- 1Rural Development Institute, Chinese Academy of Social Sciences, Beijing, China

- 2Chinese Academy of Fiscal Sciences, Beijing, China

- 3College of Economics and Management, China Agricultural University, Beijing, China

Unlike existing research from the perspective of financiers or farmers’ financial literacy, this Manuscript investigates the impact of personality traits on Chinese farmers’ credit exclusion using data from 2018 to 2019 of China Agricultural University’s Rural Inclusive Finance Survey. The empirical findings show that farmers’ personality traits significantly affect their credit exclusion. Specifically, conscientiousness and extroversion alleviate the credit exclusion, while agreeableness significantly intensifies the credit exclusion. In addition, the Blinder–Oaxaca decomposition method is used to analyze the contribution of personality traits to each dimension of credit exclusion, and the results of the study show that personality traits mainly affected farmers’ self-exclusion. Therefore, to develop inclusive finance in China, training and improving farmers’ positive personality traits must be fostered.

Introduction

Rural financial markets in developing countries have serious information asymmetry problems (Giang et al., 2015; Hoff and Stiglitz, 2016), and the credit constraints that farmers face are particularly obvious (Banerjee and Newman, 1993; Zakaria et al., 2019). Therefore, alleviating farmers’ difficulty in acquiring loans has always been the focus of deepening China’s rural inclusive finance system. In 2005, the Chinese government surveyed farmers in 29 provinces, and the results showed that 60.6% of farmers needed loans but only 52.6% of them could obtain funds from banks, which meant that the rate of credit acquisition was about 31.87% (Han et al., 2007). In 2019, China Agricultural University conducted a sample survey on inclusive finance across the country and found that farmers’ rate of credit acquisition was 31.21%, indicating that Chinese farmers still faced serious credit exclusion (He et al., 2018). Over the past decade or so, the Chinese government has required commercial banks to set up more institutions in rural areas and evaluated commercial banks’ agriculture-related loans, which has not only increased the bank branch coverage rate to 97.13% in townships but also caused commercial banks to value rural financial products and services. This has gradually decreased the influence of unreasonable institutional distribution or insufficient financial services on farmers facing credit exclusion (Jayati, 2013). At the same time, a strange phenomenon has arisen in China’s rural financial market: even if credit services are available, many farmers do not obtain or even hate credit services. With sufficient financial supply, are farmers’ traits affecting their financial exclusion? Some scholars have proven that cognitive ability, such as financial literacy (Bernheim and Garrett, 2003; Lusardi, 2012; Agarwal and Mazumder, 2013; Brown et al., 2016; Xu et al., 2022), is an important factor in this phenomenon. So, are there factors aside from cognitive ability?

The rational man hypothesis is the core hypothesis of traditional microeconomics, but individuals are not completely rational when making economic decisions; they are often affected by personality traits and other factors (Heckman, 2006; Kautz et al., 2014; Heckman and Corbin, 2016; Gianpaolo and Peijnenburg, 2019). In the existing research literature, personality traits are generally defined as a series of behavioral habits, or cognitive and affective patterns formed under the influence of genetics and environmental factors (Roberts, 2009). Personality traits are quite stable and unique and can affect individual responses in different situations (Mischel, 1973; Costa and McCrae, 1992; Almlund et al., 2011; Schultz and Schultz, 2016; Salameh et al., 2022), which supports introducing personality traits into economic research to explain individual economic behaviors and derive a personality economics (Heckman, 2011; Li and Zhang, 2015). As the formation of personality traits is influenced by the interaction of innate heredity and acquired environment (Caspi et al., 2005; Heineck and Anger, 2010; Anger and Schnitzlein, 2017), it is easy for farmers to form personality traits that are different from those of urban residents because of their unique living environment in rural China. For example, traditional Chinese farmers are often described as amiable, diligent, and tough (Potter, 1968; Zhou and Li, 2022). However, farmers are also conservative, dependent, and strongly influenced by the small-scale peasant economy and patriarchal family system (Skinner, 1971; Li, 2022). Therefore, this Manuscript demonstrates that if farmers have certain personality traits that enable them to actively connect with financial institutions, establish a receptive attitude, and then form the intention to actively seek credit support from formal financial institutions (Brown and Taylor, 2014), they can obtain formal financial credit services and ultimately, reduce credit exclusion—or not.

The existing research fails to discuss financial exclusion from the perspective of personality traits. Thus, this Manuscript has two contributions: first, it studies the influence of personality traits on credit exclusion in depth and promotes interdisciplinary research in psychology and finance; second, it focuses on Chinese farmers and their distinctive Chinese traits. Because farmers’ issues are a key issue in China’s development, China, as a responsible large country, must ensure that farmers enjoy basic financial rights. Research on this issue will help regulators adjust rural financial policies to better serve rural revitalization.

Theoretical framework and hypotheses

Personality traits

Personality traits are relatively stable and are a comprehensive reflection of different psychological characteristics. McAdams (1994) believes that personality characteristics determine the different modes of thinking and behavior among individuals, as well as the unique adjustment modes to the environment. As personality is an abstract concept, how to measure it scientifically is in advance of carrying out relevant research. The “Big Five” personality measurement method is widely used by scholars. It was first proposed by Allport and Odbert (1936), that is, by classifying and summarizing the daily words used by individuals, the main differences of personality characteristics can be measured. And on that basis, Costa and McCrae (1992) classified personality traits into five personality types: conscientiousness, extroversion, openness, agreeableness, and neuroticism, creating the widely accepted “Big Five personality theory.” Conscientiousness reflects an individual’s self-discipline, rationality, and prudence in dealing with others; extroversion describes how enthusiastic, gregarious, talkative, and active an individual is in dealing with others; openness mainly highlights an individual’s curiosity, innovation, and creativity toward new things; agreeableness reflects their altruistic tendencies such as trust, empathy, and obedience to others; and neuroticism emphasizes individual emotional instability or emotional tendencies, and mainly manifests as inner depression, anxiety, poor tolerance, and difficulty in facing setbacks. Further, conscientiousness, extroversion, and openness are considered positive personality traits, while agreeableness and neuroticism are considered negative personality traits (Cheng and Li, 2017).

Personality traits and credit exclusion

Kempson and Whyley (1999) divided financial exclusion into six dimensions: geographic exclusion, price exclusion, evaluation exclusion, conditional exclusion, marketing exclusion, and self-exclusion. Credit exclusion is a type of financial exclusion that refers to the customer’s inability or unwillingness to obtain credit services (Panigyrakis et al., 2002). Most scholars believe that in rural areas, factors such as the unreasonable distribution of financial institutions (Agarwal and Hauswald, 2010; Dong and Xu, 2012; Dai, 2022), insufficient financial infrastructure (Degryse and Ongena, 2005; Wang et al., 2013), mismatched service supply (Leyshon and Thrift, 1994; Alessandrini et al., 2009; Hollander and Verriest, 2016), and insufficient penetration of financial institutions (Cooper and Zhu, 2018; Cai M. et al., 2020) can easily lead to financial exclusion. Some scholars have analyzed this phenomenon from the perspective of financial literacy and how a low level of education or financial knowledge can lead to self-credit exclusion (Su and Fang, 2016; Zhang and Yin, 2016; Pinjisakikool, 2017). In addition to cognitive abilities, such as financial literacy, a growing body of research has shown that non-cognitive abilities, such as personality traits, are also important components of individual abilities, influencing people’s economic and financial decisions (Becker et al., 2012; Thiel and Thomsen, 2013).

Davey and George (2011) examined the effects of personality traits on financial attitudes and behaviors and it is stated that conscientiousness and extraversion affected their savings and borrowing behaviors more than others. Kubilay and Bayrakdaroglu (2016) examined the personality traits, psychological tendencies and financial risk tolerance of the individual investor. It was stated that there was a significant relationship between the personality traits and psychological tendencies of the investors and the personal characteristics affect the financial risk tolerance. If investors think credit management is risky, they will refuse to lend. Gianpaolo and Kim (2017) found that financial distress and choices are affected by non-cognitive abilities. In a representative panel of households, they found that people in the bottom decile of non-cognitive abilities are five times more likely to experience credit distress compared to those in the top decile. Camelia and Brian (2018) conducted that individuals with high self-efficacy are more likely to take precautions that mitigate adverse financial shocks. They are subsequently less likely to default on financial exclusion. Ozer and Mutlu (2019) deduces that there is a direct relationship between the personality traits and financial behaviors. Among the various elements of personality traits, conscientiousness, agreeableness, and openness to experience were found to be related to financial behaviors.

The deep-rooted clan culture, friendly neighborly culture, and family-based ideology in rural China make it easy for farmers to find guarantors and obtain loans (Gao and Huang, 2019). However, farmers are still largely excluded from acquiring credit. Information collection and processing are important processes in credit decision-making behavior (Choi and Laschever, 2018). However, the credit decision is not the only decision in a family’s economic life (Bortoli et al., 2019). Farmers must also make many decisions about agricultural production and consumption (Giovanni et al., 2017), and each decision requires substantial time and energy (Cobb-Clark et al., 2016; Brooks and Williams, 2021). Therefore, farmers are often unwilling to spend time and energy on researching the family’s credit needs, instead following the “inertia” of previous family fund allocation plans and exhibiting reluctance to obtain help from external financial institutions (Reis, 2006; Dimmock et al., 2016; Dong et al., 2017; Fei, 2017). In addition, when farmers are faced with complicated information, they are often depressed and agitated (Parise and Peijnenburg, 2019), making it difficult for them to sort out and obtain useful information. Without access to sufficient information, household decision-makers cannot choose effectively and actively exclude themselves from credit services. Therefore, we propose:

Hypothesis 1: Personality traits affect farmers’ credit exclusion, and mainly affect farmers’ self-exclusion.

Different types of personality traits manifest in differentiated social networks and information transfer abilities, leading to varying degrees of credit exclusion (Borghans et al., 2008; Wang and Qiu, 2011; He et al., 2017; He and Yue, 2021). From the perspective of the social network, the lack of legally qualified collateral is the main reason farmers face credit exclusion (Tian and Fan, 2020), but a developed social network grants farmers sufficient guarantee capacity when applying for formal credit (Vodosek, 2003; Zhao et al., 2010; Zhang et al., 2017; Li et al., 2022). Studies have found that individuals with strong communication motivation and communication skills are more likely to have mature social network relationships (Diener et al., 1984; Li et al., 2018; Zhang and Ji, 2020). Compared with those with negative personalities, farmers with extroverted and open-minded personality traits more strongly prefer social interaction, and farmers with conscientious personalities are more likely to gain others’ trust (Dohmen et al., 2010; Donnelly et al., 2012), so farmers with positive personalities often have broader social networks and find guarantors more easily. Considering information transmission ability, individuals with positive personalities usually have strong transmission abilities and their economic information is more likely to be accurately assessed by financial institutions (van Rooij et al., 2011; Li and Zhang, 2015; Song et al., 2017), while farmers with prominent negative personality traits often find it difficult to express their economic information clearly and tend to convey negative information (Borghans et al., 2008; Oehler et al., 2018), which increases the possibility of banks rejecting their loan applications (Elul et al., 2010). Therefore, we propose:

Hypothesis 2: The degree of credit exclusion is related to personality traits. Farmers with positive personalities have a low degree of credit exclusion, and those with negative personalities have a high degree of credit exclusion.

Materials and methods

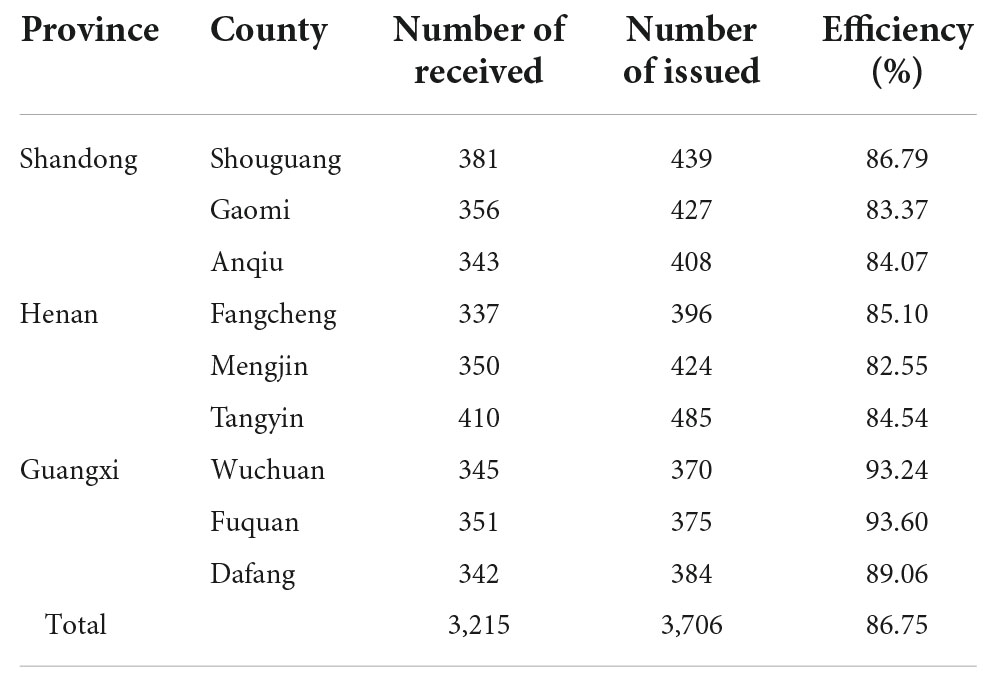

The data in this article come from the 2018 and 2019 China Rural Financial Inclusion Survey conducted by the School of Economics and Management of the China Agricultural University. The survey uses stratified random sampling. According to China’s administrative divisions, three provinces are randomly selected from the eastern, central, and western regions. Based on per capita gross domestic product (GDP), each province selects three counties with high, medium, and low levels of economic development. The investigation team selected Shouguang County, Gaomi County, and Anqiu County in Shandong Province in the eastern region, Fangcheng County, Mengjin County, and Tangyin County in Henan Province in the central region, and Wuchuan County, Dafang County, and Fuquan County in Guizhou Province in the western region. Each county then selected three towns according to their level of economic development, and then randomly selected two villages in each town and 20–30 sample farmers in each sample village. In 2018 and 2019, the research team issued a total of 3,706 questionnaires and received 3,215 valid questionnaires, with an effectiveness rate of 86.75% (Table 1).

Measurement of the variables

Dependent variable

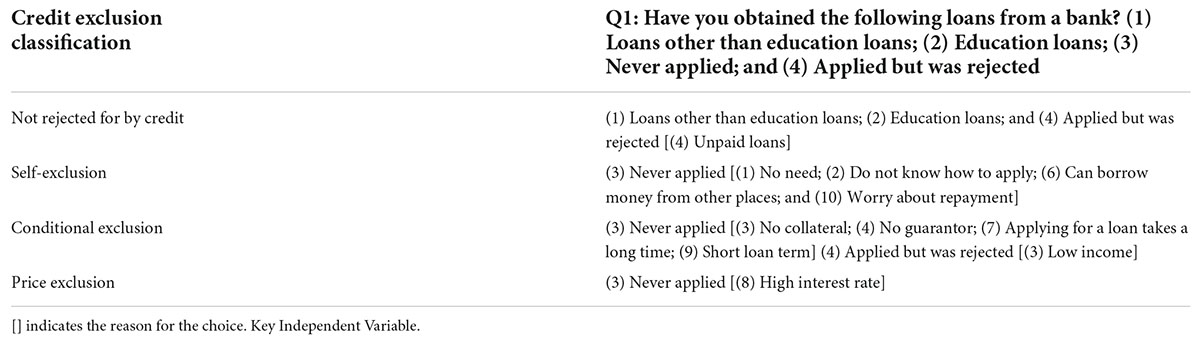

This Manuscript draws on the discrete element method (DEM) method of previous research on credit rationing (Devlin, 2005), and mainly judges whether farmers are excluded from credit by the following three questions (Table 2).

If the respondent chose “3–Never applied” in Q1, and the answer to Q2 is not “1–No need,” the respondent has been excluded from credit; likewise, if the respondent chose “4–Applied but was rejected,” we argue that the respondent is subject to credit exclusion. Credit exclusion is recorded as Exclu_credit = 1; if other answers were selected, the respondent was not subject to credit exclusion, which is recorded as Exclu_credit = 0.

To analyze credit exclusion in depth, this Manuscript divides the types of credit exclusion into three categories: (1) Self-exclusion, in which farmers believe that banks will not lend them money or habitually borrow money from relatives and friends without trying to apply for loans; (2) Conditional exclusion, in which farmers are excluded from credit activities due to high loan conditions, such as a lack of collateral or guarantors or the high risk of loan projects; (3) Price exclusion, in which farmers do not apply to banks because of high loan interest, time cost, or bank fees. The specific division method is shown in Table 3.

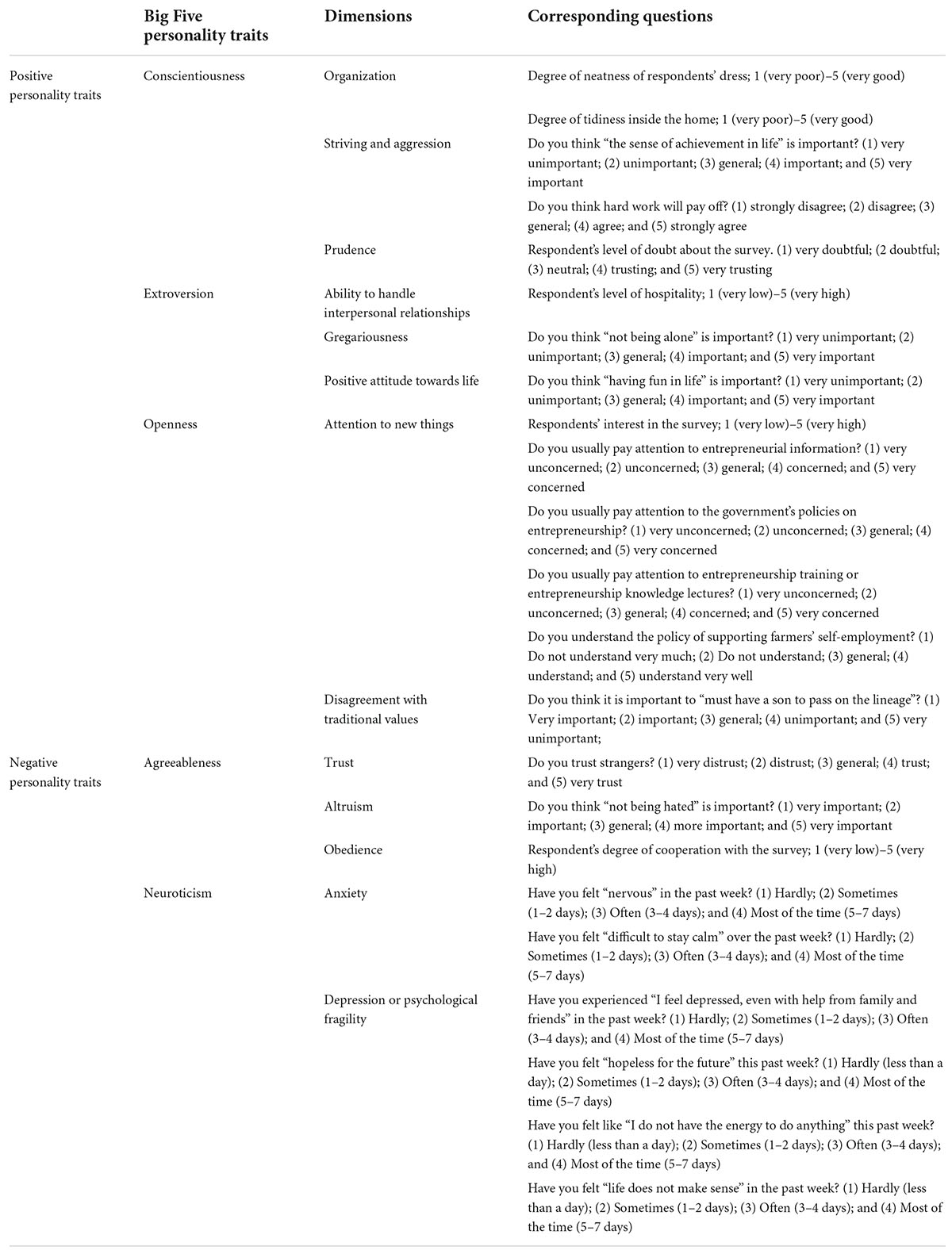

According to the Big Five personality taxonomy (Costa and McCrae, 1992), everyone has five personality traits, namely conscientiousness (con), extroversion (ext), openness (ope), agreeableness (agr), and neuroticism (neu). Based on this theory, a series of questions were set in the survey to identify each personality trait, and each question was assigned a corresponding score. Considering the many sub-problems involved in each personality trait, a factor analysis method was adopted to reduce the dimensionality of the sub-problems and select factors with Kaiser–Meyer–Olkin (KMO) values greater than 0.7 to align with the five personality traits, the extracted factors were named the conscientiousness factor, extroversion factor, openness factor, agreeableness factor, and neuroticism factor. Conscientiousness, extroversion, and openness were defined as positive personality traits, while agreeableness and neuroticism were defined as negative personality traits, as shown in Table 4.

Control variable

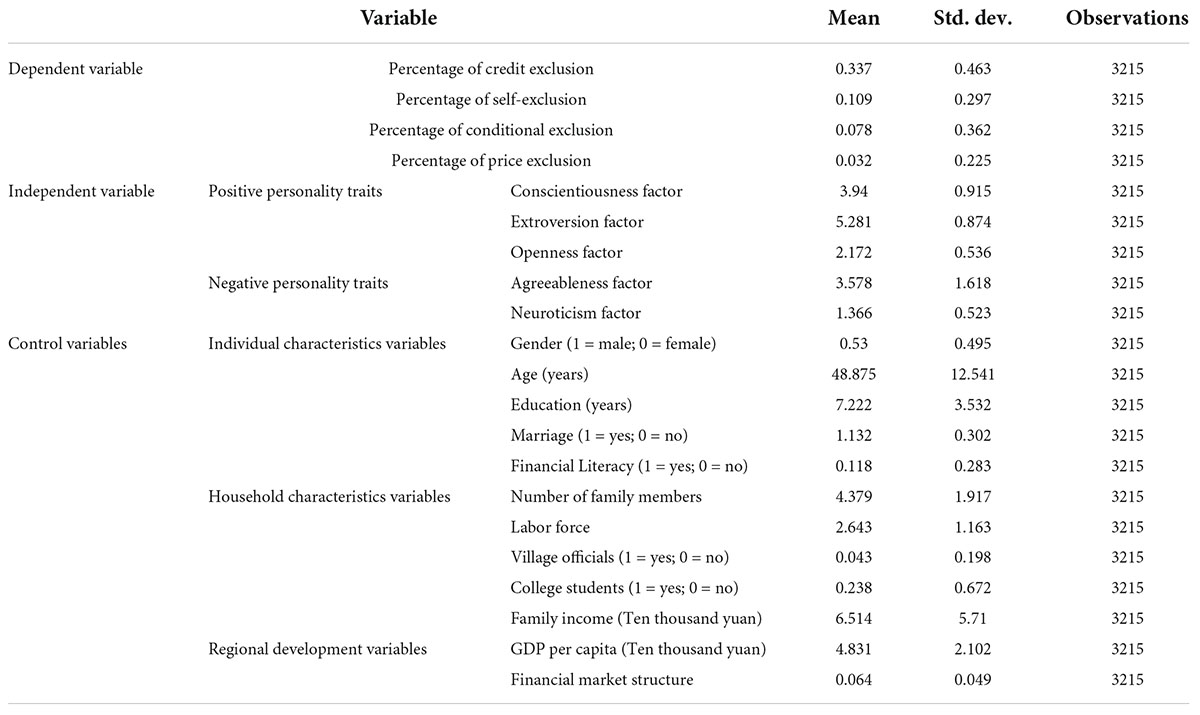

After reviewing the existing literature, we selected the control variables that jointly affect the credit exclusion and personality traits of farmers according to three aspects: individual characteristics variables, household characteristics variables, and regional development variables (Cho, 2016; Han and Chen, 2019; Cai Q. F. et al., 2020; Guan et al., 2020). Among these, personal characteristic variables include gender (Niu et al., 2022), age (Liao et al., 2019), education level (Zhu et al., 2021), marital status (Shen et al., 2022) and financial literacy (Yin and Zhang, 2020). The identification question for financial literacy is “Suppose you have 100 yuan in savings at 2% interest rate for 5 years, how much money will you have in your account after 5 years?” If the farmer answers correctly, Financial_literacy = 1, otherwise, Financial_literacy = 0. Household characteristics variables include the number of family members (Wang and He, 2020), the number of family members in the labor force (Fan et al., 2022), whether there are village officials in the family (Xue, 2022), whether there are college students in the family (Zhang and Li, 2022), and family income (Tian and Zhang, 2022). Regional development variables include per capita income (Jin et al., 2022) and the county’s financial market structure (Wang and He, 2020; Wang and Bei, 2022). The descriptive statistics of variables is shown in Table 5.

Estimation strategy

This Manuscript mainly reports on the influence of farmers’ personality traits on the degree of credit exclusion they experience and further explores the influence of personality traits on different dimensions of farmers’ credit exclusion. First, Probit Model is used to estimate whether farmers’ credit exclusion is related to their personality traits. Then, a follow-up regression is conducted to test whether the personality traits of sample farmers lead to self-exclusion, conditional and evaluation exclusion, or price exclusion among farmers under credit exclusion. The model is as follows:

Where exclu_credit is a dummy variable; when exclu_credit=1, the farmer is subject to credit constraints, otherwise, exclu_credit=0. The variables of the farmers’ personality traits are the Conscientiousness_Factori, Extroversion_Factori, Openness_Factori, Agreeableness_Factori, and Neuroticism_Factori; controlsi presents a series of control variables; and ηi is the random error term.

In cases where farmers experience credit exclusion, this Manuscript further studies which personality characteristics affect self-exclusion, conditional exclusion, and price exclusion, and the model is:

Where exclui represents the dummy variable of self-exclusion, conditional exclusion, or price exclusion.

Results

Descriptive statistics

According to the statistical results of the surveyed sample, one-third of the sample farmers are excluded from credit. Of the total sample, 10.9% are self-excluded, 7.8% are excluded conditionally, 3.2% are subject to price exclusion, and the remaining farmers experiencing exclusion did not explain the reason. In addition, the statistical results reflect the universal traits of rural families in China: (1) families usually have four members, with 2–3 workers and a total annual family income of about 65,100 yuan; (2) Household heads have received 7 years of education on average and have not completed the compulsory education period stipulated in China; (3) About 25% of families include college students, and only 4.3% of families include village officials.

Baseline results

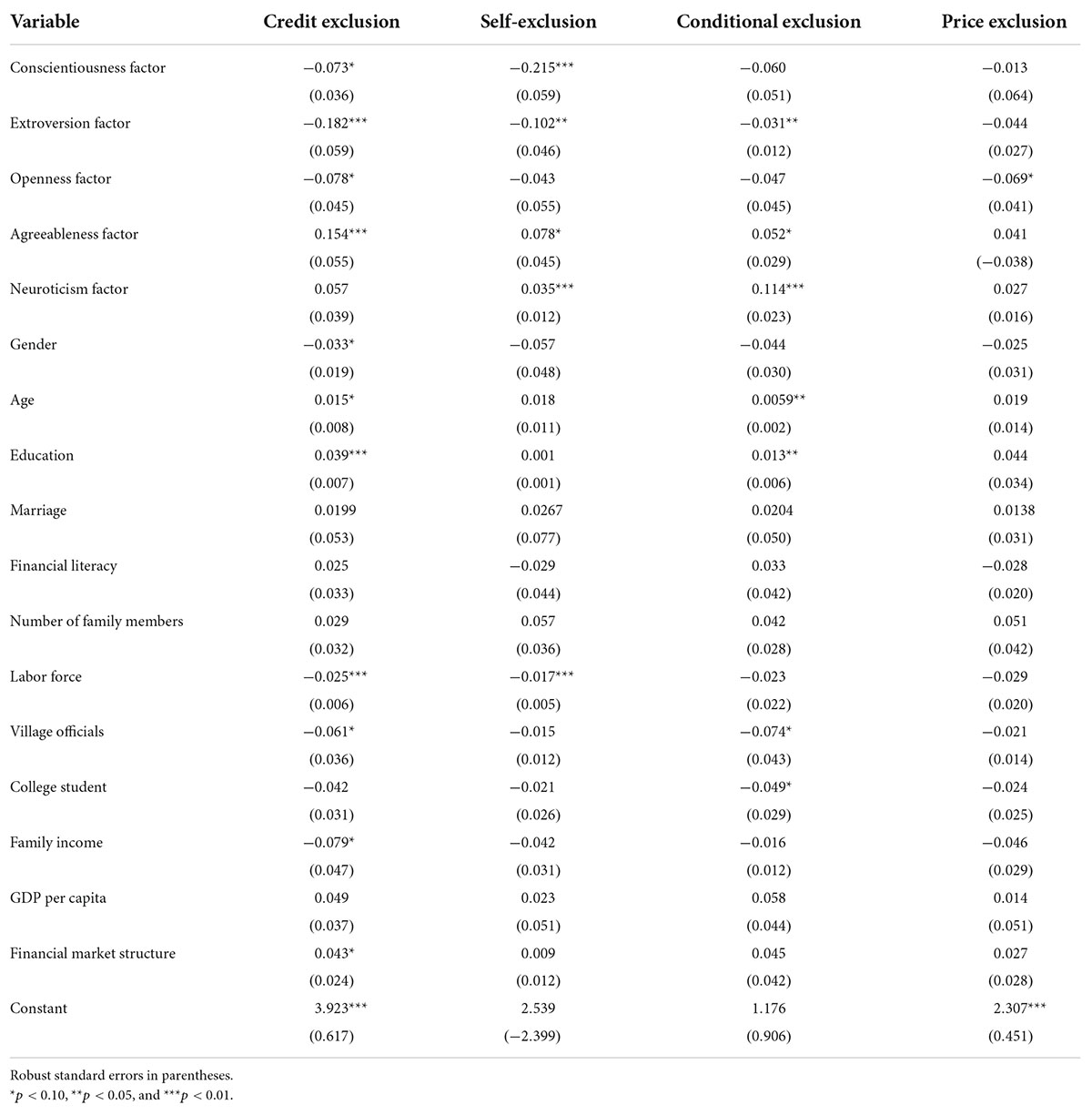

Positive personality factors are negatively correlated with farmers’ credit exclusion. That is, the more positive a farmer’s personality is, the less likely they are to be rejected for credit. Of the negative personality traits, agreeableness factors significantly increase the degree of credit exclusion that farmers experience, indicating that the more agreeableness they exhibit, the greater the degree of credit exclusion they will experience. Neuroticism has no significant effect on credit rejection.

The sub-dimension empirical results show that (1) The regression results for self-exclusion show that the higher the conscientiousness and extroversion factors in the positive personality traits, the lower the probability of farmers being self-excluded; the higher the agreeableness and neuroticism factors in the negative personality traits, the higher the probability of self-rejection. (2) The regression results of conditional rejection show that the coefficient of the extroversion factor is significantly negative, indicating that the more extroversion a farmer has, the less likely they will be subject to conditional rejection. The coefficients of both the agreeableness and neuroticism factors are positive, indicating that negative personality traits increase the conditional rejection of farmers to some extent. (3) The regression results of price exclusion show that the extroversion, openness, and agreeableness factors significantly affect price exclusion, which means that higher extroversion and openness in farmers can reduce the price exclusion they experience, while higher agreeableness increases the possibility of price exclusion.

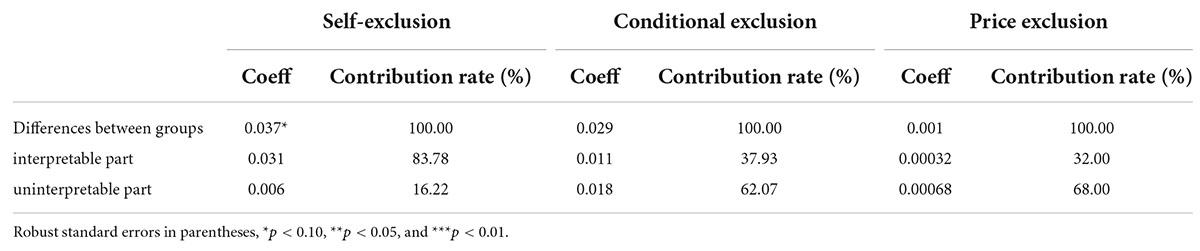

To explore the influence of farmers’ personality traits on self-exclusion, conditional exclusion, and price exclusion, the Blinder–Oaxaca decomposition method was adopted to analyze personality traits’ contributions to each dimension of credit exclusion by constructing combinations of different personality traits, referring to Wu’s (2019) study. The Blinder–Oaxaca decomposition method is often used to analyze the contribution of factors between groups, which reflects the idea of counterfactual analysis (Fairlie, 2005). The regression results in Table 6 show that the extroversion and agreeableness factors are the primary factors affecting credit exclusion. Therefore, we constructed two combinations of different levels of extroversion and agreeableness. In this study, based on Ling et al. (2017), the farmers in the bottom third of the extroversion factor scores and the top third of the agreeableness factor scores are regarded as the low-level group (control group); these farmers face high credit exclusion. The farmers in the top third of the extroversion factor scores and the bottom third of the agreeableness factor scores are regarded as the high-level group (experimental group) and face lower credit exclusion. On this basis, the credit exclusion functions of the high-level and low-level groups are established:

Where exclu_credit_highm and exclu_credit_loww are credit exclusions in the high-level and low-level groups, respectively; personalitiesm and personalitiesw correspond to the personality characteristics of each group, controlsi is a series of control variables, and εi is the random error term.

The factors affecting farmers’ credit exclusion in the two groups were estimated, and the differences in regression coefficients between the two groups were decomposed according to the Oaxaca-Blinder decomposition method as follows:

Where E(exclu_credit_high)−E(exclu_credit_low) is the difference between the eigenvalues of the high- and low-level groups, generally referred to as the interpretable part. (γm−δw)E(personalitiesm) is the uninterpretable part. During data analysis, due to the difference in sample size between the two groups, we randomly selected samples from the larger group to match the size of the smaller group, and randomly sampled them 100 times.

The regression results in Table 7 show the significant differences in the influence of personality traits on credit exclusion. Among the factors affecting credit exclusion, personality traits significantly affect self-exclusion, accounting for 83.78% of self-exclusion, but have no significant impact on conditional or price exclusion. This implies that personality traits affect credit exclusion mainly by affecting self-exclusion. Specifically, the extroversion and agreeableness factors primarily affect the overall degree of credit exclusion by influencing self-exclusion, which is consistent with the conclusions Table 6 displays. The farmers with obvious extroverted personalities usually have strong social communication abilities, which helps them obtain the support of guarantors. Conversely, farmers with obvious agreeable personality traits are easily bound by traditional ideas and lack subjective judgment abilities. This may explain why a low score for the extroversion factor and a high score for the agreeableness factor predicts that farmers are more likely to think that banks will not provide them with loans, resulting in credit self-exclusion.

Robustness checks and endogeneity

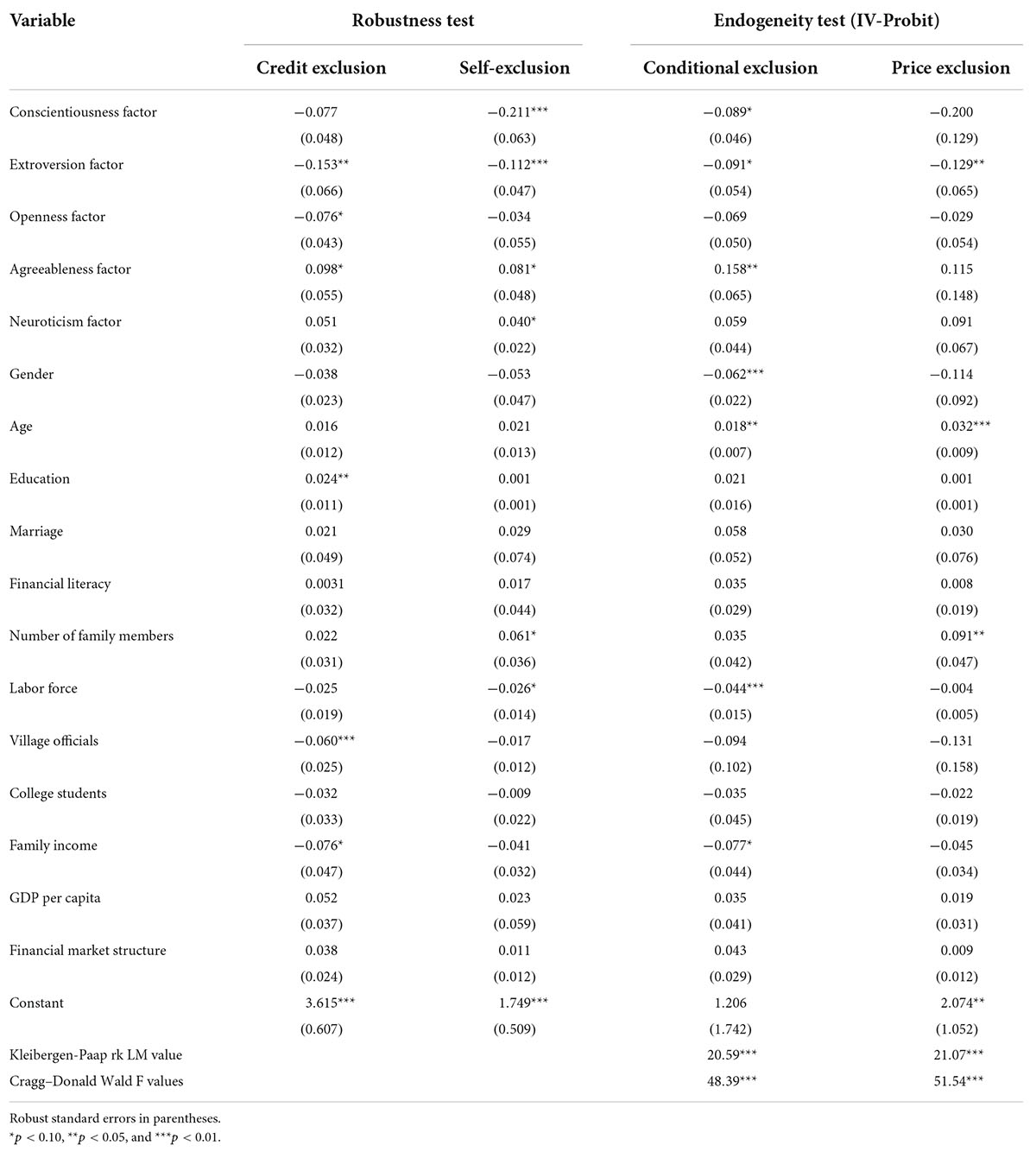

To demonstrate the robustness of the results, extreme income values are excluded, as people with extremely low incomes are more likely to be excluded from credit, and people with high incomes may be able to meet their spending needs without borrowing. Specifically, the Winsorize method was used to eliminate the highest and lowest 5% of the high- and low-income samples. Robust results show that positive personality traits can significantly reduce farmers’ credit exclusion, while negative personality traits can significantly increase farmers’ credit exclusion.

In addition, the credit exclusion data may have endogeneity problems due to omitted variables, measurement errors or mutual causation. This Manuscript uses an instrumental variable method to solve endogeneity problems. Referring to the method Bucher-Koenen and Lusardi (2011) used, the average of the personality scores of other farmers in a village was adopted as the instrumental variable of the interviewees’ personality traits. The average level of other farmers’ personality traits in the village affected the interviewees’ personality traits (Araujo et al., 2011), which met the requirement to correlate instrumental variables. However, the interviewees’ personality traits could hardly affect the overall level of the village’s personality traits, which also met the exogenous requirements of instrumental variables. The Kleibergen-Paap rk LM values show a strong rejection of the unidentifiable null hypothesis. The Cragg–Donald Wald F values are greater than 10, indicating that the null hypothesis of “weak instrumental variables” is rejected, so the instrumental variables are valid. At the same time, the regression conclusion remains stable (Table 8).

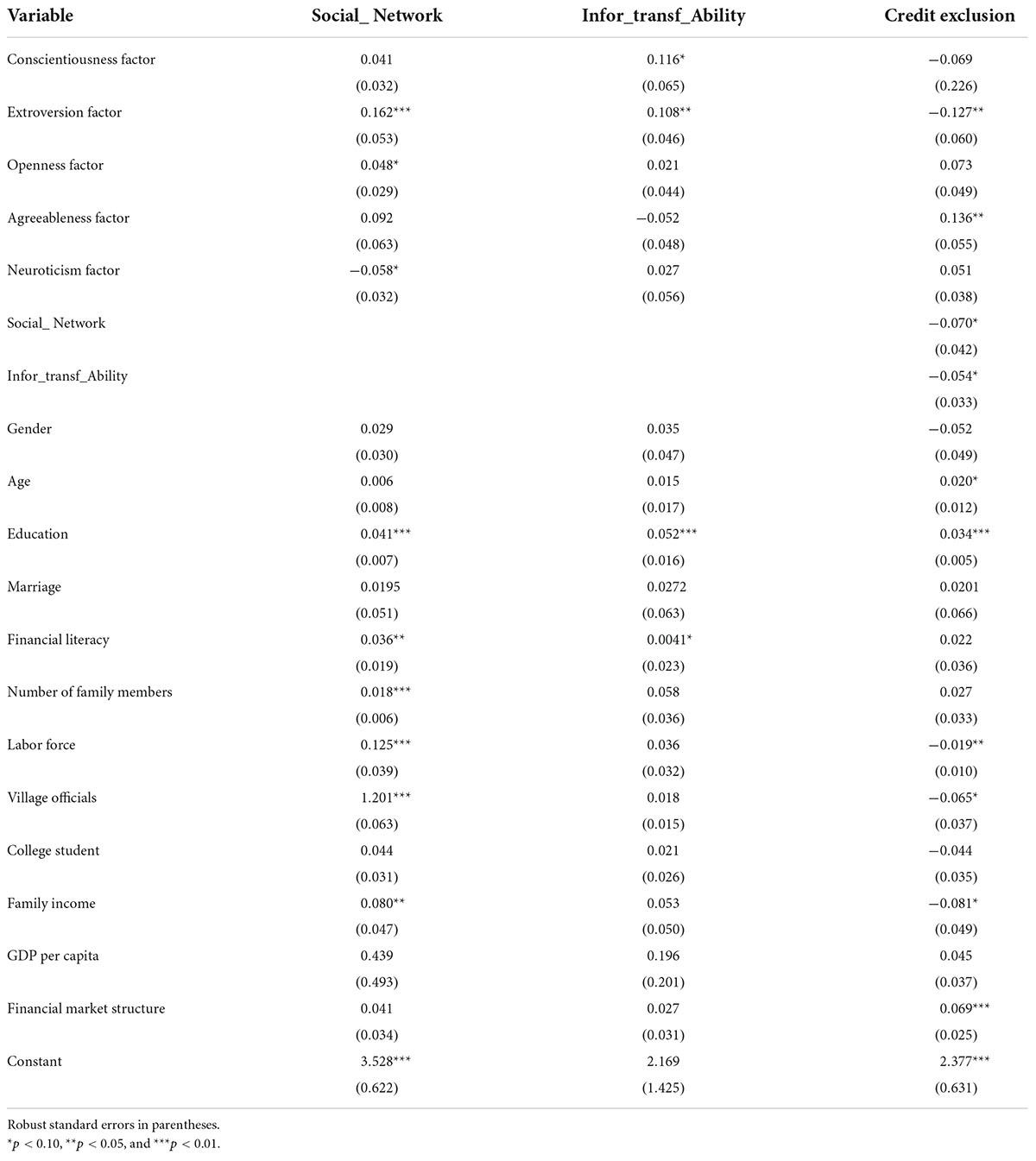

Mechanism verification

Theoretical analysis suggests that social network and information transmission ability are the mechanisms of personality traits affecting credit exclusion. This Manuscript constructs the following equation to verify whether these mechanisms are valid, referring to Dai’s (2022) study. Among them, the social network identification question is “ If you are sick and in need of money, how many people can you turn to?” The more people you can turn to, the wider your social network. According to the survey, farmers who are proficient in Mandarin generally have strong information transmission ability. Therefore, this Manuscript takes “mandarin proficiency of interviewees (1 very poor–5 very good)” as the identification problem of information transmission ability. The regression results demonstrated the existence of a mechanism of action (Table 9).

Discussion

Theoretical implications

In this study, the effect of farmer’s personality traits on credit exclusion is analyzed by regression analysis of the data obtained from the 2018 and 2019 China Rural Financial Inclusion Survey conducted by the School of Economics and Management of the China Agricultural University. According to the findings of the analysis, the personality dimensions of conscientiousness, extroversion and openness have a statistically significant effect on the credit exclusion of farmers. However, agreeableness and neuroticism have no significant or negative effect on framer’s credit exclusion. This result is consistent with the results of many studies (Davey and George, 2011; Kubilay and Bayrakdaroglu, 2016; Camelia and Brian, 2018) in the literature. In addition, this Manuscript has some different findings: firstly, the research object of this Manuscript is “vulnerable or marginalized groups”, while some scholars study “high-quality customers”, such as Gianpaolo and Kim (2017) and Ozer and Mutlu (2019). Secondly, different from the general analysis of Camelia and Brian (2018), this Manuscript subdivides credit exclusion into three dimensions, deeply studies the influence of personality traits on credit exclusion of different dimensions, and then finds that personality traits mainly affect self-exclusion in credit exclusion. Thirdly, the significance of this Manuscript is to promote the personality education of farmers and promote their overall development. In contrast, the research of Ozer and Mutlu (2019) focuses on how to guide financial institutions to match user needs according to user personality traits.

Practical implications

This Manuscript has realistic significance. In China, the realization of inclusive finance requires the joint efforts of both clients and suppliers. From the perspective of the supply side, it is very important to increase the number of financial institutions, improve the level of financial services, and make use of modern financial means, such as digital finance. Meanwhile, we must also consider how to improve farmers’ financial acceptance and reduce their self-exclusion. This study’s results show that we must strengthen farmers’ personality education, reduce the negative aspects of their personality traits, and improve the positive aspects of their personality traits.

Limitations and future research direction

The conclusion of this Manuscript shows that price exclusion is not the main factor affecting farmers’ credit exclusion. This does not mean that farmers do not care about loan interest rates but that farmers can enjoy low-interest or interest-free loans under China’s national rural revitalization strategy, which does not impose a real market interest rate. In follow-up research, the author will investigate financial institutions, and study the impact of farmers’ personality traits on price exclusion under the condition of determining market interest rates.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

YT performed the conceptualization, methodology, visualization, and wrote the original draft. YF performed the conceptualization, methodology, validation, and wrote the original draft. GH was involved in the conceptualization, methodology, validation, and writing—review and editing. YT, YF, and GH collected the data, contributed to the article, and approved the submitted article.

Funding

This project is supported by the National Nature Science Foundation of China (Grant Nos. 72173121 and 72141003).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Agarwal, S., and Hauswald, R. (2010). Distance and private information in lending. Rev. Financ. Stud. 23, 2757–2788. doi: 10.1093/rfs/hhq001

Agarwal, S., and Mazumder, B. (2013). Cognitive abilities and household financial decision making. Am. Econ. J. 5, 193–207. doi: 10.1257/app.5.1.193

Alessandrini, P., Presbitero, A. F., and Zazzaro, A. (2009). Banks, distances and firms’ financing constraints. Rev. Financ. 13, 261–307. doi: 10.1093/rof/rfn010

Allport, G. W., and Odbert, H. S. (1936). Trait-names: A psycho-lexical study. Psychol. Monogr. 47, 1–171. doi: 10.1037/h0093360

Almlund, M., Duckworth, A. L., Heckman, J., and Kautz, T. (2011). Personality psychology and economics. Natl. Bur. Econ. Res. 4, 1–181. doi: 10.1016/B978-0-444-53444-6.00001-8

Anger, S., and Schnitzlein, D. D. (2017). Cognitive skills, non-cognitive skills, and family background: Evidence from sibling correlations. J. Popul. Econ. 30, 591–620. doi: 10.1007/s00148-016-0625-9

Araujo, C., Alain, J., and Elisabeth, S. (2011). Peer effects in employment: Results from Mexico’s poor rural communities. Can. J. Dev. Stud. 15, 565–589. doi: 10.1080/02255189.2010.9669316

Banerjee, A. V., and Newman, A. F. (1993). Occupational choice and the progress of development. J. Polit. Econ. 101, 274–298. doi: 10.1086/261876

Becker, A., Deckers, T., Dohmen, T., Falk, A., and Kosse, F. (2012). The relationship between economic preferences and psychological personality measures. Annu. Rev. Econ. 4, 453–478. doi: 10.1146/annurev-economics-080511-110922

Bernheim, B. D., and Garrett, D. M. (2003). The effects of financial education in the workplace: Evidence from a survey of households. J. Public Econ. 87, 1487–1519. doi: 10.1016/S0047-2727(01)00184-0

Borghans, L., Duckworth, A. L., Heckman, J. J., and Weel, B. (2008). The economics and psychology of personality traits. J. Hum. Resour. 43, 972–1059. doi: 10.3386/w13810

Bortoli, D. D., Costa, N. D., Goulart, M., Campara, J., and Gherghina, S. C. (2019). Personality traits and investor profile analysis: A behavioral finance study. PLoS One 14:e0214062. doi: 10.1371/journal.pone.0214062

Brooks, C., and Williams, L. (2021). The impact of personality traits on attitude to financial risk. Res. Int. Bus. Financ. 58:101501. doi: 10.1016/j.ribaf.2021.101501

Brown, M., Grigsby, J., van der Klauw, W., Wen, J., and Zafar, B. (2016). Financial education and the debt behavior of the young. Rev. Financ. Stud. 29, 2490–2522. doi: 10.1093/rfs/hhw006

Brown, S., and Taylor, K. (2014). Household finances and the “big five” personality traits. J. Econ. Psychol. 45, 197–212. doi: 10.1016/j.joep.2014.10.006

Bucher-Koenen, T., and Lusardi, A. (2011). Financial literacy and retirement planning in Germany. J. Pens. Econ. Financ. 10, 565–584. doi: 10.1017/S1474747211000485

Cai, M., Liu, P., and Wang, H. (2020). Political trust, risk preferences, and policy support: A study of land dispossessed villagers in China. World Dev. 125:104687. doi: 10.1016/j.worlddev.2019.104687

Cai, Q. F., Chen, Y. H., and Lin, K. (2020). Does access to credit availability encourage corporate innovation? −evidence from the geographic network of banks in China. Econ. Res. J. 55, 124–140.

Camelia, M. K., and Brian, T. M. (2018). Noncognitive abilities and financial delinquency: The role of self-efficacy in avoiding financial distress. J. Financ. 73, 2837–2869. doi: 10.1111/jofi.12724

Caspi, A., Roberts, B. W., and Shiner, R. L. (2005). Personality development: Stability and change. Annu. Rev. Psychol. 56, 453–484. doi: 10.1146/annurev.psych.55.090902.141913

Cheng, H., and Li, T. (2017). The effects of personality traits on wages: Empirical analyses based on the China employer-employee survey (CEES). Econ. Res. J. 52, 171–186.

Cho, S. (2016). Does gender equality promote social trust? An empirical analysis. World Dev. 88, 175–187. doi: 10.1016/j.worlddev.2016.07.019

Choi, H., and Laschever, R. A. (2018). The credit card debt puzzle and noncognitive ability. Rev. Financ. 22, 2109–2137. doi: 10.1093/rof/rfx020

Cobb-Clark, D. A., Kassenboehmer, S. C., and Sinning, M. G. (2016). Locus of control and savings. J. Bank. Financ. 73, 113–130. doi: 10.1016/j.jbankfin.2016.06.013

Cooper, R., and Zhu, G. (2018). Household finance in China. NBER working paper 23741. doi: 10.3386/w23741

Costa, P. T., and McCrae, R. R. (1992). Four ways five factors are basic. Pers. Individ. Differ. 13, 653–665. doi: 10.1016/0191-8869(92)90236-I

Dai, M. H. (2022). Geographical structure of finance, bank competition, and business environment: Empirical evidence from branches of commercial banks and blacklisted firms. Financ. Trade Econ. 43, 66–81.

Davey, J., and George, C. (2011). Personality and finance: The effects of personality on financial attitudes and behavior. Int. J. Interdiscipl. Soc. Sci. 5, 275–292. doi: 10.18848/1833-1882/CGP/v05i09/51887

Degryse, H., and Ongena, S. (2005). Distance, lending relationships, and competition. J. Financ. 60, 231–266. doi: 10.1111/j.1540-6261.2005.00729.x

Devlin, J. F. (2005). A detailed study of financial exclusion in the UK. J. Consum. Policy 28, 75–108. doi: 10.1007/s10603-004-7313-y

Diener, E., Larsen, R. J., and Emmons, R. A. (1984). Person situation Interactions: Choice of situations and congruence response models. J. Pers. Soc. Psychol. 47, 580–592. doi: 10.1037/0022-3514.47.3.580

Dimmock, S., Kouwenberg, R., Mitchell, O. S., and Peijnenburg, K. (2016). Ambiguity aversion and household portfolio choice puzzles: Empirical evidence. J. Financ. Econol. 119, 559–577. doi: 10.1016/j.jfineco.2016.01.003

Dohmen, T., Falk, A., Huffman, D., and Sunde, U. (2010). Are risk aversion and impatience related to cognitive ability? Am. Econ. Rev. 100, 1238–1260. doi: 10.1257/aer.100.3.1238

Dong, X. L., and Xu, H. (2012). An empirical analysis of the influencing factors of Rural financial exclusion in China - based on the perspective of the distribution of financial institutions at county level. J. Financ. Res. 9, 115–126.

Dong, X. L., Yu, W. P., and Zhu, M. J. (2017). Financial market participants and asset choice among rural and urban household under different information channels. Financ. Trade Res. 28, 33–42.

Donnelly, G., Iyer, R., and Howella, R. T. (2012). The big five personality traits, material values, and financial well-being of self-described money managers. J. Econ. Psychol. 33, 1129–1142. doi: 10.1016/j.joep.2012.08.001

Elul, R., Souleles, N. S., Chomsisengphet, S., Glennon, D., and Hunt, R. (2010). What “triggers” mortgage default? Am. Econ. Rev. 100, 490–494. doi: 10.1257/aer.100.2.490

Fairlie, R. W. (2005). An extension of the Blinder-Oaxaca decomposition technique to logit and probit models. J. Econ. Soc. Meas. 30, 305–316. doi: 10.3233/JEM-2005-0259

Fan, P. F., Zhang, L., Su, M., and Feng, S. Y. (2022). The impact of farmland transfer target assessment on village farmland transfer: An integrated analysis of the moderating effect of village institutional environment. Chin. Rur. Sur. 3, 112–127.

Fei, S. L. (2017). The distributional decomposition on the urban-rural gap of wealth and property. Issues Agric. Econ. 38, 55–64+111.

Gao, Y. F., and Huang, Y. L. (2019). Research on the function of rule of virtue concerning village regulations and its contemporary value- from the perspective of establishing “three integrated management method” of rural governance system. Soc. Stud. 2, 102–109.

Giang, T. T., Wang, G. H., and Dinh, C. N. (2015). Impact of credit on poor household’s income: Evidence from rural areas of Vietnam. J. Financ. Econ. 3, 29–35.

Gianpaolo, P., and Kim, P. (2017). Understanding the determinants of financial outcomes and choices: The role of noncognitive abilities. BIS Working Papers. Basel: Bank for International Settlements

Gianpaolo, P., and Peijnenburg, K. (2019). Noncognitive abilities and financial distress: Evidence from a representative household panel. Rev. Financ. Stud. 32, 3884–3919.

Giovanni, F., Erwan, M., Enrique, S., and Philip, V. (2017). Debt enforcement, investment, and risk taking across countries. J. Financ. Econ. 123, 22–41. doi: 10.1016/j.jfineco.2016.09.002

Guan, R., Liu, X., and Yu, J. (2020). Precise poverty alleviation policy and marginal poverty group’ grassroots political trus. J. Agric. Econ. 3, 97–109.

Han, J., Luo, D., and Cheng, Y. (2007). An empirical study on farmers’ borrowing demand behavior under credit constraints. Issues Agric. Econ. 2, 44–52

Han, W. H., and Chen, B. L. (2019). Political and social effects of the rural Dibao program: An empirical study based on CFPS panel data. Issues Agric. Econ. 4, 88–97.

He, G. W., He, J., and Gui, P. (2018). Rethinking the credit demand and availability of farm household. Issues Agric. Econ. 2, 38–49.

He, J., and Yue, L. (2021). “Cannot” or “unwilling”? A research on the impact of non-cognitive abilities on farmers’ credit exclusion. J. Shanghai Univ. Financ. Econ. 23, 95–106.

He, J., Tian, Y. Q., Liu, T., and Li, Q. H. (2017). How far is Internet finance from farmers?- Internet financial exclusion in developing areas. Financ. Trade Econ. 38, 70–84.

Heckman, J. (2011). Integrating personality psychology into economics. Natl. Bur. Econ. Res. 33, 1–31. doi: 10.3386/w17378

Heckman, J. J. (2006). Skill formation and the economics of investing in disadvantaged children. Science 312, 1900–1902. doi: 10.1126/science.1128898

Heckman, J., and Corbin, C. O. (2016). Capabilities and skills. NBER Working Paper 22339. Cambridge, MA: National Bureau of Economic Research. doi: 10.3386/w22339

Heineck, G., and Anger, S. (2010). The returns to cognitive abilities and personality traits in Germany. Labour. Econ. 17, 535–546. doi: 10.1016/j.labeco.2009.06.001

Hoff, K., and Stiglitz, J. E. (2016). Striving for balance in economics: Towards a theory of the social determination of behavior. J. Econ. Behav. Organ. 126, 1–33. doi: 10.1016/j.jebo.2016.01.005

Hollander, S., and Verriest, A. (2016). Bridging the gap: the design of bank loan contracts and distance. J. Financ. Econ. 119, 399–419. doi: 10.1016/j.jfineco.2015.09.006

Jayati, G. (2013). Microfinance and the challenge of financial inclusion for development. Camb. J. Econ. 37, 1203–1219. doi: 10.1093/cje/bet042

Jin, Y., Zheng, W. P., and Wang, W. K. (2022). Does the minimum wage increase the consumption of low-income population? A comparative analysis of urban minimum wage households in China. J. Cent. Univ. Financ. Econ. 6, 82–92.

Kautz, T., Heckman, J., Diris, R., Weel, B., and Borghans, L. (2014). Fostering and measuring skills: Improving cognitive and non-cognitive skills to promote lifetime success. NBER Working Paper 20749. Cambridge, MA: National Bureau of Economic Research. doi: 10.3386/w20749

Kempson, E., and Whyley, C. (1999). Kept out or opted out?: Understanding and combating financial exclusion. Bristol: Policy Press.

Kubilay, B., and Bayrakdaroglu, A. (2016). An empirical research on investor biases in financial decision-making, financial risk tolerance and financial personality. Int. J. Financ. Res 7, 171–182. doi: 10.5430/ijfr.v7n2p171

Leyshon, A., and Thrift, N. J. (1994). Access to financial services and financial infrastructure withdrawal: Problems and policies. Area 26, 268–275.

Li, H. Y. (2022). “Revival of rites”: The shared tradition and its modern reconstruction in Chinese rural society. J. Nanjing. Agric. Univ. (Soc. Sci. Ed.) 22, 19–27.

Li, L. M., Long, X., and Li, X. G. (2018). Who will be more willing to operate social capital? -empirical analysis based on psychological personalities. Soc. Rev. China 6, 44–56.

Li, T., and Zhang, W. T. (2015). Personality traits and stock investment. Econ. Res. J. 50, 103–116.

Li, Z. H., Zhang, Z. X., and Ehsan, E. (2022). A nexus of social capital-based financing and farmers’ scale operation, and its environmental impact. Front. Psychol. 13:950046. doi: 10.3389/fpsyg.2022.950046

Liao, G., Yao, D., and Hu, Z. (2019). The spatial effect of the efficiency of regional financial resource allocation from the perspective of internet finance: Evidence from Chinese Provinces. Emerg. Mark. Financ. Trad. 56, 1211–1223. doi: 10.1080/1540496X.2018.1564658

Ling, Y. H., Zhang, Y. Y., and Xu, C. C. (2017). Can negative list system promote industrial structure adjustment? Circumstantial evidences from the natural experiment of China’s administrative permission law. Contemp. Financ. Econ. 5, 89–102.

Lusardi, A. (2012). Numeracy, financial literacy, and financial decision-making. Numeracy 5:2. doi: 10.3386/w17821

McAdams, D. P. (1994). The person: An introduction to personality psychology, 2nd Edn. Fort Worth, TX: Harcourt Brace.

Mischel, W. (1973). Toward a cognitive social learning reconceptualization of personality. Psychol. Rev. 80, 252–283. doi: 10.1037/h0035002

Niu, Z. K., Xu, H. Z., and Chi, X. (2022). Impact of farmland certification and lineage network on the transfer of farmland: Substitute or complement. J. Nanjing Agric. Univ. (Soc. Sci. Ed.) 22, 139–150.

Oehler, A., Wendt, S., Wedlich, F., and Horn, M. (2018). Investors’ personality influences investment decisions: Experimental evidence on extraversion and neuroticism. J. Behav. Financ. 19, 30–48. doi: 10.1080/15427560.2017.1366495

Ozer, G., and Mutlu, U. (2019). The effects of personality traits on financial behavior. J. Bus. Econ Financ. 8, 155–164. doi: 10.17261/Pressacademia.2019.1122

Panigyrakis, G. G., Theodoridis, P. K., and Veloutsou, C. A. (2002). All customers are not treated equally: Financial exclusion in isolated Greek islands. J. Financ. Serv. Mark. 7, 54–66. doi: 10.1057/palgrave.fsm.4770072

Parise, G., and Peijnenburg, K. (2019). Noncognitive abilities and financial distress:evidence from a representative household panel. Rev. Financ. Stud. 32, 3884–3919. doi: 10.1093/rfs/hhz010

Pinjisakikool, T. (2017). The effect of personality traits on households’ financial literacy. Citizsh. Soc. Econ. Educ. 16, 39–51. doi: 10.1177/2047173417690005

Potter, J. (1968). Capitalism and the Chinese peasant: Social and economic change in a Hong Kong village. Am. Anthropol. 70, 1214–1215. doi: 10.1525/aa.1968.70.6.02a00500

Reis, R. (2006). Inattentive consumers. J. Monet. Econ. 53, 1761–1800. doi: 10.1016/j.jmoneco.2006.03.001

Roberts, B. W. (2009). Back to the future: Personality and assessment and personality development. J. Res. Pers. 43, 137–145. doi: 10.1016/j.jrp.2008.12.015

Salameh, A. A., Akhtar, H., Gul, R., Abdullah, B., and Sobia, H. (2022). Personality traits & entrepreneurial intentions: Financial risk taking as a mediator. Front. Psychol. 13:927718. doi: 10.3389/fpsyg.2022.927718

Schultz, D. P., and Schultz, S. E. (2016). Theories of personality, 11th Edn. Boston, MA: Cengage Learn.

Shen, Y., Hu, W. X., and Zhang, Y. (2022). Digital finance, household income and household risky financial asset investment. Proc. Comput. Sci. 202, 244–251. doi: 10.1016/j.procs.2022.04.032

Skinner, G. W. (1971). Chinese peasants and the closed community: An open and shut case. Comp. Stud. Soc. Hist. 13, 270–281. doi: 10.1017/S0010417500006289

Song, Q. Y., Wu, Y., and Yin, Z. C. (2017). Financial literacy and household borrowing behavior. J. Financ. Res. 6, 95–110.

Su, F., and Fang, L. (2016). Regional differences in rural financial exclusion in China: Insufficient supply or insufficient demand? - comparative analysis of banking, insurance, and Internet finance. J. Manag. World 9, 70–83.

Thiel, H., and Thomsen, S. L. (2013). Noncognitive skills in economics: Models, measurement, and empirical evidence. Res. Econ. 67, 189–214. doi: 10.1016/j.rie.2013.03.002

Tian, G., and Zhang, X. (2022). Digital economy, non-agricultural employment, and division of labor. J. Manag. World 38, 72–84.

Tian, Y. Q., and Fan, Y. C. (2020). The influence of personality characteristics on farmers’ credit behavior: An empirical study based on the Rural inclusive finance survey in China. Mod. Econ. Res. 1, 124–132.

van Rooij, M., Lusardi, A., and Alessie, R. (2011). Financial literacy and stock market participation. J. Financ. Econ. 101, 449–472. doi: 10.1016/j.jfineco.2011.03.006

Vodosek, M. (2003). “Personality and the formation of social networks,” in Proceedings of the ASA annual meeting, conference paper, New York, NY.

Wang, W. Y., and Bei, D. G. (2022). Digital inclusive finance, covernment intervention and county economic growth- an empirical analysis based on threshold panel regression. Econ. Theory Bus. Manag. 42, 41–53.

Wang, X. H., Fu, Y., He, X. J., and Tan, K. T. (2013). Research on the financial exclusion situation of the rural households in China-based on the survey data of 1547 rural households from 29 counties in 8 provinces. J. Financ. Res. 7, 139–152.

Wang, X., and He, G. W. (2020). Digital financial inclusion and farmers’ vulnerability to poverty: Evidence from rural China. Sustainability 12:1668. doi: 10.3390/su12041668

Wang, X. H., and Qiu, Z. X. (2011). The influence mechanism and empirical study of rural financial development on urban-rural income gap. Econ. Res. J. 2, 71–75.

Wu, B. B. (2019). Gender difference in social security participation rate of migrant workers in cities and towns: An analysis based on the extended blinder-Oaxaca decomposition. Chin. Rural Econ. 5, 89–108.

Xu, S. L., Yang, Z., Tauseef, A. S., Li, Y. F., and Cui, J. W. (2022). Does financial literacy affect household financial behavior? The role of limited attention. Front. Psychol 20:906153. doi: 10.3389/fpsyg.2022.906153

Xue, C. X. (2022). Leading effect of households’ political identity on green agricultural production technology. J. Northwest. Agric. For. Univ. (Soc. Sci. Ed.) 22, 148–160.

Yin, Z. C., and Zhang, H. D. (2020). Financial inclusion, household poverty and vulnerability. China Econ. Q. 20, 153–172. doi: 10.13821/j.cnki.ceq

Zakaria, M., Wen, J., and Khan, M. F. (2019). Impact of financial development on agricultural productivity in South Asia. Agric. Econ. 65, 232–239. doi: 10.17221/199/2018-AGRICECON

Zhang, H. D., and Yin, Z. C. (2016). Financial literacy and households’ financial exclusion in China: Evidence from CHFS data. J. Financ. Res. 7, 80–95.

Zhang, J. H., Guo, Y. N., and Huang, Y. W. (2017). The influence of social Network on farmers’ formal credit: Evidence from Probit model and SEM model. J. Zhongnan Univ. Econ. Law 6, 83–93.

Zhang, X. Y., and Ji, Z. Y. (2020). The way and practice of new able villagers participating in rural community governance: Based on the perspective of social network. Nanjing J. Soc. Sci. 8, 82–87.

Zhang, Y. L., and Li, Q. Y. (2022). Does salient future necessarily lead to work engagement? Qualitative comparative study from a systematic perspective. Manag. Rev. 4, 130–141.

Zhao, H., Seibert, S. E., and Lumpkin, G. T. (2010). The relationship of personality to entrepreneurial intentions and performance: A meta-analytic review. J. Manag. 36, 381–404. doi: 10.1177/0149206309335187

Zhou, S. S., and Li, X. P. (2022). Zhongyong thinking style and resilience capacity in Chinese undergraduates: The chain mediating role of cognitive reappraisal and positive affect. Front. Psychol. 13:814039. doi: 10.3389/fpsyg.2022.814039

Keywords: personality traits, farmers, credit exclusion, extroversion factor, agreeableness factor

Citation: Tian Y, Fan Y and He G (2022) Farmers’ personality traits and credit exclusion: Evidence from rural China. Front. Psychol. 13:979588. doi: 10.3389/fpsyg.2022.979588

Received: 27 June 2022; Accepted: 29 July 2022;

Published: 26 August 2022.

Edited by:

Kui Yi, East China Jiaotong University, ChinaReviewed by:

Guoyi Chen, Chongqing Three Gorges University, ChinaJun Li, Shanghai University of Finance and Economics, China

Copyright © 2022 Tian, Fan and He. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yachen Fan, ZmFueWFjaGVuMDA4QDE2My5jb20=

Yaqun Tian

Yaqun Tian Yachen Fan2*

Yachen Fan2*