethlefsen, M. L., Kleijnen, J., and Franco, O. H. (2017). Optimal database combinations for literature searches in systematic reviews: a prospective exploratory study. Syst. Rev. 6:245. doi: 10.1186/s13643-017-0644-y

Bridges, S., and Disney, R. (2010). Debt and depression. J. Health Econ. 29, 388–403. doi: 10.1016/j.jhealeco.2010.02.003

Britt, S. L., Canale, A., Fernatt, F., Stutz, K., and Tibbetts, R. (2015). Financial stress and financial counseling: Helping college students. J. Finan. Couns. Plan. 26, 172–186. doi: 10.1891/1052-3073.26.2.172

Brown, S., Taylor, K., and Wheatley Price, S. (2005). Debt and distress: evaluating the psychological cost of credit. J. Econ. Psychol. 26, 642–663. doi: 10.1016/j.joep.2005.01.002

Callegari, J., Liedgren, P., and Kullberg, C. (2019). Gendered debt – a scoping study review of research on debt acquisition and management in single and couple households. Eur. J. Soc. Work. 1–13. doi: 10.1080/13691457.2019.1567467

Cannuscio, C. C., Alley, D. E., Pagán, J. A., Soldo, B., Krasny, S., Shardell, M., et al. (2012). Housing strain, mortgage foreclosure, and health. Nurs. Outlook 60, 1–14. doi: 10.1016/j.outlook.2011.08.004

Carbia, C., López-Caneda, E., Corral, M., and Cadaveira, F. (2018). A systematic review of neuropsychological studies involving young binge drinkers. Neurosci. Biobehav. Rev. 90, 332–349. doi: 10.1016/j.neubiorev.2018.04.013

Carr, L. T. (1994). The strengths and weaknesses of quantitative and qualitative research: what method for nursing? J. Adv. Nurs. 20, 716–721. doi: 10.1046/j.1365-2648.1994.20040716.x

Chang, S.-S., Cheng, Q., Lee, E. S. T., and Yip, P. S. F. (2016). Suicide by gassing in Hong Kong 2005–2013: Emerging trends and characteristics of suicide by helium inhalation. J. Affect. Disord. 192, 162–166. doi: 10.1016/j.jad.2015.12.026

Charrois, T. L. (2015). Systematic reviews: what do you need to know to get started? Can J. Hosp. Pharm. 68, 144–148. doi: 10.4212/cjhp.v68i2.1440

Charron-Chénier, R., and Seamster, L. (2018). (Good) debt is an asset. Contexts 17, 88–90. doi: 10.1177/1536504218767126

Connolly, M. P., Haitsma, G., Hernández, A. V., and Vidal, J. E. (2017). Systematic review and meta-analysis of secondary prophylaxis for prevention of HIV-related toxoplasmic encephalitis relapse using trimethoprim-sulfamethoxazole. Pathog. Glob. Health. 111, 327–331. doi: 10.1080/20477724.2017.1377974

Dackehag, M., Ellegård, L.-M., Gerdtham, U.-G., and Nilsson, T. (2019). Debt and mental health: new insights about the relationship and the importance of the measure of mental health. Eur. J. Public Health. 1–6. doi: 10.1093/eurpub/ckz002

Drentea, P., and Lavrakas, P. J. (2000). Over the limit: The association among health, race and debt. Soc. Sci. Med. 50, 517–529. doi: 10.1016/S0277-9536(99)00298-1

Drentea, P., and Reynolds, J. R. (2012). Neither a borrower nor a lender be. J. Aging Health 24, 673–695. doi: 10.1177/0898264311431304

Elsevier. (2017). Scopus: Content coverage guide. Available online at: https://www.elsevier.com/__data/assets/pdf_file/0007/69451/Scopus_ContentCoverage_Guide_WEB.pdf (accessed November 5 2019).

French, D., and McKillop, D. (2017). The impact of debt and financial stress on health in Northern Irish households. J. Eur. Soc. Policy 27, 458–473. doi: 10.1177/0958928717717657

Gerrard, E., and Roberts, R. (2006). Student parents, hardship and debt: a qualitative study. J. Furth High. Educ. 30, 393–403. doi: 10.1080/03098770600965409

Ghasemi, P., Shaghaghi, A., and Allahverdipour, H. (2015). Measurement scales of suicidal ideation and attitudes: a systematic review article. Health Promot. Perspect. 5, 156–168. doi: 10.15171/hpp.2015.019

Gopalkrishnan, N., and Babacan, H. (2015). Cultural diversity and mental health. Austr. Psychiatry 23, 6–8. doi: 10.1177/1039856215609769

Harnegie, M. P. (2013). SciVerse science direct. J. Med. Libr. Assoc. 101:2. doi: 10.3163/1536-5050.101.2.020

Harris, J. A., Moniz, M. H., Iott, B., Power, R., and Griggs, J. J. (2016). Obesity and the receipt of influenza and pneumococcal vaccination: A systematic review and meta-analysis. BMC Obes. 3:5. doi: 10.1186/s40608-016-0105-5

Henchoz, C., Coste, T., and Wernli, B. (2019). Culture, money attitudes and economic outcomes. Swiss J. Econ. Stat. 155, 1–13. doi: 10.1186/s41937-019-0028-4

Heppner, P. P., Kivlighan, D. M., and Wampold, B. E. (2007). Research Design in Counseling. Belmont: Thomson higher Education.

Hodson, R., Dwyer, R. E., and Neilson, L. A. (2014). Credit card blues: the middle class and the hidden costs of easy credit. Sociol. Q. 55, 315–340. doi: 10.1111/tsq.12059

Hoeve, M., Stams, G. J. J. M., van der Zouwen, M., Vergeer, M., Jurrius, K., and Asscher, J. J. (2014). A systematic review of financial debt in adolescents and young adults: Prevalence, correlates and associations with crime. PLoS ONE. 9:909. doi: 10.1371/journal.pone.0104909

Hojman, D. A., Miranda, Á., and Ruiz-Tagle, J. (2016). Debt trajectories and mental health. Soc Sci. Med. 167, 54–62. doi: 10.1016/j.socscimed.2016.08.027

Hood, A., Joyce, R., and Sturrock. (2018). Problem Debt and Low-Income Households. London: Institute for Fiscal Studies. Available online at: https://www.ifs.org.uk/uploads/publications/comms/R138%20-%20Problem%20debt.pdf (accessed November 15, 2019).

Huang, D., Yang, L. H., and Pescosolido, B. A. (2019). Understanding the public's profile of mental health literacy in China: a nationwide study. BMC Psychiatry19:8. doi: 10.1186/s12888-018-1980-8

Ibrahim, N., Amit, N., and Suen, M. W. Y. (2014). Psychological factors as predictors of suicidal ideation among adolescents in Malaysia. PLoS ONE 9:e110670. doi: 10.1371/journal.pone.0110670

Ibrahim, N., Che Din, N., Ahmad, M., Amit, N., Ghazali, S. E., Wahab, S., et al. (2019). The role of social support and spiritual wellbeing in predicting suicidal ideation among marginalized adolescents in Malaysia. BMC Public Health 19:553. doi: 10.1186/s12889-019-6861-7

Johnson, K. W., and Li, G. (2010). The debt-payment-to-income ratio as an indicator of borrowing constraints: Evidence from two household surveys. J. Money Credit. Bank. 42, 1373–1390. doi: 10.1111/j.1538-4616.2010.00345.x

Kaufman, A. (2015). Unraveling the differences between organic and non-organic Thai rice farmers' environmental views and perceptions of well-being. J. Agric. Food Syst. Community Dev. 5, 29–47. doi: 10.5304/jafscd.2015.054.002

Keatley, D. (2014). The toxic relationship between debt and mental and physical health in low income households in Northern Ireland in 2014. Eur. J. Public Health. 24:195. doi: 10.1093/eurpub/cku163.107

Kidger, J., Gunnell, D., Jarvik, J. G., Overstreet, K. A., and Hollingworth, W. (2011). The association between bankruptcy and hospital-presenting attempted suicide: a record linkage study. Suicide Life Threat Behav. 41, 676–684. doi: 10.1111/j.1943-278X.2011.00063.x

Kim, K. T., Willmarth, M. J., and Henager, R. (2017). Poverty levels and debt indicators among low-income households before and after the Great Recession. Ethics Debt. 28, 197–212. doi: 10.1891/1052-3073.28.2.196

Koppen, I. J. N., Kuizenga-Wessel, S., Saps, M., Di Lorenzo, C., Benninga, M. A., van Etten-Jamaludin, F. S., et al. (2016). Functional defecation disorders and excessive body weight: a systematic review. Pediatrics 138:e20161417. doi: 10.1542/peds.2016-1417

Lee, T.-H., Park, E.-C., Kim, W., Kim, J., Shin, J., and Kim, T. H. (2016). Depressive symptoms of house-poor persons: Korean panel data evidence. Int. J. Soc. Psychiatry. 62, 569–577. doi: 10.1177/0020764016653773

Li, N. P., Lim, A. J. Y., Tsai, M.-H., and O, J. (2015). Too materialistic to get married and have children? PLoS ONE 10:543. doi: 10.1371/journal.pone.0126543

Libman, K., Fields, D., and Saegert, S. (2012). Housing and health: A social ecological Perspective on the US foreclosure crisis. Housing Theory Soc. 29, 1–24. doi: 10.1080/14036096.2012.624881

Lune, H., and Berg, B. L. (2017). Qualitative Research Methods for the Social Sciences. Edinburgh Gate: Pearson Education Limited.

Lupascu, N., Timar, B., Albai, A., Roman, D., Potre, O., and Timar, R. (2019). Validation and cross-cultural adaptation of the depression Patient's Health Questionnaire – 9 in the Romanian population of patients with Type 2 Diabetes Mellitus. Diabetes Metab. Syndr. Obes. 12, 841–849. doi: 10.2147/DMSO.S203099

Malaysian Department of Insolvency. (2019). Bankruptcy Statistic December 2016. Available online at: http://www.mdi.gov.my/index.php/about-us/resources/statistics/bankruptcy/1167 (accessed December 20 2019).

Manning, V., Koh, P. K., Yang, Y., Ng, A., Guo, S., Kandasami, G., et al. (2015). Suicidal ideation and lifetime attempts in substance and gambling disorders. Psychiatry Res. 225, 706–709. doi: 10.1016/j.psychres.2014.11.011

Maroufizadeh, S., Omani-Samani, R., Almasi-Hashiani, A., Amini, P., and Sepidarkish, M. (2019). The reliability and validity of the Patient Health Questionnaire-9 (PHQ-9) and PHQ-2 in patients with infertility. Reprod. Health. 16:1. doi: 10.1186/s12978-019-0802-x

Maselko, J., Bates, L., Bhalotra, S., Gallis, J. A., O'Donnell, K., Sikander, S., et al. (2018). Socioeconomic status indicators and common mental disorders: evidence from a study of prenatal depression in Pakistan. SSM Popul Health 4, 1–9. doi: 10.1016/j.ssmph.2017.10.004

Mathias, K., Goicolea, I., Kermode, M., Singh, L., Shidhaye, R., and Sebastian, M. S. (2015). Cross-sectional study of depression and help-seeking in Uttarakhand, North India. BMJ Open. 5:e008992. doi: 10.1136/bmjopen-2015-008992

McLaughlin, K. A., Nandi, A., Keyes, K. M., Uddin, M., Aiello, A. E., Galea, S., et al. (2011). Home foreclosure and risk of psychiatric morbidity during the recent financial crisis. Psychol. Med. 42, 1441–1448. doi: 10.1017/S0033291711002613

Meltzer, H., Bebbington, P., Brugha, T., Farrell, M., and Jenkins, R. (2012). The relationship between personal debt and specific common mental disorders. Eur. J. Public Health 23, 108–113. doi: 10.1093/eurpub/cks021

Moher, D., Liberati, A., Tetzlaff, J., Altman, D. G., and PRISMA Group (2009). Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. PLoS Med. 6:e1000097. doi: 10.1371/journal.pmed.1000097

Morrison, A., Polisena, J., Husereau, D., Moulton, K., Clark, M., Fiander, M., et al. (2012). The effect of English-language restriction on systematic review-based meta-analyses: a systematic review of empirical studies. Int. J. Technol. Assess Health Care 28, 138–144. doi: 10.1017/S0266462312000086

National Heart Lung Blood Institute. (2019). Study Quality Assessment Tools. Available online at: https://www.nhlbi.nih.gov/health-topics/study-quality-assessment-tools (accessed November 1 2019).

Nissen, S., Hayward, B., and McManus, R. (2019): Student Debt Wellbeing: A Research Agenda. Kotuitui: N Z J Soc Sci Online.

Norvilitis, J. M., Merwin, M. M., Osberg, T. M., Roehling, P. V., Young, P., and Kamas, M. M. (2006). Personality factors, money attitudes, financial knowledge, and credit-card debt in college students. J. Appl. Soc. Psychol. 36, 1395–1413. doi: 10.1111/j.0021-9029.2006.00065.x

Pang, S., Liu, J., Mahesh, M., Chua, B. Y., Shahwan, S., Lee, S. P., et al. (2017). Stigma among Singaporean youth: a cross-sectional study on adolescent attitudes towards serious mental illness and social tolerance in a multiethnic population. BMJ Open. 7:e016432. doi: 10.1136/bmjopen-2017-016432

Panic, N., Leoncini, E., de Belvis, G., Ricciardi, W., and Boccia, S. (2013). Evaluation of the endorsement of the preferred reporting items for systematic reviews and meta-analysis (PRISMA) statement on the quality of published systematic review and meta-analyses. PLoS ONE 8:e083138. doi: 10.1371/journal.pone.0083138

Richardson, T., Elliott, P., and Roberts, R. (2013). The relationship between personal unsecured debt and mental and physical health: A systematic review and meta-analysis. Clin. Psychol. Rev. 33, 1148–1162. doi: 10.1016/j.cpr.2013.08.009

Richardson, T., Elliott, P., Roberts, R., and Jansen, M. (2016). A longitudinal study of financial difficulties and mental health in a national sample of British undergraduate students. Commun. Ment. Health J. 53, 344–352. doi: 10.1007/s10597-016-0052-0

Roth, A. V., Schroeder, R., Huang, X., and Kristal, M. M. (2008). Measurement Scales for Operations Management. Thousand Oaks, CA: SAGE Publications Inc.

Scourfield, J., Fincham, B., Langer, S., and Shiner, M. (2012). Sociological autopsy: an integrated approach to the study of suicide in men. Soc. Sci. Med. 74, 466–473. doi: 10.1016/j.socscimed.2010.01.054

Seponski, D. M., Lahar, C. J., Khann, S., Kao, S., and Schunert, T. (2018). Four decades following the Khmer rouge: sociodemographic factors impacting depression, anxiety and PTSD in Cambodia. J Ment Health 28, 175–180. doi: 10.1080/09638237.2018.1466039

Sharma, R., Sharma, S. C., and Pradhan, S. N. (2018). Assessing caregiver burden in caregivers of patients with Schizophrenia and Bipolar Affective Disorder in Kathmandu Medical College. J. Nepal. Health Res. Counc. 15, 258–263. doi: 10.3126/jnhrc.v15i3.18851

Shidhaye, R., Gangale, S., and Patel, V. (2016). Prevalence and treatment coverage for depression: a population-based survey in Vidarbha, India. Soc. Psychiatry Psychiatr. Epidemiol. 51, 993–1003. doi: 10.1007/s00127-016-1220-9

Siti, H. B. N., Lim, S. L., and Muhammad, K. M. A. A. (2018). “Indebted to debt: an assessment of debt levels and financial buffers of households,” in The Financial Stability and Payment Systems Report 2017. Available online at: http://www.bnm.gov.my/files/publication/fsps/en/2017/fs2017_book.pdf (accessed November 01 2019).

Sweet, E., Nandi, A., Adam, E. K., and McDade, T. W. (2013). The high price of debt: household financial debt and its impact on mental and physical health. Soc. Sci. Med. 91, 94–100. doi: 10.1016/j.socscimed.2013.05.009

Tatsuhiko, K., Kazuo, M., Shingo, K., Minori, E., Yukihiro, N., Lan, L., et al. (2010). Relationship between late-life depression and life stressors: Large-scale cross-sectional study of a representative sample of the Japanese general population. Psychiatry Clin. Neurosci. 64, 426–434. doi: 10.1111/j.1440-1819.2010.02097.x

Turunen, E., and Hiilamo, H. (2014). Health effects of indebtedness: a systematic review. BMC Public Health. 14:489. doi: 10.1186/1471-2458-14-489

U.S. National Library of Medicine. (2019a). MEDLINE®: Description of the Database. Available online at: https://www.nlm.nih.gov/bsd/medline.html (accessed November 01 2019).

U.S. National Library of Medicine. (2019b). MEDLINE®: Description of the Database. Available online at: https://www.nlm.nih.gov/bsd/pubmed.html (accessed November 07 2019).

Uman, L. S. (2011). Systematic reviews and meta-analyses. J. Can. Acad. Child Adolesc. Psychiatry 20, 57–59.

Van Mil, J. W. F., and Henman, M. (2016). Terminology, the importance of defining. Int. J. Clin. Pharm. 38, 709–714. doi: 10.1007/s11096-016-0294-5

Venkatesh, B. T., Andrews, T., Mayya, S. S., Singh, M. M., and Parsekar, S. S. (2015). Perception of stigma toward mental illness in South India. J. Family Med. Prim Care 4, 449–453. doi: 10.4103/2249-4863.161352

Web of Science Group. (2019). Web of Science Platform: Web of Science: Summary of Coverage. Available online at: https://clarivate.libguides.com/webofscienceplatform/coverage (accessed November 01 2019).

World Health Organization (2018). World Health Statistics Data Visualizations Dashboard. Available online at: https://apps.who.int/gho/data/node.sdg.3-4-viz-2?lang=en (accessed November 05, 2019).

Xu, H., Zhang, W., Wang, X., Yuan, J., Tang, X., Yin, Y., et al. (2015). Prevalence and influence factors of suicidal ideation among females and males in Northwestern urban China: a population-based epidemiological study. BMC Public Health 15:961. doi: 10.1186/s12889-015-2257-5

Keywords: indebtedness, depression, anxiety, stress, suicide, systematic review, Asia, relationship

Citation: Amit N, Ismail R, Zumrah AR, Mohd Nizah MA, Tengku Muda TEA, Tat Meng EC, Ibrahim N and Che Din N (2020) Relationship Between Debt and Depression, Anxiety, Stress, or Suicide Ideation in Asia: A Systematic Review. Front. Psychol. 11:1336. doi: 10.3389/fpsyg.2020.01336

Received: 28 January 2020; Accepted: 20 May 2020;

Published: 10 July 2020.

Edited by:

Sara Carletto, University of Turin, ItalyReviewed by:

Long Sun, Shandong University, ChinaBerta Rodrigues Maia, Catholic University of Portugal, Portugal

Copyright © 2020 Amit, Ismail, Zumrah, Mohd Nizah, Tengku Muda, Tat Meng, Ibrahim and Che Din. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Noh Amit, bm9oYW1pdEB1a20uZWR1Lm15

Noh Amit

Noh Amit Rozmi Ismail

Rozmi Ismail Abdul Rahim Zumrah

Abdul Rahim Zumrah Mohd Azmir Mohd Nizah

Mohd Azmir Mohd Nizah Tengku Elmi Azlina Tengku Muda

Tengku Elmi Azlina Tengku Muda Edbert Chia Tat Meng

Edbert Chia Tat Meng Norhayati Ibrahim

Norhayati Ibrahim Normah Che Din

Normah Che Din