- 1College of Wealth Management, Ningbo University of Finance and Economics, Ningbo, China

- 2College of Digital Technology and Engineering, Ningbo University of Finance and Economics, Ningbo, China

Introduction: In the new pattern of digital economy, digital finance, as an innovative financial model, is reshaping the development path of cities, yet its impact on resourcebased cities remains largely unexplored.

Methods: Based on the panel data of resourcebased cities in China from 2014 to 2023, this paper uses the mediation effect model to investigate the mechanism by which digital finance affects urban economic development through regional innovation and industrial structure. By constructing the urban heterogeneity grouped regression model, this paper analyzes the differentiated impact of digital finance on resource-based cities at different development stages (mature, regenerative, growing and declining). Meanwhile, through the interaction effect analysis, this paper explores the synergistic effect between digital finance and regional entrepreneurship.

Result: We find that (1) Digital finance affects urban economic development through the positive mediating effect of regional innovation and the negative mediating effect of industrial structure, showing significant dual characteristics; (2) Further heterogeneity analysis shows that the impact of digital finance on cities at different stages of development is significantly different: it has the most significant promoting effect on mature and regenerating cities, followed by growing cities, while the effect on declining cities is relatively weak; (3) At the same time, the study identifies the “critical point effect” of digital financial development, which provides a theoretical basis for formulating differentiated urban development strategies.

Discussion: This study systematically reveals the transmission mechanism of digital finance on the economic development of resource-based cities, and provides theoretical basis and practical enlightenment for formulating differentiated digital inclusive financial policies and promoting the high-quality transformation of resource-based cities.

1 Introduction

As a special type of city established based on the development of natural resources, the resource-based city has an important strategic position in the national economic development. However, these cities are generally faced with development difficulties such as single industrial structure, insufficient innovation capacity and serious environmental pollution [1]. Especially in declining resource cities, the pressure of economic transformation is more prominent, and the traditional financial system is difficult to meet the financing needs of its transformation and development [2]. As a product of scientific and technological innovation and financial deepening, digital finance is reshaping the traditional financial service model. Its characteristics of low cost, high efficiency and wide coverage provide new opportunities for the economic transformation of resource-based cities [3]. Digital finance can effectively reduce information asymmetry, improve the availability of financial services, provide more convenient financing channels for the development of small and medium-sized enterprises, and help the optimization and upgrading of industrial structure [42].

Research on the impact of digital finance on China’s environmental governance, urban economic development, and other aspects has been very rich at the enterprise level, urban level, and provincial level. Different from using resource-based cities as sub-samples for heterogeneity testing, this paper takes resource-based cities as the main research subject rather than a supplement to heterogeneity analysis, and constructs a theoretical framework for the impact of digital finance on the economic development of resource-based cities. However, the specific mechanism of how digital finance affects the economic transformation of resource-based cities through industrial upgrading and regional innovation is still unclear. In particular, under the perspective of integrating institutional economics and innovation diffusion theory, key issues such as whether and how digital finance can solve the resource curse, its mechanism of action in different types of resource-based cities, and the moderating role of policy environment still need to be further explored. In view of these research gaps, this paper constructs a special analysis framework, designs a more accurate identification strategy, and adopts multiple method combination for empirical test, which provides new theoretical perspective and empirical evidence for understanding the transformation of resource-based economy driven by digital finance.

To address these questions, this paper investigates the impact of digital finance on the economic development of resource-based cities in China, using panel data from 116 cities between 2014 and 2023. A two-way fixed effects model is employed to control for time and individual fixed effects, and potential endogeneity issues are addressed through instrumental variable approaches and quasi-natural experiments. In addition, the role and mechanism of industrial structure upgrading, regional innovation and entrepreneurship in the relationship between digital finance and economic development is also discussed. The possible marginal contribution of this paper lies in: (1) It provides new insights into the relationship between digital finance and the economic development of resource-based cities, and fills an important gap in the literature. Unlike previous studies that have focused on macro-level impacts, this study specifically examines how digital finance influences the economic development of resource-dependent areas. (2) A comprehensive analytical framework is established to systematically examine three key channels: industrial structure upgrading, regional innovation and entrepreneurial activities, and deeply explains how digital finance can help break the “resource curse.” (3) The empirical strategy of combining two-way fixed effect model with instrumental variable method and quasi-natural experiment is adopted to provide empirical evidence on the heterogeneous impact of digital finance on different types of resource-based cities, and contributes to the theoretical understanding and practical application of regional economic development policies. These contributions not only advance academic research on digital finance and regional economic development, but also provide valuable references for policymakers committed to promoting sustainable development in resource-dependent regions.

2 Literature review

2.1 Literature review of resource-based cities

Resource-based city is the type of city with natural resources mining and processing as the leading industry. The proportion of mining industry and raw material industry exceeds 40%, and resource reserves and development activities have an important impact on urban economic and social development [4]. According to the stage of resource development and the level of economic development, resource-based cities can be divided into four types: growing, mature, declining and regenerative. Growing cities are rich in resources and great development potential. Mature cities have a large scale, but face the challenge of single industrial structure. Declining cities encounter resource exhaustion and weak economic growth. Regenerative cities have begun to foster emerging industries and gradually get rid of resource dependence [5]. Empirical studies show that China’s resource-based cities generally have problems such as the low quality of economic growth, unbalanced industrial structure, and serious environmental pollution, which is highly consistent with the phenomenon described by the “resource curse” theory [6]. International experience research shows that the key to the sustainable development of resource-based cities lies in accelerating the adjustment of industrial structure, strengthening the drive of scientific and technological innovation, improving the environmental governance mechanism, and building a diversified economic development model [4]. These theoretical research and practical experience provide important enlightenment for exploring the transformation and development path of China’s resource-based cities.

2.2 Literature review of digital finance

Digital finance is a new financial service model generated by the development of Internet, big data and artificial intelligence and other technologies. Its connotation has gradually expanded from the initial electronic payment to diversified financial services such as online credit and online financial management [7]. Digital finance has significant advantages of universality, convenience and low cost. It can break through the geographical limitations of traditional financial services, provide personalized services for long tail customers, and rely on big data risk control to effectively reduce information asymmetry; it can also significantly reduce transaction costs through the Internet platform [8]. From the perspective of development status, new financial forms represented by mobile payment, online lending and digital currency are constantly emerging [9]. China’s development in the field of digital inclusive finance is particularly significant, which effectively improves the availability of financial services in rural areas and low-income people [10]. Empirical studies show that digital finance promotes economic development through various mechanisms. For example, it has improved the financing constraints of small and micro businesses by improving the accessibility of financial services [11]. By reducing transaction costs and information asymmetry, the financial asset allocation efficiency improves the household consumption level and its efficiency [42]. At the same time, the application of digital technology has promoted the business innovation of traditional financial institutions and injected new impetus into economic growth [12]. However, the development of digital finance also brings new problems, such as data security, financial risks and regulatory challenges, which require an adaptive regulatory framework.

2.3 Research review of digital finance’s influence on resource-based cities

As a new financial service model, digital finance has exerted a significant impact on the economic transformation and development of resource-based cities. In terms of industrial structure optimization, digital finance has promoted the development of non-resource-based industries, especially the service industry, by reducing financing costs and providing inclusive financial services, and effectively alleviated the dilemma of “single industry” in resource-based cities [13]. The popularization of digital payment and Internet credit has significantly increased the proportion of the tertiary industry in resource-based cities and accelerated the process of advanced industrial structure [43]. In terms of innovation-driven development, digital finance provides more flexible financing channels for technology-oriented enterprises and effectively alleviates the financing constraints of innovation subjects [14]. The development of digital financial platforms is significantly and positively correlated with the number of patent applications and the intensity of R&D investment in resource-based cities, indicating that digital finance is conducive to promoting the agglomeration of innovation elements and the transformation of scientific and technological achievements [15]. In terms of improving financial efficiency, the application of digital technology has significantly reduced the degree of information asymmetry and improved the efficiency of credit resource allocation [8]. The development of digital finance has reduced the non-performing loan ratio of banks, improved the efficiency of financial resource allocation, and provided strong support for economic transformation [16].

2.4 Research gaps and contributions

Previous studies have provided useful insights into the link between digital finance and economic growth, but there are still the following gaps: Firstly, most studies focus on the overall impact of digital finance on the macro economy, while few studies focus on how digital finance affects the economic growth of resource-dependent cities. Secondly, most of the research mainly focuses on the overall level of digital finance, and the exploration of the specific dimensions of digital finance (such as coverage breadth, depth of use, digital level, etc.) is limited. Thirdly, the extent to which digital finance affects different types of resource-based cities (such as growing, mature, regenerative, and declining cities) is not well understood. This paper aims to fill these gaps. It examines the impact of digital finance on the economic development of resource-based cities in China, and focuses on the role of industrial structure upgrading, regional innovation and entrepreneurship. By comparing the impact of digital finance in different resource-based cities, it provides a more comprehensive understanding of how digital finance promotes the sustainable economic development.

3 Theoretical analysis and research hypotheses

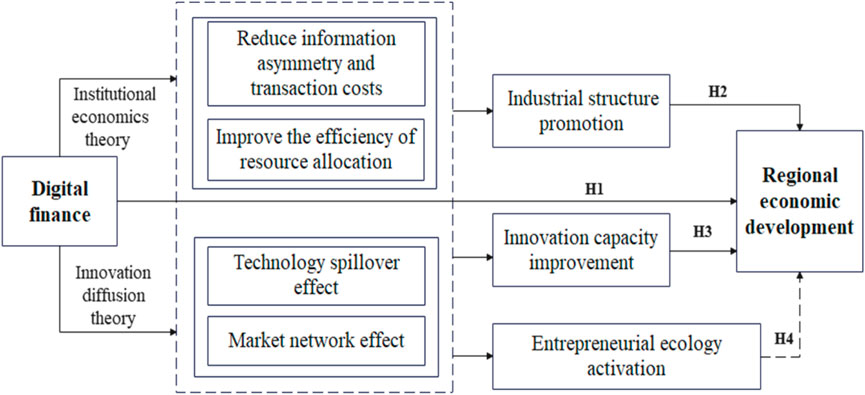

Based on the dual perspective of institutional economics and innovation diffusion theory, this paper constructs a theoretical framework for digital finance to influence the economic development of resource-based cities [17]. At the institutional level, digital finance reconstructs the allocation rules of financial resources by reducing information asymmetry [18] and institutional transaction costs [19]: On the one hand, digital technology reduces the cost of information search and contract performance; on the other hand, inclusive financial instruments (such as mobile payment and P2P lending) improve the efficiency of capital allocation by reducing intermediate links [11]. In terms of innovation diffusion, digital finance, as a technology carrier [44], drives regional economic transformation through two types of paths: First, the technology spillover effect, that is, digital financial infrastructure (such as blockchain, big data risk control) reduces the cost of innovation trial and error; Second, the market network effect, which accelerates the agglomeration of innovation factors (technology and talent) to resource-based cities [20]. Finally, the synergistic effect of system optimization and innovation diffusion, through the transmission path of industrial structure upgrading and entrepreneurial ecology activation, realizes the transition of economic development from resource dependence to innovation-driven (see Figure 1 for the specific mechanism).

As an innovative financial service model, digital finance has significantly improved the availability of financial services and reduced transaction costs [21]. Its development has effectively alleviated the problem of credit constraints, improved the level of household financial inclusion, and had a significant positive impact on economic growth [8]. Specifically, by reducing transaction costs and improving service efficiency, digital finance has expanded the coverage of financial services [16], opened up new business opportunities and financing channels for small and medium-sized enterprises, and promoted the cultivation and growth of emerging industries [22]. In the development of resource-based cities, the popularization and application of digital finance has injected new development energy into the regional economic transformation and sustainable development [23]. Based on this, this paper proposes Hypothesis 1: Digital finance helps improve the economy of resource-based cities.

Digital finance promotes the optimization and upgrading of the industrial structure through different mechanisms [24]. By reducing financing costs and improving the efficiency of resource allocation, the transformation of traditional industries has been promoted [25]. Digital finance provides necessary financial support for emerging industries, cultivates new economic growth points, and promotes industrial diversification through inclusive financial services [26]. Based on this, this paper proposes Hypothesis 2: Digital finance facilitates economic advancement in resource-based cities through structural industrial transformation.

Digital finance promotes economic growth by promoting regional innovation capacity. Digital finance provides a variety of financing tools and reduces the cost of innovative financing [27], while fintech innovation improves the efficiency of financial services and provides support for innovation-driven development. The development level of digital finance is significantly positively correlated with the number of patent applications and the intensity of R&D investment, and this promotion effect is more obvious in less developed areas [8]. Based on this, this paper proposes Hypothesis 3: Digital finance helps economic growth in resource-based cities through regional innovation.

The entrepreneurial business environment provides a broad space for the application and innovation of digital finance. Resource-based cities with an active entrepreneurial atmosphere usually have a more open culture of innovation, and entrepreneurs are more likely to accept new financial tools and service models [28]. The demand of a large number of entrepreneurs for convenient financial services has driven the continuous innovation of digital finance [29,30]. Based on this, this paper proposes Hypothesis 4: Resource cities with active regional entrepreneurship can better utilize the enhancement effect of digital finance on their economic development.

4 Research design

4.1 Sample selection and instructions

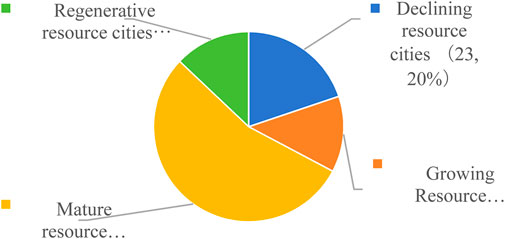

According to the National Sustainable Development Plan for Resource-based Cities compiled and issued by the Development and Reform Commission of The State Council, there are 262 resource-based cities at the prefecture-level level. Excluding the resource-based cities with serious data loss, a total of 116 resource-based cities were obtained as sample data. Among them, there are 23 resource-declining cities, 15 resource-renewable cities, 15 growth cities and 63 mature cities. The control variables and other data selected in the empirical research part are all from the China City Statistical Yearbook over the years, and the data of digital finance are from the Digital Inclusive Finance Index (PKU-DFIIC) published by the Digital Finance Research Center of Peking University. The type distribution of resource-based cities is shown in Figure 2.

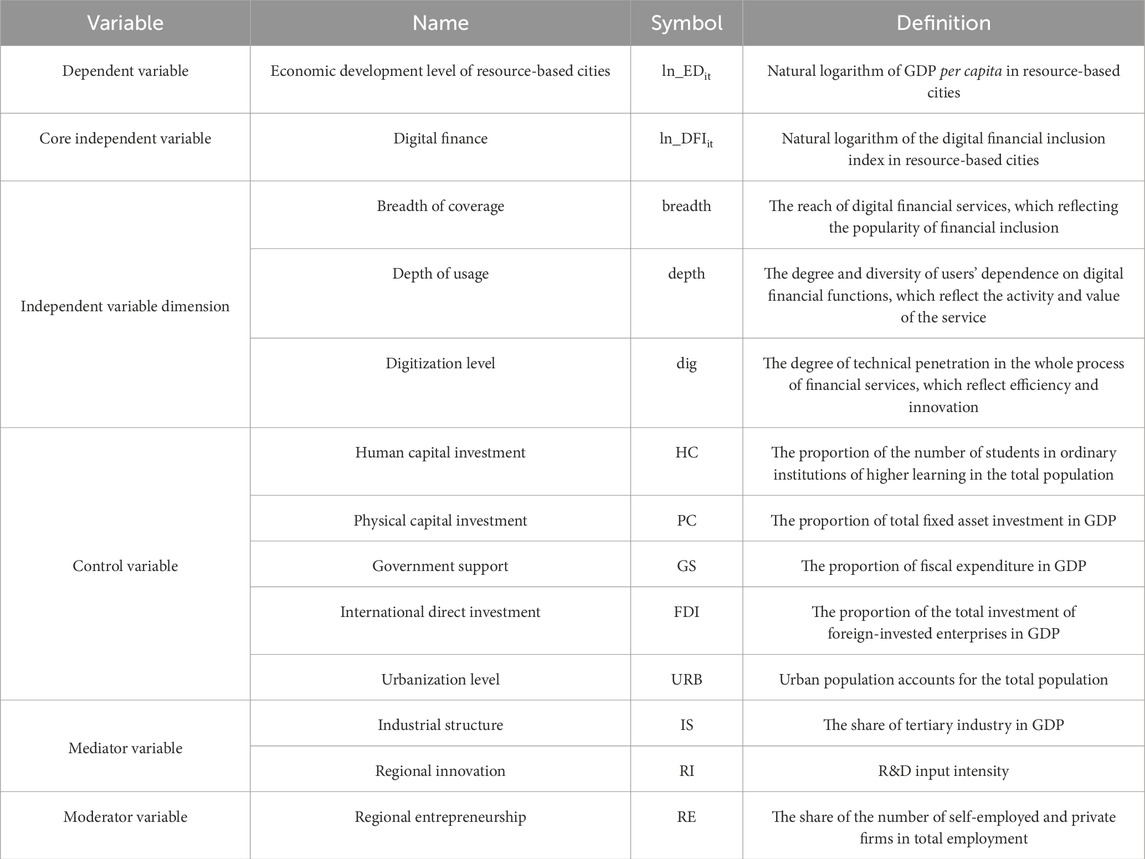

4.2 Variable selection and data sources

4.2.1 Explained variable (ln_EDit)

The explained variable represents the economic development level of resource-based city i in year t. This paper refers to the study of Cao et al. [31] to use the city’s per capita GDP to measure the level of economic development of resource-based cities, and takes the natural logarithm to deal with it.

4.2.2 Core explanatory variable (ln_DFIit)

DFIit is the development level of digital finance in resource-based cities. The digital financial index mainly consists of three dimensions: breadth of coverage (measuring account penetration and service point distribution),depth of usage (capturing transaction frequency, credit services, and digital payment adoption), and digitalization level (reflecting the integration of digital technology in financial services). This paper draws on the research ideas of Guo et al. [32], uses the urban digital financial inclusion index to measure, and takes the natural logarithmic processing. The larger the index is, the higher the level of digital financial inclusion development is.

4.2.3 Control variables

In this paper, referring to previous studies of Zuo et al. [45], Xu et al. [33], Lin and Ma [34], Rahim et al. [35], the following control variables were selected: Human capital investment (HC) is expressed by the proportion of the number of students in ordinary institutions of higher learning in the total population. Physical Capital investment (PC), expressed by the proportion of total social fixed asset investment in GDP. Government support (GS), expressed by the proportion of fiscal expenditure to GDP. International direct investment (FDI) is expressed by the proportion of total investment by foreign-invested enterprises in GDP. Urbanization level (URB) is expressed by the proportion of urban population in the total population.

4.2.4 Mediator variable

This paper takes industrial structure and regional innovation as the mediating variables to explore the influence of digital finance on the economic development of resource-based cities. The industrial structure (IS) is measured by the proportion of the tertiary industry in GDP; Regional innovation (RI) takes R&D investment intensity as the measurement index.

4.2.5 Moderator variable

This paper takes regional entrepreneurship as a moderating variable to explore whether digital finance can promote the economic development of resource-based cities by promoting regional entrepreneurship. Regional entrepreneurship (RE) is measured by the proportion of total employment in self-employment and private enterprises [36]. The variables are described in Table 1.

4.3 Model design

In order to explore the impact of digital finance on the economic development level of resource-based cities, the following panel data regression models were established according to the studies of Liu et al. [37] and Cao et al. [31]:

where ln_EDit denotes the economic development level of city i in year t, ln_DFIit denotes the digital finance level of city i in year t, Controlit denotes the set of control variables at the municipal level, αi denotes the area fixed effect, γt denotes the time fixed effect, and εit denotes the random disturbance term.

4.4 Empirical results and analysis

4.4.1 Descriptive statistics

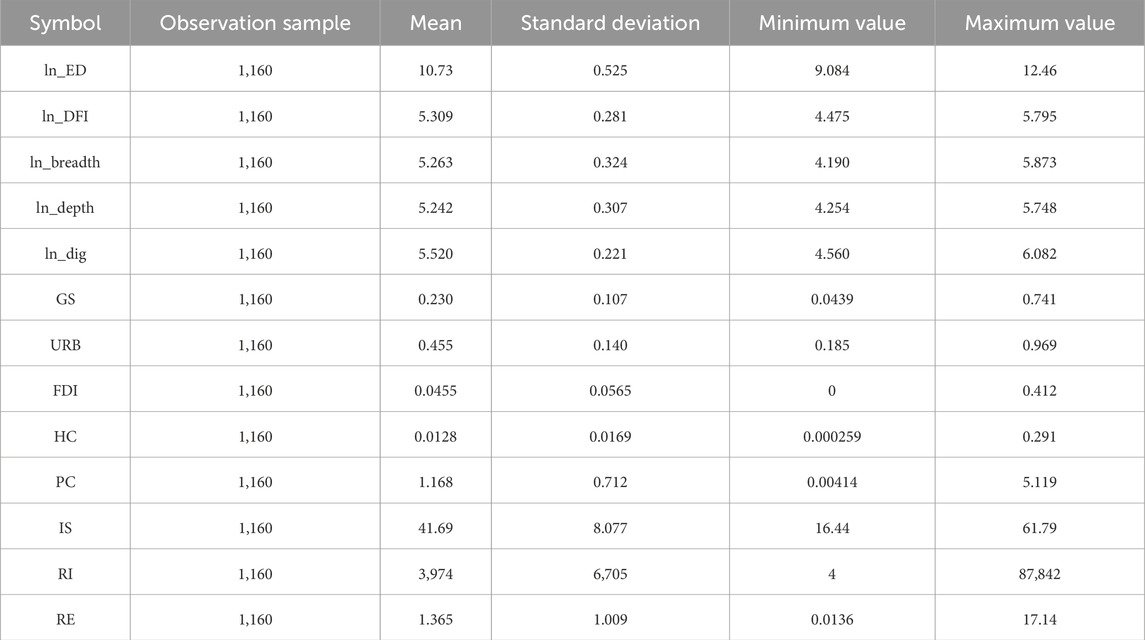

Table 2 presents the descriptive statistics of the key variables. The logarithm of GDP per capita (ln_ED) shows a mean value of 10.732 with a standard deviation of 0.525, indicating substantial variations in economic development levels across resource-based cities. The digital financial index (ln_DFI) exhibits a mean of 5.309, with a range of 1.320 between its maximum and minimum values, suggesting significant disparities in digital financial development. From the specific dimensions of digital financial inclusion,the average values of breadth (ln_breadth), depth (ln_depth) and digitalization level (ln_dig) are 5.263, 5.242 and 5.520 respectively, and the standard deviation is 0.324, 0.307 and 0.221 respectively, indicating that the development level of digital finance in different dimensions is relatively balanced.

Among the control variables, the average value of physical capital investment (PC) is 1.168, the standard deviation is 0.712, and the maximum value reaches 5.119, showing a large investment difference. The average value of human capital investment (HC) is 0.0128 and the standard deviation is 0.0169, reflecting the relatively low input of human capital. The average value of government support (GS) and foreign direct investment (FDI) is 0.230 and 0.0455 respectively, and the standard deviation is 0.107 and 0.0565 respectively, indicating that the degree of government intervention and the level of foreign capital introduction are generally low. The average urbanization rate (URB) is 0.455, the standard deviation is 0.140, and the gap between the maximum value of 0.969 and the minimum value of 0.185 reaches 0.784, showing significant differences in the process of urbanization.

In addition, the standard deviation of industrial structure (IS), technological innovation (RI) and resource entrepreneurship (RE) is relatively large (8.077, 6.705 and 1.009 respectively), indicating that resource-based cities have obvious differences in industrial transformation, innovation ability and environmental performance. These data highlight the diversity of resource-based cities in China at different stages of economic development, especially the heterogeneous characteristics of economic base, digital financial infrastructure and transformation development, which may affect the role of digital financial development in promoting economic growth.

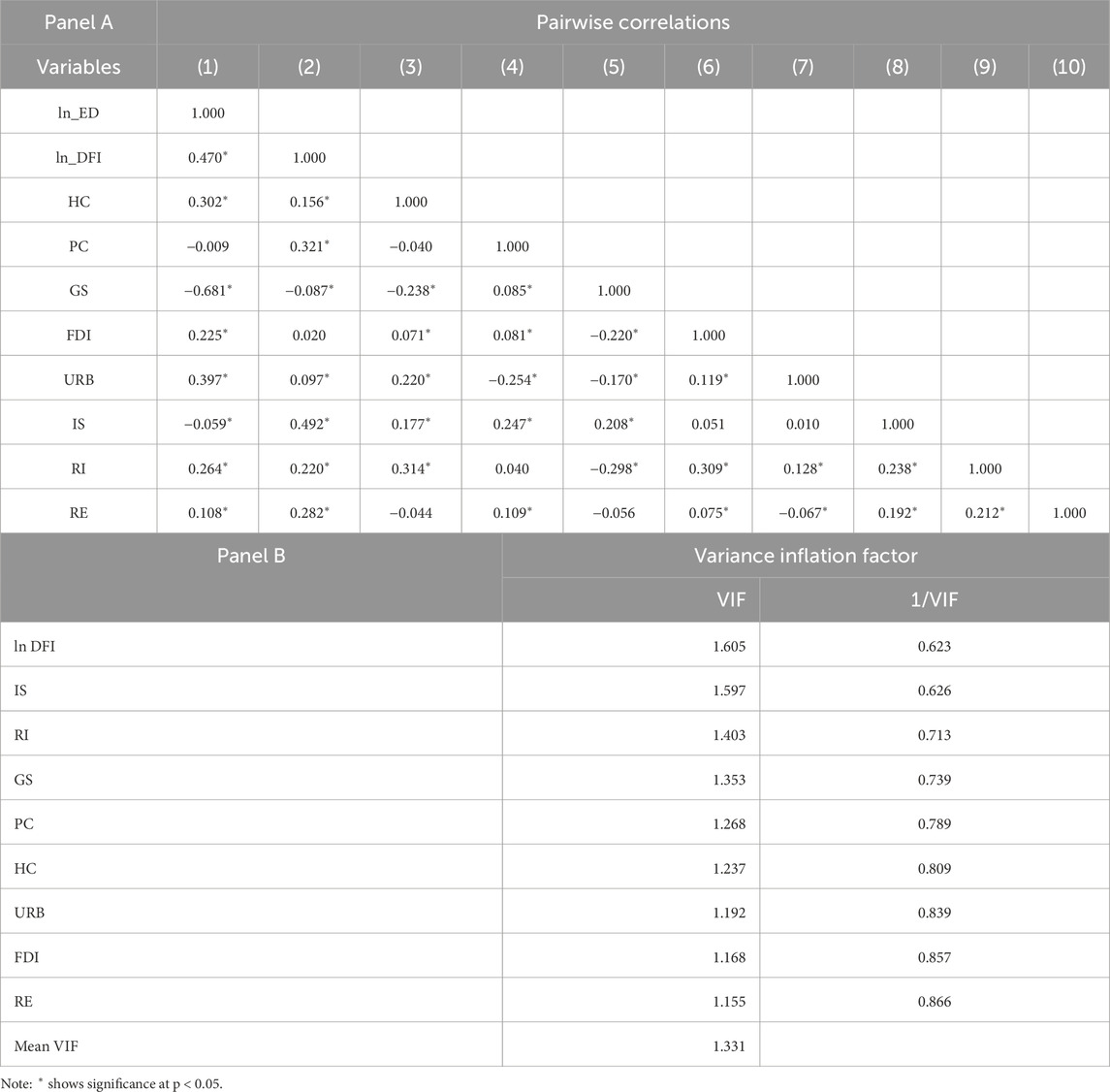

In order to test the correlation between variables in the model and the problem of multicollinearity, correlation and VIF tests were conducted in this study, and the results are shown in Table 3. The results of correlation analysis and multicollinearity test show that there is no serious correlation problem between variables. The correlation matrix shows that the level of economic development (ln_ED) is significantly positively correlated with digital financial inclusion (ln_DFI) (0.470, p < 0.05), and negatively correlated with government support (GS) (−0.681, p < 0.05). The correlation coefficient between digital inclusive finance and industrial structure (IS) is the highest (0.492, p < 0.05), but it is still significantly lower than the critical value of 0.7. The VIF test further supports the judgment that there is no serious multicollinearity among the variables: the VIF value of all variables is less than 2, far below the critical value of 5 or 10. Among them, the VIF value of digital inclusive finance index is the highest (1.605), followed by industrial structure (1.597), and the average VIF value of the model is 1.331. These test results jointly show the reliability of regression analysis and support the validity of subsequent empirical analysis.

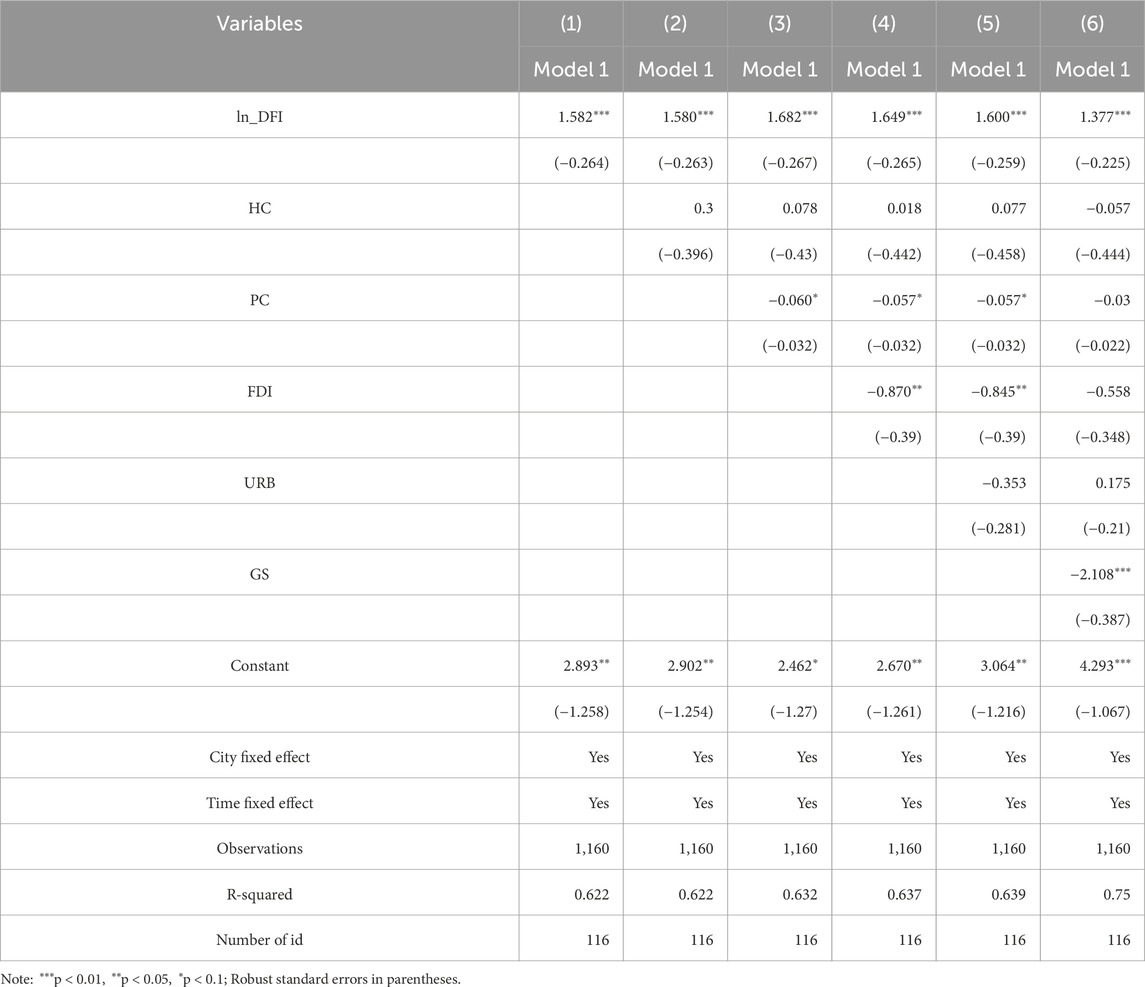

4.4.2 Benchmark regression results

In order to verify whether digital finance can promote the economic development of resource-based cities, this paper uses model (1) for regression, and the control variables are gradually added to the model for analysis, as shown in Table 4. The results listed in Table 4 (1) show that the estimated coefficient of digital finance (ln _ DFI) is positive when studying only the impact of digital finance on the economic development of resource-based cities. When the control variable was gradually included in the regression, the coefficient was still positive. After including all control variables in the model for regression, the estimated coefficient for digital finance (ln _ DFI) was 1.377 and significant at the 1% level. This indicates that digital finance can effectively promote the economic development of resource-oriented cities, which verifies Hypothesis 1.

4.4.3 Endogeneity concerns

4.4.3.1 Tool variable method

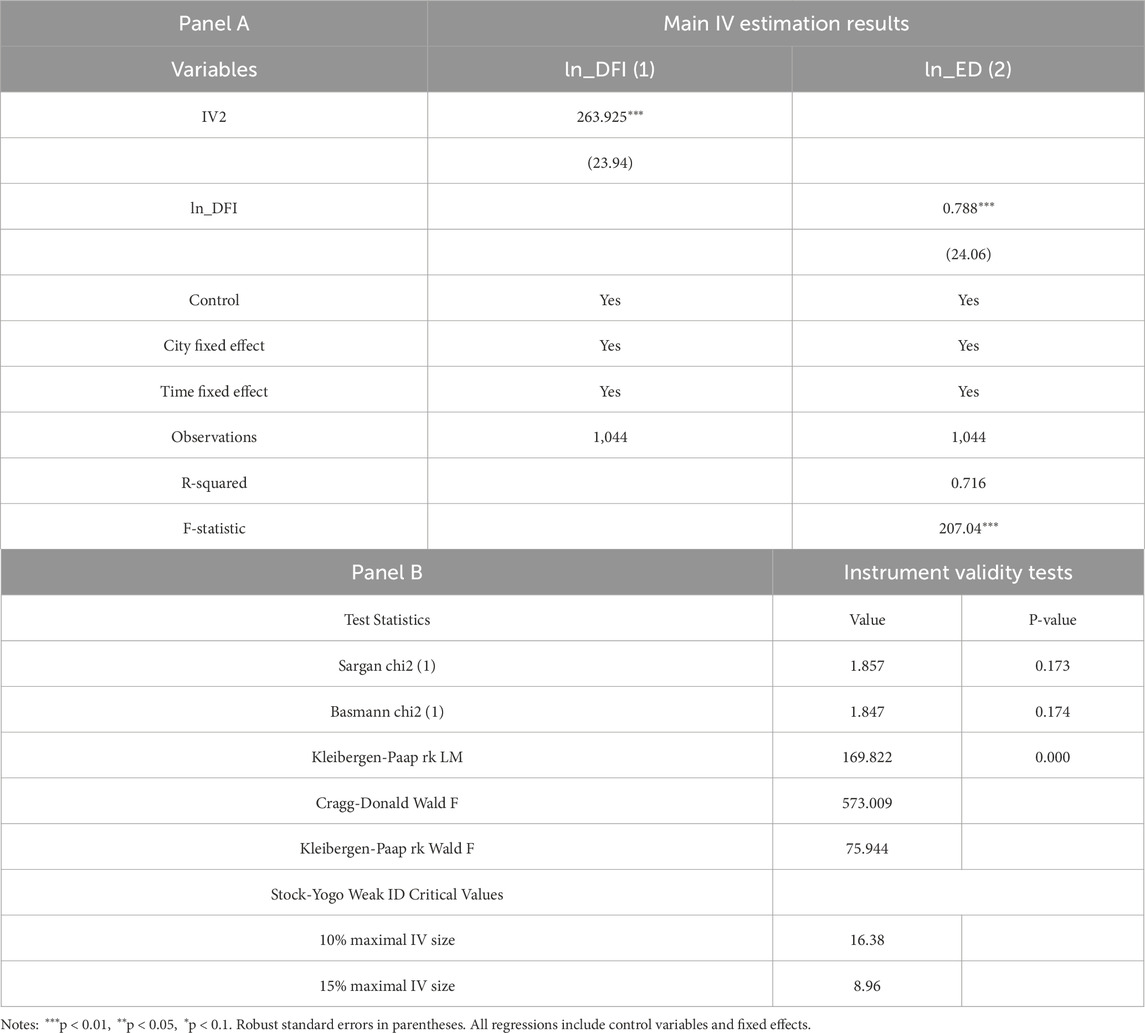

In order to solve the endogenous problem caused by the reverse causality, this paper constructs the interaction term of the inverse of the geographical distance between resource-based city and Hangzhou (which varies with individuals) and the lagged one-period Digital Financial Inclusion Index (which varies over time) as an instrumental variable for the variable ln_DFI. Table 5 presents the main results of the IV estimation and the test of the validity of the instrument. The results of empirical tests show that the validity of instrumental variables is supported by multiple tests. The Sargan test (χ2 (1) = 1.857, p = 0.173) and Basmann test (χ2 (1) = 1.847, p = 0.174) failed to reject the null hypothesis that the instrumental variables were valid, and supported the exclusive hypothesis that geographical distance only affects economic development through digital financial inclusion. The identification strength of the instrumental variables is confirmed by several tests: The Kleibergen-Paap rk LM statistic was 169.822 (p < 0.001), which strongly rejected the original hypothesis of under-identification; The Cragg-Donald Wald F-statistic (573.009) and Kleibergen-Paap rk Wald F-statistic (75.944) both significantly exceed the Stock-Yogo critical value of 16.38 at the level of 10%, indicating that the instrumental variables are well identified; The F-statistic of the first stage was 207.04 (p < 0.001), which further confirmed the correlation of the instrumental variables. The instrumental variable estimation results show that digital financial inclusion has a significant positive impact on economic development (β = 0.788, p < 0.01), and the effect is still robust after controlling for urban, time fixed effects and other related variables. These test results collectively support the validity of the instrumental variables: the instrumental variables meet the exclusive requirements, have strong correlation with the endogenous variables, and the identification results remain robust after considering heteroscedasticity.

4.4.3.2 Difference-in-differences regression

To address potential endogeneity concerns, this paper employs a difference-in-differences (DID) approach to examine the impact of digital finance development on enterprise development. In December 2015, the People’s Bank of China and other nine departments jointly issued the “Guiding Opinions on Promoting the Healthy Development of Internet Finance,” which marks a significant policy shock for China’s digital finance sector. Following this quasi-natural experiment, we construct our DID model by dividing cities into treatment and control groups based on their digital finance development index (DFI) in 2015. Specifically, cities with DFI above the median are assigned to the treatment group, while those below the median constitute the control group.

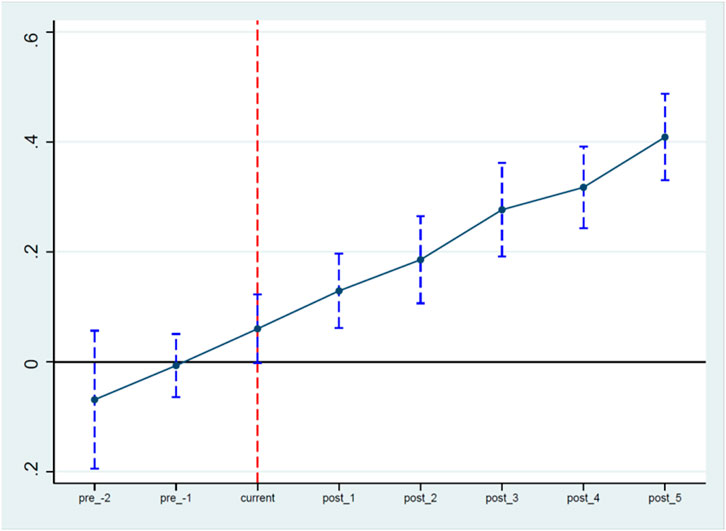

In order to verify the reliability of DID method, a parallel trend test was conducted first. Figure 3 shows the dynamic effects of the treatment group and the control group before and after policy implementation. It can be observed from Figure 3 that before the implementation of the policy (pre_2 and pre_1 periods), the estimated coefficient of the treatment effect is not significantly different from 0 (the confidence interval contains 0), indicating that the treatment group and the control group have similar change trends before the implementation of the policy, which satisfies the parallel trend hypothesis of DID method. After the implementation of the policy, the treatment effect showed a significant upward trend: in the early stage (post_1 and post_2), the treatment effect gradually emerged; in the middle stage (post_3 and post_4), the effect was further enhanced; at the end of the observation period (post_5), the treatment effect reached about 0.4. This trend of continuous enhancement shows that the promotion effect of digital finance development on enterprise development has long-term and cumulative characteristics.

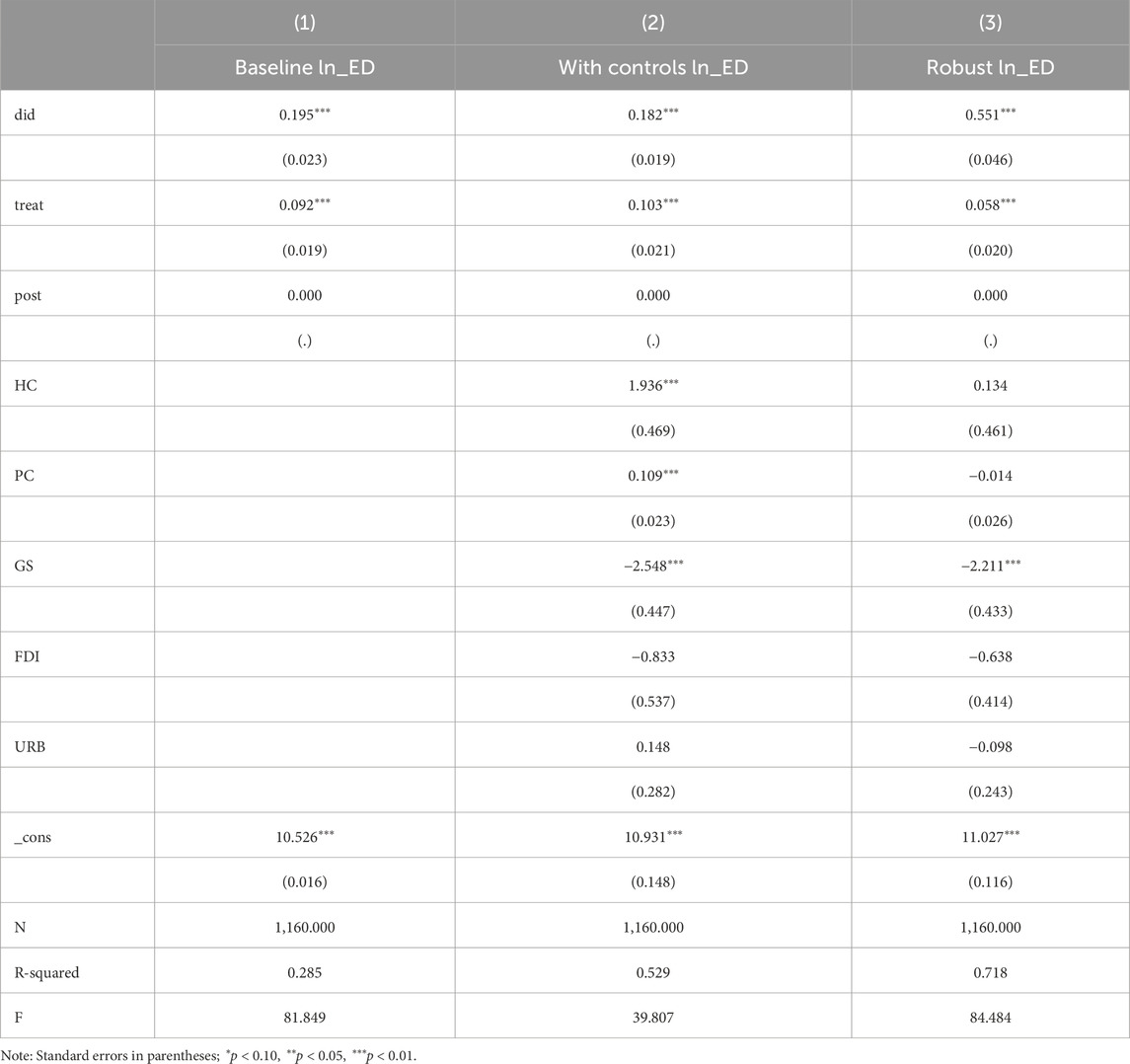

Table 6 reports the double difference (DID) estimates. Column (1) is the result of the benchmark model, column (2) is the result of adding control variables, and column (3) is the robustness test. The DID coefficient is significantly positive at the 1% level in all models, and the coefficient ranges from 0.182 to 0.551, indicating that the policy intervention has a significant positive effect. The coefficient of the treatment group dummy variable (treat) remained significantly positive (0.058–0.103). Among the control variables, human capital (HC) and physical capital (PC) show a significant positive effect (coefficient is 1.936 and 0.109 respectively), while government support (GS) shows a significant negative effect (−2.548). The explanatory power of the model increased from 0.285 in the benchmark model to 0.718 in the robustness test, indicating that the results are highly reliable.

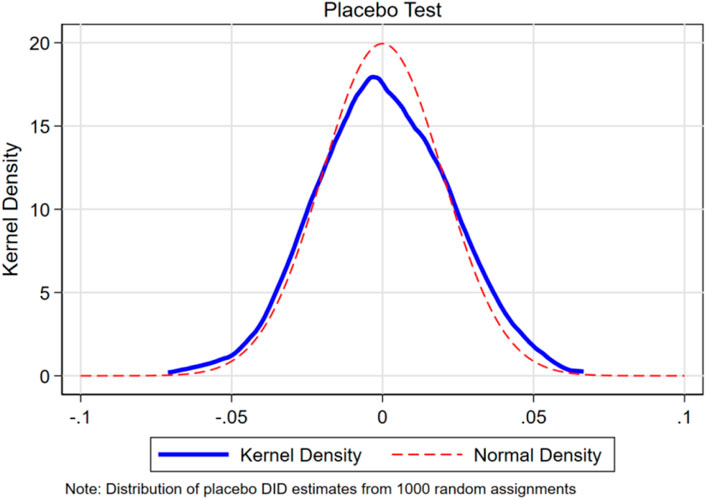

To verify the reliability of the results, a placebo test was conducted. Specifically, simulated DID estimates were generated by randomly assigning 1,000 treatments to the treatment group and the control group. Figure 4 shows the kernel density distribution (blue solid line) and the corresponding normal distribution fit curve (red dashed line) of these estimated coefficients. The results showed that the estimated values generated by random allocation showed a good normal distribution, with the distribution center close to 0% and 95% of the estimated values distributed within the range of ±0.05. This suggests that the benchmark results of this paper are unlikely to be caused by random factors or other unobserved factors, further supporting the robustness of the research conclusions.

4.4.4 Robustness test

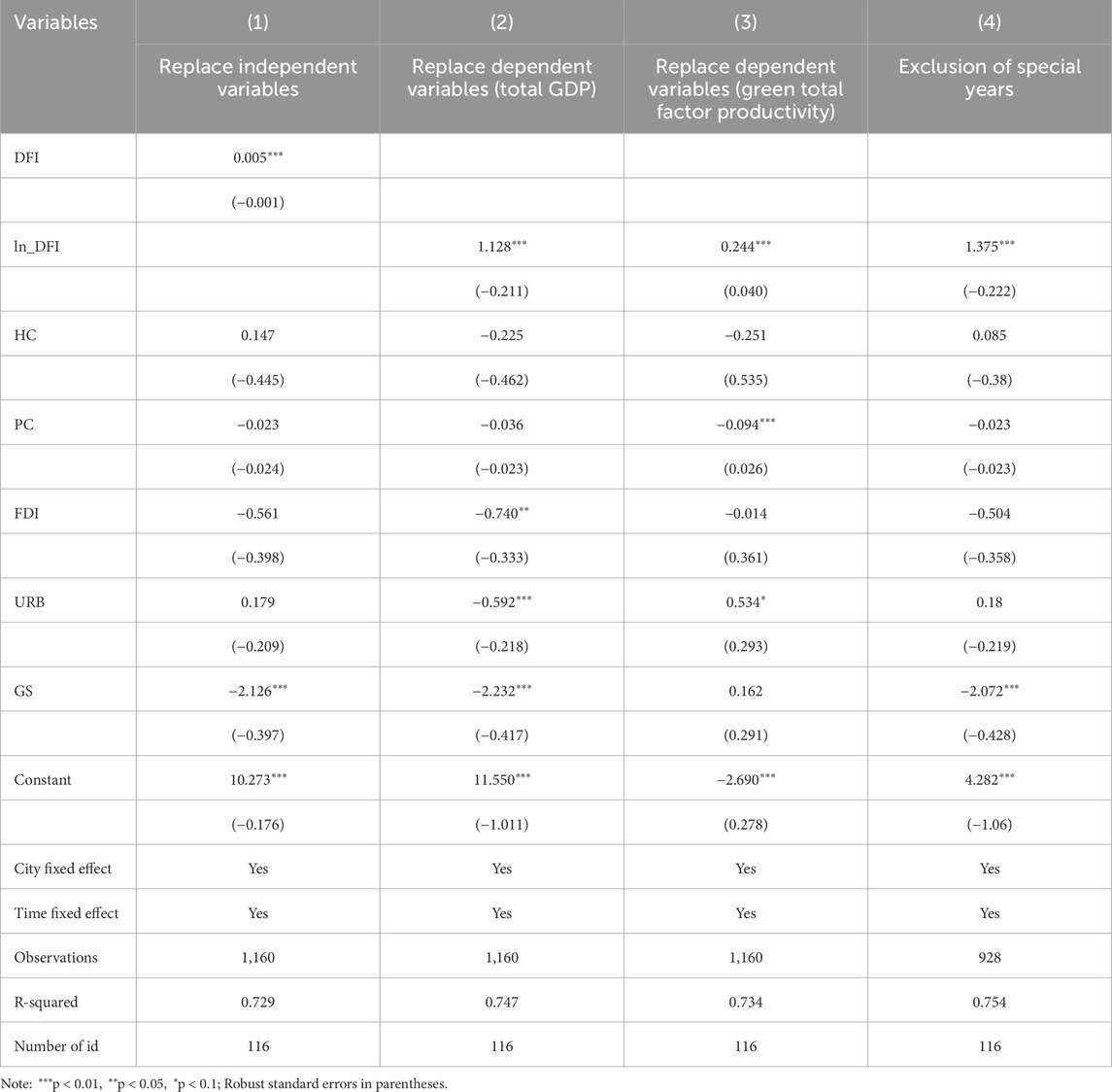

This paper mainly adopts the methods of changing the measures of independent and dependent variables and excluding the effects of some factors to conduct the robustness test. Column (1) of Table 7 reports the regression results when the independent variable, the level of digital financial development, is not taken as the logarithm (dif), column (2) reports the regression results when the logarithm of the city’s total GDP is used as the dependent variable in Equation 1, column (3) reports the regression results when the logarithm of the city’s green total factor productivity (super efficiency SBM) is used as the dependent variable in Equation 1 and column (4) excludes the regression results for the two anomalous years in the sample period, 2015 (the stock market decline) and 2020 (the new Crown Pneumonia outbreak). It can be found that the level of digital financial development still significantly improves the level of economic development in resource cities.

4.4.5 Heterogeneity analysis

4.4.5.1 Heterogeneity of resource-based cities

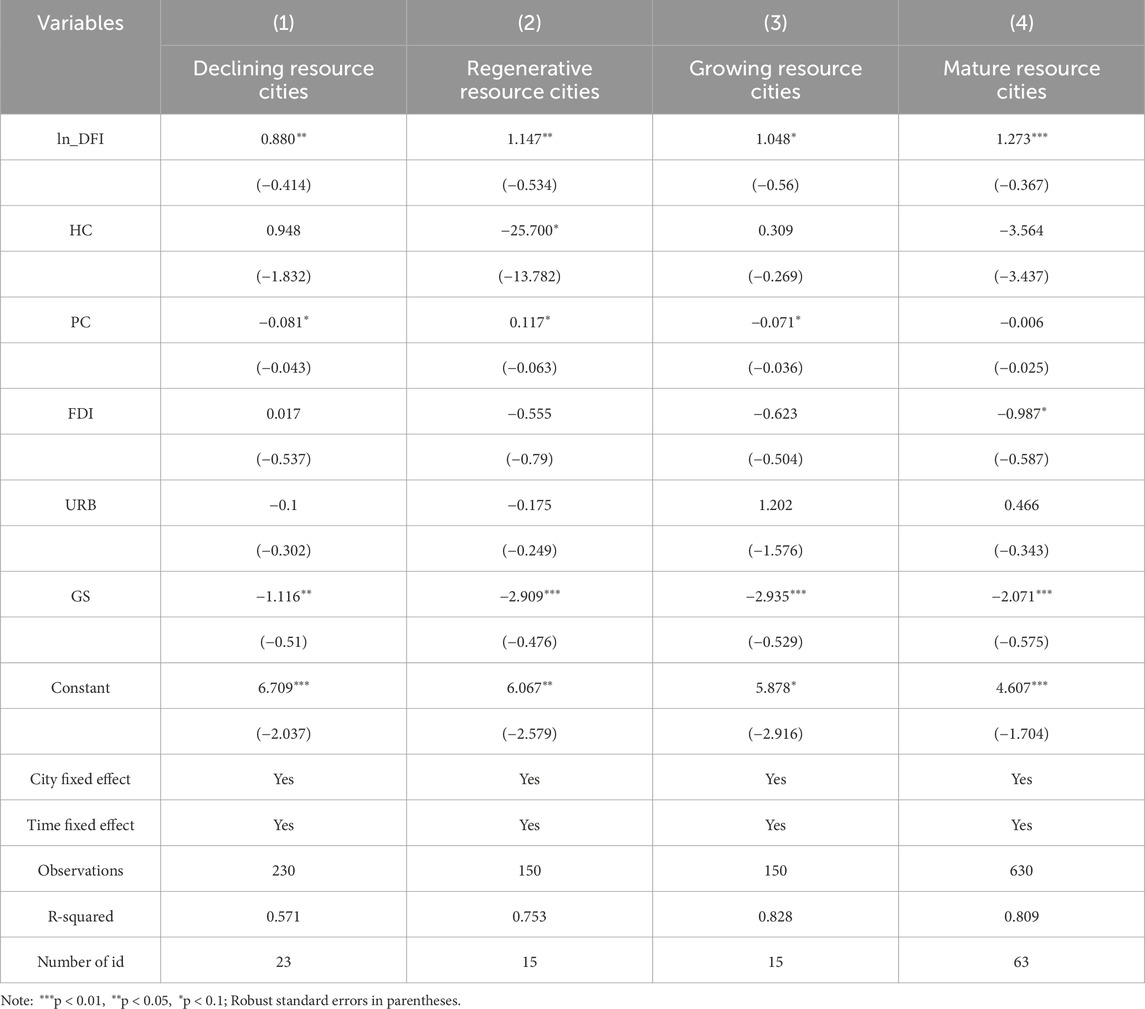

Based on the empirical model, a group regression analysis of different types of resource cities was performed to test for the heterogeneous effects of digital financial. The regression results in Table 8 reveal that digital financial has a significant positive impact on the economic development of all types of resource cities, though with notable variations in magnitude. Specifically, digital financial demonstrates the strongest promoting effect on mature resource cities (coefficient = 1.273, p < 0.01) and regenerative resource cities (coefficient = 1.147, p < 0.05), suggesting that a 1% increase in digital financial inclusion leads to approximately 1.27% and 1.15% growth in economic development, respectively. Growing resource cities also exhibit a substantial positive coefficient (1.048, p < 0.1), while declining resource cities show a relatively smaller but still significant effect (0.880, p < 0.05).

The heterogeneous effects might be attributed to the varying developmental stages and economic structures of these cities. Mature resource cities, with their well-established financial ecosystems and digital infrastructure, can more effectively leverage digital financial inclusion to enhance financial service efficiency. Regenerative cities, despite undergoing economic transformation, show strong potential in utilizing digital financial inclusion to support their emerging industries. The relatively high R-squared values for mature (0.809), growing (0.828), and regenerative cities (0.753) indicate that the model explains a large proportion of the variation in economic development for these city types. The lower R-squared value for declining cities (0.571) suggests that other factors may play more important roles in their economic development. These findings provide valuable insights for formulating differentiated digital financial inclusion policies across different types of resource cities.

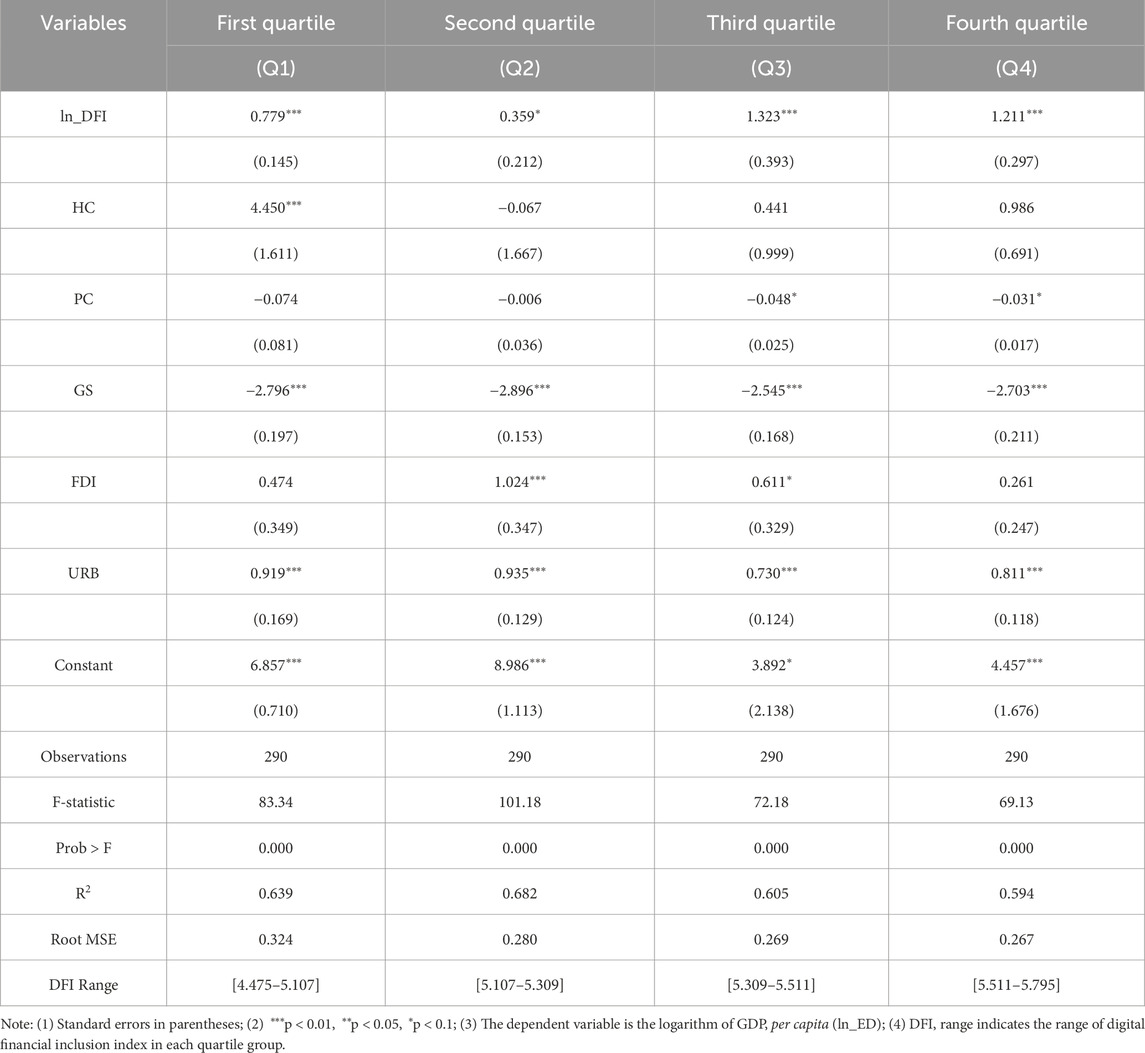

In order to further explore the nonlinear impact of digital financial development level on economic growth, this paper further adopts the method of quantile regression and divides the sample into four intervals according to the level of digital financial development for analysis. This method can not only capture the threshold effect of digital finance development, but also reveal the heterogeneous impact under different levels of development. The results of the quantile regression are reported in Table 9. From the regression coefficient, the relationship between digital finance and economic development shows significant nonlinear characteristics: In the first quartile group (DFI∈[4.475, 5.107]), digital finance has a significant promoting effect on economic development (β = 0.779, p < 0.01); In the second quartile group (DFI∈[5.107, 5.309]), this promoting effect was significantly weakened (β = 0.359, p < 0.1); However, after crossing a specific threshold, the effect of influence was significantly enhanced in the third quartile group (DFI∈[5.309, 5.511]) and the fourth quartile group (DFI∈[5.511, 5.795]) (β = 1.323, p < 0.01 and β = 1.211, p < 0.01, respectively). This result not only verifies the previous findings on the heterogeneity of resource-based cities, but also further reveals that there is an obvious “critical point effect” in the development of digital finance, that is, it needs to reach a certain level of development (about 5.309) to give full play to its promoting role.

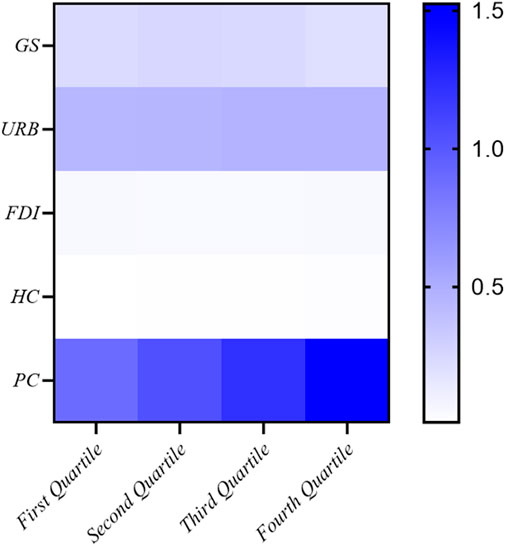

In order to more intuitively show the heterogeneous effect of digital financial development, Figure 5 presents the influence intensity of each control variable under different quantile groups in the form of heat map. As shown in Figure 5, physical capital (PC) shows the most significant heterogeneity characteristics, and its economic promotion effect increases significantly with the development level of digital finance, reaching the strongest in the fourth quartile group (dark blue area). This progressive enhancement pattern suggests that there may be an important complementary effect between digital finance and physical capital. In contrast, other control variables show different heterogeneous characteristics: The level of urbanization (URB) has a relatively stable moderate impact in each percentile group (light blue area), indicating that its promoting effect on economic development is relatively robust; Government support (GS) shows a weak but stable positive impact (lightest blue area); The independent impact of human capital (HC) and foreign direct investment (FDI) is relatively limited.

Based on the results of heat map analysis and grouped regression, the phenomenon that the digital financial effect of declining cities is weak (β = 0.88) can be explained from the perspective of factor matching. The heat map shows that the effect of physical capital (PC) increases significantly with the development level of digital finance, while the declining cities are generally in the low quartile group, which makes it difficult to activate the synergistic effect between physical capital and digital finance. At the same time, the stable positive impact of urbanization (URB) is weakened in the context of aging infrastructure, and the effects of human capital (HC) and foreign investment (FDI) are weak, resulting in the imbalance of factor matching and restricting the effect of digital finance. This finding reveals the “threshold effect” of digital finance development and provides a theoretical basis for urban differentiated development strategy.

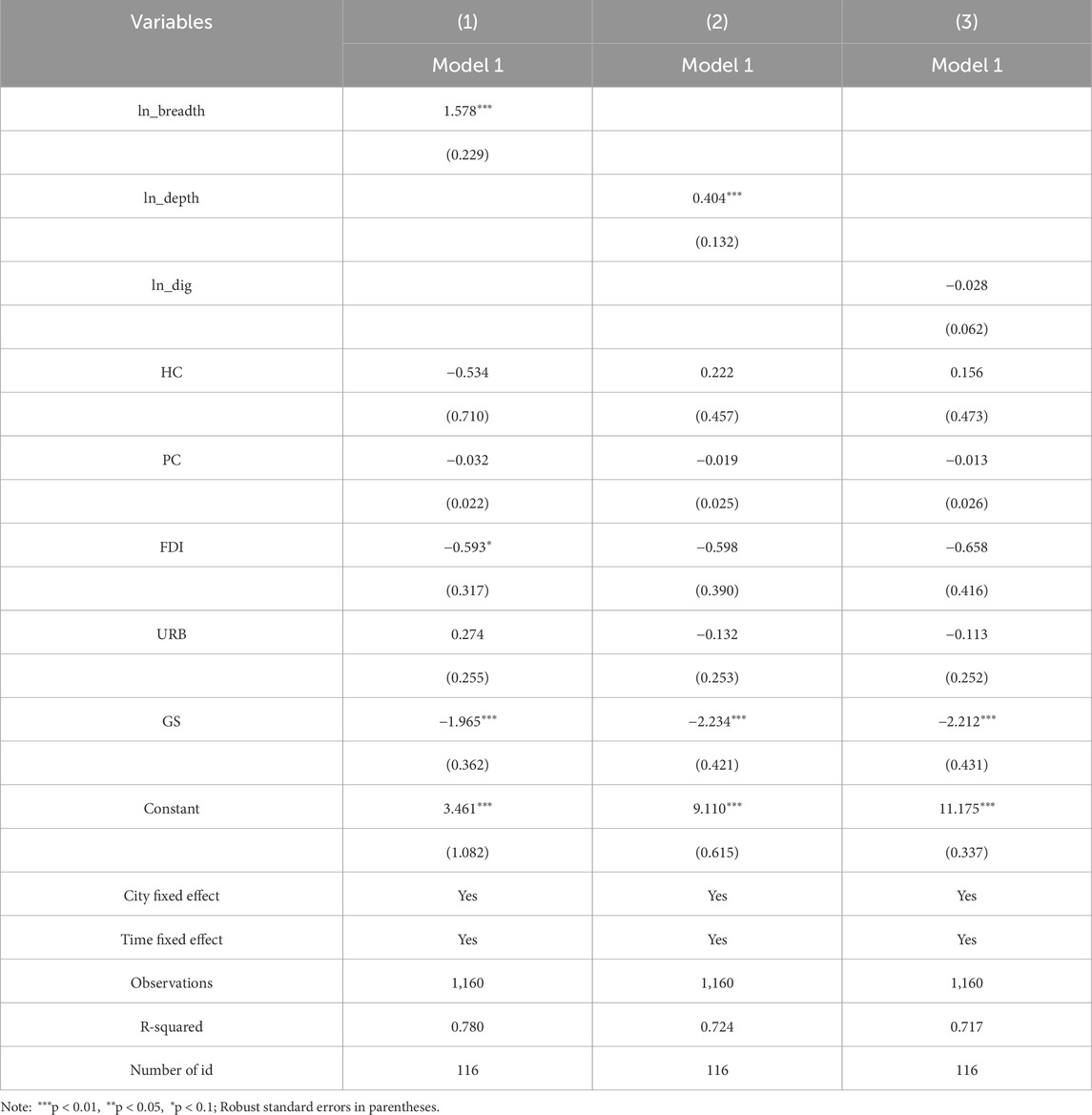

4.4.5.2 Heterogeneity of digital financial inclusion segmentation dimension

Based on the empirical results shown in Table 10, the heterogeneous effects of different dimensions of digital finance on economic development is analyzed. The regression results reveal distinct impacts across the three dimensions: coverage breadth (ln_breadth), usage depth (ln_depth), and digitization degree (ln_dig). The breadth of digital financial demonstrates the strongest positive effect on economic development, with a coefficient of 1.578 (p < 0.01). This substantial impact suggests that a 1% increase in coverage breadth leads to approximately 1.58% growth in economic development. The high statistical significance and large magnitude of this coefficient emphasize the crucial role of expanding financial service accessibility in resource-based cities, where traditional financial services may be inadequate. The depth of digital financial usage shows a moderate but significant positive effect, with a coefficient of 0.404 (p < 0.01). This indicates that intensifying the usage of digital financial services contributes positively to economic development, though with less impact than coverage breadth. The smaller coefficient might reflect existing barriers to deep financial service utilization, such as limitations in financial literacy or sophisticated financial product demand. Interestingly, the digitization degree (ln_dig) shows a non-significant negative coefficient (−0.028), suggesting that mere technological advancement in financial services may not automatically translate into economic benefits. This finding implies that the effectiveness of digital financial may depend more on its reach and actual usage rather than the level of digitization alone. The consistently high R-squared values across all models (ranging from 0.717 to 0.780) indicate strong explanatory power of the regression models. These findings provide important implications for policymakers in resource-based cities, suggesting that priority should be given to expanding financial service coverage while simultaneously promoting deeper usage of these services.

5 Mechanism analysis

The previous benchmark regression results show that digital finance can obviously promote the economic development of resource-oriented cities, so how digital finance affects economic development through the conduction channel and the mechanism of action is the focus of the next research.

In this paper, the Bootstrap method recommended by Preacher and Hayes [38] is used to test the mediation effect. This method generates empirical distribution of mediation effect through repeated sampling and calculates the confidence interval with bias correction, which effectively overcomes the problems such as low test power and logical defects of the traditional three-step method [39]. In this paper, the Bootstrap repeated sampling times are set to 5,000 times and the confidence level is 95%. When the confidence interval does not contain 0, it indicates that the mediation effect is significant. The specific model is as follows:

The main effect is calculated using Equation 2 as follows:

The mediation effects are calculated using Equations 3, 4 as follows:

where Controlit represents the set of control variables (HC, PC, GS, FDI, URB). Industrial structure (IS) is measured by the share of tertiary industry in GDP; regional innovation (RI) is selected as R&D input intensity.

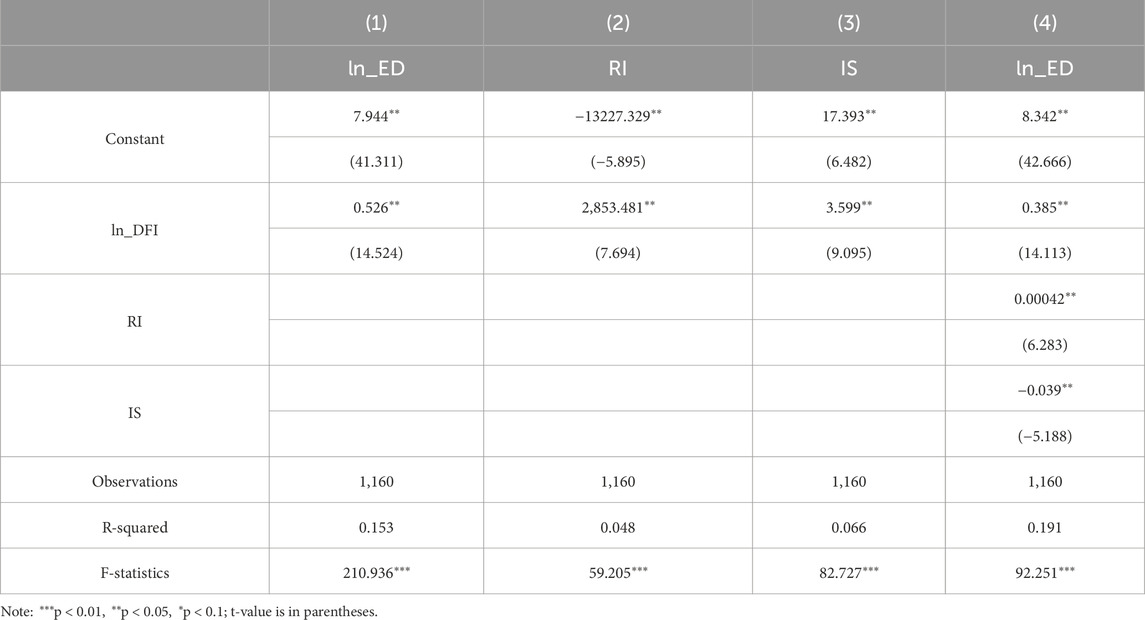

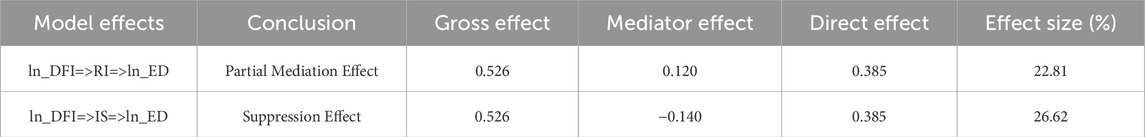

As shown in Table 11, the results of Bootstrap mediation effect test show that digital financial inclusion (ln_DFI) affects economic development (ln_ED) through a double mediation path. The empirical results show that digital financial inclusion has a significant direct promoting effect on economic development (β = 0.385, t = 14.113, p < 0.05). In terms of the intermediary transmission mechanism, digital financial inclusion has a significant positive impact on regional innovation (β = 2,853.481, t = 7.694, p < 0.05) and industrial structure (β = 3.599, t = 9.095, p < 0.05). Regional innovation has a significant positive effect on economic development (β = 0.00042, t = 6.283, p < 0.05), while industrial structure has a significant negative impact (β = −0.039, t = −5.188, p < 0.05). The goodness of fit and F-statistic of the regression model (R2 = 0.191, F = 92.251, p < 0.01) indicate that the estimated results have strong statistical significance.

Based on the analysis of the effect size of the mediation effect in Table 12, it is found that there are significant differences in the mechanism by which digital financial inclusion (ln_DFI) affects economic development (ln_ED) through regional innovation (RI) and industrial structure (IS). Specifically, the partial mediation effect (Partial Mediation Effect) is observed through the regional innovation (RI) pathway, with a total effect of 0.526, a mediation effect of 0.120, and a direct effect of 0.385, representing an effect size of 22.81%. Similarly, the partial mediation effect (Partial Mediation Effect) is also observed through the industrial structure (IS) pathway, with a total effect of 0.526, a mediation effect of-0.140, and a direct effect of 0.385, representing an effect size of 26.62%. This result indicates that the mechanisms by which digital financial inclusion influences economic development through regional innovation and industrial structure are complex. On one hand, it creates a positive partial mediating effect through regional innovation; on the other hand, it generates a negative partial mediating effect through industrial structure. Although the magnitude of these effects is similar, they have opposite directions, collectively shaping the overall impact of digital financial inclusion on economic development.

The complexity of the impact mechanism of digital financial inclusion is reflected by the dual mediating effect of regional innovation and industrial structure on economic development. As for the positive mediating effect of regional innovation, it mainly stems from digital finance improving the allocation efficiency of innovation factors, reducing information asymmetry, optimizing risk dispersion mechanism, and promoting collaborative innovation among enterprises, universities and research institutes. The negative mediating effect of industrial structure is reflected in that digital finance may lead to the imbalance between virtual and real economy, aggravate the Matthew effect, increase the transformation cost and strengthen the path dependence. The mediation effect in the opposite direction is also affected by the interaction of time lag effect, regional heterogeneity and policy environment. The innovation effect needs time to accumulate, while the negative impact of structural adjustment is quickly revealed. The finding shows that to promote the development of digital finance, we need to take into account innovation-driven and structural optimization, and adopt differentiated and precise policy combinations.

To test Hypothesis 4, inspired by Song et al. [40], this paper introduces the interaction term between digital finance (Ln_DFI) and regional entrepreneurship (RE) to investigate whether digital finance can promote economic development in resource-based cities by fostering regional entrepreneurial activities. The model is specified with Equation 5 as follows:

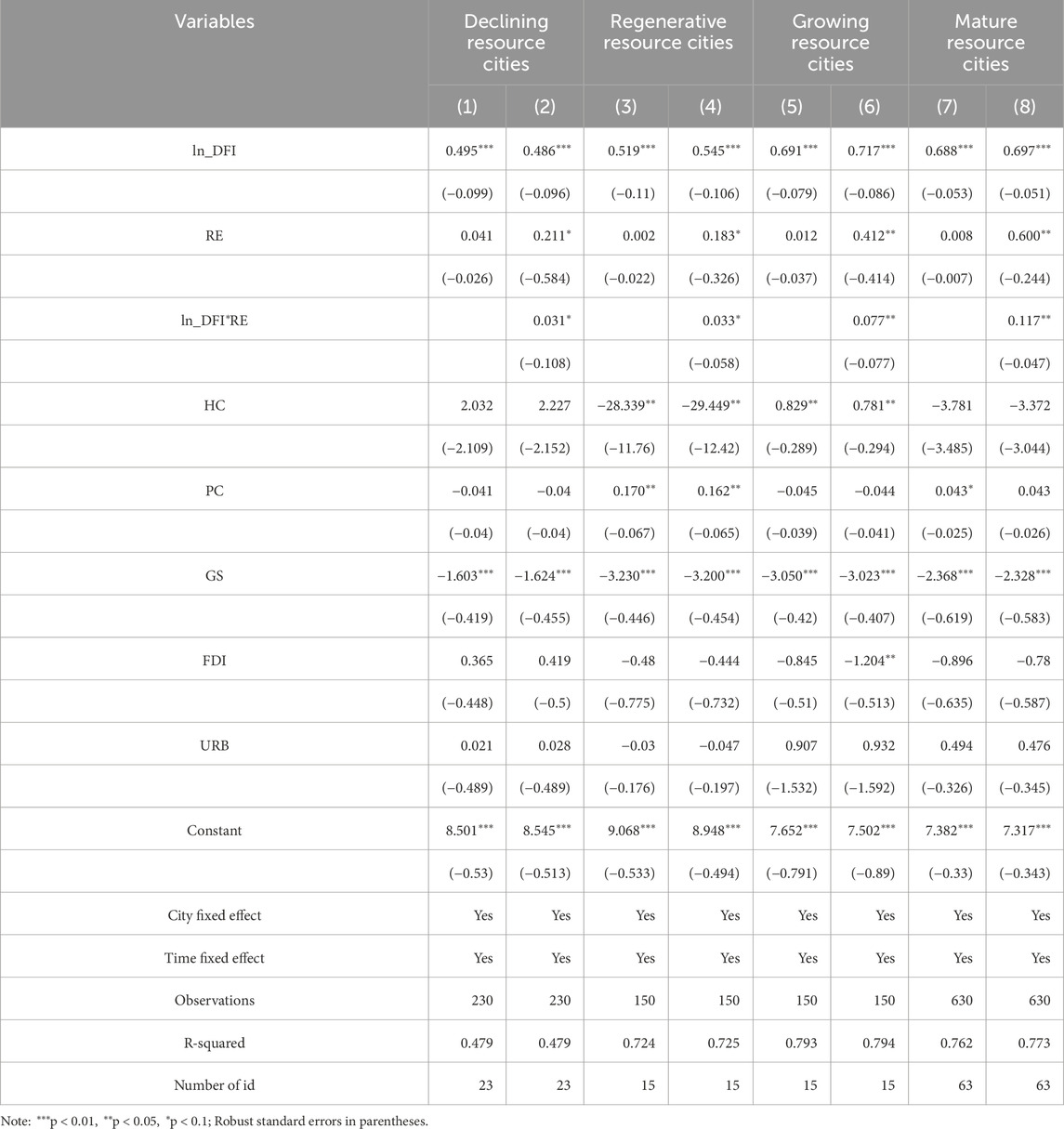

where RE denotes regional entrepreneurship, which is measured by the share of the number of self-employed and private firms in total employment [36]. Ln_ DFI* RE denotes the interaction term between digital finance and regional entrepreneurship, and in this paper, the coefficient of the interaction term ϕ 3 is of primary concern. Table 13 shows the results of the empirical analyses.

Table 13 presents the impact of the interaction term between digital finance and regional entrepreneurship on economic development across different types of resource-based cities. The interaction effect between digital finance (ln_DFI) and regional entrepreneurship (RE) demonstrates significant positive impacts across resource-based cities at different development stages, showing a clear ascending pattern from declining cities (0.031*) to mature cities (0.117*). In resource-based cities with active entrepreneurship, entrepreneurs are more willing to try new financial tools and service models to accelerate the penetration and application of digital finance in various industries [41]. At the same time, the active entrepreneurial ecosystem can provide more application scenarios and innovation opportunities for digital finance, and promote the continuous innovation and improvement of digital finance in its products and services, forming a virtuous circle. Therefore, resource cities with active regional entrepreneurship can better utilize the role of digital finance in enhancing their economic development level, verifying Hypothesis 4.

6 Conclusion and recommendations

6.1 Conclusion

This paper examines the impact of digital finance on the economic development of resource-based cities in China, using panel data from 116 cities between 2014 and 2023. The results show that: (1) Digital finance significantly improves the economic development of these cities. This finding holds true even after addressing potential issues such as endogeneity, replacing key variables, and excluding unusual years. (2) The impact of digital finance varies across different types of resource-based cities. For example, growing and mature cities benefit more from digital finance than declining and regenerative cities. This difference is likely because cities with stronger economic foundations and better digital infrastructure can use digital finance more effectively. (3) Digital financial has a significant impact on economic development through two intermediary channels of regional innovation and industrial structure, but there are obvious differences in the direction and effect size of its effects. (4) Cities with active entrepreneurial ecosystems are more effective in leveraging digital finance to enhance their economies. Entrepreneurship plays an obvious role in regulating the relationship between digital finance and economic development, especially in mature cities and growing cities.

6.2 Recommendations

Based on the results of empirical research, this paper puts forward differentiated digital financial development suggestions for different types of resource cities. For mature cities, the positive intermediary effect of regional innovation should be fully utilized to reduce the cost of innovation by setting up financial technology innovation experimental zones. Specifically, the establishment of fintech talent center can cultivate professional talents through the mode of “integration of industry and education, learning by use,” and provide intellectual support for regional innovation; At the same time, an intellectual property securitization platform should be built to realize the value transformation of innovative assets and improve the efficiency of innovative factor allocation. For growing cities, the focus is to build an industrial digital financial service system, promote the improvement of service innovation ability by cultivating a digital financial talent base, and guide financial institutions to expand the coverage of inclusive services by shifting their service focus downward. Regenerative cities need to balance innovation-driven and structural adjustment, solve the financing problems of small and medium-sized enterprises by building a supply chain finance platform, and build a collaborative innovation platform among industry, university and research institutes to promote the transformation of technological achievements. For declining cities, in order to prevent and control the negative structural effect and solve the financial constraint, it is suggested to adopt the innovative fund operation mode of “government guidance and market dominance”: introduce social capital to build digital infrastructure through PPP mode, set up government risk compensation fund to leverage credit supply from financial institutions, and introduce market-oriented operation mechanism to improve the efficiency of fund use.

6.3 Limitations and future research

Although this paper provides valuable findings, there are still some limitations. First of all, the digital finance index used in this study is mainly based on Alipay data, which fails to fully cover other digital finance platforms and does not deeply describe the characteristics of digital finance use of industrial enterprises. Secondly, the sample only covers 116 resource-based cities in China, which fails to fully reflect the diversity of global resource-based cities. Thirdly, the existing measurement methods may have endogeneity problems and fail to fully consider the spatial spillover effect. Future research can: (1) integrate multi-platform data to build a more comprehensive digital financial index system; (2) Incorporating samples from other developing countries for cross-country comparative studies; (3) New methods such as machine learning are used to verify the results. These expansions will help deepen the understanding of how digital finance can drive the development of resource-based cities.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

PQ: Writing – original draft. QW: Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was supported by the 2023 Master’s Degree Cultivation Program of the University Research Fund of Ningbo University of Finance and Economics (grant number 1320230917); the Major Humanities and Social Sciences Research Projects in Zhejiang higher education institutions (grant number 2024QN030); and the Soft Science Research Program of Zhejiang Province (grant number 2025C35063); Visiting Scholars Professional Development Program of Zhejiang Education Department[grant number FX2024082].

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Li W, Li N. Natural resource endowment, market-oriented allocation, and industrial structure transformation: empirical evidence from 116 resource-based cities. Mod Econ (2021) 8:52–63. doi:10.13891/j.cnki.mer.2021.08.006

2. Wang F, Wang R, He Z. Exploring the impact of “double cycle” and industrial upgrading on sustainable high-quality economic development: application of spatial and mediation models. Sustainability (2022) 14(4):2432. doi:10.3390/su140424322

3. Li G, Zhang R, Feng S, Wang Y. Digital finance and sustainable development: evidence from environmental inequality in China. Bus Strategy Environ (2022) 31 (7):3574–3594. doi:10.1002/bse.3105

4. Yu J, Zhang Z, Zhou Y. The sustainability of China's major mining cities. Resour Pol (2008) 33(1):12–22. doi:10.1016/j.resourpol.2007.10.001

5. Li H, Li L. Employment situation and transition strategy in Chinese resource-based cities. China Popul Resour Environ (2017) 27(8):227–34.

6. Lei Y, Cui N, Pan D. Economic and social effects analysis of mineral development in China and policy implications. Resour Pol (2013) 38(4):448–57. doi:10.1016/j.resourpol.2013.06.005

7. Frost J, Gambacorta L, Huang Y, Shin HS, Zbinden P. BigTech and the changing structure of financial intermediation. Econ Pol (2019) 34(100):761–99. doi:10.1093/epolic/eiaa003

8. Beck T, Frame WS. Technological change, financial innovation, and economic development. Handbook of finance and development, Cheltenham, Edward Elgar Publishing (2018). doi:10.4337/9781785360510.00021

9. Berger AN, Gleisner F. Emergence of financial intermediaries in electronic markets: the case of online P2P lending. BuR-Business Res (2009) 2(1):39–65. doi:10.1007/bf03343528

10. Shen Y, Hueng CJ, Hu W. Using digital technology to improve financial inclusion in China. Appl Econ Lett (2020) 27(1):30–4. doi:10.1080/13504851.2019.1606401

11. Goldstein I, Jiang W, Karolyi GA. To FinTech and beyond. Rev Financial Stud (2019) 32(5):1647–61. doi:10.1093/rfs/hhz025

12. Li J, Wu Y, Xiao JJ. The impact of digital finance on household consumption: evidence from China. Econ Model (2020) 86:317–26. doi:10.1016/j.econmod.2019.09.027

13. Peng R, Zeng B. Digital financial inclusion and inclusive green growth: evidence from China’s green growth initiatives. Int J Financ Stud (2024) 11(1):2. doi:10.3390/ijfs13010002

14. Brown JR, Cookson JA, Heimer RZ. Growing up without finance. J Financial Econ (2019) 134(3):591–616. doi:10.1016/j.jfineco.2019.05.006

15. Wang W, He T, Li Z. Digital inclusive finance, economic growth and innovative development. Kybernetes (2023) 52(9):3064–3084. doi:10.1108/K-09-2021-0866

16. Liu Z, Feng Q, Li H. Digital finance, bank competition shocks and operational efficiency of local commercial banks in Western China. Pac Basin Finance J (2024) 85:102377. doi:10.1016/j.pacfin.2024.102377

17. Acemoglu D, Akcigit U, Kerr WR. Innovation network. PNAS (2016) 113(41):11483–8. doi:10.1073/pnas.1613559113

18. Akerlof GA. The market for “lemons”: quality uncertainty and the market mechanism. Q J Econ (1970) 84(3):488–500. doi:10.2307/1879431

19. Williamson OE. The economic institutions of capitalism: firms, markets, relational contracting. New York: New York Free Press (1985).

20. Bresnahan TF, Trajtenberg M. General purpose technologies: “Engines of growth”. J Econom (1995) 65(1):83–108. doi:10.1016/0304-4076(94)01598-t

21. Ozili PK. Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev (2018) 18(4):329–40. doi:10.1016/j.bir.2017.12.003

22. Mao X, Wang R. Digital finance and green development: empirical evidence from 286 Chinese cities. Finance Forum (2023) 28 (9):69–80. doi:10.16529/j.cnki.11-4613/f.2023.09.006

23. Cheng M, Qu Y. Does bank FinTech reduce credit risk? Evidence from China. Pacific-Basin Finance J (2020) 63:101398. doi:10.1016/j.pacfin.2020.101398

24. Sun X, Tian Y. he impact of digital finance on county-level green total factor productivity. Shandong Social Sciences (2022) 4:156–163. doi:10.14112/j.cnki.37-1053/c.2022.04.026

25. Xiao J, Wen R. The impact of digital finance on industrial structure optimization: the moderating role of innovation factor allocation efficiency. Research on Developmental Finance (2023) (5):43–52. doi:10.16556/j.cnki.kfxjr.2023.05.003

26. Huang A, Hong D, Ma Y. Can digital inclusive finance alleviate health inequality among the elderly population? J Financ Econ (2024) 12:41–52. doi:10.14057/j.cnki.cn43-1156/f.2024.12.001

27. Li X, Ran G. How does digital finance development affect technological innovation quality? Mod Econ (2021) 9:69–77. doi:10.13891/j.cnki.mer.2021.09.008

28. Block JH, Colombo MG, Cumming DJ, Vismara S. New players in entrepreneurial finance and why they are there. Small Business Econ (2018) 50(2):239–50. doi:10.1007/s11187-016-9826-6

29. Claessens S, Frost J, Turner G, Zhu F. Fintech credit markets around the world: size, drivers and policy issues. BIS Q Rev September (2018). doi:10.2139/ssrn.3288096

30. Cumming DJ, Schwienbacher A. Fintech venture capital. Corporate Governance: Int Rev (2018) 26(5):374–89. doi:10.1111/corg.12256

31. Cao Q, Jia J, Feng J. The impact and mechanism of digital inclusive finance on economic development in resource-based cities. Study and Practice (2024) 5:66–77. doi:10.19624/j.cnki.cn42-1005/c.2024.05.012

32. Guo F, Wang JY, Wang F, Kong T, Zhang X, Cheng ZY. Measuring China's digital financial inclusion: index compilation and spatial characteristics. China Econ Q (2020) 19(4):1401–18.

33. Xu J, Liu Q. Digital inclusive finance and quality of economic growth: a provincial panel data analysis based on green total factor productivity. Stat Theory and Practice (2022) 7:19–26. doi:10.13999/j.cnki.tjllysj.2022.07.004

34. Lin C, Ma Y, Malatesta P, Xuan Y. Ownership structure and the cost of corporate borrowing. J financ econ (2011) 100 (1):1–23. doi:10.1016/j.jfineco.2010.10.012

35. Rahim S, Murshed M, Umarbeyli S, Kirikkaleli D, Ahmad M, Tufail M, et al. Do natural resources abundance and human capital development promote economic growth? A study on the resource curse hypothesis in Next Eleven countries. Resour Environ Sustain (2021) 4:100018. doi:10.1016/j.resenv.2021.100018

36. Qian H, Tao Y, Cao S. Digital finance development and economic growth in China: theoretical and empirical analysis. J Quant Tech Econ (2020) 37(6):26–46. doi:10.13653/j.cnki.jqte.2020.06.002

37. Liu M, Luo YQ, Ping WY. The impact of digital finance development on regional financial stability. Collected Essays on Finance and Economics (2025) 6:52–64. doi:10.13762/j.cnki.cjlc.20250228.001

38. Preacher KJ, Hayes AF. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav Res Methods (2008) 40(3):879–91. doi:10.3758/brm.40.3.879

39. Jiang T. Mediating effects and moderating effects in empirical research of causal inference. China Industrial Economics (2022) 5:100–120. doi:10.19581/j.cnki.ciejournal.2022.05.005

40. Song H, Yang X, Yu K. How do supply chain network and SMEs' operational capabilities enhance working capital financing? An integrative signaling view. Int J Prod Econ (2019) 220:107447. doi:10.1016/j.ijpe.2019.07.020

41. Nanda R, Rhodes-Kropf M. Investment cycles and startup innovation. J Financial Econ (2013) 110(2):403–18. doi:10.1016/j.jfineco.2013.07.001

42. Zhang Z, Wang L. The impact of digital finance on the operational efficiency of small and medium-sized enterprises: an empirical study based on Shenzhen Growth Enterprise Market data. China Business and Market (2021) 35(8):30–39. doi:10.14089/j.cnki.cn11-3664/f.2021.08.003

43. Zhang J, Li J, Ye D, Sun C. Impact of digital economy of resource-based city on carbon emissions trading by blockchain technology. Comput Intell Neurosci (2022)(1):6366061. doi:10.1155/2022/6366061

Keywords: digital finance, resource-based cities, economic development, industrial structure upgrade, regional innovation

Citation: Qi P and Wang Q (2025) The impact and role mechanism of digital finance on the economic development of resource-based cities--an empirical study from China. Front. Phys. 13:1606093. doi: 10.3389/fphy.2025.1606093

Received: 04 April 2025; Accepted: 12 June 2025;

Published: 07 July 2025.

Edited by:

Chengyi Xia, Tianjin Polytechnic University, ChinaReviewed by:

Tianyi Lei, Zhongnan University of Economics and Law, ChinaYaohui Liu, Shandong Jianzhu University, China

Copyright © 2025 Qi and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qi Wang, d3EwMDExMTVAMTI2LmNvbQ==

Peipei Qi1

Peipei Qi1 Qi Wang

Qi Wang