- 1College of International Economics & Trade, Ningbo University of Finance & Economics, Ningbo, Zhejiang, China

- 2Department of NBUFE, Ningbo Philosophy and Social Science Key Research Base “Research Base on Digital Economy Innovation and Linkage with Hub Free Trade Zones”, Ningbo, Zhejiang, China

- 3School of Economic & Management, Shanghai Maritime University, Shanghai, China

- 4School of Economics, Shanghai University, Shanghai, China

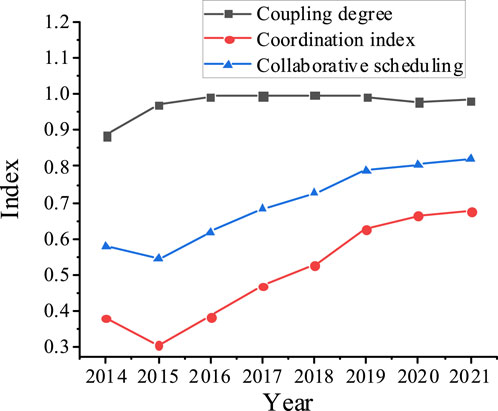

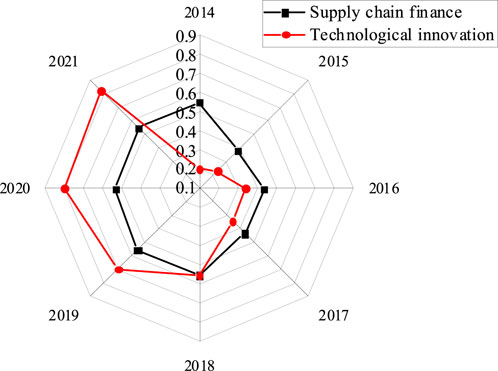

This paper aims to deeply explore the synergistic effect of digital transformation technology innovation and supply chain finance (SCF) to promote enterprise innovation and enhance competitiveness. Based on the co-evolution theory and economic effect theory, a theoretical framework is constructed to analyze the synergistic effects of SCF and technological innovation. The paper employs the entropy weight-TOPSIS model and the Coupling Coordination Degree model to conduct an in-depth analysis of the synergistic effects from both quantitative and qualitative dimensions. A sample of 500 listed companies from various industries and sizes, covering the period from 2014 to 2021, is selected. By analyzing the financial data and technological innovation indicators of these companies, the relationship and synergistic effects between SCF and technological innovation are investigated. The data analysis results show that starting from 2015, the coupling coordination degree between SCF and technological innovation began to rise rapidly due to fluctuations in the global financial market and the domestic industrial chain transfer. During this period, the coupling coordination degree of the composite system increased significantly from 0.5432 in 2015 to 0.8185 in 2021. This indicates a significant synergistic effect between SCF and technological innovation, with technological innovation playing a leading role in the co-evolution process. This paper reveals the dominant role of technological innovation in the co-evolution process, providing important insights for enterprise development and innovation.

1 Introduction

With the digital transformation of the global economy, the operational and management models of enterprises have undergone profound changes. Digital transformation technology, encompassing cutting-edge technologies such as big data analytics, the Internet of Things (IoT), blockchain, and artificial intelligence (AI), is profoundly impacting various industries, especially supply chain management and financial services [1–3]. Supply chain finance (SCF), as an innovative financial service model, effectively alleviates the difficulties and high costs of financing faced by small and medium-sized enterprises (SMEs) by integrating the flow of funds, logistics, and information within the supply chain. SMEs, as crucial components of the supply chain, have long been constrained by financing challenges. SCF helps SMEs obtain financing support by leveraging the credit of core enterprises, thus easing their financial pressures [4]. Furthermore, technological innovation provides more efficient and flexible solutions for SCF. Through big data and AI technologies, dynamic assessment of SME credit and precise financing can be achieved.

In the current global market environment, increasing uncertainties such as trade frictions and geopolitical risks pose greater risk management challenges for SCF. Technological innovation offers advanced risk assessment and management tools to help enterprises cope with these uncertainties. For instance, IoT technology can monitor risk events in the supply chain in real-time, enhancing the risk warning capabilities of SCF [5–7]. However, with the increasing complexity of supply chains and the rapid changes in the global market, traditional SCF models also face numerous challenges. Enhancing the efficiency and security of SCF through digital transformation technology has become a focal point of interest for both academia and industry.

Academia has conducted extensive theoretical discussions on the synergistic effects of SCF and technological innovation. Researchers have analyzed the mechanisms and pathways of their co-evolution from various perspectives, including supply chain management, financial theory, and information technology. Studies have indicated that digital technologies can promote the development of SCF by enhancing information transparency and transaction efficiency, while SCF can support enterprise technological innovation by optimizing fund flows [8]. Empirical analyses have verified the practical effects of the co-evolution of SCF and technological innovation. Research has found that enterprises applying big data and AI technologies significantly improve the efficiency and accuracy of their SCF services. SCF platforms using blockchain technology exhibit clear advantages in transaction security and transparency [9].

Current research primarily focuses on the independent development and single effects of digital transformation technology and SCF [10]. There is extensive empirical research on the role of digital transformation in improving operational efficiency, optimizing resource allocation, and enhancing the competitiveness of enterprises. Similarly, the contributions of SCF in alleviating SMEs’ financing difficulties and promoting coordinated development of supply chain links are well recognized. However, studies on the synergistic effects between digital transformation technology and SCF, especially their combined impact on actual enterprise operations, remain scarce. Existing literature often centres on case studies or theoretical discussions, lacking the support of large samples and empirical data, thus failing to fully reveal the mechanisms and effects of their synergistic development.

Although scholars have examined digital technologies, supply chain finance (SCF) and firm performance in isolation, we still lack large-sample, cross-industry evidence on how these elements co-evolve—especially in China, the world’s largest manufacturing base and digital-finance laboratory. This study is the first to: (1) Treat the “technology–finance coupling-coordination degree” as a continuous, quantifiable metric using 2014–2021 panel data from 500 A-share listed firms. (2) Anchor the analysis in co-evolution and synergetic theories, demonstrating that technological innovation—not financial supply—acts as the dominant order parameter. (3) Combine micro-level firm data with the macro-level “Made in China 2025” policy shock to show how exogenous interventions can shift the coupling trajectory.

This paper aims to fill this research gap by empirically analyzing the synergistic effects of digital transformation technology and SCF in enterprise operations. Specifically, it seeks to reveal how technological innovation and SCF interact to jointly promote the improvement of enterprise performance. The paper focuses on the similarities and differences in the synergistic effects of digital transformation technology and SCF across different industry contexts and analyzes the underlying reasons and mechanisms. This paper hopes to provide new research perspectives and empirical evidence for academia and offer valuable references for enterprise practices, aiding enterprises in achieving higher quality and more innovative development amid the wave of digital transformation. These findings not only fill a China-specific gap in the “technology × finance” synergy literature, but also deliver a replicable framework: the coupling index requires only publicly available financial statements and patent data, making it portable to the EU, North America or any emerging economy that seeks to benchmark its own policy experiments.

2 Methods

2.1 Co-evolution theory and its economic effects

Co-evolution originally comes from biology and describes the process where two or more species evolve together through mutual influence. For instance, the relationships between predators and prey, or parasites and hosts, can be explained through co-evolution theory. In these relationships, the interactions between species trigger adaptive changes, causing alterations in their evolutionary directions and speeds. Introducing co-evolution theory into social sciences helps explain the dynamic evolution of systems like enterprises, technology, and markets in complex environments. In this process, the interactions and feedback mechanisms among different entities continuously drive system evolution, allowing it to adapt to external environmental changes while achieving internal coordination and optimization [11, 12]. This theory emphasizes that system evolution results from the interactions among its parts rather than the isolated development of a single entity.

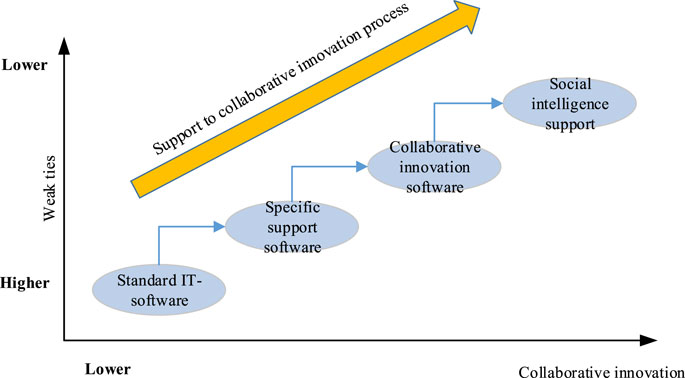

With the support of technological innovations such as cloud computing, big data, AI, the IoT, and blockchain, collaborative innovation among enterprises has become more efficient, intelligent, and secure. Figure 1 illustrates the evolution trend of collaborative innovation underpinned by technology. Big data technology has made the collection, analysis, and utilization of vast amounts of information more efficient, providing abundant data support for collaborative innovation. AI, through machine learning and deep learning technologies, offers intelligent solutions to problems encountered in the innovation process. Applications of AI in innovation include intelligent recommendation systems, natural language processing, and image recognition. Enterprises can automate many repetitive tasks in the innovation process using AI technology, thereby increasing efficiency. For example, AI can help pharmaceutical companies screen potential new drug molecules, significantly shortening the development cycle. The IoT technology connects various devices, enabling real-time data collection and feedback. For instance, in manufacturing, IoT devices can monitor the operating status of production lines in real-time, quickly identifying and resolving issues to improve production efficiency and product quality. Cloud computing platforms, through virtualization technology, provide on-demand allocation of computing resources and storage space, enabling enterprises to flexibly adjust resource allocation according to actual needs. This reduces fixed asset investments and improves resource utilization. The elasticity and scalability of cloud computing lower IT costs for enterprises and enhance the efficiency of collaborative innovation. Enterprises no longer need to purchase and maintain expensive hardware equipment; instead, they can quickly set up and deploy innovative projects using resources provided by cloud service providers.

An increasing number of enterprises and organizations are building open innovation platforms that integrate various stages such as research and development (R&D), production, and sales, forming collaborative innovation ecosystems. These platforms connect different innovation entities like enterprises, research institutions, and entrepreneurs, promoting resource sharing and collaboration. Crowdsourcing platforms attract innovators around the world to jointly solve innovation challenges. Crowdfunding gathers funds to support innovative projects, allowing more ideas to come to fruition. Enterprises and organizations are breaking away from traditional closed innovation models, actively incorporating external innovation resources through cooperation, mergers, acquisitions, and joint ventures to develop new technologies and products with external innovation entities. Collaboration across different industries and fields is becoming increasingly common. Through cross-sector collaboration, parties can share each other’s technological and market resources, achieving an innovation effect where the whole is greater than the sum of its parts (1 + 1>2).

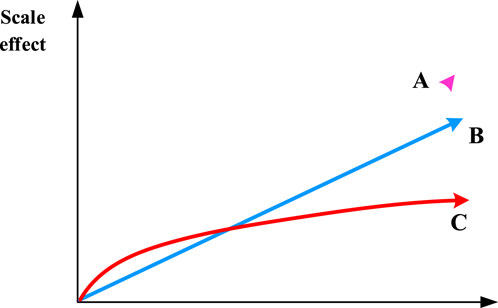

In economics and management, the scale effect curve (Figure 2) shows the changes in costs and efficiency of enterprises at different production scales. Curve a (Strongest Effect): This curve indicates that as the scale increases, the unit cost rapidly decreases and maintains a low cost at a larger scale. This is typically applicable to industries with significant economies of scale, such as manufacturing and heavy industries. Curve B (Moderate Effect): This curve shows that as the scale increases, the unit cost gradually decreases, but the effect is weaker and the decrease slows down after a certain scale. This applies to industries with moderate economies of scale, such as retail and some service sectors. Curve C (Weakest Effect): This curve suggests that as the scale increases, the unit cost only slightly decreases or remains unchanged. This is suitable for industries with weak economies of scale or those approaching perfect competition, such as some handicrafts and small service industries.

A-curve primarily applies to manufacturing industries, particularly in sectors such as automotive, electronics, and chemicals, where large-scale production significantly reduces unit costs. By means of bulk purchasing raw materials, optimizing production processes, and utilizing automated equipment, enterprises achieve substantial economies of scale. Technological advancements and innovations further enhance these scale effects in these industries. For instance, advanced automation and AI technologies can further reduce costs and enhance production efficiency in large-scale manufacturing. Globalization and supply chain management are crucial factors facilitating significant scale effects. By optimizing raw material procurement, production, and distribution on a global scale, enterprises can achieve more efficient operations.

B-curve is mainly applicable to the retail industry, where expanding store networks can generate some economies of scale. However, as scale increases, the rising costs of management and logistics gradually offset some of these benefits. For example, large chain supermarkets can reduce costs through centralized procurement and distribution, but managing too many stores adds complexity. Similarly, in service industries like banking and insurance, expanding customer bases and service networks can achieve some scale effects, but beyond a certain scale, controlling service quality and management costs becomes increasingly challenging. Digital transformation in retail and service industries can further enhance economies of scale. Big data analytics can be used to optimize inventory management, enhance customer relationship management systems, and improve customer service efficiency.

C-curve primarily applies to handicrafts and small-scale industries, such as traditional handicraft production, where small-scale production offers flexibility and personalized advantages but struggles to achieve significant cost reductions through scale. It also applies to small service industries such as small restaurants and personal care services, where personalized services and higher labor costs make achieving significant cost reductions through scale difficult. For handicrafts and small service industries, enhancing customer loyalty and market competitiveness can be achieved through community engagement and localized operations. Localized services and customized products cater to specific market demands, thereby increasing market share.

When the input of production factors increases, the output increases at a faster rate than the input. This situation typically occurs in emerging industries or fields with rapid technological advancements. In these areas, as the production scale expands, enterprises can utilize resources more efficiently, improve production efficiency, and achieve higher output. Conversely, when the input of production factors increases, the output increases at a slower rate than the input [13]. This scenario is common in mature industries or where there is a substitution between production factors. In these areas, as the production scale expands, enterprises may face resource bottlenecks, increased management difficulties, and other issues that lead to decreased production efficiency.

In economics, co-evolution theory is used to study the dynamic relationships among multiple entities in market competition, technological innovation, and institutional changes. Specifically, in the fields of technological innovation and industrial evolution, co-evolution theory provides a framework to explain the interactions among technological development, corporate strategies, and market structures. Technological innovation is not only the result of internal R&D activities but also influenced by external factors such as market demand, competitor behavior, and government policies [14–16]. These external factors, in turn, are affected by technological innovation, forming a dynamic co-evolution process.

Synergetics and evolutionary economics, though originating from different academic backgrounds, have high compatibility in explaining complex economic phenomena and guiding enterprise innovation management. The combined application of these two theories can provide more comprehensive theoretical support and practical guidance for the dynamic evolution and collaborative innovation of enterprises and economic systems.

The combined application of synergetics and evolutionary economics emphasizes that enterprises achieve dynamic competitive advantages and sustained innovation capabilities through internal coordination and external cooperation. Enterprises can enhance market competitiveness and adaptability by collaborating across departments and engaging in open innovation with partners and supply chain members to develop new technologies and products. The combination also supports the collaborative development and evolutionary optimization of industrial clusters and regional economies. For example, different enterprises and institutions can share resources and knowledge through the synergy of industrial clusters, achieving technological progress and industrial upgrades. It can promote sustainable development and enhance the competitiveness of regional economies. The application of synergetics and evolutionary economics provides a theoretical framework to explain the self-organization and evolutionary mechanisms of complex economic systems. Markets and industries, as complex economic systems, achieve self-organization and evolutionary optimization through the collaborative actions and dynamic adaptations of enterprises and individuals, forming diverse and dynamically balanced economic structures. Results reveal that agile leadership not only accelerates digital transformation but also drives stronger, more sustainable performance on both financial and non-financial fronts [27].

In enterprise management practices, the combined application of synergetics and evolutionary economics emphasizes the optimization of resource allocation and enhancement of innovation capabilities through internal coordination and external cooperation. In regional economic and industrial development, this combination supports the collaborative development and dynamic evolution of industrial clusters and regional economies, driving technological progress and industrial upgrades, and improving regional competitiveness and the quality of economic growth.

2.2 SCF in the context of digital transformation needs

Traditional SCF models primarily include accounts receivable financing, prepayment financing, and inventory financing. In accounts receivable financing, a company transfers its accounts receivable to a financial institution to obtain financing, which mainly addresses the cash flow issues caused by sales on credit [17]. In prepayment financing, suppliers receive prepayment financing from financial institutions based on purchase orders from buyers, which is used to procure raw materials and production. This model effectively alleviates the financial pressure on suppliers. In inventory financing, a company uses its inventory as collateral to obtain financing from financial institutions. This model is primarily suitable for companies with stringent inventory management, helping them improve their capital utilization [18–20]. Although these traditional models address the financing needs of enterprises to some extent, they also have limitations such as information asymmetry, high financing costs, and complex processes.

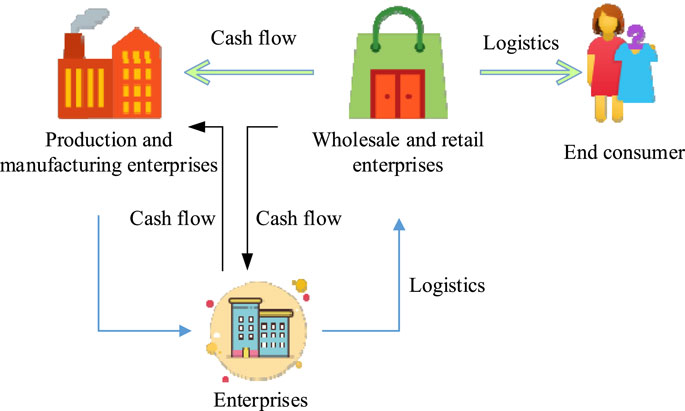

The supply chain symbiotic system (Figure 3) is derived from the ecological concept of symbiosis, emphasizing cooperation and coordination among enterprises within the supply chain. Symbiotic relationships include mutualism, commensalism, and parasitism. The most common type in supply chains is mutualism, where all enterprises within the supply chain enhance overall efficiency and competitiveness through resource sharing, information exchange, and collaborative efforts.

Digital transformation facilitates seamless connectivity and real-time data transmission across various stages of the supply chain through the introduction of advanced information technology and digital tools. This efficient information exchange and coordination not only enhances the responsiveness and accuracy of the supply chain but also provides more precise and timely data support for SCF. Digital transformation brings profound changes to SCF, mainly manifested in aspects such as information transparency and data sharing, the intelligence and automation of financial services, innovation and diversification of SCF products, and the expansion and inclusiveness of financing channels [21]. First, digital technologies, especially blockchain and big data analytics, significantly enhance the transparency of information at various stages of the supply chain. Blockchain technology ensures the authenticity and reliability of supply chain transaction data through distributed ledgers and immutable characteristics, effectively addressing information asymmetry issues. IoT and cloud computing technologies enable data sharing and real-time monitoring among various nodes of the supply chain. Financial institutions can comprehensively assess the credit risks and operational conditions of enterprises by obtaining and analyzing transaction and logistics data on the supply chain, thus providing more accurate financial services. In the process of digital transformation, companies can enhance supply chain resilience by restructuring supply chain resources through capability transformation, which encompasses manufacturing, digital platform, and innovation capabilities, thereby positively impacting supply chain resilience [22]. Local digital economic growth also exerts a significant influence on enterprise transformation, with higher levels of local digital development acting as a powerful catalyst. This catalyst not only accelerates the pace of enterprise transformation but also brings about tangible benefits, such as enhancing short-term operational efficiency and driving long-term innovative capabilities, thus enabling enterprises to better adapt to market changes and achieve sustainable development [23]. Next, the intelligence and automation of financial services have been significantly improved. AI and machine learning technologies are applied to risk management in SCF. By analyzing and modeling large amounts of historical data, AI intelligently identifies and predicts potential risks, thereby improving risk control capabilities and decision-making efficiency. The application of digital technologies enables highly automated business processes in SCF. Smart contracts and robotic process automation technologies can automatically execute financial contracts and business operations, reducing manual intervention and operational risks, and improving business processing efficiency.

Additionally, digital transformation drives innovation and diversification of SCF products. Various blockchain-based SCF products have emerged, such as digital bills, smart contract loans, and supply chain tokens. Automated and efficient financing and settlement are realized through smart contracts. The development of online and platform-based SCF services is also a major trend. Various SCF platforms integrate financial institutions, core enterprises, and SMEs to provide one-stop financial services, simplify business processes, and reduce financing costs. The application of digital technologies also expands the financing channels of SCF, enabling more SMEs to enjoy convenient and low-cost financial services. Enterprises can obtain more flexible and diversified financing support through emerging channels such as Internet finance platforms, P2P loans, and crowdfunding. This solves the problem of the long tail market uncovered by traditional financial services and promotes the development of inclusive finance.

In the field of SCF and technological innovation, the co-evolution theory provides a powerful tool for understanding how they evolve together through interaction, driving enterprise performance and economic growth. SCF solves the financing problems of SMEs by integrating information flow, fund flow, and logistics in the supply chain. Technology innovation enhances the efficiency and security of SCF by providing new technologies and tools. It can advance the theory of digital transformation in mental-health care and provides actionable guidance for designing and rolling out effective digital mental-health interventions [26].

The impact of technological innovation on SCF mainly includes the following aspects:

1. Data Transparency and Visualization: The application of big data and IoT technologies makes various stages of the supply chain more transparent and visual. Through real-time monitoring and data analysis, financial institutions can more accurately assess the operational status and credit risks of enterprises, thereby providing more precise financing solutions. For example, real-time tracking of the location and status of goods through IoT technology can significantly reduce financing risks and improve capital utilization efficiency.

2. Intelligent Decision-Making and Risk Management: AI technology analyzes and predicts a large amount of supply chain data through machine learning and deep learning algorithms, which helps financial institutions and enterprises make better decisions and risk management. Predictive models based on historical data can identify potential risk events in advance, provide early warnings, and reduce uncertainty and volatility in the supply chain.

3. Transaction Security and Trust Mechanism: The decentralized, tamper-proof, and transparent characteristics of blockchain technology make the transaction process of SCF more secure and trustworthy. Through blockchain technology, digital and transparent transactions of accounts receivable can be realized, reducing information asymmetry and credit risks, and improving financing efficiency and transaction transparency.

2.3 Co-evolution of technological innovation and SCF

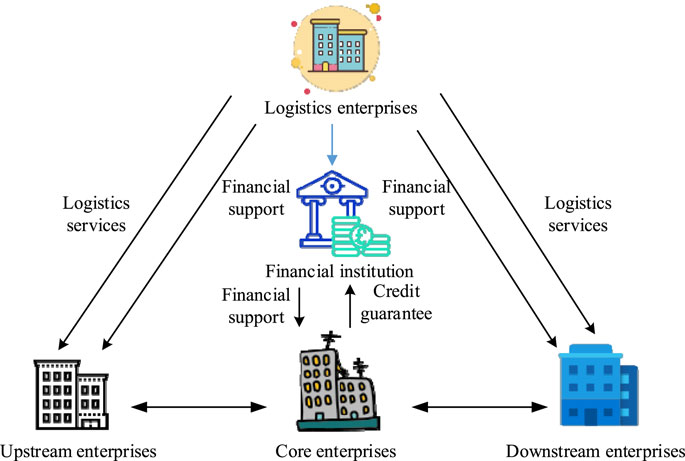

The ecosystem of SCF (Figure 4) is a complex network composed of various stakeholders. It facilitates efficient collaboration and mutually beneficial development of upstream and downstream enterprises in the supply chain through the flow of technology, funds, information, and services. This ecosystem includes not only core enterprises and their upstream and downstream counterparts in the supply chain but also financial institutions, technology providers, third-party service providers, and regulatory bodies. Within the ecosystem of SCF, stakeholders form close connections through information sharing, risk sharing, and benefit sharing, collectively driving the healthy development of the SCF ecosystem. By building a robust ecosystem, it is possible to enhance the efficiency and quality of SCF services, promote innovation and development among enterprises, and achieve continuous optimization and upgrading of the supply chain.

The collaborative evolution of SCF and technological innovation is first manifested in the integration of technology platforms and financial services. Financial institutions have built SCF platforms based on blockchain and big data technologies, realizing the digitization and intelligence of financial services, thereby enhancing the overall efficiency and security of SCF. Technological innovation provides decision support for SCF in a data-driven manner. AI and big data analytics can provide financial institutions with real-time market analysis and risk assessment, helping them make precise financing decisions and risk controls, thereby improving the service level and competitiveness of SCF.

In addition, blockchain technology enables the automation of transactions and credit management in SCF through the application of smart contracts. For example, smart contracts can automatically execute transactions and payments based on preset conditions, reducing transaction costs and credit risks, and improving the efficiency and security of SCF. SCF and technological innovation achieve multi-party collaboration and resource sharing by building a collaborative innovation ecosystem. Financial institutions, technology providers, and enterprises participate in the SCF ecosystem, jointly developing and promoting new technologies and products, driving innovation and upgrading in SCF.

The co-evolution of technological innovation and SCF are primarily reflected in the integration and innovative application of technologies such as big data, blockchain, AI, and IoT within SCF. These technologies have been widely adopted, enhancing the intelligence and automation levels of SCF. Through technological integration, seamless connections and efficient operations across various stages of SCF have been achieved, driving continuous innovation and development in this field. Furthermore, technological innovation has facilitated the platformization and ecosystem construction of SCF. By establishing open SCF platforms, various enterprises, financial institutions, and technology service providers within the supply chain are interconnected, forming a collaborative ecosystem. This platform-based development not only improves the efficiency and quality of services in SCF but also provides ample opportunities for innovative applications.

Digital transformation and intelligent upgrading in SCF have been propelled by technological innovation. Through the application of information technology, SCF has achieved comprehensive digitization and intelligence, enhancing transparency, and controllability, and reducing financial risks. Additionally, digital and intelligent SCF provides enterprises with more precise and efficient financial services, thereby enhancing the overall competitiveness of the supply chain. Some scholars suggest a straightforward, user-friendly system for tracking greenhouse-gas emissions from transport and a suite of practical mitigation measures [24]. Also, it’s underscored that the urgency of continuously expanding renewable energy and addressing every sector in parallel if deeper emission cuts are to be achieved [25].

Ant Group, through its fintech subsidiary Ant Financial, has successfully built a financial services ecosystem that covers the upstream and downstream of the supply chain using technological innovation. Leveraging vast transaction data from the Alibaba platform and employing big data analytics, Ant Financial conducts credit assessments for SMEs in the supply chain, offering precise financing services. The application of blockchain technology ensures transparency and traceability in SCF transactions, enhancing transaction security and credibility. Through smart contract technology, Ant Financial automates various transactions within SCF, improving transaction efficiency and reducing operational costs. Furthermore, Ant Financial utilizes IoT technology to monitor goods in the supply chain in real-time, obtaining accurate logistics information to support financial decision-making.

JD Digits, another tech giant, has established a financial services platform that covers various stages of the supply chain through technological innovation. JD Digits utilizes transaction data and user behavior data from the JD.com platform, employing big data analytics to provide credit assessment and risk management services for enterprises in the supply chain. Blockchain technology is extensively applied in JD Digits’ SCF, ensuring transaction transparency and immutability through distributed ledgers and smart contracts, thereby enhancing transaction security and efficiency. AI technology also enables intelligent customer service and automated decision-making in SCF, enhancing service efficiency and decision-making quality. IoT technology is also employed to monitor and manage goods in real-time within the supply chain, improving transparency and controllability.

JD Finance provides efficient financing services for upstream and downstream SMEs through its SCF platform, combining big data and AI technologies. PLS-SEM indicates that learning agility boosts the uptake of digital technology innovations, and it does so largely by cultivating transformational leadership, which in turn acts as the key intermediary [28]. Through data analysis and intelligent risk control systems, JD Finance can accurately assess enterprise credit and risk, provide flexible financing solutions, and improve the overall efficiency and stability of the supply chain. AntChain, leveraging blockchain technology, has created a transparent and trustworthy ecosystem for SCF. The platform facilitates information exchange and data transparency across various stages of the supply chain, enhancing the overall efficiency and security of the supply chain. Through the AntChain SCF platform, SMEs can access financing services more conveniently, enhancing their capital turnover capability and market competitiveness.

2.4 Model construction and empirical analysis

In order to study the synergistic effect of technological innovation and SCF, this paper selects 500 listed companies from 2014 to 2021 as samples. These companies cover various industries, including manufacturing, services, and high-tech industries. The data mainly come from the following aspects: (1) Financial data: Derived from annual reports and financial statements of companies, covering financial indicators such as assets, liabilities, profits, and operating income. They are obtained from databases such as Wind and CSMAR (China Securities Index). (2) Technological innovation data: Includes R&D investment, number of patent applications, and number of technological innovation projects of enterprises. They are sourced from annual reports of enterprises, patent databases, and relevant data released by the Ministry of Science and Technology. (3) SCF data: Includes information on supply chain financing of enterprises, such as receivables financing, inventory financing, and the usage of supply chain financial products. They are sourced from financial reports of enterprises and publicly available data provided by banks and financial institutions.

The entropy weight-TOPSIS model, as a comprehensive evaluation method, can effectively assess the comprehensive performance of multi-index systems. After determining the index system, the data are processed using minimization-maximization standardization:

The entropy value

The weight

The coupling coordination model is used to evaluate the coordination relationship between two systems. The comprehensive evaluation function of the science and technology innovation system is

The equation for calculating the coordination degree

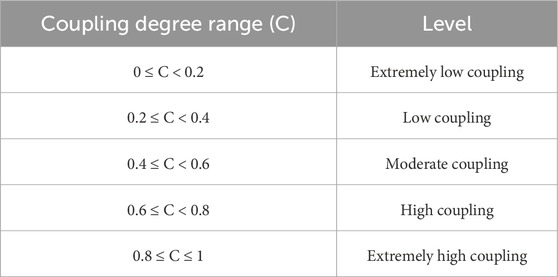

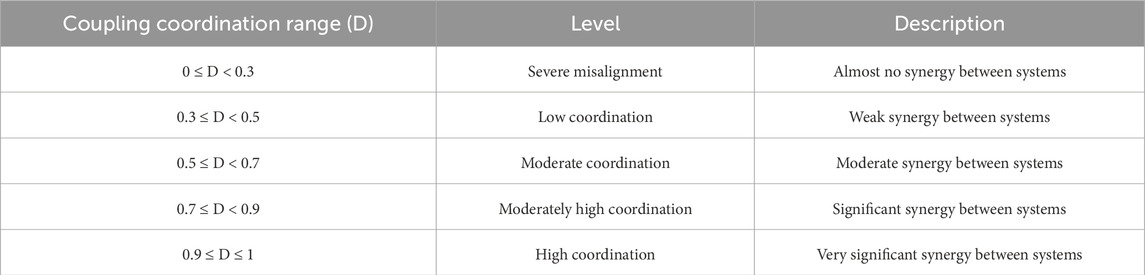

Based on the coupling degree and coordination, the synergistic relationship between SCF and technological innovation is classified into different levels, such as highly coordinated, moderately coordinated, moderately coordinated, low coordinated, and misaligned. Tables 1, 2 respectively show the division of coupling degree levels and coupling coordination level.

3 Results and discussion

3.1 Coupling coordination test

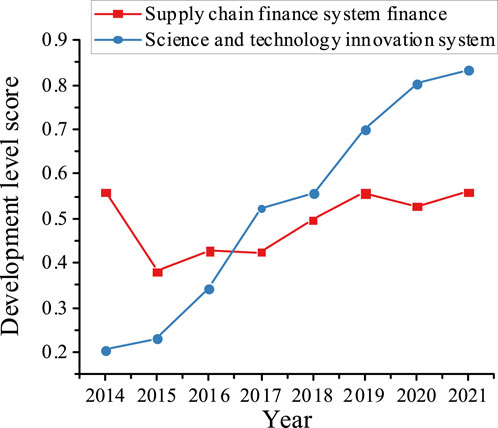

The development level of the SCF subsystem directly affects the liquidity of enterprises and the efficiency of supply chain management. Figure 5 shows the comprehensive development level of SCF and technological innovation. Data analysis from 2014 to 2021 shows that the coupling degree during this period ranged between 0.8 and 1.0. In 2015, the global financial market fluctuations and the transfer of domestic industrial chains posed significant challenges to the development of SCF, limiting its growth during this period. Starting from 2016, there was a significant increase in the coverage rate and financing amount of SCF products, indicating a wider and more mature application of SCF tools by enterprises.

With the introduction of the “Made in China 2025” strategy, the coupling coordination between SCF and technological innovation has begun to increase rapidly. Figure 6 suggests that, during this period, the coupling coordination of the composite system increased from 0.5432 in 2015 to 0.8185 in 2021, showing a significant growth rate. Technological innovation and financial innovation mutually promote each other, driving the deep integration of SCF and technological innovation. The application of new technologies such as blockchain and AI provides more innovative possibilities for SCF, while financial innovation provides more financial support and risk management tools for technological innovation. The improvement in coupling coordination implies a strengthened mutual promotion between SCF and technological innovation, enabling enterprises to better utilize financial means to support technological innovation. Meanwhile, technological innovation also provides more development opportunities and possibilities for financial activities.

3.2 Analysis of the Co-evolution of the composite system

Based on the entropy weight-TOPSIS model, this paper calculates the development levels of SCF and technological innovation from 2014 to 2021 using enterprise data, as shown in Figure 7. With the existence of co-evolution between SCF and technological innovation, interactions between the two subsystems lead to the emergence of new stable solutions within the system. Driven by this co-evolution, the dynamic evolution of the composite system exhibits an ordered structure, where changes in the technological innovation subsystem play a crucial role in the overall system stability. Co-evolution refers to the process where different parts or subsystems within a system interact with each other, leading to their mutual development and change. In the co-evolution of SCF and technological innovation, the two subsystems interact and influence each other’s development direction and speed. In this process, the technological innovation subsystem plays a leading role, with its changes significantly impacting the stability and development direction of the entire system.

When the system reaches a new stable solution, that is, the stable steady-state solution of the composite system, changes in the technological innovation subsystem play a decisive role in the overall system state. This indicates that during co-evolution, the level of technological innovation has significant effects on the stability and development of the SCF system. Therefore, in research and practice, it is essential to emphasize the driving role of technological innovation and provide strong impetus and support for the co-evolution of the SCF system.

During the co-evolution process of the composite system, the dominant servomechanism subsystem plays a crucial role. This subsystem is responsible for monitoring and regulating the interactions and feedback among various parts of the composite system to ensure its stability and coordinated development. At critical points, the dominant servomechanism subsystem particularly focuses on the status and changes of the technological innovation subsystem to ensure the stability and development direction of the entire composite system.

In the co-evolution process of the composite system, there exists a dominant order parameter that governs the evolution of the entire system, determining its stable solutions and evolutionary direction. At critical points, this order parameter is dominated by technological innovation. The level and dynamic changes of technological innovation play a decisive role in the stability and development of the entire composite system. Therefore, during co-evolution, it is crucial to pay special attention to and guide the development of technological innovation to ensure the stability and good evolutionary state of the composite system.

4 Conclusion

With technological progress and economic development, SCF and technological innovation, as crucial economic activities, play key roles in driving enterprise development and economic growth. This paper provides the first cross-industry, large-sample confirmation that “technology leads, SCF follows” in the co-evolutionary sequence, resolving prior debates on causal direction. Based on the co-evolution theory and economic effects, this paper constructs a theoretical framework to analyze the synergy effects between SCF and technological innovation. Furthermore, it employs the entropy weight-TOPSIS model and the coupling coordination model to conduct an in-depth analysis of synergy effects from both quantitative and qualitative perspectives. We scale the coupling-coordination model from regional/industry levels down to individual firms, offering a transferable quantitative toolkit for micro-level research. The paper finds that there exists a phenomenon of co-evolution between SCF and technological innovation. Their interactions mutually propel the development and changes of the entire composite system. In the process of co-evolution, technological innovation plays a leading role, exerting a crucial influence on the stability and development direction of the composite system. The research results indicate a significant synergy effect between SCF and technological innovation. Through the impetus of technological innovation, SCF achieves better development and application. Moreover, the support from SCF also provides stable financial support and risk management for technological innovation, jointly promoting innovation and enhancing the competitiveness of enterprises.

Although this paper conducts an in-depth analysis on the synergy effects between SCF and technological innovation, there are still some future research directions worth exploring. Subsequent research can further investigate the impact of different industries and enterprise scales on synergy effects, and explore more refined synergy mechanisms and models. Additionally, combining empirical research and case analysis can delve deeper into the specific practical experiences of SCF and technological innovation, providing more effective management and decision support for enterprises. By delivering a measurable, experimental and scalable “technology–finance coupling” framework, this study advances the academic conversation on digital finance and innovation management, while equipping policymakers worldwide with a scientific lever to allocate scarce resources and accelerate industrial upgrading amid uncertainty.

5 Policy implications

The policymakers can use the “Technology–Finance Coupling Index” as an Actionable Lever for Macro-Governance and Corporate Decision-Making. By translating the coupling-coordination score into a concrete policy instrument, regulators can transform academic insights into measurable, enforceable and scalable actions, dramatically raising the precision of macro-governance and the efficiency of public-resource allocation.

1. Embed the coupling-coordination score (D) into national and regional digital-economy dashboards

The empirical evidence shows that D rose from 0.54 in 2015 to 0.82 in 2021, with technological innovation consistently acting as the leading driver. Governments can operationalize this finding by setting.

• D ≥ 0.7 as a “benchmark corridor” that unlocks preferential tax, fiscal and credit incentives;

• 0.5 ≤ D < 0.7 as an “upgrade zone” where targeted grants and subsidised training are provided;

• D < 0.5 as a “red-flag zone” triggering intensified regulatory oversight and technical assistance, thereby avoiding one-size-fits-all support schemes.

2. Build a real-time “Tech–Finance” monitoring sandbox

Leveraging the replicable entropy-weight TOPSIS and coupling framework presented in the paper, the Ministry of Industry and Information Technology (MIIT) and the central bank can co-create a sector-level data sandbox. Continuous ingestion of R&D spends, patent counts, SCF volumes and non-performing-loan rates will generate a quarterly coupling index that functions as an early-warning system for liquidity or innovation bottlenecks, enabling policy tweaks before systemic stress emerges.

3. Calibrate SCF pilot programmes with precision

Once the coupling index surpasses 0.8, the marginal impact of innovation on firm performance turns exponential. Regulators should therefore prioritize high-index, technology-leading value chains (e.g., advanced equipment, new-energy vehicles) for pilots such as “blockchain + receivables financing” or “AI + dynamic inventory pledging”, while granting pilot firms access to re-lending facilities, interest subsidies or credit-guarantee fee waivers. Successful templates can then be scaled horizontally to other sectors.

4. Package place-based “dual-wheel” policy bundles

Local governments can embed coupling-index targets in their digital-economy action plans:

• For tech-leading but under-financed SMEs: “Data-enhanced” credit lines that use real-time production and logistics data to substitute traditional collateral.

• For SCF-active but R&D-shy core firms: super-deduction of R&D expenses combined with preferential re-discounting of green trade bills.

• An annual “coupling leap reward” that grants lump-sum funds or land/energy quotas to firms that move up one coordination bracket within a year.

5. Align standards and prudential rules

Codify the coupling model into industry standards: harmonize blockchain and IoT interface protocols to cut SME onboarding costs, while linking the model’s risk-weight outputs to macro-prudential assessments. This allows dynamic adjustment of banks’ SCF exposure limits, balancing innovation promotion with systemic-risk containment.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

ZL: Conceptualization, Data curation, Investigation, Methodology, Software, Writing – original draft. JZ: Conceptualization, Data curation, Investigation, Methodology, Software, Writing – original draft. LC: Data curation, Investigation, Supervision, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Du M, Chen Q, Xiao J, Yang H, Ma X. Supply chain finance innovation using blockchain. IEEE Trans Eng Management (2020) 67(4):1045–58. doi:10.1109/tem.2020.2971858

2. Jia F, Blome C, Sun H, Yang Y, Zhi B. Towards an integrated conceptual framework of supply chain finance: an information processing perspective. Int J Prod Econ (2020) 219:18–30. doi:10.1016/j.ijpe.2019.05.013

3. Hasan MM, Popp J, Oláh J. Current landscape and influence of big data on finance. J Big Data (2020) 7(1):21. doi:10.1186/s40537-020-00291-z

4. Dutta P, Choi TM, Somani S, Butala R. Blockchain technology in supply chain operations: applications, challenges and research opportunities. Transportation Res E: Logistics transportation Rev (2020) 142:102067. doi:10.1016/j.tre.2020.102067

5. Sternberg HS, Hofmann E, Roeck D. The struggle is real: insights from a supply chain blockchain case. J Business Logistics (2021) 42(1):71–87. doi:10.1111/jbl.12240

6. Govindan K, Rajeev A, Padhi SS, Pati RK. Supply chain sustainability and performance of firms: a meta-analysis of the literature. Transportation Res E: Logistics Transportation Rev (2020) 137:101923. doi:10.1016/j.tre.2020.101923

7. Lim MK, Li Y, Wang C, Tseng ML. A literature review of blockchain technology applications in supply chains: a comprehensive analysis of themes, methodologies and industries. Comput & Ind Eng (2021) 154:107133. doi:10.1016/j.cie.2021.107133

8. Paliwal V, Chandra S, Sharma S. Blockchain technology for sustainable supply chain management: a systematic literature review and a classification framework. Sustainability (2020) 12(18):7638. doi:10.3390/su12187638

9. Lee K, Azmi N, Hanaysha J, Alzoubi HM, Alshurideh MT. The effect of digital supply chain on organizational performance: an empirical study in Malaysia manufacturing industry. Uncertain Supply Chain Management (2022) 10(2):495–510. doi:10.5267/j.uscm.2021.12.002

10. Oliveira-Dias D, Maqueira-Marín JM, Moyano-Fuentes J. The link between information and digital technologies of industry 4.0 and agile supply chain: mapping current research and establishing new research avenues. Comput & Ind Eng (2022) 167:108000. doi:10.1016/j.cie.2022.108000

11. Razak GM, Hendry LC, Stevenson M. Supply chain traceability: a review of the benefits and its relationship with supply chain resilience. Prod Plann & Control (2023) 34(11):1114–34. doi:10.1080/09537287.2021.1983661

12. Nandi ML, Nandi S, Moya H, Kaynak H. Blockchain technology-enabled supply chain systems and supply chain performance: a resource-based view. Supply Chain Manag An Int J (2020) 25(6):841–62. doi:10.1108/scm-12-2019-0444

13. An S, Li B, Song D, Chen X. Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur J Oper Res (2021) 292(1):125–42. doi:10.1016/j.ejor.2020.10.025

14. Kouhizadeh M, Saberi S, Sarkis J. Blockchain technology and the sustainable supply chain: theoretically exploring adoption barriers. Int J Prod Econ (2021) 231:107831. doi:10.1016/j.ijpe.2020.107831

15. Bag S, Gupta S, Kumar S, Sivarajah U. Role of technological dimensions of green supply chain management practices on firm performance. J Enterprise Inf Management (2021) 34(1):1–27. doi:10.1108/jeim-10-2019-0324

16. Aslam J, Saleem A, Khan NT, Kim YB. Factors influencing blockchain adoption in supply chain management practices: a study based on the oil industry. J Innovation & Knowledge (2021) 6(2):124–34. doi:10.1016/j.jik.2021.01.002

17. Munir M, Jajja MSS, Chatha KA, Farooq S. Supply chain risk management and operational performance: the enabling role of supply chain integration. Int J Prod Econ (2020) 227:107667. doi:10.1016/j.ijpe.2020.107667

18. Kurpjuweit S, Schmidt CG, Klöckner M, Wagner SM. Blockchain in additive manufacturing and its impact on supply chains. J Business Logistics (2021) 42(1):46–70. doi:10.1111/jbl.12231

19. Di Vaio A, Varriale L. Blockchain technology in supply chain management for sustainable performance: evidence from the airport industry. Int J Inf Management (2020) 52:102014. doi:10.1016/j.ijinfomgt.2019.09.010

20. Del Giudice M, Chierici R, Mazzucchelli A, Fiano F. Supply chain management in the era of circular economy: the moderating effect of big data. The Int J Logistics Management (2021) 32(2):337–56. doi:10.1108/ijlm-03-2020-0119

21. Wong LW, Tan GWH, Lee VH, Ooi KB, Sohal A. Unearthing the determinants of blockchain adoption in supply chain management. Int J Prod Res (2020) 58(7):2100–23. doi:10.1080/00207543.2020.1730463

22. Long H, Zhang H, Wu T, Han J. The effect of resource restructuring on supply chain resilience in the context of digital transformation. Systems (2025) 13(5):324. doi:10.3390/systems13050324

23. Yang Y, Lin GT. Local digital economic growth, enterprise digital transformation, and digital dividends: evidence from China. Systems (2025) 13(4):297. doi:10.3390/systems13040297

24. Bozoudis V, Sebos I. The carbon footprint of transport activities of the 401 military general hospital of Athens. Environ Model & Assess (2021) 26(2): 155–62. doi:10.1007/s10666-020-09701-1

25. Tsepi E, Sebos I, Kyriakopoulos GL. Decomposition analysis of CO2 Emissions in Greece from 1996 to 2020. Strateg Plann Energy Environ (2024) 517–44. doi:10.13052/spee1048-5236.4332

26. Lee BW, Darmadi D, Gardanova Z, Kostyrin E, Gilmanova N, Kosov M, et al. Impact of digital transformation on mental healthcare: opportunities, challenges, and role of AI Chat-bots in symptom management. Emerging Sci J (2024) 8(4):1440–61. doi:10.28991/esj-2024-08-04-012

27. Esamah A, Aujirapongpan S, Rakangthong NK, Imjai N. Agile leadership and digital transformation in savings cooperative limited: impact on sustainable performance amidst COVID-19. J Hum Earth, Future (2023) 4(1):36–53. doi:10.28991/hef-2023-04-01-04

Keywords: digital transformation, technological innovation, supply chain finance, synergistic effect, listed companies

Citation: Liu Z, Zhang J and Cao L (2025) The synergistic effect of digital transformation technology and supply chain finance: empirical evidence from 500 listed companies. Front. Phys. 13:1664273. doi: 10.3389/fphy.2025.1664273

Received: 11 July 2025; Accepted: 11 August 2025;

Published: 25 August 2025.

Edited by:

Grigorios L. Kyriakopoulos, National Technical University of Athens, GreeceReviewed by:

Ioannis Sebos, National Technical University of Athens, GreeceOmid Aminoroayaie Yamini, K. N. Toosi University of Technology, Iran

Copyright © 2025 Liu, Zhang and Cao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zongtuan Liu, enRsaXVAbmJ1ZmUuZWR1LmNu

Zongtuan Liu

Zongtuan Liu Jiajie Zhang

Jiajie Zhang Lei Cao4

Lei Cao4